Financial Statement Analysis of Gillette Ltd

VerifiedAdded on 2023/01/13

|12

|2863

|33

AI Summary

This report presents a financial analysis of Gillette Ltd using ratio analysis to assess profitability, liquidity, and leverage position. It also discusses the benefits and limitations of ratio analysis in decision making within the tourism industry.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Analysis of the financial

statements

statements

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Executive Summary

The report is based on the hotel management company named as Gillette. The study will be

presenting the financial analysis of the firm by making use of the ratio analysis tool so that

profitability, liquidity and leverage position of the company could be assessed in an effective

way. This tool played an important role with respect to making a comparative analysis fro the

two periods in order to determine the trend. Though this tool is attached with various limitation

like manipulation, estimated figures etc. so it cannot be used as an accurate and reliable measure.

The report is based on the hotel management company named as Gillette. The study will be

presenting the financial analysis of the firm by making use of the ratio analysis tool so that

profitability, liquidity and leverage position of the company could be assessed in an effective

way. This tool played an important role with respect to making a comparative analysis fro the

two periods in order to determine the trend. Though this tool is attached with various limitation

like manipulation, estimated figures etc. so it cannot be used as an accurate and reliable measure.

Table of Contents

Executive Summary ........................................................................................................................2

INTRODUCTION...........................................................................................................................4

Financial analysis.............................................................................................................................4

Trends of financial analysis ............................................................................................................4

Liquidity analysis.........................................................................................................................4

Profitability analysis...................................................................................................................5

leverage or gearing analysis.........................................................................................................6

Efficiency analysis.......................................................................................................................6

Knowledge generated from ratio analysis ...................................................................................7

Benefits and the limitation of using the ratio analysis in making decisions within tourism

industry .......................................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES................................................................................................................................1

Executive Summary ........................................................................................................................2

INTRODUCTION...........................................................................................................................4

Financial analysis.............................................................................................................................4

Trends of financial analysis ............................................................................................................4

Liquidity analysis.........................................................................................................................4

Profitability analysis...................................................................................................................5

leverage or gearing analysis.........................................................................................................6

Efficiency analysis.......................................................................................................................6

Knowledge generated from ratio analysis ...................................................................................7

Benefits and the limitation of using the ratio analysis in making decisions within tourism

industry .......................................................................................................................................8

CONCLUSION..............................................................................................................................10

REFERENCES................................................................................................................................1

INTRODUCTION

Financial statement analysis is a practice of assessing financial information of an entity

for the purpose of making appropriate decisions. External stakeholders uses it for understanding

an overall organizational health and in evaluating financial performance and value of the

business. The present report is based on Gillette Ltd which is seen as the hospitality company

that is involved in managing the portfolio of the hotels in the United Kingdom and the Northern

Ireland. Furthermore, the study highlights computation of the ratios for making financial

analysis and present liquidity, profitability and gearing position of the company. Moreover, the

report describes uses or importance of the ratio analysis and the benefits & limitations associated

with the ratio analysis tool.

Financial analysis

Trends of financial analysis

Liquidity analysis

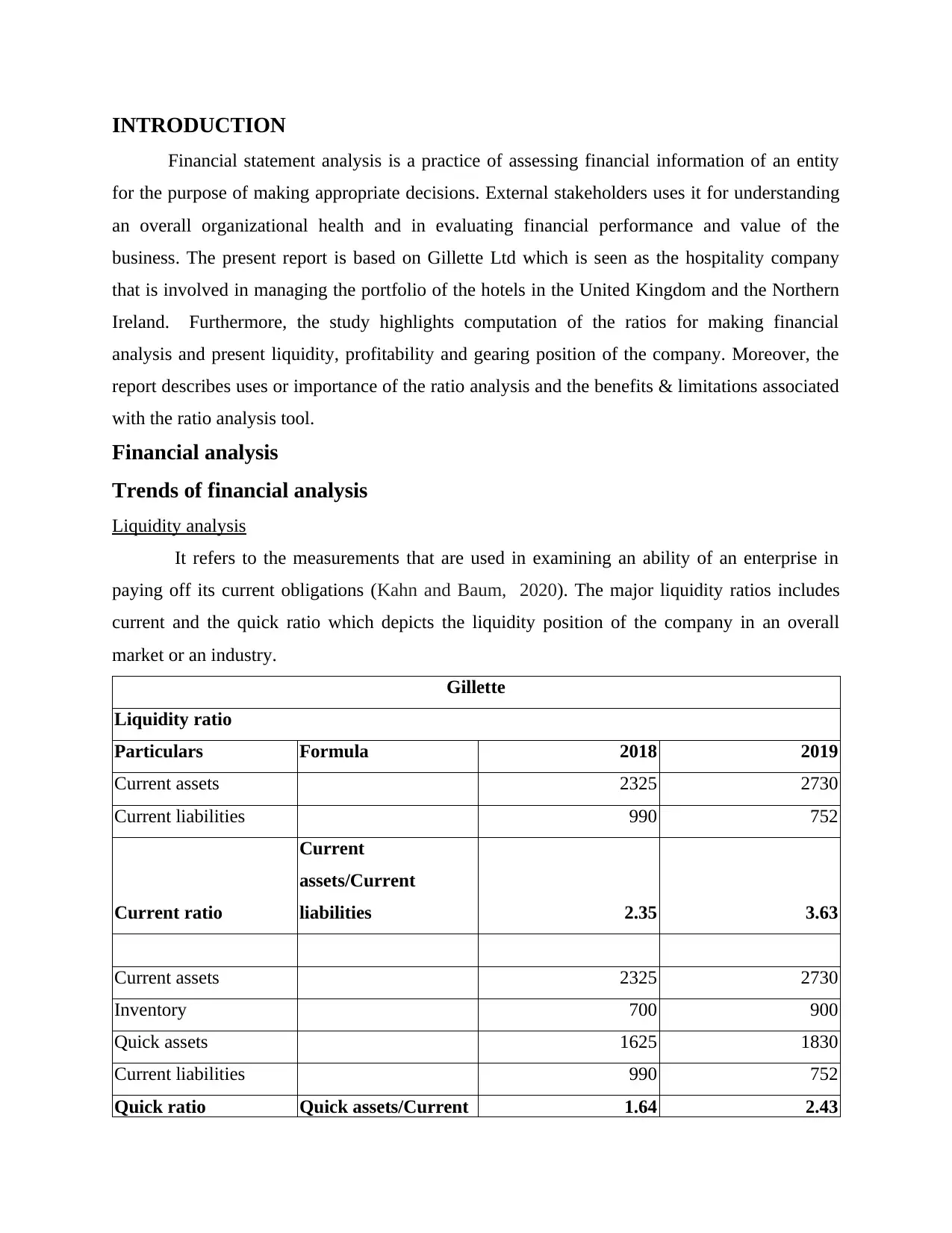

It refers to the measurements that are used in examining an ability of an enterprise in

paying off its current obligations (Kahn and Baum, 2020). The major liquidity ratios includes

current and the quick ratio which depicts the liquidity position of the company in an overall

market or an industry.

Gillette

Liquidity ratio

Particulars Formula 2018 2019

Current assets 2325 2730

Current liabilities 990 752

Current ratio

Current

assets/Current

liabilities 2.35 3.63

Current assets 2325 2730

Inventory 700 900

Quick assets 1625 1830

Current liabilities 990 752

Quick ratio Quick assets/Current 1.64 2.43

Financial statement analysis is a practice of assessing financial information of an entity

for the purpose of making appropriate decisions. External stakeholders uses it for understanding

an overall organizational health and in evaluating financial performance and value of the

business. The present report is based on Gillette Ltd which is seen as the hospitality company

that is involved in managing the portfolio of the hotels in the United Kingdom and the Northern

Ireland. Furthermore, the study highlights computation of the ratios for making financial

analysis and present liquidity, profitability and gearing position of the company. Moreover, the

report describes uses or importance of the ratio analysis and the benefits & limitations associated

with the ratio analysis tool.

Financial analysis

Trends of financial analysis

Liquidity analysis

It refers to the measurements that are used in examining an ability of an enterprise in

paying off its current obligations (Kahn and Baum, 2020). The major liquidity ratios includes

current and the quick ratio which depicts the liquidity position of the company in an overall

market or an industry.

Gillette

Liquidity ratio

Particulars Formula 2018 2019

Current assets 2325 2730

Current liabilities 990 752

Current ratio

Current

assets/Current

liabilities 2.35 3.63

Current assets 2325 2730

Inventory 700 900

Quick assets 1625 1830

Current liabilities 990 752

Quick ratio Quick assets/Current 1.64 2.43

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

liabilities

Interpretation- The above results generated reflects that over the years the current and

quick ratio of Gillette Ltd is increasing which means that its liquidity position is getting better.

This shows that Gillette Ltd is making an effective and efficient use of the current assets in order

to meet its short term obligations. In the year 2018, the current ratio accounted as 2.35 which is

been stated as an ideal ratio where the assets are seen as doubled the current liabilities which in

turn counted as an ideal liquidity state of the firm. Moreover, the current and the quick ratio of

the company is rising which clearly states that an enterprise is having adequate cash in meeting

its current liabilities.

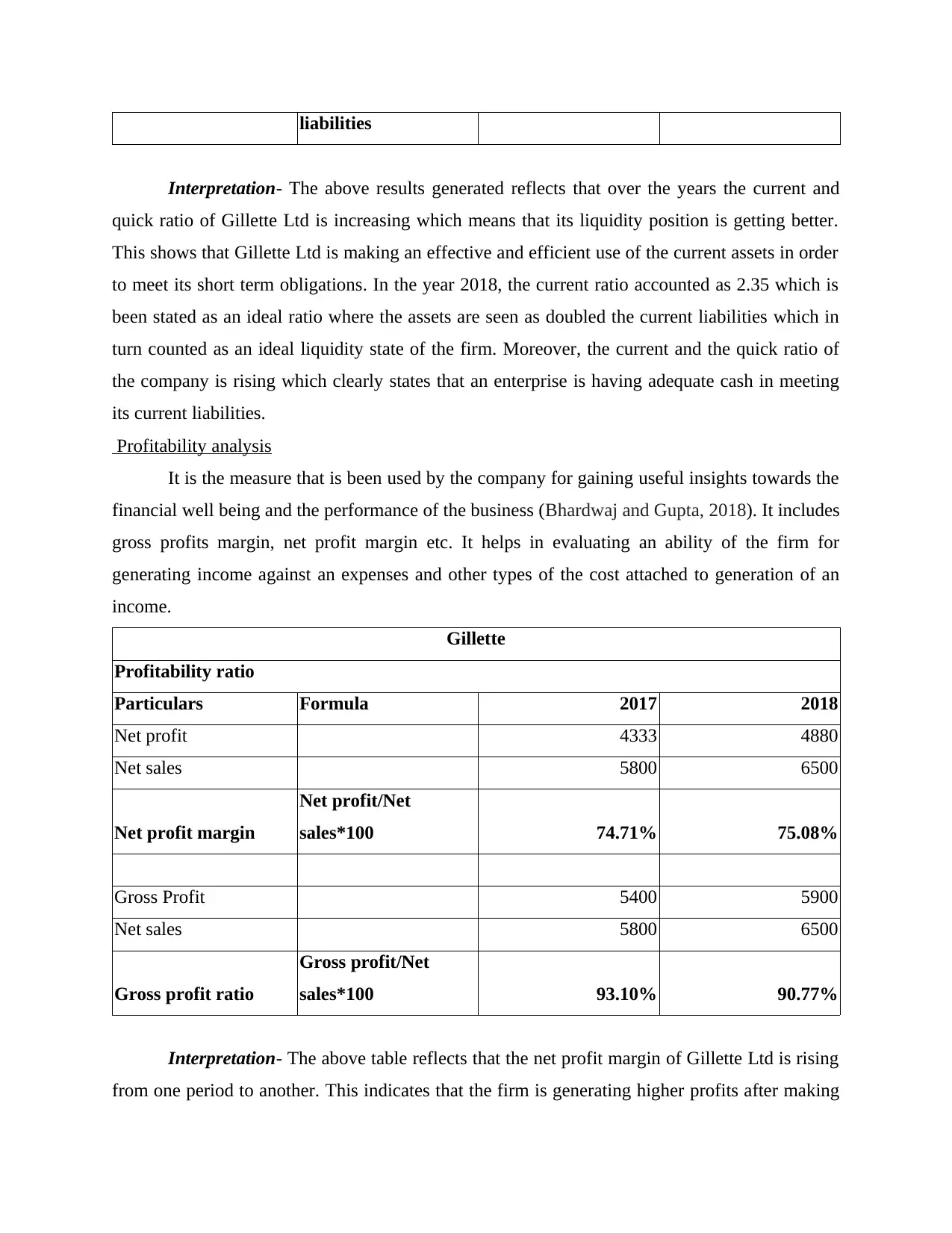

Profitability analysis

It is the measure that is been used by the company for gaining useful insights towards the

financial well being and the performance of the business (Bhardwaj and Gupta, 2018). It includes

gross profits margin, net profit margin etc. It helps in evaluating an ability of the firm for

generating income against an expenses and other types of the cost attached to generation of an

income.

Gillette

Profitability ratio

Particulars Formula 2017 2018

Net profit 4333 4880

Net sales 5800 6500

Net profit margin

Net profit/Net

sales*100 74.71% 75.08%

Gross Profit 5400 5900

Net sales 5800 6500

Gross profit ratio

Gross profit/Net

sales*100 93.10% 90.77%

Interpretation- The above table reflects that the net profit margin of Gillette Ltd is rising

from one period to another. This indicates that the firm is generating higher profits after making

Interpretation- The above results generated reflects that over the years the current and

quick ratio of Gillette Ltd is increasing which means that its liquidity position is getting better.

This shows that Gillette Ltd is making an effective and efficient use of the current assets in order

to meet its short term obligations. In the year 2018, the current ratio accounted as 2.35 which is

been stated as an ideal ratio where the assets are seen as doubled the current liabilities which in

turn counted as an ideal liquidity state of the firm. Moreover, the current and the quick ratio of

the company is rising which clearly states that an enterprise is having adequate cash in meeting

its current liabilities.

Profitability analysis

It is the measure that is been used by the company for gaining useful insights towards the

financial well being and the performance of the business (Bhardwaj and Gupta, 2018). It includes

gross profits margin, net profit margin etc. It helps in evaluating an ability of the firm for

generating income against an expenses and other types of the cost attached to generation of an

income.

Gillette

Profitability ratio

Particulars Formula 2017 2018

Net profit 4333 4880

Net sales 5800 6500

Net profit margin

Net profit/Net

sales*100 74.71% 75.08%

Gross Profit 5400 5900

Net sales 5800 6500

Gross profit ratio

Gross profit/Net

sales*100 93.10% 90.77%

Interpretation- The above table reflects that the net profit margin of Gillette Ltd is rising

from one period to another. This indicates that the firm is generating higher profits after making

payment of all its costs, expenses and taxes. This in turn states that the company is performing

better with passage of one accounting period. On the other hand, the gross profit margin is seen

as declining over the period that is from 93% in the year 2018 to 90.77% in the year 2019. It

clearly depicts that cost of sales is increasing which results to decrease in the profits. This also

reflects that company need to focus on controlling the expenses that are incurred in relation to

sales for improving its gross margin.

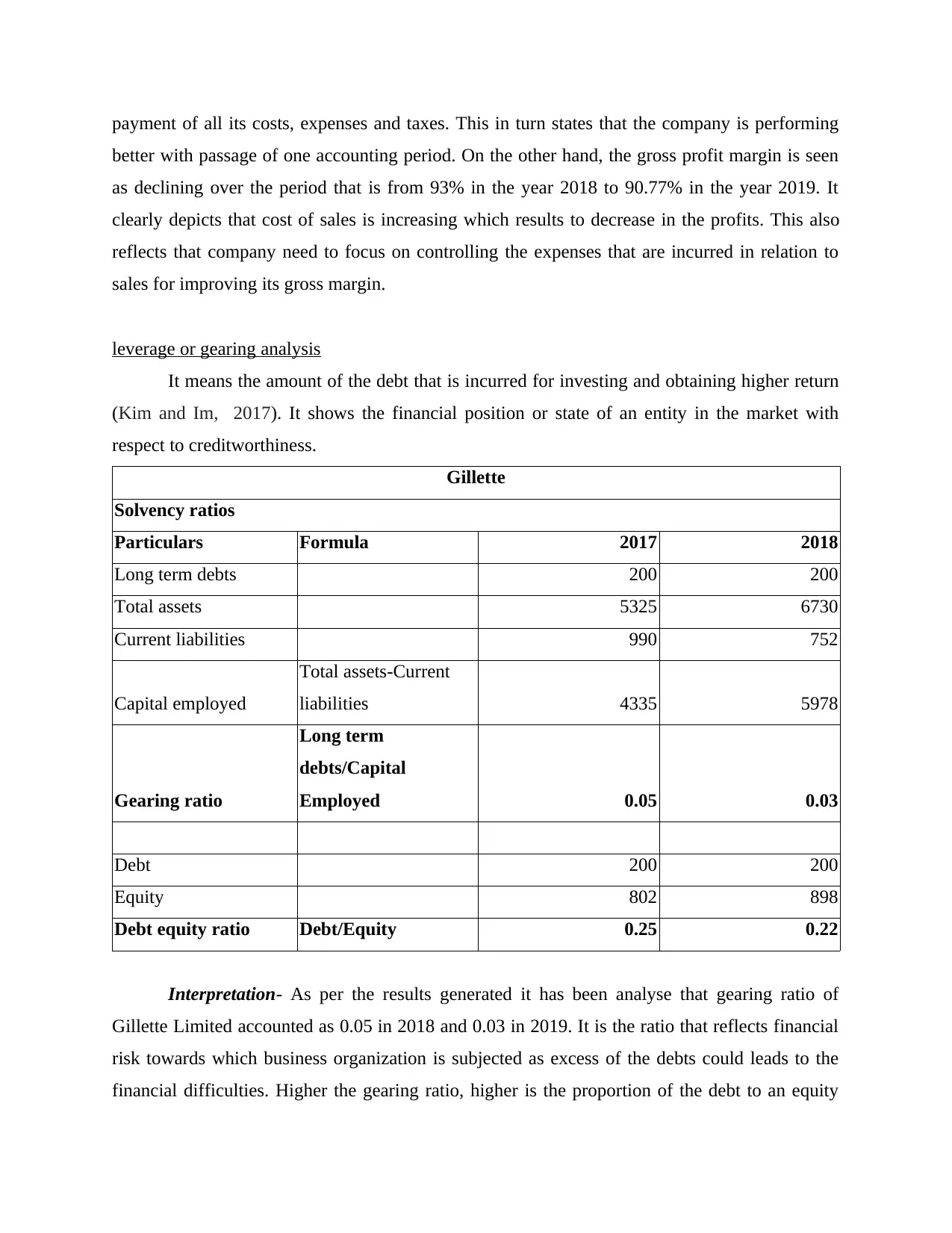

leverage or gearing analysis

It means the amount of the debt that is incurred for investing and obtaining higher return

(Kim and Im, 2017). It shows the financial position or state of an entity in the market with

respect to creditworthiness.

Gillette

Solvency ratios

Particulars Formula 2017 2018

Long term debts 200 200

Total assets 5325 6730

Current liabilities 990 752

Capital employed

Total assets-Current

liabilities 4335 5978

Gearing ratio

Long term

debts/Capital

Employed 0.05 0.03

Debt 200 200

Equity 802 898

Debt equity ratio Debt/Equity 0.25 0.22

Interpretation- As per the results generated it has been analyse that gearing ratio of

Gillette Limited accounted as 0.05 in 2018 and 0.03 in 2019. It is the ratio that reflects financial

risk towards which business organization is subjected as excess of the debts could leads to the

financial difficulties. Higher the gearing ratio, higher is the proportion of the debt to an equity

better with passage of one accounting period. On the other hand, the gross profit margin is seen

as declining over the period that is from 93% in the year 2018 to 90.77% in the year 2019. It

clearly depicts that cost of sales is increasing which results to decrease in the profits. This also

reflects that company need to focus on controlling the expenses that are incurred in relation to

sales for improving its gross margin.

leverage or gearing analysis

It means the amount of the debt that is incurred for investing and obtaining higher return

(Kim and Im, 2017). It shows the financial position or state of an entity in the market with

respect to creditworthiness.

Gillette

Solvency ratios

Particulars Formula 2017 2018

Long term debts 200 200

Total assets 5325 6730

Current liabilities 990 752

Capital employed

Total assets-Current

liabilities 4335 5978

Gearing ratio

Long term

debts/Capital

Employed 0.05 0.03

Debt 200 200

Equity 802 898

Debt equity ratio Debt/Equity 0.25 0.22

Interpretation- As per the results generated it has been analyse that gearing ratio of

Gillette Limited accounted as 0.05 in 2018 and 0.03 in 2019. It is the ratio that reflects financial

risk towards which business organization is subjected as excess of the debts could leads to the

financial difficulties. Higher the gearing ratio, higher is the proportion of the debt to an equity

whereas the low gearing ratio represents lower risk as proportion of the debt is less than equity.

As the above results shows that the gearing and the debt equity ratio of Gillette Ltd is decreasing

from one period to another which means that firm is capable of meeting its debts against its

equities and depicts a better leverage position.

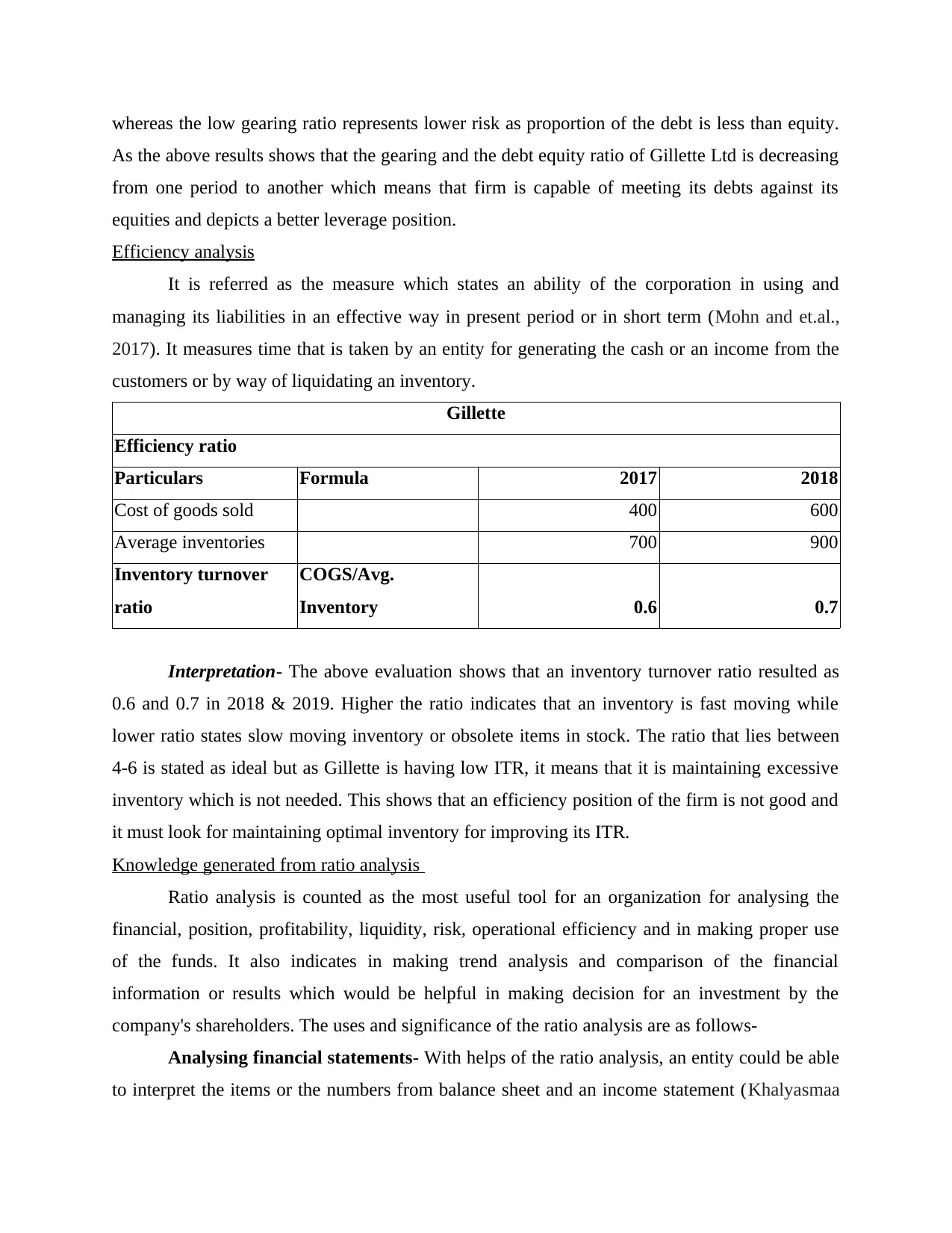

Efficiency analysis

It is referred as the measure which states an ability of the corporation in using and

managing its liabilities in an effective way in present period or in short term (Mohn and et.al.,

2017). It measures time that is taken by an entity for generating the cash or an income from the

customers or by way of liquidating an inventory.

Gillette

Efficiency ratio

Particulars Formula 2017 2018

Cost of goods sold 400 600

Average inventories 700 900

Inventory turnover

ratio

COGS/Avg.

Inventory 0.6 0.7

Interpretation- The above evaluation shows that an inventory turnover ratio resulted as

0.6 and 0.7 in 2018 & 2019. Higher the ratio indicates that an inventory is fast moving while

lower ratio states slow moving inventory or obsolete items in stock. The ratio that lies between

4-6 is stated as ideal but as Gillette is having low ITR, it means that it is maintaining excessive

inventory which is not needed. This shows that an efficiency position of the firm is not good and

it must look for maintaining optimal inventory for improving its ITR.

Knowledge generated from ratio analysis

Ratio analysis is counted as the most useful tool for an organization for analysing the

financial, position, profitability, liquidity, risk, operational efficiency and in making proper use

of the funds. It also indicates in making trend analysis and comparison of the financial

information or results which would be helpful in making decision for an investment by the

company's shareholders. The uses and significance of the ratio analysis are as follows-

Analysing financial statements- With helps of the ratio analysis, an entity could be able

to interpret the items or the numbers from balance sheet and an income statement (Khalyasmaa

As the above results shows that the gearing and the debt equity ratio of Gillette Ltd is decreasing

from one period to another which means that firm is capable of meeting its debts against its

equities and depicts a better leverage position.

Efficiency analysis

It is referred as the measure which states an ability of the corporation in using and

managing its liabilities in an effective way in present period or in short term (Mohn and et.al.,

2017). It measures time that is taken by an entity for generating the cash or an income from the

customers or by way of liquidating an inventory.

Gillette

Efficiency ratio

Particulars Formula 2017 2018

Cost of goods sold 400 600

Average inventories 700 900

Inventory turnover

ratio

COGS/Avg.

Inventory 0.6 0.7

Interpretation- The above evaluation shows that an inventory turnover ratio resulted as

0.6 and 0.7 in 2018 & 2019. Higher the ratio indicates that an inventory is fast moving while

lower ratio states slow moving inventory or obsolete items in stock. The ratio that lies between

4-6 is stated as ideal but as Gillette is having low ITR, it means that it is maintaining excessive

inventory which is not needed. This shows that an efficiency position of the firm is not good and

it must look for maintaining optimal inventory for improving its ITR.

Knowledge generated from ratio analysis

Ratio analysis is counted as the most useful tool for an organization for analysing the

financial, position, profitability, liquidity, risk, operational efficiency and in making proper use

of the funds. It also indicates in making trend analysis and comparison of the financial

information or results which would be helpful in making decision for an investment by the

company's shareholders. The uses and significance of the ratio analysis are as follows-

Analysing financial statements- With helps of the ratio analysis, an entity could be able

to interpret the items or the numbers from balance sheet and an income statement (Khalyasmaa

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and et.al., 2016). Each and every stakeholder is having different interest in respect to results from

financials such as equity investors shows a keen interest in company's growth and its earning

power in long period. However, creditors would ensure that they would be getting their

repayments on time.

Helps in measuring performance of an entity- Profitability ratios helps in determining

an ability of the company in generating earnings. For example- return on equity reflects an

earnings generated by the firm in respect of equity. Gross and the net profit ratio enables in

analysing an ability of the company in translating sales to the profits.

Assessing operational efficiency- Ratio analysis helps in identifying the degree to which

the firm is efficiently working its business operations. Such ratios includes inventory turnover,

asset turnover etc (Andjelic and Vesic, 2017). These type of ratios could be compared with other

peers of similar industry and in analysing which type of firm is managed in a better way in

comparison to other. It measures the capability of the company in generating income with the use

of its current and non-current assets.

Liquidity of an entity- Ratio analysis is the main tool that helps in determining

capability of the firm in paying off its current obligation. Through the current ratio, quick ratio,

working capital ratio etc company can assess its liquidity condition in a better way.

Identifies business risks- Ratios helps in understanding business risk within the firm. It

reflects the sensitivity of the an entity towards profitability with respect to deployment of the

fixed cost and outstanding debts.

Helps in determining financial risk- The other major use of ratio analysis tool is that it

enables in determining financial risks. Ratios such as leverage ratio, ICR etc assist the company

in understanding the extent to which it is dependent on an external capital and it is capable in

repaying its debt by making use of the own capital.

Planning and forecasting- Financial ratios are the tool that shows the trend which the

manager uses in order to forecast the future and could be used for the purpose of making

important decisions fro the stakeholders (Dong and et.al., 2016). Investors can make suitable

decisions by using this tool in respect of making the investment in the particular proposal or not.

Comparing performance- ratio analysis is mainly used fro comparing the strengths and

the weaknesses of the firm. It could be used for comparing previous ratios of the company and

helps in analysing the progress made by an entity.

financials such as equity investors shows a keen interest in company's growth and its earning

power in long period. However, creditors would ensure that they would be getting their

repayments on time.

Helps in measuring performance of an entity- Profitability ratios helps in determining

an ability of the company in generating earnings. For example- return on equity reflects an

earnings generated by the firm in respect of equity. Gross and the net profit ratio enables in

analysing an ability of the company in translating sales to the profits.

Assessing operational efficiency- Ratio analysis helps in identifying the degree to which

the firm is efficiently working its business operations. Such ratios includes inventory turnover,

asset turnover etc (Andjelic and Vesic, 2017). These type of ratios could be compared with other

peers of similar industry and in analysing which type of firm is managed in a better way in

comparison to other. It measures the capability of the company in generating income with the use

of its current and non-current assets.

Liquidity of an entity- Ratio analysis is the main tool that helps in determining

capability of the firm in paying off its current obligation. Through the current ratio, quick ratio,

working capital ratio etc company can assess its liquidity condition in a better way.

Identifies business risks- Ratios helps in understanding business risk within the firm. It

reflects the sensitivity of the an entity towards profitability with respect to deployment of the

fixed cost and outstanding debts.

Helps in determining financial risk- The other major use of ratio analysis tool is that it

enables in determining financial risks. Ratios such as leverage ratio, ICR etc assist the company

in understanding the extent to which it is dependent on an external capital and it is capable in

repaying its debt by making use of the own capital.

Planning and forecasting- Financial ratios are the tool that shows the trend which the

manager uses in order to forecast the future and could be used for the purpose of making

important decisions fro the stakeholders (Dong and et.al., 2016). Investors can make suitable

decisions by using this tool in respect of making the investment in the particular proposal or not.

Comparing performance- ratio analysis is mainly used fro comparing the strengths and

the weaknesses of the firm. It could be used for comparing previous ratios of the company and

helps in analysing the progress made by an entity.

Benefits and the limitation of using the ratio analysis in making decisions within tourism

industry

Ratio analysis is quantitative method of identifying the insights about the financial health

and position of company. It is used for assessing the liquidity, profitability and operational

efficiency. Ratio analysis is used as the tool for assessing the financial performance of the

business. There are several types of ratios which are used by the organisations and experts for

decision making. The historical data about the company or companies are compared to know the

position of company (Campbell and et.al., 2019). They are used in analysing of financial

statements by computing the values in percentage rather than comparison of the line items in

financial statements.

Advantages of Ratio Analysis

It is useful in the analysis of financial position.

Accounting ratios are mainly computed for revealing the financial position of the

company. It helps banks, financial institutions, investors and insurance companies in making

decisions related to lending and investments. This provides the investors internal and external

position of company as compared with other entities and organisations.

Useful in simplification of accounting figures

Financial ratios helps in simplifying, summarising and systematizing accounting and

financial figures for making them understandable for the decision makers and in lucid form.

These ratios highlights the inter relationship existing between the different segments of business

as represented by the financial statements (Easton and Sommers, 2018). Most often figures alone

are not capable of conveying the meaning, but the rations enable them in relating them with the

other figures.

Useful in assessing Operational Efficiency

Financial ratios helps organisation in getting an overview about the working of the

concern. Investors finds the efficiency of the business to be more effective and evident when the

analysis is based over the accounting ratios. These ratios are used for diagnosing the financial

health of the organisation by evaluation of the profitability, liquidity and solvency and many

more. It helps the managers and executives in assessing financial capabilities and requirements

of the business units.

industry

Ratio analysis is quantitative method of identifying the insights about the financial health

and position of company. It is used for assessing the liquidity, profitability and operational

efficiency. Ratio analysis is used as the tool for assessing the financial performance of the

business. There are several types of ratios which are used by the organisations and experts for

decision making. The historical data about the company or companies are compared to know the

position of company (Campbell and et.al., 2019). They are used in analysing of financial

statements by computing the values in percentage rather than comparison of the line items in

financial statements.

Advantages of Ratio Analysis

It is useful in the analysis of financial position.

Accounting ratios are mainly computed for revealing the financial position of the

company. It helps banks, financial institutions, investors and insurance companies in making

decisions related to lending and investments. This provides the investors internal and external

position of company as compared with other entities and organisations.

Useful in simplification of accounting figures

Financial ratios helps in simplifying, summarising and systematizing accounting and

financial figures for making them understandable for the decision makers and in lucid form.

These ratios highlights the inter relationship existing between the different segments of business

as represented by the financial statements (Easton and Sommers, 2018). Most often figures alone

are not capable of conveying the meaning, but the rations enable them in relating them with the

other figures.

Useful in assessing Operational Efficiency

Financial ratios helps organisation in getting an overview about the working of the

concern. Investors finds the efficiency of the business to be more effective and evident when the

analysis is based over the accounting ratios. These ratios are used for diagnosing the financial

health of the organisation by evaluation of the profitability, liquidity and solvency and many

more. It helps the managers and executives in assessing financial capabilities and requirements

of the business units.

Useful in future forecasts

When the accounting ratios are calculated for more than two years a business trend can

be obtained. The trend helps the management in setting the plans for future operations and

making forecasts. Example ; sales expenses against the sales could be forecasted easily on the

basis of figures of past years.

Useful in locating the weak points of Business

These financial ratios play a great role in assisting and identifying the weak points of

Hotel even when the overall performance is good. Weakness in the financial structures because

of incorrect policies could be identified easily by the accounting ratios (Aman, 2016). This helps

in taking corrective steps about the company on time.

Limitations of ratio analysis

It is a complicated process to analyse the financial statements.

There are various companies working in different enterprises with each possessing their

own environmental positions like, regulations, market structure etc,. These factors have

importance as comparison between the organisations from different industries may be

ambiguous.

Financial data have influence of the views & hypotheses. The accounting criteria lay

different methods for the enterprises, that reduces the comparability of financial

statements and this makes ratio analysis ineffective in such circumstances.

The financial ratios provide for the association between the data of previous years where

the investors or users of financial statements are more concerned with the current and

future data (Bragg, 2018).

These ratios do not consider the changes in pricing factors due to the inflations. They are

calculated over historical costs and price level changes are ignored between periods.

CONCLUSION

By summing up the above report ratios analysis helps in making the comparative analysis

of the present with the past periods. It helps in analysing the trend of performance and the

position of the company.

When the accounting ratios are calculated for more than two years a business trend can

be obtained. The trend helps the management in setting the plans for future operations and

making forecasts. Example ; sales expenses against the sales could be forecasted easily on the

basis of figures of past years.

Useful in locating the weak points of Business

These financial ratios play a great role in assisting and identifying the weak points of

Hotel even when the overall performance is good. Weakness in the financial structures because

of incorrect policies could be identified easily by the accounting ratios (Aman, 2016). This helps

in taking corrective steps about the company on time.

Limitations of ratio analysis

It is a complicated process to analyse the financial statements.

There are various companies working in different enterprises with each possessing their

own environmental positions like, regulations, market structure etc,. These factors have

importance as comparison between the organisations from different industries may be

ambiguous.

Financial data have influence of the views & hypotheses. The accounting criteria lay

different methods for the enterprises, that reduces the comparability of financial

statements and this makes ratio analysis ineffective in such circumstances.

The financial ratios provide for the association between the data of previous years where

the investors or users of financial statements are more concerned with the current and

future data (Bragg, 2018).

These ratios do not consider the changes in pricing factors due to the inflations. They are

calculated over historical costs and price level changes are ignored between periods.

CONCLUSION

By summing up the above report ratios analysis helps in making the comparative analysis

of the present with the past periods. It helps in analysing the trend of performance and the

position of the company.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

REFERENCES

Books and journals

Aman, S.M., 2016. Analysis of financial statements using ratio analysis for the last 5 years.

Andjelic, S. and Vesic, T., 2017. The importance of financial analysis for business decision

making. In Book of proceedings from Sixth International Scientific Conference

Employment, Education and Entrepreneurship (pp. 9-25).

Bhardwaj, M. A. and Gupta, R., 2018, October. Qualitative analysis of financial statements for

fraud detection. In 2018 International Conference on Advances in Computing,

Communication Control and Networking (ICACCCN) (pp. 318-320). IEEE.

Bragg, S.M., 2018. The Interpretation of Financial Statements. AccountingTools, Incorporated.

Campbell, J.L., and et.al., 2019. Do Investors Adjust Financial Statement Ratios when Financial

Statements Fail to Reflect Economic Substance? Evidence from Cash Flow

Hedges. Evidence from Cash Flow Hedges (April 2019).

Dong, G. and et.al., 2016. A generalized analytic solution to the win ratio to analyze a composite

endpoint considering the clinical importance order among components. Pharmaceutical

statistics. 15(5). pp.430-437.

Easton, M. and Sommers, Z., 2018. Financial Statement Analysis & Valuation, 5e.

Kahn, M. J. and Baum, N., 2020. Basic Accounting and Interpretation of Financial Statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

Khalyasmaa, A. I. and et.al., 2016, October. The problems of dissolved in oil gases analysis

results' interpretation in information analytical systems. In 2016 International Conference

and Exposition on Electrical and Power Engineering (EPE) (pp. 743-747). IEEE.

Kim, J. H. and Im, C. C., 2017. Reported Profits And Effective Tax Rate Following Accounting

Standards Changes Analysis Of Consolidated Financial Statements And Separate Financial

Statements. Journal of Applied Business Research (JABR). 33(6). pp.1171-1186.

1

Books and journals

Aman, S.M., 2016. Analysis of financial statements using ratio analysis for the last 5 years.

Andjelic, S. and Vesic, T., 2017. The importance of financial analysis for business decision

making. In Book of proceedings from Sixth International Scientific Conference

Employment, Education and Entrepreneurship (pp. 9-25).

Bhardwaj, M. A. and Gupta, R., 2018, October. Qualitative analysis of financial statements for

fraud detection. In 2018 International Conference on Advances in Computing,

Communication Control and Networking (ICACCCN) (pp. 318-320). IEEE.

Bragg, S.M., 2018. The Interpretation of Financial Statements. AccountingTools, Incorporated.

Campbell, J.L., and et.al., 2019. Do Investors Adjust Financial Statement Ratios when Financial

Statements Fail to Reflect Economic Substance? Evidence from Cash Flow

Hedges. Evidence from Cash Flow Hedges (April 2019).

Dong, G. and et.al., 2016. A generalized analytic solution to the win ratio to analyze a composite

endpoint considering the clinical importance order among components. Pharmaceutical

statistics. 15(5). pp.430-437.

Easton, M. and Sommers, Z., 2018. Financial Statement Analysis & Valuation, 5e.

Kahn, M. J. and Baum, N., 2020. Basic Accounting and Interpretation of Financial Statements.

In The Business Basics of Building and Managing a Healthcare Practice (pp. 13-18).

Springer, Cham.

Khalyasmaa, A. I. and et.al., 2016, October. The problems of dissolved in oil gases analysis

results' interpretation in information analytical systems. In 2016 International Conference

and Exposition on Electrical and Power Engineering (EPE) (pp. 743-747). IEEE.

Kim, J. H. and Im, C. C., 2017. Reported Profits And Effective Tax Rate Following Accounting

Standards Changes Analysis Of Consolidated Financial Statements And Separate Financial

Statements. Journal of Applied Business Research (JABR). 33(6). pp.1171-1186.

1

Mohn, J. and et.al., 2017, April. Progress in the analysis and interpretation of N2O isotopes:

Potential and future challenges. In EGU General Assembly Conference Abstracts(Vol. 19,

p. 7034).

2

Potential and future challenges. In EGU General Assembly Conference Abstracts(Vol. 19,

p. 7034).

2

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.