Comprehensive Management Accounting Report for Good Clothing Ltd

VerifiedAdded on 2020/06/04

|18

|5583

|347

Report

AI Summary

This report provides a detailed analysis of management accounting practices for Good Clothing Ltd. It begins with an introduction to management accounting and its benefits, followed by a critical evaluation of the management reporting system. The report delves into various costing methods, including absorption and marginal costing, with calculations and comparisons. It then explores financial planning, statement analysis, and standard costing techniques, including forecasted financial statements and balance sheets. Furthermore, the report examines the application of planning tools, their advantages, and disadvantages, and concludes with a comparison between two organizations regarding the adoption of management accounting systems. Profitability ratios are also calculated to determine the company's ability to generate profit. The report provides an in-depth understanding of how management accounting aids in resolving financial issues within an organization.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

M1: Benefits of management accounting system ......................................................................3

D1: Critical evaluation of management reporting system...........................................................3

P3: Calculation of cost by using various costing methods..........................................................4

M2: Various range of management accounting techniques........................................................6

D2: Produce financial reports by apply and interpret data for Good clothing Ltd.....................8

TASK 3..........................................................................................................................................11

P4 and D3: Advantages and disadvantages of different types of planning tools .....................11

M3 Use of planning tools and their application........................................................................14

TASK 4..........................................................................................................................................14

P5 Comparison between two organisation for adopting management accounting system.......14

M4 Management accounting lead enterprise to solve financial issues ...................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

M1: Benefits of management accounting system ......................................................................3

D1: Critical evaluation of management reporting system...........................................................3

P3: Calculation of cost by using various costing methods..........................................................4

M2: Various range of management accounting techniques........................................................6

D2: Produce financial reports by apply and interpret data for Good clothing Ltd.....................8

TASK 3..........................................................................................................................................11

P4 and D3: Advantages and disadvantages of different types of planning tools .....................11

M3 Use of planning tools and their application........................................................................14

TASK 4..........................................................................................................................................14

P5 Comparison between two organisation for adopting management accounting system.......14

M4 Management accounting lead enterprise to solve financial issues ...................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Management accounting is a necessary tool by which every organisation can manager

and operate their every day financial as well as non-financial transactions. The primary motive of

using accounting systems is to summarise, record and evaluate different outcomes that can be

beneficial for the company in next coming time. The provision of accounting information is an

essential aspects for “Good clothing Ltd” that can be use in order to generate more specific

results. It is crucial for them to make use of management accounting system in their operations to

control costs and other expenses those are affecting the profitability of the company.

This project report provide more valuable information about use of accounting and

reporting systems by various departments in an organisation (DRURY, 2013). Some specific

costing method is been used those are helpful in analysing net profitability of the company.

Advantages and disadvantage of using planning tools in budgetary-control are discuss more

effectively. Whereas understanding of financial issue and all those effective techniques those are

useful in resolving those issues are explain clearly under this report.

TASK 1

M1: Benefits of management accounting system

In every business organisation, it is vital for them to make use of accounting systems in

more effective manner. This would help in gain competitive advantages over other companies.

There are various advantages of using this accounting system that is usually happen with the

capability for companies to improve operations and efficiencies. It will enable the fluctuation of

business financial capital gains.

D1: Critical evaluation of management reporting system

It is vital for the Good clothing companies to make sure that every data would be

properly recorded into the various accounting books so that valuable decision can be done. There

are crucial statements those are helpful for taking crucial decision-making for the further

expansion of business operations.

TASK 2

3

Management accounting is a necessary tool by which every organisation can manager

and operate their every day financial as well as non-financial transactions. The primary motive of

using accounting systems is to summarise, record and evaluate different outcomes that can be

beneficial for the company in next coming time. The provision of accounting information is an

essential aspects for “Good clothing Ltd” that can be use in order to generate more specific

results. It is crucial for them to make use of management accounting system in their operations to

control costs and other expenses those are affecting the profitability of the company.

This project report provide more valuable information about use of accounting and

reporting systems by various departments in an organisation (DRURY, 2013). Some specific

costing method is been used those are helpful in analysing net profitability of the company.

Advantages and disadvantage of using planning tools in budgetary-control are discuss more

effectively. Whereas understanding of financial issue and all those effective techniques those are

useful in resolving those issues are explain clearly under this report.

TASK 1

M1: Benefits of management accounting system

In every business organisation, it is vital for them to make use of accounting systems in

more effective manner. This would help in gain competitive advantages over other companies.

There are various advantages of using this accounting system that is usually happen with the

capability for companies to improve operations and efficiencies. It will enable the fluctuation of

business financial capital gains.

D1: Critical evaluation of management reporting system

It is vital for the Good clothing companies to make sure that every data would be

properly recorded into the various accounting books so that valuable decision can be done. There

are crucial statements those are helpful for taking crucial decision-making for the further

expansion of business operations.

TASK 2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

P3: Calculation of cost by using various costing methods

Cost is said to be the value of money that has been given up to produce something or

deliver better services to an organisation. In this business operations, the cost can be related with

formation of new manufacturing units. The total amount of expenditure incurred by managers

during proper establishment of the plant consider as cost to company. In accounting context, cost

which is define as cost amount that is given up an equipments. This would consists of all those

costs which is essential to get an assets in accordance to use.

This cost accounting helps in assisting in decision-making that is processes “Good

clothing company” to evaluate its costs (Vasile and Man, 2012). Some of them are direct,

indirect, fixed and operating cost. There are some valuable costing methods those are helpful in

determining net profitability of the company. In order to make vital decision it is essential for

them to make use of accounting data in proper manner so that estimation of total cost can be

determined. Costing is a well organise process of forecasting total cost that involves in a

particular projects of a company. Basically, it is perfect system of evaluating cost of production

in order to analyse expenses at various level of production. Those are explain underneath:

Absorption costing: It refers to the costs which is associated with every manufacturing

activity such as production of products and services. In some other terms, these are total costs of

a finish goods in inventory that will be related with direct labour, material and semi-flexible cost

at the time of manufacturing process. These types of costing is require to be followed as per the

set accounting standards in accordance with developing an stock evaluation which is mention in

the company's balance sheet (Brandau, and et. al., 2013)

Marginal costing: It is known as those are cost which is incur by the Good clothing

company during the production of one extra units. It is generally determine as the part of variable

cost because id does not consider fixed cost. This seems to be a variation in total cost that is

comes out after making production of additional units. The primary objectives of this costing is

to determine at which level of manufacturing the company is going to attain its break-even point.

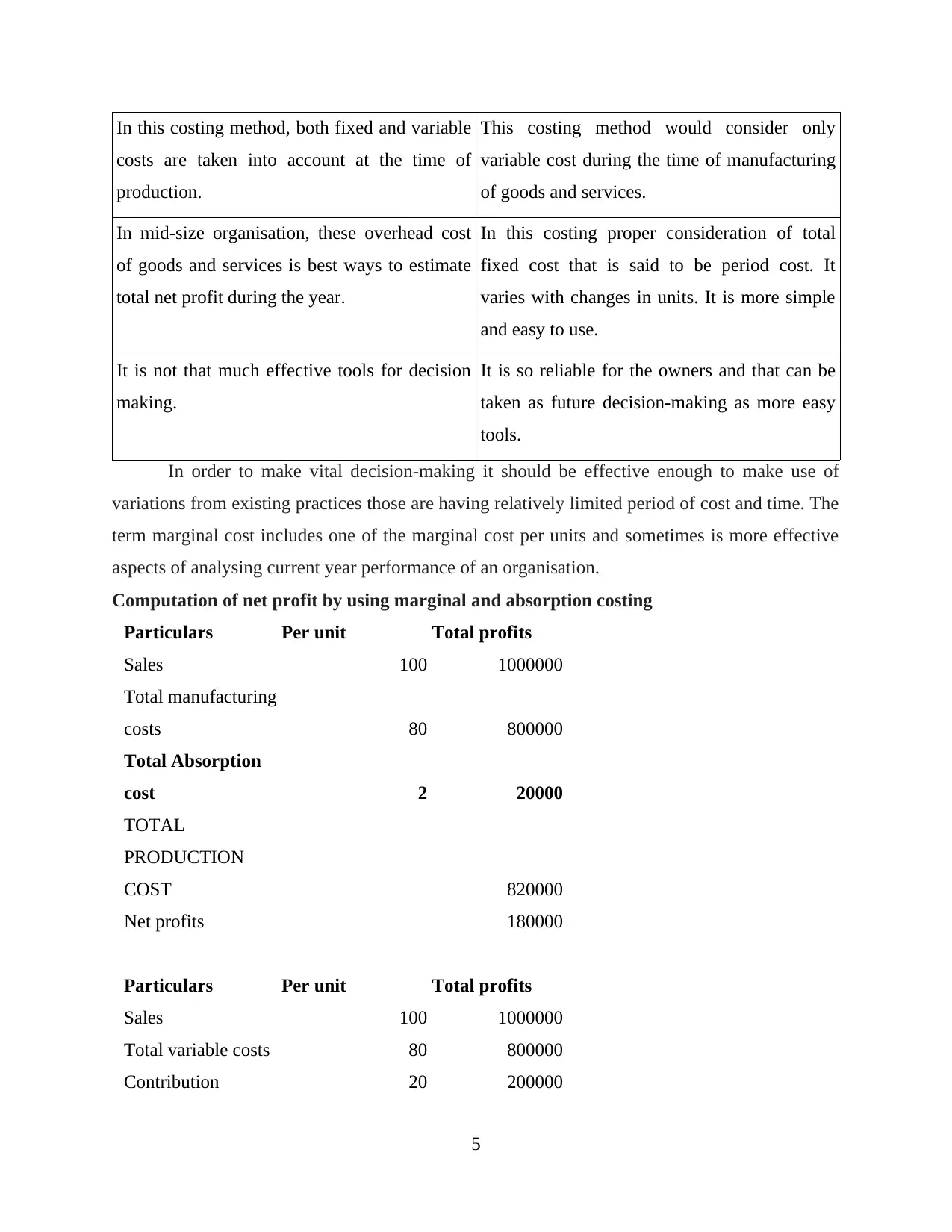

Comparison

Absorption costing Marginal costing

4

Cost is said to be the value of money that has been given up to produce something or

deliver better services to an organisation. In this business operations, the cost can be related with

formation of new manufacturing units. The total amount of expenditure incurred by managers

during proper establishment of the plant consider as cost to company. In accounting context, cost

which is define as cost amount that is given up an equipments. This would consists of all those

costs which is essential to get an assets in accordance to use.

This cost accounting helps in assisting in decision-making that is processes “Good

clothing company” to evaluate its costs (Vasile and Man, 2012). Some of them are direct,

indirect, fixed and operating cost. There are some valuable costing methods those are helpful in

determining net profitability of the company. In order to make vital decision it is essential for

them to make use of accounting data in proper manner so that estimation of total cost can be

determined. Costing is a well organise process of forecasting total cost that involves in a

particular projects of a company. Basically, it is perfect system of evaluating cost of production

in order to analyse expenses at various level of production. Those are explain underneath:

Absorption costing: It refers to the costs which is associated with every manufacturing

activity such as production of products and services. In some other terms, these are total costs of

a finish goods in inventory that will be related with direct labour, material and semi-flexible cost

at the time of manufacturing process. These types of costing is require to be followed as per the

set accounting standards in accordance with developing an stock evaluation which is mention in

the company's balance sheet (Brandau, and et. al., 2013)

Marginal costing: It is known as those are cost which is incur by the Good clothing

company during the production of one extra units. It is generally determine as the part of variable

cost because id does not consider fixed cost. This seems to be a variation in total cost that is

comes out after making production of additional units. The primary objectives of this costing is

to determine at which level of manufacturing the company is going to attain its break-even point.

Comparison

Absorption costing Marginal costing

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In this costing method, both fixed and variable

costs are taken into account at the time of

production.

This costing method would consider only

variable cost during the time of manufacturing

of goods and services.

In mid-size organisation, these overhead cost

of goods and services is best ways to estimate

total net profit during the year.

In this costing proper consideration of total

fixed cost that is said to be period cost. It

varies with changes in units. It is more simple

and easy to use.

It is not that much effective tools for decision

making.

It is so reliable for the owners and that can be

taken as future decision-making as more easy

tools.

In order to make vital decision-making it should be effective enough to make use of

variations from existing practices those are having relatively limited period of cost and time. The

term marginal cost includes one of the marginal cost per units and sometimes is more effective

aspects of analysing current year performance of an organisation.

Computation of net profit by using marginal and absorption costing

Particulars Per unit Total profits

Sales 100 1000000

Total manufacturing

costs 80 800000

Total Absorption

cost 2 20000

TOTAL

PRODUCTION

COST 820000

Net profits 180000

Particulars Per unit Total profits

Sales 100 1000000

Total variable costs 80 800000

Contribution 20 200000

5

costs are taken into account at the time of

production.

This costing method would consider only

variable cost during the time of manufacturing

of goods and services.

In mid-size organisation, these overhead cost

of goods and services is best ways to estimate

total net profit during the year.

In this costing proper consideration of total

fixed cost that is said to be period cost. It

varies with changes in units. It is more simple

and easy to use.

It is not that much effective tools for decision

making.

It is so reliable for the owners and that can be

taken as future decision-making as more easy

tools.

In order to make vital decision-making it should be effective enough to make use of

variations from existing practices those are having relatively limited period of cost and time. The

term marginal cost includes one of the marginal cost per units and sometimes is more effective

aspects of analysing current year performance of an organisation.

Computation of net profit by using marginal and absorption costing

Particulars Per unit Total profits

Sales 100 1000000

Total manufacturing

costs 80 800000

Total Absorption

cost 2 20000

TOTAL

PRODUCTION

COST 820000

Net profits 180000

Particulars Per unit Total profits

Sales 100 1000000

Total variable costs 80 800000

Contribution 20 200000

5

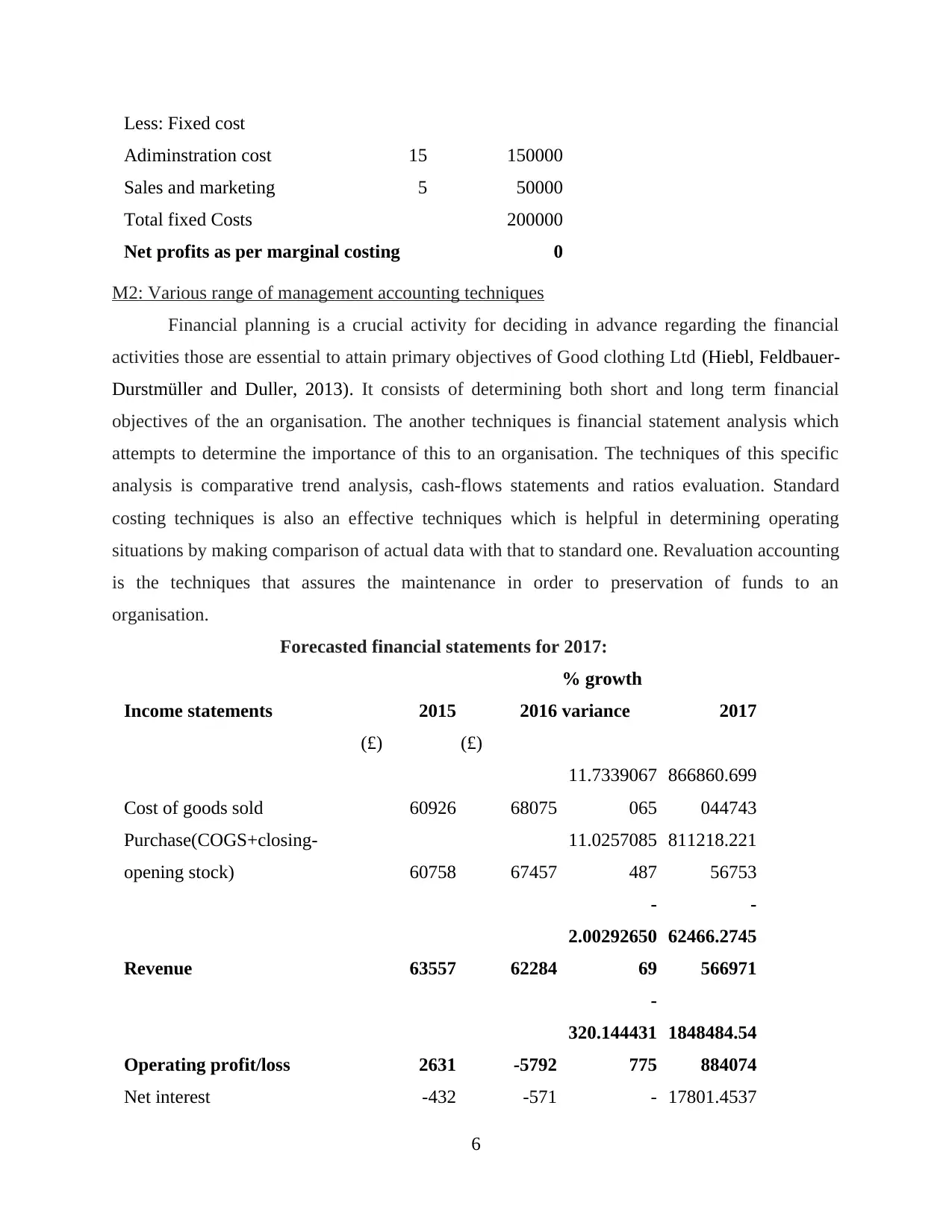

Less: Fixed cost

Adiminstration cost 15 150000

Sales and marketing 5 50000

Total fixed Costs 200000

Net profits as per marginal costing 0

M2: Various range of management accounting techniques

Financial planning is a crucial activity for deciding in advance regarding the financial

activities those are essential to attain primary objectives of Good clothing Ltd (Hiebl, Feldbauer-

Durstmüller and Duller, 2013). It consists of determining both short and long term financial

objectives of the an organisation. The another techniques is financial statement analysis which

attempts to determine the importance of this to an organisation. The techniques of this specific

analysis is comparative trend analysis, cash-flows statements and ratios evaluation. Standard

costing techniques is also an effective techniques which is helpful in determining operating

situations by making comparison of actual data with that to standard one. Revaluation accounting

is the techniques that assures the maintenance in order to preservation of funds to an

organisation.

Forecasted financial statements for 2017:

Income statements 2015 2016

% growth

variance 2017

(£) (£)

Cost of goods sold 60926 68075

11.7339067

065

866860.699

044743

Purchase(COGS+closing-

opening stock) 60758 67457

11.0257085

487

811218.221

56753

Revenue 63557 62284

-

2.00292650

69

-

62466.2745

566971

Operating profit/loss 2631 -5792

-

320.144431

775

1848484.54

884074

Net interest -432 -571 - 17801.4537

6

Adiminstration cost 15 150000

Sales and marketing 5 50000

Total fixed Costs 200000

Net profits as per marginal costing 0

M2: Various range of management accounting techniques

Financial planning is a crucial activity for deciding in advance regarding the financial

activities those are essential to attain primary objectives of Good clothing Ltd (Hiebl, Feldbauer-

Durstmüller and Duller, 2013). It consists of determining both short and long term financial

objectives of the an organisation. The another techniques is financial statement analysis which

attempts to determine the importance of this to an organisation. The techniques of this specific

analysis is comparative trend analysis, cash-flows statements and ratios evaluation. Standard

costing techniques is also an effective techniques which is helpful in determining operating

situations by making comparison of actual data with that to standard one. Revaluation accounting

is the techniques that assures the maintenance in order to preservation of funds to an

organisation.

Forecasted financial statements for 2017:

Income statements 2015 2016

% growth

variance 2017

(£) (£)

Cost of goods sold 60926 68075

11.7339067

065

866860.699

044743

Purchase(COGS+closing-

opening stock) 60758 67457

11.0257085

487

811218.221

56753

Revenue 63557 62284

-

2.00292650

69

-

62466.2745

566971

Operating profit/loss 2631 -5792

-

320.144431

775

1848484.54

884074

Net interest -432 -571 - 17801.4537

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

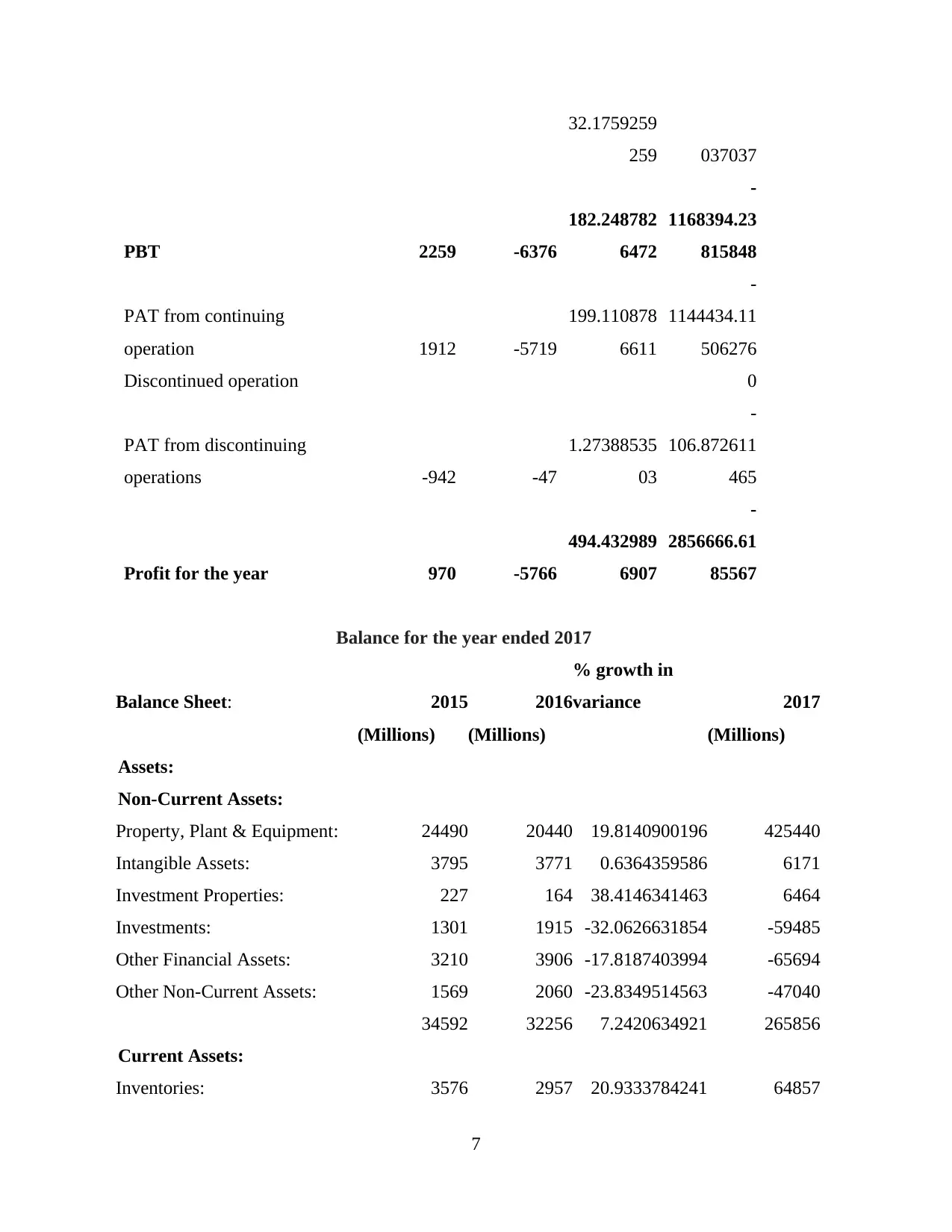

32.1759259

259 037037

PBT 2259 -6376

182.248782

6472

-

1168394.23

815848

PAT from continuing

operation 1912 -5719

199.110878

6611

-

1144434.11

506276

Discontinued operation 0

PAT from discontinuing

operations -942 -47

1.27388535

03

-

106.872611

465

Profit for the year 970 -5766

494.432989

6907

-

2856666.61

85567

Balance for the year ended 2017

Balance Sheet: 2015 2016

% growth in

variance 2017

(Millions) (Millions) (Millions)

Assets:

Non-Current Assets:

Property, Plant & Equipment: 24490 20440 19.8140900196 425440

Intangible Assets: 3795 3771 0.6364359586 6171

Investment Properties: 227 164 38.4146341463 6464

Investments: 1301 1915 -32.0626631854 -59485

Other Financial Assets: 3210 3906 -17.8187403994 -65694

Other Non-Current Assets: 1569 2060 -23.8349514563 -47040

34592 32256 7.2420634921 265856

Current Assets:

Inventories: 3576 2957 20.9333784241 64857

7

259 037037

PBT 2259 -6376

182.248782

6472

-

1168394.23

815848

PAT from continuing

operation 1912 -5719

199.110878

6611

-

1144434.11

506276

Discontinued operation 0

PAT from discontinuing

operations -942 -47

1.27388535

03

-

106.872611

465

Profit for the year 970 -5766

494.432989

6907

-

2856666.61

85567

Balance for the year ended 2017

Balance Sheet: 2015 2016

% growth in

variance 2017

(Millions) (Millions) (Millions)

Assets:

Non-Current Assets:

Property, Plant & Equipment: 24490 20440 19.8140900196 425440

Intangible Assets: 3795 3771 0.6364359586 6171

Investment Properties: 227 164 38.4146341463 6464

Investments: 1301 1915 -32.0626631854 -59485

Other Financial Assets: 3210 3906 -17.8187403994 -65694

Other Non-Current Assets: 1569 2060 -23.8349514563 -47040

34592 32256 7.2420634921 265856

Current Assets:

Inventories: 3576 2957 20.9333784241 64857

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

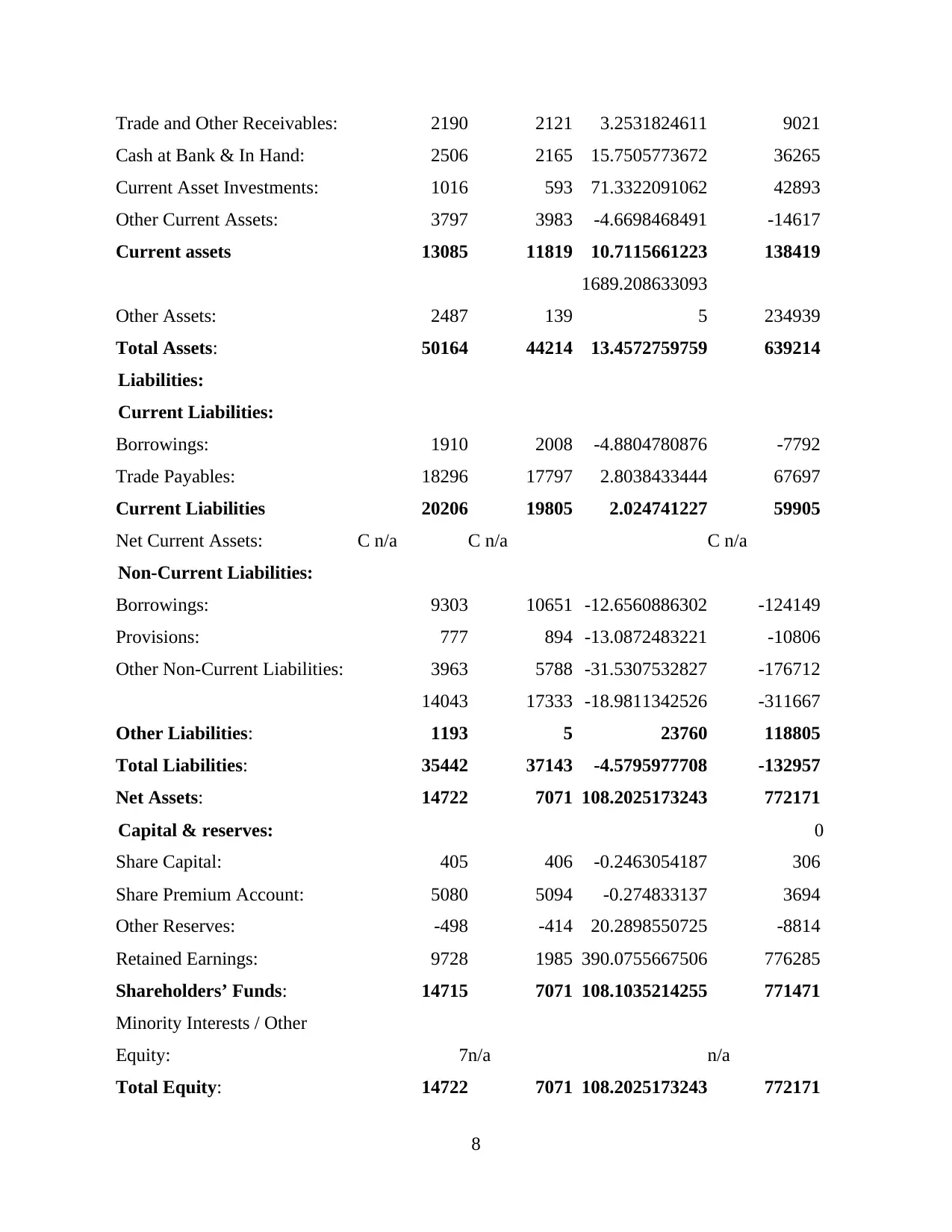

Trade and Other Receivables: 2190 2121 3.2531824611 9021

Cash at Bank & In Hand: 2506 2165 15.7505773672 36265

Current Asset Investments: 1016 593 71.3322091062 42893

Other Current Assets: 3797 3983 -4.6698468491 -14617

Current assets 13085 11819 10.7115661223 138419

Other Assets: 2487 139

1689.208633093

5 234939

Total Assets: 50164 44214 13.4572759759 639214

Liabilities:

Current Liabilities:

Borrowings: 1910 2008 -4.8804780876 -7792

Trade Payables: 18296 17797 2.8038433444 67697

Current Liabilities 20206 19805 2.024741227 59905

Net Current Assets: C n/a C n/a C n/a

Non-Current Liabilities:

Borrowings: 9303 10651 -12.6560886302 -124149

Provisions: 777 894 -13.0872483221 -10806

Other Non-Current Liabilities: 3963 5788 -31.5307532827 -176712

14043 17333 -18.9811342526 -311667

Other Liabilities: 1193 5 23760 118805

Total Liabilities: 35442 37143 -4.5795977708 -132957

Net Assets: 14722 7071 108.2025173243 772171

Capital & reserves: 0

Share Capital: 405 406 -0.2463054187 306

Share Premium Account: 5080 5094 -0.274833137 3694

Other Reserves: -498 -414 20.2898550725 -8814

Retained Earnings: 9728 1985 390.0755667506 776285

Shareholders’ Funds: 14715 7071 108.1035214255 771471

Minority Interests / Other

Equity: 7n/a n/a

Total Equity: 14722 7071 108.2025173243 772171

8

Cash at Bank & In Hand: 2506 2165 15.7505773672 36265

Current Asset Investments: 1016 593 71.3322091062 42893

Other Current Assets: 3797 3983 -4.6698468491 -14617

Current assets 13085 11819 10.7115661223 138419

Other Assets: 2487 139

1689.208633093

5 234939

Total Assets: 50164 44214 13.4572759759 639214

Liabilities:

Current Liabilities:

Borrowings: 1910 2008 -4.8804780876 -7792

Trade Payables: 18296 17797 2.8038433444 67697

Current Liabilities 20206 19805 2.024741227 59905

Net Current Assets: C n/a C n/a C n/a

Non-Current Liabilities:

Borrowings: 9303 10651 -12.6560886302 -124149

Provisions: 777 894 -13.0872483221 -10806

Other Non-Current Liabilities: 3963 5788 -31.5307532827 -176712

14043 17333 -18.9811342526 -311667

Other Liabilities: 1193 5 23760 118805

Total Liabilities: 35442 37143 -4.5795977708 -132957

Net Assets: 14722 7071 108.2025173243 772171

Capital & reserves: 0

Share Capital: 405 406 -0.2463054187 306

Share Premium Account: 5080 5094 -0.274833137 3694

Other Reserves: -498 -414 20.2898550725 -8814

Retained Earnings: 9728 1985 390.0755667506 776285

Shareholders’ Funds: 14715 7071 108.1035214255 771471

Minority Interests / Other

Equity: 7n/a n/a

Total Equity: 14722 7071 108.2025173243 772171

8

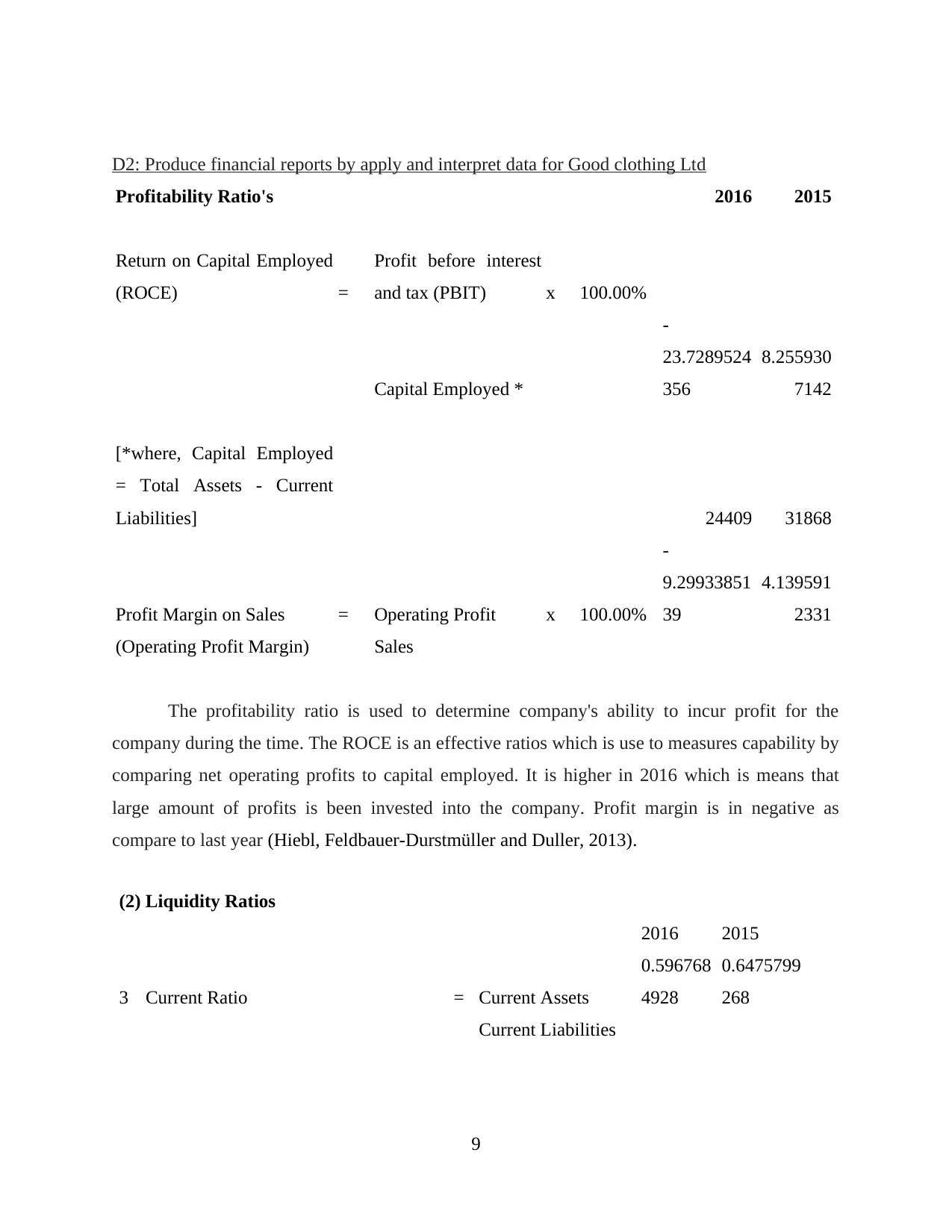

D2: Produce financial reports by apply and interpret data for Good clothing Ltd

Profitability Ratio's 2016 2015

Return on Capital Employed

(ROCE) =

Profit before interest

and tax (PBIT) x 100.00%

Capital Employed *

-

23.7289524

356

8.255930

7142

[*where, Capital Employed

= Total Assets - Current

Liabilities] 24409 31868

Profit Margin on Sales = Operating Profit x 100.00%

-

9.29933851

39

4.139591

2331

(Operating Profit Margin) Sales

The profitability ratio is used to determine company's ability to incur profit for the

company during the time. The ROCE is an effective ratios which is use to measures capability by

comparing net operating profits to capital employed. It is higher in 2016 which is means that

large amount of profits is been invested into the company. Profit margin is in negative as

compare to last year (Hiebl, Feldbauer-Durstmüller and Duller, 2013).

(2) Liquidity Ratios

2016 2015

3 Current Ratio = Current Assets

0.596768

4928

0.6475799

268

Current Liabilities

9

Profitability Ratio's 2016 2015

Return on Capital Employed

(ROCE) =

Profit before interest

and tax (PBIT) x 100.00%

Capital Employed *

-

23.7289524

356

8.255930

7142

[*where, Capital Employed

= Total Assets - Current

Liabilities] 24409 31868

Profit Margin on Sales = Operating Profit x 100.00%

-

9.29933851

39

4.139591

2331

(Operating Profit Margin) Sales

The profitability ratio is used to determine company's ability to incur profit for the

company during the time. The ROCE is an effective ratios which is use to measures capability by

comparing net operating profits to capital employed. It is higher in 2016 which is means that

large amount of profits is been invested into the company. Profit margin is in negative as

compare to last year (Hiebl, Feldbauer-Durstmüller and Duller, 2013).

(2) Liquidity Ratios

2016 2015

3 Current Ratio = Current Assets

0.596768

4928

0.6475799

268

Current Liabilities

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

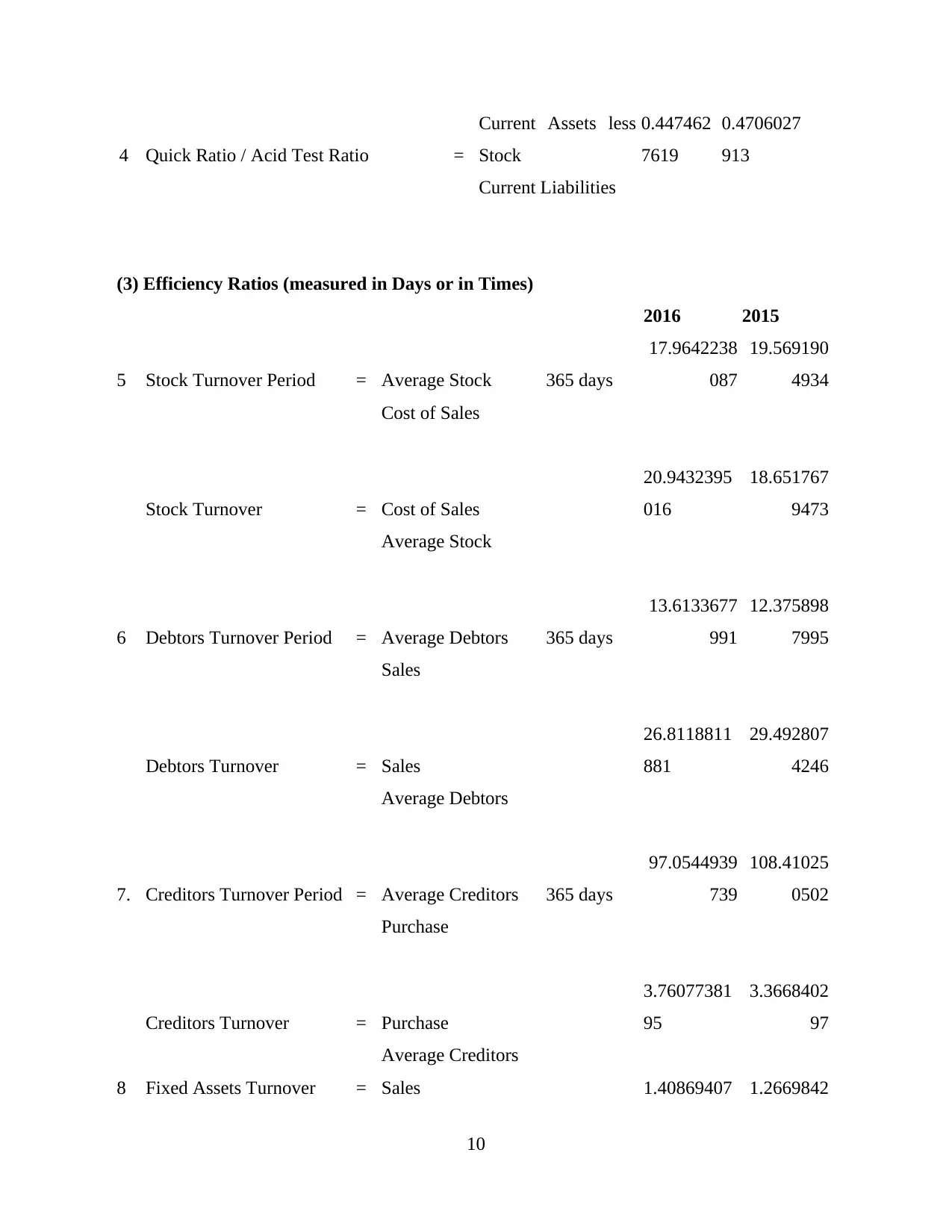

4 Quick Ratio / Acid Test Ratio =

Current Assets less

Stock

0.447462

7619

0.4706027

913

Current Liabilities

(3) Efficiency Ratios (measured in Days or in Times)

2016 2015

5 Stock Turnover Period = Average Stock 365 days

17.9642238

087

19.569190

4934

Cost of Sales

Stock Turnover = Cost of Sales

20.9432395

016

18.651767

9473

Average Stock

6 Debtors Turnover Period = Average Debtors 365 days

13.6133677

991

12.375898

7995

Sales

Debtors Turnover = Sales

26.8118811

881

29.492807

4246

Average Debtors

7. Creditors Turnover Period = Average Creditors 365 days

97.0544939

739

108.41025

0502

Purchase

Creditors Turnover = Purchase

3.76077381

95

3.3668402

97

Average Creditors

8 Fixed Assets Turnover = Sales 1.40869407 1.2669842

10

Current Assets less

Stock

0.447462

7619

0.4706027

913

Current Liabilities

(3) Efficiency Ratios (measured in Days or in Times)

2016 2015

5 Stock Turnover Period = Average Stock 365 days

17.9642238

087

19.569190

4934

Cost of Sales

Stock Turnover = Cost of Sales

20.9432395

016

18.651767

9473

Average Stock

6 Debtors Turnover Period = Average Debtors 365 days

13.6133677

991

12.375898

7995

Sales

Debtors Turnover = Sales

26.8118811

881

29.492807

4246

Average Debtors

7. Creditors Turnover Period = Average Creditors 365 days

97.0544939

739

108.41025

0502

Purchase

Creditors Turnover = Purchase

3.76077381

95

3.3668402

97

Average Creditors

8 Fixed Assets Turnover = Sales 1.40869407 1.2669842

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

88 915

Fixed Assets

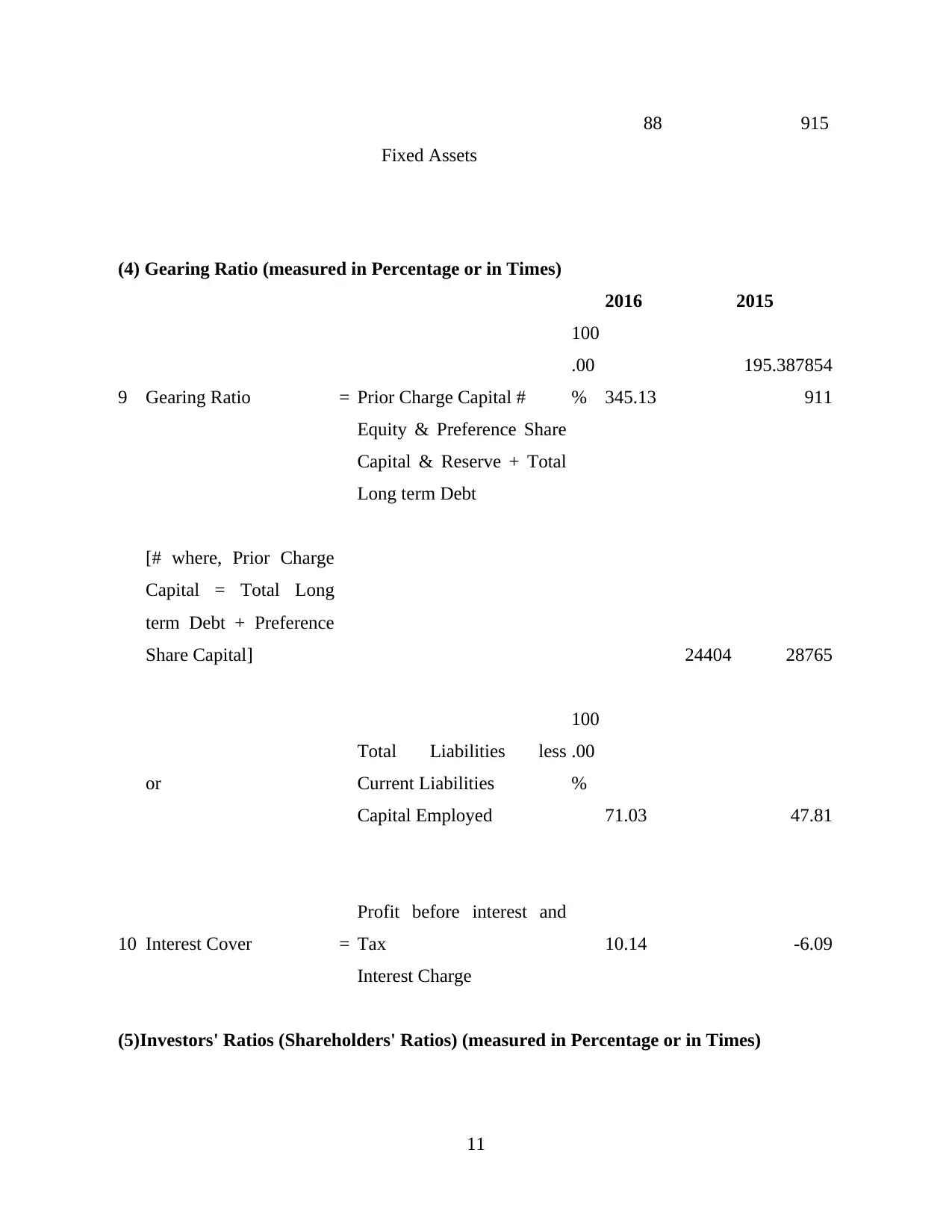

(4) Gearing Ratio (measured in Percentage or in Times)

2016 2015

9 Gearing Ratio = Prior Charge Capital #

100

.00

% 345.13

195.387854

911

Equity & Preference Share

Capital & Reserve + Total

Long term Debt

[# where, Prior Charge

Capital = Total Long

term Debt + Preference

Share Capital] 24404 28765

or

Total Liabilities less

Current Liabilities

100

.00

%

Capital Employed 71.03 47.81

10 Interest Cover =

Profit before interest and

Tax 10.14 -6.09

Interest Charge

(5)Investors' Ratios (Shareholders' Ratios) (measured in Percentage or in Times)

11

Fixed Assets

(4) Gearing Ratio (measured in Percentage or in Times)

2016 2015

9 Gearing Ratio = Prior Charge Capital #

100

.00

% 345.13

195.387854

911

Equity & Preference Share

Capital & Reserve + Total

Long term Debt

[# where, Prior Charge

Capital = Total Long

term Debt + Preference

Share Capital] 24404 28765

or

Total Liabilities less

Current Liabilities

100

.00

%

Capital Employed 71.03 47.81

10 Interest Cover =

Profit before interest and

Tax 10.14 -6.09

Interest Charge

(5)Investors' Ratios (Shareholders' Ratios) (measured in Percentage or in Times)

11

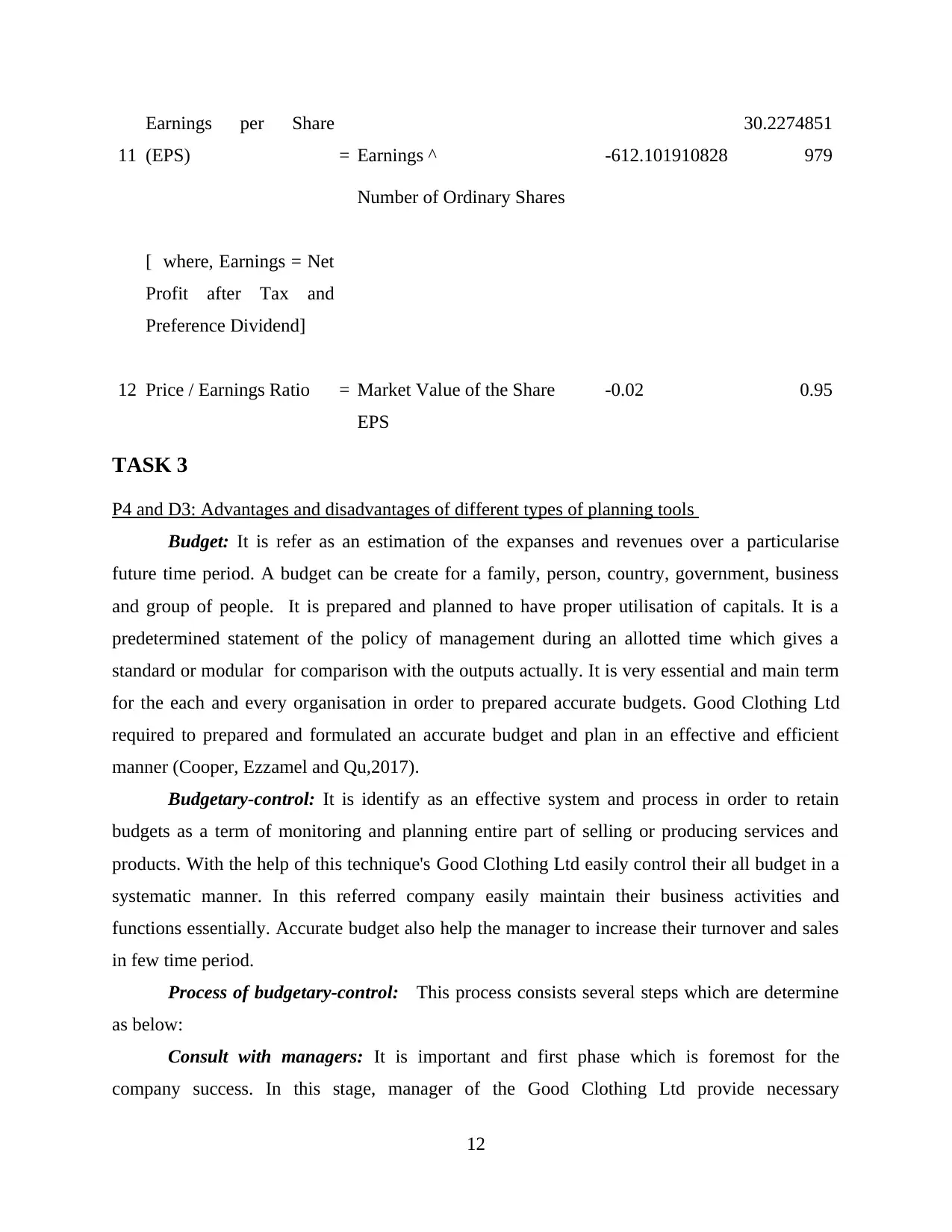

11

Earnings per Share

(EPS) = Earnings ^ -612.101910828

30.2274851

979

Number of Ordinary Shares

[ where, Earnings = Net

Profit after Tax and

Preference Dividend]

12 Price / Earnings Ratio = Market Value of the Share -0.02 0.95

EPS

TASK 3

P4 and D3: Advantages and disadvantages of different types of planning tools

Budget: It is refer as an estimation of the expanses and revenues over a particularise

future time period. A budget can be create for a family, person, country, government, business

and group of people. It is prepared and planned to have proper utilisation of capitals. It is a

predetermined statement of the policy of management during an allotted time which gives a

standard or modular for comparison with the outputs actually. It is very essential and main term

for the each and every organisation in order to prepared accurate budgets. Good Clothing Ltd

required to prepared and formulated an accurate budget and plan in an effective and efficient

manner (Cooper, Ezzamel and Qu,2017).

Budgetary-control: It is identify as an effective system and process in order to retain

budgets as a term of monitoring and planning entire part of selling or producing services and

products. With the help of this technique's Good Clothing Ltd easily control their all budget in a

systematic manner. In this referred company easily maintain their business activities and

functions essentially. Accurate budget also help the manager to increase their turnover and sales

in few time period.

Process of budgetary-control: This process consists several steps which are determine

as below:

Consult with managers: It is important and first phase which is foremost for the

company success. In this stage, manager of the Good Clothing Ltd provide necessary

12

Earnings per Share

(EPS) = Earnings ^ -612.101910828

30.2274851

979

Number of Ordinary Shares

[ where, Earnings = Net

Profit after Tax and

Preference Dividend]

12 Price / Earnings Ratio = Market Value of the Share -0.02 0.95

EPS

TASK 3

P4 and D3: Advantages and disadvantages of different types of planning tools

Budget: It is refer as an estimation of the expanses and revenues over a particularise

future time period. A budget can be create for a family, person, country, government, business

and group of people. It is prepared and planned to have proper utilisation of capitals. It is a

predetermined statement of the policy of management during an allotted time which gives a

standard or modular for comparison with the outputs actually. It is very essential and main term

for the each and every organisation in order to prepared accurate budgets. Good Clothing Ltd

required to prepared and formulated an accurate budget and plan in an effective and efficient

manner (Cooper, Ezzamel and Qu,2017).

Budgetary-control: It is identify as an effective system and process in order to retain

budgets as a term of monitoring and planning entire part of selling or producing services and

products. With the help of this technique's Good Clothing Ltd easily control their all budget in a

systematic manner. In this referred company easily maintain their business activities and

functions essentially. Accurate budget also help the manager to increase their turnover and sales

in few time period.

Process of budgetary-control: This process consists several steps which are determine

as below:

Consult with managers: It is important and first phase which is foremost for the

company success. In this stage, manager of the Good Clothing Ltd provide necessary

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.