External Influences on Shell Petroleum Operations

VerifiedAdded on 2023/03/31

|9

|2192

|208

AI Summary

This document discusses the external influences on Shell petroleum operations, including the impact of competition and globalization. It explores the current competition landscape and the effects of globalization on the company's operations. The document also highlights Shell's poor ethical behavior and the potential benefits of being an ethical company. A cost benefit analysis chart is included to illustrate the financial implications of environmental costs and benefits. References are provided for further reading.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

EXTERNAL INFLUENCES

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

Contents

Task 1....................................................................................................................................................1

Executive Summary...........................................................................................................................1

Current competition impact...............................................................................................................2

Globalisation and its effect on Shell petroleum operations................................................................2

Task 2....................................................................................................................................................3

Impact of Shell’s poor ethical behaviour...........................................................................................3

If Shell was a very ethical firm..........................................................................................................4

Cost Benefit analysis chart................................................................................................................4

Conclusion.............................................................................................................................................5

References.............................................................................................................................................6

Contents

Task 1....................................................................................................................................................1

Executive Summary...........................................................................................................................1

Current competition impact...............................................................................................................2

Globalisation and its effect on Shell petroleum operations................................................................2

Task 2....................................................................................................................................................3

Impact of Shell’s poor ethical behaviour...........................................................................................3

If Shell was a very ethical firm..........................................................................................................4

Cost Benefit analysis chart................................................................................................................4

Conclusion.............................................................................................................................................5

References.............................................................................................................................................6

2

Task 1

Executive Summary

Royal Dutch Shell plc. also known by the name Shell and it is a British-Dutch oil and gas

firm. This company was established back in the year 1907 by merger of Netherland’s Royal

Dutch Petroleum company and United Kingdom’s “Shell” Transport and Trading Company.

This company first entered into the chemical industry in the year 1929. It is one of the six

major oil and gas firm and it is the fifth largest in terms of revenue. In 2013, its revenue was

around 84% of the Dutch national $556 billion GDP. This company is vertically integrated

and is highly active in the different regions of oil and gas industry (Schifferes, 2007). This

includes production, transportation, petrochemicals, trading, exploration, refining, marketing

and distribution and power generation. It is having renewable energy activities that include

hydrogen, wind biofuels and energy-kite systems. This company does operations in over 70

nations and it produces approx. 3.7 million barrels of oil equivalent per day. They are having

44,000 service stations throughout the world. This company till the year 2014 had a total

proved reserves of around 13.7 billion barrels of oil equivalent.

In the recent decades exploration and production of gas has become extensively essential for

this firm’s business. After acquisition of BG group in the year 2016, this company became

the largest producer of the liquefied natural gas. This company has primary listing on the

London Stock Exchange and is a part of the FTSE 100 index (Shell, 2018). This company is

organised into four major business groupings namely upstream (It searches for and recovers

crude oil and natural gas and also operates the midstream and upstream infrastructure that is

crucial for delivering oil and gas to the market), Integrated gas and new engines, Downstream

(manages manufacturing, distribution and marketing of Shell for chemical and oil products),

Project and technology (manages the delivery of major projects of Shell) (Topmba, 2014).

Apart from all stages of vertical integration their other competencies lies in natural gas.

Vertical integration business model gives significant barriers to entry and economies of scale.

Their full year profits in 2018 jumped by around 36% to reach to $21.4 billion. National

competitors of Shell include British Petroleum, Opus Energy, Calor Gas, New World Oil and

Gas, Ophir Energy, Petroceltic international etc. International competitors of Shell includes

Valero energy, Citgo, Chevron, DCP Midstream partners, Conocophilips, Repsol,

HollyFrontier etc (Shell, 2018).

Task 1

Executive Summary

Royal Dutch Shell plc. also known by the name Shell and it is a British-Dutch oil and gas

firm. This company was established back in the year 1907 by merger of Netherland’s Royal

Dutch Petroleum company and United Kingdom’s “Shell” Transport and Trading Company.

This company first entered into the chemical industry in the year 1929. It is one of the six

major oil and gas firm and it is the fifth largest in terms of revenue. In 2013, its revenue was

around 84% of the Dutch national $556 billion GDP. This company is vertically integrated

and is highly active in the different regions of oil and gas industry (Schifferes, 2007). This

includes production, transportation, petrochemicals, trading, exploration, refining, marketing

and distribution and power generation. It is having renewable energy activities that include

hydrogen, wind biofuels and energy-kite systems. This company does operations in over 70

nations and it produces approx. 3.7 million barrels of oil equivalent per day. They are having

44,000 service stations throughout the world. This company till the year 2014 had a total

proved reserves of around 13.7 billion barrels of oil equivalent.

In the recent decades exploration and production of gas has become extensively essential for

this firm’s business. After acquisition of BG group in the year 2016, this company became

the largest producer of the liquefied natural gas. This company has primary listing on the

London Stock Exchange and is a part of the FTSE 100 index (Shell, 2018). This company is

organised into four major business groupings namely upstream (It searches for and recovers

crude oil and natural gas and also operates the midstream and upstream infrastructure that is

crucial for delivering oil and gas to the market), Integrated gas and new engines, Downstream

(manages manufacturing, distribution and marketing of Shell for chemical and oil products),

Project and technology (manages the delivery of major projects of Shell) (Topmba, 2014).

Apart from all stages of vertical integration their other competencies lies in natural gas.

Vertical integration business model gives significant barriers to entry and economies of scale.

Their full year profits in 2018 jumped by around 36% to reach to $21.4 billion. National

competitors of Shell include British Petroleum, Opus Energy, Calor Gas, New World Oil and

Gas, Ophir Energy, Petroceltic international etc. International competitors of Shell includes

Valero energy, Citgo, Chevron, DCP Midstream partners, Conocophilips, Repsol,

HollyFrontier etc (Shell, 2018).

3

Current competition impact

Shell is facing many types of competition from different competitors from both multi-

national and national firms. There are many firms that are finding new markets in different

parts of the world and hence the competition in the industry has become cut-throat. The first

impact can be seen from the fact that oil and gas resources of the world are continuously

decreasing (Brown, 2017). This decrease in the available oil and gas resource has resulted in

a tension for the firm as they will have to look for new oil reserves. Deep ocean explorations

are highly expensive but Shell has to do this in order to succeed in the market.

In the time when the economy of Britain and Europe is not showing too much growth, huge

investments are always at risk especially when the growth opportunities have been limited by

the amount of competition. This high competition has reduced the profit margins of the

company as companies are forced to reduce their oil and gas prices. This competition is

further high in the upstream sector. It is also to be noted that this competition has forced the

company to make regular changes in their strategies and also in the business process

(O’Callaghan, 2016). This has increased the pressure on the management to stay ahead of

their competitors. This competition has also subjected the company to ensure that they do not

compromise with quality of the oil and gas. The competition has also forced the firms to look

at improving resources and capabilities because it is this resources and capabilities that give a

firm to gain competitive advantage over the rivals. The competition has also affected the

company in terms of sustainability. This is because all the companies are in a race to be

largest oil and gas producing company and also selling it in the market. For this, they are

exploiting their available oil reserves at the maximum possible levels which are acting as a

threat for their sustainability and also for the environment (Ekatah, et al. 2011). This national

and international competition has also forced Shell to do cost cuts in many areas of operation

so as to enhance their revenue.

Globalisation and its effect on Shell petroleum operations

Globalisation is understood as the process of integration and interaction among firms,

governments, companies and individuals at the worldwide level. Globalisation has acted as a

most powerful force that helped company to expand their business in different parts of the

world. Since the trade rules are made easier hence the companies can sell their products in

other parts of the world with their available resources (Cramer, 2017). At the same time,

globalisation is empowered by technology which again allows the company to do business at

the global levels effectively.

Current competition impact

Shell is facing many types of competition from different competitors from both multi-

national and national firms. There are many firms that are finding new markets in different

parts of the world and hence the competition in the industry has become cut-throat. The first

impact can be seen from the fact that oil and gas resources of the world are continuously

decreasing (Brown, 2017). This decrease in the available oil and gas resource has resulted in

a tension for the firm as they will have to look for new oil reserves. Deep ocean explorations

are highly expensive but Shell has to do this in order to succeed in the market.

In the time when the economy of Britain and Europe is not showing too much growth, huge

investments are always at risk especially when the growth opportunities have been limited by

the amount of competition. This high competition has reduced the profit margins of the

company as companies are forced to reduce their oil and gas prices. This competition is

further high in the upstream sector. It is also to be noted that this competition has forced the

company to make regular changes in their strategies and also in the business process

(O’Callaghan, 2016). This has increased the pressure on the management to stay ahead of

their competitors. This competition has also subjected the company to ensure that they do not

compromise with quality of the oil and gas. The competition has also forced the firms to look

at improving resources and capabilities because it is this resources and capabilities that give a

firm to gain competitive advantage over the rivals. The competition has also affected the

company in terms of sustainability. This is because all the companies are in a race to be

largest oil and gas producing company and also selling it in the market. For this, they are

exploiting their available oil reserves at the maximum possible levels which are acting as a

threat for their sustainability and also for the environment (Ekatah, et al. 2011). This national

and international competition has also forced Shell to do cost cuts in many areas of operation

so as to enhance their revenue.

Globalisation and its effect on Shell petroleum operations

Globalisation is understood as the process of integration and interaction among firms,

governments, companies and individuals at the worldwide level. Globalisation has acted as a

most powerful force that helped company to expand their business in different parts of the

world. Since the trade rules are made easier hence the companies can sell their products in

other parts of the world with their available resources (Cramer, 2017). At the same time,

globalisation is empowered by technology which again allows the company to do business at

the global levels effectively.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

Shell being a multinational firm has its operations in different parts of the world.

Globalisation has helped the company to do business in a larger part of the world with limited

use of resources (Lee and Kim, 2014). For instance previously companies had to set up their

units in that particular country for doing their business but due to globalisation, they could

produce in one part of the world and can sell in any part of the world. Due to globalisation,

Shell has been able to add investors from other parts of the world. This increased their

chances of exploiting opportunities available at the global levels (Meredith, 2019).

Globalisation has also given chance to the company to find out new supply chain routes that

reduce their cost of delivery of their products and also maintain a balance between the

demand and supply. For instance OPEC countries have decided to reduce their production in

that case Shell can move in some other part of the world to meet their production demands.

Globalisation also had impact on the policies made by the firm. This can be understood in

terms of the fact that now the company has to rethink about their strategies in the global

perspective especially when it comes to areas such as legal and environmental concerns

(Donovan, 2013). Otherwise it might create controversy in any other part of the world.

Globalisation has allowed Shell to improve their partnership and add new partners in some

other parts of the world.

Task 2

Impact of Shell’s poor ethical behaviour

Shell has faced many unethical issues in different parts of the world. One of the practices in

Nigeria of which Shell was accused off was a bribery practice for gaining profits. Shell

bribed Nigerian officials so that their import of equipment and goods can become easier for

them. Officials in return would take lower taxes from them and also avoid customs. Shell

gained around $14 million profits from this bribery but ultimately they had to pay $48.1

million dollars for settling the probe by U.S. justice department. In the larger context it was a

loss to the company which affected their profits in the country. In India they have been using

unethical practices with their retailers (Upadhyay and Singh, 2010).

Another unethical behaviour was seen from the incident in January 2004 where Shell gave a

misleading statement about its reserves for which they had to pay $120 million as a fine

(Floros and Sapp, 2011). This again was a burden to their profit share. This also had impact

on the image of the firm. This company is not spending too much money on the environment

Shell being a multinational firm has its operations in different parts of the world.

Globalisation has helped the company to do business in a larger part of the world with limited

use of resources (Lee and Kim, 2014). For instance previously companies had to set up their

units in that particular country for doing their business but due to globalisation, they could

produce in one part of the world and can sell in any part of the world. Due to globalisation,

Shell has been able to add investors from other parts of the world. This increased their

chances of exploiting opportunities available at the global levels (Meredith, 2019).

Globalisation has also given chance to the company to find out new supply chain routes that

reduce their cost of delivery of their products and also maintain a balance between the

demand and supply. For instance OPEC countries have decided to reduce their production in

that case Shell can move in some other part of the world to meet their production demands.

Globalisation also had impact on the policies made by the firm. This can be understood in

terms of the fact that now the company has to rethink about their strategies in the global

perspective especially when it comes to areas such as legal and environmental concerns

(Donovan, 2013). Otherwise it might create controversy in any other part of the world.

Globalisation has allowed Shell to improve their partnership and add new partners in some

other parts of the world.

Task 2

Impact of Shell’s poor ethical behaviour

Shell has faced many unethical issues in different parts of the world. One of the practices in

Nigeria of which Shell was accused off was a bribery practice for gaining profits. Shell

bribed Nigerian officials so that their import of equipment and goods can become easier for

them. Officials in return would take lower taxes from them and also avoid customs. Shell

gained around $14 million profits from this bribery but ultimately they had to pay $48.1

million dollars for settling the probe by U.S. justice department. In the larger context it was a

loss to the company which affected their profits in the country. In India they have been using

unethical practices with their retailers (Upadhyay and Singh, 2010).

Another unethical behaviour was seen from the incident in January 2004 where Shell gave a

misleading statement about its reserves for which they had to pay $120 million as a fine

(Floros and Sapp, 2011). This again was a burden to their profit share. This also had impact

on the image of the firm. This company is not spending too much money on the environment

5

related concerns. Their practices have had impact on the health of the UK community. They

have also not invested in the initiatives towards climate change which again has impact on

the lives of the people living in UK. Since many of the people in UK are the shareholders of

this company hence these unethical practices will have a long term impact on their interests

(Lindenmeier, Tscheulin and Drevs, 2012). Their lower priorities towards data protection

have kept them at a threat of some major cyber-attack which will have impact on the

communities associated with the firm.

If Shell was a very ethical firm

If Shell was a very ethical company, then the chance of the success of the organisation

increases. This can be understood in terms of the fact that more number of stakeholders

would have come to join the firm. This would increase their chances of growth at much faster

rate. Ethical company always attracts more investors as they are at lowest of risk to failure

due to any kind of agitation against the company (Hassan and Mollah, 2018).

If shell was a very ethical company then it would not have to face the legal charges for which

they had to pay a lot of fine. This is quite a many time, a threat to the profit generation

capacity of the firm. This would have saved a lot of money of the company on the legal

compliances. If Shell was an ethical company it would have been easier for them to control

the image of the company in the market so as to build trust in the minds of consumers which

is very much necessary for success in the market (Gupta, 2017).

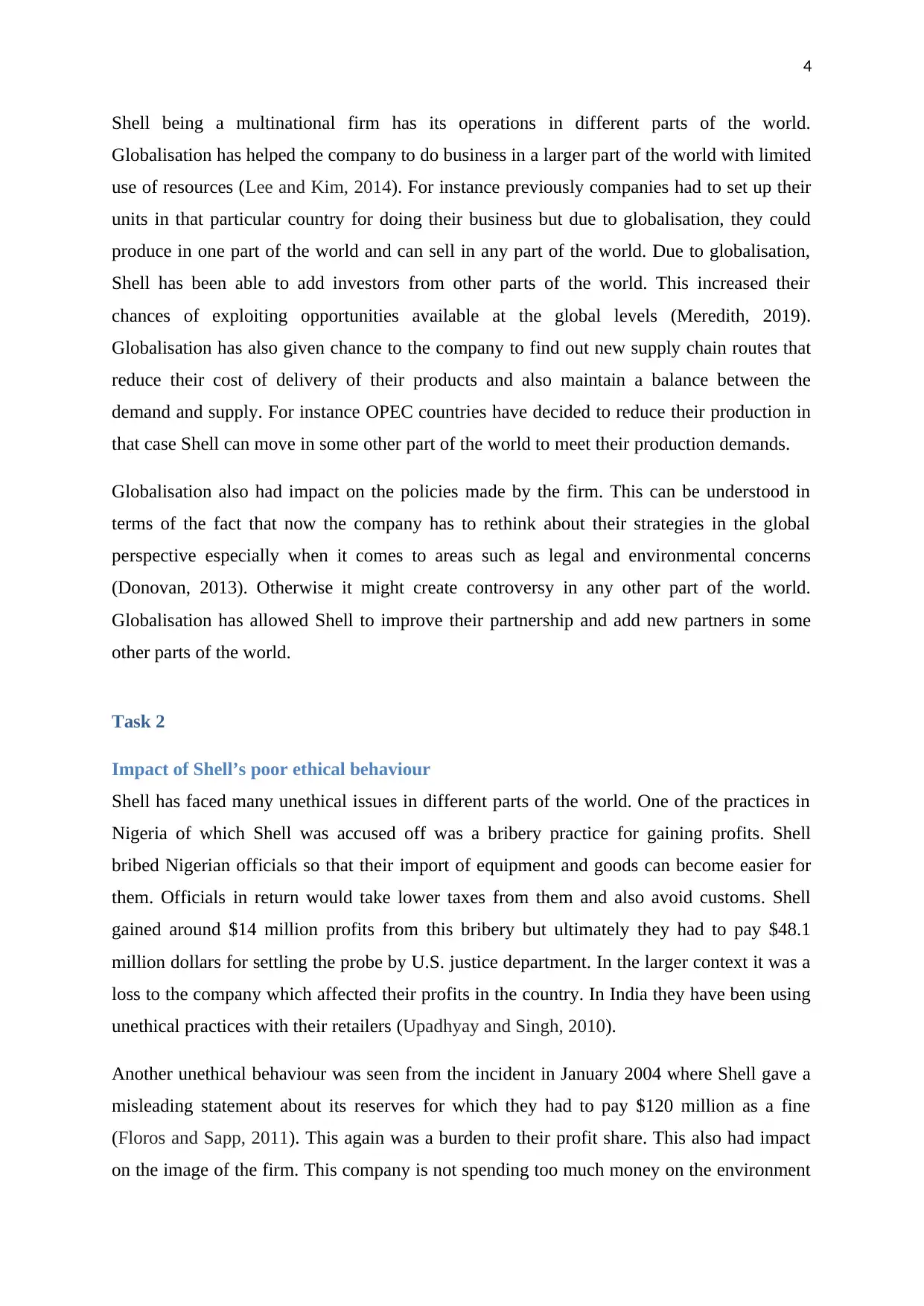

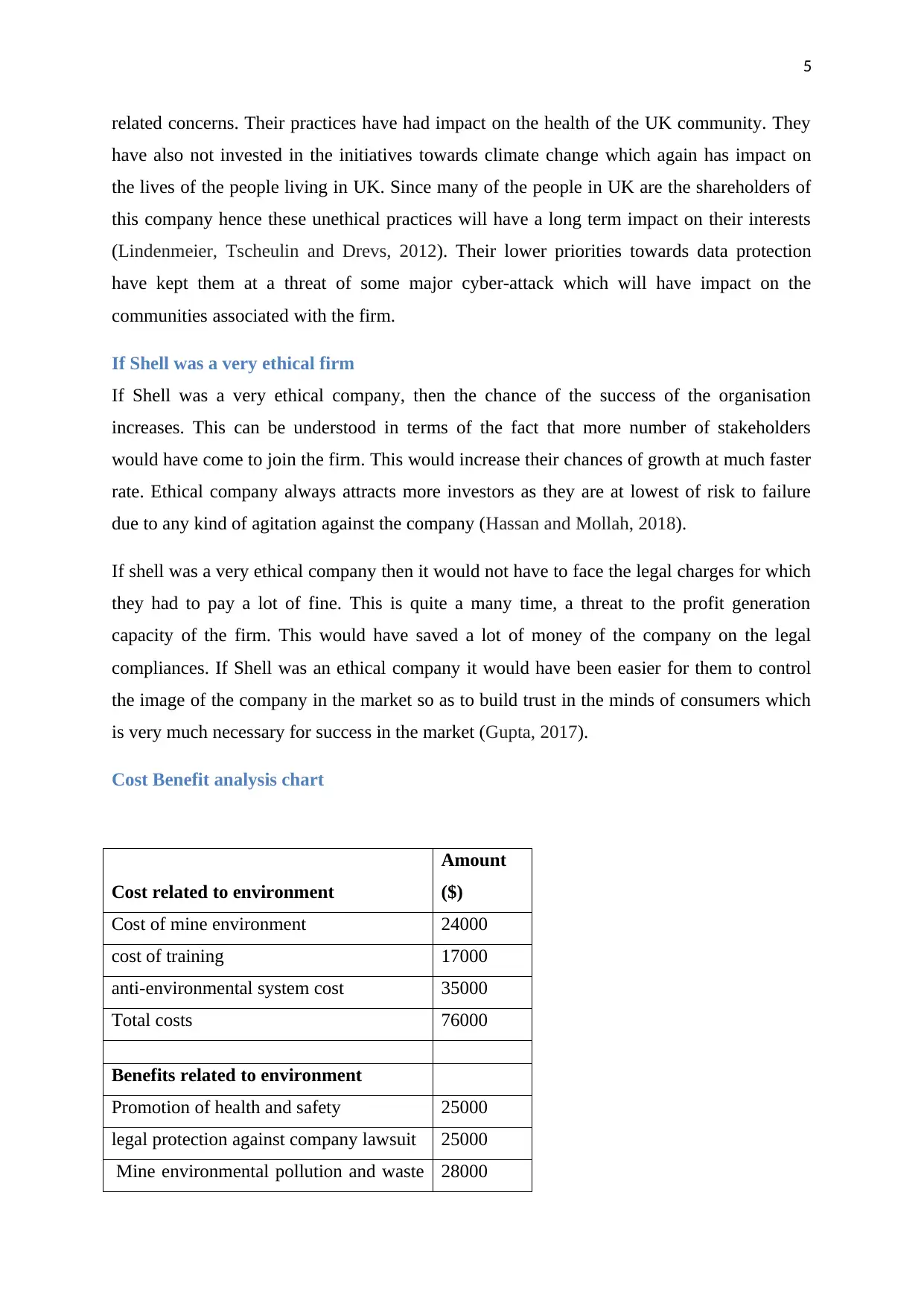

Cost Benefit analysis chart

Cost related to environment

Amount

($)

Cost of mine environment 24000

cost of training 17000

anti-environmental system cost 35000

Total costs 76000

Benefits related to environment

Promotion of health and safety 25000

legal protection against company lawsuit 25000

Mine environmental pollution and waste 28000

related concerns. Their practices have had impact on the health of the UK community. They

have also not invested in the initiatives towards climate change which again has impact on

the lives of the people living in UK. Since many of the people in UK are the shareholders of

this company hence these unethical practices will have a long term impact on their interests

(Lindenmeier, Tscheulin and Drevs, 2012). Their lower priorities towards data protection

have kept them at a threat of some major cyber-attack which will have impact on the

communities associated with the firm.

If Shell was a very ethical firm

If Shell was a very ethical company, then the chance of the success of the organisation

increases. This can be understood in terms of the fact that more number of stakeholders

would have come to join the firm. This would increase their chances of growth at much faster

rate. Ethical company always attracts more investors as they are at lowest of risk to failure

due to any kind of agitation against the company (Hassan and Mollah, 2018).

If shell was a very ethical company then it would not have to face the legal charges for which

they had to pay a lot of fine. This is quite a many time, a threat to the profit generation

capacity of the firm. This would have saved a lot of money of the company on the legal

compliances. If Shell was an ethical company it would have been easier for them to control

the image of the company in the market so as to build trust in the minds of consumers which

is very much necessary for success in the market (Gupta, 2017).

Cost Benefit analysis chart

Cost related to environment

Amount

($)

Cost of mine environment 24000

cost of training 17000

anti-environmental system cost 35000

Total costs 76000

Benefits related to environment

Promotion of health and safety 25000

legal protection against company lawsuit 25000

Mine environmental pollution and waste 28000

6

minimization

prevention of damages to social system 38000

Total benefits 116000

Net cost benefit 40000

As per the above mentioned cost benefit analysis of environment, it can say that this tool can

work effectively to avoid the environmental issues. The total cost such as cost of training,

cost of mine environment and cost of Anti-environmental system set up is 76,000 $. On the

other hand, the total benefits such as Promotion of health and safety, mine environmental

pollution and waste minimization, legal protection against company lawsuit and prevention of

damages to social system will be 116,000 $. The net cost benefit will be 40000 $. It will be

beneficial for this company.

Conclusion

From the above based report it can be concluded that Shell is facing competition from both

national and international competitors. This is having severe impact on the operations of the

firm and it is also affecting the profitability of the company. Shell Company was indulged in

many unethical behaviour which had impact on the business of the company and the

communities that are attached with its operations.

minimization

prevention of damages to social system 38000

Total benefits 116000

Net cost benefit 40000

As per the above mentioned cost benefit analysis of environment, it can say that this tool can

work effectively to avoid the environmental issues. The total cost such as cost of training,

cost of mine environment and cost of Anti-environmental system set up is 76,000 $. On the

other hand, the total benefits such as Promotion of health and safety, mine environmental

pollution and waste minimization, legal protection against company lawsuit and prevention of

damages to social system will be 116,000 $. The net cost benefit will be 40000 $. It will be

beneficial for this company.

Conclusion

From the above based report it can be concluded that Shell is facing competition from both

national and international competitors. This is having severe impact on the operations of the

firm and it is also affecting the profitability of the company. Shell Company was indulged in

many unethical behaviour which had impact on the business of the company and the

communities that are attached with its operations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

References

Brown, D., 2017. Globalisation, ethnicity and the nation-state: The case of Singapore.

In Singapore (pp. 45-56). Routledge.

Cramer, J., 2017. Corporate Social Responsibility and Globalisation: an action plan for

business. Routledge.

Donovan, J. 2013. Shell accused of unethical conduct against Shell retailers in India. [Online]

Available at: https://royaldutchshellplc.com/2013/01/25/shell-accused-of-unethical-conduct-

against-shell-retailers-in-india/. [Accessed on 29th May 2019]

Ekatah, I., Samy, M., Bampton, R. and Halabi, A., 2011. The relationship between corporate

social responsibility and profitability: The case of royal Dutch shell plc. Corporate

Reputation Review, 14(4), pp.249-261.

Floros, I.V. and Sapp, T.R., 2011. Shell games: On the value of shell companies. Journal of

Corporate Finance, 17(4), pp.850-867.

Gupta, K., 2017. Are oil and gas firms more likely to engage in unethical practices than other

firms?. Energy policy, 100, pp.101-112.

Hassan, A. and Mollah, S., 2018. Following the Rules: How Do Islamic and Ethical Investing

Impact Portfolio Performance?. In Islamic Finance (pp. 35-43). Palgrave Macmillan, Cham.

Lee, K.H. and Kim, C.H., 2014. Corporate Social Responsibility (CSR) practice and

implementation within the institutional context: The case of the Republic of Korea.

In Corporate social responsibility in Asia (pp. 65-82). Springer, Cham.

Lindenmeier, J., Tscheulin, D.K. and Drevs, F., 2012. The effects of unethical conduct of

pharmaceutical companies on consumer behavior: Empirical evidence from

Germany. International Journal of Pharmaceutical and Healthcare Marketing, 6(2), pp.108-

123.

Meredith, S. 2019. Shell’s full-year profit surges to four-year high, beats expectations.

[Online] Available at: https://www.cnbc.com/2019/01/31/shell-earnings-full-year-profits-

soar-to-four-year-high.html. [Accessed on 29th May 2019]

O’Callaghan, T., 2016. Reputation risk and globalisation: exploring the idea of a self-

regulating corporation. Edward Elgar Publishing.

References

Brown, D., 2017. Globalisation, ethnicity and the nation-state: The case of Singapore.

In Singapore (pp. 45-56). Routledge.

Cramer, J., 2017. Corporate Social Responsibility and Globalisation: an action plan for

business. Routledge.

Donovan, J. 2013. Shell accused of unethical conduct against Shell retailers in India. [Online]

Available at: https://royaldutchshellplc.com/2013/01/25/shell-accused-of-unethical-conduct-

against-shell-retailers-in-india/. [Accessed on 29th May 2019]

Ekatah, I., Samy, M., Bampton, R. and Halabi, A., 2011. The relationship between corporate

social responsibility and profitability: The case of royal Dutch shell plc. Corporate

Reputation Review, 14(4), pp.249-261.

Floros, I.V. and Sapp, T.R., 2011. Shell games: On the value of shell companies. Journal of

Corporate Finance, 17(4), pp.850-867.

Gupta, K., 2017. Are oil and gas firms more likely to engage in unethical practices than other

firms?. Energy policy, 100, pp.101-112.

Hassan, A. and Mollah, S., 2018. Following the Rules: How Do Islamic and Ethical Investing

Impact Portfolio Performance?. In Islamic Finance (pp. 35-43). Palgrave Macmillan, Cham.

Lee, K.H. and Kim, C.H., 2014. Corporate Social Responsibility (CSR) practice and

implementation within the institutional context: The case of the Republic of Korea.

In Corporate social responsibility in Asia (pp. 65-82). Springer, Cham.

Lindenmeier, J., Tscheulin, D.K. and Drevs, F., 2012. The effects of unethical conduct of

pharmaceutical companies on consumer behavior: Empirical evidence from

Germany. International Journal of Pharmaceutical and Healthcare Marketing, 6(2), pp.108-

123.

Meredith, S. 2019. Shell’s full-year profit surges to four-year high, beats expectations.

[Online] Available at: https://www.cnbc.com/2019/01/31/shell-earnings-full-year-profits-

soar-to-four-year-high.html. [Accessed on 29th May 2019]

O’Callaghan, T., 2016. Reputation risk and globalisation: exploring the idea of a self-

regulating corporation. Edward Elgar Publishing.

8

Schifferes, S. 2007. Globalisation Shakes the World. [Online] Available at:

http://news.bbc.co.uk/2/hi/business/6279679.stm. [Accessed on 29th May 2019]

Shell, 2018. Annual report. [Online] Available at: https://www.shell.com/media/annual-

reports-and-publications.html#iframe=L3JlcG9ydC1ob21lLzIwMTgv. [Accessed on 29th

May 2019]

Topmba, 2014. Business Ethics: What is the Role of Business?. [Online] Available at:

https://www.topmba.com/jobs/career-trends/business-ethics-what-role-business. [Accessed

on 29th May 2019]

Upadhyay, Y. and Singh, S.K., 2010. In favour of ethics in business: the linkage between

ethical behaviour and performance. Journal of Human Values, 16(1), pp.9-19.

Schifferes, S. 2007. Globalisation Shakes the World. [Online] Available at:

http://news.bbc.co.uk/2/hi/business/6279679.stm. [Accessed on 29th May 2019]

Shell, 2018. Annual report. [Online] Available at: https://www.shell.com/media/annual-

reports-and-publications.html#iframe=L3JlcG9ydC1ob21lLzIwMTgv. [Accessed on 29th

May 2019]

Topmba, 2014. Business Ethics: What is the Role of Business?. [Online] Available at:

https://www.topmba.com/jobs/career-trends/business-ethics-what-role-business. [Accessed

on 29th May 2019]

Upadhyay, Y. and Singh, S.K., 2010. In favour of ethics in business: the linkage between

ethical behaviour and performance. Journal of Human Values, 16(1), pp.9-19.

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.