Detailed Financial Ratio Analysis Report of ASOS plc (2019-2020)

VerifiedAdded on 2023/06/12

|6

|1198

|195

Report

AI Summary

This report provides a financial ratio analysis of ASOS plc for the years 2019 and 2020. It includes calculations and interpretations of key ratios such as Return on Capital Employed (ROCE), Gross Profit Margin, Operating Profit Margin, Inventory Turnover Period, Average Settlement Periods for Trade Receivables and Payables, Current Ratio, Acid Test Ratio, Gearing Ratio, and Interest Coverage Ratio. The analysis indicates improvements in ROCE, Operating Profit Margin, and Current Ratio, suggesting better financial health. However, the Gross Profit Margin decreased slightly. The report also discusses the advantages and limitations of using financial ratios for decision-making, concluding that while ratios offer valuable insights, they should be used cautiously due to the unpredictable nature of future events. Desklib offers a platform to explore this and similar solved assignments.

Project One - Financial

Ratios Report

Ratios Report

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

Ratio calculation..........................................................................................................................1

Interpretation................................................................................................................................1

Advantages and limitations of ratios...........................................................................................3

CONCLUSION................................................................................................................................3

REFERENCES................................................................................................................................4

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

MAIN BODY..................................................................................................................................1

Ratio calculation..........................................................................................................................1

Interpretation................................................................................................................................1

Advantages and limitations of ratios...........................................................................................3

CONCLUSION................................................................................................................................3

REFERENCES................................................................................................................................4

INTRODUCTION

In this report ratio calculation its interpretation and advantage and limitations are described

with respect of the ASOS plc so that appropriate decisions can be taken.

MAIN BODY

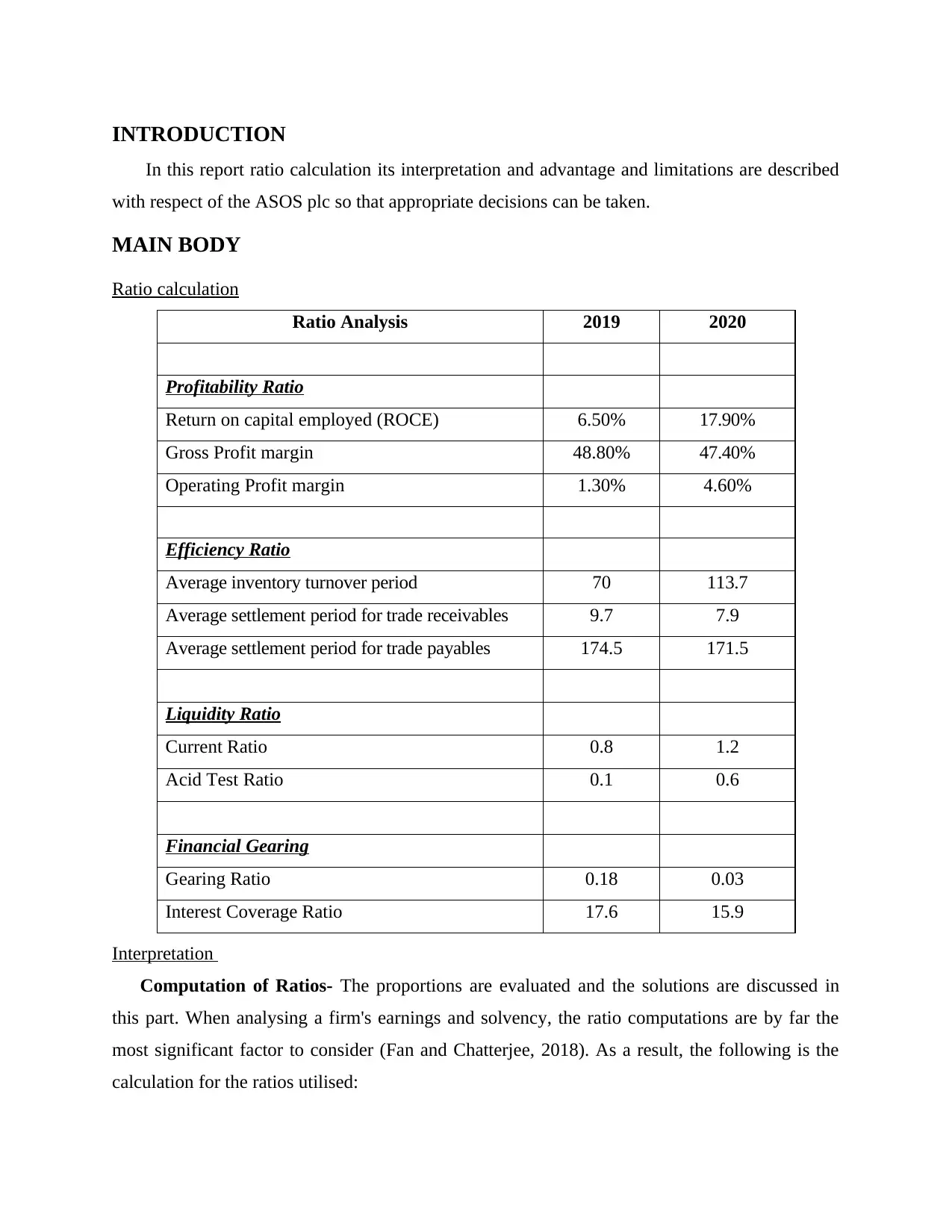

Ratio calculation

Ratio Analysis 2019 2020

Profitability Ratio

Return on capital employed (ROCE) 6.50% 17.90%

Gross Profit margin 48.80% 47.40%

Operating Profit margin 1.30% 4.60%

Efficiency Ratio

Average inventory turnover period 70 113.7

Average settlement period for trade receivables 9.7 7.9

Average settlement period for trade payables 174.5 171.5

Liquidity Ratio

Current Ratio 0.8 1.2

Acid Test Ratio 0.1 0.6

Financial Gearing

Gearing Ratio 0.18 0.03

Interest Coverage Ratio 17.6 15.9

Interpretation

Computation of Ratios- The proportions are evaluated and the solutions are discussed in

this part. When analysing a firm's earnings and solvency, the ratio computations are by far the

most significant factor to consider (Fan and Chatterjee, 2018). As a result, the following is the

calculation for the ratios utilised:

In this report ratio calculation its interpretation and advantage and limitations are described

with respect of the ASOS plc so that appropriate decisions can be taken.

MAIN BODY

Ratio calculation

Ratio Analysis 2019 2020

Profitability Ratio

Return on capital employed (ROCE) 6.50% 17.90%

Gross Profit margin 48.80% 47.40%

Operating Profit margin 1.30% 4.60%

Efficiency Ratio

Average inventory turnover period 70 113.7

Average settlement period for trade receivables 9.7 7.9

Average settlement period for trade payables 174.5 171.5

Liquidity Ratio

Current Ratio 0.8 1.2

Acid Test Ratio 0.1 0.6

Financial Gearing

Gearing Ratio 0.18 0.03

Interest Coverage Ratio 17.6 15.9

Interpretation

Computation of Ratios- The proportions are evaluated and the solutions are discussed in

this part. When analysing a firm's earnings and solvency, the ratio computations are by far the

most significant factor to consider (Fan and Chatterjee, 2018). As a result, the following is the

calculation for the ratios utilised:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ROCE is used to determine how much a firm or a firm earns from its holdings and debts.

The ROCE has risen from 6.5 percent to 17.9 percent that is good news for the firm's

investors and customers. Since long-term debt was written off in 2020 and net capital

rose, the ROCE risen, indicating a stronger financial condition.

Gross profit ratio refers to the income generated per £ of selling. The greater the revenue

per item sold, the greater the firm's performance and revenue. The gross profit margin has

shrunk by 14 basis points, from 48.8% to 47.4%. The drop is due to a rise in

manufacturing costs and related expenditures. Thus investors and customers may not

invest easily as compared to that of earlier times (Maaldu, 2019).

Operational profit ratio refers to a firm's viability after all of its expenses have been

deducted. In FY2019 and FY2020, this ratio climbed from 1.3 percent to 4.6 percent,

correspondingly. Thus it is a good sign and investors and clients would be willing to

engage in the firm after seeing it. It is the outcome of improved price and spending

control as well as a rise in other sources of revenue.

The average stock turnover duration is a metric that indicates how well a firm sells its

goods. Lower stock in side or a shorter turnover time means that things are traded quicker

and there is lower stock in the firm's facilities. A rise in stock turnover time could be

regarded as a red flag, since it indicates that the company has invested too much money

in its stock. Thus this ratio was satisfactory and customers and investors would be glad to

see this ratio being improving on a year to year basis.

Average settling duration for accounts receivables as the shorter the settling term for

accounts receivable, the healthier it is for the firm, as it indicates that customers clear

their debts to the business more quickly, allowing for a strong relationship to develop and

vice versa. This ratio is also at a positive side and thus both the investors and clients

would be contended to see and thus will invest in the firm after seeing this margin.

The average settling term for accounts payable is shorter, indicating that the firm is

repaying its debtors more quickly over a shorter duration. The settlement duration for

trade payables has stayed stable, only decreasing by three days which is a positive sign to

see from the perspective of buyers and investors.

The current ratio gauges a firm's capacity to fulfil short-term obligations arising from its

routine day-to-day activities. The increase in this ratio from 0.8 to 1.2 times would allow

The ROCE has risen from 6.5 percent to 17.9 percent that is good news for the firm's

investors and customers. Since long-term debt was written off in 2020 and net capital

rose, the ROCE risen, indicating a stronger financial condition.

Gross profit ratio refers to the income generated per £ of selling. The greater the revenue

per item sold, the greater the firm's performance and revenue. The gross profit margin has

shrunk by 14 basis points, from 48.8% to 47.4%. The drop is due to a rise in

manufacturing costs and related expenditures. Thus investors and customers may not

invest easily as compared to that of earlier times (Maaldu, 2019).

Operational profit ratio refers to a firm's viability after all of its expenses have been

deducted. In FY2019 and FY2020, this ratio climbed from 1.3 percent to 4.6 percent,

correspondingly. Thus it is a good sign and investors and clients would be willing to

engage in the firm after seeing it. It is the outcome of improved price and spending

control as well as a rise in other sources of revenue.

The average stock turnover duration is a metric that indicates how well a firm sells its

goods. Lower stock in side or a shorter turnover time means that things are traded quicker

and there is lower stock in the firm's facilities. A rise in stock turnover time could be

regarded as a red flag, since it indicates that the company has invested too much money

in its stock. Thus this ratio was satisfactory and customers and investors would be glad to

see this ratio being improving on a year to year basis.

Average settling duration for accounts receivables as the shorter the settling term for

accounts receivable, the healthier it is for the firm, as it indicates that customers clear

their debts to the business more quickly, allowing for a strong relationship to develop and

vice versa. This ratio is also at a positive side and thus both the investors and clients

would be contended to see and thus will invest in the firm after seeing this margin.

The average settling term for accounts payable is shorter, indicating that the firm is

repaying its debtors more quickly over a shorter duration. The settlement duration for

trade payables has stayed stable, only decreasing by three days which is a positive sign to

see from the perspective of buyers and investors.

The current ratio gauges a firm's capacity to fulfil short-term obligations arising from its

routine day-to-day activities. The increase in this ratio from 0.8 to 1.2 times would allow

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

for improved volatility monitoring. A rise in this ratio indicates that the business has

more and greater flexibility which will attract both investors and clients (Morris and

Daley, 2017).

The acid test ratio is the current ratio minus stock balances. A corporation with too much

stock is likewise at risk. Lowering the acid test indicates that too much investment is

invested in stock, which would affect the business if the stock becomes outdated and thus

this ratio is not satisfactory which hence will make investors and buyers restrain from

engaging with the firm.

The gearing ratio is a metric of the firm's fiscal reliance in order to finance its day-to-day

operations. The drop in this ratio is a favourable trend, indicating that borrowing has been

paid on schedule and that loan has been removed from the income statement, indicating

less dependence on borrowing and greater emphasis on equities as a source of finance

and thus will entice investors and customers to do engage in the company.

Interest Coverage proportion indicates the extent to which a firm's interest expenses

coming from borrowing could be covered. The fall in this ratio from 17.6 to 15.9 is due to

a reduction in borrowing on the income statement as well as prompt loan repayment,

resulting in less existing credit on the income statement every year. Thus it can entice

both investors and buyers to make an appropriate investment in the firm.

Advantages and limitations of ratios

There are many advantages of ratios as one being that it helps in an evaluation of the past

and future so that appropriate decisions can be taken in the present (Njeru, 2016). The

disadvantage of it is that the future is unforeseen and thus it is not beneficial to plan for the

things that are not necessary to happen thus only adding to the cost.

CONCLUSION

It can be concluded from the above that the firm is performing well in the market and thus

only a few changes here and there can make the firm stay ahead of all its competitors in the long

run scenario.

more and greater flexibility which will attract both investors and clients (Morris and

Daley, 2017).

The acid test ratio is the current ratio minus stock balances. A corporation with too much

stock is likewise at risk. Lowering the acid test indicates that too much investment is

invested in stock, which would affect the business if the stock becomes outdated and thus

this ratio is not satisfactory which hence will make investors and buyers restrain from

engaging with the firm.

The gearing ratio is a metric of the firm's fiscal reliance in order to finance its day-to-day

operations. The drop in this ratio is a favourable trend, indicating that borrowing has been

paid on schedule and that loan has been removed from the income statement, indicating

less dependence on borrowing and greater emphasis on equities as a source of finance

and thus will entice investors and customers to do engage in the company.

Interest Coverage proportion indicates the extent to which a firm's interest expenses

coming from borrowing could be covered. The fall in this ratio from 17.6 to 15.9 is due to

a reduction in borrowing on the income statement as well as prompt loan repayment,

resulting in less existing credit on the income statement every year. Thus it can entice

both investors and buyers to make an appropriate investment in the firm.

Advantages and limitations of ratios

There are many advantages of ratios as one being that it helps in an evaluation of the past

and future so that appropriate decisions can be taken in the present (Njeru, 2016). The

disadvantage of it is that the future is unforeseen and thus it is not beneficial to plan for the

things that are not necessary to happen thus only adding to the cost.

CONCLUSION

It can be concluded from the above that the firm is performing well in the market and thus

only a few changes here and there can make the firm stay ahead of all its competitors in the long

run scenario.

REFERENCES

Books and journals

Fan, L. and Chatterjee, S., 2018. Application of situational stimuli for examining the

effectiveness of financial education: A behavioral finance perspective. Journal of

Behavioral and Experimental Finance. 17. pp.68-75.

Maaldu, E.B., 2019. FINANCIAL MANAGEMENT PRACTICES AND FINANCIAL

SUSTAINABILITY OF LOCAL NON-GOVERNMENTAL ORGANIZATIONS (Doctoral

dissertation).

Morris, J.R. and Daley, J.P., 2017. Introduction to financial models for management and

planning. CRC press.

Njeru, M.D., 2016. Effect of Liquidity Management on financial performance of Deposit Taking

Saving and credit co-operative society in Kenya (Doctoral dissertation, Business

Administration (Finance), JKUAT).

Books and journals

Fan, L. and Chatterjee, S., 2018. Application of situational stimuli for examining the

effectiveness of financial education: A behavioral finance perspective. Journal of

Behavioral and Experimental Finance. 17. pp.68-75.

Maaldu, E.B., 2019. FINANCIAL MANAGEMENT PRACTICES AND FINANCIAL

SUSTAINABILITY OF LOCAL NON-GOVERNMENTAL ORGANIZATIONS (Doctoral

dissertation).

Morris, J.R. and Daley, J.P., 2017. Introduction to financial models for management and

planning. CRC press.

Njeru, M.D., 2016. Effect of Liquidity Management on financial performance of Deposit Taking

Saving and credit co-operative society in Kenya (Doctoral dissertation, Business

Administration (Finance), JKUAT).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.