Taxation and Consolidation: Green Bay Ltd Analysis Assignment

VerifiedAdded on 2020/03/23

|11

|1807

|53

Homework Assignment

AI Summary

This assignment presents two comprehensive solutions. The first solution calculates the taxable income for Green Bay Ltd. for the year ended June 30, 2017. It meticulously adjusts the profit before tax by adding and subtracting various items such as depreciation, provisions, and research and development expenses to arrive at the final taxable income. The solution includes a detailed depreciation calculation worksheet and a taxation worksheet outlining temporary differences, tax bases, and tax expenses. It also provides the journal entries required by AASB 112 Income Taxes, including entries for current and deferred tax liabilities, and adjustments for a change in the tax rate. The second solution focuses on the acquisition analysis of Blue Sky Ltd. by Green Bay Ltd. as of July 1, 2012. It calculates the fair value of net assets acquired, goodwill, and non-controlling interest. The solution includes business combination valuation entries, pre-acquisition entries, and consolidation entries for dividends, inventory, and intercompany transactions. It also provides a consolidation worksheet and consolidated financial statements, including an income statement, statement of changes in equity, and statement of financial position. The analysis reflects adjustments for depreciation, impairment, and deferred tax, providing a complete picture of the consolidated financial position.

Solution-1

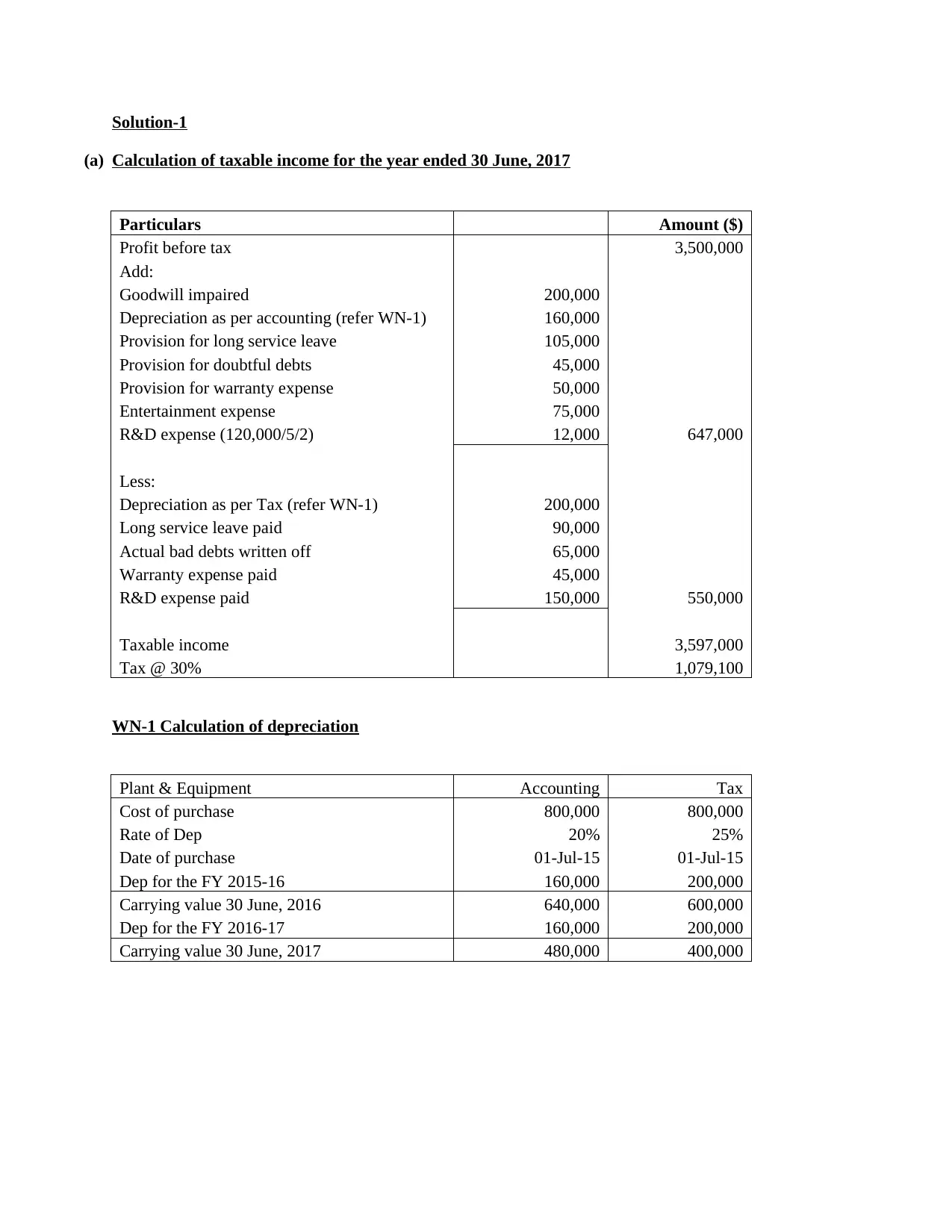

(a) Calculation of taxable income for the year ended 30 June, 2017

Particulars Amount ($)

Profit before tax 3,500,000

Add:

Goodwill impaired 200,000

Depreciation as per accounting (refer WN-1) 160,000

Provision for long service leave 105,000

Provision for doubtful debts 45,000

Provision for warranty expense 50,000

Entertainment expense 75,000

R&D expense (120,000/5/2) 12,000 647,000

Less:

Depreciation as per Tax (refer WN-1) 200,000

Long service leave paid 90,000

Actual bad debts written off 65,000

Warranty expense paid 45,000

R&D expense paid 150,000 550,000

Taxable income 3,597,000

Tax @ 30% 1,079,100

WN-1 Calculation of depreciation

Plant & Equipment Accounting Tax

Cost of purchase 800,000 800,000

Rate of Dep 20% 25%

Date of purchase 01-Jul-15 01-Jul-15

Dep for the FY 2015-16 160,000 200,000

Carrying value 30 June, 2016 640,000 600,000

Dep for the FY 2016-17 160,000 200,000

Carrying value 30 June, 2017 480,000 400,000

(a) Calculation of taxable income for the year ended 30 June, 2017

Particulars Amount ($)

Profit before tax 3,500,000

Add:

Goodwill impaired 200,000

Depreciation as per accounting (refer WN-1) 160,000

Provision for long service leave 105,000

Provision for doubtful debts 45,000

Provision for warranty expense 50,000

Entertainment expense 75,000

R&D expense (120,000/5/2) 12,000 647,000

Less:

Depreciation as per Tax (refer WN-1) 200,000

Long service leave paid 90,000

Actual bad debts written off 65,000

Warranty expense paid 45,000

R&D expense paid 150,000 550,000

Taxable income 3,597,000

Tax @ 30% 1,079,100

WN-1 Calculation of depreciation

Plant & Equipment Accounting Tax

Cost of purchase 800,000 800,000

Rate of Dep 20% 25%

Date of purchase 01-Jul-15 01-Jul-15

Dep for the FY 2015-16 160,000 200,000

Carrying value 30 June, 2016 640,000 600,000

Dep for the FY 2016-17 160,000 200,000

Carrying value 30 June, 2017 480,000 400,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

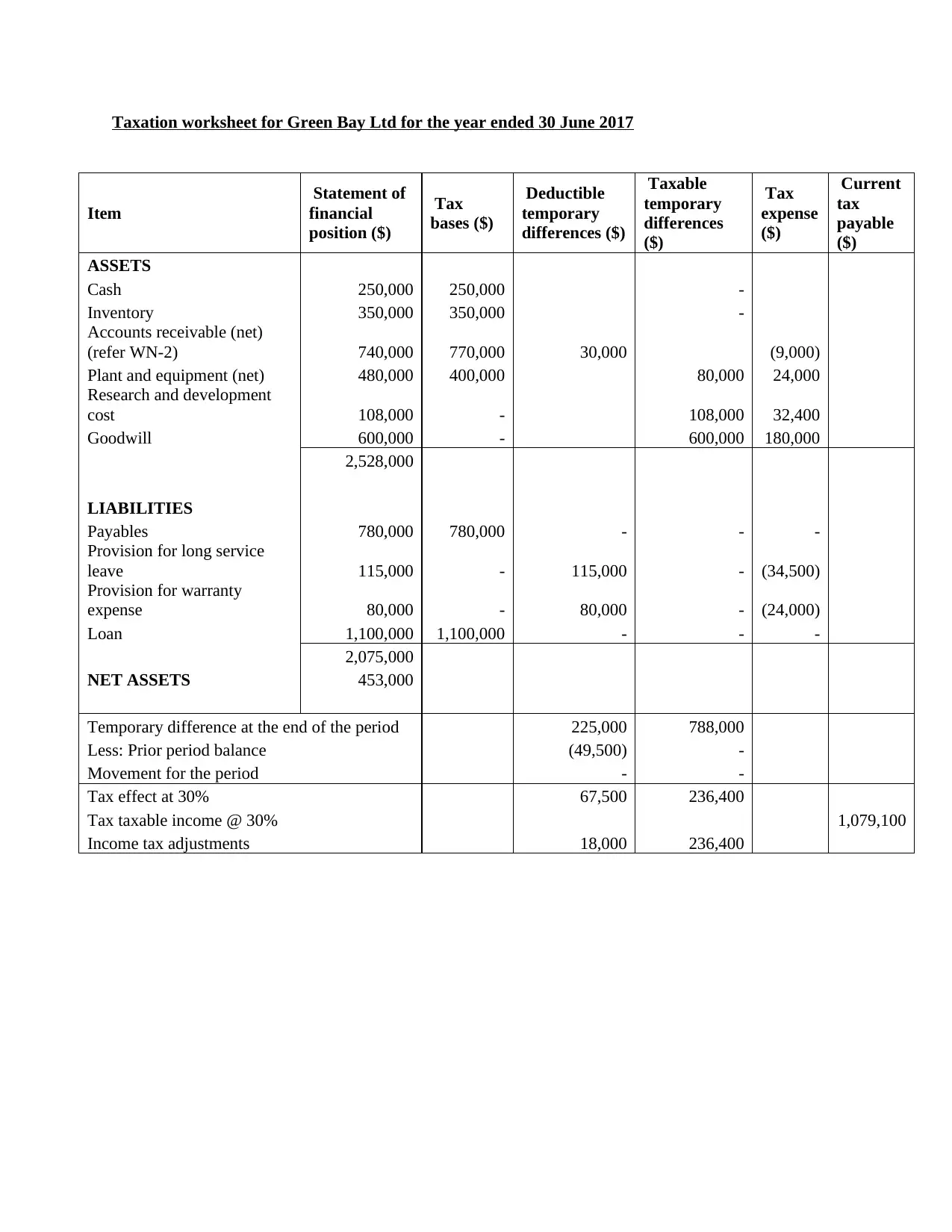

Taxation worksheet for Green Bay Ltd for the year ended 30 June 2017

Item

Statement of

financial

position ($)

Tax

bases ($)

Deductible

temporary

differences ($)

Taxable

temporary

differences

($)

Tax

expense

($)

Current

tax

payable

($)

ASSETS

Cash 250,000 250,000 -

Inventory 350,000 350,000 -

Accounts receivable (net)

(refer WN-2) 740,000 770,000 30,000 (9,000)

Plant and equipment (net) 480,000 400,000 80,000 24,000

Research and development

cost 108,000 - 108,000 32,400

Goodwill 600,000 - 600,000 180,000

2,528,000

LIABILITIES

Payables 780,000 780,000 - - -

Provision for long service

leave 115,000 - 115,000 - (34,500)

Provision for warranty

expense 80,000 - 80,000 - (24,000)

Loan 1,100,000 1,100,000 - - -

2,075,000

NET ASSETS 453,000

Temporary difference at the end of the period 225,000 788,000

Less: Prior period balance (49,500) -

Movement for the period - -

Tax effect at 30% 67,500 236,400

Tax taxable income @ 30% 1,079,100

Income tax adjustments 18,000 236,400

Item

Statement of

financial

position ($)

Tax

bases ($)

Deductible

temporary

differences ($)

Taxable

temporary

differences

($)

Tax

expense

($)

Current

tax

payable

($)

ASSETS

Cash 250,000 250,000 -

Inventory 350,000 350,000 -

Accounts receivable (net)

(refer WN-2) 740,000 770,000 30,000 (9,000)

Plant and equipment (net) 480,000 400,000 80,000 24,000

Research and development

cost 108,000 - 108,000 32,400

Goodwill 600,000 - 600,000 180,000

2,528,000

LIABILITIES

Payables 780,000 780,000 - - -

Provision for long service

leave 115,000 - 115,000 - (34,500)

Provision for warranty

expense 80,000 - 80,000 - (24,000)

Loan 1,100,000 1,100,000 - - -

2,075,000

NET ASSETS 453,000

Temporary difference at the end of the period 225,000 788,000

Less: Prior period balance (49,500) -

Movement for the period - -

Tax effect at 30% 67,500 236,400

Tax taxable income @ 30% 1,079,100

Income tax adjustments 18,000 236,400

WN-2: Calculation of balance in Accounts Receivable in tax books as on 30 June, 2017

In Accounting Books

Accounts Receivable

Particulars Amount ($) Particulars Amount ($)

Opening balance 320,000 Bad debts w/o 65,000

sales 485,000 Closing balance 740,000

805,000 805,000

Allowance for doubtful debts

Particulars Amount ($) Particulars Amount ($)

Bad debts w/o 65,000 Opening balance 30,000

Closing balance 10,000 Provision created 45,000

75,000 75,000

In Tax Books

Accounts Receivable

Particulars Amount ($) Particulars Amount ($)

Opening balance 350,000 Bad debts w/o 65,000

Sales 485,000 Closing balance 770,000

835,000 835,000

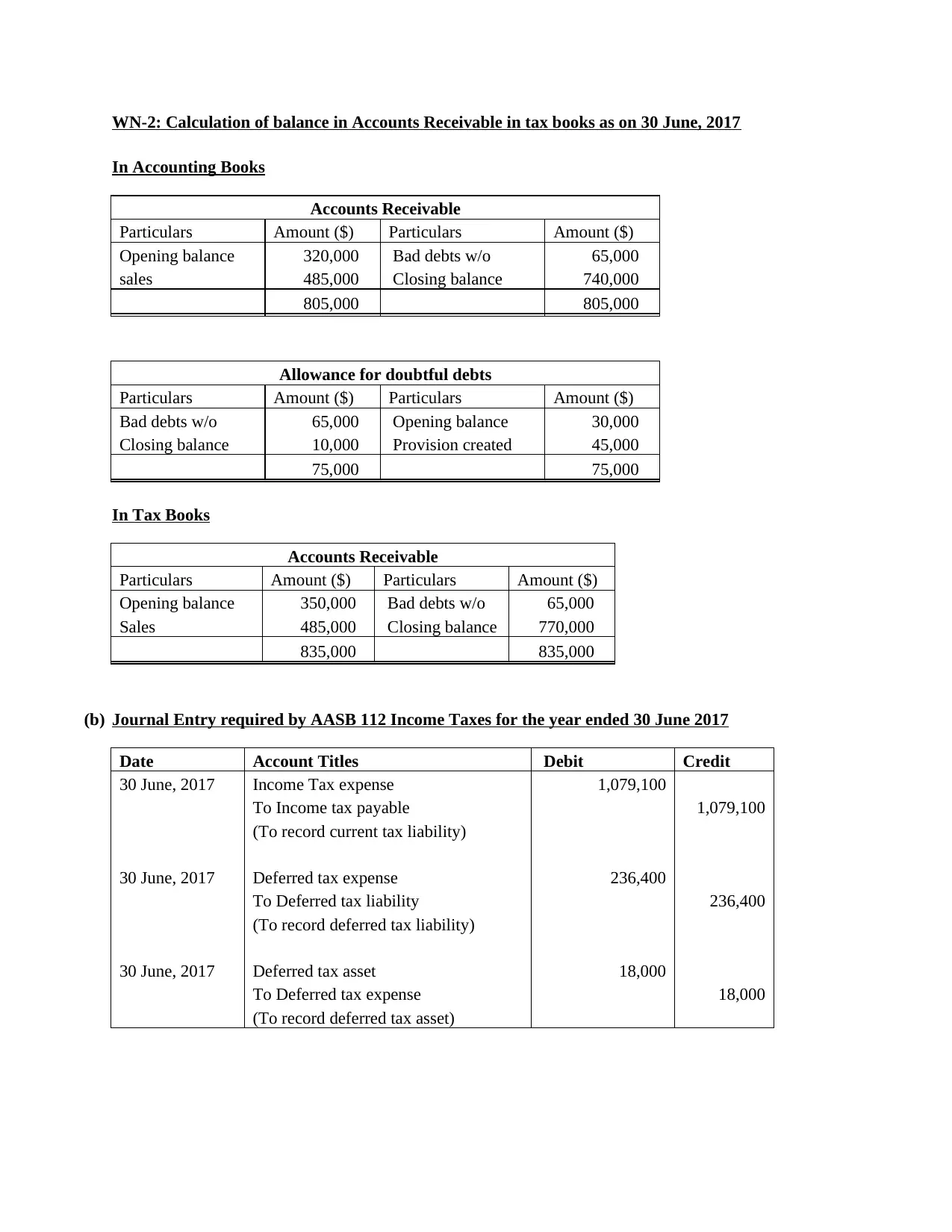

(b) Journal Entry required by AASB 112 Income Taxes for the year ended 30 June 2017

Date Account Titles Debit Credit

30 June, 2017 Income Tax expense 1,079,100

To Income tax payable 1,079,100

(To record current tax liability)

30 June, 2017 Deferred tax expense 236,400

To Deferred tax liability 236,400

(To record deferred tax liability)

30 June, 2017 Deferred tax asset 18,000

To Deferred tax expense 18,000

(To record deferred tax asset)

In Accounting Books

Accounts Receivable

Particulars Amount ($) Particulars Amount ($)

Opening balance 320,000 Bad debts w/o 65,000

sales 485,000 Closing balance 740,000

805,000 805,000

Allowance for doubtful debts

Particulars Amount ($) Particulars Amount ($)

Bad debts w/o 65,000 Opening balance 30,000

Closing balance 10,000 Provision created 45,000

75,000 75,000

In Tax Books

Accounts Receivable

Particulars Amount ($) Particulars Amount ($)

Opening balance 350,000 Bad debts w/o 65,000

Sales 485,000 Closing balance 770,000

835,000 835,000

(b) Journal Entry required by AASB 112 Income Taxes for the year ended 30 June 2017

Date Account Titles Debit Credit

30 June, 2017 Income Tax expense 1,079,100

To Income tax payable 1,079,100

(To record current tax liability)

30 June, 2017 Deferred tax expense 236,400

To Deferred tax liability 236,400

(To record deferred tax liability)

30 June, 2017 Deferred tax asset 18,000

To Deferred tax expense 18,000

(To record deferred tax asset)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(c) Journal Entries to reflect this change of tax rate on 1 July 2017

If the tax rate changes from 30% to 25% then the balances of deferred tax asset and liabilities will change

to the extent of change in the rate of tax. In that case, the entries will be:

Date Account Titles Debit Credit

30 June, 2017 Deferred tax liability (788,000*5%) 39,400

To Deferred tax expense 39,400

(To record change in rate of tax by 5%)

30 June, 2017 Deferred tax expense ((225,000*25%)-49,500) 6,750

To Deferred tax asset 6,750

(To record change in rate of tax by 5%)

If the tax rate changes from 30% to 25% then the balances of deferred tax asset and liabilities will change

to the extent of change in the rate of tax. In that case, the entries will be:

Date Account Titles Debit Credit

30 June, 2017 Deferred tax liability (788,000*5%) 39,400

To Deferred tax expense 39,400

(To record change in rate of tax by 5%)

30 June, 2017 Deferred tax expense ((225,000*25%)-49,500) 6,750

To Deferred tax asset 6,750

(To record change in rate of tax by 5%)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

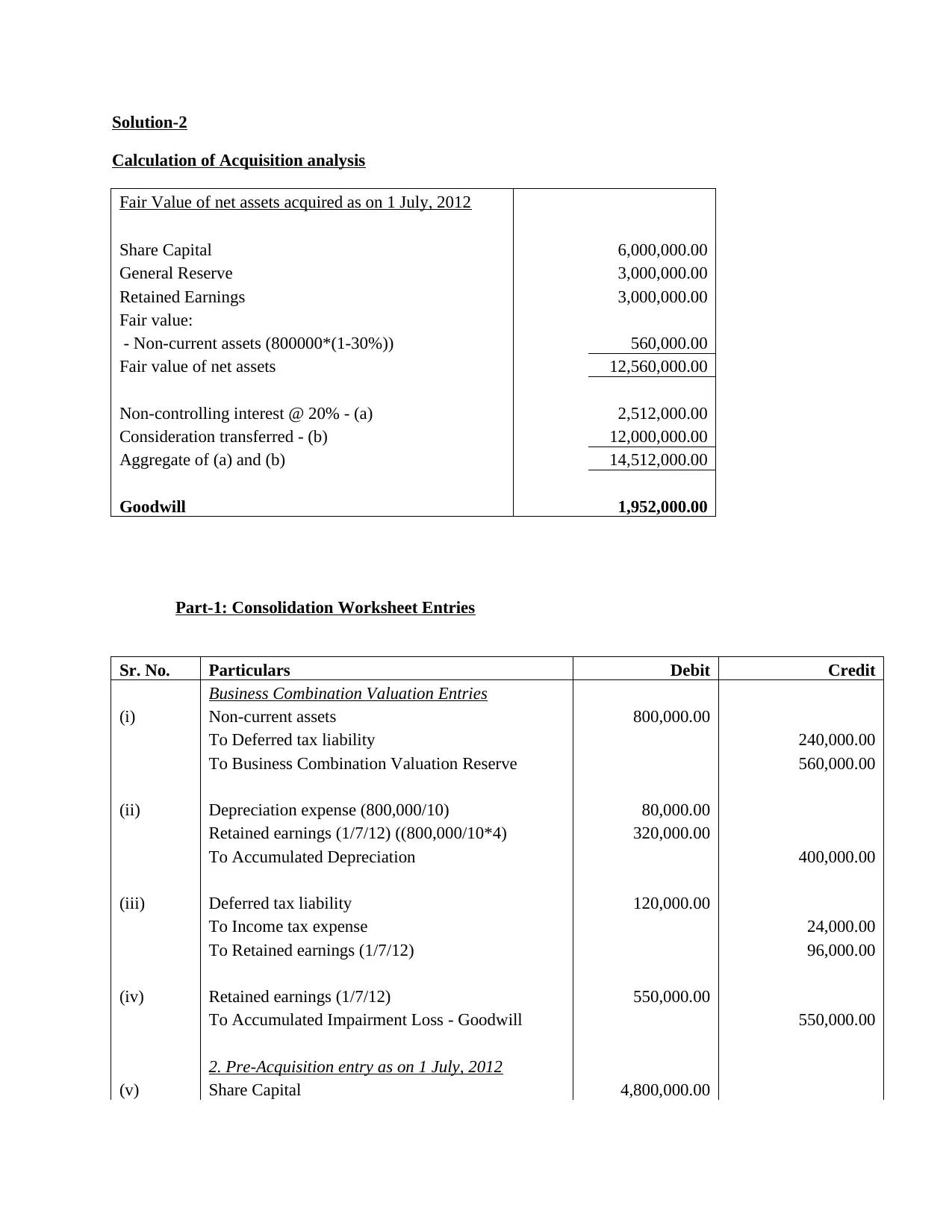

Solution-2

Calculation of Acquisition analysis

Fair Value of net assets acquired as on 1 July, 2012

Share Capital 6,000,000.00

General Reserve 3,000,000.00

Retained Earnings 3,000,000.00

Fair value:

- Non-current assets (800000*(1-30%)) 560,000.00

Fair value of net assets 12,560,000.00

Non-controlling interest @ 20% - (a) 2,512,000.00

Consideration transferred - (b) 12,000,000.00

Aggregate of (a) and (b) 14,512,000.00

Goodwill 1,952,000.00

Part-1: Consolidation Worksheet Entries

Sr. No. Particulars Debit Credit

Business Combination Valuation Entries

(i) Non-current assets 800,000.00

To Deferred tax liability 240,000.00

To Business Combination Valuation Reserve 560,000.00

(ii) Depreciation expense (800,000/10) 80,000.00

Retained earnings (1/7/12) ((800,000/10*4) 320,000.00

To Accumulated Depreciation 400,000.00

(iii) Deferred tax liability 120,000.00

To Income tax expense 24,000.00

To Retained earnings (1/7/12) 96,000.00

(iv) Retained earnings (1/7/12) 550,000.00

To Accumulated Impairment Loss - Goodwill 550,000.00

2. Pre-Acquisition entry as on 1 July, 2012

(v) Share Capital 4,800,000.00

Calculation of Acquisition analysis

Fair Value of net assets acquired as on 1 July, 2012

Share Capital 6,000,000.00

General Reserve 3,000,000.00

Retained Earnings 3,000,000.00

Fair value:

- Non-current assets (800000*(1-30%)) 560,000.00

Fair value of net assets 12,560,000.00

Non-controlling interest @ 20% - (a) 2,512,000.00

Consideration transferred - (b) 12,000,000.00

Aggregate of (a) and (b) 14,512,000.00

Goodwill 1,952,000.00

Part-1: Consolidation Worksheet Entries

Sr. No. Particulars Debit Credit

Business Combination Valuation Entries

(i) Non-current assets 800,000.00

To Deferred tax liability 240,000.00

To Business Combination Valuation Reserve 560,000.00

(ii) Depreciation expense (800,000/10) 80,000.00

Retained earnings (1/7/12) ((800,000/10*4) 320,000.00

To Accumulated Depreciation 400,000.00

(iii) Deferred tax liability 120,000.00

To Income tax expense 24,000.00

To Retained earnings (1/7/12) 96,000.00

(iv) Retained earnings (1/7/12) 550,000.00

To Accumulated Impairment Loss - Goodwill 550,000.00

2. Pre-Acquisition entry as on 1 July, 2012

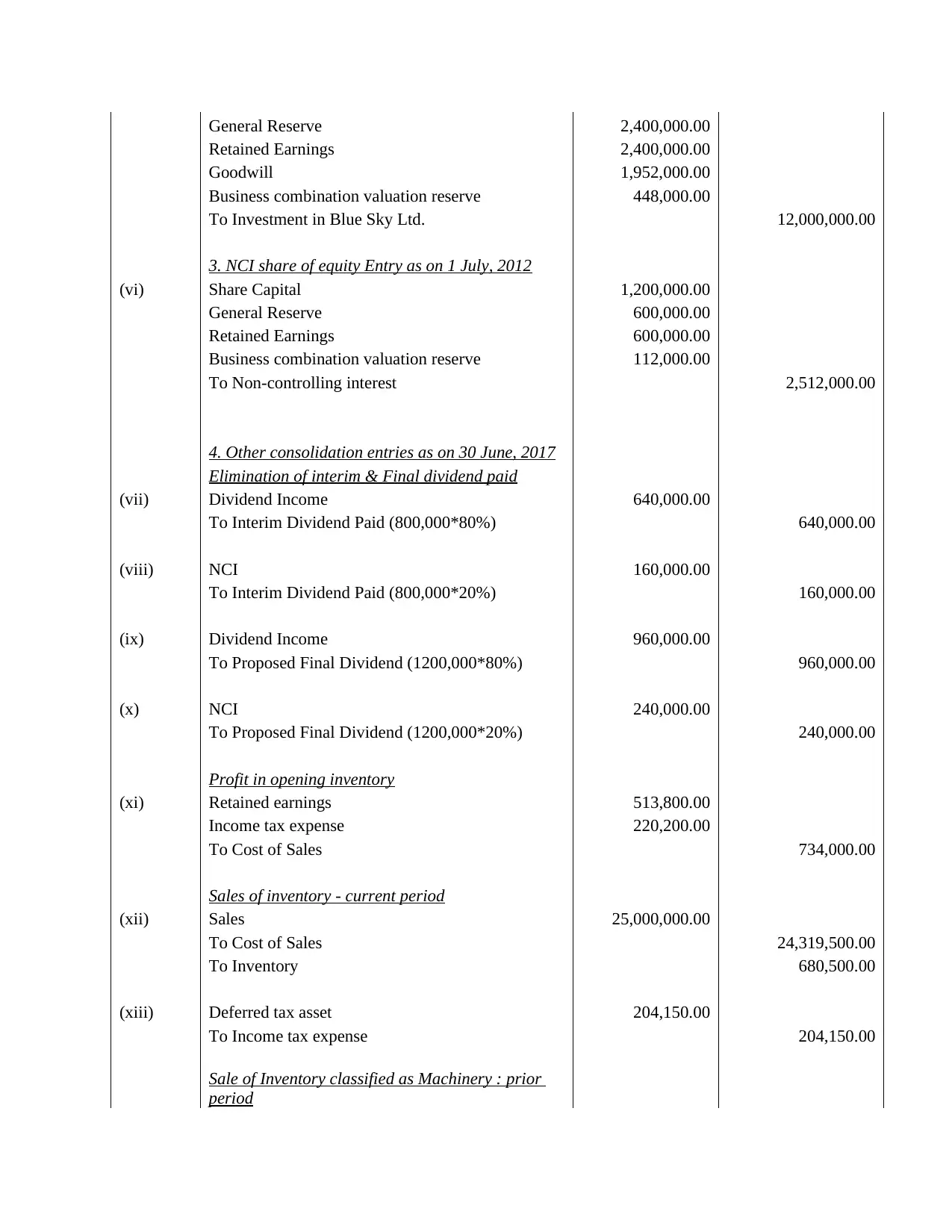

(v) Share Capital 4,800,000.00

General Reserve 2,400,000.00

Retained Earnings 2,400,000.00

Goodwill 1,952,000.00

Business combination valuation reserve 448,000.00

To Investment in Blue Sky Ltd. 12,000,000.00

3. NCI share of equity Entry as on 1 July, 2012

(vi) Share Capital 1,200,000.00

General Reserve 600,000.00

Retained Earnings 600,000.00

Business combination valuation reserve 112,000.00

To Non-controlling interest 2,512,000.00

4. Other consolidation entries as on 30 June, 2017

Elimination of interim & Final dividend paid

(vii) Dividend Income 640,000.00

To Interim Dividend Paid (800,000*80%) 640,000.00

(viii) NCI 160,000.00

To Interim Dividend Paid (800,000*20%) 160,000.00

(ix) Dividend Income 960,000.00

To Proposed Final Dividend (1200,000*80%) 960,000.00

(x) NCI 240,000.00

To Proposed Final Dividend (1200,000*20%) 240,000.00

Profit in opening inventory

(xi) Retained earnings 513,800.00

Income tax expense 220,200.00

To Cost of Sales 734,000.00

Sales of inventory - current period

(xii) Sales 25,000,000.00

To Cost of Sales 24,319,500.00

To Inventory 680,500.00

(xiii) Deferred tax asset 204,150.00

To Income tax expense 204,150.00

Sale of Inventory classified as Machinery : prior

period

Retained Earnings 2,400,000.00

Goodwill 1,952,000.00

Business combination valuation reserve 448,000.00

To Investment in Blue Sky Ltd. 12,000,000.00

3. NCI share of equity Entry as on 1 July, 2012

(vi) Share Capital 1,200,000.00

General Reserve 600,000.00

Retained Earnings 600,000.00

Business combination valuation reserve 112,000.00

To Non-controlling interest 2,512,000.00

4. Other consolidation entries as on 30 June, 2017

Elimination of interim & Final dividend paid

(vii) Dividend Income 640,000.00

To Interim Dividend Paid (800,000*80%) 640,000.00

(viii) NCI 160,000.00

To Interim Dividend Paid (800,000*20%) 160,000.00

(ix) Dividend Income 960,000.00

To Proposed Final Dividend (1200,000*80%) 960,000.00

(x) NCI 240,000.00

To Proposed Final Dividend (1200,000*20%) 240,000.00

Profit in opening inventory

(xi) Retained earnings 513,800.00

Income tax expense 220,200.00

To Cost of Sales 734,000.00

Sales of inventory - current period

(xii) Sales 25,000,000.00

To Cost of Sales 24,319,500.00

To Inventory 680,500.00

(xiii) Deferred tax asset 204,150.00

To Income tax expense 204,150.00

Sale of Inventory classified as Machinery : prior

period

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(xiv) Retained earnings 525,000.00

Deferred tax asset 225,000.00

To Plant (1,950,000 - 1,500,000 -

1,500,000*10%*2) 750,000.00

(xv) Accumulated depreciation 281,250.00

To Depreciation expense (750,000/8*1) 93,750.00

To Retained earnings (750,000/8*2) 187,500.00

(xvi) Income tax expense 28,125.00

Retained earnings 56,250.00

To Deferred tax asset 84,375.00

Elimination of Loan and its interest

(xvii) Liabilities 2,500,000.00

To Investments 2,500,000.00

(xviii) Interest income on loan 187,500.00

To Interest expenses 187,500.00

Impairment of Goodwill

(xix) Impairment Loss 600,000.00

To Accumulated Impairment Loss - Goodwill 600,000.00

Deferred tax asset 225,000.00

To Plant (1,950,000 - 1,500,000 -

1,500,000*10%*2) 750,000.00

(xv) Accumulated depreciation 281,250.00

To Depreciation expense (750,000/8*1) 93,750.00

To Retained earnings (750,000/8*2) 187,500.00

(xvi) Income tax expense 28,125.00

Retained earnings 56,250.00

To Deferred tax asset 84,375.00

Elimination of Loan and its interest

(xvii) Liabilities 2,500,000.00

To Investments 2,500,000.00

(xviii) Interest income on loan 187,500.00

To Interest expenses 187,500.00

Impairment of Goodwill

(xix) Impairment Loss 600,000.00

To Accumulated Impairment Loss - Goodwill 600,000.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

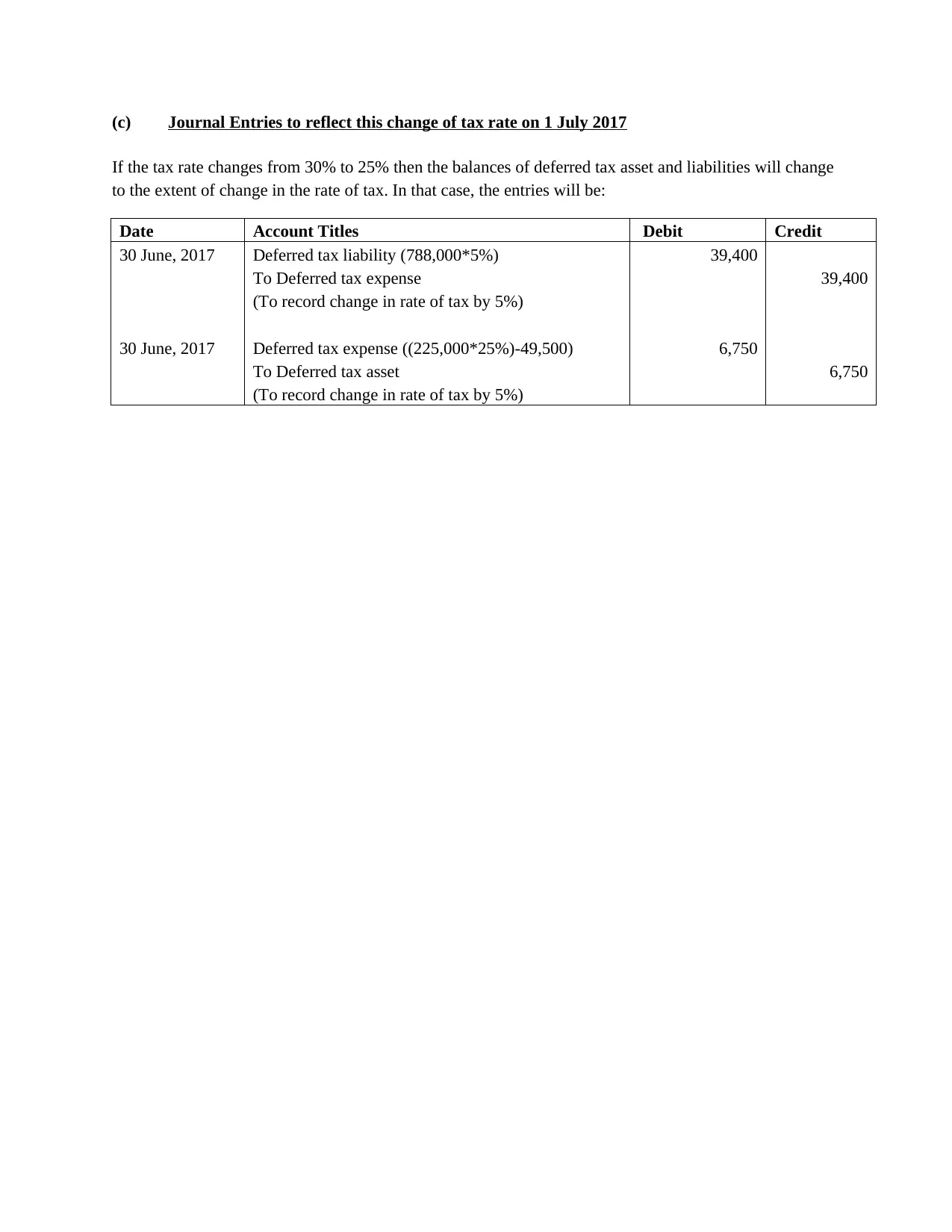

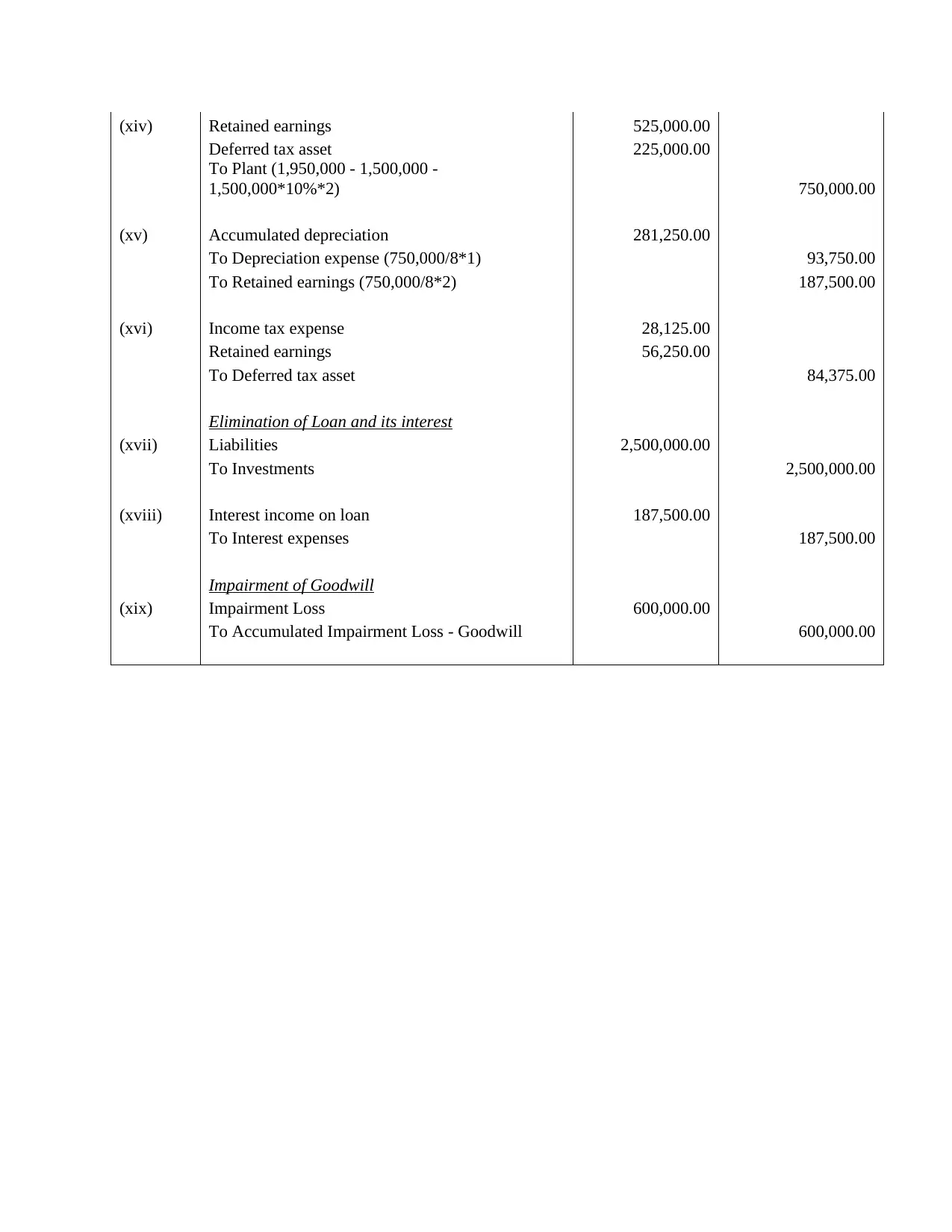

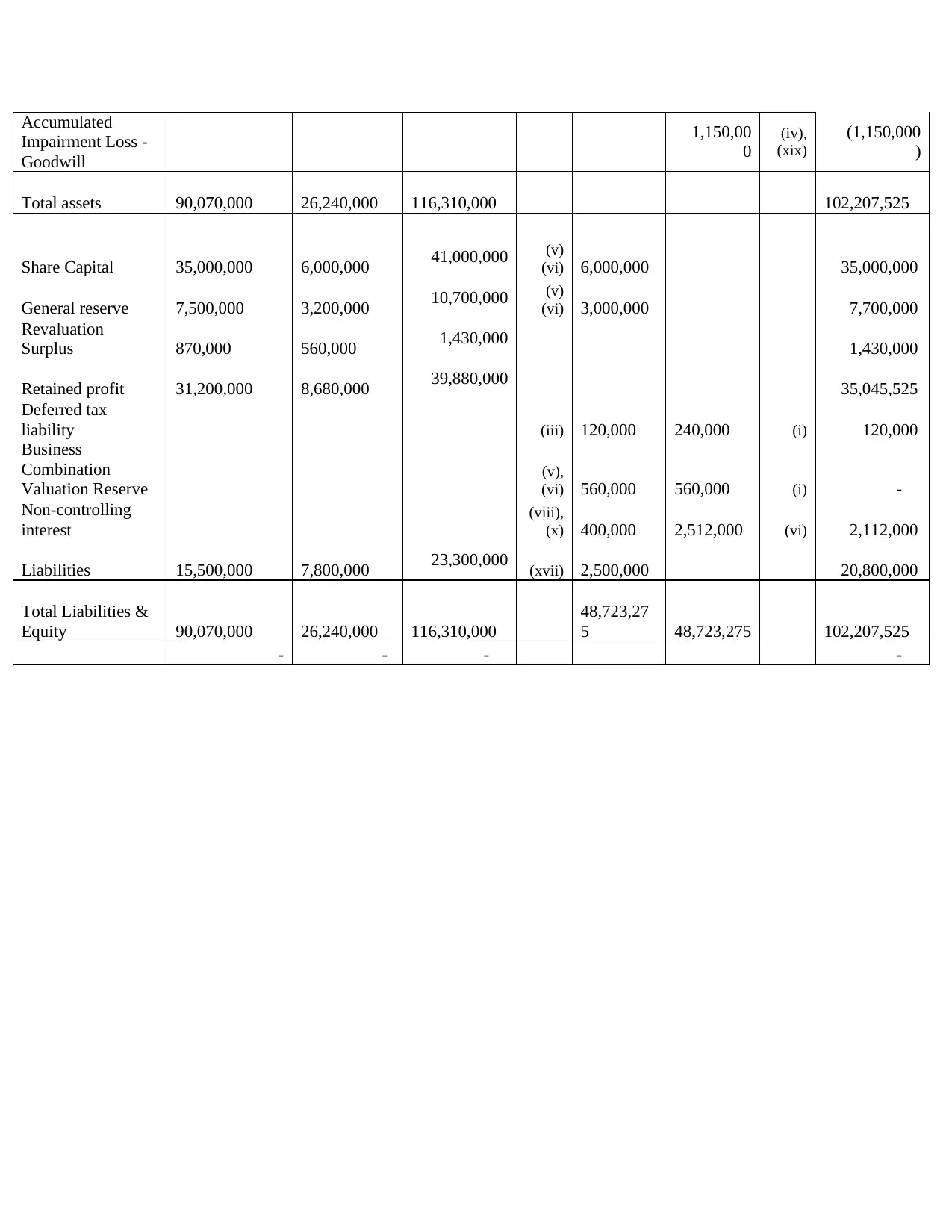

Part-2: Consolidation Worksheet

Particulars Green Bay

Ltd

Blue Sky

Ltd Total Adjustments Total

Income Statement $ $ Ref. Dr Cr Ref.

Sales 125,000,

000

75,000,0

00

200,000,00

0 (xii) 25,000,0

00

175,000,00

0

Cost of goods sold (80,000,0

00)

(69,000,0

00)

(149,000,000

)

25,053,50

0

(xi),

(xii)

(123,946,500

)

Gross Profits 45,000,

000

6,000,0

00 51,000,000 51,053,500

Other income 5,000,0

00

3,000,0

00 8,000,000

(vii),

(ix),

(xviii)

1,787,5

00 6,212,500

Operating expenses (4,000,0

00)

(2,600,0

00)

(6,600,000

)

(ii),

(xix)

680,00

0

281,25

0

(xv),

(xviii

)

(6,998,750

)

Operating profit

before income tax

expense

46,000,

000

6,400,0

00 52,400,000 50,267,250

Income tax expense (13,800,0

00)

(1,920,0

00)

(15,720,000

)

(xi),

(xvi)

248,32

5

228,15

0

(iii),

(xiii)

(15,740,175

)

Operating profit

after income tax

expense

32,200,

000

4,480,0

00 36,680,000 34,527,075

Retained profit

(1/7/16)

12,000,

000

6,200,0

00 18,200,000

(ii),

(iv),

(v),

(vi),

(xi),

(xiv),

(xvi)

4,965,0

50

283,50

0

(iii),

(xv) 13,518,450

Interim dividend

paid (1/1/17)

(8,200,0

00)

(800,0

00)

(9,000,000

)

800,00

0

(vii),

(viii)

(8,200,000

)

Proposed Final

dividend

(4,800,0

00)

(1,200,0

00)

(6,000,000

)

1,200,00

0

(ix),

(x)

(4,800,000

)

Retained profit

(30/6/17)

31,200,

000

8,680,0

00 39,880,000 35,045,525

Balance Sheet

Current Assets 18,274,

000

4,678,0

00 22,952,000 680,50

0 (xii) 22,271,500

Non-Current Assets 55,443,

000

16,449,0

00 71,892,000 (i),

(xv)

1,081,2

50

1,150,00

0

(ii),

(xiv) 71,823,250

Investments 16,353,

000

5,113,0

00 21,466,000 14,500,00

0

(v),

(xvii) 6,966,000

Deferred tax assets (xiii),

(xiv)

429,15

0

84,37

5 (xiv) 344,775

Goodwill (v) 1,952,0

00 1,952,000

Particulars Green Bay

Ltd

Blue Sky

Ltd Total Adjustments Total

Income Statement $ $ Ref. Dr Cr Ref.

Sales 125,000,

000

75,000,0

00

200,000,00

0 (xii) 25,000,0

00

175,000,00

0

Cost of goods sold (80,000,0

00)

(69,000,0

00)

(149,000,000

)

25,053,50

0

(xi),

(xii)

(123,946,500

)

Gross Profits 45,000,

000

6,000,0

00 51,000,000 51,053,500

Other income 5,000,0

00

3,000,0

00 8,000,000

(vii),

(ix),

(xviii)

1,787,5

00 6,212,500

Operating expenses (4,000,0

00)

(2,600,0

00)

(6,600,000

)

(ii),

(xix)

680,00

0

281,25

0

(xv),

(xviii

)

(6,998,750

)

Operating profit

before income tax

expense

46,000,

000

6,400,0

00 52,400,000 50,267,250

Income tax expense (13,800,0

00)

(1,920,0

00)

(15,720,000

)

(xi),

(xvi)

248,32

5

228,15

0

(iii),

(xiii)

(15,740,175

)

Operating profit

after income tax

expense

32,200,

000

4,480,0

00 36,680,000 34,527,075

Retained profit

(1/7/16)

12,000,

000

6,200,0

00 18,200,000

(ii),

(iv),

(v),

(vi),

(xi),

(xiv),

(xvi)

4,965,0

50

283,50

0

(iii),

(xv) 13,518,450

Interim dividend

paid (1/1/17)

(8,200,0

00)

(800,0

00)

(9,000,000

)

800,00

0

(vii),

(viii)

(8,200,000

)

Proposed Final

dividend

(4,800,0

00)

(1,200,0

00)

(6,000,000

)

1,200,00

0

(ix),

(x)

(4,800,000

)

Retained profit

(30/6/17)

31,200,

000

8,680,0

00 39,880,000 35,045,525

Balance Sheet

Current Assets 18,274,

000

4,678,0

00 22,952,000 680,50

0 (xii) 22,271,500

Non-Current Assets 55,443,

000

16,449,0

00 71,892,000 (i),

(xv)

1,081,2

50

1,150,00

0

(ii),

(xiv) 71,823,250

Investments 16,353,

000

5,113,0

00 21,466,000 14,500,00

0

(v),

(xvii) 6,966,000

Deferred tax assets (xiii),

(xiv)

429,15

0

84,37

5 (xiv) 344,775

Goodwill (v) 1,952,0

00 1,952,000

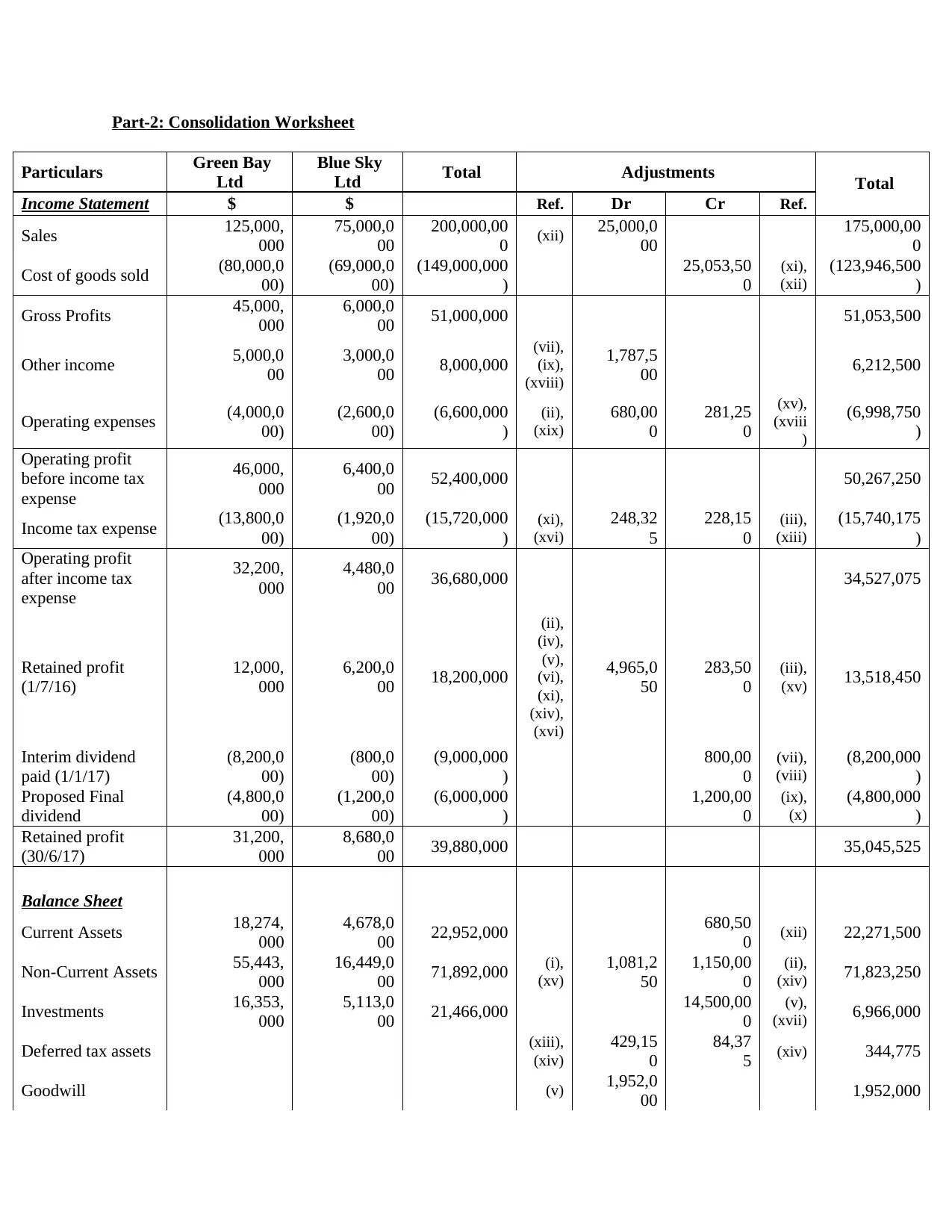

Accumulated

Impairment Loss -

Goodwill

1,150,00

0

(iv),

(xix)

(1,150,000

)

Total assets 90,070,000 26,240,000 116,310,000 102,207,525

Share Capital 35,000,000 6,000,000 41,000,000 (v)

(vi) 6,000,000 35,000,000

General reserve 7,500,000 3,200,000 10,700,000 (v)

(vi) 3,000,000 7,700,000

Revaluation

Surplus 870,000 560,000 1,430,000 1,430,000

Retained profit 31,200,000 8,680,000 39,880,000 35,045,525

Deferred tax

liability (iii) 120,000 240,000 (i) 120,000

Business

Combination

Valuation Reserve

(v),

(vi) 560,000 560,000 (i) -

Non-controlling

interest

(viii),

(x) 400,000 2,512,000 (vi) 2,112,000

Liabilities 15,500,000 7,800,000 23,300,000 (xvii) 2,500,000 20,800,000

Total Liabilities &

Equity 90,070,000 26,240,000 116,310,000

48,723,27

5 48,723,275 102,207,525

- - - -

Impairment Loss -

Goodwill

1,150,00

0

(iv),

(xix)

(1,150,000

)

Total assets 90,070,000 26,240,000 116,310,000 102,207,525

Share Capital 35,000,000 6,000,000 41,000,000 (v)

(vi) 6,000,000 35,000,000

General reserve 7,500,000 3,200,000 10,700,000 (v)

(vi) 3,000,000 7,700,000

Revaluation

Surplus 870,000 560,000 1,430,000 1,430,000

Retained profit 31,200,000 8,680,000 39,880,000 35,045,525

Deferred tax

liability (iii) 120,000 240,000 (i) 120,000

Business

Combination

Valuation Reserve

(v),

(vi) 560,000 560,000 (i) -

Non-controlling

interest

(viii),

(x) 400,000 2,512,000 (vi) 2,112,000

Liabilities 15,500,000 7,800,000 23,300,000 (xvii) 2,500,000 20,800,000

Total Liabilities &

Equity 90,070,000 26,240,000 116,310,000

48,723,27

5 48,723,275 102,207,525

- - - -

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

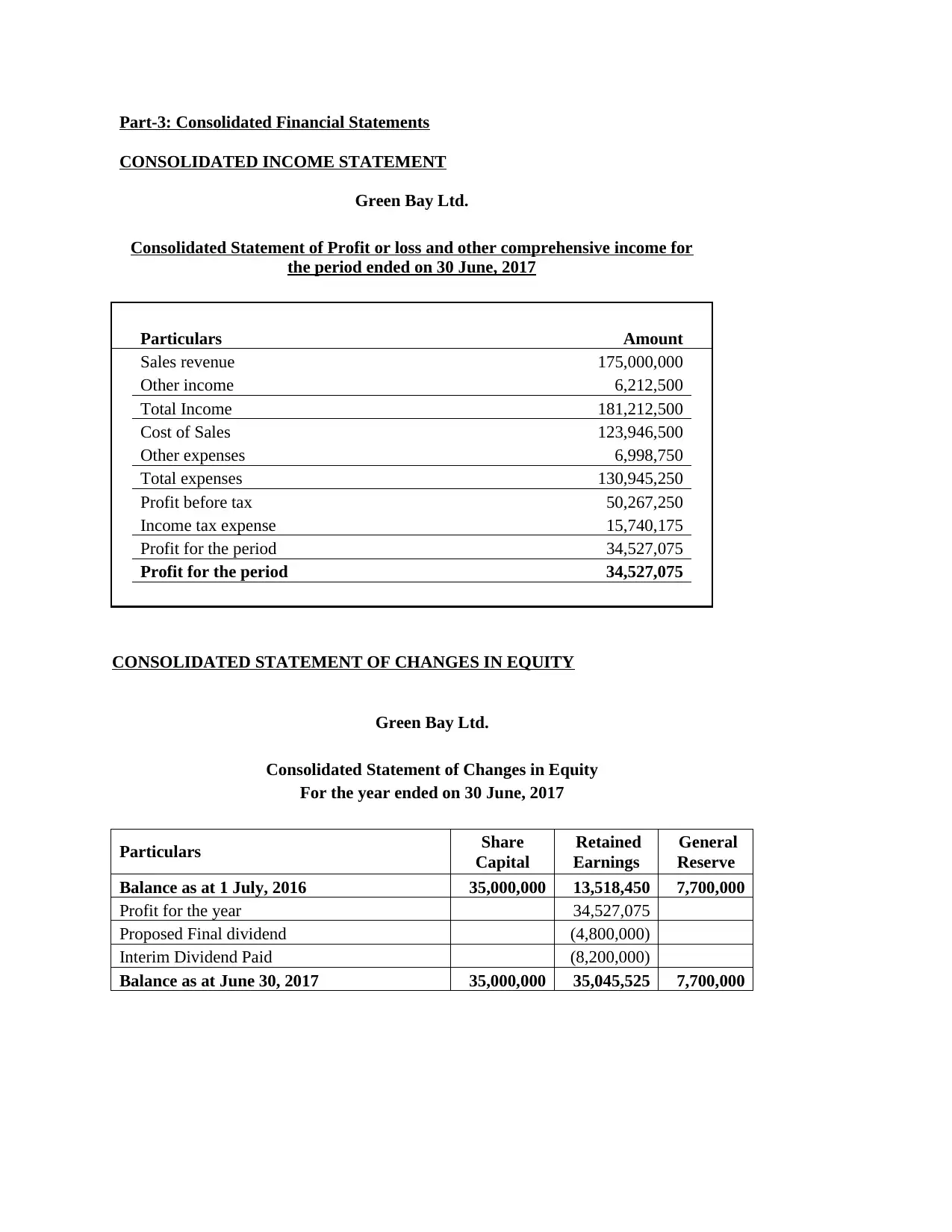

Part-3: Consolidated Financial Statements

CONSOLIDATED INCOME STATEMENT

Green Bay Ltd.

Consolidated Statement of Profit or loss and other comprehensive income for

the period ended on 30 June, 2017

Particulars Amount

Sales revenue 175,000,000

Other income 6,212,500

Total Income 181,212,500

Cost of Sales 123,946,500

Other expenses 6,998,750

Total expenses 130,945,250

Profit before tax 50,267,250

Income tax expense 15,740,175

Profit for the period 34,527,075

Profit for the period 34,527,075

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Green Bay Ltd.

Consolidated Statement of Changes in Equity

For the year ended on 30 June, 2017

Particulars Share

Capital

Retained

Earnings

General

Reserve

Balance as at 1 July, 2016 35,000,000 13,518,450 7,700,000

Profit for the year 34,527,075

Proposed Final dividend (4,800,000)

Interim Dividend Paid (8,200,000)

Balance as at June 30, 2017 35,000,000 35,045,525 7,700,000

CONSOLIDATED INCOME STATEMENT

Green Bay Ltd.

Consolidated Statement of Profit or loss and other comprehensive income for

the period ended on 30 June, 2017

Particulars Amount

Sales revenue 175,000,000

Other income 6,212,500

Total Income 181,212,500

Cost of Sales 123,946,500

Other expenses 6,998,750

Total expenses 130,945,250

Profit before tax 50,267,250

Income tax expense 15,740,175

Profit for the period 34,527,075

Profit for the period 34,527,075

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Green Bay Ltd.

Consolidated Statement of Changes in Equity

For the year ended on 30 June, 2017

Particulars Share

Capital

Retained

Earnings

General

Reserve

Balance as at 1 July, 2016 35,000,000 13,518,450 7,700,000

Profit for the year 34,527,075

Proposed Final dividend (4,800,000)

Interim Dividend Paid (8,200,000)

Balance as at June 30, 2017 35,000,000 35,045,525 7,700,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

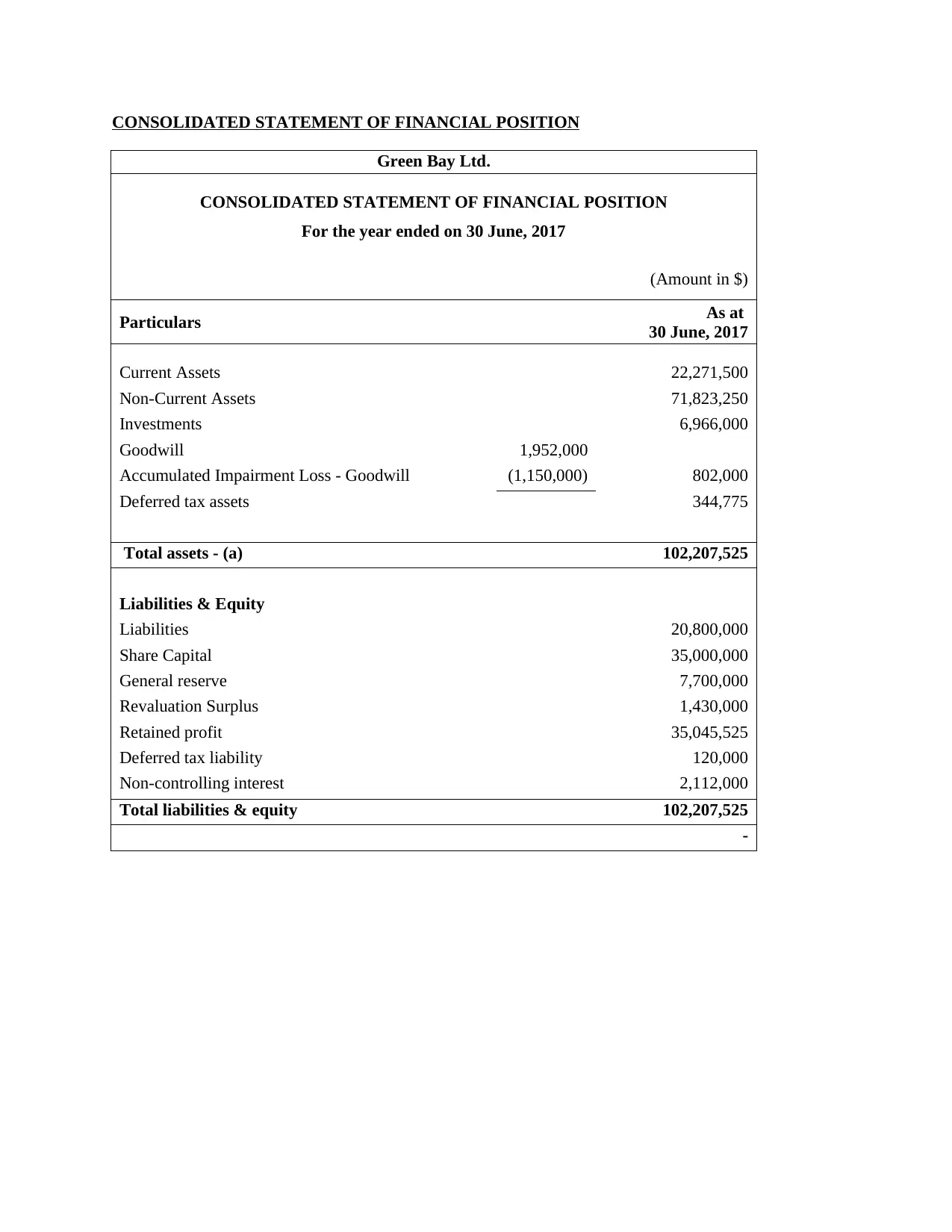

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Green Bay Ltd.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended on 30 June, 2017

(Amount in $)

Particulars As at

30 June, 2017

Current Assets 22,271,500

Non-Current Assets 71,823,250

Investments 6,966,000

Goodwill 1,952,000

Accumulated Impairment Loss - Goodwill (1,150,000) 802,000

Deferred tax assets 344,775

Total assets - (a) 102,207,525

Liabilities & Equity

Liabilities 20,800,000

Share Capital 35,000,000

General reserve 7,700,000

Revaluation Surplus 1,430,000

Retained profit 35,045,525

Deferred tax liability 120,000

Non-controlling interest 2,112,000

Total liabilities & equity 102,207,525

-

Green Bay Ltd.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended on 30 June, 2017

(Amount in $)

Particulars As at

30 June, 2017

Current Assets 22,271,500

Non-Current Assets 71,823,250

Investments 6,966,000

Goodwill 1,952,000

Accumulated Impairment Loss - Goodwill (1,150,000) 802,000

Deferred tax assets 344,775

Total assets - (a) 102,207,525

Liabilities & Equity

Liabilities 20,800,000

Share Capital 35,000,000

General reserve 7,700,000

Revaluation Surplus 1,430,000

Retained profit 35,045,525

Deferred tax liability 120,000

Non-controlling interest 2,112,000

Total liabilities & equity 102,207,525

-

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.