Comprehensive Management Accounting Report: Zyalla Company Case Study

VerifiedAdded on 2020/12/09

|16

|5100

|461

Report

AI Summary

This report provides a comprehensive analysis of management accounting practices at Zyalla Company. It begins with an introduction to management accounting, its essential requirements, and diverse reporting methods, including job cost reports, operational budget reports, performance reports, inventory management reports, and account receivable reports. The report then explores cost analysis techniques, emphasizing their role in preparing income statements and generating accurate financial reports. It further examines various planning tools used in budgeting and control, discussing their advantages and disadvantages. The report also delves into how organizations implement management accounting systems to respond to financial problems, ultimately evaluating how these responses contribute to an organization's sustainable success. The analysis is based on the case study of Zyalla Company, highlighting the practical application of management accounting principles in a real-world business context. The report concludes by summarizing the key findings and insights gained from the analysis.

MANAGEMENT ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement of different type of management

accounting system.......................................................................................................................1

P2 Diverse methods used for management accounting reporting...............................................3

M1 Benefits of management accounting.....................................................................................5

D1 Evaluate how management accounting is system is integrated with accounting reporting. .6

TASK 2............................................................................................................................................6

P3 Evaluation of cost using appropriate techniques of cost analysis to prepare income

statement.....................................................................................................................................6

M2 Range of management accounting techniques and prepare accurate financial report..........8

D2 Financial reports which are applied and interpret data and activities...................................8

TASK 3............................................................................................................................................8

P4 Advantages and disadvantages of various type of planning tools used in budgeting control8

M3 use of various kind of planning tools and application for making and forecasting budgets 9

D3 How planning tools for accounting respond appropriately solve financial issues and

problems....................................................................................................................................10

TASK 4..........................................................................................................................................10

P5 How associations are implementing management accounting system to respond financial

problems....................................................................................................................................10

M4 How responding financial problems lead an organisation towards sustainable success ...11

CONLUSION................................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement of different type of management

accounting system.......................................................................................................................1

P2 Diverse methods used for management accounting reporting...............................................3

M1 Benefits of management accounting.....................................................................................5

D1 Evaluate how management accounting is system is integrated with accounting reporting. .6

TASK 2............................................................................................................................................6

P3 Evaluation of cost using appropriate techniques of cost analysis to prepare income

statement.....................................................................................................................................6

M2 Range of management accounting techniques and prepare accurate financial report..........8

D2 Financial reports which are applied and interpret data and activities...................................8

TASK 3............................................................................................................................................8

P4 Advantages and disadvantages of various type of planning tools used in budgeting control8

M3 use of various kind of planning tools and application for making and forecasting budgets 9

D3 How planning tools for accounting respond appropriately solve financial issues and

problems....................................................................................................................................10

TASK 4..........................................................................................................................................10

P5 How associations are implementing management accounting system to respond financial

problems....................................................................................................................................10

M4 How responding financial problems lead an organisation towards sustainable success ...11

CONLUSION................................................................................................................................11

REFERENCES..............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Accounting process which is undertaken by associations and organisations to manage and

control the operations and functions are considered as a management accounting. As per

changing business requirements and needs the concept of management accounting also has been

changed in organisational context (Lavia, López and Hiebl, 2014). Management accounting is

also known as managerial accounting. This remain the part of internal control and management

that is the reason this is used at managerial level. Management accounting assist the

organisational structure not only inner way but also on external way. Being a part of

management decisions and decision making process management accounting contains large

share in operational management in organisation.

This report defined the concept of management accounting and also highlight the

essential requirement of management accounting system in organisational context. Management

accounting reporting methods also elaborated in this report to manage the management

accounting reports. Cost accounting methods related to evaluate the profit also defined in this

context. Planning tools which are used to assist the budgetary control process also defined in this

context. Modes are found in which organisations are adapting management accounting system to

respond financial problems. Zyalla company is taken organisation to elaborate the concept of

management accounting.

TASK 1

P1 Management accounting and essential requirement of different type of management

accounting system

Management accounting

Management accounting is considered as an assumption, process, concept of managing

the operations and management subject to record the information which are related to

management and senior management level. There is a particular formate and structure is made in

terms of managing the financial resources and the operating the financial resources for better

execution management accounting is adopted by organisation. This contains overall process of

evaluation of business problems, analysing the management issues, critical measurement of

business strategies and plans (Kotas, 2014). With the help of management accounting system

managers be able to summarise the information and details in single format so that business

1

Accounting process which is undertaken by associations and organisations to manage and

control the operations and functions are considered as a management accounting. As per

changing business requirements and needs the concept of management accounting also has been

changed in organisational context (Lavia, López and Hiebl, 2014). Management accounting is

also known as managerial accounting. This remain the part of internal control and management

that is the reason this is used at managerial level. Management accounting assist the

organisational structure not only inner way but also on external way. Being a part of

management decisions and decision making process management accounting contains large

share in operational management in organisation.

This report defined the concept of management accounting and also highlight the

essential requirement of management accounting system in organisational context. Management

accounting reporting methods also elaborated in this report to manage the management

accounting reports. Cost accounting methods related to evaluate the profit also defined in this

context. Planning tools which are used to assist the budgetary control process also defined in this

context. Modes are found in which organisations are adapting management accounting system to

respond financial problems. Zyalla company is taken organisation to elaborate the concept of

management accounting.

TASK 1

P1 Management accounting and essential requirement of different type of management

accounting system

Management accounting

Management accounting is considered as an assumption, process, concept of managing

the operations and management subject to record the information which are related to

management and senior management level. There is a particular formate and structure is made in

terms of managing the financial resources and the operating the financial resources for better

execution management accounting is adopted by organisation. This contains overall process of

evaluation of business problems, analysing the management issues, critical measurement of

business strategies and plans (Kotas, 2014). With the help of management accounting system

managers be able to summarise the information and details in single format so that business

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

issues and problems be able to sort out easily. There are type of management accounting systems

are used in business context to summarise the information and data for better management and

operations of business.

Corporate accounts information, reports, management accountants and working with

selected organisations and other subsidiary operations easily be managed with the help of

management accounting system. This mainly associated with analysing the profitability and

income with the help of creating plans and objectivity.

Job costing system: this accounting system mainly help to centralise the type of jobs and

the sections in single for better execution of task and projects. This is the accounting system

helps to consolidate the details and information form different sections and groups in one format

and helps to manage the individual groups and sections. It summarise the overall cost of

individual departments and cost sections subject to evaluate profitability form each section. It

effect the price of particular figures and information for each department and section. This is the

only system which helps to understand the departmental cost as operational and departmental

cost for particular job centre (Kober, Subraamanniam and Watson, 2012).

Price optimising system: this is the system which assist managers and accountants to

consolidate the price and value of products and services. Price of per product is evaluated on the

basis of summarising the overall manufacturing cost. There is a mathematical analysis done in

terms of price of different products and the prices which remain associated with analysing the

profitability of organisation and recording the price by considering the all relevant aspect in

organisational context. Comprise the cost and maximise the profitability is the main objective of

price optimisation system. This accounting sustem is mainly used by the organisations which

deals in multiple products in which price and cost remain bifurcated in separate parts.

MIS system: this management accounting system is also considered as a management

information system which helps to determine the cost of operations and management in

summarised and consolidating the accounting and information in single format. This is one of the

essential aspect in terms of managing the information related to system based accounting and

management. There is a particular format and structure designed under this management

accounting system. With the helps of software programs and applications the process of

designing the plans and strategies become more fluent and easy in organisational context.

2

are used in business context to summarise the information and data for better management and

operations of business.

Corporate accounts information, reports, management accountants and working with

selected organisations and other subsidiary operations easily be managed with the help of

management accounting system. This mainly associated with analysing the profitability and

income with the help of creating plans and objectivity.

Job costing system: this accounting system mainly help to centralise the type of jobs and

the sections in single for better execution of task and projects. This is the accounting system

helps to consolidate the details and information form different sections and groups in one format

and helps to manage the individual groups and sections. It summarise the overall cost of

individual departments and cost sections subject to evaluate profitability form each section. It

effect the price of particular figures and information for each department and section. This is the

only system which helps to understand the departmental cost as operational and departmental

cost for particular job centre (Kober, Subraamanniam and Watson, 2012).

Price optimising system: this is the system which assist managers and accountants to

consolidate the price and value of products and services. Price of per product is evaluated on the

basis of summarising the overall manufacturing cost. There is a mathematical analysis done in

terms of price of different products and the prices which remain associated with analysing the

profitability of organisation and recording the price by considering the all relevant aspect in

organisational context. Comprise the cost and maximise the profitability is the main objective of

price optimisation system. This accounting sustem is mainly used by the organisations which

deals in multiple products in which price and cost remain bifurcated in separate parts.

MIS system: this management accounting system is also considered as a management

information system which helps to determine the cost of operations and management in

summarised and consolidating the accounting and information in single format. This is one of the

essential aspect in terms of managing the information related to system based accounting and

management. There is a particular format and structure designed under this management

accounting system. With the helps of software programs and applications the process of

designing the plans and strategies become more fluent and easy in organisational context.

2

Inventory management system: this is the system which helps to manage the flow of

inventories and manage the order of inventories in organisational context. All the relevant

information and details remain associated with analysing the requirement of inventories and

managing the demand of raw material. ABC inventory management, EOQ (Economic order

Quantity) and material management are the essential inventory management systems which are

used to control and manage the flow of inventories with in the organisation (Hilton and Platt,

2013).

Cost accounting system: this is the accounting system which helps to analyse the cost of

manufacturing process or production process. This is mainly associated with analysing and

comprising the cost of manufactured products and services in organisational context. Cost

accounting is the only accounting system with the help of managers and accountants be able to

analyse the cost of operations and management be able to utilised in more better manner. It

contains type of methods and techniques to consolidate the information related to cost and cost

reports in single format to reduce the cost and analyse the comprised tasks in single format.

P2 Diverse methods used for management accounting reporting

Reporting is a key aspect in organisational context subject to analyse the information and

creating the challenges regarding the financial problems and the management challenges.

Management accounting reports contains the summarised information and data related to

management decisions and the strategies which are made for boosting the structure of business

and the operations at next level. These reports are also called as managerial accounting reports as

emphasising the cost of operations and the management in terms of deriving the applications and

related to defining the objectives and the strategies. These reports are mainly helps to prepare

strategies and plans for better execution and assistance of management and functions. At

management level these reports not only used for framing the plans but also used to keep the

records and analyse the financial challenges related to decisions and making plans for measuring

performance.

This is by all accounts most extreme critical viewpoint which incorporates gathering and

dispensing of information amid a bookkeeping time frame (Van der Stede, 2011). In each

business association, regardless of whether related generation of retail segments need culminate

bookkeeping detailing frameworks. This can helps chiefs to record all urgent data that are

profitable for settling on choice more viable in coming time. Based on different reports that are

3

inventories and manage the order of inventories in organisational context. All the relevant

information and details remain associated with analysing the requirement of inventories and

managing the demand of raw material. ABC inventory management, EOQ (Economic order

Quantity) and material management are the essential inventory management systems which are

used to control and manage the flow of inventories with in the organisation (Hilton and Platt,

2013).

Cost accounting system: this is the accounting system which helps to analyse the cost of

manufacturing process or production process. This is mainly associated with analysing and

comprising the cost of manufactured products and services in organisational context. Cost

accounting is the only accounting system with the help of managers and accountants be able to

analyse the cost of operations and management be able to utilised in more better manner. It

contains type of methods and techniques to consolidate the information related to cost and cost

reports in single format to reduce the cost and analyse the comprised tasks in single format.

P2 Diverse methods used for management accounting reporting

Reporting is a key aspect in organisational context subject to analyse the information and

creating the challenges regarding the financial problems and the management challenges.

Management accounting reports contains the summarised information and data related to

management decisions and the strategies which are made for boosting the structure of business

and the operations at next level. These reports are also called as managerial accounting reports as

emphasising the cost of operations and the management in terms of deriving the applications and

related to defining the objectives and the strategies. These reports are mainly helps to prepare

strategies and plans for better execution and assistance of management and functions. At

management level these reports not only used for framing the plans but also used to keep the

records and analyse the financial challenges related to decisions and making plans for measuring

performance.

This is by all accounts most extreme critical viewpoint which incorporates gathering and

dispensing of information amid a bookkeeping time frame (Van der Stede, 2011). In each

business association, regardless of whether related generation of retail segments need culminate

bookkeeping detailing frameworks. This can helps chiefs to record all urgent data that are

profitable for settling on choice more viable in coming time. Based on different reports that are

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

set up in Zylla Company, they can figure out how to record information according to their date of

event (Van der Meer-Kooistra and Vosselman, 2012). By the usage of revealing framework

would have wide number of points of interest to an association, for example, making

arrangements for future administration, designation of assets, assessment of worker execution

and to settle on change in up and coming basic leadership at inside level. There are different

kinds of bookkeeping detailing frameworks are accessible with Zylla Company. Out of which

some are examine as follows:

Job cost report: there are some reports associated This sort of report created by

bookkeeping supervisors. This will increase sufficient measure of assets to an association.

According to this report, comprises of particular information about aggregate costs Zylla

Company is causing amid the generation of specific items. These are the reports which basically

helps to determine the cost and of each departments. These reports presents a summary report

which contains the total cost represent a particular job and section. It mainly associated with

analysing the profitability and consistency of networks and management tools. More over the

information and details also remains apart form the job cost reports.

Operational budget reports: These reports give finish state of any pivotal basic

leadership so as to achieve most extreme increases amid the time. Such sort of report is set up by

an association to make investigation of all cost and costs that are acquire by the organization

amid the particular duration. This report likewise comprises of significant strategy for planning

spending plans with the goal that association can't get any decrease of capital amid the time.

These reports contains the information related how to expense and income form operating

functions utilised during the year. Moreover the information which remains related to exploring

the operations are also considered in these reports.

Performance reports: these are the reports which are used to measure and analyse the

performance of organisation. By the assistance of this report, appropriate coordination between

different elements of the division can be breaking down more adequately. According to this

specific report which depends on recording of organizations' execution about their general

budgetary circumstances (Suomala and Lyly-Yrjänäinen, 2012). It is essential part of

administrator to ensure that each data specified in the report must be precise and solid. In large

organisation some departments are made through which organisations functions and operations

managed in effective manner. Classification of management accounting techniques also based

4

event (Van der Meer-Kooistra and Vosselman, 2012). By the usage of revealing framework

would have wide number of points of interest to an association, for example, making

arrangements for future administration, designation of assets, assessment of worker execution

and to settle on change in up and coming basic leadership at inside level. There are different

kinds of bookkeeping detailing frameworks are accessible with Zylla Company. Out of which

some are examine as follows:

Job cost report: there are some reports associated This sort of report created by

bookkeeping supervisors. This will increase sufficient measure of assets to an association.

According to this report, comprises of particular information about aggregate costs Zylla

Company is causing amid the generation of specific items. These are the reports which basically

helps to determine the cost and of each departments. These reports presents a summary report

which contains the total cost represent a particular job and section. It mainly associated with

analysing the profitability and consistency of networks and management tools. More over the

information and details also remains apart form the job cost reports.

Operational budget reports: These reports give finish state of any pivotal basic

leadership so as to achieve most extreme increases amid the time. Such sort of report is set up by

an association to make investigation of all cost and costs that are acquire by the organization

amid the particular duration. This report likewise comprises of significant strategy for planning

spending plans with the goal that association can't get any decrease of capital amid the time.

These reports contains the information related how to expense and income form operating

functions utilised during the year. Moreover the information which remains related to exploring

the operations are also considered in these reports.

Performance reports: these are the reports which are used to measure and analyse the

performance of organisation. By the assistance of this report, appropriate coordination between

different elements of the division can be breaking down more adequately. According to this

specific report which depends on recording of organizations' execution about their general

budgetary circumstances (Suomala and Lyly-Yrjänäinen, 2012). It is essential part of

administrator to ensure that each data specified in the report must be precise and solid. In large

organisation some departments are made through which organisations functions and operations

managed in effective manner. Classification of management accounting techniques also based

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

upon the effective management and operations. These reports consolidate overall performance

report form departments and sections and calculate average performance of organisation. This

can be breaking down by utilizing real or standard information which is being bring about amid

the time.

Inventory management reports: According to the Zylla organization, they can get more

significant results in not so distant future just in that condition, on the off chance that they are

having appropriate control of aggregate stocks that are being stayed with by the. There are

different apparatuses and systems which would be useful for an association to control stock.

Some of them are stock turnover proportion, EOQ and ABC costing. This report used to record

all information in regards to opening and shutting stock stay with by in their stockrooms.

Account receivable report: This sort of report is useful to an association to give

administration to settle on significant choice with respect to making alteration about the

recuperation of sums from the indebted individuals. Subsequently, these kinds of report are

planned to get instalment from the gatherings amid the time. As per this specific report, chiefs

would effectively ready to comprehend add up to arrangements of unpaid clients solicitations of

different account holders. These reports mainly used to compress the average collection process

which also measured the position of debtors. With the help of account receivable reports

managers and accountants be able to determine the credit limit for debtors (Soin and Collier,

2013).

M1 Benefits of management accounting

Role of management accounting and systems has been crucial in organisational context in

terms of assisting the management functions and the operations. As it is described that form

decision making perspective and forecasting process management accounting is widely used in

organisations. This is a part of internal control and management which helps to manage the

orders and instructions in general business context (Shields, 2015). This need to distinguish

appropriation of administration bookkeeping hones, hold benefit and make greatest accentuation

on future targets. As indicated by the previously mentioned bookkeeping frameworks, it has been

seen that Zylla Company must be turned out to be more compelling in the event that they use to

embrace bookkeeping framework in more viable way.

5

report form departments and sections and calculate average performance of organisation. This

can be breaking down by utilizing real or standard information which is being bring about amid

the time.

Inventory management reports: According to the Zylla organization, they can get more

significant results in not so distant future just in that condition, on the off chance that they are

having appropriate control of aggregate stocks that are being stayed with by the. There are

different apparatuses and systems which would be useful for an association to control stock.

Some of them are stock turnover proportion, EOQ and ABC costing. This report used to record

all information in regards to opening and shutting stock stay with by in their stockrooms.

Account receivable report: This sort of report is useful to an association to give

administration to settle on significant choice with respect to making alteration about the

recuperation of sums from the indebted individuals. Subsequently, these kinds of report are

planned to get instalment from the gatherings amid the time. As per this specific report, chiefs

would effectively ready to comprehend add up to arrangements of unpaid clients solicitations of

different account holders. These reports mainly used to compress the average collection process

which also measured the position of debtors. With the help of account receivable reports

managers and accountants be able to determine the credit limit for debtors (Soin and Collier,

2013).

M1 Benefits of management accounting

Role of management accounting and systems has been crucial in organisational context in

terms of assisting the management functions and the operations. As it is described that form

decision making perspective and forecasting process management accounting is widely used in

organisations. This is a part of internal control and management which helps to manage the

orders and instructions in general business context (Shields, 2015). This need to distinguish

appropriation of administration bookkeeping hones, hold benefit and make greatest accentuation

on future targets. As indicated by the previously mentioned bookkeeping frameworks, it has been

seen that Zylla Company must be turned out to be more compelling in the event that they use to

embrace bookkeeping framework in more viable way.

5

D1 Evaluate how management accounting is system is integrated with accounting reporting

It is very important for every business organisations and associations to track the

information and data for more effective control and operation. Management reporting provides a

tool to track all the information and data which are produced under management accounting

system. The essential part of directors is to make utilization of best options that are connected

with the organization (Renz and Herman, 2016). While, value streamlining is a fundamental

frameworks to investigate general impression of clients with respect to costs of items that are set

by the organization. According to the specified reports, for example, execution report which is

more solid in investigation general execution of Zylla organization amid a bookkeeping time

frame. More over the information and details are appropriately addressed in report format. With

the utilization of cost bookkeeping framework every important datum in regards to expenses and

costs ought to be investigate all the more successfully.

TASK 2

P3 Evaluation of cost using appropriate techniques of cost analysis to prepare income statement

The expenses can be classifying into different parts either straightforwardly or in a

roundabout way. Each cost is having particular relationship among each other. It support

underway of successful items and administrations to separate clients. This is by all accounts most

extreme vital perspectives for achieving want results by utilizing more solid costs. Cost is

anything that is connected with the creation of item and conveyance administrations to an

association. It is financial valuation of endeavours, crude material and utility that are basic for

the development of an association. As it is said to be estimation of cash which will be paid by the

organization for getting something. It is a fundamental piece of an association which is use in

assembling process by the organization. Costing is said to be a basic procedure of cost

administration in an association with utilizing particular apparatuses and strategies. It comprises

of each one of those variable costs that are useful for increment benefit of an association. There

are different sorts of costing techniques which are use as essential apparatuses to figure net

benefit of an association. Some of them are examine underneath:

Marginal costing: this is one of the management accounting system which helps to

analyse the cost of production and manufactured goods and services (Wickramasinghe and

Alawattage, 2012). There are type of strategies and plans and made with the help of this

6

It is very important for every business organisations and associations to track the

information and data for more effective control and operation. Management reporting provides a

tool to track all the information and data which are produced under management accounting

system. The essential part of directors is to make utilization of best options that are connected

with the organization (Renz and Herman, 2016). While, value streamlining is a fundamental

frameworks to investigate general impression of clients with respect to costs of items that are set

by the organization. According to the specified reports, for example, execution report which is

more solid in investigation general execution of Zylla organization amid a bookkeeping time

frame. More over the information and details are appropriately addressed in report format. With

the utilization of cost bookkeeping framework every important datum in regards to expenses and

costs ought to be investigate all the more successfully.

TASK 2

P3 Evaluation of cost using appropriate techniques of cost analysis to prepare income statement

The expenses can be classifying into different parts either straightforwardly or in a

roundabout way. Each cost is having particular relationship among each other. It support

underway of successful items and administrations to separate clients. This is by all accounts most

extreme vital perspectives for achieving want results by utilizing more solid costs. Cost is

anything that is connected with the creation of item and conveyance administrations to an

association. It is financial valuation of endeavours, crude material and utility that are basic for

the development of an association. As it is said to be estimation of cash which will be paid by the

organization for getting something. It is a fundamental piece of an association which is use in

assembling process by the organization. Costing is said to be a basic procedure of cost

administration in an association with utilizing particular apparatuses and strategies. It comprises

of each one of those variable costs that are useful for increment benefit of an association. There

are different sorts of costing techniques which are use as essential apparatuses to figure net

benefit of an association. Some of them are examine underneath:

Marginal costing: this is one of the management accounting system which helps to

analyse the cost of production and manufactured goods and services (Wickramasinghe and

Alawattage, 2012). There are type of strategies and plans and made with the help of this

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management accounting technique. Marginal costing basically helps to consolidate the important

information related to subject to cost of production and operation. This is the cost technique in

which the variable cost is charged in proportionate in production units and fixed cost are charged

in the basic of periodic basis or written off in full against the aggregate. This costing techniques

also helps in decision making process subject to analyse the possible outcomes in terms of

managing the operations and manufacturing cost.

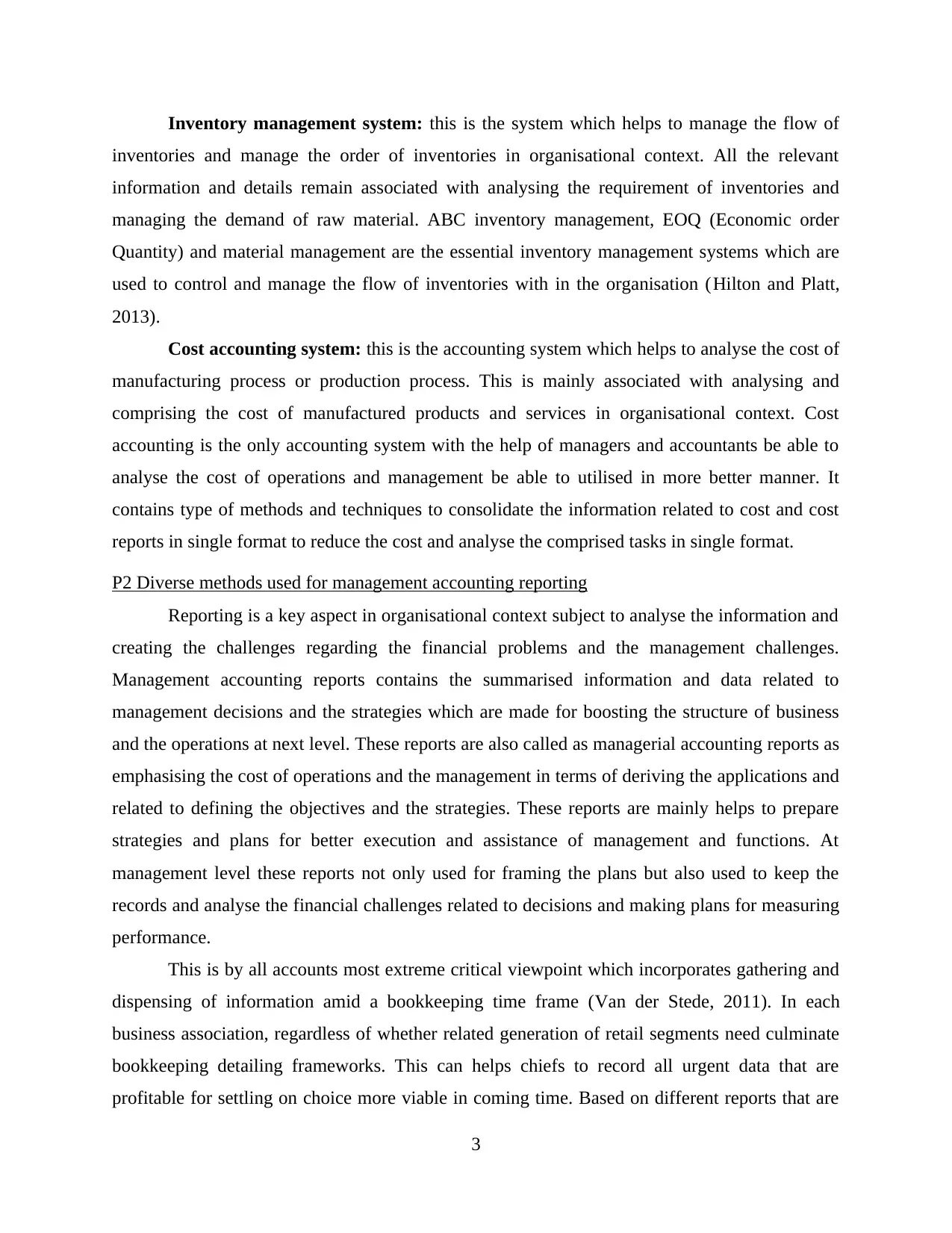

Calculation through marginal costing using

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2+3 = 16*500

8000 8000

Contribution 9500

Less:

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

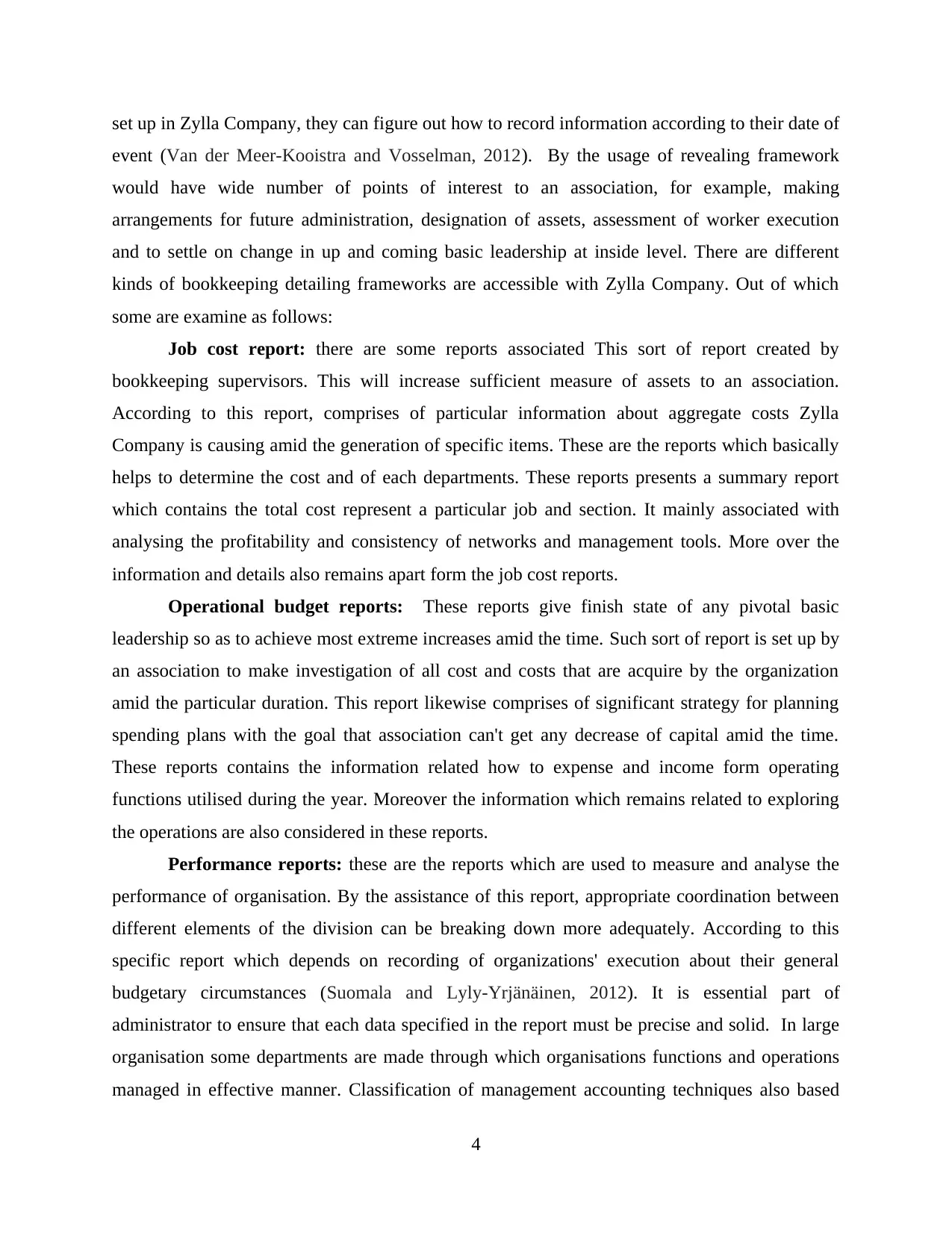

Absorption costing: this costing techniques basically helps to demonstrate the costing

structure of organisation in terms of units produced during the year. According to this particular

costing method which is applicable to all manufacturing costs (Absorption costing, 2012.). Cost

of finished units and inventories contains the cost of direct material, direct labour, material

variance and fixed manufacturing overheads. This is the main aspect in terms of managing the

cost of production and manufacturing in organisational context.

Computation of Net profit by using absorption costing

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

7

information related to subject to cost of production and operation. This is the cost technique in

which the variable cost is charged in proportionate in production units and fixed cost are charged

in the basic of periodic basis or written off in full against the aggregate. This costing techniques

also helps in decision making process subject to analyse the possible outcomes in terms of

managing the operations and manufacturing cost.

Calculation through marginal costing using

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2+3 = 16*500

8000 8000

Contribution 9500

Less:

Variable sales overhead 500*1 500

Selling and administrative cost expenses (800+400) 1200 -1700

Total Profit / Loss 7800

Absorption costing: this costing techniques basically helps to demonstrate the costing

structure of organisation in terms of units produced during the year. According to this particular

costing method which is applicable to all manufacturing costs (Absorption costing, 2012.). Cost

of finished units and inventories contains the cost of direct material, direct labour, material

variance and fixed manufacturing overheads. This is the main aspect in terms of managing the

cost of production and manufacturing in organisational context.

Computation of Net profit by using absorption costing

Income statements

Particulars Amount

Sales 35*500 17500

Less:

Production cost 6+5+2 - 7800

Closing stock: 100*13 - 1300 -6500

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

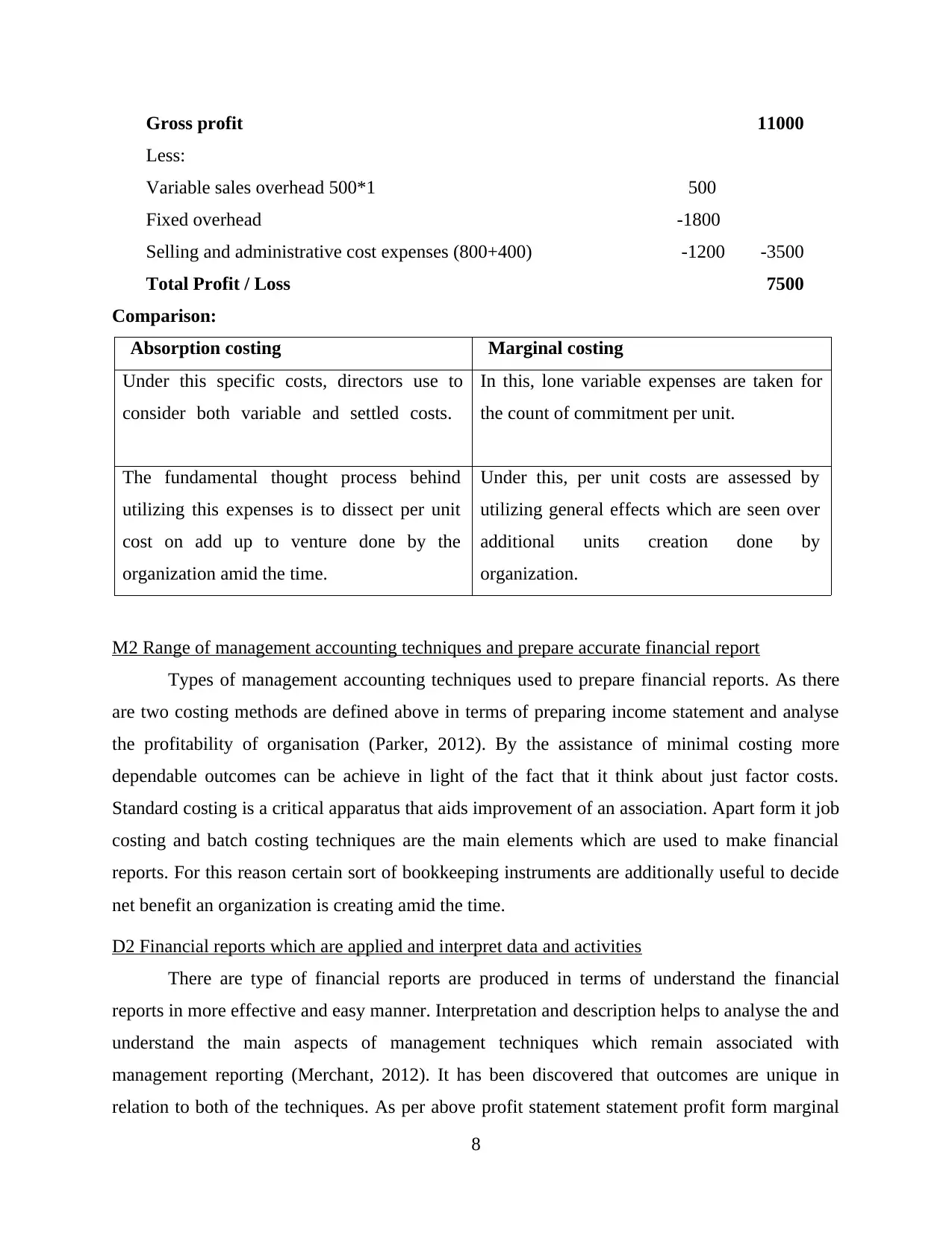

Gross profit 11000

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

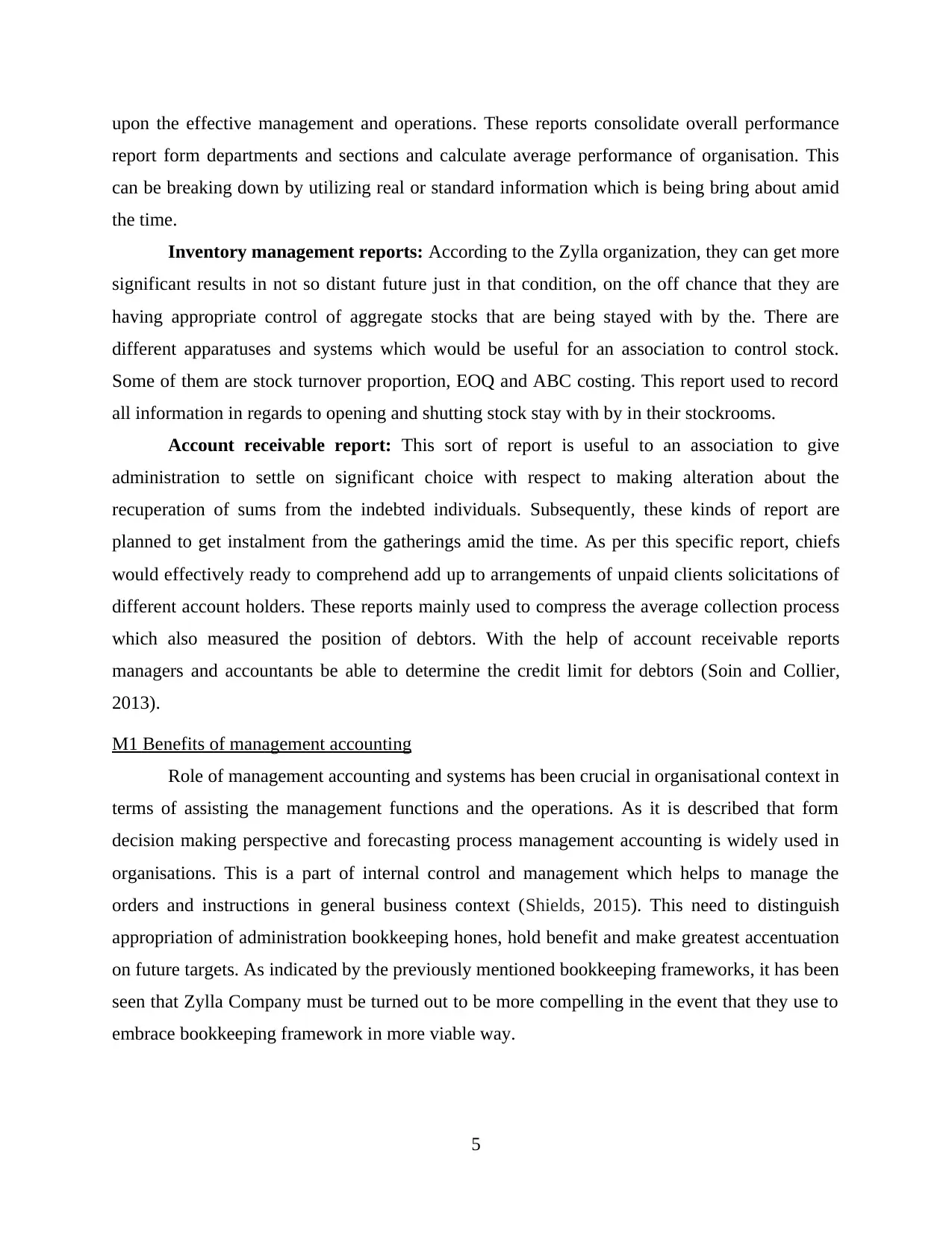

Comparison:

Absorption costing Marginal costing

Under this specific costs, directors use to

consider both variable and settled costs.

In this, lone variable expenses are taken for

the count of commitment per unit.

The fundamental thought process behind

utilizing this expenses is to dissect per unit

cost on add up to venture done by the

organization amid the time.

Under this, per unit costs are assessed by

utilizing general effects which are seen over

additional units creation done by

organization.

M2 Range of management accounting techniques and prepare accurate financial report

Types of management accounting techniques used to prepare financial reports. As there

are two costing methods are defined above in terms of preparing income statement and analyse

the profitability of organisation (Parker, 2012). By the assistance of minimal costing more

dependable outcomes can be achieve in light of the fact that it think about just factor costs.

Standard costing is a critical apparatus that aids improvement of an association. Apart form it job

costing and batch costing techniques are the main elements which are used to make financial

reports. For this reason certain sort of bookkeeping instruments are additionally useful to decide

net benefit an organization is creating amid the time.

D2 Financial reports which are applied and interpret data and activities

There are type of financial reports are produced in terms of understand the financial

reports in more effective and easy manner. Interpretation and description helps to analyse the and

understand the main aspects of management techniques which remain associated with

management reporting (Merchant, 2012). It has been discovered that outcomes are unique in

relation to both of the techniques. As per above profit statement statement profit form marginal

8

Less:

Variable sales overhead 500*1 500

Fixed overhead -1800

Selling and administrative cost expenses (800+400) -1200 -3500

Total Profit / Loss 7500

Comparison:

Absorption costing Marginal costing

Under this specific costs, directors use to

consider both variable and settled costs.

In this, lone variable expenses are taken for

the count of commitment per unit.

The fundamental thought process behind

utilizing this expenses is to dissect per unit

cost on add up to venture done by the

organization amid the time.

Under this, per unit costs are assessed by

utilizing general effects which are seen over

additional units creation done by

organization.

M2 Range of management accounting techniques and prepare accurate financial report

Types of management accounting techniques used to prepare financial reports. As there

are two costing methods are defined above in terms of preparing income statement and analyse

the profitability of organisation (Parker, 2012). By the assistance of minimal costing more

dependable outcomes can be achieve in light of the fact that it think about just factor costs.

Standard costing is a critical apparatus that aids improvement of an association. Apart form it job

costing and batch costing techniques are the main elements which are used to make financial

reports. For this reason certain sort of bookkeeping instruments are additionally useful to decide

net benefit an organization is creating amid the time.

D2 Financial reports which are applied and interpret data and activities

There are type of financial reports are produced in terms of understand the financial

reports in more effective and easy manner. Interpretation and description helps to analyse the and

understand the main aspects of management techniques which remain associated with

management reporting (Merchant, 2012). It has been discovered that outcomes are unique in

relation to both of the techniques. As per above profit statement statement profit form marginal

8

costing was measured as £7800 and £7500 by the absorption costing. From the above table,

retention is more exact and giving more positive outcomes as far as benefit. In this way, it will be

more solid for the organization.

TASK 3

P4 Advantages and disadvantages of various type of planning tools used in budgeting control

Planning tools are analysed in terms of forecasting the future plans and strategies are

analysed in this context. There are different arranging apparatuses that are useful for an

association to deal with their execution and future expenses and costs. In any benefit intention

business, it is important to have appropriate arranging which will be useful to create more

positive outcomes in coming time with the utilization of assets in more viable way. Some of

them are talk about underneath:

Contingency planning tool: This strategy is more important in the event that issue is

harder to director. This is by all accounts one of the essential devices which are use by chiefs to

outline successful destinations keeping in mind the end goal to create firms in any basic

circumstances. In this organization use to make earlier intending to control their up and coming

ramifications that can influence execution of an association.

Advantage: In that specific circumstance it will work all the more viably. This arranging

instrument is more precise and dependable for little and medium size association since

they tasks are very little and odds of oversights can be high as well.

Disadvantage: In some sort of circumstance, it doesn't take as more solid as a result of

their mind boggling and dynamic nature.

Forecasting tools: By the utilization of these specific instruments Zylla Company can

have the capacity to appraise add up to procuring and misfortunes done by the organization and

measures to control them. This is by all accounts one of the more compelling devices which are

powerful in future arranging of an association assets.

Advantage: By the assistance of this, directors can without much of a stretch have the

capacity to appraise future expenses and costs. This is taken into accounts as most

extreme critical systems for the organizations to assess pre-decide general vision of an

association.

9

retention is more exact and giving more positive outcomes as far as benefit. In this way, it will be

more solid for the organization.

TASK 3

P4 Advantages and disadvantages of various type of planning tools used in budgeting control

Planning tools are analysed in terms of forecasting the future plans and strategies are

analysed in this context. There are different arranging apparatuses that are useful for an

association to deal with their execution and future expenses and costs. In any benefit intention

business, it is important to have appropriate arranging which will be useful to create more

positive outcomes in coming time with the utilization of assets in more viable way. Some of

them are talk about underneath:

Contingency planning tool: This strategy is more important in the event that issue is

harder to director. This is by all accounts one of the essential devices which are use by chiefs to

outline successful destinations keeping in mind the end goal to create firms in any basic

circumstances. In this organization use to make earlier intending to control their up and coming

ramifications that can influence execution of an association.

Advantage: In that specific circumstance it will work all the more viably. This arranging

instrument is more precise and dependable for little and medium size association since

they tasks are very little and odds of oversights can be high as well.

Disadvantage: In some sort of circumstance, it doesn't take as more solid as a result of

their mind boggling and dynamic nature.

Forecasting tools: By the utilization of these specific instruments Zylla Company can

have the capacity to appraise add up to procuring and misfortunes done by the organization and

measures to control them. This is by all accounts one of the more compelling devices which are

powerful in future arranging of an association assets.

Advantage: By the assistance of this, directors can without much of a stretch have the

capacity to appraise future expenses and costs. This is taken into accounts as most

extreme critical systems for the organizations to assess pre-decide general vision of an

association.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.