Business Statistics Assignment: Analyzing Investment Data and Surveys

VerifiedAdded on 2020/03/23

|11

|2103

|110

Homework Assignment

AI Summary

This business statistics assignment requires students to analyze various datasets using Excel. Section 1 involves regression analysis, calculating z-scores, and interpreting scatter plots of investment data. Section 2 focuses on using pivot tables to analyze proportions of high and low-risk investments, conduct hypothesis tests, and interpret results. Section 3 involves further pivot table analysis, calculating sample means, standard deviations, and conducting hypothesis tests to compare investment returns. Section 4 analyzes a business opinion poll using pivot tables and confidence intervals. Section 5 involves the student collecting and analyzing their own dataset. Finally, Section 6 summarizes a video on computing expected rate of return and risk.

Business Statistics

Name

Institution

Instructor

Date

1

Name

Institution

Instructor

Date

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Section 1

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/56pb6hqu0ypcg0f3lhy6cl5szt1jgdla

Note that for section 1 the answers are provided so you can check your work, the answers will

not be provided for the other sections.

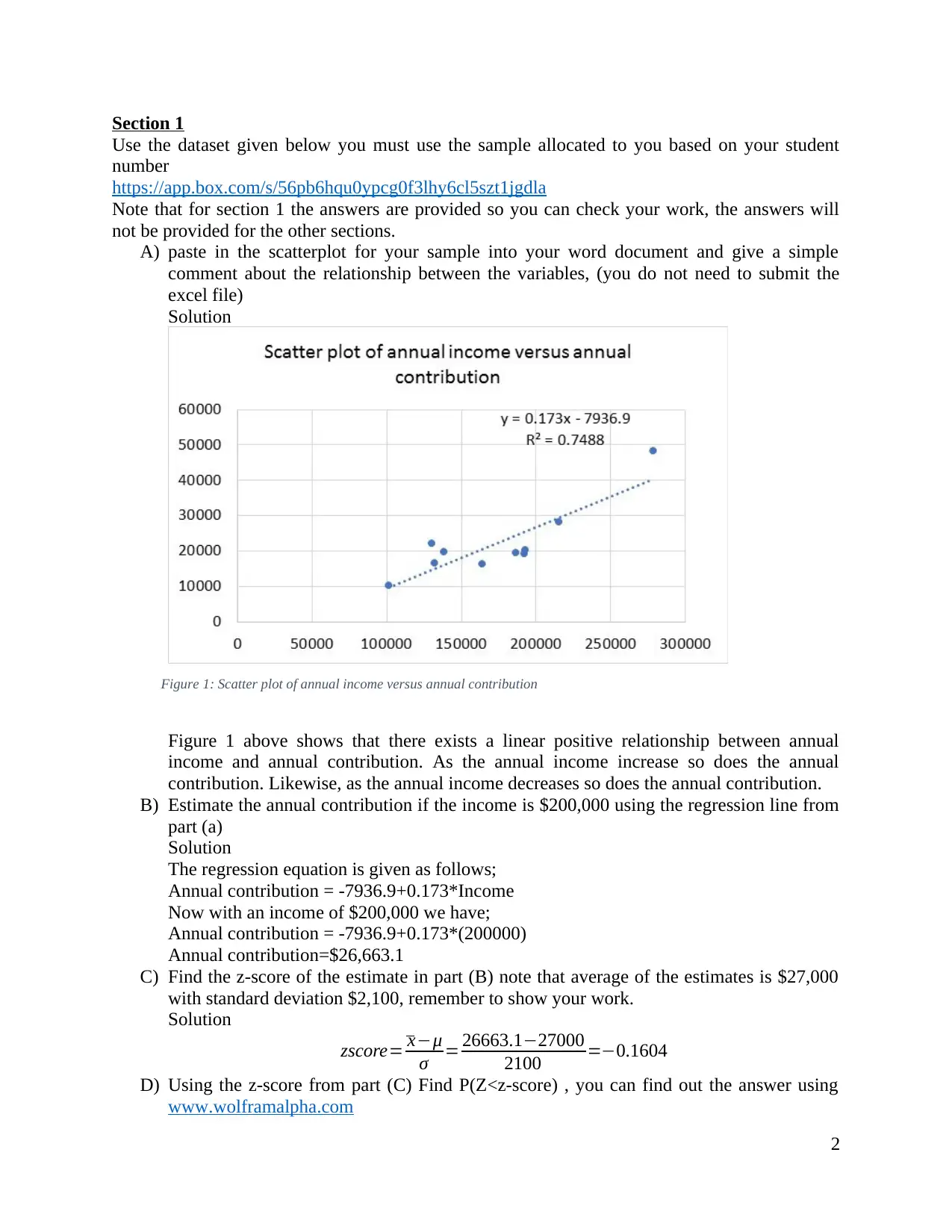

A) paste in the scatterplot for your sample into your word document and give a simple

comment about the relationship between the variables, (you do not need to submit the

excel file)

Solution

Figure 1: Scatter plot of annual income versus annual contribution

Figure 1 above shows that there exists a linear positive relationship between annual

income and annual contribution. As the annual income increase so does the annual

contribution. Likewise, as the annual income decreases so does the annual contribution.

B) Estimate the annual contribution if the income is $200,000 using the regression line from

part (a)

Solution

The regression equation is given as follows;

Annual contribution = -7936.9+0.173*Income

Now with an income of $200,000 we have;

Annual contribution = -7936.9+0.173*(200000)

Annual contribution=$26,663.1

C) Find the z-score of the estimate in part (B) note that average of the estimates is $27,000

with standard deviation $2,100, remember to show your work.

Solution

zscore= x−μ

σ = 26663.1−27000

2100 =−0.1604

D) Using the z-score from part (C) Find P(Z<z-score) , you can find out the answer using

www.wolframalpha.com

2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/56pb6hqu0ypcg0f3lhy6cl5szt1jgdla

Note that for section 1 the answers are provided so you can check your work, the answers will

not be provided for the other sections.

A) paste in the scatterplot for your sample into your word document and give a simple

comment about the relationship between the variables, (you do not need to submit the

excel file)

Solution

Figure 1: Scatter plot of annual income versus annual contribution

Figure 1 above shows that there exists a linear positive relationship between annual

income and annual contribution. As the annual income increase so does the annual

contribution. Likewise, as the annual income decreases so does the annual contribution.

B) Estimate the annual contribution if the income is $200,000 using the regression line from

part (a)

Solution

The regression equation is given as follows;

Annual contribution = -7936.9+0.173*Income

Now with an income of $200,000 we have;

Annual contribution = -7936.9+0.173*(200000)

Annual contribution=$26,663.1

C) Find the z-score of the estimate in part (B) note that average of the estimates is $27,000

with standard deviation $2,100, remember to show your work.

Solution

zscore= x−μ

σ = 26663.1−27000

2100 =−0.1604

D) Using the z-score from part (C) Find P(Z<z-score) , you can find out the answer using

www.wolframalpha.com

2

for example found the z-score was 1.5 if the z-score is 1.5 type in

P(Z<1.5)

into wolfram alpha.com

Solution

P( Z< zscore)=P( Z <−0.1604)=0.4363

E) If there was a list of 10,000 estimates ranked from lowest to highest, what rank do you

think your estimate would be close to?

Hint: just use the formula

expected rank = P(Z<zscore)*10000, remember to show your work.

Solution

Expected rank =P(Z < zscore )∗10000

Expected rank =0.4363∗10000=4363

Section 2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/yvhk3e3oymbs3toy6j5xetid82dsjyz4

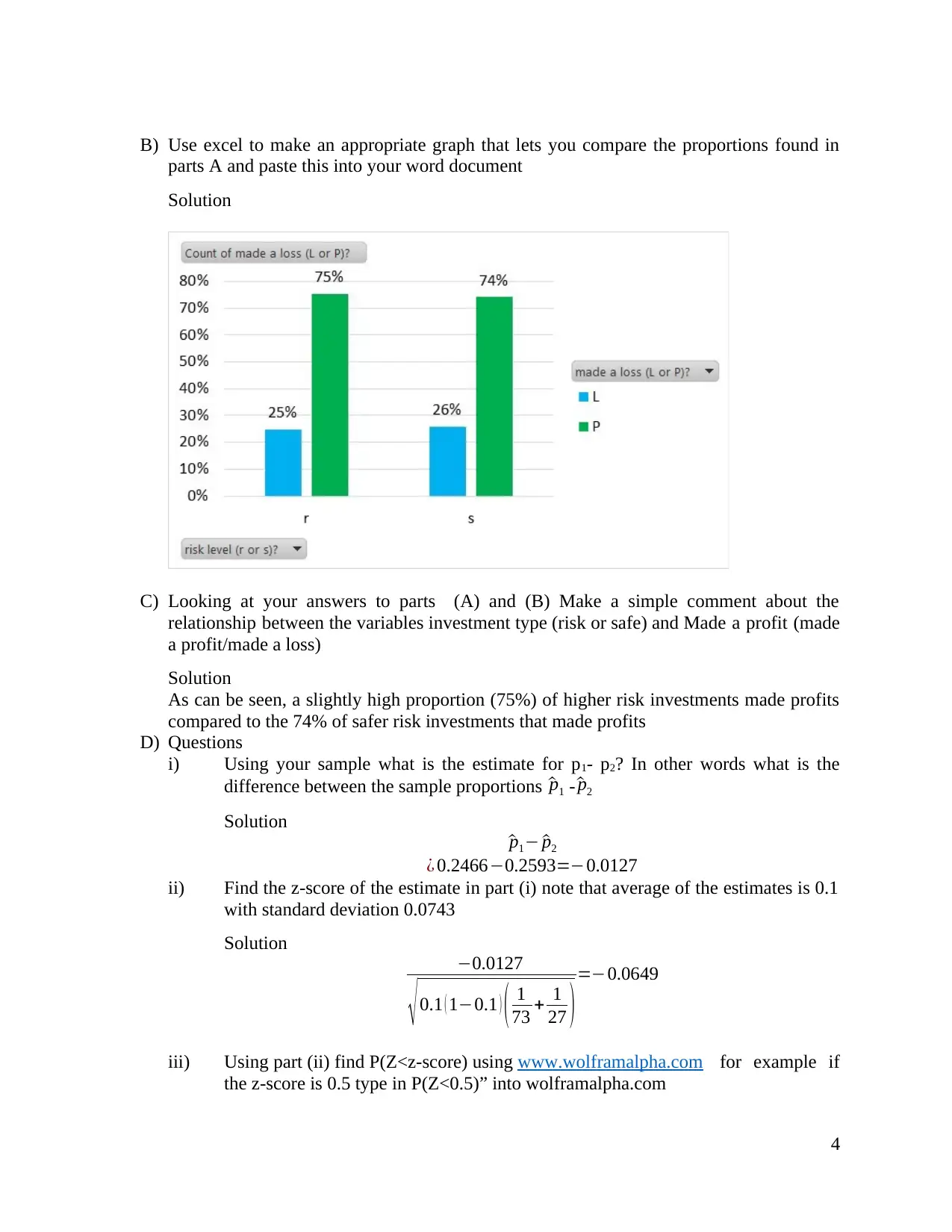

A) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample, This will probably require two PivotTables. You should paste both into word,

you do not need the excel file.

Make sure the pivot table (or pivot tables) include the following statistics

*Just considering the high risk (riskier type) investments what is the sample size n1 and

the proportion of high risk investments that made a loss ^p1

*Just considering the low risk (safer type) investments what is the sample size =n2 and

What is the proportion of low risk investments that made a loss ^p2

Solution

Count of made a loss (L or

P)? Column Labels

Row Labels L P

Grand

Total

r 18

5

5 73

s 7

2

0 27

Grand Total 25

7

5 100

The sample size for high risk investment, n1 is 73 while the proportion of high risk

investments that made a loss ^p1 is 18

73 =0.2 466

The sample size for low risk investment, n2 is 30 while the proportion of low risk

investments that made a loss ^p2 is 7

27 =0.2593

3

P(Z<1.5)

into wolfram alpha.com

Solution

P( Z< zscore)=P( Z <−0.1604)=0.4363

E) If there was a list of 10,000 estimates ranked from lowest to highest, what rank do you

think your estimate would be close to?

Hint: just use the formula

expected rank = P(Z<zscore)*10000, remember to show your work.

Solution

Expected rank =P(Z < zscore )∗10000

Expected rank =0.4363∗10000=4363

Section 2

Use the dataset given below you must use the sample allocated to you based on your student

number

https://app.box.com/s/yvhk3e3oymbs3toy6j5xetid82dsjyz4

A) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample, This will probably require two PivotTables. You should paste both into word,

you do not need the excel file.

Make sure the pivot table (or pivot tables) include the following statistics

*Just considering the high risk (riskier type) investments what is the sample size n1 and

the proportion of high risk investments that made a loss ^p1

*Just considering the low risk (safer type) investments what is the sample size =n2 and

What is the proportion of low risk investments that made a loss ^p2

Solution

Count of made a loss (L or

P)? Column Labels

Row Labels L P

Grand

Total

r 18

5

5 73

s 7

2

0 27

Grand Total 25

7

5 100

The sample size for high risk investment, n1 is 73 while the proportion of high risk

investments that made a loss ^p1 is 18

73 =0.2 466

The sample size for low risk investment, n2 is 30 while the proportion of low risk

investments that made a loss ^p2 is 7

27 =0.2593

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

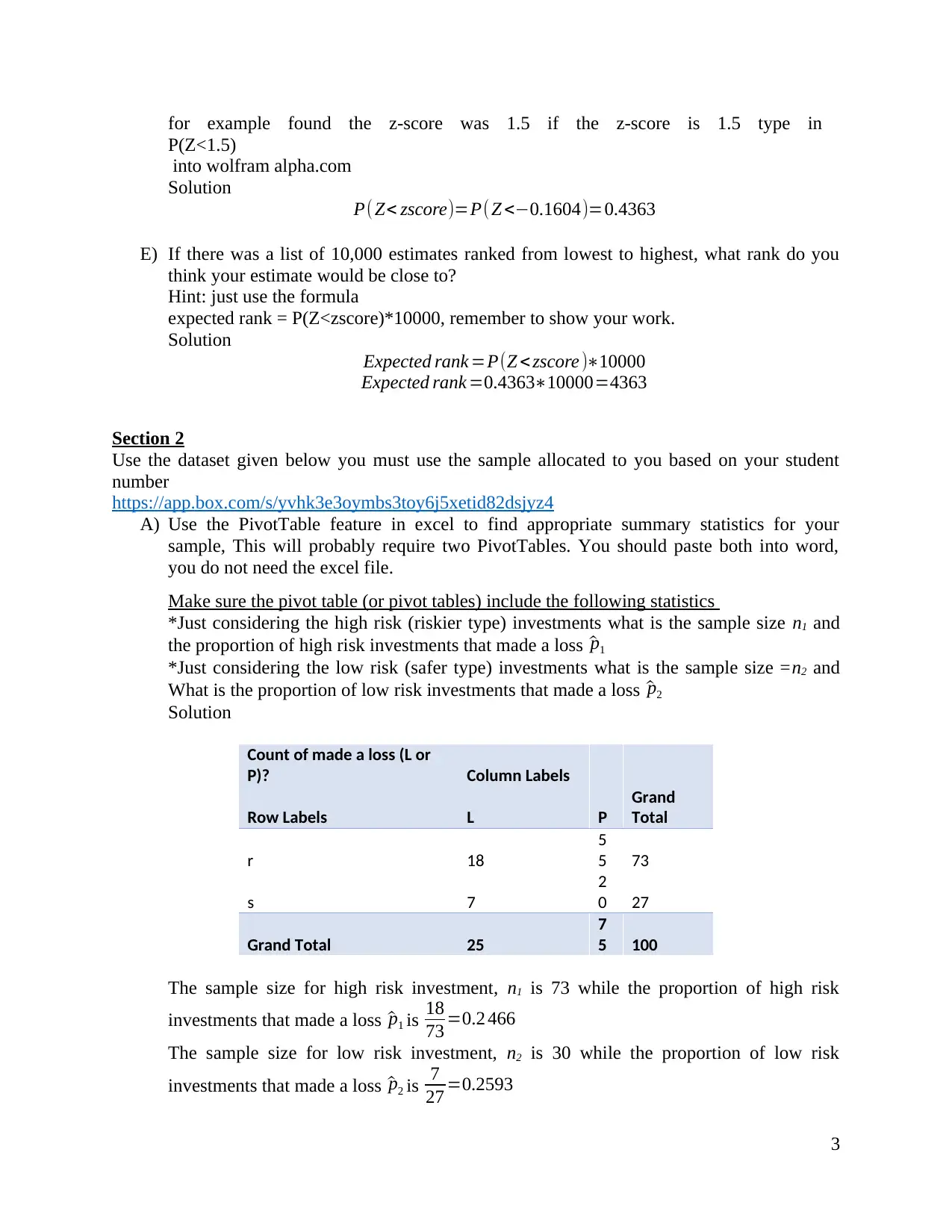

B) Use excel to make an appropriate graph that lets you compare the proportions found in

parts A and paste this into your word document

Solution

C) Looking at your answers to parts (A) and (B) Make a simple comment about the

relationship between the variables investment type (risk or safe) and Made a profit (made

a profit/made a loss)

Solution

As can be seen, a slightly high proportion (75%) of higher risk investments made profits

compared to the 74% of safer risk investments that made profits

D) Questions

i) Using your sample what is the estimate for p1- p2? In other words what is the

difference between the sample proportions ^p1 - ^p2

Solution

^p1− ^p2

¿ 0.2466−0.2593=−0.0127

ii) Find the z-score of the estimate in part (i) note that average of the estimates is 0.1

with standard deviation 0.0743

Solution

−0.0127

√ 0.1 ( 1−0.1 ) ( 1

73 + 1

27 ) =−0.0649

iii) Using part (ii) find P(Z<z-score) using www.wolframalpha.com for example if

the z-score is 0.5 type in P(Z<0.5)” into wolframalpha.com

4

parts A and paste this into your word document

Solution

C) Looking at your answers to parts (A) and (B) Make a simple comment about the

relationship between the variables investment type (risk or safe) and Made a profit (made

a profit/made a loss)

Solution

As can be seen, a slightly high proportion (75%) of higher risk investments made profits

compared to the 74% of safer risk investments that made profits

D) Questions

i) Using your sample what is the estimate for p1- p2? In other words what is the

difference between the sample proportions ^p1 - ^p2

Solution

^p1− ^p2

¿ 0.2466−0.2593=−0.0127

ii) Find the z-score of the estimate in part (i) note that average of the estimates is 0.1

with standard deviation 0.0743

Solution

−0.0127

√ 0.1 ( 1−0.1 ) ( 1

73 + 1

27 ) =−0.0649

iii) Using part (ii) find P(Z<z-score) using www.wolframalpha.com for example if

the z-score is 0.5 type in P(Z<0.5)” into wolframalpha.com

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Solution

P( Z ←0.0649)=0.4741

iv) IF there was a list of 4000 estimates ranked from lowest to highest, roughly what

rank do you expect your estimate to have? Hint: just use the formula expected

rank = P(Z<z-score)*4000

Solution

Expected rank = P(Z<z-score)*4000

Expected rank =0.4741*4000=1897

E) Test the claim there is a difference in the proportions use a 5% level of significance

i) State an appropriate H0 and H1

Solution

H0 : ^p1= ^p2

H1 : ^p1 ≠ ^p2

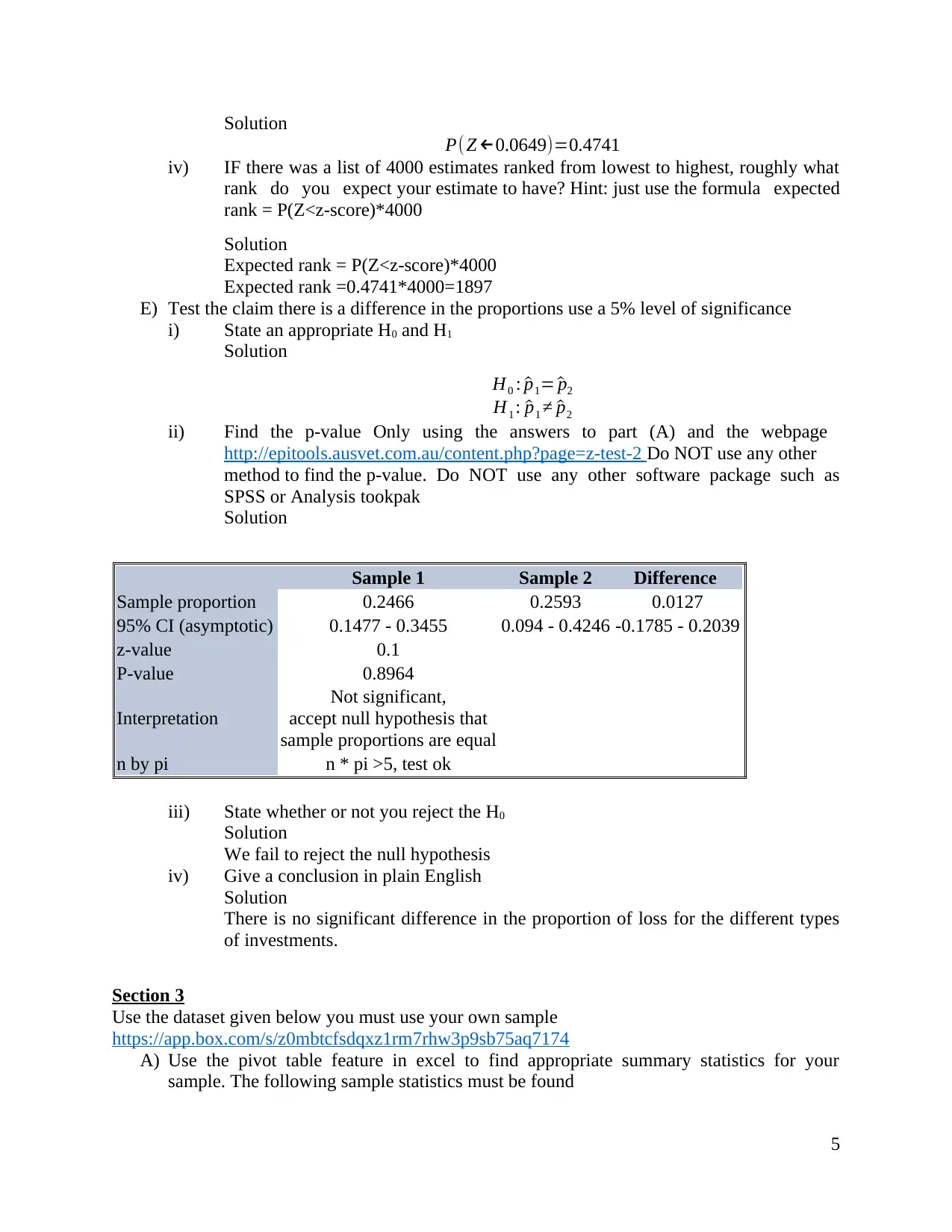

ii) Find the p-value Only using the answers to part (A) and the webpage

http://epitools.ausvet.com.au/content.php?page=z-test-2 Do NOT use any other

method to find the p-value. Do NOT use any other software package such as

SPSS or Analysis tookpak

Solution

Sample 1 Sample 2 Difference

Sample proportion 0.2466 0.2593 0.0127

95% CI (asymptotic) 0.1477 - 0.3455 0.094 - 0.4246 -0.1785 - 0.2039

z-value 0.1

P-value 0.8964

Interpretation

Not significant,

accept null hypothesis that

sample proportions are equal

n by pi n * pi >5, test ok

iii) State whether or not you reject the H0

Solution

We fail to reject the null hypothesis

iv) Give a conclusion in plain English

Solution

There is no significant difference in the proportion of loss for the different types

of investments.

Section 3

Use the dataset given below you must use your own sample

https://app.box.com/s/z0mbtcfsdqxz1rm7rhw3p9sb75aq7174

A) Use the pivot table feature in excel to find appropriate summary statistics for your

sample. The following sample statistics must be found

5

P( Z ←0.0649)=0.4741

iv) IF there was a list of 4000 estimates ranked from lowest to highest, roughly what

rank do you expect your estimate to have? Hint: just use the formula expected

rank = P(Z<z-score)*4000

Solution

Expected rank = P(Z<z-score)*4000

Expected rank =0.4741*4000=1897

E) Test the claim there is a difference in the proportions use a 5% level of significance

i) State an appropriate H0 and H1

Solution

H0 : ^p1= ^p2

H1 : ^p1 ≠ ^p2

ii) Find the p-value Only using the answers to part (A) and the webpage

http://epitools.ausvet.com.au/content.php?page=z-test-2 Do NOT use any other

method to find the p-value. Do NOT use any other software package such as

SPSS or Analysis tookpak

Solution

Sample 1 Sample 2 Difference

Sample proportion 0.2466 0.2593 0.0127

95% CI (asymptotic) 0.1477 - 0.3455 0.094 - 0.4246 -0.1785 - 0.2039

z-value 0.1

P-value 0.8964

Interpretation

Not significant,

accept null hypothesis that

sample proportions are equal

n by pi n * pi >5, test ok

iii) State whether or not you reject the H0

Solution

We fail to reject the null hypothesis

iv) Give a conclusion in plain English

Solution

There is no significant difference in the proportion of loss for the different types

of investments.

Section 3

Use the dataset given below you must use your own sample

https://app.box.com/s/z0mbtcfsdqxz1rm7rhw3p9sb75aq7174

A) Use the pivot table feature in excel to find appropriate summary statistics for your

sample. The following sample statistics must be found

5

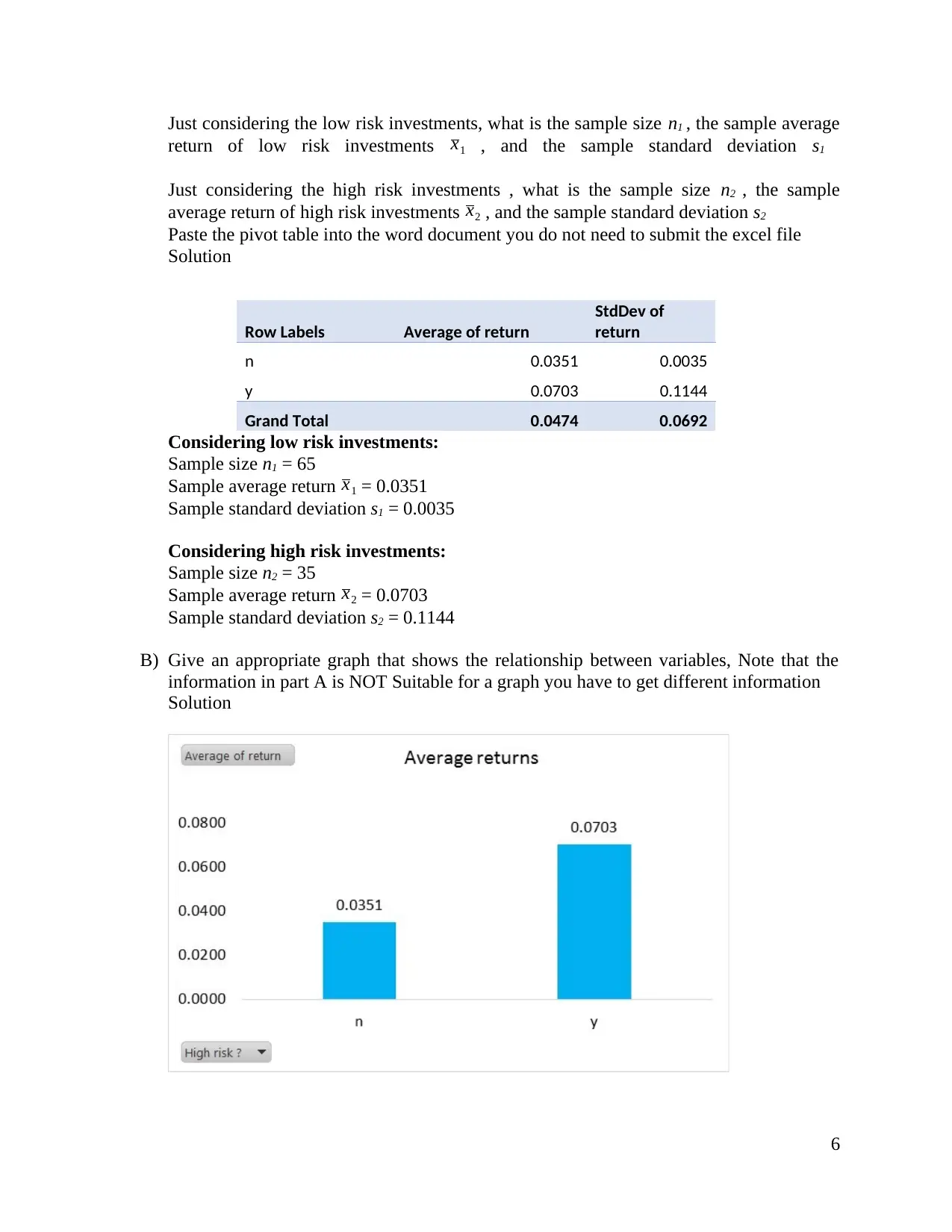

Just considering the low risk investments, what is the sample size n1 , the sample average

return of low risk investments x1 , and the sample standard deviation s1

Just considering the high risk investments , what is the sample size n2 , the sample

average return of high risk investments x2 , and the sample standard deviation s2

Paste the pivot table into the word document you do not need to submit the excel file

Solution

Row Labels Average of return

StdDev of

return

n 0.0351 0.0035

y 0.0703 0.1144

Grand Total 0.0474 0.0692

Considering low risk investments:

Sample size n1 = 65

Sample average return x1 = 0.0351

Sample standard deviation s1 = 0.0035

Considering high risk investments:

Sample size n2 = 35

Sample average return x2 = 0.0703

Sample standard deviation s2 = 0.1144

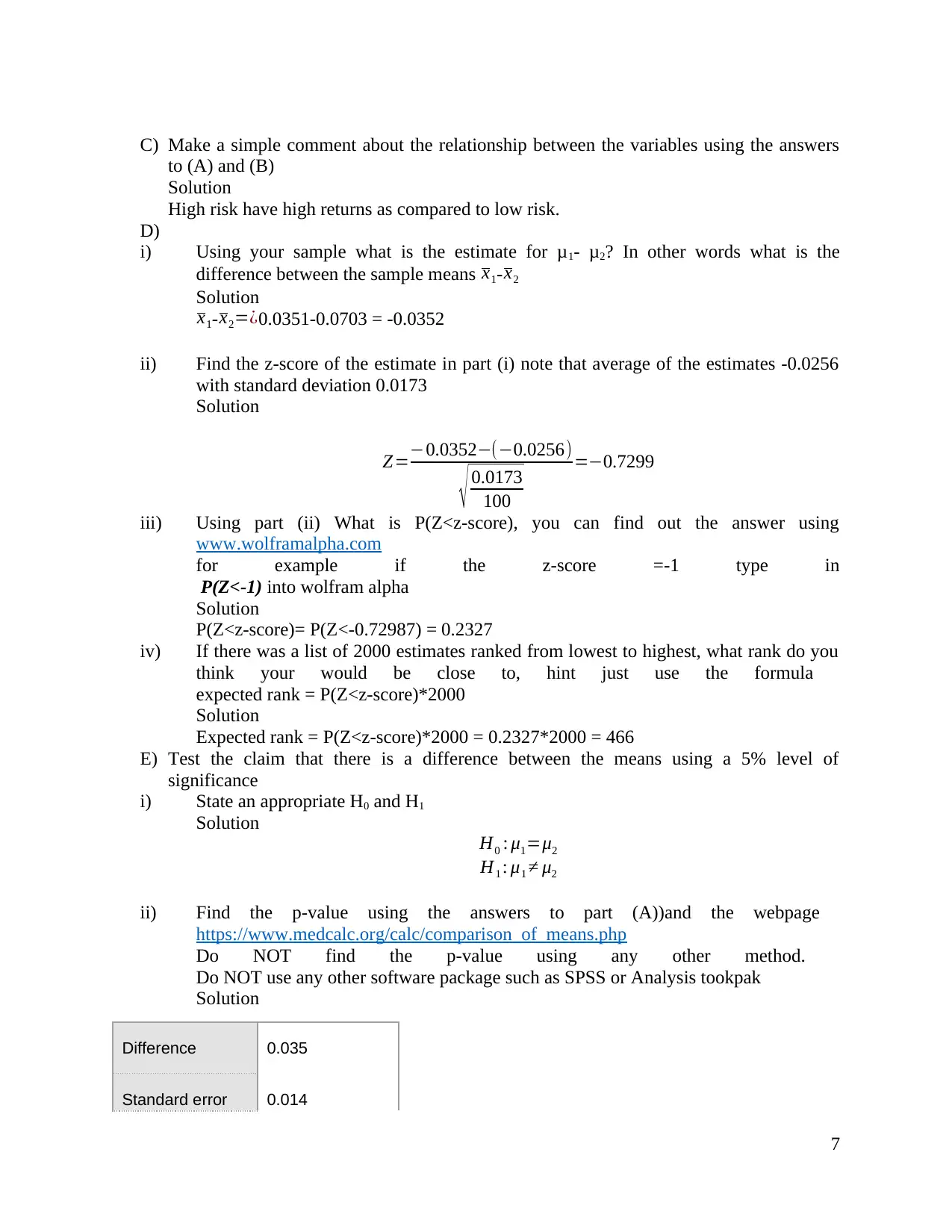

B) Give an appropriate graph that shows the relationship between variables, Note that the

information in part A is NOT Suitable for a graph you have to get different information

Solution

6

return of low risk investments x1 , and the sample standard deviation s1

Just considering the high risk investments , what is the sample size n2 , the sample

average return of high risk investments x2 , and the sample standard deviation s2

Paste the pivot table into the word document you do not need to submit the excel file

Solution

Row Labels Average of return

StdDev of

return

n 0.0351 0.0035

y 0.0703 0.1144

Grand Total 0.0474 0.0692

Considering low risk investments:

Sample size n1 = 65

Sample average return x1 = 0.0351

Sample standard deviation s1 = 0.0035

Considering high risk investments:

Sample size n2 = 35

Sample average return x2 = 0.0703

Sample standard deviation s2 = 0.1144

B) Give an appropriate graph that shows the relationship between variables, Note that the

information in part A is NOT Suitable for a graph you have to get different information

Solution

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

C) Make a simple comment about the relationship between the variables using the answers

to (A) and (B)

Solution

High risk have high returns as compared to low risk.

D)

i) Using your sample what is the estimate for μ1- μ2? In other words what is the

difference between the sample means x1- x2

Solution

x1-x2=¿0.0351-0.0703 = -0.0352

ii) Find the z-score of the estimate in part (i) note that average of the estimates -0.0256

with standard deviation 0.0173

Solution

Z=−0.0352−(−0.0256)

√ 0.0173

100

=−0.7299

iii) Using part (ii) What is P(Z<z-score), you can find out the answer using

www.wolframalpha.com

for example if the z-score =-1 type in

P(Z<-1) into wolfram alpha

Solution

P(Z<z-score)= P(Z<-0.72987) = 0.2327

iv) If there was a list of 2000 estimates ranked from lowest to highest, what rank do you

think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*2000

Solution

Expected rank = P(Z<z-score)*2000 = 0.2327*2000 = 466

E) Test the claim that there is a difference between the means using a 5% level of

significance

i) State an appropriate H0 and H1

Solution

H0 : μ1=μ2

H1 : μ1 ≠ μ2

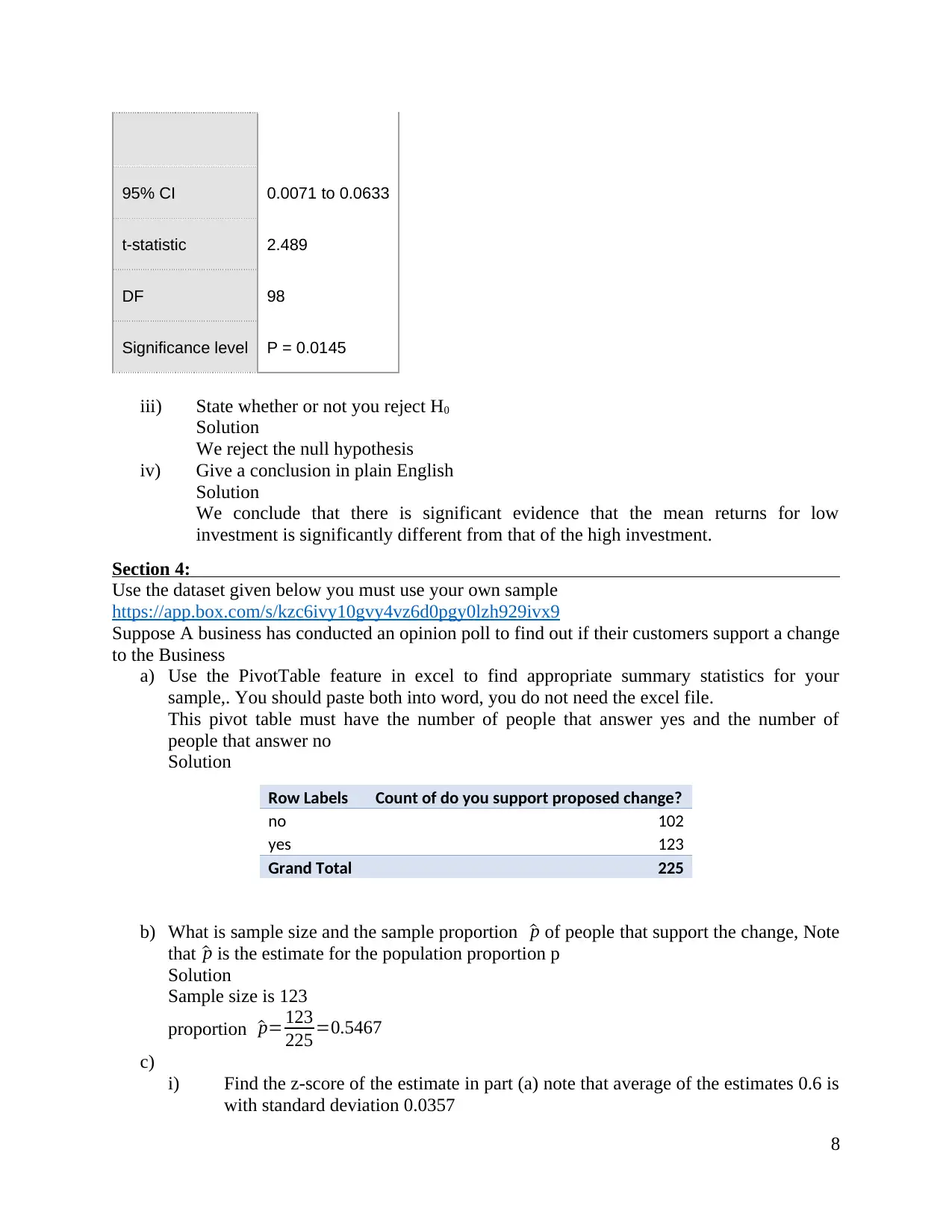

ii) Find the p-value using the answers to part (A))and the webpage

https://www.medcalc.org/calc/comparison_of_means.php

Do NOT find the p-value using any other method.

Do NOT use any other software package such as SPSS or Analysis tookpak

Solution

Difference 0.035

Standard error 0.014

7

to (A) and (B)

Solution

High risk have high returns as compared to low risk.

D)

i) Using your sample what is the estimate for μ1- μ2? In other words what is the

difference between the sample means x1- x2

Solution

x1-x2=¿0.0351-0.0703 = -0.0352

ii) Find the z-score of the estimate in part (i) note that average of the estimates -0.0256

with standard deviation 0.0173

Solution

Z=−0.0352−(−0.0256)

√ 0.0173

100

=−0.7299

iii) Using part (ii) What is P(Z<z-score), you can find out the answer using

www.wolframalpha.com

for example if the z-score =-1 type in

P(Z<-1) into wolfram alpha

Solution

P(Z<z-score)= P(Z<-0.72987) = 0.2327

iv) If there was a list of 2000 estimates ranked from lowest to highest, what rank do you

think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*2000

Solution

Expected rank = P(Z<z-score)*2000 = 0.2327*2000 = 466

E) Test the claim that there is a difference between the means using a 5% level of

significance

i) State an appropriate H0 and H1

Solution

H0 : μ1=μ2

H1 : μ1 ≠ μ2

ii) Find the p-value using the answers to part (A))and the webpage

https://www.medcalc.org/calc/comparison_of_means.php

Do NOT find the p-value using any other method.

Do NOT use any other software package such as SPSS or Analysis tookpak

Solution

Difference 0.035

Standard error 0.014

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

95% CI 0.0071 to 0.0633

t-statistic 2.489

DF 98

Significance level P = 0.0145

iii) State whether or not you reject H0

Solution

We reject the null hypothesis

iv) Give a conclusion in plain English

Solution

We conclude that there is significant evidence that the mean returns for low

investment is significantly different from that of the high investment.

Section 4:

Use the dataset given below you must use your own sample

https://app.box.com/s/kzc6ivy10gvy4vz6d0pgy0lzh929ivx9

Suppose A business has conducted an opinion poll to find out if their customers support a change

to the Business

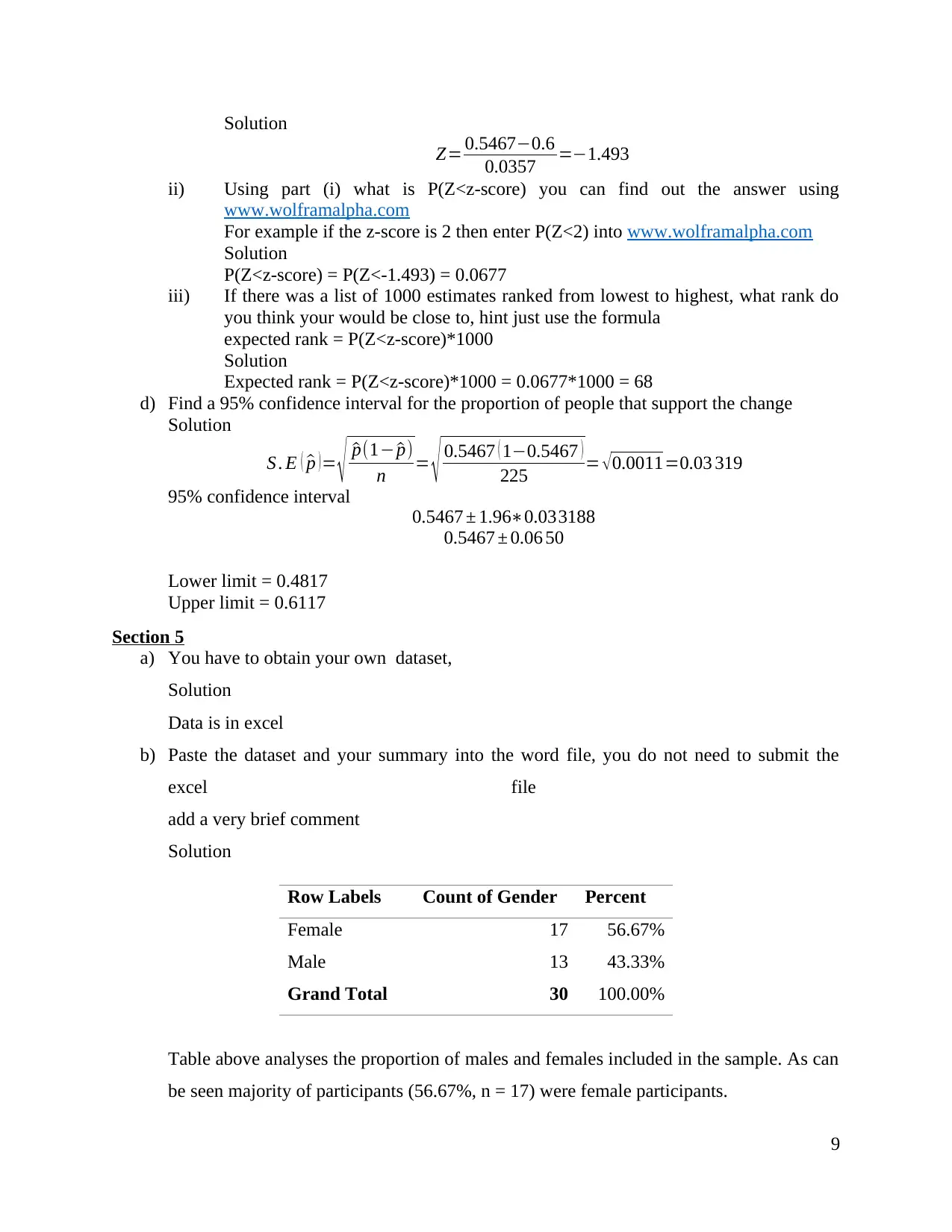

a) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample,. You should paste both into word, you do not need the excel file.

This pivot table must have the number of people that answer yes and the number of

people that answer no

Solution

Row Labels Count of do you support proposed change?

no 102

yes 123

Grand Total 225

b) What is sample size and the sample proportion ^p of people that support the change, Note

that ^p is the estimate for the population proportion p

Solution

Sample size is 123

proportion ^p= 123

225 =0.5467

c)

i) Find the z-score of the estimate in part (a) note that average of the estimates 0.6 is

with standard deviation 0.0357

8

t-statistic 2.489

DF 98

Significance level P = 0.0145

iii) State whether or not you reject H0

Solution

We reject the null hypothesis

iv) Give a conclusion in plain English

Solution

We conclude that there is significant evidence that the mean returns for low

investment is significantly different from that of the high investment.

Section 4:

Use the dataset given below you must use your own sample

https://app.box.com/s/kzc6ivy10gvy4vz6d0pgy0lzh929ivx9

Suppose A business has conducted an opinion poll to find out if their customers support a change

to the Business

a) Use the PivotTable feature in excel to find appropriate summary statistics for your

sample,. You should paste both into word, you do not need the excel file.

This pivot table must have the number of people that answer yes and the number of

people that answer no

Solution

Row Labels Count of do you support proposed change?

no 102

yes 123

Grand Total 225

b) What is sample size and the sample proportion ^p of people that support the change, Note

that ^p is the estimate for the population proportion p

Solution

Sample size is 123

proportion ^p= 123

225 =0.5467

c)

i) Find the z-score of the estimate in part (a) note that average of the estimates 0.6 is

with standard deviation 0.0357

8

Solution

Z= 0.5467−0.6

0.0357 =−1.493

ii) Using part (i) what is P(Z<z-score) you can find out the answer using

www.wolframalpha.com

For example if the z-score is 2 then enter P(Z<2) into www.wolframalpha.com

Solution

P(Z<z-score) = P(Z<-1.493) = 0.0677

iii) If there was a list of 1000 estimates ranked from lowest to highest, what rank do

you think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*1000

Solution

Expected rank = P(Z<z-score)*1000 = 0.0677*1000 = 68

d) Find a 95% confidence interval for the proportion of people that support the change

Solution

S . E ( ^p )= √ ^p(1− ^p)

n = √ 0.5467 ( 1−0.5467 )

225 = √0.0011=0.03 319

95% confidence interval

0.5467 ± 1.96∗0.033188

0.5467 ± 0.06 50

Lower limit = 0.4817

Upper limit = 0.6117

Section 5

a) You have to obtain your own dataset,

Solution

Data is in excel

b) Paste the dataset and your summary into the word file, you do not need to submit the

excel file

add a very brief comment

Solution

Row Labels Count of Gender Percent

Female 17 56.67%

Male 13 43.33%

Grand Total 30 100.00%

Table above analyses the proportion of males and females included in the sample. As can

be seen majority of participants (56.67%, n = 17) were female participants.

9

Z= 0.5467−0.6

0.0357 =−1.493

ii) Using part (i) what is P(Z<z-score) you can find out the answer using

www.wolframalpha.com

For example if the z-score is 2 then enter P(Z<2) into www.wolframalpha.com

Solution

P(Z<z-score) = P(Z<-1.493) = 0.0677

iii) If there was a list of 1000 estimates ranked from lowest to highest, what rank do

you think your would be close to, hint just use the formula

expected rank = P(Z<z-score)*1000

Solution

Expected rank = P(Z<z-score)*1000 = 0.0677*1000 = 68

d) Find a 95% confidence interval for the proportion of people that support the change

Solution

S . E ( ^p )= √ ^p(1− ^p)

n = √ 0.5467 ( 1−0.5467 )

225 = √0.0011=0.03 319

95% confidence interval

0.5467 ± 1.96∗0.033188

0.5467 ± 0.06 50

Lower limit = 0.4817

Upper limit = 0.6117

Section 5

a) You have to obtain your own dataset,

Solution

Data is in excel

b) Paste the dataset and your summary into the word file, you do not need to submit the

excel file

add a very brief comment

Solution

Row Labels Count of Gender Percent

Female 17 56.67%

Male 13 43.33%

Grand Total 30 100.00%

Table above analyses the proportion of males and females included in the sample. As can

be seen majority of participants (56.67%, n = 17) were female participants.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

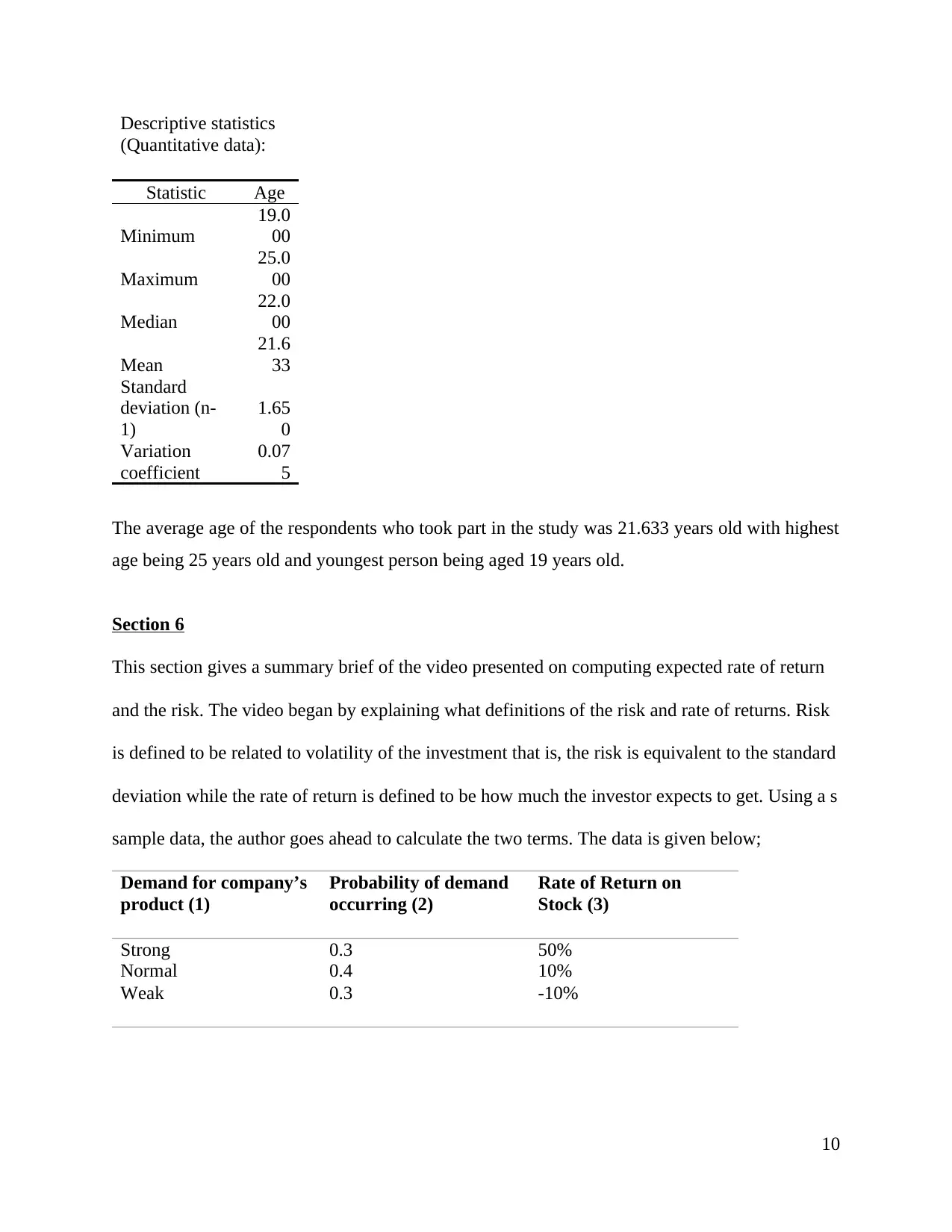

Descriptive statistics

(Quantitative data):

Statistic Age

Minimum

19.0

00

Maximum

25.0

00

Median

22.0

00

Mean

21.6

33

Standard

deviation (n-

1)

1.65

0

Variation

coefficient

0.07

5

The average age of the respondents who took part in the study was 21.633 years old with highest

age being 25 years old and youngest person being aged 19 years old.

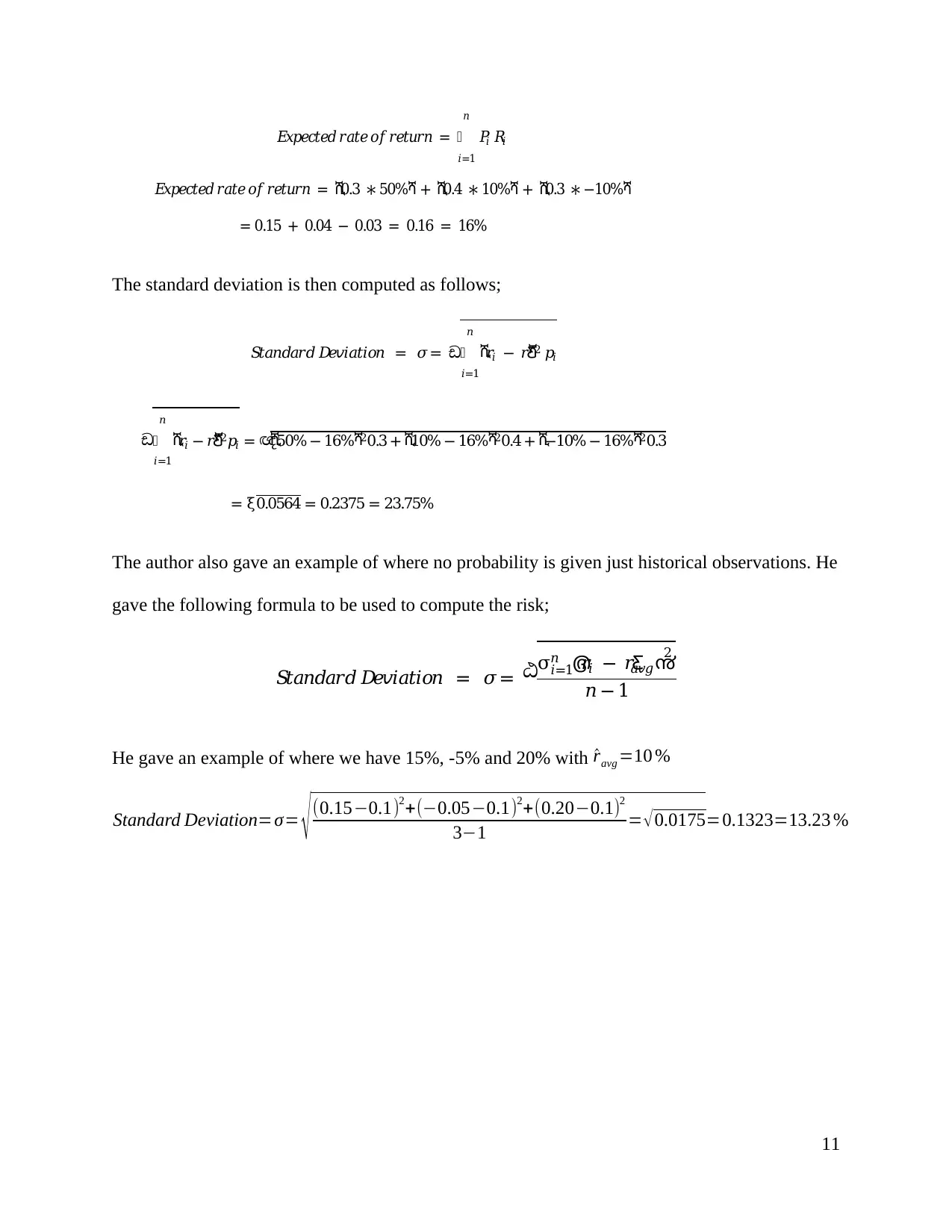

Section 6

This section gives a summary brief of the video presented on computing expected rate of return

and the risk. The video began by explaining what definitions of the risk and rate of returns. Risk

is defined to be related to volatility of the investment that is, the risk is equivalent to the standard

deviation while the rate of return is defined to be how much the investor expects to get. Using a s

sample data, the author goes ahead to calculate the two terms. The data is given below;

Demand for company’s

product (1)

Probability of demand

occurring (2)

Rate of Return on

Stock (3)

Strong 0.3 50%

Normal 0.4 10%

Weak 0.3 -10%

10

(Quantitative data):

Statistic Age

Minimum

19.0

00

Maximum

25.0

00

Median

22.0

00

Mean

21.6

33

Standard

deviation (n-

1)

1.65

0

Variation

coefficient

0.07

5

The average age of the respondents who took part in the study was 21.633 years old with highest

age being 25 years old and youngest person being aged 19 years old.

Section 6

This section gives a summary brief of the video presented on computing expected rate of return

and the risk. The video began by explaining what definitions of the risk and rate of returns. Risk

is defined to be related to volatility of the investment that is, the risk is equivalent to the standard

deviation while the rate of return is defined to be how much the investor expects to get. Using a s

sample data, the author goes ahead to calculate the two terms. The data is given below;

Demand for company’s

product (1)

Probability of demand

occurring (2)

Rate of Return on

Stock (3)

Strong 0.3 50%

Normal 0.4 10%

Weak 0.3 -10%

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 = 𝑃𝑖 𝑅𝑖

𝑛

𝑖=1

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 = ሺ0.3 ∗ 50%ሻ + ሺ0.4 ∗ 10%ሻ + ሺ0.3 ∗ −10%ሻ

= 0.15 + 0.04 − 0.03 = 0.16 = 16%

The standard deviation is then computed as follows;

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = 𝜎= ඩ ሺ𝑟𝑖 − 𝑟Ƹሻ2 𝑝𝑖

𝑛

𝑖=1

ඩ ሺ𝑟𝑖 − 𝑟Ƹሻ2𝑝𝑖

𝑛

𝑖=1

= ඥሺ50% − 16%ሻ20.3 + ሺ10% − 16%ሻ20.4 + ሺ−10% − 16%ሻ20.3

= ξ0.0564 = 0.2375 = 23.75%

The author also gave an example of where no probability is given just historical observations. He

gave the following formula to be used to compute the risk;

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = 𝜎= ඨσ ൫𝑟𝑖 − 𝑟Ƹ𝑎𝑣𝑔൯

2𝑛

𝑖=1

𝑛 − 1

He gave an example of where we have 15%, -5% and 20% with ^ravg =10 %

Standard Deviation=σ= √ (0.15−0.1)2+(−0.05−0.1)2+(0.20−0.1)2

3−1 = √ 0.0175=0.1323=13.23 %

11

𝑛

𝑖=1

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 = ሺ0.3 ∗ 50%ሻ + ሺ0.4 ∗ 10%ሻ + ሺ0.3 ∗ −10%ሻ

= 0.15 + 0.04 − 0.03 = 0.16 = 16%

The standard deviation is then computed as follows;

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = 𝜎= ඩ ሺ𝑟𝑖 − 𝑟Ƹሻ2 𝑝𝑖

𝑛

𝑖=1

ඩ ሺ𝑟𝑖 − 𝑟Ƹሻ2𝑝𝑖

𝑛

𝑖=1

= ඥሺ50% − 16%ሻ20.3 + ሺ10% − 16%ሻ20.4 + ሺ−10% − 16%ሻ20.3

= ξ0.0564 = 0.2375 = 23.75%

The author also gave an example of where no probability is given just historical observations. He

gave the following formula to be used to compute the risk;

𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 = 𝜎= ඨσ ൫𝑟𝑖 − 𝑟Ƹ𝑎𝑣𝑔൯

2𝑛

𝑖=1

𝑛 − 1

He gave an example of where we have 15%, -5% and 20% with ^ravg =10 %

Standard Deviation=σ= √ (0.15−0.1)2+(−0.05−0.1)2+(0.20−0.1)2

3−1 = √ 0.0175=0.1323=13.23 %

11

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.