Comprehensive Cost Accounting Project: Coca-Cola Product Analysis

VerifiedAdded on 2023/06/09

|19

|3115

|284

Project

AI Summary

This project provides a comprehensive analysis of Coca-Cola's cost accounting, focusing on product costing, gross profit margins, and competitor comparisons with Pepsi. The project details the manufacturing locations, calculates the cost price of Coke, and compares its gross profit margin to Pepsi's. It also explores the value chain concept within Coca-Cola, examining inbound logistics, operations, and marketing. The research section investigates the impact of sugar price fluctuations on the product's cost. Furthermore, the project highlights opportunities and potential challenges in the market. Tables and figures are used to illustrate financial data, and the report concludes with a summary of the key findings, offering insights into the financial health and competitive positioning of Coca-Cola.

Running head: COST ACCOUNTING

Cost Accounting of Coke produced by Coca-Cola Company

Name of the student

Name of the university

Author Note:

Cost Accounting of Coke produced by Coca-Cola Company

Name of the student

Name of the university

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

COST ACCOUNTING

Table of Contents

Introduction......................................................................................................................................4

Place of Manufacturing....................................................................................................................4

Gross Margin and Cost of the Product............................................................................................5

Table No 1: Table of Gross Profit Margin of Coke.....................................................................6

Figure 1: Gross profit margin of Coke........................................................................................6

Table 2: Calculation of the Cost Price of Coke...........................................................................7

Competitors Product........................................................................................................................7

Table 3: Pepsi Gross profit Margin.............................................................................................8

Comparison between Two different Competitors............................................................................8

Table 4: Comparison of Earnings of Coke and Pepsi..................................................................9

Table 5: Comparison of Sales of Coke and Pepsi......................................................................10

Table 6: Comparison of Dividend Increase of Coca-Cola and Pepsi........................................11

Table 7: Comparison of Dividend Growth over the year of Coke and Pepsi............................12

Value Chain Concept.....................................................................................................................12

Figure 2: Coca Cola or Coke the Product..................................................................................13

Research.........................................................................................................................................14

Table No 8: Sugar Price Estimates............................................................................................14

Opportunities.................................................................................................................................15

COST ACCOUNTING

Table of Contents

Introduction......................................................................................................................................4

Place of Manufacturing....................................................................................................................4

Gross Margin and Cost of the Product............................................................................................5

Table No 1: Table of Gross Profit Margin of Coke.....................................................................6

Figure 1: Gross profit margin of Coke........................................................................................6

Table 2: Calculation of the Cost Price of Coke...........................................................................7

Competitors Product........................................................................................................................7

Table 3: Pepsi Gross profit Margin.............................................................................................8

Comparison between Two different Competitors............................................................................8

Table 4: Comparison of Earnings of Coke and Pepsi..................................................................9

Table 5: Comparison of Sales of Coke and Pepsi......................................................................10

Table 6: Comparison of Dividend Increase of Coca-Cola and Pepsi........................................11

Table 7: Comparison of Dividend Growth over the year of Coke and Pepsi............................12

Value Chain Concept.....................................................................................................................12

Figure 2: Coca Cola or Coke the Product..................................................................................13

Research.........................................................................................................................................14

Table No 8: Sugar Price Estimates............................................................................................14

Opportunities.................................................................................................................................15

3

COST ACCOUNTING

Figure 3: Price Maintenance of Coke........................................................................................16

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

COST ACCOUNTING

Figure 3: Price Maintenance of Coke........................................................................................16

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

COST ACCOUNTING

Introduction

The following project is based on comprehensive product costing. The product selected is

one of the most popular drinks of the world which is Coke produced by Coca-Cola Company.

The company has its origin in the United States. The following project aims to discuss the most

effective and efficient ways to find out the elements related to the product costing of the

following. The company was formed as a medicine company in the 19th century by John

Pemberton. However after some time a businessman named Asa Griggs Candler bought the

company and changed its fortunes from a mere medicine producing company to its present status

of a dominating soft drink company of the world. The main features of this particular project are

provided below. They are categorized as follows;

Place of Manufacturing

Coca Cola is one of the largest manufacturers of cold drinks and beverages across the

world. The particular product has its manufacturing plant all across the globe. The main reason

behind this is the wide acceptability of Coke across the globe. The company has mainly its

bottling units all across the world. The company has least number of plants in its place of origin

which is in North America. It has its production and bottling plants in USA and Canada. In the

South Americas the company has its plants located at almost all of the countries. This includes

the likes of Argentina, Bahamas, Brazil, Chile, El-Salvador, Mexico and many more as such. In

Europe it has similar presence in all over the continent with different kind of factories in Ireland,

Italy, France, Sweden, Switzerland, Romania, Spain and in many other countries. IN Africa too

the company has its plants in almost all the countries. Last but not the least it has a strong

presence in Asia with huge number of units in India, Pakistan, China, West Asia and many other

COST ACCOUNTING

Introduction

The following project is based on comprehensive product costing. The product selected is

one of the most popular drinks of the world which is Coke produced by Coca-Cola Company.

The company has its origin in the United States. The following project aims to discuss the most

effective and efficient ways to find out the elements related to the product costing of the

following. The company was formed as a medicine company in the 19th century by John

Pemberton. However after some time a businessman named Asa Griggs Candler bought the

company and changed its fortunes from a mere medicine producing company to its present status

of a dominating soft drink company of the world. The main features of this particular project are

provided below. They are categorized as follows;

Place of Manufacturing

Coca Cola is one of the largest manufacturers of cold drinks and beverages across the

world. The particular product has its manufacturing plant all across the globe. The main reason

behind this is the wide acceptability of Coke across the globe. The company has mainly its

bottling units all across the world. The company has least number of plants in its place of origin

which is in North America. It has its production and bottling plants in USA and Canada. In the

South Americas the company has its plants located at almost all of the countries. This includes

the likes of Argentina, Bahamas, Brazil, Chile, El-Salvador, Mexico and many more as such. In

Europe it has similar presence in all over the continent with different kind of factories in Ireland,

Italy, France, Sweden, Switzerland, Romania, Spain and in many other countries. IN Africa too

the company has its plants in almost all the countries. Last but not the least it has a strong

presence in Asia with huge number of units in India, Pakistan, China, West Asia and many other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

COST ACCOUNTING

countries. Thus in a short and brief statement its business can be easily identified with the

number of companies it has under its fold and the number of workers working under the

management of the company (Sekaran & Bougie, 2016).

Gross Margin and Cost of the Product

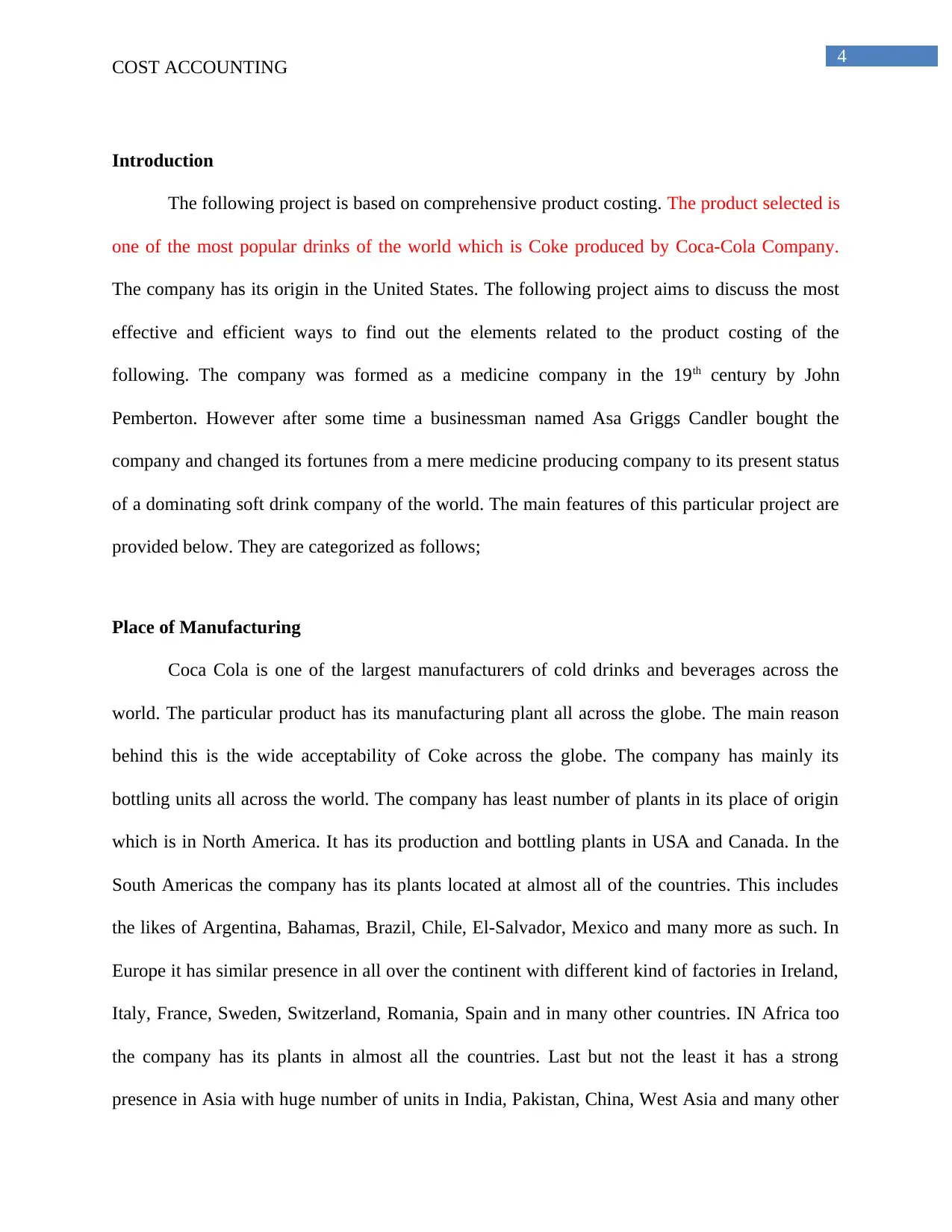

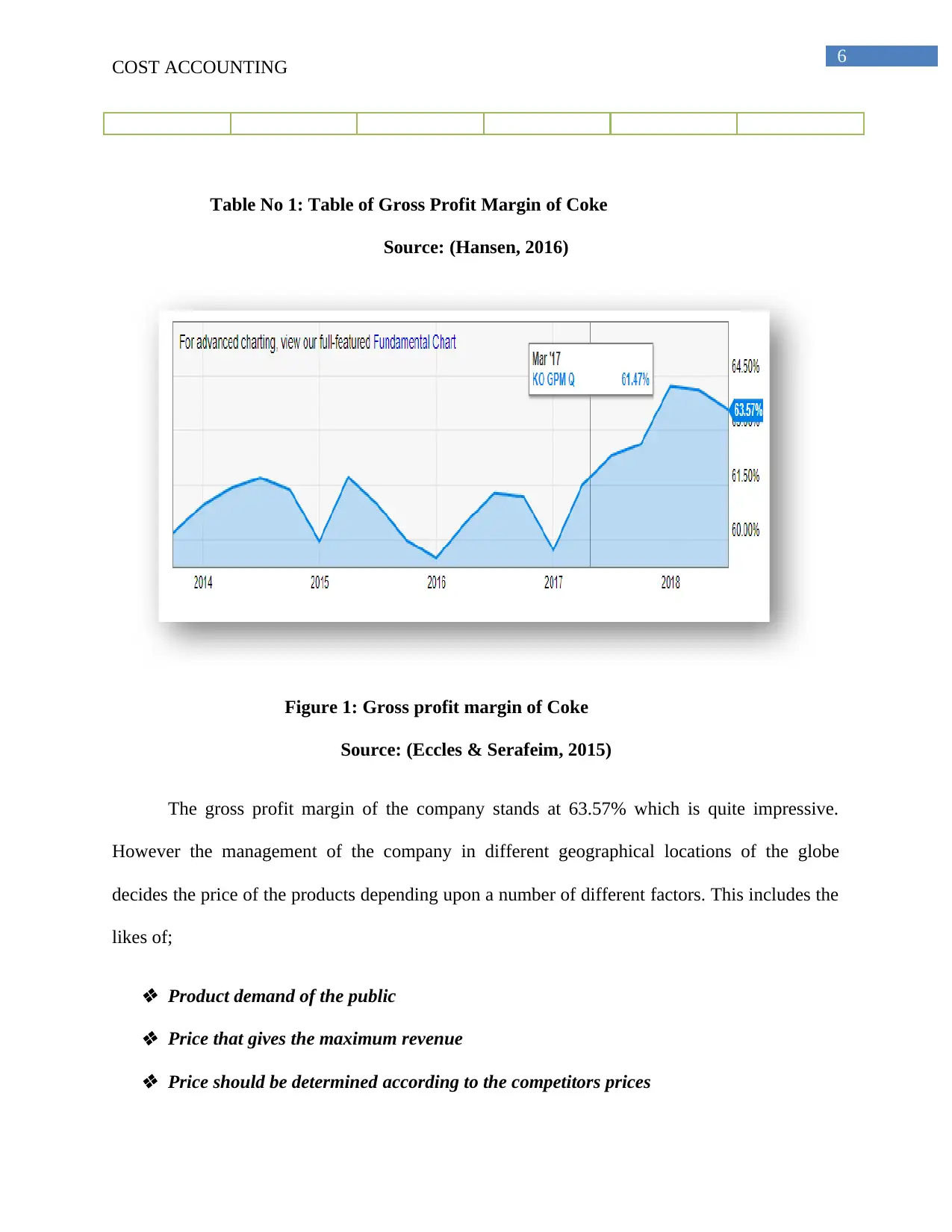

Gross Profit margin is the financial metric that determines the financial health of the

company. It also determines the business model that the company follows by revealing the

proportion of the money that is left over from the revenues after accounting for the cost of the

different types of goods sold by the company (Andrews & Shimp 2017). However the following

project aims to determine the profit margin of the selected product. According to the annual

reports of Coca Cola Company, the organization has managed to improve the revenue

sequentially to $8927 million by an increase of 17.06% faster than the increase in the gross profit

of the company which is close to 16.1% that sums up to $5,675 million. The following activity

led to the contraction in the gross profit margin to 63.57%. The quarterly gross profit margin

remained around the average rate of 62.07%.

Coca Cola

Gross profit

Margin

June 29, 2018

2nd Quarter

March 30,

2018

1st Quarter

December 31,

2017

4th quarter

September 29

2017

3rd Quarter

June 30 2017

2nd Quarter

Revenue

Change

-7.99% -16.36% -20.16% -14.62% -15.92%

Gross Profit

Change

-6.09% -12.79% -14.11% -12.6% -14.5%

Gross Profit

margin

63.57% 64.1% 64.2% 62.6% 62.29%

Gross Profit

margin Total

Ranking

#480 #1665 #1759 #1846 #1790

Revenue

Change

17.06% 1.52% -17.25% -6.43% 6.4%

Gross Profit

Change

16.1% 1.35% -15.13% -5.96% 7.81%

COST ACCOUNTING

countries. Thus in a short and brief statement its business can be easily identified with the

number of companies it has under its fold and the number of workers working under the

management of the company (Sekaran & Bougie, 2016).

Gross Margin and Cost of the Product

Gross Profit margin is the financial metric that determines the financial health of the

company. It also determines the business model that the company follows by revealing the

proportion of the money that is left over from the revenues after accounting for the cost of the

different types of goods sold by the company (Andrews & Shimp 2017). However the following

project aims to determine the profit margin of the selected product. According to the annual

reports of Coca Cola Company, the organization has managed to improve the revenue

sequentially to $8927 million by an increase of 17.06% faster than the increase in the gross profit

of the company which is close to 16.1% that sums up to $5,675 million. The following activity

led to the contraction in the gross profit margin to 63.57%. The quarterly gross profit margin

remained around the average rate of 62.07%.

Coca Cola

Gross profit

Margin

June 29, 2018

2nd Quarter

March 30,

2018

1st Quarter

December 31,

2017

4th quarter

September 29

2017

3rd Quarter

June 30 2017

2nd Quarter

Revenue

Change

-7.99% -16.36% -20.16% -14.62% -15.92%

Gross Profit

Change

-6.09% -12.79% -14.11% -12.6% -14.5%

Gross Profit

margin

63.57% 64.1% 64.2% 62.6% 62.29%

Gross Profit

margin Total

Ranking

#480 #1665 #1759 #1846 #1790

Revenue

Change

17.06% 1.52% -17.25% -6.43% 6.4%

Gross Profit

Change

16.1% 1.35% -15.13% -5.96% 7.81%

6

COST ACCOUNTING

Table No 1: Table of Gross Profit Margin of Coke

Source: (Hansen, 2016)

Figure 1: Gross profit margin of Coke

Source: (Eccles & Serafeim, 2015)

The gross profit margin of the company stands at 63.57% which is quite impressive.

However the management of the company in different geographical locations of the globe

decides the price of the products depending upon a number of different factors. This includes the

likes of;

Product demand of the public Price that gives the maximum revenue Price should be determined according to the competitors prices

COST ACCOUNTING

Table No 1: Table of Gross Profit Margin of Coke

Source: (Hansen, 2016)

Figure 1: Gross profit margin of Coke

Source: (Eccles & Serafeim, 2015)

The gross profit margin of the company stands at 63.57% which is quite impressive.

However the management of the company in different geographical locations of the globe

decides the price of the products depending upon a number of different factors. This includes the

likes of;

Product demand of the public Price that gives the maximum revenue Price should be determined according to the competitors prices

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

COST ACCOUNTING

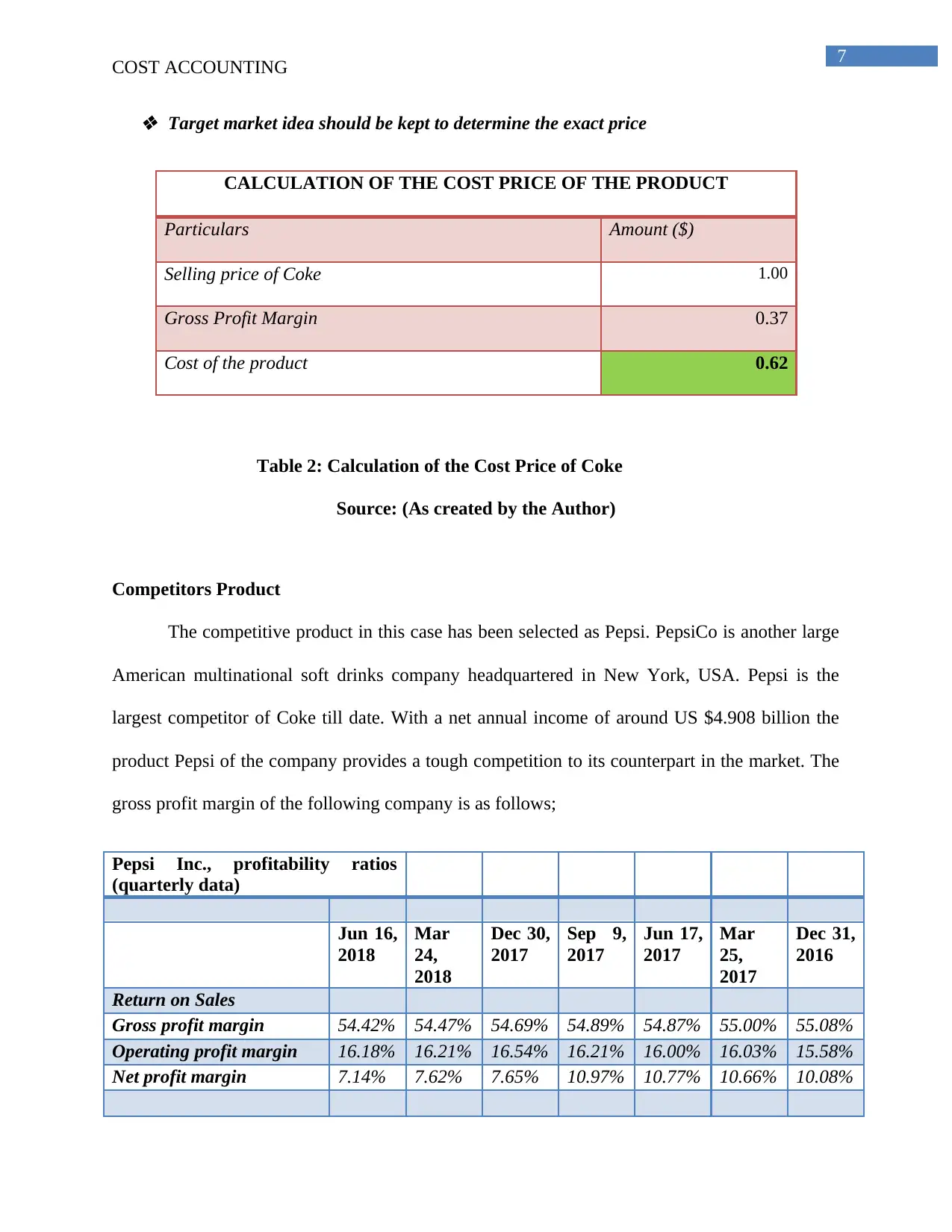

Target market idea should be kept to determine the exact price

CALCULATION OF THE COST PRICE OF THE PRODUCT

Particulars Amount ($)

Selling price of Coke 1.00

Gross Profit Margin 0.37

Cost of the product 0.62

Table 2: Calculation of the Cost Price of Coke

Source: (As created by the Author)

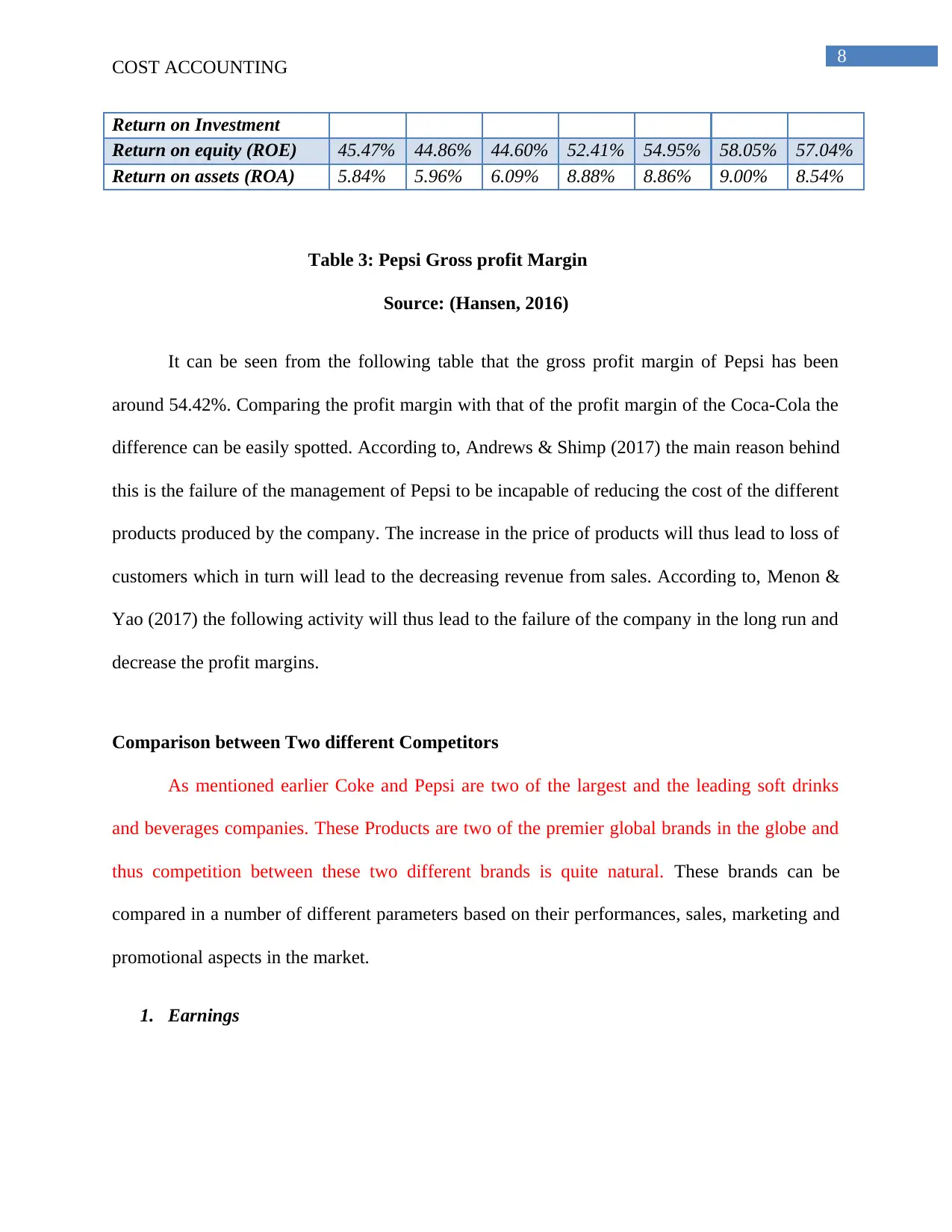

Competitors Product

The competitive product in this case has been selected as Pepsi. PepsiCo is another large

American multinational soft drinks company headquartered in New York, USA. Pepsi is the

largest competitor of Coke till date. With a net annual income of around US $4.908 billion the

product Pepsi of the company provides a tough competition to its counterpart in the market. The

gross profit margin of the following company is as follows;

Pepsi Inc., profitability ratios

(quarterly data)

Jun 16,

2018

Mar

24,

2018

Dec 30,

2017

Sep 9,

2017

Jun 17,

2017

Mar

25,

2017

Dec 31,

2016

Return on Sales

Gross profit margin 54.42% 54.47% 54.69% 54.89% 54.87% 55.00% 55.08%

Operating profit margin 16.18% 16.21% 16.54% 16.21% 16.00% 16.03% 15.58%

Net profit margin 7.14% 7.62% 7.65% 10.97% 10.77% 10.66% 10.08%

COST ACCOUNTING

Target market idea should be kept to determine the exact price

CALCULATION OF THE COST PRICE OF THE PRODUCT

Particulars Amount ($)

Selling price of Coke 1.00

Gross Profit Margin 0.37

Cost of the product 0.62

Table 2: Calculation of the Cost Price of Coke

Source: (As created by the Author)

Competitors Product

The competitive product in this case has been selected as Pepsi. PepsiCo is another large

American multinational soft drinks company headquartered in New York, USA. Pepsi is the

largest competitor of Coke till date. With a net annual income of around US $4.908 billion the

product Pepsi of the company provides a tough competition to its counterpart in the market. The

gross profit margin of the following company is as follows;

Pepsi Inc., profitability ratios

(quarterly data)

Jun 16,

2018

Mar

24,

2018

Dec 30,

2017

Sep 9,

2017

Jun 17,

2017

Mar

25,

2017

Dec 31,

2016

Return on Sales

Gross profit margin 54.42% 54.47% 54.69% 54.89% 54.87% 55.00% 55.08%

Operating profit margin 16.18% 16.21% 16.54% 16.21% 16.00% 16.03% 15.58%

Net profit margin 7.14% 7.62% 7.65% 10.97% 10.77% 10.66% 10.08%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

COST ACCOUNTING

Return on Investment

Return on equity (ROE) 45.47% 44.86% 44.60% 52.41% 54.95% 58.05% 57.04%

Return on assets (ROA) 5.84% 5.96% 6.09% 8.88% 8.86% 9.00% 8.54%

Table 3: Pepsi Gross profit Margin

Source: (Hansen, 2016)

It can be seen from the following table that the gross profit margin of Pepsi has been

around 54.42%. Comparing the profit margin with that of the profit margin of the Coca-Cola the

difference can be easily spotted. According to, Andrews & Shimp (2017) the main reason behind

this is the failure of the management of Pepsi to be incapable of reducing the cost of the different

products produced by the company. The increase in the price of products will thus lead to loss of

customers which in turn will lead to the decreasing revenue from sales. According to, Menon &

Yao (2017) the following activity will thus lead to the failure of the company in the long run and

decrease the profit margins.

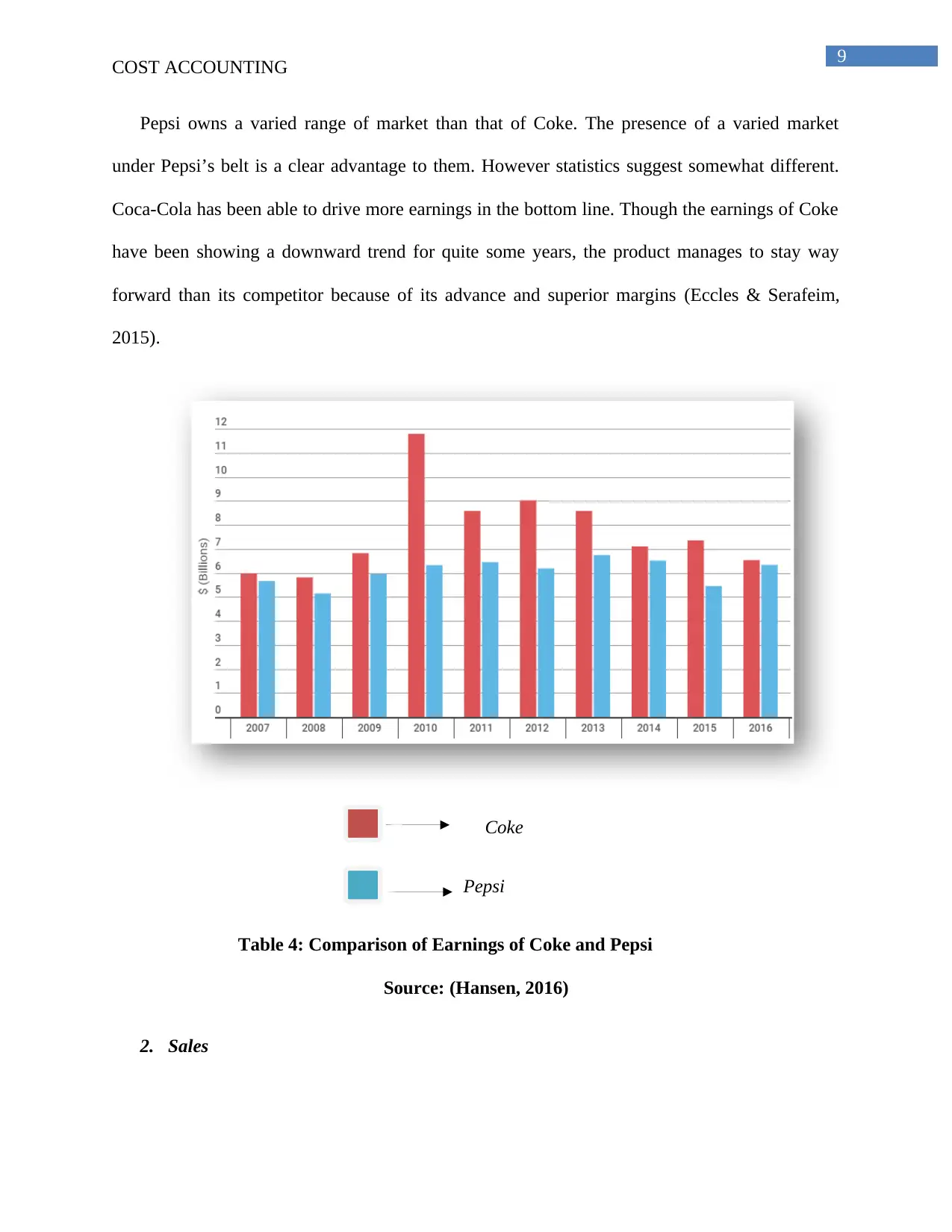

Comparison between Two different Competitors

As mentioned earlier Coke and Pepsi are two of the largest and the leading soft drinks

and beverages companies. These Products are two of the premier global brands in the globe and

thus competition between these two different brands is quite natural. These brands can be

compared in a number of different parameters based on their performances, sales, marketing and

promotional aspects in the market.

1. Earnings

COST ACCOUNTING

Return on Investment

Return on equity (ROE) 45.47% 44.86% 44.60% 52.41% 54.95% 58.05% 57.04%

Return on assets (ROA) 5.84% 5.96% 6.09% 8.88% 8.86% 9.00% 8.54%

Table 3: Pepsi Gross profit Margin

Source: (Hansen, 2016)

It can be seen from the following table that the gross profit margin of Pepsi has been

around 54.42%. Comparing the profit margin with that of the profit margin of the Coca-Cola the

difference can be easily spotted. According to, Andrews & Shimp (2017) the main reason behind

this is the failure of the management of Pepsi to be incapable of reducing the cost of the different

products produced by the company. The increase in the price of products will thus lead to loss of

customers which in turn will lead to the decreasing revenue from sales. According to, Menon &

Yao (2017) the following activity will thus lead to the failure of the company in the long run and

decrease the profit margins.

Comparison between Two different Competitors

As mentioned earlier Coke and Pepsi are two of the largest and the leading soft drinks

and beverages companies. These Products are two of the premier global brands in the globe and

thus competition between these two different brands is quite natural. These brands can be

compared in a number of different parameters based on their performances, sales, marketing and

promotional aspects in the market.

1. Earnings

9

COST ACCOUNTING

Pepsi owns a varied range of market than that of Coke. The presence of a varied market

under Pepsi’s belt is a clear advantage to them. However statistics suggest somewhat different.

Coca-Cola has been able to drive more earnings in the bottom line. Though the earnings of Coke

have been showing a downward trend for quite some years, the product manages to stay way

forward than its competitor because of its advance and superior margins (Eccles & Serafeim,

2015).

Coke

Pepsi

Table 4: Comparison of Earnings of Coke and Pepsi

Source: (Hansen, 2016)

2. Sales

COST ACCOUNTING

Pepsi owns a varied range of market than that of Coke. The presence of a varied market

under Pepsi’s belt is a clear advantage to them. However statistics suggest somewhat different.

Coca-Cola has been able to drive more earnings in the bottom line. Though the earnings of Coke

have been showing a downward trend for quite some years, the product manages to stay way

forward than its competitor because of its advance and superior margins (Eccles & Serafeim,

2015).

Coke

Pepsi

Table 4: Comparison of Earnings of Coke and Pepsi

Source: (Hansen, 2016)

2. Sales

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

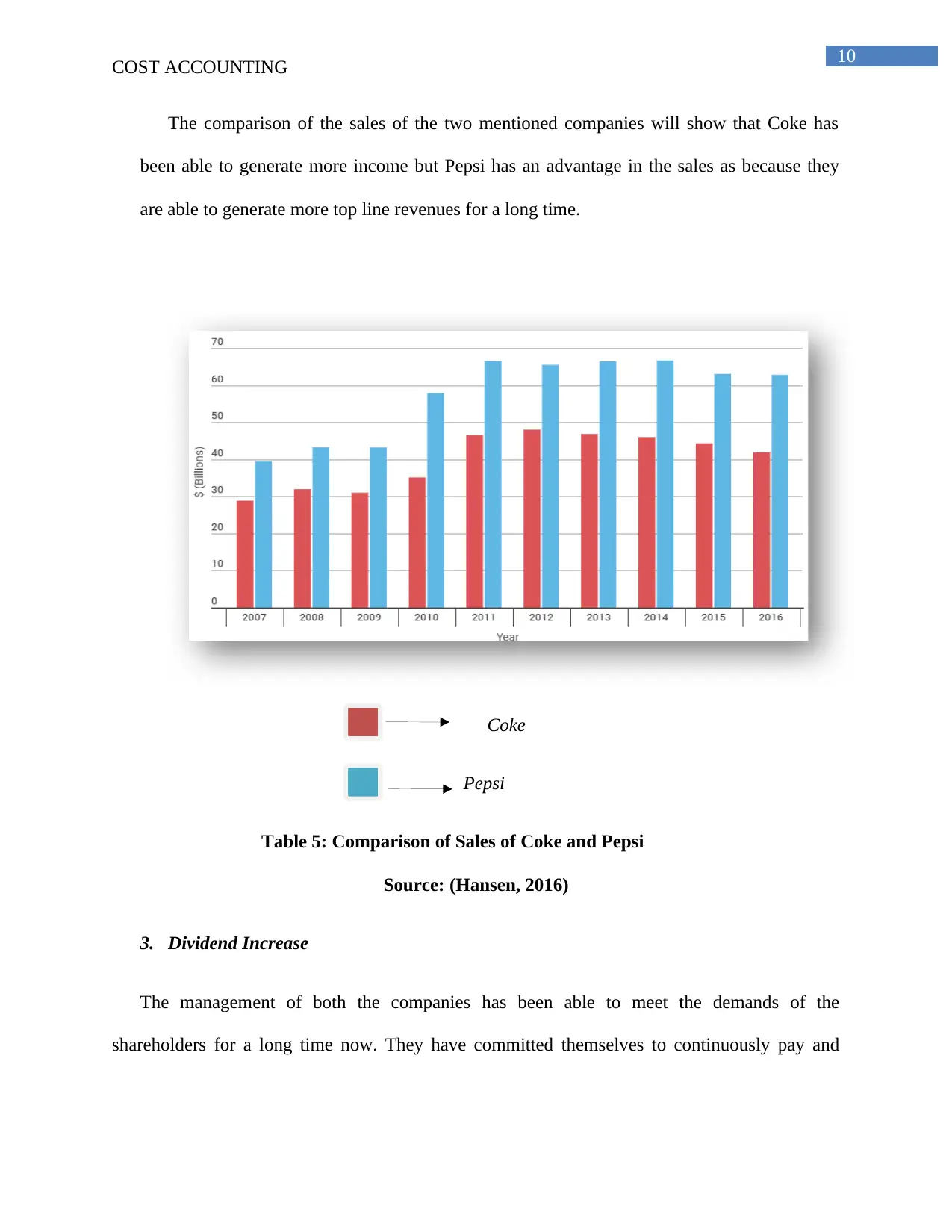

10

COST ACCOUNTING

The comparison of the sales of the two mentioned companies will show that Coke has

been able to generate more income but Pepsi has an advantage in the sales as because they

are able to generate more top line revenues for a long time.

Coke

Pepsi

Table 5: Comparison of Sales of Coke and Pepsi

Source: (Hansen, 2016)

3. Dividend Increase

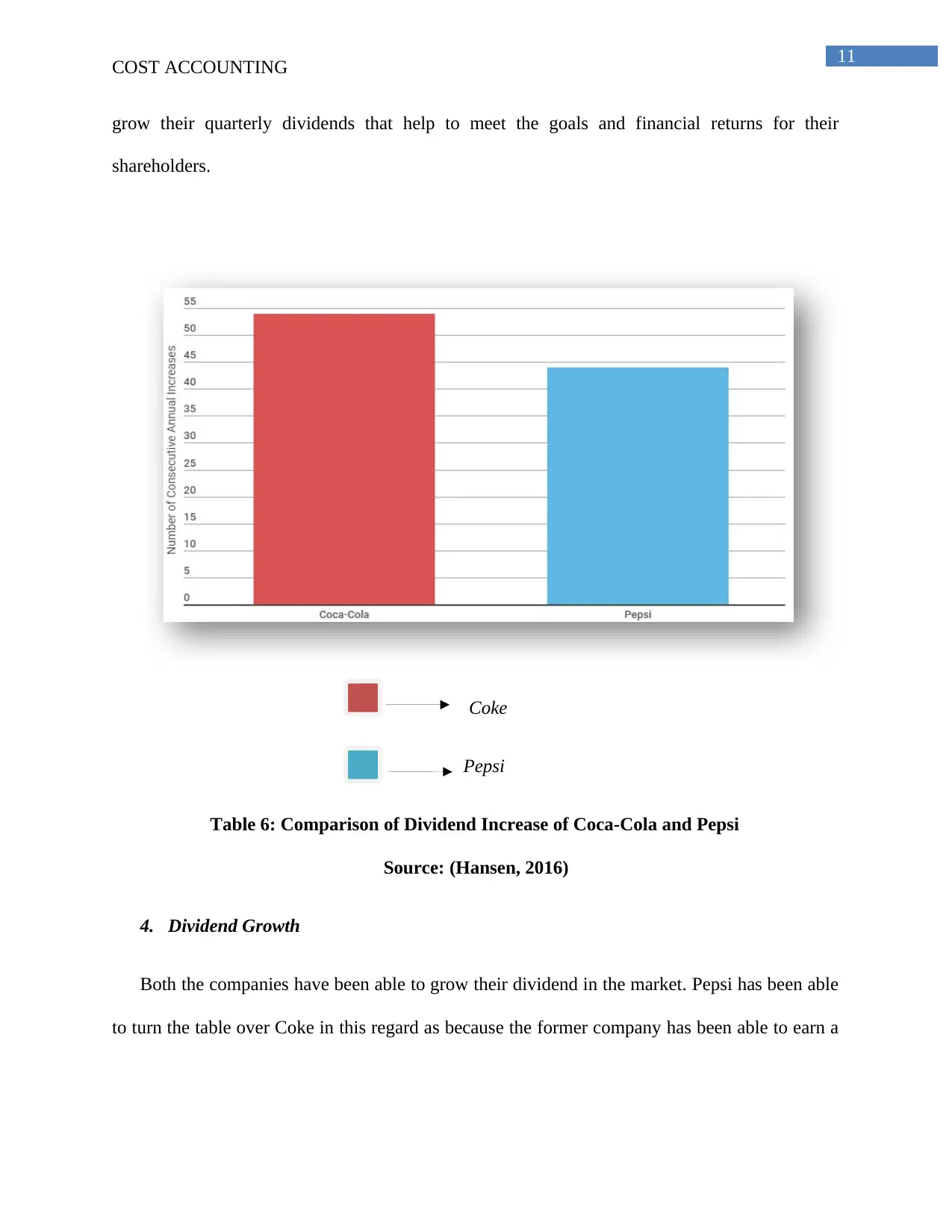

The management of both the companies has been able to meet the demands of the

shareholders for a long time now. They have committed themselves to continuously pay and

COST ACCOUNTING

The comparison of the sales of the two mentioned companies will show that Coke has

been able to generate more income but Pepsi has an advantage in the sales as because they

are able to generate more top line revenues for a long time.

Coke

Pepsi

Table 5: Comparison of Sales of Coke and Pepsi

Source: (Hansen, 2016)

3. Dividend Increase

The management of both the companies has been able to meet the demands of the

shareholders for a long time now. They have committed themselves to continuously pay and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

COST ACCOUNTING

grow their quarterly dividends that help to meet the goals and financial returns for their

shareholders.

Coke

Pepsi

Table 6: Comparison of Dividend Increase of Coca-Cola and Pepsi

Source: (Hansen, 2016)

4. Dividend Growth

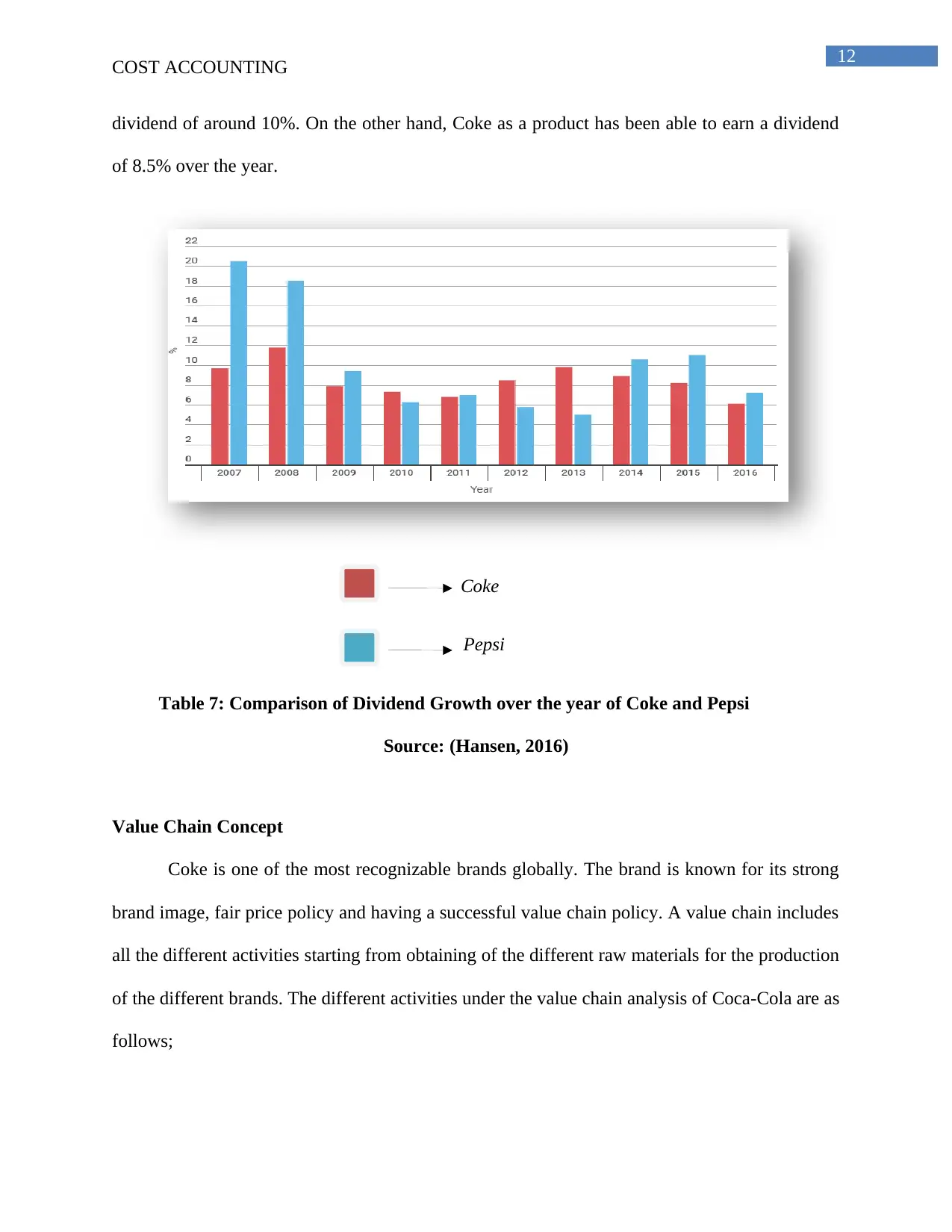

Both the companies have been able to grow their dividend in the market. Pepsi has been able

to turn the table over Coke in this regard as because the former company has been able to earn a

COST ACCOUNTING

grow their quarterly dividends that help to meet the goals and financial returns for their

shareholders.

Coke

Pepsi

Table 6: Comparison of Dividend Increase of Coca-Cola and Pepsi

Source: (Hansen, 2016)

4. Dividend Growth

Both the companies have been able to grow their dividend in the market. Pepsi has been able

to turn the table over Coke in this regard as because the former company has been able to earn a

12

COST ACCOUNTING

dividend of around 10%. On the other hand, Coke as a product has been able to earn a dividend

of 8.5% over the year.

Coke

Pepsi

Table 7: Comparison of Dividend Growth over the year of Coke and Pepsi

Source: (Hansen, 2016)

Value Chain Concept

Coke is one of the most recognizable brands globally. The brand is known for its strong

brand image, fair price policy and having a successful value chain policy. A value chain includes

all the different activities starting from obtaining of the different raw materials for the production

of the different brands. The different activities under the value chain analysis of Coca-Cola are as

follows;

COST ACCOUNTING

dividend of around 10%. On the other hand, Coke as a product has been able to earn a dividend

of 8.5% over the year.

Coke

Pepsi

Table 7: Comparison of Dividend Growth over the year of Coke and Pepsi

Source: (Hansen, 2016)

Value Chain Concept

Coke is one of the most recognizable brands globally. The brand is known for its strong

brand image, fair price policy and having a successful value chain policy. A value chain includes

all the different activities starting from obtaining of the different raw materials for the production

of the different brands. The different activities under the value chain analysis of Coca-Cola are as

follows;

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.