Business Analytics: Costing, Revenue, and Competitive Advantage

VerifiedAdded on 2023/06/18

|15

|4345

|165

Report

AI Summary

This business analytics report delves into various aspects of a company's financial and marketing performance. It includes a mathematical model for cost analysis, profit/loss calculations, and a five-year projection plan, highlighting the relationship between costs and revenue. The report also examines the correlation between advertising expenditure and sales, using a scatter diagram to visualize the relationship. Furthermore, it calculates break-even points and margins of safety for different business options, discussing factors to consider before making strategic decisions, along with the benefits and limitations of the break-even model. The analysis aims to provide insights for strategic planning and decision-making, ultimately supporting the company's future obligations and business objectives. Desklib offers similar solved assignments and past papers for students.

BUSINESS ANALYTIC

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

QUESTION- 1.................................................................................................................................1

a) Mathematical model for cost...................................................................................................1

b) Calculation of the profit or loss for CF ltd..............................................................................1

c) Five-year projection plan for the business...............................................................................1

d) Analysis of the costing and revenue behaviour.......................................................................1

QUESTION- 2.................................................................................................................................1

a) Calculation of correlation coefficient of advertising and sales...............................................1

b) Scatter diagram and the pattern of relationship of the two variables......................................1

c) Impact of the advertising expenditure on sales and advice regarding how the company can

gain competitive advantage by using the marketing tactics........................................................1

QUESTION- 3.................................................................................................................................1

a) Calculation of the break-even point and margin of safety for the different options in the

company.......................................................................................................................................2

b) Reasons for adopting a particular plan for the Mansleep plc..................................................5

c) Factors that needs to be considered before committing to a particular course of action.........5

d) Benefits and limitations of the break-even model...................................................................6

Application of the break-even model in marginal costing and the formulation of the business

strategy.........................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

TABLE OF CONTENTS................................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

QUESTION- 1.................................................................................................................................1

a) Mathematical model for cost...................................................................................................1

b) Calculation of the profit or loss for CF ltd..............................................................................1

c) Five-year projection plan for the business...............................................................................1

d) Analysis of the costing and revenue behaviour.......................................................................1

QUESTION- 2.................................................................................................................................1

a) Calculation of correlation coefficient of advertising and sales...............................................1

b) Scatter diagram and the pattern of relationship of the two variables......................................1

c) Impact of the advertising expenditure on sales and advice regarding how the company can

gain competitive advantage by using the marketing tactics........................................................1

QUESTION- 3.................................................................................................................................1

a) Calculation of the break-even point and margin of safety for the different options in the

company.......................................................................................................................................2

b) Reasons for adopting a particular plan for the Mansleep plc..................................................5

c) Factors that needs to be considered before committing to a particular course of action.........5

d) Benefits and limitations of the break-even model...................................................................6

Application of the break-even model in marginal costing and the formulation of the business

strategy.........................................................................................................................................7

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUCTION

Business analytic is the process using which the companies shall be applying the

statistical tools on the historical data that is available in order to generate the deeper insights

regarding the same. Further this analysis regarding the various important factors and their

interrelationship shall be helpful in generating the meaningful decisions for the company. It shall

be assisting in providing the strategic direction to the company and accordingly shall be defining

the competencies in the market. The current project shall be dealing with the similar business

problems and data analysis in order to define the relationship of the different variables in the

business and which shall be contributing to the success of the organization. The mathematical

models shall be defined, the statistical techniques like the correlation shall be incorporated and

apart from that the break-even model to analyse the interrelationship among the different variants

of the business. This can further lead to the strategical planning and decision making in the entity

to support its future obligations and fulfil the required business objectives.

MAIN BODY

QUESTION- 1

a) Mathematical model for cost

Particulars Amount

Annual output 200000

Fixed cost 80000

Variable cost (per unit) 0.65

Sales price (per unit) 3

The mathematical model shall be showing the function that is being followed in the

business which shall be leading to the calculations that can be made at the various levels of the

sales that are being executed in the company. The model that is being used in the above scenario

is Sales – Variable cost – Fixed cost= Profits. The costs in the company can be divided into two

parts one is the variable cost which remains constant per unit and the fixed cost remains constant

in the company in totality. So with the help of this function any value in the equation can be

found out.

1

Business analytic is the process using which the companies shall be applying the

statistical tools on the historical data that is available in order to generate the deeper insights

regarding the same. Further this analysis regarding the various important factors and their

interrelationship shall be helpful in generating the meaningful decisions for the company. It shall

be assisting in providing the strategic direction to the company and accordingly shall be defining

the competencies in the market. The current project shall be dealing with the similar business

problems and data analysis in order to define the relationship of the different variables in the

business and which shall be contributing to the success of the organization. The mathematical

models shall be defined, the statistical techniques like the correlation shall be incorporated and

apart from that the break-even model to analyse the interrelationship among the different variants

of the business. This can further lead to the strategical planning and decision making in the entity

to support its future obligations and fulfil the required business objectives.

MAIN BODY

QUESTION- 1

a) Mathematical model for cost

Particulars Amount

Annual output 200000

Fixed cost 80000

Variable cost (per unit) 0.65

Sales price (per unit) 3

The mathematical model shall be showing the function that is being followed in the

business which shall be leading to the calculations that can be made at the various levels of the

sales that are being executed in the company. The model that is being used in the above scenario

is Sales – Variable cost – Fixed cost= Profits. The costs in the company can be divided into two

parts one is the variable cost which remains constant per unit and the fixed cost remains constant

in the company in totality. So with the help of this function any value in the equation can be

found out.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

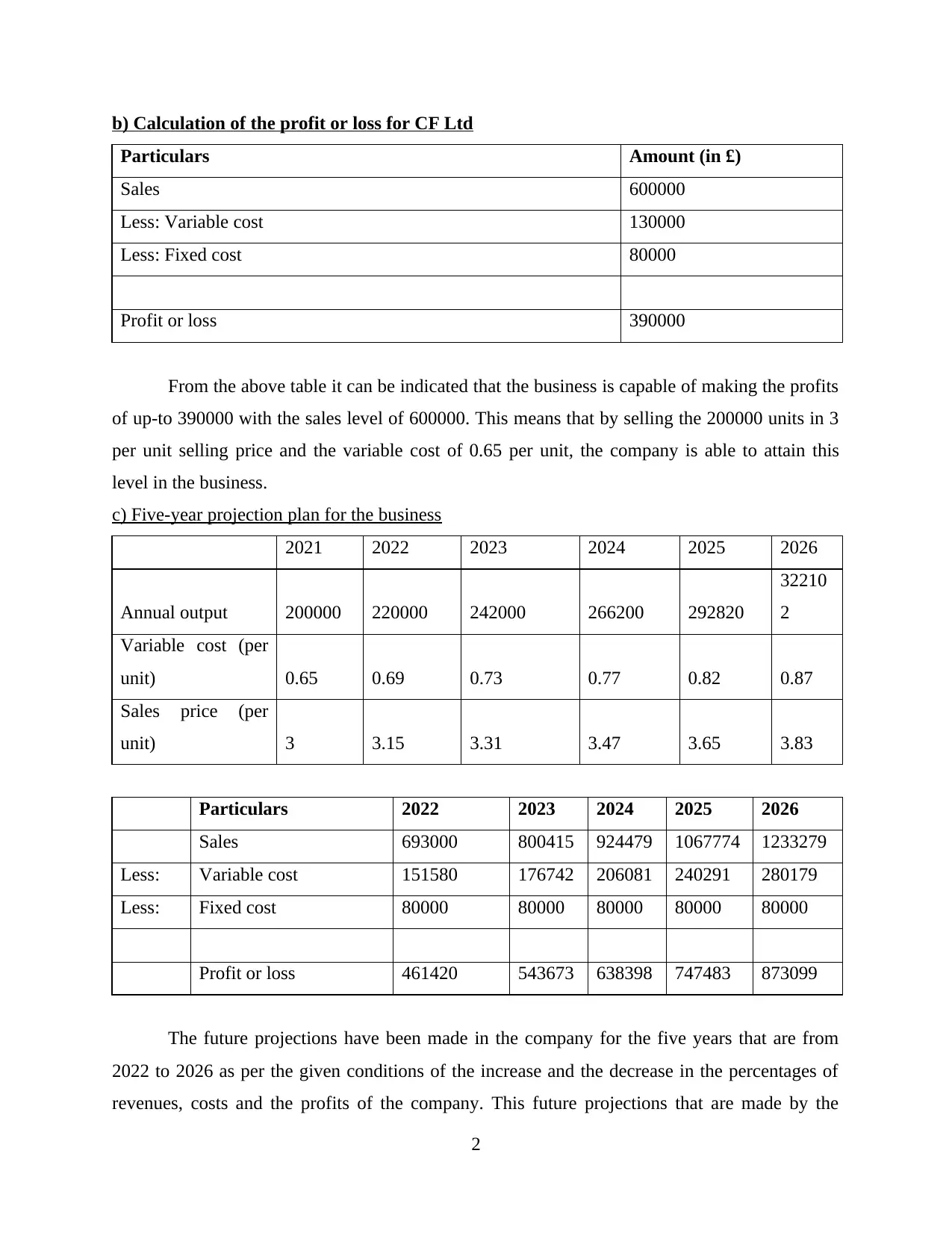

b) Calculation of the profit or loss for CF Ltd

Particulars Amount (in £)

Sales 600000

Less: Variable cost 130000

Less: Fixed cost 80000

Profit or loss 390000

From the above table it can be indicated that the business is capable of making the profits

of up-to 390000 with the sales level of 600000. This means that by selling the 200000 units in 3

per unit selling price and the variable cost of 0.65 per unit, the company is able to attain this

level in the business.

c) Five-year projection plan for the business

2021 2022 2023 2024 2025 2026

Annual output 200000 220000 242000 266200 292820

32210

2

Variable cost (per

unit) 0.65 0.69 0.73 0.77 0.82 0.87

Sales price (per

unit) 3 3.15 3.31 3.47 3.65 3.83

Particulars 2022 2023 2024 2025 2026

Sales 693000 800415 924479 1067774 1233279

Less: Variable cost 151580 176742 206081 240291 280179

Less: Fixed cost 80000 80000 80000 80000 80000

Profit or loss 461420 543673 638398 747483 873099

The future projections have been made in the company for the five years that are from

2022 to 2026 as per the given conditions of the increase and the decrease in the percentages of

revenues, costs and the profits of the company. This future projections that are made by the

2

Particulars Amount (in £)

Sales 600000

Less: Variable cost 130000

Less: Fixed cost 80000

Profit or loss 390000

From the above table it can be indicated that the business is capable of making the profits

of up-to 390000 with the sales level of 600000. This means that by selling the 200000 units in 3

per unit selling price and the variable cost of 0.65 per unit, the company is able to attain this

level in the business.

c) Five-year projection plan for the business

2021 2022 2023 2024 2025 2026

Annual output 200000 220000 242000 266200 292820

32210

2

Variable cost (per

unit) 0.65 0.69 0.73 0.77 0.82 0.87

Sales price (per

unit) 3 3.15 3.31 3.47 3.65 3.83

Particulars 2022 2023 2024 2025 2026

Sales 693000 800415 924479 1067774 1233279

Less: Variable cost 151580 176742 206081 240291 280179

Less: Fixed cost 80000 80000 80000 80000 80000

Profit or loss 461420 543673 638398 747483 873099

The future projections have been made in the company for the five years that are from

2022 to 2026 as per the given conditions of the increase and the decrease in the percentages of

revenues, costs and the profits of the company. This future projections that are made by the

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company shall be helping the business in developing the understanding that the sales and the

profitability both are showing the growing trend in the company. By optimizing the higher level

of sales the company is able to generate competencies based on market share and is able to gain

the competitive edge in the market (Krishnamoorthi and Mathew, 2018). With the progression in

each year the profit margin of the company is constantly increasing and by the year 2026 it has

almost doubled as compared to the recent profitability.

d) Analysis of the costing and revenue behaviour

The costs and the revenues of the company both show the increasing trends in the company

and are also positively related for the company as the increase in one leads to the increase in

other. The fixed component of the costs are constant but the variable costs are fluctuating and in

the future projections show the rising trend of 6%. Apart from that the output produced by the

company is also increasing with the increase in the selling price that is leading to the

maximization of the sales revenue in the company. The behaviour of the costs and revenues

show the favourable movement in the increasing direction finally leading to the increase in the

overall profitability of the company.

QUESTION- 2

a) Calculation of correlation coefficient of advertising and sales

Year Advertising expenditure Revenue from operations

2016 2 100

2017 5 90

2018 4 70

2019 6 60

2020 3 80

Correlation coefficient -0.70

The correlation coefficients are the statistical tool that is applied to find out the

relationship between the two variables and with what rate of change in one shall be impacting the

rate of change of the other. In the current situation the variables are the advertisement

expenditure and the sales generated in the company. Both the variables are interrelated as with

3

profitability both are showing the growing trend in the company. By optimizing the higher level

of sales the company is able to generate competencies based on market share and is able to gain

the competitive edge in the market (Krishnamoorthi and Mathew, 2018). With the progression in

each year the profit margin of the company is constantly increasing and by the year 2026 it has

almost doubled as compared to the recent profitability.

d) Analysis of the costing and revenue behaviour

The costs and the revenues of the company both show the increasing trends in the company

and are also positively related for the company as the increase in one leads to the increase in

other. The fixed component of the costs are constant but the variable costs are fluctuating and in

the future projections show the rising trend of 6%. Apart from that the output produced by the

company is also increasing with the increase in the selling price that is leading to the

maximization of the sales revenue in the company. The behaviour of the costs and revenues

show the favourable movement in the increasing direction finally leading to the increase in the

overall profitability of the company.

QUESTION- 2

a) Calculation of correlation coefficient of advertising and sales

Year Advertising expenditure Revenue from operations

2016 2 100

2017 5 90

2018 4 70

2019 6 60

2020 3 80

Correlation coefficient -0.70

The correlation coefficients are the statistical tool that is applied to find out the

relationship between the two variables and with what rate of change in one shall be impacting the

rate of change of the other. In the current situation the variables are the advertisement

expenditure and the sales generated in the company. Both the variables are interrelated as with

3

the change in one it shall be leading to the change in the other. The results of the calculations

show that in WW ltd the advertising expenditure and the sales of the company are moderately

related as from 0.25 to 0.75 the relationship is classified as moderate wherein the change in one

variable will moderately affect the other (Aydiner and et.al., 2019). It can also be observed from

the above table that the relationship is adverse which is negative means the increase in one

variable shall be decreasing the other. So, overall the relationship is moderately adverse. This

can be evidently be observed that in 2016 when the advertising expense was 2 the revenues

simultaneously generated were 100. But as soon as the advertising expenditure in 2020 increased

to 3 the revenues dropped to 80 which shows the moderately adverse relationship. This means

that the increased expenditure of advertisements is not contributing positively to the sales figure

of the company rather it is posing the negative impacts on the company. This calls for the urgent

action in terms of reviewing the marketing strategy that is applied by the business as this in

increasing the costs of the business and in return is not giving any benefits to the organization.

b) Scatter diagram and the pattern of relationship of the two variables

The above figure represents the scattered diagram that is showing the relationship of the

two variables graphically. The two variables whose correlation has been identified are the

advertisement expenditure and the generation of sales in the company which can be used to see

4

show that in WW ltd the advertising expenditure and the sales of the company are moderately

related as from 0.25 to 0.75 the relationship is classified as moderate wherein the change in one

variable will moderately affect the other (Aydiner and et.al., 2019). It can also be observed from

the above table that the relationship is adverse which is negative means the increase in one

variable shall be decreasing the other. So, overall the relationship is moderately adverse. This

can be evidently be observed that in 2016 when the advertising expense was 2 the revenues

simultaneously generated were 100. But as soon as the advertising expenditure in 2020 increased

to 3 the revenues dropped to 80 which shows the moderately adverse relationship. This means

that the increased expenditure of advertisements is not contributing positively to the sales figure

of the company rather it is posing the negative impacts on the company. This calls for the urgent

action in terms of reviewing the marketing strategy that is applied by the business as this in

increasing the costs of the business and in return is not giving any benefits to the organization.

b) Scatter diagram and the pattern of relationship of the two variables

The above figure represents the scattered diagram that is showing the relationship of the

two variables graphically. The two variables whose correlation has been identified are the

advertisement expenditure and the generation of sales in the company which can be used to see

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the effect of one on the other. It can be evaluated that the relationship is inverse showing that the

increase in the advertisement expenditure of the company shall be leading to the reduction in the

revenues of the company. But the effect of such variable on the other is with the moderate

intensity in the business. The downward slope of the sales in the company is the major concern

of the business wherein the effect shall be deepening and it shall be the red signal of the

company which shall indicate that the marketing strategies needs to be changed in the company

such that it leads to the effectiveness in the sales and that results in the profitability of the

business.

c) Impact of the advertising expenditure on sales and advice regarding how the company can

gain competitive advantage by using the marketing tactics

As per the above data that is provided to the company it can be assessed that the

advertisement expenditure that is made by the company is negatively impacting the revenues

from operations that are generated for the business over the last few years. It can also be known

that with every additional penny that was spent for the promotion and marketing of the detergent

products led to the negative impact and ultimately decreased the sales that was generated by the

company in the complete year (Kraus, Feuerriegel and Oztekin, 2020). The application of the

statistical tool showed that there is a moderately adverse correlation among the two variables of

the business. It became a serious concern for the company to find out the prominent reasons for

such an impact as this can be leading to the serious consequences for the business. It can also be

known that generally the relationship between the advertisement and the sales of the company is

positive but the same is not the case with the detergent business of the company.

The marketing advice can be provided to the management and the marketing manager of

the company to review the strategies and find out the possible factors that are impacting the

overall business prosperity in the organization. There can be several reasons for the

ineffectiveness out of which one can be the outdated product or service that is being offered by

the business that is not attracting the potential customers despite the efforts put in for the

advertisement of the brand. In such a case the company must mould the product that is offered

with the help of the required technology such that it is capable of meeting the consumer demands

and is up-to the expectations and the tastes and preferences.

5

increase in the advertisement expenditure of the company shall be leading to the reduction in the

revenues of the company. But the effect of such variable on the other is with the moderate

intensity in the business. The downward slope of the sales in the company is the major concern

of the business wherein the effect shall be deepening and it shall be the red signal of the

company which shall indicate that the marketing strategies needs to be changed in the company

such that it leads to the effectiveness in the sales and that results in the profitability of the

business.

c) Impact of the advertising expenditure on sales and advice regarding how the company can

gain competitive advantage by using the marketing tactics

As per the above data that is provided to the company it can be assessed that the

advertisement expenditure that is made by the company is negatively impacting the revenues

from operations that are generated for the business over the last few years. It can also be known

that with every additional penny that was spent for the promotion and marketing of the detergent

products led to the negative impact and ultimately decreased the sales that was generated by the

company in the complete year (Kraus, Feuerriegel and Oztekin, 2020). The application of the

statistical tool showed that there is a moderately adverse correlation among the two variables of

the business. It became a serious concern for the company to find out the prominent reasons for

such an impact as this can be leading to the serious consequences for the business. It can also be

known that generally the relationship between the advertisement and the sales of the company is

positive but the same is not the case with the detergent business of the company.

The marketing advice can be provided to the management and the marketing manager of

the company to review the strategies and find out the possible factors that are impacting the

overall business prosperity in the organization. There can be several reasons for the

ineffectiveness out of which one can be the outdated product or service that is being offered by

the business that is not attracting the potential customers despite the efforts put in for the

advertisement of the brand. In such a case the company must mould the product that is offered

with the help of the required technology such that it is capable of meeting the consumer demands

and is up-to the expectations and the tastes and preferences.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The other reason can be that the right platforms for the marketing are not being used by

the company. As in the current era digital marketing is in trend and has the benefits of covering

the vast target market and also attracts the desired customer. So it can be advised to the

marketing agent that they should apply the various digital marketing platforms like search engine

optimization, optimized company website, social media marketing and the internet ads that shall

generate the crowd for the company. This shall be ultimately leading to the increase in the brand

awareness and will be boosting the target market such that the competitive advantage can be

built in the market. These competencies will definitely result in the increase of the sales with the

increased expenditure in the advertisement of the detergent products.

QUESTION- 3

Break-even point- The break-even point is the level of sales in the business at which the total

revenues shall be equivalent to the total costs of operations and this shall be leading to a no profit

no loss zone in the business (Ashrafi and et.al., 2019). It is the minimum level of the sales that

can be executed such that the company can just survive without making the losses in the

company. At this level there is zero profitability for the company as the total revenues are equal

to the total costs in the company.

Margin of safety- It shows the difference between the intrinsic value of the stock and the market

value that is being received for it. The margin of safety shall be representing the amount of the

sales that the company is executing before it reaches the break-even point in the company.

Basically it is the difference between the actual sales level and the break-even point for the

company.

a) Calculation of the break-even point and margin of safety for the different options in the

company

Profit statement as per the original estimates of the company: -

Original

Per unit £ £

Selling price 4,40,000

Variable costs:

Labour 1,40,000

Materials 1,02,000

6

the company. As in the current era digital marketing is in trend and has the benefits of covering

the vast target market and also attracts the desired customer. So it can be advised to the

marketing agent that they should apply the various digital marketing platforms like search engine

optimization, optimized company website, social media marketing and the internet ads that shall

generate the crowd for the company. This shall be ultimately leading to the increase in the brand

awareness and will be boosting the target market such that the competitive advantage can be

built in the market. These competencies will definitely result in the increase of the sales with the

increased expenditure in the advertisement of the detergent products.

QUESTION- 3

Break-even point- The break-even point is the level of sales in the business at which the total

revenues shall be equivalent to the total costs of operations and this shall be leading to a no profit

no loss zone in the business (Ashrafi and et.al., 2019). It is the minimum level of the sales that

can be executed such that the company can just survive without making the losses in the

company. At this level there is zero profitability for the company as the total revenues are equal

to the total costs in the company.

Margin of safety- It shows the difference between the intrinsic value of the stock and the market

value that is being received for it. The margin of safety shall be representing the amount of the

sales that the company is executing before it reaches the break-even point in the company.

Basically it is the difference between the actual sales level and the break-even point for the

company.

a) Calculation of the break-even point and margin of safety for the different options in the

company

Profit statement as per the original estimates of the company: -

Original

Per unit £ £

Selling price 4,40,000

Variable costs:

Labour 1,40,000

Materials 1,02,000

6

Contribution 1,98,000

Less Fixed Costs:

Administration 40,000

Other 50,000 90,000

Profit 1,08,000

Calculation of the break-even point and the margin of safety: -

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 198000 / 440000 * 100

PV ratio = 45%

Break-even point (in amount) = Fixed costs / PV ratio

= 90000 / 0.45

= 200000

Break-even point (% of sales) = Break-even point / Sales * 100

= 200000 / 440000 * 100

= 45.45%

Margin of Safety (MOS) = Actual sales – Break-even sales

= Actual sales - Break-even sales

= 440000 – 200000

Margin of safety= 240000

= Current sales – Break-even sales / Current sales * 100

= 440000 – 200000 / 440000 * 100

= 54.54%

Profit statement as per the Production manager's suggestion in the company: -

Particulars £ £

SP 4,40,000

Variable expenses

Labour 1,40,000

Materials 80,000

7

Less Fixed Costs:

Administration 40,000

Other 50,000 90,000

Profit 1,08,000

Calculation of the break-even point and the margin of safety: -

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 198000 / 440000 * 100

PV ratio = 45%

Break-even point (in amount) = Fixed costs / PV ratio

= 90000 / 0.45

= 200000

Break-even point (% of sales) = Break-even point / Sales * 100

= 200000 / 440000 * 100

= 45.45%

Margin of Safety (MOS) = Actual sales – Break-even sales

= Actual sales - Break-even sales

= 440000 – 200000

Margin of safety= 240000

= Current sales – Break-even sales / Current sales * 100

= 440000 – 200000 / 440000 * 100

= 54.54%

Profit statement as per the Production manager's suggestion in the company: -

Particulars £ £

SP 4,40,000

Variable expenses

Labour 1,40,000

Materials 80,000

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Contribution 2,20,000

Less Fixed expenses

Administration 40,000

Other (50000 + 24000) 74,000 1,14,000

Profit 1,06,000

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 220000 / 440000 * 100

PV ratio = 50%

Break-even point (in amount) = Fixed costs / PV ratio

Break-even point (in amount) = 114000 / 0.50

Break-even point (in amount) = 228000

Break-even point (% of sales) = Break-even point / Sales * 100

Break-even point (% of sales) = 228000 / 440000 * 100

Break-even point (% of sales) = 51.81%

Margin of Safety (MOS) = Actual sales – Break-even sales

Margin of safety= Actual sales - Break-even sales

Margin of safety= 440000 – 228000

Margin of safety= 212000

Margin of safety (% of sales) = Current sales – Break-even sales / Current sales * 100

Margin of safety (% of sales) = 440000 – 228000 / 440000 * 100

Margin of safety (% of sales) = 48.18%

Profit statement as per the Marketing manager's suggestion in the company: -

Particulars £ £

Selling price (increase by 20%) 5,28,000

Variable costs:

Labour 1,68000

Materials 1,22400 290400

8

Less Fixed expenses

Administration 40,000

Other (50000 + 24000) 74,000 1,14,000

Profit 1,06,000

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 220000 / 440000 * 100

PV ratio = 50%

Break-even point (in amount) = Fixed costs / PV ratio

Break-even point (in amount) = 114000 / 0.50

Break-even point (in amount) = 228000

Break-even point (% of sales) = Break-even point / Sales * 100

Break-even point (% of sales) = 228000 / 440000 * 100

Break-even point (% of sales) = 51.81%

Margin of Safety (MOS) = Actual sales – Break-even sales

Margin of safety= Actual sales - Break-even sales

Margin of safety= 440000 – 228000

Margin of safety= 212000

Margin of safety (% of sales) = Current sales – Break-even sales / Current sales * 100

Margin of safety (% of sales) = 440000 – 228000 / 440000 * 100

Margin of safety (% of sales) = 48.18%

Profit statement as per the Marketing manager's suggestion in the company: -

Particulars £ £

Selling price (increase by 20%) 5,28,000

Variable costs:

Labour 1,68000

Materials 1,22400 290400

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contribution 237600

Less Fixed Costs:

Administration 40,000

Other 50,000

Advertising campaign 24,000 1,14,000

Profit 123600

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 237600 / 528000 * 100

PV ratio = 45%

Break-even point (in amount) = Fixed costs / PV ratio

Break-even point (in amount) = 114000 / 0.45

Break-even point (in amount) = 253333

Break-even point (% of sales) = Break-even point / Sales * 100

Break-even point (% of sales) = 253333 / 528000 * 100

Break-even point (% of sales) = 48%

Margin of Safety (MOS) = Actual sales – Break-even sales

Margin of safety= Actual sales - Break-even sales

Margin of safety= 528000 – 253333

Margin of safety= 274667

Margin of safety (% of sales) = Current sales – Break-even sales / Current sales * 100

Margin of safety (% of sales) = 528000 – 253333 / 440000 * 100

Margin of safety (% of sales) = 52%

b) Reasons for adopting a particular plan for the Mansleep plc.

Mansleep plc shall be adopting the plan which shall be the most profitable for the

business rendering the maximum profits. This is possible in the case where the break-even point

is the lowest which means it shall be increasing the scope of profitability. In accordance with this

it can be assessed that the most suitable option is the original estimates that were earlier

9

Less Fixed Costs:

Administration 40,000

Other 50,000

Advertising campaign 24,000 1,14,000

Profit 123600

Break-even point (in amount) = Fixed costs / Profit volume ratio

PV ratio = Contribution / Sales revenue * 100

PV ratio = 237600 / 528000 * 100

PV ratio = 45%

Break-even point (in amount) = Fixed costs / PV ratio

Break-even point (in amount) = 114000 / 0.45

Break-even point (in amount) = 253333

Break-even point (% of sales) = Break-even point / Sales * 100

Break-even point (% of sales) = 253333 / 528000 * 100

Break-even point (% of sales) = 48%

Margin of Safety (MOS) = Actual sales – Break-even sales

Margin of safety= Actual sales - Break-even sales

Margin of safety= 528000 – 253333

Margin of safety= 274667

Margin of safety (% of sales) = Current sales – Break-even sales / Current sales * 100

Margin of safety (% of sales) = 528000 – 253333 / 440000 * 100

Margin of safety (% of sales) = 52%

b) Reasons for adopting a particular plan for the Mansleep plc.

Mansleep plc shall be adopting the plan which shall be the most profitable for the

business rendering the maximum profits. This is possible in the case where the break-even point

is the lowest which means it shall be increasing the scope of profitability. In accordance with this

it can be assessed that the most suitable option is the original estimates that were earlier

9

determined by the company because they have the lowest BEP at 45.45%. Apart from that in

case of the margin of safety the highest level shall be the most desired one wherein the chances

of profitability are higher. The highest difference between the actual and the break-even sales is

the most profitable level. According to this also the original estimates is the best for the company

as this has the maximum profits at 54.54%.

c) Factors that needs to be considered before committing to a particular course of action

Apart from the cost and the profitability analysis of a particular product there are other

factors in the business that needs to be considered before the adoption of a particular plan and

committing to a course of action. Some of such important factors are: - Competition- Apart from the profitability in the operations post the analysis of the cost

and sales in the company, there are other factors that are equivalently important for the

business. Amongst which competition that is persisting in the market is one of the major

factors that shall be determining the market share that can be optimized by the company.

It shall be impacting the competencies in the business and accordingly the reputation of

the brand in the market. Technology- Another major factor that shall be contributing to the successful

implementation in the company is the technological aspect in the form of advancements

and the modifications of the processes and the equipment’s that are being used in the

company (Appelbaum and et.al., 2017). It is necessary before the execution of the plan

that the required technology is there with the business. Manpower- In order to successfully execute the operations in the business the company

needs to have the availability of the skilled and talented manpower resources who have

the necessary qualification. Before the implementation of the course of action the

business has to recruit the right employees at the right position. Availability of the funds- This is the factor that is the most crucial for the application in

the business as the finance is the life blood of the business. It is very essential to have the

required funds in the company so that the operations can be executed and there is the

smooth flow of the working capital cycle for the company (Mikalef and et.al., 2020).

Governmental regulations- Apart from all the other factors it is also important for the

business to ascertain that the operations are within the legal parameters and none of them

are being violated by the company so as to attract the interference of the government and

10

case of the margin of safety the highest level shall be the most desired one wherein the chances

of profitability are higher. The highest difference between the actual and the break-even sales is

the most profitable level. According to this also the original estimates is the best for the company

as this has the maximum profits at 54.54%.

c) Factors that needs to be considered before committing to a particular course of action

Apart from the cost and the profitability analysis of a particular product there are other

factors in the business that needs to be considered before the adoption of a particular plan and

committing to a course of action. Some of such important factors are: - Competition- Apart from the profitability in the operations post the analysis of the cost

and sales in the company, there are other factors that are equivalently important for the

business. Amongst which competition that is persisting in the market is one of the major

factors that shall be determining the market share that can be optimized by the company.

It shall be impacting the competencies in the business and accordingly the reputation of

the brand in the market. Technology- Another major factor that shall be contributing to the successful

implementation in the company is the technological aspect in the form of advancements

and the modifications of the processes and the equipment’s that are being used in the

company (Appelbaum and et.al., 2017). It is necessary before the execution of the plan

that the required technology is there with the business. Manpower- In order to successfully execute the operations in the business the company

needs to have the availability of the skilled and talented manpower resources who have

the necessary qualification. Before the implementation of the course of action the

business has to recruit the right employees at the right position. Availability of the funds- This is the factor that is the most crucial for the application in

the business as the finance is the life blood of the business. It is very essential to have the

required funds in the company so that the operations can be executed and there is the

smooth flow of the working capital cycle for the company (Mikalef and et.al., 2020).

Governmental regulations- Apart from all the other factors it is also important for the

business to ascertain that the operations are within the legal parameters and none of them

are being violated by the company so as to attract the interference of the government and

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.