Business Organization Analysis

VerifiedAdded on 2023/04/06

|83

|13746

|326

AI Summary

This document provides a detailed analysis of the balance sheet, P&L account, cash flow, and ratio analysis of Sony Corporation. It includes information on the company's history, subsidiaries, board of directors, auditors, and registered office address. The document also highlights the company's strengths, weaknesses, and strategic alliances.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: BUSINESS ORGANIZATION ANALYSIS

Business organization analysis

Name of the Student

Name of the University

Author Note

Business organization analysis

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

BUSINESS ORGANIZATION ANALYSIS

Table of Contents

1. INTRODUCTION..................................................................................................................6

1.1 Introduction of Company.................................................................................................6

1.2 Group Companies.............................................................................................................7

1.3 History..............................................................................................................................7

1.4 Company Profile..............................................................................................................8

1.5 Registered Office Address...............................................................................................9

1.6 Board of Directors of the Company.................................................................................9

1.7 Auditors of the Company...............................................................................................11

2. Analysis of balance sheet.....................................................................................................12

2.1 Trend analysis of balance sheet:........................................................................................12

2.1.1 Trend analysis of fixed assets.....................................................................................14

2.1.2 Trend analysis of current assets..................................................................................15

2.1.3 Trend analysis of total liabilities.................................................................................16

2.1.4 Trend analysis of shareholders’ equity.......................................................................17

2.1.5 Trend analysis of total loan fund.................................................................................18

2.1.6 Trend analysis of shareholder fund.............................................................................19

2.1.7 Trend analysis of sources of fund...............................................................................20

2.1.8 Trend analysis of investment......................................................................................22

2.1.9 Trend analysis of funds application............................................................................23

2.2 Horizontal analysis of balance sheet:.................................................................................25

2.2.1 Fund’s sources 2018....................................................................................................26

BUSINESS ORGANIZATION ANALYSIS

Table of Contents

1. INTRODUCTION..................................................................................................................6

1.1 Introduction of Company.................................................................................................6

1.2 Group Companies.............................................................................................................7

1.3 History..............................................................................................................................7

1.4 Company Profile..............................................................................................................8

1.5 Registered Office Address...............................................................................................9

1.6 Board of Directors of the Company.................................................................................9

1.7 Auditors of the Company...............................................................................................11

2. Analysis of balance sheet.....................................................................................................12

2.1 Trend analysis of balance sheet:........................................................................................12

2.1.1 Trend analysis of fixed assets.....................................................................................14

2.1.2 Trend analysis of current assets..................................................................................15

2.1.3 Trend analysis of total liabilities.................................................................................16

2.1.4 Trend analysis of shareholders’ equity.......................................................................17

2.1.5 Trend analysis of total loan fund.................................................................................18

2.1.6 Trend analysis of shareholder fund.............................................................................19

2.1.7 Trend analysis of sources of fund...............................................................................20

2.1.8 Trend analysis of investment......................................................................................22

2.1.9 Trend analysis of funds application............................................................................23

2.2 Horizontal analysis of balance sheet:.................................................................................25

2.2.1 Fund’s sources 2018....................................................................................................26

2

BUSINESS ORGANIZATION ANALYSIS

2.2.3 Fund’s sources for five years......................................................................................28

2.2.4 Fund’s application for five years.................................................................................29

3. Analyzing the P& L account................................................................................................30

3.1 Trend analysis of P & L.....................................................................................................30

3.1.1 Trend analysis of total income with expenditure:.......................................................31

3.1.2 Profit after tax.............................................................................................................32

3.1.3 Transfer to reserve:.....................................................................................................33

3.1.4 Trend analysis of sales................................................................................................34

3.2 Horizontal analysis of P & L..............................................................................................36

3.2.1 Comparison of income with expenditure with profit before tax.................................36

4. Cash flow analysis................................................................................................................37

4.1 Introduction........................................................................................................................37

4.2 Analyzing the cash flow statement....................................................................................38

4.3 Interpretation of cash flow statement.................................................................................39

5. Ratio analysis.......................................................................................................................40

5.2 Liquidity ratio.....................................................................................................................40

5.2.1 Current ratio....................................................................................................................40

5.2.2 Quick ratio...................................................................................................................41

5.2.3 Net working capital.........................................................................................................43

5.3 Profitability ratio................................................................................................................44

5.3.1 Gross profit..................................................................................................................44

BUSINESS ORGANIZATION ANALYSIS

2.2.3 Fund’s sources for five years......................................................................................28

2.2.4 Fund’s application for five years.................................................................................29

3. Analyzing the P& L account................................................................................................30

3.1 Trend analysis of P & L.....................................................................................................30

3.1.1 Trend analysis of total income with expenditure:.......................................................31

3.1.2 Profit after tax.............................................................................................................32

3.1.3 Transfer to reserve:.....................................................................................................33

3.1.4 Trend analysis of sales................................................................................................34

3.2 Horizontal analysis of P & L..............................................................................................36

3.2.1 Comparison of income with expenditure with profit before tax.................................36

4. Cash flow analysis................................................................................................................37

4.1 Introduction........................................................................................................................37

4.2 Analyzing the cash flow statement....................................................................................38

4.3 Interpretation of cash flow statement.................................................................................39

5. Ratio analysis.......................................................................................................................40

5.2 Liquidity ratio.....................................................................................................................40

5.2.1 Current ratio....................................................................................................................40

5.2.2 Quick ratio...................................................................................................................41

5.2.3 Net working capital.........................................................................................................43

5.3 Profitability ratio................................................................................................................44

5.3.1 Gross profit..................................................................................................................44

3

BUSINESS ORGANIZATION ANALYSIS

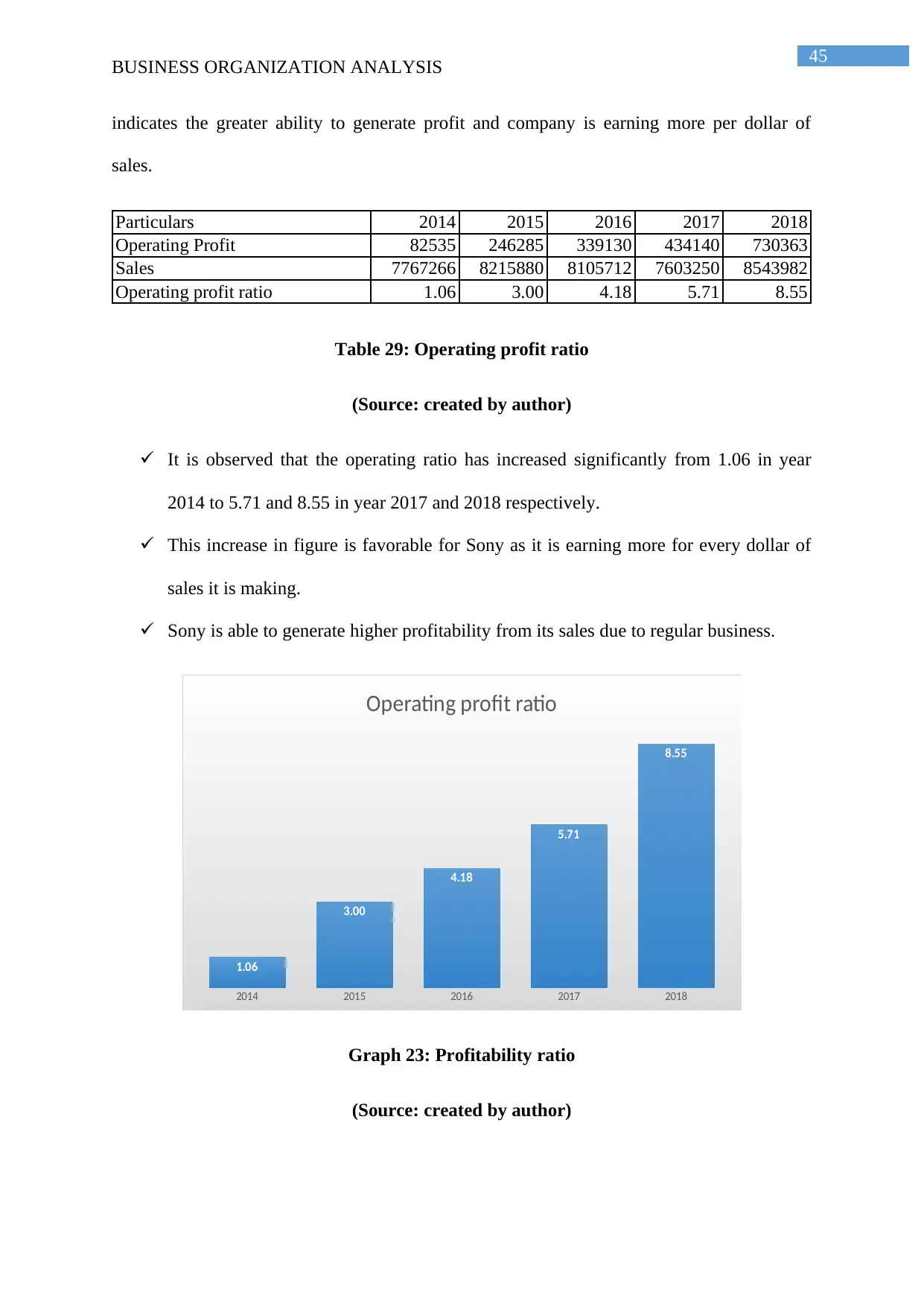

5.3.2 Operating ratio............................................................................................................45

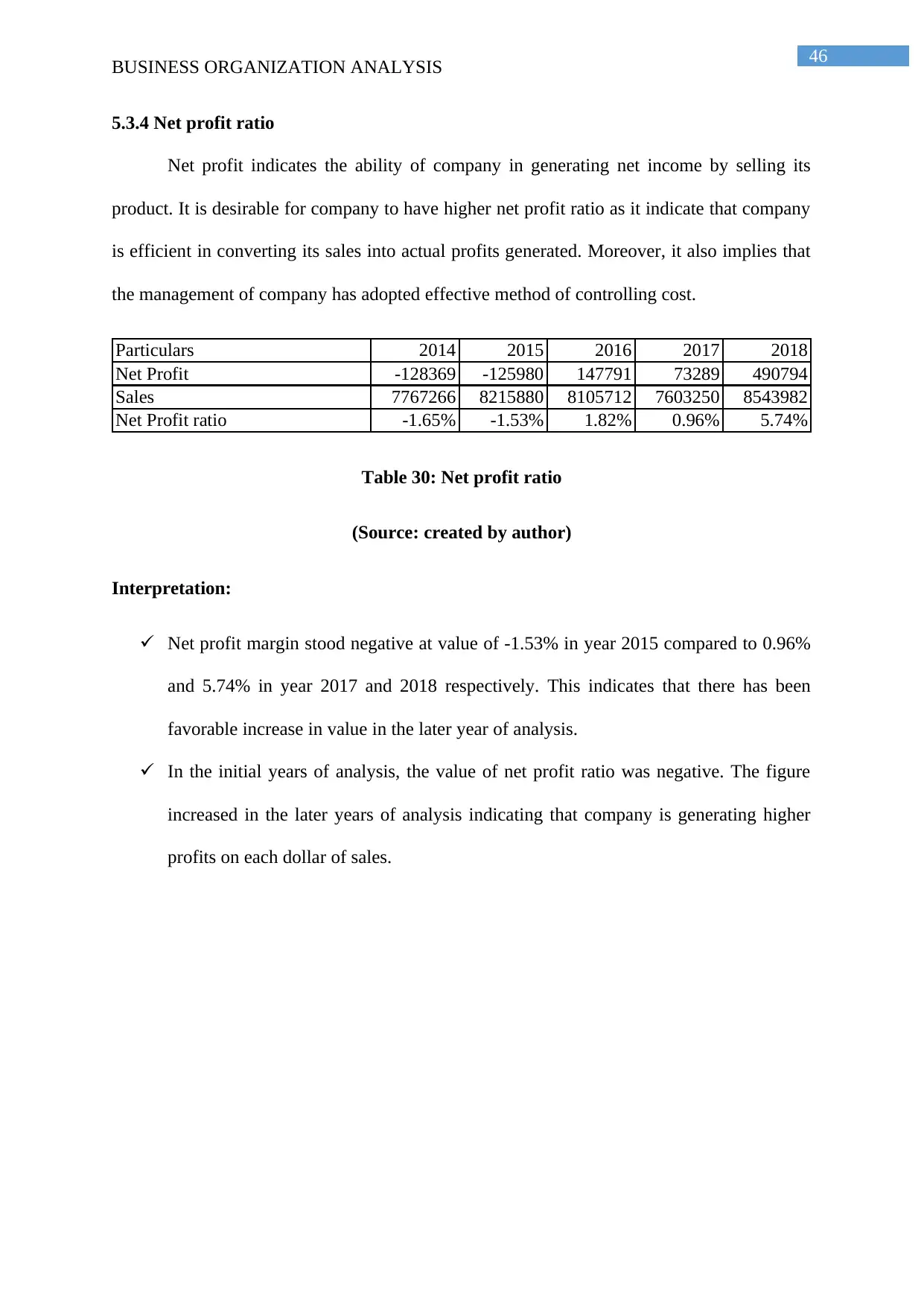

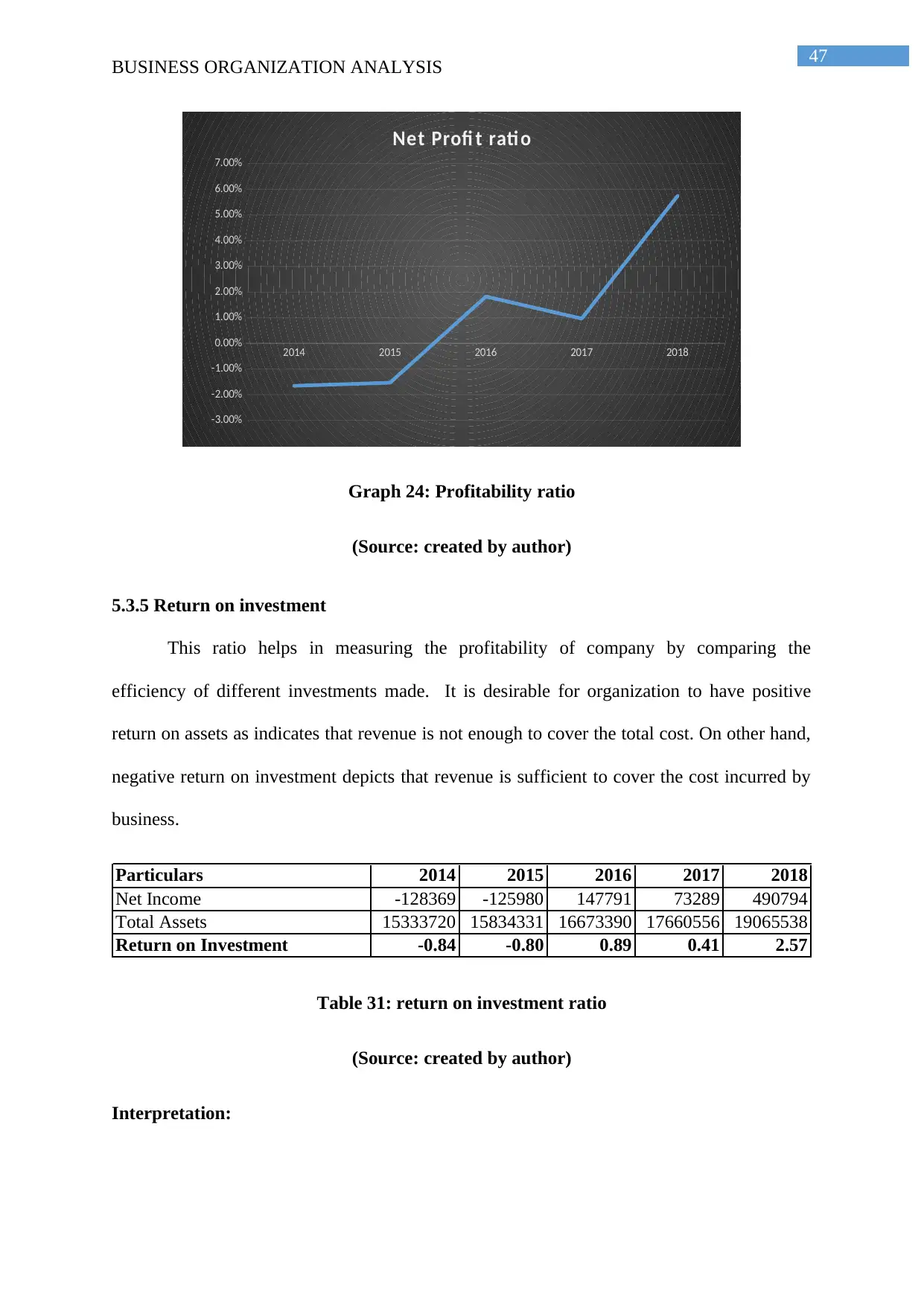

5.3.4 Net profit ratio.............................................................................................................47

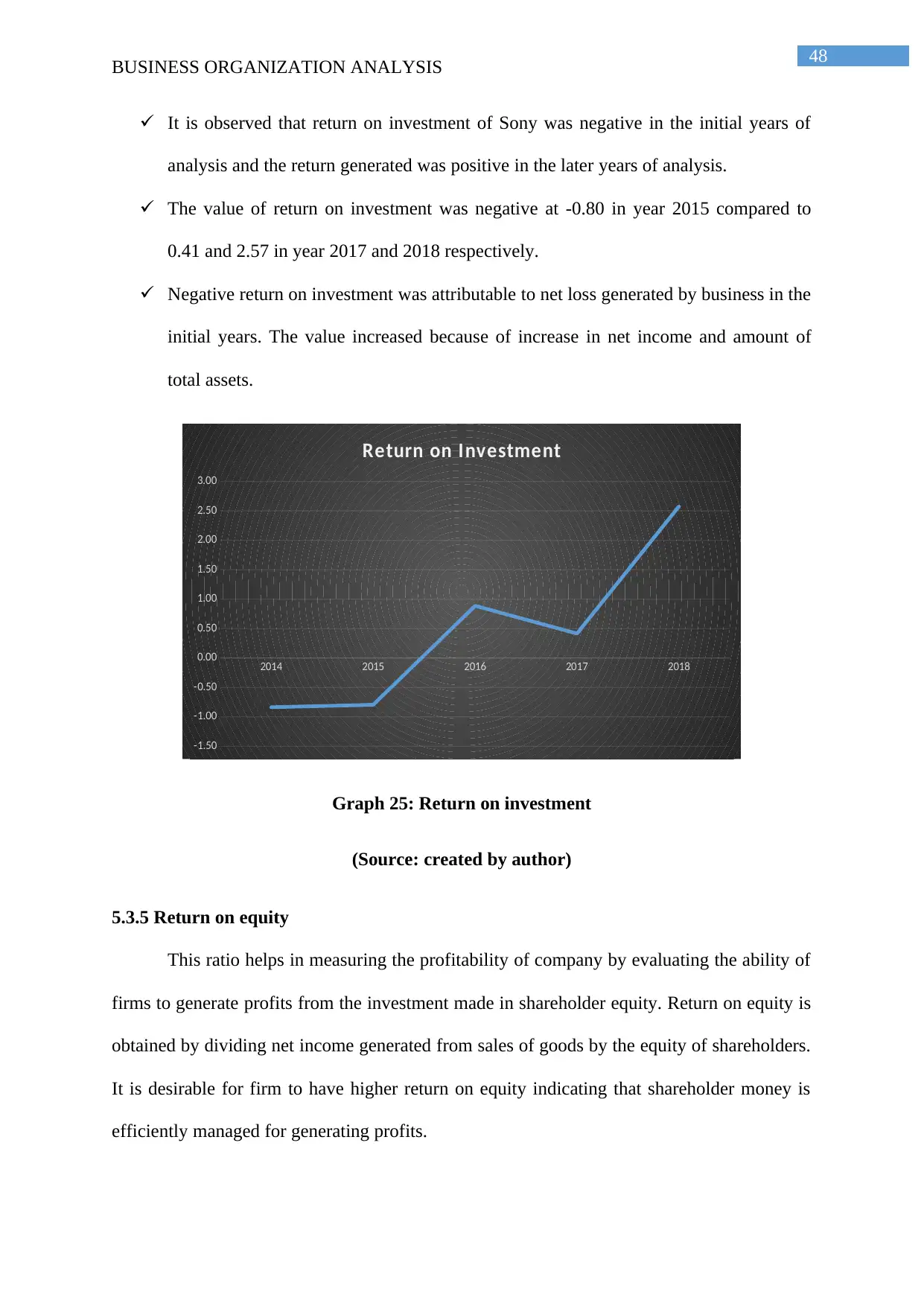

5.3.5 Return on investment..................................................................................................48

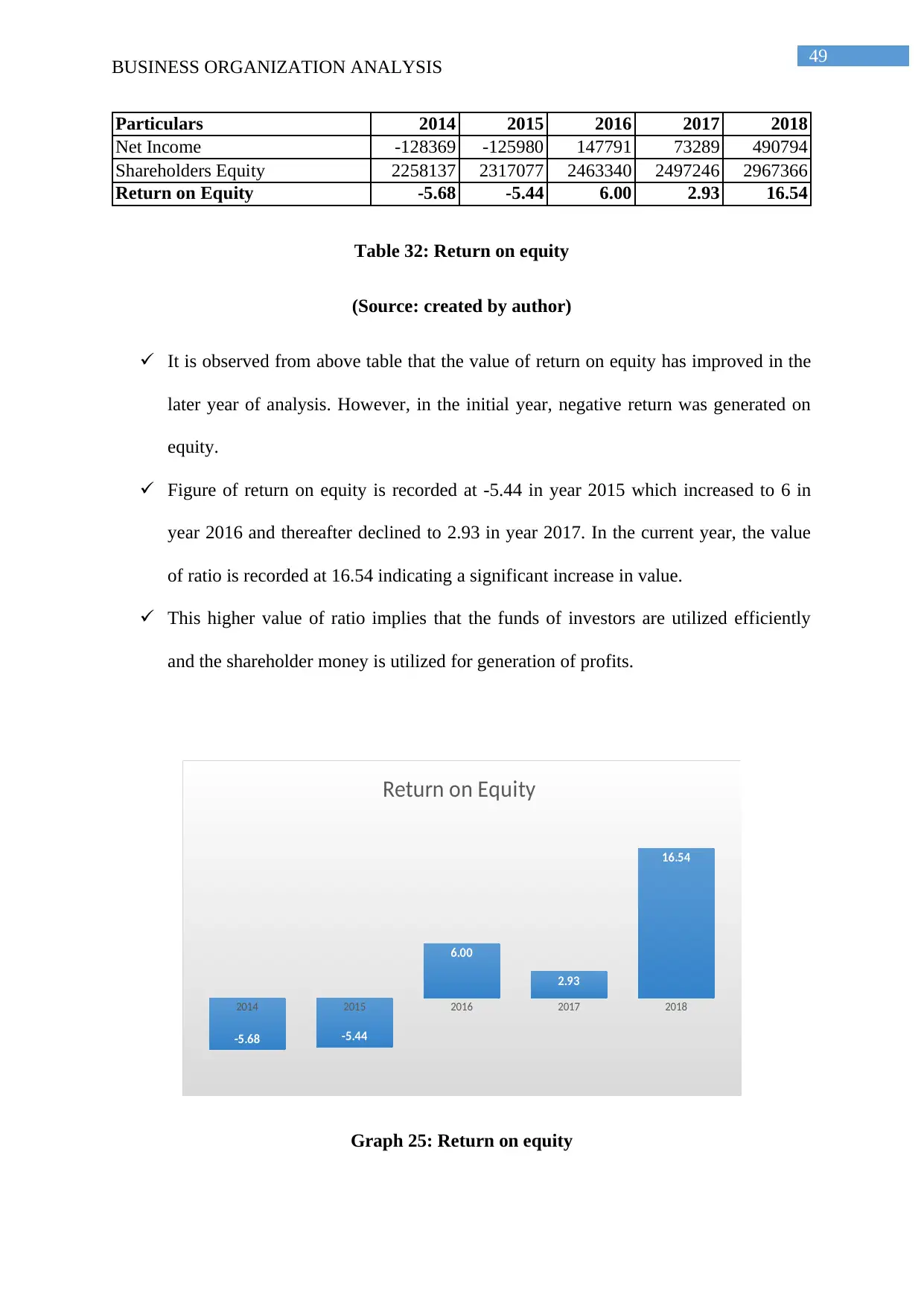

5.3.5 Return on equity..........................................................................................................49

5.4 Efficiency ratio...................................................................................................................51

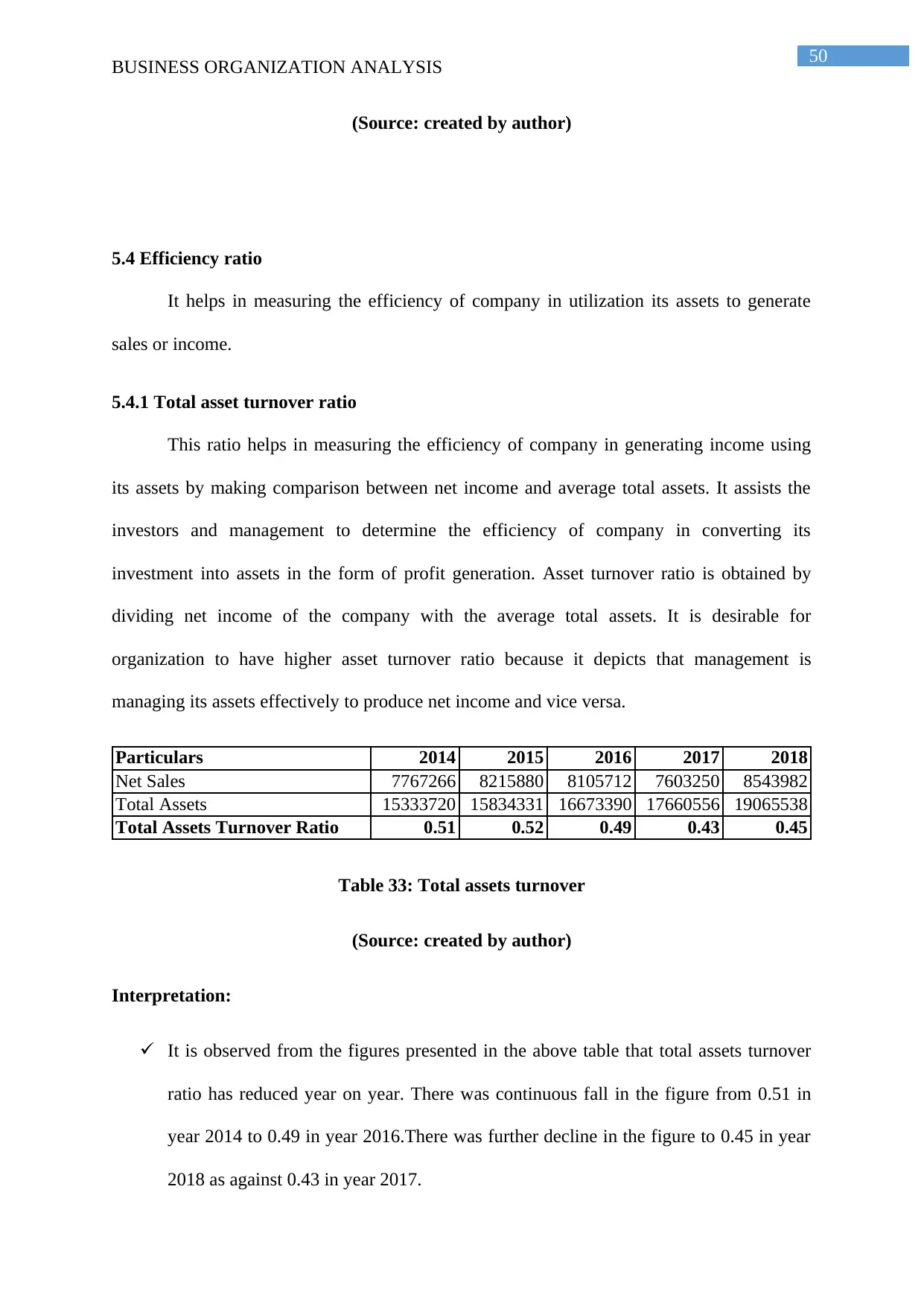

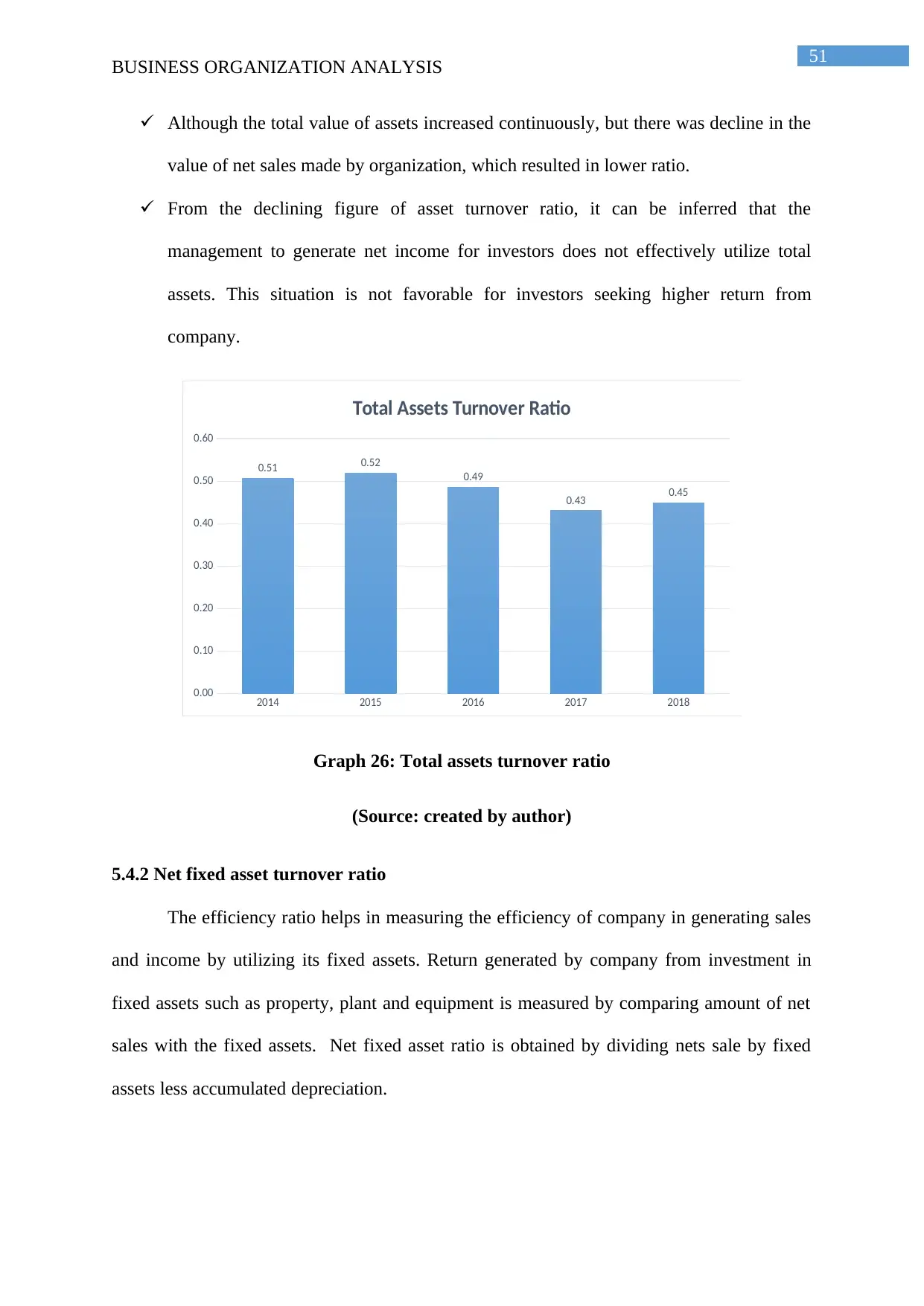

5.4.1 Total asset turnover ratio.............................................................................................51

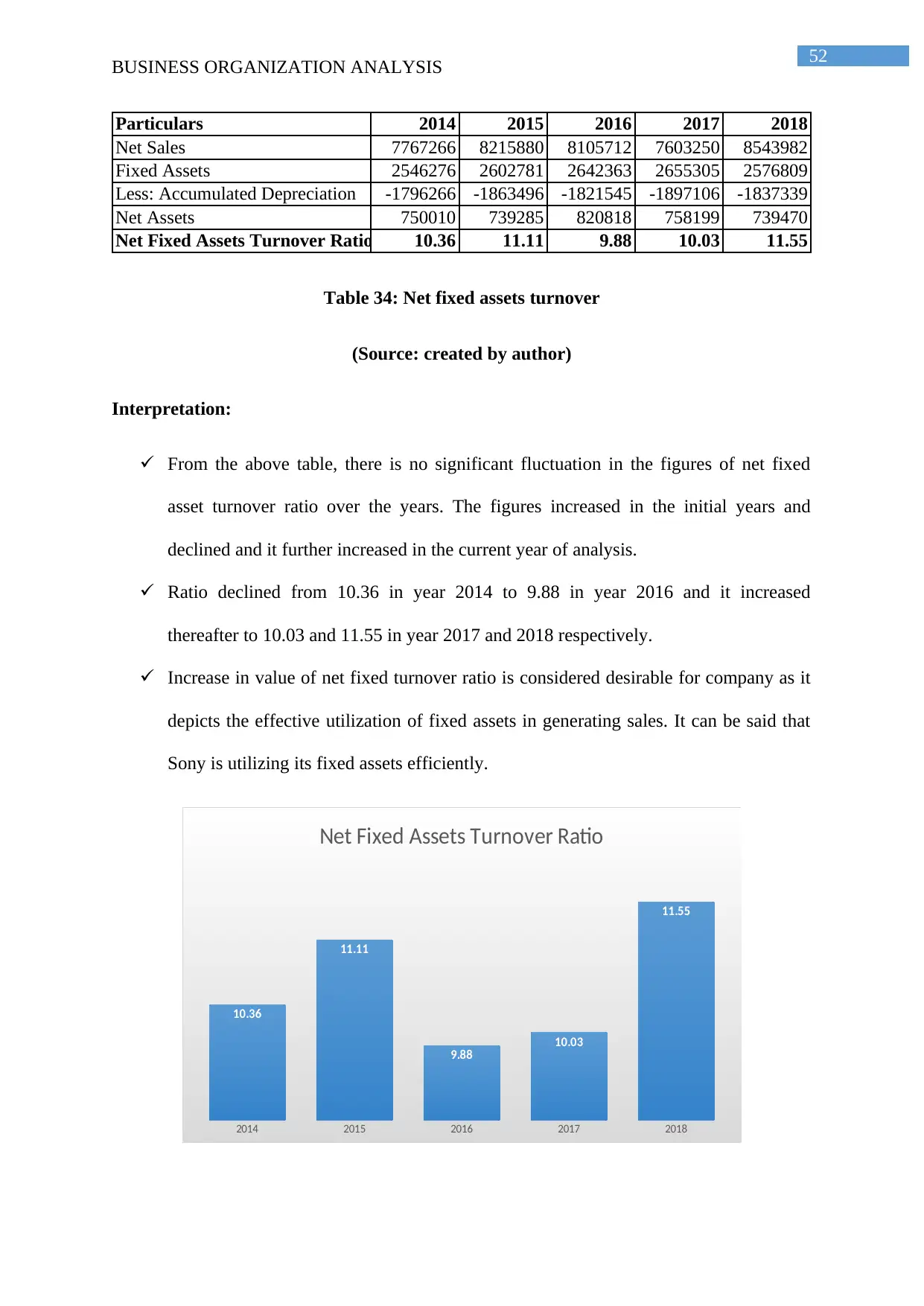

5.4.2 Net fixed asset turnover ratio......................................................................................52

5.4.3 Inventories turnover ratio............................................................................................54

5.4.4 Average age of inventories..........................................................................................55

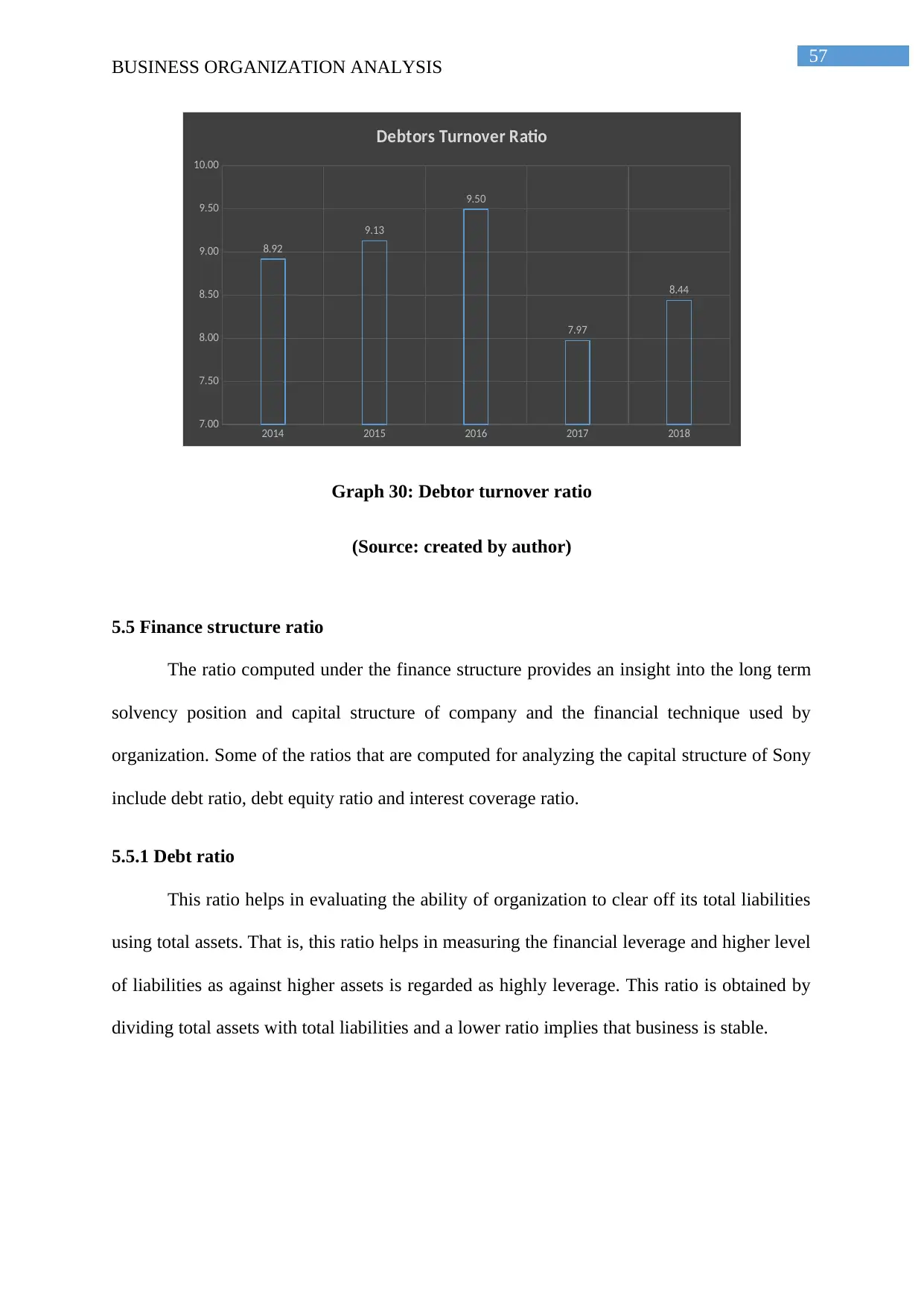

5.4.5 Debtor turnover ratio...................................................................................................57

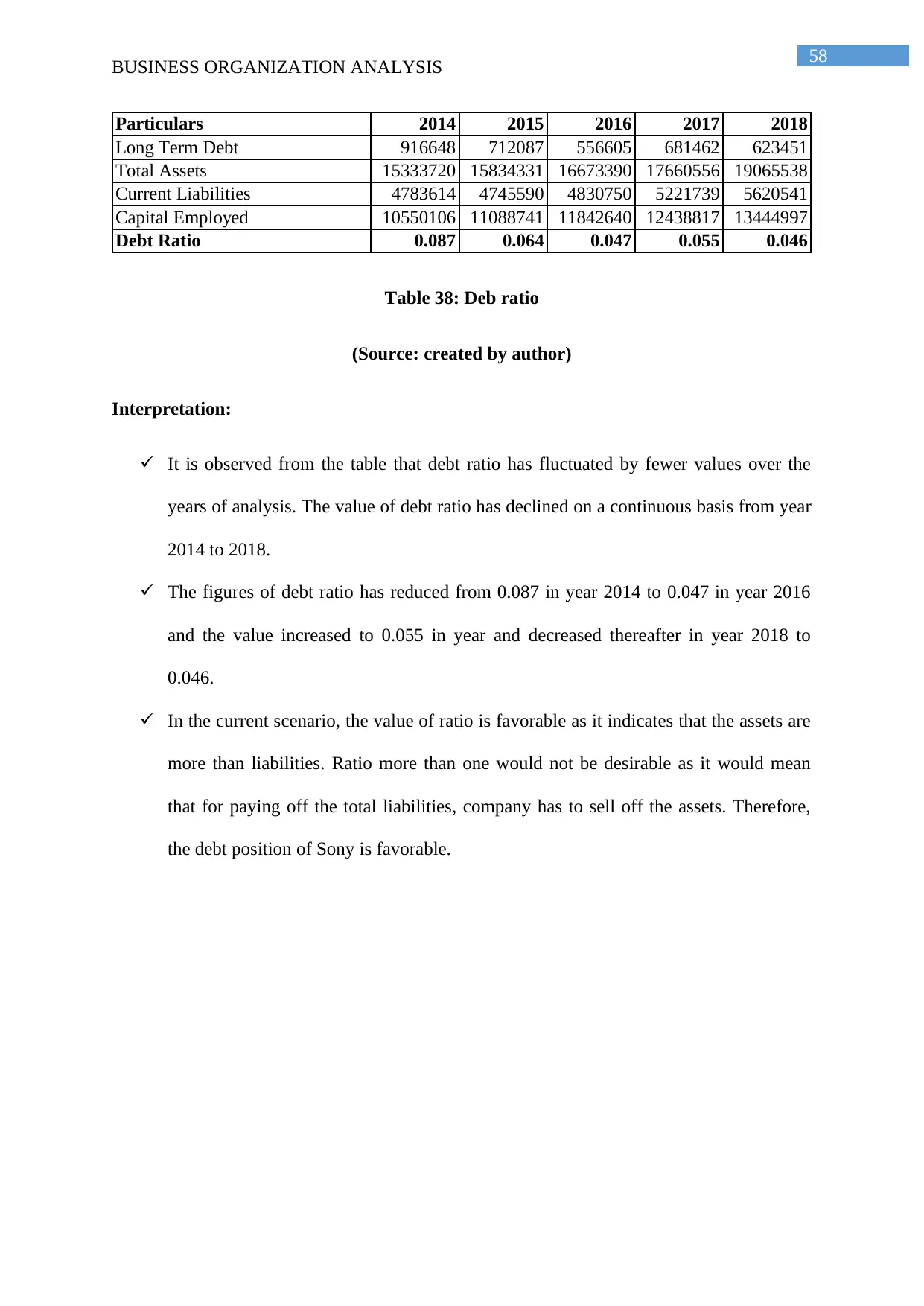

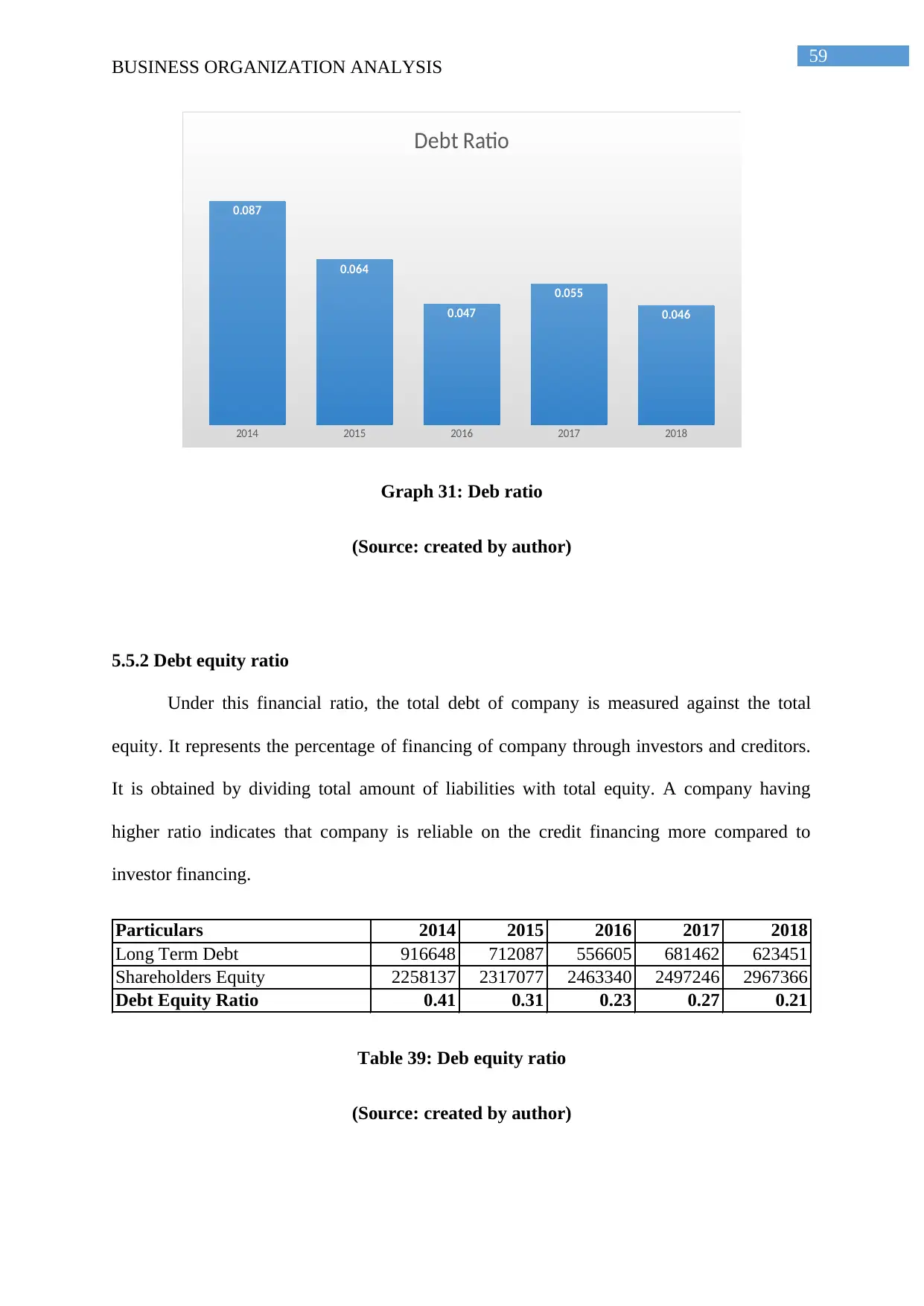

5.5 Finance structure ratio........................................................................................................58

5.5.1 Debt ratio.....................................................................................................................58

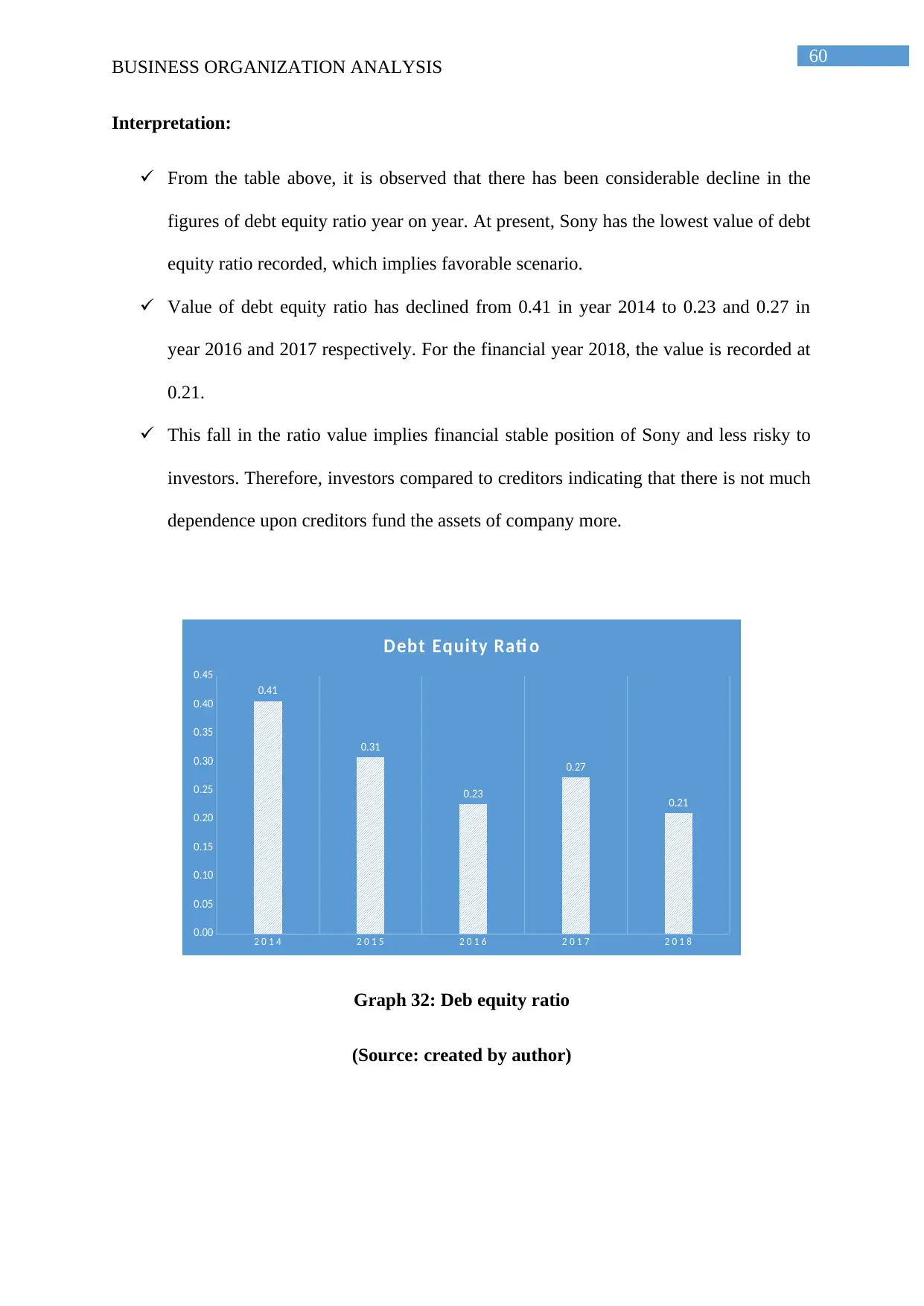

5.5.2 Debt equity ratio..........................................................................................................60

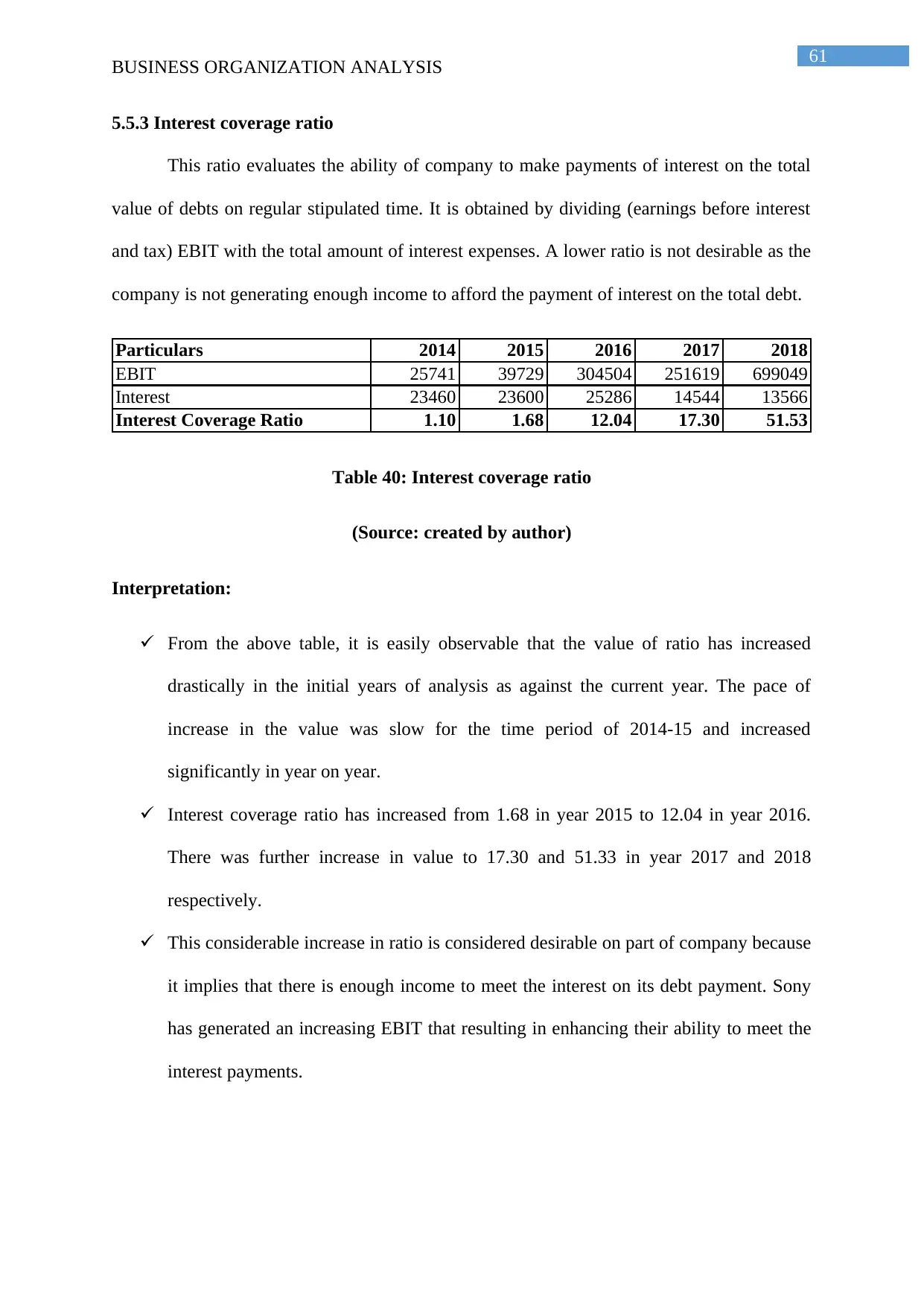

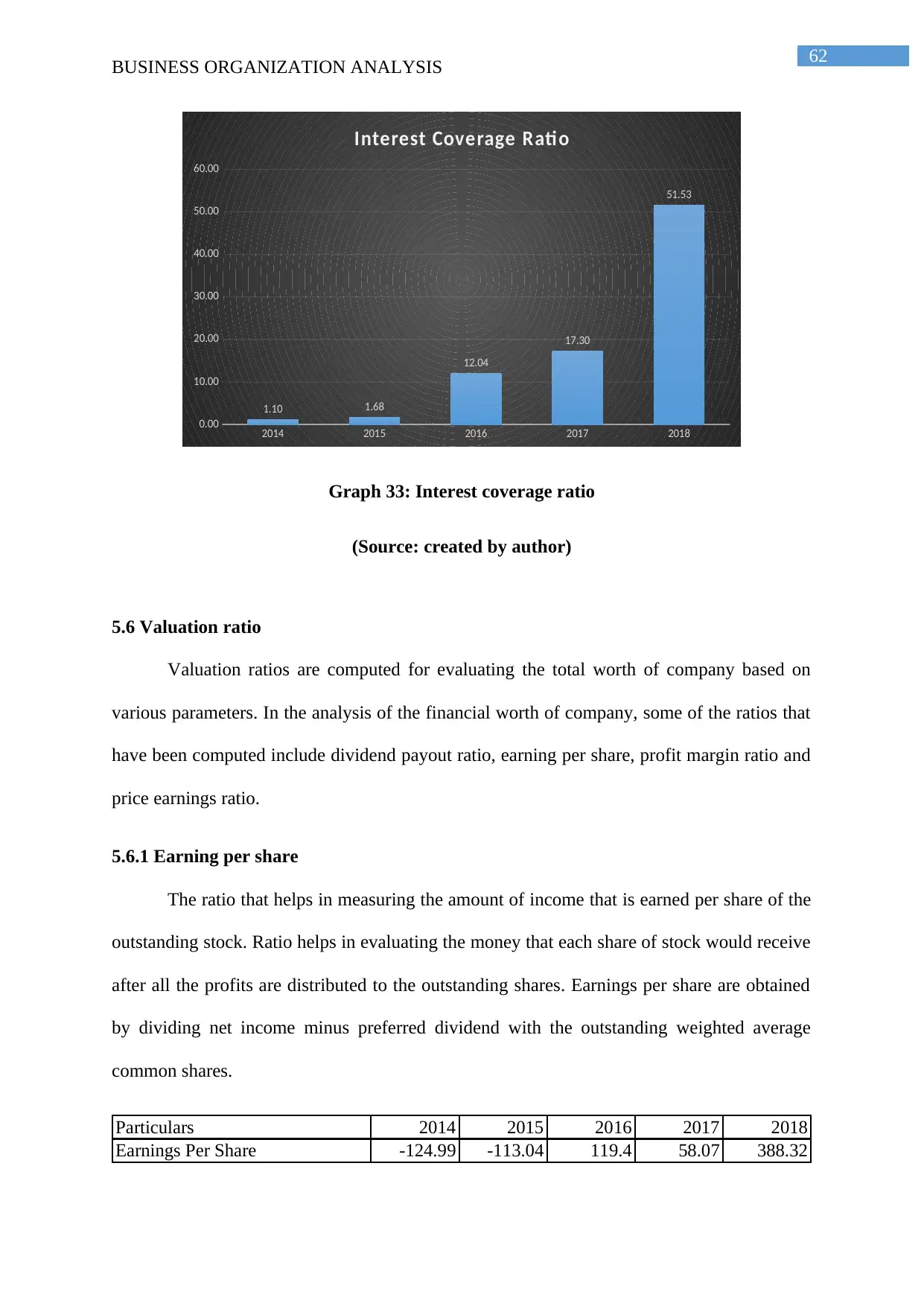

5.5.3 Interest coverage ratio.................................................................................................62

5.6 Valuation ratio....................................................................................................................63

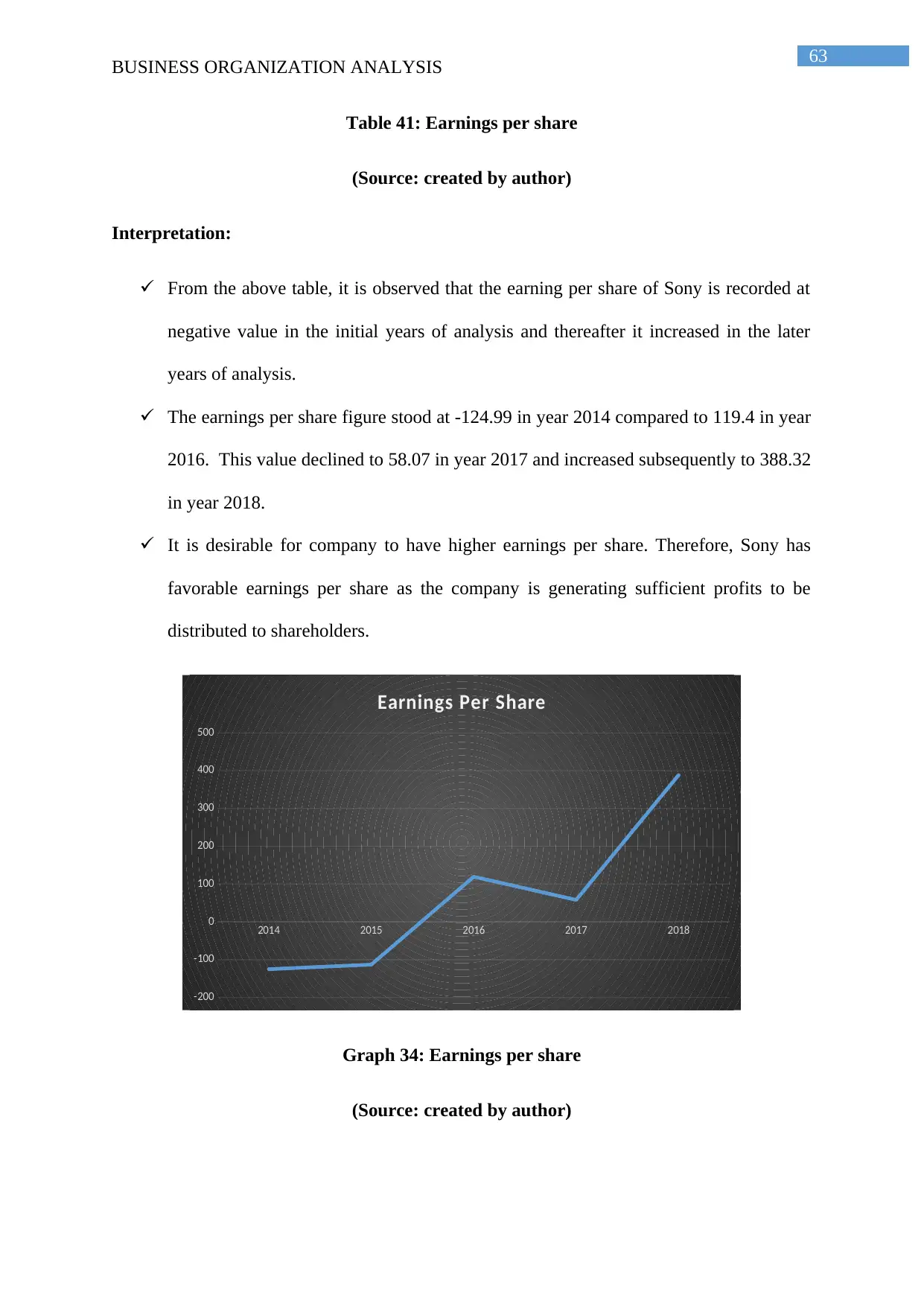

5.6.1 Earning per share.........................................................................................................63

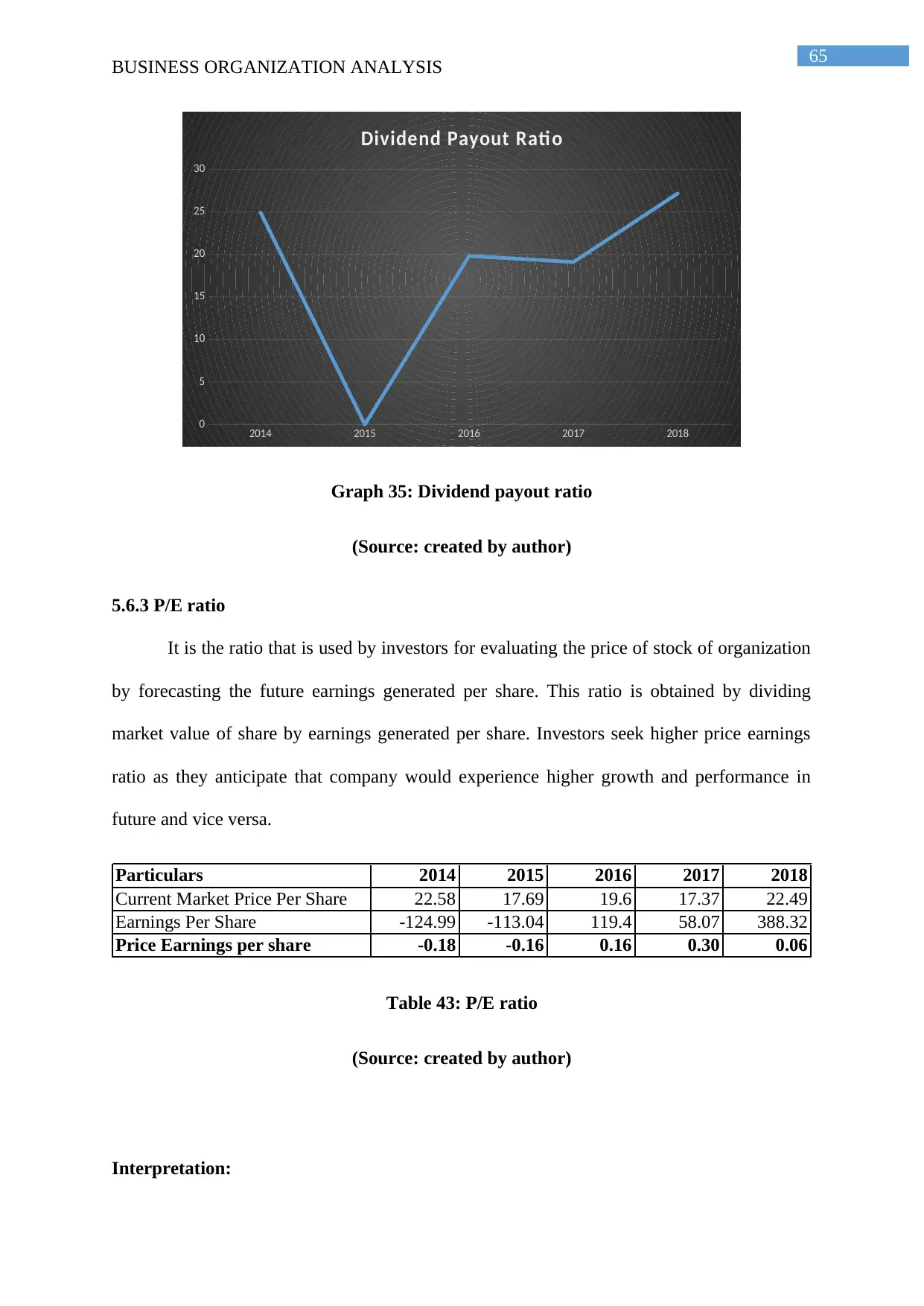

5.6.2 Dividend payout ratio..................................................................................................65

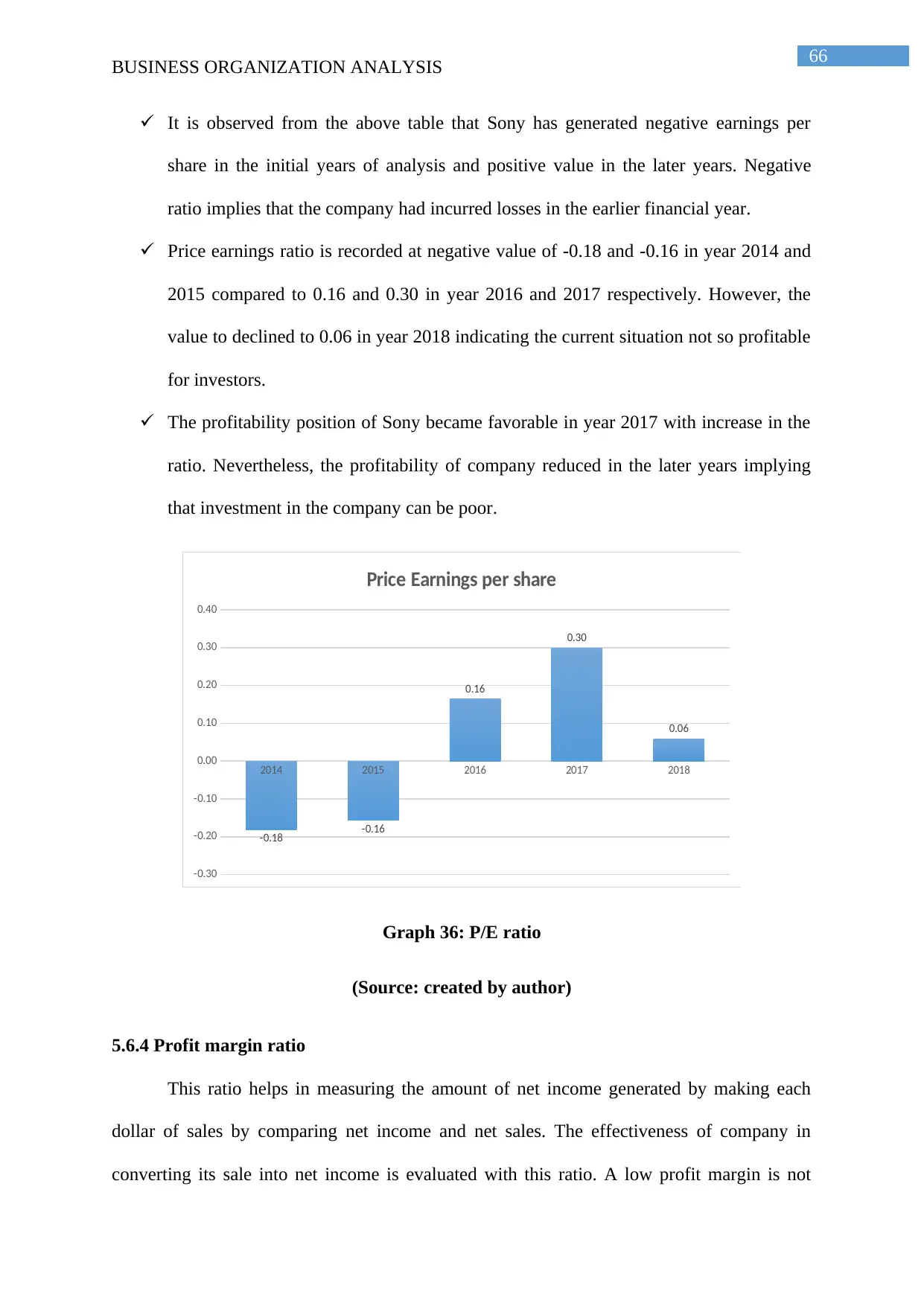

5.6.3 P/E ratio.......................................................................................................................66

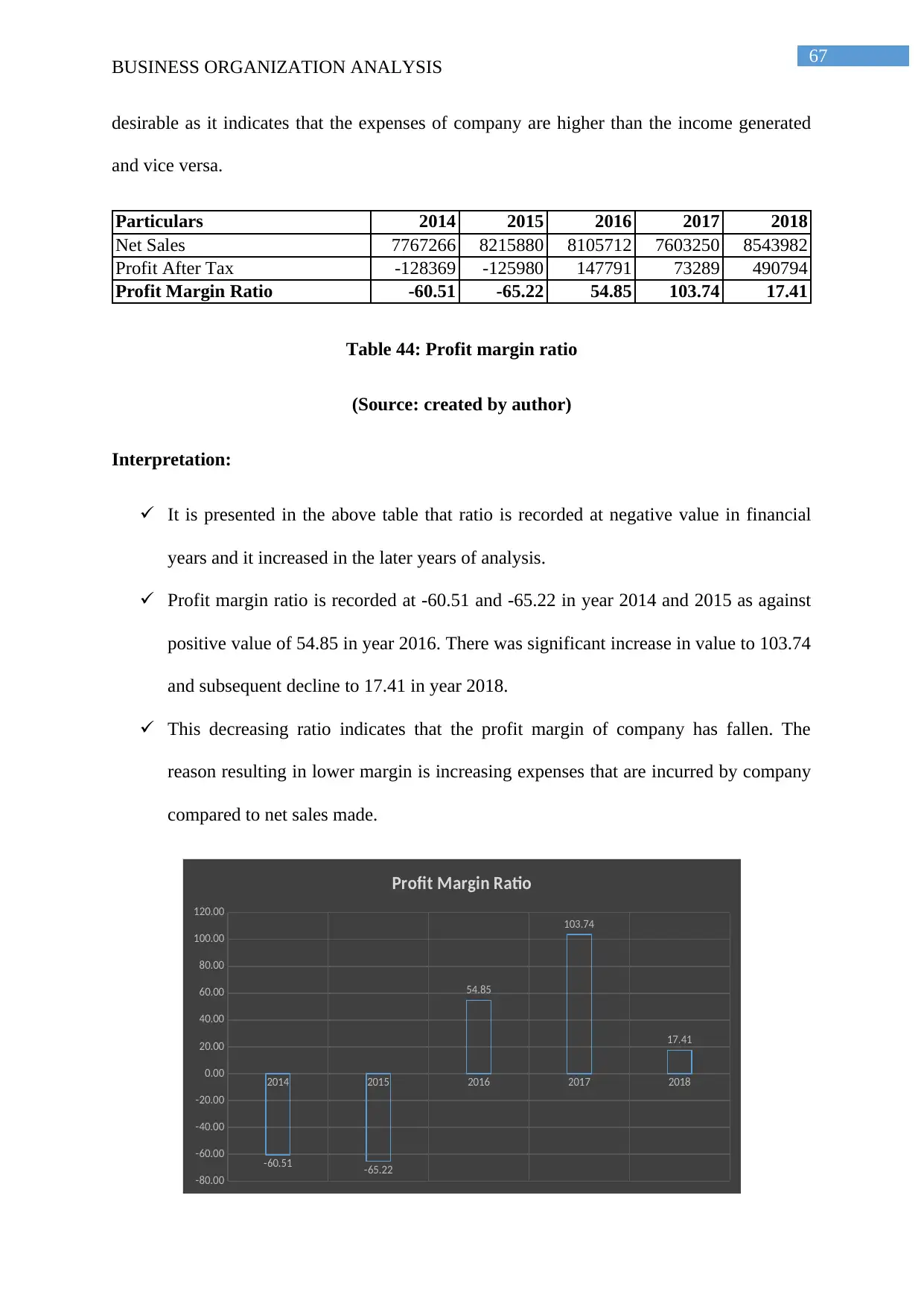

5.6.4 Profit margin ratio.......................................................................................................67

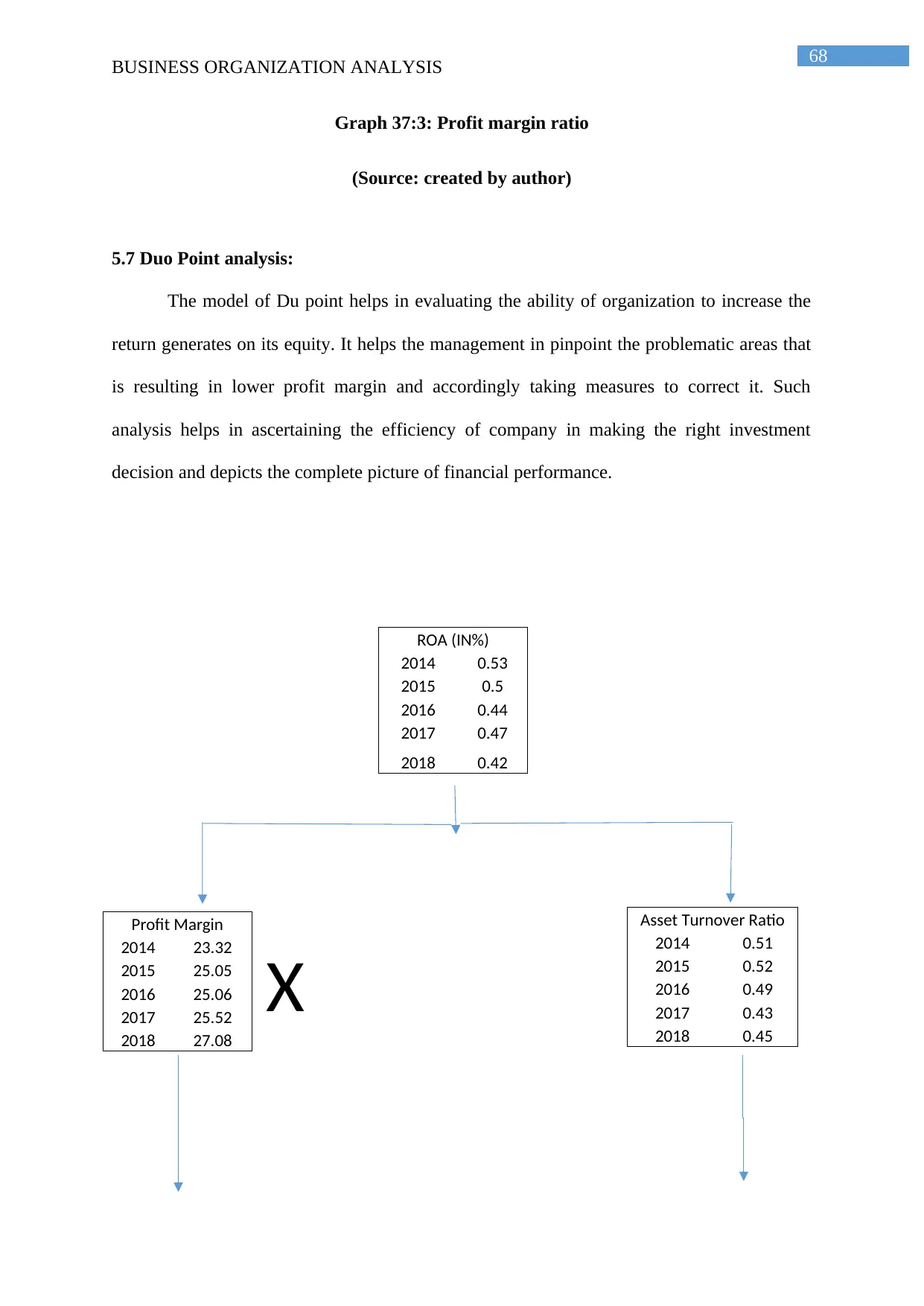

5.7 Duo Point analysis:............................................................................................................69

6. Scenario analysis..................................................................................................................71

BUSINESS ORGANIZATION ANALYSIS

5.3.2 Operating ratio............................................................................................................45

5.3.4 Net profit ratio.............................................................................................................47

5.3.5 Return on investment..................................................................................................48

5.3.5 Return on equity..........................................................................................................49

5.4 Efficiency ratio...................................................................................................................51

5.4.1 Total asset turnover ratio.............................................................................................51

5.4.2 Net fixed asset turnover ratio......................................................................................52

5.4.3 Inventories turnover ratio............................................................................................54

5.4.4 Average age of inventories..........................................................................................55

5.4.5 Debtor turnover ratio...................................................................................................57

5.5 Finance structure ratio........................................................................................................58

5.5.1 Debt ratio.....................................................................................................................58

5.5.2 Debt equity ratio..........................................................................................................60

5.5.3 Interest coverage ratio.................................................................................................62

5.6 Valuation ratio....................................................................................................................63

5.6.1 Earning per share.........................................................................................................63

5.6.2 Dividend payout ratio..................................................................................................65

5.6.3 P/E ratio.......................................................................................................................66

5.6.4 Profit margin ratio.......................................................................................................67

5.7 Duo Point analysis:............................................................................................................69

6. Scenario analysis..................................................................................................................71

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

BUSINESS ORGANIZATION ANALYSIS

6.1 Company analysis..............................................................................................................71

6.2 Shareholding pattern..........................................................................................................72

Findings and Conclusion:.........................................................................................................73

Reference and Bibliography:....................................................................................................75

BUSINESS ORGANIZATION ANALYSIS

6.1 Company analysis..............................................................................................................71

6.2 Shareholding pattern..........................................................................................................72

Findings and Conclusion:.........................................................................................................73

Reference and Bibliography:....................................................................................................75

5

BUSINESS ORGANIZATION ANALYSIS

1. INTRODUCTION

1.1 Introduction of Company

Sony Corporation is a well-known Japanese multinational company, which was

initiated in the May 1946 in Japan. The company is headquartered in Sony City, Minato, and

Tokyo (Motoyama, 2016). The company predominantly focuses on the manufacturing,

production, development of design, sale and offer of different types of electronic instruments,

equipment and devices for potential customers. The company also provides services to the

international markets, industrial markets as well as to the professionals working on software,

game hardware, network services, cameras, semiconductors and mobile phones. The

company is also engaged in the manufacture, distribution and production of recorded music

the licensing and the management of the music and words of the songs. The company deals

with the distribution and production of animation titles which game applications, motion

pictures and deals with television and digital network operations. With all these innovation

and entertainment factors, Sony is considered to be as the most inclusive global entertainment

company. The company delivers high-level business value to the potential customers through

a deliberate mixture of quality, innovation and service.

BUSINESS ORGANIZATION ANALYSIS

1. INTRODUCTION

1.1 Introduction of Company

Sony Corporation is a well-known Japanese multinational company, which was

initiated in the May 1946 in Japan. The company is headquartered in Sony City, Minato, and

Tokyo (Motoyama, 2016). The company predominantly focuses on the manufacturing,

production, development of design, sale and offer of different types of electronic instruments,

equipment and devices for potential customers. The company also provides services to the

international markets, industrial markets as well as to the professionals working on software,

game hardware, network services, cameras, semiconductors and mobile phones. The

company is also engaged in the manufacture, distribution and production of recorded music

the licensing and the management of the music and words of the songs. The company deals

with the distribution and production of animation titles which game applications, motion

pictures and deals with television and digital network operations. With all these innovation

and entertainment factors, Sony is considered to be as the most inclusive global entertainment

company. The company delivers high-level business value to the potential customers through

a deliberate mixture of quality, innovation and service.

6

BUSINESS ORGANIZATION ANALYSIS

1.2 Group Companies

Sony owns a list of renowned companies which includes Aniplex Inc. as the first

Sony subsidiaries which is a music and anime producing company. Aniplex is well-known

for its planning, distribution and production of many anime series. The other subsidiaries of

Sony are:

Sony Interactive Entertainment Inc.

Sony Global Solution Inc.

Sony Bank Inc.

Sony Energy Devices Corporation

Sony Global Manufacturing and Operation Corporation

Sony LSI Design Inc.

Sony Life Insurance Co., Ltd

Apart from these companies, there are other companies which deals with the IT

and gaming companies. The major holdings and affiliations of Sony are located

worldwide that is predominantly in Japan, Canada, United States, Latin America,

Europe, Hong-Kong and China, South Korea, India, Oceania and Southeast Asia and

Middle East.

1.3 History

The company Sony was established in the year 1946 in May in Japan which was

named as “Tokyo Tsushin Kogyo Kabushiki Kaisha” which was a joint stock exchange

company. It was in 1958 when the name was changed to “Sony Kabushiki Kaisha” in

English it is “Sony Corporation”. In 1988 January, the joint stock exchange company

transformed into wholly-owned branch of Sony Corporation and the name was changed in

1991 April to Sony Music Entertainment (Hong, 2018). The company was ranked on the

BUSINESS ORGANIZATION ANALYSIS

1.2 Group Companies

Sony owns a list of renowned companies which includes Aniplex Inc. as the first

Sony subsidiaries which is a music and anime producing company. Aniplex is well-known

for its planning, distribution and production of many anime series. The other subsidiaries of

Sony are:

Sony Interactive Entertainment Inc.

Sony Global Solution Inc.

Sony Bank Inc.

Sony Energy Devices Corporation

Sony Global Manufacturing and Operation Corporation

Sony LSI Design Inc.

Sony Life Insurance Co., Ltd

Apart from these companies, there are other companies which deals with the IT

and gaming companies. The major holdings and affiliations of Sony are located

worldwide that is predominantly in Japan, Canada, United States, Latin America,

Europe, Hong-Kong and China, South Korea, India, Oceania and Southeast Asia and

Middle East.

1.3 History

The company Sony was established in the year 1946 in May in Japan which was

named as “Tokyo Tsushin Kogyo Kabushiki Kaisha” which was a joint stock exchange

company. It was in 1958 when the name was changed to “Sony Kabushiki Kaisha” in

English it is “Sony Corporation”. In 1988 January, the joint stock exchange company

transformed into wholly-owned branch of Sony Corporation and the name was changed in

1991 April to Sony Music Entertainment (Hong, 2018). The company was ranked on the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

BUSINESS ORGANIZATION ANALYSIS

“New York Stock Exchange” (Davlin, 2016). In 2017 April the battery business of Sony

was transferred to “Murata Manufacturing Co.” Ltd Group. Over the past years the

company has emerged with many other subsidiaries with increasing productivity (Oki,

2016).

1.4 Company Profile

The Sony Corporation is the leading company for electronic, IT, gaming, video and

communication. It has been working to enlarge its market by restructuring its corporate base

and taking initiatives in product development. The company accounts varieties of other

consumer electronic products, VCRs and TVs. Sony has also incorporated itself with

financial service enterprises such as insurance operations, banking operations, credit and

leasing finance operations. The conjugate operation dealt with these companies includes

advertising agency business, entertainment with location-based business and predominantly

the internet- related business. The key strategy of the company is to focus on CSR

abbreviated as “Corporate Social Responsibility” (Clevenger &MacGregor, 2019). The

company has encouraged itself with many activities which includes “Climate Saver

Programmes”. Sony has achieved many awards for sustainable energy held in Europe by the

European Commission as Sony enrols itself improving the energy efficient products as well

as for being transparent with the consumers about its products (Bartoli et al., 2019).

The key strength of Sony is it holds the rank of largest entertainment company all

over the world-operating world widely with the varieties of products. It is well-known brand,

which holds good customer loyalty and has the advantage of customer retention (Garga et al.,

2019). Considering the weakness of the company, it lacks good quality of mobile phones,

which shows low performance in the market. The major strategic alliances of the company

are Viacom, Monex Beans holdings and Sony financial holdings. The significant mergers

include Toshiba, Sandisk and Kodak.

BUSINESS ORGANIZATION ANALYSIS

“New York Stock Exchange” (Davlin, 2016). In 2017 April the battery business of Sony

was transferred to “Murata Manufacturing Co.” Ltd Group. Over the past years the

company has emerged with many other subsidiaries with increasing productivity (Oki,

2016).

1.4 Company Profile

The Sony Corporation is the leading company for electronic, IT, gaming, video and

communication. It has been working to enlarge its market by restructuring its corporate base

and taking initiatives in product development. The company accounts varieties of other

consumer electronic products, VCRs and TVs. Sony has also incorporated itself with

financial service enterprises such as insurance operations, banking operations, credit and

leasing finance operations. The conjugate operation dealt with these companies includes

advertising agency business, entertainment with location-based business and predominantly

the internet- related business. The key strategy of the company is to focus on CSR

abbreviated as “Corporate Social Responsibility” (Clevenger &MacGregor, 2019). The

company has encouraged itself with many activities which includes “Climate Saver

Programmes”. Sony has achieved many awards for sustainable energy held in Europe by the

European Commission as Sony enrols itself improving the energy efficient products as well

as for being transparent with the consumers about its products (Bartoli et al., 2019).

The key strength of Sony is it holds the rank of largest entertainment company all

over the world-operating world widely with the varieties of products. It is well-known brand,

which holds good customer loyalty and has the advantage of customer retention (Garga et al.,

2019). Considering the weakness of the company, it lacks good quality of mobile phones,

which shows low performance in the market. The major strategic alliances of the company

are Viacom, Monex Beans holdings and Sony financial holdings. The significant mergers

include Toshiba, Sandisk and Kodak.

8

BUSINESS ORGANIZATION ANALYSIS

1.5 Registered Office Address

Company name -Sony Corporation

Founded May 7, 1946

Headquarters 1-7-1 Konan Minato-ku, Tokyo, 108-0075 Japan

TEL 81-3-6748-2111, Access from Konan Exit of Shinanagava Station.

1.6 Board of Directors of the Company

The advisors and Board of members of Sony are:

Kazuo Hirai – Chairman

Kenichiro Yoshida – CEO, President, Representative Corporate Executive officer and

director

BUSINESS ORGANIZATION ANALYSIS

1.5 Registered Office Address

Company name -Sony Corporation

Founded May 7, 1946

Headquarters 1-7-1 Konan Minato-ku, Tokyo, 108-0075 Japan

TEL 81-3-6748-2111, Access from Konan Exit of Shinanagava Station.

1.6 Board of Directors of the Company

The advisors and Board of members of Sony are:

Kazuo Hirai – Chairman

Kenichiro Yoshida – CEO, President, Representative Corporate Executive officer and

director

9

BUSINESS ORGANIZATION ANALYSIS

Hiroshi Kawano- Representative Director, President of Sony Marketing Inc and Sony

Markleting Japan Inc.

The other board members:

Shuzo Sumi- Vice Chairman

Osamu Nagayama- Member of BOD

Toshiko Oka- Member of BOD

Tim Schaaff – Member of BOD

KunihitoMinakawa- Member of BOD

Koichi Miyata – Member of BOD

Louis Gerstner Jr. - Member of BOD

Eriko Sakurai- Member of BOD

Eikoh Harada- Member of BOD

Peter Liguori- Member of BOD

Kazuo Matsunaga-Member of BOD

John Roos- Member of BOD

BUSINESS ORGANIZATION ANALYSIS

Hiroshi Kawano- Representative Director, President of Sony Marketing Inc and Sony

Markleting Japan Inc.

The other board members:

Shuzo Sumi- Vice Chairman

Osamu Nagayama- Member of BOD

Toshiko Oka- Member of BOD

Tim Schaaff – Member of BOD

KunihitoMinakawa- Member of BOD

Koichi Miyata – Member of BOD

Louis Gerstner Jr. - Member of BOD

Eriko Sakurai- Member of BOD

Eikoh Harada- Member of BOD

Peter Liguori- Member of BOD

Kazuo Matsunaga-Member of BOD

John Roos- Member of BOD

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

BUSINESS ORGANIZATION ANALYSIS

1.7 Auditors of the Company

The company’s accounting audit is usually conducted by Prince Water House

Coopers Aarata, which is obliged under an agreement (Gray &Ehoff, 2015). Currently the

accounting auditors for the 2017 fiscal year, with ended 31st March 2018 for the company are

the followings:Hitoshi Kiuchi, TakaaiIno and Masataka Kubota (Rowledge et al., 2017).

BUSINESS ORGANIZATION ANALYSIS

1.7 Auditors of the Company

The company’s accounting audit is usually conducted by Prince Water House

Coopers Aarata, which is obliged under an agreement (Gray &Ehoff, 2015). Currently the

accounting auditors for the 2017 fiscal year, with ended 31st March 2018 for the company are

the followings:Hitoshi Kiuchi, TakaaiIno and Masataka Kubota (Rowledge et al., 2017).

11

BUSINESS ORGANIZATION ANALYSIS

2. Analysis of balance sheet

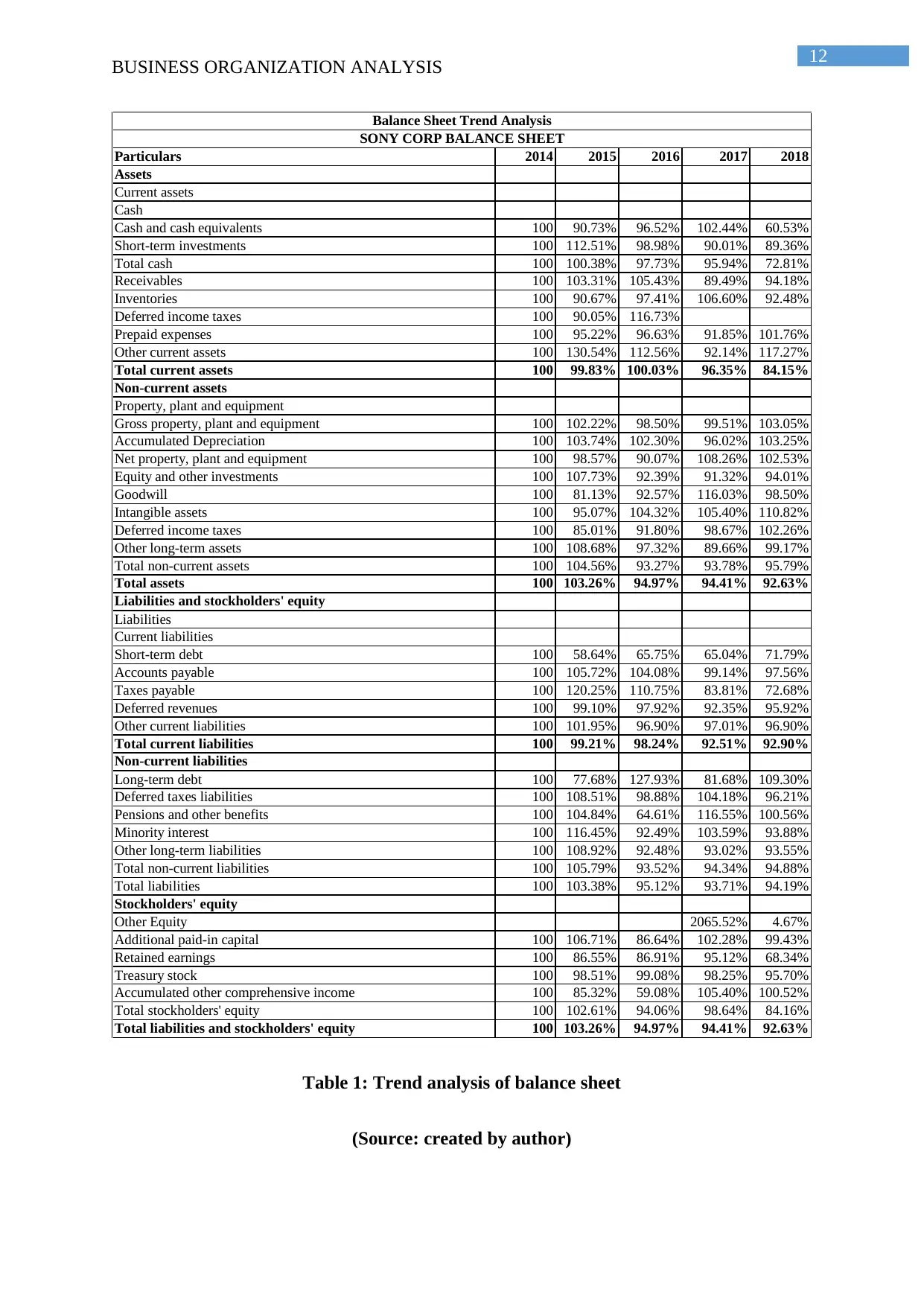

2.1 Trend analysis of balance sheet:

For a number of successive years the trend analysis of balance sheet includes the

calculations of the percentage change of the particulars. This is done by taking the particulars

of previous financial years, which is used as the base year, and the particulars of the other

years expressed as percentage of the base year. For computing the trend analysis, the base

year, which has been taken, is 2014.

BUSINESS ORGANIZATION ANALYSIS

2. Analysis of balance sheet

2.1 Trend analysis of balance sheet:

For a number of successive years the trend analysis of balance sheet includes the

calculations of the percentage change of the particulars. This is done by taking the particulars

of previous financial years, which is used as the base year, and the particulars of the other

years expressed as percentage of the base year. For computing the trend analysis, the base

year, which has been taken, is 2014.

12

BUSINESS ORGANIZATION ANALYSIS

Particulars 2014 2015 2016 2017 2018

Assets

Current assets

Cash

Cash and cash equivalents 100 90.73% 96.52% 102.44% 60.53%

Short-term investments 100 112.51% 98.98% 90.01% 89.36%

Total cash 100 100.38% 97.73% 95.94% 72.81%

Receivables 100 103.31% 105.43% 89.49% 94.18%

Inventories 100 90.67% 97.41% 106.60% 92.48%

Deferred income taxes 100 90.05% 116.73%

Prepaid expenses 100 95.22% 96.63% 91.85% 101.76%

Other current assets 100 130.54% 112.56% 92.14% 117.27%

Total current assets 100 99.83% 100.03% 96.35% 84.15%

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 100 102.22% 98.50% 99.51% 103.05%

Accumulated Depreciation 100 103.74% 102.30% 96.02% 103.25%

Net property, plant and equipment 100 98.57% 90.07% 108.26% 102.53%

Equity and other investments 100 107.73% 92.39% 91.32% 94.01%

Goodwill 100 81.13% 92.57% 116.03% 98.50%

Intangible assets 100 95.07% 104.32% 105.40% 110.82%

Deferred income taxes 100 85.01% 91.80% 98.67% 102.26%

Other long-term assets 100 108.68% 97.32% 89.66% 99.17%

Total non-current assets 100 104.56% 93.27% 93.78% 95.79%

Total assets 100 103.26% 94.97% 94.41% 92.63%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 100 58.64% 65.75% 65.04% 71.79%

Accounts payable 100 105.72% 104.08% 99.14% 97.56%

Taxes payable 100 120.25% 110.75% 83.81% 72.68%

Deferred revenues 100 99.10% 97.92% 92.35% 95.92%

Other current liabilities 100 101.95% 96.90% 97.01% 96.90%

Total current liabilities 100 99.21% 98.24% 92.51% 92.90%

Non-current liabilities

Long-term debt 100 77.68% 127.93% 81.68% 109.30%

Deferred taxes liabilities 100 108.51% 98.88% 104.18% 96.21%

Pensions and other benefits 100 104.84% 64.61% 116.55% 100.56%

Minority interest 100 116.45% 92.49% 103.59% 93.88%

Other long-term liabilities 100 108.92% 92.48% 93.02% 93.55%

Total non-current liabilities 100 105.79% 93.52% 94.34% 94.88%

Total liabilities 100 103.38% 95.12% 93.71% 94.19%

Stockholders' equity

Other Equity 2065.52% 4.67%

Additional paid-in capital 100 106.71% 86.64% 102.28% 99.43%

Retained earnings 100 86.55% 86.91% 95.12% 68.34%

Treasury stock 100 98.51% 99.08% 98.25% 95.70%

Accumulated other comprehensive income 100 85.32% 59.08% 105.40% 100.52%

Total stockholders' equity 100 102.61% 94.06% 98.64% 84.16%

Total liabilities and stockholders' equity 100 103.26% 94.97% 94.41% 92.63%

SONY CORP BALANCE SHEET

Balance Sheet Trend Analysis

Table 1: Trend analysis of balance sheet

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

Particulars 2014 2015 2016 2017 2018

Assets

Current assets

Cash

Cash and cash equivalents 100 90.73% 96.52% 102.44% 60.53%

Short-term investments 100 112.51% 98.98% 90.01% 89.36%

Total cash 100 100.38% 97.73% 95.94% 72.81%

Receivables 100 103.31% 105.43% 89.49% 94.18%

Inventories 100 90.67% 97.41% 106.60% 92.48%

Deferred income taxes 100 90.05% 116.73%

Prepaid expenses 100 95.22% 96.63% 91.85% 101.76%

Other current assets 100 130.54% 112.56% 92.14% 117.27%

Total current assets 100 99.83% 100.03% 96.35% 84.15%

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 100 102.22% 98.50% 99.51% 103.05%

Accumulated Depreciation 100 103.74% 102.30% 96.02% 103.25%

Net property, plant and equipment 100 98.57% 90.07% 108.26% 102.53%

Equity and other investments 100 107.73% 92.39% 91.32% 94.01%

Goodwill 100 81.13% 92.57% 116.03% 98.50%

Intangible assets 100 95.07% 104.32% 105.40% 110.82%

Deferred income taxes 100 85.01% 91.80% 98.67% 102.26%

Other long-term assets 100 108.68% 97.32% 89.66% 99.17%

Total non-current assets 100 104.56% 93.27% 93.78% 95.79%

Total assets 100 103.26% 94.97% 94.41% 92.63%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 100 58.64% 65.75% 65.04% 71.79%

Accounts payable 100 105.72% 104.08% 99.14% 97.56%

Taxes payable 100 120.25% 110.75% 83.81% 72.68%

Deferred revenues 100 99.10% 97.92% 92.35% 95.92%

Other current liabilities 100 101.95% 96.90% 97.01% 96.90%

Total current liabilities 100 99.21% 98.24% 92.51% 92.90%

Non-current liabilities

Long-term debt 100 77.68% 127.93% 81.68% 109.30%

Deferred taxes liabilities 100 108.51% 98.88% 104.18% 96.21%

Pensions and other benefits 100 104.84% 64.61% 116.55% 100.56%

Minority interest 100 116.45% 92.49% 103.59% 93.88%

Other long-term liabilities 100 108.92% 92.48% 93.02% 93.55%

Total non-current liabilities 100 105.79% 93.52% 94.34% 94.88%

Total liabilities 100 103.38% 95.12% 93.71% 94.19%

Stockholders' equity

Other Equity 2065.52% 4.67%

Additional paid-in capital 100 106.71% 86.64% 102.28% 99.43%

Retained earnings 100 86.55% 86.91% 95.12% 68.34%

Treasury stock 100 98.51% 99.08% 98.25% 95.70%

Accumulated other comprehensive income 100 85.32% 59.08% 105.40% 100.52%

Total stockholders' equity 100 102.61% 94.06% 98.64% 84.16%

Total liabilities and stockholders' equity 100 103.26% 94.97% 94.41% 92.63%

SONY CORP BALANCE SHEET

Balance Sheet Trend Analysis

Table 1: Trend analysis of balance sheet

(Source: created by author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

BUSINESS ORGANIZATION ANALYSIS

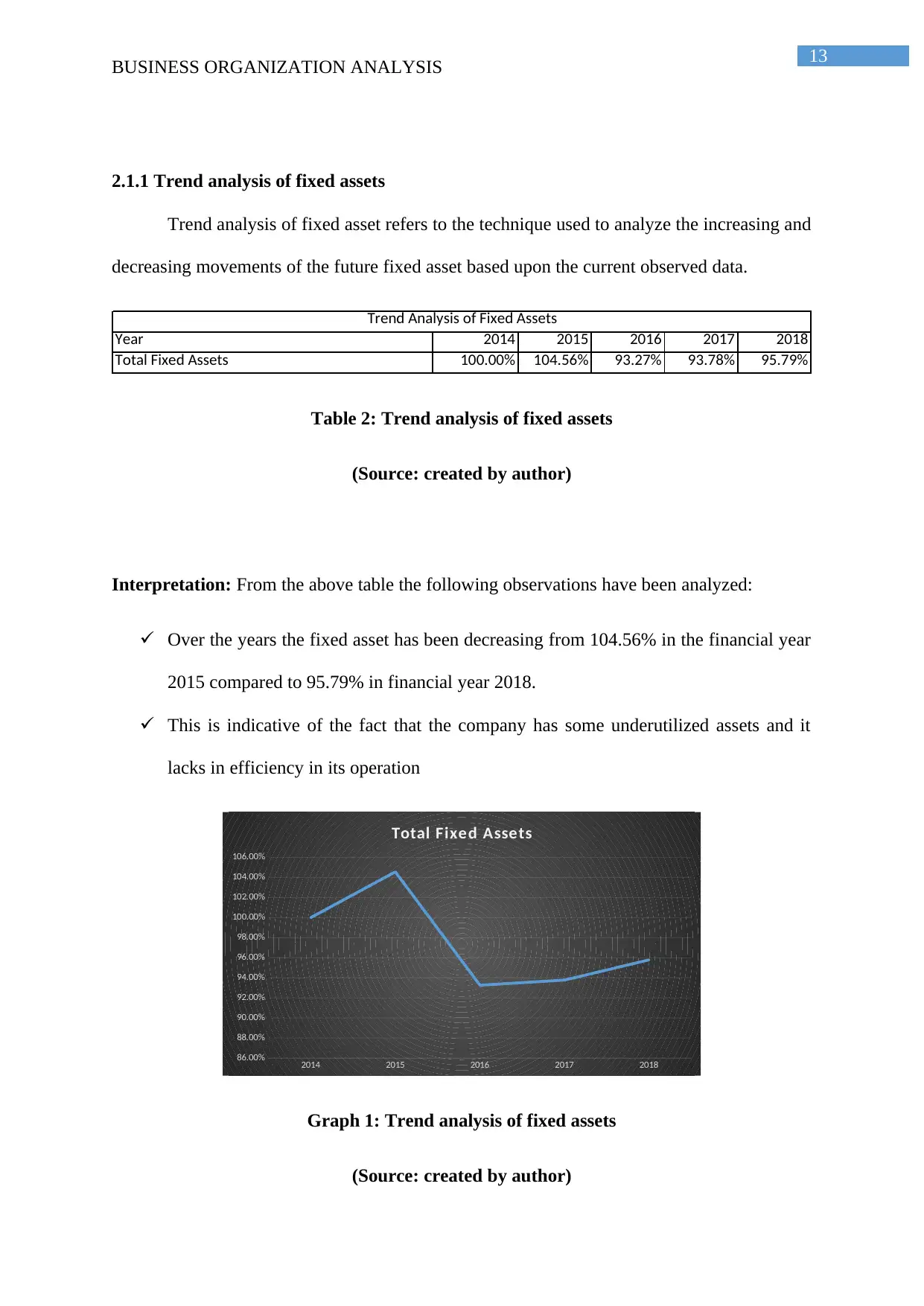

2.1.1 Trend analysis of fixed assets

Trend analysis of fixed asset refers to the technique used to analyze the increasing and

decreasing movements of the future fixed asset based upon the current observed data.

Year 2014 2015 2016 2017 2018

Total Fixed Assets 100.00% 104.56% 93.27% 93.78% 95.79%

Trend Analysis of Fixed Assets

Table 2: Trend analysis of fixed assets

(Source: created by author)

Interpretation: From the above table the following observations have been analyzed:

Over the years the fixed asset has been decreasing from 104.56% in the financial year

2015 compared to 95.79% in financial year 2018.

This is indicative of the fact that the company has some underutilized assets and it

lacks in efficiency in its operation

2014 2015 2016 2017 2018

86.00%

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

Total Fixed Assets

Graph 1: Trend analysis of fixed assets

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

2.1.1 Trend analysis of fixed assets

Trend analysis of fixed asset refers to the technique used to analyze the increasing and

decreasing movements of the future fixed asset based upon the current observed data.

Year 2014 2015 2016 2017 2018

Total Fixed Assets 100.00% 104.56% 93.27% 93.78% 95.79%

Trend Analysis of Fixed Assets

Table 2: Trend analysis of fixed assets

(Source: created by author)

Interpretation: From the above table the following observations have been analyzed:

Over the years the fixed asset has been decreasing from 104.56% in the financial year

2015 compared to 95.79% in financial year 2018.

This is indicative of the fact that the company has some underutilized assets and it

lacks in efficiency in its operation

2014 2015 2016 2017 2018

86.00%

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

Total Fixed Assets

Graph 1: Trend analysis of fixed assets

(Source: created by author)

14

BUSINESS ORGANIZATION ANALYSIS

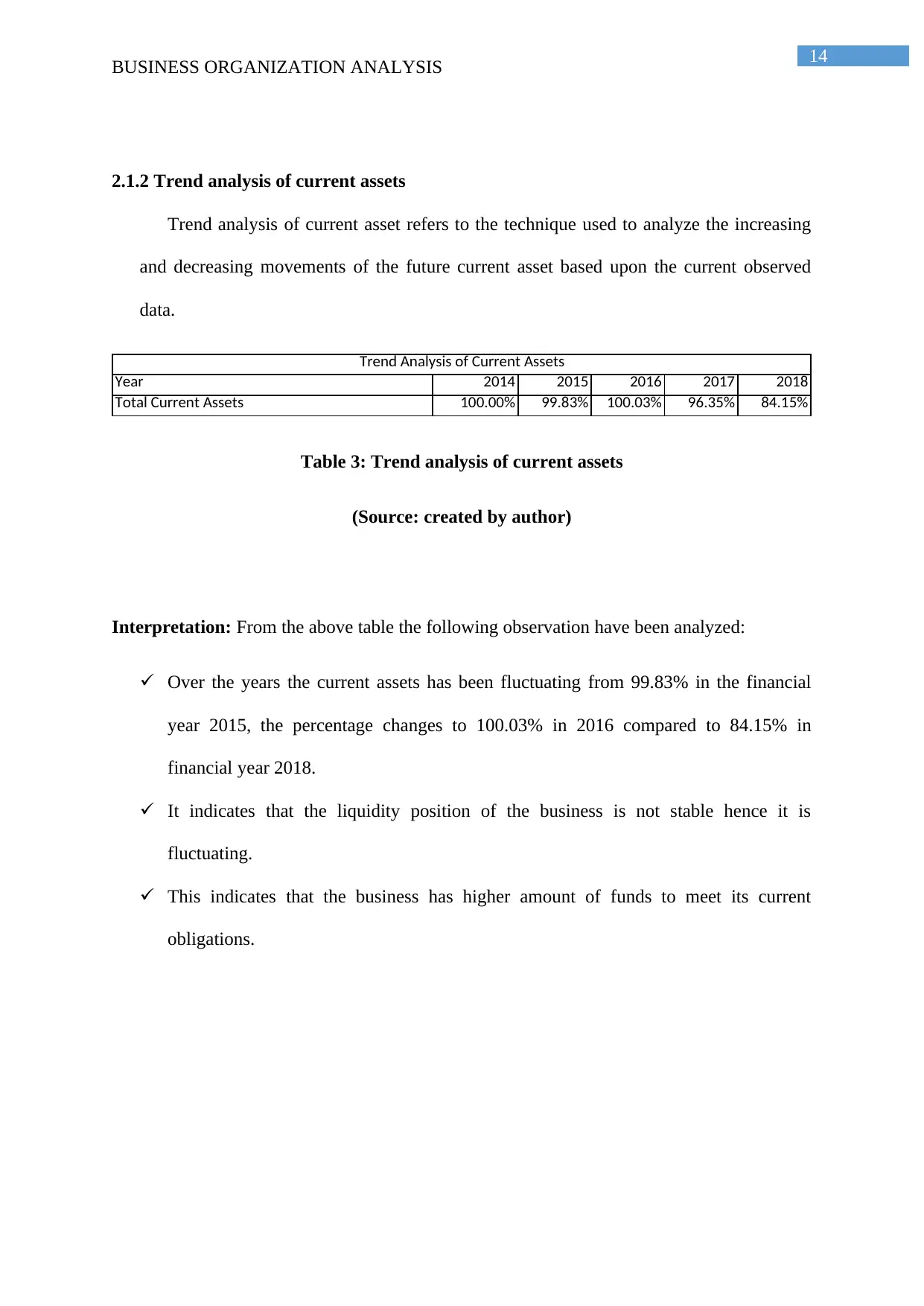

2.1.2 Trend analysis of current assets

Trend analysis of current asset refers to the technique used to analyze the increasing

and decreasing movements of the future current asset based upon the current observed

data.

Year 2014 2015 2016 2017 2018

Total Current Assets 100.00% 99.83% 100.03% 96.35% 84.15%

Trend Analysis of Current Assets

Table 3: Trend analysis of current assets

(Source: created by author)

Interpretation: From the above table the following observation have been analyzed:

Over the years the current assets has been fluctuating from 99.83% in the financial

year 2015, the percentage changes to 100.03% in 2016 compared to 84.15% in

financial year 2018.

It indicates that the liquidity position of the business is not stable hence it is

fluctuating.

This indicates that the business has higher amount of funds to meet its current

obligations.

BUSINESS ORGANIZATION ANALYSIS

2.1.2 Trend analysis of current assets

Trend analysis of current asset refers to the technique used to analyze the increasing

and decreasing movements of the future current asset based upon the current observed

data.

Year 2014 2015 2016 2017 2018

Total Current Assets 100.00% 99.83% 100.03% 96.35% 84.15%

Trend Analysis of Current Assets

Table 3: Trend analysis of current assets

(Source: created by author)

Interpretation: From the above table the following observation have been analyzed:

Over the years the current assets has been fluctuating from 99.83% in the financial

year 2015, the percentage changes to 100.03% in 2016 compared to 84.15% in

financial year 2018.

It indicates that the liquidity position of the business is not stable hence it is

fluctuating.

This indicates that the business has higher amount of funds to meet its current

obligations.

15

BUSINESS ORGANIZATION ANALYSIS

2014 2015 2016 2017 2018

75.00%

80.00%

85.00%

90.00%

95.00%

100.00%

105.00%

Total Current Assets

Graph 2: Trend analysis of current assets

(Source: created by author)

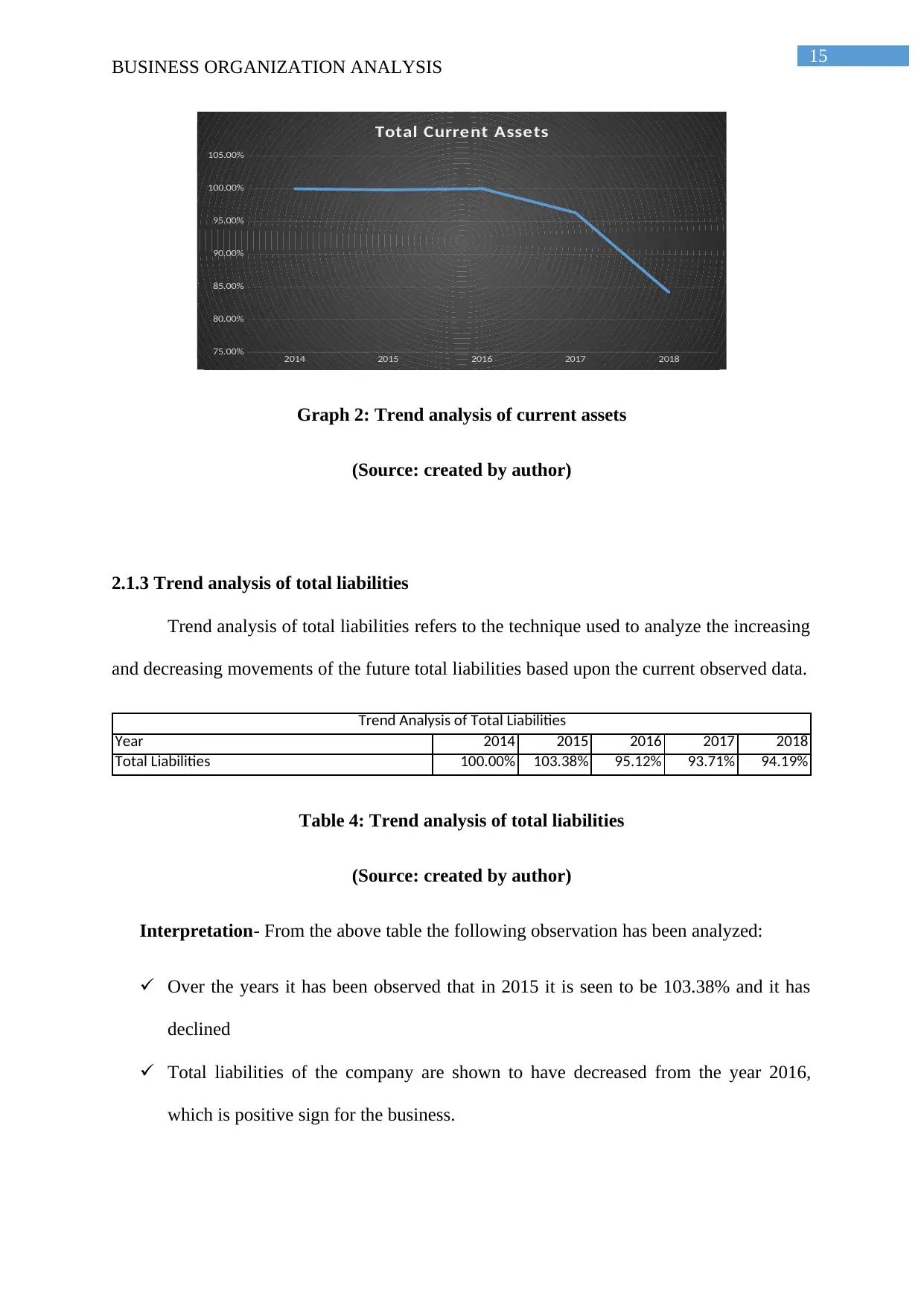

2.1.3 Trend analysis of total liabilities

Trend analysis of total liabilities refers to the technique used to analyze the increasing

and decreasing movements of the future total liabilities based upon the current observed data.

Year 2014 2015 2016 2017 2018

Total Liabilities 100.00% 103.38% 95.12% 93.71% 94.19%

Trend Analysis of Total Liabilities

Table 4: Trend analysis of total liabilities

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

Over the years it has been observed that in 2015 it is seen to be 103.38% and it has

declined

Total liabilities of the company are shown to have decreased from the year 2016,

which is positive sign for the business.

BUSINESS ORGANIZATION ANALYSIS

2014 2015 2016 2017 2018

75.00%

80.00%

85.00%

90.00%

95.00%

100.00%

105.00%

Total Current Assets

Graph 2: Trend analysis of current assets

(Source: created by author)

2.1.3 Trend analysis of total liabilities

Trend analysis of total liabilities refers to the technique used to analyze the increasing

and decreasing movements of the future total liabilities based upon the current observed data.

Year 2014 2015 2016 2017 2018

Total Liabilities 100.00% 103.38% 95.12% 93.71% 94.19%

Trend Analysis of Total Liabilities

Table 4: Trend analysis of total liabilities

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

Over the years it has been observed that in 2015 it is seen to be 103.38% and it has

declined

Total liabilities of the company are shown to have decreased from the year 2016,

which is positive sign for the business.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

BUSINESS ORGANIZATION ANALYSIS

The decrease in total liabilities indicates that the financial position of the business is

strong and it is stable as well.

2014 2015 2016 2017 2018

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

Total Liabiliti es

Graph 3: Trend analysis of total liabilities

(Source: created by author)

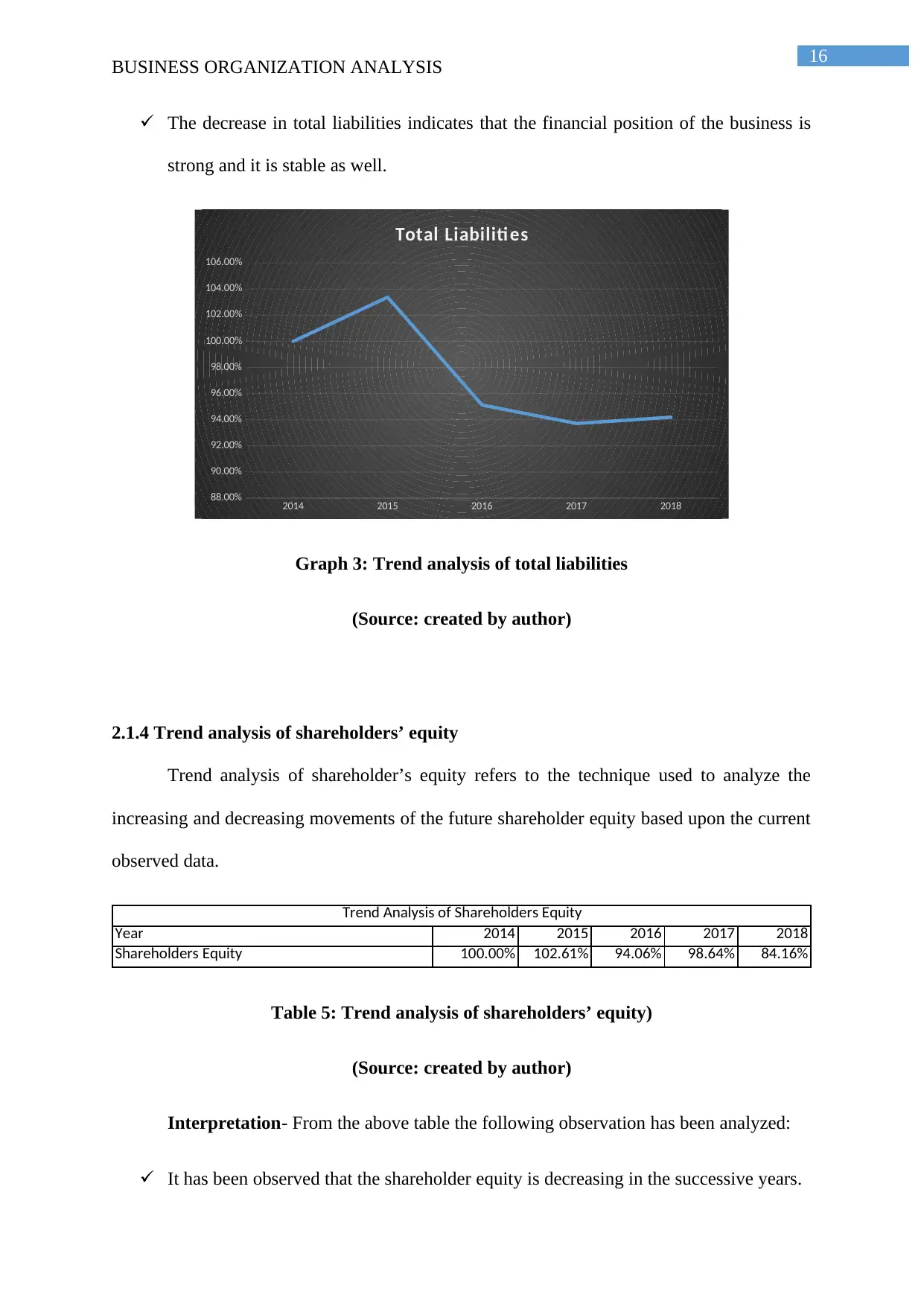

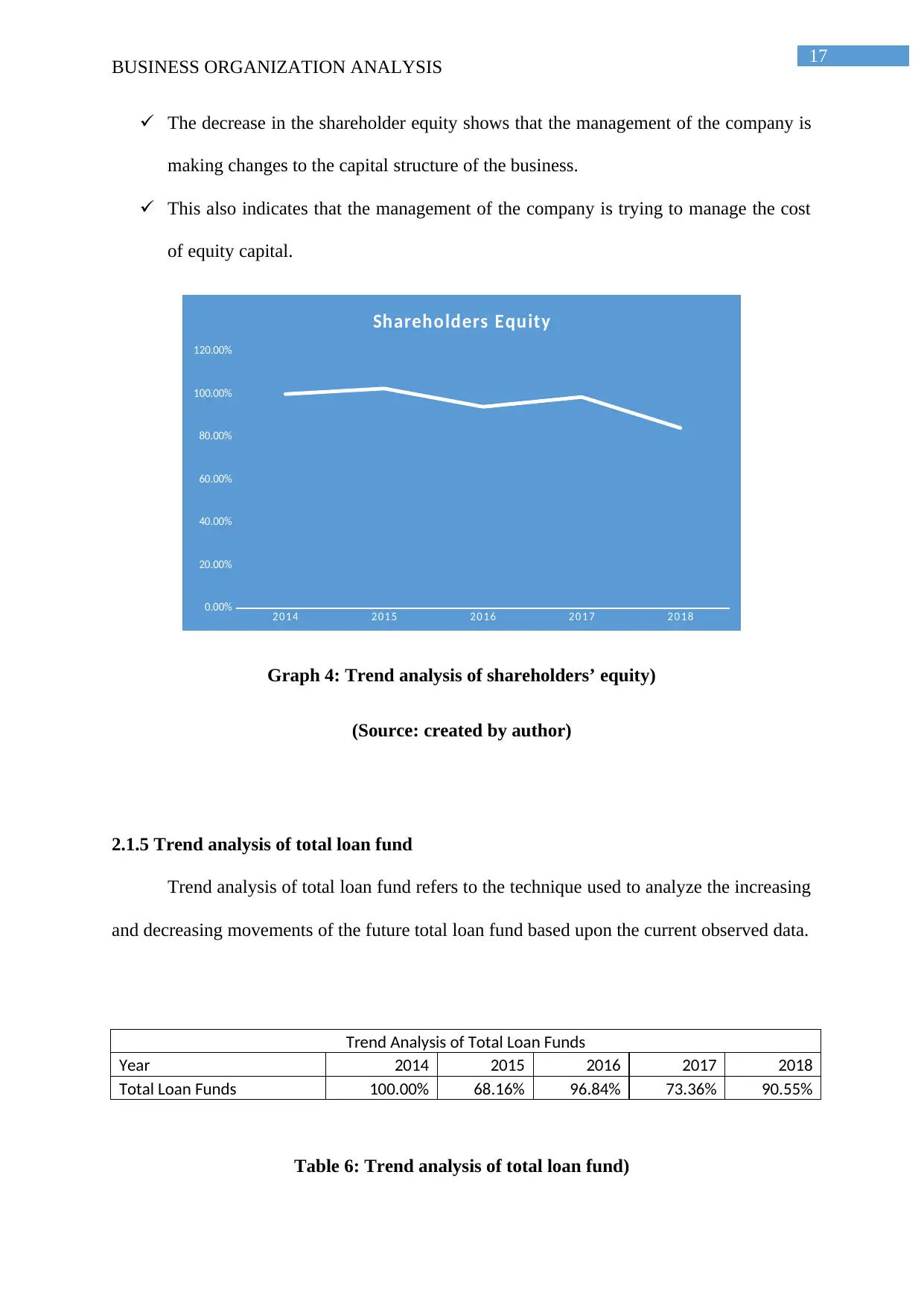

2.1.4 Trend analysis of shareholders’ equity

Trend analysis of shareholder’s equity refers to the technique used to analyze the

increasing and decreasing movements of the future shareholder equity based upon the current

observed data.

Year 2014 2015 2016 2017 2018

Shareholders Equity 100.00% 102.61% 94.06% 98.64% 84.16%

Trend Analysis of Shareholders Equity

Table 5: Trend analysis of shareholders’ equity)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

It has been observed that the shareholder equity is decreasing in the successive years.

BUSINESS ORGANIZATION ANALYSIS

The decrease in total liabilities indicates that the financial position of the business is

strong and it is stable as well.

2014 2015 2016 2017 2018

88.00%

90.00%

92.00%

94.00%

96.00%

98.00%

100.00%

102.00%

104.00%

106.00%

Total Liabiliti es

Graph 3: Trend analysis of total liabilities

(Source: created by author)

2.1.4 Trend analysis of shareholders’ equity

Trend analysis of shareholder’s equity refers to the technique used to analyze the

increasing and decreasing movements of the future shareholder equity based upon the current

observed data.

Year 2014 2015 2016 2017 2018

Shareholders Equity 100.00% 102.61% 94.06% 98.64% 84.16%

Trend Analysis of Shareholders Equity

Table 5: Trend analysis of shareholders’ equity)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

It has been observed that the shareholder equity is decreasing in the successive years.

17

BUSINESS ORGANIZATION ANALYSIS

The decrease in the shareholder equity shows that the management of the company is

making changes to the capital structure of the business.

This also indicates that the management of the company is trying to manage the cost

of equity capital.

20 14 2 01 5 20 16 20 1 7 20 18

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Shareholders Equity

Graph 4: Trend analysis of shareholders’ equity)

(Source: created by author)

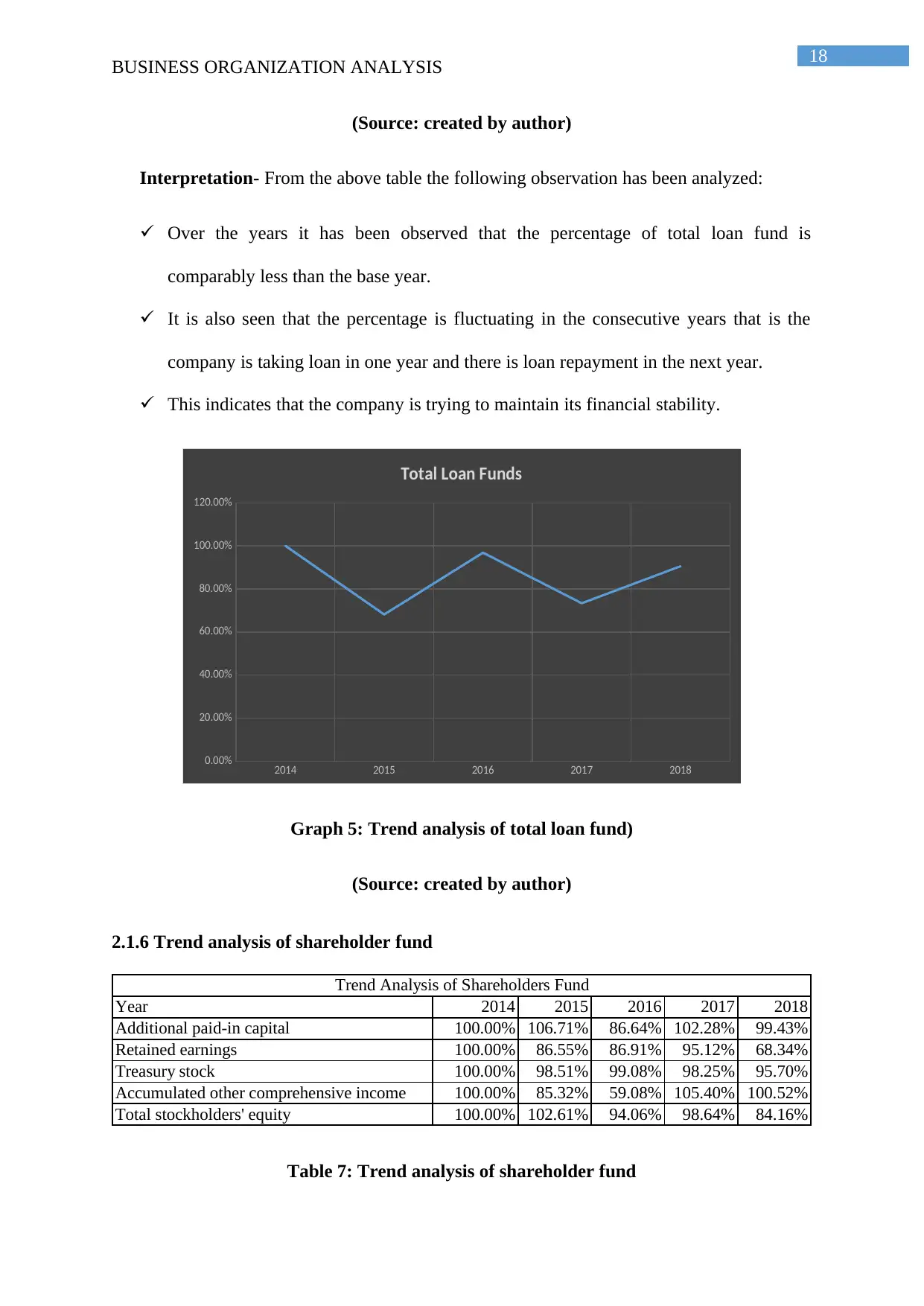

2.1.5 Trend analysis of total loan fund

Trend analysis of total loan fund refers to the technique used to analyze the increasing

and decreasing movements of the future total loan fund based upon the current observed data.

Trend Analysis of Total Loan Funds

Year 2014 2015 2016 2017 2018

Total Loan Funds 100.00% 68.16% 96.84% 73.36% 90.55%

Table 6: Trend analysis of total loan fund)

BUSINESS ORGANIZATION ANALYSIS

The decrease in the shareholder equity shows that the management of the company is

making changes to the capital structure of the business.

This also indicates that the management of the company is trying to manage the cost

of equity capital.

20 14 2 01 5 20 16 20 1 7 20 18

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Shareholders Equity

Graph 4: Trend analysis of shareholders’ equity)

(Source: created by author)

2.1.5 Trend analysis of total loan fund

Trend analysis of total loan fund refers to the technique used to analyze the increasing

and decreasing movements of the future total loan fund based upon the current observed data.

Trend Analysis of Total Loan Funds

Year 2014 2015 2016 2017 2018

Total Loan Funds 100.00% 68.16% 96.84% 73.36% 90.55%

Table 6: Trend analysis of total loan fund)

18

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

Over the years it has been observed that the percentage of total loan fund is

comparably less than the base year.

It is also seen that the percentage is fluctuating in the consecutive years that is the

company is taking loan in one year and there is loan repayment in the next year.

This indicates that the company is trying to maintain its financial stability.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Total Loan Funds

Graph 5: Trend analysis of total loan fund)

(Source: created by author)

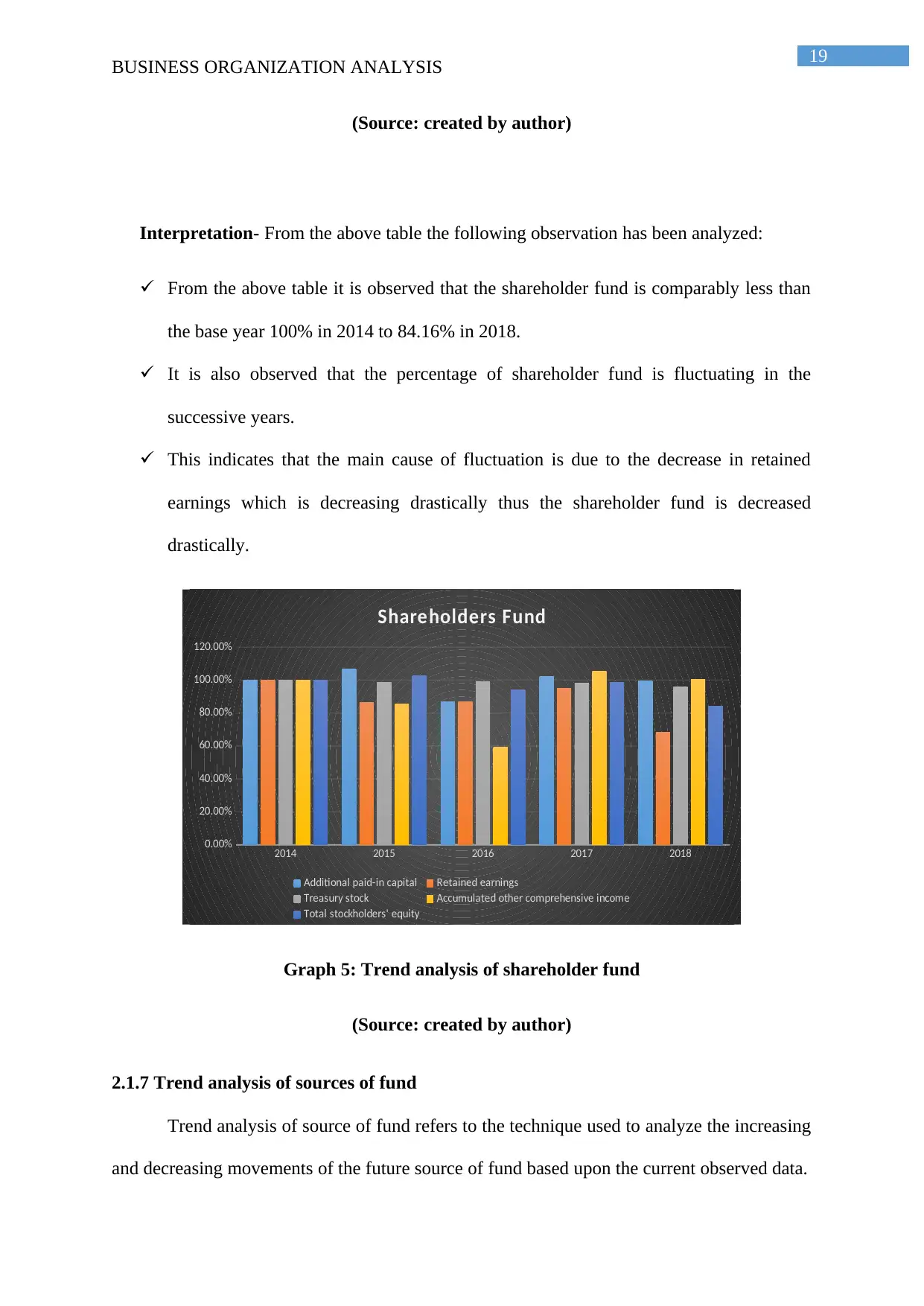

2.1.6 Trend analysis of shareholder fund

Year 2014 2015 2016 2017 2018

Additional paid-in capital 100.00% 106.71% 86.64% 102.28% 99.43%

Retained earnings 100.00% 86.55% 86.91% 95.12% 68.34%

Treasury stock 100.00% 98.51% 99.08% 98.25% 95.70%

Accumulated other comprehensive income 100.00% 85.32% 59.08% 105.40% 100.52%

Total stockholders' equity 100.00% 102.61% 94.06% 98.64% 84.16%

Trend Analysis of Shareholders Fund

Table 7: Trend analysis of shareholder fund

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

Over the years it has been observed that the percentage of total loan fund is

comparably less than the base year.

It is also seen that the percentage is fluctuating in the consecutive years that is the

company is taking loan in one year and there is loan repayment in the next year.

This indicates that the company is trying to maintain its financial stability.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Total Loan Funds

Graph 5: Trend analysis of total loan fund)

(Source: created by author)

2.1.6 Trend analysis of shareholder fund

Year 2014 2015 2016 2017 2018

Additional paid-in capital 100.00% 106.71% 86.64% 102.28% 99.43%

Retained earnings 100.00% 86.55% 86.91% 95.12% 68.34%

Treasury stock 100.00% 98.51% 99.08% 98.25% 95.70%

Accumulated other comprehensive income 100.00% 85.32% 59.08% 105.40% 100.52%

Total stockholders' equity 100.00% 102.61% 94.06% 98.64% 84.16%

Trend Analysis of Shareholders Fund

Table 7: Trend analysis of shareholder fund

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

19

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the shareholder fund is comparably less than

the base year 100% in 2014 to 84.16% in 2018.

It is also observed that the percentage of shareholder fund is fluctuating in the

successive years.

This indicates that the main cause of fluctuation is due to the decrease in retained

earnings which is decreasing drastically thus the shareholder fund is decreased

drastically.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Shareholders Fund

Additional paid-in capital Retained earnings

Treasury stock Accumulated other comprehensive income

Total stockholders' equity

Graph 5: Trend analysis of shareholder fund

(Source: created by author)

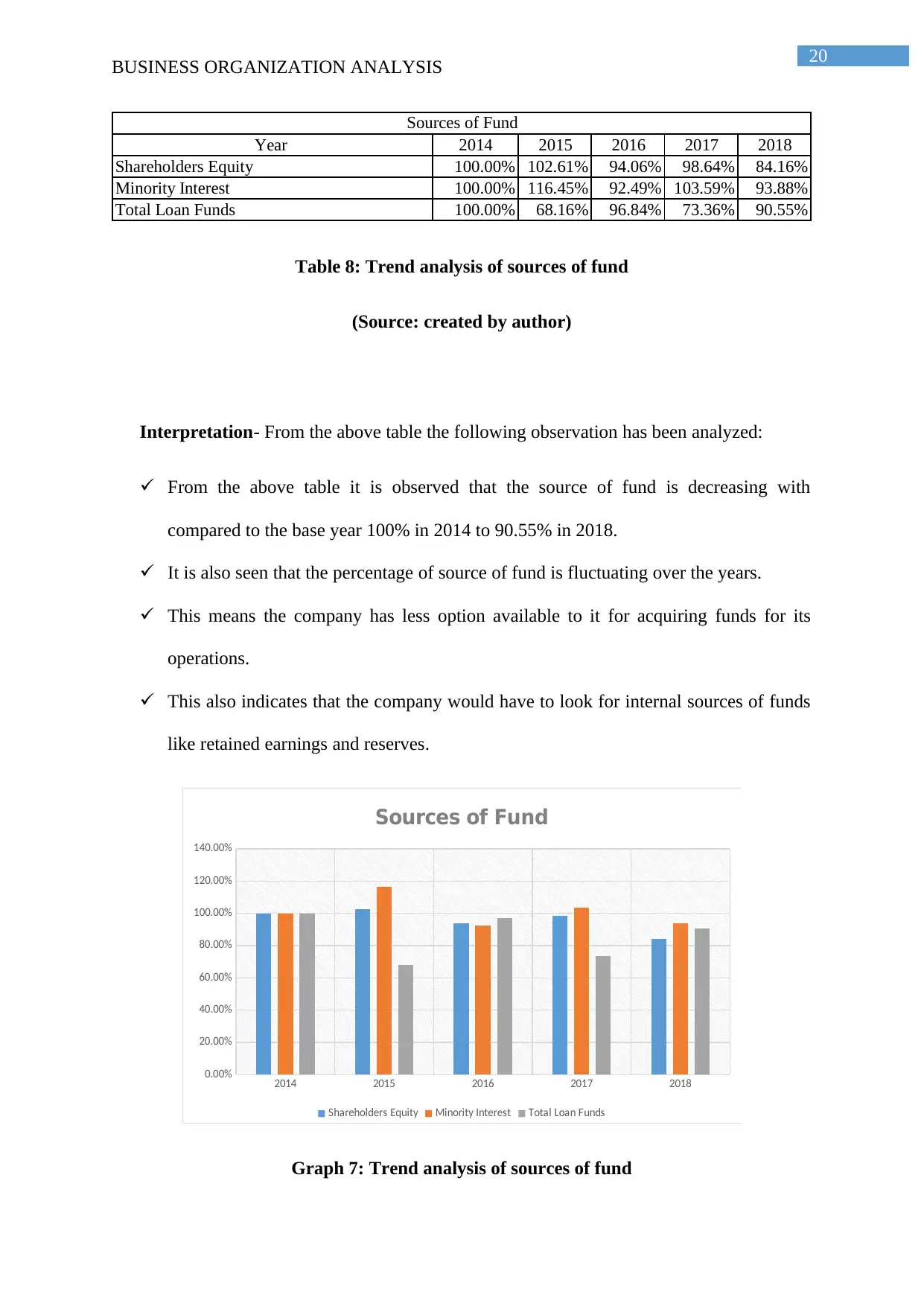

2.1.7 Trend analysis of sources of fund

Trend analysis of source of fund refers to the technique used to analyze the increasing

and decreasing movements of the future source of fund based upon the current observed data.

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the shareholder fund is comparably less than

the base year 100% in 2014 to 84.16% in 2018.

It is also observed that the percentage of shareholder fund is fluctuating in the

successive years.

This indicates that the main cause of fluctuation is due to the decrease in retained

earnings which is decreasing drastically thus the shareholder fund is decreased

drastically.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Shareholders Fund

Additional paid-in capital Retained earnings

Treasury stock Accumulated other comprehensive income

Total stockholders' equity

Graph 5: Trend analysis of shareholder fund

(Source: created by author)

2.1.7 Trend analysis of sources of fund

Trend analysis of source of fund refers to the technique used to analyze the increasing

and decreasing movements of the future source of fund based upon the current observed data.

20

BUSINESS ORGANIZATION ANALYSIS

Year 2014 2015 2016 2017 2018

Shareholders Equity 100.00% 102.61% 94.06% 98.64% 84.16%

Minority Interest 100.00% 116.45% 92.49% 103.59% 93.88%

Total Loan Funds 100.00% 68.16% 96.84% 73.36% 90.55%

Sources of Fund

Table 8: Trend analysis of sources of fund

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the source of fund is decreasing with

compared to the base year 100% in 2014 to 90.55% in 2018.

It is also seen that the percentage of source of fund is fluctuating over the years.

This means the company has less option available to it for acquiring funds for its

operations.

This also indicates that the company would have to look for internal sources of funds

like retained earnings and reserves.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

140.00%

Sources of Fund

Shareholders Equity Minority Interest Total Loan Funds

Graph 7: Trend analysis of sources of fund

BUSINESS ORGANIZATION ANALYSIS

Year 2014 2015 2016 2017 2018

Shareholders Equity 100.00% 102.61% 94.06% 98.64% 84.16%

Minority Interest 100.00% 116.45% 92.49% 103.59% 93.88%

Total Loan Funds 100.00% 68.16% 96.84% 73.36% 90.55%

Sources of Fund

Table 8: Trend analysis of sources of fund

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the source of fund is decreasing with

compared to the base year 100% in 2014 to 90.55% in 2018.

It is also seen that the percentage of source of fund is fluctuating over the years.

This means the company has less option available to it for acquiring funds for its

operations.

This also indicates that the company would have to look for internal sources of funds

like retained earnings and reserves.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

140.00%

Sources of Fund

Shareholders Equity Minority Interest Total Loan Funds

Graph 7: Trend analysis of sources of fund

21

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

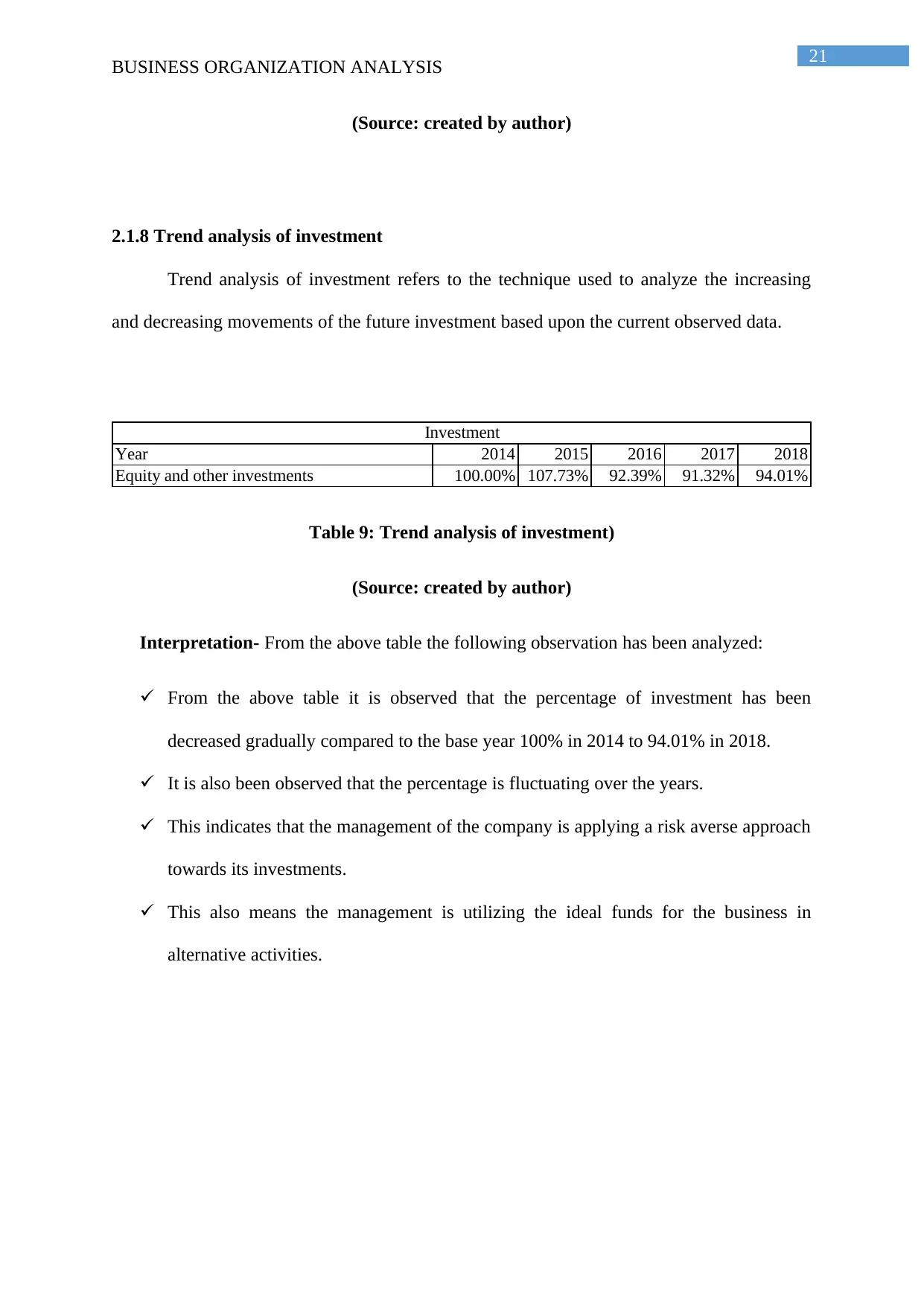

2.1.8 Trend analysis of investment

Trend analysis of investment refers to the technique used to analyze the increasing

and decreasing movements of the future investment based upon the current observed data.

Year 2014 2015 2016 2017 2018

Equity and other investments 100.00% 107.73% 92.39% 91.32% 94.01%

Investment

Table 9: Trend analysis of investment)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the percentage of investment has been

decreased gradually compared to the base year 100% in 2014 to 94.01% in 2018.

It is also been observed that the percentage is fluctuating over the years.

This indicates that the management of the company is applying a risk averse approach

towards its investments.

This also means the management is utilizing the ideal funds for the business in

alternative activities.

BUSINESS ORGANIZATION ANALYSIS

(Source: created by author)

2.1.8 Trend analysis of investment

Trend analysis of investment refers to the technique used to analyze the increasing

and decreasing movements of the future investment based upon the current observed data.

Year 2014 2015 2016 2017 2018

Equity and other investments 100.00% 107.73% 92.39% 91.32% 94.01%

Investment

Table 9: Trend analysis of investment)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

From the above table it is observed that the percentage of investment has been

decreased gradually compared to the base year 100% in 2014 to 94.01% in 2018.

It is also been observed that the percentage is fluctuating over the years.

This indicates that the management of the company is applying a risk averse approach

towards its investments.

This also means the management is utilizing the ideal funds for the business in

alternative activities.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

22

BUSINESS ORGANIZATION ANALYSIS

2014 2015 2016 2017 2018

80.00%

85.00%

90.00%

95.00%

100.00%

105.00%

110.00%

Investment

Graph 8: Trend analysis of investment)

(Source: created by author)

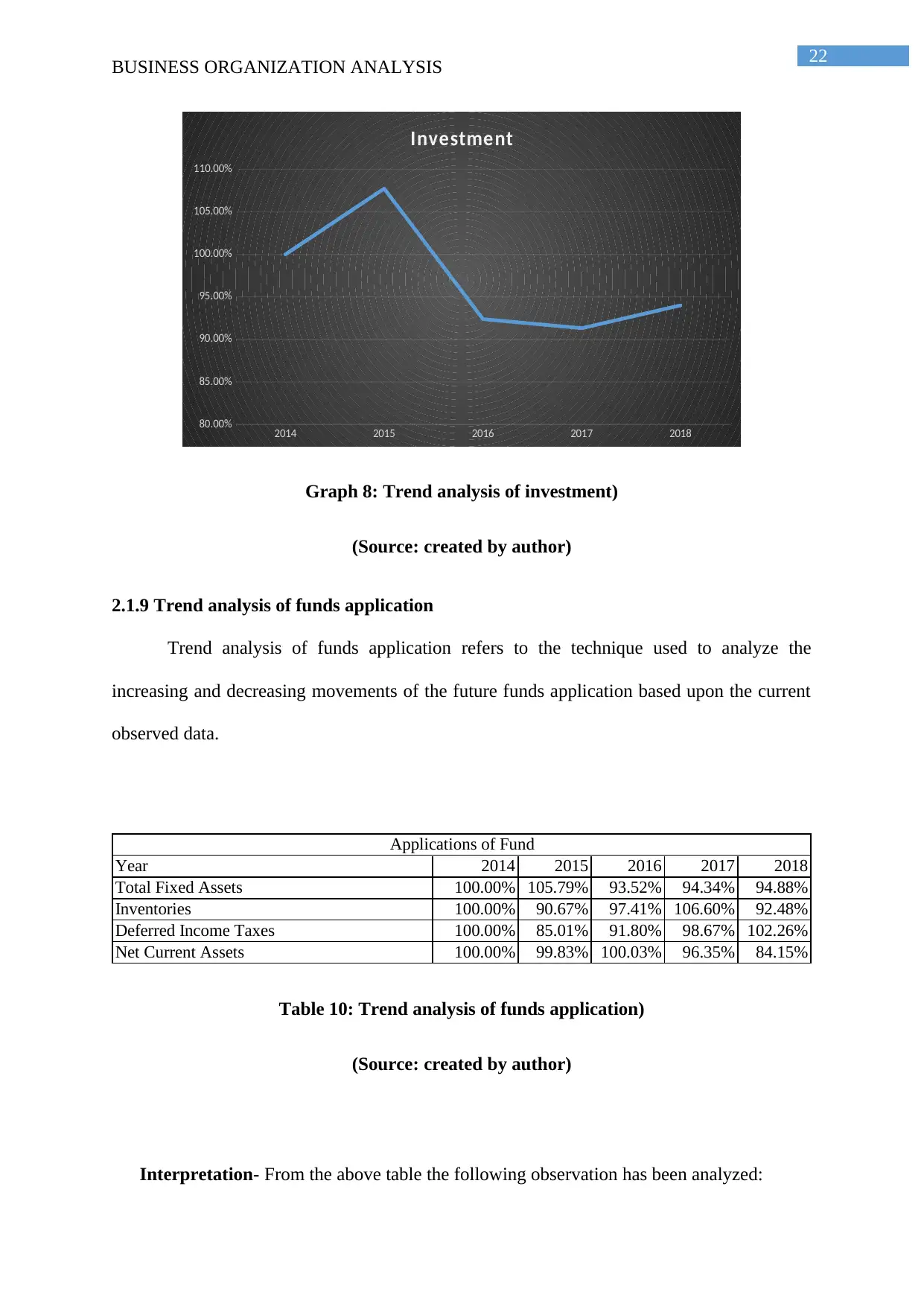

2.1.9 Trend analysis of funds application

Trend analysis of funds application refers to the technique used to analyze the

increasing and decreasing movements of the future funds application based upon the current

observed data.

Year 2014 2015 2016 2017 2018

Total Fixed Assets 100.00% 105.79% 93.52% 94.34% 94.88%

Inventories 100.00% 90.67% 97.41% 106.60% 92.48%

Deferred Income Taxes 100.00% 85.01% 91.80% 98.67% 102.26%

Net Current Assets 100.00% 99.83% 100.03% 96.35% 84.15%

Applications of Fund

Table 10: Trend analysis of funds application)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

BUSINESS ORGANIZATION ANALYSIS

2014 2015 2016 2017 2018

80.00%

85.00%

90.00%

95.00%

100.00%

105.00%

110.00%

Investment

Graph 8: Trend analysis of investment)

(Source: created by author)

2.1.9 Trend analysis of funds application

Trend analysis of funds application refers to the technique used to analyze the

increasing and decreasing movements of the future funds application based upon the current

observed data.

Year 2014 2015 2016 2017 2018

Total Fixed Assets 100.00% 105.79% 93.52% 94.34% 94.88%

Inventories 100.00% 90.67% 97.41% 106.60% 92.48%

Deferred Income Taxes 100.00% 85.01% 91.80% 98.67% 102.26%

Net Current Assets 100.00% 99.83% 100.03% 96.35% 84.15%

Applications of Fund

Table 10: Trend analysis of funds application)

(Source: created by author)

Interpretation- From the above table the following observation has been analyzed:

23

BUSINESS ORGANIZATION ANALYSIS

Over the years it has been observed that the percentage is decreased from the base

year 100% in 2014 to 84.15% in 2018.

It is also observed that the percentage of funds application is fluctuating over the

years.

This indicates that the company Sony is trying to increase it sources so that it can

manufacture for products or services and enhance its revenue.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Application of Funds

Total Fixed Assets Invetories Deferred Income Taxes Net Current Assets

Graph 9: Trend analysis of funds application)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

Over the years it has been observed that the percentage is decreased from the base

year 100% in 2014 to 84.15% in 2018.

It is also observed that the percentage of funds application is fluctuating over the

years.

This indicates that the company Sony is trying to increase it sources so that it can

manufacture for products or services and enhance its revenue.

2014 2015 2016 2017 2018

0.00%

20.00%

40.00%

60.00%

80.00%

100.00%

120.00%

Application of Funds

Total Fixed Assets Invetories Deferred Income Taxes Net Current Assets

Graph 9: Trend analysis of funds application)

(Source: created by author)

24

BUSINESS ORGANIZATION ANALYSIS

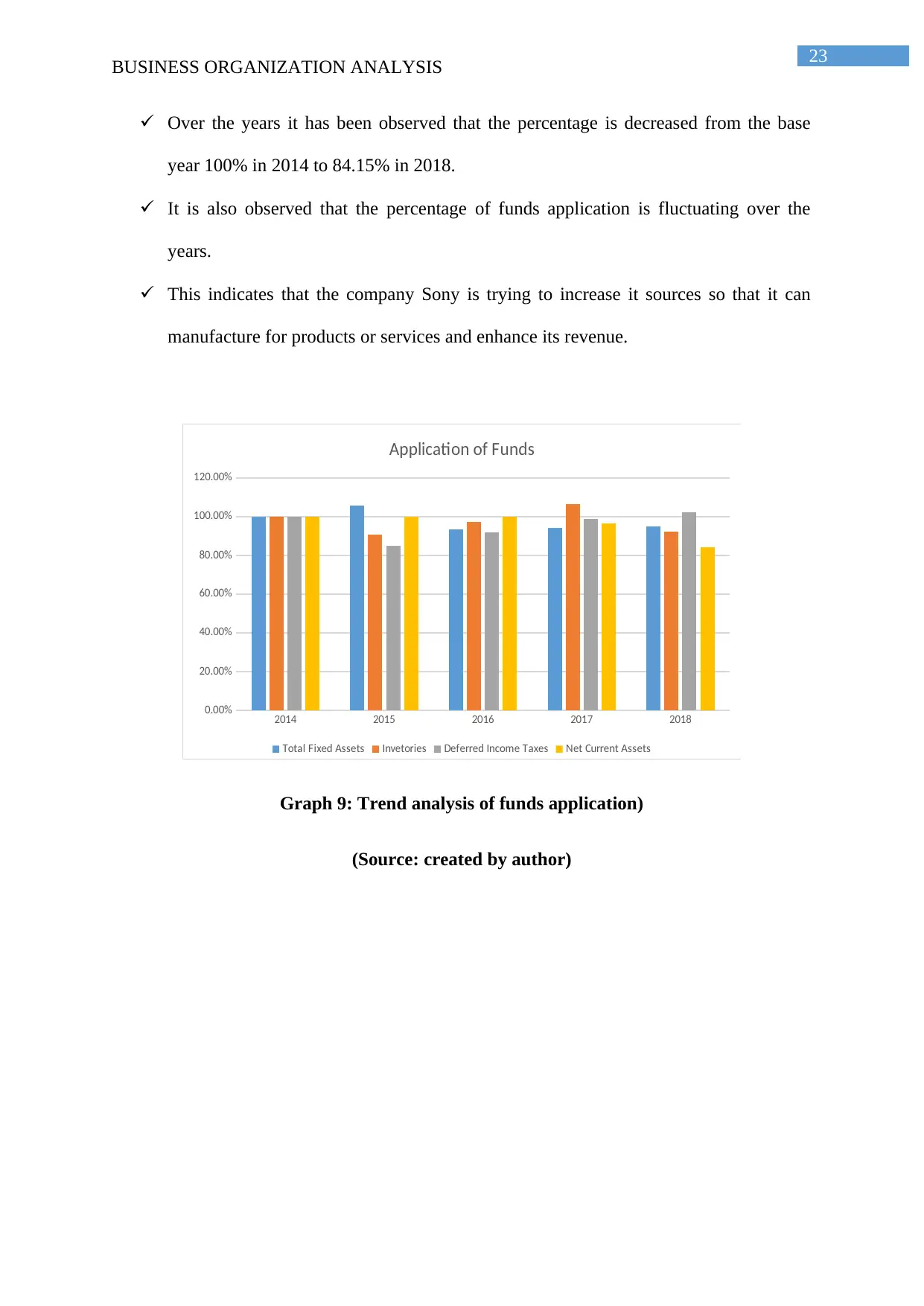

2.2 Horizontal analysis of balance sheet:

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Assets

Current assets

Cash

Cash and cash equivalents 6.82% 6.00% 5.90% 5.44% 8.32%

Short-term investments 5.43% 5.92% 5.68% 5.95% 6.17%

Total cash 12.25% 11.91% 11.58% 11.39% 14.49%

Receivables 5.68% 5.68% 5.12% 5.40% 5.31%

Inventories 4.79% 4.20% 4.10% 3.63% 3.63%

Deferred income taxes 0.35% 0.30% 0.25% 0.00% 0.00%

Prepaid expenses 3.20% 2.95% 2.90% 2.98% 2.71%

Other current assets 1.16% 1.46% 1.24% 1.27% 1.00%

Total current assets 27.42% 26.51% 25.17% 24.66% 27.15%

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 16.61% 16.44% 15.85% 15.04% 13.52%

Accumulated Depreciation -11.71% -11.77% -10.92% -10.74% -9.64%

Net property, plant and equipment 4.89% 4.67% 4.92% 4.29% 3.88%

Equity and other investments 51.64% 53.88% 55.38% 57.26% 56.42%

Goodwill 4.51% 3.54% 3.64% 2.96% 2.78%

Intangible assets 4.41% 4.06% 3.69% 3.31% 2.77%

Deferred income taxes 0.69% 0.57% 0.59% 0.56% 0.51%

Other long-term assets 6.44% 6.77% 6.61% 6.96% 6.50%

Total non-current assets 72.58% 73.49% 74.83% 75.34% 72.85%

Total assets 100.00% 100.00% 100.00% 100.00% 100.00%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 7.90% 4.67% 6.97% 9.92% 12.84%

Accounts payable 39.47% 42.07% 39.71% 37.05% 35.28%

Taxes payable 1.71% 2.07% 1.84% 2.03% 2.60%

Deferred revenues 39.51% 39.47% 39.59% 39.66% 38.42%

Other current liabilities 11.41% 11.72% 11.89% 11.33% 10.87%

Total current liabilities 100.00% 100.00% 100.00% 100.00% 100.00%

Non-current liabilities

Long-term debt 7.01% 5.27% 3.92% 4.49% 3.87%

Deferred taxes liabilities 3.14% 3.30% 3.17% 2.85% 2.79%

Pensions and other benefits 2.18% 2.21% 3.25% 2.62% 2.45%

Minority interest 4.02% 4.52% 4.65% 4.21% 4.22%

Other long-term liabilities 47.07% 49.59% 51.01% 51.39% 51.75%

Total non-current liabilities 63.42% 64.89% 66.00% 65.56% 65.09%

Total liabilities 100.00% 100.00% 100.00% 100.00% 100.00%

Stockholders' equity

Other Equity

Additional paid-in capital 11.57% 11.95% 13.10% 12.09% 11.27%

Retained earnings 6.13% 5.14% 5.62% 5.57% 7.55%

Treasury stock -0.03% -0.03% -0.03% -0.02% -0.02%

Accumulated other comprehensive income -2.95% -2.43% -3.91% -3.50% -3.23%

Total stockholders' equity 14.73% 14.63% 14.77% 14.14% 15.56%

Total liabilities and stockholders' equity 100.00% 100.00% 100.00% 100.00% 100.00%

Horizontal Analysis of Balance Sheet

BUSINESS ORGANIZATION ANALYSIS

2.2 Horizontal analysis of balance sheet:

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Assets

Current assets

Cash

Cash and cash equivalents 6.82% 6.00% 5.90% 5.44% 8.32%

Short-term investments 5.43% 5.92% 5.68% 5.95% 6.17%

Total cash 12.25% 11.91% 11.58% 11.39% 14.49%

Receivables 5.68% 5.68% 5.12% 5.40% 5.31%

Inventories 4.79% 4.20% 4.10% 3.63% 3.63%

Deferred income taxes 0.35% 0.30% 0.25% 0.00% 0.00%

Prepaid expenses 3.20% 2.95% 2.90% 2.98% 2.71%

Other current assets 1.16% 1.46% 1.24% 1.27% 1.00%

Total current assets 27.42% 26.51% 25.17% 24.66% 27.15%

Non-current assets

Property, plant and equipment

Gross property, plant and equipment 16.61% 16.44% 15.85% 15.04% 13.52%

Accumulated Depreciation -11.71% -11.77% -10.92% -10.74% -9.64%

Net property, plant and equipment 4.89% 4.67% 4.92% 4.29% 3.88%

Equity and other investments 51.64% 53.88% 55.38% 57.26% 56.42%

Goodwill 4.51% 3.54% 3.64% 2.96% 2.78%

Intangible assets 4.41% 4.06% 3.69% 3.31% 2.77%

Deferred income taxes 0.69% 0.57% 0.59% 0.56% 0.51%

Other long-term assets 6.44% 6.77% 6.61% 6.96% 6.50%

Total non-current assets 72.58% 73.49% 74.83% 75.34% 72.85%

Total assets 100.00% 100.00% 100.00% 100.00% 100.00%

Liabilities and stockholders' equity

Liabilities

Current liabilities

Short-term debt 7.90% 4.67% 6.97% 9.92% 12.84%

Accounts payable 39.47% 42.07% 39.71% 37.05% 35.28%

Taxes payable 1.71% 2.07% 1.84% 2.03% 2.60%

Deferred revenues 39.51% 39.47% 39.59% 39.66% 38.42%

Other current liabilities 11.41% 11.72% 11.89% 11.33% 10.87%

Total current liabilities 100.00% 100.00% 100.00% 100.00% 100.00%

Non-current liabilities

Long-term debt 7.01% 5.27% 3.92% 4.49% 3.87%

Deferred taxes liabilities 3.14% 3.30% 3.17% 2.85% 2.79%

Pensions and other benefits 2.18% 2.21% 3.25% 2.62% 2.45%

Minority interest 4.02% 4.52% 4.65% 4.21% 4.22%

Other long-term liabilities 47.07% 49.59% 51.01% 51.39% 51.75%

Total non-current liabilities 63.42% 64.89% 66.00% 65.56% 65.09%

Total liabilities 100.00% 100.00% 100.00% 100.00% 100.00%

Stockholders' equity

Other Equity

Additional paid-in capital 11.57% 11.95% 13.10% 12.09% 11.27%

Retained earnings 6.13% 5.14% 5.62% 5.57% 7.55%

Treasury stock -0.03% -0.03% -0.03% -0.02% -0.02%

Accumulated other comprehensive income -2.95% -2.43% -3.91% -3.50% -3.23%

Total stockholders' equity 14.73% 14.63% 14.77% 14.14% 15.56%

Total liabilities and stockholders' equity 100.00% 100.00% 100.00% 100.00% 100.00%

Horizontal Analysis of Balance Sheet

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

25

BUSINESS ORGANIZATION ANALYSIS

Table 11: Trend analysis of horizontal analysis of balance sheet

(Source: created by author)

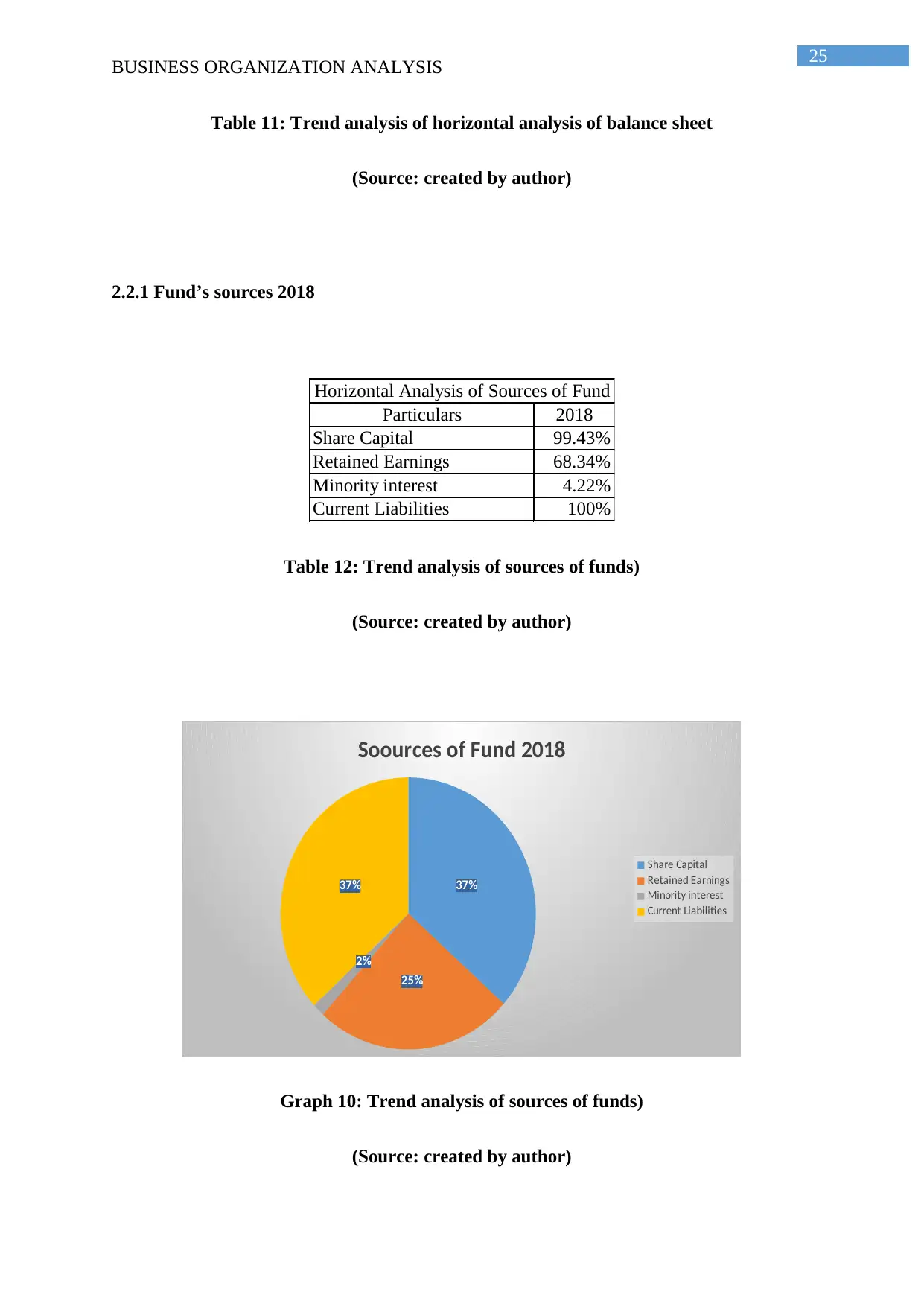

2.2.1 Fund’s sources 2018

Particulars 2018

Share Capital 99.43%

Retained Earnings 68.34%

Minority interest 4.22%

Current Liabilities 100%

Horizontal Analysis of Sources of Fund

Table 12: Trend analysis of sources of funds)

(Source: created by author)

37%

25%

2%

37%

Soources of Fund 2018

Share Capital

Retained Earnings

Minority interest

Current Liabilities

Graph 10: Trend analysis of sources of funds)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

Table 11: Trend analysis of horizontal analysis of balance sheet

(Source: created by author)

2.2.1 Fund’s sources 2018

Particulars 2018

Share Capital 99.43%

Retained Earnings 68.34%

Minority interest 4.22%

Current Liabilities 100%

Horizontal Analysis of Sources of Fund

Table 12: Trend analysis of sources of funds)

(Source: created by author)

37%

25%

2%

37%

Soources of Fund 2018

Share Capital

Retained Earnings

Minority interest

Current Liabilities

Graph 10: Trend analysis of sources of funds)

(Source: created by author)

26

BUSINESS ORGANIZATION ANALYSIS

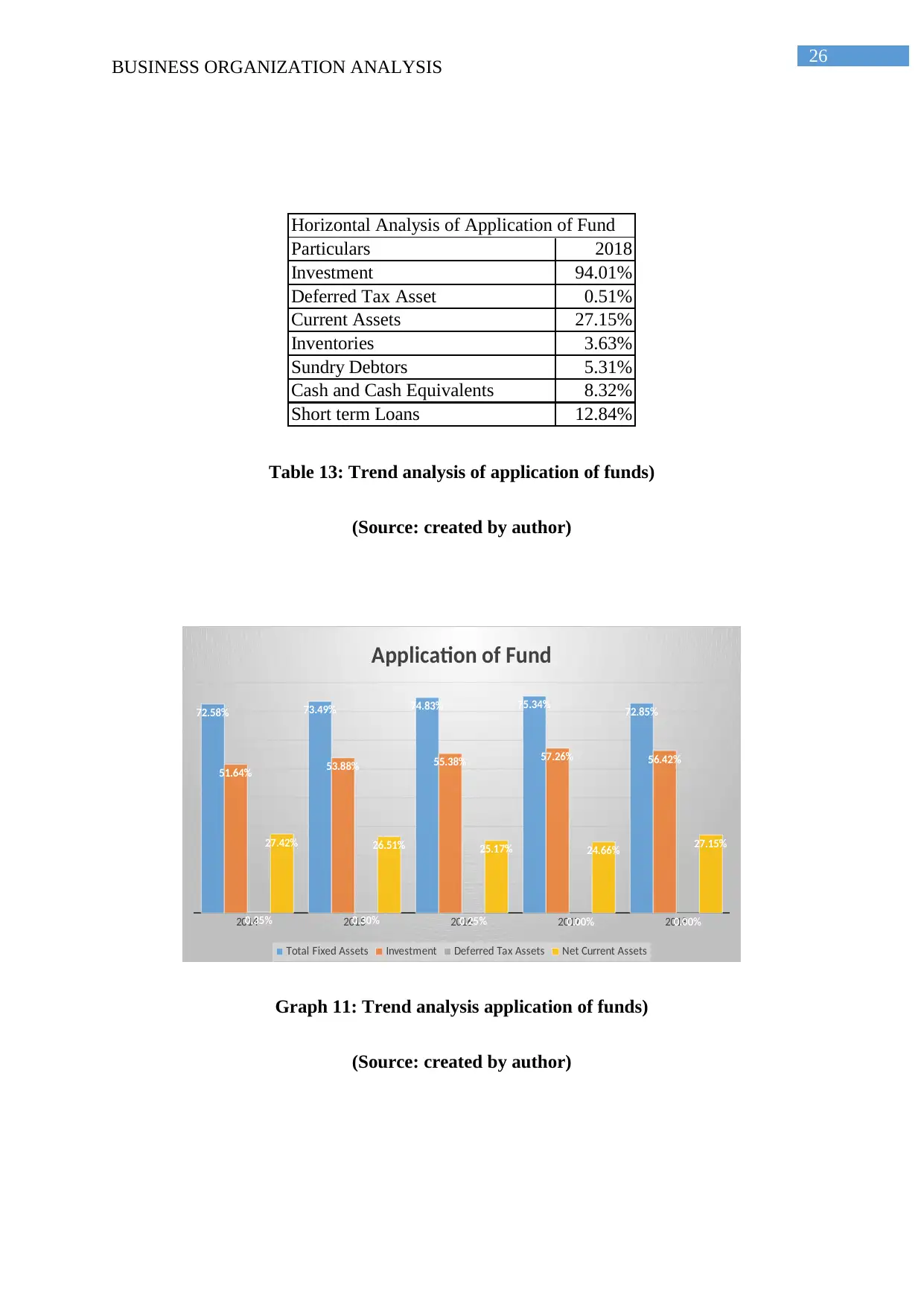

Horizontal Analysis of Application of Fund

Particulars 2018

Investment 94.01%

Deferred Tax Asset 0.51%

Current Assets 27.15%

Inventories 3.63%

Sundry Debtors 5.31%

Cash and Cash Equivalents 8.32%

Short term Loans 12.84%

Table 13: Trend analysis of application of funds)

(Source: created by author)

2014 2015 2016 2017 2018

72.58% 73.49% 74.83% 75.34% 72.85%

51.64% 53.88% 55.38% 57.26% 56.42%

0.35% 0.30% 0.25% 0.00% 0.00%

27.42% 26.51% 25.17% 24.66% 27.15%

Application of Fund

Total Fixed Assets Investment Deferred Tax Assets Net Current Assets

Graph 11: Trend analysis application of funds)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

Horizontal Analysis of Application of Fund

Particulars 2018

Investment 94.01%

Deferred Tax Asset 0.51%

Current Assets 27.15%

Inventories 3.63%

Sundry Debtors 5.31%

Cash and Cash Equivalents 8.32%

Short term Loans 12.84%

Table 13: Trend analysis of application of funds)

(Source: created by author)

2014 2015 2016 2017 2018

72.58% 73.49% 74.83% 75.34% 72.85%

51.64% 53.88% 55.38% 57.26% 56.42%

0.35% 0.30% 0.25% 0.00% 0.00%

27.42% 26.51% 25.17% 24.66% 27.15%

Application of Fund

Total Fixed Assets Investment Deferred Tax Assets Net Current Assets

Graph 11: Trend analysis application of funds)

(Source: created by author)

27

BUSINESS ORGANIZATION ANALYSIS

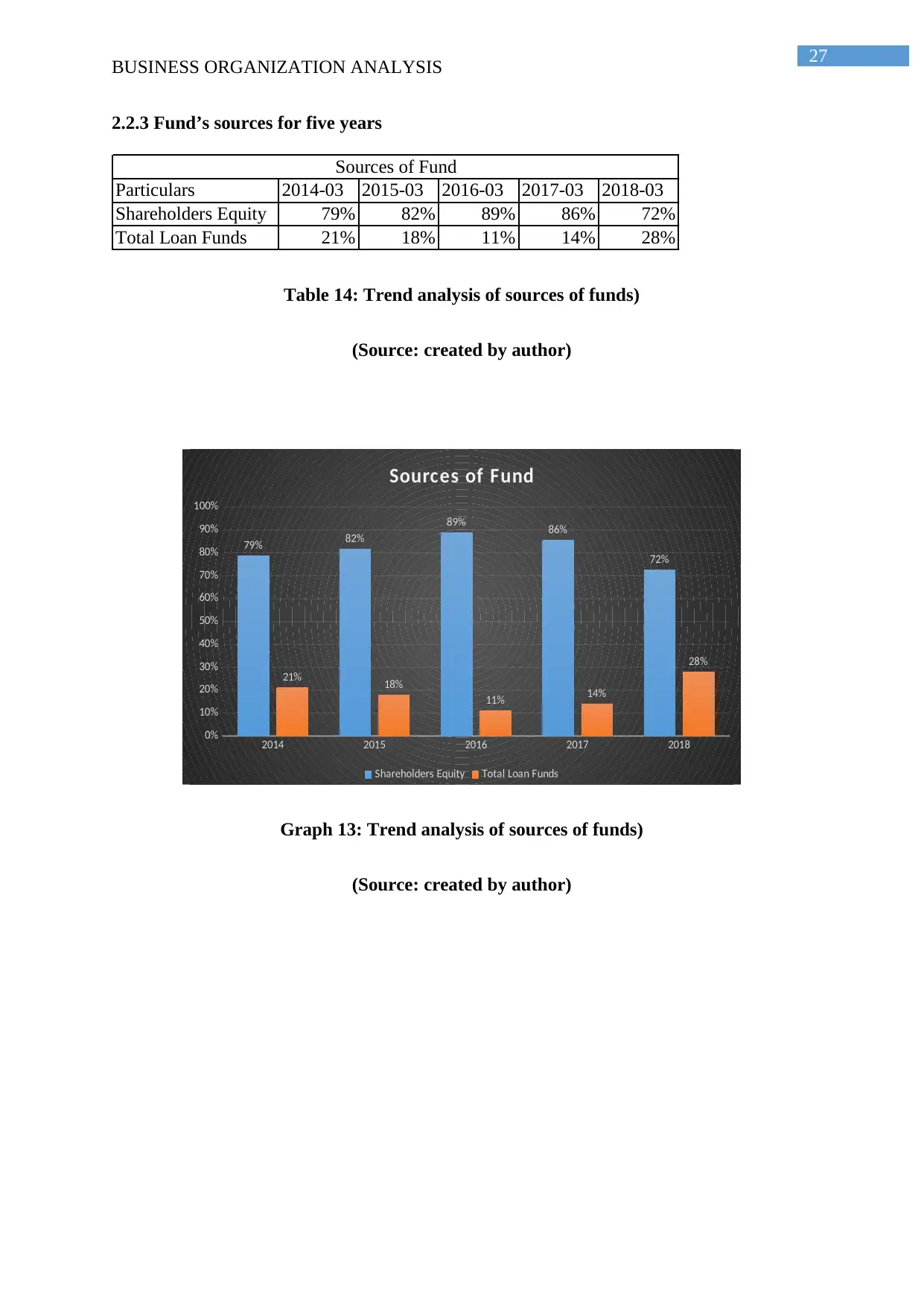

2.2.3 Fund’s sources for five years

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Shareholders Equity 79% 82% 89% 86% 72%

Total Loan Funds 21% 18% 11% 14% 28%

Sources of Fund

Table 14: Trend analysis of sources of funds)

(Source: created by author)

2014 2015 2016 2017 2018

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

79% 82%

89% 86%

72%

21% 18%

11% 14%

28%

Sources of Fund

Shareholders Equity Total Loan Funds

Graph 13: Trend analysis of sources of funds)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

2.2.3 Fund’s sources for five years

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Shareholders Equity 79% 82% 89% 86% 72%

Total Loan Funds 21% 18% 11% 14% 28%

Sources of Fund

Table 14: Trend analysis of sources of funds)

(Source: created by author)

2014 2015 2016 2017 2018

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

79% 82%

89% 86%

72%

21% 18%

11% 14%

28%

Sources of Fund

Shareholders Equity Total Loan Funds

Graph 13: Trend analysis of sources of funds)

(Source: created by author)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

28

BUSINESS ORGANIZATION ANALYSIS

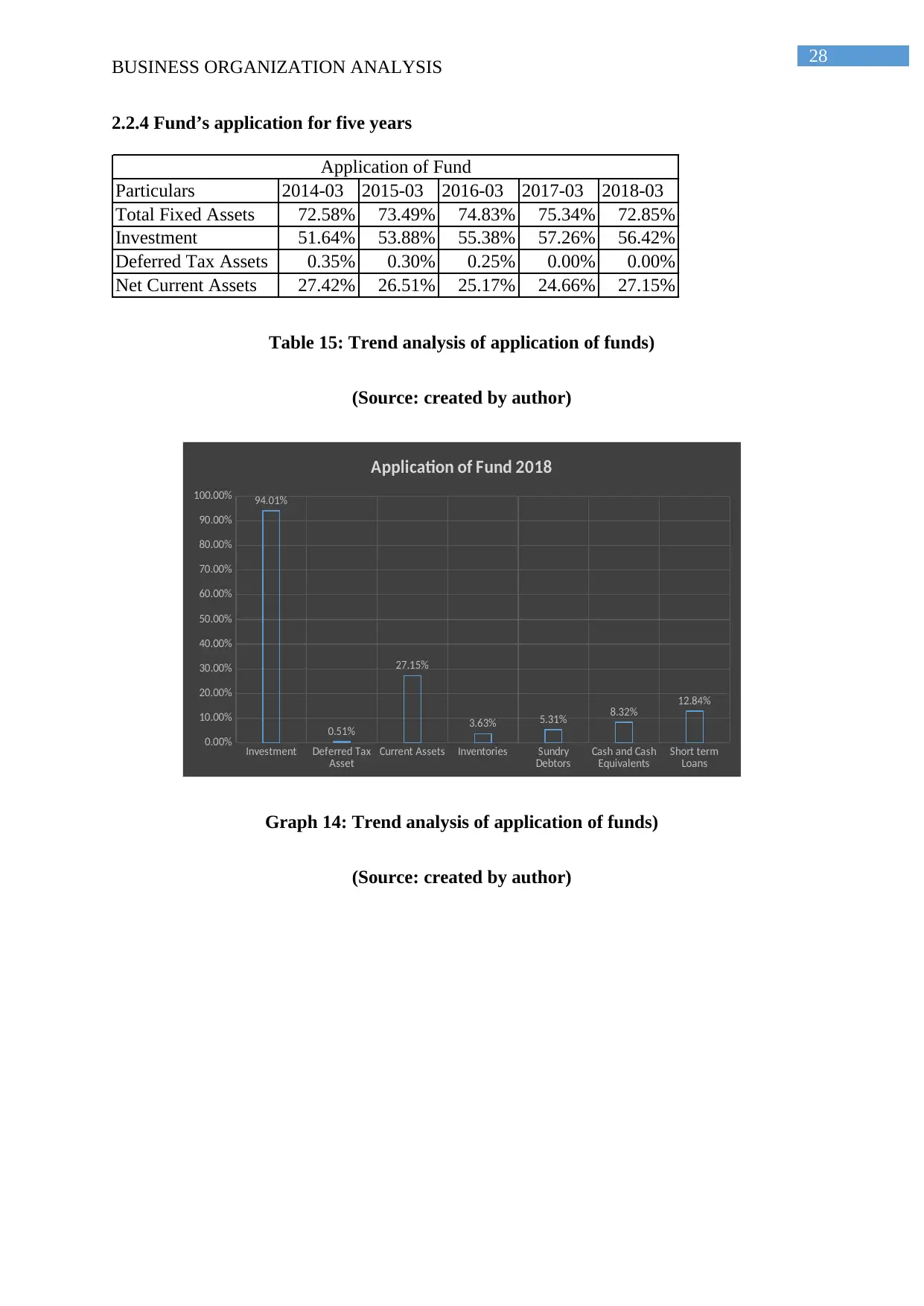

2.2.4 Fund’s application for five years

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Total Fixed Assets 72.58% 73.49% 74.83% 75.34% 72.85%

Investment 51.64% 53.88% 55.38% 57.26% 56.42%

Deferred Tax Assets 0.35% 0.30% 0.25% 0.00% 0.00%

Net Current Assets 27.42% 26.51% 25.17% 24.66% 27.15%

Application of Fund

Table 15: Trend analysis of application of funds)

(Source: created by author)

Investment Deferred Tax

Asset

Current Assets Inventories Sundry

Debtors

Cash and Cash

Equivalents

Short term

Loans

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

100.00% 94.01%

0.51%

27.15%

3.63% 5.31% 8.32% 12.84%

Application of Fund 2018

Graph 14: Trend analysis of application of funds)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

2.2.4 Fund’s application for five years

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Total Fixed Assets 72.58% 73.49% 74.83% 75.34% 72.85%

Investment 51.64% 53.88% 55.38% 57.26% 56.42%

Deferred Tax Assets 0.35% 0.30% 0.25% 0.00% 0.00%

Net Current Assets 27.42% 26.51% 25.17% 24.66% 27.15%

Application of Fund

Table 15: Trend analysis of application of funds)

(Source: created by author)

Investment Deferred Tax

Asset

Current Assets Inventories Sundry

Debtors

Cash and Cash

Equivalents

Short term

Loans

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

100.00% 94.01%

0.51%

27.15%

3.63% 5.31% 8.32% 12.84%

Application of Fund 2018

Graph 14: Trend analysis of application of funds)

(Source: created by author)

29

BUSINESS ORGANIZATION ANALYSIS

3. Analyzing the P& L account

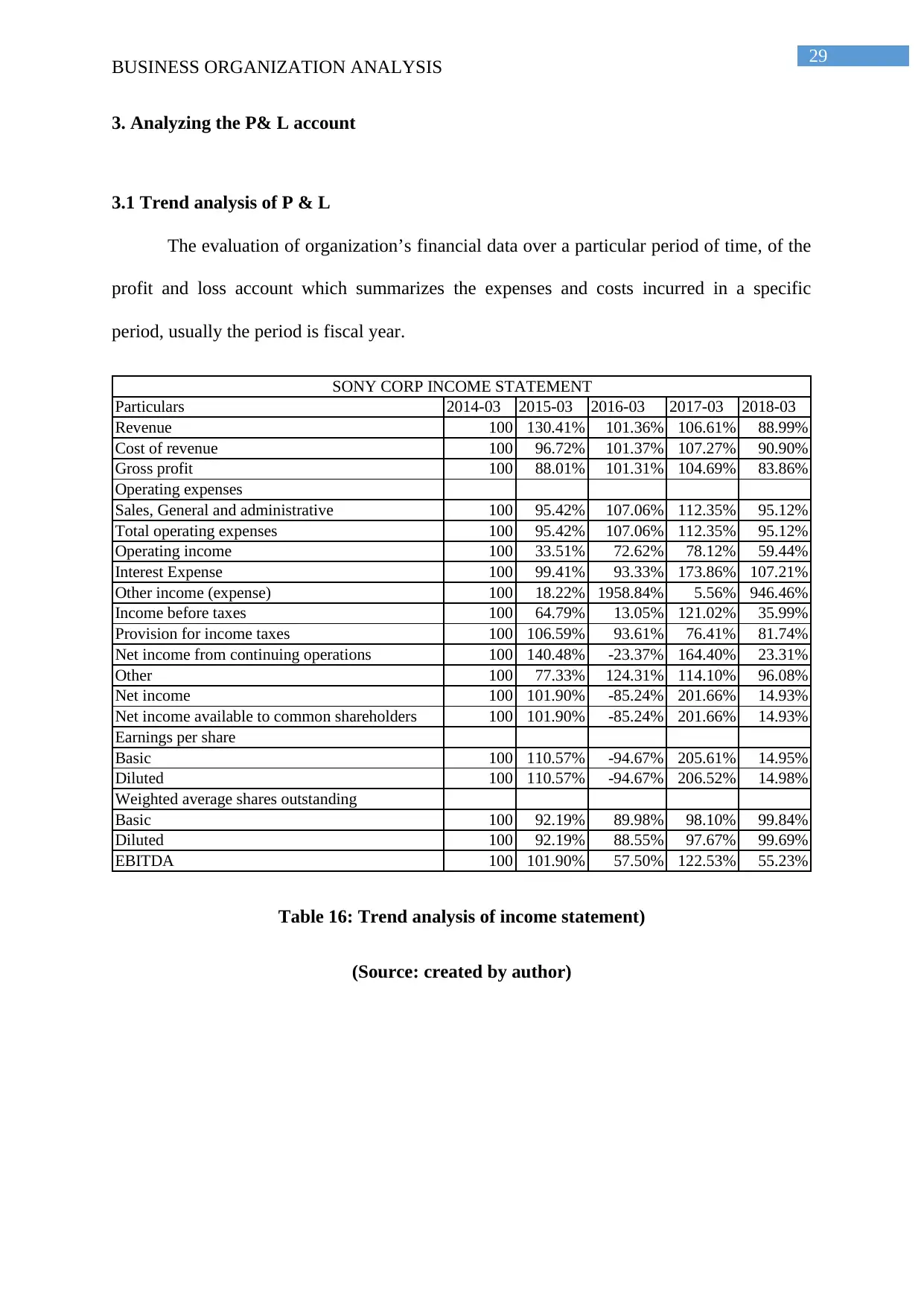

3.1 Trend analysis of P & L

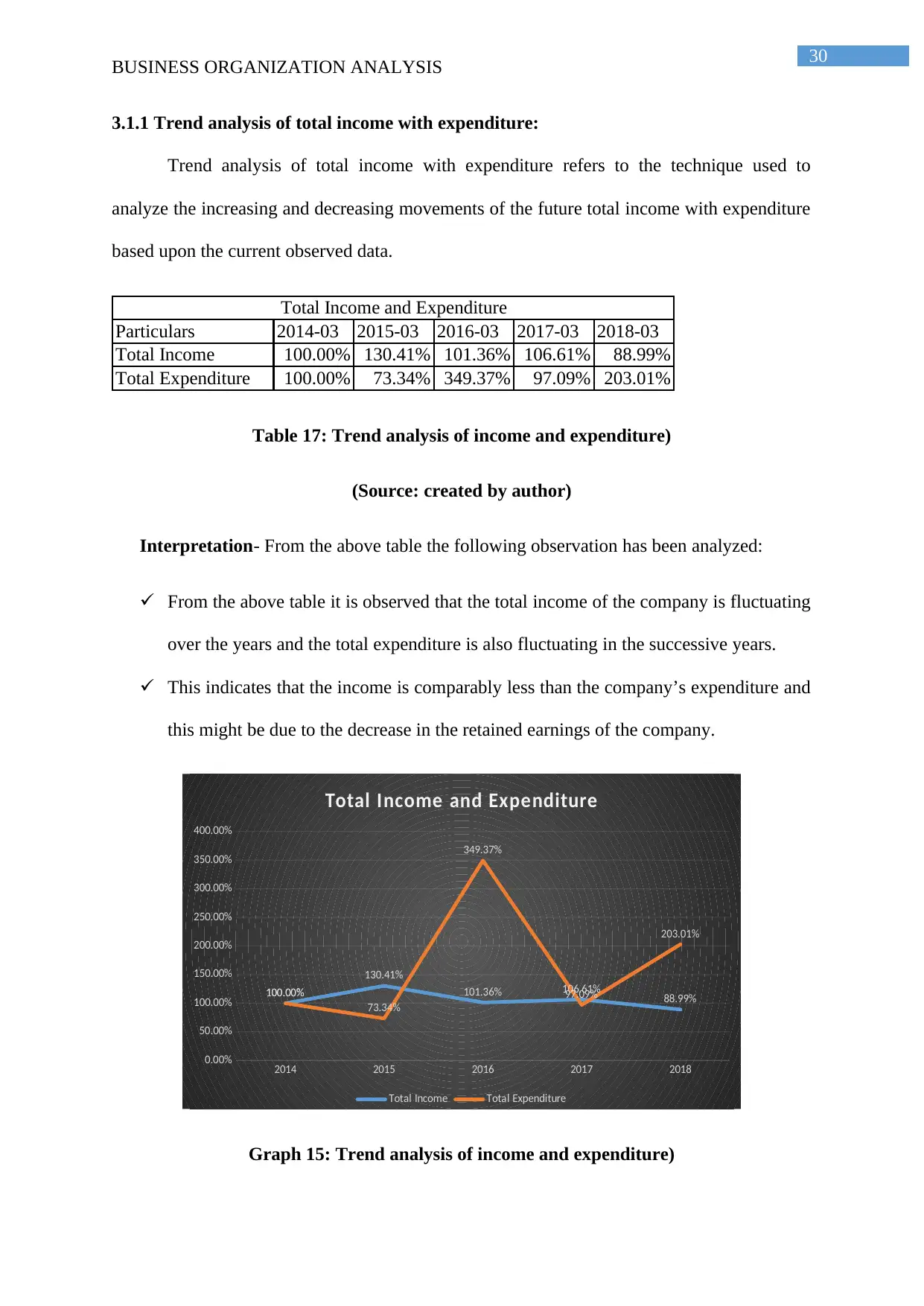

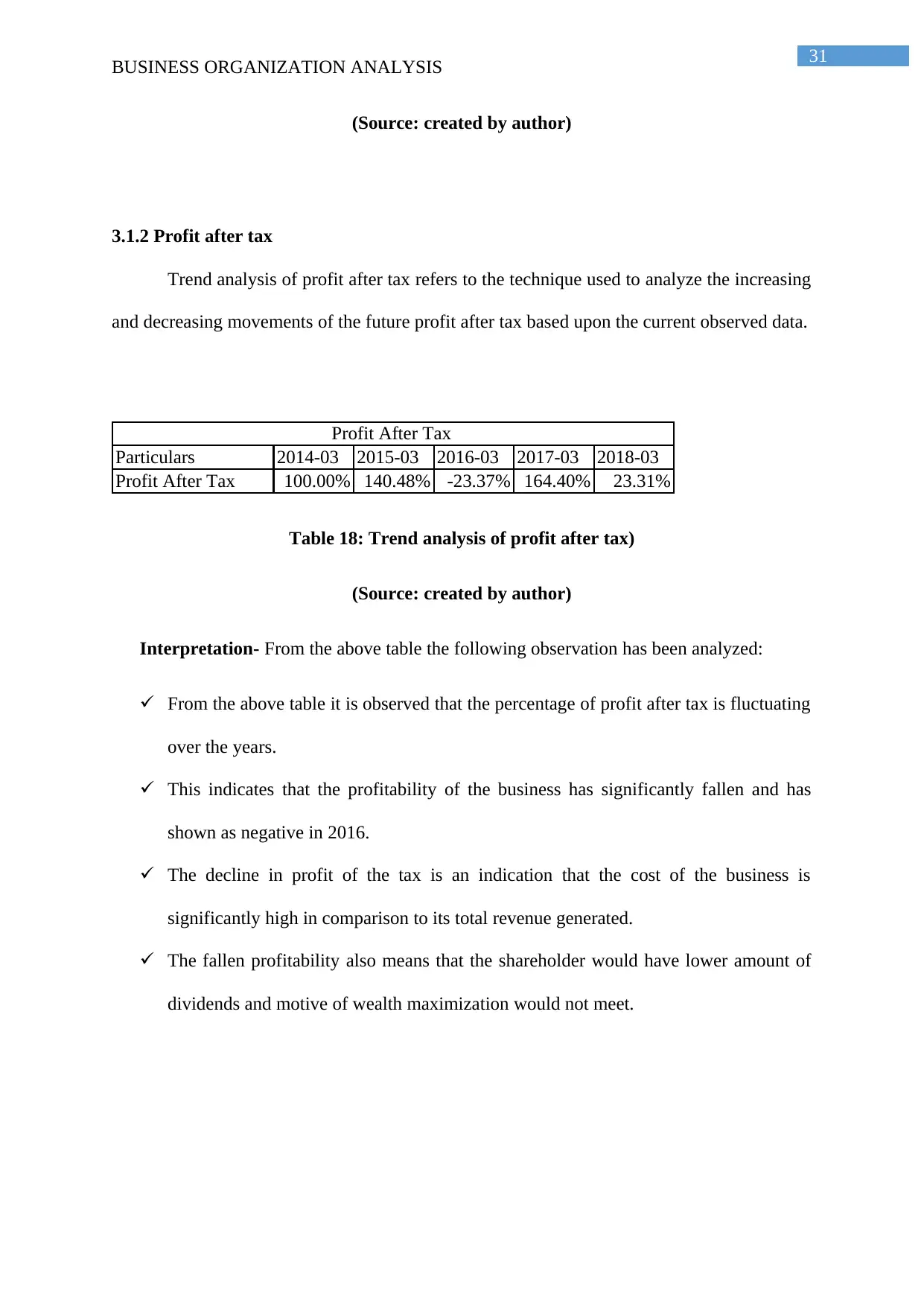

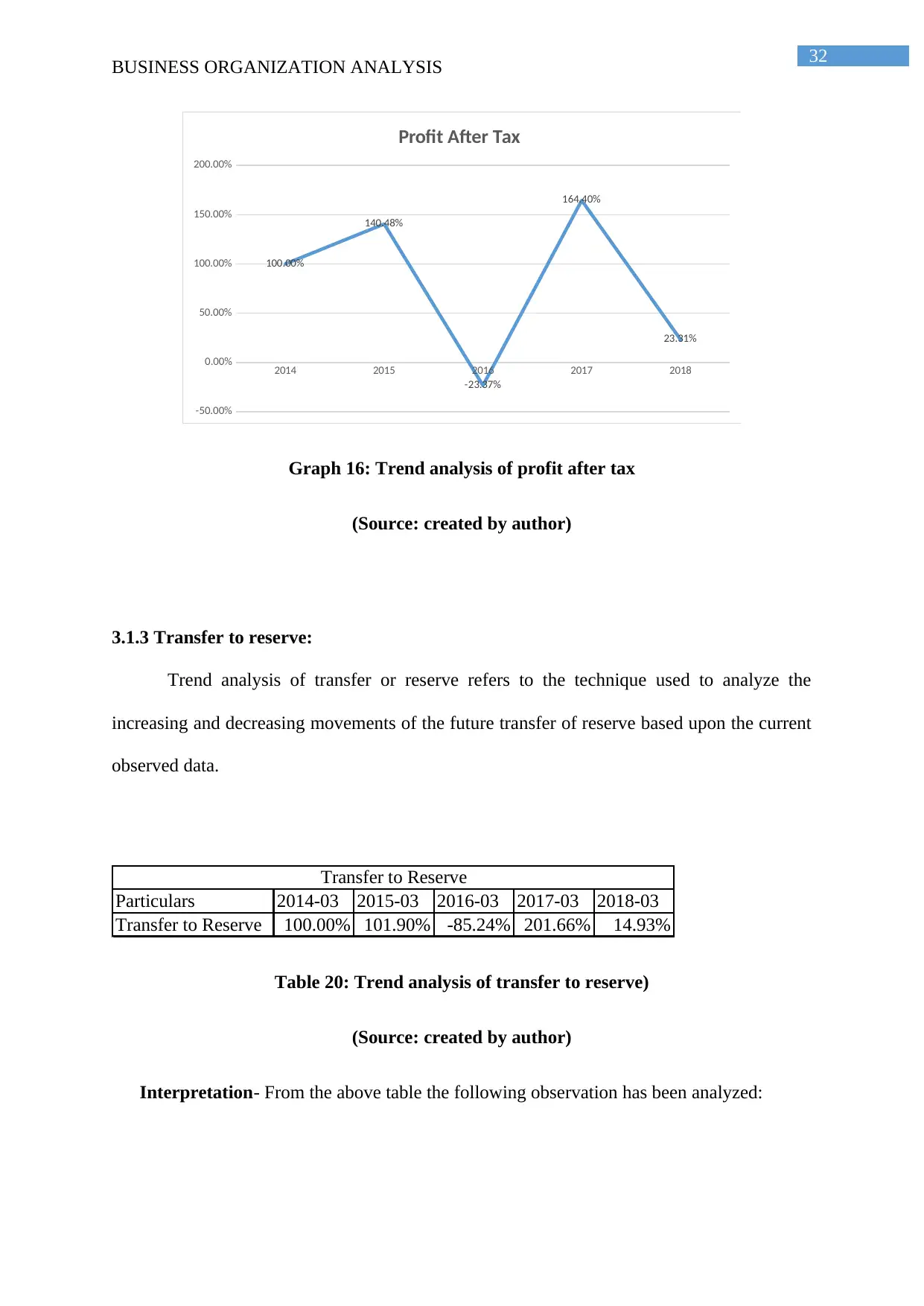

The evaluation of organization’s financial data over a particular period of time, of the

profit and loss account which summarizes the expenses and costs incurred in a specific

period, usually the period is fiscal year.

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Revenue 100 130.41% 101.36% 106.61% 88.99%

Cost of revenue 100 96.72% 101.37% 107.27% 90.90%

Gross profit 100 88.01% 101.31% 104.69% 83.86%

Operating expenses

Sales, General and administrative 100 95.42% 107.06% 112.35% 95.12%

Total operating expenses 100 95.42% 107.06% 112.35% 95.12%

Operating income 100 33.51% 72.62% 78.12% 59.44%

Interest Expense 100 99.41% 93.33% 173.86% 107.21%

Other income (expense) 100 18.22% 1958.84% 5.56% 946.46%

Income before taxes 100 64.79% 13.05% 121.02% 35.99%

Provision for income taxes 100 106.59% 93.61% 76.41% 81.74%

Net income from continuing operations 100 140.48% -23.37% 164.40% 23.31%

Other 100 77.33% 124.31% 114.10% 96.08%

Net income 100 101.90% -85.24% 201.66% 14.93%

Net income available to common shareholders 100 101.90% -85.24% 201.66% 14.93%

Earnings per share

Basic 100 110.57% -94.67% 205.61% 14.95%

Diluted 100 110.57% -94.67% 206.52% 14.98%

Weighted average shares outstanding

Basic 100 92.19% 89.98% 98.10% 99.84%

Diluted 100 92.19% 88.55% 97.67% 99.69%

EBITDA 100 101.90% 57.50% 122.53% 55.23%

SONY CORP INCOME STATEMENT

Table 16: Trend analysis of income statement)

(Source: created by author)

BUSINESS ORGANIZATION ANALYSIS

3. Analyzing the P& L account

3.1 Trend analysis of P & L

The evaluation of organization’s financial data over a particular period of time, of the

profit and loss account which summarizes the expenses and costs incurred in a specific

period, usually the period is fiscal year.

Particulars 2014-03 2015-03 2016-03 2017-03 2018-03

Revenue 100 130.41% 101.36% 106.61% 88.99%

Cost of revenue 100 96.72% 101.37% 107.27% 90.90%

Gross profit 100 88.01% 101.31% 104.69% 83.86%

Operating expenses

Sales, General and administrative 100 95.42% 107.06% 112.35% 95.12%

Total operating expenses 100 95.42% 107.06% 112.35% 95.12%

Operating income 100 33.51% 72.62% 78.12% 59.44%

Interest Expense 100 99.41% 93.33% 173.86% 107.21%

Other income (expense) 100 18.22% 1958.84% 5.56% 946.46%

Income before taxes 100 64.79% 13.05% 121.02% 35.99%

Provision for income taxes 100 106.59% 93.61% 76.41% 81.74%

Net income from continuing operations 100 140.48% -23.37% 164.40% 23.31%

Other 100 77.33% 124.31% 114.10% 96.08%

Net income 100 101.90% -85.24% 201.66% 14.93%

Net income available to common shareholders 100 101.90% -85.24% 201.66% 14.93%

Earnings per share

Basic 100 110.57% -94.67% 205.61% 14.95%

Diluted 100 110.57% -94.67% 206.52% 14.98%

Weighted average shares outstanding

Basic 100 92.19% 89.98% 98.10% 99.84%

Diluted 100 92.19% 88.55% 97.67% 99.69%

EBITDA 100 101.90% 57.50% 122.53% 55.23%

SONY CORP INCOME STATEMENT