University Audit and Assurance Report: Business Risks Analysis

VerifiedAdded on 2023/03/20

|15

|3782

|81

Report

AI Summary

This comprehensive audit and assurance report meticulously examines the audit risks associated with a business, focusing on key financial ratios, internal control settings, and potential weaknesses within the system. The report analyzes ratios like current ratio, quick ratio, return on equity, return on total assets, gross profit margin, marketing expenses, administrative expenses, and times interest earned ratio, as well as inventory and accounts receivable days. For each ratio, the report identifies potential audit risks and suggests appropriate audit procedures, including tests of detail and internal control assessments. The report highlights weaknesses in inventory internal control and provides corresponding audit procedures to mitigate the associated risks, emphasizing the importance of computerized processes and the need for regular monitoring to ensure accuracy and prevent misstatements in financial reporting.

Running head: AUDIT AND ASSURANCE

Audit and Assurance

Name of the Student:

Name of the University:

Author’s Note

Audit and Assurance

Name of the Student:

Name of the University:

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

AUDIT AND ASSURANCE

Memo

To: Wayne Wiadrowski

From: The Audit Manager

Date: 8th May, 2019

Subject: Audit risks applicable to the business

Purpose and Scope

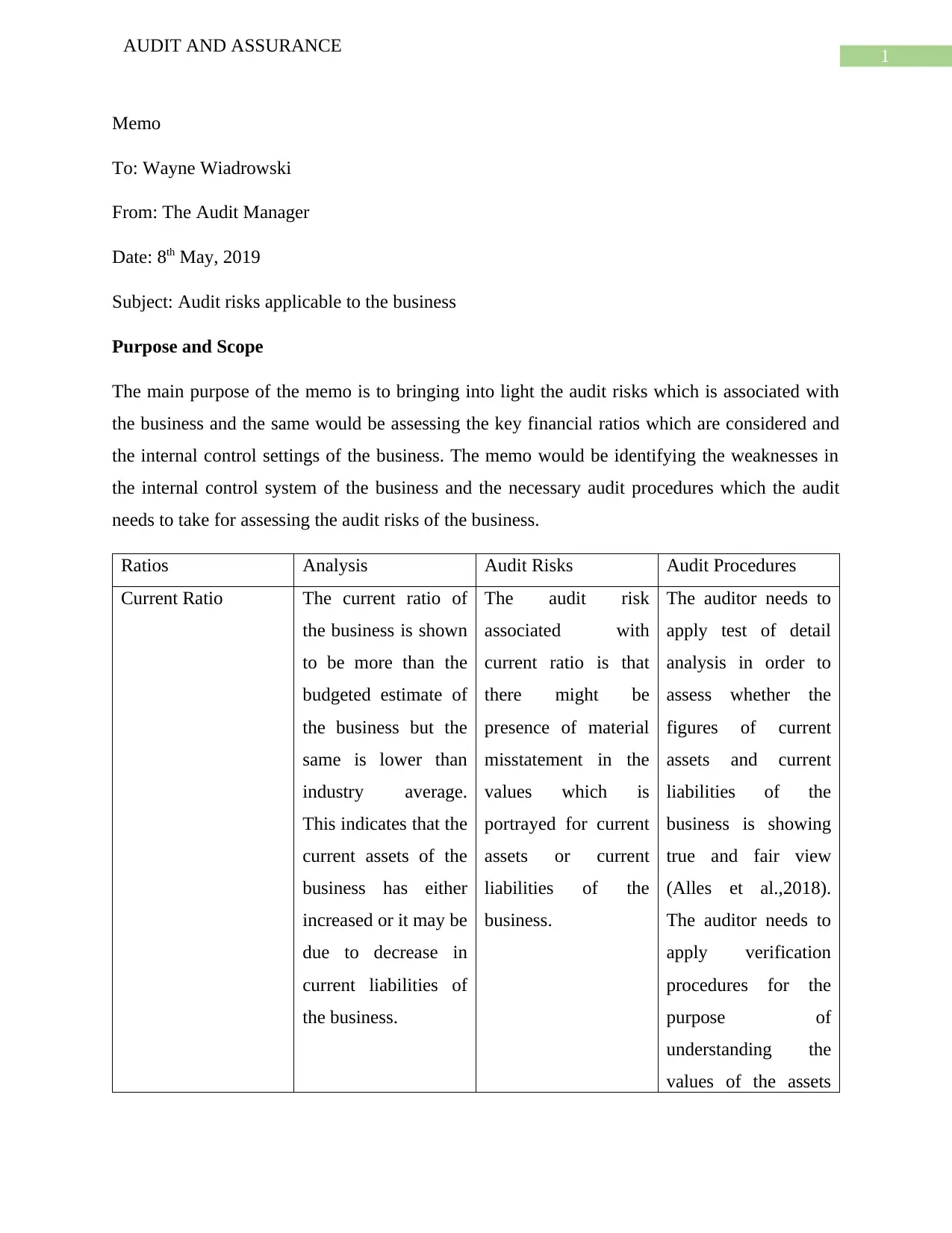

The main purpose of the memo is to bringing into light the audit risks which is associated with

the business and the same would be assessing the key financial ratios which are considered and

the internal control settings of the business. The memo would be identifying the weaknesses in

the internal control system of the business and the necessary audit procedures which the audit

needs to take for assessing the audit risks of the business.

Ratios Analysis Audit Risks Audit Procedures

Current Ratio The current ratio of

the business is shown

to be more than the

budgeted estimate of

the business but the

same is lower than

industry average.

This indicates that the

current assets of the

business has either

increased or it may be

due to decrease in

current liabilities of

the business.

The audit risk

associated with

current ratio is that

there might be

presence of material

misstatement in the

values which is

portrayed for current

assets or current

liabilities of the

business.

The auditor needs to

apply test of detail

analysis in order to

assess whether the

figures of current

assets and current

liabilities of the

business is showing

true and fair view

(Alles et al.,2018).

The auditor needs to

apply verification

procedures for the

purpose of

understanding the

values of the assets

AUDIT AND ASSURANCE

Memo

To: Wayne Wiadrowski

From: The Audit Manager

Date: 8th May, 2019

Subject: Audit risks applicable to the business

Purpose and Scope

The main purpose of the memo is to bringing into light the audit risks which is associated with

the business and the same would be assessing the key financial ratios which are considered and

the internal control settings of the business. The memo would be identifying the weaknesses in

the internal control system of the business and the necessary audit procedures which the audit

needs to take for assessing the audit risks of the business.

Ratios Analysis Audit Risks Audit Procedures

Current Ratio The current ratio of

the business is shown

to be more than the

budgeted estimate of

the business but the

same is lower than

industry average.

This indicates that the

current assets of the

business has either

increased or it may be

due to decrease in

current liabilities of

the business.

The audit risk

associated with

current ratio is that

there might be

presence of material

misstatement in the

values which is

portrayed for current

assets or current

liabilities of the

business.

The auditor needs to

apply test of detail

analysis in order to

assess whether the

figures of current

assets and current

liabilities of the

business is showing

true and fair view

(Alles et al.,2018).

The auditor needs to

apply verification

procedures for the

purpose of

understanding the

values of the assets

2

AUDIT AND ASSURANCE

and liabilities of the

business.

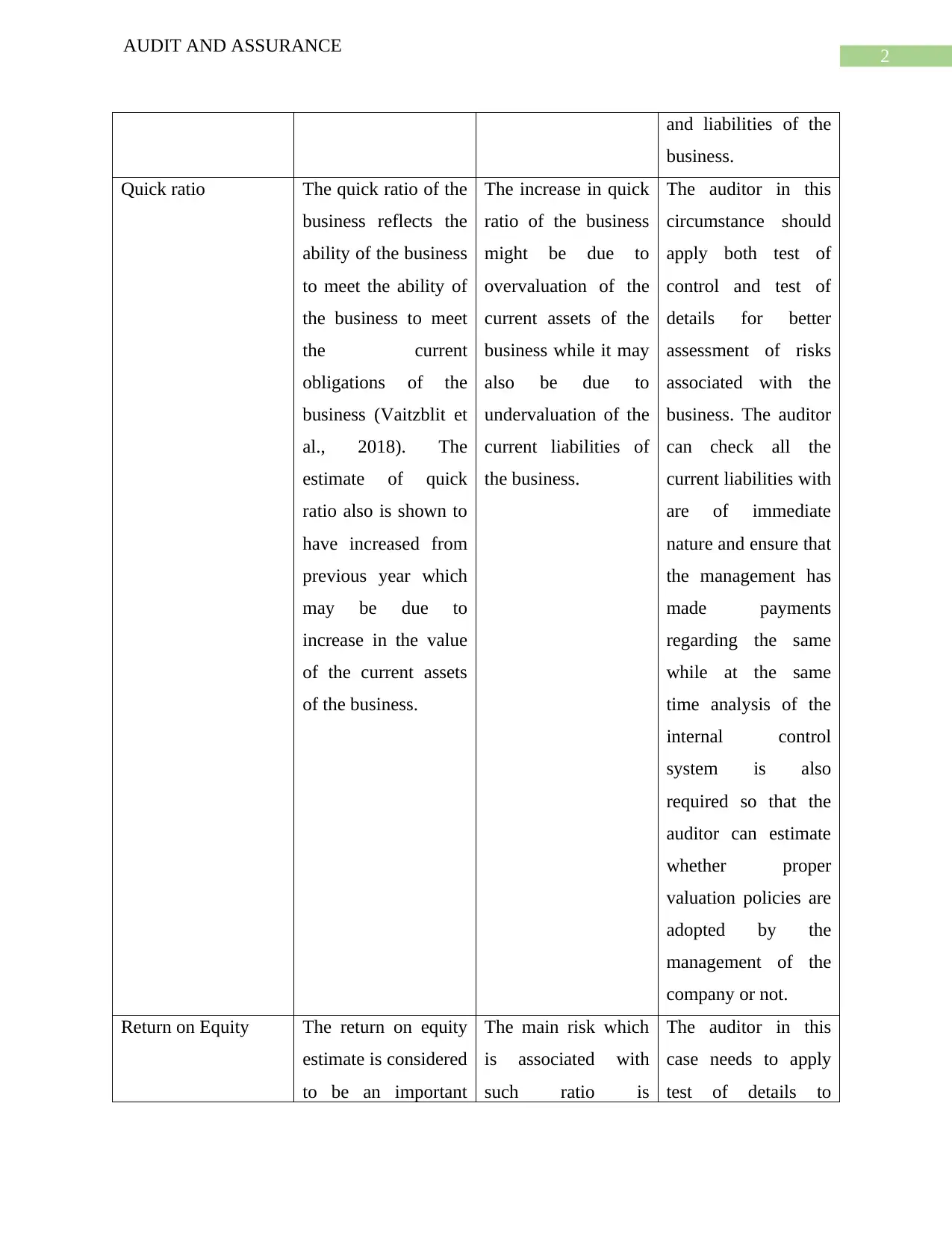

Quick ratio The quick ratio of the

business reflects the

ability of the business

to meet the ability of

the business to meet

the current

obligations of the

business (Vaitzblit et

al., 2018). The

estimate of quick

ratio also is shown to

have increased from

previous year which

may be due to

increase in the value

of the current assets

of the business.

The increase in quick

ratio of the business

might be due to

overvaluation of the

current assets of the

business while it may

also be due to

undervaluation of the

current liabilities of

the business.

The auditor in this

circumstance should

apply both test of

control and test of

details for better

assessment of risks

associated with the

business. The auditor

can check all the

current liabilities with

are of immediate

nature and ensure that

the management has

made payments

regarding the same

while at the same

time analysis of the

internal control

system is also

required so that the

auditor can estimate

whether proper

valuation policies are

adopted by the

management of the

company or not.

Return on Equity The return on equity

estimate is considered

to be an important

The main risk which

is associated with

such ratio is

The auditor in this

case needs to apply

test of details to

AUDIT AND ASSURANCE

and liabilities of the

business.

Quick ratio The quick ratio of the

business reflects the

ability of the business

to meet the ability of

the business to meet

the current

obligations of the

business (Vaitzblit et

al., 2018). The

estimate of quick

ratio also is shown to

have increased from

previous year which

may be due to

increase in the value

of the current assets

of the business.

The increase in quick

ratio of the business

might be due to

overvaluation of the

current assets of the

business while it may

also be due to

undervaluation of the

current liabilities of

the business.

The auditor in this

circumstance should

apply both test of

control and test of

details for better

assessment of risks

associated with the

business. The auditor

can check all the

current liabilities with

are of immediate

nature and ensure that

the management has

made payments

regarding the same

while at the same

time analysis of the

internal control

system is also

required so that the

auditor can estimate

whether proper

valuation policies are

adopted by the

management of the

company or not.

Return on Equity The return on equity

estimate is considered

to be an important

The main risk which

is associated with

such ratio is

The auditor in this

case needs to apply

test of details to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

AUDIT AND ASSURANCE

estimate for the

shareholders of the

business and the

same shows that there

is a tremendous fall

in the estimate which

can be a result of low

profits which is

earned by the

business during the

period.

misstatement in the

figures of profits or

misstatement in

equity estimates. The

profits of the business

might be shown

lower than the real

profits in case of

misstatement in

profits of the

business. In case of

misstatement in

equity values, the

same might be shown

a bit above the real

value.

understand every

aspect of the ledgers

relating to expenses

incurred by the

business and also the

revenue earned by the

business (Jans, Alles

& Vasarhelyi, 2013).

The auditor would be

conducting vouching

practices in the

business so as to

ascertain the items

presented in profit

and loss statement are

accurate.

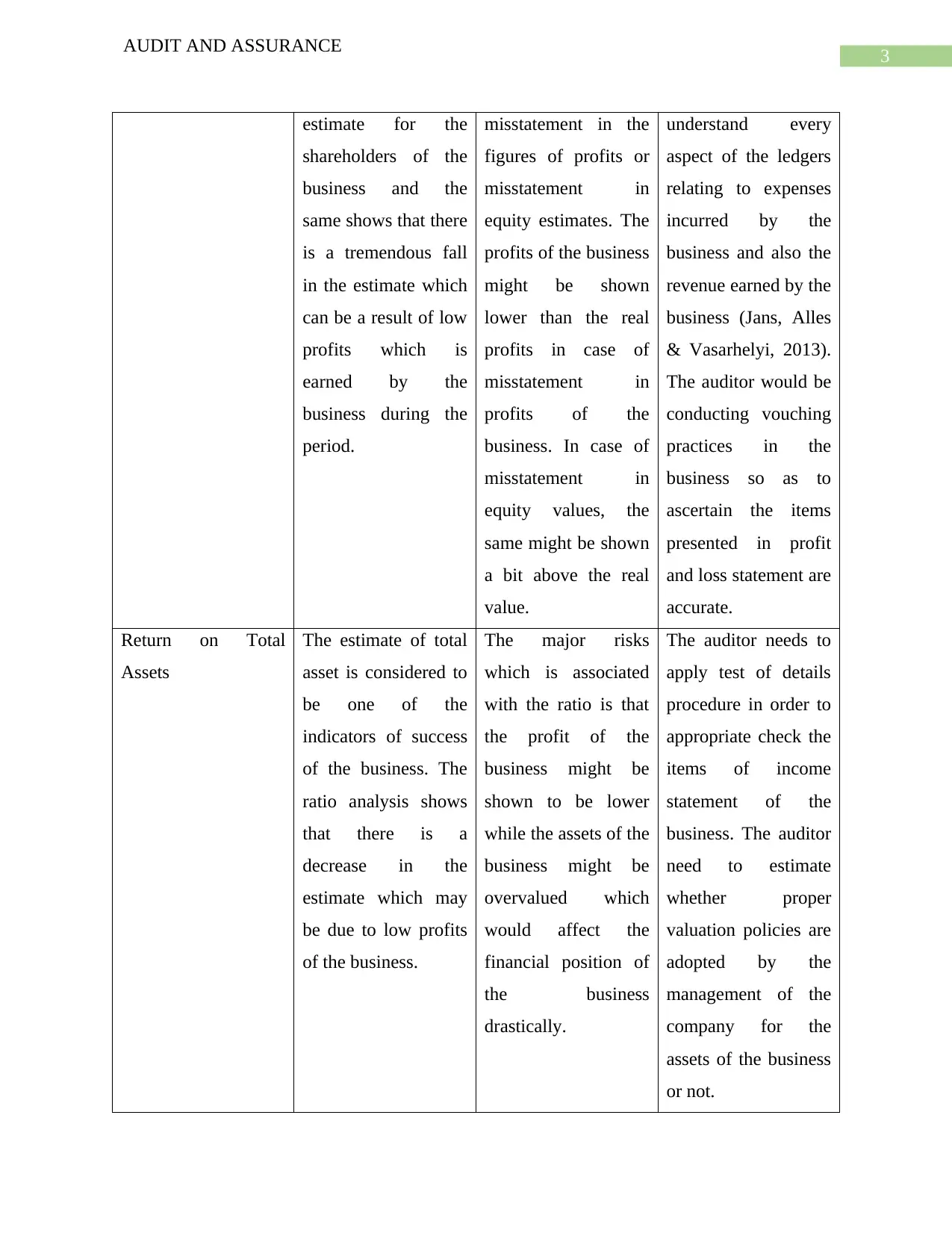

Return on Total

Assets

The estimate of total

asset is considered to

be one of the

indicators of success

of the business. The

ratio analysis shows

that there is a

decrease in the

estimate which may

be due to low profits

of the business.

The major risks

which is associated

with the ratio is that

the profit of the

business might be

shown to be lower

while the assets of the

business might be

overvalued which

would affect the

financial position of

the business

drastically.

The auditor needs to

apply test of details

procedure in order to

appropriate check the

items of income

statement of the

business. The auditor

need to estimate

whether proper

valuation policies are

adopted by the

management of the

company for the

assets of the business

or not.

AUDIT AND ASSURANCE

estimate for the

shareholders of the

business and the

same shows that there

is a tremendous fall

in the estimate which

can be a result of low

profits which is

earned by the

business during the

period.

misstatement in the

figures of profits or

misstatement in

equity estimates. The

profits of the business

might be shown

lower than the real

profits in case of

misstatement in

profits of the

business. In case of

misstatement in

equity values, the

same might be shown

a bit above the real

value.

understand every

aspect of the ledgers

relating to expenses

incurred by the

business and also the

revenue earned by the

business (Jans, Alles

& Vasarhelyi, 2013).

The auditor would be

conducting vouching

practices in the

business so as to

ascertain the items

presented in profit

and loss statement are

accurate.

Return on Total

Assets

The estimate of total

asset is considered to

be one of the

indicators of success

of the business. The

ratio analysis shows

that there is a

decrease in the

estimate which may

be due to low profits

of the business.

The major risks

which is associated

with the ratio is that

the profit of the

business might be

shown to be lower

while the assets of the

business might be

overvalued which

would affect the

financial position of

the business

drastically.

The auditor needs to

apply test of details

procedure in order to

appropriate check the

items of income

statement of the

business. The auditor

need to estimate

whether proper

valuation policies are

adopted by the

management of the

company for the

assets of the business

or not.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

AUDIT AND ASSURANCE

Gross Profit Margin Another important

estimate is gross

profit margin for a

business as the same

represent the

operational efficiency

and capability of the

business (Jans, Alles

& Vasarhelyi, 2014).

There is a decrease in

the estimate in 2018

as compared to the

budgeted estimate for

API. This may be due

to low sales figure

during the period or

high costs of the

business.

The audit risk is most

high in such cases as

there is more of a

chance of under

valuation of sales

figure in order to

conceal extra revenue

of the business. The

costs of the business

can also be

misappropriated. The

audit risks of the

business affects the

business in case of

misrepresentation of

the figure of sales of

the business.

The auditor of the

business needs to

apply test of detail

approach for

assessing each items

of revenue generating

activities and

expenses incurring

activities of the

business. In addition

to this, the auditor

also needs to apply

detailed substantive

procedures for

ensuring that the

items which are

represented in the

annual reports are

showing true and fair

view.

Marketing Expenses The market expenses

of the business are

shown to be much

more than the

estimate which is

presented in the

budget of the

business. This may

due to increase

activities of the

business relating to

The main risk which

is associated with

marketing expenses

of the business is

related to

misstatement in the

expenses of the

business. This would

relate to

overstatement in the

value of the business.

The auditor needs to

apply test of details

procedures so that

every transaction

related to expenses of

the business is

assessed by the

auditor of the

business so as to

ensure that the items

are appropriately

AUDIT AND ASSURANCE

Gross Profit Margin Another important

estimate is gross

profit margin for a

business as the same

represent the

operational efficiency

and capability of the

business (Jans, Alles

& Vasarhelyi, 2014).

There is a decrease in

the estimate in 2018

as compared to the

budgeted estimate for

API. This may be due

to low sales figure

during the period or

high costs of the

business.

The audit risk is most

high in such cases as

there is more of a

chance of under

valuation of sales

figure in order to

conceal extra revenue

of the business. The

costs of the business

can also be

misappropriated. The

audit risks of the

business affects the

business in case of

misrepresentation of

the figure of sales of

the business.

The auditor of the

business needs to

apply test of detail

approach for

assessing each items

of revenue generating

activities and

expenses incurring

activities of the

business. In addition

to this, the auditor

also needs to apply

detailed substantive

procedures for

ensuring that the

items which are

represented in the

annual reports are

showing true and fair

view.

Marketing Expenses The market expenses

of the business are

shown to be much

more than the

estimate which is

presented in the

budget of the

business. This may

due to increase

activities of the

business relating to

The main risk which

is associated with

marketing expenses

of the business is

related to

misstatement in the

expenses of the

business. This would

relate to

overstatement in the

value of the business.

The auditor needs to

apply test of details

procedures so that

every transaction

related to expenses of

the business is

assessed by the

auditor of the

business so as to

ensure that the items

are appropriately

5

AUDIT AND ASSURANCE

sales and operations

of the business.

represented in the

financial statements

of the business.

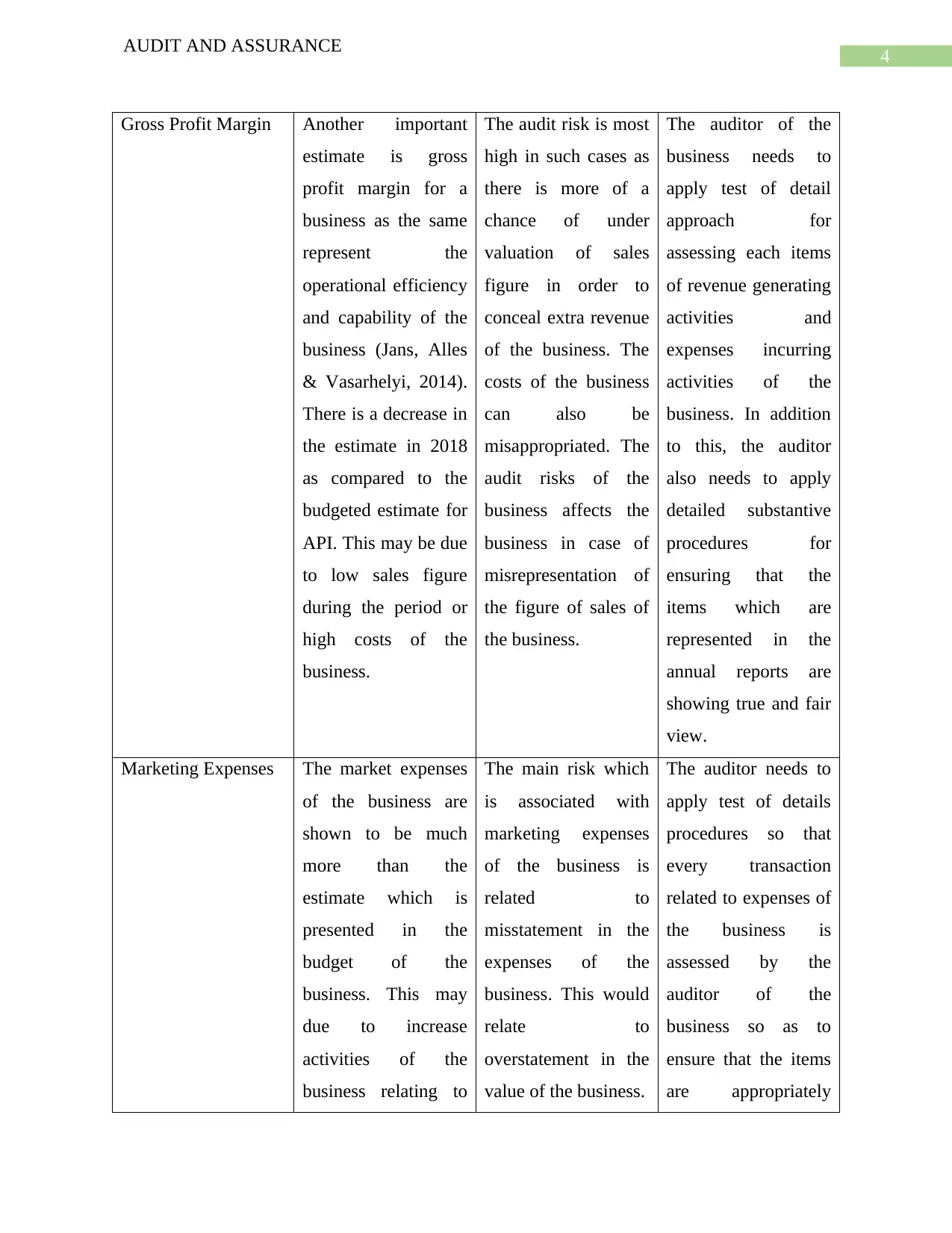

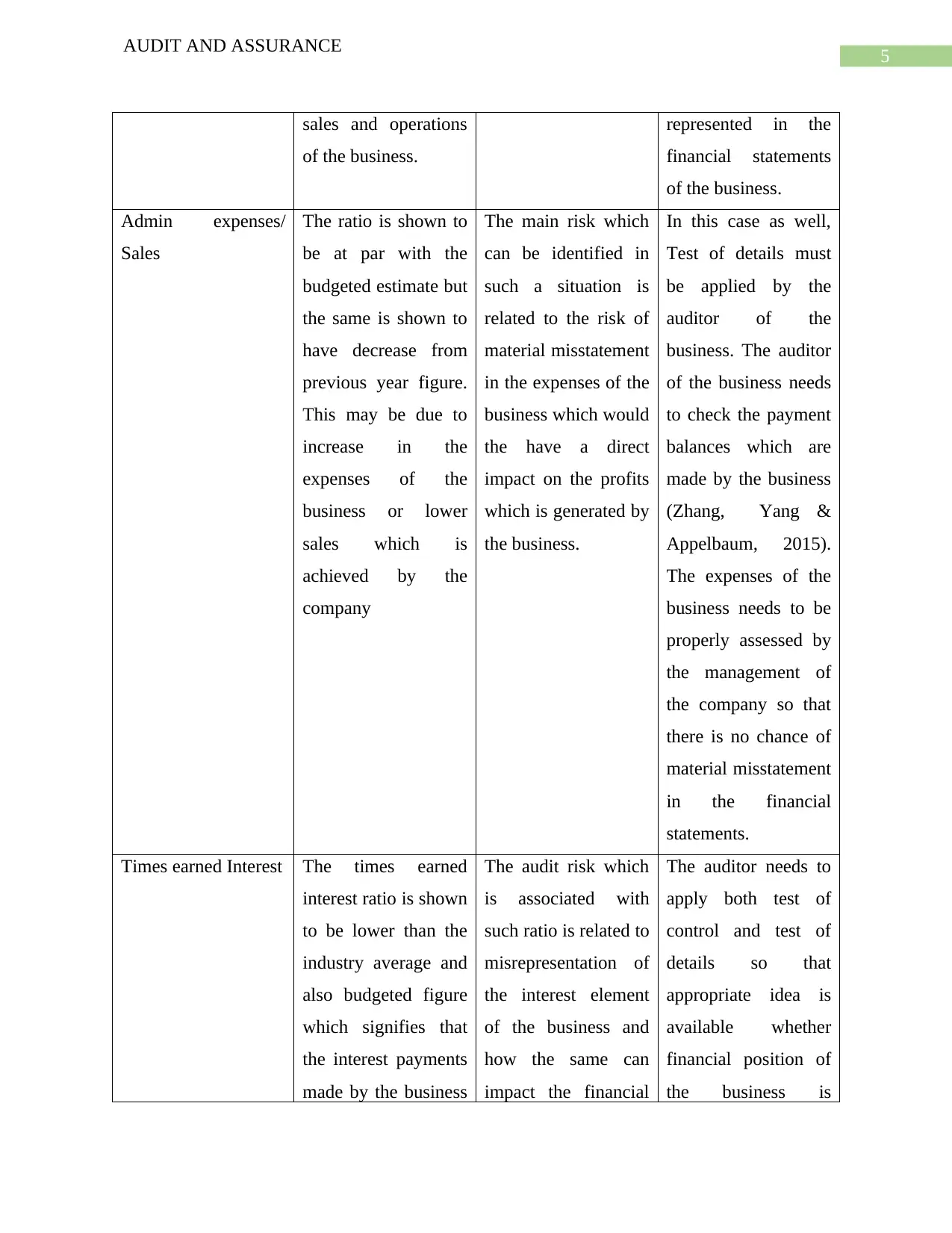

Admin expenses/

Sales

The ratio is shown to

be at par with the

budgeted estimate but

the same is shown to

have decrease from

previous year figure.

This may be due to

increase in the

expenses of the

business or lower

sales which is

achieved by the

company

The main risk which

can be identified in

such a situation is

related to the risk of

material misstatement

in the expenses of the

business which would

the have a direct

impact on the profits

which is generated by

the business.

In this case as well,

Test of details must

be applied by the

auditor of the

business. The auditor

of the business needs

to check the payment

balances which are

made by the business

(Zhang, Yang &

Appelbaum, 2015).

The expenses of the

business needs to be

properly assessed by

the management of

the company so that

there is no chance of

material misstatement

in the financial

statements.

Times earned Interest The times earned

interest ratio is shown

to be lower than the

industry average and

also budgeted figure

which signifies that

the interest payments

made by the business

The audit risk which

is associated with

such ratio is related to

misrepresentation of

the interest element

of the business and

how the same can

impact the financial

The auditor needs to

apply both test of

control and test of

details so that

appropriate idea is

available whether

financial position of

the business is

AUDIT AND ASSURANCE

sales and operations

of the business.

represented in the

financial statements

of the business.

Admin expenses/

Sales

The ratio is shown to

be at par with the

budgeted estimate but

the same is shown to

have decrease from

previous year figure.

This may be due to

increase in the

expenses of the

business or lower

sales which is

achieved by the

company

The main risk which

can be identified in

such a situation is

related to the risk of

material misstatement

in the expenses of the

business which would

the have a direct

impact on the profits

which is generated by

the business.

In this case as well,

Test of details must

be applied by the

auditor of the

business. The auditor

of the business needs

to check the payment

balances which are

made by the business

(Zhang, Yang &

Appelbaum, 2015).

The expenses of the

business needs to be

properly assessed by

the management of

the company so that

there is no chance of

material misstatement

in the financial

statements.

Times earned Interest The times earned

interest ratio is shown

to be lower than the

industry average and

also budgeted figure

which signifies that

the interest payments

made by the business

The audit risk which

is associated with

such ratio is related to

misrepresentation of

the interest element

of the business and

how the same can

impact the financial

The auditor needs to

apply both test of

control and test of

details so that

appropriate idea is

available whether

financial position of

the business is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

AUDIT AND ASSURANCE

has been lower. position of the

business as well as

the profits of the

business.

appropriately

represented or not

(Ryoo et al., 2013).

The auditor of the

business needs to

apply vouching

practices in the

business.

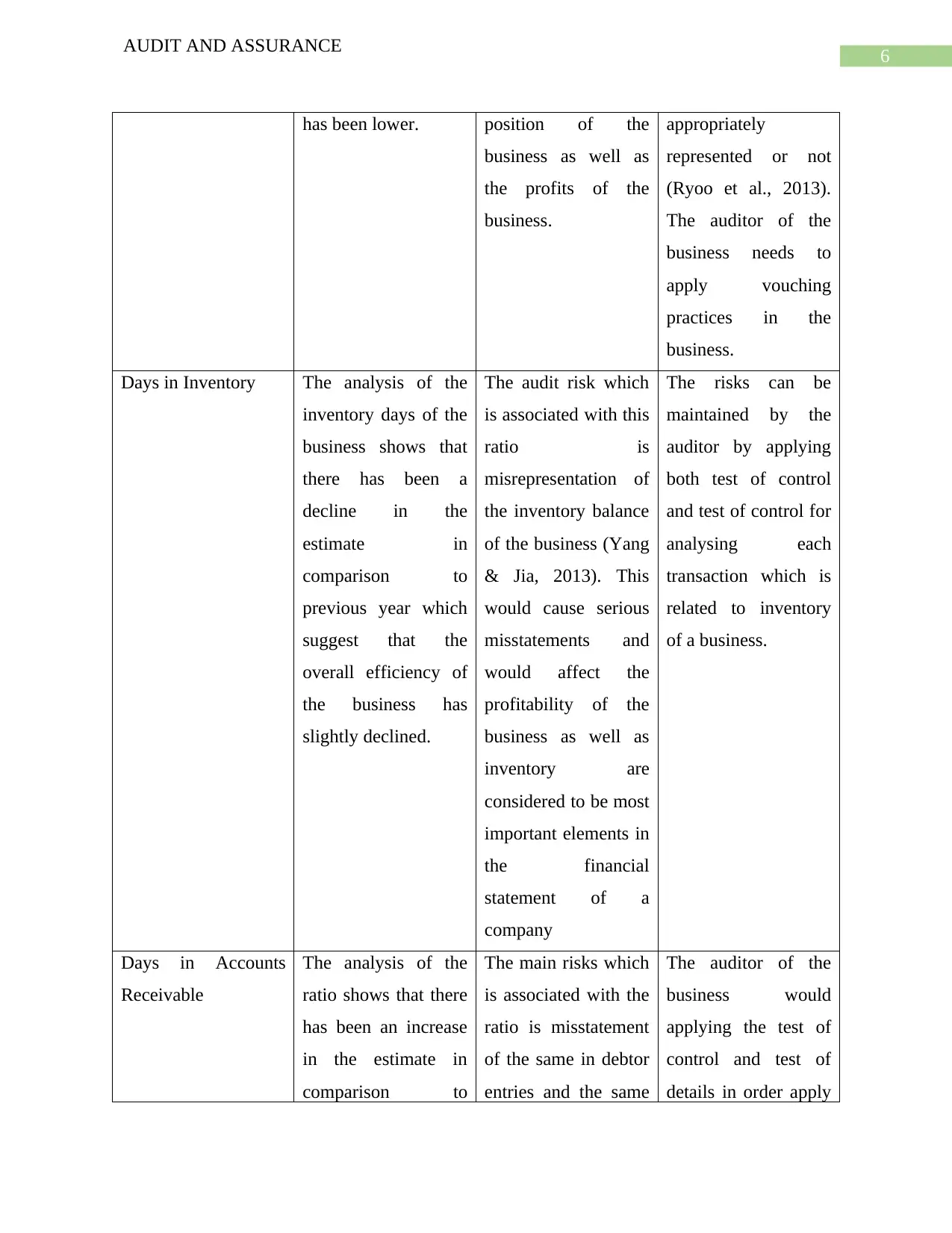

Days in Inventory The analysis of the

inventory days of the

business shows that

there has been a

decline in the

estimate in

comparison to

previous year which

suggest that the

overall efficiency of

the business has

slightly declined.

The audit risk which

is associated with this

ratio is

misrepresentation of

the inventory balance

of the business (Yang

& Jia, 2013). This

would cause serious

misstatements and

would affect the

profitability of the

business as well as

inventory are

considered to be most

important elements in

the financial

statement of a

company

The risks can be

maintained by the

auditor by applying

both test of control

and test of control for

analysing each

transaction which is

related to inventory

of a business.

Days in Accounts

Receivable

The analysis of the

ratio shows that there

has been an increase

in the estimate in

comparison to

The main risks which

is associated with the

ratio is misstatement

of the same in debtor

entries and the same

The auditor of the

business would

applying the test of

control and test of

details in order apply

AUDIT AND ASSURANCE

has been lower. position of the

business as well as

the profits of the

business.

appropriately

represented or not

(Ryoo et al., 2013).

The auditor of the

business needs to

apply vouching

practices in the

business.

Days in Inventory The analysis of the

inventory days of the

business shows that

there has been a

decline in the

estimate in

comparison to

previous year which

suggest that the

overall efficiency of

the business has

slightly declined.

The audit risk which

is associated with this

ratio is

misrepresentation of

the inventory balance

of the business (Yang

& Jia, 2013). This

would cause serious

misstatements and

would affect the

profitability of the

business as well as

inventory are

considered to be most

important elements in

the financial

statement of a

company

The risks can be

maintained by the

auditor by applying

both test of control

and test of control for

analysing each

transaction which is

related to inventory

of a business.

Days in Accounts

Receivable

The analysis of the

ratio shows that there

has been an increase

in the estimate in

comparison to

The main risks which

is associated with the

ratio is misstatement

of the same in debtor

entries and the same

The auditor of the

business would

applying the test of

control and test of

details in order apply

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

AUDIT AND ASSURANCE

previous year. would also affect the

sales of the business

which in turn would

also affect the profits

of the business

appropriate scrutiny

of the financial

statements of the

business.

Debt to Equity Ratio As per the estimate

which is presented

shows that there has

been a decline in the

ratio which may be

due to increase in

debt capital of the

business.

The main risk which

is associated with the

ratio is misstatement

in the debt balance of

the business which

would have direct

impact on the

financial position of

the business. There is

a risk of misstatement

related to the capital

structure of the

business.

The auditor needs to

assess the balances of

the debt and apply

test of control for

identifying any

discrepancies which

may exist in the

financial statement of

the business.

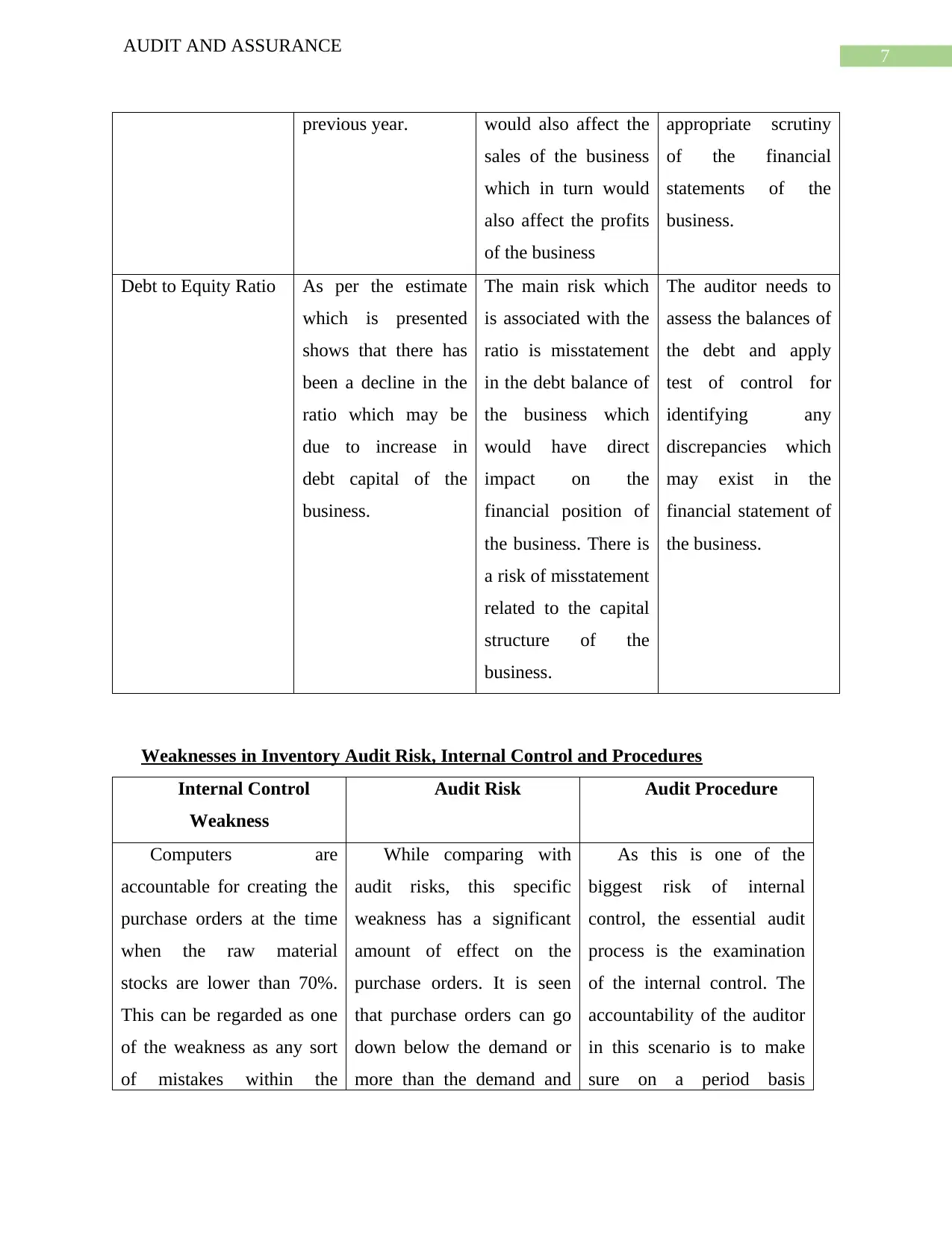

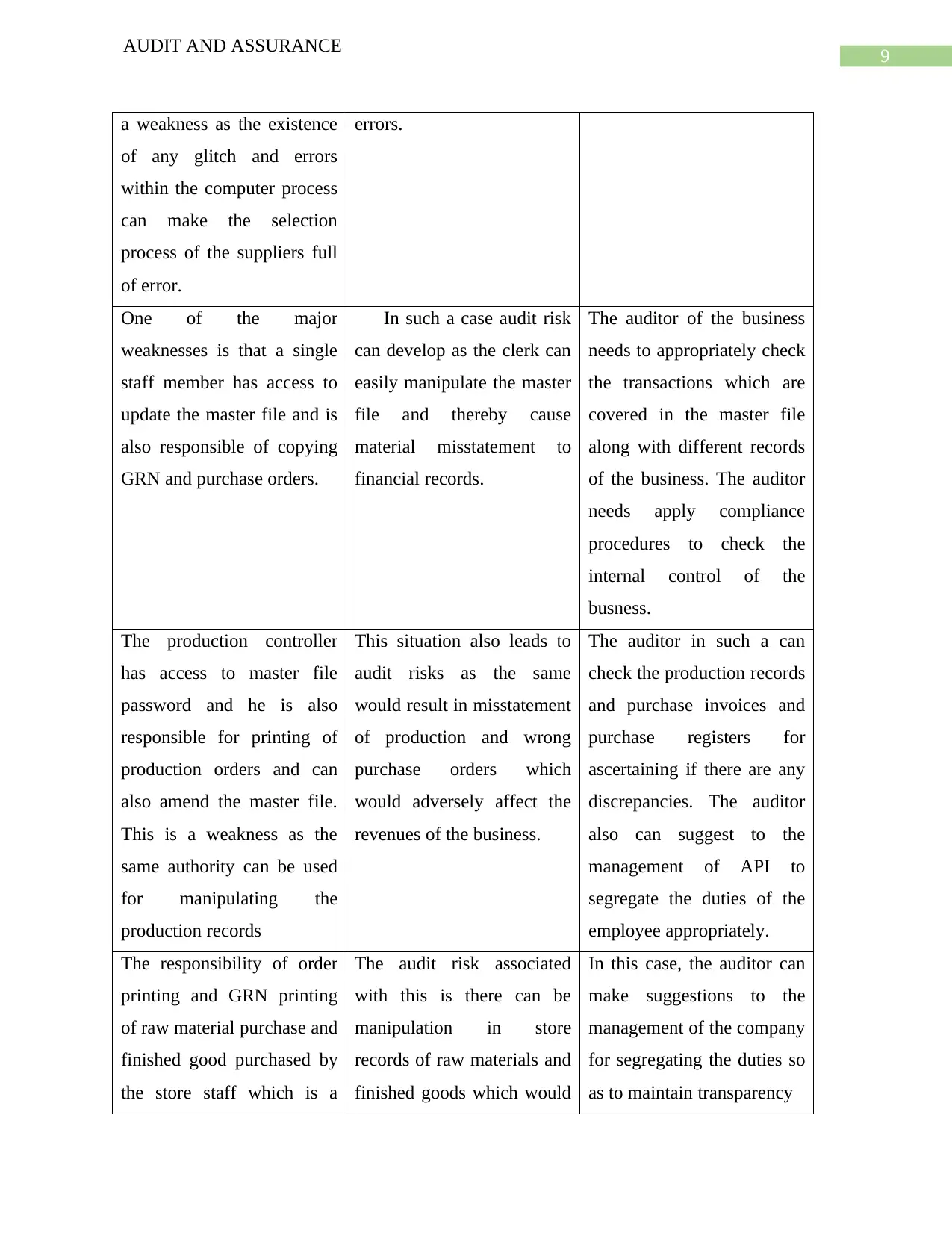

Weaknesses in Inventory Audit Risk, Internal Control and Procedures

Internal Control

Weakness

Audit Risk Audit Procedure

Computers are

accountable for creating the

purchase orders at the time

when the raw material

stocks are lower than 70%.

This can be regarded as one

of the weakness as any sort

of mistakes within the

While comparing with

audit risks, this specific

weakness has a significant

amount of effect on the

purchase orders. It is seen

that purchase orders can go

down below the demand or

more than the demand and

As this is one of the

biggest risk of internal

control, the essential audit

process is the examination

of the internal control. The

accountability of the auditor

in this scenario is to make

sure on a period basis

AUDIT AND ASSURANCE

previous year. would also affect the

sales of the business

which in turn would

also affect the profits

of the business

appropriate scrutiny

of the financial

statements of the

business.

Debt to Equity Ratio As per the estimate

which is presented

shows that there has

been a decline in the

ratio which may be

due to increase in

debt capital of the

business.

The main risk which

is associated with the

ratio is misstatement

in the debt balance of

the business which

would have direct

impact on the

financial position of

the business. There is

a risk of misstatement

related to the capital

structure of the

business.

The auditor needs to

assess the balances of

the debt and apply

test of control for

identifying any

discrepancies which

may exist in the

financial statement of

the business.

Weaknesses in Inventory Audit Risk, Internal Control and Procedures

Internal Control

Weakness

Audit Risk Audit Procedure

Computers are

accountable for creating the

purchase orders at the time

when the raw material

stocks are lower than 70%.

This can be regarded as one

of the weakness as any sort

of mistakes within the

While comparing with

audit risks, this specific

weakness has a significant

amount of effect on the

purchase orders. It is seen

that purchase orders can go

down below the demand or

more than the demand and

As this is one of the

biggest risk of internal

control, the essential audit

process is the examination

of the internal control. The

accountability of the auditor

in this scenario is to make

sure on a period basis

8

AUDIT AND ASSURANCE

process can create purchase

order disputes.

this can make an API loss. examination of the

computerized process is

done in order to make sure

that any sorts of errors are

not discovered and the

system is properly updated.

By looking at the above

case, the other key weakness

within the internal control

process of API is the entire

responsibility of the

computerized process for the

creation of the orders of

production. The availability

of any sort of errors or fault

within the system can have

significant amount of impact

on the production orders.

This sort of weakness

leads to a specific sort of

audit risk where the

production system of the

organization can be

impacted in a significant

manner. it is because of this

risk that there are chances of

over and under placement of

the raw materials and even

the finished and in some

cases both. The date of order

can be altered as well and

this can make the finished

goods and raw materials

unutilized.

This is associated to the

control and the essential

audit process and this is the

examination of control that

is done internally

(Kharisova & Kozlova,

2014).. It is required for the

auditor to make a periodic

check of the computer

process and this would make

sure that there is no

existence of mistakes in the

process and the entire

system is up to date.

It is observed that the

API computerised process is

accountable for the supplier

selection for the purpose of

raw materials and the

finished goods, which is on

the basis of the current

prices and the time of

delivery. This is regarded as

There exists a controlled

audit risk which is related to

this weakness and this can

have an impact in the raw

material supply and the

finished products. The

selection process of the

suppliers may not be ideal

when there is any kind of

As this risk is known to

the controlled risk in nature,

substantive process of audit

requires to be incorporated

where the accountability on

the auditors is to examine

the computer process on a

periodic manner van

(Buuren et al., 2014).

AUDIT AND ASSURANCE

process can create purchase

order disputes.

this can make an API loss. examination of the

computerized process is

done in order to make sure

that any sorts of errors are

not discovered and the

system is properly updated.

By looking at the above

case, the other key weakness

within the internal control

process of API is the entire

responsibility of the

computerized process for the

creation of the orders of

production. The availability

of any sort of errors or fault

within the system can have

significant amount of impact

on the production orders.

This sort of weakness

leads to a specific sort of

audit risk where the

production system of the

organization can be

impacted in a significant

manner. it is because of this

risk that there are chances of

over and under placement of

the raw materials and even

the finished and in some

cases both. The date of order

can be altered as well and

this can make the finished

goods and raw materials

unutilized.

This is associated to the

control and the essential

audit process and this is the

examination of control that

is done internally

(Kharisova & Kozlova,

2014).. It is required for the

auditor to make a periodic

check of the computer

process and this would make

sure that there is no

existence of mistakes in the

process and the entire

system is up to date.

It is observed that the

API computerised process is

accountable for the supplier

selection for the purpose of

raw materials and the

finished goods, which is on

the basis of the current

prices and the time of

delivery. This is regarded as

There exists a controlled

audit risk which is related to

this weakness and this can

have an impact in the raw

material supply and the

finished products. The

selection process of the

suppliers may not be ideal

when there is any kind of

As this risk is known to

the controlled risk in nature,

substantive process of audit

requires to be incorporated

where the accountability on

the auditors is to examine

the computer process on a

periodic manner van

(Buuren et al., 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

AUDIT AND ASSURANCE

a weakness as the existence

of any glitch and errors

within the computer process

can make the selection

process of the suppliers full

of error.

errors.

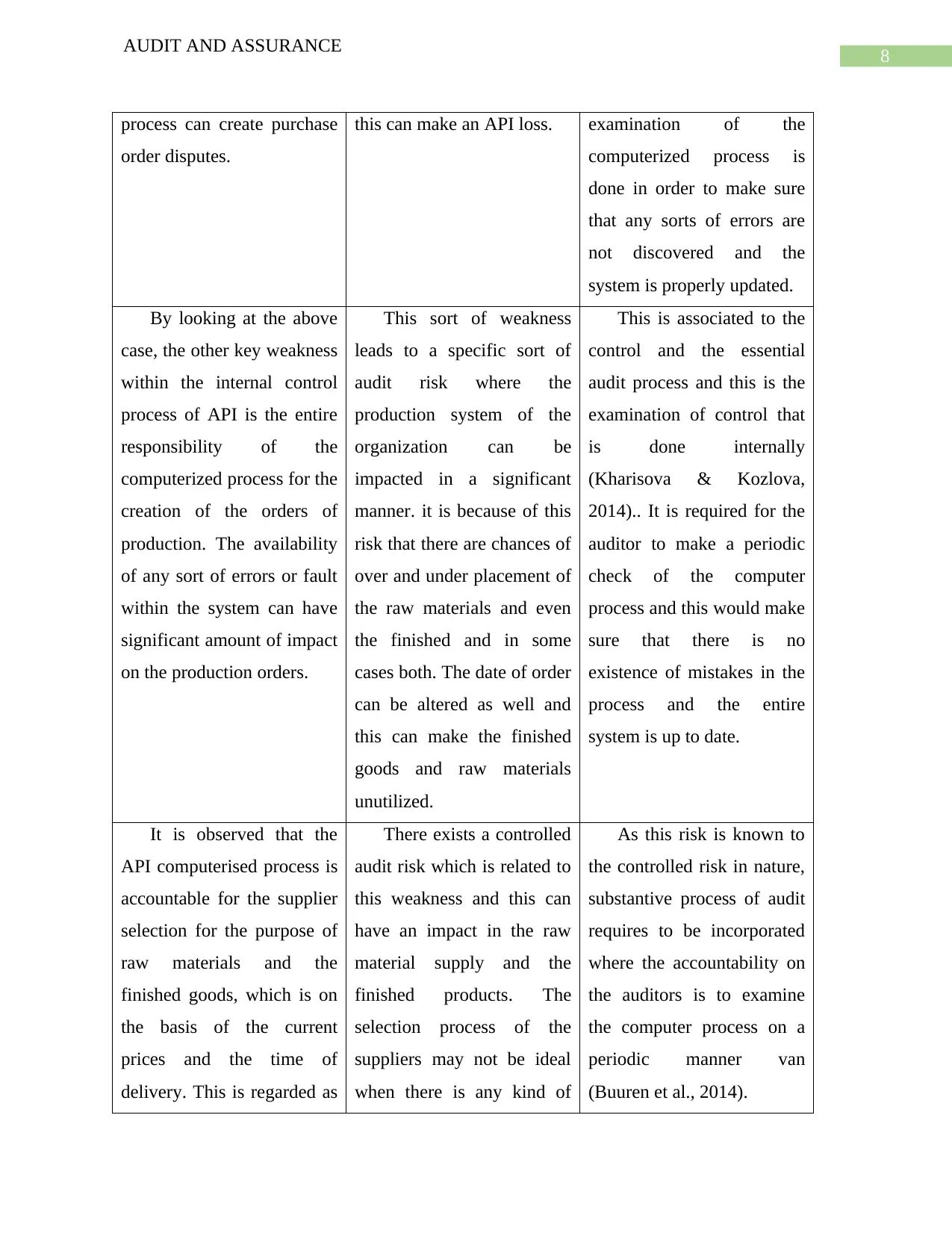

One of the major

weaknesses is that a single

staff member has access to

update the master file and is

also responsible of copying

GRN and purchase orders.

In such a case audit risk

can develop as the clerk can

easily manipulate the master

file and thereby cause

material misstatement to

financial records.

The auditor of the business

needs to appropriately check

the transactions which are

covered in the master file

along with different records

of the business. The auditor

needs apply compliance

procedures to check the

internal control of the

busness.

The production controller

has access to master file

password and he is also

responsible for printing of

production orders and can

also amend the master file.

This is a weakness as the

same authority can be used

for manipulating the

production records

This situation also leads to

audit risks as the same

would result in misstatement

of production and wrong

purchase orders which

would adversely affect the

revenues of the business.

The auditor in such a can

check the production records

and purchase invoices and

purchase registers for

ascertaining if there are any

discrepancies. The auditor

also can suggest to the

management of API to

segregate the duties of the

employee appropriately.

The responsibility of order

printing and GRN printing

of raw material purchase and

finished good purchased by

the store staff which is a

The audit risk associated

with this is there can be

manipulation in store

records of raw materials and

finished goods which would

In this case, the auditor can

make suggestions to the

management of the company

for segregating the duties so

as to maintain transparency

AUDIT AND ASSURANCE

a weakness as the existence

of any glitch and errors

within the computer process

can make the selection

process of the suppliers full

of error.

errors.

One of the major

weaknesses is that a single

staff member has access to

update the master file and is

also responsible of copying

GRN and purchase orders.

In such a case audit risk

can develop as the clerk can

easily manipulate the master

file and thereby cause

material misstatement to

financial records.

The auditor of the business

needs to appropriately check

the transactions which are

covered in the master file

along with different records

of the business. The auditor

needs apply compliance

procedures to check the

internal control of the

busness.

The production controller

has access to master file

password and he is also

responsible for printing of

production orders and can

also amend the master file.

This is a weakness as the

same authority can be used

for manipulating the

production records

This situation also leads to

audit risks as the same

would result in misstatement

of production and wrong

purchase orders which

would adversely affect the

revenues of the business.

The auditor in such a can

check the production records

and purchase invoices and

purchase registers for

ascertaining if there are any

discrepancies. The auditor

also can suggest to the

management of API to

segregate the duties of the

employee appropriately.

The responsibility of order

printing and GRN printing

of raw material purchase and

finished good purchased by

the store staff which is a

The audit risk associated

with this is there can be

manipulation in store

records of raw materials and

finished goods which would

In this case, the auditor can

make suggestions to the

management of the company

for segregating the duties so

as to maintain transparency

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

AUDIT AND ASSURANCE

weakness as the same can

lead to fraudulent activities

in a business

affect the operations of the

business adversely.

Orders will be generated

to the suppliers and sub-

contractors based on the

master file. There is a scope

for manipulation in the

financial information which

is included in the master file

of the business.

This risk severely affects the

operations financial

statements of the business

and leaves a scope for

making manipulations in the

accounting entries and

thereby causing

misstatement in the financial

records of the business.

The password which allows

access to the master file

should not be allowed to all

employee but limited access

policy should be followed.

The objective of the

management should be to

protect the information kept

in master file.

The stock sheet of the

business does not show the

quantities of the stock which

the business has and this can

be considered as major

weakness in the internal

control system as this can

affect the valuation of stocks

of the business.

The risk is related with

misstatement in the

inventory account of the

business as there is a high

chance that the same can be

overvalued.

The auditor of the business

needs to check all the

inventory records of the

business and the auditor also

needs to undertake physical

count of the stock. This can

appropriately reveal the

quantities of the stocks of

the business for proper

valuation of the stock of the

business.

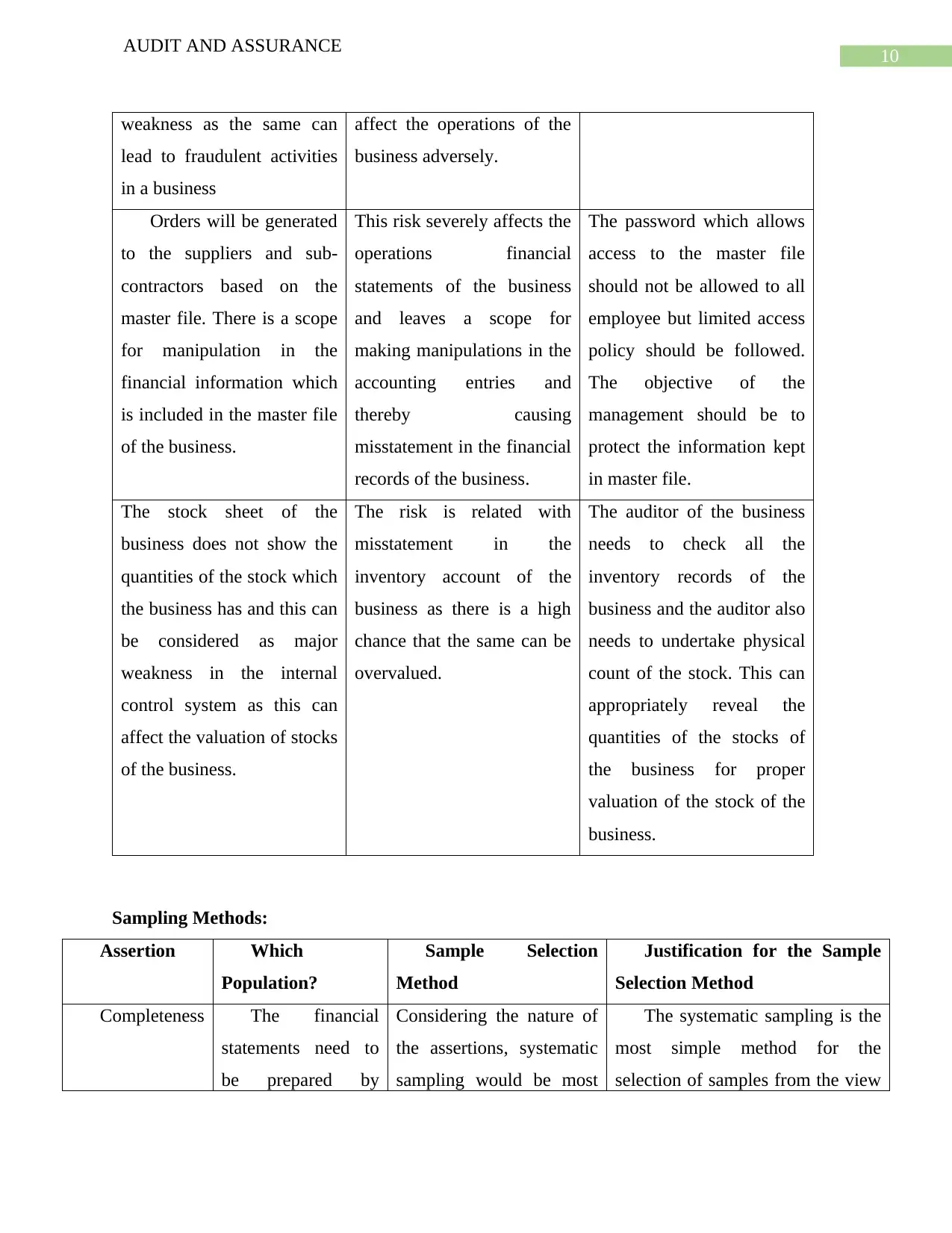

Sampling Methods:

Assertion Which

Population?

Sample Selection

Method

Justification for the Sample

Selection Method

Completeness The financial

statements need to

be prepared by

Considering the nature of

the assertions, systematic

sampling would be most

The systematic sampling is the

most simple method for the

selection of samples from the view

AUDIT AND ASSURANCE

weakness as the same can

lead to fraudulent activities

in a business

affect the operations of the

business adversely.

Orders will be generated

to the suppliers and sub-

contractors based on the

master file. There is a scope

for manipulation in the

financial information which

is included in the master file

of the business.

This risk severely affects the

operations financial

statements of the business

and leaves a scope for

making manipulations in the

accounting entries and

thereby causing

misstatement in the financial

records of the business.

The password which allows

access to the master file

should not be allowed to all

employee but limited access

policy should be followed.

The objective of the

management should be to

protect the information kept

in master file.

The stock sheet of the

business does not show the

quantities of the stock which

the business has and this can

be considered as major

weakness in the internal

control system as this can

affect the valuation of stocks

of the business.

The risk is related with

misstatement in the

inventory account of the

business as there is a high

chance that the same can be

overvalued.

The auditor of the business

needs to check all the

inventory records of the

business and the auditor also

needs to undertake physical

count of the stock. This can

appropriately reveal the

quantities of the stocks of

the business for proper

valuation of the stock of the

business.

Sampling Methods:

Assertion Which

Population?

Sample Selection

Method

Justification for the Sample

Selection Method

Completeness The financial

statements need to

be prepared by

Considering the nature of

the assertions, systematic

sampling would be most

The systematic sampling is the

most simple method for the

selection of samples from the view

11

AUDIT AND ASSURANCE

taking into account

all the transactions

and related

accounting

treatments.

Therefore, it can be

said that the

assertion has a direct

indication with

understatement of

inventory value.

Therefore, it is

necessary to

consider a sample

from purchased

finished products

and raw materials.

appropriate for the most

feasible results in terms of

sample selection (Jones,

2017). This method would

appropriately ascertain the

sample which is required

for ascertaining the

appropriate results

point of the auditor of the business.

As per this method, it can be

assured to Wayne that smallest

elements would be considered and

the system would be applied in

order to sample the entire

population of the chosen sample.

The management of API can be

assured that this method would

appropriately help the

management. This sampling stage

effectively identifies the material

misstatements associated with the

inventories of the business. Along

with this, systematic sampling

method uses random number

tables, which would be valuable

for Wayne

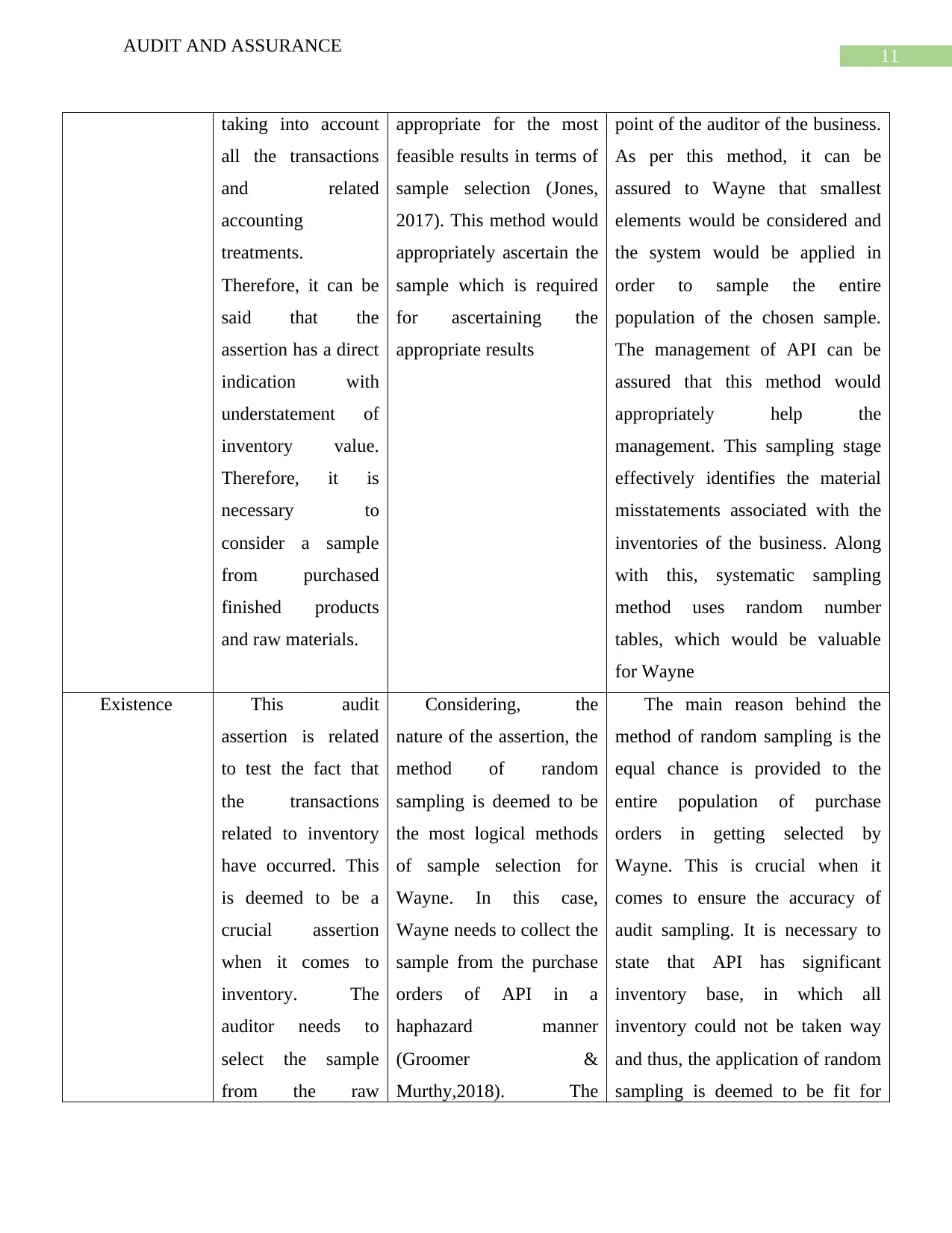

Existence This audit

assertion is related

to test the fact that

the transactions

related to inventory

have occurred. This

is deemed to be a

crucial assertion

when it comes to

inventory. The

auditor needs to

select the sample

from the raw

Considering, the

nature of the assertion, the

method of random

sampling is deemed to be

the most logical methods

of sample selection for

Wayne. In this case,

Wayne needs to collect the

sample from the purchase

orders of API in a

haphazard manner

(Groomer &

Murthy,2018). The

The main reason behind the

method of random sampling is the

equal chance is provided to the

entire population of purchase

orders in getting selected by

Wayne. This is crucial when it

comes to ensure the accuracy of

audit sampling. It is necessary to

state that API has significant

inventory base, in which all

inventory could not be taken way

and thus, the application of random

sampling is deemed to be fit for

AUDIT AND ASSURANCE

taking into account

all the transactions

and related

accounting

treatments.

Therefore, it can be

said that the

assertion has a direct

indication with

understatement of

inventory value.

Therefore, it is

necessary to

consider a sample

from purchased

finished products

and raw materials.

appropriate for the most

feasible results in terms of

sample selection (Jones,

2017). This method would

appropriately ascertain the

sample which is required

for ascertaining the

appropriate results

point of the auditor of the business.

As per this method, it can be

assured to Wayne that smallest

elements would be considered and

the system would be applied in

order to sample the entire

population of the chosen sample.

The management of API can be

assured that this method would

appropriately help the

management. This sampling stage

effectively identifies the material

misstatements associated with the

inventories of the business. Along

with this, systematic sampling

method uses random number

tables, which would be valuable

for Wayne

Existence This audit

assertion is related

to test the fact that

the transactions

related to inventory

have occurred. This

is deemed to be a

crucial assertion

when it comes to

inventory. The

auditor needs to

select the sample

from the raw

Considering, the

nature of the assertion, the

method of random

sampling is deemed to be

the most logical methods

of sample selection for

Wayne. In this case,

Wayne needs to collect the

sample from the purchase

orders of API in a

haphazard manner

(Groomer &

Murthy,2018). The

The main reason behind the

method of random sampling is the

equal chance is provided to the

entire population of purchase

orders in getting selected by

Wayne. This is crucial when it

comes to ensure the accuracy of

audit sampling. It is necessary to

state that API has significant

inventory base, in which all

inventory could not be taken way

and thus, the application of random

sampling is deemed to be fit for

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.