[DOCUMENT] Financial Analysis of Apple Inc.

VerifiedAdded on 2020/10/22

|18

|1325

|176

AI Summary

The provided assignment is a comprehensive financial analysis of Apple Inc. It includes a horizontal analysis of the company's income statement and balance sheet over three years, highlighting increases or decreases in specific items such as sales, gross profit, operating profit, net profit, assets, liabilities, and equity. The vertical analysis provides a percentage comparison of these items to their respective totals. Additionally, the assignment discusses the importance of reuse and recycling, carbon footprint, and carbon emission, with illustrations. It serves as a valuable resource for students seeking past papers and solved assignments on financial analysis.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL ANALYSIS

MANAGEMENT &

ENTREPRENEURSHIP

MANAGEMENT &

ENTREPRENEURSHIP

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Vertical analysis..........................................................................................................................5

Horizontal analysis......................................................................................................................6

2. CSR report of Apple and Samsung.........................................................................................7

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

APPENDIX....................................................................................................................................13

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Vertical analysis..........................................................................................................................5

Horizontal analysis......................................................................................................................6

2. CSR report of Apple and Samsung.........................................................................................7

CONCLUSION..............................................................................................................................10

REFERENCES..............................................................................................................................11

APPENDIX....................................................................................................................................13

INTRODUCTION

Financial analysis refers to a measurement of stability, profitability of the company.

Chief financial officer prepare report by using key ratio and information would be taken by

financial statement and other report reports. Financial analysis management is essential for take

investment decision by comparing past performance and future performance of the company. It

helps to analysis to meet long term obligations, liquidity. Stability and profitability so company

can achieve goals and objectives. Present report based on financial analysts of apple and

Samsung company both company deals in electronic items like laptop, mobile, I-pad and

refrigerator etc. Apple Company is the largest company all over the world. Financial analysts and

management report includes compare the financial performance and financial position of the

Apple company and Samsung company by using last four years data. It also includes analysis of

their corporate social responsibility sections over the last years.

MAIN BODY

Ratios analysis – It is quantitative analysis that represent financial position and financial

health of the company. It involves evaluating the financial position and performance by

evaluating current data and historical data of the company . It provides liquidity position ,

operational performance, profitability and profitability of the company . It provide information to

customers , investor and employees of the company . It is essential to comparison of one's

company with other company . It is better way to understand profitability and efficiency of the

company.

Profitability ratios- it is use to assess the business earning capacity from the sales of the

company over a specific year. Higher profitability ratio shows positive impact on investors and

customers. It includes net profit margin , gross profit margin etc.

Liquidity ratio- it represents the relationship between current assets and current liabilities.

It shows company have sufficient assets to meet out its current liabilities . Assets must be higher

than liabilities to reduce their debt. It includes quick ratio, current ratios.

Solvency ratios- it measure the companies abilities to meet out its long term debt of the

company. It is mostly used by lenders and investors to determine companies abilities to pay their

debt. It includes equity debt ratios, debt to assets ratio etc.

Ratio analysis of apple

1

Financial analysis refers to a measurement of stability, profitability of the company.

Chief financial officer prepare report by using key ratio and information would be taken by

financial statement and other report reports. Financial analysis management is essential for take

investment decision by comparing past performance and future performance of the company. It

helps to analysis to meet long term obligations, liquidity. Stability and profitability so company

can achieve goals and objectives. Present report based on financial analysts of apple and

Samsung company both company deals in electronic items like laptop, mobile, I-pad and

refrigerator etc. Apple Company is the largest company all over the world. Financial analysts and

management report includes compare the financial performance and financial position of the

Apple company and Samsung company by using last four years data. It also includes analysis of

their corporate social responsibility sections over the last years.

MAIN BODY

Ratios analysis – It is quantitative analysis that represent financial position and financial

health of the company. It involves evaluating the financial position and performance by

evaluating current data and historical data of the company . It provides liquidity position ,

operational performance, profitability and profitability of the company . It provide information to

customers , investor and employees of the company . It is essential to comparison of one's

company with other company . It is better way to understand profitability and efficiency of the

company.

Profitability ratios- it is use to assess the business earning capacity from the sales of the

company over a specific year. Higher profitability ratio shows positive impact on investors and

customers. It includes net profit margin , gross profit margin etc.

Liquidity ratio- it represents the relationship between current assets and current liabilities.

It shows company have sufficient assets to meet out its current liabilities . Assets must be higher

than liabilities to reduce their debt. It includes quick ratio, current ratios.

Solvency ratios- it measure the companies abilities to meet out its long term debt of the

company. It is mostly used by lenders and investors to determine companies abilities to pay their

debt. It includes equity debt ratios, debt to assets ratio etc.

Ratio analysis of apple

1

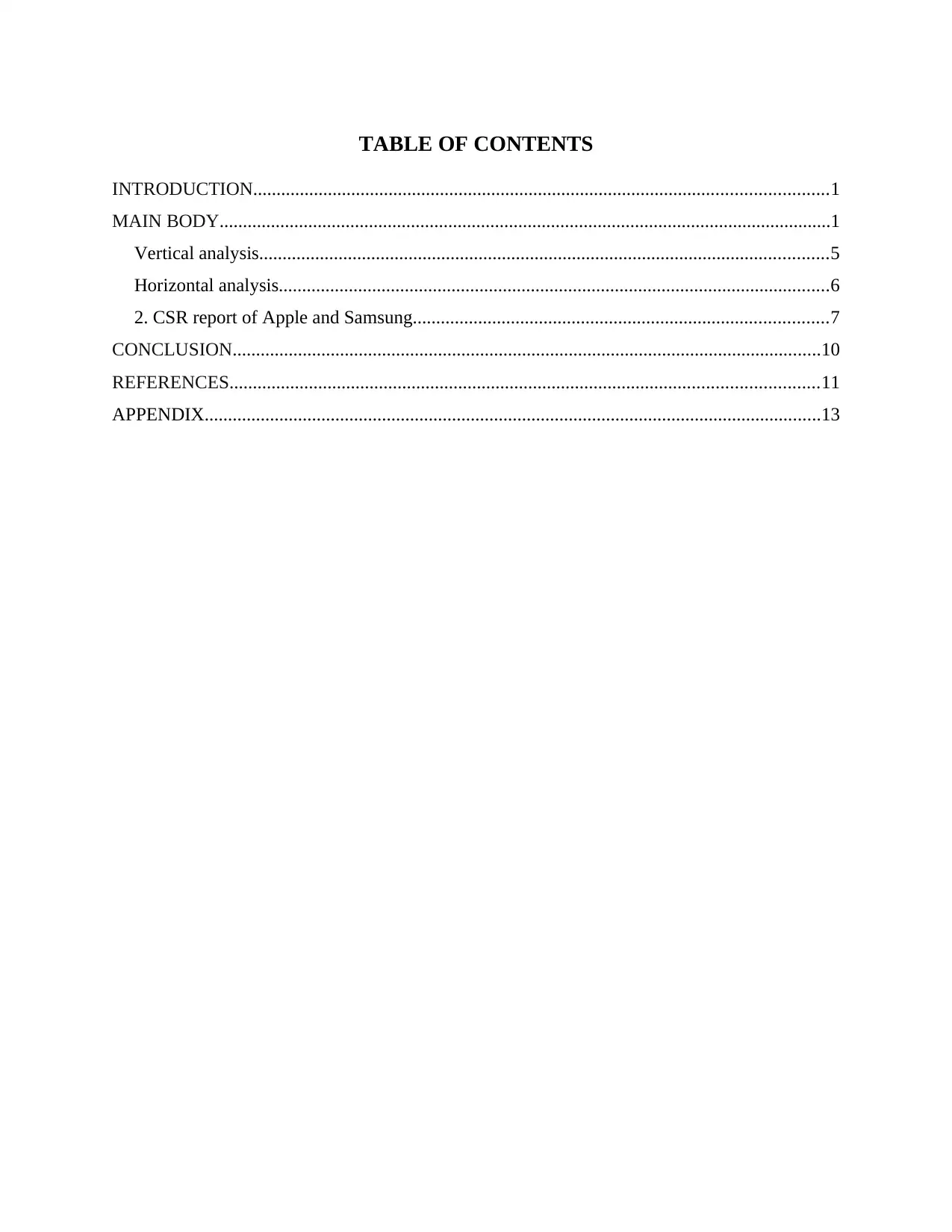

Profitability ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

GP ratio

Gross profit /

sales * 100 38.59% 40.06% 39.08% 38.47%

37.79% 38.46%

40.4

2%

46.0

3%

NP ratio

Net profit /

sales * 100 21.61% 22.85% 21.19% 21.09%

.11.19

%

9.32% 11.1

0%

17.2

6%

Interpretation:

From the above table can evaluate that apple company have 40.06 % it was the Highest

gross profit over the years. However, from 2015 company gross profit ratio decreased year by

year because company fails to manage all direct expenses. On the other hand Samsung follow

strong strategy for adjust direct expenses and purchases of raw material so there is increase in

trends company increase their gross profit ratio from 37.79% to 46.03%.

Net profit ratio represent the relationship between net profits and revenue or net sales of

company. Apple's net profit ratio have been decreasing trends because there indirect expenses

was high rather than indirect receivable. On 2015 net profit ratio was 21.61% but on 2017 net

profit ratio was decrease till 21.09% . On the other hand company indirect expenses was high so

there net profit ratio was lower than other year but from 2016 company was decrease indirect

expenses so net profit ratio was improved.

2

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

GP ratio

Gross profit /

sales * 100 38.59% 40.06% 39.08% 38.47%

37.79% 38.46%

40.4

2%

46.0

3%

NP ratio

Net profit /

sales * 100 21.61% 22.85% 21.19% 21.09%

.11.19

%

9.32% 11.1

0%

17.2

6%

Interpretation:

From the above table can evaluate that apple company have 40.06 % it was the Highest

gross profit over the years. However, from 2015 company gross profit ratio decreased year by

year because company fails to manage all direct expenses. On the other hand Samsung follow

strong strategy for adjust direct expenses and purchases of raw material so there is increase in

trends company increase their gross profit ratio from 37.79% to 46.03%.

Net profit ratio represent the relationship between net profits and revenue or net sales of

company. Apple's net profit ratio have been decreasing trends because there indirect expenses

was high rather than indirect receivable. On 2015 net profit ratio was 21.61% but on 2017 net

profit ratio was decrease till 21.09% . On the other hand company indirect expenses was high so

there net profit ratio was lower than other year but from 2016 company was decrease indirect

expenses so net profit ratio was improved.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

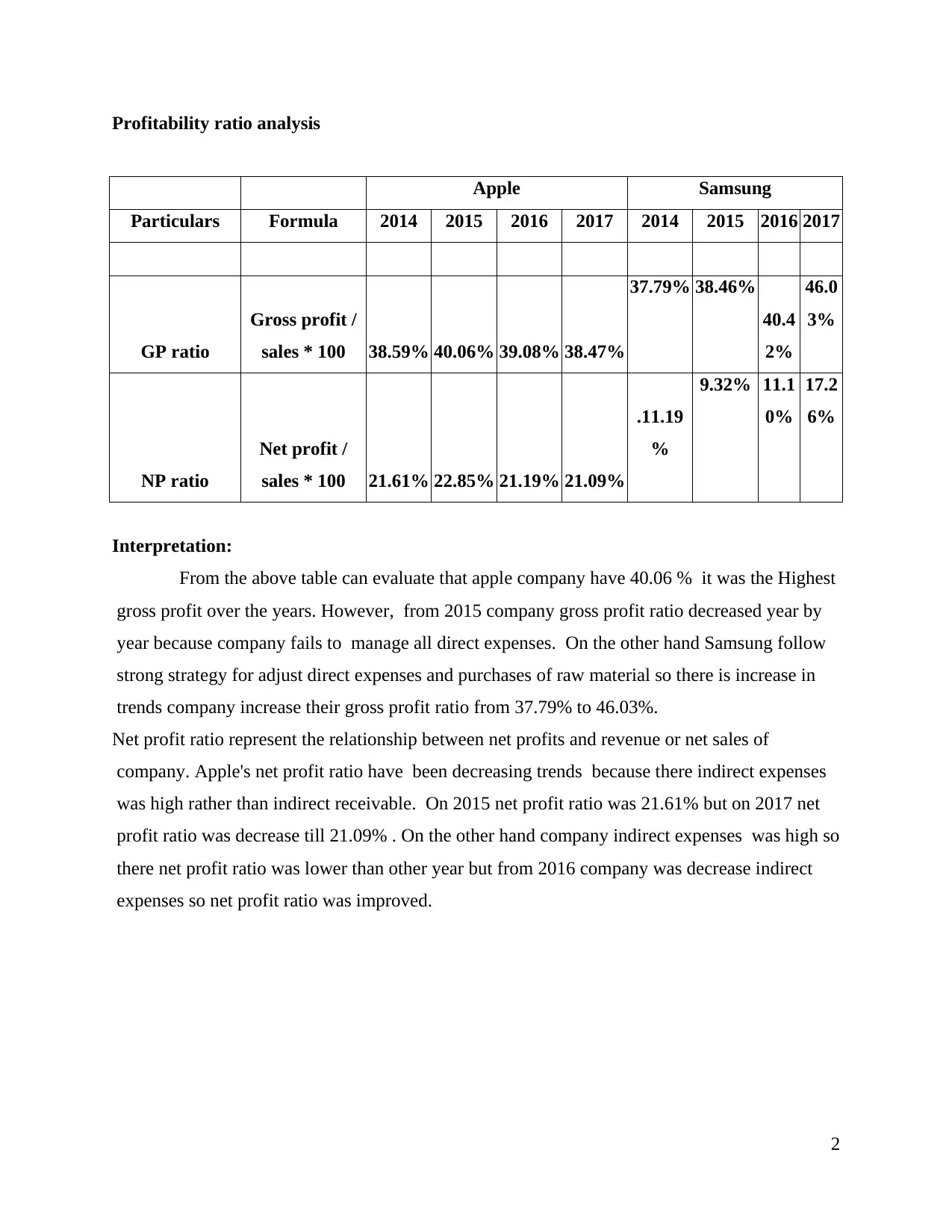

Liquidity ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Current ratio

Current assets / current

liabilities 1.08 1.11 1.35 1.28

2.21 2.47 2.58 2.18

Quick ratio

Current assets - (stock

+ prepaid expenses) 1.05 1.08 1.33 1.23

1.77 2 2.15 1.73

Interpretation

From the presented table Apple have sufficient liquidity to meet out the liabilities over the

year. In 2014 current ratio was 1.08 but it has increased trend because company manage all

assets in Such a way so company pay all liabilities and obligations. High liquidity ratio show the

Company's ability to meet out the obligation. In the flip side Samsung liquidity ratio higher than

Apple ratio they manage current assets and current liabilities so company had high liquidity ratio

in 2016 that was 2.58 but in 2017 company ratio decreased to 2.18.

Apple has sufficient assets which are quick convert into the cash on 2016 apple have

higher quick ratio that was 1.33 it shows that time they manage all quick assets which are easily

Converted into the cash so company paid all liabilities. But in the flip side Samsung have huge

stock and prepaid expense to pay liabilities on 2015 and 2016 that was 2 and 2.15 receptively but

On 2017 it was reduced from 2.15 to 1.73.

Solvency ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Debt-equity ratio

Long-term debt /

shareholders’ equity 0.26 0.45 0.59 0.73

0.01 0.01 0.01 0.01

Interpretation:

3

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Current ratio

Current assets / current

liabilities 1.08 1.11 1.35 1.28

2.21 2.47 2.58 2.18

Quick ratio

Current assets - (stock

+ prepaid expenses) 1.05 1.08 1.33 1.23

1.77 2 2.15 1.73

Interpretation

From the presented table Apple have sufficient liquidity to meet out the liabilities over the

year. In 2014 current ratio was 1.08 but it has increased trend because company manage all

assets in Such a way so company pay all liabilities and obligations. High liquidity ratio show the

Company's ability to meet out the obligation. In the flip side Samsung liquidity ratio higher than

Apple ratio they manage current assets and current liabilities so company had high liquidity ratio

in 2016 that was 2.58 but in 2017 company ratio decreased to 2.18.

Apple has sufficient assets which are quick convert into the cash on 2016 apple have

higher quick ratio that was 1.33 it shows that time they manage all quick assets which are easily

Converted into the cash so company paid all liabilities. But in the flip side Samsung have huge

stock and prepaid expense to pay liabilities on 2015 and 2016 that was 2 and 2.15 receptively but

On 2017 it was reduced from 2.15 to 1.73.

Solvency ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Debt-equity ratio

Long-term debt /

shareholders’ equity 0.26 0.45 0.59 0.73

0.01 0.01 0.01 0.01

Interpretation:

3

From the above table Apple have efficient solvency ratio that refers that they able ro meet

its long term debt. Company's debt equity ratio have increased over the year on 2014 solvency

ratio was 0.26 but in 2017 ratio 0.73. However, company manage equity shareholders to pay all

long term debt. But on the other hand Samsung have equal debt equity ratio over the year that

was 0.1 it lower than Apple. They have no huge shareholders' equity to pay debt.

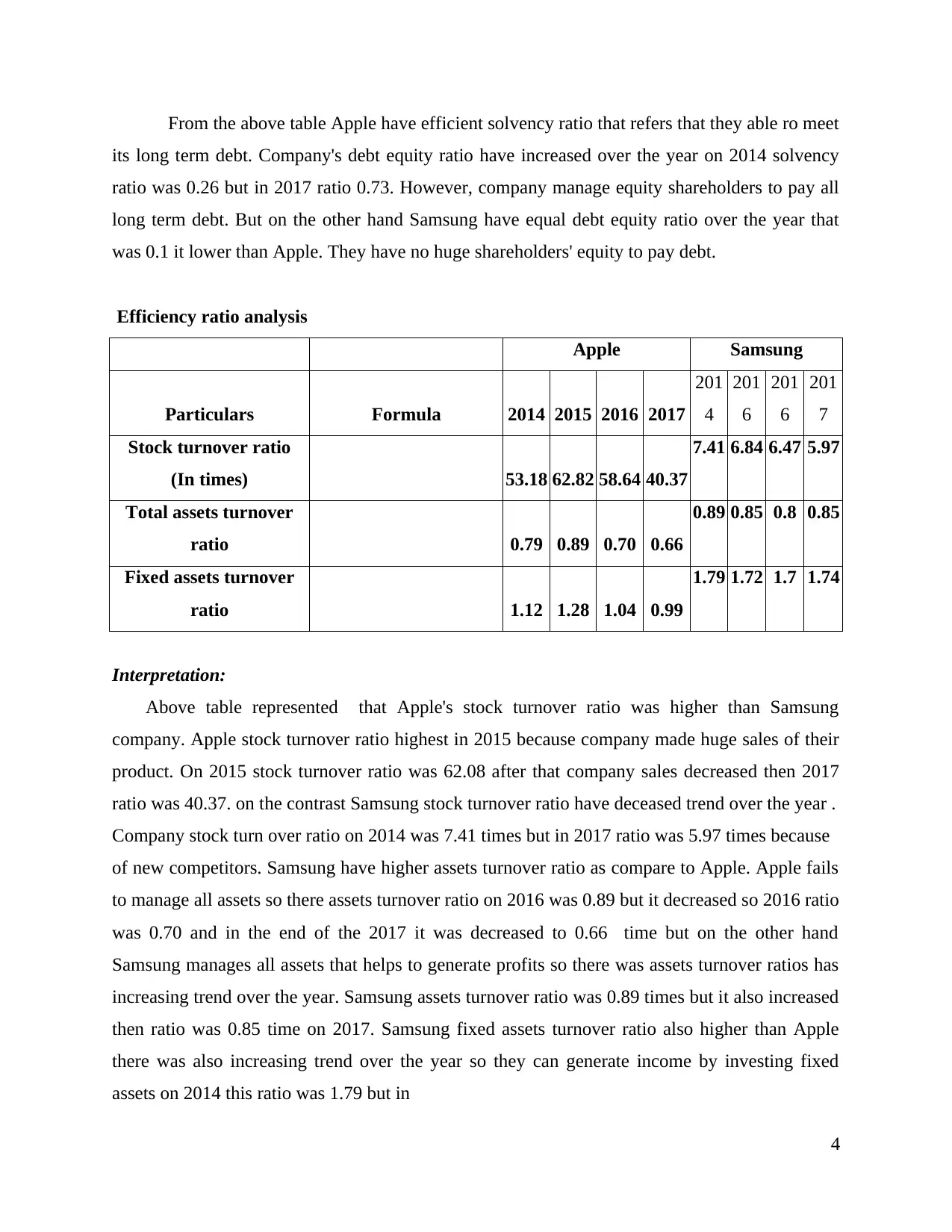

Efficiency ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017

201

4

201

6

201

6

201

7

Stock turnover ratio

(In times) 53.18 62.82 58.64 40.37

7.41 6.84 6.47 5.97

Total assets turnover

ratio 0.79 0.89 0.70 0.66

0.89 0.85 0.8 0.85

Fixed assets turnover

ratio 1.12 1.28 1.04 0.99

1.79 1.72 1.7 1.74

Interpretation:

Above table represented that Apple's stock turnover ratio was higher than Samsung

company. Apple stock turnover ratio highest in 2015 because company made huge sales of their

product. On 2015 stock turnover ratio was 62.08 after that company sales decreased then 2017

ratio was 40.37. on the contrast Samsung stock turnover ratio have deceased trend over the year .

Company stock turn over ratio on 2014 was 7.41 times but in 2017 ratio was 5.97 times because

of new competitors. Samsung have higher assets turnover ratio as compare to Apple. Apple fails

to manage all assets so there assets turnover ratio on 2016 was 0.89 but it decreased so 2016 ratio

was 0.70 and in the end of the 2017 it was decreased to 0.66 time but on the other hand

Samsung manages all assets that helps to generate profits so there was assets turnover ratios has

increasing trend over the year. Samsung assets turnover ratio was 0.89 times but it also increased

then ratio was 0.85 time on 2017. Samsung fixed assets turnover ratio also higher than Apple

there was also increasing trend over the year so they can generate income by investing fixed

assets on 2014 this ratio was 1.79 but in

4

its long term debt. Company's debt equity ratio have increased over the year on 2014 solvency

ratio was 0.26 but in 2017 ratio 0.73. However, company manage equity shareholders to pay all

long term debt. But on the other hand Samsung have equal debt equity ratio over the year that

was 0.1 it lower than Apple. They have no huge shareholders' equity to pay debt.

Efficiency ratio analysis

Apple Samsung

Particulars Formula 2014 2015 2016 2017

201

4

201

6

201

6

201

7

Stock turnover ratio

(In times) 53.18 62.82 58.64 40.37

7.41 6.84 6.47 5.97

Total assets turnover

ratio 0.79 0.89 0.70 0.66

0.89 0.85 0.8 0.85

Fixed assets turnover

ratio 1.12 1.28 1.04 0.99

1.79 1.72 1.7 1.74

Interpretation:

Above table represented that Apple's stock turnover ratio was higher than Samsung

company. Apple stock turnover ratio highest in 2015 because company made huge sales of their

product. On 2015 stock turnover ratio was 62.08 after that company sales decreased then 2017

ratio was 40.37. on the contrast Samsung stock turnover ratio have deceased trend over the year .

Company stock turn over ratio on 2014 was 7.41 times but in 2017 ratio was 5.97 times because

of new competitors. Samsung have higher assets turnover ratio as compare to Apple. Apple fails

to manage all assets so there assets turnover ratio on 2016 was 0.89 but it decreased so 2016 ratio

was 0.70 and in the end of the 2017 it was decreased to 0.66 time but on the other hand

Samsung manages all assets that helps to generate profits so there was assets turnover ratios has

increasing trend over the year. Samsung assets turnover ratio was 0.89 times but it also increased

then ratio was 0.85 time on 2017. Samsung fixed assets turnover ratio also higher than Apple

there was also increasing trend over the year so they can generate income by investing fixed

assets on 2014 this ratio was 1.79 but in

4

would decrease over the year so on 2017 ratio was 1.74. on the flip side Apple have also

reducing trend so ratio of the 2017 was 0.99 times.

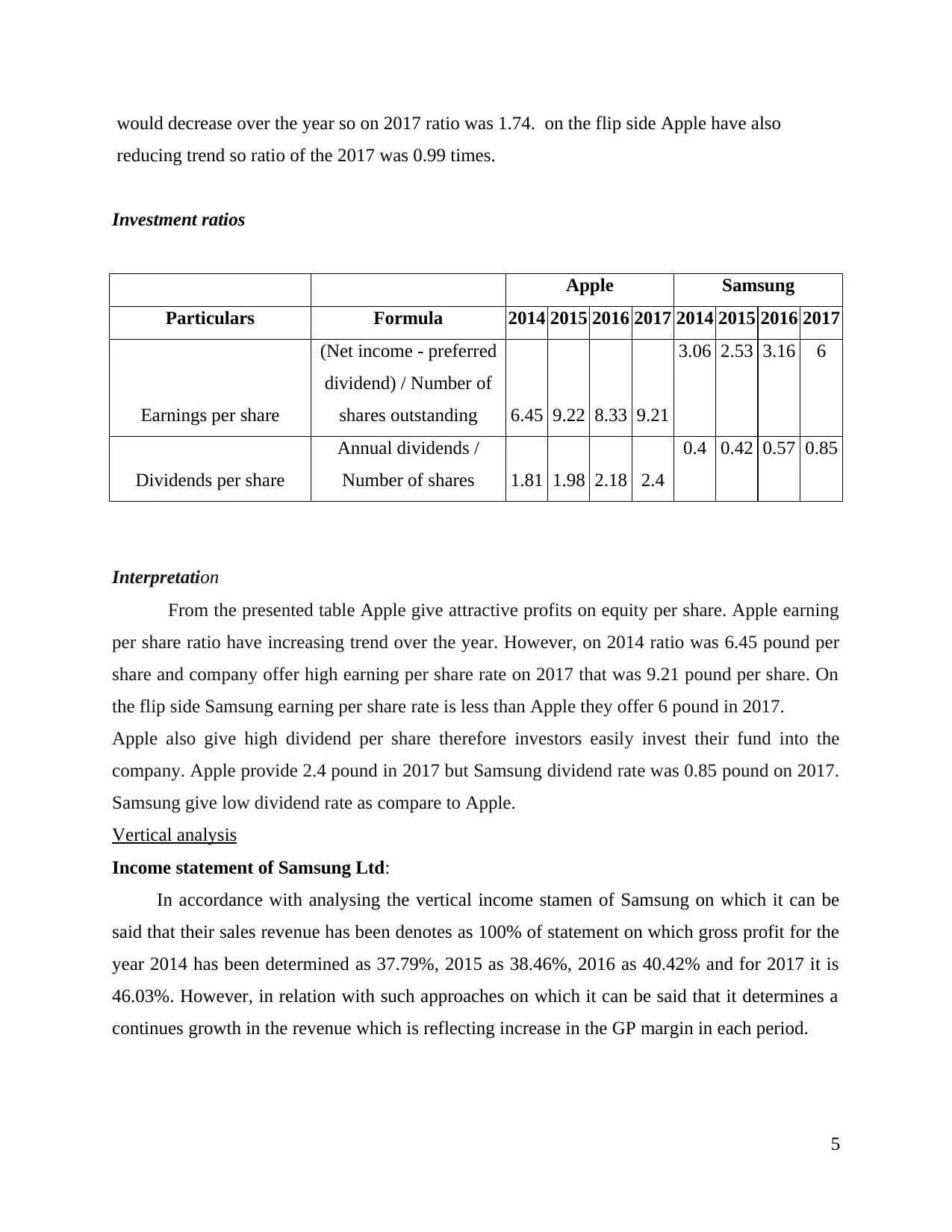

Investment ratios

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Earnings per share

(Net income - preferred

dividend) / Number of

shares outstanding 6.45 9.22 8.33 9.21

3.06 2.53 3.16 6

Dividends per share

Annual dividends /

Number of shares 1.81 1.98 2.18 2.4

0.4 0.42 0.57 0.85

Interpretation

From the presented table Apple give attractive profits on equity per share. Apple earning

per share ratio have increasing trend over the year. However, on 2014 ratio was 6.45 pound per

share and company offer high earning per share rate on 2017 that was 9.21 pound per share. On

the flip side Samsung earning per share rate is less than Apple they offer 6 pound in 2017.

Apple also give high dividend per share therefore investors easily invest their fund into the

company. Apple provide 2.4 pound in 2017 but Samsung dividend rate was 0.85 pound on 2017.

Samsung give low dividend rate as compare to Apple.

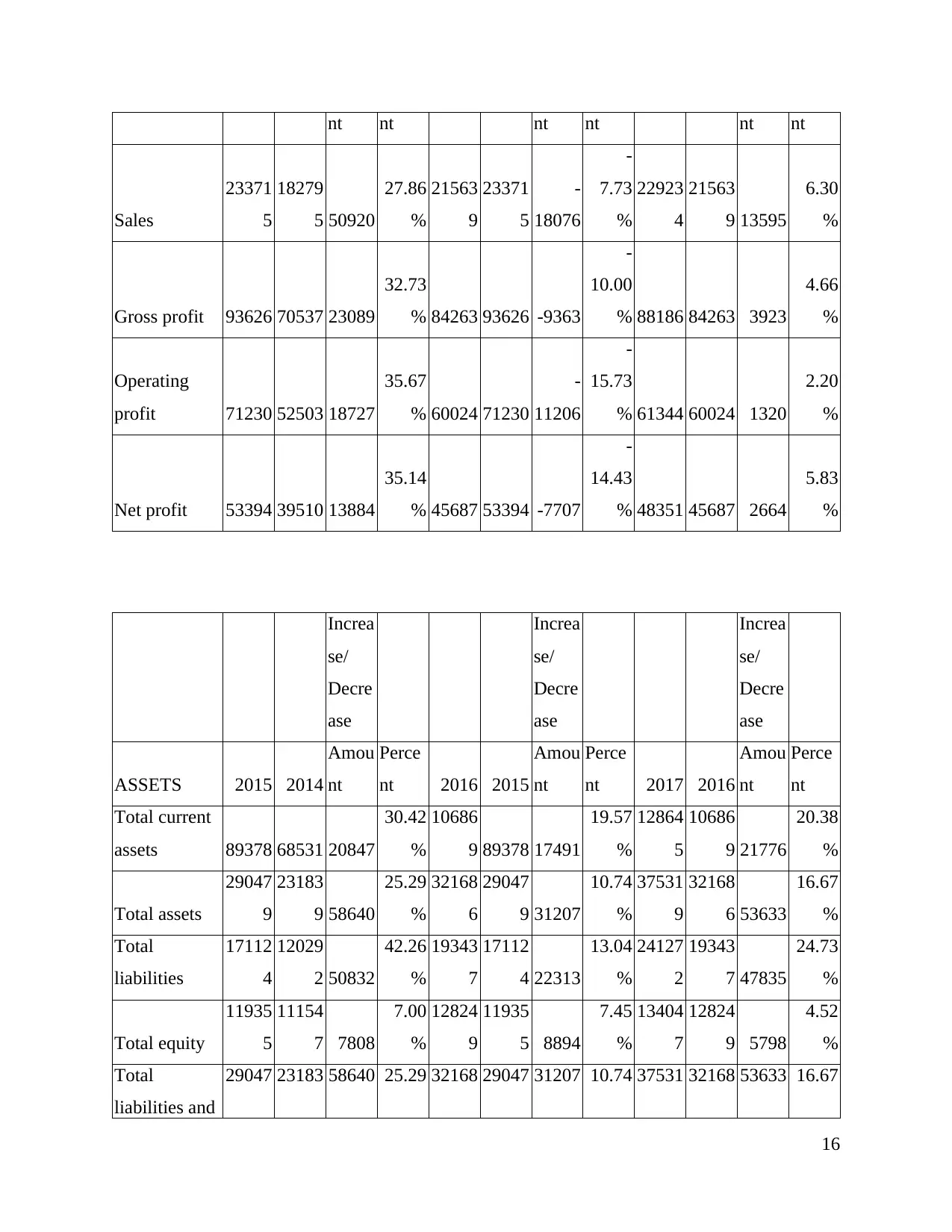

Vertical analysis

Income statement of Samsung Ltd:

In accordance with analysing the vertical income stamen of Samsung on which it can be

said that their sales revenue has been denotes as 100% of statement on which gross profit for the

year 2014 has been determined as 37.79%, 2015 as 38.46%, 2016 as 40.42% and for 2017 it is

46.03%. However, in relation with such approaches on which it can be said that it determines a

continues growth in the revenue which is reflecting increase in the GP margin in each period.

5

reducing trend so ratio of the 2017 was 0.99 times.

Investment ratios

Apple Samsung

Particulars Formula 2014 2015 2016 2017 2014 2015 2016 2017

Earnings per share

(Net income - preferred

dividend) / Number of

shares outstanding 6.45 9.22 8.33 9.21

3.06 2.53 3.16 6

Dividends per share

Annual dividends /

Number of shares 1.81 1.98 2.18 2.4

0.4 0.42 0.57 0.85

Interpretation

From the presented table Apple give attractive profits on equity per share. Apple earning

per share ratio have increasing trend over the year. However, on 2014 ratio was 6.45 pound per

share and company offer high earning per share rate on 2017 that was 9.21 pound per share. On

the flip side Samsung earning per share rate is less than Apple they offer 6 pound in 2017.

Apple also give high dividend per share therefore investors easily invest their fund into the

company. Apple provide 2.4 pound in 2017 but Samsung dividend rate was 0.85 pound on 2017.

Samsung give low dividend rate as compare to Apple.

Vertical analysis

Income statement of Samsung Ltd:

In accordance with analysing the vertical income stamen of Samsung on which it can be

said that their sales revenue has been denotes as 100% of statement on which gross profit for the

year 2014 has been determined as 37.79%, 2015 as 38.46%, 2016 as 40.42% and for 2017 it is

46.03%. However, in relation with such approaches on which it can be said that it determines a

continues growth in the revenue which is reflecting increase in the GP margin in each period.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Similarly, the operating income of firm which was 12.14 in 2014 has been raised to

22.39% in 2017. Therefore, there have been adequate growth and operational gains which would

be effective in leading the firm to retain the qualitative success.

Balance sheet of Samsung:

In respect with the horizontal analysis where total assets and liabilities have been denoted

as 100%. Thus, there have been reduction in the current assets of the firm from 2014 to 2017.

Similarly, liabilities have been increased. Moreover, in this aspect would be suggested to the

professionals to have a control over liabilities which would reflect the better long term as well as

short term solvency.

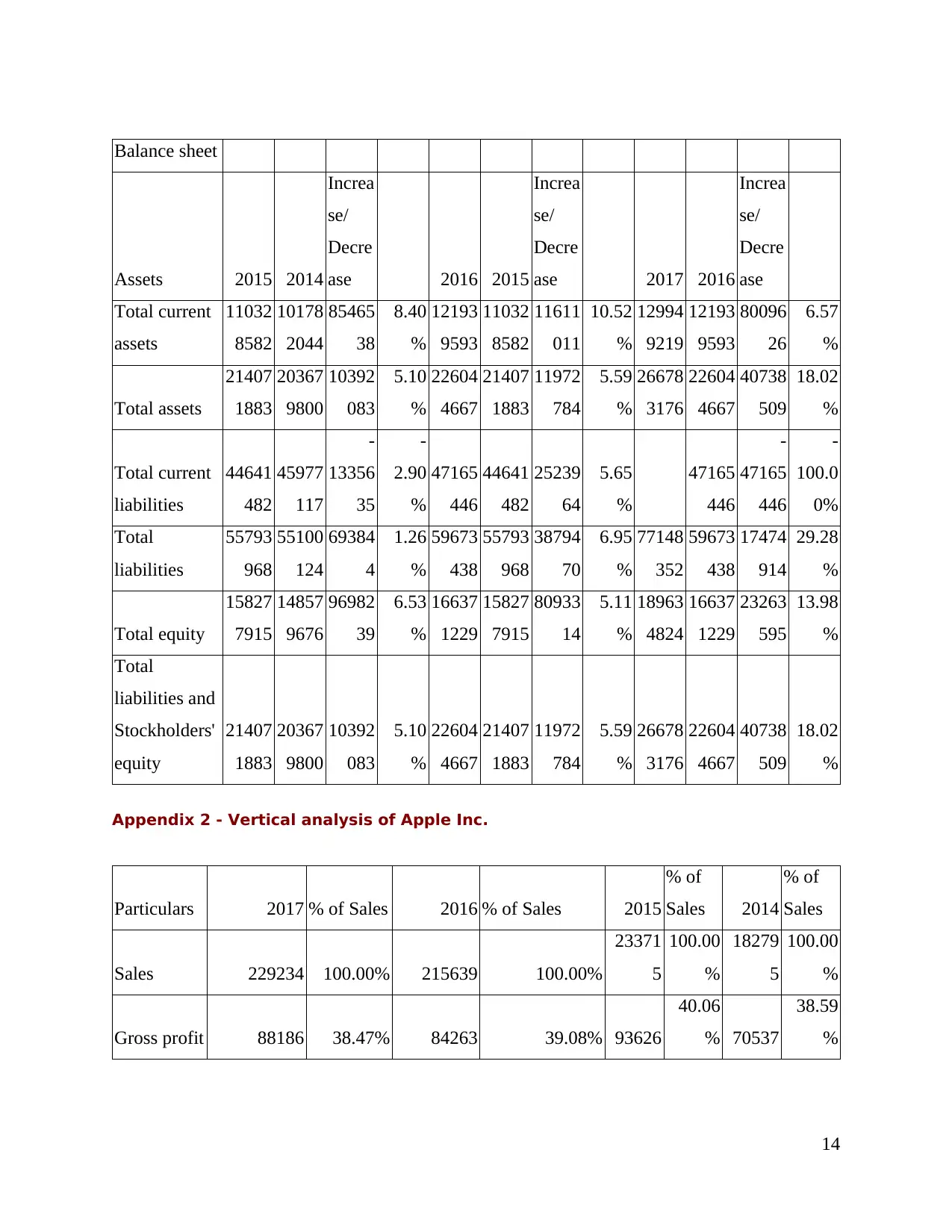

Income statement of Apple Inc.

By considering the vertical analysis on the income statement of Apple Inc. which defines

GP margin in 2014 38.59% which reaches to 38.47% in 2017. However, in relation with

outcome on which it could be interpreted that, firm has higher costs of goods sold than compared

to the sales. Thus, higher costs affect the revenue generated through the sales of product in

reflecting the profitability of industry.

Balance sheet of Apple Inc.

It defines the total assets and liabilities to 100% of proportion. Thus, on which the current

assets of Apple were in 32014 as 29.56% which reaches to 34.28%^ in 2017. Therefore, there

have been raise in the current assets over the period. Thus, it can be said that the short terms

solvency of firm will be effective and adequate in terms of meeting the operational requirement

at the right time.

Horizontal analysis

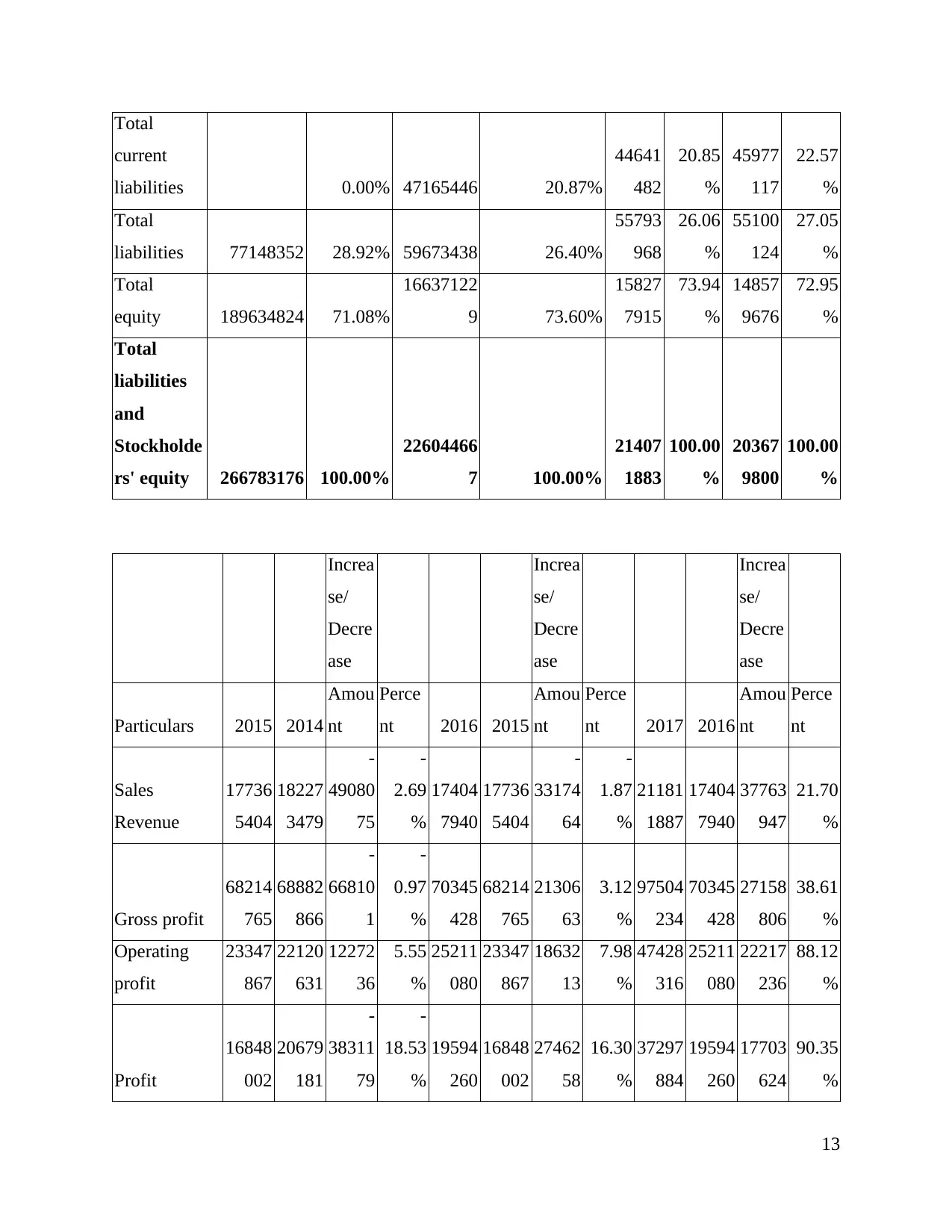

Income statement of Samsung:

In this technique there have been consideration analysing the data base with the previous

year’s outcomes. However, it determines the changes incurred in each element as compared with

its past data base. The changes in sales revenue was in 2015 as comparing with 2014 was 2.69%

therefore, in 2017 it was 21.70. It indicates that currently the firm has increase sales revenue

which defines its profitable state.

Balance sheet of Samsung:

In accordance with such operations on which it can be said that there has been

determination of changes which have been incurred in the operational practices that have defined

6

22.39% in 2017. Therefore, there have been adequate growth and operational gains which would

be effective in leading the firm to retain the qualitative success.

Balance sheet of Samsung:

In respect with the horizontal analysis where total assets and liabilities have been denoted

as 100%. Thus, there have been reduction in the current assets of the firm from 2014 to 2017.

Similarly, liabilities have been increased. Moreover, in this aspect would be suggested to the

professionals to have a control over liabilities which would reflect the better long term as well as

short term solvency.

Income statement of Apple Inc.

By considering the vertical analysis on the income statement of Apple Inc. which defines

GP margin in 2014 38.59% which reaches to 38.47% in 2017. However, in relation with

outcome on which it could be interpreted that, firm has higher costs of goods sold than compared

to the sales. Thus, higher costs affect the revenue generated through the sales of product in

reflecting the profitability of industry.

Balance sheet of Apple Inc.

It defines the total assets and liabilities to 100% of proportion. Thus, on which the current

assets of Apple were in 32014 as 29.56% which reaches to 34.28%^ in 2017. Therefore, there

have been raise in the current assets over the period. Thus, it can be said that the short terms

solvency of firm will be effective and adequate in terms of meeting the operational requirement

at the right time.

Horizontal analysis

Income statement of Samsung:

In this technique there have been consideration analysing the data base with the previous

year’s outcomes. However, it determines the changes incurred in each element as compared with

its past data base. The changes in sales revenue was in 2015 as comparing with 2014 was 2.69%

therefore, in 2017 it was 21.70. It indicates that currently the firm has increase sales revenue

which defines its profitable state.

Balance sheet of Samsung:

In accordance with such operations on which it can be said that there has been

determination of changes which have been incurred in the operational practices that have defined

6

the outcomes as changes in the total current assets was 8.40% in 2015 and reaches to 6.57%.

there has been reduction in the total current assets of the firm. On the other side in respect with

analysing the current liabilities of the firm on which it was 2.90% in 2015 and 2017 it reaches to

100%. Therefore in 2016 and 2017 the liabilities amount remains same.

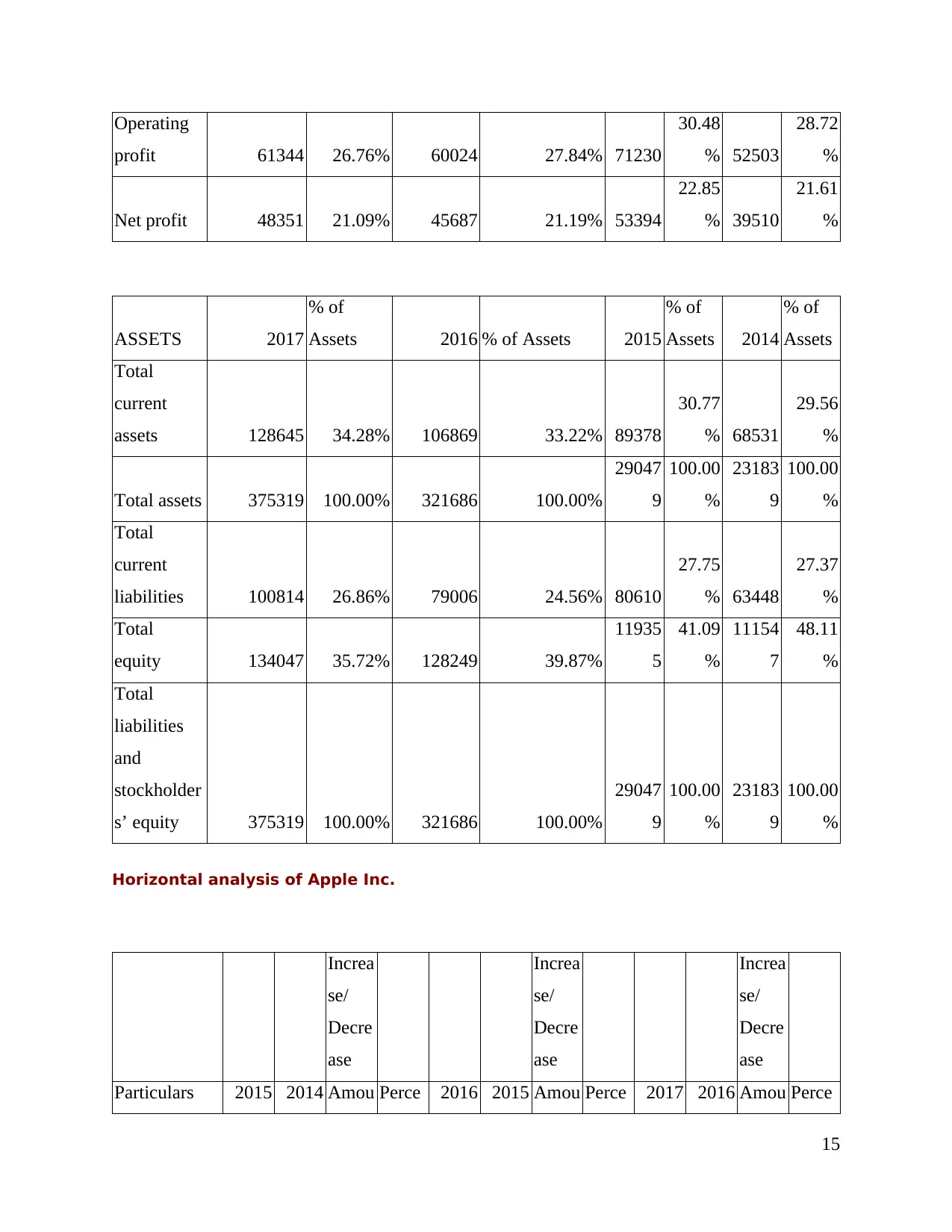

Income statement of Apple Inc.

As per making analysis over the horizontal analysing of the income stamen of Apple Inc.

Thus, on which it can be said that there are changes in sales between 2014 and 2015 was 27.86%

while in accordance with determining the changes between 201+6 and 2017 on which it reflects

6.30% Thus, in relation with such aspects it can be said that there have been effective changes in

the operational ascertainment over increasing the sales volume of organisation.

Balance sheet of Apple Inc.

By considering the horizontal analysis over the balance sheet of Apple Inc. on which it can

be said that firm has effective ascertainment of operational practices. The current assets of firm

which were in 2014 and 2015 had defined the changes in percentage such as 30.42% in 2016 and

2017 which defines as 20.38%. However, in accordance with such operations on which it can be

said that, firm need to manage the short and long-term solvency. It can be done by recovering

receivables within limited time frame, managing cash flows, inventories etc.

Similarly, by reducing the liabilities it will be effective for the firm in relation with

managing all the debts which have been influencing he management of operational practices.

Thus, managing solvency will result in bringing long term advantages as well as will bring a

favourable disclosure among the external users. They would make investment decision as per

analysing the security of their investment funds into operations.

2. CSR report of Apple and Samsung

Apple report: the CSR of the company involves the environmental responsibility and the

reports enlighten the three main areas for themselves and the stakeholder as well. The Apple

have focuses on the area of reducing the impact on the climate change with use of renewable

energy sources, conservation of the precious resources for sustainable developments and to

pioneer the use of safer materials in its products and processes. The achievements of the Apple in

conservation of the energy in year 2016-2017 can be defined as, 96% of the energy used by

Apple in its global facilitates had come from renewable energy which reduced the carbon

emission by approximately 585000 metric tons.

7

there has been reduction in the total current assets of the firm. On the other side in respect with

analysing the current liabilities of the firm on which it was 2.90% in 2015 and 2017 it reaches to

100%. Therefore in 2016 and 2017 the liabilities amount remains same.

Income statement of Apple Inc.

As per making analysis over the horizontal analysing of the income stamen of Apple Inc.

Thus, on which it can be said that there are changes in sales between 2014 and 2015 was 27.86%

while in accordance with determining the changes between 201+6 and 2017 on which it reflects

6.30% Thus, in relation with such aspects it can be said that there have been effective changes in

the operational ascertainment over increasing the sales volume of organisation.

Balance sheet of Apple Inc.

By considering the horizontal analysis over the balance sheet of Apple Inc. on which it can

be said that firm has effective ascertainment of operational practices. The current assets of firm

which were in 2014 and 2015 had defined the changes in percentage such as 30.42% in 2016 and

2017 which defines as 20.38%. However, in accordance with such operations on which it can be

said that, firm need to manage the short and long-term solvency. It can be done by recovering

receivables within limited time frame, managing cash flows, inventories etc.

Similarly, by reducing the liabilities it will be effective for the firm in relation with

managing all the debts which have been influencing he management of operational practices.

Thus, managing solvency will result in bringing long term advantages as well as will bring a

favourable disclosure among the external users. They would make investment decision as per

analysing the security of their investment funds into operations.

2. CSR report of Apple and Samsung

Apple report: the CSR of the company involves the environmental responsibility and the

reports enlighten the three main areas for themselves and the stakeholder as well. The Apple

have focuses on the area of reducing the impact on the climate change with use of renewable

energy sources, conservation of the precious resources for sustainable developments and to

pioneer the use of safer materials in its products and processes. The achievements of the Apple in

conservation of the energy in year 2016-2017 can be defined as, 96% of the energy used by

Apple in its global facilitates had come from renewable energy which reduced the carbon

emission by approximately 585000 metric tons.

7

Illustration 1: Reuse and recycling

(Source: )

The Apple park is the largesse LED platinum certified building in the world which shows the

energy saving. Over 80% of the campus of Apple are planting the drought tolerant trees

(Environmental Responsibility Report, 2017). The Apple is planning to bring in 4 gigawatts of

renewable power online by 2020.

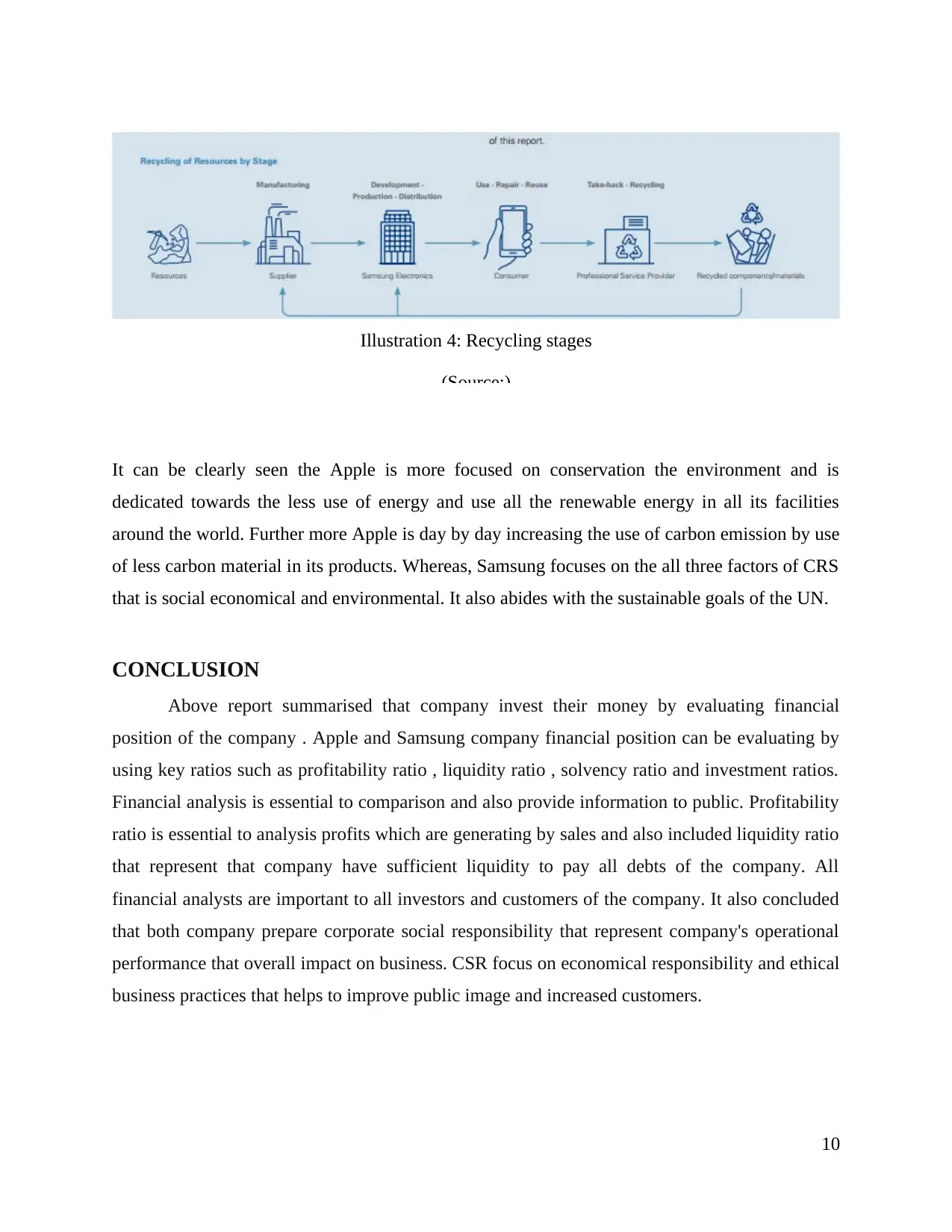

Illustration 2: Carbon Footprint

(Source: )

For preservation of the natural and scared resources Apple have taken master-stroke as

99% of the paper used in the product packaging of Apple comes form the recycled resources or

those which are managed responsibly. The company is improving it carbon footprints in five

major areas which are manufacturing, product use, facilities, transportation and recycling. For

this the Apple have generated the design for each of its product which can be energy efficient.

The company is more focused on use of low carbon materials and is partnering with the suppliers

to use clean energy in their facilities. The carbon foot print of the Apple for the year 2016 was

29.5 million metric tons which have reduced from 38.4 million metric tones in 2015.

8

(Source: )

The Apple park is the largesse LED platinum certified building in the world which shows the

energy saving. Over 80% of the campus of Apple are planting the drought tolerant trees

(Environmental Responsibility Report, 2017). The Apple is planning to bring in 4 gigawatts of

renewable power online by 2020.

Illustration 2: Carbon Footprint

(Source: )

For preservation of the natural and scared resources Apple have taken master-stroke as

99% of the paper used in the product packaging of Apple comes form the recycled resources or

those which are managed responsibly. The company is improving it carbon footprints in five

major areas which are manufacturing, product use, facilities, transportation and recycling. For

this the Apple have generated the design for each of its product which can be energy efficient.

The company is more focused on use of low carbon materials and is partnering with the suppliers

to use clean energy in their facilities. The carbon foot print of the Apple for the year 2016 was

29.5 million metric tons which have reduced from 38.4 million metric tones in 2015.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Illustration 3: Carbon Emission

(Source:)

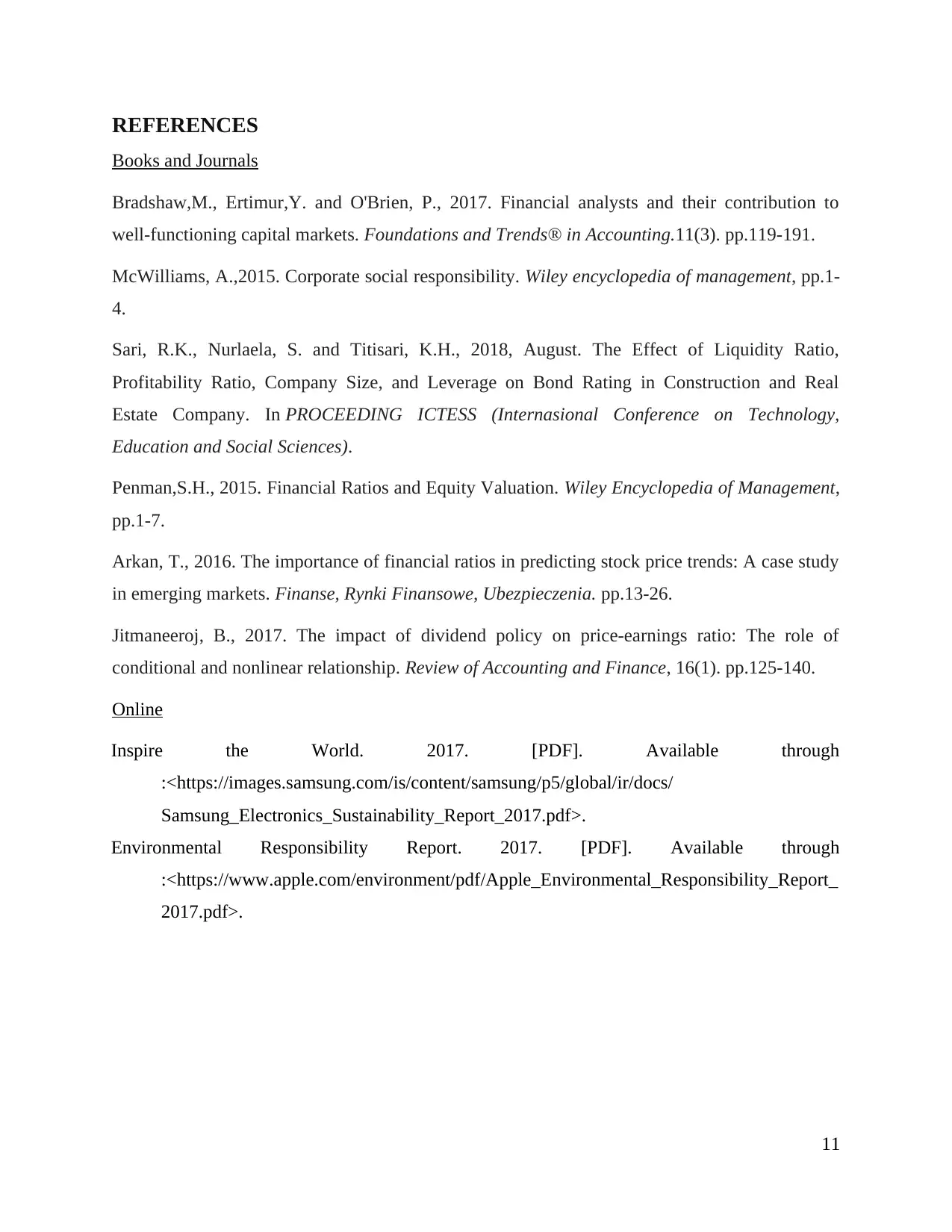

Samsung Report: the CRS of Samsung includes achieving the economic, social and

environmental values along with wide array of stakeholders. The company also endorse the UN

sustainable Development goals which aims at achieving a balanced development with

engagements of value creation. At Samsung, our sustainability policy aims to create integrated

values. Not only do we create economic value by maximizing profits and shareholder value, but

also we take on a broader responsibility as a global corporate citizen to create societal values.

The company have engaged in practices of providing eco friendly and safe workplace. At

Samsung negative social or environmental impact throughout the entire process of product

development, manufacturing, use and disposal can be seen. Broad-ranging initiatives are

undertaken to efficiently use our valuable resources: planning products that reduce energy and

resource consumption in accordance with our Eco-Design Process, converting waste generated

from the manufacturing process into resouces, offering firmware upgrades to extend the life

cycle of our products, and operating country-specific end-of-life product take-back programs.

The CSR practices of Samsung includes ensuring the quality of education and promotion

of life long learning opportunistic for everyone (Inspire the World, 2017). To mitigate the gender

equality and empower the girls and women. To ensure the availability of safe, sustainable waters

with its effective managements for coming generation. To ensure the healthy lives and promotion

of the well being of each person. To put an end to the hunger and improvise the quality off the

food and promotion of the sustainable agriculture. To take immediate and speedy action to

combat the changing climatic conditions and its global impact.

9

(Source:)

Samsung Report: the CRS of Samsung includes achieving the economic, social and

environmental values along with wide array of stakeholders. The company also endorse the UN

sustainable Development goals which aims at achieving a balanced development with

engagements of value creation. At Samsung, our sustainability policy aims to create integrated

values. Not only do we create economic value by maximizing profits and shareholder value, but

also we take on a broader responsibility as a global corporate citizen to create societal values.

The company have engaged in practices of providing eco friendly and safe workplace. At

Samsung negative social or environmental impact throughout the entire process of product

development, manufacturing, use and disposal can be seen. Broad-ranging initiatives are

undertaken to efficiently use our valuable resources: planning products that reduce energy and

resource consumption in accordance with our Eco-Design Process, converting waste generated

from the manufacturing process into resouces, offering firmware upgrades to extend the life

cycle of our products, and operating country-specific end-of-life product take-back programs.

The CSR practices of Samsung includes ensuring the quality of education and promotion

of life long learning opportunistic for everyone (Inspire the World, 2017). To mitigate the gender

equality and empower the girls and women. To ensure the availability of safe, sustainable waters

with its effective managements for coming generation. To ensure the healthy lives and promotion

of the well being of each person. To put an end to the hunger and improvise the quality off the

food and promotion of the sustainable agriculture. To take immediate and speedy action to

combat the changing climatic conditions and its global impact.

9

It can be clearly seen the Apple is more focused on conservation the environment and is

dedicated towards the less use of energy and use all the renewable energy in all its facilities

around the world. Further more Apple is day by day increasing the use of carbon emission by use

of less carbon material in its products. Whereas, Samsung focuses on the all three factors of CRS

that is social economical and environmental. It also abides with the sustainable goals of the UN.

CONCLUSION

Above report summarised that company invest their money by evaluating financial

position of the company . Apple and Samsung company financial position can be evaluating by

using key ratios such as profitability ratio , liquidity ratio , solvency ratio and investment ratios.

Financial analysis is essential to comparison and also provide information to public. Profitability

ratio is essential to analysis profits which are generating by sales and also included liquidity ratio

that represent that company have sufficient liquidity to pay all debts of the company. All

financial analysts are important to all investors and customers of the company. It also concluded

that both company prepare corporate social responsibility that represent company's operational

performance that overall impact on business. CSR focus on economical responsibility and ethical

business practices that helps to improve public image and increased customers.

10

Illustration 4: Recycling stages

(Source:)

dedicated towards the less use of energy and use all the renewable energy in all its facilities

around the world. Further more Apple is day by day increasing the use of carbon emission by use

of less carbon material in its products. Whereas, Samsung focuses on the all three factors of CRS

that is social economical and environmental. It also abides with the sustainable goals of the UN.

CONCLUSION

Above report summarised that company invest their money by evaluating financial

position of the company . Apple and Samsung company financial position can be evaluating by

using key ratios such as profitability ratio , liquidity ratio , solvency ratio and investment ratios.

Financial analysis is essential to comparison and also provide information to public. Profitability

ratio is essential to analysis profits which are generating by sales and also included liquidity ratio

that represent that company have sufficient liquidity to pay all debts of the company. All

financial analysts are important to all investors and customers of the company. It also concluded

that both company prepare corporate social responsibility that represent company's operational

performance that overall impact on business. CSR focus on economical responsibility and ethical

business practices that helps to improve public image and increased customers.

10

Illustration 4: Recycling stages

(Source:)

REFERENCES

Books and Journals

Bradshaw,M., Ertimur,Y. and O'Brien, P., 2017. Financial analysts and their contribution to

well-functioning capital markets. Foundations and Trends® in Accounting.11(3). pp.119-191.

McWilliams, A.,2015. Corporate social responsibility. Wiley encyclopedia of management, pp.1-

4.

Sari, R.K., Nurlaela, S. and Titisari, K.H., 2018, August. The Effect of Liquidity Ratio,

Profitability Ratio, Company Size, and Leverage on Bond Rating in Construction and Real

Estate Company. In PROCEEDING ICTESS (Internasional Conference on Technology,

Education and Social Sciences).

Penman,S.H., 2015. Financial Ratios and Equity Valuation. Wiley Encyclopedia of Management,

pp.1-7.

Arkan, T., 2016. The importance of financial ratios in predicting stock price trends: A case study

in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia. pp.13-26.

Jitmaneeroj, B., 2017. The impact of dividend policy on price-earnings ratio: The role of

conditional and nonlinear relationship. Review of Accounting and Finance, 16(1). pp.125-140.

Online

Inspire the World. 2017. [PDF]. Available through

:<https://images.samsung.com/is/content/samsung/p5/global/ir/docs/

Samsung_Electronics_Sustainability_Report_2017.pdf>.

Environmental Responsibility Report. 2017. [PDF]. Available through

:<https://www.apple.com/environment/pdf/Apple_Environmental_Responsibility_Report_

2017.pdf>.

11

Books and Journals

Bradshaw,M., Ertimur,Y. and O'Brien, P., 2017. Financial analysts and their contribution to

well-functioning capital markets. Foundations and Trends® in Accounting.11(3). pp.119-191.

McWilliams, A.,2015. Corporate social responsibility. Wiley encyclopedia of management, pp.1-

4.

Sari, R.K., Nurlaela, S. and Titisari, K.H., 2018, August. The Effect of Liquidity Ratio,

Profitability Ratio, Company Size, and Leverage on Bond Rating in Construction and Real

Estate Company. In PROCEEDING ICTESS (Internasional Conference on Technology,

Education and Social Sciences).

Penman,S.H., 2015. Financial Ratios and Equity Valuation. Wiley Encyclopedia of Management,

pp.1-7.

Arkan, T., 2016. The importance of financial ratios in predicting stock price trends: A case study

in emerging markets. Finanse, Rynki Finansowe, Ubezpieczenia. pp.13-26.

Jitmaneeroj, B., 2017. The impact of dividend policy on price-earnings ratio: The role of

conditional and nonlinear relationship. Review of Accounting and Finance, 16(1). pp.125-140.

Online

Inspire the World. 2017. [PDF]. Available through

:<https://images.samsung.com/is/content/samsung/p5/global/ir/docs/

Samsung_Electronics_Sustainability_Report_2017.pdf>.

Environmental Responsibility Report. 2017. [PDF]. Available through

:<https://www.apple.com/environment/pdf/Apple_Environmental_Responsibility_Report_

2017.pdf>.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

APPENDIX

Appendix 1 - Vertical Analysis of Samsung Ltd

Particulars 2017

% of

Sales 2016 % of Sales 2015

% of

Sales 2014

% of

Sales

Sales

Revenue 211811887 100.00%

17404794

0 100.00%

17736

5404

100.00

%

18227

3479

100.00

%

Gross profit 97504234 46.03% 70345428 40.42%

68214

765

38.46

%

68882

866

37.79

%

Operating

profit 47428316 22.39% 25211080 14.49%

23347

867

13.16

%

22120

631

12.14

%

Profit 37297884 17.61% 19594260 11.26%

16848

002 9.50%

20679

181

11.35

%

Horizontal Analysis of Samsung Ltd

Balance sheet

Assets 2017

% of Total

assets 2016

% of Total

assets 2015

% of

Total

assets 2014

% of

Total

assets

Total

current

assets 129949219 48.71%

12193959

3 53.94%

11032

8582

51.54

%

10178

2044

49.97

%

Total

assets 266783176 100.00%

22604466

7 100.00%

21407

1883

100.00

%

20367

9800

100.00

%

Liabilities

and

Stockholde

rs' Equity

12

Appendix 1 - Vertical Analysis of Samsung Ltd

Particulars 2017

% of

Sales 2016 % of Sales 2015

% of

Sales 2014

% of

Sales

Sales

Revenue 211811887 100.00%

17404794

0 100.00%

17736

5404

100.00

%

18227

3479

100.00

%

Gross profit 97504234 46.03% 70345428 40.42%

68214

765

38.46

%

68882

866

37.79

%

Operating

profit 47428316 22.39% 25211080 14.49%

23347

867

13.16

%

22120

631

12.14

%

Profit 37297884 17.61% 19594260 11.26%

16848

002 9.50%

20679

181

11.35

%

Horizontal Analysis of Samsung Ltd

Balance sheet

Assets 2017

% of Total

assets 2016

% of Total

assets 2015

% of

Total

assets 2014

% of

Total

assets

Total

current

assets 129949219 48.71%

12193959

3 53.94%

11032

8582

51.54

%

10178

2044

49.97

%

Total

assets 266783176 100.00%

22604466

7 100.00%

21407

1883

100.00

%

20367

9800

100.00

%

Liabilities

and

Stockholde

rs' Equity

12

Total

current

liabilities 0.00% 47165446 20.87%

44641

482

20.85

%

45977

117

22.57

%

Total

liabilities 77148352 28.92% 59673438 26.40%

55793

968

26.06

%

55100

124

27.05

%

Total

equity 189634824 71.08%

16637122

9 73.60%

15827

7915

73.94

%

14857

9676

72.95

%

Total

liabilities

and

Stockholde

rs' equity 266783176 100.00%

22604466

7 100.00%

21407

1883

100.00

%

20367

9800

100.00

%

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Particulars 2015 2014

Amou

nt

Perce

nt 2016 2015

Amou

nt

Perce

nt 2017 2016

Amou

nt

Perce

nt

Sales

Revenue

17736

5404

18227

3479

-

49080

75

-

2.69

%

17404

7940

17736

5404

-

33174

64

-

1.87

%

21181

1887

17404

7940

37763

947

21.70

%

Gross profit

68214

765

68882

866

-

66810

1

-

0.97

%

70345

428

68214

765

21306

63

3.12

%

97504

234

70345

428

27158

806

38.61

%

Operating

profit

23347

867

22120

631

12272

36

5.55

%

25211

080

23347

867

18632

13

7.98

%

47428

316

25211

080

22217

236

88.12

%

Profit

16848

002

20679

181

-

38311

79

-

18.53

%

19594

260

16848

002

27462

58

16.30

%

37297

884

19594

260

17703

624

90.35

%

13

current

liabilities 0.00% 47165446 20.87%

44641

482

20.85

%

45977

117

22.57

%

Total

liabilities 77148352 28.92% 59673438 26.40%

55793

968

26.06

%

55100

124

27.05

%

Total

equity 189634824 71.08%

16637122

9 73.60%

15827

7915

73.94

%

14857

9676

72.95

%

Total

liabilities

and

Stockholde

rs' equity 266783176 100.00%

22604466

7 100.00%

21407

1883

100.00

%

20367

9800

100.00

%

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Particulars 2015 2014

Amou

nt

Perce

nt 2016 2015

Amou

nt

Perce

nt 2017 2016

Amou

nt

Perce

nt

Sales

Revenue

17736

5404

18227

3479

-

49080

75

-

2.69

%

17404

7940

17736

5404

-

33174

64

-

1.87

%

21181

1887

17404

7940

37763

947

21.70

%

Gross profit

68214

765

68882

866

-

66810

1

-

0.97

%

70345

428

68214

765

21306

63

3.12

%

97504

234

70345

428

27158

806

38.61

%

Operating

profit

23347

867

22120

631

12272

36

5.55

%

25211

080

23347

867

18632

13

7.98

%

47428

316

25211

080

22217

236

88.12

%

Profit

16848

002

20679

181

-

38311

79

-

18.53

%

19594

260

16848

002

27462

58

16.30

%

37297

884

19594

260

17703

624

90.35

%

13

Balance sheet

Assets 2015 2014

Increa

se/

Decre

ase 2016 2015

Increa

se/

Decre

ase 2017 2016

Increa

se/

Decre

ase

Total current

assets

11032

8582

10178

2044

85465

38

8.40

%

12193

9593

11032

8582

11611

011

10.52

%

12994

9219

12193

9593

80096

26

6.57

%

Total assets

21407

1883

20367

9800

10392

083

5.10

%

22604

4667

21407

1883

11972

784

5.59

%

26678

3176

22604

4667

40738

509

18.02

%

Total current

liabilities

44641

482

45977

117

-

13356

35

-

2.90

%

47165

446

44641

482

25239

64

5.65

%

47165

446

-

47165

446

-

100.0

0%

Total

liabilities

55793

968

55100

124

69384

4

1.26

%

59673

438

55793

968

38794

70

6.95

%

77148

352

59673

438

17474

914

29.28

%

Total equity

15827

7915

14857

9676

96982

39

6.53

%

16637

1229

15827

7915

80933

14

5.11

%

18963

4824

16637

1229

23263

595

13.98

%

Total

liabilities and

Stockholders'

equity

21407

1883

20367

9800

10392

083

5.10

%

22604

4667

21407

1883

11972

784

5.59

%

26678

3176

22604

4667

40738

509

18.02

%

Appendix 2 - Vertical analysis of Apple Inc.

Particulars 2017 % of Sales 2016 % of Sales 2015

% of

Sales 2014

% of

Sales

Sales 229234 100.00% 215639 100.00%

23371

5

100.00

%

18279

5

100.00

%

Gross profit 88186 38.47% 84263 39.08% 93626

40.06

% 70537

38.59

%

14

Assets 2015 2014

Increa

se/

Decre

ase 2016 2015

Increa

se/

Decre

ase 2017 2016

Increa

se/

Decre

ase

Total current

assets

11032

8582

10178

2044

85465

38

8.40

%

12193

9593

11032

8582

11611

011

10.52

%

12994

9219

12193

9593

80096

26

6.57

%

Total assets

21407

1883

20367

9800

10392

083

5.10

%

22604

4667

21407

1883

11972

784

5.59

%

26678

3176

22604

4667

40738

509

18.02

%

Total current

liabilities

44641

482

45977

117

-

13356

35

-

2.90

%

47165

446

44641

482

25239

64

5.65

%

47165

446

-

47165

446

-

100.0

0%

Total

liabilities

55793

968

55100

124

69384

4

1.26

%

59673

438

55793

968

38794

70

6.95

%

77148

352

59673

438

17474

914

29.28

%

Total equity

15827

7915

14857

9676

96982

39

6.53

%

16637

1229

15827

7915

80933

14

5.11

%

18963

4824

16637

1229

23263

595

13.98

%

Total

liabilities and

Stockholders'

equity

21407

1883

20367

9800

10392

083

5.10

%

22604

4667

21407

1883

11972

784

5.59

%

26678

3176

22604

4667

40738

509

18.02

%

Appendix 2 - Vertical analysis of Apple Inc.

Particulars 2017 % of Sales 2016 % of Sales 2015

% of

Sales 2014

% of

Sales

Sales 229234 100.00% 215639 100.00%

23371

5

100.00

%

18279

5

100.00

%

Gross profit 88186 38.47% 84263 39.08% 93626

40.06

% 70537

38.59

%

14

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Operating

profit 61344 26.76% 60024 27.84% 71230

30.48

% 52503

28.72

%

Net profit 48351 21.09% 45687 21.19% 53394

22.85

% 39510

21.61

%

ASSETS 2017

% of

Assets 2016 % of Assets 2015

% of

Assets 2014

% of

Assets

Total

current

assets 128645 34.28% 106869 33.22% 89378

30.77

% 68531

29.56

%

Total assets 375319 100.00% 321686 100.00%

29047

9

100.00

%

23183

9

100.00

%

Total

current

liabilities 100814 26.86% 79006 24.56% 80610

27.75

% 63448

27.37

%

Total

equity 134047 35.72% 128249 39.87%

11935

5

41.09

%

11154

7

48.11

%

Total

liabilities

and

stockholder

s’ equity 375319 100.00% 321686 100.00%

29047

9

100.00

%

23183

9

100.00

%

Horizontal analysis of Apple Inc.

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Particulars 2015 2014 Amou Perce 2016 2015 Amou Perce 2017 2016 Amou Perce

15

profit 61344 26.76% 60024 27.84% 71230

30.48

% 52503

28.72

%

Net profit 48351 21.09% 45687 21.19% 53394

22.85

% 39510

21.61

%

ASSETS 2017

% of

Assets 2016 % of Assets 2015

% of

Assets 2014

% of

Assets

Total

current

assets 128645 34.28% 106869 33.22% 89378

30.77

% 68531

29.56

%

Total assets 375319 100.00% 321686 100.00%

29047

9

100.00

%

23183

9

100.00

%

Total

current

liabilities 100814 26.86% 79006 24.56% 80610

27.75

% 63448

27.37

%

Total

equity 134047 35.72% 128249 39.87%

11935

5

41.09

%

11154

7

48.11

%

Total

liabilities

and

stockholder

s’ equity 375319 100.00% 321686 100.00%

29047

9

100.00

%

23183

9

100.00

%

Horizontal analysis of Apple Inc.

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Particulars 2015 2014 Amou Perce 2016 2015 Amou Perce 2017 2016 Amou Perce

15

nt nt nt nt nt nt

Sales

23371

5

18279

5 50920

27.86

%

21563

9

23371

5

-

18076

-

7.73

%

22923

4

21563

9 13595

6.30

%

Gross profit 93626 70537 23089

32.73

% 84263 93626 -9363

-

10.00

% 88186 84263 3923

4.66

%

Operating

profit 71230 52503 18727

35.67

% 60024 71230

-

11206

-

15.73

% 61344 60024 1320

2.20

%

Net profit 53394 39510 13884

35.14

% 45687 53394 -7707

-

14.43

% 48351 45687 2664

5.83

%

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

ASSETS 2015 2014

Amou

nt

Perce

nt 2016 2015

Amou

nt

Perce

nt 2017 2016

Amou

nt

Perce

nt

Total current

assets 89378 68531 20847

30.42

%

10686

9 89378 17491

19.57

%

12864

5

10686

9 21776

20.38

%

Total assets

29047

9

23183

9 58640

25.29

%

32168

6

29047

9 31207

10.74

%

37531

9

32168

6 53633

16.67

%

Total

liabilities

17112

4

12029

2 50832

42.26

%

19343

7

17112

4 22313

13.04

%

24127

2

19343

7 47835

24.73

%

Total equity

11935

5

11154

7 7808

7.00

%

12824

9

11935

5 8894

7.45

%

13404

7

12824

9 5798

4.52

%

Total

liabilities and

29047 23183 58640 25.29 32168 29047 31207 10.74 37531 32168 53633 16.67

16

Sales

23371

5

18279

5 50920

27.86

%

21563

9

23371

5

-

18076

-

7.73

%

22923

4

21563

9 13595

6.30

%

Gross profit 93626 70537 23089

32.73

% 84263 93626 -9363

-

10.00

% 88186 84263 3923

4.66

%

Operating

profit 71230 52503 18727

35.67

% 60024 71230

-

11206

-

15.73

% 61344 60024 1320

2.20

%

Net profit 53394 39510 13884

35.14

% 45687 53394 -7707

-

14.43

% 48351 45687 2664

5.83

%

Increa

se/

Decre

ase

Increa

se/

Decre

ase

Increa

se/

Decre

ase

ASSETS 2015 2014

Amou

nt

Perce

nt 2016 2015

Amou

nt

Perce

nt 2017 2016

Amou

nt

Perce

nt

Total current

assets 89378 68531 20847

30.42

%

10686

9 89378 17491

19.57

%

12864

5

10686

9 21776

20.38

%

Total assets

29047

9

23183

9 58640

25.29

%

32168

6

29047

9 31207

10.74

%

37531

9

32168

6 53633

16.67

%

Total

liabilities

17112

4

12029

2 50832

42.26

%

19343

7

17112

4 22313

13.04

%

24127

2

19343

7 47835

24.73

%

Total equity

11935

5

11154

7 7808

7.00

%

12824

9

11935

5 8894

7.45

%

13404

7

12824

9 5798

4.52

%

Total

liabilities and

29047 23183 58640 25.29 32168 29047 31207 10.74 37531 32168 53633 16.67

16

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.