Bowman's Strategy Clock and Ansoff Matrix: A Case Study on Tesco

VerifiedAdded on 2021/09/27

|8

|2515

|250

Report

AI Summary

This report analyzes Tesco's strategic positioning within the UK supermarket industry using Bowman's Strategy Clock and its relationship with the Ansoff Matrix. It explores how Tesco leverages the clock's framework to assess its competitive environment, focusing on price, differentiation, and hybrid strategies. The analysis examines Tesco's market environment, its historical success, and its application of Bowman's eight strategic positions, including low price, hybrid, and differentiation. The report also considers Tesco's focus on customer-centricity, its expansion into various business fields, and its commitment to providing value-added services. Furthermore, the report highlights Tesco's efforts to maintain a strong position in the market through strategic decisions, such as expansion and customer loyalty programs. The report includes the application of the Bowman's Clock to Tesco's market environment and strategic choices. The report also includes references to the relevant studies used.

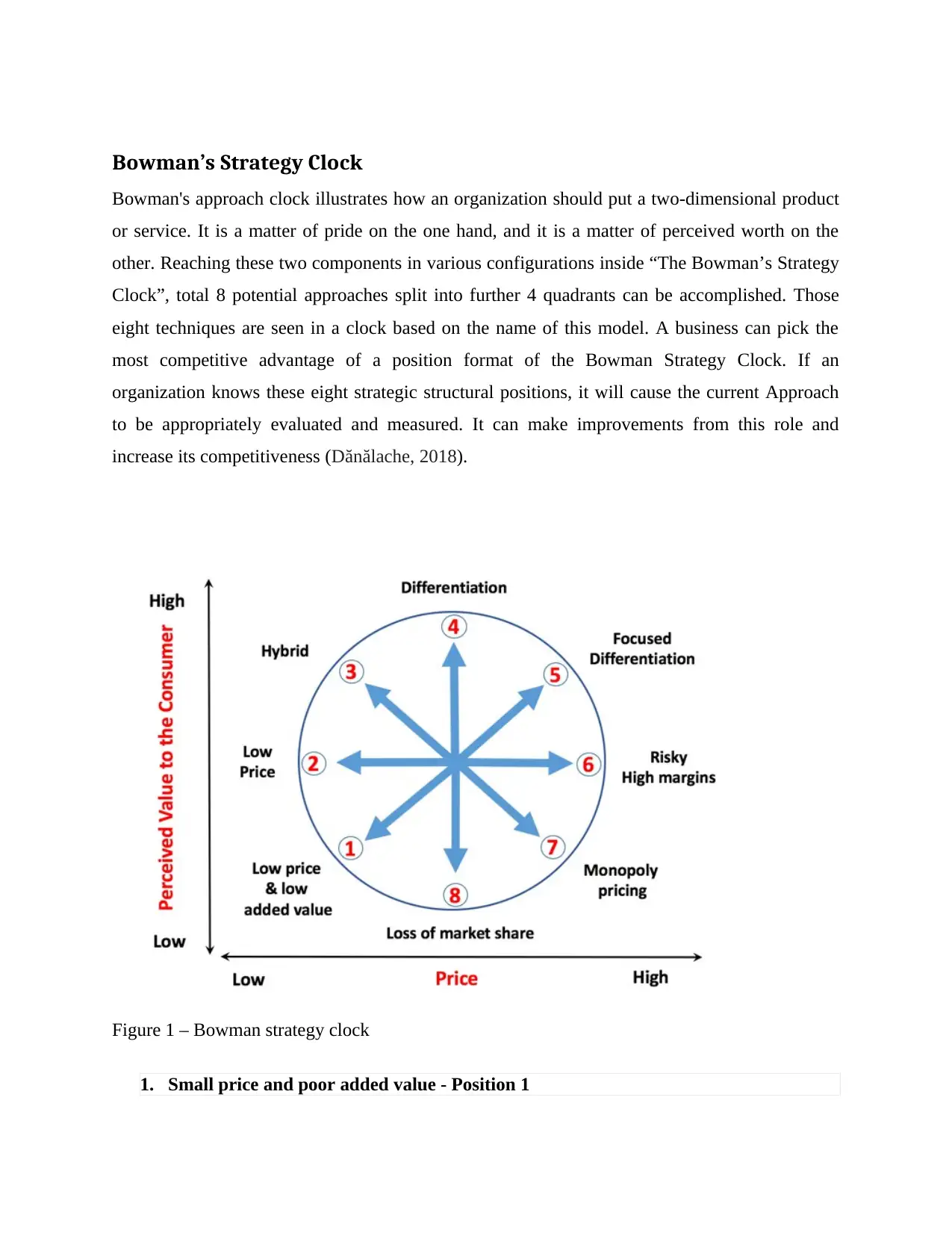

Bowman’s Strategy Clock

Bowman's approach clock illustrates how an organization should put a two-dimensional product

or service. It is a matter of pride on the one hand, and it is a matter of perceived worth on the

other. Reaching these two components in various configurations inside “The Bowman’s Strategy

Clock”, total 8 potential approaches split into further 4 quadrants can be accomplished. Those

eight techniques are seen in a clock based on the name of this model. A business can pick the

most competitive advantage of a position format of the Bowman Strategy Clock. If an

organization knows these eight strategic structural positions, it will cause the current Approach

to be appropriately evaluated and measured. It can make improvements from this role and

increase its competitiveness (Dănălache, 2018).

Figure 1 – Bowman strategy clock

1. Small price and poor added value - Position 1

Bowman's approach clock illustrates how an organization should put a two-dimensional product

or service. It is a matter of pride on the one hand, and it is a matter of perceived worth on the

other. Reaching these two components in various configurations inside “The Bowman’s Strategy

Clock”, total 8 potential approaches split into further 4 quadrants can be accomplished. Those

eight techniques are seen in a clock based on the name of this model. A business can pick the

most competitive advantage of a position format of the Bowman Strategy Clock. If an

organization knows these eight strategic structural positions, it will cause the current Approach

to be appropriately evaluated and measured. It can make improvements from this role and

increase its competitiveness (Dănălache, 2018).

Figure 1 – Bowman strategy clock

1. Small price and poor added value - Position 1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This does not work for an organization. The product is not distinctive and the customer earns

very little advantage despite a low price.

This is a negotiation-based strategy. You are 'cheap as chips' and hope nobody can dismiss you

the only way to be successful.

2. Low cost - Position 2

Companies who put themselves here look similar to the low-cost business leaders.

To thrive, this is also related to economies of scale. A cost-cutting approach is required. Each

commodity has poor revenue margins, but significant making levels will also yield higher total

profits.

Rivalry between low-cost firms is typically severe – often involving price wars (Haselwanter et

al., 2016).

3. Hybrid - Position three

As the name suggests, a hybrid position entails a particular aspect of low-price and a specific

distinction of goods. Its mission is to reassure customers that a reasonable values as well as

suitable product distinction combine positive benefit.

This could be a powerful technique for placement, specifically if the benefit is consistently

offered.

4. Distinguishing - Position 4

The objective of a differentiation method is to have the most apparent value provided to

customers. Marketing and product consistency plays an integral part in this Approach.

The best place to attain comparatively reasonable prices and add value that a differentiation

approach needs might be a high-quality commodity with solid market recognition and loyalty.

5. Differentiation based - Position 5

very little advantage despite a low price.

This is a negotiation-based strategy. You are 'cheap as chips' and hope nobody can dismiss you

the only way to be successful.

2. Low cost - Position 2

Companies who put themselves here look similar to the low-cost business leaders.

To thrive, this is also related to economies of scale. A cost-cutting approach is required. Each

commodity has poor revenue margins, but significant making levels will also yield higher total

profits.

Rivalry between low-cost firms is typically severe – often involving price wars (Haselwanter et

al., 2016).

3. Hybrid - Position three

As the name suggests, a hybrid position entails a particular aspect of low-price and a specific

distinction of goods. Its mission is to reassure customers that a reasonable values as well as

suitable product distinction combine positive benefit.

This could be a powerful technique for placement, specifically if the benefit is consistently

offered.

4. Distinguishing - Position 4

The objective of a differentiation method is to have the most apparent value provided to

customers. Marketing and product consistency plays an integral part in this Approach.

The best place to attain comparatively reasonable prices and add value that a differentiation

approach needs might be a high-quality commodity with solid market recognition and loyalty.

5. Differentiation based - Position 5

This Approach aims at putting a commodity at the best cost, with the high expected value that

consumers purchase. This is the positioning approach embraced by extravagance brands to

obtain high rates by exact division, advertising, and marketing.

This Tactic can positively lead to unusually high-profit margins, but the strategy can only be

replicated in the end for the correct goods and labels.

6. Strong Margins Vulnerable - Position 6

This is a strategy of high-risk placing that one may claim would fail – unavoidably. In this

Approach, the firm sets high rates without giving added value. The benefit will be increased if

consumers keep buying at these increased rates. Yet buyers will ultimately find a commodity that

is better suited and delivers more perceived value at the exact and low costs.

In comparison, Risky High Margins are a non-competitive solution in the short term. It is

difficult for any standard competitive market to sell for a price premium without excuse.

7. Pricing in monopoly - Position 7

When a monopoly remains on the market, the commodity is sold exclusively by one firm. The

monopoly firm does not even have to think about the benefit that the buyer sees with the product

- the only alternative is to order or not. No other options are available. The monopolist can

technically usual whatsoever value he wishes. Surprisingly, controls are severely monitored in

most nations to keep them from putting rates as they like.

8. Business loss equity - Position 8

This is a catastrophe formula in any dynamic market. It is doubtful that a middle-range or

average pricing can win over many buyers who have far better alternatives for a commodity with

low sensed value (for example, a higher value for the same price from other contestants).

consumers purchase. This is the positioning approach embraced by extravagance brands to

obtain high rates by exact division, advertising, and marketing.

This Tactic can positively lead to unusually high-profit margins, but the strategy can only be

replicated in the end for the correct goods and labels.

6. Strong Margins Vulnerable - Position 6

This is a strategy of high-risk placing that one may claim would fail – unavoidably. In this

Approach, the firm sets high rates without giving added value. The benefit will be increased if

consumers keep buying at these increased rates. Yet buyers will ultimately find a commodity that

is better suited and delivers more perceived value at the exact and low costs.

In comparison, Risky High Margins are a non-competitive solution in the short term. It is

difficult for any standard competitive market to sell for a price premium without excuse.

7. Pricing in monopoly - Position 7

When a monopoly remains on the market, the commodity is sold exclusively by one firm. The

monopoly firm does not even have to think about the benefit that the buyer sees with the product

- the only alternative is to order or not. No other options are available. The monopolist can

technically usual whatsoever value he wishes. Surprisingly, controls are severely monitored in

most nations to keep them from putting rates as they like.

8. Business loss equity - Position 8

This is a catastrophe formula in any dynamic market. It is doubtful that a middle-range or

average pricing can win over many buyers who have far better alternatives for a commodity with

low sensed value (for example, a higher value for the same price from other contestants).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Relation of strategy clock and Ansoff matrix

Igor Ansoff, an applied Russian mathematician, defined by the theorists as the "founder of

modern strategic planning," developed the Ansoff-Matrix in the mid-1950s. Ansoff's initial study

was not associated with the Development of businesses at the height of the Cold War in the early

sixties but formed to assist NATO in its strategic resolution of the problems (Ansoff was Rand

Corporation analyst and Lockheed vice president before moving to university).

Multiple possible alternatives for planners' growth strategies can be routinely evaluated in the

matrix using the generic methods represented by them (Utrilla et al., 2012). The main flaw of the

Ansoff matrix is that it is, in fact, more a knowledge processing tool than a planning or analytical

tool; this makes it very useful for analyzing firms from an external point of view (as part of

market analysis), but it is not so helpful in policy planning (Hussain et al., 2013).

A plan for market expansion is one where the Company markets current consumers. In this

Approach, the Company's choices will be to sell the product, change the price, upgrade or

reposition the brand, etc. No additional product is released, and the Company is merely

expanding its existing customer base. A product growth approach includes the marketing of new

goods to the same consumer base, but products that are also expected developments of existing

products, rather than entirely irrelevant. When new opportunities are found for current goods, a

market growth plan is established. The Development of new technologies and industries is part

of a diversification plan. Business and product growth plans are mutually incompatible, as are

market expansion and diversification strategies (Haselwanter, 2019).

The strategy clock is a strategic forecasting instrument at the firm level and the basis of Porter's

Generic Tactics or Five Forces analysis, as opposed to the Ansoff or Boston matrices built for

product and marketing preparation. Initializing alternatives for strategic positioning’s at the price

level (costs advantage strategy) or the perceived added benefit level (differentiating advantage

strategies) as first printed in 1996.

Out of the eight walk-in options 6, 7, and 8, the organization would prefer to decide whether it

follows or goes; one of these approach options is almost definitely bound to fail. Choice 6 will

only be practical where competition is doing either the same or reducing their goods' prices,

which is the price rise on a common interest. In a monopoly situation, alternative seven, a high

Igor Ansoff, an applied Russian mathematician, defined by the theorists as the "founder of

modern strategic planning," developed the Ansoff-Matrix in the mid-1950s. Ansoff's initial study

was not associated with the Development of businesses at the height of the Cold War in the early

sixties but formed to assist NATO in its strategic resolution of the problems (Ansoff was Rand

Corporation analyst and Lockheed vice president before moving to university).

Multiple possible alternatives for planners' growth strategies can be routinely evaluated in the

matrix using the generic methods represented by them (Utrilla et al., 2012). The main flaw of the

Ansoff matrix is that it is, in fact, more a knowledge processing tool than a planning or analytical

tool; this makes it very useful for analyzing firms from an external point of view (as part of

market analysis), but it is not so helpful in policy planning (Hussain et al., 2013).

A plan for market expansion is one where the Company markets current consumers. In this

Approach, the Company's choices will be to sell the product, change the price, upgrade or

reposition the brand, etc. No additional product is released, and the Company is merely

expanding its existing customer base. A product growth approach includes the marketing of new

goods to the same consumer base, but products that are also expected developments of existing

products, rather than entirely irrelevant. When new opportunities are found for current goods, a

market growth plan is established. The Development of new technologies and industries is part

of a diversification plan. Business and product growth plans are mutually incompatible, as are

market expansion and diversification strategies (Haselwanter, 2019).

The strategy clock is a strategic forecasting instrument at the firm level and the basis of Porter's

Generic Tactics or Five Forces analysis, as opposed to the Ansoff or Boston matrices built for

product and marketing preparation. Initializing alternatives for strategic positioning’s at the price

level (costs advantage strategy) or the perceived added benefit level (differentiating advantage

strategies) as first printed in 1996.

Out of the eight walk-in options 6, 7, and 8, the organization would prefer to decide whether it

follows or goes; one of these approach options is almost definitely bound to fail. Choice 6 will

only be practical where competition is doing either the same or reducing their goods' prices,

which is the price rise on a common interest. In a monopoly situation, alternative seven, a high

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

price for a low-value commodity, may be effective only. Choice 8 is an automatic refusal to sell

a value well at average prices since it gives the rivals two possibilities of taking up marketplace

share by the low prices or higher-margin goods.

The only real downside to the Strategy Timer is, it only offers valuable details if it involves more

than one competitive Company; this might be more useful, like the Ansoff Matrix, than a

comprehensive strategic research and preparation method for a case study or market analysis

(Loredana, 2017).

Chosen topic: Tesco

The reasoning for a Tesco theme is that it is one of the UK's leading supermarkets since 1995.

Tesco's success has been dramatically rising and compensated. In our review of Tesco's market

climate, we have learned in the last five years that all environmental indicators are continuously

changing. We have clarified Tesco's effective strategy by connecting it to Bowman's Clock

strategy, which allows us to understand Tesco's process over the years. The facts that show why

Tesco is the best UK supermarket are included in our assessment of Tesco. Our figures reflect

the rise in the number of customers in previous years in Tesco. In conclusion, we have both

shown the good strategic aspects of Tesco. We have always sought to do something creative that

can maintain consumer-centeredness because of customer demands in various cultural contexts.

Tesco's manager was Jack Cohen. The day he started Tesco, he managed to get £1 and profits of

£4. With activities in more than 14 countries, Tesco is recognized worldwide as the largest food

distributor. The brand "Tesco" first emerged in 1924, and the first store in London was

established. This plan has worked and is now the UK's largest supermarket. Tesco has now taken

over non-food and has grown kitchen goods, toiletries, electronic products, clothes, and so on

and become one of the biggest suppliers in food. Tesco's policy is to rely on its clients

(Munusamy & Wong, 2008).

Applications of the strategy Clock in Tesco

"Environment is something outside of an organization which can influence organizations, present

or future activities. Therefore the environment is situational and is unique for each organization"

(J. Kew, J. Stredwick, 2005). Market environment: "Business Environment is the total of things

a value well at average prices since it gives the rivals two possibilities of taking up marketplace

share by the low prices or higher-margin goods.

The only real downside to the Strategy Timer is, it only offers valuable details if it involves more

than one competitive Company; this might be more useful, like the Ansoff Matrix, than a

comprehensive strategic research and preparation method for a case study or market analysis

(Loredana, 2017).

Chosen topic: Tesco

The reasoning for a Tesco theme is that it is one of the UK's leading supermarkets since 1995.

Tesco's success has been dramatically rising and compensated. In our review of Tesco's market

climate, we have learned in the last five years that all environmental indicators are continuously

changing. We have clarified Tesco's effective strategy by connecting it to Bowman's Clock

strategy, which allows us to understand Tesco's process over the years. The facts that show why

Tesco is the best UK supermarket are included in our assessment of Tesco. Our figures reflect

the rise in the number of customers in previous years in Tesco. In conclusion, we have both

shown the good strategic aspects of Tesco. We have always sought to do something creative that

can maintain consumer-centeredness because of customer demands in various cultural contexts.

Tesco's manager was Jack Cohen. The day he started Tesco, he managed to get £1 and profits of

£4. With activities in more than 14 countries, Tesco is recognized worldwide as the largest food

distributor. The brand "Tesco" first emerged in 1924, and the first store in London was

established. This plan has worked and is now the UK's largest supermarket. Tesco has now taken

over non-food and has grown kitchen goods, toiletries, electronic products, clothes, and so on

and become one of the biggest suppliers in food. Tesco's policy is to rely on its clients

(Munusamy & Wong, 2008).

Applications of the strategy Clock in Tesco

"Environment is something outside of an organization which can influence organizations, present

or future activities. Therefore the environment is situational and is unique for each organization"

(J. Kew, J. Stredwick, 2005). Market environment: "Business Environment is the total of things

outside businesses and industries which affect their organization or operations" (B. Wheeler,

1968). This influences the Company's priorities and plans.

The Bowman's clock is a tool to assess market competition with other rivals. "The first step is the

study of rivals, the commitment, selection, and choice of main competitors. The second stage

includes designing competitive e-marketing approaches that put the Company firmly against

rivals and give it the full competitive edge" (2008). Eight options are available:

1. Low Price: Tesco is the industry leader and must retain a shallow margin on goods. Tesco

has a low price on all its goods but relies more on the consumers than on low costs,

which other rivals actively practice.

2. Hybrid: Tesco's price is relatively low and takes measures to reinvest in the low-price

aspect, a justification for its leadership. The organization aims to navigate the

reinvestment cycle.

3. Differentiation: Tesco distinguishes itself by its core goal of providing consumers with

value-added offerings that take their main focus into account.

Concentrated differentiation: To stay faithful to its consumers in such a highly competitive

market, Tesco primarily concentrates and strengthens its relationship with its customers (Palmer,

2005).

Tesco's main driving wheel is its success in the spread of its operations in all business fields such

as financial, non-food, telecommunications, and new companies. There are a few important

points here:

1. Tesco is focused on becoming a profitable multinational retailer: it relies not only on

the UK market but also on foreign markets. They open multiple outlets again in

China, Brazil, and India.

2. Providing best service to consumers: Tesco can still give its customers a decent

service with value-added with their critical targets in the UK market.

1968). This influences the Company's priorities and plans.

The Bowman's clock is a tool to assess market competition with other rivals. "The first step is the

study of rivals, the commitment, selection, and choice of main competitors. The second stage

includes designing competitive e-marketing approaches that put the Company firmly against

rivals and give it the full competitive edge" (2008). Eight options are available:

1. Low Price: Tesco is the industry leader and must retain a shallow margin on goods. Tesco

has a low price on all its goods but relies more on the consumers than on low costs,

which other rivals actively practice.

2. Hybrid: Tesco's price is relatively low and takes measures to reinvest in the low-price

aspect, a justification for its leadership. The organization aims to navigate the

reinvestment cycle.

3. Differentiation: Tesco distinguishes itself by its core goal of providing consumers with

value-added offerings that take their main focus into account.

Concentrated differentiation: To stay faithful to its consumers in such a highly competitive

market, Tesco primarily concentrates and strengthens its relationship with its customers (Palmer,

2005).

Tesco's main driving wheel is its success in the spread of its operations in all business fields such

as financial, non-food, telecommunications, and new companies. There are a few important

points here:

1. Tesco is focused on becoming a profitable multinational retailer: it relies not only on

the UK market but also on foreign markets. They open multiple outlets again in

China, Brazil, and India.

2. Providing best service to consumers: Tesco can still give its customers a decent

service with value-added with their critical targets in the UK market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. They're suitable in both food and non-food, not only within the non-food industry but

also in the food market; they're perfect. Tesco has an outstanding and broad section to

satisfy the rising market demand for fast food goods.

4. Retail Development: it has always concentrated on improving its consumer loyalty

service businesses such as Tesco Finance and Telecommunications.

5. They won the best manufacturer in 2008 and showed their success.

References

1. C. Britton, I. Worthington, 2006, Business Environment, Pearson Education.

2. J. Kew, J. Stredwick, (2005), Business environment: Managing in a strategic context,

CIPD Publishing

3. Kotler, et-al, (2008), Principles of Marketing, Pearson's Education

4. Echchakoui, S. (2018). An analytical model that links customer-perceived value and

competitive strategies. Journal of Marketing Analytics, 6(4), 138-149.

5. Dănălache, F. (2018). The Way to Efficiency. FAIMA Business & Management

Journal, 6(2), 3-4.

6. Desai, C. (2019). Strategy and Strategic Management. In Management for Scientists.

Emerald Publishing Limited.

7. Haselwanter, S., Muskat, B., & Zehrer, A. (2016). Strategic Planning in Micro

Businesses: Adapting the Strategic Clock for Micro Firms.

8. Carlisle, Y. M., & Faulkner, D. O. (2005). The strategy of reputation. Strategic

Change, 14(8), 413-422.

9. Arshad, A., & Yazdanifard, R. (2017). Investigative Synopsis of Sony Inc.’s Strategic

Management Issues/Failures and How to Overcome Them. International Journal of

Management, Accounting & Economics, 4(9), 917-936.

10. Utrilla, P. N. C., Torraleja, F. A. G., Vázquez, A. M., & Ogáyar, M. A. (2012). How

does strategic choice affect business results? A case study of mutual guarantee

societies. International Journal of Business and Management, 7(7), 51

also in the food market; they're perfect. Tesco has an outstanding and broad section to

satisfy the rising market demand for fast food goods.

4. Retail Development: it has always concentrated on improving its consumer loyalty

service businesses such as Tesco Finance and Telecommunications.

5. They won the best manufacturer in 2008 and showed their success.

References

1. C. Britton, I. Worthington, 2006, Business Environment, Pearson Education.

2. J. Kew, J. Stredwick, (2005), Business environment: Managing in a strategic context,

CIPD Publishing

3. Kotler, et-al, (2008), Principles of Marketing, Pearson's Education

4. Echchakoui, S. (2018). An analytical model that links customer-perceived value and

competitive strategies. Journal of Marketing Analytics, 6(4), 138-149.

5. Dănălache, F. (2018). The Way to Efficiency. FAIMA Business & Management

Journal, 6(2), 3-4.

6. Desai, C. (2019). Strategy and Strategic Management. In Management for Scientists.

Emerald Publishing Limited.

7. Haselwanter, S., Muskat, B., & Zehrer, A. (2016). Strategic Planning in Micro

Businesses: Adapting the Strategic Clock for Micro Firms.

8. Carlisle, Y. M., & Faulkner, D. O. (2005). The strategy of reputation. Strategic

Change, 14(8), 413-422.

9. Arshad, A., & Yazdanifard, R. (2017). Investigative Synopsis of Sony Inc.’s Strategic

Management Issues/Failures and How to Overcome Them. International Journal of

Management, Accounting & Economics, 4(9), 917-936.

10. Utrilla, P. N. C., Torraleja, F. A. G., Vázquez, A. M., & Ogáyar, M. A. (2012). How

does strategic choice affect business results? A case study of mutual guarantee

societies. International Journal of Business and Management, 7(7), 51

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11. Hussain, S., Khattak, J., Rizwan, A., & Latif, M. A. (2013). ANSOFF matrix,

environment, and growth-an an interactive triangle. Management and Administrative

Sciences Review, 2(2), 196-206

12. Loredana, E. M. (2017). The use of Ansoff matrix in the field of business. Annals-

Economy Series, 2, 141-149.

13. Munusamy, J., & Wong, C. H. (2008). Relationship between marketing mix strategy

and consumer motive: an empirical study in major Tesco stores. Unitar e-

journal, 4(2), 41-56.

14. Palmer, M. (2005). Retail multinational learning: a case study of Tesco. International

journal of retail & distribution management.

15. Coe, N. M., & Lee, Y. S. (2006). The strategic localization of transnational retailers:

The case of Samsung‐Tesco in South Korea. Economic Geography, 82(1), 61-88.

environment, and growth-an an interactive triangle. Management and Administrative

Sciences Review, 2(2), 196-206

12. Loredana, E. M. (2017). The use of Ansoff matrix in the field of business. Annals-

Economy Series, 2, 141-149.

13. Munusamy, J., & Wong, C. H. (2008). Relationship between marketing mix strategy

and consumer motive: an empirical study in major Tesco stores. Unitar e-

journal, 4(2), 41-56.

14. Palmer, M. (2005). Retail multinational learning: a case study of Tesco. International

journal of retail & distribution management.

15. Coe, N. M., & Lee, Y. S. (2006). The strategic localization of transnational retailers:

The case of Samsung‐Tesco in South Korea. Economic Geography, 82(1), 61-88.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.