Wesfarmers Financial Analysis Report

VerifiedAdded on 2020/03/16

|20

|1671

|383

AI Summary

This assignment requires a thorough analysis of Wesfarmers' financial performance based on their provided annual report. The analysis should cover key financial statement items like dividend, EPS, equity return, and working capital ratio. Additionally, it must address risks associated with the financial reporting and assess the company's long-term sustainability. Finally, the assignment concludes with a recommendation for an investor considering Wesfarmers based on its financial health.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: ACCOUNTING SYSTEM AND PROCESS

Accounting system and process

Name of the University

Subject code and name ‘

Student Name and ID

Assignment Task Number

Author Note

Accounting system and process

Name of the University

Subject code and name ‘

Student Name and ID

Assignment Task Number

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1ACCOUNTING SYSTEM AND PROCESS

Table of Contents

Answer 1:................................................................................................................................................3

Answer 2:................................................................................................................................................3

Answer 3:................................................................................................................................................4

Answer 4:................................................................................................................................................4

Answer 5:................................................................................................................................................5

Answer 6:................................................................................................................................................5

Answer 7:................................................................................................................................................7

Answer 8:................................................................................................................................................9

Answer 9:..............................................................................................................................................10

Answer 10:............................................................................................................................................10

Answer 11:............................................................................................................................................10

Answer 12:............................................................................................................................................11

Answer 13:............................................................................................................................................11

References:............................................................................................................................................14

Table of Contents

Answer 1:................................................................................................................................................3

Answer 2:................................................................................................................................................3

Answer 3:................................................................................................................................................4

Answer 4:................................................................................................................................................4

Answer 5:................................................................................................................................................5

Answer 6:................................................................................................................................................5

Answer 7:................................................................................................................................................7

Answer 8:................................................................................................................................................9

Answer 9:..............................................................................................................................................10

Answer 10:............................................................................................................................................10

Answer 11:............................................................................................................................................10

Answer 12:............................................................................................................................................11

Answer 13:............................................................................................................................................11

References:............................................................................................................................................14

2ACCOUNTING SYSTEM AND PROCESS

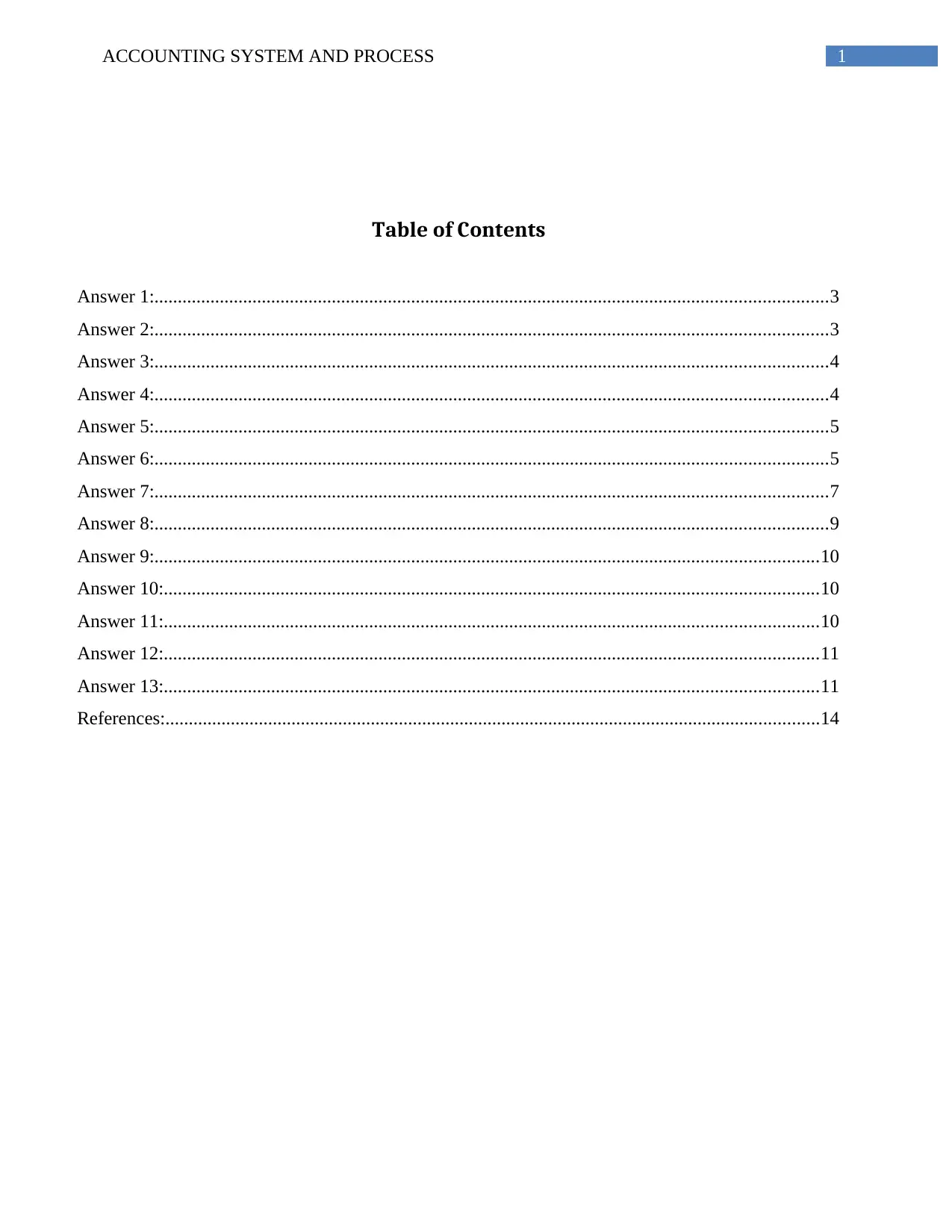

Answer 1:

A name is the meaningful shorthand and it makes the sheet easier for understanding. Through

using the names, the users can use the formulas easily and the sheets can be maintained easily

(Baños-Caballero, García-Teruel & Martínez-Solano, 2014). Further, after naming the cells it can be

used for formatting, editing, addition and deletion of data.

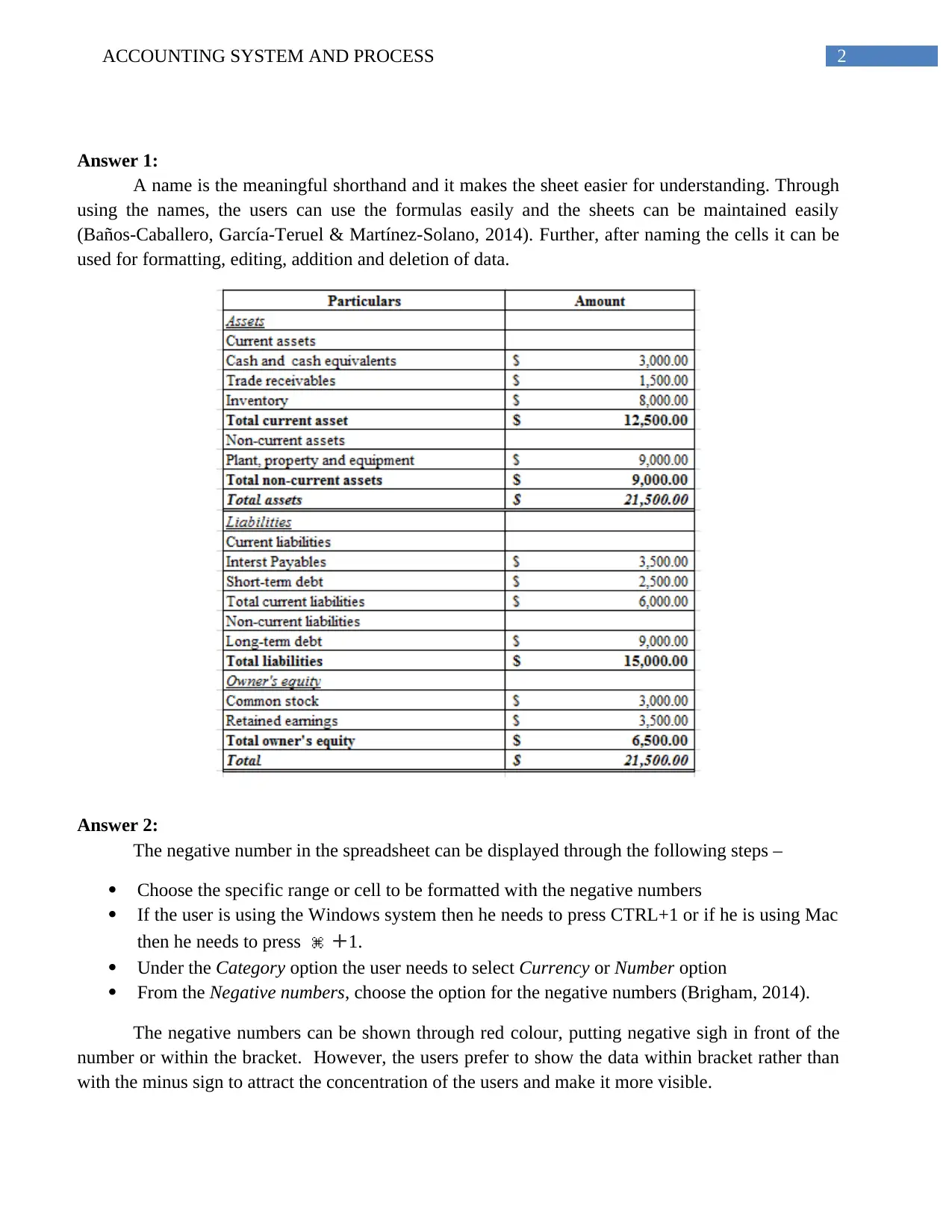

Answer 2:

The negative number in the spreadsheet can be displayed through the following steps –

Choose the specific range or cell to be formatted with the negative numbers

If the user is using the Windows system then he needs to press CTRL+1 or if he is using Mac

then he needs to press +1.

Under the Category option the user needs to select Currency or Number option

From the Negative numbers, choose the option for the negative numbers (Brigham, 2014).

The negative numbers can be shown through red colour, putting negative sigh in front of the

number or within the bracket. However, the users prefer to show the data within bracket rather than

with the minus sign to attract the concentration of the users and make it more visible.

Answer 1:

A name is the meaningful shorthand and it makes the sheet easier for understanding. Through

using the names, the users can use the formulas easily and the sheets can be maintained easily

(Baños-Caballero, García-Teruel & Martínez-Solano, 2014). Further, after naming the cells it can be

used for formatting, editing, addition and deletion of data.

Answer 2:

The negative number in the spreadsheet can be displayed through the following steps –

Choose the specific range or cell to be formatted with the negative numbers

If the user is using the Windows system then he needs to press CTRL+1 or if he is using Mac

then he needs to press +1.

Under the Category option the user needs to select Currency or Number option

From the Negative numbers, choose the option for the negative numbers (Brigham, 2014).

The negative numbers can be shown through red colour, putting negative sigh in front of the

number or within the bracket. However, the users prefer to show the data within bracket rather than

with the minus sign to attract the concentration of the users and make it more visible.

3ACCOUNTING SYSTEM AND PROCESS

Below shown example represent the negative numbers in bracket -

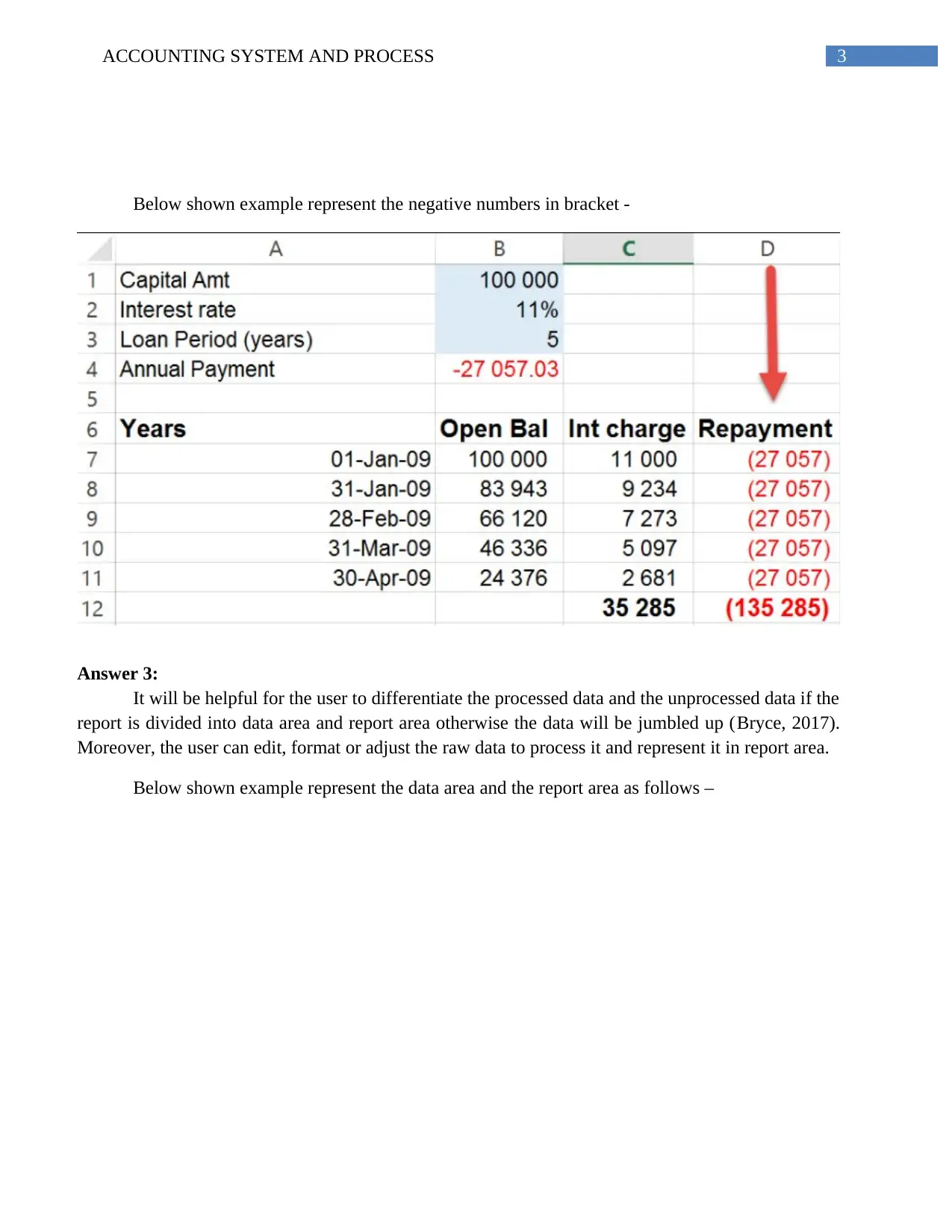

Answer 3:

It will be helpful for the user to differentiate the processed data and the unprocessed data if the

report is divided into data area and report area otherwise the data will be jumbled up (Bryce, 2017).

Moreover, the user can edit, format or adjust the raw data to process it and represent it in report area.

Below shown example represent the data area and the report area as follows –

Below shown example represent the negative numbers in bracket -

Answer 3:

It will be helpful for the user to differentiate the processed data and the unprocessed data if the

report is divided into data area and report area otherwise the data will be jumbled up (Bryce, 2017).

Moreover, the user can edit, format or adjust the raw data to process it and represent it in report area.

Below shown example represent the data area and the report area as follows –

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4ACCOUNTING SYSTEM AND PROCESS

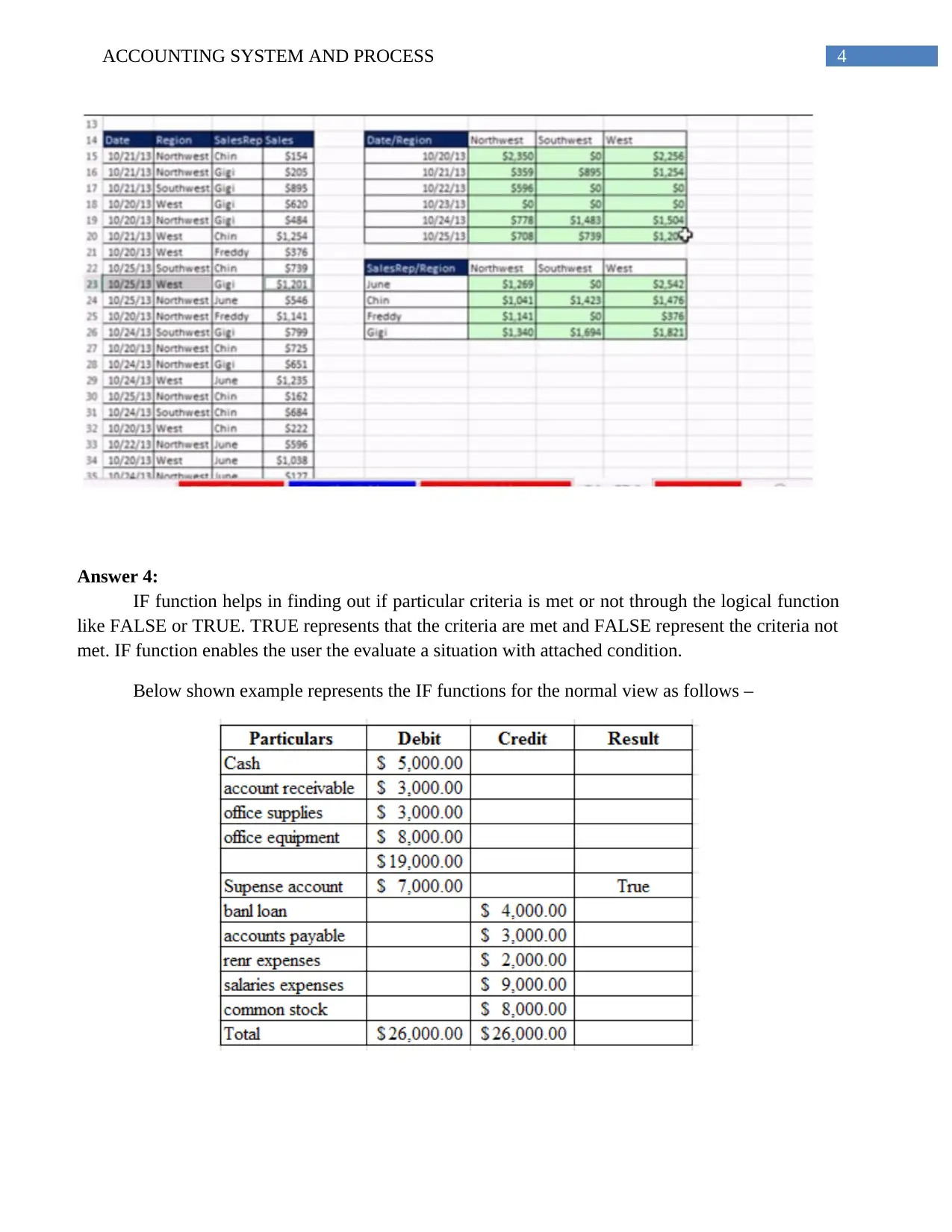

Answer 4:

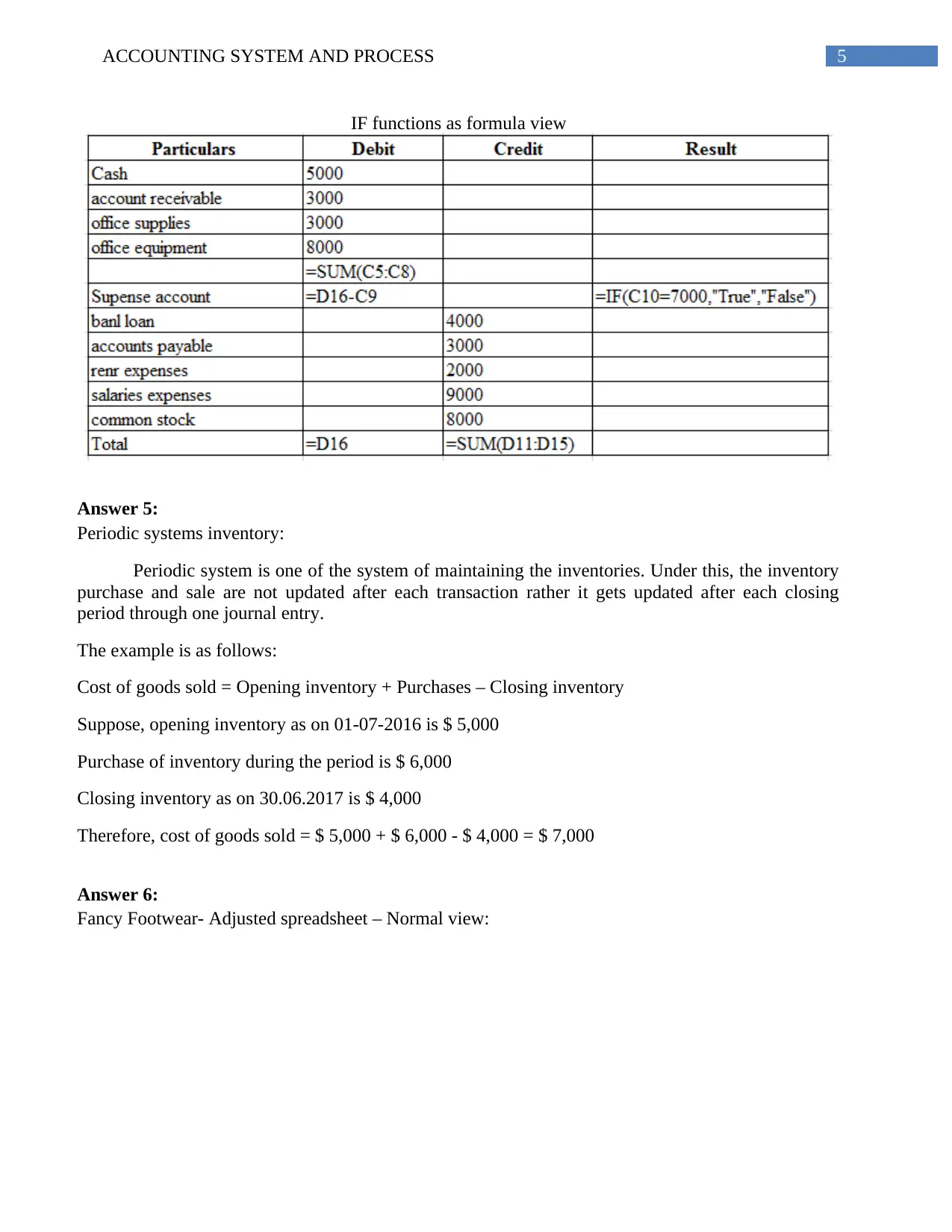

IF function helps in finding out if particular criteria is met or not through the logical function

like FALSE or TRUE. TRUE represents that the criteria are met and FALSE represent the criteria not

met. IF function enables the user the evaluate a situation with attached condition.

Below shown example represents the IF functions for the normal view as follows –

Answer 4:

IF function helps in finding out if particular criteria is met or not through the logical function

like FALSE or TRUE. TRUE represents that the criteria are met and FALSE represent the criteria not

met. IF function enables the user the evaluate a situation with attached condition.

Below shown example represents the IF functions for the normal view as follows –

5ACCOUNTING SYSTEM AND PROCESS

IF functions as formula view

Answer 5:

Periodic systems inventory:

Periodic system is one of the system of maintaining the inventories. Under this, the inventory

purchase and sale are not updated after each transaction rather it gets updated after each closing

period through one journal entry.

The example is as follows:

Cost of goods sold = Opening inventory + Purchases – Closing inventory

Suppose, opening inventory as on 01-07-2016 is $ 5,000

Purchase of inventory during the period is $ 6,000

Closing inventory as on 30.06.2017 is $ 4,000

Therefore, cost of goods sold = $ 5,000 + $ 6,000 - $ 4,000 = $ 7,000

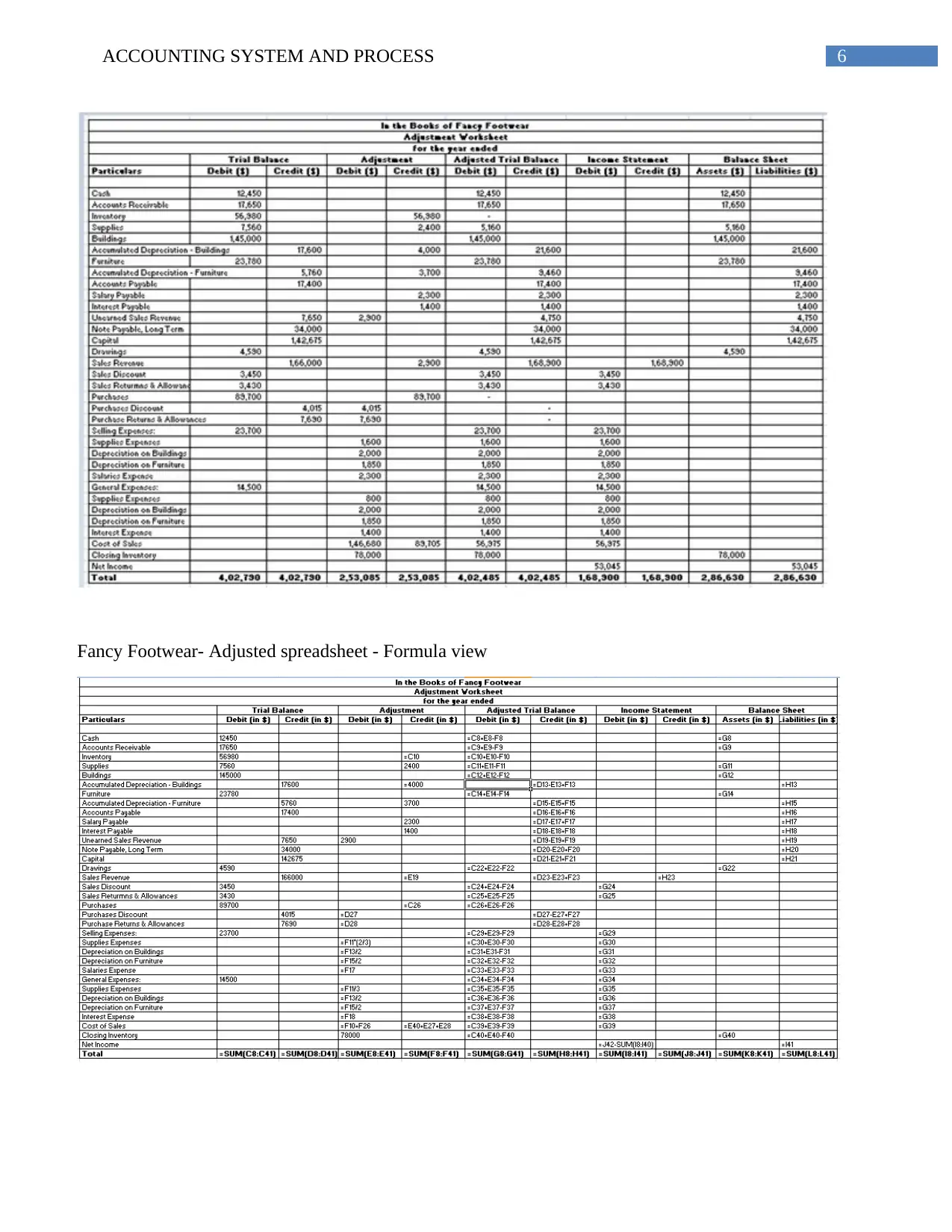

Answer 6:

Fancy Footwear- Adjusted spreadsheet – Normal view:

IF functions as formula view

Answer 5:

Periodic systems inventory:

Periodic system is one of the system of maintaining the inventories. Under this, the inventory

purchase and sale are not updated after each transaction rather it gets updated after each closing

period through one journal entry.

The example is as follows:

Cost of goods sold = Opening inventory + Purchases – Closing inventory

Suppose, opening inventory as on 01-07-2016 is $ 5,000

Purchase of inventory during the period is $ 6,000

Closing inventory as on 30.06.2017 is $ 4,000

Therefore, cost of goods sold = $ 5,000 + $ 6,000 - $ 4,000 = $ 7,000

Answer 6:

Fancy Footwear- Adjusted spreadsheet – Normal view:

6ACCOUNTING SYSTEM AND PROCESS

Fancy Footwear- Adjusted spreadsheet - Formula view

Fancy Footwear- Adjusted spreadsheet - Formula view

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING SYSTEM AND PROCESS

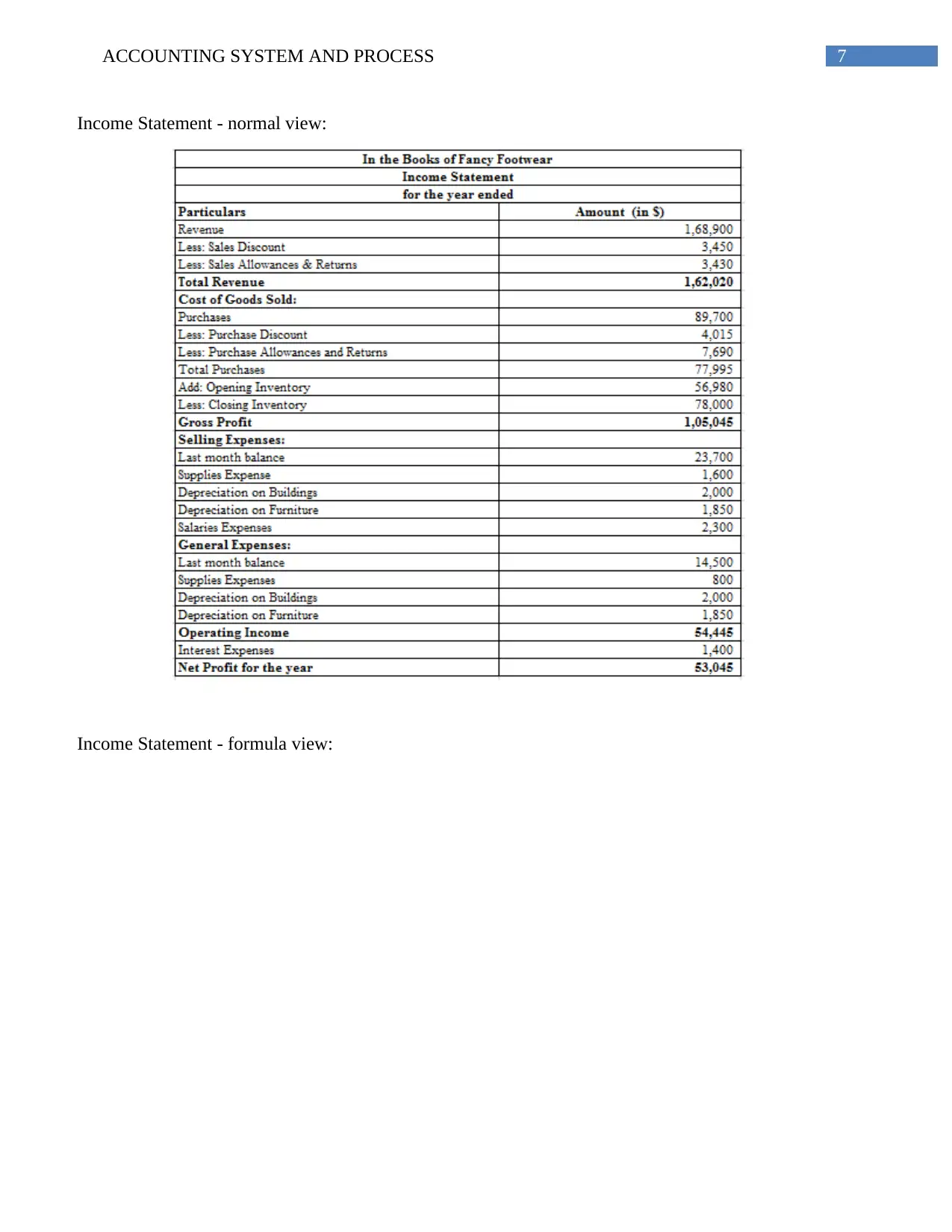

Income Statement - normal view:

Income Statement - formula view:

Income Statement - normal view:

Income Statement - formula view:

8ACCOUNTING SYSTEM AND PROCESS

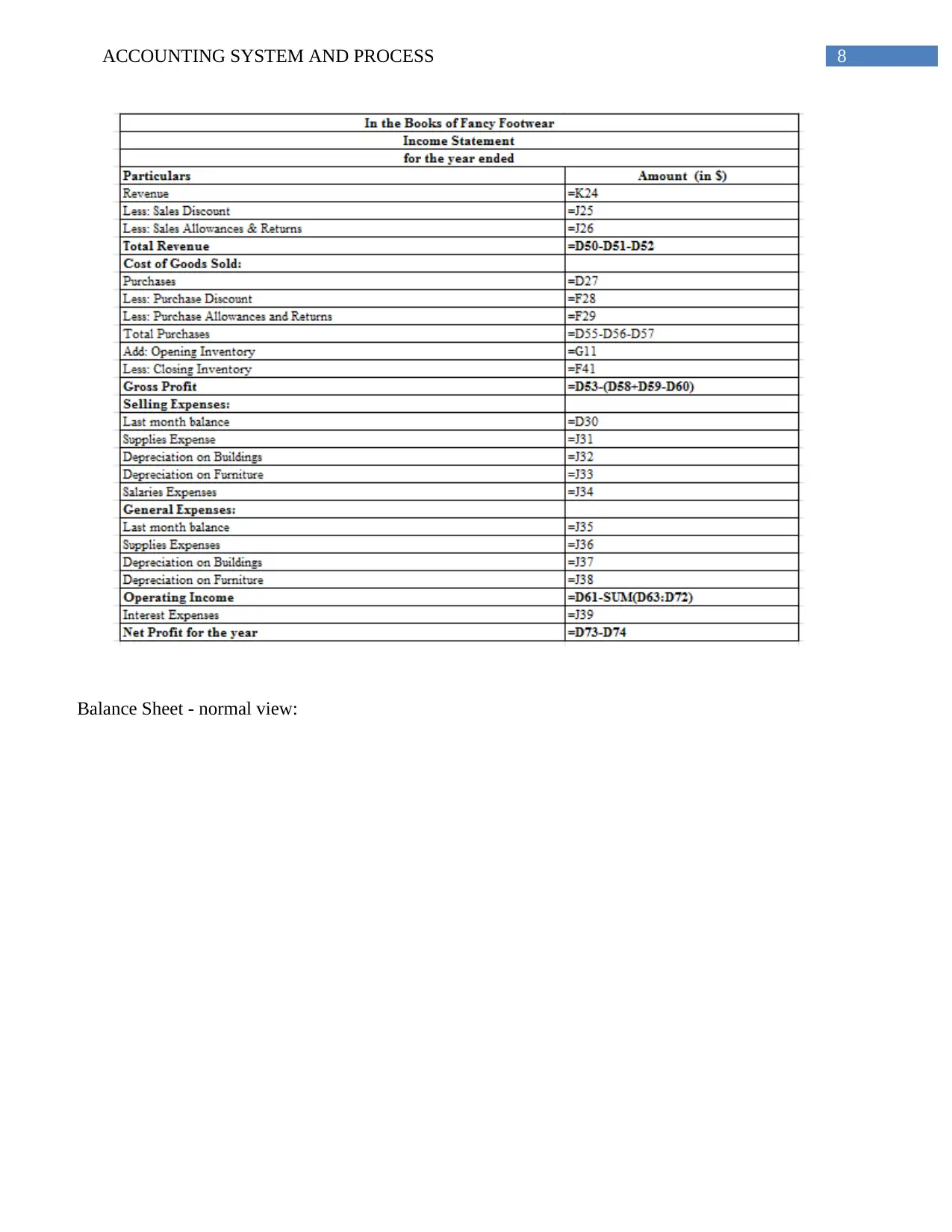

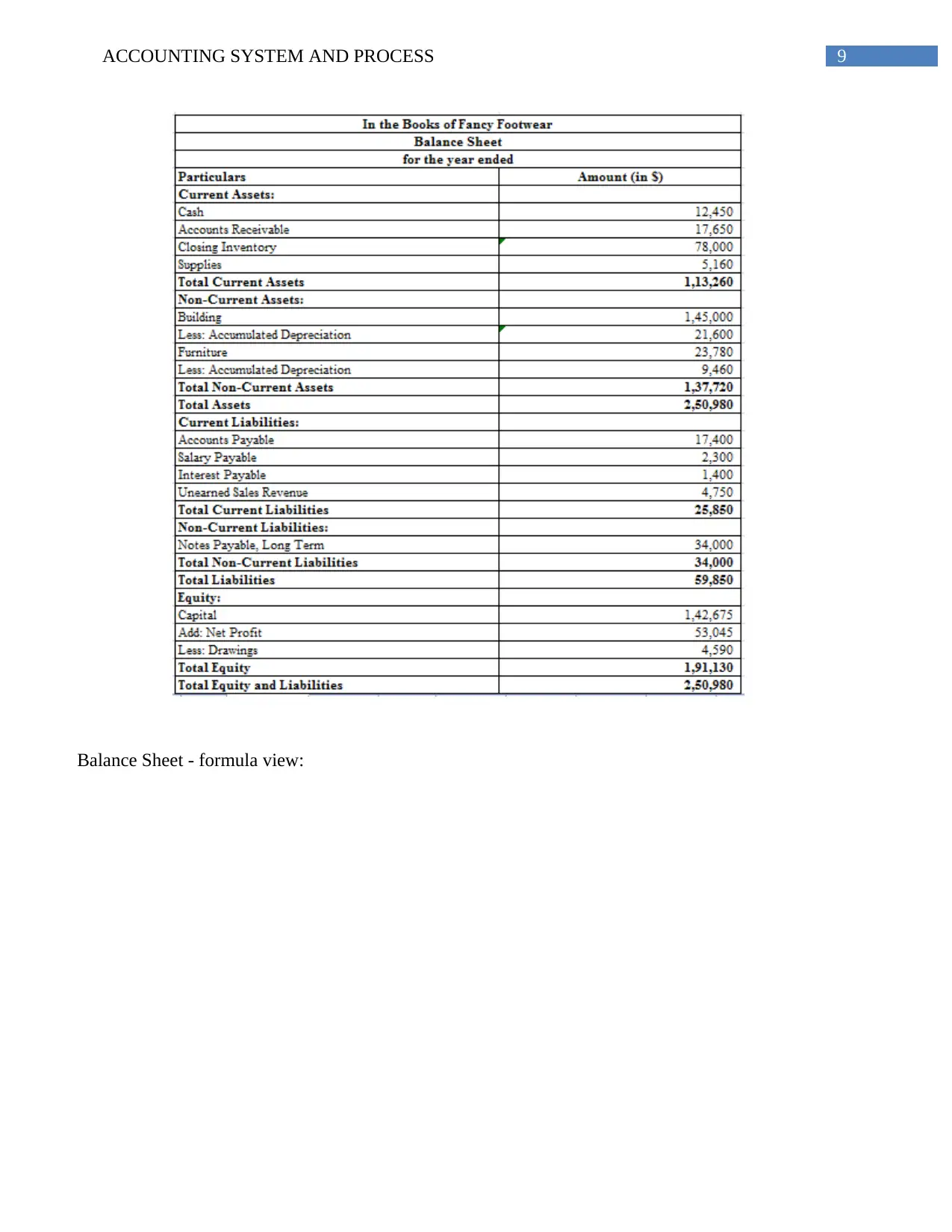

Balance Sheet - normal view:

Balance Sheet - normal view:

9ACCOUNTING SYSTEM AND PROCESS

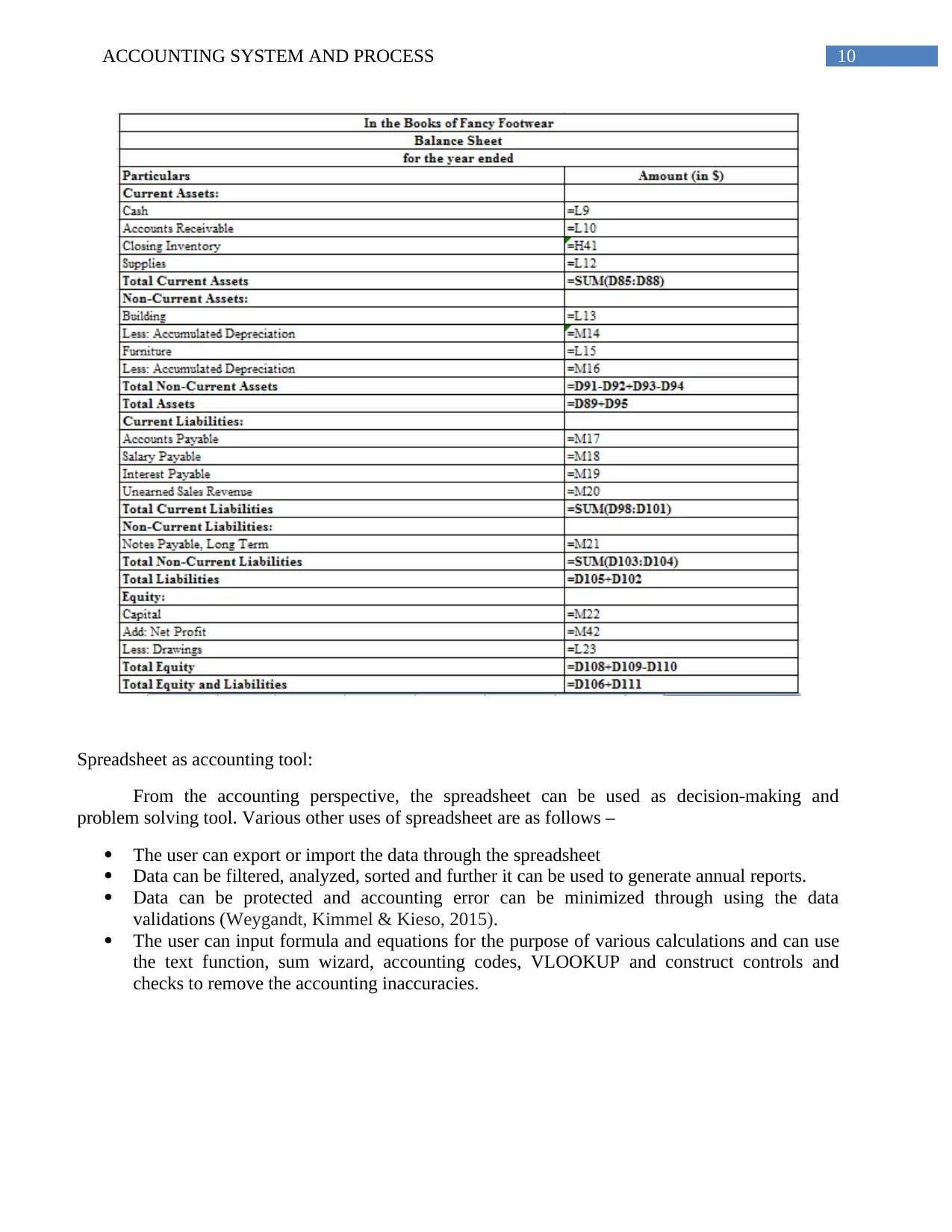

Balance Sheet - formula view:

Balance Sheet - formula view:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10ACCOUNTING SYSTEM AND PROCESS

Spreadsheet as accounting tool:

From the accounting perspective, the spreadsheet can be used as decision-making and

problem solving tool. Various other uses of spreadsheet are as follows –

The user can export or import the data through the spreadsheet

Data can be filtered, analyzed, sorted and further it can be used to generate annual reports.

Data can be protected and accounting error can be minimized through using the data

validations (Weygandt, Kimmel & Kieso, 2015).

The user can input formula and equations for the purpose of various calculations and can use

the text function, sum wizard, accounting codes, VLOOKUP and construct controls and

checks to remove the accounting inaccuracies.

Spreadsheet as accounting tool:

From the accounting perspective, the spreadsheet can be used as decision-making and

problem solving tool. Various other uses of spreadsheet are as follows –

The user can export or import the data through the spreadsheet

Data can be filtered, analyzed, sorted and further it can be used to generate annual reports.

Data can be protected and accounting error can be minimized through using the data

validations (Weygandt, Kimmel & Kieso, 2015).

The user can input formula and equations for the purpose of various calculations and can use

the text function, sum wizard, accounting codes, VLOOKUP and construct controls and

checks to remove the accounting inaccuracies.

11ACCOUNTING SYSTEM AND PROCESS

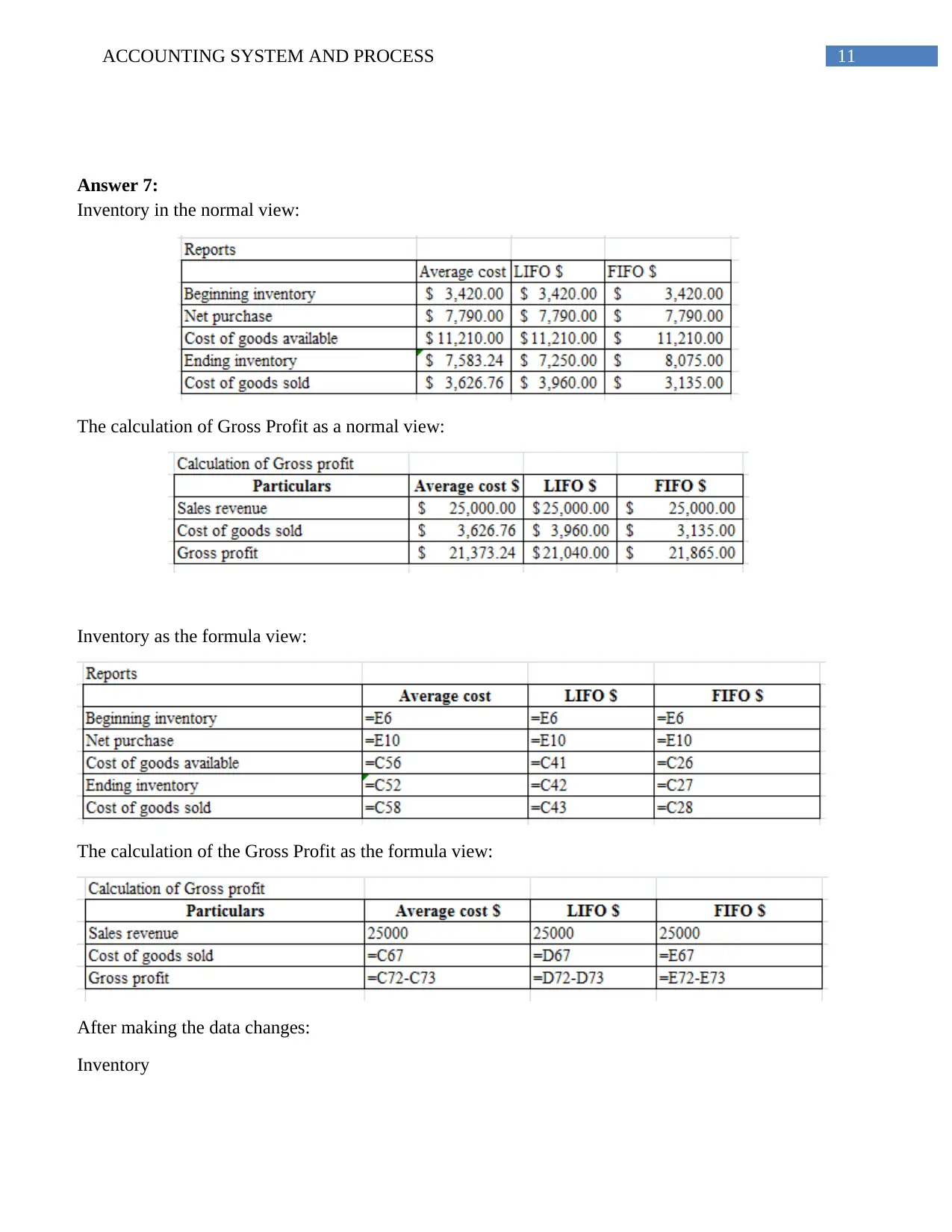

Answer 7:

Inventory in the normal view:

The calculation of Gross Profit as a normal view:

Inventory as the formula view:

The calculation of the Gross Profit as the formula view:

After making the data changes:

Inventory

Answer 7:

Inventory in the normal view:

The calculation of Gross Profit as a normal view:

Inventory as the formula view:

The calculation of the Gross Profit as the formula view:

After making the data changes:

Inventory

12ACCOUNTING SYSTEM AND PROCESS

Gross Profit

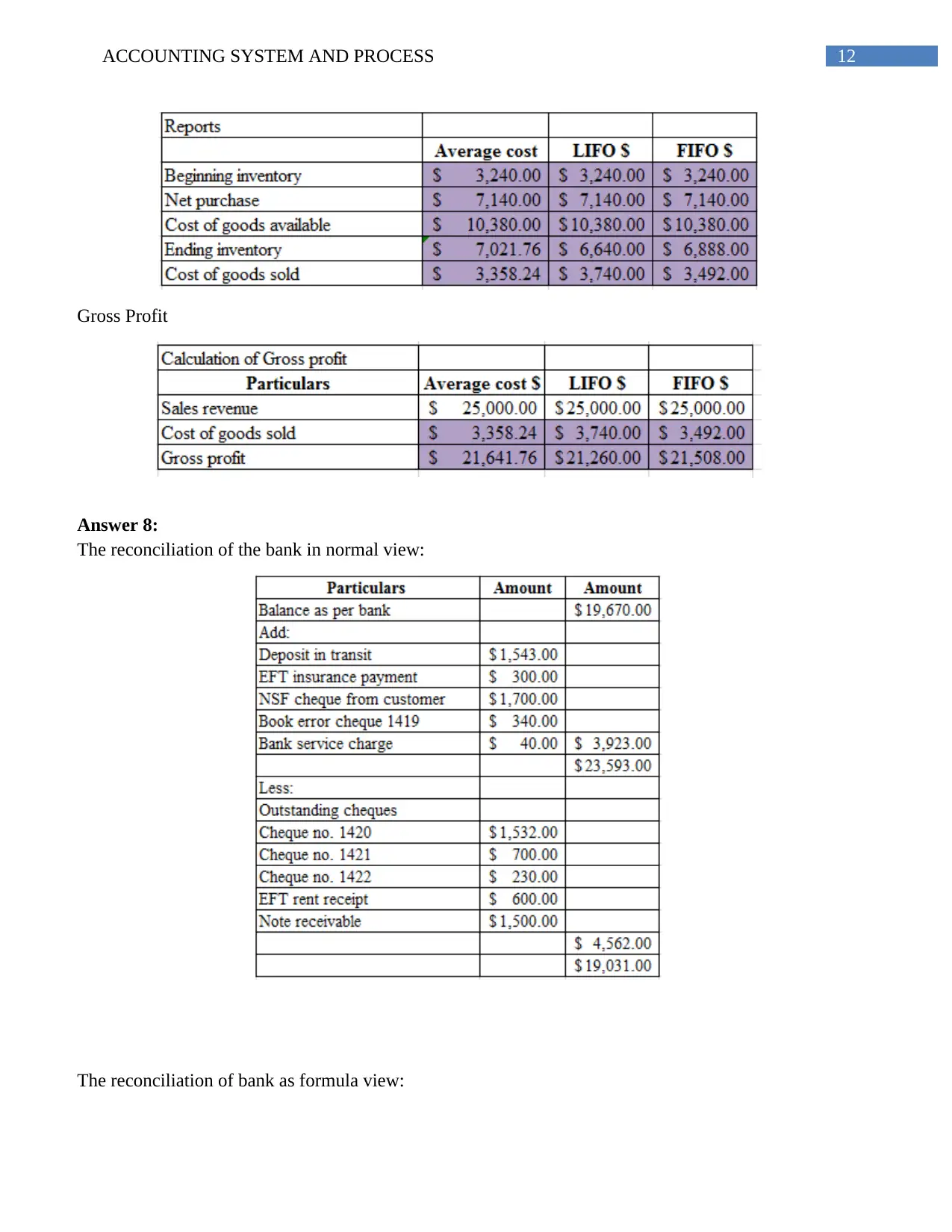

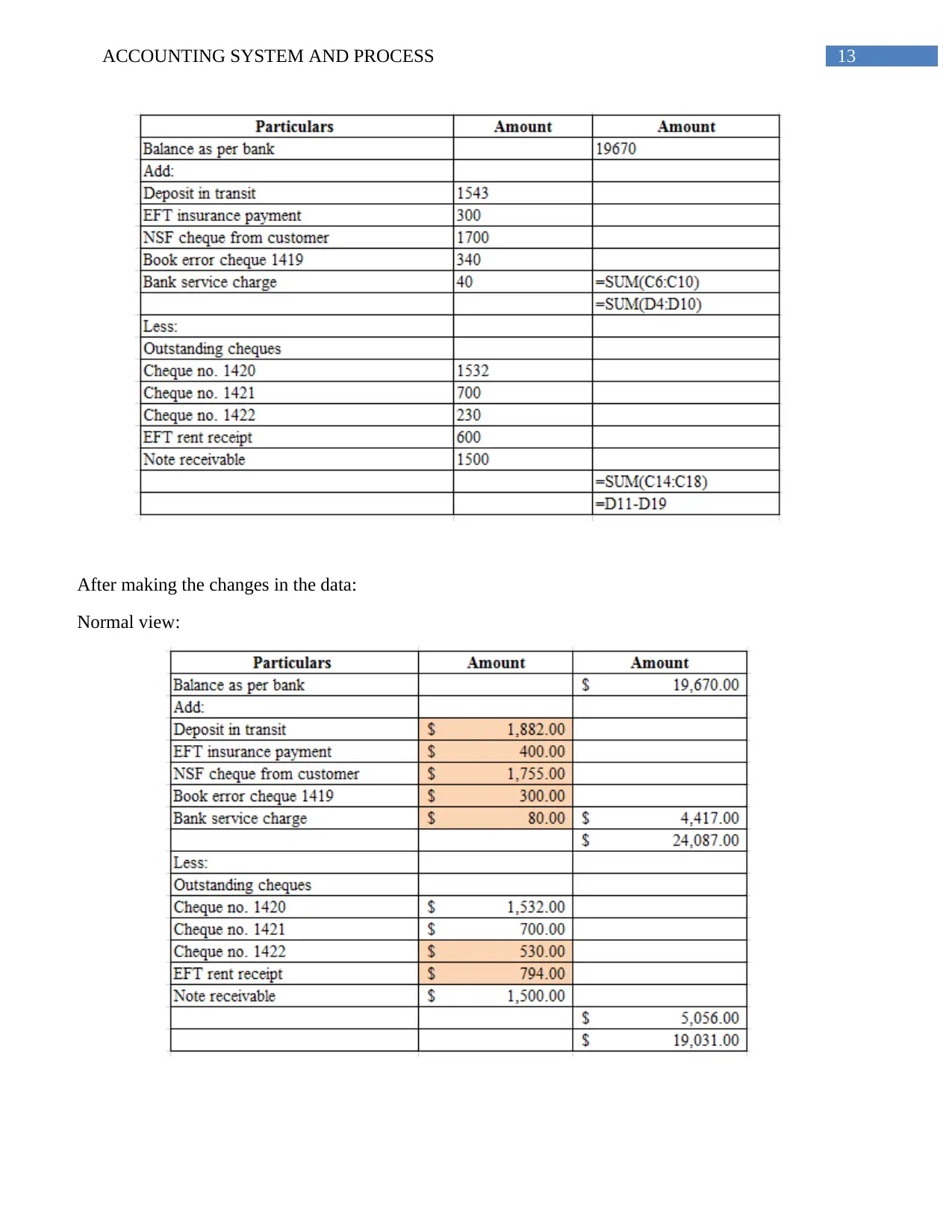

Answer 8:

The reconciliation of the bank in normal view:

The reconciliation of bank as formula view:

Gross Profit

Answer 8:

The reconciliation of the bank in normal view:

The reconciliation of bank as formula view:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13ACCOUNTING SYSTEM AND PROCESS

After making the changes in the data:

Normal view:

After making the changes in the data:

Normal view:

14ACCOUNTING SYSTEM AND PROCESS

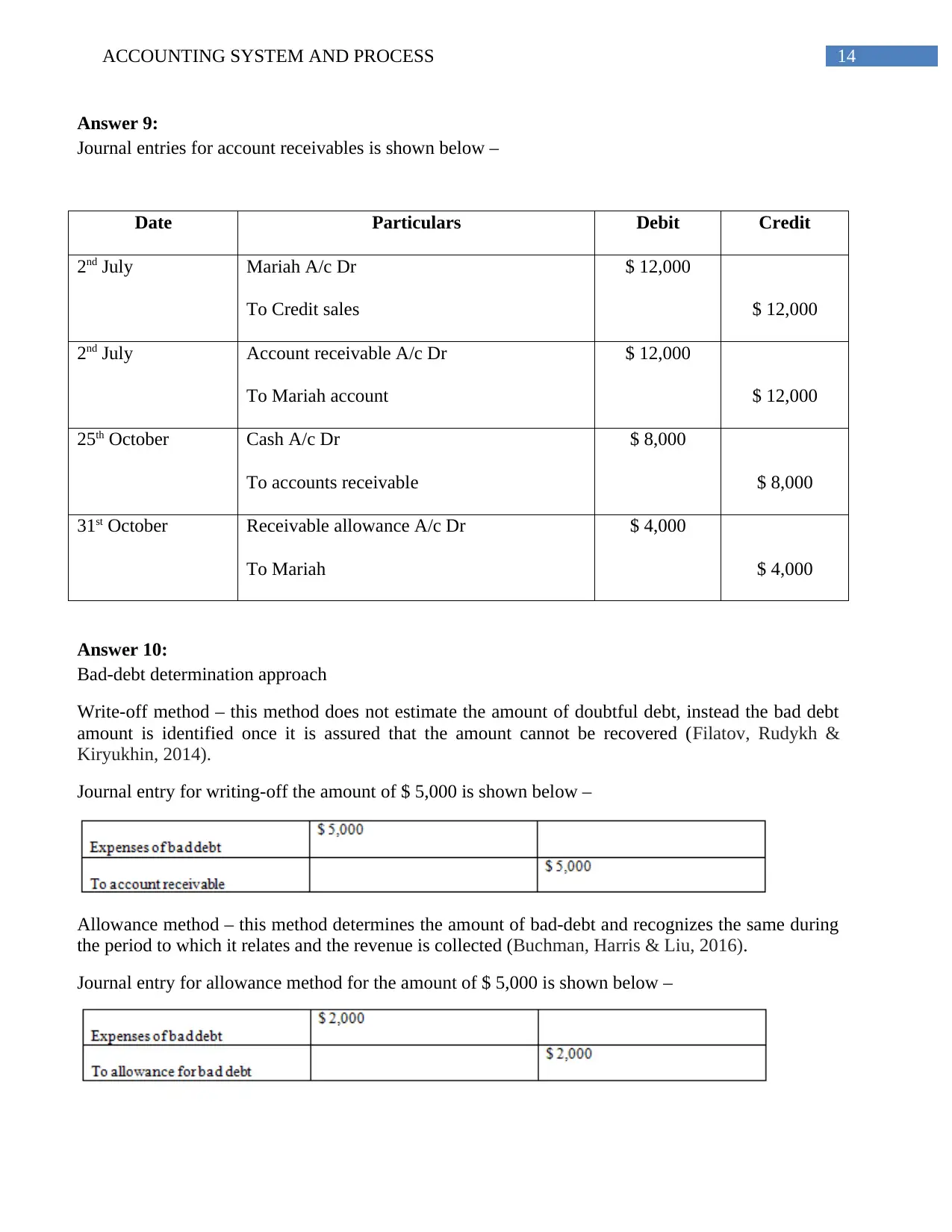

Answer 9:

Journal entries for account receivables is shown below –

Date Particulars Debit Credit

2nd July Mariah A/c Dr

To Credit sales

$ 12,000

$ 12,000

2nd July Account receivable A/c Dr

To Mariah account

$ 12,000

$ 12,000

25th October Cash A/c Dr

To accounts receivable

$ 8,000

$ 8,000

31st October Receivable allowance A/c Dr

To Mariah

$ 4,000

$ 4,000

Answer 10:

Bad-debt determination approach

Write-off method – this method does not estimate the amount of doubtful debt, instead the bad debt

amount is identified once it is assured that the amount cannot be recovered (Filatov, Rudykh &

Kiryukhin, 2014).

Journal entry for writing-off the amount of $ 5,000 is shown below –

Allowance method – this method determines the amount of bad-debt and recognizes the same during

the period to which it relates and the revenue is collected (Buchman, Harris & Liu, 2016).

Journal entry for allowance method for the amount of $ 5,000 is shown below –

Answer 9:

Journal entries for account receivables is shown below –

Date Particulars Debit Credit

2nd July Mariah A/c Dr

To Credit sales

$ 12,000

$ 12,000

2nd July Account receivable A/c Dr

To Mariah account

$ 12,000

$ 12,000

25th October Cash A/c Dr

To accounts receivable

$ 8,000

$ 8,000

31st October Receivable allowance A/c Dr

To Mariah

$ 4,000

$ 4,000

Answer 10:

Bad-debt determination approach

Write-off method – this method does not estimate the amount of doubtful debt, instead the bad debt

amount is identified once it is assured that the amount cannot be recovered (Filatov, Rudykh &

Kiryukhin, 2014).

Journal entry for writing-off the amount of $ 5,000 is shown below –

Allowance method – this method determines the amount of bad-debt and recognizes the same during

the period to which it relates and the revenue is collected (Buchman, Harris & Liu, 2016).

Journal entry for allowance method for the amount of $ 5,000 is shown below –

15ACCOUNTING SYSTEM AND PROCESS

Answer 11:

The receivable turnover ratio of any company can be used to analyze the performance of the

company (Drury, 2013). If the turnover ratio of the company is high, it represents that the company is

proficient is collecting its receivable which in turn represent that the company has a sound and strong

financial position.

Answer 12:

Entry of journals

Answer 11:

The receivable turnover ratio of any company can be used to analyze the performance of the

company (Drury, 2013). If the turnover ratio of the company is high, it represents that the company is

proficient is collecting its receivable which in turn represent that the company has a sound and strong

financial position.

Answer 12:

Entry of journals

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16ACCOUNTING SYSTEM AND PROCESS

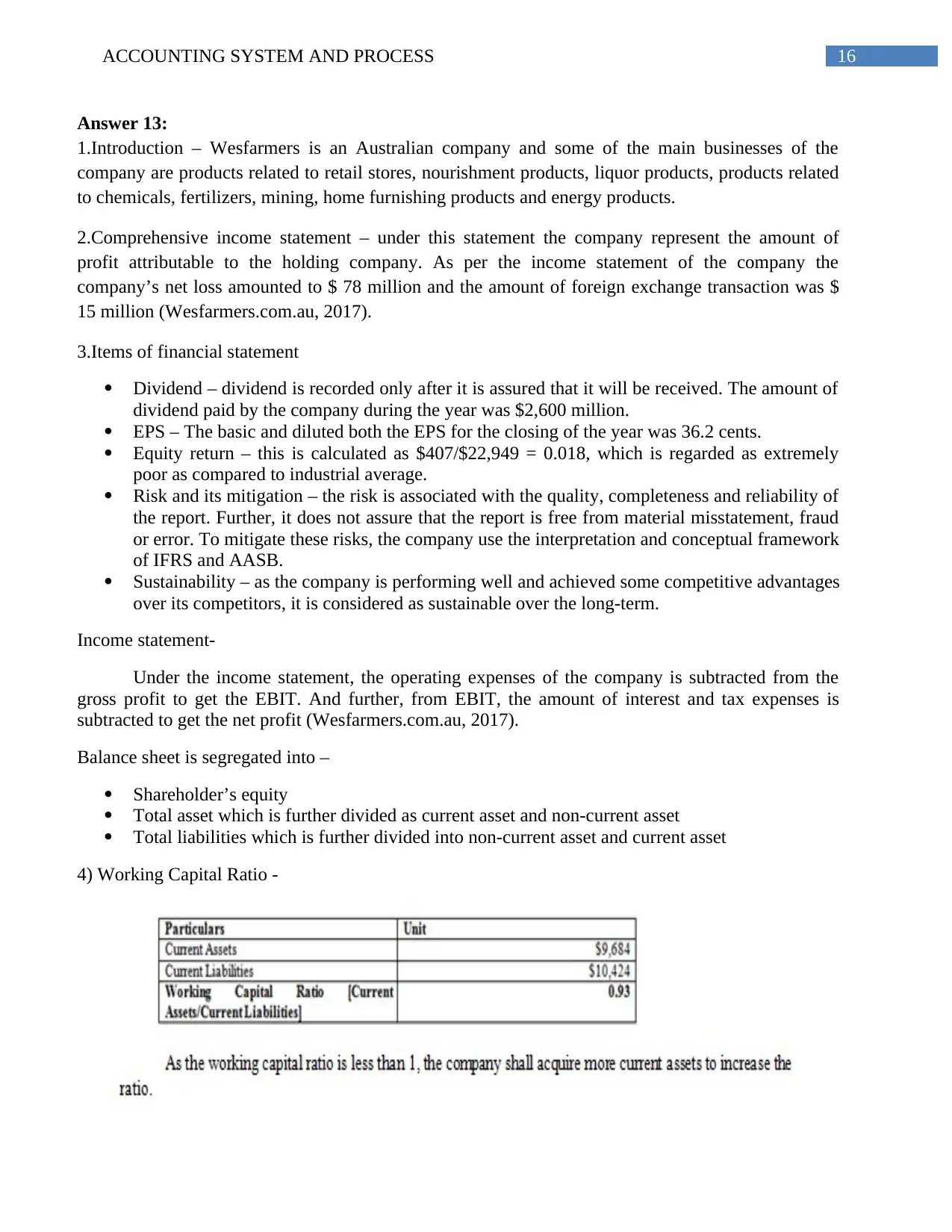

Answer 13:

1.Introduction – Wesfarmers is an Australian company and some of the main businesses of the

company are products related to retail stores, nourishment products, liquor products, products related

to chemicals, fertilizers, mining, home furnishing products and energy products.

2.Comprehensive income statement – under this statement the company represent the amount of

profit attributable to the holding company. As per the income statement of the company the

company’s net loss amounted to $ 78 million and the amount of foreign exchange transaction was $

15 million (Wesfarmers.com.au, 2017).

3.Items of financial statement

Dividend – dividend is recorded only after it is assured that it will be received. The amount of

dividend paid by the company during the year was $2,600 million.

EPS – The basic and diluted both the EPS for the closing of the year was 36.2 cents.

Equity return – this is calculated as $407/$22,949 = 0.018, which is regarded as extremely

poor as compared to industrial average.

Risk and its mitigation – the risk is associated with the quality, completeness and reliability of

the report. Further, it does not assure that the report is free from material misstatement, fraud

or error. To mitigate these risks, the company use the interpretation and conceptual framework

of IFRS and AASB.

Sustainability – as the company is performing well and achieved some competitive advantages

over its competitors, it is considered as sustainable over the long-term.

Income statement-

Under the income statement, the operating expenses of the company is subtracted from the

gross profit to get the EBIT. And further, from EBIT, the amount of interest and tax expenses is

subtracted to get the net profit (Wesfarmers.com.au, 2017).

Balance sheet is segregated into –

Shareholder’s equity

Total asset which is further divided as current asset and non-current asset

Total liabilities which is further divided into non-current asset and current asset

4) Working Capital Ratio -

Answer 13:

1.Introduction – Wesfarmers is an Australian company and some of the main businesses of the

company are products related to retail stores, nourishment products, liquor products, products related

to chemicals, fertilizers, mining, home furnishing products and energy products.

2.Comprehensive income statement – under this statement the company represent the amount of

profit attributable to the holding company. As per the income statement of the company the

company’s net loss amounted to $ 78 million and the amount of foreign exchange transaction was $

15 million (Wesfarmers.com.au, 2017).

3.Items of financial statement

Dividend – dividend is recorded only after it is assured that it will be received. The amount of

dividend paid by the company during the year was $2,600 million.

EPS – The basic and diluted both the EPS for the closing of the year was 36.2 cents.

Equity return – this is calculated as $407/$22,949 = 0.018, which is regarded as extremely

poor as compared to industrial average.

Risk and its mitigation – the risk is associated with the quality, completeness and reliability of

the report. Further, it does not assure that the report is free from material misstatement, fraud

or error. To mitigate these risks, the company use the interpretation and conceptual framework

of IFRS and AASB.

Sustainability – as the company is performing well and achieved some competitive advantages

over its competitors, it is considered as sustainable over the long-term.

Income statement-

Under the income statement, the operating expenses of the company is subtracted from the

gross profit to get the EBIT. And further, from EBIT, the amount of interest and tax expenses is

subtracted to get the net profit (Wesfarmers.com.au, 2017).

Balance sheet is segregated into –

Shareholder’s equity

Total asset which is further divided as current asset and non-current asset

Total liabilities which is further divided into non-current asset and current asset

4) Working Capital Ratio -

17ACCOUNTING SYSTEM AND PROCESS

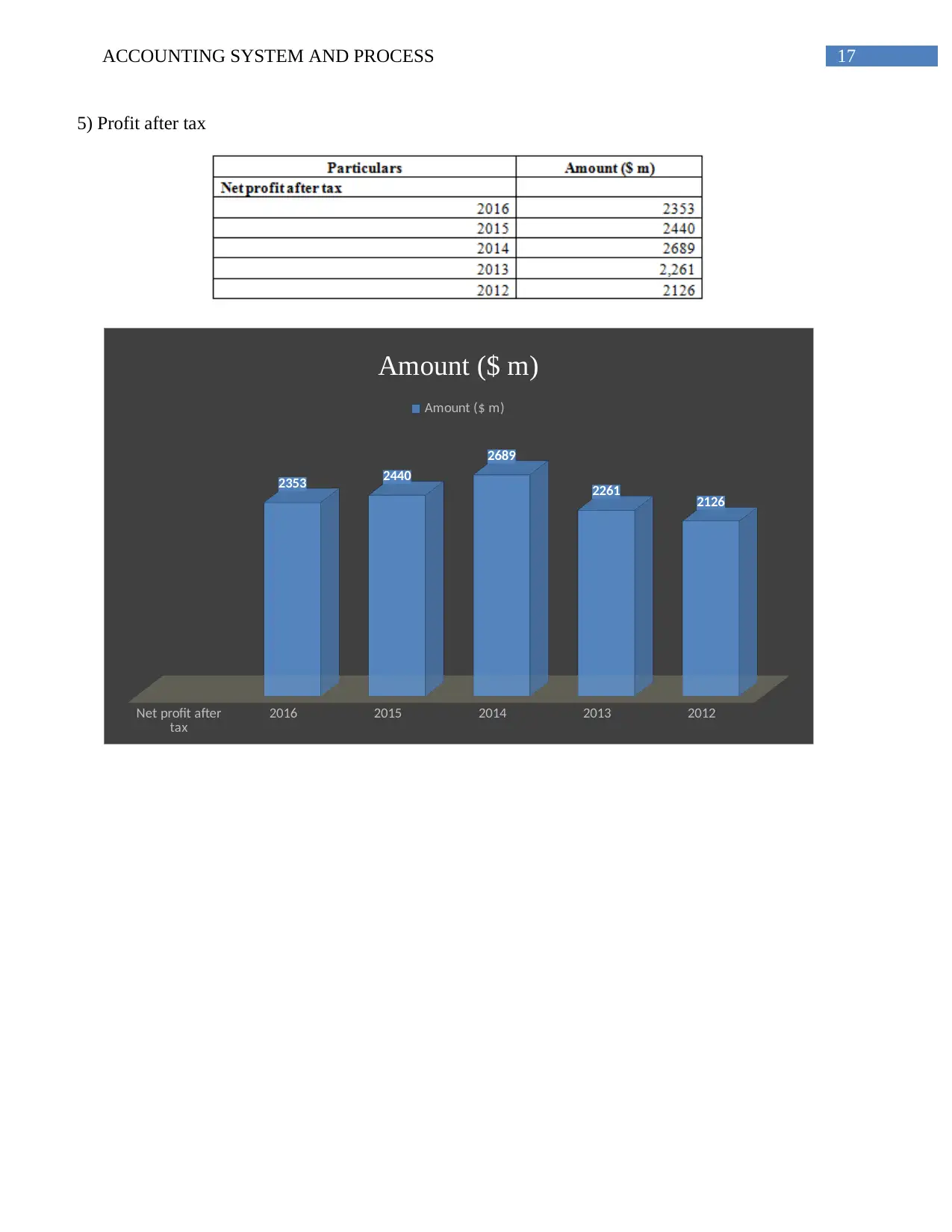

5) Profit after tax

Net profit after

tax 2016 2015 2014 2013 2012

2353 2440

2689

2261 2126

Amount ($ m)

Amount ($ m)

5) Profit after tax

Net profit after

tax 2016 2015 2014 2013 2012

2353 2440

2689

2261 2126

Amount ($ m)

Amount ($ m)

18ACCOUNTING SYSTEM AND PROCESS

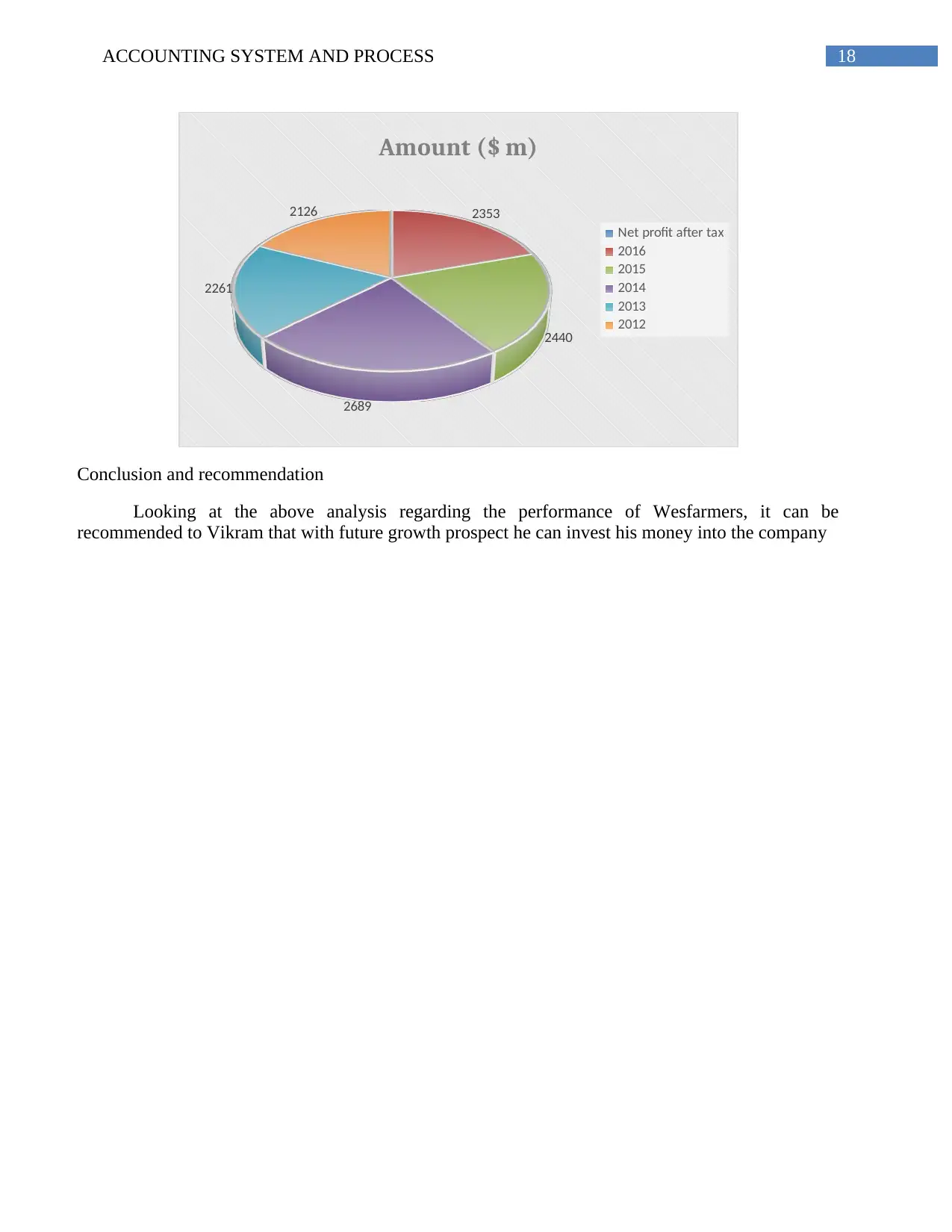

2353

2440

2689

2261

2126

Amount ($ m)

Net profit after tax

2016

2015

2014

2013

2012

Conclusion and recommendation

Looking at the above analysis regarding the performance of Wesfarmers, it can be

recommended to Vikram that with future growth prospect he can invest his money into the company

2353

2440

2689

2261

2126

Amount ($ m)

Net profit after tax

2016

2015

2014

2013

2012

Conclusion and recommendation

Looking at the above analysis regarding the performance of Wesfarmers, it can be

recommended to Vikram that with future growth prospect he can invest his money into the company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19ACCOUNTING SYSTEM AND PROCESS

References:

Baños-Caballero, S., García-Teruel, P. J., & Martínez-Solano, P. (2014). Working capital

management, corporate performance, and financial constraints. Journal of Business

Research, 67(3), 332-338.

Brigham, E. F. (2014). Financial management theory and practice. Atlantic Publishers & Distri.

Bryce, H. J. (2017). Financial and strategic management for nonprofit organizations. Walter de

Gruyter GmbH & Co KG.

Buchman, T. A., Harris, P., & Liu, M. (2016). GAAP vs. IFRS Treatment of Leases and the Impact

on Financial Ratios.

DRURY, C. M. (2013). Management and cost accounting. Springer.

Filatov, E. A., Rudykh, L. G., & Kiryukhin, Y. A. (2014). Variational methods of forming

depreciation deductions. American Journal of Applied Sciences, 11(4), 631.

Wesfarmers.com.au. (2017). Retrieved 03 October 2017, from

https://www.wesfarmers.com.au/infodetail/about/investors/2015AnnualReport.pdf

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial & Managerial Accounting. John

Wiley & Sons.

References:

Baños-Caballero, S., García-Teruel, P. J., & Martínez-Solano, P. (2014). Working capital

management, corporate performance, and financial constraints. Journal of Business

Research, 67(3), 332-338.

Brigham, E. F. (2014). Financial management theory and practice. Atlantic Publishers & Distri.

Bryce, H. J. (2017). Financial and strategic management for nonprofit organizations. Walter de

Gruyter GmbH & Co KG.

Buchman, T. A., Harris, P., & Liu, M. (2016). GAAP vs. IFRS Treatment of Leases and the Impact

on Financial Ratios.

DRURY, C. M. (2013). Management and cost accounting. Springer.

Filatov, E. A., Rudykh, L. G., & Kiryukhin, Y. A. (2014). Variational methods of forming

depreciation deductions. American Journal of Applied Sciences, 11(4), 631.

Wesfarmers.com.au. (2017). Retrieved 03 October 2017, from

https://www.wesfarmers.com.au/infodetail/about/investors/2015AnnualReport.pdf

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial & Managerial Accounting. John

Wiley & Sons.

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.