Financial Analysis of Scentre Group Limited (2017-2018)

VerifiedAdded on 2022/08/29

|20

|2997

|15

Report

AI Summary

This report provides a comprehensive financial analysis of Scentre Group Limited, focusing on its performance during 2017 and 2018. The analysis includes an executive summary, introduction, and detailed examination of profitability, liquidity, solvency, efficiency, and market performance ratios. A competitor analysis is also presented. The report employs horizontal and vertical analysis techniques to identify trends and variances in the company's financial statements, including the income statement and balance sheet. Key findings reveal insights into the company's financial health, including shifts in profitability, liquidity, and debt levels. The analysis concludes with recommendations aimed at improving Scentre Group's financial standing and competitiveness, along with references to supporting sources.

Accounting and Finance for managers 1

Accounting and Finance for managers

Accounting and Finance for managers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance for managers

Executive summary

Scentre Group Limited is one of the core companies in the area of property management,

designing and construction. In this report a detailed analysis of the company has been undertaken

to analyze the financial performance of the business. In order to analyze the financial

performance of any business, there are several techniques that are required to be undertaken to

get in-depth information. Further, ratio analysis techniques have been used to evaluate the how

well the companies have performed on the basis of previous year and against the competitors.

Each category of ratios has been ascertained to be aware of each department. The techniques foe

evaluation such as horizontal and vertical analysis has been used to record the differences

between the items of the income statement and balance sheet to understand the area of variance if

any. In order to improve the financial performance following recommendations and conclusions

are also provided. These strategies could help the company lift up its position.

Executive summary

Scentre Group Limited is one of the core companies in the area of property management,

designing and construction. In this report a detailed analysis of the company has been undertaken

to analyze the financial performance of the business. In order to analyze the financial

performance of any business, there are several techniques that are required to be undertaken to

get in-depth information. Further, ratio analysis techniques have been used to evaluate the how

well the companies have performed on the basis of previous year and against the competitors.

Each category of ratios has been ascertained to be aware of each department. The techniques foe

evaluation such as horizontal and vertical analysis has been used to record the differences

between the items of the income statement and balance sheet to understand the area of variance if

any. In order to improve the financial performance following recommendations and conclusions

are also provided. These strategies could help the company lift up its position.

Accounting and Finance for managers

Contents

Introduction......................................................................................................................................3

Ratio analysis...................................................................................................................................3

Profitability..................................................................................................................................4

Liquidity.......................................................................................................................................4

Solvency.......................................................................................................................................5

Efficiency.....................................................................................................................................6

Market Performance.....................................................................................................................6

Competitor analysis.........................................................................................................................7

Horizontal Analysis.........................................................................................................................7

Vertical Analysis.............................................................................................................................9

Recommendations and Conclusion................................................................................................12

References......................................................................................................................................13

Appendix 1.....................................................................................................................................15

Contents

Introduction......................................................................................................................................3

Ratio analysis...................................................................................................................................3

Profitability..................................................................................................................................4

Liquidity.......................................................................................................................................4

Solvency.......................................................................................................................................5

Efficiency.....................................................................................................................................6

Market Performance.....................................................................................................................6

Competitor analysis.........................................................................................................................7

Horizontal Analysis.........................................................................................................................7

Vertical Analysis.............................................................................................................................9

Recommendations and Conclusion................................................................................................12

References......................................................................................................................................13

Appendix 1.....................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance for managers

Introduction

Scentre Group Limited is one of the Australian flagships, commonly known as a

shopping Centre having features with retail destinations which is currently operating under the

Westfield brand in Australia and New Zealand. Originally the Scentre Group limited belongs to

the western Suburbs of Sydney. These primary activities of this corporation are to undertake the

ownership, designs or constructs, development, property management, leasing and creating

marketing centers. Founded in the year 2014, as a spin off from Westfield Development

Corporation, the same was also listed on Australian Stock Exchange (Scentre Group Limited,

2019).

Ratio analysis

Ratio analysis is understood as a technique that is useful for comparison of the items

available in the financial report of the Scentre Group limited. Ratios can be evaluated on the

basis of the previous years or on the basis of the benchmark. There are several categories on the

basis of which these ratios are being compared to get an insight of the financial performance off

the business. Mainly this comparison is undertaken to understand the position of the Scentre

Group limited with respect to the competitors (Accountingtools.com, 2018). In this section a

detailed ratio analysis has been undertaken for Scentre Group Limited for the period of 2017 and

2018 (Setiawan & Amboningtyas, 2018).

Introduction

Scentre Group Limited is one of the Australian flagships, commonly known as a

shopping Centre having features with retail destinations which is currently operating under the

Westfield brand in Australia and New Zealand. Originally the Scentre Group limited belongs to

the western Suburbs of Sydney. These primary activities of this corporation are to undertake the

ownership, designs or constructs, development, property management, leasing and creating

marketing centers. Founded in the year 2014, as a spin off from Westfield Development

Corporation, the same was also listed on Australian Stock Exchange (Scentre Group Limited,

2019).

Ratio analysis

Ratio analysis is understood as a technique that is useful for comparison of the items

available in the financial report of the Scentre Group limited. Ratios can be evaluated on the

basis of the previous years or on the basis of the benchmark. There are several categories on the

basis of which these ratios are being compared to get an insight of the financial performance off

the business. Mainly this comparison is undertaken to understand the position of the Scentre

Group limited with respect to the competitors (Accountingtools.com, 2018). In this section a

detailed ratio analysis has been undertaken for Scentre Group Limited for the period of 2017 and

2018 (Setiawan & Amboningtyas, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance for managers

Profitability

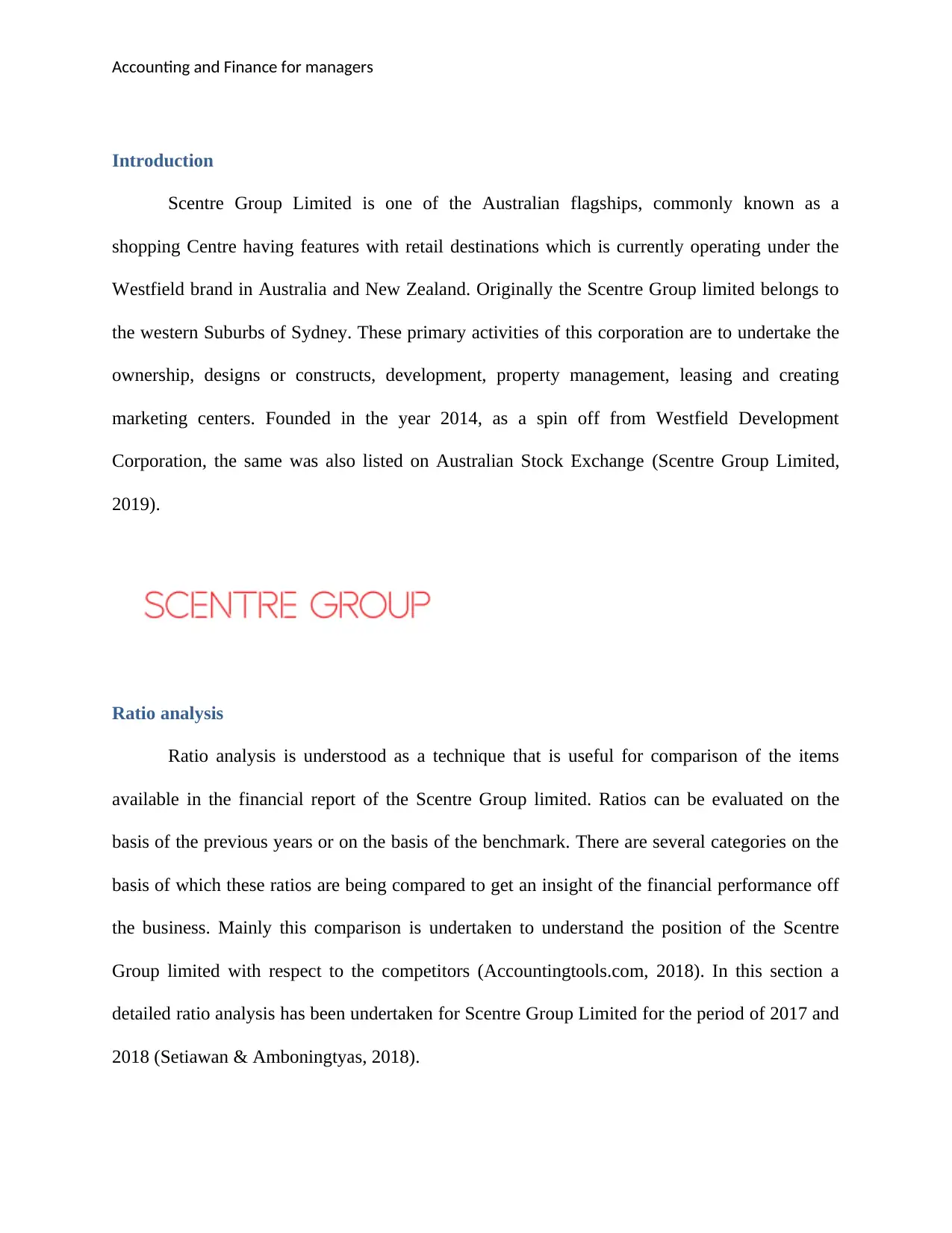

The profitability of the Scentre Group limited is determined by the net margin, gross

margin and return on equity ratio. These ratios are of core importance to the investors and hence,

this is the most important technique to analyze. The net profit margin has fallen to a shocking

level from 171% to 87%. Since this is a construction Scentre Group limited the net profit is not

measured on usual terms, but due to the less demand and higher commercial rates (McLean,

2020). The return on equity is the ratio that defines the share of the shareholders left after the

payments of all the expenses. The ratio decreased from 18.57% to 9.62% and this indicates that

the share allotted to the shareholders is lower than the previous year. The operating margin also

declined from 80% to 53.7% due to the increase in the cost of the raw materials (Robinson,

2020).

2015 2016 2017 2018

2200

2300

2400

2500

2600

2700

2800

2900

3000

Revenue

Revenue

Liquidity

The liquidity position of the Scentre Group limited is determined by the current ratio and

quick ratio. The current ratio of the Scentre Group limited have increased in comparison to the

Profitability

The profitability of the Scentre Group limited is determined by the net margin, gross

margin and return on equity ratio. These ratios are of core importance to the investors and hence,

this is the most important technique to analyze. The net profit margin has fallen to a shocking

level from 171% to 87%. Since this is a construction Scentre Group limited the net profit is not

measured on usual terms, but due to the less demand and higher commercial rates (McLean,

2020). The return on equity is the ratio that defines the share of the shareholders left after the

payments of all the expenses. The ratio decreased from 18.57% to 9.62% and this indicates that

the share allotted to the shareholders is lower than the previous year. The operating margin also

declined from 80% to 53.7% due to the increase in the cost of the raw materials (Robinson,

2020).

2015 2016 2017 2018

2200

2300

2400

2500

2600

2700

2800

2900

3000

Revenue

Revenue

Liquidity

The liquidity position of the Scentre Group limited is determined by the current ratio and

quick ratio. The current ratio of the Scentre Group limited have increased in comparison to the

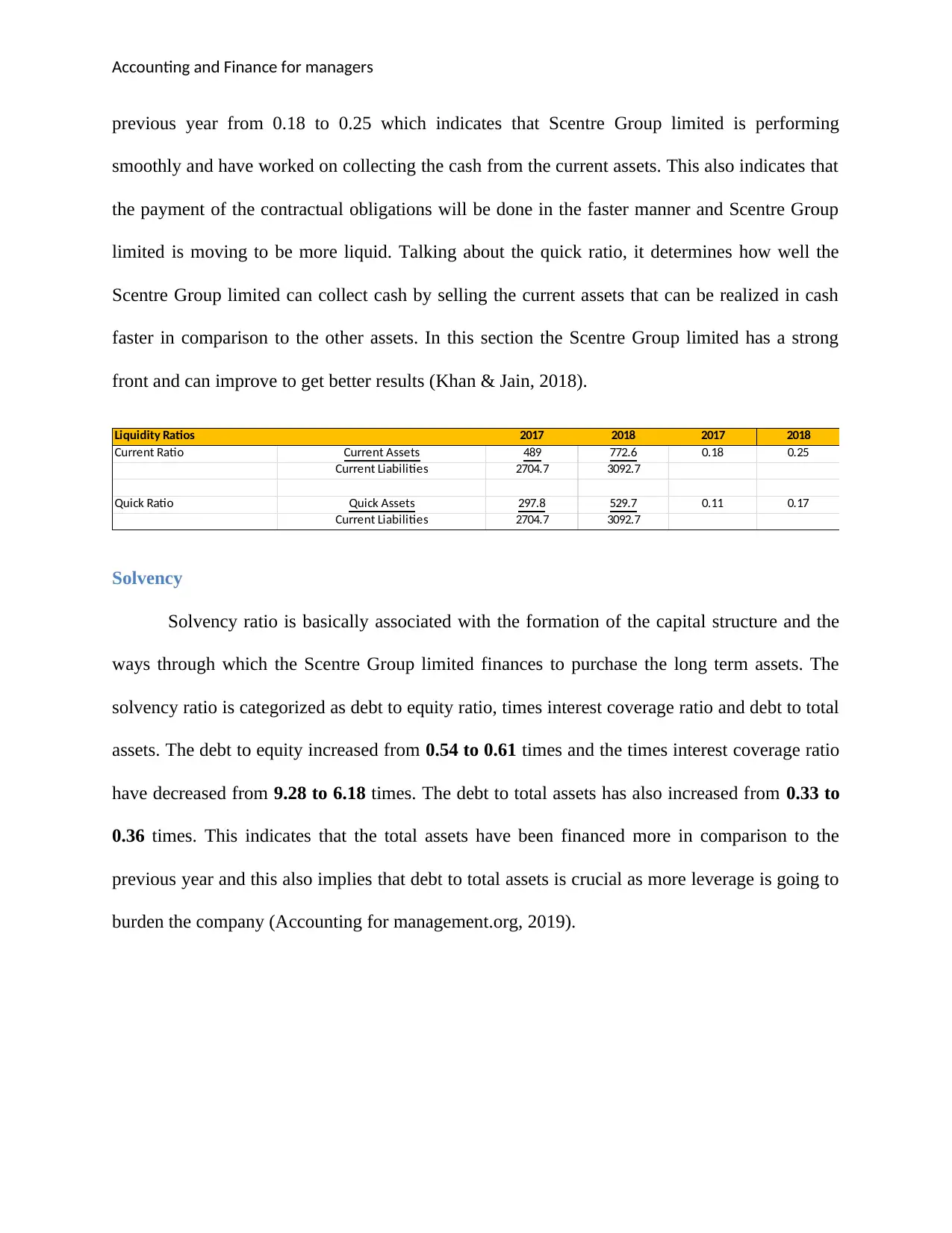

Accounting and Finance for managers

previous year from 0.18 to 0.25 which indicates that Scentre Group limited is performing

smoothly and have worked on collecting the cash from the current assets. This also indicates that

the payment of the contractual obligations will be done in the faster manner and Scentre Group

limited is moving to be more liquid. Talking about the quick ratio, it determines how well the

Scentre Group limited can collect cash by selling the current assets that can be realized in cash

faster in comparison to the other assets. In this section the Scentre Group limited has a strong

front and can improve to get better results (Khan & Jain, 2018).

Liquidity Ratios 2017 2018 2017 2018

Current Ratio Current Assets 489 772.6 0.18 0.25

Current Liabilities 2704.7 3092.7

Quick Ratio Quick Assets 297.8 529.7 0.11 0.17

Current Liabilities 2704.7 3092.7

Solvency

Solvency ratio is basically associated with the formation of the capital structure and the

ways through which the Scentre Group limited finances to purchase the long term assets. The

solvency ratio is categorized as debt to equity ratio, times interest coverage ratio and debt to total

assets. The debt to equity increased from 0.54 to 0.61 times and the times interest coverage ratio

have decreased from 9.28 to 6.18 times. The debt to total assets has also increased from 0.33 to

0.36 times. This indicates that the total assets have been financed more in comparison to the

previous year and this also implies that debt to total assets is crucial as more leverage is going to

burden the company (Accounting for management.org, 2019).

previous year from 0.18 to 0.25 which indicates that Scentre Group limited is performing

smoothly and have worked on collecting the cash from the current assets. This also indicates that

the payment of the contractual obligations will be done in the faster manner and Scentre Group

limited is moving to be more liquid. Talking about the quick ratio, it determines how well the

Scentre Group limited can collect cash by selling the current assets that can be realized in cash

faster in comparison to the other assets. In this section the Scentre Group limited has a strong

front and can improve to get better results (Khan & Jain, 2018).

Liquidity Ratios 2017 2018 2017 2018

Current Ratio Current Assets 489 772.6 0.18 0.25

Current Liabilities 2704.7 3092.7

Quick Ratio Quick Assets 297.8 529.7 0.11 0.17

Current Liabilities 2704.7 3092.7

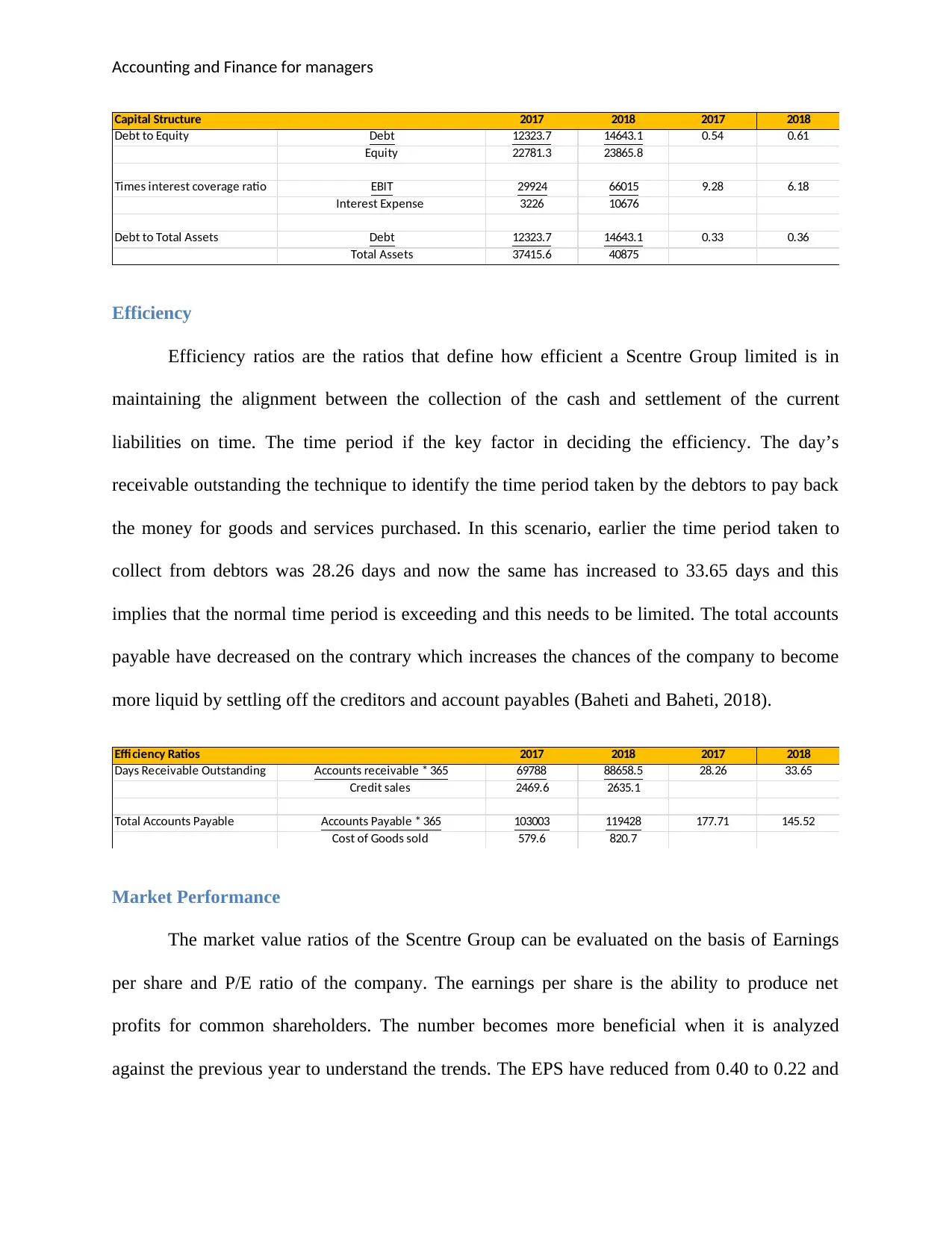

Solvency

Solvency ratio is basically associated with the formation of the capital structure and the

ways through which the Scentre Group limited finances to purchase the long term assets. The

solvency ratio is categorized as debt to equity ratio, times interest coverage ratio and debt to total

assets. The debt to equity increased from 0.54 to 0.61 times and the times interest coverage ratio

have decreased from 9.28 to 6.18 times. The debt to total assets has also increased from 0.33 to

0.36 times. This indicates that the total assets have been financed more in comparison to the

previous year and this also implies that debt to total assets is crucial as more leverage is going to

burden the company (Accounting for management.org, 2019).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance for managers

Capital Structure 2017 2018 2017 2018

Debt to Equity Debt 12323.7 14643.1 0.54 0.61

Equity 22781.3 23865.8

Times interest coverage ratio EBIT 29924 66015 9.28 6.18

Interest Expense 3226 10676

Debt to Total Assets Debt 12323.7 14643.1 0.33 0.36

Total Assets 37415.6 40875

Efficiency

Efficiency ratios are the ratios that define how efficient a Scentre Group limited is in

maintaining the alignment between the collection of the cash and settlement of the current

liabilities on time. The time period if the key factor in deciding the efficiency. The day’s

receivable outstanding the technique to identify the time period taken by the debtors to pay back

the money for goods and services purchased. In this scenario, earlier the time period taken to

collect from debtors was 28.26 days and now the same has increased to 33.65 days and this

implies that the normal time period is exceeding and this needs to be limited. The total accounts

payable have decreased on the contrary which increases the chances of the company to become

more liquid by settling off the creditors and account payables (Baheti and Baheti, 2018).

Efficiency Ratios 2017 2018 2017 2018

Days Receivable Outstanding Accounts receivable * 365 69788 88658.5 28.26 33.65

Credit sales 2469.6 2635.1

Total Accounts Payable Accounts Payable * 365 103003 119428 177.71 145.52

Cost of Goods sold 579.6 820.7

Market Performance

The market value ratios of the Scentre Group can be evaluated on the basis of Earnings

per share and P/E ratio of the company. The earnings per share is the ability to produce net

profits for common shareholders. The number becomes more beneficial when it is analyzed

against the previous year to understand the trends. The EPS have reduced from 0.40 to 0.22 and

Capital Structure 2017 2018 2017 2018

Debt to Equity Debt 12323.7 14643.1 0.54 0.61

Equity 22781.3 23865.8

Times interest coverage ratio EBIT 29924 66015 9.28 6.18

Interest Expense 3226 10676

Debt to Total Assets Debt 12323.7 14643.1 0.33 0.36

Total Assets 37415.6 40875

Efficiency

Efficiency ratios are the ratios that define how efficient a Scentre Group limited is in

maintaining the alignment between the collection of the cash and settlement of the current

liabilities on time. The time period if the key factor in deciding the efficiency. The day’s

receivable outstanding the technique to identify the time period taken by the debtors to pay back

the money for goods and services purchased. In this scenario, earlier the time period taken to

collect from debtors was 28.26 days and now the same has increased to 33.65 days and this

implies that the normal time period is exceeding and this needs to be limited. The total accounts

payable have decreased on the contrary which increases the chances of the company to become

more liquid by settling off the creditors and account payables (Baheti and Baheti, 2018).

Efficiency Ratios 2017 2018 2017 2018

Days Receivable Outstanding Accounts receivable * 365 69788 88658.5 28.26 33.65

Credit sales 2469.6 2635.1

Total Accounts Payable Accounts Payable * 365 103003 119428 177.71 145.52

Cost of Goods sold 579.6 820.7

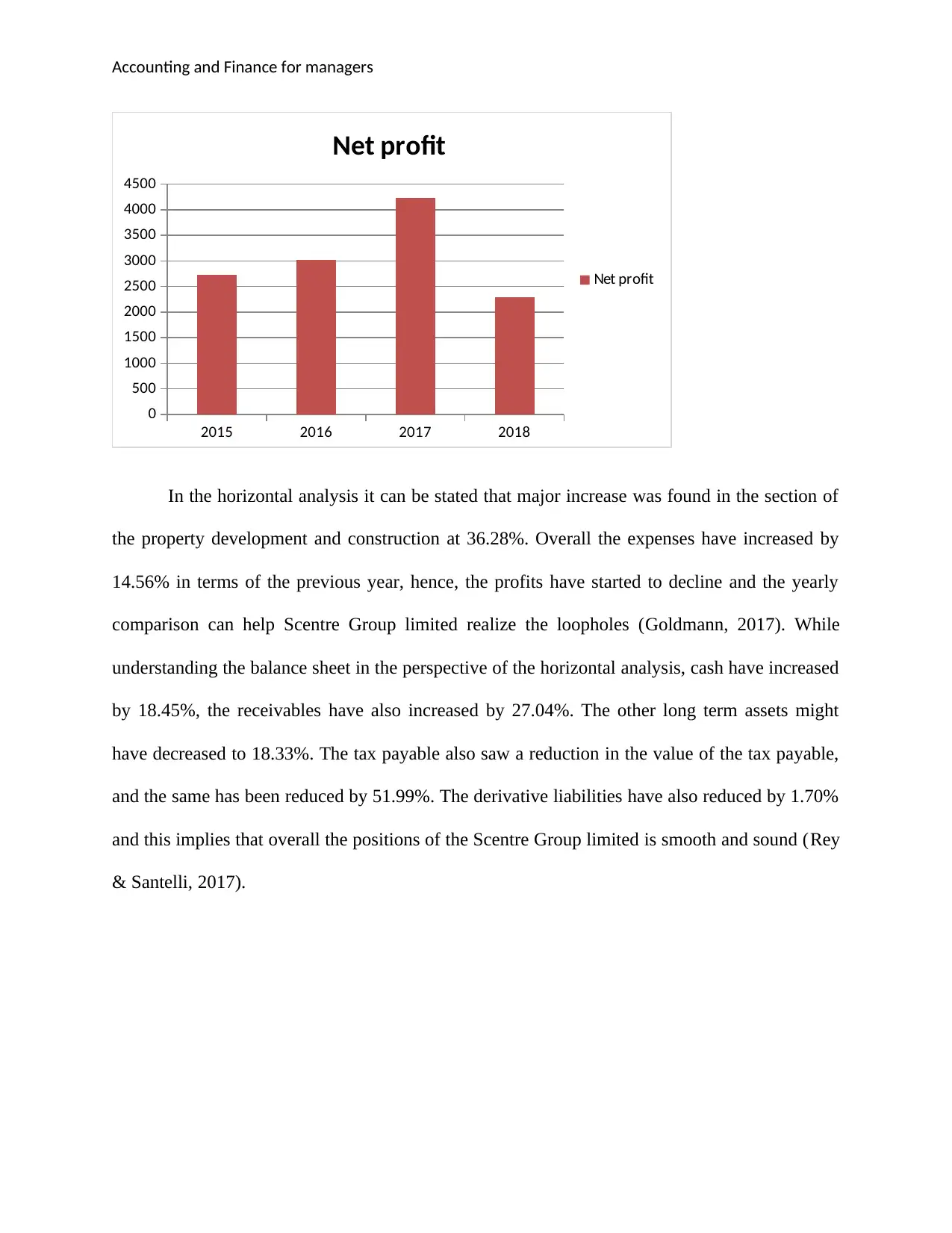

Market Performance

The market value ratios of the Scentre Group can be evaluated on the basis of Earnings

per share and P/E ratio of the company. The earnings per share is the ability to produce net

profits for common shareholders. The number becomes more beneficial when it is analyzed

against the previous year to understand the trends. The EPS have reduced from 0.40 to 0.22 and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance for managers

this implies that shareholders will get the lower returns in comparison to the previous years. The

price earnings ratio on the other hand is a measure of the current price and used to value whether

the company is performing outstandingly well or not. The higher the ratio, the greater amount is

required to be paid to the investors. The P/E ratio has increased which means the company is

going to have future returns as well (Efinance management.com, 2019).

Competitor analysis

As per the competitors analysis it can be ascertained that the number of competitors in

the industry in which Scentre Group operates are very few. Most of these are also large in size,

which indicates that firms in the industry will not make moves without being unnoticed. This

makes the rivalry among existing firms a weaker force within the industry (Murphy & McGrath,

2016).

Market Value ratios 2017 2018 2017 2018

EPS Net income 4231.4 2295.9 0.40 0.22

Weigthed avergae outstanding shares 10495.2 10465.1

Price to Earnings Ratio Market Price 6.75 3.98 16.74 18.14

EPS 0.40 0.22

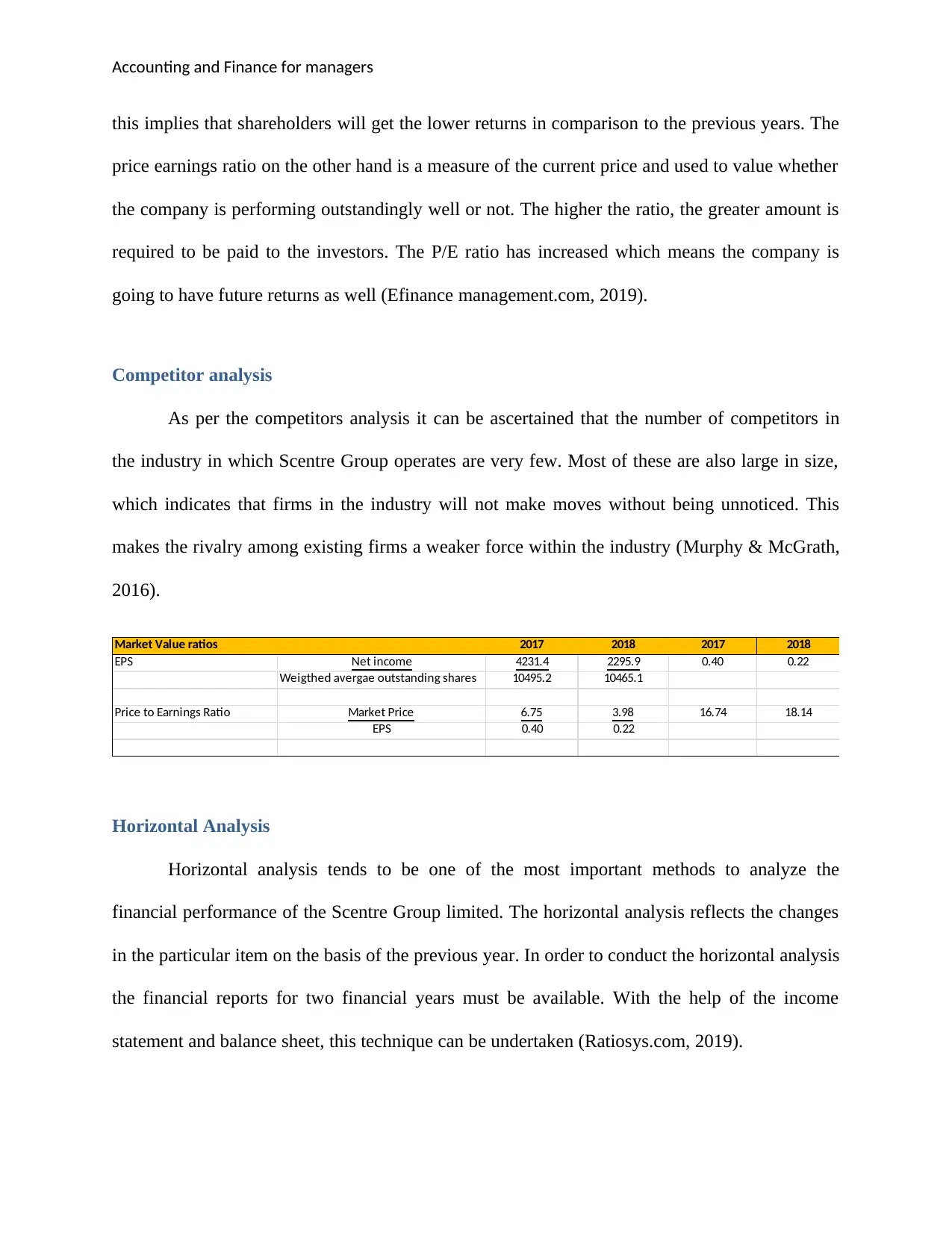

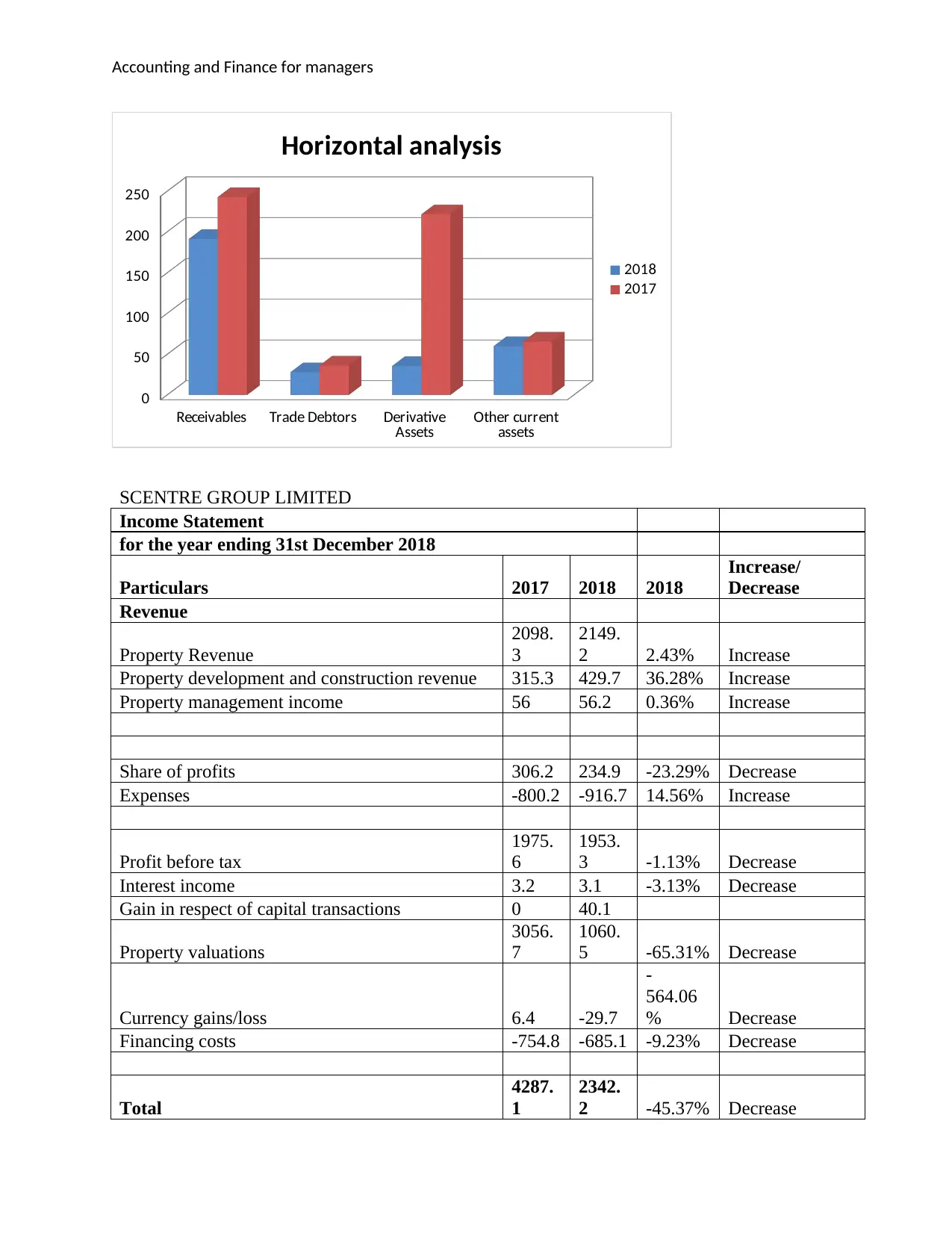

Horizontal Analysis

Horizontal analysis tends to be one of the most important methods to analyze the

financial performance of the Scentre Group limited. The horizontal analysis reflects the changes

in the particular item on the basis of the previous year. In order to conduct the horizontal analysis

the financial reports for two financial years must be available. With the help of the income

statement and balance sheet, this technique can be undertaken (Ratiosys.com, 2019).

this implies that shareholders will get the lower returns in comparison to the previous years. The

price earnings ratio on the other hand is a measure of the current price and used to value whether

the company is performing outstandingly well or not. The higher the ratio, the greater amount is

required to be paid to the investors. The P/E ratio has increased which means the company is

going to have future returns as well (Efinance management.com, 2019).

Competitor analysis

As per the competitors analysis it can be ascertained that the number of competitors in

the industry in which Scentre Group operates are very few. Most of these are also large in size,

which indicates that firms in the industry will not make moves without being unnoticed. This

makes the rivalry among existing firms a weaker force within the industry (Murphy & McGrath,

2016).

Market Value ratios 2017 2018 2017 2018

EPS Net income 4231.4 2295.9 0.40 0.22

Weigthed avergae outstanding shares 10495.2 10465.1

Price to Earnings Ratio Market Price 6.75 3.98 16.74 18.14

EPS 0.40 0.22

Horizontal Analysis

Horizontal analysis tends to be one of the most important methods to analyze the

financial performance of the Scentre Group limited. The horizontal analysis reflects the changes

in the particular item on the basis of the previous year. In order to conduct the horizontal analysis

the financial reports for two financial years must be available. With the help of the income

statement and balance sheet, this technique can be undertaken (Ratiosys.com, 2019).

Accounting and Finance for managers

2015 2016 2017 2018

0

500

1000

1500

2000

2500

3000

3500

4000

4500

Net profit

Net profit

In the horizontal analysis it can be stated that major increase was found in the section of

the property development and construction at 36.28%. Overall the expenses have increased by

14.56% in terms of the previous year, hence, the profits have started to decline and the yearly

comparison can help Scentre Group limited realize the loopholes (Goldmann, 2017). While

understanding the balance sheet in the perspective of the horizontal analysis, cash have increased

by 18.45%, the receivables have also increased by 27.04%. The other long term assets might

have decreased to 18.33%. The tax payable also saw a reduction in the value of the tax payable,

and the same has been reduced by 51.99%. The derivative liabilities have also reduced by 1.70%

and this implies that overall the positions of the Scentre Group limited is smooth and sound (Rey

& Santelli, 2017).

2015 2016 2017 2018

0

500

1000

1500

2000

2500

3000

3500

4000

4500

Net profit

Net profit

In the horizontal analysis it can be stated that major increase was found in the section of

the property development and construction at 36.28%. Overall the expenses have increased by

14.56% in terms of the previous year, hence, the profits have started to decline and the yearly

comparison can help Scentre Group limited realize the loopholes (Goldmann, 2017). While

understanding the balance sheet in the perspective of the horizontal analysis, cash have increased

by 18.45%, the receivables have also increased by 27.04%. The other long term assets might

have decreased to 18.33%. The tax payable also saw a reduction in the value of the tax payable,

and the same has been reduced by 51.99%. The derivative liabilities have also reduced by 1.70%

and this implies that overall the positions of the Scentre Group limited is smooth and sound (Rey

& Santelli, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Accounting and Finance for managers

Receivables Trade Debtors Derivative

Assets Other current

assets

0

50

100

150

200

250

Horizontal analysis

2018

2017

SCENTRE GROUP LIMITED

Income Statement

for the year ending 31st December 2018

Particulars 2017 2018 2018

Increase/

Decrease

Revenue

Property Revenue

2098.

3

2149.

2 2.43% Increase

Property development and construction revenue 315.3 429.7 36.28% Increase

Property management income 56 56.2 0.36% Increase

Share of profits 306.2 234.9 -23.29% Decrease

Expenses -800.2 -916.7 14.56% Increase

Profit before tax

1975.

6

1953.

3 -1.13% Decrease

Interest income 3.2 3.1 -3.13% Decrease

Gain in respect of capital transactions 0 40.1

Property valuations

3056.

7

1060.

5 -65.31% Decrease

Currency gains/loss 6.4 -29.7

-

564.06

% Decrease

Financing costs -754.8 -685.1 -9.23% Decrease

Total

4287.

1

2342.

2 -45.37% Decrease

Receivables Trade Debtors Derivative

Assets Other current

assets

0

50

100

150

200

250

Horizontal analysis

2018

2017

SCENTRE GROUP LIMITED

Income Statement

for the year ending 31st December 2018

Particulars 2017 2018 2018

Increase/

Decrease

Revenue

Property Revenue

2098.

3

2149.

2 2.43% Increase

Property development and construction revenue 315.3 429.7 36.28% Increase

Property management income 56 56.2 0.36% Increase

Share of profits 306.2 234.9 -23.29% Decrease

Expenses -800.2 -916.7 14.56% Increase

Profit before tax

1975.

6

1953.

3 -1.13% Decrease

Interest income 3.2 3.1 -3.13% Decrease

Gain in respect of capital transactions 0 40.1

Property valuations

3056.

7

1060.

5 -65.31% Decrease

Currency gains/loss 6.4 -29.7

-

564.06

% Decrease

Financing costs -754.8 -685.1 -9.23% Decrease

Total

4287.

1

2342.

2 -45.37% Decrease

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounting and Finance for managers

Tax expense -55.7 -46.3 -16.88% Decrease

Profit after tax

4231.

4

2295.

9 -45.74% Decrease

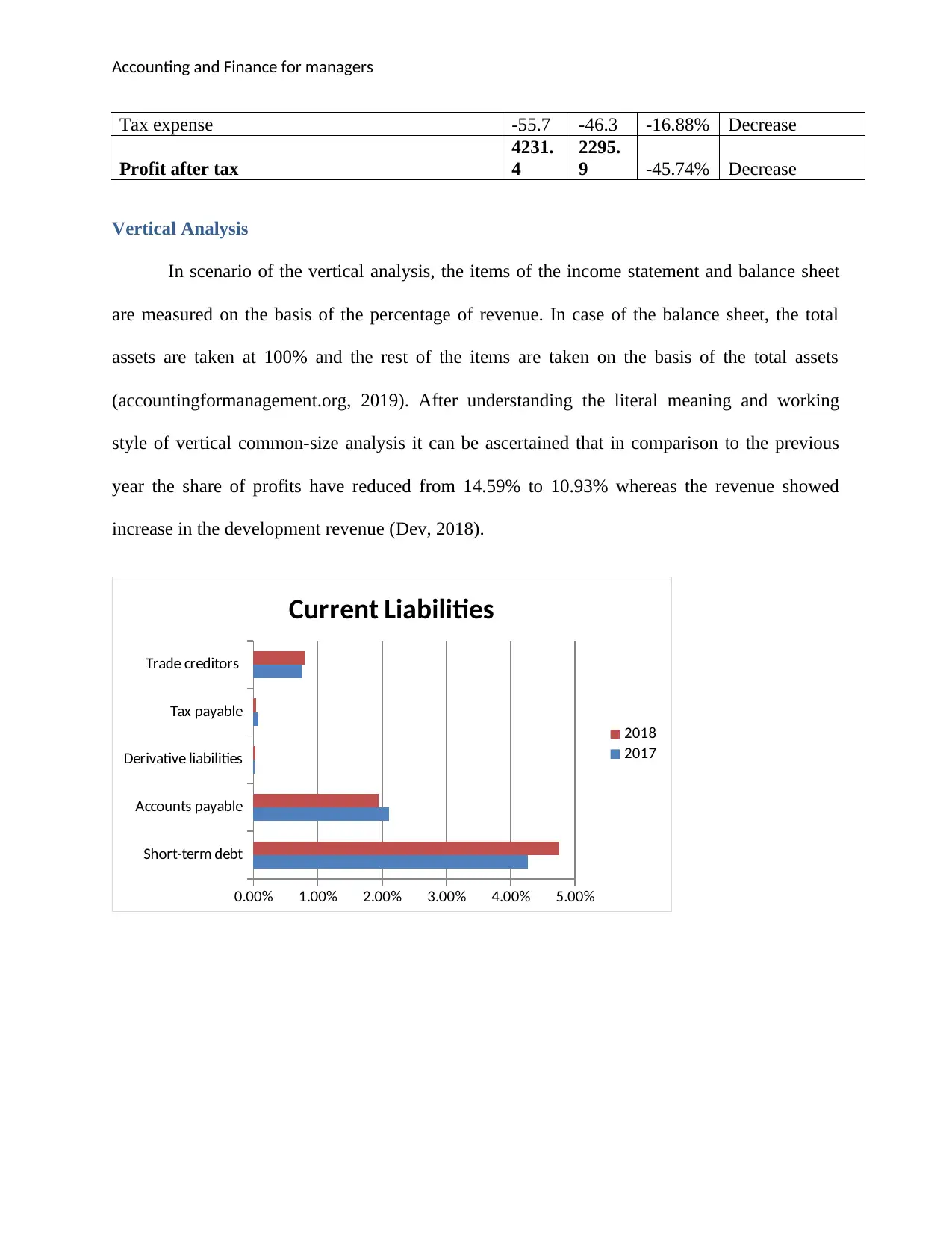

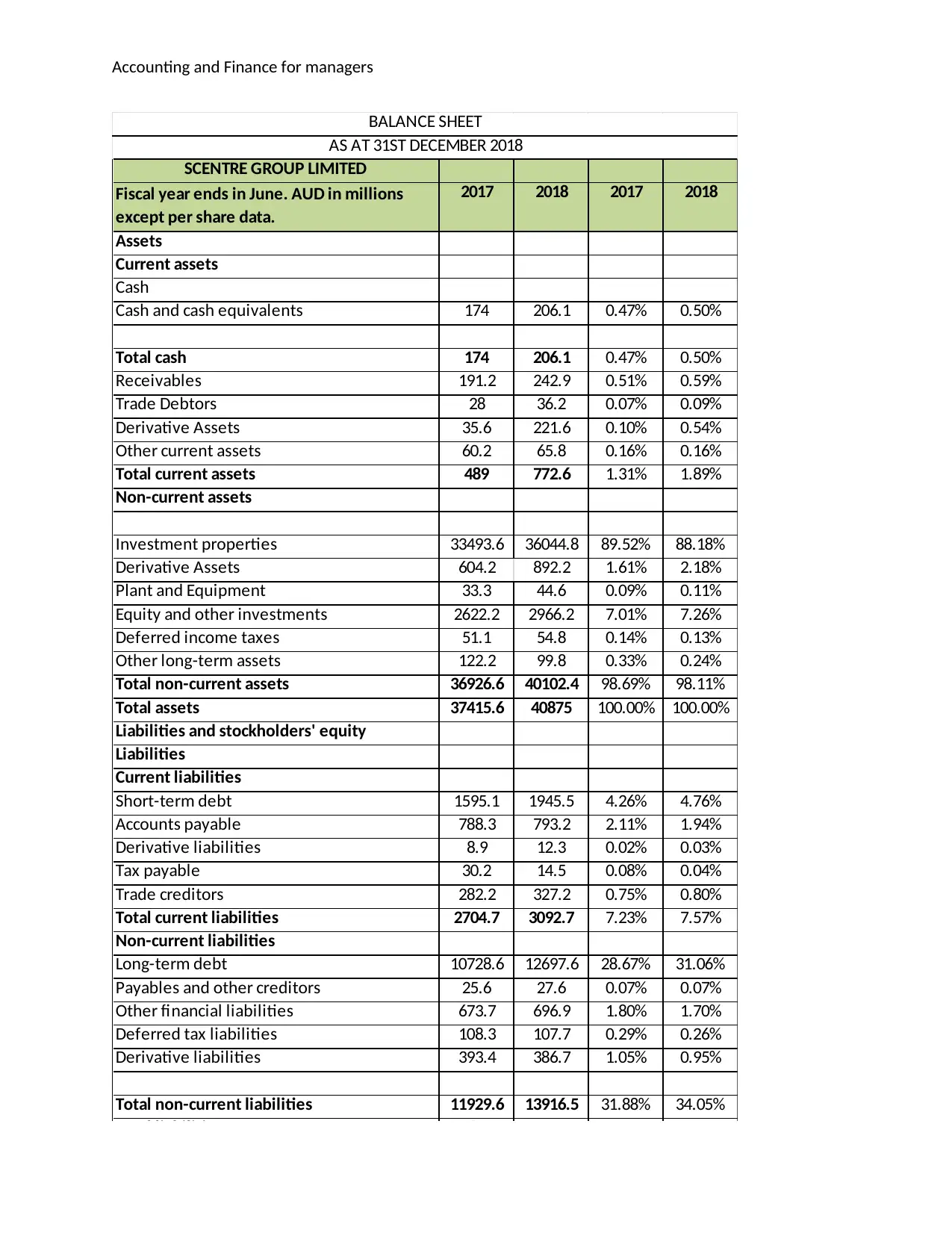

Vertical Analysis

In scenario of the vertical analysis, the items of the income statement and balance sheet

are measured on the basis of the percentage of revenue. In case of the balance sheet, the total

assets are taken at 100% and the rest of the items are taken on the basis of the total assets

(accountingformanagement.org, 2019). After understanding the literal meaning and working

style of vertical common-size analysis it can be ascertained that in comparison to the previous

year the share of profits have reduced from 14.59% to 10.93% whereas the revenue showed

increase in the development revenue (Dev, 2018).

Short-term debt

Accounts payable

Derivative liabilities

Tax payable

Trade creditors

0.00% 1.00% 2.00% 3.00% 4.00% 5.00%

Current Liabilities

2018

2017

Tax expense -55.7 -46.3 -16.88% Decrease

Profit after tax

4231.

4

2295.

9 -45.74% Decrease

Vertical Analysis

In scenario of the vertical analysis, the items of the income statement and balance sheet

are measured on the basis of the percentage of revenue. In case of the balance sheet, the total

assets are taken at 100% and the rest of the items are taken on the basis of the total assets

(accountingformanagement.org, 2019). After understanding the literal meaning and working

style of vertical common-size analysis it can be ascertained that in comparison to the previous

year the share of profits have reduced from 14.59% to 10.93% whereas the revenue showed

increase in the development revenue (Dev, 2018).

Short-term debt

Accounts payable

Derivative liabilities

Tax payable

Trade creditors

0.00% 1.00% 2.00% 3.00% 4.00% 5.00%

Current Liabilities

2018

2017

Accounting and Finance for managers

SCENTRE GROUP LIMITED

Fiscal year ends in June. AUD in millions

except per share data.

2017 2018 2017 2018

Assets

Current assets

Cash

Cash and cash equivalents 174 206.1 0.47% 0.50%

Total cash 174 206.1 0.47% 0.50%

Receivables 191.2 242.9 0.51% 0.59%

Trade Debtors 28 36.2 0.07% 0.09%

Derivative Assets 35.6 221.6 0.10% 0.54%

Other current assets 60.2 65.8 0.16% 0.16%

Total current assets 489 772.6 1.31% 1.89%

Non-current assets

Investment properties 33493.6 36044.8 89.52% 88.18%

Derivative Assets 604.2 892.2 1.61% 2.18%

Plant and Equipment 33.3 44.6 0.09% 0.11%

Equity and other investments 2622.2 2966.2 7.01% 7.26%

Deferred income taxes 51.1 54.8 0.14% 0.13%

Other long-term assets 122.2 99.8 0.33% 0.24%

Total non-current assets 36926.6 40102.4 98.69% 98.11%

Total assets 37415.6 40875 100.00% 100.00%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 1595.1 1945.5 4.26% 4.76%

Accounts payable 788.3 793.2 2.11% 1.94%

Derivative liabilities 8.9 12.3 0.02% 0.03%

Tax payable 30.2 14.5 0.08% 0.04%

Trade creditors 282.2 327.2 0.75% 0.80%

Total current liabilities 2704.7 3092.7 7.23% 7.57%

Non-current liabilities

Long-term debt 10728.6 12697.6 28.67% 31.06%

Payables and other creditors 25.6 27.6 0.07% 0.07%

Other financial liabilities 673.7 696.9 1.80% 1.70%

Deferred tax liabilities 108.3 107.7 0.29% 0.26%

Derivative liabilities 393.4 386.7 1.05% 0.95%

Total non-current liabilities 11929.6 13916.5 31.88% 34.05%

Total liabilities 14634.3 17009.2 39.11% 41.61%

Stockholders' equity

Common stock 10495.2 10465.1 28.05% 25.60%

Reserves 86.6 108.7 0.23% 0.27%

Retained profits 11952.1 13063.9 31.94% 31.96%

BALANCE SHEET

AS AT 31ST DECEMBER 2018

SCENTRE GROUP LIMITED

Fiscal year ends in June. AUD in millions

except per share data.

2017 2018 2017 2018

Assets

Current assets

Cash

Cash and cash equivalents 174 206.1 0.47% 0.50%

Total cash 174 206.1 0.47% 0.50%

Receivables 191.2 242.9 0.51% 0.59%

Trade Debtors 28 36.2 0.07% 0.09%

Derivative Assets 35.6 221.6 0.10% 0.54%

Other current assets 60.2 65.8 0.16% 0.16%

Total current assets 489 772.6 1.31% 1.89%

Non-current assets

Investment properties 33493.6 36044.8 89.52% 88.18%

Derivative Assets 604.2 892.2 1.61% 2.18%

Plant and Equipment 33.3 44.6 0.09% 0.11%

Equity and other investments 2622.2 2966.2 7.01% 7.26%

Deferred income taxes 51.1 54.8 0.14% 0.13%

Other long-term assets 122.2 99.8 0.33% 0.24%

Total non-current assets 36926.6 40102.4 98.69% 98.11%

Total assets 37415.6 40875 100.00% 100.00%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 1595.1 1945.5 4.26% 4.76%

Accounts payable 788.3 793.2 2.11% 1.94%

Derivative liabilities 8.9 12.3 0.02% 0.03%

Tax payable 30.2 14.5 0.08% 0.04%

Trade creditors 282.2 327.2 0.75% 0.80%

Total current liabilities 2704.7 3092.7 7.23% 7.57%

Non-current liabilities

Long-term debt 10728.6 12697.6 28.67% 31.06%

Payables and other creditors 25.6 27.6 0.07% 0.07%

Other financial liabilities 673.7 696.9 1.80% 1.70%

Deferred tax liabilities 108.3 107.7 0.29% 0.26%

Derivative liabilities 393.4 386.7 1.05% 0.95%

Total non-current liabilities 11929.6 13916.5 31.88% 34.05%

Total liabilities 14634.3 17009.2 39.11% 41.61%

Stockholders' equity

Common stock 10495.2 10465.1 28.05% 25.60%

Reserves 86.6 108.7 0.23% 0.27%

Retained profits 11952.1 13063.9 31.94% 31.96%

BALANCE SHEET

AS AT 31ST DECEMBER 2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.