Introduction to Financial Project

VerifiedAdded on 2023/01/09

|15

|3071

|38

AI Summary

This document provides an introduction to financial project, including topics such as trading account, profit and loss account, financial position, ratio analysis, and more. It also discusses the features and benefits of financial statements for users. Find solved assignments and study material on Desklib.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

INTRODUCTION TO

FINANCIAL PROJECT

1

FINANCIAL PROJECT

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

MAIN BODY..................................................................................................................................3

Question 1a)....................................................................................................................................3

(a) Trading Account for the year ending 30th April 2019.......................................................3

(b) Profit and loss account for the year ending 30th April 2019.............................................3

(c) Financial position as on 30th April 2019...........................................................................3

Question 1b)....................................................................................................................................4

Six main features for users of financial statements and importance and benefits to users....4

Question 2a)....................................................................................................................................6

Ratio Analysis........................................................................................................................6

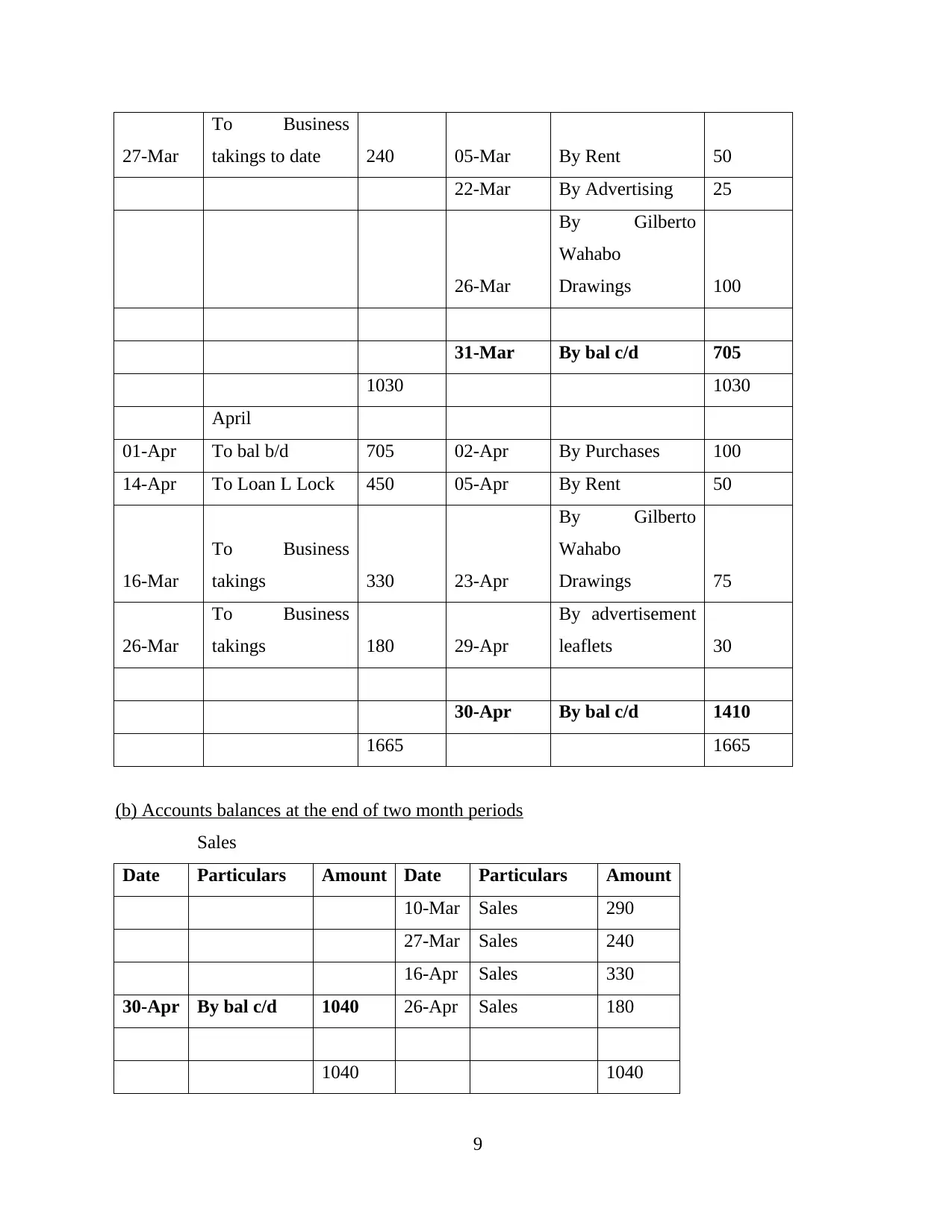

Question 2b)....................................................................................................................................9

(a) Bank account balancing at the end of each month............................................................9

(b) Accounts balances at the end of two month periods.........................................................9

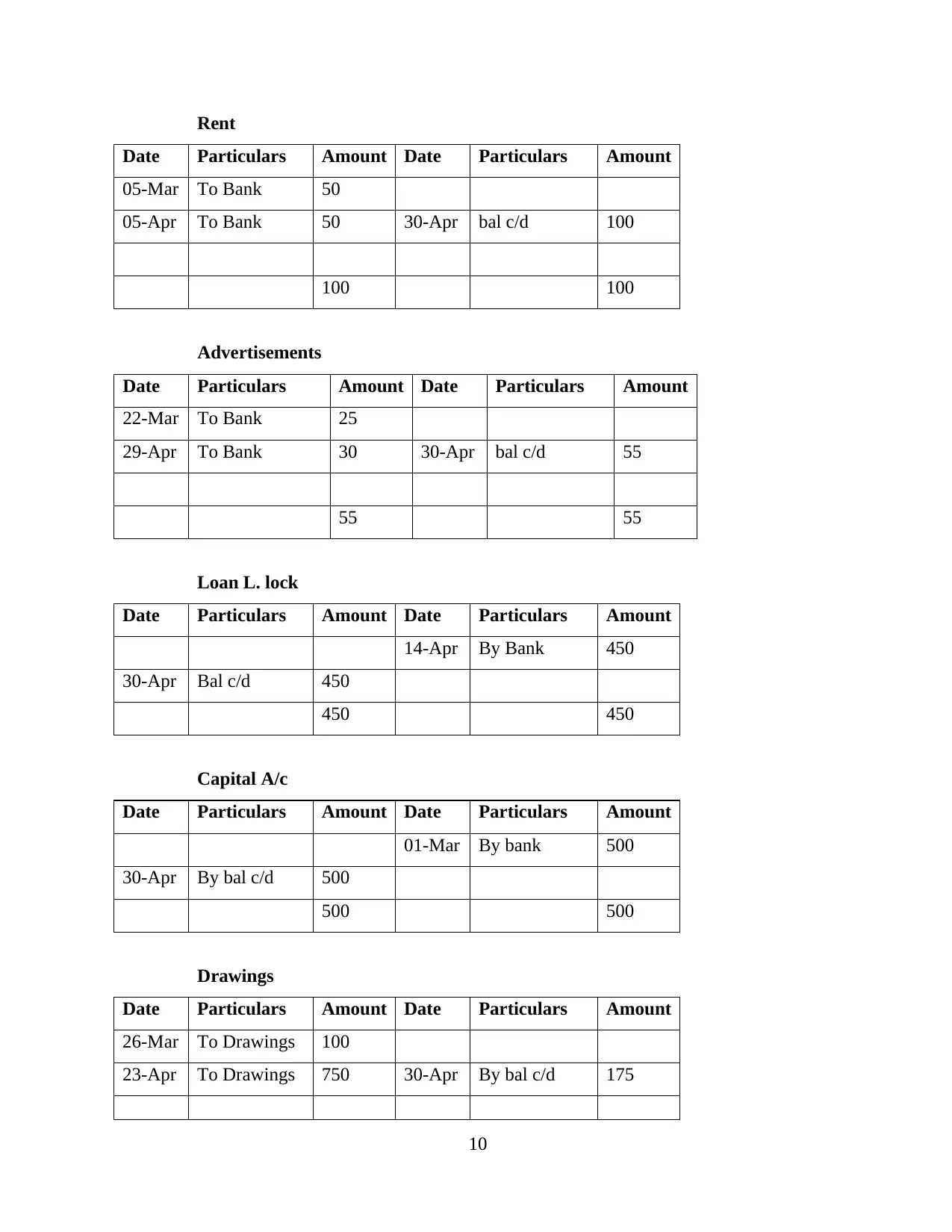

(c) Trial balance as at 30 April 2018....................................................................................11

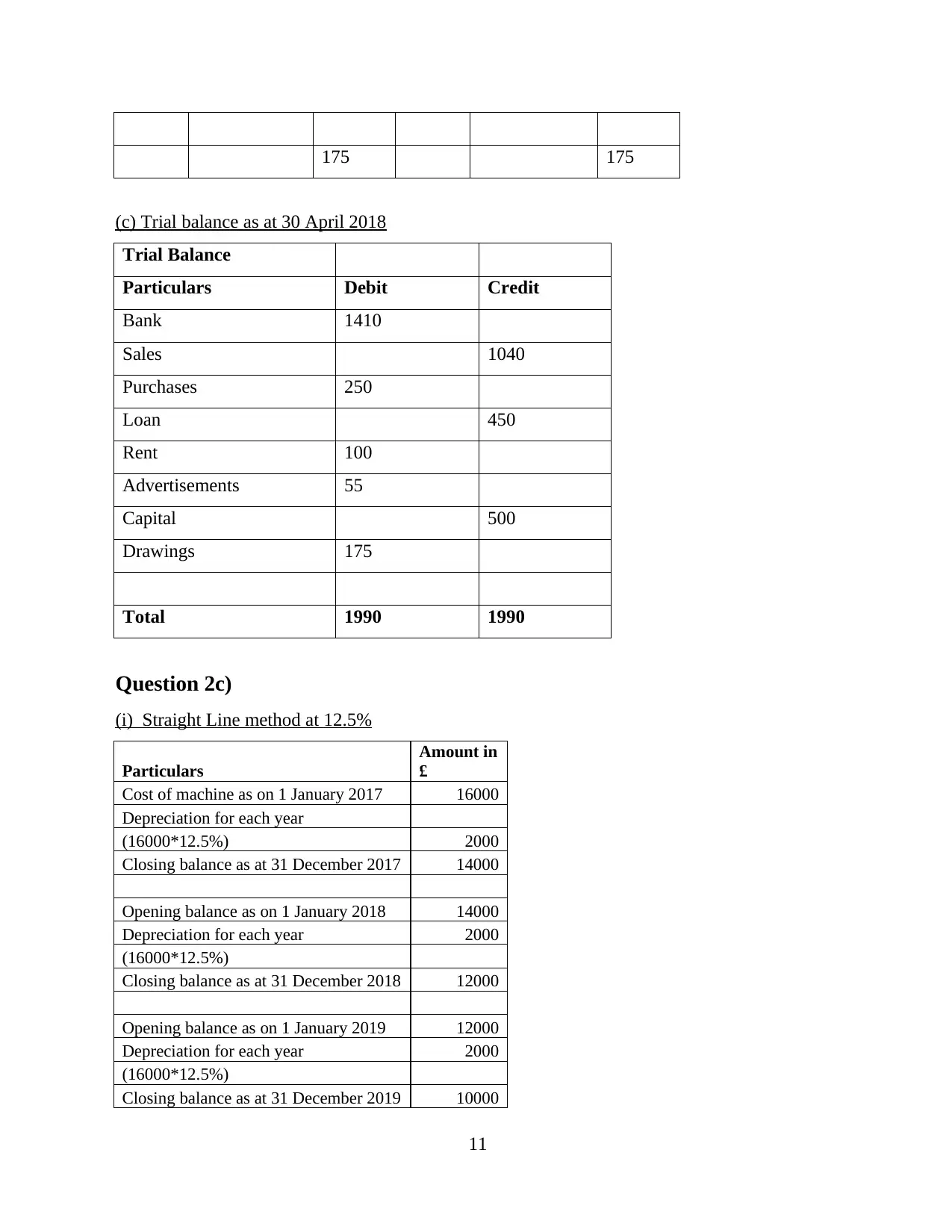

Question 2c)..................................................................................................................................11

(i) Straight Line method at 12.5%.......................................................................................11

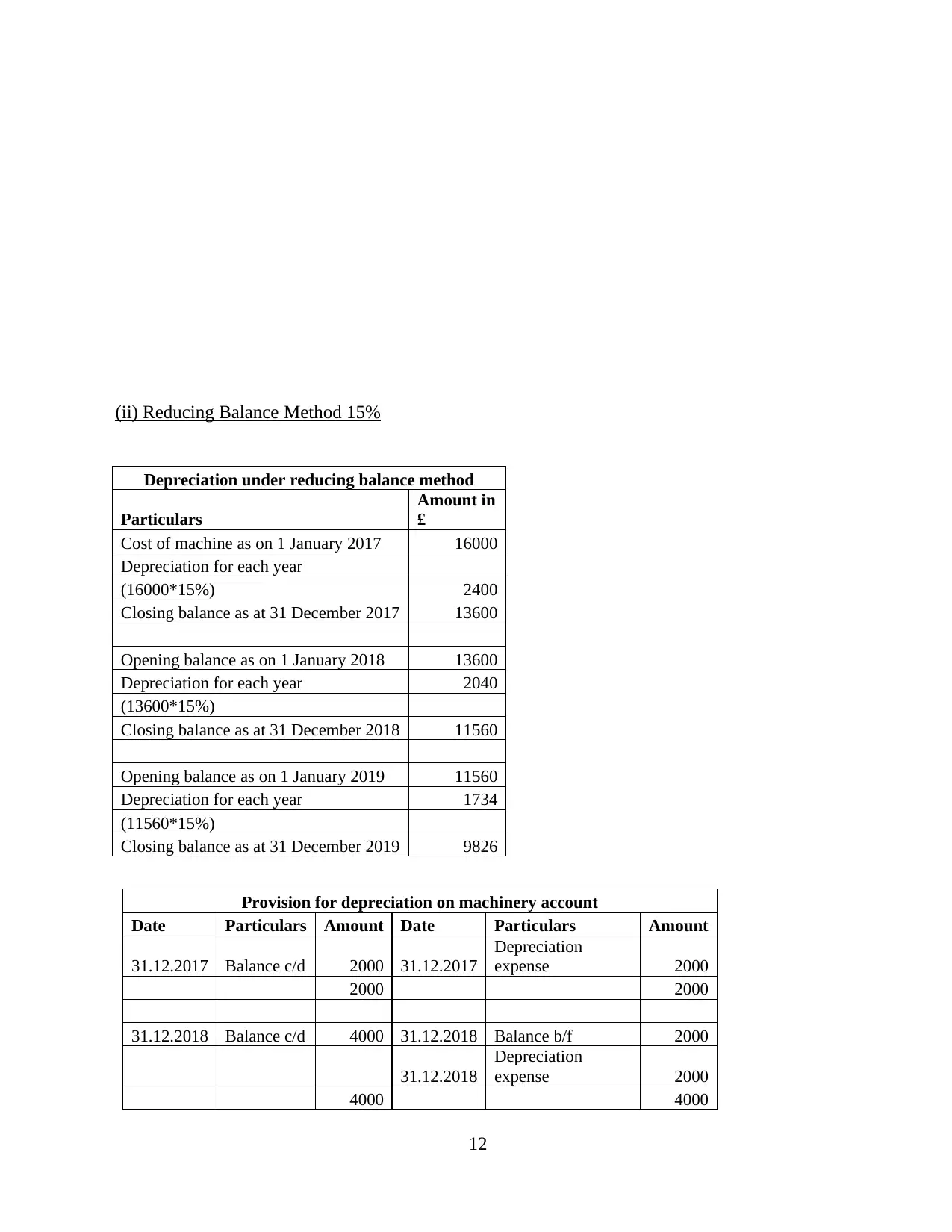

(ii) Reducing Balance Method 15%.....................................................................................12

(iii) Meaning and significance of the accounting concepts..................................................13

REFERENCES..............................................................................................................................15

2

MAIN BODY..................................................................................................................................3

Question 1a)....................................................................................................................................3

(a) Trading Account for the year ending 30th April 2019.......................................................3

(b) Profit and loss account for the year ending 30th April 2019.............................................3

(c) Financial position as on 30th April 2019...........................................................................3

Question 1b)....................................................................................................................................4

Six main features for users of financial statements and importance and benefits to users....4

Question 2a)....................................................................................................................................6

Ratio Analysis........................................................................................................................6

Question 2b)....................................................................................................................................9

(a) Bank account balancing at the end of each month............................................................9

(b) Accounts balances at the end of two month periods.........................................................9

(c) Trial balance as at 30 April 2018....................................................................................11

Question 2c)..................................................................................................................................11

(i) Straight Line method at 12.5%.......................................................................................11

(ii) Reducing Balance Method 15%.....................................................................................12

(iii) Meaning and significance of the accounting concepts..................................................13

REFERENCES..............................................................................................................................15

2

MAIN BODY

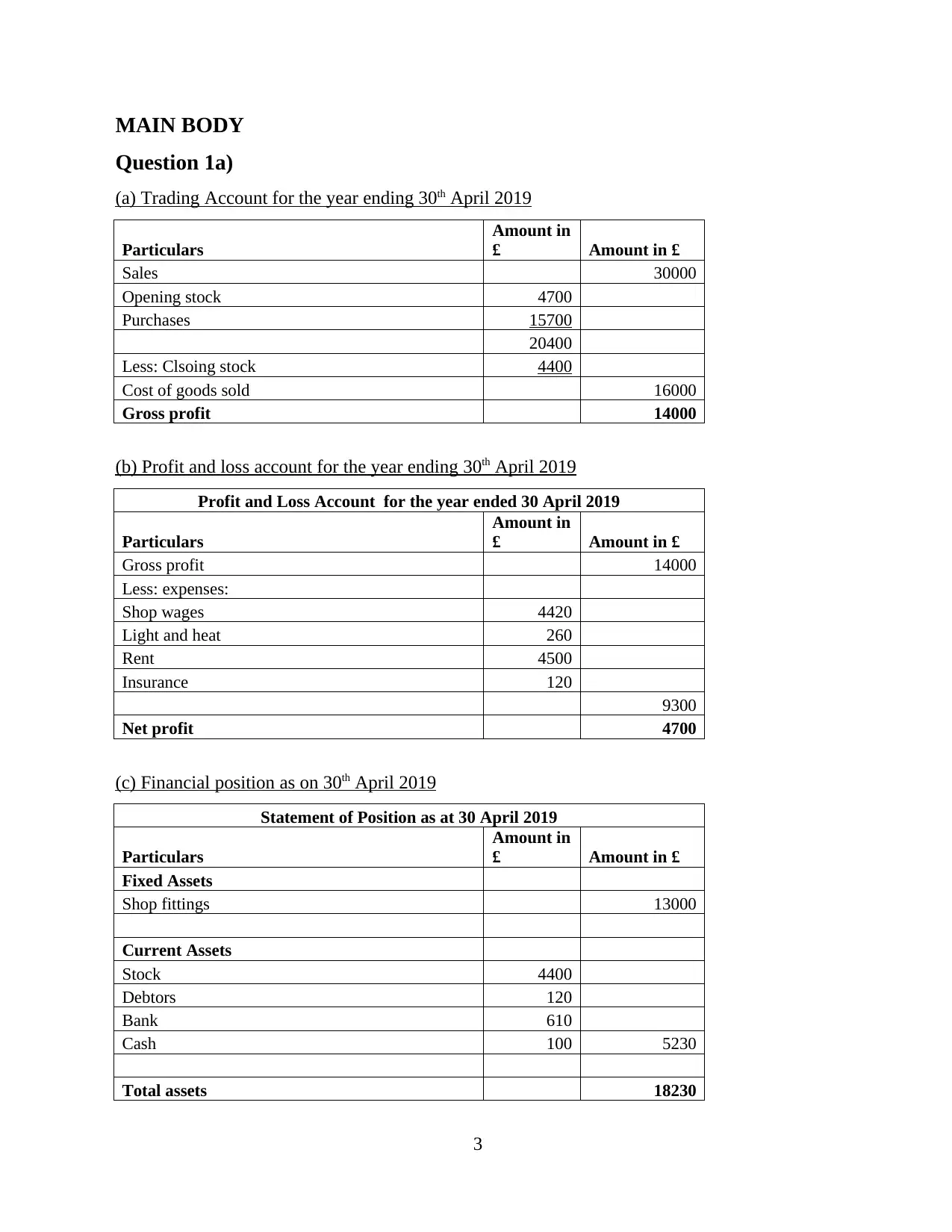

Question 1a)

(a) Trading Account for the year ending 30th April 2019

Particulars

Amount in

£ Amount in £

Sales 30000

Opening stock 4700

Purchases 15700

20400

Less: Clsoing stock 4400

Cost of goods sold 16000

Gross profit 14000

(b) Profit and loss account for the year ending 30th April 2019

Profit and Loss Account for the year ended 30 April 2019

Particulars

Amount in

£ Amount in £

Gross profit 14000

Less: expenses:

Shop wages 4420

Light and heat 260

Rent 4500

Insurance 120

9300

Net profit 4700

(c) Financial position as on 30th April 2019

Statement of Position as at 30 April 2019

Particulars

Amount in

£ Amount in £

Fixed Assets

Shop fittings 13000

Current Assets

Stock 4400

Debtors 120

Bank 610

Cash 100 5230

Total assets 18230

3

Question 1a)

(a) Trading Account for the year ending 30th April 2019

Particulars

Amount in

£ Amount in £

Sales 30000

Opening stock 4700

Purchases 15700

20400

Less: Clsoing stock 4400

Cost of goods sold 16000

Gross profit 14000

(b) Profit and loss account for the year ending 30th April 2019

Profit and Loss Account for the year ended 30 April 2019

Particulars

Amount in

£ Amount in £

Gross profit 14000

Less: expenses:

Shop wages 4420

Light and heat 260

Rent 4500

Insurance 120

9300

Net profit 4700

(c) Financial position as on 30th April 2019

Statement of Position as at 30 April 2019

Particulars

Amount in

£ Amount in £

Fixed Assets

Shop fittings 13000

Current Assets

Stock 4400

Debtors 120

Bank 610

Cash 100 5230

Total assets 18230

3

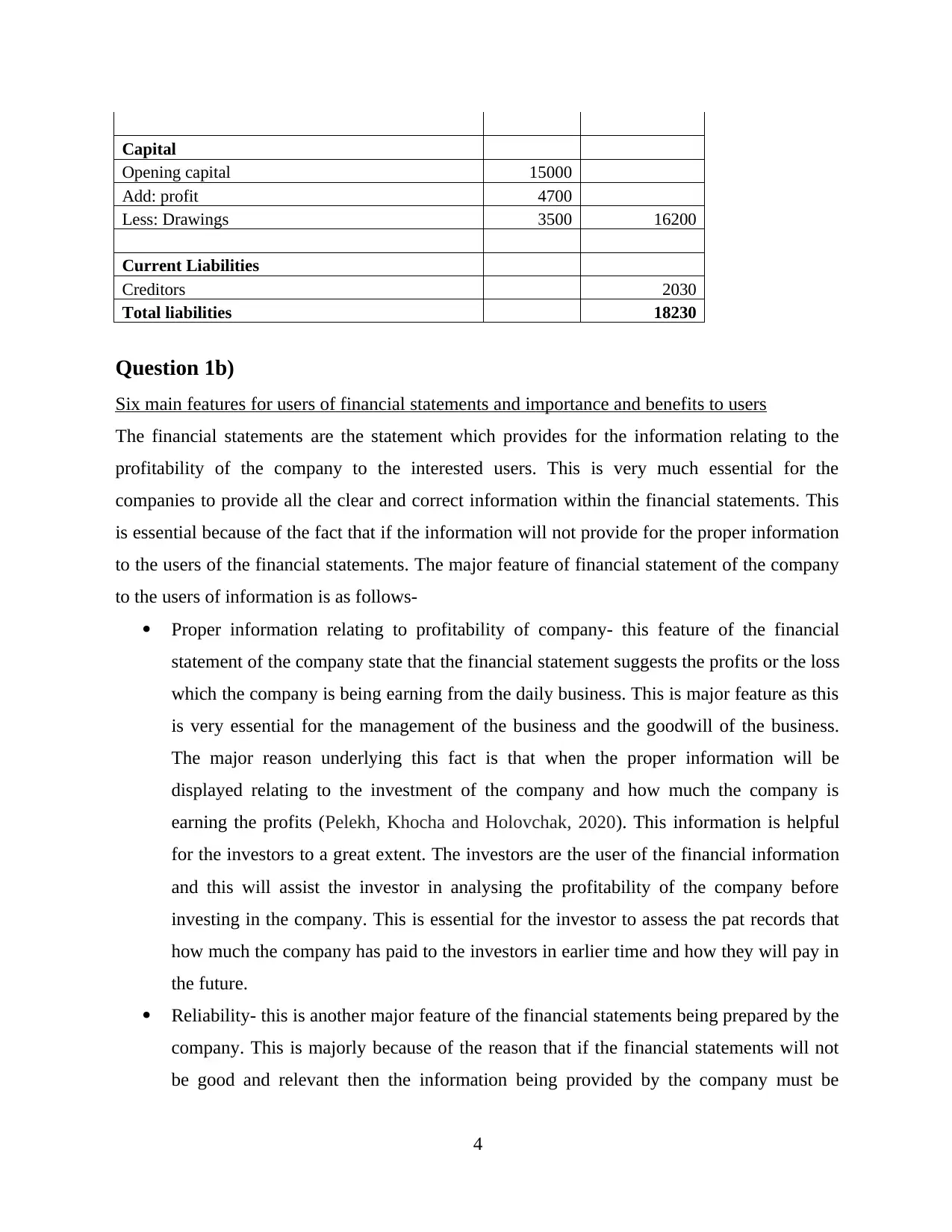

Capital

Opening capital 15000

Add: profit 4700

Less: Drawings 3500 16200

Current Liabilities

Creditors 2030

Total liabilities 18230

Question 1b)

Six main features for users of financial statements and importance and benefits to users

The financial statements are the statement which provides for the information relating to the

profitability of the company to the interested users. This is very much essential for the

companies to provide all the clear and correct information within the financial statements. This

is essential because of the fact that if the information will not provide for the proper information

to the users of the financial statements. The major feature of financial statement of the company

to the users of information is as follows-

Proper information relating to profitability of company- this feature of the financial

statement of the company state that the financial statement suggests the profits or the loss

which the company is being earning from the daily business. This is major feature as this

is very essential for the management of the business and the goodwill of the business.

The major reason underlying this fact is that when the proper information will be

displayed relating to the investment of the company and how much the company is

earning the profits (Pelekh, Khocha and Holovchak, 2020). This information is helpful

for the investors to a great extent. The investors are the user of the financial information

and this will assist the investor in analysing the profitability of the company before

investing in the company. This is essential for the investor to assess the pat records that

how much the company has paid to the investors in earlier time and how they will pay in

the future.

Reliability- this is another major feature of the financial statements being prepared by the

company. This is majorly because of the reason that if the financial statements will not

be good and relevant then the information being provided by the company must be

4

Opening capital 15000

Add: profit 4700

Less: Drawings 3500 16200

Current Liabilities

Creditors 2030

Total liabilities 18230

Question 1b)

Six main features for users of financial statements and importance and benefits to users

The financial statements are the statement which provides for the information relating to the

profitability of the company to the interested users. This is very much essential for the

companies to provide all the clear and correct information within the financial statements. This

is essential because of the fact that if the information will not provide for the proper information

to the users of the financial statements. The major feature of financial statement of the company

to the users of information is as follows-

Proper information relating to profitability of company- this feature of the financial

statement of the company state that the financial statement suggests the profits or the loss

which the company is being earning from the daily business. This is major feature as this

is very essential for the management of the business and the goodwill of the business.

The major reason underlying this fact is that when the proper information will be

displayed relating to the investment of the company and how much the company is

earning the profits (Pelekh, Khocha and Holovchak, 2020). This information is helpful

for the investors to a great extent. The investors are the user of the financial information

and this will assist the investor in analysing the profitability of the company before

investing in the company. This is essential for the investor to assess the pat records that

how much the company has paid to the investors in earlier time and how they will pay in

the future.

Reliability- this is another major feature of the financial statements being prepared by the

company. This is majorly because of the reason that if the financial statements will not

be good and relevant then the information being provided by the company must be

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

reliable and accurate. This is important because of the fact that when the company will

provide for reliable information then only the major user of the company that is

consumer will decide that whether they have to deal with the company or not

(Duvanskaya and Ol’ga, 2016). This is majorly because of the reason that if the

consumer will not get the actual and the correct values then the consumer will not have

faith over the company and its product.

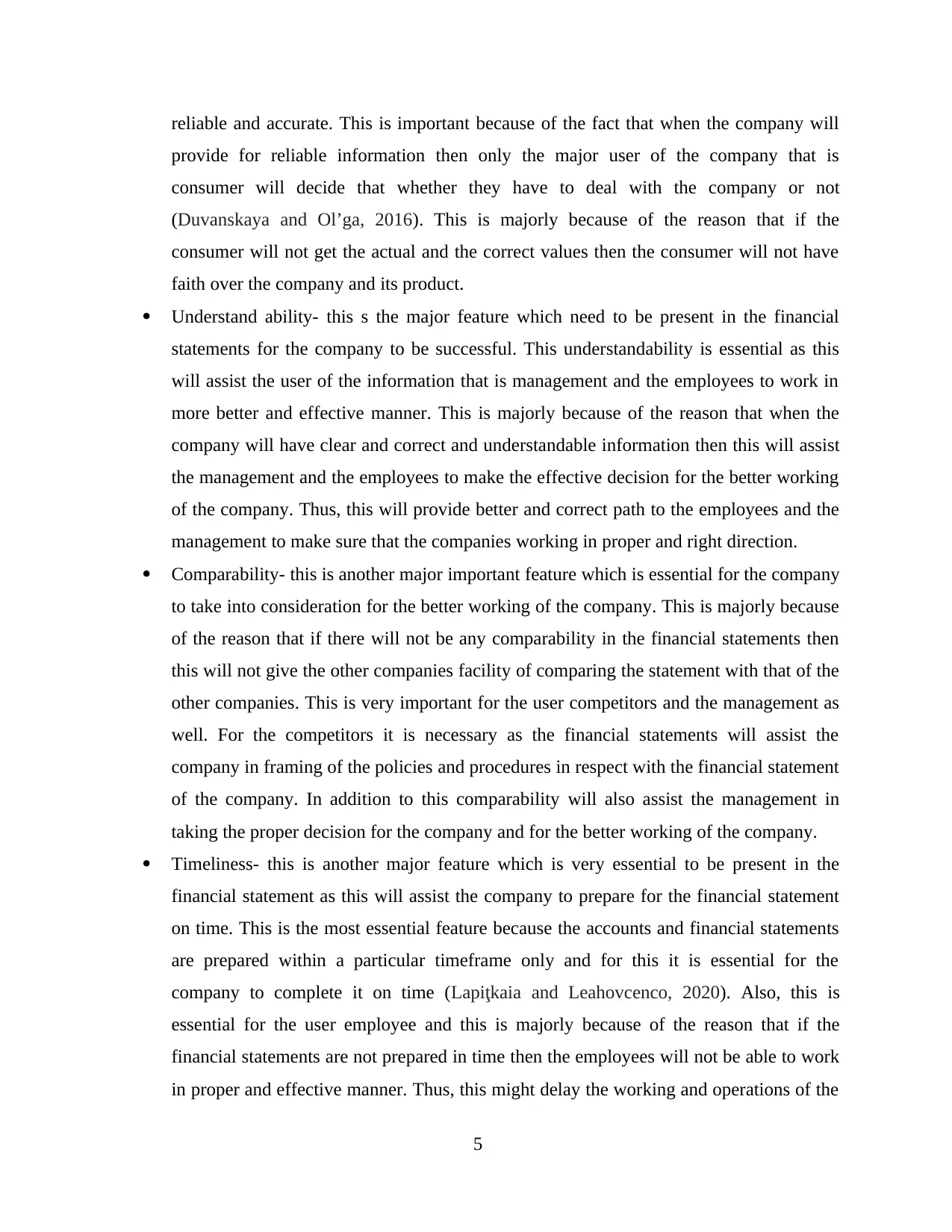

Understand ability- this s the major feature which need to be present in the financial

statements for the company to be successful. This understandability is essential as this

will assist the user of the information that is management and the employees to work in

more better and effective manner. This is majorly because of the reason that when the

company will have clear and correct and understandable information then this will assist

the management and the employees to make the effective decision for the better working

of the company. Thus, this will provide better and correct path to the employees and the

management to make sure that the companies working in proper and right direction.

Comparability- this is another major important feature which is essential for the company

to take into consideration for the better working of the company. This is majorly because

of the reason that if there will not be any comparability in the financial statements then

this will not give the other companies facility of comparing the statement with that of the

other companies. This is very important for the user competitors and the management as

well. For the competitors it is necessary as the financial statements will assist the

company in framing of the policies and procedures in respect with the financial statement

of the company. In addition to this comparability will also assist the management in

taking the proper decision for the company and for the better working of the company.

Timeliness- this is another major feature which is very essential to be present in the

financial statement as this will assist the company to prepare for the financial statement

on time. This is the most essential feature because the accounts and financial statements

are prepared within a particular timeframe only and for this it is essential for the

company to complete it on time (Lapiţkaia and Leahovcenco, 2020). Also, this is

essential for the user employee and this is majorly because of the reason that if the

financial statements are not prepared in time then the employees will not be able to work

in proper and effective manner. Thus, this might delay the working and operations of the

5

provide for reliable information then only the major user of the company that is

consumer will decide that whether they have to deal with the company or not

(Duvanskaya and Ol’ga, 2016). This is majorly because of the reason that if the

consumer will not get the actual and the correct values then the consumer will not have

faith over the company and its product.

Understand ability- this s the major feature which need to be present in the financial

statements for the company to be successful. This understandability is essential as this

will assist the user of the information that is management and the employees to work in

more better and effective manner. This is majorly because of the reason that when the

company will have clear and correct and understandable information then this will assist

the management and the employees to make the effective decision for the better working

of the company. Thus, this will provide better and correct path to the employees and the

management to make sure that the companies working in proper and right direction.

Comparability- this is another major important feature which is essential for the company

to take into consideration for the better working of the company. This is majorly because

of the reason that if there will not be any comparability in the financial statements then

this will not give the other companies facility of comparing the statement with that of the

other companies. This is very important for the user competitors and the management as

well. For the competitors it is necessary as the financial statements will assist the

company in framing of the policies and procedures in respect with the financial statement

of the company. In addition to this comparability will also assist the management in

taking the proper decision for the company and for the better working of the company.

Timeliness- this is another major feature which is very essential to be present in the

financial statement as this will assist the company to prepare for the financial statement

on time. This is the most essential feature because the accounts and financial statements

are prepared within a particular timeframe only and for this it is essential for the

company to complete it on time (Lapiţkaia and Leahovcenco, 2020). Also, this is

essential for the user employee and this is majorly because of the reason that if the

financial statements are not prepared in time then the employees will not be able to work

in proper and effective manner. Thus, this might delay the working and operations of the

5

company. Thus, for this it is essential for the company to finish the financial statements

on time (Hajek and Henriques, 2017).

Verifiability- this is referred to as keeping the proof of every record and every

transaction taking place within the company. This is essential for the company as this

will help the company in keeping the track and record of all the small and big transaction

and this will assist the company in any case of contingency. Thus, this feature is very

helpful for the company in keeping the record of all the transaction within the company.

This feature is very helpful for the users like government and the auditors of the

company. This is majorly because of the reason that when the government levies the

taxes and other charges over the company then they have to analyse all the transaction of

the company and for this they use the financial statements. In the similar manner the

auditor are hired for the analysis of the financial statements of the company and for this

they have to analyse the financial transaction are correct and accurate or not and for this

they require the proof of every transaction which this feature provides for.

The financial statements and the information being provided by them are both important and

beneficial for the company as this will assist the company in managing the business and the

decision relating to the business (Sorkun and Toraman, 2017). This is pertaining to the fact that

when the financial statements are prepared in proper and effective manner then this will help the

company in making a clear picture of the company and of the profitability of the company.

Thus, this will benefit the company in taking proper decision for the betterment and

development of the business in good and effective manner.

Question 2a)

Ratio Analysis

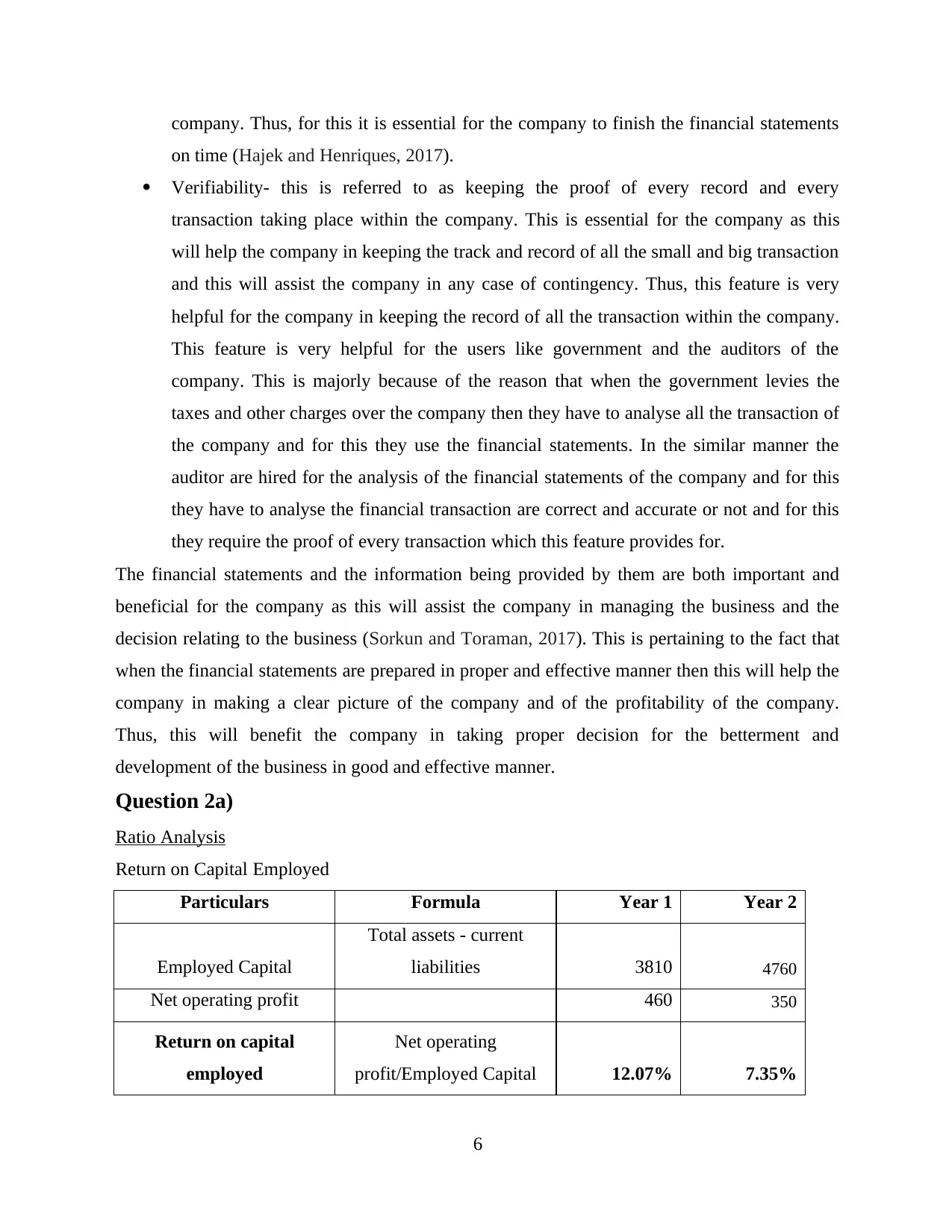

Return on Capital Employed

Particulars Formula Year 1 Year 2

Employed Capital

Total assets - current

liabilities 3810 4760

Net operating profit 460 350

Return on capital

employed

Net operating

profit/Employed Capital 12.07% 7.35%

6

on time (Hajek and Henriques, 2017).

Verifiability- this is referred to as keeping the proof of every record and every

transaction taking place within the company. This is essential for the company as this

will help the company in keeping the track and record of all the small and big transaction

and this will assist the company in any case of contingency. Thus, this feature is very

helpful for the company in keeping the record of all the transaction within the company.

This feature is very helpful for the users like government and the auditors of the

company. This is majorly because of the reason that when the government levies the

taxes and other charges over the company then they have to analyse all the transaction of

the company and for this they use the financial statements. In the similar manner the

auditor are hired for the analysis of the financial statements of the company and for this

they have to analyse the financial transaction are correct and accurate or not and for this

they require the proof of every transaction which this feature provides for.

The financial statements and the information being provided by them are both important and

beneficial for the company as this will assist the company in managing the business and the

decision relating to the business (Sorkun and Toraman, 2017). This is pertaining to the fact that

when the financial statements are prepared in proper and effective manner then this will help the

company in making a clear picture of the company and of the profitability of the company.

Thus, this will benefit the company in taking proper decision for the betterment and

development of the business in good and effective manner.

Question 2a)

Ratio Analysis

Return on Capital Employed

Particulars Formula Year 1 Year 2

Employed Capital

Total assets - current

liabilities 3810 4760

Net operating profit 460 350

Return on capital

employed

Net operating

profit/Employed Capital 12.07% 7.35%

6

It is the ratio which generally used to provide the information about the efficiency of

management of organization. Ration shows that company has earned the return of 7.35% in the

past 2 years which is downward movement from the earning of 12.07% in past. So management

has to make sure that management has to change the strategy to increase the return. Decreasing

return brings negative impact on the business performance.

Gross Profit Margin

Particulars Formula Year 1 Year 2

Cost of Sales 3020 4650

Sales 4940 6850

Gross profit 1920 2200

Gross profit margin ratio shows that gross profit which is earned by the company during the

year. Gross profit is calculated by meeting all the cost of sales. Gross profit of the company

derived is 32.12% which has decline from the last year. As last year the Gross profit was

38.87%. Reason behind the same is identified that there is good sort of the increase in the cost of

the company from the last year.

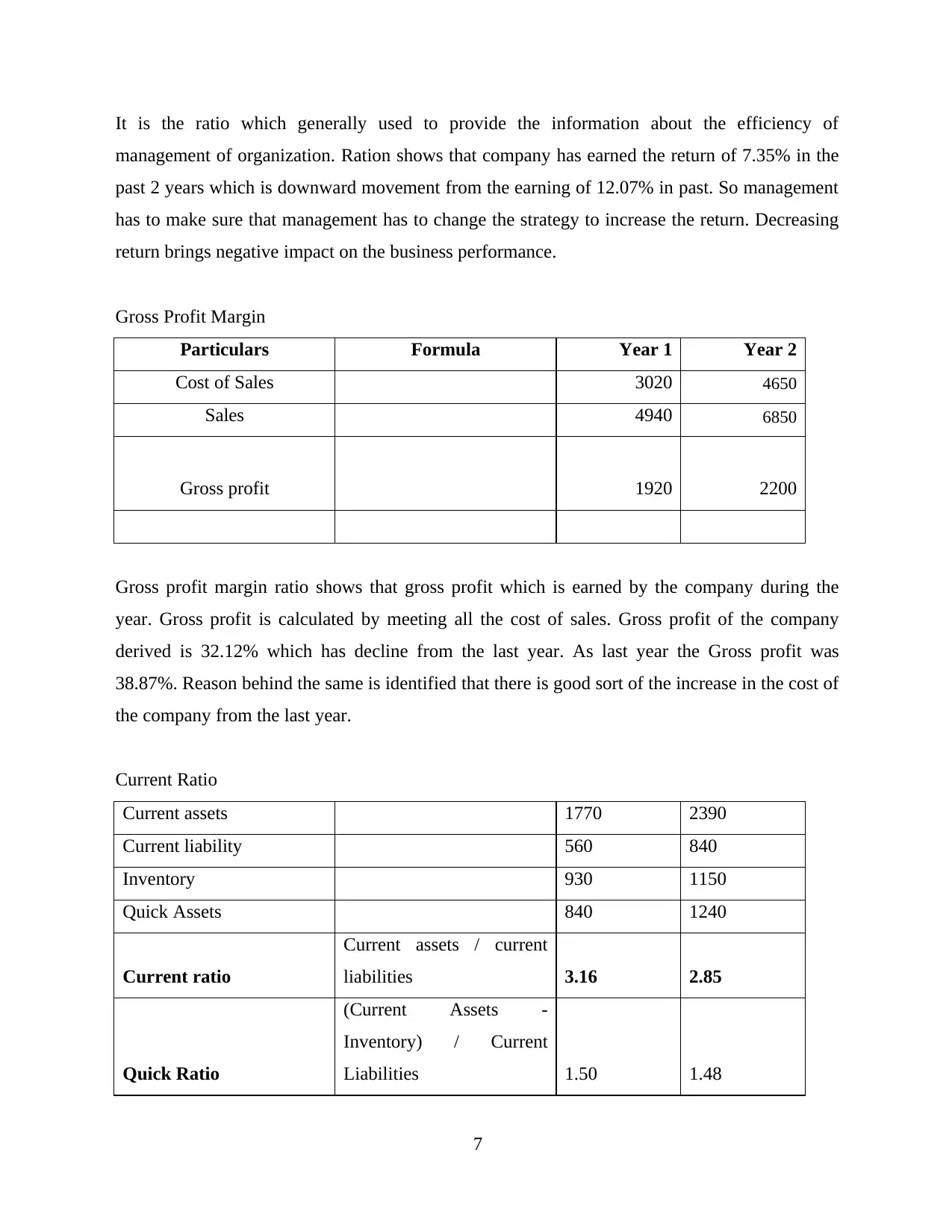

Current Ratio

Current assets 1770 2390

Current liability 560 840

Inventory 930 1150

Quick Assets 840 1240

Current ratio

Current assets / current

liabilities 3.16 2.85

Quick Ratio

(Current Assets -

Inventory) / Current

Liabilities 1.50 1.48

7

management of organization. Ration shows that company has earned the return of 7.35% in the

past 2 years which is downward movement from the earning of 12.07% in past. So management

has to make sure that management has to change the strategy to increase the return. Decreasing

return brings negative impact on the business performance.

Gross Profit Margin

Particulars Formula Year 1 Year 2

Cost of Sales 3020 4650

Sales 4940 6850

Gross profit 1920 2200

Gross profit margin ratio shows that gross profit which is earned by the company during the

year. Gross profit is calculated by meeting all the cost of sales. Gross profit of the company

derived is 32.12% which has decline from the last year. As last year the Gross profit was

38.87%. Reason behind the same is identified that there is good sort of the increase in the cost of

the company from the last year.

Current Ratio

Current assets 1770 2390

Current liability 560 840

Inventory 930 1150

Quick Assets 840 1240

Current ratio

Current assets / current

liabilities 3.16 2.85

Quick Ratio

(Current Assets -

Inventory) / Current

Liabilities 1.50 1.48

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Liquidity is one of the important elements which need to be considering by the organization

before making any sort of the investment decision. It is also consider by different management

for taking variety of different strategic decision to enhance liquidity of company. The above

table and the data shows that liquidity position in the year 2 are 2.85 which was in the year 1

were 3.16. These shows that there is been downward movement. For the same reason the

company has the enough amount of the assets which can help them in meeting the short term

obligation and working capital requirement of business.

Trade Payable and Receivable Ratio

Particulars Formula Year 1 Year 2

Trade payables 560 840

Purchase 3320 4870

Creditors payment period Trade payables / purchase *365 62 63

Particulars Formula Year 1 Year 2

Trade receivables 820 1230

Sales 4940 6850

Debtors collection period Trade receivables / Sales *365 60.59 65.54

Looking at the trade payable day it has been identified that it is 45 days which has been

increased in last year as it was 41 days in that year. It means that this decision is taken to cash

operating cycle of the business in the long run.

Trade receivable days has been also increased very rapidly as it has been identified that it has

increased from 61 days to 65 days in the last year. This has been done as a part of the sales

promotional policy. This enables the company to enhance the sales revenue of the company.

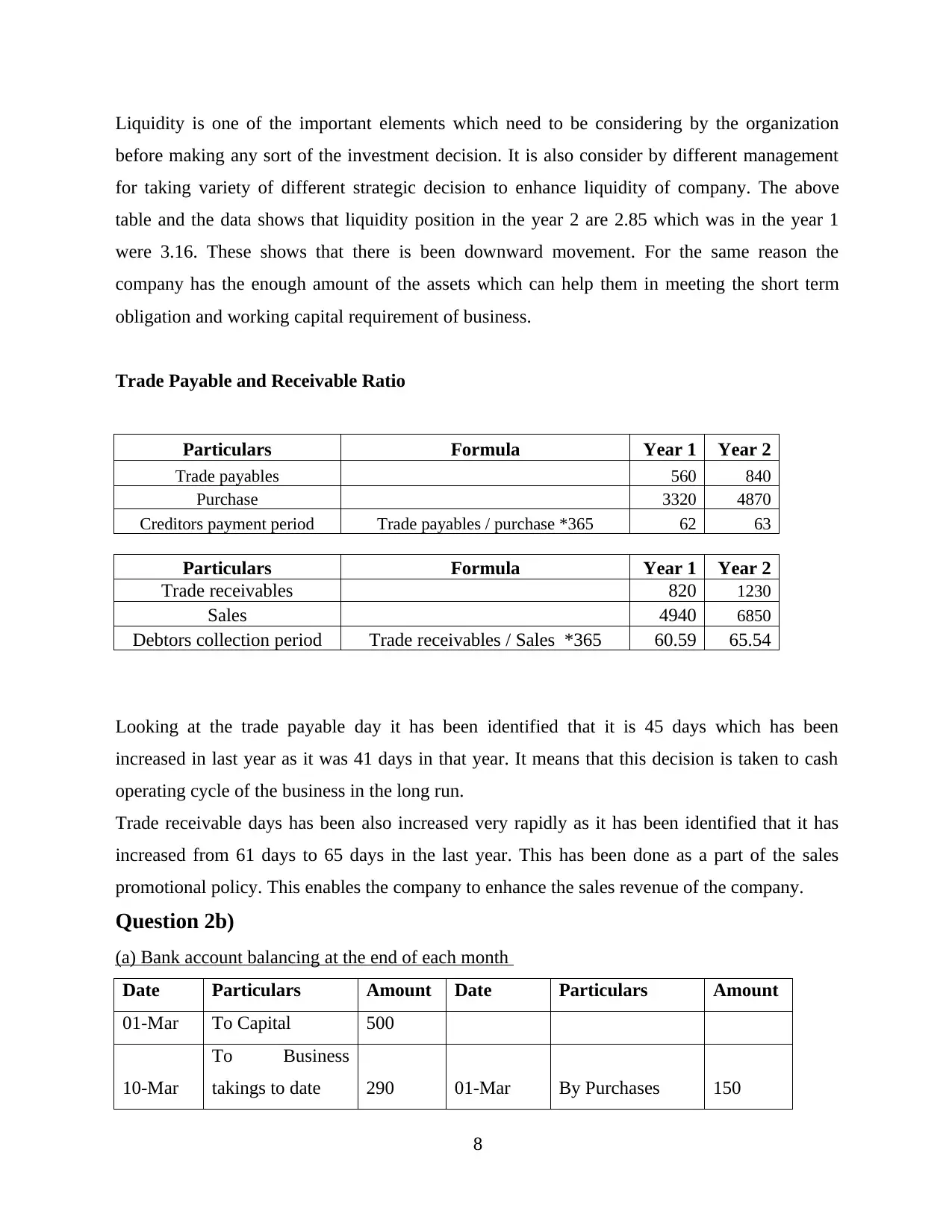

Question 2b)

(a) Bank account balancing at the end of each month

Date Particulars Amount Date Particulars Amount

01-Mar To Capital 500

10-Mar

To Business

takings to date 290 01-Mar By Purchases 150

8

before making any sort of the investment decision. It is also consider by different management

for taking variety of different strategic decision to enhance liquidity of company. The above

table and the data shows that liquidity position in the year 2 are 2.85 which was in the year 1

were 3.16. These shows that there is been downward movement. For the same reason the

company has the enough amount of the assets which can help them in meeting the short term

obligation and working capital requirement of business.

Trade Payable and Receivable Ratio

Particulars Formula Year 1 Year 2

Trade payables 560 840

Purchase 3320 4870

Creditors payment period Trade payables / purchase *365 62 63

Particulars Formula Year 1 Year 2

Trade receivables 820 1230

Sales 4940 6850

Debtors collection period Trade receivables / Sales *365 60.59 65.54

Looking at the trade payable day it has been identified that it is 45 days which has been

increased in last year as it was 41 days in that year. It means that this decision is taken to cash

operating cycle of the business in the long run.

Trade receivable days has been also increased very rapidly as it has been identified that it has

increased from 61 days to 65 days in the last year. This has been done as a part of the sales

promotional policy. This enables the company to enhance the sales revenue of the company.

Question 2b)

(a) Bank account balancing at the end of each month

Date Particulars Amount Date Particulars Amount

01-Mar To Capital 500

10-Mar

To Business

takings to date 290 01-Mar By Purchases 150

8

27-Mar

To Business

takings to date 240 05-Mar By Rent 50

22-Mar By Advertising 25

26-Mar

By Gilberto

Wahabo

Drawings 100

31-Mar By bal c/d 705

1030 1030

April

01-Apr To bal b/d 705 02-Apr By Purchases 100

14-Apr To Loan L Lock 450 05-Apr By Rent 50

16-Mar

To Business

takings 330 23-Apr

By Gilberto

Wahabo

Drawings 75

26-Mar

To Business

takings 180 29-Apr

By advertisement

leaflets 30

30-Apr By bal c/d 1410

1665 1665

(b) Accounts balances at the end of two month periods

Sales

Date Particulars Amount Date Particulars Amount

10-Mar Sales 290

27-Mar Sales 240

16-Apr Sales 330

30-Apr By bal c/d 1040 26-Apr Sales 180

1040 1040

9

To Business

takings to date 240 05-Mar By Rent 50

22-Mar By Advertising 25

26-Mar

By Gilberto

Wahabo

Drawings 100

31-Mar By bal c/d 705

1030 1030

April

01-Apr To bal b/d 705 02-Apr By Purchases 100

14-Apr To Loan L Lock 450 05-Apr By Rent 50

16-Mar

To Business

takings 330 23-Apr

By Gilberto

Wahabo

Drawings 75

26-Mar

To Business

takings 180 29-Apr

By advertisement

leaflets 30

30-Apr By bal c/d 1410

1665 1665

(b) Accounts balances at the end of two month periods

Sales

Date Particulars Amount Date Particulars Amount

10-Mar Sales 290

27-Mar Sales 240

16-Apr Sales 330

30-Apr By bal c/d 1040 26-Apr Sales 180

1040 1040

9

Rent

Date Particulars Amount Date Particulars Amount

05-Mar To Bank 50

05-Apr To Bank 50 30-Apr bal c/d 100

100 100

Advertisements

Date Particulars Amount Date Particulars Amount

22-Mar To Bank 25

29-Apr To Bank 30 30-Apr bal c/d 55

55 55

Loan L. lock

Date Particulars Amount Date Particulars Amount

14-Apr By Bank 450

30-Apr Bal c/d 450

450 450

Capital A/c

Date Particulars Amount Date Particulars Amount

01-Mar By bank 500

30-Apr By bal c/d 500

500 500

Drawings

Date Particulars Amount Date Particulars Amount

26-Mar To Drawings 100

23-Apr To Drawings 750 30-Apr By bal c/d 175

10

Date Particulars Amount Date Particulars Amount

05-Mar To Bank 50

05-Apr To Bank 50 30-Apr bal c/d 100

100 100

Advertisements

Date Particulars Amount Date Particulars Amount

22-Mar To Bank 25

29-Apr To Bank 30 30-Apr bal c/d 55

55 55

Loan L. lock

Date Particulars Amount Date Particulars Amount

14-Apr By Bank 450

30-Apr Bal c/d 450

450 450

Capital A/c

Date Particulars Amount Date Particulars Amount

01-Mar By bank 500

30-Apr By bal c/d 500

500 500

Drawings

Date Particulars Amount Date Particulars Amount

26-Mar To Drawings 100

23-Apr To Drawings 750 30-Apr By bal c/d 175

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

175 175

(c) Trial balance as at 30 April 2018

Trial Balance

Particulars Debit Credit

Bank 1410

Sales 1040

Purchases 250

Loan 450

Rent 100

Advertisements 55

Capital 500

Drawings 175

Total 1990 1990

Question 2c)

(i) Straight Line method at 12.5%

Particulars

Amount in

£

Cost of machine as on 1 January 2017 16000

Depreciation for each year

(16000*12.5%) 2000

Closing balance as at 31 December 2017 14000

Opening balance as on 1 January 2018 14000

Depreciation for each year 2000

(16000*12.5%)

Closing balance as at 31 December 2018 12000

Opening balance as on 1 January 2019 12000

Depreciation for each year 2000

(16000*12.5%)

Closing balance as at 31 December 2019 10000

11

(c) Trial balance as at 30 April 2018

Trial Balance

Particulars Debit Credit

Bank 1410

Sales 1040

Purchases 250

Loan 450

Rent 100

Advertisements 55

Capital 500

Drawings 175

Total 1990 1990

Question 2c)

(i) Straight Line method at 12.5%

Particulars

Amount in

£

Cost of machine as on 1 January 2017 16000

Depreciation for each year

(16000*12.5%) 2000

Closing balance as at 31 December 2017 14000

Opening balance as on 1 January 2018 14000

Depreciation for each year 2000

(16000*12.5%)

Closing balance as at 31 December 2018 12000

Opening balance as on 1 January 2019 12000

Depreciation for each year 2000

(16000*12.5%)

Closing balance as at 31 December 2019 10000

11

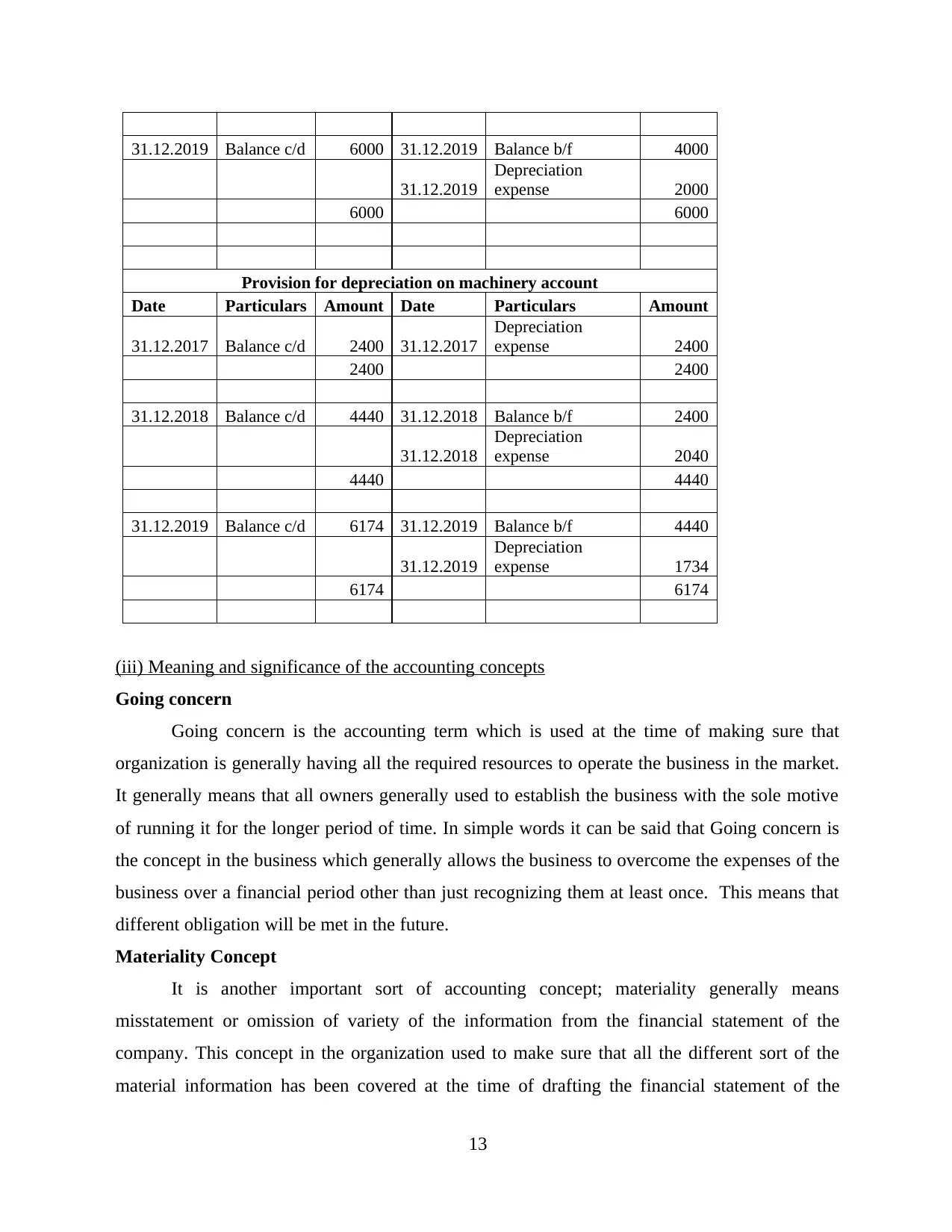

(ii) Reducing Balance Method 15%

Depreciation under reducing balance method

Particulars

Amount in

£

Cost of machine as on 1 January 2017 16000

Depreciation for each year

(16000*15%) 2400

Closing balance as at 31 December 2017 13600

Opening balance as on 1 January 2018 13600

Depreciation for each year 2040

(13600*15%)

Closing balance as at 31 December 2018 11560

Opening balance as on 1 January 2019 11560

Depreciation for each year 1734

(11560*15%)

Closing balance as at 31 December 2019 9826

Provision for depreciation on machinery account

Date Particulars Amount Date Particulars Amount

31.12.2017 Balance c/d 2000 31.12.2017

Depreciation

expense 2000

2000 2000

31.12.2018 Balance c/d 4000 31.12.2018 Balance b/f 2000

31.12.2018

Depreciation

expense 2000

4000 4000

12

Depreciation under reducing balance method

Particulars

Amount in

£

Cost of machine as on 1 January 2017 16000

Depreciation for each year

(16000*15%) 2400

Closing balance as at 31 December 2017 13600

Opening balance as on 1 January 2018 13600

Depreciation for each year 2040

(13600*15%)

Closing balance as at 31 December 2018 11560

Opening balance as on 1 January 2019 11560

Depreciation for each year 1734

(11560*15%)

Closing balance as at 31 December 2019 9826

Provision for depreciation on machinery account

Date Particulars Amount Date Particulars Amount

31.12.2017 Balance c/d 2000 31.12.2017

Depreciation

expense 2000

2000 2000

31.12.2018 Balance c/d 4000 31.12.2018 Balance b/f 2000

31.12.2018

Depreciation

expense 2000

4000 4000

12

31.12.2019 Balance c/d 6000 31.12.2019 Balance b/f 4000

31.12.2019

Depreciation

expense 2000

6000 6000

Provision for depreciation on machinery account

Date Particulars Amount Date Particulars Amount

31.12.2017 Balance c/d 2400 31.12.2017

Depreciation

expense 2400

2400 2400

31.12.2018 Balance c/d 4440 31.12.2018 Balance b/f 2400

31.12.2018

Depreciation

expense 2040

4440 4440

31.12.2019 Balance c/d 6174 31.12.2019 Balance b/f 4440

31.12.2019

Depreciation

expense 1734

6174 6174

(iii) Meaning and significance of the accounting concepts

Going concern

Going concern is the accounting term which is used at the time of making sure that

organization is generally having all the required resources to operate the business in the market.

It generally means that all owners generally used to establish the business with the sole motive

of running it for the longer period of time. In simple words it can be said that Going concern is

the concept in the business which generally allows the business to overcome the expenses of the

business over a financial period other than just recognizing them at least once. This means that

different obligation will be met in the future.

Materiality Concept

It is another important sort of accounting concept; materiality generally means

misstatement or omission of variety of the information from the financial statement of the

company. This concept in the organization used to make sure that all the different sort of the

material information has been covered at the time of drafting the financial statement of the

13

31.12.2019

Depreciation

expense 2000

6000 6000

Provision for depreciation on machinery account

Date Particulars Amount Date Particulars Amount

31.12.2017 Balance c/d 2400 31.12.2017

Depreciation

expense 2400

2400 2400

31.12.2018 Balance c/d 4440 31.12.2018 Balance b/f 2400

31.12.2018

Depreciation

expense 2040

4440 4440

31.12.2019 Balance c/d 6174 31.12.2019 Balance b/f 4440

31.12.2019

Depreciation

expense 1734

6174 6174

(iii) Meaning and significance of the accounting concepts

Going concern

Going concern is the accounting term which is used at the time of making sure that

organization is generally having all the required resources to operate the business in the market.

It generally means that all owners generally used to establish the business with the sole motive

of running it for the longer period of time. In simple words it can be said that Going concern is

the concept in the business which generally allows the business to overcome the expenses of the

business over a financial period other than just recognizing them at least once. This means that

different obligation will be met in the future.

Materiality Concept

It is another important sort of accounting concept; materiality generally means

misstatement or omission of variety of the information from the financial statement of the

company. This concept in the organization used to make sure that all the different sort of the

material information has been covered at the time of drafting the financial statement of the

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company. In simple words this concept used to make sure that financial statement of the

company used to display all the material information and information about the different

transaction which has been taken place in the year.

Business Entity concept

This is the simplest accounting concept; this concept used to define that company is the

legal entity which is different from the owner. All the transaction such as sales purchase in its

own name and all the other transaction are generally made in its own name. It generally used to

restrict the liability of the business to the business only it do not extent to the owner as they are

separate legal entity.

14

company used to display all the material information and information about the different

transaction which has been taken place in the year.

Business Entity concept

This is the simplest accounting concept; this concept used to define that company is the

legal entity which is different from the owner. All the transaction such as sales purchase in its

own name and all the other transaction are generally made in its own name. It generally used to

restrict the liability of the business to the business only it do not extent to the owner as they are

separate legal entity.

14

REFERENCES

Books and Journals

Duvanskaya, N.A. and Ol’ga, F.S., 2016. Features of adaptation of international financial

reporting standards in the Russian commercial organizations. International Journal of

Economics and Financial Issues. 6(1S). pp.68-73.

Hajek, P. and Henriques, R., 2017. Mining corporate annual reports for intelligent detection of

financial statement fraud–A comparative study of machine learning

methods. Knowledge-Based Systems. 128. pp.139-152.

Lapiţkaia, L. and Leahovcenco, A., 2020. Features of intellectual property reflection in

accounting and in financial statements. Eastern European Journal for Regional Studies

(EEJRS). 6(1). pp.102-112.

Pelekh, U., Khocha, N. and Holovchak, H., 2020. Financial statements as a management

tool. Management Science Letters. 10(1). pp.197-208.

Sorkun, M.C. and Toraman, T., 2017. Fraud detection on financial statements using data mining

techniques. International Journal of Intelligent Systems and Applications in

Engineering. 5(3). pp.132-134.

15

Books and Journals

Duvanskaya, N.A. and Ol’ga, F.S., 2016. Features of adaptation of international financial

reporting standards in the Russian commercial organizations. International Journal of

Economics and Financial Issues. 6(1S). pp.68-73.

Hajek, P. and Henriques, R., 2017. Mining corporate annual reports for intelligent detection of

financial statement fraud–A comparative study of machine learning

methods. Knowledge-Based Systems. 128. pp.139-152.

Lapiţkaia, L. and Leahovcenco, A., 2020. Features of intellectual property reflection in

accounting and in financial statements. Eastern European Journal for Regional Studies

(EEJRS). 6(1). pp.102-112.

Pelekh, U., Khocha, N. and Holovchak, H., 2020. Financial statements as a management

tool. Management Science Letters. 10(1). pp.197-208.

Sorkun, M.C. and Toraman, T., 2017. Fraud detection on financial statements using data mining

techniques. International Journal of Intelligent Systems and Applications in

Engineering. 5(3). pp.132-134.

15

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.