Revenue and Cost Planning for New Restaurant in Sydney

VerifiedAdded on 2019/11/14

|12

|3065

|257

Report

AI Summary

The assignment content discusses the financial activities of a restaurant for hospital in Sydney. To maintain operational activities, the top management assesses revenue from business and distributes resources accordingly to receive certain benefits during moments of crisis. The break-even analysis indicates that at this point, operating expenses incurred are $320000, long-term debt is $20000, and sales revenue generated is $650000, making the break-even point 52.30%. The cash flow statement shows a significant increase in sales turnover over three financial years, with a slight increase in expenses. To secure financing, the business will not pay dividends and will incur expenses to acquire assets and pay long-term debt. Tight control will be imposed by management to increase the rate of return.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Grant application or

business case

business case

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

1. Identification of the new project or service and supply.....................................................4

2. Preparation of the budget....................................................................................................5

3. Build-up of the budget from a zero-based..........................................................................7

4. A contingency plan for managing the financial needs.......................................................7

5. Break-even analysis............................................................................................................8

CONCLUSION........................................................................................................................11

References................................................................................................................................12

1. Identification of the new project or service and supply.....................................................4

2. Preparation of the budget....................................................................................................5

3. Build-up of the budget from a zero-based..........................................................................7

4. A contingency plan for managing the financial needs.......................................................7

5. Break-even analysis............................................................................................................8

CONCLUSION........................................................................................................................11

References................................................................................................................................12

List of tables

Table 1: Zero-based cash budget................................................................................................6

Table 2: Cash budget..................................................................................................................7

Table 3: Cash flow statement.....................................................................................................9

Table 1: Zero-based cash budget................................................................................................6

Table 2: Cash budget..................................................................................................................7

Table 3: Cash flow statement.....................................................................................................9

1. Identification of the new project or service and supply

In the current scenario, the food industry is growing with rapid speed and having

significant contribution in the GDP and tourism activities of the nations. The planning of

business about food restaurant in hospital will require skilled human resources who can help

in the development of menu, planning of operations, preparation and delivery of the food.

The infrastructure and implementation of technical tools for taking the order and offering the

information to the customer. The prior planning of business and development of the roadmap

of the business would be beneficial for the management. The opening of the restaurant to

provide food in the hospital in Sidney, Australia would be the major task that will require

financial resources to establish the restaurant. For starting the business in Australia the option

of the opening of food restaurant in hospital would be more feasible (Fuller, 2016). The

supply of the services would be manageable as there are many vendors are available for

offering the raw material to prepare the food in hospital according to menu and requirements

of customers. The consideration of issues of economy, human resources and implementation

of technical resources would be the major concern of the management to meet the objectives.

Following are the key objectives of starting the new business:

To meet the needs of local and international customers.

To offer high-quality food and services.

To gain profit from the organization.

Reason for funding

The small business unit requires funds for managing the following operations in the

business which are playing vital role in the planning and implantation of business project,

Working capital: For starting the business sufficient amount of working capital is required

which is the major reason for funding. The working capital helps to maintain the health of the

business that can be gain from the external sources like banking institute and investors. A

loan can help the management to cover the short-term fund requirements of business to grow

to meet the needs of customers and supplier for food restaurants in hospital (Junior.et al.

2016). This kind of approach in funding of working capital will help the organization to gain

the advantage of new opportunities by investing in the development of new products and

services for customers.

Asset purchase: In the business of food restaurant in hospital, the funds are required for

purchasing of assets to prepare and deliver the food to the customers. The major assets of the

In the current scenario, the food industry is growing with rapid speed and having

significant contribution in the GDP and tourism activities of the nations. The planning of

business about food restaurant in hospital will require skilled human resources who can help

in the development of menu, planning of operations, preparation and delivery of the food.

The infrastructure and implementation of technical tools for taking the order and offering the

information to the customer. The prior planning of business and development of the roadmap

of the business would be beneficial for the management. The opening of the restaurant to

provide food in the hospital in Sidney, Australia would be the major task that will require

financial resources to establish the restaurant. For starting the business in Australia the option

of the opening of food restaurant in hospital would be more feasible (Fuller, 2016). The

supply of the services would be manageable as there are many vendors are available for

offering the raw material to prepare the food in hospital according to menu and requirements

of customers. The consideration of issues of economy, human resources and implementation

of technical resources would be the major concern of the management to meet the objectives.

Following are the key objectives of starting the new business:

To meet the needs of local and international customers.

To offer high-quality food and services.

To gain profit from the organization.

Reason for funding

The small business unit requires funds for managing the following operations in the

business which are playing vital role in the planning and implantation of business project,

Working capital: For starting the business sufficient amount of working capital is required

which is the major reason for funding. The working capital helps to maintain the health of the

business that can be gain from the external sources like banking institute and investors. A

loan can help the management to cover the short-term fund requirements of business to grow

to meet the needs of customers and supplier for food restaurants in hospital (Junior.et al.

2016). This kind of approach in funding of working capital will help the organization to gain

the advantage of new opportunities by investing in the development of new products and

services for customers.

Asset purchase: In the business of food restaurant in hospital, the funds are required for

purchasing of assets to prepare and deliver the food to the customers. The major assets of the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

restaurant are furniture, determination of quality interior and ambience as well human

resources. In the current scenario, customer demands entertainment too with food so

implementation of equipment’s like music system, big projector screen as well development

of facilities would be requires funding. The setup of kitchen and machinery for preparing and

offering the food demand funds (Wray.et al. 2015).

Cash flow: the process of owning a business can be a roller coaster especially in a hard time

of slow demand and the weak economy. To survive in these conditions the management will

require funds to maintain the cost of the basic operations and pay to the human resources. For

that reason, owner of the restaurant will need funds to keep the ship afloat.

Inventory: For the food product and services business in hospital, inventory of the raw

material plays the critical role in the management of timely services (Malherbe, 2015). The

prior forecasting and availability of raw material are essential to meet the needs and demand

of the customer. This would be a major reason for funding in the business.

Location

For opening the restaurant in hospital the location Sydney is selected as there football

of international and local people is high that are looking for quality food and services to

spend some quality time with the friends and family members. The growth of food industry is

8% which indicates that business of food restaurant would have potential to grow with the

effectiveness.

Rational

According to analysis, the demand for quality food and services is high in the selected

region of Australia. The business process of food is beneficial for management as a demand

of verity food is increasing as people are investing on quality food and services that are

encouraging the food business. By considering information, the financial required are high

for the establishment of a restaurant as a development of infrastructure and recruitment of

skilled human resource will be important (Begenau, 2016). The major food business is also

having significant contribution in the GDP and attraction of tourist to the particular location.

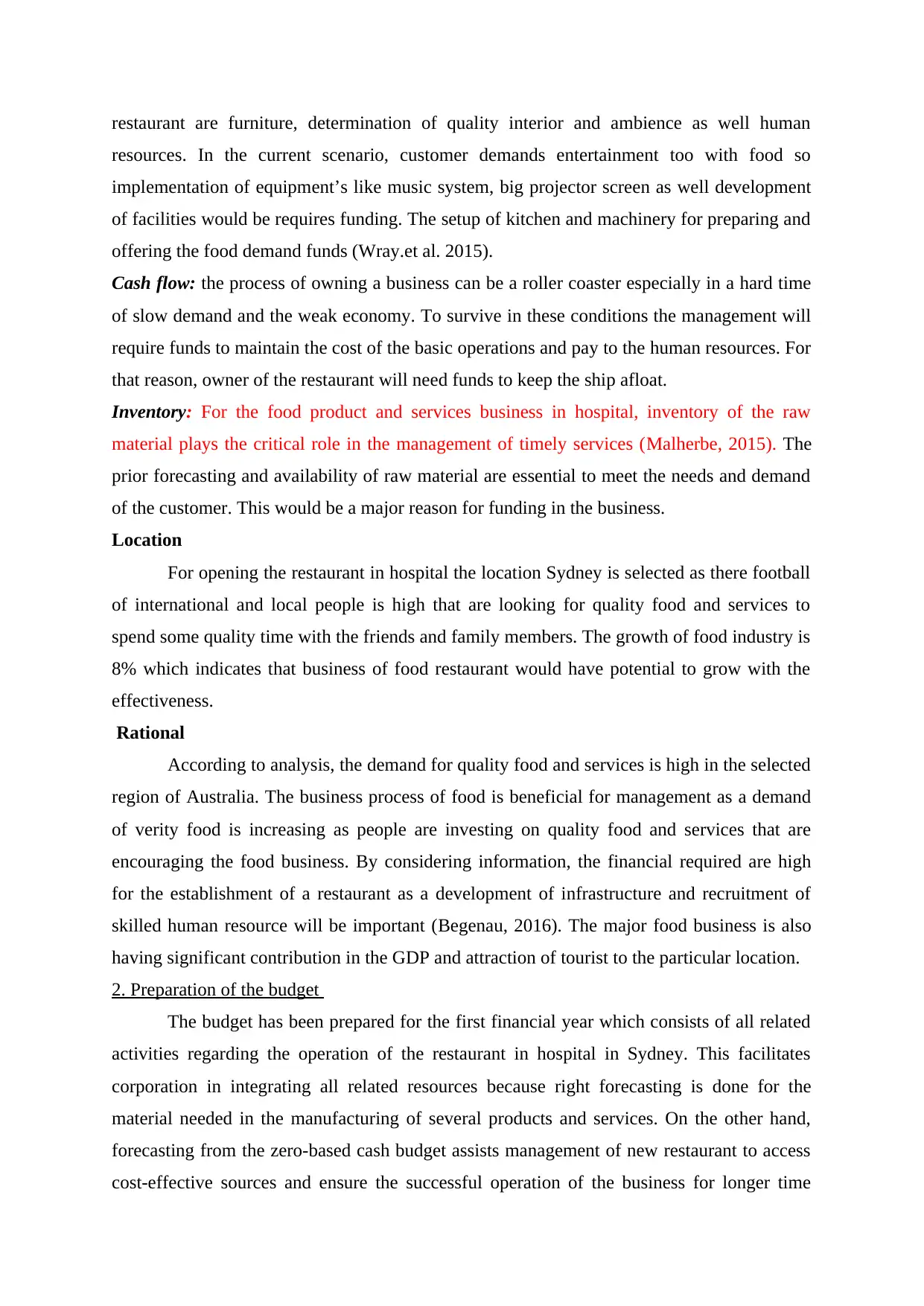

2. Preparation of the budget

The budget has been prepared for the first financial year which consists of all related

activities regarding the operation of the restaurant in hospital in Sydney. This facilitates

corporation in integrating all related resources because right forecasting is done for the

material needed in the manufacturing of several products and services. On the other hand,

forecasting from the zero-based cash budget assists management of new restaurant to access

cost-effective sources and ensure the successful operation of the business for longer time

resources. In the current scenario, customer demands entertainment too with food so

implementation of equipment’s like music system, big projector screen as well development

of facilities would be requires funding. The setup of kitchen and machinery for preparing and

offering the food demand funds (Wray.et al. 2015).

Cash flow: the process of owning a business can be a roller coaster especially in a hard time

of slow demand and the weak economy. To survive in these conditions the management will

require funds to maintain the cost of the basic operations and pay to the human resources. For

that reason, owner of the restaurant will need funds to keep the ship afloat.

Inventory: For the food product and services business in hospital, inventory of the raw

material plays the critical role in the management of timely services (Malherbe, 2015). The

prior forecasting and availability of raw material are essential to meet the needs and demand

of the customer. This would be a major reason for funding in the business.

Location

For opening the restaurant in hospital the location Sydney is selected as there football

of international and local people is high that are looking for quality food and services to

spend some quality time with the friends and family members. The growth of food industry is

8% which indicates that business of food restaurant would have potential to grow with the

effectiveness.

Rational

According to analysis, the demand for quality food and services is high in the selected

region of Australia. The business process of food is beneficial for management as a demand

of verity food is increasing as people are investing on quality food and services that are

encouraging the food business. By considering information, the financial required are high

for the establishment of a restaurant as a development of infrastructure and recruitment of

skilled human resource will be important (Begenau, 2016). The major food business is also

having significant contribution in the GDP and attraction of tourist to the particular location.

2. Preparation of the budget

The budget has been prepared for the first financial year which consists of all related

activities regarding the operation of the restaurant in hospital in Sydney. This facilitates

corporation in integrating all related resources because right forecasting is done for the

material needed in the manufacturing of several products and services. On the other hand,

forecasting from the zero-based cash budget assists management of new restaurant to access

cost-effective sources and ensure the successful operation of the business for longer time

span. The budget of the business has been prepared in accordance with the outcome presented

in the cash flow statement. For this purpose, each year is considered as the financial year and

accordingly amount of revenue and expenses has been divided for each year. It is assumed

that amount of expenses will remain same in all months of the single financial year. This

helps management keep a record of the expenses in a more effective manner.

Table 1: Zero-based cash budget

Janu

ary

Febru

ary

Mar

ch

Apri

l May June July

Aug

ust

Septe

mber

Octo

ber

Nove

mber

Dece

mber

Reven

ue

Cash

balanc

e

2483

2.7

4966

5.3

7449

8

9933

0.7

1241

63

1489

96

1738

29

19866

1

2234

94

24832

7

27315

9

Sales

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6 54166

5416

6 54166 54166

Total

reven

ue

5416

6

7899

8.7

1038

31

1286

64

1534

97

1783

29

2031

62

2279

95

25282

7

2776

60

30249

3

32732

5

Expen

ses

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

18333.

3

1833

3.3

18333

.3

18333

.3

Purch

ase 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000

Loan

1666

.67

1666.

67

1666

.67

1666

.67

1666

.67

1666

.67

1666

.67

1666

.67

1666.6

7

1666

.67

1666.

67

1666.

67

Electri

city

bill

8333

.33

8333.

33

8333

.33

8333

.33

8333

.33

8333

.33

8333

.33

8333

.33

8333.3

3

8333

.33

8333.

33

8333.

33

Total

expen

se

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

29333.

3

2933

3.3

29333

.3

29333

.3

Surplu

s/

deficit

2483

2.7

4966

5.3

7449

8

9933

0.7

1241

63

1489

96

1738

29

1986

61

22349

4

2483

27

27315

9

29799

2

The above-mentioned budget shows that in every year the company will increase its revenue

because of its unique identity in the marketplace and meeting the expectations of customers.

However, loan or long-term debt will be paid on time every month so as to reduce the

financial burden. It aids to achieve the long as well as short-term objectives of the business as

management would be able to arrange other resources accordingly. The constant increase or

rise in the profitability of restaurant in hospital in Sydney shows that it can effectively

in the cash flow statement. For this purpose, each year is considered as the financial year and

accordingly amount of revenue and expenses has been divided for each year. It is assumed

that amount of expenses will remain same in all months of the single financial year. This

helps management keep a record of the expenses in a more effective manner.

Table 1: Zero-based cash budget

Janu

ary

Febru

ary

Mar

ch

Apri

l May June July

Aug

ust

Septe

mber

Octo

ber

Nove

mber

Dece

mber

Reven

ue

Cash

balanc

e

2483

2.7

4966

5.3

7449

8

9933

0.7

1241

63

1489

96

1738

29

19866

1

2234

94

24832

7

27315

9

Sales

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6

5416

6 54166

5416

6 54166 54166

Total

reven

ue

5416

6

7899

8.7

1038

31

1286

64

1534

97

1783

29

2031

62

2279

95

25282

7

2776

60

30249

3

32732

5

Expen

ses

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

1833

3.3

18333.

3

1833

3.3

18333

.3

18333

.3

Purch

ase 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000 1000

Loan

1666

.67

1666.

67

1666

.67

1666

.67

1666

.67

1666

.67

1666

.67

1666

.67

1666.6

7

1666

.67

1666.

67

1666.

67

Electri

city

bill

8333

.33

8333.

33

8333

.33

8333

.33

8333

.33

8333

.33

8333

.33

8333

.33

8333.3

3

8333

.33

8333.

33

8333.

33

Total

expen

se

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

2933

3.3

29333.

3

2933

3.3

29333

.3

29333

.3

Surplu

s/

deficit

2483

2.7

4966

5.3

7449

8

9933

0.7

1241

63

1489

96

1738

29

1986

61

22349

4

2483

27

27315

9

29799

2

The above-mentioned budget shows that in every year the company will increase its revenue

because of its unique identity in the marketplace and meeting the expectations of customers.

However, loan or long-term debt will be paid on time every month so as to reduce the

financial burden. It aids to achieve the long as well as short-term objectives of the business as

management would be able to arrange other resources accordingly. The constant increase or

rise in the profitability of restaurant in hospital in Sydney shows that it can effectively

recover the cost of production and increase the overall rate of return. This aids to cater the

requirement of the business and shed light on its expansion for a long term.

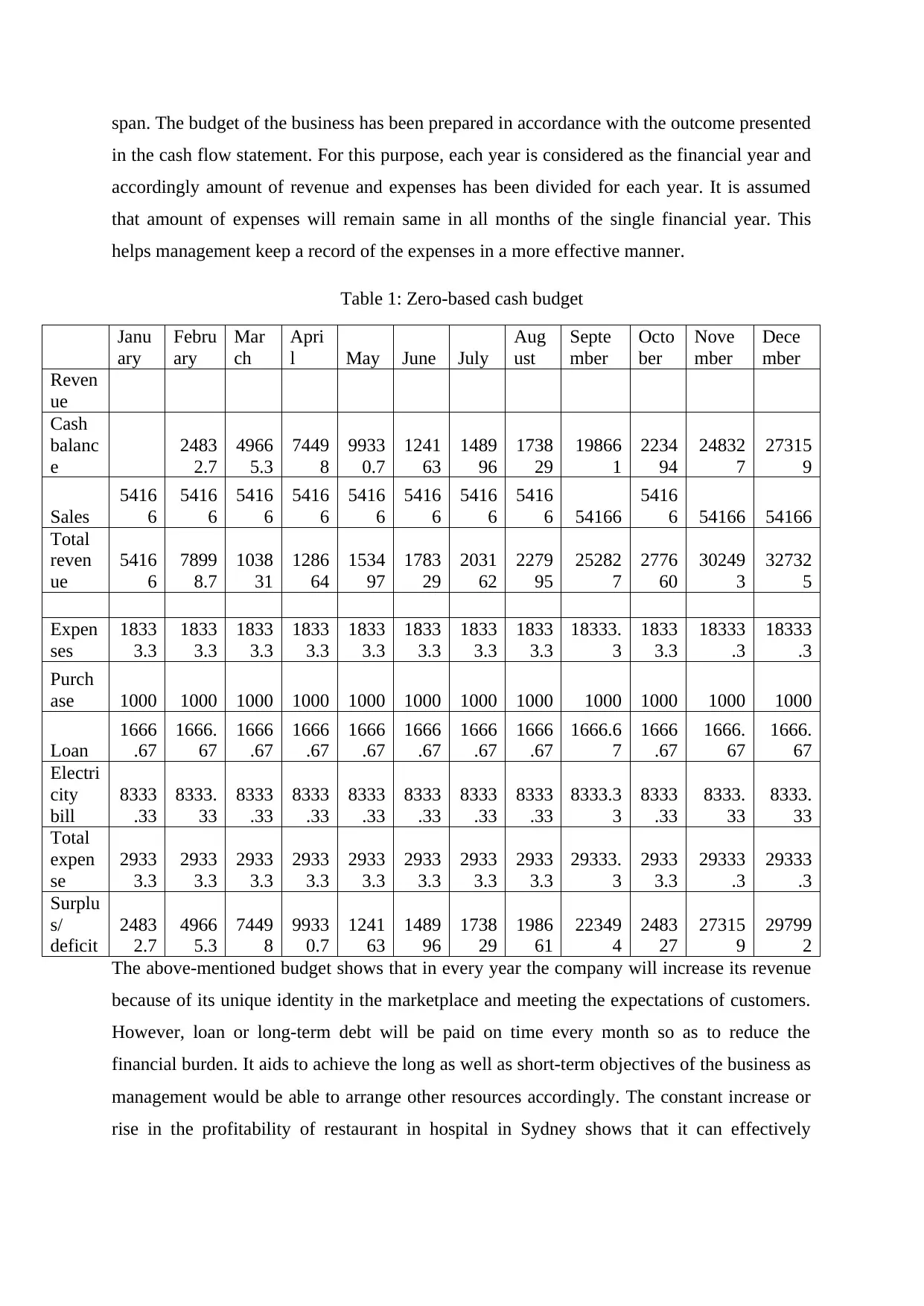

3. Build-up of the budget from a zero-based

The budget for the second financial year has been prepared as follows where the

outcome generated from first financial year considered (Malherbe, 2015). This enables

management of restaurant in hospital in Sydney to estimate the requirement of the financial

resources and accordingly access suitable sources. However, the below-mentioned budget

reflects that company is not required to acquire the financial resources from any other party.

The most significant or crucial aspect is that firm has control over its expenses so that

accordingly revenue is increased. This, in turn, the company is ensuring consistent growth

and development in the marketplace. However, unfavourable condition might face when the

business

Table 2: Cash budget

January-March April-June July-

September

October-

December

Revenue

Cash balance 297992 348992 399992 450992

Sales 195000 195000 195000 195000

Total revenue 492992 543992 594992 645992

Expenses 60500 60500 60500 60500

Purchase 3500 3500 3500 3500

Loan 5000 5000 5000 5000

Electricity bill 75000 75000 75000 75000

Total expenses 144000 144000 144000 144000

Surplus/ deficit 348992 399992 450992 501992

The aforementioned budget is prepared on a quarterly basis in which in the first

quarter business get surplus worth 348992 because the cash balance of the previous year is

added in the revenue. In this manner, it becomes easy for the new restaurant in Sydney to

ensure smooth operation without acquiring the loan. Furthermore, revenue or rate of return

for the business is increasing in all the quarter. It proves to be effective in expanding the

business in the future time span and meeting the requirement of the business in the right

manner. Moreover, yearly expenses are divided per month so that it becomes easy for a

requirement of the business and shed light on its expansion for a long term.

3. Build-up of the budget from a zero-based

The budget for the second financial year has been prepared as follows where the

outcome generated from first financial year considered (Malherbe, 2015). This enables

management of restaurant in hospital in Sydney to estimate the requirement of the financial

resources and accordingly access suitable sources. However, the below-mentioned budget

reflects that company is not required to acquire the financial resources from any other party.

The most significant or crucial aspect is that firm has control over its expenses so that

accordingly revenue is increased. This, in turn, the company is ensuring consistent growth

and development in the marketplace. However, unfavourable condition might face when the

business

Table 2: Cash budget

January-March April-June July-

September

October-

December

Revenue

Cash balance 297992 348992 399992 450992

Sales 195000 195000 195000 195000

Total revenue 492992 543992 594992 645992

Expenses 60500 60500 60500 60500

Purchase 3500 3500 3500 3500

Loan 5000 5000 5000 5000

Electricity bill 75000 75000 75000 75000

Total expenses 144000 144000 144000 144000

Surplus/ deficit 348992 399992 450992 501992

The aforementioned budget is prepared on a quarterly basis in which in the first

quarter business get surplus worth 348992 because the cash balance of the previous year is

added in the revenue. In this manner, it becomes easy for the new restaurant in Sydney to

ensure smooth operation without acquiring the loan. Furthermore, revenue or rate of return

for the business is increasing in all the quarter. It proves to be effective in expanding the

business in the future time span and meeting the requirement of the business in the right

manner. Moreover, yearly expenses are divided per month so that it becomes easy for a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

corporation to have right control over the expenses and accordingly overall performance of

the business can be managed in an effectual manner.

4. A contingency plan for managing the financial needs

For an implementation of new project or plan, there is need of contingency planning

that helps to deal with the unexpected situations as well maintaining the financial health of

the organization. For planning of financial needs for surviving in the crisis conditions would

be involve following steps:

Specific actions: The top amendment of an organization need to plan the specific actions for

fund management for future by considering the multiple scenarios using the contingency

planning. This kind of planning would involve opinion of stakeholder as well actions that

have been taken by the competitor organizations in these situations (Iacoviello, 2015). For

example, the organization will deposit some amount for the security of the business which

can be used in this kind of situations to run the business without interruption.

Adjustment in working capital: The contingency planning of business will involve the

adjustment in the allocation and utilization of working capital to meet the financial needs of a

particular situation. As the situation of business gets improved the management can increase

the bonus accruals (Sadgrove, 2016). The preferable actions need to be taken to mitigate the

situation of crisis. The prior adjustment by forecasting financial situations will be beneficial

for an organization to meet the objectives.

Assessment of revenue and resources allocation: the planning will be the focus on revenue

and cost of the operations to make changes in the financial activities to have sufficient funds

for maintaining the operational activities. The top management will assess revenue from the

business as well make the distribution of resources accordingly which will help to receive

certain benefits in the moment of crisis (Finch, 2016). For example, the management could

influence the prices of products and services to maintain the financial investment.

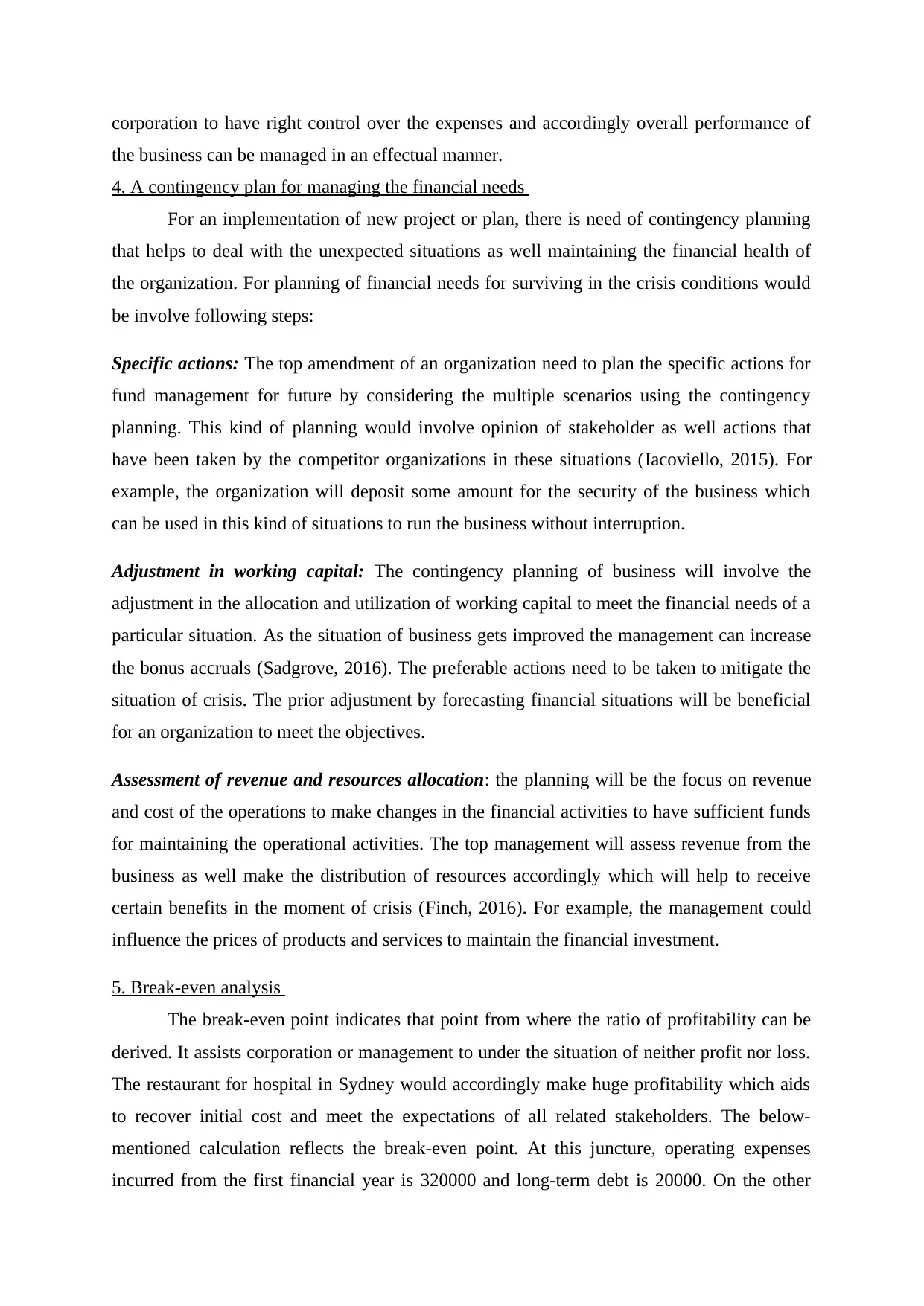

5. Break-even analysis

The break-even point indicates that point from where the ratio of profitability can be

derived. It assists corporation or management to under the situation of neither profit nor loss.

The restaurant for hospital in Sydney would accordingly make huge profitability which aids

to recover initial cost and meet the expectations of all related stakeholders. The below-

mentioned calculation reflects the break-even point. At this juncture, operating expenses

incurred from the first financial year is 320000 and long-term debt is 20000. On the other

the business can be managed in an effectual manner.

4. A contingency plan for managing the financial needs

For an implementation of new project or plan, there is need of contingency planning

that helps to deal with the unexpected situations as well maintaining the financial health of

the organization. For planning of financial needs for surviving in the crisis conditions would

be involve following steps:

Specific actions: The top amendment of an organization need to plan the specific actions for

fund management for future by considering the multiple scenarios using the contingency

planning. This kind of planning would involve opinion of stakeholder as well actions that

have been taken by the competitor organizations in these situations (Iacoviello, 2015). For

example, the organization will deposit some amount for the security of the business which

can be used in this kind of situations to run the business without interruption.

Adjustment in working capital: The contingency planning of business will involve the

adjustment in the allocation and utilization of working capital to meet the financial needs of a

particular situation. As the situation of business gets improved the management can increase

the bonus accruals (Sadgrove, 2016). The preferable actions need to be taken to mitigate the

situation of crisis. The prior adjustment by forecasting financial situations will be beneficial

for an organization to meet the objectives.

Assessment of revenue and resources allocation: the planning will be the focus on revenue

and cost of the operations to make changes in the financial activities to have sufficient funds

for maintaining the operational activities. The top management will assess revenue from the

business as well make the distribution of resources accordingly which will help to receive

certain benefits in the moment of crisis (Finch, 2016). For example, the management could

influence the prices of products and services to maintain the financial investment.

5. Break-even analysis

The break-even point indicates that point from where the ratio of profitability can be

derived. It assists corporation or management to under the situation of neither profit nor loss.

The restaurant for hospital in Sydney would accordingly make huge profitability which aids

to recover initial cost and meet the expectations of all related stakeholders. The below-

mentioned calculation reflects the break-even point. At this juncture, operating expenses

incurred from the first financial year is 320000 and long-term debt is 20000. On the other

hand, sales revenue generated from the first financial year is 650000. Owing to this, 52.30%

is considered as the break-even point.

Operating Expenses + Long-term debt/sales

(320000+20000)/650000=52.30%

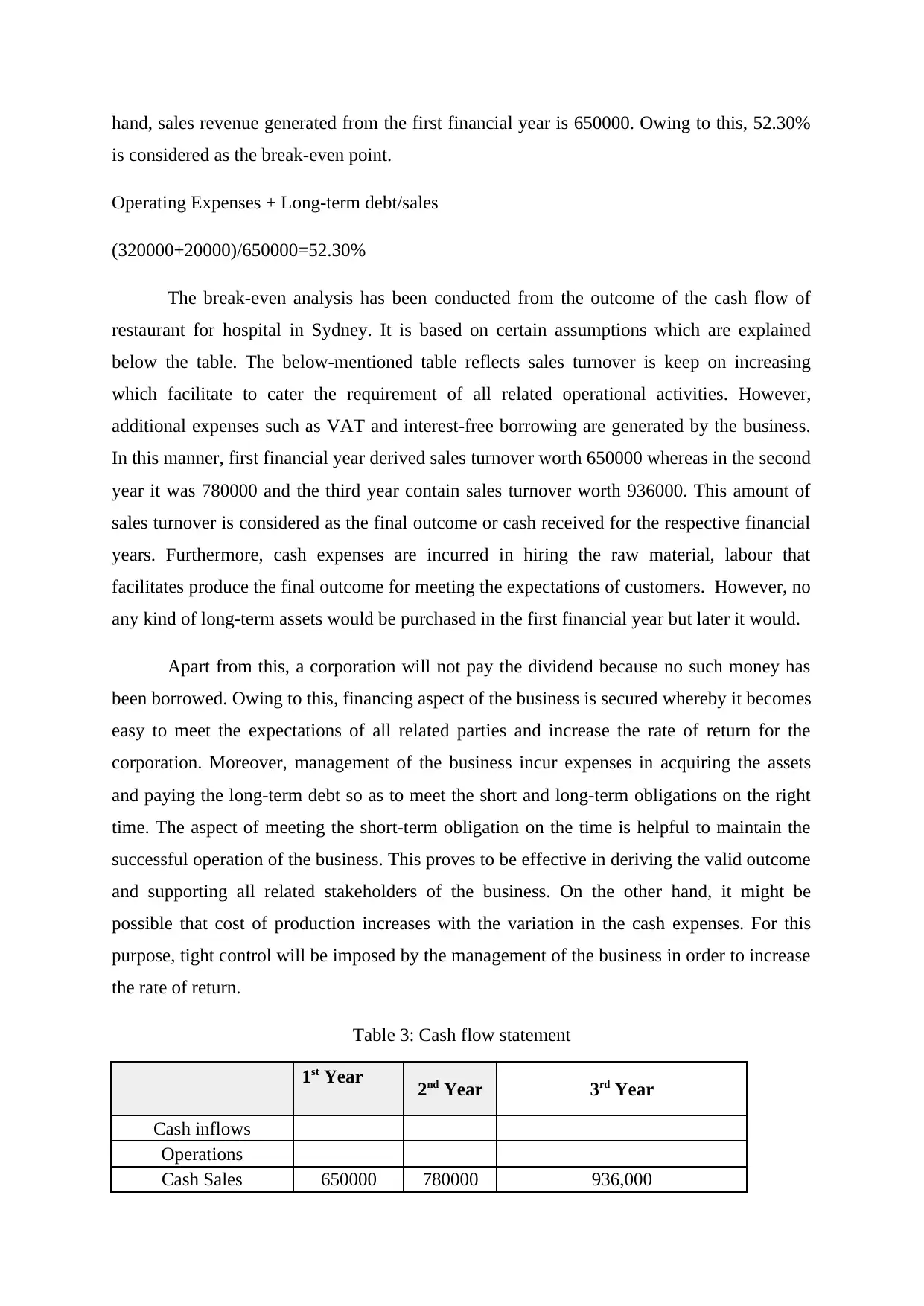

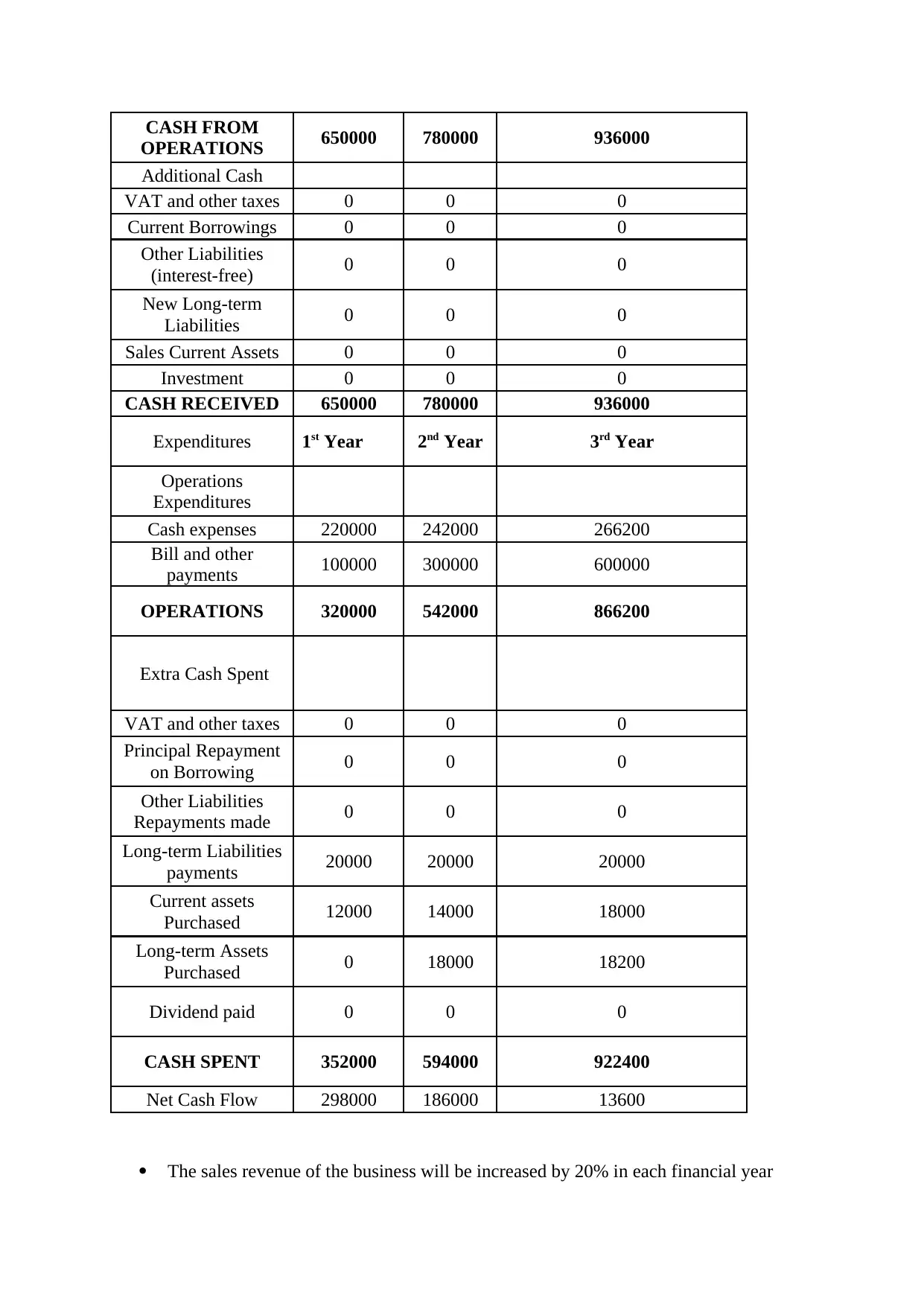

The break-even analysis has been conducted from the outcome of the cash flow of

restaurant for hospital in Sydney. It is based on certain assumptions which are explained

below the table. The below-mentioned table reflects sales turnover is keep on increasing

which facilitate to cater the requirement of all related operational activities. However,

additional expenses such as VAT and interest-free borrowing are generated by the business.

In this manner, first financial year derived sales turnover worth 650000 whereas in the second

year it was 780000 and the third year contain sales turnover worth 936000. This amount of

sales turnover is considered as the final outcome or cash received for the respective financial

years. Furthermore, cash expenses are incurred in hiring the raw material, labour that

facilitates produce the final outcome for meeting the expectations of customers. However, no

any kind of long-term assets would be purchased in the first financial year but later it would.

Apart from this, a corporation will not pay the dividend because no such money has

been borrowed. Owing to this, financing aspect of the business is secured whereby it becomes

easy to meet the expectations of all related parties and increase the rate of return for the

corporation. Moreover, management of the business incur expenses in acquiring the assets

and paying the long-term debt so as to meet the short and long-term obligations on the right

time. The aspect of meeting the short-term obligation on the time is helpful to maintain the

successful operation of the business. This proves to be effective in deriving the valid outcome

and supporting all related stakeholders of the business. On the other hand, it might be

possible that cost of production increases with the variation in the cash expenses. For this

purpose, tight control will be imposed by the management of the business in order to increase

the rate of return.

Table 3: Cash flow statement

1st Year 2nd Year 3rd Year

Cash inflows

Operations

Cash Sales 650000 780000 936,000

is considered as the break-even point.

Operating Expenses + Long-term debt/sales

(320000+20000)/650000=52.30%

The break-even analysis has been conducted from the outcome of the cash flow of

restaurant for hospital in Sydney. It is based on certain assumptions which are explained

below the table. The below-mentioned table reflects sales turnover is keep on increasing

which facilitate to cater the requirement of all related operational activities. However,

additional expenses such as VAT and interest-free borrowing are generated by the business.

In this manner, first financial year derived sales turnover worth 650000 whereas in the second

year it was 780000 and the third year contain sales turnover worth 936000. This amount of

sales turnover is considered as the final outcome or cash received for the respective financial

years. Furthermore, cash expenses are incurred in hiring the raw material, labour that

facilitates produce the final outcome for meeting the expectations of customers. However, no

any kind of long-term assets would be purchased in the first financial year but later it would.

Apart from this, a corporation will not pay the dividend because no such money has

been borrowed. Owing to this, financing aspect of the business is secured whereby it becomes

easy to meet the expectations of all related parties and increase the rate of return for the

corporation. Moreover, management of the business incur expenses in acquiring the assets

and paying the long-term debt so as to meet the short and long-term obligations on the right

time. The aspect of meeting the short-term obligation on the time is helpful to maintain the

successful operation of the business. This proves to be effective in deriving the valid outcome

and supporting all related stakeholders of the business. On the other hand, it might be

possible that cost of production increases with the variation in the cash expenses. For this

purpose, tight control will be imposed by the management of the business in order to increase

the rate of return.

Table 3: Cash flow statement

1st Year 2nd Year 3rd Year

Cash inflows

Operations

Cash Sales 650000 780000 936,000

CASH FROM

OPERATIONS 650000 780000 936000

Additional Cash

VAT and other taxes 0 0 0

Current Borrowings 0 0 0

Other Liabilities

(interest-free) 0 0 0

New Long-term

Liabilities 0 0 0

Sales Current Assets 0 0 0

Investment 0 0 0

CASH RECEIVED 650000 780000 936000

Expenditures 1st Year 2nd Year 3rd Year

Operations

Expenditures

Cash expenses 220000 242000 266200

Bill and other

payments 100000 300000 600000

OPERATIONS 320000 542000 866200

Extra Cash Spent

VAT and other taxes 0 0 0

Principal Repayment

on Borrowing 0 0 0

Other Liabilities

Repayments made 0 0 0

Long-term Liabilities

payments 20000 20000 20000

Current assets

Purchased 12000 14000 18000

Long-term Assets

Purchased 0 18000 18200

Dividend paid 0 0 0

CASH SPENT 352000 594000 922400

Net Cash Flow 298000 186000 13600

The sales revenue of the business will be increased by 20% in each financial year

OPERATIONS 650000 780000 936000

Additional Cash

VAT and other taxes 0 0 0

Current Borrowings 0 0 0

Other Liabilities

(interest-free) 0 0 0

New Long-term

Liabilities 0 0 0

Sales Current Assets 0 0 0

Investment 0 0 0

CASH RECEIVED 650000 780000 936000

Expenditures 1st Year 2nd Year 3rd Year

Operations

Expenditures

Cash expenses 220000 242000 266200

Bill and other

payments 100000 300000 600000

OPERATIONS 320000 542000 866200

Extra Cash Spent

VAT and other taxes 0 0 0

Principal Repayment

on Borrowing 0 0 0

Other Liabilities

Repayments made 0 0 0

Long-term Liabilities

payments 20000 20000 20000

Current assets

Purchased 12000 14000 18000

Long-term Assets

Purchased 0 18000 18200

Dividend paid 0 0 0

CASH SPENT 352000 594000 922400

Net Cash Flow 298000 186000 13600

The sales revenue of the business will be increased by 20% in each financial year

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The expenses incurred in the production phase will be increased through 10%

Uniqueness in the products and services reduces the need for marketing

There will be the high or large number of customers.

The firm will outperform in the marketplace as it would offer varied range of products

and services

The suppliers are easily approachable and they provide timely material of the

production of safe and quality products.

The new service of product which is being offered by new restaurant would be

different from other competitors and perfectly meet the expectations of customers.

Owing to this, sales turnover will be increased continuously.

The cost of production or indirect cost might increase due to a poor economic

condition. At this juncture, management might be in the need for acquiring sources.

Therefore, the new restaurant in Sydney considers both positive and negative outcome

and accordingly contingency plan has also been provided.

CONCLUSION

The aforementioned report concludes that management of new restaurant can easily

manage its profitability and expenses by having control over different business activities. It

can also be said that At this juncture, the price of products might be increased so as to recover

the cost and increase the rate of return from the business. Also, training can be provided to

personnel so they focus on the quality of products and services whereby sales can be

increased automatically.

Uniqueness in the products and services reduces the need for marketing

There will be the high or large number of customers.

The firm will outperform in the marketplace as it would offer varied range of products

and services

The suppliers are easily approachable and they provide timely material of the

production of safe and quality products.

The new service of product which is being offered by new restaurant would be

different from other competitors and perfectly meet the expectations of customers.

Owing to this, sales turnover will be increased continuously.

The cost of production or indirect cost might increase due to a poor economic

condition. At this juncture, management might be in the need for acquiring sources.

Therefore, the new restaurant in Sydney considers both positive and negative outcome

and accordingly contingency plan has also been provided.

CONCLUSION

The aforementioned report concludes that management of new restaurant can easily

manage its profitability and expenses by having control over different business activities. It

can also be said that At this juncture, the price of products might be increased so as to recover

the cost and increase the rate of return from the business. Also, training can be provided to

personnel so they focus on the quality of products and services whereby sales can be

increased automatically.

REFERENCES

Begenau, J., 2016. Capital requirements, risk choice, and liquidity provision in a business

cycle model.

Finch, B., 2016. How to write a business plan. Kogan Page Publishers.

Fuller, G.W., 2016. New food product development: from concept to marketplace. CRC

Press.

Iacoviello, M., 2015. Financial business cycles. Review of Economic Dynamics, 18(1),

pp.140-163.

Junior, E.L.C. and Morand, C., 2016. Interest of mate (Ilex paraguariensis A. St.-Hil.) as a

new natural functional food to preserve human cardiovascular health–A review. Journal

of Functional Foods, 21, pp.440-454.

Malherbe, F., 2015. Optimal capital requirements over the business and financial cycles.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

Wray, H.E., Grant, S., Kofman, E. and Peel, C., 2015. Family friendly? The impact on

children of the family migration rules: a review of the financial requirements.

Begenau, J., 2016. Capital requirements, risk choice, and liquidity provision in a business

cycle model.

Finch, B., 2016. How to write a business plan. Kogan Page Publishers.

Fuller, G.W., 2016. New food product development: from concept to marketplace. CRC

Press.

Iacoviello, M., 2015. Financial business cycles. Review of Economic Dynamics, 18(1),

pp.140-163.

Junior, E.L.C. and Morand, C., 2016. Interest of mate (Ilex paraguariensis A. St.-Hil.) as a

new natural functional food to preserve human cardiovascular health–A review. Journal

of Functional Foods, 21, pp.440-454.

Malherbe, F., 2015. Optimal capital requirements over the business and financial cycles.

Sadgrove, K., 2016. The complete guide to business risk management. Routledge.

Wray, H.E., Grant, S., Kofman, E. and Peel, C., 2015. Family friendly? The impact on

children of the family migration rules: a review of the financial requirements.

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.