Building Project: Cash Flow Forecast and Construction Program Report

VerifiedAdded on 2023/06/08

|38

|10145

|136

Report

AI Summary

This report provides a detailed cash flow forecast and construction program for a domestic house construction project. It emphasizes the importance of financial and program management in achieving quality within the constraints of time, cost, and scope. The cash flow forecast models the financial needs at each stage, considering potential risks and payment schedules. The construction program, aligned with the cash flow forecast, utilizes CPM and Gantt charts for effective resource allocation. The report also addresses negative cash flow mitigation strategies, the relationship between the triple constraints (time, cost, scope) and quality, and the potential impact on the construction company's operations. It further explores the influence of the construction contract, Building Act 1995, and Australian Building Standards on project execution. The report concludes with recommendations for optimizing project outcomes and ensuring quality assurance, leading to customer satisfaction and organizational success. Desklib offers similar resources for students.

Cash flows and Quality 1

CASH FLOW FORECAST AND CONSTRUCTION PROGRAM IN BUILDING QUALITY

Name

Course

Tutor

University

City and State

Date

CASH FLOW FORECAST AND CONSTRUCTION PROGRAM IN BUILDING QUALITY

Name

Course

Tutor

University

City and State

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flows and Quality 2

Executive Summary

This cash flow forecast details the daily procedures and methodologies that will be utilized

during the construction phase of the domestic home belonging to William and Pamela Thiel. The

cash flow model will be used in this project to guide the management of financial resources of

the site. This document comprises of the cash flow model and the cash flow forecast that will be

used to manage the financial resources of the construction to ensure that the best possible

construction outcome is achieved. The cash flow model will consider each stage in the

construction process to ensure that the financial budget and the allocated time are not exceeded

for the success of the project. It also comprises of a construction program that has been edited to

reflect the insights of the cash flow forecast in mind. The report also includes an exploration of

the different methods that the construction manager will utilize to mitigate the cash flow

situation if it happens to be negative. Considering that quality is always achieved when the scope

is clearly defined, and the constraints of time and finances are effectively managed, the cash flow

forecast and the construction program will be the first steps in the achievement of quality in the

construction of this house. It also explores how the triple constraints of time, cost, scope and

quality relate as well as how these constraints can affect the operations of the construction

company given that quality assurance guarantees more referrals thus organizational success.

Executive Summary

This cash flow forecast details the daily procedures and methodologies that will be utilized

during the construction phase of the domestic home belonging to William and Pamela Thiel. The

cash flow model will be used in this project to guide the management of financial resources of

the site. This document comprises of the cash flow model and the cash flow forecast that will be

used to manage the financial resources of the construction to ensure that the best possible

construction outcome is achieved. The cash flow model will consider each stage in the

construction process to ensure that the financial budget and the allocated time are not exceeded

for the success of the project. It also comprises of a construction program that has been edited to

reflect the insights of the cash flow forecast in mind. The report also includes an exploration of

the different methods that the construction manager will utilize to mitigate the cash flow

situation if it happens to be negative. Considering that quality is always achieved when the scope

is clearly defined, and the constraints of time and finances are effectively managed, the cash flow

forecast and the construction program will be the first steps in the achievement of quality in the

construction of this house. It also explores how the triple constraints of time, cost, scope and

quality relate as well as how these constraints can affect the operations of the construction

company given that quality assurance guarantees more referrals thus organizational success.

Cash flows and Quality 3

TOC

Table of Contents

Introduction.................................................................................................................................................4

Background..............................................................................................................................................4

Summary.................................................................................................................................................6

Methodology...............................................................................................................................................7

Financial Management............................................................................................................................7

The cash flow Forecast........................................................................................................................8

Negative cash flows...........................................................................................................................16

Program Management...........................................................................................................................18

The construction Program.................................................................................................................18

HIA, Building Act 1995, and the Australian Building Standards.............................................................24

The Contract in Program and Financial Management...........................................................................25

Risk Management Plan..........................................................................................................................26

Cost Management.................................................................................................................................26

Summary...............................................................................................................................................27

Conclusion.................................................................................................................................................29

Time, Scope and Cost in relation to Quality...........................................................................................29

Summary...............................................................................................................................................31

Recommendation.......................................................................................................................................32

Impact on organizational operations.....................................................................................................32

Summary...............................................................................................................................................33

Critical Reflection.....................................................................................................................................34

Summary...............................................................................................................................................35

References.................................................................................................................................................36

TOC

Table of Contents

Introduction.................................................................................................................................................4

Background..............................................................................................................................................4

Summary.................................................................................................................................................6

Methodology...............................................................................................................................................7

Financial Management............................................................................................................................7

The cash flow Forecast........................................................................................................................8

Negative cash flows...........................................................................................................................16

Program Management...........................................................................................................................18

The construction Program.................................................................................................................18

HIA, Building Act 1995, and the Australian Building Standards.............................................................24

The Contract in Program and Financial Management...........................................................................25

Risk Management Plan..........................................................................................................................26

Cost Management.................................................................................................................................26

Summary...............................................................................................................................................27

Conclusion.................................................................................................................................................29

Time, Scope and Cost in relation to Quality...........................................................................................29

Summary...............................................................................................................................................31

Recommendation.......................................................................................................................................32

Impact on organizational operations.....................................................................................................32

Summary...............................................................................................................................................33

Critical Reflection.....................................................................................................................................34

Summary...............................................................................................................................................35

References.................................................................................................................................................36

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash flows and Quality 4

Cash Flow Forecast and Construction Program in Building Quality

Client Details: William and Pamela Thiel

Contact Number:

Type of building: Domestic House

Site Address: 8 Learmonth Street in Queens Cliff Victoria

Approximate Cost: $495,475.00

Project Time: 8 months

Introduction

In a construction project, the role of financial and program management is necessary as it

guarantees that the resources of time and finances are available for the remainder of the

construction project. Cash flow management cannot be overemphasized as it is cash that finances

the construction activities that are done during the project. This clearly brings out the connection

between the cost constraints in the project and the quality of the building as the mismanagement

of the cash flow could result into a complete halt of project activities thus compromising the

quality of the outcome of the project. This exercise looks into the importance of cash flow

management and program management as well as how it can be beneficial for both the owners of

the home in terms of customer service and the construction company in terms of profitability

(Sommerville and Robertson, 2000, p. 457). This exercise explores the relationships between the

constraints of time, scope, and cost in order to bring out the relationship between cash flow

management, program management and the product quality.

Project Objectives

The main aim of this exercise is to establish the different tools and techniques that will be

utilized to guarantee that quality is achieved in the project through the management of the

constraints of time, costs and scope. Since the project is expected to encounter different internal

and external risks that may cause the project to be completed after exceeding the triple

constraints of the project, the concepts of financial and program management have been

employed to manage these resources and thus guarantee the achievement of quality in the

Cash Flow Forecast and Construction Program in Building Quality

Client Details: William and Pamela Thiel

Contact Number:

Type of building: Domestic House

Site Address: 8 Learmonth Street in Queens Cliff Victoria

Approximate Cost: $495,475.00

Project Time: 8 months

Introduction

In a construction project, the role of financial and program management is necessary as it

guarantees that the resources of time and finances are available for the remainder of the

construction project. Cash flow management cannot be overemphasized as it is cash that finances

the construction activities that are done during the project. This clearly brings out the connection

between the cost constraints in the project and the quality of the building as the mismanagement

of the cash flow could result into a complete halt of project activities thus compromising the

quality of the outcome of the project. This exercise looks into the importance of cash flow

management and program management as well as how it can be beneficial for both the owners of

the home in terms of customer service and the construction company in terms of profitability

(Sommerville and Robertson, 2000, p. 457). This exercise explores the relationships between the

constraints of time, scope, and cost in order to bring out the relationship between cash flow

management, program management and the product quality.

Project Objectives

The main aim of this exercise is to establish the different tools and techniques that will be

utilized to guarantee that quality is achieved in the project through the management of the

constraints of time, costs and scope. Since the project is expected to encounter different internal

and external risks that may cause the project to be completed after exceeding the triple

constraints of the project, the concepts of financial and program management have been

employed to manage these resources and thus guarantee the achievement of quality in the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flows and Quality 5

project. These techniques will ensure that the project factors are controlled to ensure that the

deliverables of the project are achieved to guarantee project quality through managing the triple

constraints.

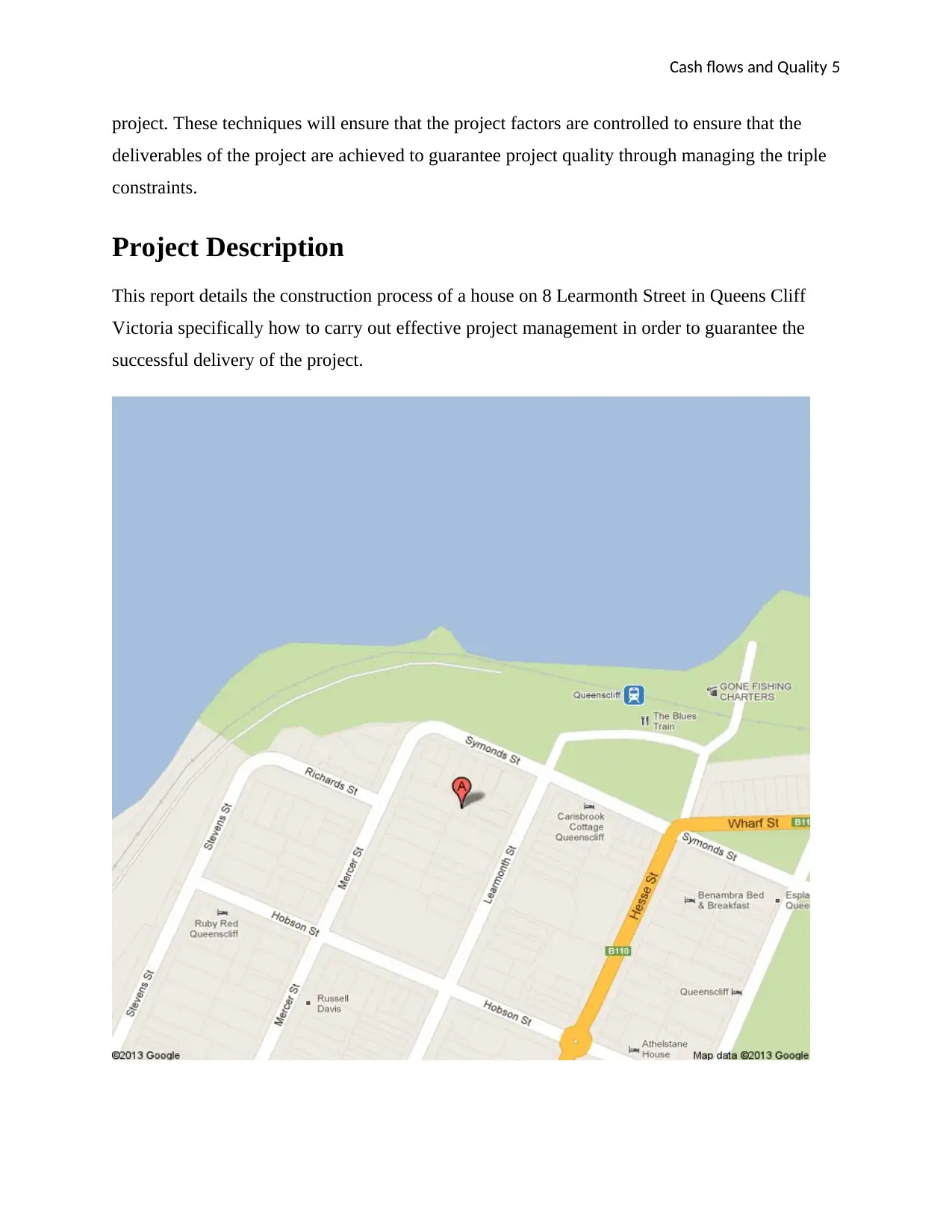

Project Description

This report details the construction process of a house on 8 Learmonth Street in Queens Cliff

Victoria specifically how to carry out effective project management in order to guarantee the

successful delivery of the project.

project. These techniques will ensure that the project factors are controlled to ensure that the

deliverables of the project are achieved to guarantee project quality through managing the triple

constraints.

Project Description

This report details the construction process of a house on 8 Learmonth Street in Queens Cliff

Victoria specifically how to carry out effective project management in order to guarantee the

successful delivery of the project.

Cash flows and Quality 6

It describes the methodology the project uses to monitor the constraints of time and costs which

mainly, especially in the case of domestic constructions, has the greatest impact on the

construction quality. The project was undertaken by Duncan Pascoe Pty Ltd, which is a reliable

and well accredited construction management that has been operational for the past 19 years. The

company seeks to guarantee the priority of fulfilling the construction needs of the customer

through the achievement of the best possible solution for their individual need, considering the

time and budgetary constraints of each project presents (Yu, Tweed, Al-Hussein, and Nasseri,

2009).

The company has succeeded to enter into a contractual agreement with one William and Pamela

Thiel for the construction of his domestic home on Learmonth Street in Queens Cliff Victoria.

The task of constructing this domestic home has been detailed by the tender had specified the

materials and requirements of the house he would wish for so that the company could aid to

professionally optimize the project cost and timeline. The construction process will be carried

out over a period of eight months, as the project entails the demolition of the house that already

exists on the land and constructing a double story domestic house. The estimated cost for the

construction of this project has been estimated at $495,475.00 as is detailed in the business

contract that was signed by both the company and the clients.

Summary

This section introduces the project detailing the background of the project, its location and

details about the site and the scope of the project. This section also discusses the different

constraints of this project and how these constraints affect the outcome of the project in case the

cost and time constraints are not prioritized in this project. This therefore brings out the

relationship between the triple constraints and quality as well as the meaning and implication of

quality for both the how it affects both the client and the construction company.

It describes the methodology the project uses to monitor the constraints of time and costs which

mainly, especially in the case of domestic constructions, has the greatest impact on the

construction quality. The project was undertaken by Duncan Pascoe Pty Ltd, which is a reliable

and well accredited construction management that has been operational for the past 19 years. The

company seeks to guarantee the priority of fulfilling the construction needs of the customer

through the achievement of the best possible solution for their individual need, considering the

time and budgetary constraints of each project presents (Yu, Tweed, Al-Hussein, and Nasseri,

2009).

The company has succeeded to enter into a contractual agreement with one William and Pamela

Thiel for the construction of his domestic home on Learmonth Street in Queens Cliff Victoria.

The task of constructing this domestic home has been detailed by the tender had specified the

materials and requirements of the house he would wish for so that the company could aid to

professionally optimize the project cost and timeline. The construction process will be carried

out over a period of eight months, as the project entails the demolition of the house that already

exists on the land and constructing a double story domestic house. The estimated cost for the

construction of this project has been estimated at $495,475.00 as is detailed in the business

contract that was signed by both the company and the clients.

Summary

This section introduces the project detailing the background of the project, its location and

details about the site and the scope of the project. This section also discusses the different

constraints of this project and how these constraints affect the outcome of the project in case the

cost and time constraints are not prioritized in this project. This therefore brings out the

relationship between the triple constraints and quality as well as the meaning and implication of

quality for both the how it affects both the client and the construction company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash flows and Quality 7

Methodology

This project utilizes the concepts of Financial Management and Program Management in order

to management the resources of time and money on site to guarantee that the project finally

achieves completion successfully. Specifically, the project resources of time and cost will be

managed using a construction program technique using the tools of CPM and the Gantt Chart, as

well as a financial management technique using the cash flow forecast as a tool in the project.

Monetary and time resources are fundamental resources in the successful achievement of the best

outcome in every project. Further the mismanagement of any of these constraints in any

construction project also has an impact of extending the mismanagement of the rest of the

constraints thus having a great negative impact on the quality of the construction project. For

instance the mismanagement of funds on the site may lead to exceeding the $495,475.00 budget

which may cause the construction project to stall and thus also have a time overrun exceeding 8

months.

The concepts of financial and program management are bounded by the construction contract,

the Building contract of 1995, and the Australian building standards.

Methodology

This project utilizes the concepts of Financial Management and Program Management in order

to management the resources of time and money on site to guarantee that the project finally

achieves completion successfully. Specifically, the project resources of time and cost will be

managed using a construction program technique using the tools of CPM and the Gantt Chart, as

well as a financial management technique using the cash flow forecast as a tool in the project.

Monetary and time resources are fundamental resources in the successful achievement of the best

outcome in every project. Further the mismanagement of any of these constraints in any

construction project also has an impact of extending the mismanagement of the rest of the

constraints thus having a great negative impact on the quality of the construction project. For

instance the mismanagement of funds on the site may lead to exceeding the $495,475.00 budget

which may cause the construction project to stall and thus also have a time overrun exceeding 8

months.

The concepts of financial and program management are bounded by the construction contract,

the Building contract of 1995, and the Australian building standards.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flows and Quality 8

Financial Management

As has been earlier explained the most important plans to put into place in order to guarantee the

successful and quality assured completion of the project is through the management of financial

resources on site. Financial management on a project site refers to all the activities involved in

the planning of monetary resources allocated to the project, including the cost estimations,

accounting work, reporting, cost control and auditing activities, the purchasing, payment

disbursements, as well as the other activities that guarantee the monetary resources of the project

are managed efficiently and properly to ensure that the project is completed to achieve its

individual responsibilities. This is necessary in construction projects because it aids in the

decision making processes thus ensuring that funds for the continuation of the project are always

available and no delays or challenges emerge. On the other hand, program management ensures

that the program is managed in a manner that promotes a seamless information flow among all

the major stakeholders to ensure that the full scope of the construction project is delivered

successfully and on time. This also guarantees that the project contract is used to guarantee that

the specific requirements of the project have been achieved according to the agreed performance

standards as is stipulated in the agreement contract. Financial management in this sense helps to

ensure that the time constraint is strictly observed to guarantee that the required standards of

performance according to the contract agreement have been met using critical path modelling,

effective time based resource allocation, and continuous appraisal of the rate of productivity

from the different stakeholders considering both time and financial constraints.

For this project, financial management was conducted through a cash flow forecast that would

aid the stakeholders to have a visionary outlook on the project to allow all stakeholders play their

part on time to guarantee that the project is completed successfully and quality is guaranteed.

The cash flow Forecast

The management of costs during this construction will be done using a Cash Flow Forecasting

Model which is able to plan for the costs of the different construction activities. The forecast is

able to simulate how financial needs can emerge depending on the company’s and the client

focused risk factors that could affect the general overlook of the flow of cash and the different

costs for every construction activity that is carried out (Alzahrani and Emsley, 2013, p. 319). The

Financial Management

As has been earlier explained the most important plans to put into place in order to guarantee the

successful and quality assured completion of the project is through the management of financial

resources on site. Financial management on a project site refers to all the activities involved in

the planning of monetary resources allocated to the project, including the cost estimations,

accounting work, reporting, cost control and auditing activities, the purchasing, payment

disbursements, as well as the other activities that guarantee the monetary resources of the project

are managed efficiently and properly to ensure that the project is completed to achieve its

individual responsibilities. This is necessary in construction projects because it aids in the

decision making processes thus ensuring that funds for the continuation of the project are always

available and no delays or challenges emerge. On the other hand, program management ensures

that the program is managed in a manner that promotes a seamless information flow among all

the major stakeholders to ensure that the full scope of the construction project is delivered

successfully and on time. This also guarantees that the project contract is used to guarantee that

the specific requirements of the project have been achieved according to the agreed performance

standards as is stipulated in the agreement contract. Financial management in this sense helps to

ensure that the time constraint is strictly observed to guarantee that the required standards of

performance according to the contract agreement have been met using critical path modelling,

effective time based resource allocation, and continuous appraisal of the rate of productivity

from the different stakeholders considering both time and financial constraints.

For this project, financial management was conducted through a cash flow forecast that would

aid the stakeholders to have a visionary outlook on the project to allow all stakeholders play their

part on time to guarantee that the project is completed successfully and quality is guaranteed.

The cash flow Forecast

The management of costs during this construction will be done using a Cash Flow Forecasting

Model which is able to plan for the costs of the different construction activities. The forecast is

able to simulate how financial needs can emerge depending on the company’s and the client

focused risk factors that could affect the general overlook of the flow of cash and the different

costs for every construction activity that is carried out (Alzahrani and Emsley, 2013, p. 319). The

Cash flows and Quality 9

construction industry is marred by different changes that continue to occur in industry which in

turn may have an impact of the timelines, cost estimations and resources of the project.

The use of a cash flow forecast as a mathematical model in the construction industry is extremely

beneficial. For the construction of a domestic home, the forecast will aid the construction

manager, who is responsible for all operations on the site, to find cash required to finance the

ongoing and near future construction activities as required for a smooth running of construction

activities without exceeding the triple constraints. This cash flow forecast was also designed to

reveal any instances of money spent in the project being more than what is coming in from the

client given the progressive payment per stage agreement the company made with the clients. It

also helps the construction manager to identify when to require funds from the Thiel couple to

finance the activities that will be coming in the near future in following stages and how to

manage the finances at his disposal to optimize productivity on site.

The design of this cash flow gave way for the assessment of the amount of money and batches

that the client will have to make and in the right timelines to avoid operations coming to a

standstill due to the mismanagement of funds. It also allows the construction manager to identify

the important phases when the cash requirement will be so high in order to plan for those times

and ensure that operations continue to optimize on time (Bassioni, Price, and Hassan, 2004,

p.45).

The following terms will be used in this cash flow forecast:

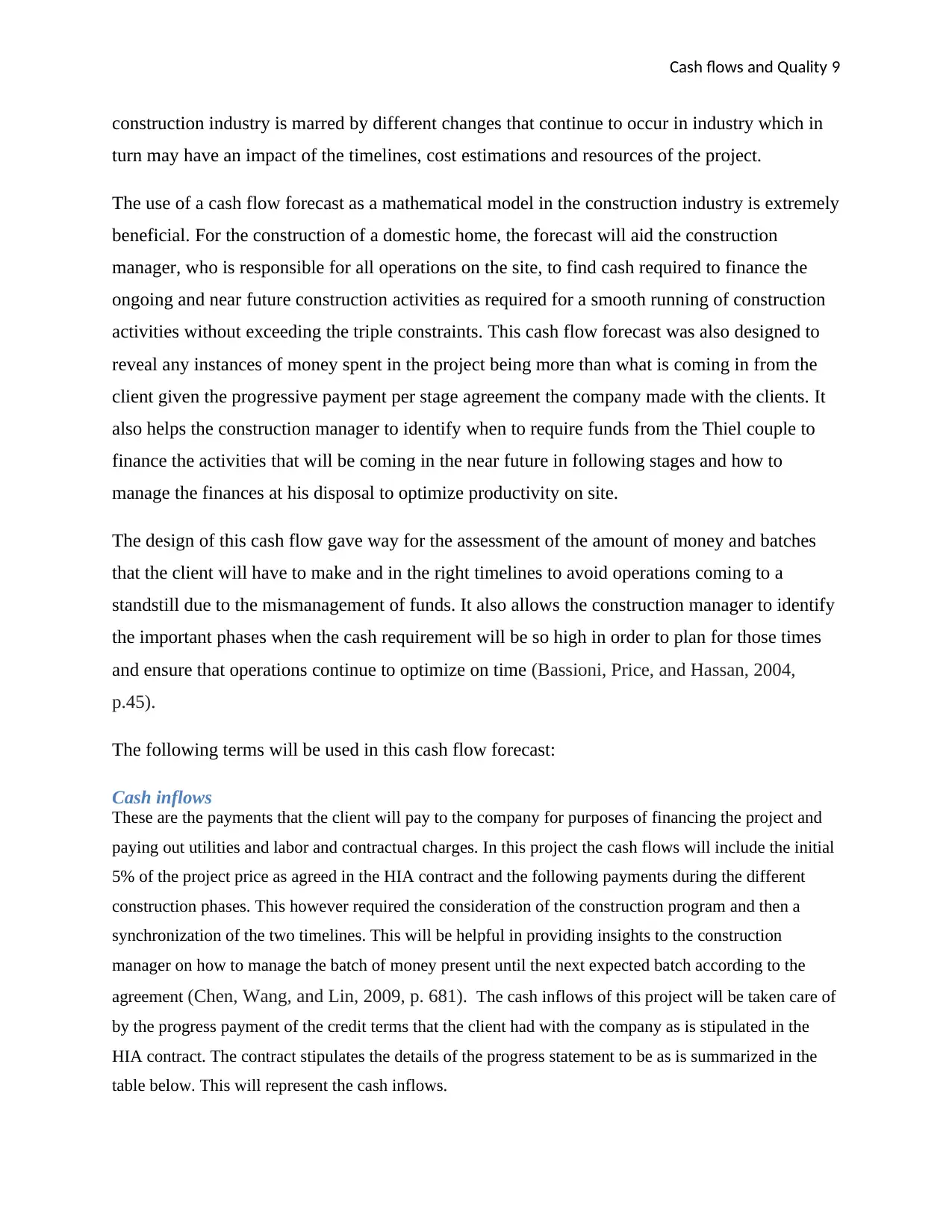

Cash inflows

These are the payments that the client will pay to the company for purposes of financing the project and

paying out utilities and labor and contractual charges. In this project the cash flows will include the initial

5% of the project price as agreed in the HIA contract and the following payments during the different

construction phases. This however required the consideration of the construction program and then a

synchronization of the two timelines. This will be helpful in providing insights to the construction

manager on how to manage the batch of money present until the next expected batch according to the

agreement (Chen, Wang, and Lin, 2009, p. 681). The cash inflows of this project will be taken care of

by the progress payment of the credit terms that the client had with the company as is stipulated in the

HIA contract. The contract stipulates the details of the progress statement to be as is summarized in the

table below. This will represent the cash inflows.

construction industry is marred by different changes that continue to occur in industry which in

turn may have an impact of the timelines, cost estimations and resources of the project.

The use of a cash flow forecast as a mathematical model in the construction industry is extremely

beneficial. For the construction of a domestic home, the forecast will aid the construction

manager, who is responsible for all operations on the site, to find cash required to finance the

ongoing and near future construction activities as required for a smooth running of construction

activities without exceeding the triple constraints. This cash flow forecast was also designed to

reveal any instances of money spent in the project being more than what is coming in from the

client given the progressive payment per stage agreement the company made with the clients. It

also helps the construction manager to identify when to require funds from the Thiel couple to

finance the activities that will be coming in the near future in following stages and how to

manage the finances at his disposal to optimize productivity on site.

The design of this cash flow gave way for the assessment of the amount of money and batches

that the client will have to make and in the right timelines to avoid operations coming to a

standstill due to the mismanagement of funds. It also allows the construction manager to identify

the important phases when the cash requirement will be so high in order to plan for those times

and ensure that operations continue to optimize on time (Bassioni, Price, and Hassan, 2004,

p.45).

The following terms will be used in this cash flow forecast:

Cash inflows

These are the payments that the client will pay to the company for purposes of financing the project and

paying out utilities and labor and contractual charges. In this project the cash flows will include the initial

5% of the project price as agreed in the HIA contract and the following payments during the different

construction phases. This however required the consideration of the construction program and then a

synchronization of the two timelines. This will be helpful in providing insights to the construction

manager on how to manage the batch of money present until the next expected batch according to the

agreement (Chen, Wang, and Lin, 2009, p. 681). The cash inflows of this project will be taken care of

by the progress payment of the credit terms that the client had with the company as is stipulated in the

HIA contract. The contract stipulates the details of the progress statement to be as is summarized in the

table below. This will represent the cash inflows.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cash flows and Quality 10

Stage Percentage of Contract Price Amount

Deposit According to Clause 9 of

the HIA Contract

5% $ 24,773.75

Base Stage 10%` $ 49,547.50

Frame Stage 15%` $ 74,321.25

Locked Up Stage 25% $ 173,416.25

Fixing Stage 25% $ 123,868.75

Completion 10% $ 49,547.50

Total Contract Price 100% $ 495,475.00

This table can thus be said to detail all the cash inflows of this project. It is important to note that the

clients have agreed to bring pump in cash into the project based on the pace of the construction as is

marked by the construction stages. These stages can be incorporated into the construction program in

order to ensure the design of an effective, efficient, and reliable cash flow plan for the successful

completion of the project.

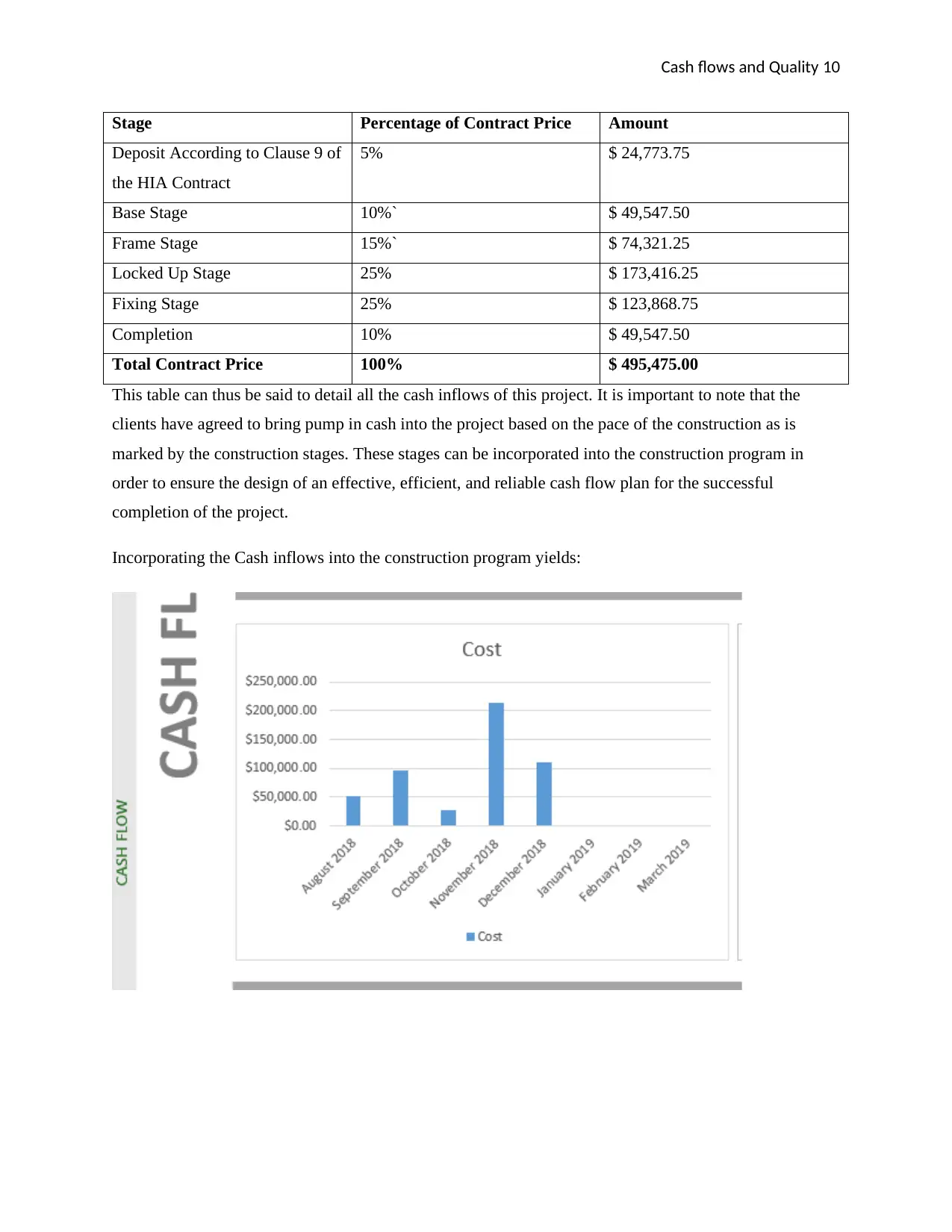

Incorporating the Cash inflows into the construction program yields:

Stage Percentage of Contract Price Amount

Deposit According to Clause 9 of

the HIA Contract

5% $ 24,773.75

Base Stage 10%` $ 49,547.50

Frame Stage 15%` $ 74,321.25

Locked Up Stage 25% $ 173,416.25

Fixing Stage 25% $ 123,868.75

Completion 10% $ 49,547.50

Total Contract Price 100% $ 495,475.00

This table can thus be said to detail all the cash inflows of this project. It is important to note that the

clients have agreed to bring pump in cash into the project based on the pace of the construction as is

marked by the construction stages. These stages can be incorporated into the construction program in

order to ensure the design of an effective, efficient, and reliable cash flow plan for the successful

completion of the project.

Incorporating the Cash inflows into the construction program yields:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cash flows and Quality 11

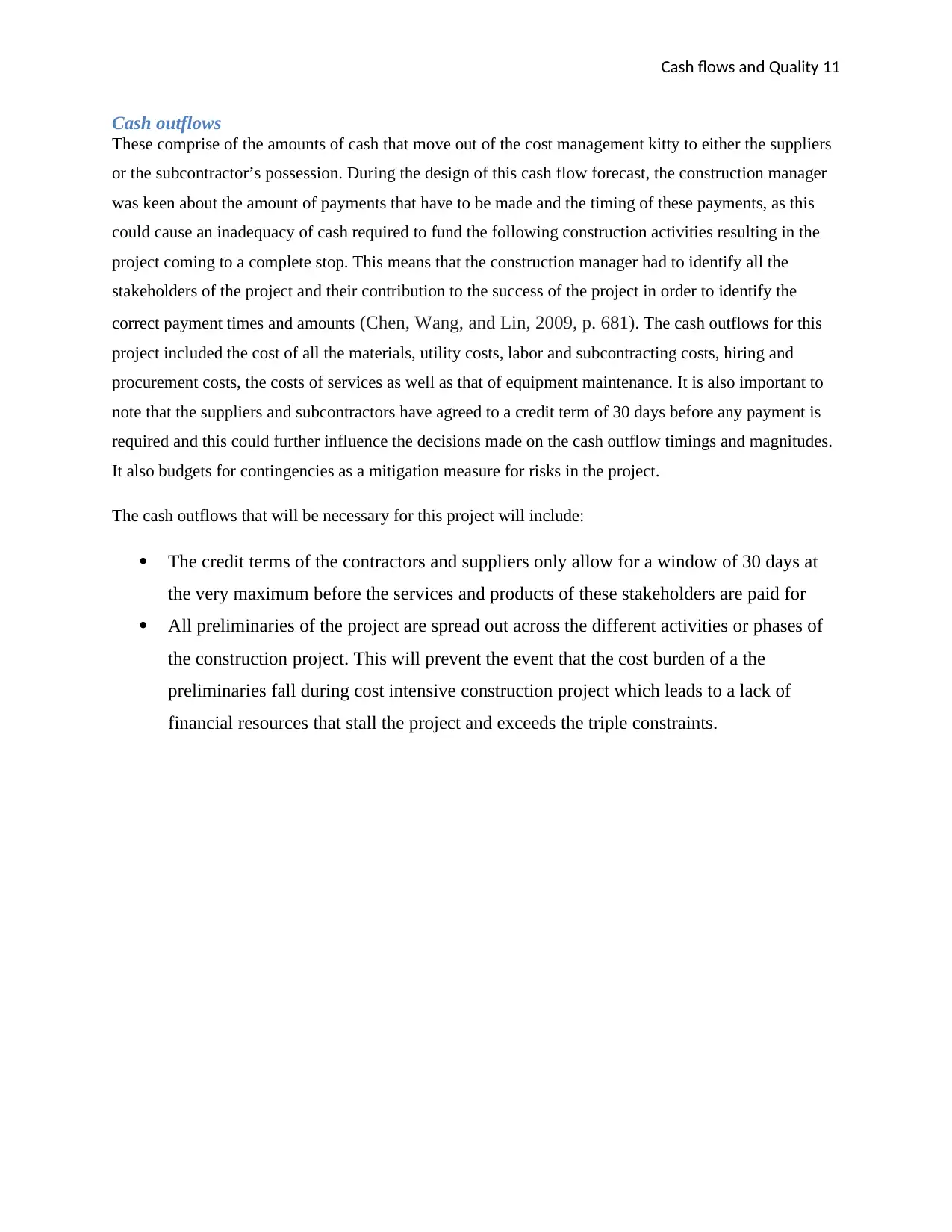

Cash outflows

These comprise of the amounts of cash that move out of the cost management kitty to either the suppliers

or the subcontractor’s possession. During the design of this cash flow forecast, the construction manager

was keen about the amount of payments that have to be made and the timing of these payments, as this

could cause an inadequacy of cash required to fund the following construction activities resulting in the

project coming to a complete stop. This means that the construction manager had to identify all the

stakeholders of the project and their contribution to the success of the project in order to identify the

correct payment times and amounts (Chen, Wang, and Lin, 2009, p. 681). The cash outflows for this

project included the cost of all the materials, utility costs, labor and subcontracting costs, hiring and

procurement costs, the costs of services as well as that of equipment maintenance. It is also important to

note that the suppliers and subcontractors have agreed to a credit term of 30 days before any payment is

required and this could further influence the decisions made on the cash outflow timings and magnitudes.

It also budgets for contingencies as a mitigation measure for risks in the project.

The cash outflows that will be necessary for this project will include:

The credit terms of the contractors and suppliers only allow for a window of 30 days at

the very maximum before the services and products of these stakeholders are paid for

All preliminaries of the project are spread out across the different activities or phases of

the construction project. This will prevent the event that the cost burden of a the

preliminaries fall during cost intensive construction project which leads to a lack of

financial resources that stall the project and exceeds the triple constraints.

Cash outflows

These comprise of the amounts of cash that move out of the cost management kitty to either the suppliers

or the subcontractor’s possession. During the design of this cash flow forecast, the construction manager

was keen about the amount of payments that have to be made and the timing of these payments, as this

could cause an inadequacy of cash required to fund the following construction activities resulting in the

project coming to a complete stop. This means that the construction manager had to identify all the

stakeholders of the project and their contribution to the success of the project in order to identify the

correct payment times and amounts (Chen, Wang, and Lin, 2009, p. 681). The cash outflows for this

project included the cost of all the materials, utility costs, labor and subcontracting costs, hiring and

procurement costs, the costs of services as well as that of equipment maintenance. It is also important to

note that the suppliers and subcontractors have agreed to a credit term of 30 days before any payment is

required and this could further influence the decisions made on the cash outflow timings and magnitudes.

It also budgets for contingencies as a mitigation measure for risks in the project.

The cash outflows that will be necessary for this project will include:

The credit terms of the contractors and suppliers only allow for a window of 30 days at

the very maximum before the services and products of these stakeholders are paid for

All preliminaries of the project are spread out across the different activities or phases of

the construction project. This will prevent the event that the cost burden of a the

preliminaries fall during cost intensive construction project which leads to a lack of

financial resources that stall the project and exceeds the triple constraints.

Cash flows and Quality 12

The other terms in the cash flow are:

Net cash flow- The difference between the cash flow inflows and outflows and it may

vary depending on the last inflow of every month. The positive figures are also referred

to as the net cash inflows while negative figures are net cash outflows are used to as a

mark that an injection of inflows is necessary for the project. These outflows are in most

cases caused by one off payments to subcontractors and vendors or in situations where

there is a long period since the last inflow.

Opening balance-This is the money the construction manager will have in his kitty at the

beginning of construction stage. For the beginning of the project the construction will

start with an opening balance of 5% of the project price as the project will commence

after the deposit is paid by the client. As more funds are added then the cash flow

commences. Its value should be the same as the closing balance of the previous month.

The Closing balance- This is the amount of cash the construction manager will have in

his kitty at the end of every construction stage.

Cash flows discussion

For this project the negative cash flows were not able to be completely avoided, as they were

identified within the first three months of the project. This can be attributed to smaller amounts

of payments that were deposited in the first three payment stages, in comparison to the

magnitude of the deposits made to in the final stages of the project. The construction manager

will be able to utilize the information identified in the cash flow to manage expenditures on site

The other terms in the cash flow are:

Net cash flow- The difference between the cash flow inflows and outflows and it may

vary depending on the last inflow of every month. The positive figures are also referred

to as the net cash inflows while negative figures are net cash outflows are used to as a

mark that an injection of inflows is necessary for the project. These outflows are in most

cases caused by one off payments to subcontractors and vendors or in situations where

there is a long period since the last inflow.

Opening balance-This is the money the construction manager will have in his kitty at the

beginning of construction stage. For the beginning of the project the construction will

start with an opening balance of 5% of the project price as the project will commence

after the deposit is paid by the client. As more funds are added then the cash flow

commences. Its value should be the same as the closing balance of the previous month.

The Closing balance- This is the amount of cash the construction manager will have in

his kitty at the end of every construction stage.

Cash flows discussion

For this project the negative cash flows were not able to be completely avoided, as they were

identified within the first three months of the project. This can be attributed to smaller amounts

of payments that were deposited in the first three payment stages, in comparison to the

magnitude of the deposits made to in the final stages of the project. The construction manager

will be able to utilize the information identified in the cash flow to manage expenditures on site

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 38

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.