Assessment Task 1- Organisational Requirements

VerifiedAdded on 2023/03/17

|16

|2439

|43

AI Summary

This document provides an assessment task on organisational requirements for Charity Care Pty. Ltd. It includes a survey form, current compliance requirements, compliance management, comparison of available compliance systems, research process, and recommendations.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assessment Task 1- Organisational Requirements

Name of the Student

Name of the University

Author note

Name of the Student

Name of the University

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

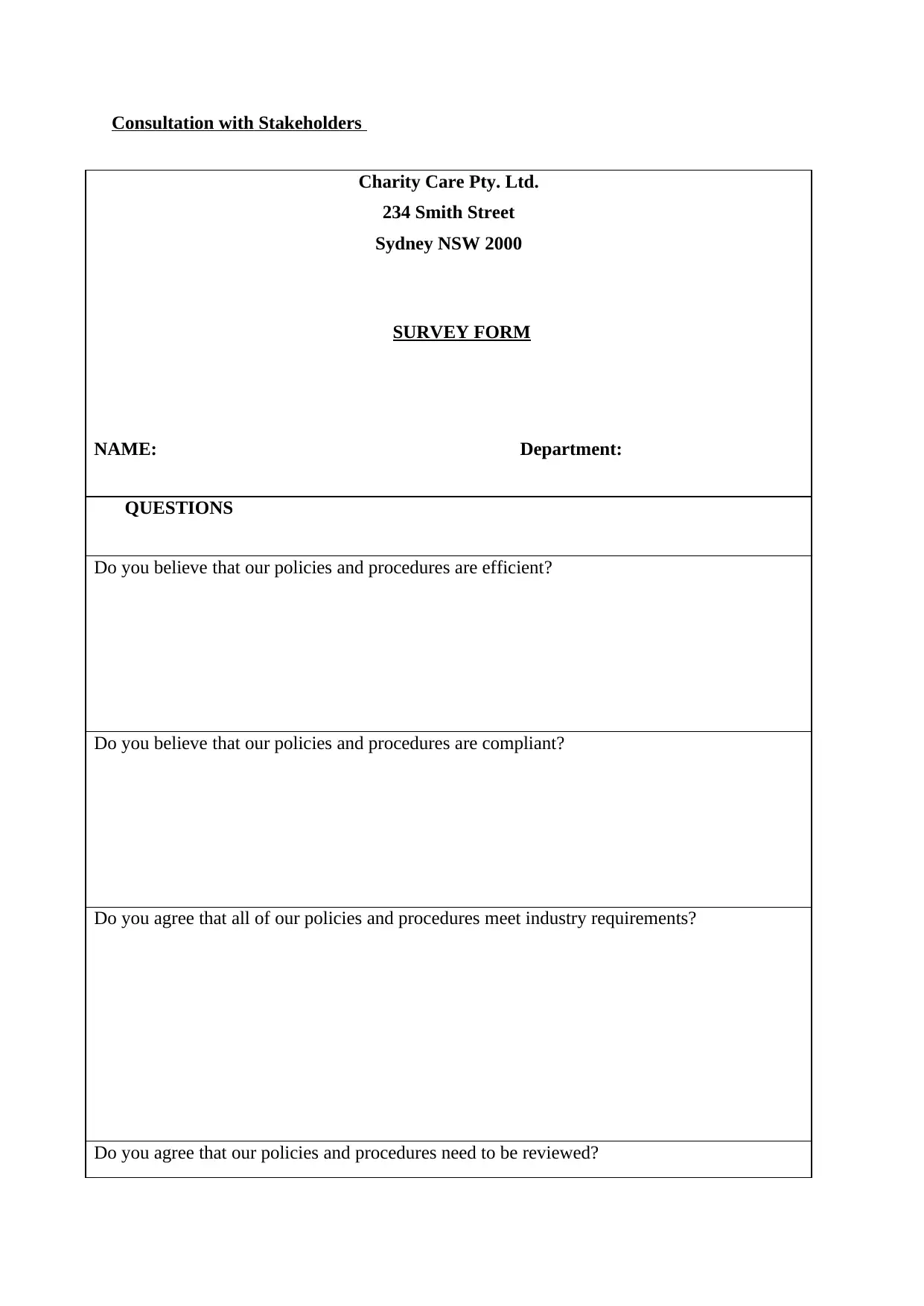

Consultation with Stakeholders

Charity Care Pty. Ltd.

234 Smith Street

Sydney NSW 2000

SURVEY FORM

NAME: Department:

QUESTIONS

Do you believe that our policies and procedures are efficient?

Do you believe that our policies and procedures are compliant?

Do you agree that all of our policies and procedures meet industry requirements?

Do you agree that our policies and procedures need to be reviewed?

Charity Care Pty. Ltd.

234 Smith Street

Sydney NSW 2000

SURVEY FORM

NAME: Department:

QUESTIONS

Do you believe that our policies and procedures are efficient?

Do you believe that our policies and procedures are compliant?

Do you agree that all of our policies and procedures meet industry requirements?

Do you agree that our policies and procedures need to be reviewed?

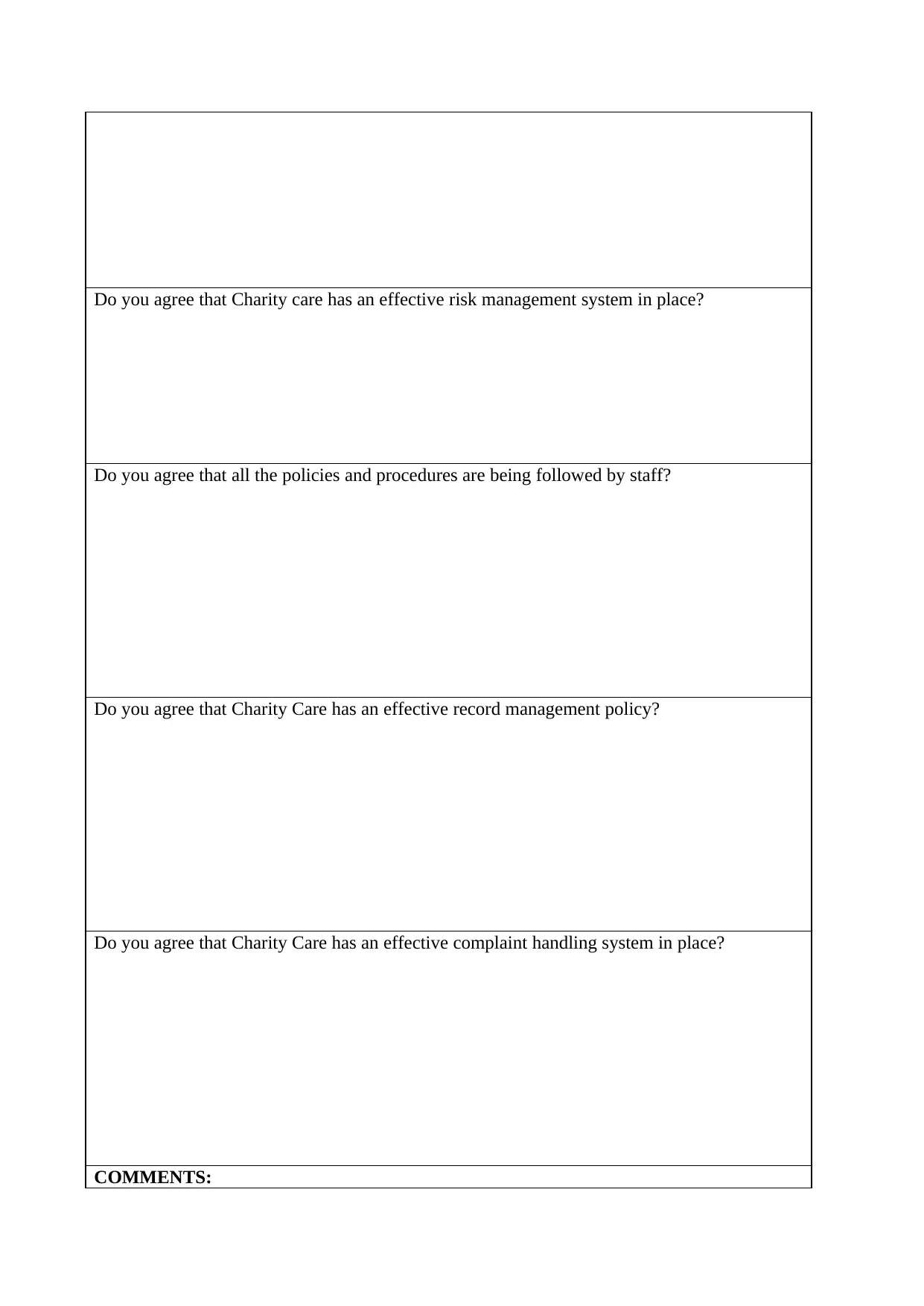

Do you agree that Charity care has an effective risk management system in place?

Do you agree that all the policies and procedures are being followed by staff?

Do you agree that Charity Care has an effective record management policy?

Do you agree that Charity Care has an effective complaint handling system in place?

COMMENTS:

Do you agree that all the policies and procedures are being followed by staff?

Do you agree that Charity Care has an effective record management policy?

Do you agree that Charity Care has an effective complaint handling system in place?

COMMENTS:

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

SIGNATURE: Date:

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

……………………………………………………………………………………………………

SIGNATURE: Date:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1. SYNOPSIS

Table of Content

1. SYNOPSIS.............................................................................................................................5

2. Current Compliance Requirements....................................................................................7

2.1 Internal compliance requirements......................................................................................7

2.2 External compliance requirements.....................................................................................7

2.3 Industry compliance requirements.....................................................................................7

3. COMPLIANCE MANAGEMENT:....................................................................................8

3.1 Areas most affected...........................................................................................................8

3.2 Risks involved....................................................................................................................8

3.3 Breaches and penalties applicable.....................................................................................8

3.4 Risk mitigation...................................................................................................................9

4. COMPARISON OF AVAILABLE COMPLIANCE SYSTEMS.....................................9

4.1 Available systems and its components and available options for compliance

management system.................................................................................................................9

4.2 Compare systems or components in terms of:...................................................................9

4.2.1 Cost............................................................................................................................9

4.2.2 Effectiveness............................................................................................................10

4.2.3 Efficiency.................................................................................................................10

4.2.4 Feasibility.................................................................................................................10

4.2.5 Match to organisational culture...............................................................................11

Size of organisation, Objectives, Policies and procedures...............................................11

5. RESEARCH PROCESS.....................................................................................................11

5.1The type of research undertaken.......................................................................................11

5.2 The development of the research plan.............................................................................11

5.3 The development of survey tools to collect required data to select compliance.............12

5.4 How the budget was assigned..........................................................................................12

5.5 Analysis of qualitative and quantitative data...................................................................12

6. RECOMMENDATIONS....................................................................................................13

1. SYNOPSIS.............................................................................................................................5

2. Current Compliance Requirements....................................................................................7

2.1 Internal compliance requirements......................................................................................7

2.2 External compliance requirements.....................................................................................7

2.3 Industry compliance requirements.....................................................................................7

3. COMPLIANCE MANAGEMENT:....................................................................................8

3.1 Areas most affected...........................................................................................................8

3.2 Risks involved....................................................................................................................8

3.3 Breaches and penalties applicable.....................................................................................8

3.4 Risk mitigation...................................................................................................................9

4. COMPARISON OF AVAILABLE COMPLIANCE SYSTEMS.....................................9

4.1 Available systems and its components and available options for compliance

management system.................................................................................................................9

4.2 Compare systems or components in terms of:...................................................................9

4.2.1 Cost............................................................................................................................9

4.2.2 Effectiveness............................................................................................................10

4.2.3 Efficiency.................................................................................................................10

4.2.4 Feasibility.................................................................................................................10

4.2.5 Match to organisational culture...............................................................................11

Size of organisation, Objectives, Policies and procedures...............................................11

5. RESEARCH PROCESS.....................................................................................................11

5.1The type of research undertaken.......................................................................................11

5.2 The development of the research plan.............................................................................11

5.3 The development of survey tools to collect required data to select compliance.............12

5.4 How the budget was assigned..........................................................................................12

5.5 Analysis of qualitative and quantitative data...................................................................12

6. RECOMMENDATIONS....................................................................................................13

2. Current Compliance Requirements

2.1 Internal compliance requirements

a. Risk management policy: It is essential to identify any potential risk for the business,

in terms of loss of physical assets, financial assets, client’s faith or social reputation of

Charity-Care to ensure stable and sustainable business growth.

b. Sexual harassment policy: It prevent any sexual harassment related misconduct within

the premises and it also leads to set-up legal procedures

c. credit card policy: It restricts the uncontrollable usage of corporate credit cards by the

employees

d. Expense reimbursement policy: This policy provides guidelines for the employee

regarding their approval or the claim for reimbursement of business.

e. Financial handling policy: It is a guideline of conducting financial transaction or

management under the regulatory practices aligned with business objectives and

business governance.

f. Expenses policy: It is a regulatory guideline to control and manage the employees

professional expenses

g. Equal employment opportunity policy: It is the regulatory policies for employment,

which ensures that Charity-Care employment system executes a unbiased,

discrimination free recruitment system.

h. Work health and safety policy: It is the workplace management policy to ensure a

healthy and hazard free environment for the employees.

2.2 External compliance requirements

1. ASIC requirements: Fulfilling the requirement of Australian Securities and

Investments Commission allows the business to have a registered Australian

Business Number (ABN) as permission for conducting any kind of corporate

activities under the Corporations Act 2001.

2. GST Act and BAS regulations: Fulfilling the requirement of Business

Activity Statement make the business registered under the GST Act (Goods

2.1 Internal compliance requirements

a. Risk management policy: It is essential to identify any potential risk for the business,

in terms of loss of physical assets, financial assets, client’s faith or social reputation of

Charity-Care to ensure stable and sustainable business growth.

b. Sexual harassment policy: It prevent any sexual harassment related misconduct within

the premises and it also leads to set-up legal procedures

c. credit card policy: It restricts the uncontrollable usage of corporate credit cards by the

employees

d. Expense reimbursement policy: This policy provides guidelines for the employee

regarding their approval or the claim for reimbursement of business.

e. Financial handling policy: It is a guideline of conducting financial transaction or

management under the regulatory practices aligned with business objectives and

business governance.

f. Expenses policy: It is a regulatory guideline to control and manage the employees

professional expenses

g. Equal employment opportunity policy: It is the regulatory policies for employment,

which ensures that Charity-Care employment system executes a unbiased,

discrimination free recruitment system.

h. Work health and safety policy: It is the workplace management policy to ensure a

healthy and hazard free environment for the employees.

2.2 External compliance requirements

1. ASIC requirements: Fulfilling the requirement of Australian Securities and

Investments Commission allows the business to have a registered Australian

Business Number (ABN) as permission for conducting any kind of corporate

activities under the Corporations Act 2001.

2. GST Act and BAS regulations: Fulfilling the requirement of Business

Activity Statement make the business registered under the GST Act (Goods

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and Service Tax), which allows the commercial handling of goods and service

under the legal compliance.

3. Income Tax Act: Fulfilling the requirement allows a business to pay tax on

annual income from business activities in order to operate a revenue

generation process legally.

4. Competition and Consumer Act: Fulfilling the requirement will allow

business operations with suppliers and consumers under product safety, fair

market price and other industry regulation. It also includes the consumer rights

related regulations.

5. Privacy law: Fulfilling the requirement will allow Charity Care to deal with

the regulating, storing, and using of personally identifiable information of

individuals, which can be collected by governments, public or private

organisations, or other individuals.

2.3 Industry compliance requirements

Collections Act: Under the regulation of Collections Act 1966, Charitable Collections Act

2003, complying this regulation allows an organisation to collect debt and charitable money

under the legal procedures and legitimate support from the governing authority

3. COMPLIANCE MANAGEMENT:

3.1 Areas most affected

1. Taxation: Through complying the tax related regulations, the corporate operation,

such as employment tax, service tax, product tax, income tax and others Charity

Care can conduct their operations without any legal issues.

2. Financial reporting: Reporting financial expense and dept collection system

along with the employees expanses will be easier and more structured through

clomping with the policies under governing regulations

3. WHS: Proper risk assessment, mitigation and contingency plan will allow the

researcher to take appropriate arrangements while having a declining rate of

workforce hazards and injury reporting

4. Asset management and security: Through complying the regulatory policy the

assets of Charity Care would be more secured, it terms of penalisations and fraud

5. Cash handling – misappropriation of funds: Financial controlling allows more

strategic investment of funds which can lead to more profitability and controlled

financial growth.

under the legal compliance.

3. Income Tax Act: Fulfilling the requirement allows a business to pay tax on

annual income from business activities in order to operate a revenue

generation process legally.

4. Competition and Consumer Act: Fulfilling the requirement will allow

business operations with suppliers and consumers under product safety, fair

market price and other industry regulation. It also includes the consumer rights

related regulations.

5. Privacy law: Fulfilling the requirement will allow Charity Care to deal with

the regulating, storing, and using of personally identifiable information of

individuals, which can be collected by governments, public or private

organisations, or other individuals.

2.3 Industry compliance requirements

Collections Act: Under the regulation of Collections Act 1966, Charitable Collections Act

2003, complying this regulation allows an organisation to collect debt and charitable money

under the legal procedures and legitimate support from the governing authority

3. COMPLIANCE MANAGEMENT:

3.1 Areas most affected

1. Taxation: Through complying the tax related regulations, the corporate operation,

such as employment tax, service tax, product tax, income tax and others Charity

Care can conduct their operations without any legal issues.

2. Financial reporting: Reporting financial expense and dept collection system

along with the employees expanses will be easier and more structured through

clomping with the policies under governing regulations

3. WHS: Proper risk assessment, mitigation and contingency plan will allow the

researcher to take appropriate arrangements while having a declining rate of

workforce hazards and injury reporting

4. Asset management and security: Through complying the regulatory policy the

assets of Charity Care would be more secured, it terms of penalisations and fraud

5. Cash handling – misappropriation of funds: Financial controlling allows more

strategic investment of funds which can lead to more profitability and controlled

financial growth.

6. Recordkeeping – confidentially of records: Keeping records under regulatory

framework enables the management to take appropriate decision. It could also

help to provide evidence against any misconduct.

7. Fraud: With the legal compliance the chances of fraud will be lower. At the same

time, in case of any fraud Charity Car can have adequate support and help from

the governing authority

8. Ethics: The legal policies and framework also enhance the ethical base of the

business operation, while having enough corporate ethical values and moral base.

3.2 Risks involved

9. Legal: It can reduces the CSR sustainability of Charity Care along with their

reputation in the industry

10. Loss of assets: It reduces the ability to invest while blocking the potentiality of

revenue generation. Loss of assets can even lead to bankruptcy.

11. Penalties: It can reduces the CSR sustainability of Charity Care along with their

reputation in the industry

3.3 Breaches and penalties applicable

12. Tax law: the taxation authority could claim the a significant amount of additional

repayment in terms of penalised tax as per the IRS decision and severity of the

issue.

13. GST law: Monitory penalisation could be enforced even government can cease

the business operation for uncertain period

3.4 Risk mitigation

14. Internal controls: It helps to regulate the business operations including the

workforce operations, code of conducts and ethical obligations.

framework enables the management to take appropriate decision. It could also

help to provide evidence against any misconduct.

7. Fraud: With the legal compliance the chances of fraud will be lower. At the same

time, in case of any fraud Charity Car can have adequate support and help from

the governing authority

8. Ethics: The legal policies and framework also enhance the ethical base of the

business operation, while having enough corporate ethical values and moral base.

3.2 Risks involved

9. Legal: It can reduces the CSR sustainability of Charity Care along with their

reputation in the industry

10. Loss of assets: It reduces the ability to invest while blocking the potentiality of

revenue generation. Loss of assets can even lead to bankruptcy.

11. Penalties: It can reduces the CSR sustainability of Charity Care along with their

reputation in the industry

3.3 Breaches and penalties applicable

12. Tax law: the taxation authority could claim the a significant amount of additional

repayment in terms of penalised tax as per the IRS decision and severity of the

issue.

13. GST law: Monitory penalisation could be enforced even government can cease

the business operation for uncertain period

3.4 Risk mitigation

14. Internal controls: It helps to regulate the business operations including the

workforce operations, code of conducts and ethical obligations.

15. Budgeting: It allows more controlled expense and business operation for better

profitability and better return on investment value

4. COMPARISON OF AVAILABLE COMPLIANCE SYSTEMS

As the organisation has grown quickly and the management and compliance systems have not

had a chance to catch up, there is no formal compliance management system in place

however the company needs a well-defined compliance management system in view of

findings of last audit report. Based on the research conducted, following are the available

options for developing compliance management system at Charity Care:

4.1 Available systems and its components and available options for compliance

management system

Risk management: Charity Care currently has a systematic model of business activities

concerning the risk management that includes the establishment of context, risk

identification, analysis, treating risk, monitoring and communication procedures.

Records management: Currently Charity Care does not have any particular record keeping

and management guideline. However, they have a document handing flow chard depending

on the hierarchy of the operational units.

Guidelines for complaints handling: Currently Charity Care does not have any particular

compliance handling guideline. However, they have a hierarchy of compliance monitoring

structure.

profitability and better return on investment value

4. COMPARISON OF AVAILABLE COMPLIANCE SYSTEMS

As the organisation has grown quickly and the management and compliance systems have not

had a chance to catch up, there is no formal compliance management system in place

however the company needs a well-defined compliance management system in view of

findings of last audit report. Based on the research conducted, following are the available

options for developing compliance management system at Charity Care:

4.1 Available systems and its components and available options for compliance

management system

Risk management: Charity Care currently has a systematic model of business activities

concerning the risk management that includes the establishment of context, risk

identification, analysis, treating risk, monitoring and communication procedures.

Records management: Currently Charity Care does not have any particular record keeping

and management guideline. However, they have a document handing flow chard depending

on the hierarchy of the operational units.

Guidelines for complaints handling: Currently Charity Care does not have any particular

compliance handling guideline. However, they have a hierarchy of compliance monitoring

structure.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4.2 Compare systems or components in terms of:

4.2.1 Cost

Labour cost: Cost for employees concerning their payroll, compliances and other

facilities

Technological cost: Cost for telecommunication, information handling and maintenance

Infrastructural or technological cost: Cost for installing technical equipments and

maintenance

Industry consultant fees: Cost for consultancy groups for various technical, legal,

operational and other consultations

4.2.2 Effectiveness

1. Results and Positive outcomes: Business growth and profitability

2. Cost and benefit analysis: compliance cost includes the legal consultancy,

facilitation and workforce and benefit includes both short term and long term benefits

including business growth, CSR, reputation, recognition and others

4.2.3 Efficiency

Currently the work efficiency, financial handling, warehouse management, retailing

activities, counselling service are not competent at all. From operational error, to unethical

vehicle handling there is many unauthorised activities are taking in place. It also causes

delay, work inefficiency and consumer dissatisfaction.

4.2.4 Feasibility

4.2.1 Cost

Labour cost: Cost for employees concerning their payroll, compliances and other

facilities

Technological cost: Cost for telecommunication, information handling and maintenance

Infrastructural or technological cost: Cost for installing technical equipments and

maintenance

Industry consultant fees: Cost for consultancy groups for various technical, legal,

operational and other consultations

4.2.2 Effectiveness

1. Results and Positive outcomes: Business growth and profitability

2. Cost and benefit analysis: compliance cost includes the legal consultancy,

facilitation and workforce and benefit includes both short term and long term benefits

including business growth, CSR, reputation, recognition and others

4.2.3 Efficiency

Currently the work efficiency, financial handling, warehouse management, retailing

activities, counselling service are not competent at all. From operational error, to unethical

vehicle handling there is many unauthorised activities are taking in place. It also causes

delay, work inefficiency and consumer dissatisfaction.

4.2.4 Feasibility

Currently Charity Care has adequate asset to train the employees to reform their operation

towards a more authentic and feasible work process. The number of workforce is also

adequate to pursue the holistic change management within Charity Care to ensure better

service.

4.2.5 Match to organisational culture

The objective of Charity Care to make the office premises healthy and encouraging for

employees, is increasing the interpersonal communication and collaborative approach under

the strict regulations or code of conducts.

5. RESEARCH PROCESS

5.1The type of research undertaken

Qualitative – A semi structured Interviews were taken where the participants were the team

leaders and managers

Quantitative – A semi structured survey was conducted on 50 employees of Charity Care by

choosing randomly through random sampling method

5.2 The development of the research plan

Steps in development of research plan

1. Problem identification – Lack of structural operations and workflow model, poor sense

of work related obligations within the existing workforce, lack of accuracy in stock

keeping, unethical activities, lack of WHS facilitation, lack of privacy control and poor

customer handling

2. Research design - We have selected qualitative approach – It allows more in depth

analysis of the situation while having more conceptual interpretation and detailed

understanding for problem resolving decision taking.

towards a more authentic and feasible work process. The number of workforce is also

adequate to pursue the holistic change management within Charity Care to ensure better

service.

4.2.5 Match to organisational culture

The objective of Charity Care to make the office premises healthy and encouraging for

employees, is increasing the interpersonal communication and collaborative approach under

the strict regulations or code of conducts.

5. RESEARCH PROCESS

5.1The type of research undertaken

Qualitative – A semi structured Interviews were taken where the participants were the team

leaders and managers

Quantitative – A semi structured survey was conducted on 50 employees of Charity Care by

choosing randomly through random sampling method

5.2 The development of the research plan

Steps in development of research plan

1. Problem identification – Lack of structural operations and workflow model, poor sense

of work related obligations within the existing workforce, lack of accuracy in stock

keeping, unethical activities, lack of WHS facilitation, lack of privacy control and poor

customer handling

2. Research design - We have selected qualitative approach – It allows more in depth

analysis of the situation while having more conceptual interpretation and detailed

understanding for problem resolving decision taking.

3. Collection of Data A semi structured Interviews were taken for qualitative primary data

collection where the participants were the team leaders and managers

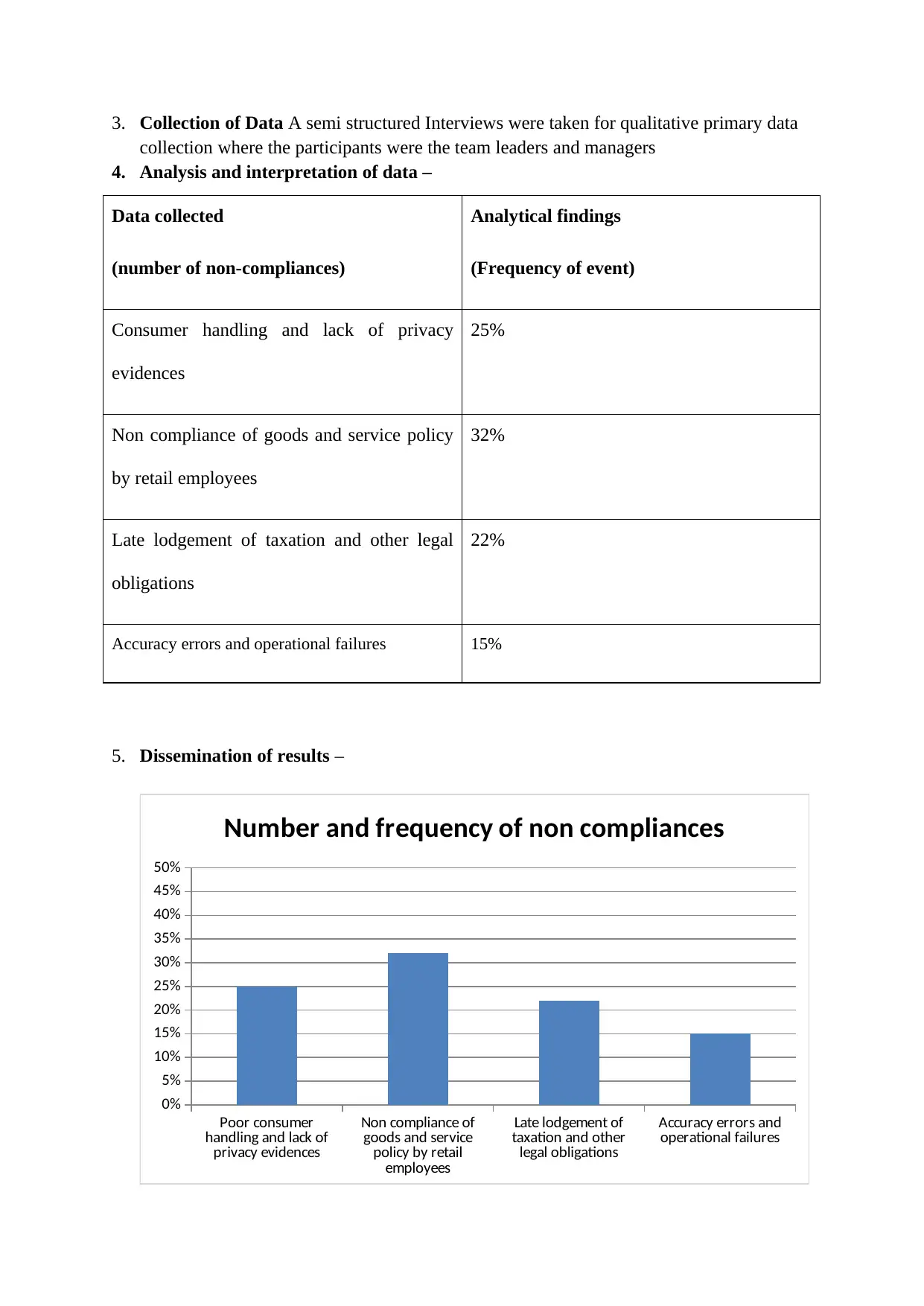

4. Analysis and interpretation of data –

Data collected

(number of non-compliances)

Analytical findings

(Frequency of event)

Consumer handling and lack of privacy

evidences

25%

Non compliance of goods and service policy

by retail employees

32%

Late lodgement of taxation and other legal

obligations

22%

Accuracy errors and operational failures 15%

5. Dissemination of results –

Poor consumer

handling and lack of

privacy evidences

Non compliance of

goods and service

policy by retail

employees

Late lodgement of

taxation and other

legal obligations

Accuracy errors and

operational failures

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Number and frequency of non compliances

collection where the participants were the team leaders and managers

4. Analysis and interpretation of data –

Data collected

(number of non-compliances)

Analytical findings

(Frequency of event)

Consumer handling and lack of privacy

evidences

25%

Non compliance of goods and service policy

by retail employees

32%

Late lodgement of taxation and other legal

obligations

22%

Accuracy errors and operational failures 15%

5. Dissemination of results –

Poor consumer

handling and lack of

privacy evidences

Non compliance of

goods and service

policy by retail

employees

Late lodgement of

taxation and other

legal obligations

Accuracy errors and

operational failures

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Number and frequency of non compliances

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Clearly it can be seen that the frequency of non compliance of goods and service policies

by retail employees are highest. Apart from that the poor consumer handling and lack of

privacy system is noticeable. Hence, to communicate the results face to face

communication, meetings and mail will be sent to the managers and other responsible

personnel.

5.3 The development of survey tools to collect required data to select compliance

The survey tool has been developed in a semi structured interview process where the

participants can convey their opinion in both structured and in depth information.

5.4 How the budget was assigned

There is no predefined budget for compliance management system. If the proposed

management system is found to be effective, it will be approved by CEO considering the cost

and anticipated benefits.

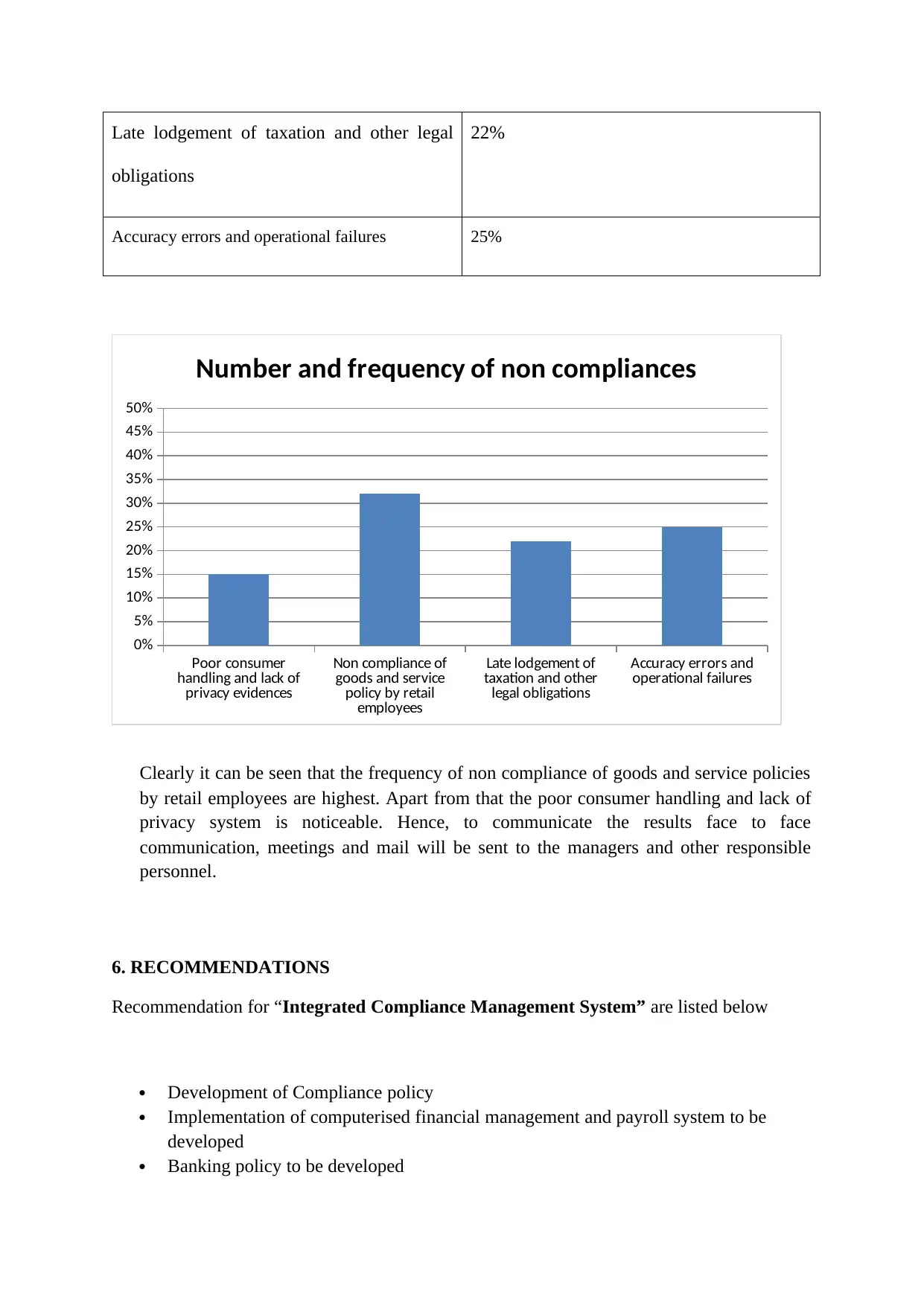

5.5 Analysis of qualitative and quantitative data

Data collected

(number of non-compliances)

Analytical findings

(Frequency of event)

Poor consumer handling and lack of privacy

evidences

15%

Non compliance of goods and service policy

by retail employees

32%

by retail employees are highest. Apart from that the poor consumer handling and lack of

privacy system is noticeable. Hence, to communicate the results face to face

communication, meetings and mail will be sent to the managers and other responsible

personnel.

5.3 The development of survey tools to collect required data to select compliance

The survey tool has been developed in a semi structured interview process where the

participants can convey their opinion in both structured and in depth information.

5.4 How the budget was assigned

There is no predefined budget for compliance management system. If the proposed

management system is found to be effective, it will be approved by CEO considering the cost

and anticipated benefits.

5.5 Analysis of qualitative and quantitative data

Data collected

(number of non-compliances)

Analytical findings

(Frequency of event)

Poor consumer handling and lack of privacy

evidences

15%

Non compliance of goods and service policy

by retail employees

32%

Late lodgement of taxation and other legal

obligations

22%

Accuracy errors and operational failures 25%

Poor consumer

handling and lack of

privacy evidences

Non compliance of

goods and service

policy by retail

employees

Late lodgement of

taxation and other

legal obligations

Accuracy errors and

operational failures

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Number and frequency of non compliances

Clearly it can be seen that the frequency of non compliance of goods and service policies

by retail employees are highest. Apart from that the poor consumer handling and lack of

privacy system is noticeable. Hence, to communicate the results face to face

communication, meetings and mail will be sent to the managers and other responsible

personnel.

6. RECOMMENDATIONS

Recommendation for “Integrated Compliance Management System” are listed below

Development of Compliance policy

Implementation of computerised financial management and payroll system to be

developed

Banking policy to be developed

obligations

22%

Accuracy errors and operational failures 25%

Poor consumer

handling and lack of

privacy evidences

Non compliance of

goods and service

policy by retail

employees

Late lodgement of

taxation and other

legal obligations

Accuracy errors and

operational failures

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Number and frequency of non compliances

Clearly it can be seen that the frequency of non compliance of goods and service policies

by retail employees are highest. Apart from that the poor consumer handling and lack of

privacy system is noticeable. Hence, to communicate the results face to face

communication, meetings and mail will be sent to the managers and other responsible

personnel.

6. RECOMMENDATIONS

Recommendation for “Integrated Compliance Management System” are listed below

Development of Compliance policy

Implementation of computerised financial management and payroll system to be

developed

Banking policy to be developed

Financial handling policy needs to be reviewed

Record keeping policy to be developed

Purchase policy to be developed

Stock taking/ Inventory policy to be developed

Risk management policy is required to be reviewed

Privacy policy is not being practiced

Recruitment, selection and Induction policy to be developed

Job descriptions to be developed

Handling company asset policy to be developed

Continuous improvement policy to be developed

Complaint handling policy to be developed

Record keeping policy to be developed

Purchase policy to be developed

Stock taking/ Inventory policy to be developed

Risk management policy is required to be reviewed

Privacy policy is not being practiced

Recruitment, selection and Induction policy to be developed

Job descriptions to be developed

Handling company asset policy to be developed

Continuous improvement policy to be developed

Complaint handling policy to be developed

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.