Management Accounting System Analysis for IMDA Tech Limited

VerifiedAdded on 2020/06/06

|17

|5411

|83

Report

AI Summary

This report provides a comprehensive analysis of management accounting systems, focusing on IMDA Tech Ltd, a retail firm producing mobile chargers and technical gadgets. It explores the essential requirements of different management accounting systems, including price optimization, cost accounting, inventory management, and job costing, outlining their applications for IMDA Tech Ltd. The report then delves into various methods of management accounting reporting, such as account receivable reports, performance reporting, job costing reports, inventory management reports, and budget operating reports, emphasizing their importance for effective decision-making. A critical analysis of the reporting system is also included. Furthermore, the report examines different costing methods like absorption costing and marginal costing, comparing their applications. The report also covers the advantages and disadvantages of different planning tools. Finally, it addresses how enterprises adapt management accounting systems to respond to financial problems, highlighting the advantages of these systems and the application of various techniques and planning tools, concluding that management accounting leads to the sustainable success of an organization.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

FROM: MANAGEMENT ACCOUNTING OFFICER..................................................................1

TO,...................................................................................................................................................1

GENERAL MANAGER..................................................................................................................1

IMDA tech limited...........................................................................................................................1

SUB: MANAGEMENT ACCOUNTING SYSTEM .....................................................................1

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting system and essential requirements of its different types..............1

P2 Methods of management accounting reporting......................................................................3

D1 Critical analysis of reporting system.....................................................................................5

TASK 2............................................................................................................................................5

P3 Few costing methods considered in management accounting...............................................5

D2 Critical analyse of income statements...................................................................................8

TASK 3............................................................................................................................................9

P4 Advantages and disadvantages of different type of planning tools.......................................9

TASK 4..........................................................................................................................................11

P5 Enterprises are adapting management accounting systems to respond financial problems.11

M1 Advantages of management accounting systems and its applications...............................12

M2 Application of various techniques of management accounting..........................................12

M3 Use of various tools of planning.........................................................................................12

D3 Planning tools for accounting respond to solve financial issues.........................................13

M4 management accounting leads to sustainable success of organisation...............................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

FROM: MANAGEMENT ACCOUNTING OFFICER..................................................................1

TO,...................................................................................................................................................1

GENERAL MANAGER..................................................................................................................1

IMDA tech limited...........................................................................................................................1

SUB: MANAGEMENT ACCOUNTING SYSTEM .....................................................................1

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting system and essential requirements of its different types..............1

P2 Methods of management accounting reporting......................................................................3

D1 Critical analysis of reporting system.....................................................................................5

TASK 2............................................................................................................................................5

P3 Few costing methods considered in management accounting...............................................5

D2 Critical analyse of income statements...................................................................................8

TASK 3............................................................................................................................................9

P4 Advantages and disadvantages of different type of planning tools.......................................9

TASK 4..........................................................................................................................................11

P5 Enterprises are adapting management accounting systems to respond financial problems.11

M1 Advantages of management accounting systems and its applications...............................12

M2 Application of various techniques of management accounting..........................................12

M3 Use of various tools of planning.........................................................................................12

D3 Planning tools for accounting respond to solve financial issues.........................................13

M4 management accounting leads to sustainable success of organisation...............................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

FROM: MANAGEMENT ACCOUNTING OFFICER

TO,

GENERAL MANAGER

IMDA tech limited

SUB: MANAGEMENT ACCOUNTING SYSTEM

INTRODUCTION

Management refers to managing business operations and activities in a way that

enterprise can achieve its set objectives and goals. Management accounting is a provision of

various financial and non financial data which help managers in take effective decisions. This is

one of the most essential part of every business enterprise whether it is small, medium or large.

One of the main feature of this concept is that it help managers in achieve set goals and

objectives and contribute more in growth of company. This tool help managers in collect

information related with financial situation of firm which help enterprise in take effective

decisions related with various activities such as planning, organising, directing and controlling.

Different type of financial reports are made in an enterprise in order to record daily financial

transaction of company. IMDA tech limited a retail firm who produce mobile charges and other

technical gadgets is taken under this report for study. Different type of management accounting

system and various methods which an enterprise can use for reporting is all detailed in this.

Further, different planning tools with their advantages and advantages is given in this report.

Along with this, adaption of various system of management accounting by different enterprises

to solve financial problems is also given.

TASK 1

P1. Management accounting system and essential requirements of its different types

If an organisation desire to gain benefits in business and commercial industry it is not a

hard process if there is appropriate sources available (Albelda, 2011). Decades back, the

organisation used to work on the monetary and financial activities focusing over solution through

the help of them, but with increasing business activities, the new issues and problems emerged

such as glocalisation, high competition, governments etc. Management accounting render a

company many perks in the sales increments and decision making process regard of investments.

1

TO,

GENERAL MANAGER

IMDA tech limited

SUB: MANAGEMENT ACCOUNTING SYSTEM

INTRODUCTION

Management refers to managing business operations and activities in a way that

enterprise can achieve its set objectives and goals. Management accounting is a provision of

various financial and non financial data which help managers in take effective decisions. This is

one of the most essential part of every business enterprise whether it is small, medium or large.

One of the main feature of this concept is that it help managers in achieve set goals and

objectives and contribute more in growth of company. This tool help managers in collect

information related with financial situation of firm which help enterprise in take effective

decisions related with various activities such as planning, organising, directing and controlling.

Different type of financial reports are made in an enterprise in order to record daily financial

transaction of company. IMDA tech limited a retail firm who produce mobile charges and other

technical gadgets is taken under this report for study. Different type of management accounting

system and various methods which an enterprise can use for reporting is all detailed in this.

Further, different planning tools with their advantages and advantages is given in this report.

Along with this, adaption of various system of management accounting by different enterprises

to solve financial problems is also given.

TASK 1

P1. Management accounting system and essential requirements of its different types

If an organisation desire to gain benefits in business and commercial industry it is not a

hard process if there is appropriate sources available (Albelda, 2011). Decades back, the

organisation used to work on the monetary and financial activities focusing over solution through

the help of them, but with increasing business activities, the new issues and problems emerged

such as glocalisation, high competition, governments etc. Management accounting render a

company many perks in the sales increments and decision making process regard of investments.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

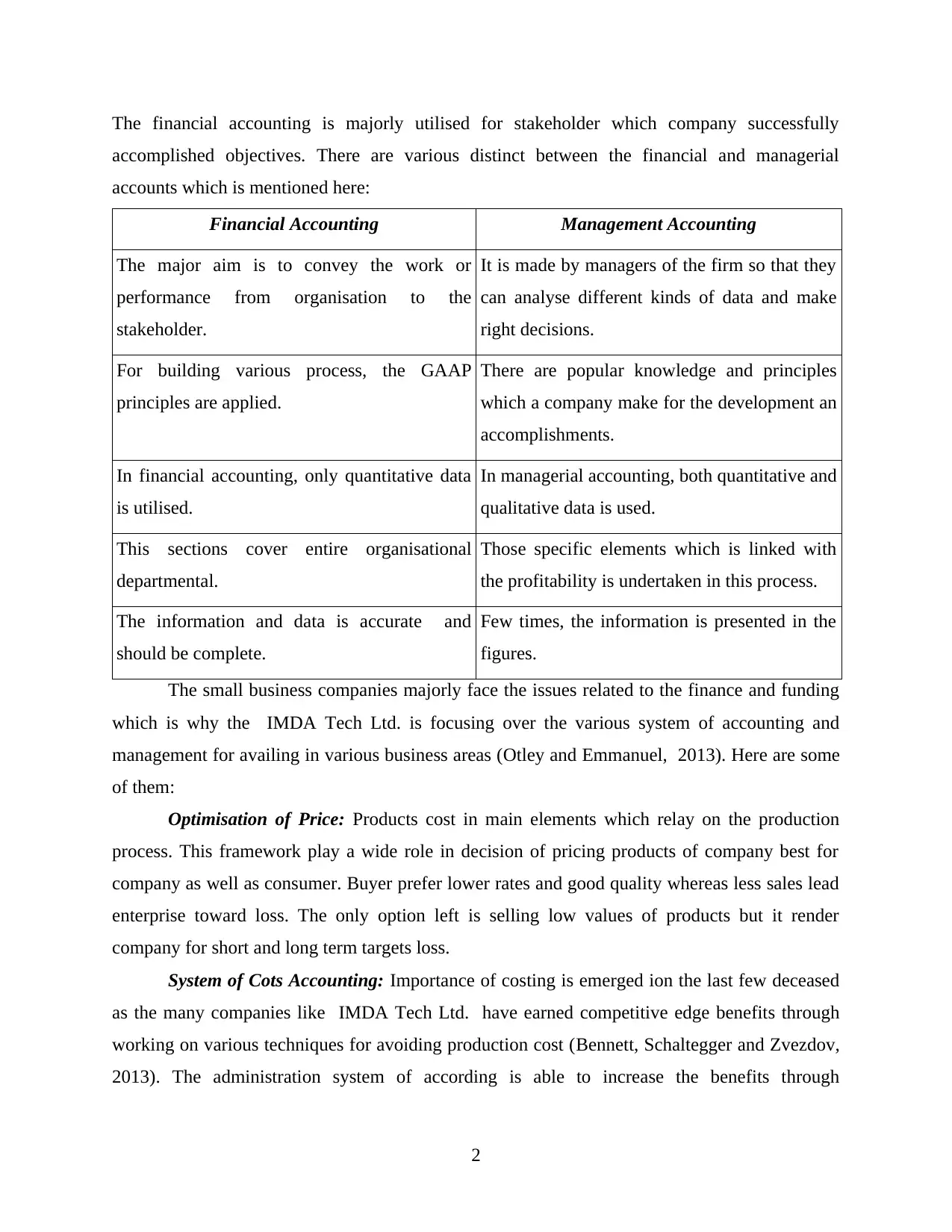

The financial accounting is majorly utilised for stakeholder which company successfully

accomplished objectives. There are various distinct between the financial and managerial

accounts which is mentioned here:

Financial Accounting Management Accounting

The major aim is to convey the work or

performance from organisation to the

stakeholder.

It is made by managers of the firm so that they

can analyse different kinds of data and make

right decisions.

For building various process, the GAAP

principles are applied.

There are popular knowledge and principles

which a company make for the development an

accomplishments.

In financial accounting, only quantitative data

is utilised.

In managerial accounting, both quantitative and

qualitative data is used.

This sections cover entire organisational

departmental.

Those specific elements which is linked with

the profitability is undertaken in this process.

The information and data is accurate and

should be complete.

Few times, the information is presented in the

figures.

The small business companies majorly face the issues related to the finance and funding

which is why the IMDA Tech Ltd. is focusing over the various system of accounting and

management for availing in various business areas (Otley and Emmanuel, 2013). Here are some

of them:

Optimisation of Price: Products cost in main elements which relay on the production

process. This framework play a wide role in decision of pricing products of company best for

company as well as consumer. Buyer prefer lower rates and good quality whereas less sales lead

enterprise toward loss. The only option left is selling low values of products but it render

company for short and long term targets loss.

System of Cots Accounting: Importance of costing is emerged ion the last few deceased

as the many companies like IMDA Tech Ltd. have earned competitive edge benefits through

working on various techniques for avoiding production cost (Bennett, Schaltegger and Zvezdov,

2013). The administration system of according is able to increase the benefits through

2

accomplished objectives. There are various distinct between the financial and managerial

accounts which is mentioned here:

Financial Accounting Management Accounting

The major aim is to convey the work or

performance from organisation to the

stakeholder.

It is made by managers of the firm so that they

can analyse different kinds of data and make

right decisions.

For building various process, the GAAP

principles are applied.

There are popular knowledge and principles

which a company make for the development an

accomplishments.

In financial accounting, only quantitative data

is utilised.

In managerial accounting, both quantitative and

qualitative data is used.

This sections cover entire organisational

departmental.

Those specific elements which is linked with

the profitability is undertaken in this process.

The information and data is accurate and

should be complete.

Few times, the information is presented in the

figures.

The small business companies majorly face the issues related to the finance and funding

which is why the IMDA Tech Ltd. is focusing over the various system of accounting and

management for availing in various business areas (Otley and Emmanuel, 2013). Here are some

of them:

Optimisation of Price: Products cost in main elements which relay on the production

process. This framework play a wide role in decision of pricing products of company best for

company as well as consumer. Buyer prefer lower rates and good quality whereas less sales lead

enterprise toward loss. The only option left is selling low values of products but it render

company for short and long term targets loss.

System of Cots Accounting: Importance of costing is emerged ion the last few deceased

as the many companies like IMDA Tech Ltd. have earned competitive edge benefits through

working on various techniques for avoiding production cost (Bennett, Schaltegger and Zvezdov,

2013). The administration system of according is able to increase the benefits through

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

recognising and removing the resource wastages, This can also deliver information linked with

profitability through

Inventory Management System: This system allows their worker in managing and strong

the information or data in the inventory software which have entered in stores as well as in

warehouse. This framework render the information about products quality that a company should

keep in their stores. This can help IMDA Tech Ltd. in managing commodities and tracking the

system through using various effective techniques as well as avail in production and

manufacture process. Through this, conflicts in context of supply chain can be resolved.

Costing of Job: In last few years, this system have gained popularity in business

industries and have positive impact. Every job benefits is checked in the job for increasing

revenues and reducing job that are not useful for burden for additional organisation.

Management Accounting System Application for IDEA Tech. Ltd.: Price Optimisation: IMDA Tech Ltd. Is selling various item on their stores as well as

through optimising this framework, they can determine proper prices of products. This

can impact on the pricing system and satisfy needs of consumer as well. System of Cost Accounting: IMDA Tech Ltd. Can use it for removing waste of resources

as well as recognising various working areas. It can avail in decreasing downs and

increase benefits. Inventory management System: For a tech. Companies like IMDA Tech Ltd., there are

various areas of expenditure and sales. Through this system company can manage entire

information system linked with billing, production, expenses, sales etc.

Job Costing: Some of job at IMDA Tech Ltd are not benefiting company as much as they

should. From this report, organization can increase more abilities and beneficial jobs that

can enhance the profitability of enterprise.

P2 Methods of management accounting reporting

Meaning: This refer to a systematic information delivering procedure to the management's

reflective stages so as altering potency analysing in responsibility centre. This have become

proper base for making the proper action which is necessary for the organisation as well.

Professional and developing practices of accounting is fundamental for any business

organisation. Management accounting dissent from system of financial accounting that avail in

developing reports from internal stakeholders from IMDA Tech Ltd as outside stakeholder

3

profitability through

Inventory Management System: This system allows their worker in managing and strong

the information or data in the inventory software which have entered in stores as well as in

warehouse. This framework render the information about products quality that a company should

keep in their stores. This can help IMDA Tech Ltd. in managing commodities and tracking the

system through using various effective techniques as well as avail in production and

manufacture process. Through this, conflicts in context of supply chain can be resolved.

Costing of Job: In last few years, this system have gained popularity in business

industries and have positive impact. Every job benefits is checked in the job for increasing

revenues and reducing job that are not useful for burden for additional organisation.

Management Accounting System Application for IDEA Tech. Ltd.: Price Optimisation: IMDA Tech Ltd. Is selling various item on their stores as well as

through optimising this framework, they can determine proper prices of products. This

can impact on the pricing system and satisfy needs of consumer as well. System of Cost Accounting: IMDA Tech Ltd. Can use it for removing waste of resources

as well as recognising various working areas. It can avail in decreasing downs and

increase benefits. Inventory management System: For a tech. Companies like IMDA Tech Ltd., there are

various areas of expenditure and sales. Through this system company can manage entire

information system linked with billing, production, expenses, sales etc.

Job Costing: Some of job at IMDA Tech Ltd are not benefiting company as much as they

should. From this report, organization can increase more abilities and beneficial jobs that

can enhance the profitability of enterprise.

P2 Methods of management accounting reporting

Meaning: This refer to a systematic information delivering procedure to the management's

reflective stages so as altering potency analysing in responsibility centre. This have become

proper base for making the proper action which is necessary for the organisation as well.

Professional and developing practices of accounting is fundamental for any business

organisation. Management accounting dissent from system of financial accounting that avail in

developing reports from internal stakeholders from IMDA Tech Ltd as outside stakeholder

3

opposed. In the company (Bodie, 2013). This is required to attain the objectives and goals for

which work occur. Development and sustainability is initial part of any manager accounting. For

it they make use of system of reporting in order to track and store records or transactions. This

can help in securing and collecting various gathered information from differ Dept. such as

Operations, marketing, JHR and other. The IMDA Tech. Ltd can utilise to review entire

statements and reports for proper decision making.

Importance of Reporting System

Here is the importance of reporting system in management accounting:

This can avail in employer in seeking the several different mistakes that organisation is

going through linked with debtors, creditors and investors.

It can help in utilising the various important strategies in effective way so strategies can

be built on accomplishing aims step for long terms business. It can support entire divisions as well a avail in establishing an organised process for

worker to make it more beneficial.

Types of Reporting System

Account Receivable report: According to this system of reporting, each data and

information linked with the bills and unpaid customer as list would be described along with

dates. The major objectives of this techniques is to evaluate payback time of prominent amounts

of debts.

System of Performance Reporting: IN this system, it states that the financial system of

company is analysed in a way to review performance of company. IN order to make the better

decision or judgements for company, the organisation need to make the report of performance

every year. This consist of analysing accounting details of IMDA Tech. Ltd as well as various

working members. This evaluation is done by gathering and reviewing past and present data of

organisation.

Report of Job Costing: This is linked with the entire costs of IMDA Tech Ltd that is

linked with entire produced and manufacturing gods during the period of time. This consist of

linked information with labour, maternity, expenses that are utilised. The major purpose of

utilising this report is to analysing the entire cost of the products of enterprise of each products

size.

4

which work occur. Development and sustainability is initial part of any manager accounting. For

it they make use of system of reporting in order to track and store records or transactions. This

can help in securing and collecting various gathered information from differ Dept. such as

Operations, marketing, JHR and other. The IMDA Tech. Ltd can utilise to review entire

statements and reports for proper decision making.

Importance of Reporting System

Here is the importance of reporting system in management accounting:

This can avail in employer in seeking the several different mistakes that organisation is

going through linked with debtors, creditors and investors.

It can help in utilising the various important strategies in effective way so strategies can

be built on accomplishing aims step for long terms business. It can support entire divisions as well a avail in establishing an organised process for

worker to make it more beneficial.

Types of Reporting System

Account Receivable report: According to this system of reporting, each data and

information linked with the bills and unpaid customer as list would be described along with

dates. The major objectives of this techniques is to evaluate payback time of prominent amounts

of debts.

System of Performance Reporting: IN this system, it states that the financial system of

company is analysed in a way to review performance of company. IN order to make the better

decision or judgements for company, the organisation need to make the report of performance

every year. This consist of analysing accounting details of IMDA Tech. Ltd as well as various

working members. This evaluation is done by gathering and reviewing past and present data of

organisation.

Report of Job Costing: This is linked with the entire costs of IMDA Tech Ltd that is

linked with entire produced and manufacturing gods during the period of time. This consist of

linked information with labour, maternity, expenses that are utilised. The major purpose of

utilising this report is to analysing the entire cost of the products of enterprise of each products

size.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory management Report: This is one of the significant system of reporting that is

optimised for controlling and managing purpose for enterprise (Boyns and Edwards, 2013).

There are several tools in IMDA Tech. Ltd which can affect in operations including inventory

turnover aggregate, EOQ, costing of ABC etc.

Budget Operating: It is associated with the cost of manufacture that is straightly linked

with the expense and income of IMDA Tech. Ltd. Organisation during the year. The objectives

of utilising this report is to decide the exact cost that is going to obtain to review or investigate

expenses of operations such as budget of sales, manufacture etc.

D1 Critical analysis of reporting system

In IMDA Tech Ltd, each worker and divisions of organisation is performing and working

their roles for attaining common objectives. The utilisation of proper system of reporting can

avail in organisation toward positive and effective outcome as well as benefits to the company.

The growth and profitability relay entirely on the system of reporting as this includes several

data and information related to statements of finance of organisation. The purpose of reporting

can be decide company performance along with working of every individual on company

operations (Macintosh and Quattrone, 2010). Critical investments on judgements or decision

making is made by the stakeholder through evaluating organisation reports in various

departments. Thus, this system can avail company organised functioning and lead to better

profitability or productivity of company.

TASK 2

P3 Few costing methods considered in management accounting

In the commercial and business environment, the statements of income can be adopted

through technique of management accounting involving absorption costing and marginal. Prior

one is trending concept as well as this focus over the decision making or judgements of

managerial activities along with dealing with the activity of production. Marginal Costing: The cost of manufacture and production process is linked with this

type of costing. This involves the cost of variable along with fixed cost on the same point

of time (DRURY, 2013). These methods can be utilised for the calculating cost purpose

of products and services through making the account of straight direct and overheads.

Absorption Costing: This refer to incurred cost of an organization like IMDA Tech. Ltd

with one extra unit production (What is absorption costing? 2017). If the cots can

5

optimised for controlling and managing purpose for enterprise (Boyns and Edwards, 2013).

There are several tools in IMDA Tech. Ltd which can affect in operations including inventory

turnover aggregate, EOQ, costing of ABC etc.

Budget Operating: It is associated with the cost of manufacture that is straightly linked

with the expense and income of IMDA Tech. Ltd. Organisation during the year. The objectives

of utilising this report is to decide the exact cost that is going to obtain to review or investigate

expenses of operations such as budget of sales, manufacture etc.

D1 Critical analysis of reporting system

In IMDA Tech Ltd, each worker and divisions of organisation is performing and working

their roles for attaining common objectives. The utilisation of proper system of reporting can

avail in organisation toward positive and effective outcome as well as benefits to the company.

The growth and profitability relay entirely on the system of reporting as this includes several

data and information related to statements of finance of organisation. The purpose of reporting

can be decide company performance along with working of every individual on company

operations (Macintosh and Quattrone, 2010). Critical investments on judgements or decision

making is made by the stakeholder through evaluating organisation reports in various

departments. Thus, this system can avail company organised functioning and lead to better

profitability or productivity of company.

TASK 2

P3 Few costing methods considered in management accounting

In the commercial and business environment, the statements of income can be adopted

through technique of management accounting involving absorption costing and marginal. Prior

one is trending concept as well as this focus over the decision making or judgements of

managerial activities along with dealing with the activity of production. Marginal Costing: The cost of manufacture and production process is linked with this

type of costing. This involves the cost of variable along with fixed cost on the same point

of time (DRURY, 2013). These methods can be utilised for the calculating cost purpose

of products and services through making the account of straight direct and overheads.

Absorption Costing: This refer to incurred cost of an organization like IMDA Tech. Ltd

with one extra unit production (What is absorption costing? 2017). If the cots can

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

charged higher for per unit then manufacturing extra marginal units cost, then this would

be effective for organisation to manufacture that units.

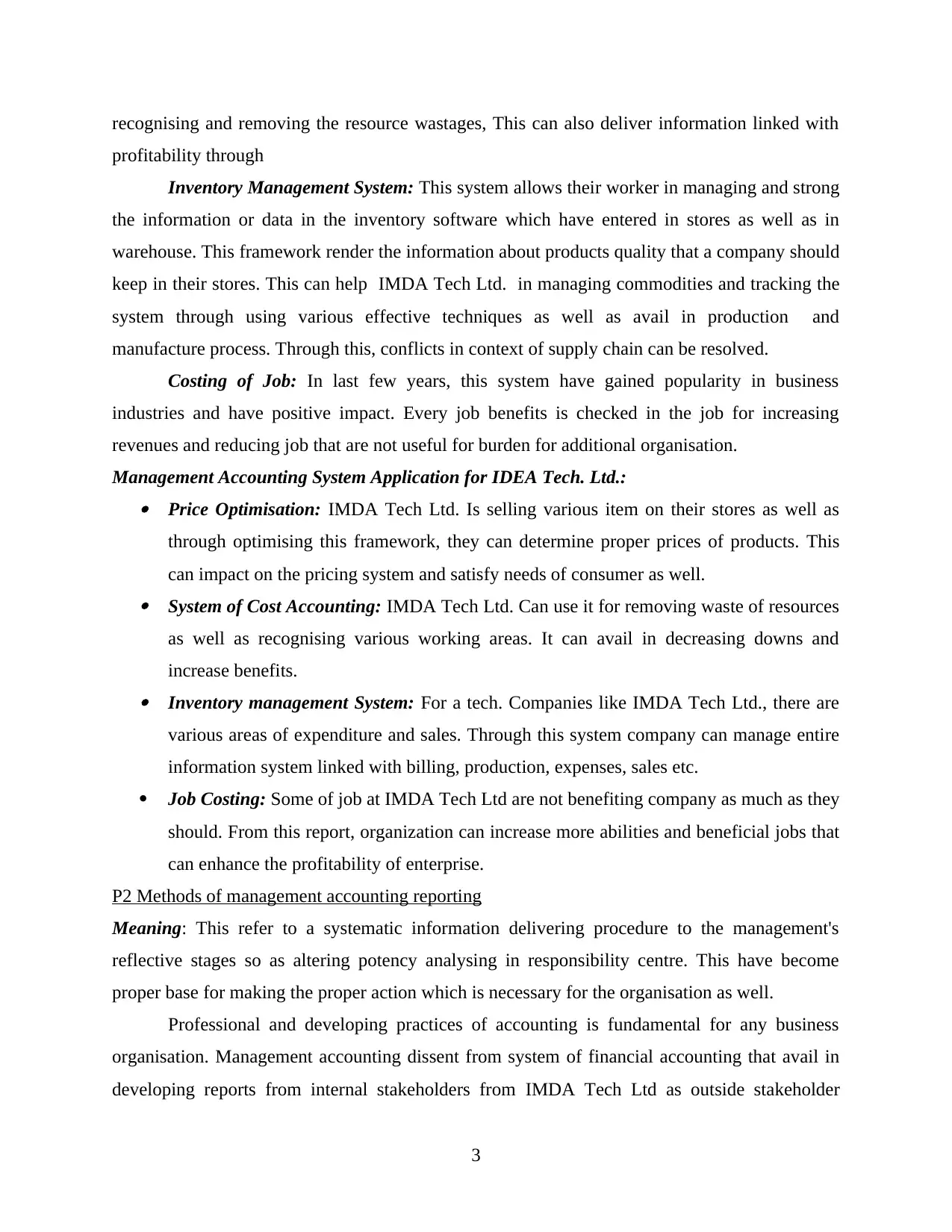

COMPARISON

Absorption costing Marginal costing

In this costing, IMDA Tech. Ltd can be

measured as gross cost for proper production

of time.

Under this,. Only cost of marginal will be

given importance for the process of

manufacturing.

This can avail in decreasing the cost of per

units of mobiles and other products of IMDA

tech Ltd.

With extra Units, there is no changes in per

unit cost in this section.

It is linked with the long term costing and

planning (Lukka and Vinnari, 2014).

This refer to the planning of short term

objectives and goals managed and determined

by their authorities.

This methods is not useful or effective for the

process of decision-making.

Majorly companies make use of this procedure

for getting proper decision.

The sustainability relay on the aspects of

external environment in regard of reporting

system.

This is linked with internal system of reporting

lead company toward the growth and better

productivity.

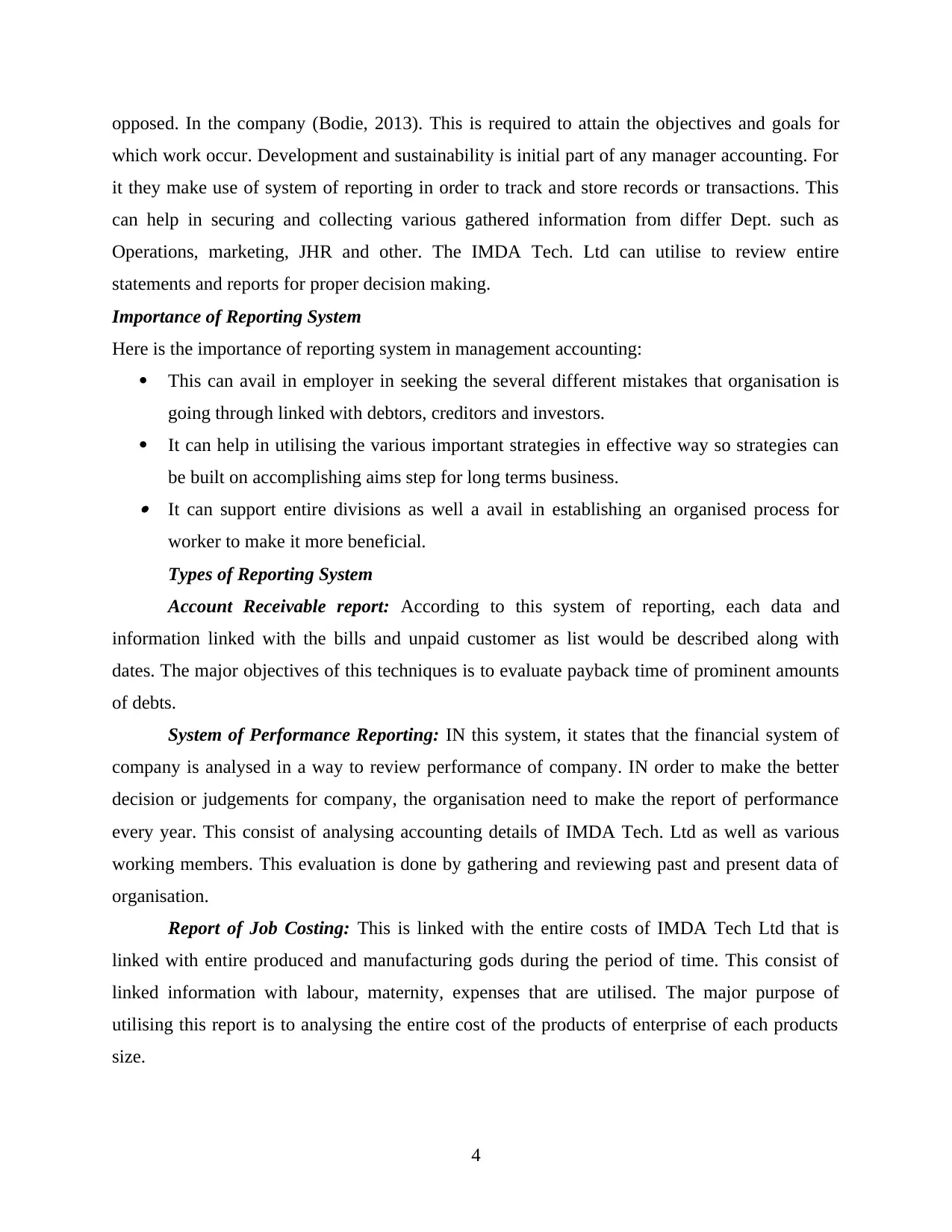

Calculation as per Absorption costing.

Working notes:

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: calculate value of inventory and production

6

be effective for organisation to manufacture that units.

COMPARISON

Absorption costing Marginal costing

In this costing, IMDA Tech. Ltd can be

measured as gross cost for proper production

of time.

Under this,. Only cost of marginal will be

given importance for the process of

manufacturing.

This can avail in decreasing the cost of per

units of mobiles and other products of IMDA

tech Ltd.

With extra Units, there is no changes in per

unit cost in this section.

It is linked with the long term costing and

planning (Lukka and Vinnari, 2014).

This refer to the planning of short term

objectives and goals managed and determined

by their authorities.

This methods is not useful or effective for the

process of decision-making.

Majorly companies make use of this procedure

for getting proper decision.

The sustainability relay on the aspects of

external environment in regard of reporting

system.

This is linked with internal system of reporting

lead company toward the growth and better

productivity.

Calculation as per Absorption costing.

Working notes:

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: calculate value of inventory and production

6

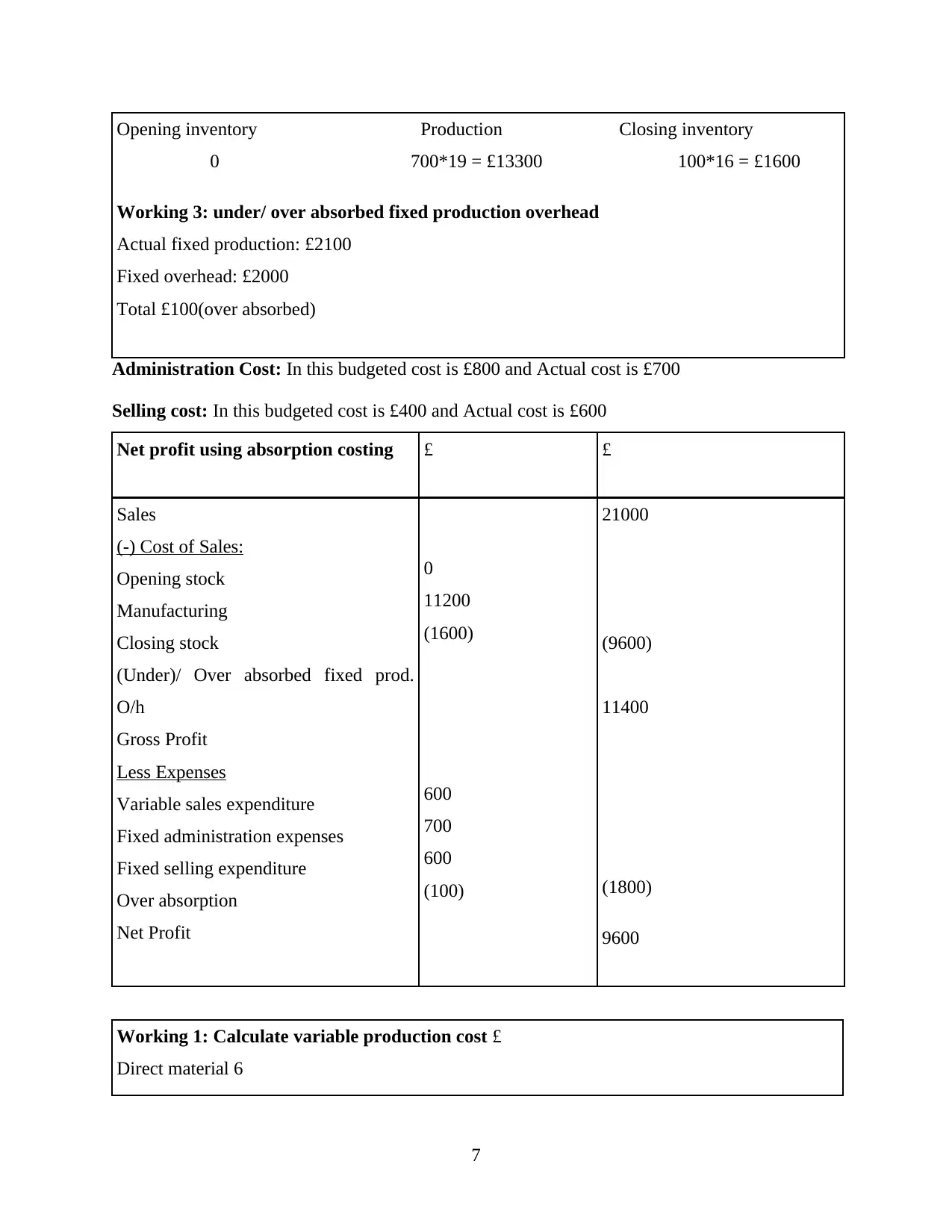

Opening inventory Production Closing inventory

0 700*19 = £13300 100*16 = £1600

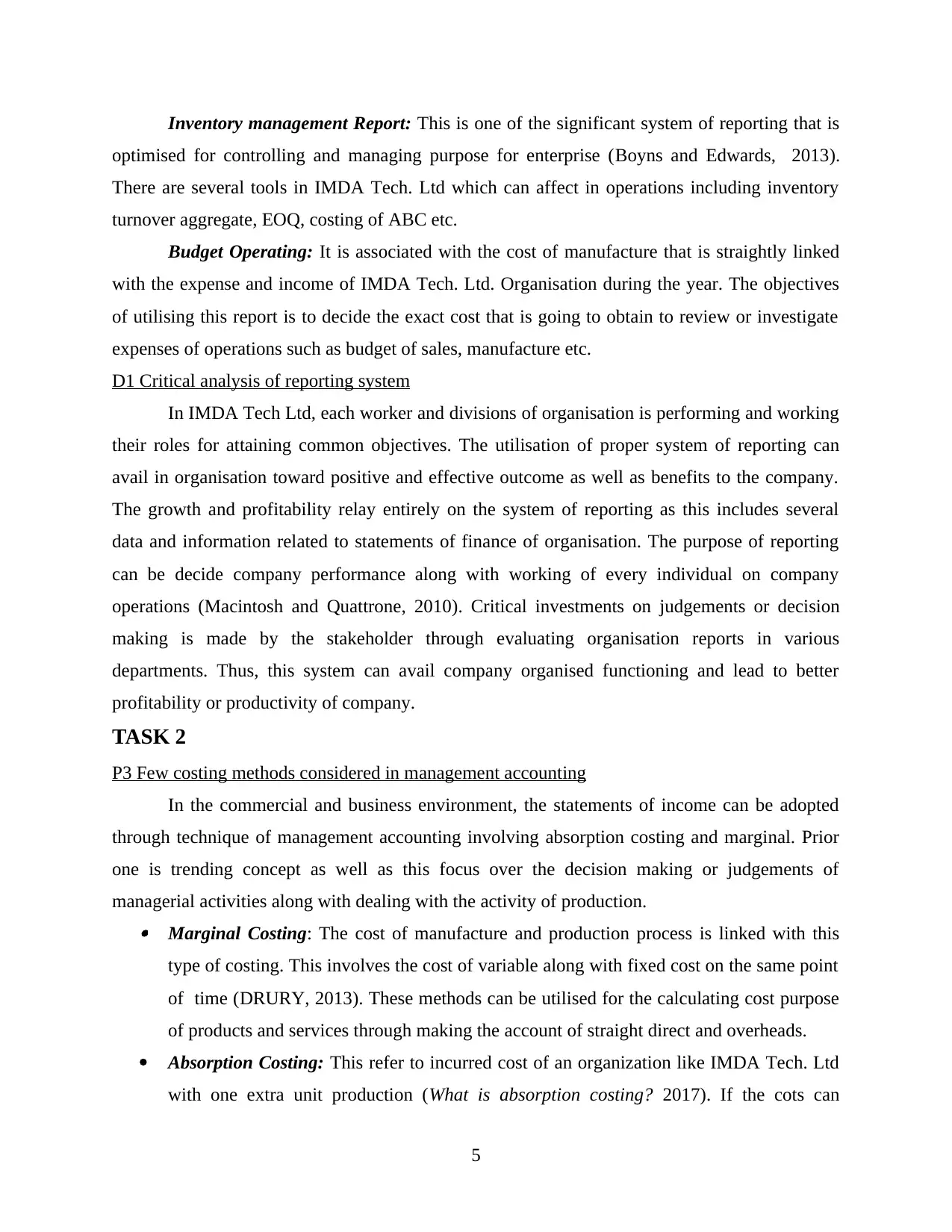

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration Cost: In this budgeted cost is £800 and Actual cost is £700

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using absorption costing £ £

Sales

(-) Cost of Sales:

Opening stock

Manufacturing

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

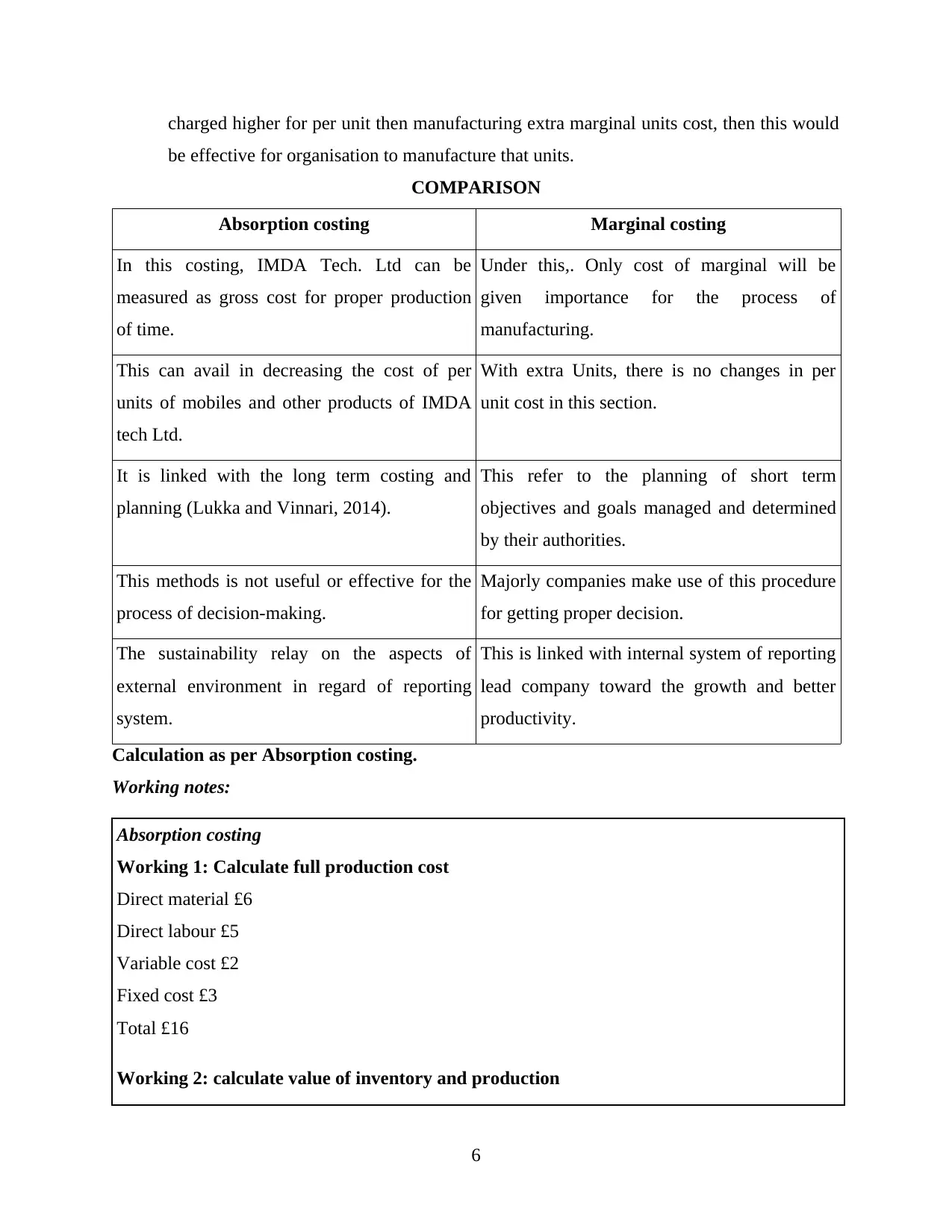

Working 1: Calculate variable production cost £

Direct material 6

7

0 700*19 = £13300 100*16 = £1600

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration Cost: In this budgeted cost is £800 and Actual cost is £700

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using absorption costing £ £

Sales

(-) Cost of Sales:

Opening stock

Manufacturing

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

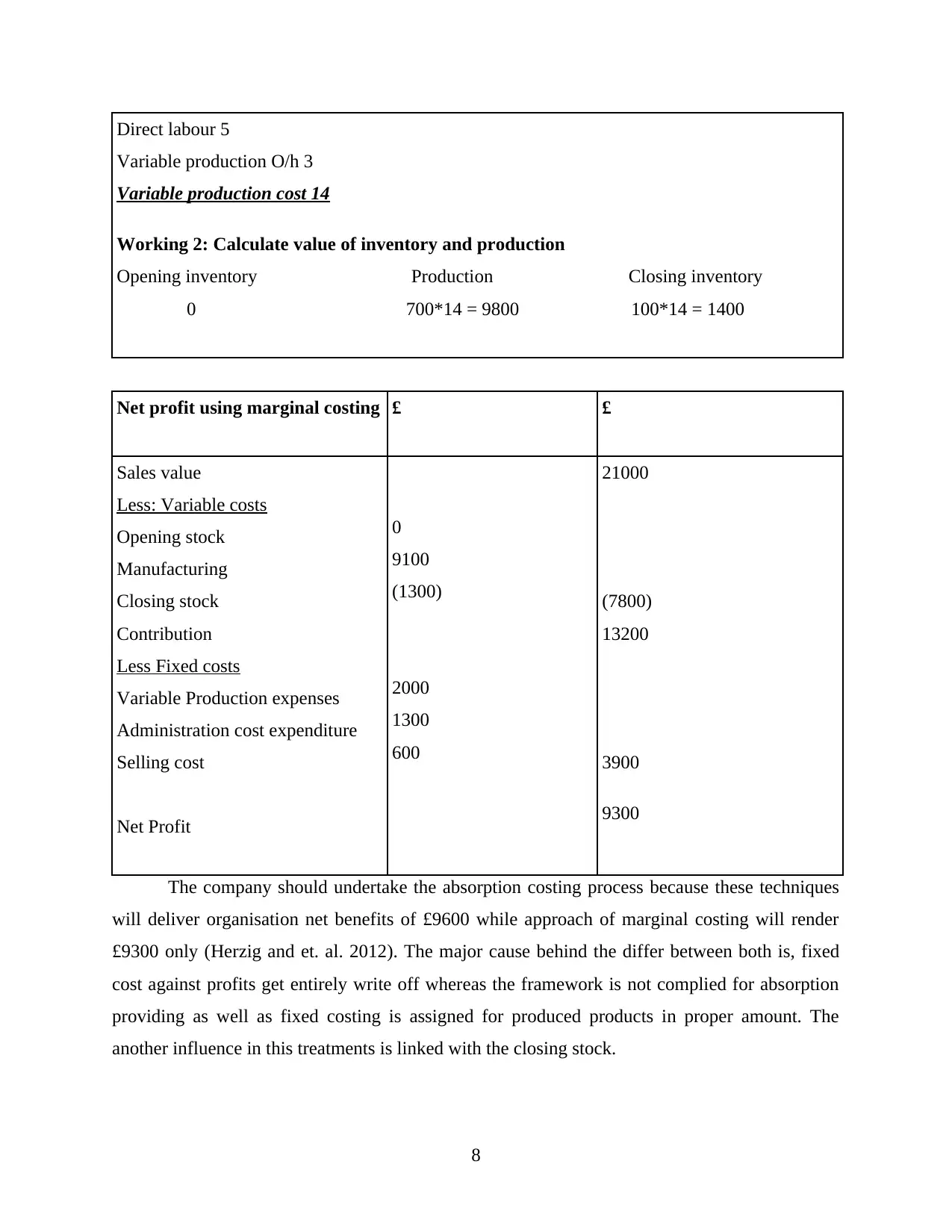

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

Net profit using marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

The company should undertake the absorption costing process because these techniques

will deliver organisation net benefits of £9600 while approach of marginal costing will render

£9300 only (Herzig and et. al. 2012). The major cause behind the differ between both is, fixed

cost against profits get entirely write off whereas the framework is not complied for absorption

providing as well as fixed costing is assigned for produced products in proper amount. The

another influence in this treatments is linked with the closing stock.

8

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

Net profit using marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

The company should undertake the absorption costing process because these techniques

will deliver organisation net benefits of £9600 while approach of marginal costing will render

£9300 only (Herzig and et. al. 2012). The major cause behind the differ between both is, fixed

cost against profits get entirely write off whereas the framework is not complied for absorption

providing as well as fixed costing is assigned for produced products in proper amount. The

another influence in this treatments is linked with the closing stock.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

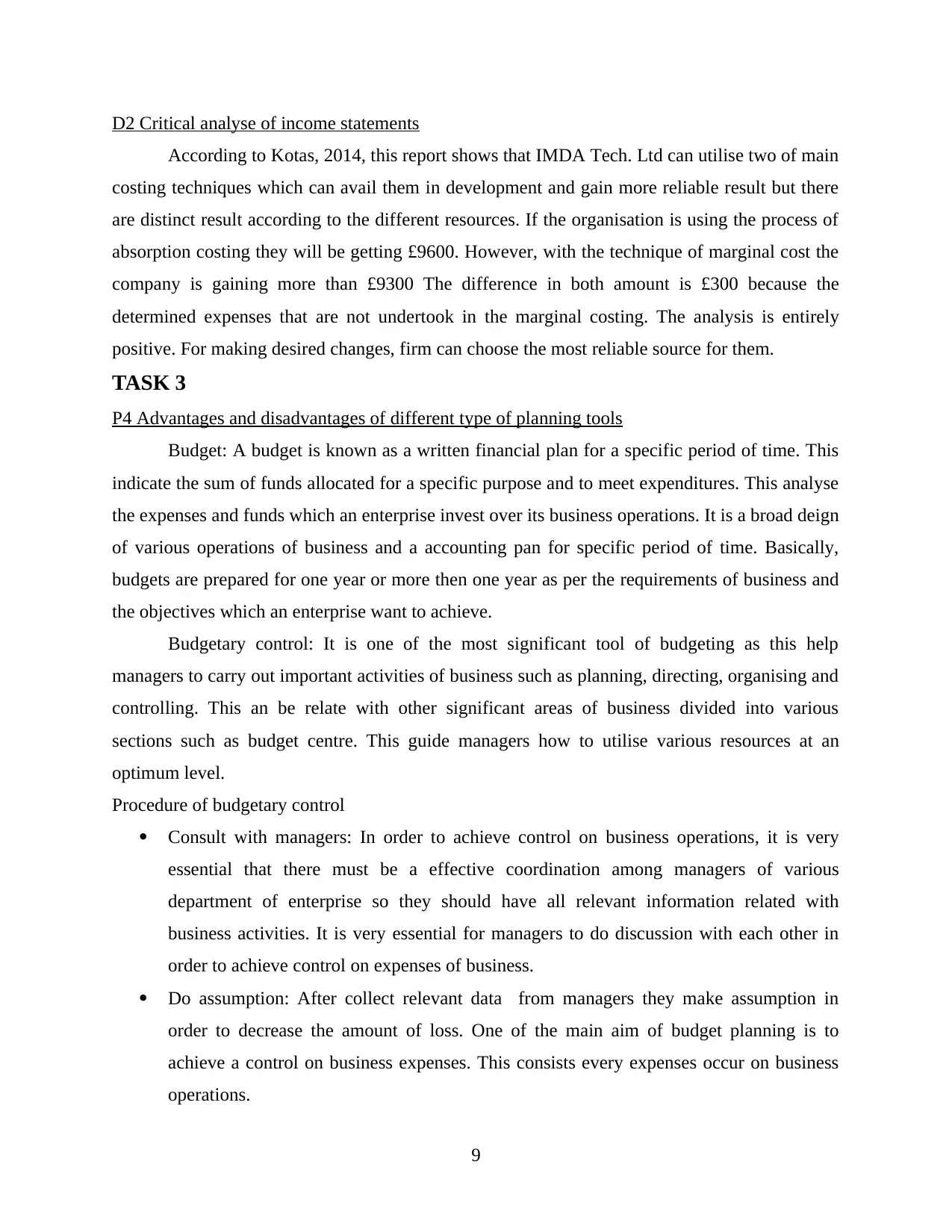

D2 Critical analyse of income statements

According to Kotas, 2014, this report shows that IMDA Tech. Ltd can utilise two of main

costing techniques which can avail them in development and gain more reliable result but there

are distinct result according to the different resources. If the organisation is using the process of

absorption costing they will be getting £9600. However, with the technique of marginal cost the

company is gaining more than £9300 The difference in both amount is £300 because the

determined expenses that are not undertook in the marginal costing. The analysis is entirely

positive. For making desired changes, firm can choose the most reliable source for them.

TASK 3

P4 Advantages and disadvantages of different type of planning tools

Budget: A budget is known as a written financial plan for a specific period of time. This

indicate the sum of funds allocated for a specific purpose and to meet expenditures. This analyse

the expenses and funds which an enterprise invest over its business operations. It is a broad deign

of various operations of business and a accounting pan for specific period of time. Basically,

budgets are prepared for one year or more then one year as per the requirements of business and

the objectives which an enterprise want to achieve.

Budgetary control: It is one of the most significant tool of budgeting as this help

managers to carry out important activities of business such as planning, directing, organising and

controlling. This an be relate with other significant areas of business divided into various

sections such as budget centre. This guide managers how to utilise various resources at an

optimum level.

Procedure of budgetary control

Consult with managers: In order to achieve control on business operations, it is very

essential that there must be a effective coordination among managers of various

department of enterprise so they should have all relevant information related with

business activities. It is very essential for managers to do discussion with each other in

order to achieve control on expenses of business.

Do assumption: After collect relevant data from managers they make assumption in

order to decrease the amount of loss. One of the main aim of budget planning is to

achieve a control on business expenses. This consists every expenses occur on business

operations.

9

According to Kotas, 2014, this report shows that IMDA Tech. Ltd can utilise two of main

costing techniques which can avail them in development and gain more reliable result but there

are distinct result according to the different resources. If the organisation is using the process of

absorption costing they will be getting £9600. However, with the technique of marginal cost the

company is gaining more than £9300 The difference in both amount is £300 because the

determined expenses that are not undertook in the marginal costing. The analysis is entirely

positive. For making desired changes, firm can choose the most reliable source for them.

TASK 3

P4 Advantages and disadvantages of different type of planning tools

Budget: A budget is known as a written financial plan for a specific period of time. This

indicate the sum of funds allocated for a specific purpose and to meet expenditures. This analyse

the expenses and funds which an enterprise invest over its business operations. It is a broad deign

of various operations of business and a accounting pan for specific period of time. Basically,

budgets are prepared for one year or more then one year as per the requirements of business and

the objectives which an enterprise want to achieve.

Budgetary control: It is one of the most significant tool of budgeting as this help

managers to carry out important activities of business such as planning, directing, organising and

controlling. This an be relate with other significant areas of business divided into various

sections such as budget centre. This guide managers how to utilise various resources at an

optimum level.

Procedure of budgetary control

Consult with managers: In order to achieve control on business operations, it is very

essential that there must be a effective coordination among managers of various

department of enterprise so they should have all relevant information related with

business activities. It is very essential for managers to do discussion with each other in

order to achieve control on expenses of business.

Do assumption: After collect relevant data from managers they make assumption in

order to decrease the amount of loss. One of the main aim of budget planning is to

achieve a control on business expenses. This consists every expenses occur on business

operations.

9

Fix data for budget to attain business targets: In this step, a list consist large amount of

data is prepare by manager by taking account relevant information from all department of

company. All this help managers in do planning in order to set objectives and goals of

business.

Compare actual data with budgeted data: In this, actual business performance of

enterprise is compare with the standard one. This help managers in identify the areas of

improvements and contribute in growth of business.

Review analysis: This is the last and final stage of budgetary control process, in this,

managers evaluate all above mentioned steps in order to known that they are in right

direction or not. Effective execution of every step ensure achievement of enterprise

objectives.

Planning tools: Planning is known as the process of decide future actions of business by consider

end objective and target of business. One of the main advantage of planning is that it provide

direction to managers and employees and encourage them to perform well so enterprise can

achieve its set goals and objectives. In order to execute planning process various tools are there

which can be use by the managers of IMDA tech limited:

1. Forecasting tools: Under this, manager undertake process of planning with some

assumptions supported by management knowledge, skills and effective judgement. Under

this manager take use of historical or past data to determine the direction of business

operations.

Advantages: It is very essential for managers to have information to have adequate

information end objectives and this same to the managers. This help managers in predict amount

of total sales and costs of business.

Disadvantages: This tool of planning fails to give accurate information about the total

expenses which will occur by enterprise. If expenses of business activities are more than the

actual cost then this affect the business objectives.

2. Scenario tools: In this various tools are used by managers in order to evaluate the

alternatives available as per the situation exist in enterprise. This assists management in

activities related with functional and operational management. This depend on the

objectives and end targets of firm and accordingly cost incur by firm.

10

data is prepare by manager by taking account relevant information from all department of

company. All this help managers in do planning in order to set objectives and goals of

business.

Compare actual data with budgeted data: In this, actual business performance of

enterprise is compare with the standard one. This help managers in identify the areas of

improvements and contribute in growth of business.

Review analysis: This is the last and final stage of budgetary control process, in this,

managers evaluate all above mentioned steps in order to known that they are in right

direction or not. Effective execution of every step ensure achievement of enterprise

objectives.

Planning tools: Planning is known as the process of decide future actions of business by consider

end objective and target of business. One of the main advantage of planning is that it provide

direction to managers and employees and encourage them to perform well so enterprise can

achieve its set goals and objectives. In order to execute planning process various tools are there

which can be use by the managers of IMDA tech limited:

1. Forecasting tools: Under this, manager undertake process of planning with some

assumptions supported by management knowledge, skills and effective judgement. Under

this manager take use of historical or past data to determine the direction of business

operations.

Advantages: It is very essential for managers to have information to have adequate

information end objectives and this same to the managers. This help managers in predict amount

of total sales and costs of business.

Disadvantages: This tool of planning fails to give accurate information about the total

expenses which will occur by enterprise. If expenses of business activities are more than the

actual cost then this affect the business objectives.

2. Scenario tools: In this various tools are used by managers in order to evaluate the

alternatives available as per the situation exist in enterprise. This assists management in

activities related with functional and operational management. This depend on the

objectives and end targets of firm and accordingly cost incur by firm.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.