Detailed Business Environment Analysis Report: British Gas Company

VerifiedAdded on 2023/06/08

|12

|2934

|374

Report

AI Summary

This report provides a comprehensive business environment analysis of British Gas, a prominent home and energy service provider in the UK. It examines both internal and external factors impacting the company's growth. The external analysis utilizes PESTEL, Porter's Five Forces, and resource-based value analysis to assess the competitive landscape, market trends, and potential threats and opportunities. The internal analysis employs VRIO, value chain analysis, and SWOT analysis to evaluate the company's resources, capabilities, and strategic advantages. The report delves into political, economic, social, technological, environmental, and legal factors (PESTEL), competitive forces, and the company's strengths, weaknesses, opportunities, and threats (SWOT). It concludes with a summary of findings and recommendations for British Gas's strategic direction. The analysis highlights the company's brand image, manufacturing capacity, innovation capabilities, and engineering staff as key assets, while also acknowledging challenges such as dependence on the wholesale market and competition from other energy providers. The report aims to provide insights into British Gas's competitive position and strategic options for future success.

Strategic Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

This report cover a business environment analysis of British Gas thorough examine of

internal and external analysis to identify every existing or upcoming factor that may or may not

affect companies growth in upcoming future. To analyse external factor the tools such as,

PESTLE, Porter's five forces and resource based value analysis and to analyse internal factor the

tools such as, VRIO, value chain and SWOT analysis.

This report cover a business environment analysis of British Gas thorough examine of

internal and external analysis to identify every existing or upcoming factor that may or may not

affect companies growth in upcoming future. To analyse external factor the tools such as,

PESTLE, Porter's five forces and resource based value analysis and to analyse internal factor the

tools such as, VRIO, value chain and SWOT analysis.

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Business Environment Analysis Of British Gas..............................................................................1

EXTERNAL ANALYSIS......................................................................................................1

1 PESTEL...............................................................................................................................1

2 Porter's Five Forces.............................................................................................................2

3 Resource Based Value.........................................................................................................3

INTERNAL ANALYSIS.......................................................................................................4

1 VRIO...................................................................................................................................4

2 Value Chain.........................................................................................................................6

3 SWOT..................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES .............................................................................................................................10

EXECUTIVE SUMMARY.............................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Business Environment Analysis Of British Gas..............................................................................1

EXTERNAL ANALYSIS......................................................................................................1

1 PESTEL...............................................................................................................................1

2 Porter's Five Forces.............................................................................................................2

3 Resource Based Value.........................................................................................................3

INTERNAL ANALYSIS.......................................................................................................4

1 VRIO...................................................................................................................................4

2 Value Chain.........................................................................................................................6

3 SWOT..................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES .............................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Strategic management is a process of procedure, objectives and setting goals in order to

give organisation a competitive advantage. (Siegel and Leih, 2018) British Gas is a home and

energy service provider in the United kingdom,(Telecom and Energy, British Gas’’) it was

founded in 1977 with headquartered in England, UK. In this report there will be a discussion of

business environment analysis of company with the help of external analysis through PESTEL,

Porter's five forces and resource based value, to understand companies competitive position with

its structure and market detail through current trends and future trends with key drives of market.

Lastly a internal analysis through VIRO, value chain and SWOT analysis, to understand the

resources and capabilities of firm that will impact on success of organisation.

MAIN BODY

Business Environment Analysis Of British Gas

Business environment analysis refers to aggregation of organisation, people and other

forces that may impact on industry with their operation and production level.(Betti and Sarens,

2020) It also helps in identifying business opportunities, resources, planning and improvements

made in performance, growth and profitability of organisation.

EXTERNAL ANALYSIS

External analysis helps in examining business environment of organisation that includes

factors as competitive structure, dynamics, history, market trends and competitive position, it

helps in analysing external factors through global, social, demographical, technological and

political analysis of company.(Erbas, 2019) To analysis external factor of British Gas with the

use of analysis tool such as,

1 PESTEL

PESTEL analysis provides a framework that can be used by company to monitor the

external factor of the organisation.

Political Factor-

Political factor has various effect on British Gas which cause risk due to different

government policies that provide a sustainable energy, low carbon and a climate resilient

development,(Alves Ribeiro Rosa, Armellini and Robert, 2021, June) Also due to recent

1

Strategic management is a process of procedure, objectives and setting goals in order to

give organisation a competitive advantage. (Siegel and Leih, 2018) British Gas is a home and

energy service provider in the United kingdom,(Telecom and Energy, British Gas’’) it was

founded in 1977 with headquartered in England, UK. In this report there will be a discussion of

business environment analysis of company with the help of external analysis through PESTEL,

Porter's five forces and resource based value, to understand companies competitive position with

its structure and market detail through current trends and future trends with key drives of market.

Lastly a internal analysis through VIRO, value chain and SWOT analysis, to understand the

resources and capabilities of firm that will impact on success of organisation.

MAIN BODY

Business Environment Analysis Of British Gas

Business environment analysis refers to aggregation of organisation, people and other

forces that may impact on industry with their operation and production level.(Betti and Sarens,

2020) It also helps in identifying business opportunities, resources, planning and improvements

made in performance, growth and profitability of organisation.

EXTERNAL ANALYSIS

External analysis helps in examining business environment of organisation that includes

factors as competitive structure, dynamics, history, market trends and competitive position, it

helps in analysing external factors through global, social, demographical, technological and

political analysis of company.(Erbas, 2019) To analysis external factor of British Gas with the

use of analysis tool such as,

1 PESTEL

PESTEL analysis provides a framework that can be used by company to monitor the

external factor of the organisation.

Political Factor-

Political factor has various effect on British Gas which cause risk due to different

government policies that provide a sustainable energy, low carbon and a climate resilient

development,(Alves Ribeiro Rosa, Armellini and Robert, 2021, June) Also due to recent

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

pandemic COVID-19 its impact cause major effects on operation of company, and trading

policies always has a effect.

Economic Factor-

Economic factor has huge impact on British Gas such as, monetary policy, inflation,

interest rate, economic growth and fiscal there is pressure from UK government on inflationary.

Constant changes in policies impact economic growth of the company.

Social Factor-

Social factor has a impact on British Gas as there are various aspects related to social

cultural of society education level as it is increasing there is a expansion on leverage on presence

of company, migration is also biggest factor that cause effects on operation as people are

migrating internationally which is negative impact on business.

Technological Factor-

Constant change in technology cause impact on operation of British Gas, technological

innovation has a fast disruption on supply chain because it provides access to information to

energy industry. (Jafari and Othman Soleiman, 2020)As there are various changes in production

and operation due to technology innovation such as, it lowers production cost, increase

empowerment supply chain and more.

Environment Factor-

Environmental factor has a impact on British Gas as there are various government in

protecting environment with the help of different laws regulation on pollution, safe disposal,

hazardous material, limiting carbon footprints, climate change.

Legal Factor-

There are various laws and regulation that may affect operation such as employment law

and national minimum laws, in context of British Gas company providing energy there are are

various laws impact on business operation as with every legal regulation company needs to take

them into consideration for successful operation.

2 Porter's Five Forces

Porter's five forces analysis provides a framework for organisation in competitive

environment through competitive rivals, suppliers, customers, substitute products and potential

new market entrants that will influence firm's profit & position in market.(Hafezi and et. al.,

2020) The main purpose of this analyse is to determine future potentiality of profit in market,

2

policies always has a effect.

Economic Factor-

Economic factor has huge impact on British Gas such as, monetary policy, inflation,

interest rate, economic growth and fiscal there is pressure from UK government on inflationary.

Constant changes in policies impact economic growth of the company.

Social Factor-

Social factor has a impact on British Gas as there are various aspects related to social

cultural of society education level as it is increasing there is a expansion on leverage on presence

of company, migration is also biggest factor that cause effects on operation as people are

migrating internationally which is negative impact on business.

Technological Factor-

Constant change in technology cause impact on operation of British Gas, technological

innovation has a fast disruption on supply chain because it provides access to information to

energy industry. (Jafari and Othman Soleiman, 2020)As there are various changes in production

and operation due to technology innovation such as, it lowers production cost, increase

empowerment supply chain and more.

Environment Factor-

Environmental factor has a impact on British Gas as there are various government in

protecting environment with the help of different laws regulation on pollution, safe disposal,

hazardous material, limiting carbon footprints, climate change.

Legal Factor-

There are various laws and regulation that may affect operation such as employment law

and national minimum laws, in context of British Gas company providing energy there are are

various laws impact on business operation as with every legal regulation company needs to take

them into consideration for successful operation.

2 Porter's Five Forces

Porter's five forces analysis provides a framework for organisation in competitive

environment through competitive rivals, suppliers, customers, substitute products and potential

new market entrants that will influence firm's profit & position in market.(Hafezi and et. al.,

2020) The main purpose of this analyse is to determine future potentiality of profit in market,

2

through which identify current position of organisation competitive market. The five elements

through which it take shape framework are-

Competition among existing competitors-

Competition in exiting market is high as there are various companies providing better

services offering energy and gas in market with much cheaper cost and with new technology, the

biggest competitors of the organisation are- Southern Electric, Npower, Synergy, Country

Energy, Opus Energy and ActewAGL.

Bargaining power of customers-

The bargaining power of customer is significantly moderate because of nature this

industry as British Gas is top company which make some loyal customers,(Hartmann, Inkpen

and Ramaswamy, 2021) but since there are other similar companies offering uncanny services in

market which gives power to customers shift to other brand.

Bargaining power of suppliers-

The bargaining power of supplier is significantly moderate because as brand image of

organisation is high in market which impact on supplier to provide products on term of company

but since there are similar companies available in market some supplier shift to other, which

make supplier power moderate.

Threats of new entrants-

The threats of new entrants is relatable low because getting into this industry requires

huge amount of investments and needs various permission before starting business, also

company is well established in market which proves low threat on organisation from new

entrants.

Threat of substitute product-

Threat of substitute product presence in market is significantly moderate because there

are similar service and products available in market for customers with much cheaper and low

quality products/ services, (Caineng and et. al., 2020) but since British Gas offers high quality

and less carbon produce products and service which give benefits to company to establish in

market.

3 Resource Based Value

The resource based value provides a managerial framework to determine strategic

resources of company that can be exploit to achieve a sustainable advantage in competitive,(Katz

3

through which it take shape framework are-

Competition among existing competitors-

Competition in exiting market is high as there are various companies providing better

services offering energy and gas in market with much cheaper cost and with new technology, the

biggest competitors of the organisation are- Southern Electric, Npower, Synergy, Country

Energy, Opus Energy and ActewAGL.

Bargaining power of customers-

The bargaining power of customer is significantly moderate because of nature this

industry as British Gas is top company which make some loyal customers,(Hartmann, Inkpen

and Ramaswamy, 2021) but since there are other similar companies offering uncanny services in

market which gives power to customers shift to other brand.

Bargaining power of suppliers-

The bargaining power of supplier is significantly moderate because as brand image of

organisation is high in market which impact on supplier to provide products on term of company

but since there are similar companies available in market some supplier shift to other, which

make supplier power moderate.

Threats of new entrants-

The threats of new entrants is relatable low because getting into this industry requires

huge amount of investments and needs various permission before starting business, also

company is well established in market which proves low threat on organisation from new

entrants.

Threat of substitute product-

Threat of substitute product presence in market is significantly moderate because there

are similar service and products available in market for customers with much cheaper and low

quality products/ services, (Caineng and et. al., 2020) but since British Gas offers high quality

and less carbon produce products and service which give benefits to company to establish in

market.

3 Resource Based Value

The resource based value provides a managerial framework to determine strategic

resources of company that can be exploit to achieve a sustainable advantage in competitive,(Katz

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

and Pietrobelli, 2018) It also helps in company to achieve a visibility a efficiency in allocation of

resources, helps to maintain a advantages in competition and a cross-functional usages of

resources.

The Tangible Resources of British Gas which helps in competitive advantages are there

products as company is offering Gas, Electricity, Boilers, Central Heating, Plumbing, Drainage

System, Renewable Energy and Home appliance services with less carbon produce. Company is

taken into consideration of environment and provide service/ products according to current

situation.

The Intangible Resources are non physical assets of company that plays a significant

role for organisation's competitiveness, as it is main source to sustain in advantage of

competition.The resources of firm are valuable, difficult to imitate, rare and non-substitutable

which provides advantages in competition, and with high brand value with unique trade mark of

the organisation it gives benefits to stay on top of competitive market.

INTERNAL ANALYSIS

Internal analysis refers to identify companies internal elements resources, processes and

assets,(Anokhina, Maksimov and Seredina, 2019). To analysis internal factors of British Gas

with the help of analysis tools such as,

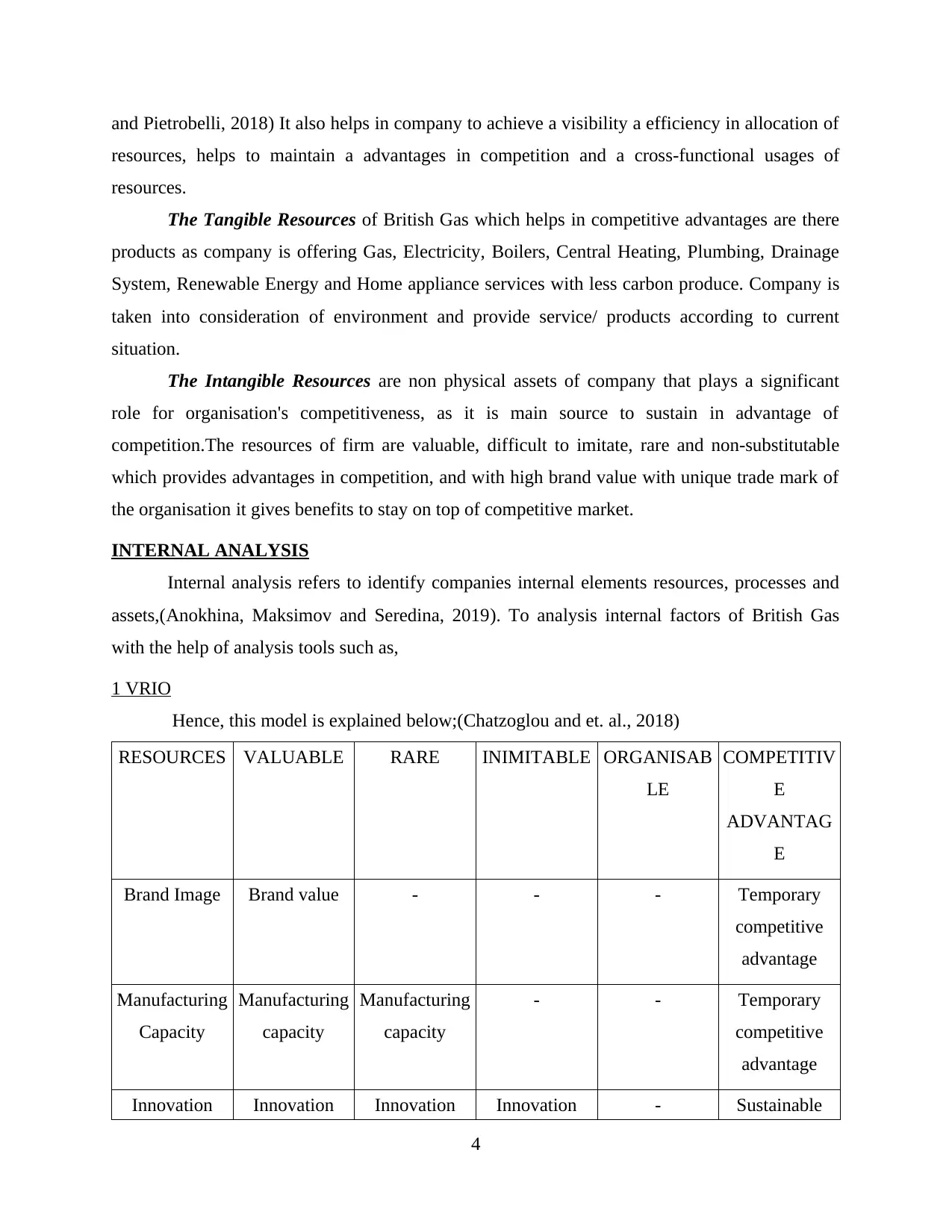

1 VRIO

Hence, this model is explained below;(Chatzoglou and et. al., 2018)

RESOURCES VALUABLE RARE INIMITABLE ORGANISAB

LE

COMPETITIV

E

ADVANTAG

E

Brand Image Brand value - - - Temporary

competitive

advantage

Manufacturing

Capacity

Manufacturing

capacity

Manufacturing

capacity

- - Temporary

competitive

advantage

Innovation Innovation Innovation Innovation - Sustainable

4

resources, helps to maintain a advantages in competition and a cross-functional usages of

resources.

The Tangible Resources of British Gas which helps in competitive advantages are there

products as company is offering Gas, Electricity, Boilers, Central Heating, Plumbing, Drainage

System, Renewable Energy and Home appliance services with less carbon produce. Company is

taken into consideration of environment and provide service/ products according to current

situation.

The Intangible Resources are non physical assets of company that plays a significant

role for organisation's competitiveness, as it is main source to sustain in advantage of

competition.The resources of firm are valuable, difficult to imitate, rare and non-substitutable

which provides advantages in competition, and with high brand value with unique trade mark of

the organisation it gives benefits to stay on top of competitive market.

INTERNAL ANALYSIS

Internal analysis refers to identify companies internal elements resources, processes and

assets,(Anokhina, Maksimov and Seredina, 2019). To analysis internal factors of British Gas

with the help of analysis tools such as,

1 VRIO

Hence, this model is explained below;(Chatzoglou and et. al., 2018)

RESOURCES VALUABLE RARE INIMITABLE ORGANISAB

LE

COMPETITIV

E

ADVANTAG

E

Brand Image Brand value - - - Temporary

competitive

advantage

Manufacturing

Capacity

Manufacturing

capacity

Manufacturing

capacity

- - Temporary

competitive

advantage

Innovation Innovation Innovation Innovation - Sustainable

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

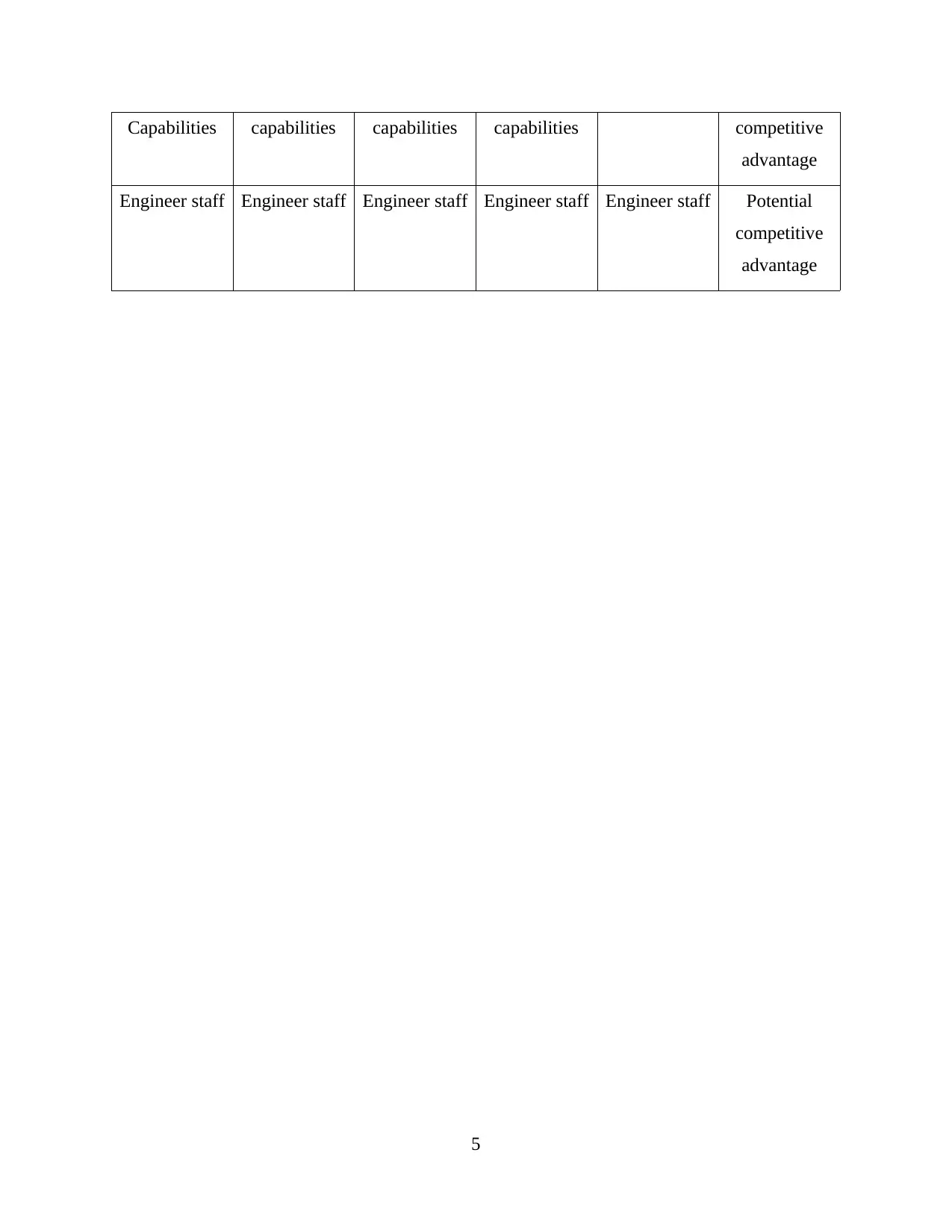

Capabilities capabilities capabilities capabilities competitive

advantage

Engineer staff Engineer staff Engineer staff Engineer staff Engineer staff Potential

competitive

advantage

5

advantage

Engineer staff Engineer staff Engineer staff Engineer staff Engineer staff Potential

competitive

advantage

5

VALUABLE:

Brand image- brand image of British gas is highly valuable, its presence in market and

has a strong establishment in market.

Manufacturing capacity- the manufacturing capacity of company is valuable which

allows benefits in market.

Innovation capabilities- the innovation capabilities of the company is valuable which give

advantage in market.

Engineer staff- it is responsible in developing offering in market and make new

innovation by understanding market needs, hence it quite valuable for British Gas.

RARE:

Manufacturing capacity- the manufacturing capacity of company is rare, which allows

many benefits in market.

Innovation capabilities- the innovation capabilities of organisation is rare which give a

benefit in competitive market.

Engineer staff- as every engineer has their own unique quality which make them rare and

give many benefits in offering products to market.

INIMITABLE:

Innovation capabilities- as company if offering energy and electricity in market which

make is easy to inimitable which give a sustainable competitive advantage in market.

Engineer staff- the talent can not be limited to staff which gives potential benefit in

market.

ORGANISABLE:

engineer staff- the employee of company is organisable which give much benefit in

operating and production level of the organisation which allow potential advantage in

competitive.

2 Value Chain

Value chain analysis refers to evaluation of each activity in firm's value chain which help

in understanding opportunity for improvement, helps in conducting a value chain analysis to

prompts each step adds and subtracts value for getting final product and service.(Ricciotti, 2020)

A value chain refers to full range, of iterative activities organisation uses to create products and

6

Brand image- brand image of British gas is highly valuable, its presence in market and

has a strong establishment in market.

Manufacturing capacity- the manufacturing capacity of company is valuable which

allows benefits in market.

Innovation capabilities- the innovation capabilities of the company is valuable which give

advantage in market.

Engineer staff- it is responsible in developing offering in market and make new

innovation by understanding market needs, hence it quite valuable for British Gas.

RARE:

Manufacturing capacity- the manufacturing capacity of company is rare, which allows

many benefits in market.

Innovation capabilities- the innovation capabilities of organisation is rare which give a

benefit in competitive market.

Engineer staff- as every engineer has their own unique quality which make them rare and

give many benefits in offering products to market.

INIMITABLE:

Innovation capabilities- as company if offering energy and electricity in market which

make is easy to inimitable which give a sustainable competitive advantage in market.

Engineer staff- the talent can not be limited to staff which gives potential benefit in

market.

ORGANISABLE:

engineer staff- the employee of company is organisable which give much benefit in

operating and production level of the organisation which allow potential advantage in

competitive.

2 Value Chain

Value chain analysis refers to evaluation of each activity in firm's value chain which help

in understanding opportunity for improvement, helps in conducting a value chain analysis to

prompts each step adds and subtracts value for getting final product and service.(Ricciotti, 2020)

A value chain refers to full range, of iterative activities organisation uses to create products and

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

services, main purpose is to analysis in increasing of production efficiency to company that can

be deliver maximum value in least possible cost.

Primary activities:

Primary activities are those activities that go directly into creation and production of

services/ products in execution that includes,

Inbound logistics- it includes all activities that are related in receiving, warehouse, and

every inventory management source such as material & elements, it also includes

sourcing of elements for making products of the organisation.

Operation- it includes all activities related to making raw material into final products that

means all material coming from inbound logistics in operation unit those material and

components into finished products.

After-sales services- activities that can take place after offering to customers that

includes installation, quality assurance, repair and customers services.

Secondary activities:

Secondary activities are that are more efficient and effectively in creating advantages for

competitive that includes,

Procurement- it includes all activities related to sourcing components, raw materials,

equipments and services.

Technological development- it includes activities that are related to development and

research which further includes market research, process development and product

services.

Infrastructure- it includes all activities related to organisation's management and

infrastructure that includes financing, planning and land for production.

3 SWOT

SWOT analysis provides a framework that helps to identify and analysing companies

strength, weakness, opportunity and threats, its main focus is to increase awareness about factors

that can affect business decision-making or strategies. In context to British Gas the SWOT

analysis are mentioned below,

Strength:

British Gas is well established in UK, it has a domination over gas and electricity

provider in market with over 24% market share.(Hajizadeh, 2019)Company has unique

7

be deliver maximum value in least possible cost.

Primary activities:

Primary activities are those activities that go directly into creation and production of

services/ products in execution that includes,

Inbound logistics- it includes all activities that are related in receiving, warehouse, and

every inventory management source such as material & elements, it also includes

sourcing of elements for making products of the organisation.

Operation- it includes all activities related to making raw material into final products that

means all material coming from inbound logistics in operation unit those material and

components into finished products.

After-sales services- activities that can take place after offering to customers that

includes installation, quality assurance, repair and customers services.

Secondary activities:

Secondary activities are that are more efficient and effectively in creating advantages for

competitive that includes,

Procurement- it includes all activities related to sourcing components, raw materials,

equipments and services.

Technological development- it includes activities that are related to development and

research which further includes market research, process development and product

services.

Infrastructure- it includes all activities related to organisation's management and

infrastructure that includes financing, planning and land for production.

3 SWOT

SWOT analysis provides a framework that helps to identify and analysing companies

strength, weakness, opportunity and threats, its main focus is to increase awareness about factors

that can affect business decision-making or strategies. In context to British Gas the SWOT

analysis are mentioned below,

Strength:

British Gas is well established in UK, it has a domination over gas and electricity

provider in market with over 24% market share.(Hajizadeh, 2019)Company has unique

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

technological innovation that firm was first to introduce mobile controlled heating and electricity

generating boilers in market.

Weakness:

Weakness of British Gas are that it has situation on dependency on wholesale market

which sometimes cause affect company, also as government hikes price range which cause

slump situation in customer base.

Opportunities:

British Gas has huge opportunities that includes growing further in residential and

commercial market of UK with gas and electricity, since there is huge demand of such smart app

company has potentials in offering to millions of customers across globe.

Threats:

The threats that can affect British Gas growth is that there are rising of power cost in

Northern sea which led to weak in economy of gas storage fired gas power generation system in

UK region, also due to increase in electricity prices and wholesale rate of gas it affect growth of

company in future aspects. (Vikane, Selvik and Abrahamsen, 2021, September)Organisation is

facing quite competition from EDF Energy, EON, Scottish-power, SSE and Npower, also legal

challenges can cause threats on company growth.

CONCLUSION

From the above report it concluded that British Gas strong establishment in market due

which most of the external factor may not affect company but there are some factor that will

directly affects companies growth and future success. From external analysis with the help of

PESTEL, Porter's five force and resource based value analysis it shows that company has strong

base. After analysing internal factors of organisation it shows that firm has strong operation and

production level and any internal factor that may affect companies operation will probably not

affect enterprise growth but still from analysing VRIO, value chain and SWOT analysis there are

some factor that can affect organisation's growth and to resolve those situation company can take

them into consideration and develop them into new strategic plan for profits and success.

8

generating boilers in market.

Weakness:

Weakness of British Gas are that it has situation on dependency on wholesale market

which sometimes cause affect company, also as government hikes price range which cause

slump situation in customer base.

Opportunities:

British Gas has huge opportunities that includes growing further in residential and

commercial market of UK with gas and electricity, since there is huge demand of such smart app

company has potentials in offering to millions of customers across globe.

Threats:

The threats that can affect British Gas growth is that there are rising of power cost in

Northern sea which led to weak in economy of gas storage fired gas power generation system in

UK region, also due to increase in electricity prices and wholesale rate of gas it affect growth of

company in future aspects. (Vikane, Selvik and Abrahamsen, 2021, September)Organisation is

facing quite competition from EDF Energy, EON, Scottish-power, SSE and Npower, also legal

challenges can cause threats on company growth.

CONCLUSION

From the above report it concluded that British Gas strong establishment in market due

which most of the external factor may not affect company but there are some factor that will

directly affects companies growth and future success. From external analysis with the help of

PESTEL, Porter's five force and resource based value analysis it shows that company has strong

base. After analysing internal factors of organisation it shows that firm has strong operation and

production level and any internal factor that may affect companies operation will probably not

affect enterprise growth but still from analysing VRIO, value chain and SWOT analysis there are

some factor that can affect organisation's growth and to resolve those situation company can take

them into consideration and develop them into new strategic plan for profits and success.

8

REFERENCES

Books and Journals

Alves Ribeiro Rosa, J.G., Armellini, F. and Robert, J.M., 2021, June. Capturing Future Trends in

Customer Needs for the Design of Next-Generation Gas Station Services. In Congress

of the International Ergonomics Association (pp. 781-787). Springer, Cham.

Anokhina, M.E., Maksimov, M.I. and Seredina, N.S., 2019. A guide to contemporary strategic

analysis.

Betti, N. and Sarens, G., 2020. Understanding the internal audit function in a digitalised business

environment. Journal of Accounting & Organizational Change.

Caineng, Z.O.U. and et. al., 2020. Shale oil and gas revolution and its impact. Acta Petrolei

Sinica, 41(1), p.1.

Chatzoglou, P. and et. al., 2018. The role of firm-specific factors in the strategy-performance

relationship: Revisiting the resource-based view of the firm and the VRIO

framework. Management Research Review.

Erbas, D.G., 2019. Identification and application of most important stages of strategic planning

on local US Business. TURAN-SAM, 11(43), pp.462-467.

Hafezi, R. and et. al., 2020. Iran in the emerging global natural gas market: A scenario-based

competitive analysis and policy assessment. Resources Policy, 68, p.101790.

Hajizadeh, Y., 2019. Machine learning in oil and gas; a SWOT analysis approach. Journal of

Petroleum Science and Engineering, 176, pp.661-663.

Hartmann, J., Inkpen, A.C. and Ramaswamy, K., 2021. Different shades of green: Global oil and

gas companies and renewable energy. Journal of International Business Studies, 52(5),

pp.879-903.

Jafari, H. and Othman Soleiman, K., 2020. Assessment of effective environmental factors in oil

and gas industry policies using PESTLE & SWOT analysis (case study: Kurdistan,

Iraq). Environmental Sciences, 18(3), pp.134-151.

Katz, J. and Pietrobelli, C., 2018. Natural resource based growth, global value chains and

domestic capabilities in the mining industry. Resources Policy, 58, pp.11-20.

Ricciotti, F., 2020. From value chain to value network: a systematic literature

review. Management Review Quarterly, 70(2), pp.191-212.

Siegel, D.S. and Leih, S., 2018. Strategic management theory and universities: An overview of

the Special Issue. Strategic Organization, 16(1), pp.6-11.

Telecom, B. and Energy, E.D.F., British Gas’’. Accounting, Organizations and Society, 22(7).

Vikane, R., Selvik, J.T. and Abrahamsen, E.B., 2021, September. Initiatives in UK Offshore

Decommissioning Following the Wood Review: Applicability for Decommissioning in

Norway. In SPE Offshore Europe Conference & Exhibition. OnePetro.

9

Books and Journals

Alves Ribeiro Rosa, J.G., Armellini, F. and Robert, J.M., 2021, June. Capturing Future Trends in

Customer Needs for the Design of Next-Generation Gas Station Services. In Congress

of the International Ergonomics Association (pp. 781-787). Springer, Cham.

Anokhina, M.E., Maksimov, M.I. and Seredina, N.S., 2019. A guide to contemporary strategic

analysis.

Betti, N. and Sarens, G., 2020. Understanding the internal audit function in a digitalised business

environment. Journal of Accounting & Organizational Change.

Caineng, Z.O.U. and et. al., 2020. Shale oil and gas revolution and its impact. Acta Petrolei

Sinica, 41(1), p.1.

Chatzoglou, P. and et. al., 2018. The role of firm-specific factors in the strategy-performance

relationship: Revisiting the resource-based view of the firm and the VRIO

framework. Management Research Review.

Erbas, D.G., 2019. Identification and application of most important stages of strategic planning

on local US Business. TURAN-SAM, 11(43), pp.462-467.

Hafezi, R. and et. al., 2020. Iran in the emerging global natural gas market: A scenario-based

competitive analysis and policy assessment. Resources Policy, 68, p.101790.

Hajizadeh, Y., 2019. Machine learning in oil and gas; a SWOT analysis approach. Journal of

Petroleum Science and Engineering, 176, pp.661-663.

Hartmann, J., Inkpen, A.C. and Ramaswamy, K., 2021. Different shades of green: Global oil and

gas companies and renewable energy. Journal of International Business Studies, 52(5),

pp.879-903.

Jafari, H. and Othman Soleiman, K., 2020. Assessment of effective environmental factors in oil

and gas industry policies using PESTLE & SWOT analysis (case study: Kurdistan,

Iraq). Environmental Sciences, 18(3), pp.134-151.

Katz, J. and Pietrobelli, C., 2018. Natural resource based growth, global value chains and

domestic capabilities in the mining industry. Resources Policy, 58, pp.11-20.

Ricciotti, F., 2020. From value chain to value network: a systematic literature

review. Management Review Quarterly, 70(2), pp.191-212.

Siegel, D.S. and Leih, S., 2018. Strategic management theory and universities: An overview of

the Special Issue. Strategic Organization, 16(1), pp.6-11.

Telecom, B. and Energy, E.D.F., British Gas’’. Accounting, Organizations and Society, 22(7).

Vikane, R., Selvik, J.T. and Abrahamsen, E.B., 2021, September. Initiatives in UK Offshore

Decommissioning Following the Wood Review: Applicability for Decommissioning in

Norway. In SPE Offshore Europe Conference & Exhibition. OnePetro.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.