Business Decision Making: Investment Appraisal and Performance Ratios

VerifiedAdded on 2023/06/17

|11

|1980

|215

Report

AI Summary

This report provides a comprehensive analysis of business decision-making through investment appraisal techniques and accounting ratios. The first section evaluates project investments using methods like payback period, accounting rate of return, net present value, and internal rate of return, highlighting their advantages and disadvantages, ultimately recommending the Manchester project based on its favorable results. The second section assesses Tesco's performance using accounting ratios, noting its fluctuating return on capital employed and liquidity, while also discussing the limitations of accounting ratios and external factors impacting Tesco's position, such as demand, innovation, and labor costs. The report concludes that while appraisal techniques and accounting ratios have limitations, they are crucial tools for making informed business decisions. Desklib offers a range of similar solved assignments and study resources for students.

Business Decision

Making

Making

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK-1............................................................................................................................................3

Evaluation of project by applying investment appraisal technique............................................3

Explain investment appraisal technique along with there advantages and disadvantages..........6

Recommend the reason for the particular project to be chosen..................................................8

TASK-2............................................................................................................................................8

Discuss the performance of Tesco through accounting ratios....................................................8

Any five limitations of accounting ratios....................................................................................8

Discuss the factors affecting the position....................................................................................9

CONCLUSION ...............................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION ..........................................................................................................................3

TASK-1............................................................................................................................................3

Evaluation of project by applying investment appraisal technique............................................3

Explain investment appraisal technique along with there advantages and disadvantages..........6

Recommend the reason for the particular project to be chosen..................................................8

TASK-2............................................................................................................................................8

Discuss the performance of Tesco through accounting ratios....................................................8

Any five limitations of accounting ratios....................................................................................8

Discuss the factors affecting the position....................................................................................9

CONCLUSION ...............................................................................................................................9

REFERENCES..............................................................................................................................10

INTRODUCTION

Investment appraisal means to assess the attractiveness of a particular project by applying

various capital financing techniques. It is an analytical tool which helps in identifying the trends

and expected profitability associated with it (Kaur and Sharma, 2018). This report has been

partitioned into two parts. First part discusses about the various appraisal techniques along with

its pros and cons and also recommends about the project to be chosen. Second section deals with

the performance of company along with providing limitations of accounting ratios, in addition to

the factors affecting its position.

TASK-1

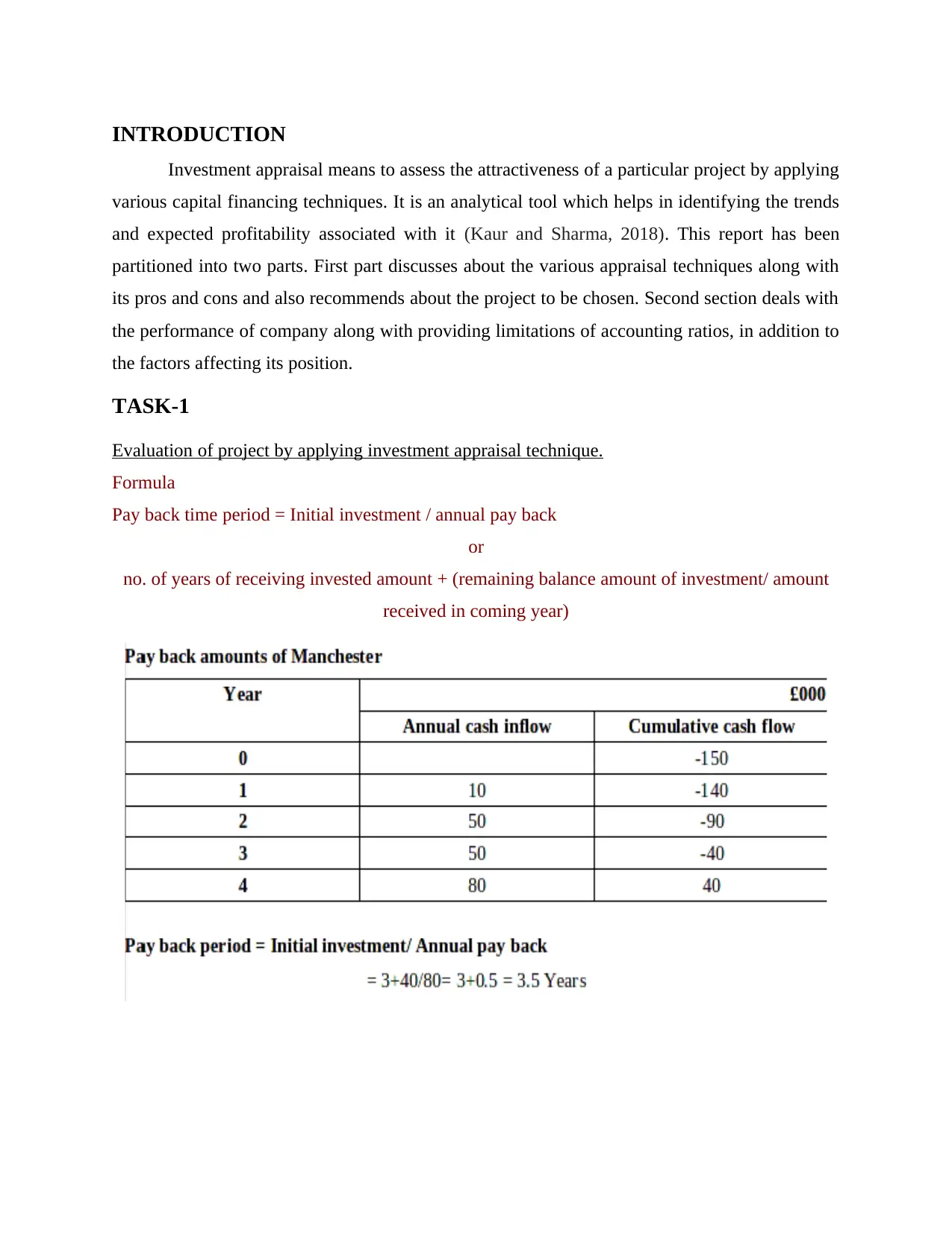

Evaluation of project by applying investment appraisal technique.

Formula

Pay back time period = Initial investment / annual pay back

or

no. of years of receiving invested amount + (remaining balance amount of investment/ amount

received in coming year)

Investment appraisal means to assess the attractiveness of a particular project by applying

various capital financing techniques. It is an analytical tool which helps in identifying the trends

and expected profitability associated with it (Kaur and Sharma, 2018). This report has been

partitioned into two parts. First part discusses about the various appraisal techniques along with

its pros and cons and also recommends about the project to be chosen. Second section deals with

the performance of company along with providing limitations of accounting ratios, in addition to

the factors affecting its position.

TASK-1

Evaluation of project by applying investment appraisal technique.

Formula

Pay back time period = Initial investment / annual pay back

or

no. of years of receiving invested amount + (remaining balance amount of investment/ amount

received in coming year)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

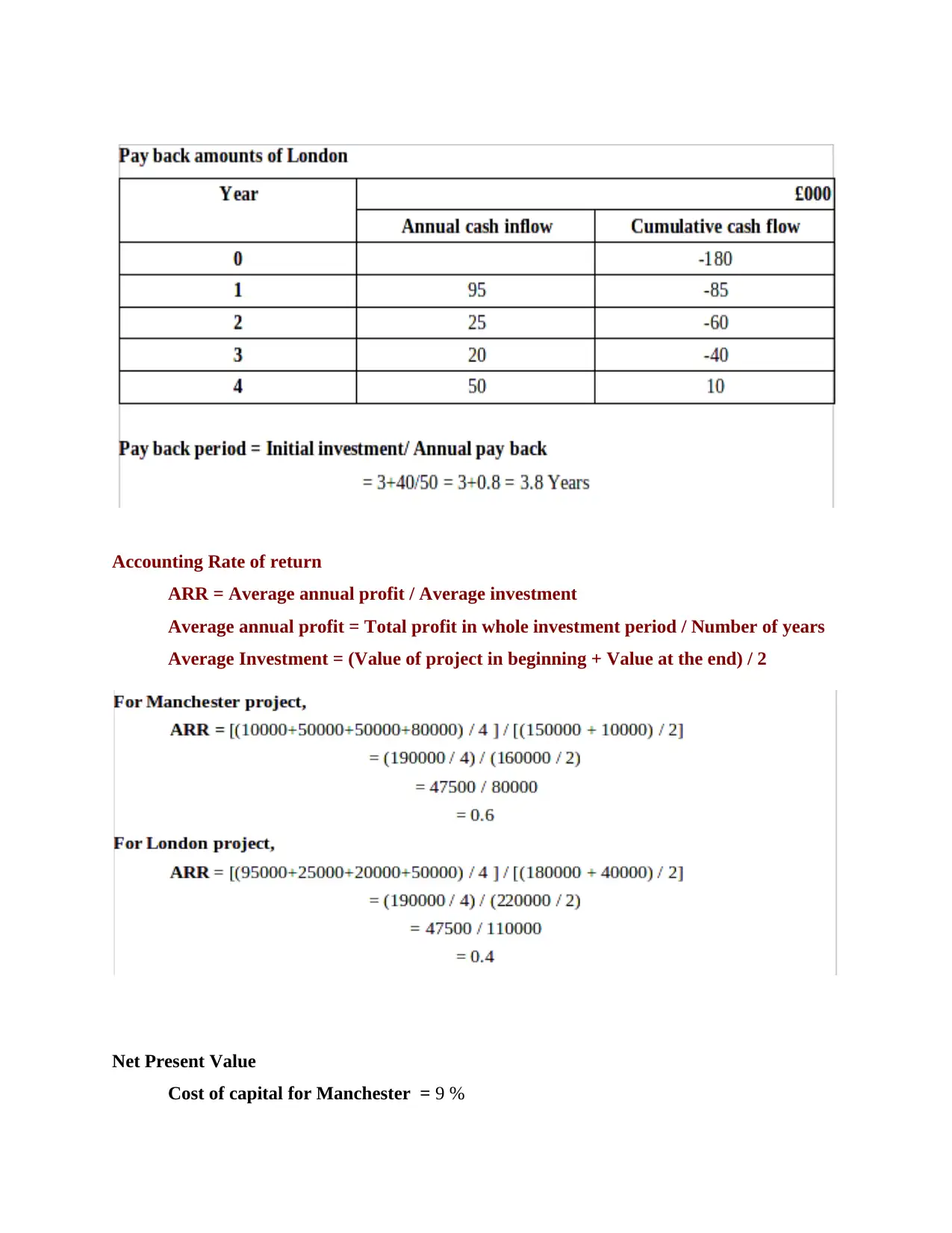

Accounting Rate of return

ARR = Average annual profit / Average investment

Average annual profit = Total profit in whole investment period / Number of years

Average Investment = (Value of project in beginning + Value at the end) / 2

Net Present Value

Cost of capital for Manchester = 9 %

ARR = Average annual profit / Average investment

Average annual profit = Total profit in whole investment period / Number of years

Average Investment = (Value of project in beginning + Value at the end) / 2

Net Present Value

Cost of capital for Manchester = 9 %

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

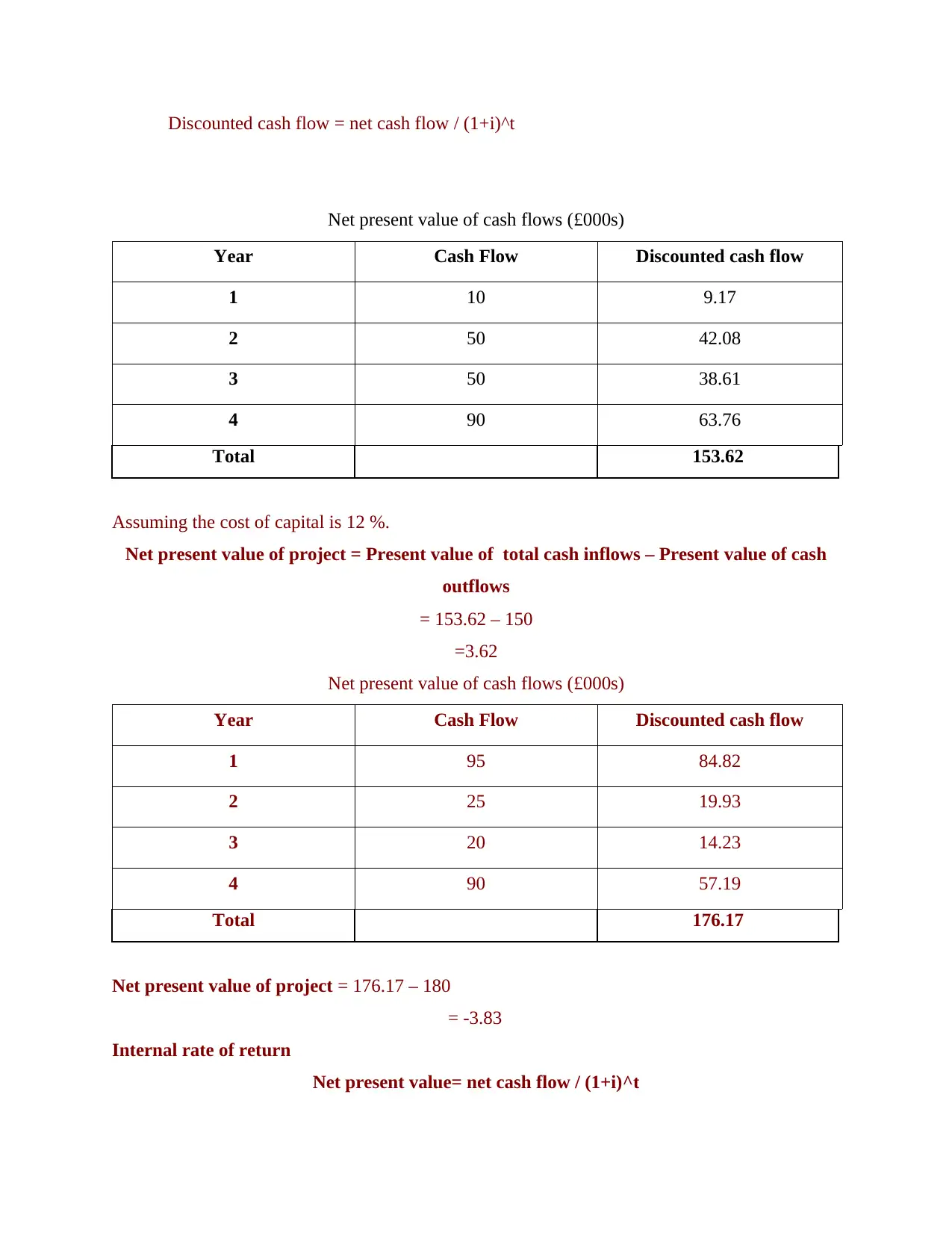

Discounted cash flow = net cash flow / (1+i)^t

Net present value of cash flows (£000s)

Year Cash Flow Discounted cash flow

1 10 9.17

2 50 42.08

3 50 38.61

4 90 63.76

Total 153.62

Assuming the cost of capital is 12 %.

Net present value of project = Present value of total cash inflows – Present value of cash

outflows

= 153.62 – 150

=3.62

Net present value of cash flows (£000s)

Year Cash Flow Discounted cash flow

1 95 84.82

2 25 19.93

3 20 14.23

4 90 57.19

Total 176.17

Net present value of project = 176.17 – 180

= -3.83

Internal rate of return

Net present value= net cash flow / (1+i)^t

Net present value of cash flows (£000s)

Year Cash Flow Discounted cash flow

1 10 9.17

2 50 42.08

3 50 38.61

4 90 63.76

Total 153.62

Assuming the cost of capital is 12 %.

Net present value of project = Present value of total cash inflows – Present value of cash

outflows

= 153.62 – 150

=3.62

Net present value of cash flows (£000s)

Year Cash Flow Discounted cash flow

1 95 84.82

2 25 19.93

3 20 14.23

4 90 57.19

Total 176.17

Net present value of project = 176.17 – 180

= -3.83

Internal rate of return

Net present value= net cash flow / (1+i)^t

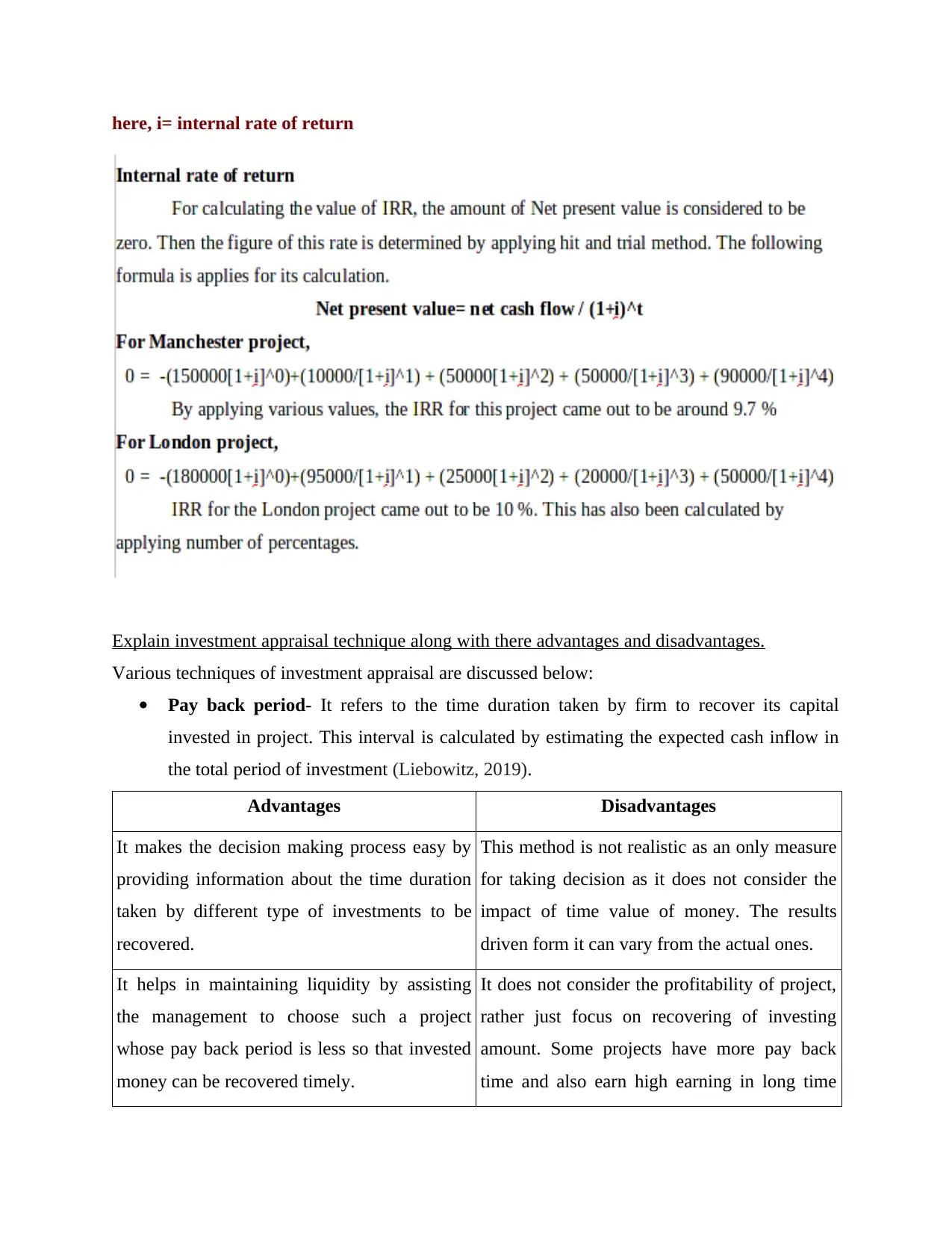

here, i= internal rate of return

Explain investment appraisal technique along with there advantages and disadvantages.

Various techniques of investment appraisal are discussed below:

Pay back period- It refers to the time duration taken by firm to recover its capital

invested in project. This interval is calculated by estimating the expected cash inflow in

the total period of investment (Liebowitz, 2019).

Advantages Disadvantages

It makes the decision making process easy by

providing information about the time duration

taken by different type of investments to be

recovered.

This method is not realistic as an only measure

for taking decision as it does not consider the

impact of time value of money. The results

driven form it can vary from the actual ones.

It helps in maintaining liquidity by assisting

the management to choose such a project

whose pay back period is less so that invested

money can be recovered timely.

It does not consider the profitability of project,

rather just focus on recovering of investing

amount. Some projects have more pay back

time and also earn high earning in long time

Explain investment appraisal technique along with there advantages and disadvantages.

Various techniques of investment appraisal are discussed below:

Pay back period- It refers to the time duration taken by firm to recover its capital

invested in project. This interval is calculated by estimating the expected cash inflow in

the total period of investment (Liebowitz, 2019).

Advantages Disadvantages

It makes the decision making process easy by

providing information about the time duration

taken by different type of investments to be

recovered.

This method is not realistic as an only measure

for taking decision as it does not consider the

impact of time value of money. The results

driven form it can vary from the actual ones.

It helps in maintaining liquidity by assisting

the management to choose such a project

whose pay back period is less so that invested

money can be recovered timely.

It does not consider the profitability of project,

rather just focus on recovering of investing

amount. Some projects have more pay back

time and also earn high earning in long time

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

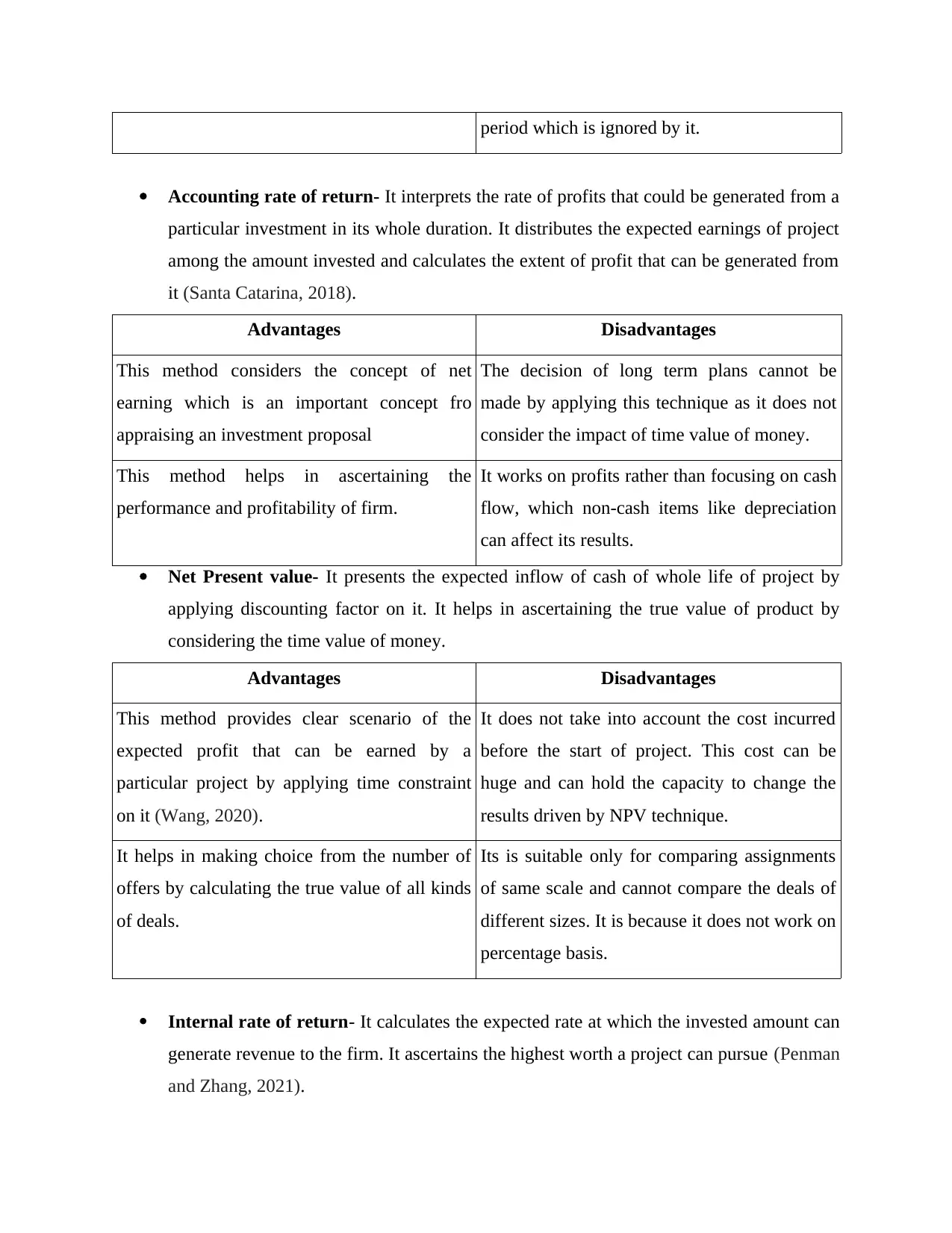

period which is ignored by it.

Accounting rate of return- It interprets the rate of profits that could be generated from a

particular investment in its whole duration. It distributes the expected earnings of project

among the amount invested and calculates the extent of profit that can be generated from

it (Santa Catarina, 2018).

Advantages Disadvantages

This method considers the concept of net

earning which is an important concept fro

appraising an investment proposal

The decision of long term plans cannot be

made by applying this technique as it does not

consider the impact of time value of money.

This method helps in ascertaining the

performance and profitability of firm.

It works on profits rather than focusing on cash

flow, which non-cash items like depreciation

can affect its results.

Net Present value- It presents the expected inflow of cash of whole life of project by

applying discounting factor on it. It helps in ascertaining the true value of product by

considering the time value of money.

Advantages Disadvantages

This method provides clear scenario of the

expected profit that can be earned by a

particular project by applying time constraint

on it (Wang, 2020).

It does not take into account the cost incurred

before the start of project. This cost can be

huge and can hold the capacity to change the

results driven by NPV technique.

It helps in making choice from the number of

offers by calculating the true value of all kinds

of deals.

Its is suitable only for comparing assignments

of same scale and cannot compare the deals of

different sizes. It is because it does not work on

percentage basis.

Internal rate of return- It calculates the expected rate at which the invested amount can

generate revenue to the firm. It ascertains the highest worth a project can pursue (Penman

and Zhang, 2021).

Accounting rate of return- It interprets the rate of profits that could be generated from a

particular investment in its whole duration. It distributes the expected earnings of project

among the amount invested and calculates the extent of profit that can be generated from

it (Santa Catarina, 2018).

Advantages Disadvantages

This method considers the concept of net

earning which is an important concept fro

appraising an investment proposal

The decision of long term plans cannot be

made by applying this technique as it does not

consider the impact of time value of money.

This method helps in ascertaining the

performance and profitability of firm.

It works on profits rather than focusing on cash

flow, which non-cash items like depreciation

can affect its results.

Net Present value- It presents the expected inflow of cash of whole life of project by

applying discounting factor on it. It helps in ascertaining the true value of product by

considering the time value of money.

Advantages Disadvantages

This method provides clear scenario of the

expected profit that can be earned by a

particular project by applying time constraint

on it (Wang, 2020).

It does not take into account the cost incurred

before the start of project. This cost can be

huge and can hold the capacity to change the

results driven by NPV technique.

It helps in making choice from the number of

offers by calculating the true value of all kinds

of deals.

Its is suitable only for comparing assignments

of same scale and cannot compare the deals of

different sizes. It is because it does not work on

percentage basis.

Internal rate of return- It calculates the expected rate at which the invested amount can

generate revenue to the firm. It ascertains the highest worth a project can pursue (Penman

and Zhang, 2021).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

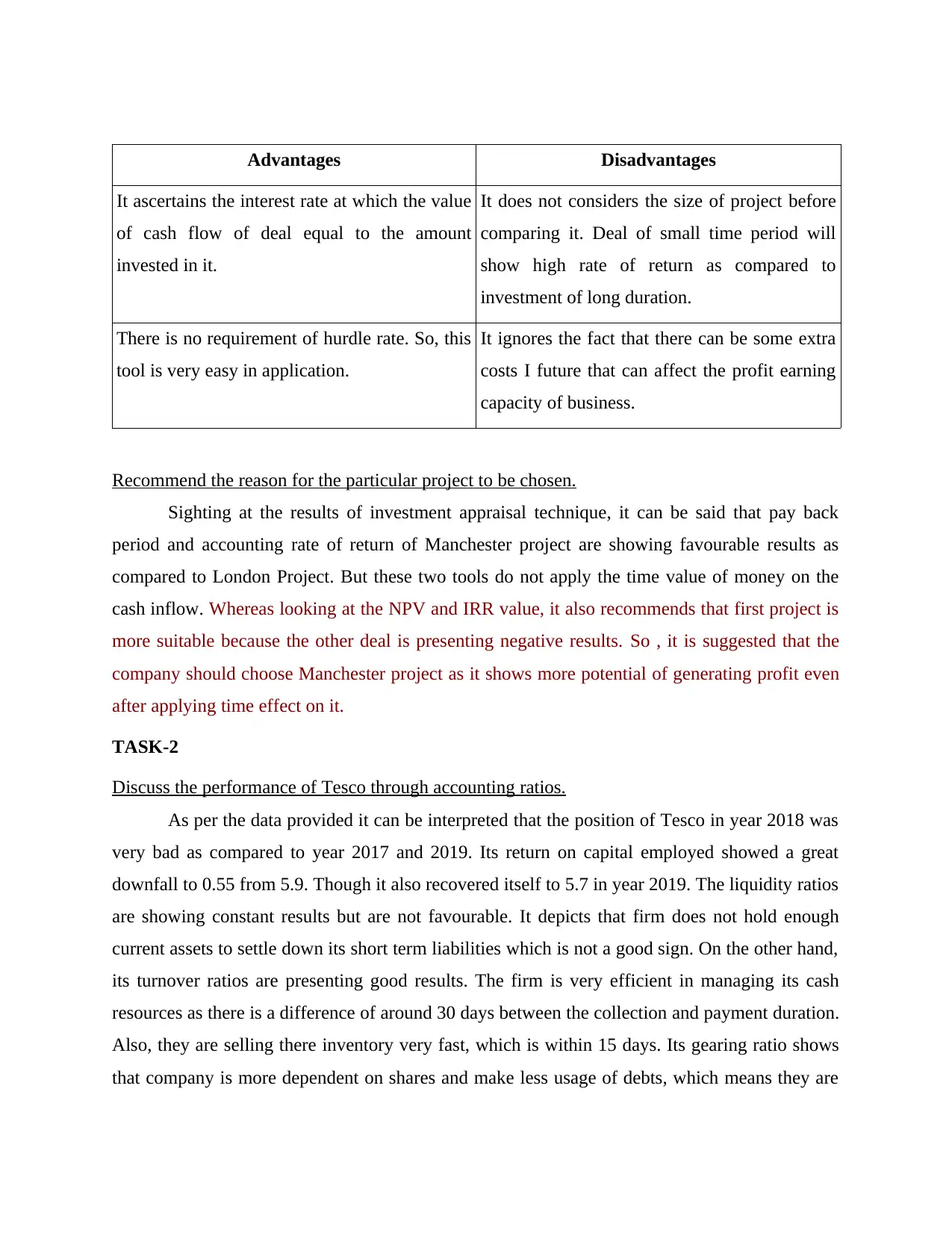

Advantages Disadvantages

It ascertains the interest rate at which the value

of cash flow of deal equal to the amount

invested in it.

It does not considers the size of project before

comparing it. Deal of small time period will

show high rate of return as compared to

investment of long duration.

There is no requirement of hurdle rate. So, this

tool is very easy in application.

It ignores the fact that there can be some extra

costs I future that can affect the profit earning

capacity of business.

Recommend the reason for the particular project to be chosen.

Sighting at the results of investment appraisal technique, it can be said that pay back

period and accounting rate of return of Manchester project are showing favourable results as

compared to London Project. But these two tools do not apply the time value of money on the

cash inflow. Whereas looking at the NPV and IRR value, it also recommends that first project is

more suitable because the other deal is presenting negative results. So , it is suggested that the

company should choose Manchester project as it shows more potential of generating profit even

after applying time effect on it.

TASK-2

Discuss the performance of Tesco through accounting ratios.

As per the data provided it can be interpreted that the position of Tesco in year 2018 was

very bad as compared to year 2017 and 2019. Its return on capital employed showed a great

downfall to 0.55 from 5.9. Though it also recovered itself to 5.7 in year 2019. The liquidity ratios

are showing constant results but are not favourable. It depicts that firm does not hold enough

current assets to settle down its short term liabilities which is not a good sign. On the other hand,

its turnover ratios are presenting good results. The firm is very efficient in managing its cash

resources as there is a difference of around 30 days between the collection and payment duration.

Also, they are selling there inventory very fast, which is within 15 days. Its gearing ratio shows

that company is more dependent on shares and make less usage of debts, which means they are

It ascertains the interest rate at which the value

of cash flow of deal equal to the amount

invested in it.

It does not considers the size of project before

comparing it. Deal of small time period will

show high rate of return as compared to

investment of long duration.

There is no requirement of hurdle rate. So, this

tool is very easy in application.

It ignores the fact that there can be some extra

costs I future that can affect the profit earning

capacity of business.

Recommend the reason for the particular project to be chosen.

Sighting at the results of investment appraisal technique, it can be said that pay back

period and accounting rate of return of Manchester project are showing favourable results as

compared to London Project. But these two tools do not apply the time value of money on the

cash inflow. Whereas looking at the NPV and IRR value, it also recommends that first project is

more suitable because the other deal is presenting negative results. So , it is suggested that the

company should choose Manchester project as it shows more potential of generating profit even

after applying time effect on it.

TASK-2

Discuss the performance of Tesco through accounting ratios.

As per the data provided it can be interpreted that the position of Tesco in year 2018 was

very bad as compared to year 2017 and 2019. Its return on capital employed showed a great

downfall to 0.55 from 5.9. Though it also recovered itself to 5.7 in year 2019. The liquidity ratios

are showing constant results but are not favourable. It depicts that firm does not hold enough

current assets to settle down its short term liabilities which is not a good sign. On the other hand,

its turnover ratios are presenting good results. The firm is very efficient in managing its cash

resources as there is a difference of around 30 days between the collection and payment duration.

Also, they are selling there inventory very fast, which is within 15 days. Its gearing ratio shows

that company is more dependent on shares and make less usage of debts, which means they are

required to pay less amount of interests. So, the overall position of Tesco is good but there is a

huge scope of growth.

Any five limitations of accounting ratios.

While analysing the ratios, the results driven can be wrong as it has some obstacles which

impact the examination results.

1. The time value of money is ignored in it while comparing values of different years. It

leads to wrong interpretation when ratios of multiple years are compared (Dong and et.

al., 2019).

2. It only considers the numerical aspect and ignores qualitative terms.

3. Their usage of formula depends on the person applying it. So, the results of different

individuals for same data can differ.

4. They are just a support to the team but odes not provide any solution to derive better

results (Oh and Penman, 2020).

5. The figures of financial statements can be altered any time. This tends to results in wrong

interpretation by ratios.

Discuss the factors affecting the position.

There are number of factors which effects the performance of Tesco. These are:

Demand- Due to increasing number of competitors, the demand of products of Tesco is

falling with a big slope. This has made the company to reduce its prices and it is further

impacting its profitability (Trent and Mohr, 2017).

Innovation- Upcoming of modern techniques has reduced its market share as new

emergents makes use of innovative techniques and tends to reduce the price of their

products.

Labour cost- With time, the cost of labour is also increasing. This is again hampering its

profit generating capacity.

CONCLUSION

It can be concluded from the above report that there are number of techniques for

appraising the profitability of various projects. On the basis of these tools, firms select the most

profitable project. Though there are different pros and cons of each method, even then they are

huge scope of growth.

Any five limitations of accounting ratios.

While analysing the ratios, the results driven can be wrong as it has some obstacles which

impact the examination results.

1. The time value of money is ignored in it while comparing values of different years. It

leads to wrong interpretation when ratios of multiple years are compared (Dong and et.

al., 2019).

2. It only considers the numerical aspect and ignores qualitative terms.

3. Their usage of formula depends on the person applying it. So, the results of different

individuals for same data can differ.

4. They are just a support to the team but odes not provide any solution to derive better

results (Oh and Penman, 2020).

5. The figures of financial statements can be altered any time. This tends to results in wrong

interpretation by ratios.

Discuss the factors affecting the position.

There are number of factors which effects the performance of Tesco. These are:

Demand- Due to increasing number of competitors, the demand of products of Tesco is

falling with a big slope. This has made the company to reduce its prices and it is further

impacting its profitability (Trent and Mohr, 2017).

Innovation- Upcoming of modern techniques has reduced its market share as new

emergents makes use of innovative techniques and tends to reduce the price of their

products.

Labour cost- With time, the cost of labour is also increasing. This is again hampering its

profit generating capacity.

CONCLUSION

It can be concluded from the above report that there are number of techniques for

appraising the profitability of various projects. On the basis of these tools, firms select the most

profitable project. Though there are different pros and cons of each method, even then they are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

very helpful. In the same way, accounting ratios are also important for analysing the performance

of business, though they too have some limitations.

of business, though they too have some limitations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Dong, G. and et. al., 2019. The win ratio: on interpretation and handling of ties. Statistics in

Biopharmaceutical Research.

Kaur, A. and Sharma, P.C., 2018. Sustainability as a strategy incorporated in decision-making at

supply chain management case study of General Motors. International Journal of

Sustainable Strategic Management. 6(1). pp.56-72.

Liebowitz, J., 2019. Developing informed intuition for decision-making. Taylor & Francis.

Oh, H.I. and Penman, S.H., 2020. Income Statement Mismatching Has Not Reduced the

Information Conveyed by Accounting Over Time. Available at SSRN 3778173.

Penman, S.H. and Zhang, X.J., 2021. Connecting book rate of return to risk and return: the

information conveyed by conservative accounting. Review of Accounting Studies. 26(1).

pp.391-423.

Santa Catarina, A., 2018, August. Long Term Capacity Planning: The Comparison Between the

Net Present Value, Return on Investment. In New Global Perspectives on Industrial

Engineering and Management: International Joint Conference ICIEOM-ADINGOR-

IISE-AIM-ASEM (p. 3). Springer.

Trent, L. and Mohr, J., 2017. Marketers' Methodologies for Valuing Brand Equity: Insights into

Accounting for Intangible Assets. The CPA Journal. 87(7). pp.58-61.

Wang, M., 2020. The impact of failed PR crisis management on the stock return within three

months (Doctoral dissertation).

Books and Journals

Dong, G. and et. al., 2019. The win ratio: on interpretation and handling of ties. Statistics in

Biopharmaceutical Research.

Kaur, A. and Sharma, P.C., 2018. Sustainability as a strategy incorporated in decision-making at

supply chain management case study of General Motors. International Journal of

Sustainable Strategic Management. 6(1). pp.56-72.

Liebowitz, J., 2019. Developing informed intuition for decision-making. Taylor & Francis.

Oh, H.I. and Penman, S.H., 2020. Income Statement Mismatching Has Not Reduced the

Information Conveyed by Accounting Over Time. Available at SSRN 3778173.

Penman, S.H. and Zhang, X.J., 2021. Connecting book rate of return to risk and return: the

information conveyed by conservative accounting. Review of Accounting Studies. 26(1).

pp.391-423.

Santa Catarina, A., 2018, August. Long Term Capacity Planning: The Comparison Between the

Net Present Value, Return on Investment. In New Global Perspectives on Industrial

Engineering and Management: International Joint Conference ICIEOM-ADINGOR-

IISE-AIM-ASEM (p. 3). Springer.

Trent, L. and Mohr, J., 2017. Marketers' Methodologies for Valuing Brand Equity: Insights into

Accounting for Intangible Assets. The CPA Journal. 87(7). pp.58-61.

Wang, M., 2020. The impact of failed PR crisis management on the stock return within three

months (Doctoral dissertation).

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.