Financial Analysis and Investment Decision: Pizza Franchise Project

VerifiedAdded on 2019/09/25

|4

|1157

|173

Project

AI Summary

This assignment presents a comprehensive financial analysis of a potential investment in a pizza franchise. The analysis includes detailed calculations of variable and fixed costs, contribution per unit, and projected financial statements over a four-year period. Key financial metrics such as EBITDA, EBT, PAT, and free cash flows are calculated. The project assesses the cost of capital, including cost of equity, cost of debt, and weighted average cost of capital (WACC). Furthermore, the analysis incorporates the Capital Asset Pricing Model (CAPM) to determine the expected return on investment. A net present value (NPV) calculation is performed, and the assignment provides a final investment recommendation based on the financial projections and risk assessment. The document also discusses the pros and cons of the investment, considering factors such as increasing demand, sales growth, and potential risks like changing customer preferences and alternative investment opportunities.

Sensitivity: Internal & Restricted

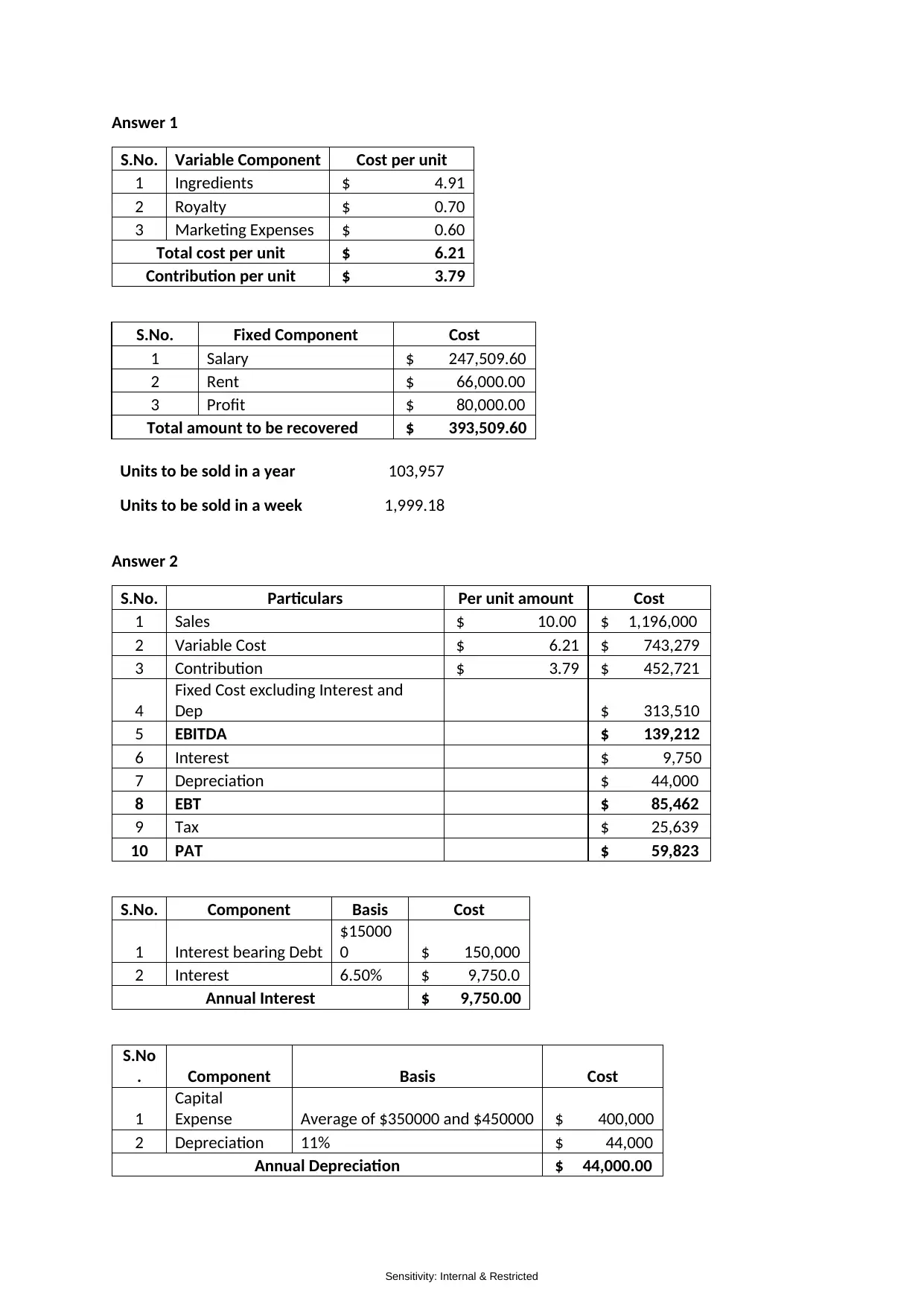

Answer 1

S.No. Variable Component Cost per unit

1 Ingredients $ 4.91

2 Royalty $ 0.70

3 Marketing Expenses $ 0.60

Total cost per unit $ 6.21

Contribution per unit $ 3.79

S.No. Fixed Component Cost

1 Salary $ 247,509.60

2 Rent $ 66,000.00

3 Profit $ 80,000.00

Total amount to be recovered $ 393,509.60

Units to be sold in a year 103,957

Units to be sold in a week 1,999.18

Answer 2

S.No. Particulars Per unit amount Cost

1 Sales $ 10.00 $ 1,196,000

2 Variable Cost $ 6.21 $ 743,279

3 Contribution $ 3.79 $ 452,721

4

Fixed Cost excluding Interest and

Dep $ 313,510

5 EBITDA $ 139,212

6 Interest $ 9,750

7 Depreciation $ 44,000

8 EBT $ 85,462

9 Tax $ 25,639

10 PAT $ 59,823

S.No. Component Basis Cost

1 Interest bearing Debt

$15000

0 $ 150,000

2 Interest 6.50% $ 9,750.0

Annual Interest $ 9,750.00

S.No

. Component Basis Cost

1

Capital

Expense Average of $350000 and $450000 $ 400,000

2 Depreciation 11% $ 44,000

Annual Depreciation $ 44,000.00

Answer 1

S.No. Variable Component Cost per unit

1 Ingredients $ 4.91

2 Royalty $ 0.70

3 Marketing Expenses $ 0.60

Total cost per unit $ 6.21

Contribution per unit $ 3.79

S.No. Fixed Component Cost

1 Salary $ 247,509.60

2 Rent $ 66,000.00

3 Profit $ 80,000.00

Total amount to be recovered $ 393,509.60

Units to be sold in a year 103,957

Units to be sold in a week 1,999.18

Answer 2

S.No. Particulars Per unit amount Cost

1 Sales $ 10.00 $ 1,196,000

2 Variable Cost $ 6.21 $ 743,279

3 Contribution $ 3.79 $ 452,721

4

Fixed Cost excluding Interest and

Dep $ 313,510

5 EBITDA $ 139,212

6 Interest $ 9,750

7 Depreciation $ 44,000

8 EBT $ 85,462

9 Tax $ 25,639

10 PAT $ 59,823

S.No. Component Basis Cost

1 Interest bearing Debt

$15000

0 $ 150,000

2 Interest 6.50% $ 9,750.0

Annual Interest $ 9,750.00

S.No

. Component Basis Cost

1

Capital

Expense Average of $350000 and $450000 $ 400,000

2 Depreciation 11% $ 44,000

Annual Depreciation $ 44,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sensitivity: Internal & Restricted

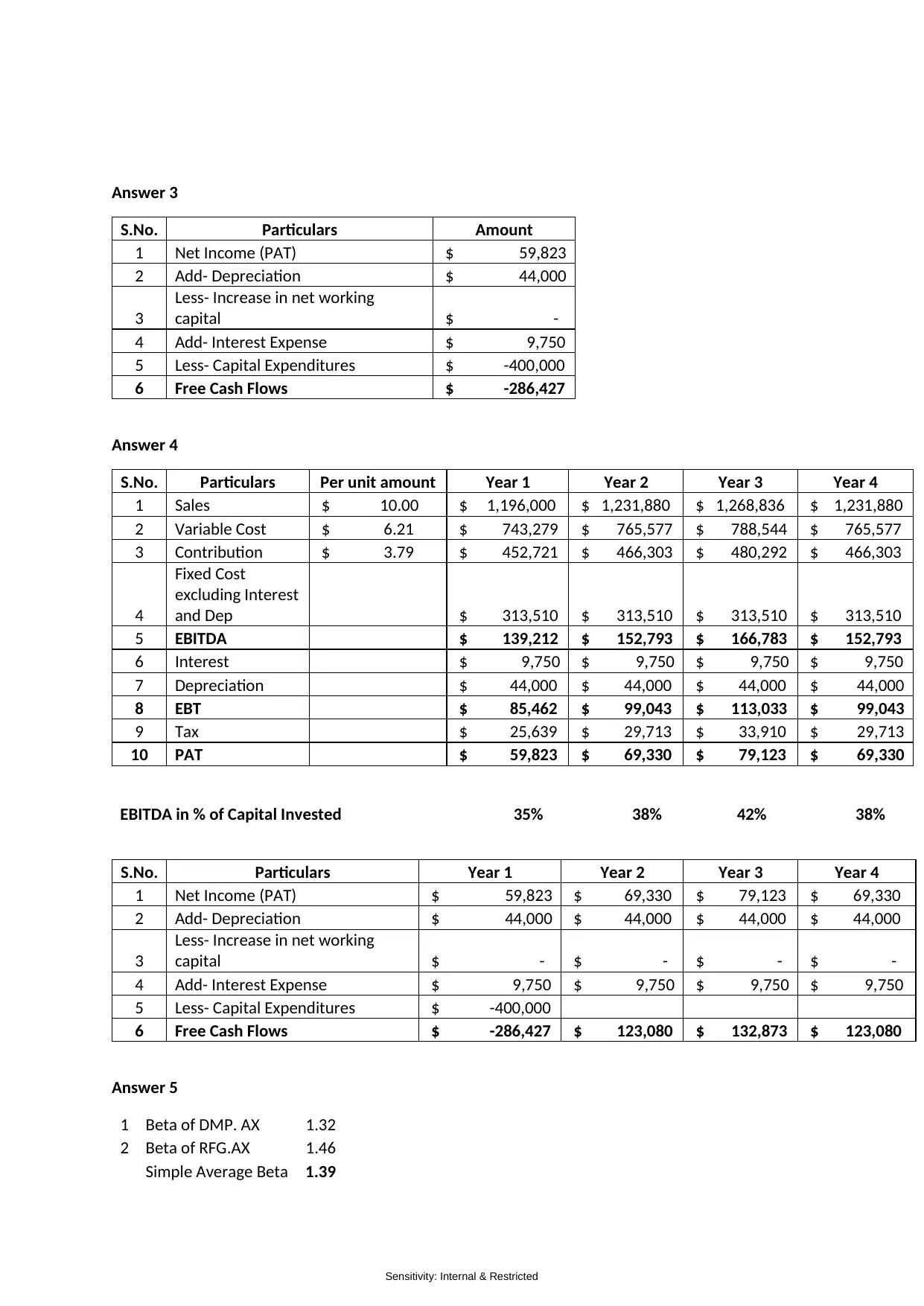

Answer 3

S.No. Particulars Amount

1 Net Income (PAT) $ 59,823

2 Add- Depreciation $ 44,000

3

Less- Increase in net working

capital $ -

4 Add- Interest Expense $ 9,750

5 Less- Capital Expenditures $ -400,000

6 Free Cash Flows $ -286,427

Answer 4

S.No. Particulars Per unit amount Year 1 Year 2 Year 3 Year 4

1 Sales $ 10.00 $ 1,196,000 $ 1,231,880 $ 1,268,836 $ 1,231,880

2 Variable Cost $ 6.21 $ 743,279 $ 765,577 $ 788,544 $ 765,577

3 Contribution $ 3.79 $ 452,721 $ 466,303 $ 480,292 $ 466,303

4

Fixed Cost

excluding Interest

and Dep $ 313,510 $ 313,510 $ 313,510 $ 313,510

5 EBITDA $ 139,212 $ 152,793 $ 166,783 $ 152,793

6 Interest $ 9,750 $ 9,750 $ 9,750 $ 9,750

7 Depreciation $ 44,000 $ 44,000 $ 44,000 $ 44,000

8 EBT $ 85,462 $ 99,043 $ 113,033 $ 99,043

9 Tax $ 25,639 $ 29,713 $ 33,910 $ 29,713

10 PAT $ 59,823 $ 69,330 $ 79,123 $ 69,330

EBITDA in % of Capital Invested 35% 38% 42% 38%

S.No. Particulars Year 1 Year 2 Year 3 Year 4

1 Net Income (PAT) $ 59,823 $ 69,330 $ 79,123 $ 69,330

2 Add- Depreciation $ 44,000 $ 44,000 $ 44,000 $ 44,000

3

Less- Increase in net working

capital $ - $ - $ - $ -

4 Add- Interest Expense $ 9,750 $ 9,750 $ 9,750 $ 9,750

5 Less- Capital Expenditures $ -400,000

6 Free Cash Flows $ -286,427 $ 123,080 $ 132,873 $ 123,080

Answer 5

1 Beta of DMP. AX 1.32

2 Beta of RFG.AX 1.46

Simple Average Beta 1.39

Answer 3

S.No. Particulars Amount

1 Net Income (PAT) $ 59,823

2 Add- Depreciation $ 44,000

3

Less- Increase in net working

capital $ -

4 Add- Interest Expense $ 9,750

5 Less- Capital Expenditures $ -400,000

6 Free Cash Flows $ -286,427

Answer 4

S.No. Particulars Per unit amount Year 1 Year 2 Year 3 Year 4

1 Sales $ 10.00 $ 1,196,000 $ 1,231,880 $ 1,268,836 $ 1,231,880

2 Variable Cost $ 6.21 $ 743,279 $ 765,577 $ 788,544 $ 765,577

3 Contribution $ 3.79 $ 452,721 $ 466,303 $ 480,292 $ 466,303

4

Fixed Cost

excluding Interest

and Dep $ 313,510 $ 313,510 $ 313,510 $ 313,510

5 EBITDA $ 139,212 $ 152,793 $ 166,783 $ 152,793

6 Interest $ 9,750 $ 9,750 $ 9,750 $ 9,750

7 Depreciation $ 44,000 $ 44,000 $ 44,000 $ 44,000

8 EBT $ 85,462 $ 99,043 $ 113,033 $ 99,043

9 Tax $ 25,639 $ 29,713 $ 33,910 $ 29,713

10 PAT $ 59,823 $ 69,330 $ 79,123 $ 69,330

EBITDA in % of Capital Invested 35% 38% 42% 38%

S.No. Particulars Year 1 Year 2 Year 3 Year 4

1 Net Income (PAT) $ 59,823 $ 69,330 $ 79,123 $ 69,330

2 Add- Depreciation $ 44,000 $ 44,000 $ 44,000 $ 44,000

3

Less- Increase in net working

capital $ - $ - $ - $ -

4 Add- Interest Expense $ 9,750 $ 9,750 $ 9,750 $ 9,750

5 Less- Capital Expenditures $ -400,000

6 Free Cash Flows $ -286,427 $ 123,080 $ 132,873 $ 123,080

Answer 5

1 Beta of DMP. AX 1.32

2 Beta of RFG.AX 1.46

Simple Average Beta 1.39

Sensitivity: Internal & Restricted

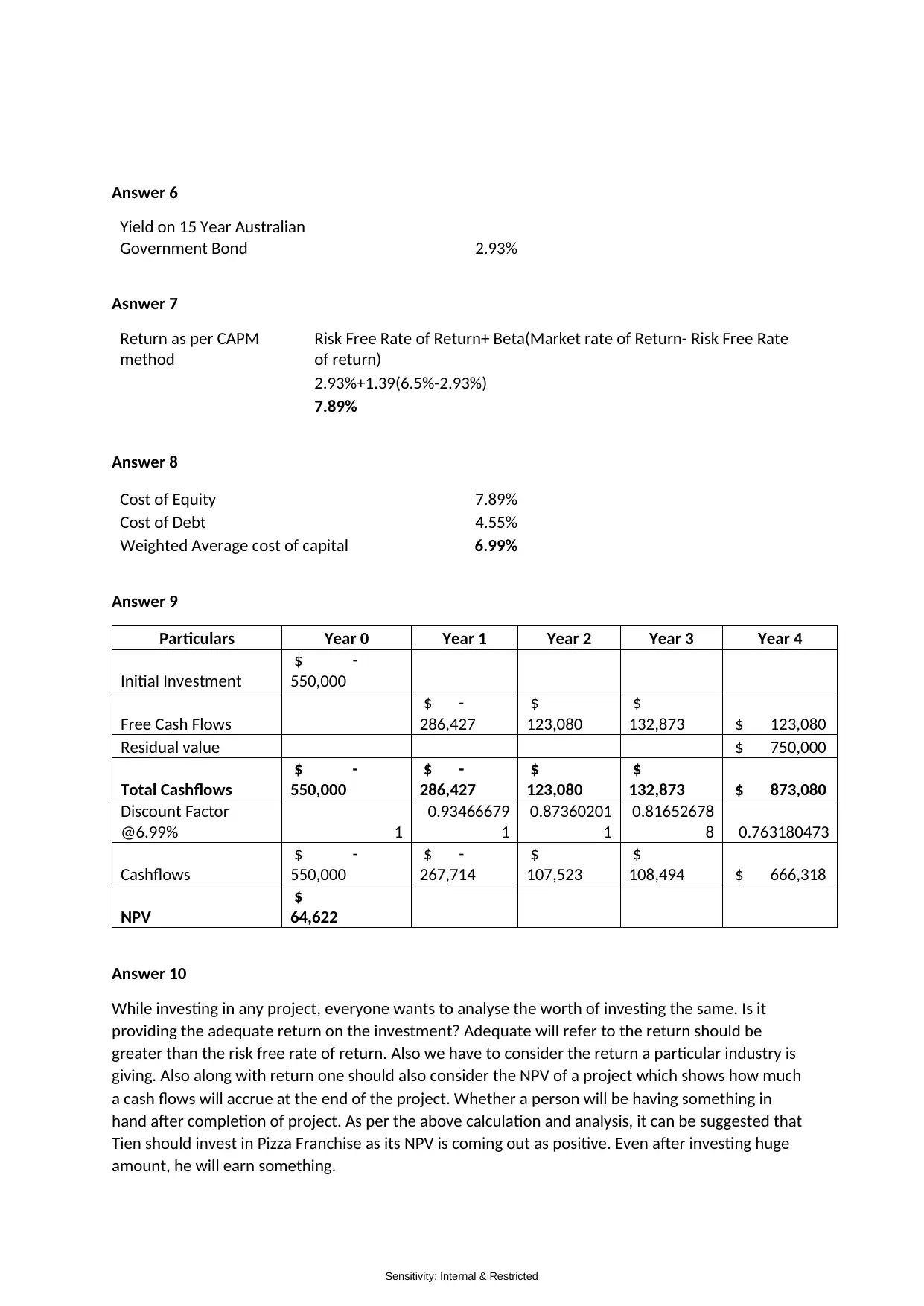

Answer 6

Yield on 15 Year Australian

Government Bond 2.93%

Asnwer 7

Return as per CAPM

method

Risk Free Rate of Return+ Beta(Market rate of Return- Risk Free Rate

of return)

2.93%+1.39(6.5%-2.93%)

7.89%

Answer 8

Cost of Equity 7.89%

Cost of Debt 4.55%

Weighted Average cost of capital 6.99%

Answer 9

Particulars Year 0 Year 1 Year 2 Year 3 Year 4

Initial Investment

$ -

550,000

Free Cash Flows

$ -

286,427

$

123,080

$

132,873 $ 123,080

Residual value $ 750,000

Total Cashflows

$ -

550,000

$ -

286,427

$

123,080

$

132,873 $ 873,080

Discount Factor

@6.99% 1

0.93466679

1

0.87360201

1

0.81652678

8 0.763180473

Cashflows

$ -

550,000

$ -

267,714

$

107,523

$

108,494 $ 666,318

NPV

$

64,622

Answer 10

While investing in any project, everyone wants to analyse the worth of investing the same. Is it

providing the adequate return on the investment? Adequate will refer to the return should be

greater than the risk free rate of return. Also we have to consider the return a particular industry is

giving. Also along with return one should also consider the NPV of a project which shows how much

a cash flows will accrue at the end of the project. Whether a person will be having something in

hand after completion of project. As per the above calculation and analysis, it can be suggested that

Tien should invest in Pizza Franchise as its NPV is coming out as positive. Even after investing huge

amount, he will earn something.

Answer 6

Yield on 15 Year Australian

Government Bond 2.93%

Asnwer 7

Return as per CAPM

method

Risk Free Rate of Return+ Beta(Market rate of Return- Risk Free Rate

of return)

2.93%+1.39(6.5%-2.93%)

7.89%

Answer 8

Cost of Equity 7.89%

Cost of Debt 4.55%

Weighted Average cost of capital 6.99%

Answer 9

Particulars Year 0 Year 1 Year 2 Year 3 Year 4

Initial Investment

$ -

550,000

Free Cash Flows

$ -

286,427

$

123,080

$

132,873 $ 123,080

Residual value $ 750,000

Total Cashflows

$ -

550,000

$ -

286,427

$

123,080

$

132,873 $ 873,080

Discount Factor

@6.99% 1

0.93466679

1

0.87360201

1

0.81652678

8 0.763180473

Cashflows

$ -

550,000

$ -

267,714

$

107,523

$

108,494 $ 666,318

NPV

$

64,622

Answer 10

While investing in any project, everyone wants to analyse the worth of investing the same. Is it

providing the adequate return on the investment? Adequate will refer to the return should be

greater than the risk free rate of return. Also we have to consider the return a particular industry is

giving. Also along with return one should also consider the NPV of a project which shows how much

a cash flows will accrue at the end of the project. Whether a person will be having something in

hand after completion of project. As per the above calculation and analysis, it can be suggested that

Tien should invest in Pizza Franchise as its NPV is coming out as positive. Even after investing huge

amount, he will earn something.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sensitivity: Internal & Restricted

Answer 11

Before investing a person should consider all the pros and cons of a project. After deriving so many

data above now we can analyse what are the major components that are in favour of investing on

pizza franchise. Below are the major points of investing in pizza franchise:

1. First of all, increasing demand of the pizza made it an attractive proposal as as there will be

increase in demand, increase in sales and ultimately will increase the profit of the Company

or the person investing in a particular business.

2. Secondly, after drafting the 4 years income statement, it can be seen that fixed expenses will

remain constant and also there is an increase in 10% sales every year which is a good sign for

investing in a particular business.

3. Also, we have calculated, number of units per week which are required to achieve 20%

return on the capital invested after recovering all the fixed costs. Per week sale units are

greater than the required return which also motivates one person to invest in a Company.

4. Also, as a thumb rule, EBITDA should be 33% of capital invested and as per calculation, it can

be seen that EBITDA is 35% of Capital invested in first year and after that it keeps on

increasing which also motivates a person to invest in this business.

Answer 12

In above answer we have stated the points which supports the investment decisions but there will

be some points which should be considered in a sarcastic way so that both pros and cons can be

analysed.

1. It is only an assumption that demand of pizzas will increase in future but it may be possible

that same thing happen in other way. If there is change in taste and preferences of customer

than one has to face losses as the sales will go down and will not be able to achieve the

targets on the basis of which investment is made.

2. While investing in a particular thing, one should consider other prospects of investment

options. If investing in other prospects may achieve more return than we have to choose

that particular option.

3. Other things that needs to be considered are the working environment in which a person

can work.

Answer 11

Before investing a person should consider all the pros and cons of a project. After deriving so many

data above now we can analyse what are the major components that are in favour of investing on

pizza franchise. Below are the major points of investing in pizza franchise:

1. First of all, increasing demand of the pizza made it an attractive proposal as as there will be

increase in demand, increase in sales and ultimately will increase the profit of the Company

or the person investing in a particular business.

2. Secondly, after drafting the 4 years income statement, it can be seen that fixed expenses will

remain constant and also there is an increase in 10% sales every year which is a good sign for

investing in a particular business.

3. Also, we have calculated, number of units per week which are required to achieve 20%

return on the capital invested after recovering all the fixed costs. Per week sale units are

greater than the required return which also motivates one person to invest in a Company.

4. Also, as a thumb rule, EBITDA should be 33% of capital invested and as per calculation, it can

be seen that EBITDA is 35% of Capital invested in first year and after that it keeps on

increasing which also motivates a person to invest in this business.

Answer 12

In above answer we have stated the points which supports the investment decisions but there will

be some points which should be considered in a sarcastic way so that both pros and cons can be

analysed.

1. It is only an assumption that demand of pizzas will increase in future but it may be possible

that same thing happen in other way. If there is change in taste and preferences of customer

than one has to face losses as the sales will go down and will not be able to achieve the

targets on the basis of which investment is made.

2. While investing in a particular thing, one should consider other prospects of investment

options. If investing in other prospects may achieve more return than we have to choose

that particular option.

3. Other things that needs to be considered are the working environment in which a person

can work.

1 out of 4

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.