Comprehensive Management Accounting Report: Dell's Strategy

VerifiedAdded on 2023/04/04

|15

|2969

|368

Report

AI Summary

This report provides a comprehensive analysis of Dell's management accounting practices. It begins by defining management accounting, its essential requirements, and its benefits within Dell, emphasizing its role in decision-making and financial planning. The report then delves into a comparative analysis of absorption and marginal costing, calculating the cost per unit under each method and illustrating their impact on income statements. Furthermore, it explores various planning tools used for budgetary control, such as incremental and zero-based budgeting, outlining their advantages and disadvantages. The report highlights how Dell utilizes these accounting methods to manage costs, plan financial activities, and make informed business decisions, ultimately contributing to the company's financial success.

MANAGEMENT ACCOUNTING

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

INTRODUCTION

Management accounting is a combination of several processes such as accounting,

finance and management of business skills and techniques which are also crucial in terms of

adding value to the organization (Hopper and Bui, 2016). The information presented in the

accounts have many implications on the organization which are being stated in the present

research study. Thus, the present research study has been made on Dell which has several

hardware products for the computer system and which uses different management accounting

system for the purpose of managing all business aspects. Therefore, in this respect discussion has

been made included regarding absorption and marginal cost which aids the business to manage

diverse aspects of the accounting procedure. Furthermore, researcher has also stated advantages

and disadvantages of types of planning that is used for budgetary control.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting can be defined as the process of preparing management reports

in order to get financial and non-financial information required by managers to take day to day

short term decisions. Management accounting reports consist of company's available cash,

revenues, sales, accounts payable and receivable etc (Messner, Becker, Schäffer and Binder,

2016).

The main aim of any business entity is to maximize its profit capacity and such objective

can be attained through adopting specific financial planning. Dell has been emphasizing on

management accounting procedure for the purpose of identifying, analysing, recording and

presenting financial information to the management. This is useful to the internal management as

that aids in undertaking proper decisions for the business.

Management accounting is very much different from financial accounting because it

gives reports about company's internal investors or stakeholders (Nasseri, Yazdifar and Askarany,

2016). In simple words we can say it is the application which provides useful information for

management.

Management accounting includes different kind of reports which are used to analyse

company's information. Some of which are:

3

Management accounting is a combination of several processes such as accounting,

finance and management of business skills and techniques which are also crucial in terms of

adding value to the organization (Hopper and Bui, 2016). The information presented in the

accounts have many implications on the organization which are being stated in the present

research study. Thus, the present research study has been made on Dell which has several

hardware products for the computer system and which uses different management accounting

system for the purpose of managing all business aspects. Therefore, in this respect discussion has

been made included regarding absorption and marginal cost which aids the business to manage

diverse aspects of the accounting procedure. Furthermore, researcher has also stated advantages

and disadvantages of types of planning that is used for budgetary control.

TASK 1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting can be defined as the process of preparing management reports

in order to get financial and non-financial information required by managers to take day to day

short term decisions. Management accounting reports consist of company's available cash,

revenues, sales, accounts payable and receivable etc (Messner, Becker, Schäffer and Binder,

2016).

The main aim of any business entity is to maximize its profit capacity and such objective

can be attained through adopting specific financial planning. Dell has been emphasizing on

management accounting procedure for the purpose of identifying, analysing, recording and

presenting financial information to the management. This is useful to the internal management as

that aids in undertaking proper decisions for the business.

Management accounting is very much different from financial accounting because it

gives reports about company's internal investors or stakeholders (Nasseri, Yazdifar and Askarany,

2016). In simple words we can say it is the application which provides useful information for

management.

Management accounting includes different kind of reports which are used to analyse

company's information. Some of which are:

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost Reports: Management accounting calculates costs of item produced. This is done

by taking all the cost of raw material, labour, overhead and all the additional cost get included in

the report.

Budget Reports: Budget reports lists all the sources of revenues and expenses. In this

company tries to achieve al its goals and objective with the budget defined in formerly.

Performance Reports: Performance report compares expenditures with respect to

revenues. This report is calculated every year and it helps manager to calculate future demand

and production as well as cost increase (Otley and Emmanuel, 2013).

Moreover, it can also be said that management accounting process aids Dell to plan and

budget the things so that resource capability can be maintained accordingly. With the help of

management accounting, it is vital for Dell to plan and control the operations so that further

decisions can be made. Dell is using such procedure because that aids the business entity to focus

on inventory management which can also assist in releasing the dead stock.

Importance of management accounting essential

• Identification, analysis and communication metrics in cost accounting: The three

basic elements of accounting helps management to find out the most efficient use of

capital resources, measuring the cost controls and communicating the information

throughout the organisation (Renz, 2016). The accumulated cost reports are drafted and

are discussed with the managers and external users. After getting all the information the

about the cost the management reallocate the capital; to improve efficiencies and to

reduce costs.

• To identify the appropriate national economic measures for analysis: These reports

provides economic productivity via standard measures known as gross domestic product.

The relevant financial data is identified and analysed regarding cash flow and profit and

loss statements and then communicated with the decision makers.

• To simplify financial statements: Management accounting provides technical reports

with simple interpretations which helps in taking different managerial decisions (Hopper

and Bui, 2016).

• For taking business critical decisions: Management accounting is necessary for taking

critical decision of any organisation because it provides it takes all the data and then

present it in a such a way that a proper analysis about feasibility and reliability can be

4

by taking all the cost of raw material, labour, overhead and all the additional cost get included in

the report.

Budget Reports: Budget reports lists all the sources of revenues and expenses. In this

company tries to achieve al its goals and objective with the budget defined in formerly.

Performance Reports: Performance report compares expenditures with respect to

revenues. This report is calculated every year and it helps manager to calculate future demand

and production as well as cost increase (Otley and Emmanuel, 2013).

Moreover, it can also be said that management accounting process aids Dell to plan and

budget the things so that resource capability can be maintained accordingly. With the help of

management accounting, it is vital for Dell to plan and control the operations so that further

decisions can be made. Dell is using such procedure because that aids the business entity to focus

on inventory management which can also assist in releasing the dead stock.

Importance of management accounting essential

• Identification, analysis and communication metrics in cost accounting: The three

basic elements of accounting helps management to find out the most efficient use of

capital resources, measuring the cost controls and communicating the information

throughout the organisation (Renz, 2016). The accumulated cost reports are drafted and

are discussed with the managers and external users. After getting all the information the

about the cost the management reallocate the capital; to improve efficiencies and to

reduce costs.

• To identify the appropriate national economic measures for analysis: These reports

provides economic productivity via standard measures known as gross domestic product.

The relevant financial data is identified and analysed regarding cash flow and profit and

loss statements and then communicated with the decision makers.

• To simplify financial statements: Management accounting provides technical reports

with simple interpretations which helps in taking different managerial decisions (Hopper

and Bui, 2016).

• For taking business critical decisions: Management accounting is necessary for taking

critical decision of any organisation because it provides it takes all the data and then

present it in a such a way that a proper analysis about feasibility and reliability can be

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

made.

P2 Explain the benefits of various management accounting systems and their application within

Dell

Management accounting reports are essential for the business entities for the purpose of

monitoring and evaluating company’s performance according to different time period. This is

dependent on the type of products which Dell is selling at the market place. Managerial

accounting reports are useful in preparing budgeting reports that aids Dell to ascertain the

performance of business through identifying different control costs (Chiwamit, Modell and

Scapens, 2017). This is also crucial for the purpose of specifying each activity of the business

and how valuable it is in managing the business aspects. Budgeting reports are useful in

investing resources and at the same time, it also helps in calculating actual costs compared with

other business entities.

It is also useful in preparing accounts receivable aging reports that is also termed as a

critical tool to manage cash flow for companies that assist their customers in providing financial

assistance. Such reports needs to be periodically reviewed because that could aid Dell to keep the

collection from the departments through considering previous debts (Dekker, 2016). Apart from

this, job cost reports are also prepared which specifies expenses for a particular project. For

instance- job cost is useful for Dell at the time when the business introduces any new software

package. Furthermore, job cost reports are also utilized for the purpose of analysing expenses of

the project especially when the project is in carried on. This aids the managers to allocate

business resources in the best possible manner.

Therefore, it can be said that Dell can use managerial accounting reports for underpinning

the value of manufacturing processes. The report will include inventory wastage, labour cost per

unit and overhead costs. Thus, with the help of such results, the managers will be able to

assemble all the processes in a single structure so that best performance can be facilitated

accordingly. This can assist Dell to identify which project is suitable for the business entity.

Different methods used for management accounting

1. Financial Planning: Financial planning decides about the financial activities necessary

to accomplish the primary objectives. It consist of both short term and long term financial

objectives of any organisation (Fullerton, Kennedy and Widener, 2014).

2. Analysis of Financial Statements: This analysis is done to determine the importance

5

P2 Explain the benefits of various management accounting systems and their application within

Dell

Management accounting reports are essential for the business entities for the purpose of

monitoring and evaluating company’s performance according to different time period. This is

dependent on the type of products which Dell is selling at the market place. Managerial

accounting reports are useful in preparing budgeting reports that aids Dell to ascertain the

performance of business through identifying different control costs (Chiwamit, Modell and

Scapens, 2017). This is also crucial for the purpose of specifying each activity of the business

and how valuable it is in managing the business aspects. Budgeting reports are useful in

investing resources and at the same time, it also helps in calculating actual costs compared with

other business entities.

It is also useful in preparing accounts receivable aging reports that is also termed as a

critical tool to manage cash flow for companies that assist their customers in providing financial

assistance. Such reports needs to be periodically reviewed because that could aid Dell to keep the

collection from the departments through considering previous debts (Dekker, 2016). Apart from

this, job cost reports are also prepared which specifies expenses for a particular project. For

instance- job cost is useful for Dell at the time when the business introduces any new software

package. Furthermore, job cost reports are also utilized for the purpose of analysing expenses of

the project especially when the project is in carried on. This aids the managers to allocate

business resources in the best possible manner.

Therefore, it can be said that Dell can use managerial accounting reports for underpinning

the value of manufacturing processes. The report will include inventory wastage, labour cost per

unit and overhead costs. Thus, with the help of such results, the managers will be able to

assemble all the processes in a single structure so that best performance can be facilitated

accordingly. This can assist Dell to identify which project is suitable for the business entity.

Different methods used for management accounting

1. Financial Planning: Financial planning decides about the financial activities necessary

to accomplish the primary objectives. It consist of both short term and long term financial

objectives of any organisation (Fullerton, Kennedy and Widener, 2014).

2. Analysis of Financial Statements: This analysis is done to determine the importance

5

and meaning of financial statements so that a prediction can be made out for the future

earnings. This analysis results in information which helps business executives and

investors.

3. Historical cost Accounting: This accounting deal with the past data so that comparison

can be made out with the standard cost. Eventually this helps for deciding the future

planning and cost control.

4. Standard Costing: Standard costing is necessary to have cost control. It compares the

actual operating condition with the standard one (Hopper and Bui, 2016.).

5. Fund Flow Statement: management accounting uses fund flow statements to determine

the changes in the financial position of an enterprise between two dates.

6. Cash Flow statements: This tool summarises the cash inflows and cash outflows of an

enterprise. It provides cash control for a particular moth or a years.

7. Revaluation Accounting: This method of management accounting provides maintenance

and protection of the capital of an organisation (Lopez-Valeiras, Gomez-Conde and

Naranjo-Gil, 2015).

8. Statistical Techniques: This technique makes the information more relevant and

meaningful that in turn helps in decision making. It provide quality control.

9. Decision making: This method provides help in choosing from the different alternatives

available. The management accounting helps the management through the techniques of

marginal costing, capital budgeting, differential costing to select the best alternative

which can enhance the profit of the business.

TASK 2

P3 Calculate cost per unit under both absorption costing and marginal costing. State difference

between both. Explain how they are used to prepare income statement

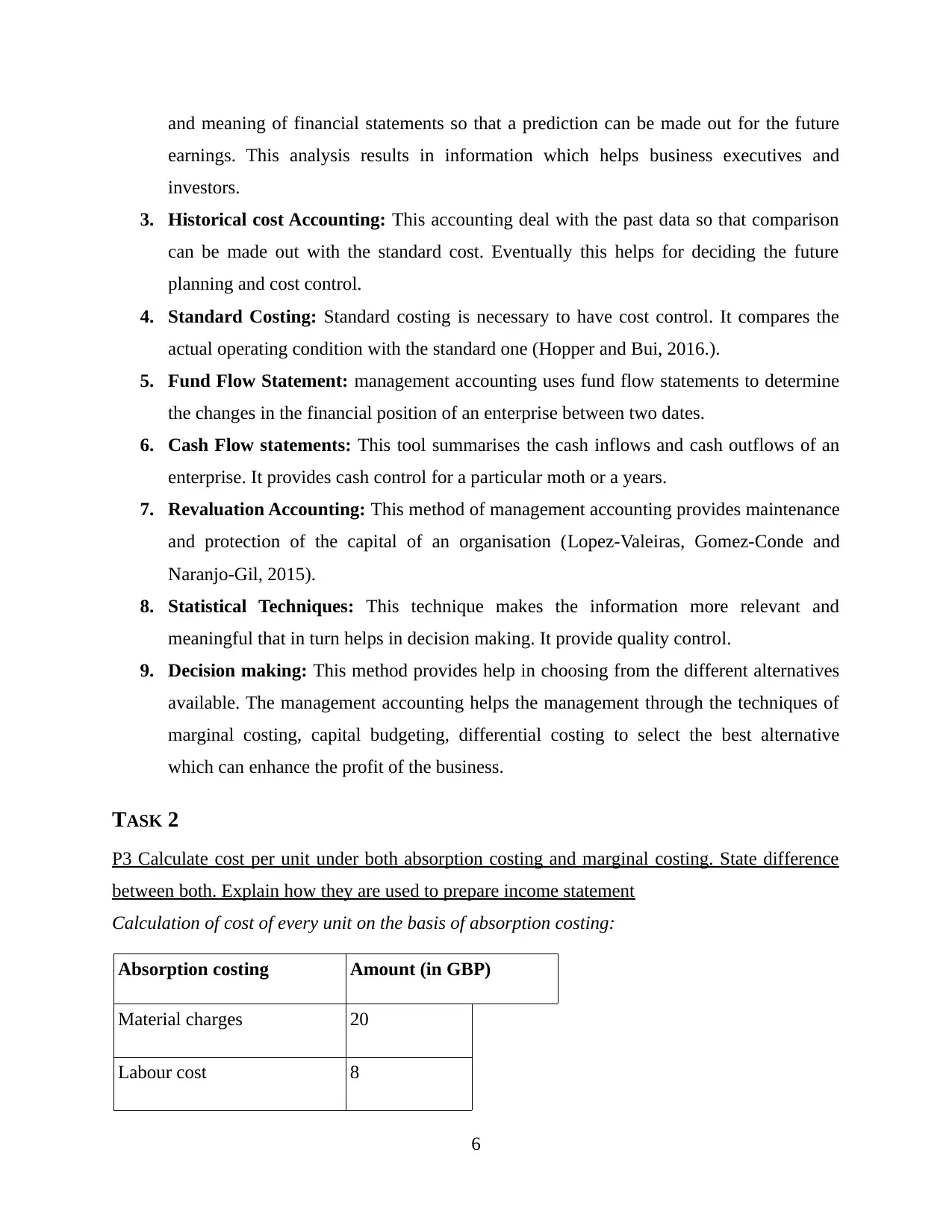

Calculation of cost of every unit on the basis of absorption costing:

Absorption costing Amount (in GBP)

Material charges 20

Labour cost 8

6

earnings. This analysis results in information which helps business executives and

investors.

3. Historical cost Accounting: This accounting deal with the past data so that comparison

can be made out with the standard cost. Eventually this helps for deciding the future

planning and cost control.

4. Standard Costing: Standard costing is necessary to have cost control. It compares the

actual operating condition with the standard one (Hopper and Bui, 2016.).

5. Fund Flow Statement: management accounting uses fund flow statements to determine

the changes in the financial position of an enterprise between two dates.

6. Cash Flow statements: This tool summarises the cash inflows and cash outflows of an

enterprise. It provides cash control for a particular moth or a years.

7. Revaluation Accounting: This method of management accounting provides maintenance

and protection of the capital of an organisation (Lopez-Valeiras, Gomez-Conde and

Naranjo-Gil, 2015).

8. Statistical Techniques: This technique makes the information more relevant and

meaningful that in turn helps in decision making. It provide quality control.

9. Decision making: This method provides help in choosing from the different alternatives

available. The management accounting helps the management through the techniques of

marginal costing, capital budgeting, differential costing to select the best alternative

which can enhance the profit of the business.

TASK 2

P3 Calculate cost per unit under both absorption costing and marginal costing. State difference

between both. Explain how they are used to prepare income statement

Calculation of cost of every unit on the basis of absorption costing:

Absorption costing Amount (in GBP)

Material charges 20

Labour cost 8

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Variable overhead expenses 4

Fixed overhead costs 10

Total cost per unit 42

Calculation of cost of every unit on the basis of marginal costing:

Marginal costing Amount (in GBP)

Material charges 20

Labour charges 8

Variable overhead expenses 4

Total cost per unit 32

The total number of units produced are 50000 and according to that total cost is being

calculated as under:

Absorption cost Marginal costing

42 * 50000 = 2100000 32 * 50000 = 1600000

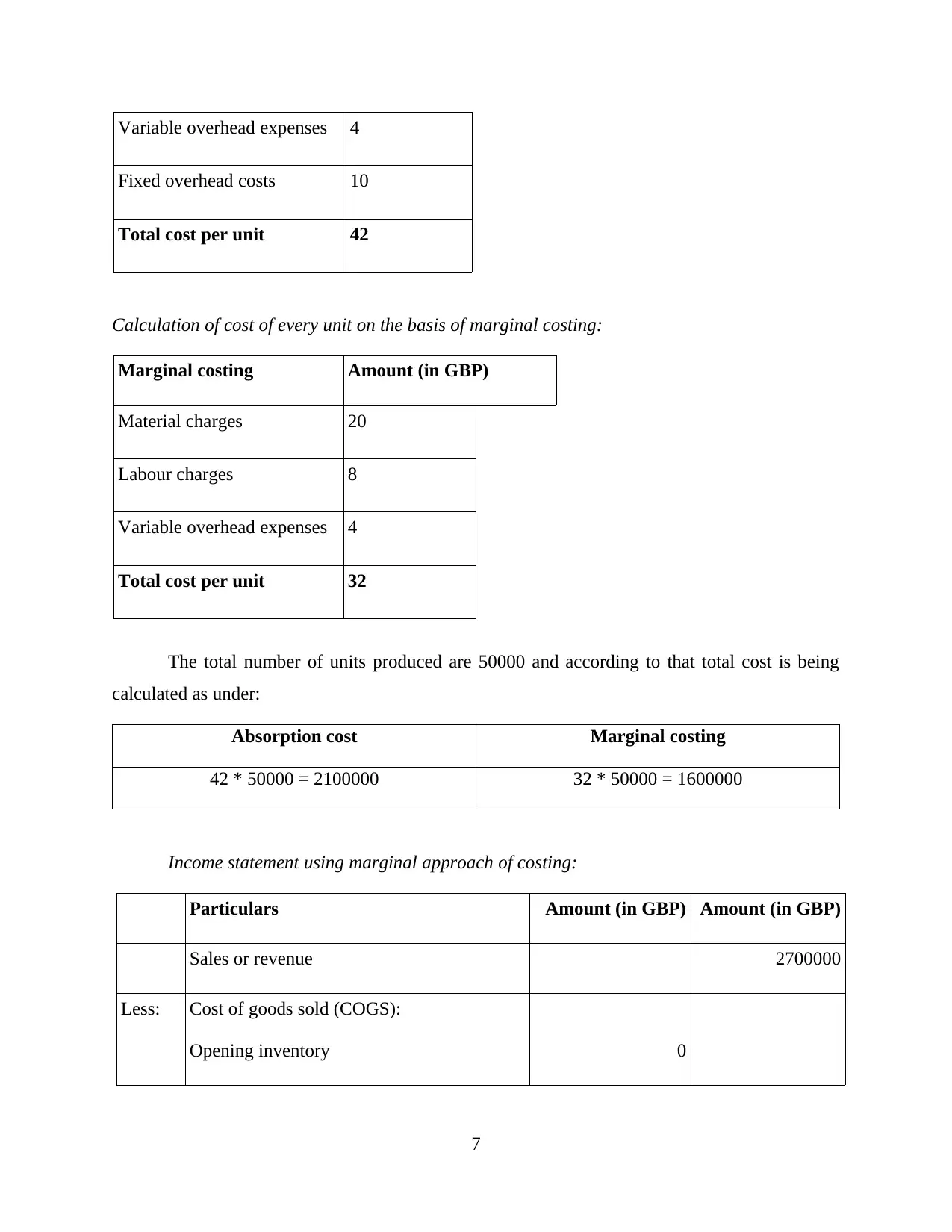

Income statement using marginal approach of costing:

Particulars Amount (in GBP) Amount (in GBP)

Sales or revenue 2700000

Less: Cost of goods sold (COGS):

Opening inventory 0

7

Fixed overhead costs 10

Total cost per unit 42

Calculation of cost of every unit on the basis of marginal costing:

Marginal costing Amount (in GBP)

Material charges 20

Labour charges 8

Variable overhead expenses 4

Total cost per unit 32

The total number of units produced are 50000 and according to that total cost is being

calculated as under:

Absorption cost Marginal costing

42 * 50000 = 2100000 32 * 50000 = 1600000

Income statement using marginal approach of costing:

Particulars Amount (in GBP) Amount (in GBP)

Sales or revenue 2700000

Less: Cost of goods sold (COGS):

Opening inventory 0

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost of direct material 1000000

Cost of direct labour 400000

Variable factory overhead charges 200000

Less: Inventory at the end of year -320000 -1280000

Contribution 1420000 GBP

Less: Variable Selling and distribution Expenses 240000

Fixed Selling and distribution Expenses 600000

Fixed factory overhead charges 500000 -1340000

Net Income or profit (loss) 80000 GBP

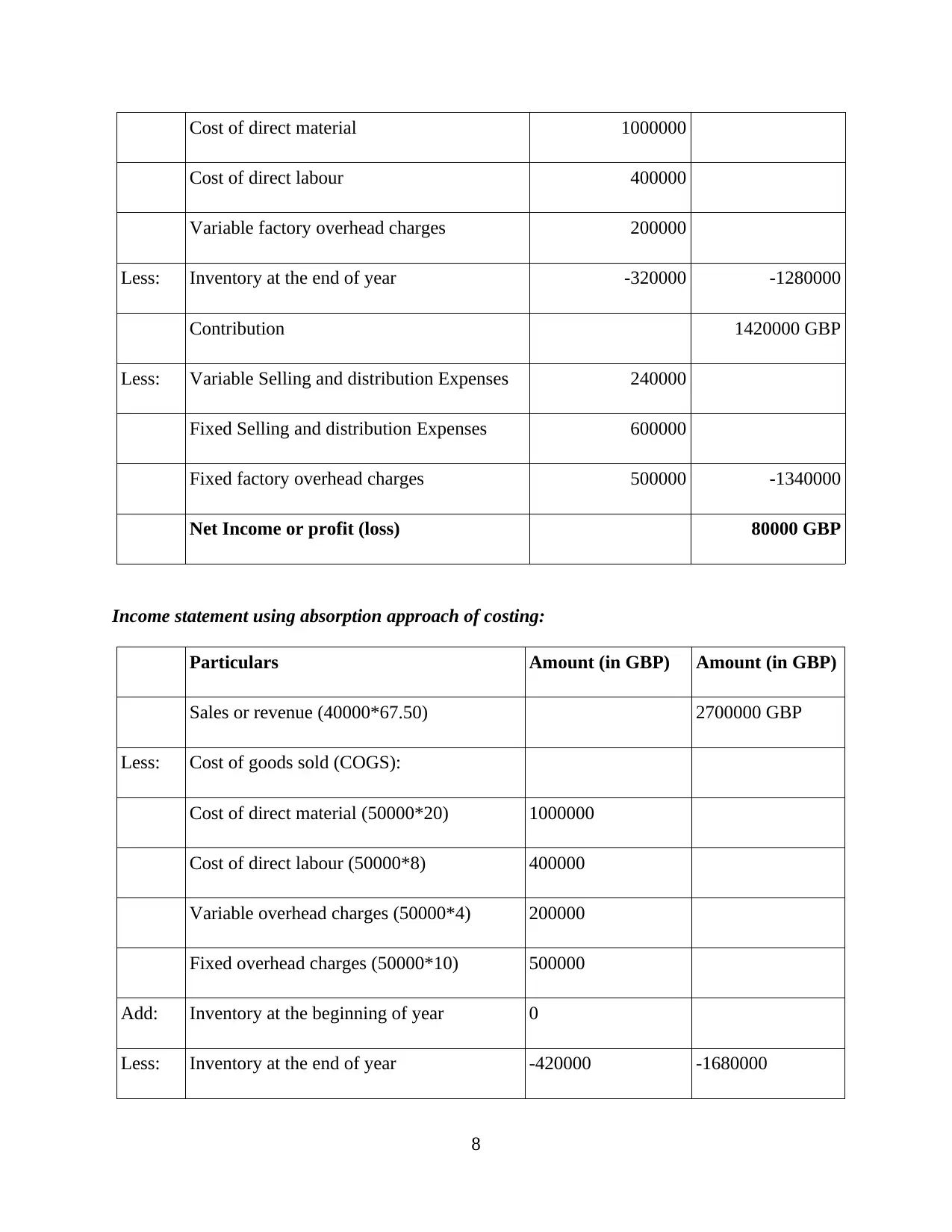

Income statement using absorption approach of costing:

Particulars Amount (in GBP) Amount (in GBP)

Sales or revenue (40000*67.50) 2700000 GBP

Less: Cost of goods sold (COGS):

Cost of direct material (50000*20) 1000000

Cost of direct labour (50000*8) 400000

Variable overhead charges (50000*4) 200000

Fixed overhead charges (50000*10) 500000

Add: Inventory at the beginning of year 0

Less: Inventory at the end of year -420000 -1680000

8

Cost of direct labour 400000

Variable factory overhead charges 200000

Less: Inventory at the end of year -320000 -1280000

Contribution 1420000 GBP

Less: Variable Selling and distribution Expenses 240000

Fixed Selling and distribution Expenses 600000

Fixed factory overhead charges 500000 -1340000

Net Income or profit (loss) 80000 GBP

Income statement using absorption approach of costing:

Particulars Amount (in GBP) Amount (in GBP)

Sales or revenue (40000*67.50) 2700000 GBP

Less: Cost of goods sold (COGS):

Cost of direct material (50000*20) 1000000

Cost of direct labour (50000*8) 400000

Variable overhead charges (50000*4) 200000

Fixed overhead charges (50000*10) 500000

Add: Inventory at the beginning of year 0

Less: Inventory at the end of year -420000 -1680000

8

Gross profit or income 1020000 GBP

Less: Non manufacturing costs

Variable Selling and distribution Expenses 240000

Fixed Selling and distribution Expenses 600000 -840000

Net income or profit (loss) 180000 GBP

Thus, on the basis of above discussion, it is clear that absorption cost is better for Dell

since it rightly recognises the importance of including fixed production cost while determining

product cost in a suitable pricing policy. Further, the pricing based on absorption costing also

ensures that all costs are recovered and the pricing is also determined in terms of only variable

costs. However, in this type of costing, it is also crucial for Dell to focus on preparing accurate

reports which includes different costs.

TASK 3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

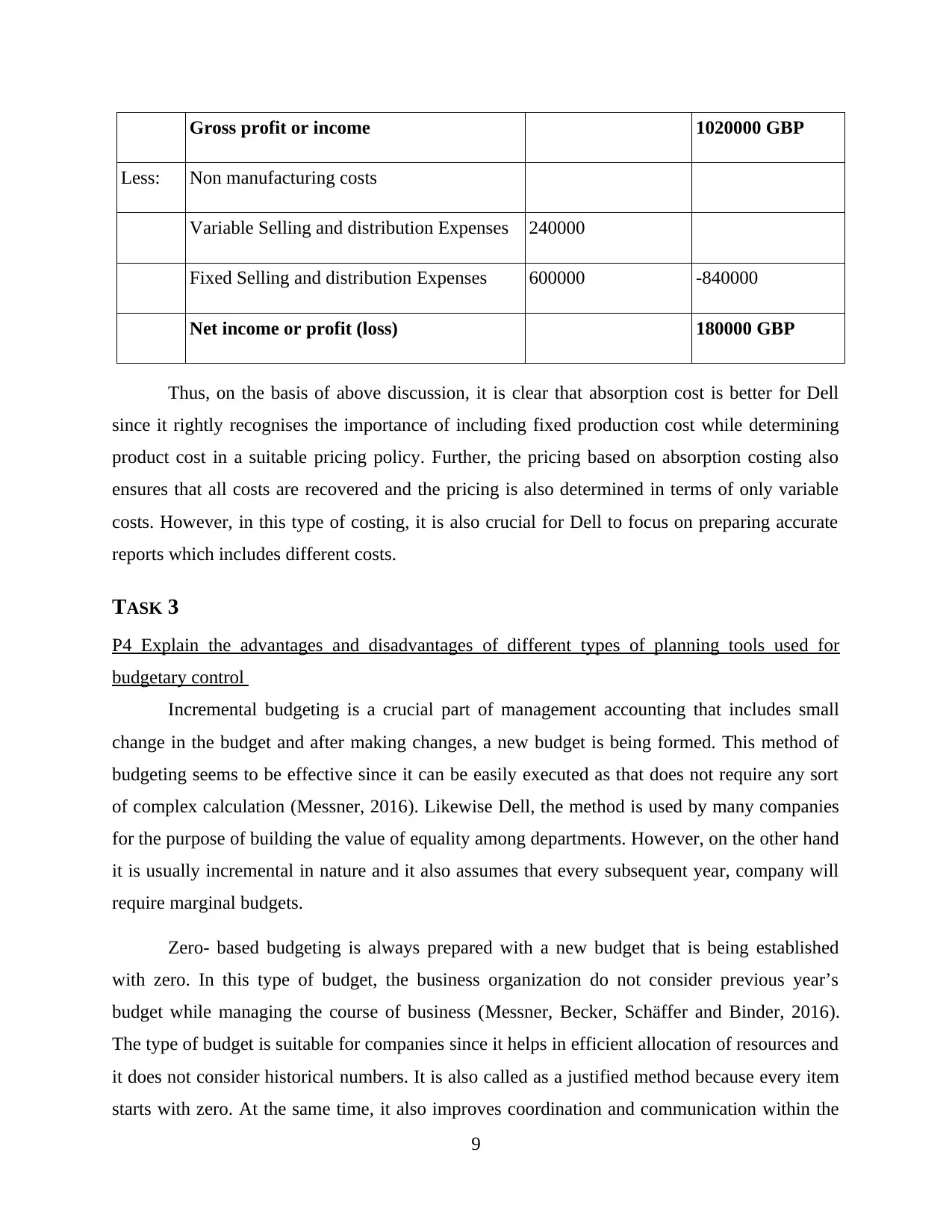

Incremental budgeting is a crucial part of management accounting that includes small

change in the budget and after making changes, a new budget is being formed. This method of

budgeting seems to be effective since it can be easily executed as that does not require any sort

of complex calculation (Messner, 2016). Likewise Dell, the method is used by many companies

for the purpose of building the value of equality among departments. However, on the other hand

it is usually incremental in nature and it also assumes that every subsequent year, company will

require marginal budgets.

Zero- based budgeting is always prepared with a new budget that is being established

with zero. In this type of budget, the business organization do not consider previous year’s

budget while managing the course of business (Messner, Becker, Schäffer and Binder, 2016).

The type of budget is suitable for companies since it helps in efficient allocation of resources and

it does not consider historical numbers. It is also called as a justified method because every item

starts with zero. At the same time, it also improves coordination and communication within the

9

Less: Non manufacturing costs

Variable Selling and distribution Expenses 240000

Fixed Selling and distribution Expenses 600000 -840000

Net income or profit (loss) 180000 GBP

Thus, on the basis of above discussion, it is clear that absorption cost is better for Dell

since it rightly recognises the importance of including fixed production cost while determining

product cost in a suitable pricing policy. Further, the pricing based on absorption costing also

ensures that all costs are recovered and the pricing is also determined in terms of only variable

costs. However, in this type of costing, it is also crucial for Dell to focus on preparing accurate

reports which includes different costs.

TASK 3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

Incremental budgeting is a crucial part of management accounting that includes small

change in the budget and after making changes, a new budget is being formed. This method of

budgeting seems to be effective since it can be easily executed as that does not require any sort

of complex calculation (Messner, 2016). Likewise Dell, the method is used by many companies

for the purpose of building the value of equality among departments. However, on the other hand

it is usually incremental in nature and it also assumes that every subsequent year, company will

require marginal budgets.

Zero- based budgeting is always prepared with a new budget that is being established

with zero. In this type of budget, the business organization do not consider previous year’s

budget while managing the course of business (Messner, Becker, Schäffer and Binder, 2016).

The type of budget is suitable for companies since it helps in efficient allocation of resources and

it does not consider historical numbers. It is also called as a justified method because every item

starts with zero. At the same time, it also improves coordination and communication within the

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

departments which aids the employees to manage all their work aspects in prominent manner.

However, on other hand, the method requires efficient and trained employees who have the

knowledge to solve complex tasks.

Variance analysis has been used in the companies for the purpose of explaining the

situation wherein actual result or outcome of any event produces different values as compared to

the planned values (Nasseri, Yazdifar and Askarany, 2016). Variance analysis is an appropriate

tool to assess the performance of managers; however at the same time, it requires proper analysis

because mistakes and omissions cannot be afforded. Contrary to this, variance analysis does not

specify the value of raw information that is applied to decision making process. Thus, it requires

actual amount of business assets in all domains.

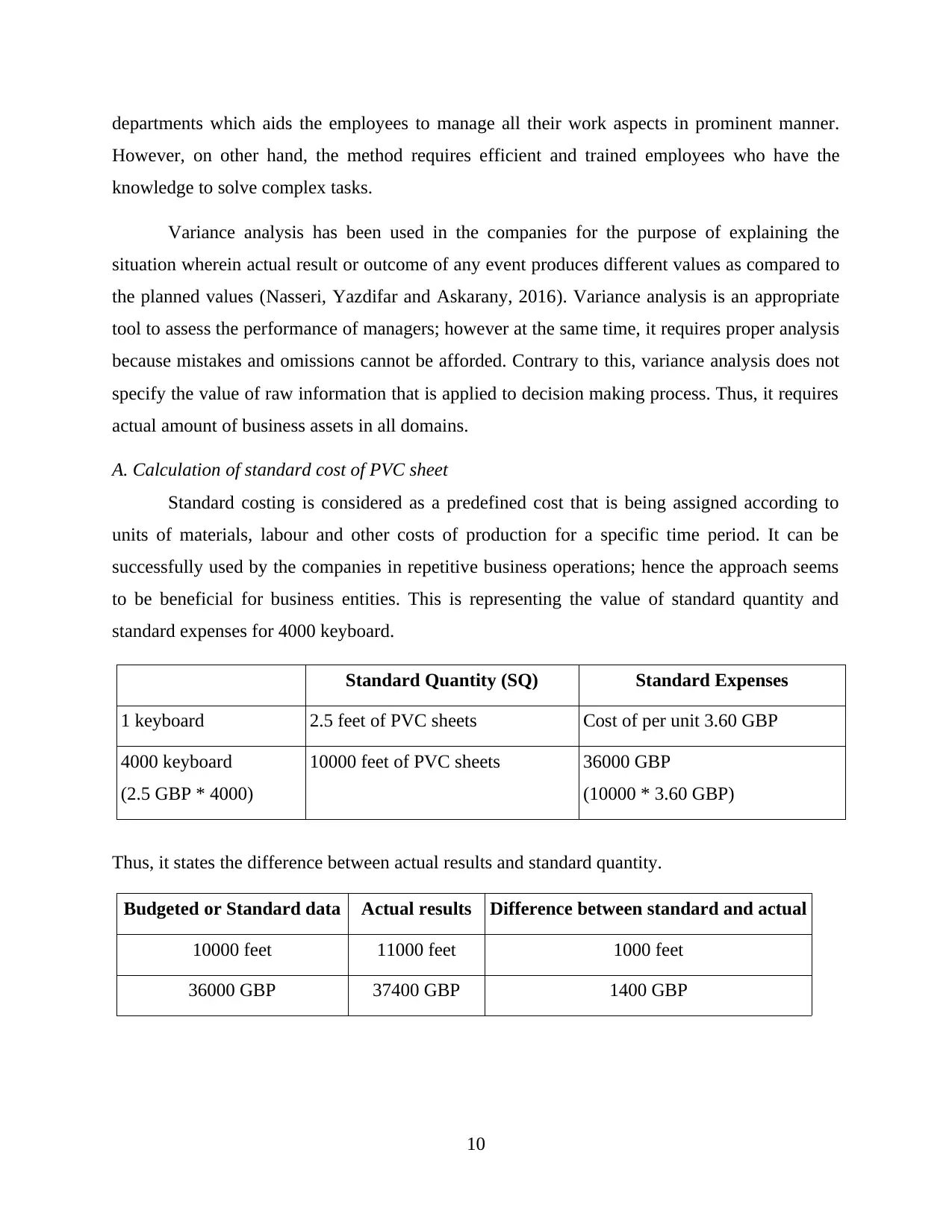

A. Calculation of standard cost of PVC sheet

Standard costing is considered as a predefined cost that is being assigned according to

units of materials, labour and other costs of production for a specific time period. It can be

successfully used by the companies in repetitive business operations; hence the approach seems

to be beneficial for business entities. This is representing the value of standard quantity and

standard expenses for 4000 keyboard.

Standard Quantity (SQ) Standard Expenses

1 keyboard 2.5 feet of PVC sheets Cost of per unit 3.60 GBP

4000 keyboard

(2.5 GBP * 4000)

10000 feet of PVC sheets 36000 GBP

(10000 * 3.60 GBP)

Thus, it states the difference between actual results and standard quantity.

Budgeted or Standard data Actual results Difference between standard and actual

10000 feet 11000 feet 1000 feet

36000 GBP 37400 GBP 1400 GBP

10

However, on other hand, the method requires efficient and trained employees who have the

knowledge to solve complex tasks.

Variance analysis has been used in the companies for the purpose of explaining the

situation wherein actual result or outcome of any event produces different values as compared to

the planned values (Nasseri, Yazdifar and Askarany, 2016). Variance analysis is an appropriate

tool to assess the performance of managers; however at the same time, it requires proper analysis

because mistakes and omissions cannot be afforded. Contrary to this, variance analysis does not

specify the value of raw information that is applied to decision making process. Thus, it requires

actual amount of business assets in all domains.

A. Calculation of standard cost of PVC sheet

Standard costing is considered as a predefined cost that is being assigned according to

units of materials, labour and other costs of production for a specific time period. It can be

successfully used by the companies in repetitive business operations; hence the approach seems

to be beneficial for business entities. This is representing the value of standard quantity and

standard expenses for 4000 keyboard.

Standard Quantity (SQ) Standard Expenses

1 keyboard 2.5 feet of PVC sheets Cost of per unit 3.60 GBP

4000 keyboard

(2.5 GBP * 4000)

10000 feet of PVC sheets 36000 GBP

(10000 * 3.60 GBP)

Thus, it states the difference between actual results and standard quantity.

Budgeted or Standard data Actual results Difference between standard and actual

10000 feet 11000 feet 1000 feet

36000 GBP 37400 GBP 1400 GBP

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

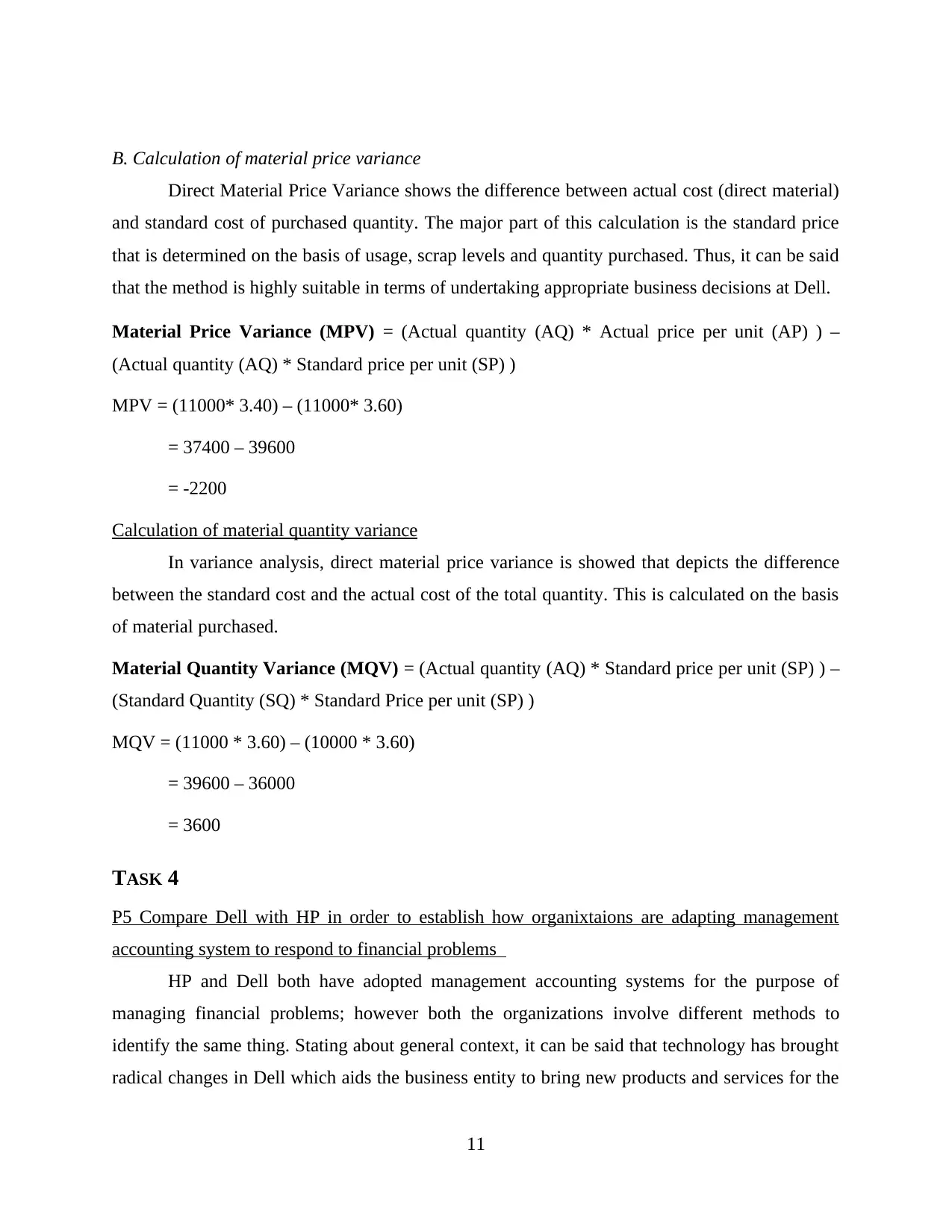

B. Calculation of material price variance

Direct Material Price Variance shows the difference between actual cost (direct material)

and standard cost of purchased quantity. The major part of this calculation is the standard price

that is determined on the basis of usage, scrap levels and quantity purchased. Thus, it can be said

that the method is highly suitable in terms of undertaking appropriate business decisions at Dell.

Material Price Variance (MPV) = (Actual quantity (AQ) * Actual price per unit (AP) ) –

(Actual quantity (AQ) * Standard price per unit (SP) )

MPV = (11000* 3.40) – (11000* 3.60)

= 37400 – 39600

= -2200

Calculation of material quantity variance

In variance analysis, direct material price variance is showed that depicts the difference

between the standard cost and the actual cost of the total quantity. This is calculated on the basis

of material purchased.

Material Quantity Variance (MQV) = (Actual quantity (AQ) * Standard price per unit (SP) ) –

(Standard Quantity (SQ) * Standard Price per unit (SP) )

MQV = (11000 * 3.60) – (10000 * 3.60)

= 39600 – 36000

= 3600

TASK 4

P5 Compare Dell with HP in order to establish how organixtaions are adapting management

accounting system to respond to financial problems

HP and Dell both have adopted management accounting systems for the purpose of

managing financial problems; however both the organizations involve different methods to

identify the same thing. Stating about general context, it can be said that technology has brought

radical changes in Dell which aids the business entity to bring new products and services for the

11

Direct Material Price Variance shows the difference between actual cost (direct material)

and standard cost of purchased quantity. The major part of this calculation is the standard price

that is determined on the basis of usage, scrap levels and quantity purchased. Thus, it can be said

that the method is highly suitable in terms of undertaking appropriate business decisions at Dell.

Material Price Variance (MPV) = (Actual quantity (AQ) * Actual price per unit (AP) ) –

(Actual quantity (AQ) * Standard price per unit (SP) )

MPV = (11000* 3.40) – (11000* 3.60)

= 37400 – 39600

= -2200

Calculation of material quantity variance

In variance analysis, direct material price variance is showed that depicts the difference

between the standard cost and the actual cost of the total quantity. This is calculated on the basis

of material purchased.

Material Quantity Variance (MQV) = (Actual quantity (AQ) * Standard price per unit (SP) ) –

(Standard Quantity (SQ) * Standard Price per unit (SP) )

MQV = (11000 * 3.60) – (10000 * 3.60)

= 39600 – 36000

= 3600

TASK 4

P5 Compare Dell with HP in order to establish how organixtaions are adapting management

accounting system to respond to financial problems

HP and Dell both have adopted management accounting systems for the purpose of

managing financial problems; however both the organizations involve different methods to

identify the same thing. Stating about general context, it can be said that technology has brought

radical changes in Dell which aids the business entity to bring new products and services for the

11

end users. Such services are technologically concerned and also aids in enhancing the ratio of

innovation (Otley and Emmanuel, 2013).

Thus, comparing both the companies, it can be said that Dell is engaged in developing,

selling and repairing computers and other products that are technologically concerned. Further,

Dell is also considered as the largest technological corporations in the world that provides quality

associated and effective services to the end users. The company is also suitable for the end users

since it supplies innovative services to the customers which enhances sales and profitability

aspects. Configured systems are also delivered by the business entity in many areas.

However, on the other hand HP is considered as the king in laptop technology as the

brand has highly competent products and services. HP is populous because the business has

variety of hardware and software components that are highly user friendly (Tucker and Lowe,

2014). All sorts of computer products are being provided by HP to different customers which

also enhances the success and growth aspects. The company is also active on online distribution

of computer services; thus it makes the brand more competent among the end users. Similarly,

HP also has consulting services which helps the partners to deliver appropriate products to the

end users.

Nonetheless, it is also identified that both HP and Dell are using variance analysis so as

to determine the budgetary aspects. This also aids the business entities to compute standard and

actual cost as per the products sold to the market place. Such method is also used for the purpose

of planning actual results and effects of the difference between two companies. This is measured

on the basis of comparing the performance aspects of the business entities (Renz, 2016).

Hence, this ensures to adopt suitable decisions for the business entity. Similarly, it is also

analysed that Dell has been focusing on incremental budgeting which holds most important role

in management accounting processes. However, the method ensures to re-calculate the budgetary

aspects in terms of adopting diverse measures for budget management. Thus, according to the

technique the management assumes that all the departments will manage their existing business

operations at current level of expenditure.

However, on the other hand, additions will also be made in the causing reduction in the

budgetary aspects. Therefore, it can be said that an increment budgeting is useful for Dell

12

innovation (Otley and Emmanuel, 2013).

Thus, comparing both the companies, it can be said that Dell is engaged in developing,

selling and repairing computers and other products that are technologically concerned. Further,

Dell is also considered as the largest technological corporations in the world that provides quality

associated and effective services to the end users. The company is also suitable for the end users

since it supplies innovative services to the customers which enhances sales and profitability

aspects. Configured systems are also delivered by the business entity in many areas.

However, on the other hand HP is considered as the king in laptop technology as the

brand has highly competent products and services. HP is populous because the business has

variety of hardware and software components that are highly user friendly (Tucker and Lowe,

2014). All sorts of computer products are being provided by HP to different customers which

also enhances the success and growth aspects. The company is also active on online distribution

of computer services; thus it makes the brand more competent among the end users. Similarly,

HP also has consulting services which helps the partners to deliver appropriate products to the

end users.

Nonetheless, it is also identified that both HP and Dell are using variance analysis so as

to determine the budgetary aspects. This also aids the business entities to compute standard and

actual cost as per the products sold to the market place. Such method is also used for the purpose

of planning actual results and effects of the difference between two companies. This is measured

on the basis of comparing the performance aspects of the business entities (Renz, 2016).

Hence, this ensures to adopt suitable decisions for the business entity. Similarly, it is also

analysed that Dell has been focusing on incremental budgeting which holds most important role

in management accounting processes. However, the method ensures to re-calculate the budgetary

aspects in terms of adopting diverse measures for budget management. Thus, according to the

technique the management assumes that all the departments will manage their existing business

operations at current level of expenditure.

However, on the other hand, additions will also be made in the causing reduction in the

budgetary aspects. Therefore, it can be said that an increment budgeting is useful for Dell

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.