Detailed Analysis of Woolworths' Cash Flow, OCI, and Corporate Tax

VerifiedAdded on 2021/06/17

|10

|2924

|160

Report

AI Summary

This report provides a detailed analysis of Woolworths Limited's financial statements, focusing on the cash flow statement, other comprehensive income (OCI), and corporate income tax. The analysis of the cash flow statement examines the inflows and outflows related to operating, investing, and financing activities over three years, including a comparative analysis of key items like receipts from customers, payments to suppliers, and dividends. The report also explores the components of OCI, such as hedging reserves, foreign currency translation, and equity instruments reserves, explaining their accounting treatment and why they are not reported in the profit and loss statement. Furthermore, it delves into the company's corporate income tax, detailing the current tax expense and any differences between accounting income and taxable income. The report concludes with an overall assessment of the company's financial performance, offering recommendations based on the findings.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

EXECUTIVE SUMMARY.................................................................................................................................2

INTRODUCTION...........................................................................................................................................2

DETAILS OF COMPANY SELECTED................................................................................................................2

ANALYSIS OF THE CASH FLOW STATEMENT................................................................................................2

ANALYSIS OF OTHER COMPREHENSIVE INCOME.........................................................................................2

ANALYSIS OF CORPORATE INCOME TAX......................................................................................................2

CONCLUSION AND RECOMMENDATION.....................................................................................................2

REFERENCES................................................................................................................................................2

EXECUTIVE SUMMARY

The financial statements of the company shall be presented in the proper and defined manner. It

includes the statement of the affairs, statement showing the profit and loss earned during the

year, statement of the cash flows detailing the cash generated from the business of the company.

The report has been framed with the three basic objectives. The main purpose of this report is to

analyze the statement of the cash flows with regard to the change in each and every item of the

statement. The second aim is to discuss and analyze the items covered under the statement of

other comprehensive income and the last aim of this report is to understand the treatment of the

corporation income tax in the financial statements of the company. With these aims and

considerations, the report has been prepared and divided into the appropriate headings and

discussions thereon.

INTRODUCTION

Each statement of the annual report has its own effect in enabling the users of the financial

statements to have the meaningful and the relevant decision. In the given case, the title of the

report deals with the analysis of the two major statements of the financial statements of the

company. Although there are four statements that is embedded in the annual report of the

EXECUTIVE SUMMARY.................................................................................................................................2

INTRODUCTION...........................................................................................................................................2

DETAILS OF COMPANY SELECTED................................................................................................................2

ANALYSIS OF THE CASH FLOW STATEMENT................................................................................................2

ANALYSIS OF OTHER COMPREHENSIVE INCOME.........................................................................................2

ANALYSIS OF CORPORATE INCOME TAX......................................................................................................2

CONCLUSION AND RECOMMENDATION.....................................................................................................2

REFERENCES................................................................................................................................................2

EXECUTIVE SUMMARY

The financial statements of the company shall be presented in the proper and defined manner. It

includes the statement of the affairs, statement showing the profit and loss earned during the

year, statement of the cash flows detailing the cash generated from the business of the company.

The report has been framed with the three basic objectives. The main purpose of this report is to

analyze the statement of the cash flows with regard to the change in each and every item of the

statement. The second aim is to discuss and analyze the items covered under the statement of

other comprehensive income and the last aim of this report is to understand the treatment of the

corporation income tax in the financial statements of the company. With these aims and

considerations, the report has been prepared and divided into the appropriate headings and

discussions thereon.

INTRODUCTION

Each statement of the annual report has its own effect in enabling the users of the financial

statements to have the meaningful and the relevant decision. In the given case, the title of the

report deals with the analysis of the two major statements of the financial statements of the

company. Although there are four statements that is embedded in the annual report of the

company but for the purpose of this report two statements have been analyzed. One is statements

showing the cash flows and statement showing the other comprehensive income. For the

furtherance of this report, the company – Woolworths Limited from the list of top hundred

companies listed in the stock exchange has been considered. The annual report for the last three

financial years ending 2017, 2016 and 2015 have been obtained and discussed in detail under the

appropriate headings. At first the statements of the cash flows have been analyzed with regard to

the three different activities which is being considered namely – operating, financing and

investing activities. The items contained in each of the activities have been discussed and

analysed. Then the items as listed in the statement of the other comprehensive income have been

detailed. The items have been discussed with regard to its meaning and the accounting treatment

in the statement of the profit and loss. Then the income tax expense recorded by the company has

been discussed in detail with regard to its accounting treatment. It has also detailed as to why the

tax on the accounting income differs from the taxable income and how these differences if any is

accounted for in the books of accounts. The report has then ended up with the appropriate

conclusion and recommendation thereon.

DETAILS OF COMPANY SELECTED

The company that has been selected for the purpose of the study is the Woolworths Limited. The

company has been formed in the year of nineteen hundred and twenty four and is into the sector

of retail in the industry. The company is registered in the country of Australia and has

supermarket chains across Australia and New Zealand and is regarded as the largest company in

the second number for supermarket chains. The company has been regular in all its compliances

related to the SEC filings and other related statutes. The annual report for the three years 2017,

2016 and 2015 has been considered.

ANALYSIS OF THE CASH FLOW STATEMENT

The cash flow statement details the total cash inflows and cash outflows of the company. The

cash flows have been bifurcated under three major heads – operating activity, financing activity

and the investing activity. Under this section the items in the cash flow statement has been

described separately and then the comparison has been made of the major heads for over the past

three years.

showing the cash flows and statement showing the other comprehensive income. For the

furtherance of this report, the company – Woolworths Limited from the list of top hundred

companies listed in the stock exchange has been considered. The annual report for the last three

financial years ending 2017, 2016 and 2015 have been obtained and discussed in detail under the

appropriate headings. At first the statements of the cash flows have been analyzed with regard to

the three different activities which is being considered namely – operating, financing and

investing activities. The items contained in each of the activities have been discussed and

analysed. Then the items as listed in the statement of the other comprehensive income have been

detailed. The items have been discussed with regard to its meaning and the accounting treatment

in the statement of the profit and loss. Then the income tax expense recorded by the company has

been discussed in detail with regard to its accounting treatment. It has also detailed as to why the

tax on the accounting income differs from the taxable income and how these differences if any is

accounted for in the books of accounts. The report has then ended up with the appropriate

conclusion and recommendation thereon.

DETAILS OF COMPANY SELECTED

The company that has been selected for the purpose of the study is the Woolworths Limited. The

company has been formed in the year of nineteen hundred and twenty four and is into the sector

of retail in the industry. The company is registered in the country of Australia and has

supermarket chains across Australia and New Zealand and is regarded as the largest company in

the second number for supermarket chains. The company has been regular in all its compliances

related to the SEC filings and other related statutes. The annual report for the three years 2017,

2016 and 2015 has been considered.

ANALYSIS OF THE CASH FLOW STATEMENT

The cash flow statement details the total cash inflows and cash outflows of the company. The

cash flows have been bifurcated under three major heads – operating activity, financing activity

and the investing activity. Under this section the items in the cash flow statement has been

described separately and then the comparison has been made of the major heads for over the past

three years.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Detail of each items

Following are the items present in the statement of the cash flow which is necessary for the

discussion and reporting:

- Receipts from Customers – It is referred to as the amount which has been collected from

the customers to whom the goods has been sold and that the amount has been received in

cash or bank. The cash receipts from the customers have been increased from $65329

million in 2016 to $65498 millions in 2017.

- Payments to suppliers and employees – It is referred to an amount which has been paid to

the persons from whom the goods have purchased and also the amount paid to the

employees as salary and other benefits in cash. The amount of payment has been

decreased from $61834 million in 2016 to $61474 millions in 2017.

- Income tax paid – It is referred to the amount of tax paid on the income earned by the

company during the year and has been decreased invariably from $848 million in 2016 to

$686 millions in 2017.

- Proceeds from the sale of property plant and equipment – Under this item all the proceeds

which are received on selling the assets under the head of property plant and equipment

like air conditioner, land and building appurtenant thereto and etc. These proceeds are the

inflows of the company and have been grouped accordingly.

- Purchase of property plant and equipment – Similarly any amount which is paid to

acquire an asset will be the cash outflow. The assets also include the intangible assets like

the goodwill, patent, insurance, etc.

- Payments for the purchase of business - Purchase of business is referred to as the

acquisition of the business of other company in order to have more synergies and more

profits in the future. Any amount paid as consideration for the purchase of business shall

be regarded as the cash outflow. It occurs only when there is the proposal and the

company agrees to it. It is not the operating activity and hence cannot be made on the

regular basis.

- Dividend received – It determines the amount which is received on regular basis on the

investment made in the other company. In other words, it is the return that the company

receives on their investment made in another company.

Following are the items present in the statement of the cash flow which is necessary for the

discussion and reporting:

- Receipts from Customers – It is referred to as the amount which has been collected from

the customers to whom the goods has been sold and that the amount has been received in

cash or bank. The cash receipts from the customers have been increased from $65329

million in 2016 to $65498 millions in 2017.

- Payments to suppliers and employees – It is referred to an amount which has been paid to

the persons from whom the goods have purchased and also the amount paid to the

employees as salary and other benefits in cash. The amount of payment has been

decreased from $61834 million in 2016 to $61474 millions in 2017.

- Income tax paid – It is referred to the amount of tax paid on the income earned by the

company during the year and has been decreased invariably from $848 million in 2016 to

$686 millions in 2017.

- Proceeds from the sale of property plant and equipment – Under this item all the proceeds

which are received on selling the assets under the head of property plant and equipment

like air conditioner, land and building appurtenant thereto and etc. These proceeds are the

inflows of the company and have been grouped accordingly.

- Purchase of property plant and equipment – Similarly any amount which is paid to

acquire an asset will be the cash outflow. The assets also include the intangible assets like

the goodwill, patent, insurance, etc.

- Payments for the purchase of business - Purchase of business is referred to as the

acquisition of the business of other company in order to have more synergies and more

profits in the future. Any amount paid as consideration for the purchase of business shall

be regarded as the cash outflow. It occurs only when there is the proposal and the

company agrees to it. It is not the operating activity and hence cannot be made on the

regular basis.

- Dividend received – It determines the amount which is received on regular basis on the

investment made in the other company. In other words, it is the return that the company

receives on their investment made in another company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

- Proceeds from issue of shares – It is the amount which is received from the issue of share

of the company. These are generally issued to have the funds in the company so as to run

the company. The company has made the issue of shares in the year ending 2017

amounting to $55.5 million. No proceeds have been received in the past year on issue of

the shares.

- Proceeds from borrowings – It is the amount which the company receives from the banks

or the financial institutions for carrying out the functions of the company (Fraser,

Ormiston and Fraser, 2010. ). In the year ending 2016 the company has borrowed the

amount of $628 million and in the year under consideration, the company has borrowed

the amount of $184 million.

- Repayment of borrowings – It is the amount which the company pays to clear the amount

of the debts. The company has paid an amount of $1406 millions in the year 2017 as

compared to $994 million in the year 2016.

- Dividend paid – It is just opposite to the dividend received. The amount is paid to the

investors of the company as a return for the amount invested in the company. Higher the

divided pay out more potential investors will be attracted. Dividends paid have been

considerably decreased from $1184 million to $540 million.

- Net decrease in cash or cash equivalents – It denotes the amount of the cash that has been

either generated from the activities of the company or has been excessively used leading

to the situation of surplus and deficit respectively (Woolworths Limited, 2016).

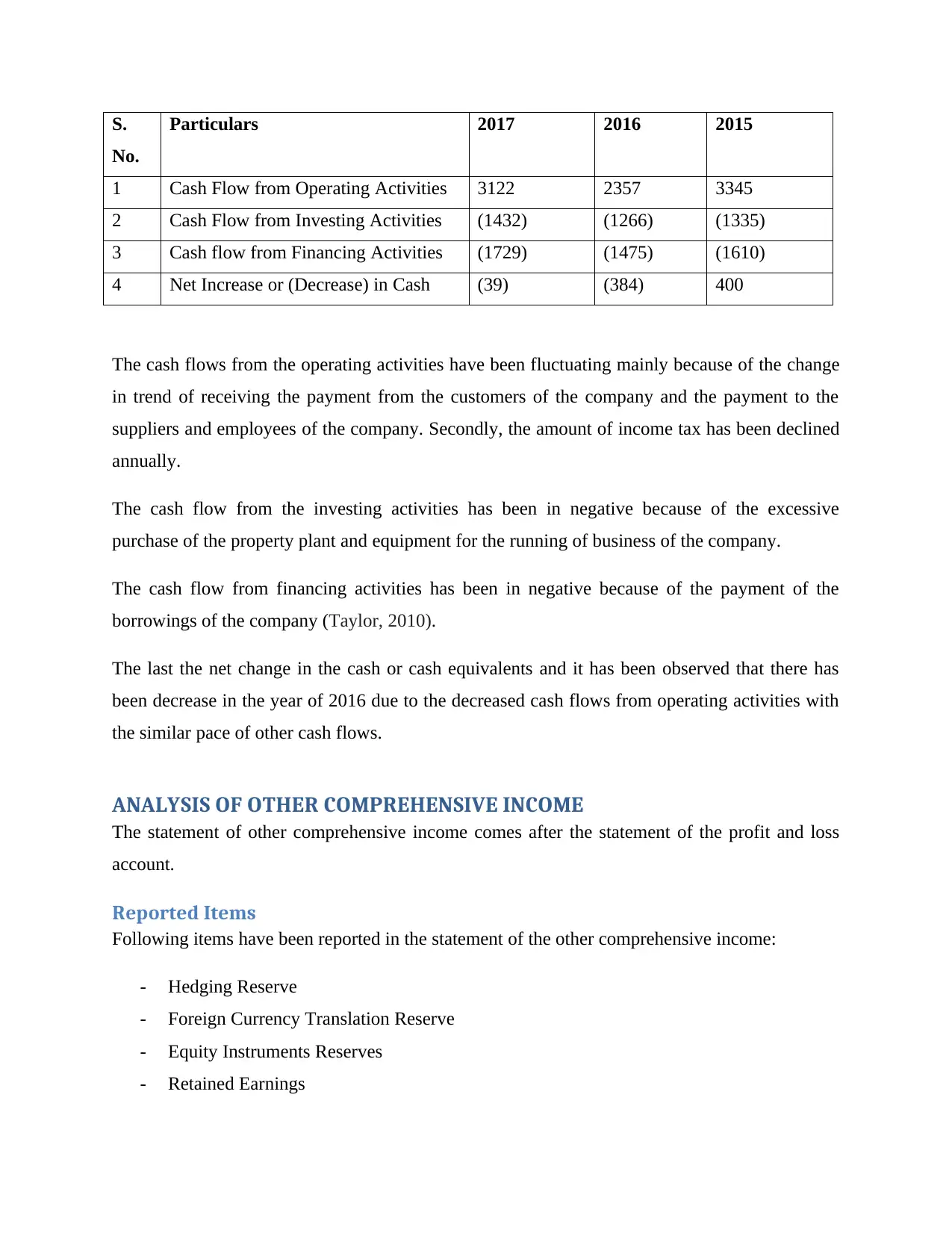

Comparative Analysis of the Major Broad Heads

The cash flow statement of every company has three major broad heads – cash flow from:

- Operating activity

- Investing activity

- Financing Activity

Apart from this activity, one major head is the net increase or decrease in cash balance. The

comparative analysis for the last three years ending 2017, 2016 and 2015 has been detailed

below:

of the company. These are generally issued to have the funds in the company so as to run

the company. The company has made the issue of shares in the year ending 2017

amounting to $55.5 million. No proceeds have been received in the past year on issue of

the shares.

- Proceeds from borrowings – It is the amount which the company receives from the banks

or the financial institutions for carrying out the functions of the company (Fraser,

Ormiston and Fraser, 2010. ). In the year ending 2016 the company has borrowed the

amount of $628 million and in the year under consideration, the company has borrowed

the amount of $184 million.

- Repayment of borrowings – It is the amount which the company pays to clear the amount

of the debts. The company has paid an amount of $1406 millions in the year 2017 as

compared to $994 million in the year 2016.

- Dividend paid – It is just opposite to the dividend received. The amount is paid to the

investors of the company as a return for the amount invested in the company. Higher the

divided pay out more potential investors will be attracted. Dividends paid have been

considerably decreased from $1184 million to $540 million.

- Net decrease in cash or cash equivalents – It denotes the amount of the cash that has been

either generated from the activities of the company or has been excessively used leading

to the situation of surplus and deficit respectively (Woolworths Limited, 2016).

Comparative Analysis of the Major Broad Heads

The cash flow statement of every company has three major broad heads – cash flow from:

- Operating activity

- Investing activity

- Financing Activity

Apart from this activity, one major head is the net increase or decrease in cash balance. The

comparative analysis for the last three years ending 2017, 2016 and 2015 has been detailed

below:

S.

No.

Particulars 2017 2016 2015

1 Cash Flow from Operating Activities 3122 2357 3345

2 Cash Flow from Investing Activities (1432) (1266) (1335)

3 Cash flow from Financing Activities (1729) (1475) (1610)

4 Net Increase or (Decrease) in Cash (39) (384) 400

The cash flows from the operating activities have been fluctuating mainly because of the change

in trend of receiving the payment from the customers of the company and the payment to the

suppliers and employees of the company. Secondly, the amount of income tax has been declined

annually.

The cash flow from the investing activities has been in negative because of the excessive

purchase of the property plant and equipment for the running of business of the company.

The cash flow from financing activities has been in negative because of the payment of the

borrowings of the company (Taylor, 2010).

The last the net change in the cash or cash equivalents and it has been observed that there has

been decrease in the year of 2016 due to the decreased cash flows from operating activities with

the similar pace of other cash flows.

ANALYSIS OF OTHER COMPREHENSIVE INCOME

The statement of other comprehensive income comes after the statement of the profit and loss

account.

Reported Items

Following items have been reported in the statement of the other comprehensive income:

- Hedging Reserve

- Foreign Currency Translation Reserve

- Equity Instruments Reserves

- Retained Earnings

No.

Particulars 2017 2016 2015

1 Cash Flow from Operating Activities 3122 2357 3345

2 Cash Flow from Investing Activities (1432) (1266) (1335)

3 Cash flow from Financing Activities (1729) (1475) (1610)

4 Net Increase or (Decrease) in Cash (39) (384) 400

The cash flows from the operating activities have been fluctuating mainly because of the change

in trend of receiving the payment from the customers of the company and the payment to the

suppliers and employees of the company. Secondly, the amount of income tax has been declined

annually.

The cash flow from the investing activities has been in negative because of the excessive

purchase of the property plant and equipment for the running of business of the company.

The cash flow from financing activities has been in negative because of the payment of the

borrowings of the company (Taylor, 2010).

The last the net change in the cash or cash equivalents and it has been observed that there has

been decrease in the year of 2016 due to the decreased cash flows from operating activities with

the similar pace of other cash flows.

ANALYSIS OF OTHER COMPREHENSIVE INCOME

The statement of other comprehensive income comes after the statement of the profit and loss

account.

Reported Items

Following items have been reported in the statement of the other comprehensive income:

- Hedging Reserve

- Foreign Currency Translation Reserve

- Equity Instruments Reserves

- Retained Earnings

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Understanding of Each item

Following are the understanding of each and every item of the other comprehensive income.

- Hedging Reserve – Under this head the amount is debited on account of change in the fair

value of the hedge instruments employed for cash flow and when the cash flow is

realized then it is transferred to the statement of the profit and loss. It is the reason as to

why it has been grouped under the head of items that can be reclassified to profit or loss.

- Foreign Currency Translation Reserve – Similarly the value of the purchase of the assets

gets changed with the change in values and the difference in that is realized in the

statement of comprehensive income. It is transferred to the statement of profit and loss

when it actually gets transferred. It is the reasons as to why it has been grouped under the

head of items that can be reclassified to profit or loss (Bamber, Jiang, Petroni and Wang,

2010).

- Equity Instruments Reserves – It has been classified in this statement under the head not

to be reclassified to the statement of the profit and loss. Under this, if there has been any

movement in the fair value of the investment of the company then the corresponding

reserve is created.

- Retained Earnings – It has also been grouped under the head of non reclassification to the

profit and loss. If there has been gain or loss on the actuarial valuation of superannuation

plans then the same shall be grouped in the comprehensive income (Chambers, 2011).

Non Reporting in Profit and Loss Statement

These items have not been presented in the statement of the profit and loss because of the reason

that the gains or losses arising from the events stated in the other comprehensive statement has

not been generated from the main activities of the company rather these belongs to other

activities which are permitted by the IFRS to be reported in the statement of the other

comprehensive income.

As the above four items have not been generated through the normal activity and hence has been

reported in the statement of other comprehensive income.

Following are the understanding of each and every item of the other comprehensive income.

- Hedging Reserve – Under this head the amount is debited on account of change in the fair

value of the hedge instruments employed for cash flow and when the cash flow is

realized then it is transferred to the statement of the profit and loss. It is the reason as to

why it has been grouped under the head of items that can be reclassified to profit or loss.

- Foreign Currency Translation Reserve – Similarly the value of the purchase of the assets

gets changed with the change in values and the difference in that is realized in the

statement of comprehensive income. It is transferred to the statement of profit and loss

when it actually gets transferred. It is the reasons as to why it has been grouped under the

head of items that can be reclassified to profit or loss (Bamber, Jiang, Petroni and Wang,

2010).

- Equity Instruments Reserves – It has been classified in this statement under the head not

to be reclassified to the statement of the profit and loss. Under this, if there has been any

movement in the fair value of the investment of the company then the corresponding

reserve is created.

- Retained Earnings – It has also been grouped under the head of non reclassification to the

profit and loss. If there has been gain or loss on the actuarial valuation of superannuation

plans then the same shall be grouped in the comprehensive income (Chambers, 2011).

Non Reporting in Profit and Loss Statement

These items have not been presented in the statement of the profit and loss because of the reason

that the gains or losses arising from the events stated in the other comprehensive statement has

not been generated from the main activities of the company rather these belongs to other

activities which are permitted by the IFRS to be reported in the statement of the other

comprehensive income.

As the above four items have not been generated through the normal activity and hence has been

reported in the statement of other comprehensive income.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ANALYSIS OF CORPORATE INCOME TAX

Current Tax Expense

For the year ending 2017, the company has reported the income tax expense of $837.70 million.

It comprises of the current tax expense, adjustment in relation to earlier years and deferred tax

expense. The figure is as per the latest annual report of the company (Woolworths Limited,

2017).

Tax on Accounting Income

No, if the tax rate is multiplied with the accounting income then the tax expense will differ. The

major difference is because of the timing difference that is considered while having the

computation of the taxable income and the tax thereon.

These differences comprise of the following tax effects on:

- Expenses which are not deductible in nature

- Impairment which is not deductible

- Tax Loss which have not been recognized and

- Differences in off shore tax rates.

Reasons for Deferred Tax Assets and Liabilities

As per the annual report of the company, amount of $372.30 million have been reported as

deferred tax assets in the financial statements of the company. It has been recognized in

accordance with the provisions of the accounting standards for consideration of the timing

differences. Following has been the major factor for its creation:

- Cash flow hedges

- Provision accounted for and the accrued expenses booked

- Foreign exchange differences which have not been realized.

- Difference in Depreciation rates (Harrington, Smith and Trippeer, 2012).

Current Tax Expense

For the year ending 2017, the company has reported the income tax expense of $837.70 million.

It comprises of the current tax expense, adjustment in relation to earlier years and deferred tax

expense. The figure is as per the latest annual report of the company (Woolworths Limited,

2017).

Tax on Accounting Income

No, if the tax rate is multiplied with the accounting income then the tax expense will differ. The

major difference is because of the timing difference that is considered while having the

computation of the taxable income and the tax thereon.

These differences comprise of the following tax effects on:

- Expenses which are not deductible in nature

- Impairment which is not deductible

- Tax Loss which have not been recognized and

- Differences in off shore tax rates.

Reasons for Deferred Tax Assets and Liabilities

As per the annual report of the company, amount of $372.30 million have been reported as

deferred tax assets in the financial statements of the company. It has been recognized in

accordance with the provisions of the accounting standards for consideration of the timing

differences. Following has been the major factor for its creation:

- Cash flow hedges

- Provision accounted for and the accrued expenses booked

- Foreign exchange differences which have not been realized.

- Difference in Depreciation rates (Harrington, Smith and Trippeer, 2012).

Income tax Payable and Income Tax Expense

Yes the company has reported the income tax payable of the company. Both of the amount are

not same because the income tax payable is the amount to be paid to the authorities whereas the

income tax expense includes the current tax and the deferred tax expense (Laux, 2013).

Income Tax Expense and Income Tax Paid

No, income tax expense is not same with income tax paid in cash flow statement as the paid

amount is only current tax and the remaining is deferred tax expense (Manzon, G.B. and Plesko,

2012).

Rating of Accounting Treatment of Tax

The treatment adopted by the company for tax is very transparent and will help the users in

making the useful decision.

CONCLUSION AND RECOMMENDATION

Financial statements as embedded in the annual report of the company have the major impact on

the decision making power of not only the stakeholders of the company but also the potential

shareholders of the company. Each of the statement of the financial report has its own meaning

and treatment and the same has been discussed in detail with regard to the financial figures of the

company – Woolworths Limited. Two statements have been analysed – cash flows and other

comprehensive income. Also the current tax expense as recorded by the company in its financial

statements has been discussed. To conclude the report, analysis has been made in detail and is

necessary as per the current scenario of the market.

It is recommended that all the statements which are required to be the part of the financial

statement shall be prepared in the true and fair manner so as to equip the users with the required

information which in turn will help them in taking the useful and meaningful decision.

Yes the company has reported the income tax payable of the company. Both of the amount are

not same because the income tax payable is the amount to be paid to the authorities whereas the

income tax expense includes the current tax and the deferred tax expense (Laux, 2013).

Income Tax Expense and Income Tax Paid

No, income tax expense is not same with income tax paid in cash flow statement as the paid

amount is only current tax and the remaining is deferred tax expense (Manzon, G.B. and Plesko,

2012).

Rating of Accounting Treatment of Tax

The treatment adopted by the company for tax is very transparent and will help the users in

making the useful decision.

CONCLUSION AND RECOMMENDATION

Financial statements as embedded in the annual report of the company have the major impact on

the decision making power of not only the stakeholders of the company but also the potential

shareholders of the company. Each of the statement of the financial report has its own meaning

and treatment and the same has been discussed in detail with regard to the financial figures of the

company – Woolworths Limited. Two statements have been analysed – cash flows and other

comprehensive income. Also the current tax expense as recorded by the company in its financial

statements has been discussed. To conclude the report, analysis has been made in detail and is

necessary as per the current scenario of the market.

It is recommended that all the statements which are required to be the part of the financial

statement shall be prepared in the true and fair manner so as to equip the users with the required

information which in turn will help them in taking the useful and meaningful decision.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Bamber, L.S., Jiang, J., Petroni, K.R. and Wang, I.Y., 2010. Comprehensive income: Who's

afraid of performance reporting?. The Accounting Review, 85(1), pp.97-126

Chambers, D.J., 2011. Comprehensive income reporting: FASB decides location matters. The

CPA Journal, 81(9), p.22.

Fraser, L.M., Ormiston, A. and Fraser, L.M., 2010. Understanding financial statements Pearson

Harrington, C., Smith, W. and Trippeer, D., 2012,Deferred tax assets and liabilities: tax benefits,

obligations and corporate debt policy. Journal of Finance and Accountancy, 11, p.1

Laux, R.C., 2013. The association between deferred tax assets and liabilities and future tax

payments The Accounting Review, 88(4), pp.1357-1383

Manzon Jr, G.B. and Plesko, G.A., 2012. The relation between financial and tax reporting

measures of income Tax L. Rev., 55, p.175

Taylor, M., 2010, Financial statement analysis, pp 13-20

Woolworths Limited (2016), Annual Report -2016 online available

https://www.woolworthsgroup.com.au/page/investors/our-performance/reports/Reports at

accessed on 12-05-2018.

Woolworths Limited (2017), Annual Report -2017 online available

https://www.woolworthsgroup.com.au/page/investors/our-performance/reports/Reports at

accessed on 12-05-2018.

Bamber, L.S., Jiang, J., Petroni, K.R. and Wang, I.Y., 2010. Comprehensive income: Who's

afraid of performance reporting?. The Accounting Review, 85(1), pp.97-126

Chambers, D.J., 2011. Comprehensive income reporting: FASB decides location matters. The

CPA Journal, 81(9), p.22.

Fraser, L.M., Ormiston, A. and Fraser, L.M., 2010. Understanding financial statements Pearson

Harrington, C., Smith, W. and Trippeer, D., 2012,Deferred tax assets and liabilities: tax benefits,

obligations and corporate debt policy. Journal of Finance and Accountancy, 11, p.1

Laux, R.C., 2013. The association between deferred tax assets and liabilities and future tax

payments The Accounting Review, 88(4), pp.1357-1383

Manzon Jr, G.B. and Plesko, G.A., 2012. The relation between financial and tax reporting

measures of income Tax L. Rev., 55, p.175

Taylor, M., 2010, Financial statement analysis, pp 13-20

Woolworths Limited (2016), Annual Report -2016 online available

https://www.woolworthsgroup.com.au/page/investors/our-performance/reports/Reports at

accessed on 12-05-2018.

Woolworths Limited (2017), Annual Report -2017 online available

https://www.woolworthsgroup.com.au/page/investors/our-performance/reports/Reports at

accessed on 12-05-2018.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.