Financial Management Assignment (May-bank and CIMB bank)

VerifiedAdded on 2021/01/03

|11

|3354

|142

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

FINANCIAL

MANAGEMENT

MANAGEMENT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Introduction of May-Bank...........................................................................................................1

Introduction of CIMB bank.........................................................................................................2

Calculation of future value of annuity of May bank...................................................................3

Calculation of future value of annuity of CIMB bank................................................................4

Comparison of the total savings between May bank and CIMB bank........................................5

Importance of time value of money concept in financial decision making to individuals..........7

Summary.....................................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES ...............................................................................................................................9

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

Introduction of May-Bank...........................................................................................................1

Introduction of CIMB bank.........................................................................................................2

Calculation of future value of annuity of May bank...................................................................3

Calculation of future value of annuity of CIMB bank................................................................4

Comparison of the total savings between May bank and CIMB bank........................................5

Importance of time value of money concept in financial decision making to individuals..........7

Summary.....................................................................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES ...............................................................................................................................9

INTRODUCTION

Financial management is critical state of any organisation that conduct all financial

activities. It is the process of preparation, executing, controlling and observation of financial

resources with a view to accomplish organizational objectives and goals. It is a perfect practice

for controlling the financial activities of an organization such as accounting, acquisition of funds,

usage of funds, payments, risk classification and every other thing related to money. In this

project selected bank of Malaysia are May-bank and CIMB bank. May-bank is the largest bank

in country in terms of market capitalization and total assets. It is also one of the largest banks in

south-east Asia. CIMB bank is the consumer banking unit of the CIMB group. The universal

bank provides banking services including wholesale and consumer banking, treasury and

strategic investment (Attig, and Cleary, 2014).

This report covers introduction of both banks and calculate future value of annuity.

Comparison of the total savings between the two commercial banks, importance of time value of

money concept in financial decision making to individuals and concluded of both banks.

MAIN BODY

Introduction of May-Bank

May-bank is the largest bank in the country of Malaysia in terms of market estimation

and total assets. It is also one of the largest banks in south east Asia with total assets exceeding

RM 165 billion and having a net profit of RM 1.75 billion in 2015. It gives a wider range of

banking products and services includes offshore banking, investment banking, leasing, Islamic

banking and hire purchase, factoring, insurance, stock broking, venture capital, nominees

service, asset management and internet banking (Barr, and McClellan, 2018). Through its all-

inclusive network of 2400 offices, duration 10 ASEAN countries and global financial services.

In 2015, May Bank was ranked 95th in the banker's top 1000 world banks and is ranked 362 in

the Forbes global 2000 major companies in June 2016. May bank Islamic, the bank's Islamic

banking arm, is the top Islamic bank in the Asia Ocean location. It is also the world's fifth sizable

Islamic bank by assets. May bank was based in 1960, with headquarters in Kuala Lumpur. May

bank's network spans across all 10 ASEAN nations as well as key Asian countries and global

financial centres with a network of 2400 offices world wide with more than 45000 employees.

1

Financial management is critical state of any organisation that conduct all financial

activities. It is the process of preparation, executing, controlling and observation of financial

resources with a view to accomplish organizational objectives and goals. It is a perfect practice

for controlling the financial activities of an organization such as accounting, acquisition of funds,

usage of funds, payments, risk classification and every other thing related to money. In this

project selected bank of Malaysia are May-bank and CIMB bank. May-bank is the largest bank

in country in terms of market capitalization and total assets. It is also one of the largest banks in

south-east Asia. CIMB bank is the consumer banking unit of the CIMB group. The universal

bank provides banking services including wholesale and consumer banking, treasury and

strategic investment (Attig, and Cleary, 2014).

This report covers introduction of both banks and calculate future value of annuity.

Comparison of the total savings between the two commercial banks, importance of time value of

money concept in financial decision making to individuals and concluded of both banks.

MAIN BODY

Introduction of May-Bank

May-bank is the largest bank in the country of Malaysia in terms of market estimation

and total assets. It is also one of the largest banks in south east Asia with total assets exceeding

RM 165 billion and having a net profit of RM 1.75 billion in 2015. It gives a wider range of

banking products and services includes offshore banking, investment banking, leasing, Islamic

banking and hire purchase, factoring, insurance, stock broking, venture capital, nominees

service, asset management and internet banking (Barr, and McClellan, 2018). Through its all-

inclusive network of 2400 offices, duration 10 ASEAN countries and global financial services.

In 2015, May Bank was ranked 95th in the banker's top 1000 world banks and is ranked 362 in

the Forbes global 2000 major companies in June 2016. May bank Islamic, the bank's Islamic

banking arm, is the top Islamic bank in the Asia Ocean location. It is also the world's fifth sizable

Islamic bank by assets. May bank was based in 1960, with headquarters in Kuala Lumpur. May

bank's network spans across all 10 ASEAN nations as well as key Asian countries and global

financial centres with a network of 2400 offices world wide with more than 45000 employees.

1

Revenue of bank in 2017 is RM 45.58 billion, Net income is RM 7.52 billion and total assets RM

765.3 billion.

Vision of may bank

To be the major financial services provider in Indonesia, driven by passionately committed and

innovative people and serving communities.

Mission of May bank

May-bank mission is to humanise financial services across Asia for providing -

Supply the people with favourable entree to financing

Someone fair terms and valuation

Advising customers based and on their needs

Being at the heart of gathering

Introduction of CIMB bank

CIMB bank is the consumer banking unit of the CIMB group. The universal bank

provides banking services including comprising investment banking, consumer, corporate

banking and wholesale banking, strategic investments, and treasury with its core markets being

Malaysian, Thailand and Indonesia and markets through wide retail branch network of 1080

branches across the region. Aside from Malaysia, the bank's core markets include Indonesia,

Singapore and Thailand. CIMB bank established in 2006, it based in Kuala Lumpur, serving

more than 13.5 million customers across the country. CIMB Islamic operates in parallel with

these businesses, in line with the group's dual banking model (Brusca, Gómez‐villegas, and

Montesinos, 2016). Revenue of CIMB bank is RM 11.49 billion in 2017, Net income RM 3.64

billion and Total assets is RM 308.45 billion.

Consumer Banking – CIMB group has full mature consumer banking services across its main

operative markets in Cambodia, Singapore, Malaysia and Indonesia which consist consumer

banking are consumers sales and arrangement which oversees the sales network consider mobile

sales teams and branches.

Vision

To be the leading ASEAN company.

Mission

To provide universal banking services in Indonesia as a high performing, institutionalized and

integrated company located in ASEAN and key markets on the far side and to champion and the

2

765.3 billion.

Vision of may bank

To be the major financial services provider in Indonesia, driven by passionately committed and

innovative people and serving communities.

Mission of May bank

May-bank mission is to humanise financial services across Asia for providing -

Supply the people with favourable entree to financing

Someone fair terms and valuation

Advising customers based and on their needs

Being at the heart of gathering

Introduction of CIMB bank

CIMB bank is the consumer banking unit of the CIMB group. The universal bank

provides banking services including comprising investment banking, consumer, corporate

banking and wholesale banking, strategic investments, and treasury with its core markets being

Malaysian, Thailand and Indonesia and markets through wide retail branch network of 1080

branches across the region. Aside from Malaysia, the bank's core markets include Indonesia,

Singapore and Thailand. CIMB bank established in 2006, it based in Kuala Lumpur, serving

more than 13.5 million customers across the country. CIMB Islamic operates in parallel with

these businesses, in line with the group's dual banking model (Brusca, Gómez‐villegas, and

Montesinos, 2016). Revenue of CIMB bank is RM 11.49 billion in 2017, Net income RM 3.64

billion and Total assets is RM 308.45 billion.

Consumer Banking – CIMB group has full mature consumer banking services across its main

operative markets in Cambodia, Singapore, Malaysia and Indonesia which consist consumer

banking are consumers sales and arrangement which oversees the sales network consider mobile

sales teams and branches.

Vision

To be the leading ASEAN company.

Mission

To provide universal banking services in Indonesia as a high performing, institutionalized and

integrated company located in ASEAN and key markets on the far side and to champion and the

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

acceleration of ASEAN integration and the region's links to the rest of the world (Cheng, and et.

al., 2014).

Core values

C – Customer centric, they are exist to serve our customers and sell products and services that

our customers understand and value.

H – High performance, they are work hard and work plan of action for customers, staff and other

stakeholders.

E – Enable power, authorise and align people to innovate and deliver value in their workplace as

well as for the community they serve.

Strength in diversity – they have respect for different cultures. Value varied perspectives and

recognise diversity as a source of strength.

Integrity – professional, honest, respectful in everything to do because integrity is the founding

value of CIMB.

Business Activity

Disregard the evaporable financial markets and slower economic growth in the area, the Bank

has maintained its leadership in Malaysian acquisitions and mergers, advisory services, debt

capital-market as well as equity league tables, and secondary equity-market trades. The Bank’s

investment banking strategy is focused on further expanding activities, both onshore and off-

shore, with particular focus on increasing assets under management and discretionary mandates.

While maintaining its focus on traditional investment banking, the Bank has known private

banking and asset direction as areas through with which the Bank may speed up growth and

increase its gainfulness (Finkler, and et. al., 2016). Where investment banking is concerned, the

Bank intends to benefit from growth opportunities in regional markets, where it has become

increasingly active. Above-market growth will, however, prove challenging.

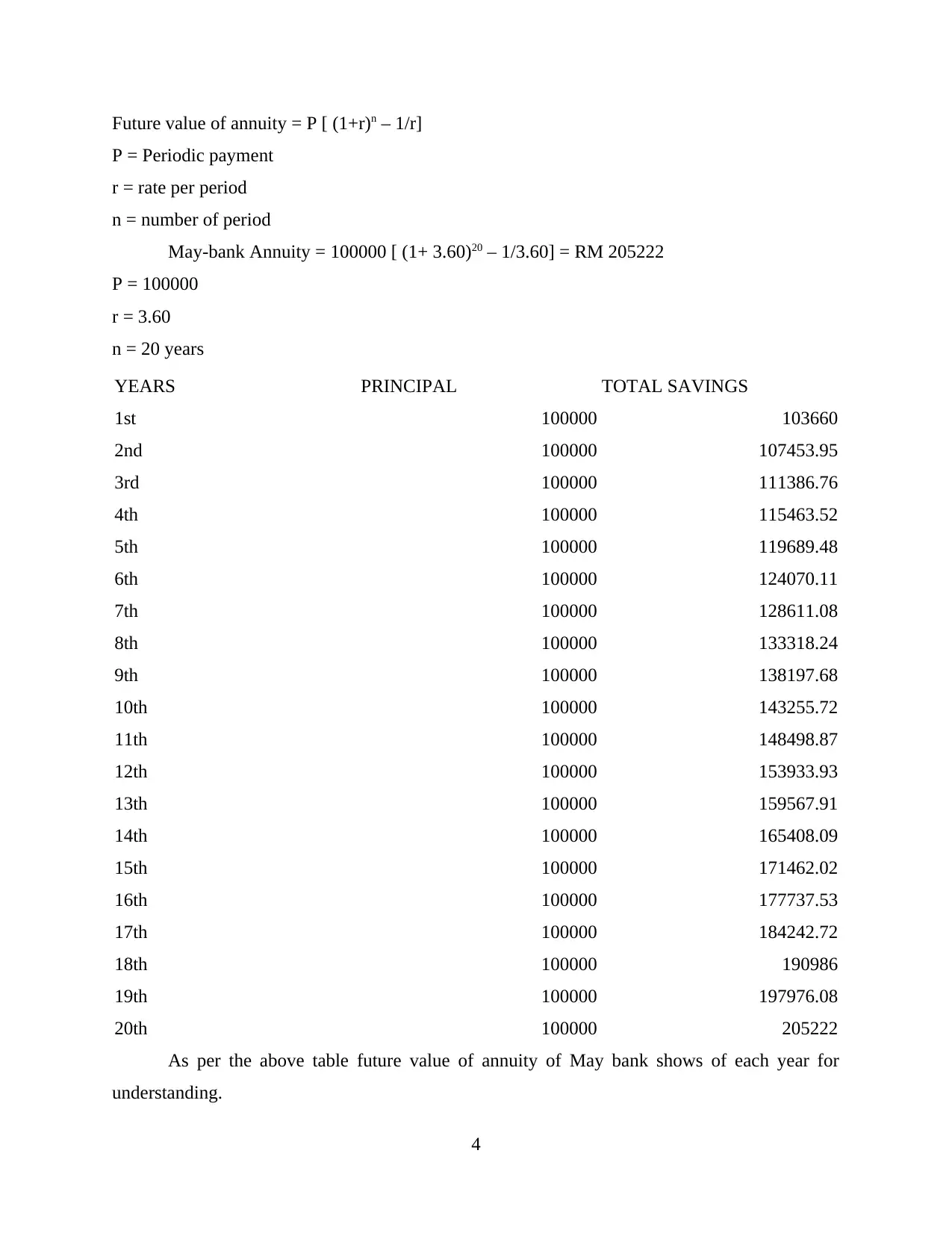

Calculation of future value of annuity of May bank

The future value of an annuity is the value of a group of continual payments at a specific

date in the future. These on a regular basis revenant payments are known as an annuity. The

future value of an annuity measures how much would have in the future at a specified rate of

return or discount rate (Hao, 2014). The annuity's future cash flows grow at the stated discount

rate, so a higher discount rate results in a higher future value for the annuity. There is formula for

Calculating future value annuity -

3

al., 2014).

Core values

C – Customer centric, they are exist to serve our customers and sell products and services that

our customers understand and value.

H – High performance, they are work hard and work plan of action for customers, staff and other

stakeholders.

E – Enable power, authorise and align people to innovate and deliver value in their workplace as

well as for the community they serve.

Strength in diversity – they have respect for different cultures. Value varied perspectives and

recognise diversity as a source of strength.

Integrity – professional, honest, respectful in everything to do because integrity is the founding

value of CIMB.

Business Activity

Disregard the evaporable financial markets and slower economic growth in the area, the Bank

has maintained its leadership in Malaysian acquisitions and mergers, advisory services, debt

capital-market as well as equity league tables, and secondary equity-market trades. The Bank’s

investment banking strategy is focused on further expanding activities, both onshore and off-

shore, with particular focus on increasing assets under management and discretionary mandates.

While maintaining its focus on traditional investment banking, the Bank has known private

banking and asset direction as areas through with which the Bank may speed up growth and

increase its gainfulness (Finkler, and et. al., 2016). Where investment banking is concerned, the

Bank intends to benefit from growth opportunities in regional markets, where it has become

increasingly active. Above-market growth will, however, prove challenging.

Calculation of future value of annuity of May bank

The future value of an annuity is the value of a group of continual payments at a specific

date in the future. These on a regular basis revenant payments are known as an annuity. The

future value of an annuity measures how much would have in the future at a specified rate of

return or discount rate (Hao, 2014). The annuity's future cash flows grow at the stated discount

rate, so a higher discount rate results in a higher future value for the annuity. There is formula for

Calculating future value annuity -

3

Future value of annuity = P [ (1+r)n – 1/r]

P = Periodic payment

r = rate per period

n = number of period

May-bank Annuity = 100000 [ (1+ 3.60)20 – 1/3.60] = RM 205222

P = 100000

r = 3.60

n = 20 years

YEARS PRINCIPAL TOTAL SAVINGS

1st 100000 103660

2nd 100000 107453.95

3rd 100000 111386.76

4th 100000 115463.52

5th 100000 119689.48

6th 100000 124070.11

7th 100000 128611.08

8th 100000 133318.24

9th 100000 138197.68

10th 100000 143255.72

11th 100000 148498.87

12th 100000 153933.93

13th 100000 159567.91

14th 100000 165408.09

15th 100000 171462.02

16th 100000 177737.53

17th 100000 184242.72

18th 100000 190986

19th 100000 197976.08

20th 100000 205222

As per the above table future value of annuity of May bank shows of each year for

understanding.

4

P = Periodic payment

r = rate per period

n = number of period

May-bank Annuity = 100000 [ (1+ 3.60)20 – 1/3.60] = RM 205222

P = 100000

r = 3.60

n = 20 years

YEARS PRINCIPAL TOTAL SAVINGS

1st 100000 103660

2nd 100000 107453.95

3rd 100000 111386.76

4th 100000 115463.52

5th 100000 119689.48

6th 100000 124070.11

7th 100000 128611.08

8th 100000 133318.24

9th 100000 138197.68

10th 100000 143255.72

11th 100000 148498.87

12th 100000 153933.93

13th 100000 159567.91

14th 100000 165408.09

15th 100000 171462.02

16th 100000 177737.53

17th 100000 184242.72

18th 100000 190986

19th 100000 197976.08

20th 100000 205222

As per the above table future value of annuity of May bank shows of each year for

understanding.

4

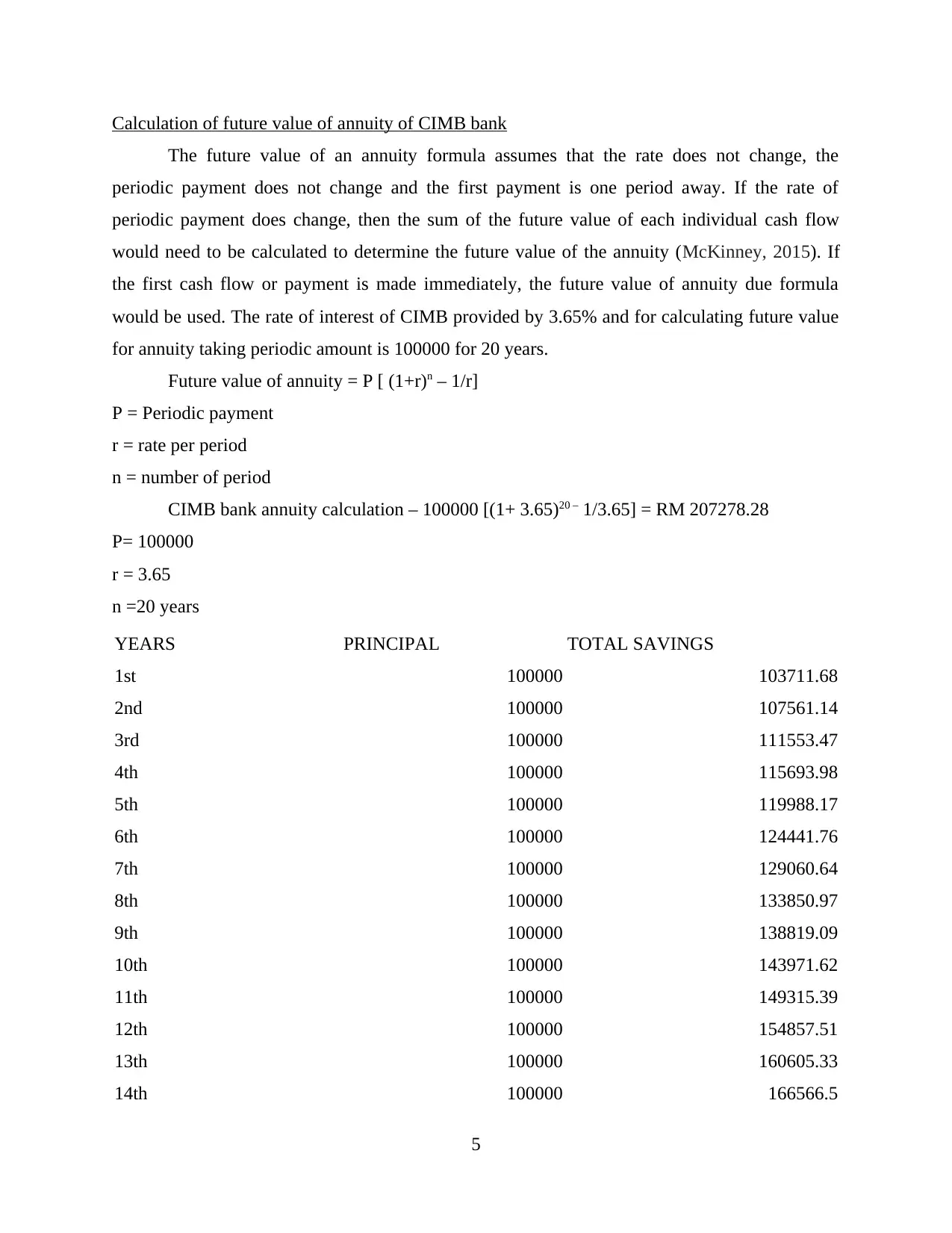

Calculation of future value of annuity of CIMB bank

The future value of an annuity formula assumes that the rate does not change, the

periodic payment does not change and the first payment is one period away. If the rate of

periodic payment does change, then the sum of the future value of each individual cash flow

would need to be calculated to determine the future value of the annuity (McKinney, 2015). If

the first cash flow or payment is made immediately, the future value of annuity due formula

would be used. The rate of interest of CIMB provided by 3.65% and for calculating future value

for annuity taking periodic amount is 100000 for 20 years.

Future value of annuity = P [ (1+r)n – 1/r]

P = Periodic payment

r = rate per period

n = number of period

CIMB bank annuity calculation – 100000 [(1+ 3.65)20 – 1/3.65] = RM 207278.28

P= 100000

r = 3.65

n =20 years

YEARS PRINCIPAL TOTAL SAVINGS

1st 100000 103711.68

2nd 100000 107561.14

3rd 100000 111553.47

4th 100000 115693.98

5th 100000 119988.17

6th 100000 124441.76

7th 100000 129060.64

8th 100000 133850.97

9th 100000 138819.09

10th 100000 143971.62

11th 100000 149315.39

12th 100000 154857.51

13th 100000 160605.33

14th 100000 166566.5

5

The future value of an annuity formula assumes that the rate does not change, the

periodic payment does not change and the first payment is one period away. If the rate of

periodic payment does change, then the sum of the future value of each individual cash flow

would need to be calculated to determine the future value of the annuity (McKinney, 2015). If

the first cash flow or payment is made immediately, the future value of annuity due formula

would be used. The rate of interest of CIMB provided by 3.65% and for calculating future value

for annuity taking periodic amount is 100000 for 20 years.

Future value of annuity = P [ (1+r)n – 1/r]

P = Periodic payment

r = rate per period

n = number of period

CIMB bank annuity calculation – 100000 [(1+ 3.65)20 – 1/3.65] = RM 207278.28

P= 100000

r = 3.65

n =20 years

YEARS PRINCIPAL TOTAL SAVINGS

1st 100000 103711.68

2nd 100000 107561.14

3rd 100000 111553.47

4th 100000 115693.98

5th 100000 119988.17

6th 100000 124441.76

7th 100000 129060.64

8th 100000 133850.97

9th 100000 138819.09

10th 100000 143971.62

11th 100000 149315.39

12th 100000 154857.51

13th 100000 160605.33

14th 100000 166566.5

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

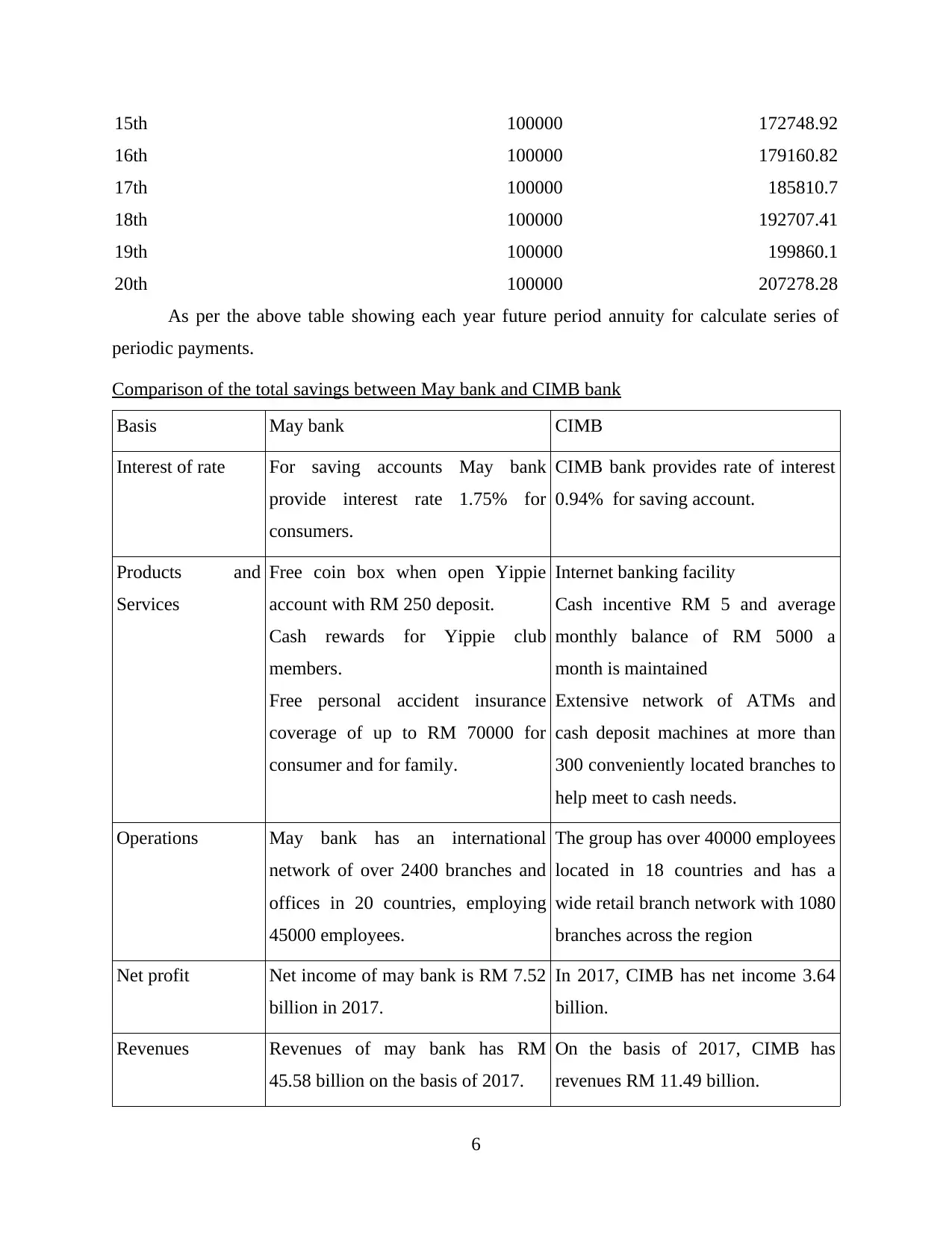

15th 100000 172748.92

16th 100000 179160.82

17th 100000 185810.7

18th 100000 192707.41

19th 100000 199860.1

20th 100000 207278.28

As per the above table showing each year future period annuity for calculate series of

periodic payments.

Comparison of the total savings between May bank and CIMB bank

Basis May bank CIMB

Interest of rate For saving accounts May bank

provide interest rate 1.75% for

consumers.

CIMB bank provides rate of interest

0.94% for saving account.

Products and

Services

Free coin box when open Yippie

account with RM 250 deposit.

Cash rewards for Yippie club

members.

Free personal accident insurance

coverage of up to RM 70000 for

consumer and for family.

Internet banking facility

Cash incentive RM 5 and average

monthly balance of RM 5000 a

month is maintained

Extensive network of ATMs and

cash deposit machines at more than

300 conveniently located branches to

help meet to cash needs.

Operations May bank has an international

network of over 2400 branches and

offices in 20 countries, employing

45000 employees.

The group has over 40000 employees

located in 18 countries and has a

wide retail branch network with 1080

branches across the region

Net profit Net income of may bank is RM 7.52

billion in 2017.

In 2017, CIMB has net income 3.64

billion.

Revenues Revenues of may bank has RM

45.58 billion on the basis of 2017.

On the basis of 2017, CIMB has

revenues RM 11.49 billion.

6

16th 100000 179160.82

17th 100000 185810.7

18th 100000 192707.41

19th 100000 199860.1

20th 100000 207278.28

As per the above table showing each year future period annuity for calculate series of

periodic payments.

Comparison of the total savings between May bank and CIMB bank

Basis May bank CIMB

Interest of rate For saving accounts May bank

provide interest rate 1.75% for

consumers.

CIMB bank provides rate of interest

0.94% for saving account.

Products and

Services

Free coin box when open Yippie

account with RM 250 deposit.

Cash rewards for Yippie club

members.

Free personal accident insurance

coverage of up to RM 70000 for

consumer and for family.

Internet banking facility

Cash incentive RM 5 and average

monthly balance of RM 5000 a

month is maintained

Extensive network of ATMs and

cash deposit machines at more than

300 conveniently located branches to

help meet to cash needs.

Operations May bank has an international

network of over 2400 branches and

offices in 20 countries, employing

45000 employees.

The group has over 40000 employees

located in 18 countries and has a

wide retail branch network with 1080

branches across the region

Net profit Net income of may bank is RM 7.52

billion in 2017.

In 2017, CIMB has net income 3.64

billion.

Revenues Revenues of may bank has RM

45.58 billion on the basis of 2017.

On the basis of 2017, CIMB has

revenues RM 11.49 billion.

6

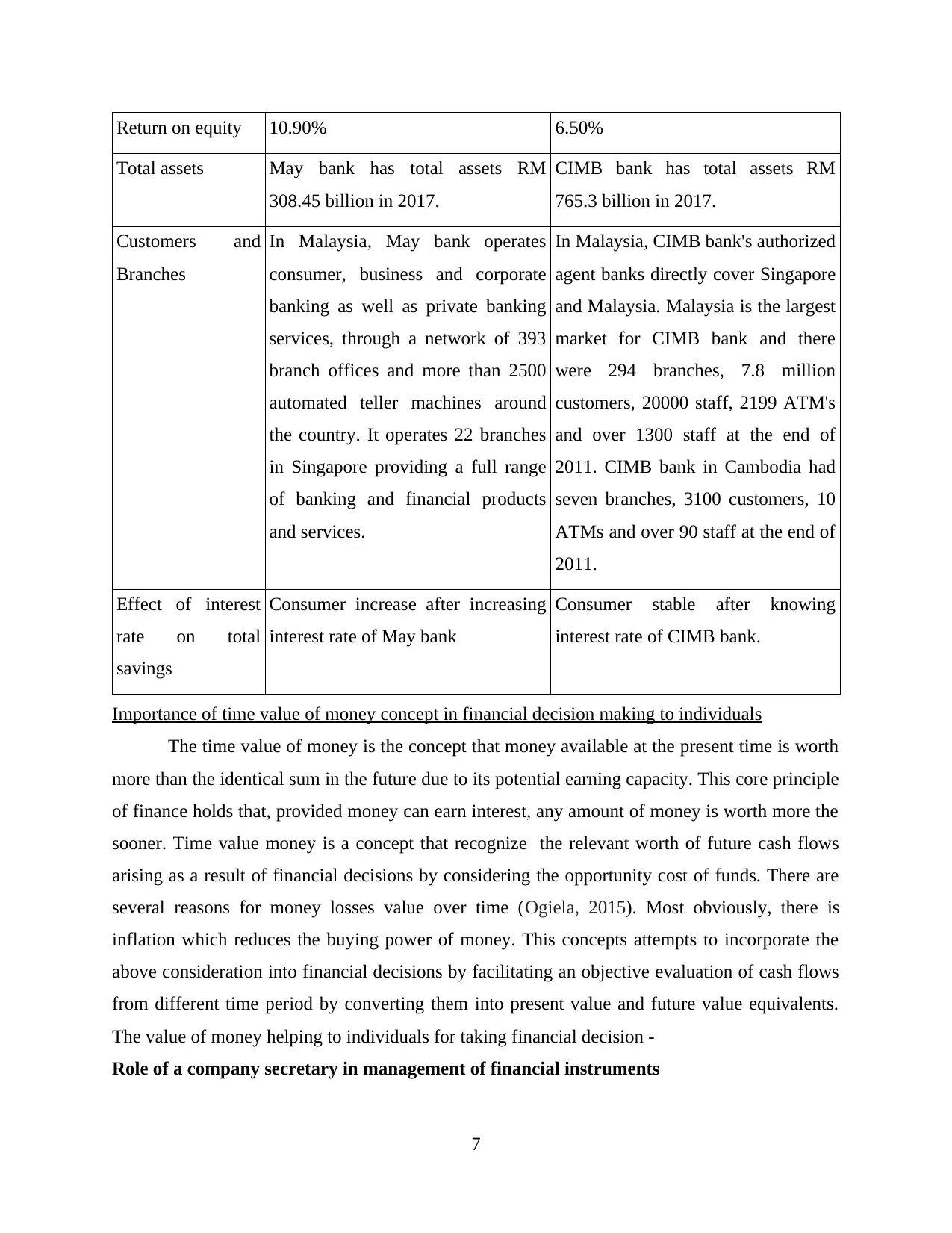

Return on equity 10.90% 6.50%

Total assets May bank has total assets RM

308.45 billion in 2017.

CIMB bank has total assets RM

765.3 billion in 2017.

Customers and

Branches

In Malaysia, May bank operates

consumer, business and corporate

banking as well as private banking

services, through a network of 393

branch offices and more than 2500

automated teller machines around

the country. It operates 22 branches

in Singapore providing a full range

of banking and financial products

and services.

In Malaysia, CIMB bank's authorized

agent banks directly cover Singapore

and Malaysia. Malaysia is the largest

market for CIMB bank and there

were 294 branches, 7.8 million

customers, 20000 staff, 2199 ATM's

and over 1300 staff at the end of

2011. CIMB bank in Cambodia had

seven branches, 3100 customers, 10

ATMs and over 90 staff at the end of

2011.

Effect of interest

rate on total

savings

Consumer increase after increasing

interest rate of May bank

Consumer stable after knowing

interest rate of CIMB bank.

Importance of time value of money concept in financial decision making to individuals

The time value of money is the concept that money available at the present time is worth

more than the identical sum in the future due to its potential earning capacity. This core principle

of finance holds that, provided money can earn interest, any amount of money is worth more the

sooner. Time value money is a concept that recognize the relevant worth of future cash flows

arising as a result of financial decisions by considering the opportunity cost of funds. There are

several reasons for money losses value over time (Ogiela, 2015). Most obviously, there is

inflation which reduces the buying power of money. This concepts attempts to incorporate the

above consideration into financial decisions by facilitating an objective evaluation of cash flows

from different time period by converting them into present value and future value equivalents.

The value of money helping to individuals for taking financial decision -

Role of a company secretary in management of financial instruments

7

Total assets May bank has total assets RM

308.45 billion in 2017.

CIMB bank has total assets RM

765.3 billion in 2017.

Customers and

Branches

In Malaysia, May bank operates

consumer, business and corporate

banking as well as private banking

services, through a network of 393

branch offices and more than 2500

automated teller machines around

the country. It operates 22 branches

in Singapore providing a full range

of banking and financial products

and services.

In Malaysia, CIMB bank's authorized

agent banks directly cover Singapore

and Malaysia. Malaysia is the largest

market for CIMB bank and there

were 294 branches, 7.8 million

customers, 20000 staff, 2199 ATM's

and over 1300 staff at the end of

2011. CIMB bank in Cambodia had

seven branches, 3100 customers, 10

ATMs and over 90 staff at the end of

2011.

Effect of interest

rate on total

savings

Consumer increase after increasing

interest rate of May bank

Consumer stable after knowing

interest rate of CIMB bank.

Importance of time value of money concept in financial decision making to individuals

The time value of money is the concept that money available at the present time is worth

more than the identical sum in the future due to its potential earning capacity. This core principle

of finance holds that, provided money can earn interest, any amount of money is worth more the

sooner. Time value money is a concept that recognize the relevant worth of future cash flows

arising as a result of financial decisions by considering the opportunity cost of funds. There are

several reasons for money losses value over time (Ogiela, 2015). Most obviously, there is

inflation which reduces the buying power of money. This concepts attempts to incorporate the

above consideration into financial decisions by facilitating an objective evaluation of cash flows

from different time period by converting them into present value and future value equivalents.

The value of money helping to individuals for taking financial decision -

Role of a company secretary in management of financial instruments

7

A company Secretary is the key to the effectiveness and efficiency of governance by the

board of directors. In state to execute duties in light of the above, it is important for a company

secretary to understand at a through level the concept of time value of money with regard to

financial liabilities and financial assets(Zietlow,and et. al., 2018).

Relevance of time value of money in financial management

Time value of money is an important concept or notion in financial management of

insurance entities, financial institutions, banks and other non financial business firms. The

tipping point of time value of money is that a dollar in hand in future. Because invest in today

and earn interest in dollars and thus multiply financial asset or use it for requirements. The op

resent day use of money is also more useful because live in the present time. The company

secretary can take decision of sales, purchase or trade of financial instruments by non financial

and financial business firm and reporting of such instruments at fair value of the board(Pauw,

and et. al., 2015).

Time value of money a basic premise under IFRS and financial market transaction

Time value of money refers to the present value of future cash outflows and inflows. The

difference between the future value and present value represents interest components. Financial

market transaction work on the notion of time value of money which is reflected in IFRS. Fair

value also described as equivalent of present value.

Fair value rule for financial instruments

Fair value is nothing else than applying the time value of money by calculating either the

Future value of present cash available

present value of future cash outflows and inflows

It may be noted that the exact method of fair valuation of financial instruments, reflecting time

value of money, depends upon the investment classification rules in IAS 39 financial instruments

(Renz, 2016). Measurement and recognition, IFRS 9 financial instrument, measurement and

Classification and valuation rules in IFRS 13 fair value measurement.

Amortised cost basis of valuing financial instruments

If financial liabilities and financial assets that are bearing of interest are at a market rate

of interest, the initial value exchanged will usually approximate to the present value of the future

payments discounted at a market rate. Amortised cost of a financial asset is the present value of

interest rate and future cash receipts, both the cash inflows and discounted at the stated rate,

8

board of directors. In state to execute duties in light of the above, it is important for a company

secretary to understand at a through level the concept of time value of money with regard to

financial liabilities and financial assets(Zietlow,and et. al., 2018).

Relevance of time value of money in financial management

Time value of money is an important concept or notion in financial management of

insurance entities, financial institutions, banks and other non financial business firms. The

tipping point of time value of money is that a dollar in hand in future. Because invest in today

and earn interest in dollars and thus multiply financial asset or use it for requirements. The op

resent day use of money is also more useful because live in the present time. The company

secretary can take decision of sales, purchase or trade of financial instruments by non financial

and financial business firm and reporting of such instruments at fair value of the board(Pauw,

and et. al., 2015).

Time value of money a basic premise under IFRS and financial market transaction

Time value of money refers to the present value of future cash outflows and inflows. The

difference between the future value and present value represents interest components. Financial

market transaction work on the notion of time value of money which is reflected in IFRS. Fair

value also described as equivalent of present value.

Fair value rule for financial instruments

Fair value is nothing else than applying the time value of money by calculating either the

Future value of present cash available

present value of future cash outflows and inflows

It may be noted that the exact method of fair valuation of financial instruments, reflecting time

value of money, depends upon the investment classification rules in IAS 39 financial instruments

(Renz, 2016). Measurement and recognition, IFRS 9 financial instrument, measurement and

Classification and valuation rules in IFRS 13 fair value measurement.

Amortised cost basis of valuing financial instruments

If financial liabilities and financial assets that are bearing of interest are at a market rate

of interest, the initial value exchanged will usually approximate to the present value of the future

payments discounted at a market rate. Amortised cost of a financial asset is the present value of

interest rate and future cash receipts, both the cash inflows and discounted at the stated rate,

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

interest cash outflows at stated rate, which will give the initial carrying amount of the financial

liability at the beginning of the period (Schaeck, and Cihák, 2014).

Summary

May bank – In the summary of May bank has different interest rate for consumer for making

consumer interest and calculating of annuity on the basis of future value.

CIMB bank – This bank part of CIMB group that are operate many businesses in many fields.

That are have interest rate of for calculating future value of annuity(Difference between May

bank and CIMB bank. 2018).

CONCLUSION

It is concluded that May bank and CIMB bank both are related to commercial bank of

Malaysia and May bank highest bank of Malaysia and have lot of consumers and branches of

banks. CIMB bank related to CIMB group that are businesses in many fields for operations.

Comparison between both banks that they have separate business activities, missions, vision and

products and services. Both banks provided different interest rate to customers. Time value of

money helping to individuals to taking decision for financial statements.

9

liability at the beginning of the period (Schaeck, and Cihák, 2014).

Summary

May bank – In the summary of May bank has different interest rate for consumer for making

consumer interest and calculating of annuity on the basis of future value.

CIMB bank – This bank part of CIMB group that are operate many businesses in many fields.

That are have interest rate of for calculating future value of annuity(Difference between May

bank and CIMB bank. 2018).

CONCLUSION

It is concluded that May bank and CIMB bank both are related to commercial bank of

Malaysia and May bank highest bank of Malaysia and have lot of consumers and branches of

banks. CIMB bank related to CIMB group that are businesses in many fields for operations.

Comparison between both banks that they have separate business activities, missions, vision and

products and services. Both banks provided different interest rate to customers. Time value of

money helping to individuals to taking decision for financial statements.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.