Management Accounting Analysis and Concepts

VerifiedAdded on 2020/02/14

|24

|6619

|45

AI Summary

This assignment delves into the core concepts of management accounting, examining its role in informing business decisions. It covers various costing methods like standard costs and variance analysis, linking them to broader strategic management accounting principles. The text references influential academic works and online resources to provide a comprehensive understanding of this essential field.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Management Accounting

1

1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P 1.1 Different types of cost classification..................................................................................3

P 1.2 Calculation of Unit cost by using unit costing method......................................................4

P 1.3 Cost of exquisite using absorption cost..............................................................................5

P 1.4 Cost data of exquisite using appropriate techniques..........................................................7

TASK 2............................................................................................................................................8

P 2.1 Preparation and analysis of cost report for the month of September and variance analysis

.....................................................................................................................................................8

P 2.2 Various areas of potential improvements using performance indicators...........................9

P 2.3 Ways to reduce cost and enhancing value and quality.....................................................10

TASK 3..........................................................................................................................................10

P 3.1 Purpose and nature of budgeting process for Jeffery and Son's Ltd.................................10

P 3.2 Use of appropriate budgeting technique...........................................................................12

P 3.3 Preparation of production and material budgets...............................................................13

P 3.4 Preparation of cash Budget...............................................................................................13

TASK 4..........................................................................................................................................16

P 4.1 Calculation of variances, identify possible causes and recommend corrective actions. . .16

P 4.2 Operating statements includes both budgeted and actual results.....................................16

P4.3 Responsibility centers........................................................................................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P 1.1 Different types of cost classification..................................................................................3

P 1.2 Calculation of Unit cost by using unit costing method......................................................4

P 1.3 Cost of exquisite using absorption cost..............................................................................5

P 1.4 Cost data of exquisite using appropriate techniques..........................................................7

TASK 2............................................................................................................................................8

P 2.1 Preparation and analysis of cost report for the month of September and variance analysis

.....................................................................................................................................................8

P 2.2 Various areas of potential improvements using performance indicators...........................9

P 2.3 Ways to reduce cost and enhancing value and quality.....................................................10

TASK 3..........................................................................................................................................10

P 3.1 Purpose and nature of budgeting process for Jeffery and Son's Ltd.................................10

P 3.2 Use of appropriate budgeting technique...........................................................................12

P 3.3 Preparation of production and material budgets...............................................................13

P 3.4 Preparation of cash Budget...............................................................................................13

TASK 4..........................................................................................................................................16

P 4.1 Calculation of variances, identify possible causes and recommend corrective actions. . .16

P 4.2 Operating statements includes both budgeted and actual results.....................................16

P4.3 Responsibility centers........................................................................................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

2

INTRODUCTION

Management accounting is also termed as managerial accounting that combines norms

which are related to costing and budgeting. This unit of accounting is significantly used by the

managers in order to collect data for making a good use of accounting information for decision

making (Ward, 2012). From past few decades, management accounting is being used in

corporate world to decide financial matters within the organization. The case scenario of Jeffrey

and Son’s manufacturing company is taken into consideration for making present report.

Furthermore, cost report is prepared for a manufacturing unit while using various performance

indicators to find out the areas of potential improvements. The purpose as well as the nature of

the budgeting process is explained to the budget holders of Jeffery and Son’s Ltd. In this respect,

different kinds of budgets such as a production budget in units; materials purchases budget and a

cash budget are prepared. At the end of the report, variance in budget is identified along with

possible causes and recommended corrective actions.

TASK 1

P 1.1 Different types of cost classification

Manufacturing company bears expenses at the time of production of goods and services,

which is generally known as “Cost”. Nonetheless, there are various cost incurred during the

production process that are further classified into various categories. In general form, the cost is

classified on the basis elements; namely behaviors, nature and function. Following points will

explain the cost classification:

Elements of cost: The cost includes three major elements which are Material, Labor and

Expenses. Material is used to produce finished goods, labor put efficiency in production and

expenses are occurred in whole process. However, these elements are further divided into direct

and indirect forms such as direct material and indirect material (Zimmerman and Yahya-Zadeh,

2011).

Nature of Expense: On the basis of nature of cost, it is divided into material, labor and

expenses. Within the manufacturing company, the remuneration paid to workforce is considered

as labor cost. Material cost, on the other hand, is paid against the purchase of raw material that is

3

Management accounting is also termed as managerial accounting that combines norms

which are related to costing and budgeting. This unit of accounting is significantly used by the

managers in order to collect data for making a good use of accounting information for decision

making (Ward, 2012). From past few decades, management accounting is being used in

corporate world to decide financial matters within the organization. The case scenario of Jeffrey

and Son’s manufacturing company is taken into consideration for making present report.

Furthermore, cost report is prepared for a manufacturing unit while using various performance

indicators to find out the areas of potential improvements. The purpose as well as the nature of

the budgeting process is explained to the budget holders of Jeffery and Son’s Ltd. In this respect,

different kinds of budgets such as a production budget in units; materials purchases budget and a

cash budget are prepared. At the end of the report, variance in budget is identified along with

possible causes and recommended corrective actions.

TASK 1

P 1.1 Different types of cost classification

Manufacturing company bears expenses at the time of production of goods and services,

which is generally known as “Cost”. Nonetheless, there are various cost incurred during the

production process that are further classified into various categories. In general form, the cost is

classified on the basis elements; namely behaviors, nature and function. Following points will

explain the cost classification:

Elements of cost: The cost includes three major elements which are Material, Labor and

Expenses. Material is used to produce finished goods, labor put efficiency in production and

expenses are occurred in whole process. However, these elements are further divided into direct

and indirect forms such as direct material and indirect material (Zimmerman and Yahya-Zadeh,

2011).

Nature of Expense: On the basis of nature of cost, it is divided into material, labor and

expenses. Within the manufacturing company, the remuneration paid to workforce is considered

as labor cost. Material cost, on the other hand, is paid against the purchase of raw material that is

3

used by the company for successful accomplishment of manufacturing process. All the expenses

made for providing services are expenses for a manufacturing unit (Nørreklit, 2010).

Functions/Activities: According to the functions of different departments of business,

the cost is classified as per the expenses made by respective departments. For example:

Production cost, Selling cost, Administration cost, Marketing cost, Distribution cost and R&D

cost are included in function based cost.

Behavior of Cost: Volume is the base of deciding behavior of cost. On the other hand,

the cost which is based on the volume of production is categorized into behavioral category. Cost

of production changes as per the production volume of a specific time span. According to the

behavior, cost is classified into three major categories such as Fixed cost, Variable cost and Semi

variable cost (McGowan, 2010). Fixed cost does not modify at any level of production or

remains same at any production volume. However, variable cost has a nature of change due to

alteration in production volume. Semi-variable cost has characteristics of both fixed and variable

cost. It can be said that to a specific level that a cost remains fixed and after this level, it leads to

change. This kind of cost which occur in production process is called as semi-variable cost.

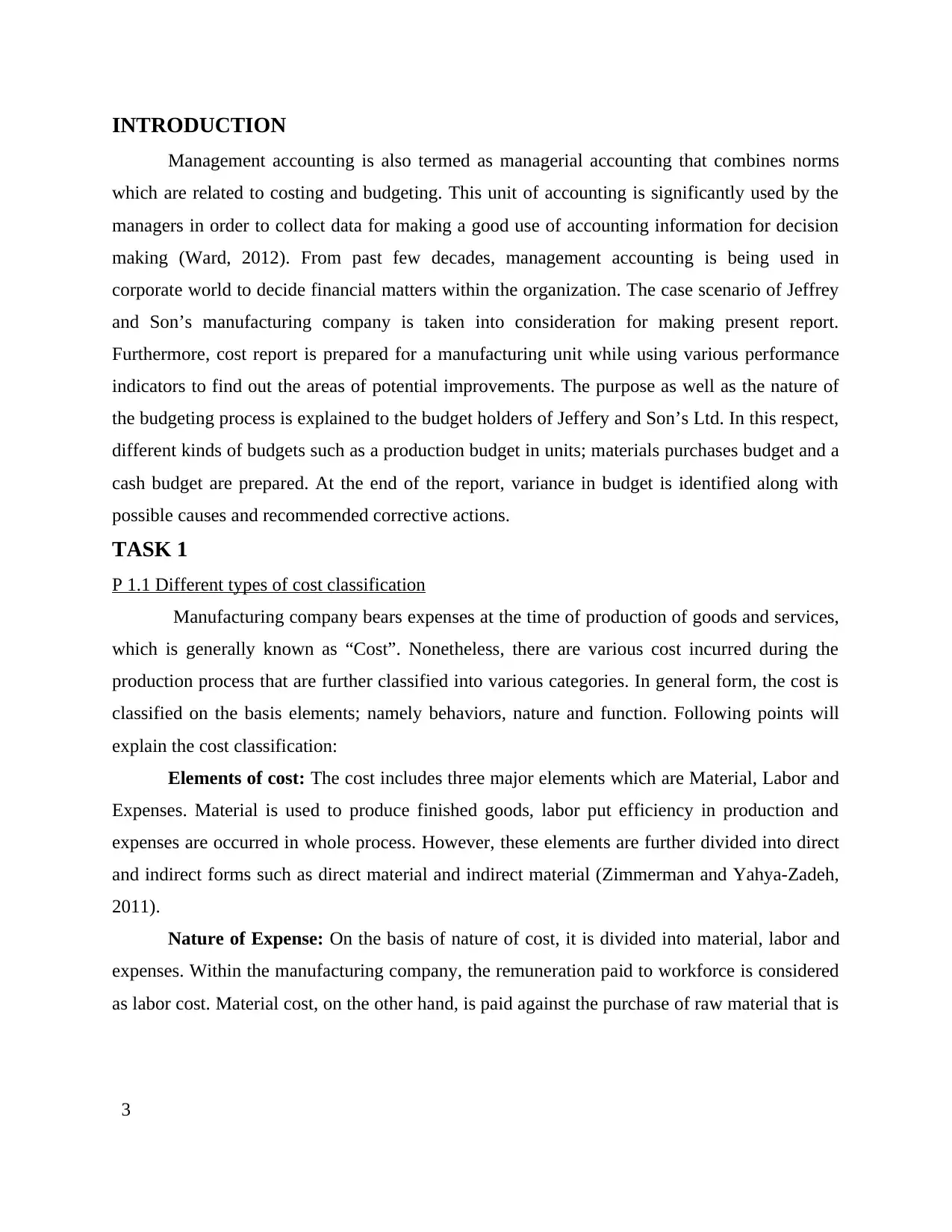

P 1.2 Calculation of Unit cost by using unit costing method

In general phenomenon, Job costing is referred as a method that is used by an

organization to compute cost for a job which is different and unique in nature and is to be

performed as per specific requirements of customers. The use of such costing methods allows

manufacturers to consider direct and indirect cost of the job at a same time. In respect with

Jeffrey and Son’s manufacturing Ltd., the calculation of cost and unit cost of job 444 is

explained below:

Table 1: Calculation of cost and unit cost of Job 444

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

4

made for providing services are expenses for a manufacturing unit (Nørreklit, 2010).

Functions/Activities: According to the functions of different departments of business,

the cost is classified as per the expenses made by respective departments. For example:

Production cost, Selling cost, Administration cost, Marketing cost, Distribution cost and R&D

cost are included in function based cost.

Behavior of Cost: Volume is the base of deciding behavior of cost. On the other hand,

the cost which is based on the volume of production is categorized into behavioral category. Cost

of production changes as per the production volume of a specific time span. According to the

behavior, cost is classified into three major categories such as Fixed cost, Variable cost and Semi

variable cost (McGowan, 2010). Fixed cost does not modify at any level of production or

remains same at any production volume. However, variable cost has a nature of change due to

alteration in production volume. Semi-variable cost has characteristics of both fixed and variable

cost. It can be said that to a specific level that a cost remains fixed and after this level, it leads to

change. This kind of cost which occur in production process is called as semi-variable cost.

P 1.2 Calculation of Unit cost by using unit costing method

In general phenomenon, Job costing is referred as a method that is used by an

organization to compute cost for a job which is different and unique in nature and is to be

performed as per specific requirements of customers. The use of such costing methods allows

manufacturers to consider direct and indirect cost of the job at a same time. In respect with

Jeffrey and Son’s manufacturing Ltd., the calculation of cost and unit cost of job 444 is

explained below:

Table 1: Calculation of cost and unit cost of Job 444

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

4

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Units to be produced 200

Total cost 770*200 154000

Working note

Fixed production overhead= (Budgeted overhead / total direct labor hours) * Direct labor hours

for Job 444

=(£80000 / 20000 hours) * 30 hours

=£120

With the help of above mentioned calculation, the total cost of job 444 is found to be

£770. However, per unit cost of job 444 is £3.85.

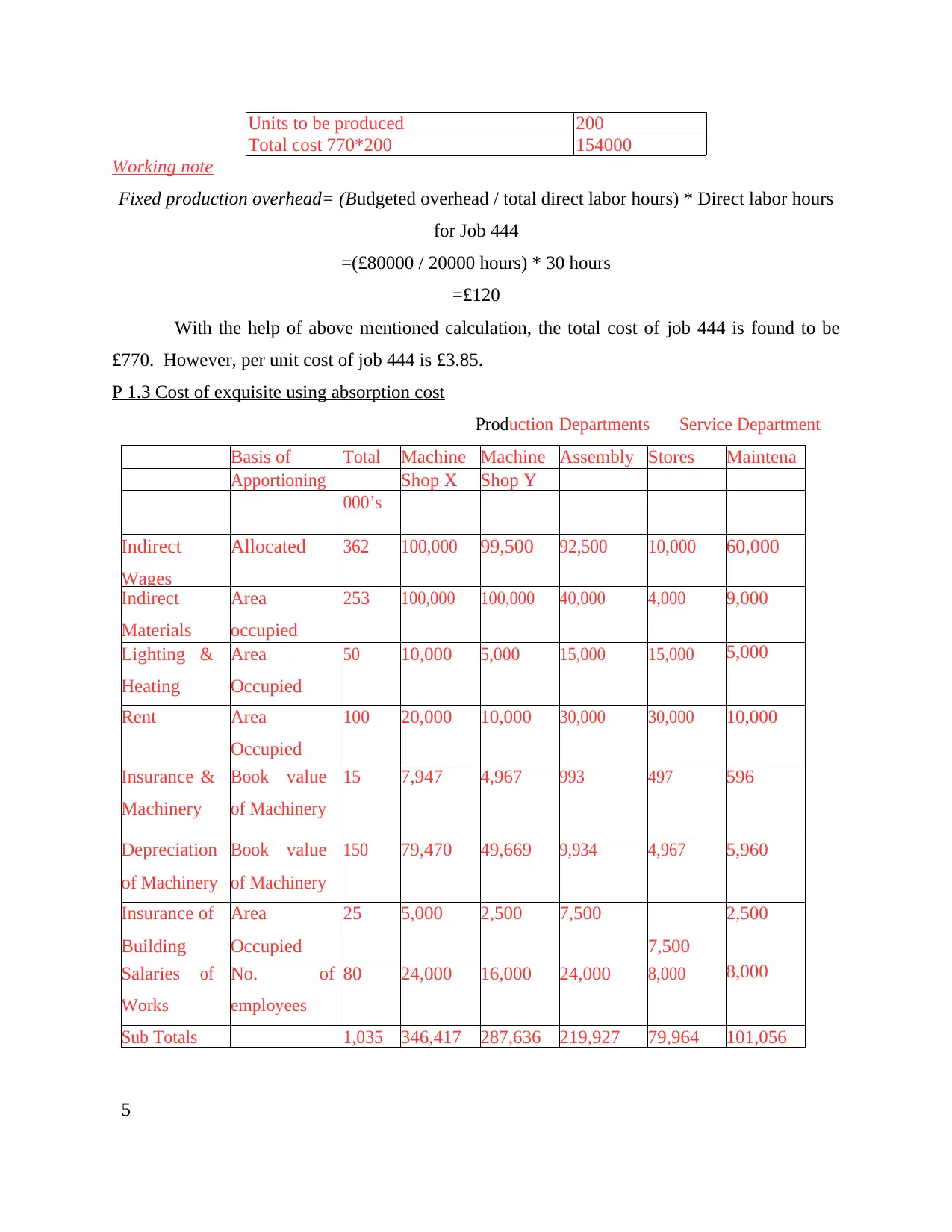

P 1.3 Cost of exquisite using absorption cost

Production Departments Service Department

Basis of Total Machine Machine Assembly Stores Maintena

nceApportioning Shop X Shop Y

000’s

Indirect

Wages

Allocated 362 100,000 99,500 92,500 10,000 60,000

Indirect

Materials

Area

occupied

253 100,000 100,000 40,000 4,000 9,000

Lighting

Heating

& Area

Occupied

50 10,000 5,000 15,000 15,000 5,000

Rent Area

Occupied

100 20,000 10,000 30,000 30,000 10,000

Insurance &

Machinery

Book value

of Machinery

15 7,947 4,967 993 497 596

Depreciation

of Machinery

Book value

of Machinery

150 79,470 49,669 9,934 4,967 5,960

Insurance of

Building

Area

Occupied

25 5,000 2,500 7,500

7,500

2,500

Salaries

Works

of No.

employees

of 80 24,000 16,000 24,000 8,000 8,000

Sub Totals 1,035 346,417 287,636 219,927 79,964 101,056

5

Total cost 770*200 154000

Working note

Fixed production overhead= (Budgeted overhead / total direct labor hours) * Direct labor hours

for Job 444

=(£80000 / 20000 hours) * 30 hours

=£120

With the help of above mentioned calculation, the total cost of job 444 is found to be

£770. However, per unit cost of job 444 is £3.85.

P 1.3 Cost of exquisite using absorption cost

Production Departments Service Department

Basis of Total Machine Machine Assembly Stores Maintena

nceApportioning Shop X Shop Y

000’s

Indirect

Wages

Allocated 362 100,000 99,500 92,500 10,000 60,000

Indirect

Materials

Area

occupied

253 100,000 100,000 40,000 4,000 9,000

Lighting

Heating

& Area

Occupied

50 10,000 5,000 15,000 15,000 5,000

Rent Area

Occupied

100 20,000 10,000 30,000 30,000 10,000

Insurance &

Machinery

Book value

of Machinery

15 7,947 4,967 993 497 596

Depreciation

of Machinery

Book value

of Machinery

150 79,470 49,669 9,934 4,967 5,960

Insurance of

Building

Area

Occupied

25 5,000 2,500 7,500

7,500

2,500

Salaries

Works

of No.

employees

of 80 24,000 16,000 24,000 8,000 8,000

Sub Totals 1,035 346,417 287,636 219,927 79,964 101,056

5

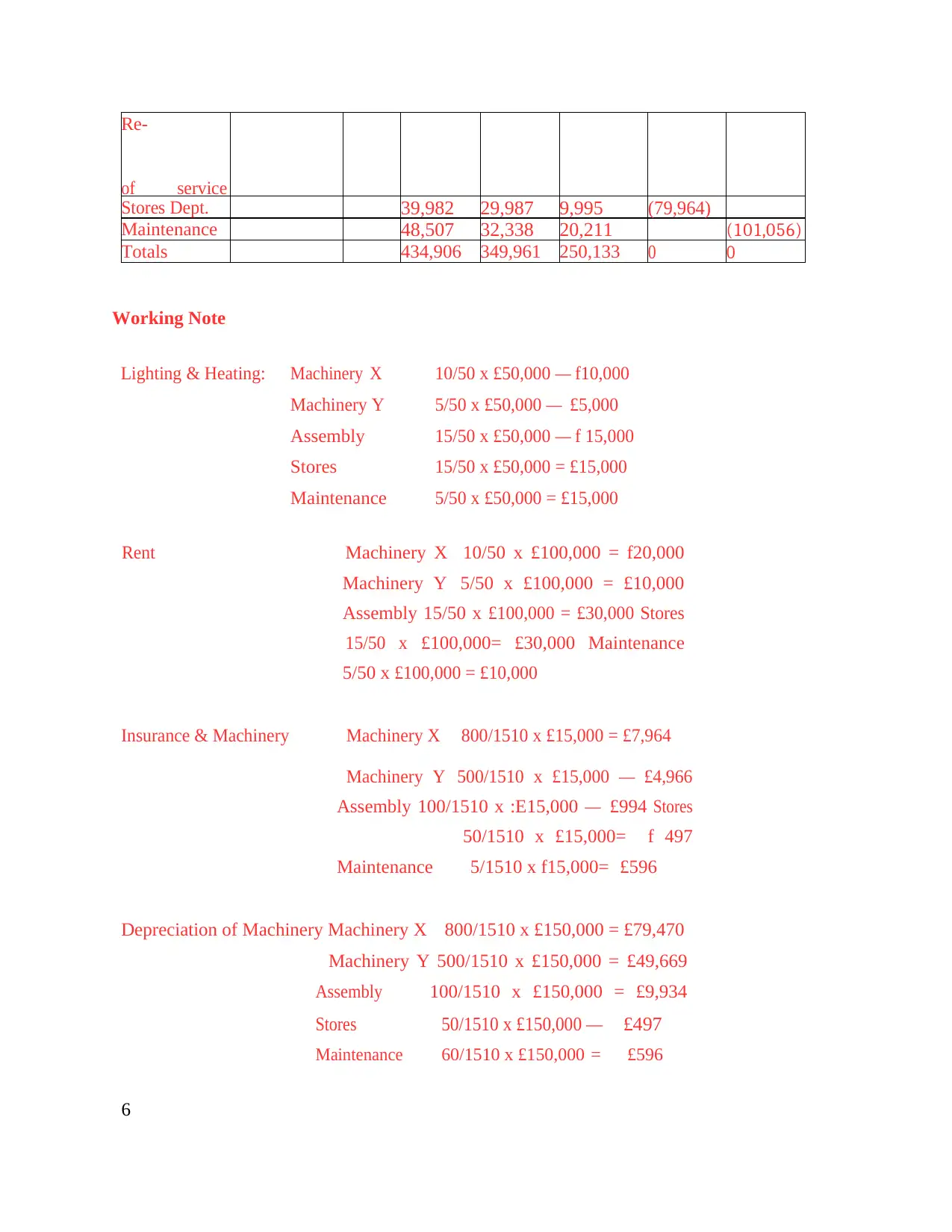

Re-

of service

Stores Dept. 39,982 29,987 9,995 (79,964)

Maintenance 48,507 32,338 20,211 (101,056)

Totals 434,906 349,961 250,133 0 0

Working Note

Lighting & Heating: Machinery X 10/50 x £50,000 — f10,000

Machinery Y 5/50 x £50,000 — £5,000

Assembly 15/50 x £50,000 — f 15,000

Stores 15/50 x £50,000 = £15,000

Maintenance 5/50 x £50,000 = £15,000

Rent Machinery X 10/50 x £100,000 = f20,000

Machinery Y 5/50 x £100,000 = £10,000

Assembly 15/50 x £100,000 = £30,000 Stores

15/50 x £100,000= £30,000 Maintenance

5/50 x £100,000 = £10,000

Insurance & Machinery Machinery X 800/1510 x £15,000 = £7,964

Machinery Y 500/1510 x £15,000 — £4,966

Assembly 100/1510 x :E15,000 — £994 Stores

50/1510 x £15,000= f 497

Maintenance 5/1510 x f15,000= £596

Depreciation of Machinery Machinery X 800/1510 x £150,000 = £79,470

Machinery Y 500/1510 x £150,000 = £49,669

Assembly 100/1510 x £150,000 = £9,934

Stores 50/1510 x £150,000 — £497

Maintenance 60/1510 x £150,000 = £596

6

of service

Stores Dept. 39,982 29,987 9,995 (79,964)

Maintenance 48,507 32,338 20,211 (101,056)

Totals 434,906 349,961 250,133 0 0

Working Note

Lighting & Heating: Machinery X 10/50 x £50,000 — f10,000

Machinery Y 5/50 x £50,000 — £5,000

Assembly 15/50 x £50,000 — f 15,000

Stores 15/50 x £50,000 = £15,000

Maintenance 5/50 x £50,000 = £15,000

Rent Machinery X 10/50 x £100,000 = f20,000

Machinery Y 5/50 x £100,000 = £10,000

Assembly 15/50 x £100,000 = £30,000 Stores

15/50 x £100,000= £30,000 Maintenance

5/50 x £100,000 = £10,000

Insurance & Machinery Machinery X 800/1510 x £15,000 = £7,964

Machinery Y 500/1510 x £15,000 — £4,966

Assembly 100/1510 x :E15,000 — £994 Stores

50/1510 x £15,000= f 497

Maintenance 5/1510 x f15,000= £596

Depreciation of Machinery Machinery X 800/1510 x £150,000 = £79,470

Machinery Y 500/1510 x £150,000 = £49,669

Assembly 100/1510 x £150,000 = £9,934

Stores 50/1510 x £150,000 — £497

Maintenance 60/1510 x £150,000 = £596

6

Insurance of Buildings Machinery X 15/50 x £25,000 — £5,000

Machinery Y 5/50 x £25,000 = £2,500

Assembly 15/50 x £25,000 = f7,500 Stores

15/50 x £25,000 — £7,500

Maintenance 5/50 x £25,000 = £2,500

Salaries of works mgmt. Machinery X 3/10 x £80,000 = £24,000

Machinery Y 2/10 x :E80,000 = £16,000

Assembly 3/10 x £80,000 = £24,000

Stores 1/10 x £80,000 — £8,000

Maintenance 1/10 x £80,000 = £8,000

Reappointing workings: based on material issues

Machinery X 400/800* £79,964 = £39,982

Machinery Y 300/800 * £79,964 = £29,987

Assembly 100/800 * £79,964 = £9,9995

Based on time spent

Machinery x 12/25 * £101,056 = £48,507

Machinery y 8/25 * £101,056 = £32,338

Assembly 5/25 * £101,056 = £20,211

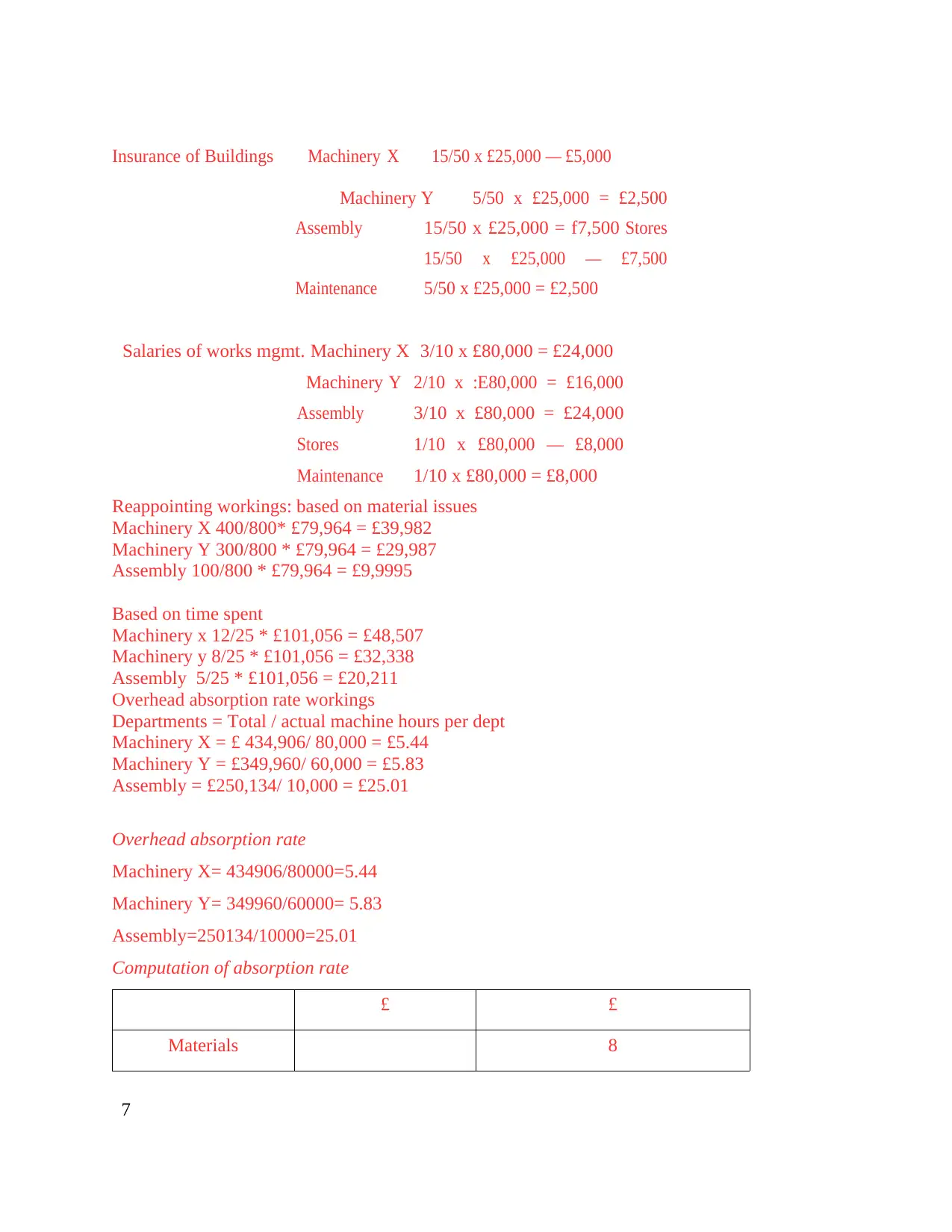

Overhead absorption rate workings

Departments = Total / actual machine hours per dept

Machinery X = £ 434,906/ 80,000 = £5.44

Machinery Y = £349,960/ 60,000 = £5.83

Assembly = £250,134/ 10,000 = £25.01

Overhead absorption rate

Machinery X= 434906/80000=5.44

Machinery Y= 349960/60000= 5.83

Assembly=250134/10000=25.01

Computation of absorption rate

£ £

Materials 8

7

Machinery Y 5/50 x £25,000 = £2,500

Assembly 15/50 x £25,000 = f7,500 Stores

15/50 x £25,000 — £7,500

Maintenance 5/50 x £25,000 = £2,500

Salaries of works mgmt. Machinery X 3/10 x £80,000 = £24,000

Machinery Y 2/10 x :E80,000 = £16,000

Assembly 3/10 x £80,000 = £24,000

Stores 1/10 x £80,000 — £8,000

Maintenance 1/10 x £80,000 = £8,000

Reappointing workings: based on material issues

Machinery X 400/800* £79,964 = £39,982

Machinery Y 300/800 * £79,964 = £29,987

Assembly 100/800 * £79,964 = £9,9995

Based on time spent

Machinery x 12/25 * £101,056 = £48,507

Machinery y 8/25 * £101,056 = £32,338

Assembly 5/25 * £101,056 = £20,211

Overhead absorption rate workings

Departments = Total / actual machine hours per dept

Machinery X = £ 434,906/ 80,000 = £5.44

Machinery Y = £349,960/ 60,000 = £5.83

Assembly = £250,134/ 10,000 = £25.01

Overhead absorption rate

Machinery X= 434906/80000=5.44

Machinery Y= 349960/60000= 5.83

Assembly=250134/10000=25.01

Computation of absorption rate

£ £

Materials 8

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

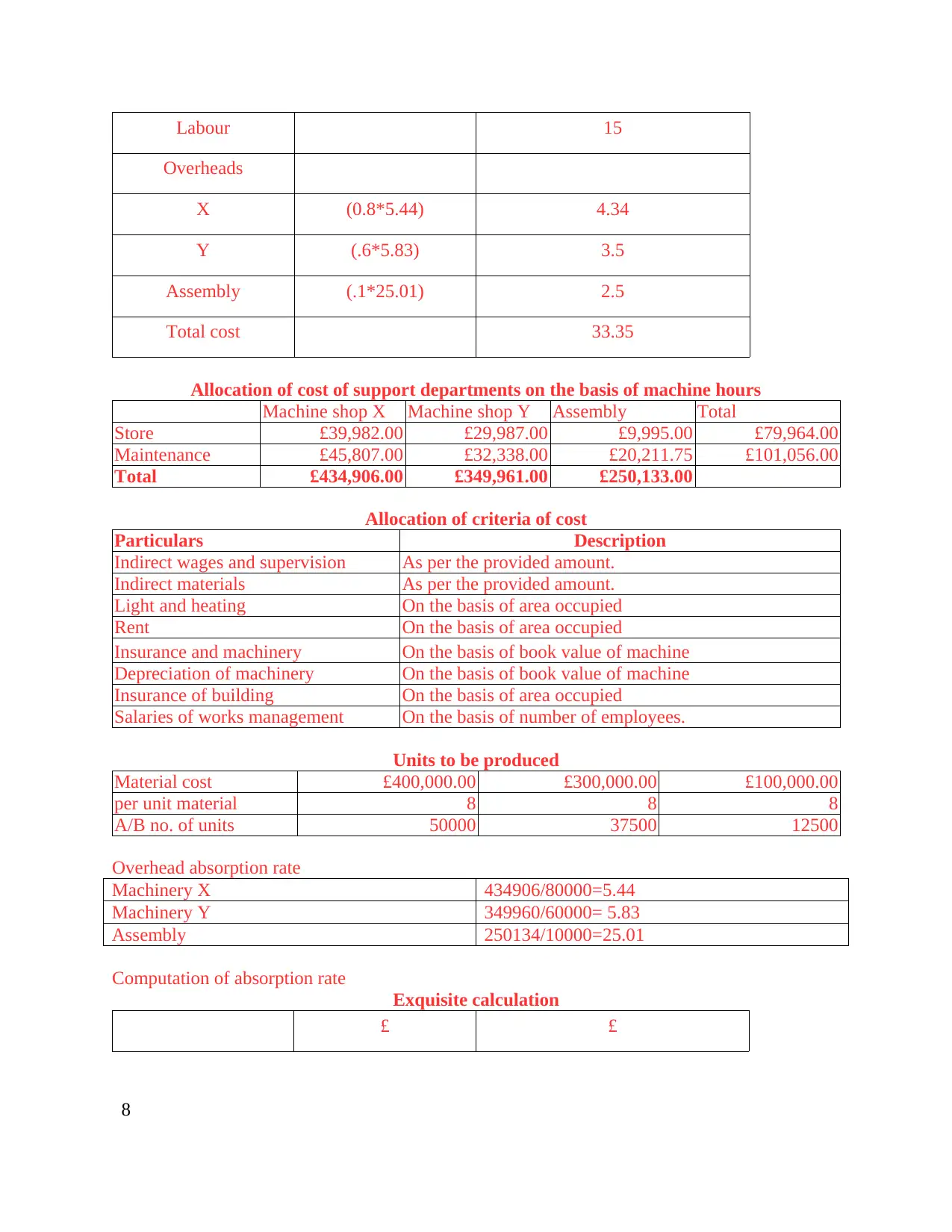

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

Allocation of cost of support departments on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39,982.00 £29,987.00 £9,995.00 £79,964.00

Maintenance £45,807.00 £32,338.00 £20,211.75 £101,056.00

Total £434,906.00 £349,961.00 £250,133.00

Allocation of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Units to be produced

Material cost £400,000.00 £300,000.00 £100,000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Computation of absorption rate

Exquisite calculation

£ £

8

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

Allocation of cost of support departments on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39,982.00 £29,987.00 £9,995.00 £79,964.00

Maintenance £45,807.00 £32,338.00 £20,211.75 £101,056.00

Total £434,906.00 £349,961.00 £250,133.00

Allocation of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Units to be produced

Material cost £400,000.00 £300,000.00 £100,000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Computation of absorption rate

Exquisite calculation

£ £

8

Materials 8

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

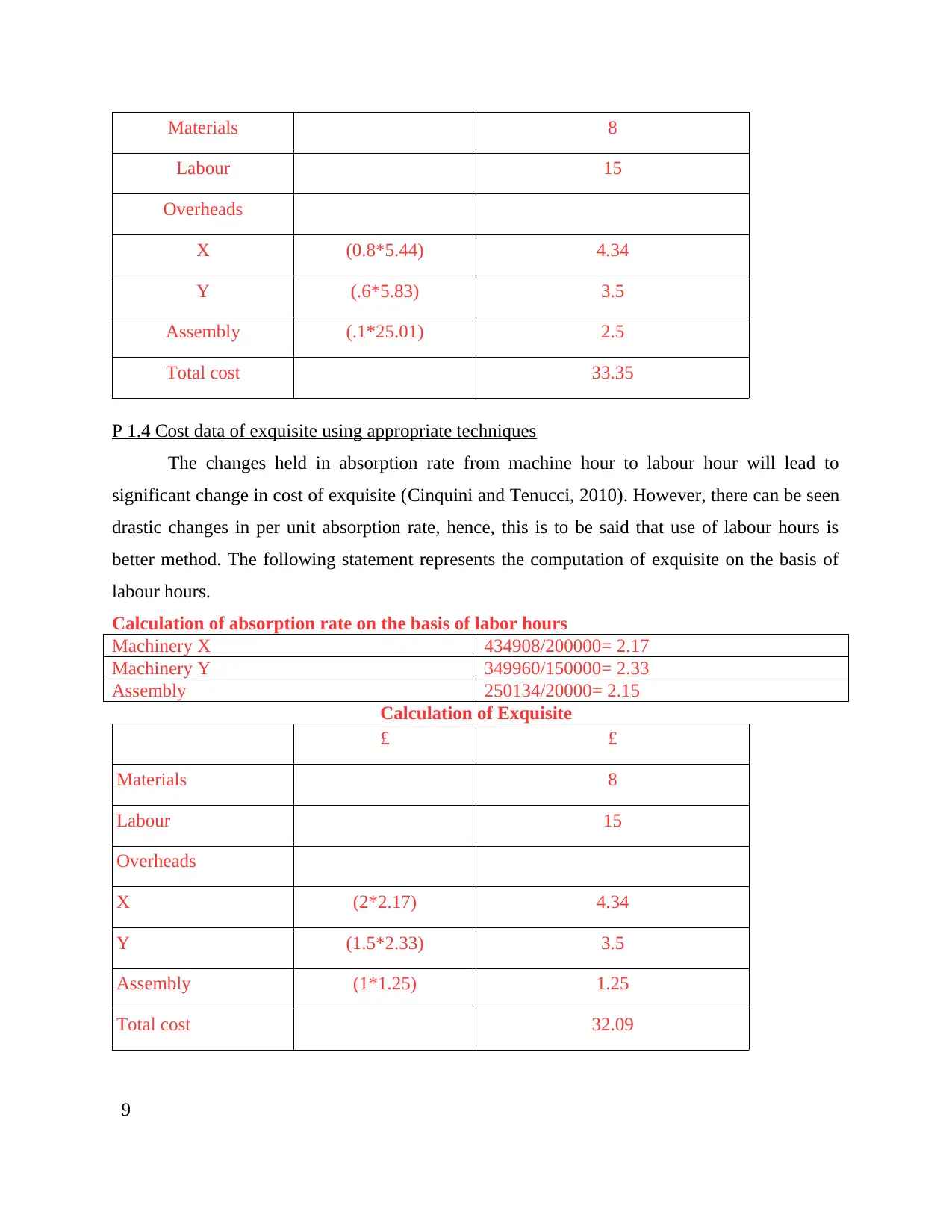

P 1.4 Cost data of exquisite using appropriate techniques

The changes held in absorption rate from machine hour to labour hour will lead to

significant change in cost of exquisite (Cinquini and Tenucci, 2010). However, there can be seen

drastic changes in per unit absorption rate, hence, this is to be said that use of labour hours is

better method. The following statement represents the computation of exquisite on the basis of

labour hours.

Calculation of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Calculation of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

9

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

P 1.4 Cost data of exquisite using appropriate techniques

The changes held in absorption rate from machine hour to labour hour will lead to

significant change in cost of exquisite (Cinquini and Tenucci, 2010). However, there can be seen

drastic changes in per unit absorption rate, hence, this is to be said that use of labour hours is

better method. The following statement represents the computation of exquisite on the basis of

labour hours.

Calculation of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Calculation of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

9

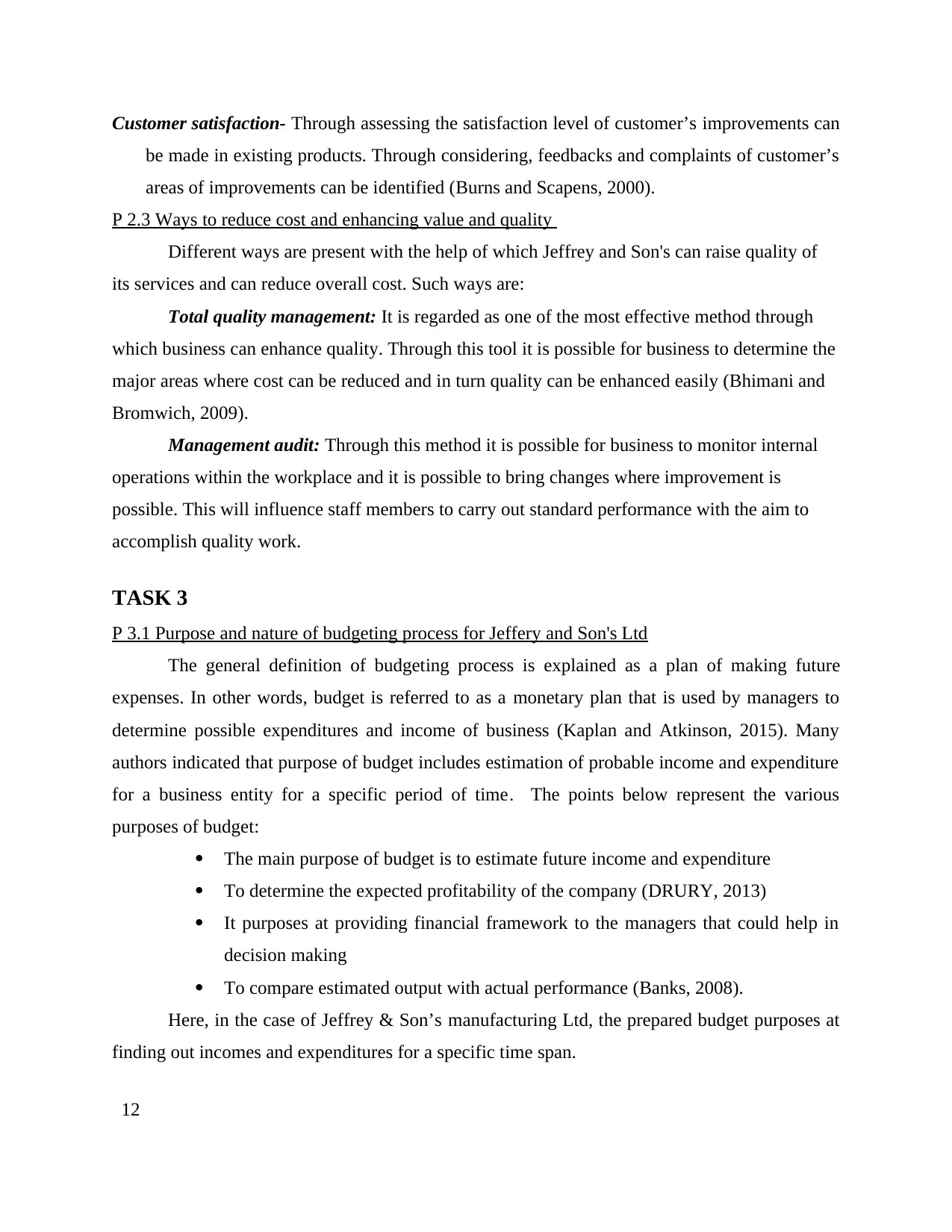

TASK 2

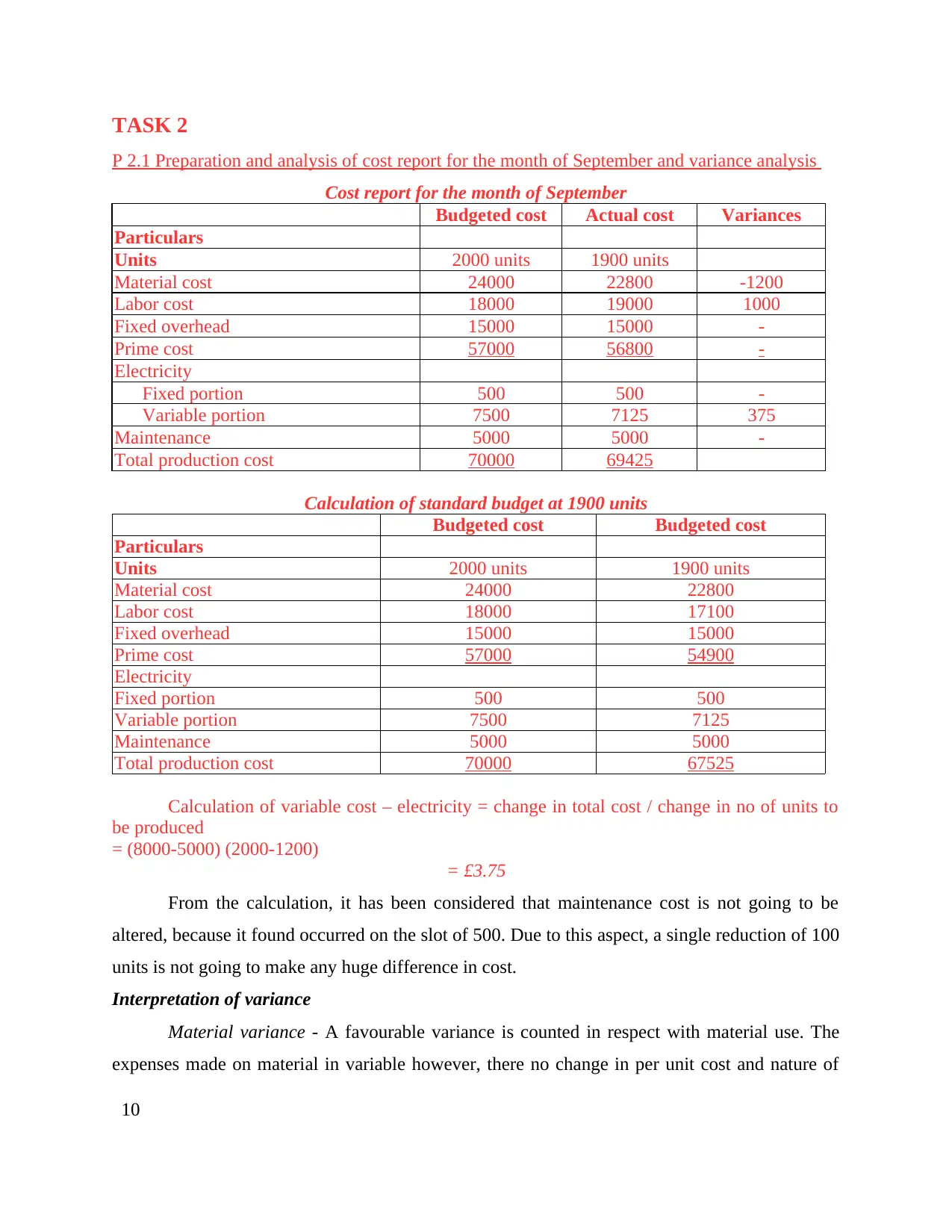

P 2.1 Preparation and analysis of cost report for the month of September and variance analysis

Cost report for the month of September

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Prime cost 57000 56800 -

Electricity

Fixed portion 500 500 -

Variable portion 7500 7125 375

Maintenance 5000 5000 -

Total production cost 70000 69425

Calculation of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

Calculation of variable cost – electricity = change in total cost / change in no of units to

be produced

= (8000-5000) (2000-1200)

= £3.75

From the calculation, it has been considered that maintenance cost is not going to be

altered, because it found occurred on the slot of 500. Due to this aspect, a single reduction of 100

units is not going to make any huge difference in cost.

Interpretation of variance

Material variance - A favourable variance is counted in respect with material use. The

expenses made on material in variable however, there no change in per unit cost and nature of

10

P 2.1 Preparation and analysis of cost report for the month of September and variance analysis

Cost report for the month of September

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Prime cost 57000 56800 -

Electricity

Fixed portion 500 500 -

Variable portion 7500 7125 375

Maintenance 5000 5000 -

Total production cost 70000 69425

Calculation of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

Calculation of variable cost – electricity = change in total cost / change in no of units to

be produced

= (8000-5000) (2000-1200)

= £3.75

From the calculation, it has been considered that maintenance cost is not going to be

altered, because it found occurred on the slot of 500. Due to this aspect, a single reduction of 100

units is not going to make any huge difference in cost.

Interpretation of variance

Material variance - A favourable variance is counted in respect with material use. The

expenses made on material in variable however, there no change in per unit cost and nature of

10

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

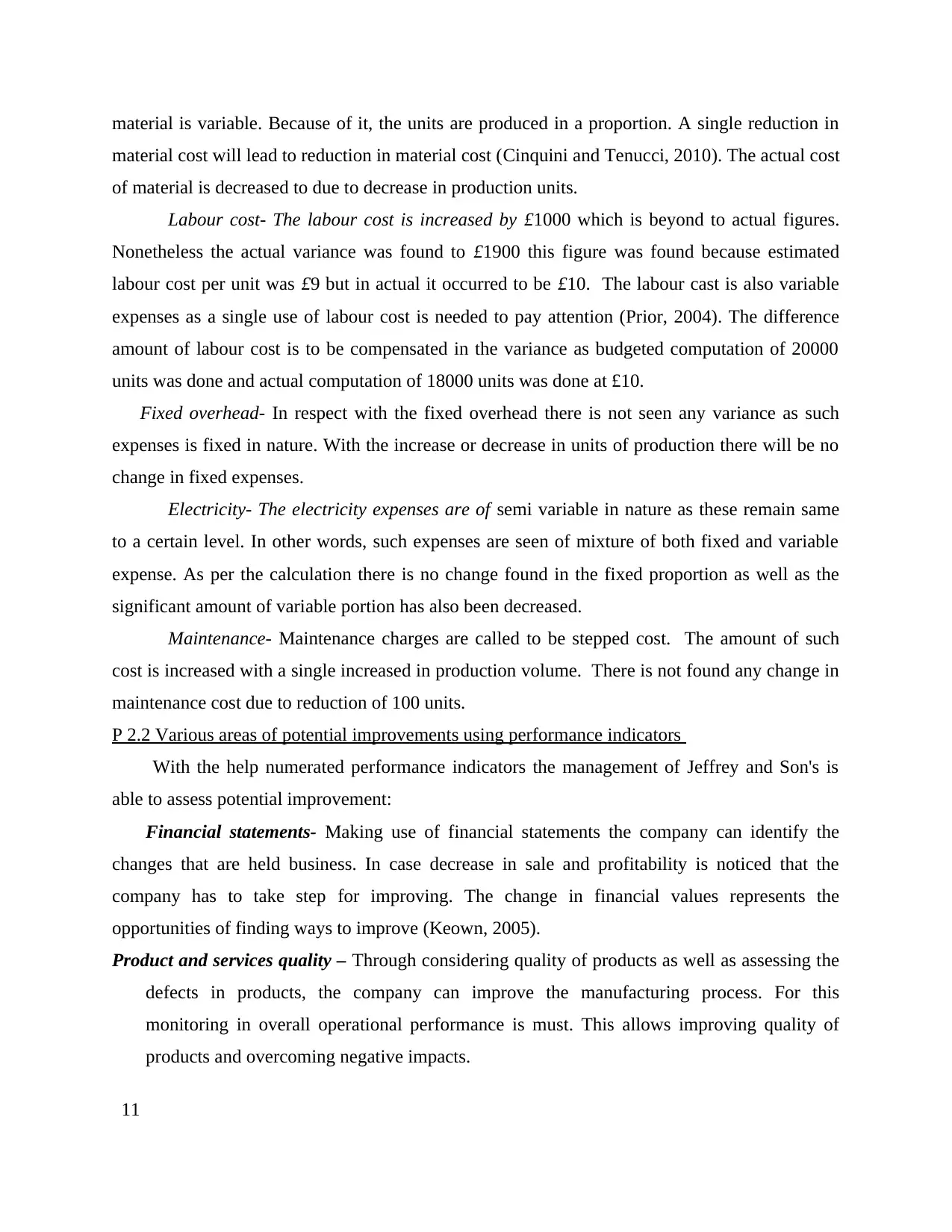

material is variable. Because of it, the units are produced in a proportion. A single reduction in

material cost will lead to reduction in material cost (Cinquini and Tenucci, 2010). The actual cost

of material is decreased to due to decrease in production units.

Labour cost- The labour cost is increased by £1000 which is beyond to actual figures.

Nonetheless the actual variance was found to £1900 this figure was found because estimated

labour cost per unit was £9 but in actual it occurred to be £10. The labour cast is also variable

expenses as a single use of labour cost is needed to pay attention (Prior, 2004). The difference

amount of labour cost is to be compensated in the variance as budgeted computation of 20000

units was done and actual computation of 18000 units was done at £10.

Fixed overhead- In respect with the fixed overhead there is not seen any variance as such

expenses is fixed in nature. With the increase or decrease in units of production there will be no

change in fixed expenses.

Electricity- The electricity expenses are of semi variable in nature as these remain same

to a certain level. In other words, such expenses are seen of mixture of both fixed and variable

expense. As per the calculation there is no change found in the fixed proportion as well as the

significant amount of variable portion has also been decreased.

Maintenance- Maintenance charges are called to be stepped cost. The amount of such

cost is increased with a single increased in production volume. There is not found any change in

maintenance cost due to reduction of 100 units.

P 2.2 Various areas of potential improvements using performance indicators

With the help numerated performance indicators the management of Jeffrey and Son's is

able to assess potential improvement:

Financial statements- Making use of financial statements the company can identify the

changes that are held business. In case decrease in sale and profitability is noticed that the

company has to take step for improving. The change in financial values represents the

opportunities of finding ways to improve (Keown, 2005).

Product and services quality – Through considering quality of products as well as assessing the

defects in products, the company can improve the manufacturing process. For this

monitoring in overall operational performance is must. This allows improving quality of

products and overcoming negative impacts.

11

material cost will lead to reduction in material cost (Cinquini and Tenucci, 2010). The actual cost

of material is decreased to due to decrease in production units.

Labour cost- The labour cost is increased by £1000 which is beyond to actual figures.

Nonetheless the actual variance was found to £1900 this figure was found because estimated

labour cost per unit was £9 but in actual it occurred to be £10. The labour cast is also variable

expenses as a single use of labour cost is needed to pay attention (Prior, 2004). The difference

amount of labour cost is to be compensated in the variance as budgeted computation of 20000

units was done and actual computation of 18000 units was done at £10.

Fixed overhead- In respect with the fixed overhead there is not seen any variance as such

expenses is fixed in nature. With the increase or decrease in units of production there will be no

change in fixed expenses.

Electricity- The electricity expenses are of semi variable in nature as these remain same

to a certain level. In other words, such expenses are seen of mixture of both fixed and variable

expense. As per the calculation there is no change found in the fixed proportion as well as the

significant amount of variable portion has also been decreased.

Maintenance- Maintenance charges are called to be stepped cost. The amount of such

cost is increased with a single increased in production volume. There is not found any change in

maintenance cost due to reduction of 100 units.

P 2.2 Various areas of potential improvements using performance indicators

With the help numerated performance indicators the management of Jeffrey and Son's is

able to assess potential improvement:

Financial statements- Making use of financial statements the company can identify the

changes that are held business. In case decrease in sale and profitability is noticed that the

company has to take step for improving. The change in financial values represents the

opportunities of finding ways to improve (Keown, 2005).

Product and services quality – Through considering quality of products as well as assessing the

defects in products, the company can improve the manufacturing process. For this

monitoring in overall operational performance is must. This allows improving quality of

products and overcoming negative impacts.

11

Customer satisfaction- Through assessing the satisfaction level of customer’s improvements can

be made in existing products. Through considering, feedbacks and complaints of customer’s

areas of improvements can be identified (Burns and Scapens, 2000).

P 2.3 Ways to reduce cost and enhancing value and quality

Different ways are present with the help of which Jeffrey and Son's can raise quality of

its services and can reduce overall cost. Such ways are:

Total quality management: It is regarded as one of the most effective method through

which business can enhance quality. Through this tool it is possible for business to determine the

major areas where cost can be reduced and in turn quality can be enhanced easily (Bhimani and

Bromwich, 2009).

Management audit: Through this method it is possible for business to monitor internal

operations within the workplace and it is possible to bring changes where improvement is

possible. This will influence staff members to carry out standard performance with the aim to

accomplish quality work.

TASK 3

P 3.1 Purpose and nature of budgeting process for Jeffery and Son's Ltd

The general definition of budgeting process is explained as a plan of making future

expenses. In other words, budget is referred to as a monetary plan that is used by managers to

determine possible expenditures and income of business (Kaplan and Atkinson, 2015). Many

authors indicated that purpose of budget includes estimation of probable income and expenditure

for a business entity for a specific period of time. The points below represent the various

purposes of budget:

The main purpose of budget is to estimate future income and expenditure

To determine the expected profitability of the company (DRURY, 2013)

It purposes at providing financial framework to the managers that could help in

decision making

To compare estimated output with actual performance (Banks, 2008).

Here, in the case of Jeffrey & Son’s manufacturing Ltd, the prepared budget purposes at

finding out incomes and expenditures for a specific time span.

12

be made in existing products. Through considering, feedbacks and complaints of customer’s

areas of improvements can be identified (Burns and Scapens, 2000).

P 2.3 Ways to reduce cost and enhancing value and quality

Different ways are present with the help of which Jeffrey and Son's can raise quality of

its services and can reduce overall cost. Such ways are:

Total quality management: It is regarded as one of the most effective method through

which business can enhance quality. Through this tool it is possible for business to determine the

major areas where cost can be reduced and in turn quality can be enhanced easily (Bhimani and

Bromwich, 2009).

Management audit: Through this method it is possible for business to monitor internal

operations within the workplace and it is possible to bring changes where improvement is

possible. This will influence staff members to carry out standard performance with the aim to

accomplish quality work.

TASK 3

P 3.1 Purpose and nature of budgeting process for Jeffery and Son's Ltd

The general definition of budgeting process is explained as a plan of making future

expenses. In other words, budget is referred to as a monetary plan that is used by managers to

determine possible expenditures and income of business (Kaplan and Atkinson, 2015). Many

authors indicated that purpose of budget includes estimation of probable income and expenditure

for a business entity for a specific period of time. The points below represent the various

purposes of budget:

The main purpose of budget is to estimate future income and expenditure

To determine the expected profitability of the company (DRURY, 2013)

It purposes at providing financial framework to the managers that could help in

decision making

To compare estimated output with actual performance (Banks, 2008).

Here, in the case of Jeffrey & Son’s manufacturing Ltd, the prepared budget purposes at

finding out incomes and expenditures for a specific time span.

12

Nature of budgeting process

Budgeting process is defined as financial tool which is used for setting anticipations for

incomes and expenses for upcoming time. While adopting budgeting process, the organization

can estimate availability of cash to operate business functions as well as to control over the

expenses (Cooper and Kaplan, 2008). Making use of budgetary process, the maintained entity

can get rid of the negative variance. In the below points, the nature of budgeting process is

explained:

With the help of budgeting process, one can assess financial situation of company

The future amount of cash generated from the sales activities can be discovered along

with the cash generated from other activities (Tsay, 2008).

The process defines necessary expenditure such as purchase of raw materials, labor,

production overheads and promotions

With the help of budgeting process surplus or deficit can be determined by deducting

estimated expenses from forecasting revenues (Nørreklit, 2010.)

Reviewing and revising the budget prepared for future actions.

Comparing actual outcome with the budgeted figures

At last, conducting a variance analysis

In relation to the given business scenario, budget is prepared by the managers of Jeffrey

& Son's through forecasting expected incomes and expenses for near future. With the help of

budgets, managers of different departments pay attention towards sales volume and prepare the

plan for enhancing sales as well as reducing cost of business to earn good profits. Nonetheless,

major task is of making an effective coordination between activities in budgeting process

(Zikmund, 2012). The in depth investigation made into budgets prepared for Jeffrey & Son's

noticed that the company has chosen incremental budgeting technique to prepare budgets. While

making use of incremental budgeting system, the mentioned entity is anticipating future incomes

and expenditures. However, it also compares actual results with budgeted figures for determining

variance and takes corrective action to overcome negative variance, if any.

P 3.2 Use of appropriate budgeting technique

The evidence of information provided in respect with Jeffrey & Son's manufacturing

company and application of management accounting concept has shown that the mentioned

13

Budgeting process is defined as financial tool which is used for setting anticipations for

incomes and expenses for upcoming time. While adopting budgeting process, the organization

can estimate availability of cash to operate business functions as well as to control over the

expenses (Cooper and Kaplan, 2008). Making use of budgetary process, the maintained entity

can get rid of the negative variance. In the below points, the nature of budgeting process is

explained:

With the help of budgeting process, one can assess financial situation of company

The future amount of cash generated from the sales activities can be discovered along

with the cash generated from other activities (Tsay, 2008).

The process defines necessary expenditure such as purchase of raw materials, labor,

production overheads and promotions

With the help of budgeting process surplus or deficit can be determined by deducting

estimated expenses from forecasting revenues (Nørreklit, 2010.)

Reviewing and revising the budget prepared for future actions.

Comparing actual outcome with the budgeted figures

At last, conducting a variance analysis

In relation to the given business scenario, budget is prepared by the managers of Jeffrey

& Son's through forecasting expected incomes and expenses for near future. With the help of

budgets, managers of different departments pay attention towards sales volume and prepare the

plan for enhancing sales as well as reducing cost of business to earn good profits. Nonetheless,

major task is of making an effective coordination between activities in budgeting process

(Zikmund, 2012). The in depth investigation made into budgets prepared for Jeffrey & Son's

noticed that the company has chosen incremental budgeting technique to prepare budgets. While

making use of incremental budgeting system, the mentioned entity is anticipating future incomes

and expenditures. However, it also compares actual results with budgeted figures for determining

variance and takes corrective action to overcome negative variance, if any.

P 3.2 Use of appropriate budgeting technique

The evidence of information provided in respect with Jeffrey & Son's manufacturing

company and application of management accounting concept has shown that the mentioned

13

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company is going to prepare budgets using incremental budgeting system. Nonetheless, there

have been countered some problems for using incremental budgeting system. As per a major

problem, the management of company is witnessed with neglecting volatility in the market and

its impacts on budgets at the time of budgetary process (Vance, 2002). The budgeted figure

prepared on the basis of incremental budgeting tactic does not include market volatility. As a

result of using such system of budgeting, company can see huge impacts on budgeted and actual

figures (Standard Costs and Variance Analysis. 2007). There can be seen huge difference

between budgeted and actual figures of mentioned company. The market volatility is neglected

hence, the company fails to meet the budget figures and there can be seen negative variance. For

getting the best results, the company is in specific needs of having change in the existing

budgeting method. The organization and its current scenario indicate to make use of “Zero base

budgeting”. Looking towards the budgeting needs of company, “Zero base budgeting” is

recommended to be used for preparing budgets

The use of new budgeting methods will allow management of Jeffrey & Son's

manufacturing company to overcome the limitations of incremental budgeting. After using such

method, the company can consider the volatility of market into budgeting process. This method

will also helpful in having a positive variance between budgeted and actual figures. This is to be

bring into consideration that “Zero base budgeting” allows management positively estimate

operational cost and anticipate revenues while considering the market behaviour (Bhimani, and

Bromwich, 2009). With the help of Zero base budgeting process, the company can come closer

to budgeted figures and can have a positive variance in budgets. In addition to that market

changes can be analysed and prepared on the basis of market volatility and its impact.

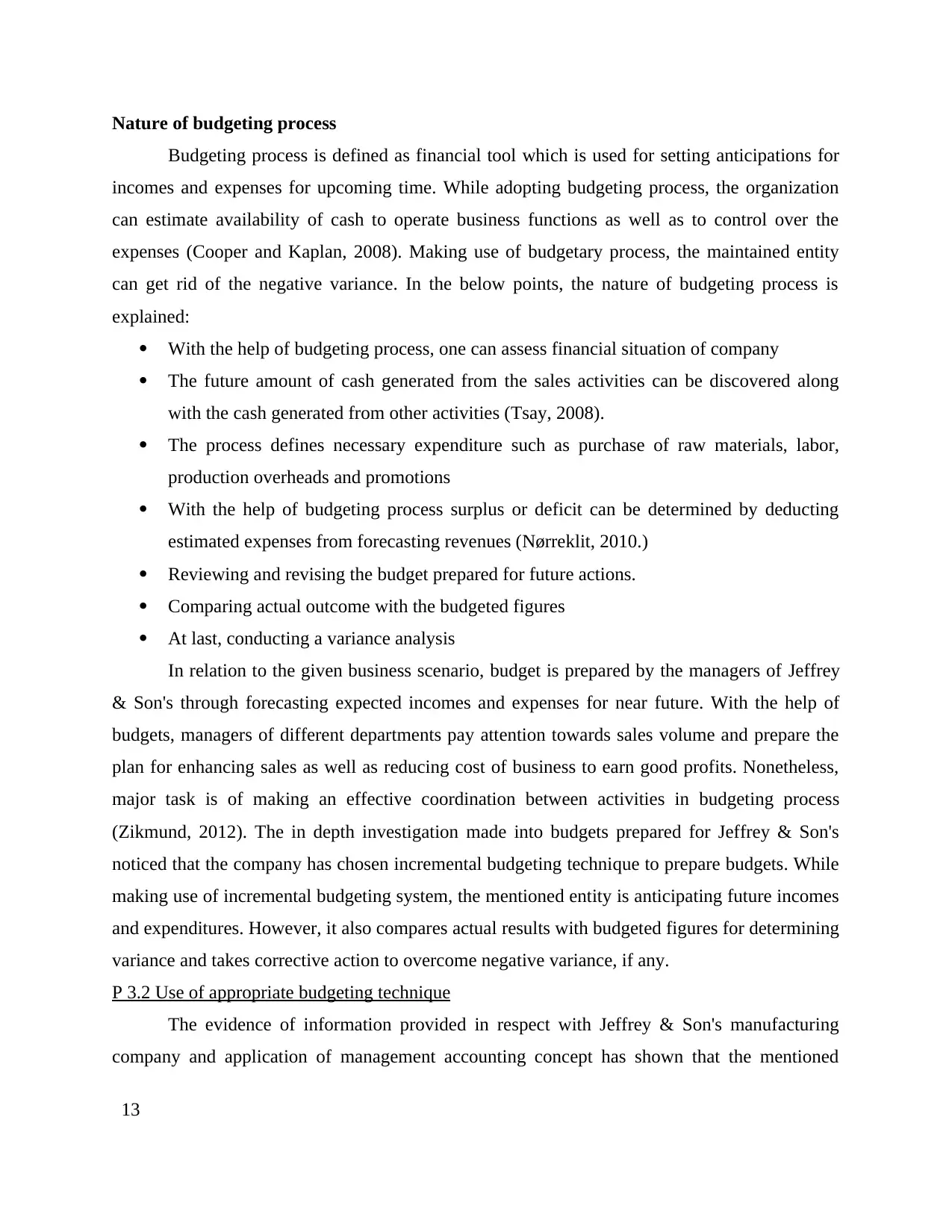

P 3.3 Preparation of production and material budgets

Production budget

Particulars July August September October

Sales 105000 90000 105000 110000

Less: opening stock 11000 13500 15750 16500

Add: Opening stock 13500 15750 16500 15000

Units to be produced 107500 92250 105750 108500

14

have been countered some problems for using incremental budgeting system. As per a major

problem, the management of company is witnessed with neglecting volatility in the market and

its impacts on budgets at the time of budgetary process (Vance, 2002). The budgeted figure

prepared on the basis of incremental budgeting tactic does not include market volatility. As a

result of using such system of budgeting, company can see huge impacts on budgeted and actual

figures (Standard Costs and Variance Analysis. 2007). There can be seen huge difference

between budgeted and actual figures of mentioned company. The market volatility is neglected

hence, the company fails to meet the budget figures and there can be seen negative variance. For

getting the best results, the company is in specific needs of having change in the existing

budgeting method. The organization and its current scenario indicate to make use of “Zero base

budgeting”. Looking towards the budgeting needs of company, “Zero base budgeting” is

recommended to be used for preparing budgets

The use of new budgeting methods will allow management of Jeffrey & Son's

manufacturing company to overcome the limitations of incremental budgeting. After using such

method, the company can consider the volatility of market into budgeting process. This method

will also helpful in having a positive variance between budgeted and actual figures. This is to be

bring into consideration that “Zero base budgeting” allows management positively estimate

operational cost and anticipate revenues while considering the market behaviour (Bhimani, and

Bromwich, 2009). With the help of Zero base budgeting process, the company can come closer

to budgeted figures and can have a positive variance in budgets. In addition to that market

changes can be analysed and prepared on the basis of market volatility and its impact.

P 3.3 Preparation of production and material budgets

Production budget

Particulars July August September October

Sales 105000 90000 105000 110000

Less: opening stock 11000 13500 15750 16500

Add: Opening stock 13500 15750 16500 15000

Units to be produced 107500 92250 105750 108500

14

Closing Stock:

July = 15% * August sales = 15%*90000 = 13500

August = 15% * Sept. sales = 15%*105000 = 15750

September = 15% * Oct. sales = 15%*110000 = 16500

October = 15%*Nov. sales = 15%*100000 = 15000

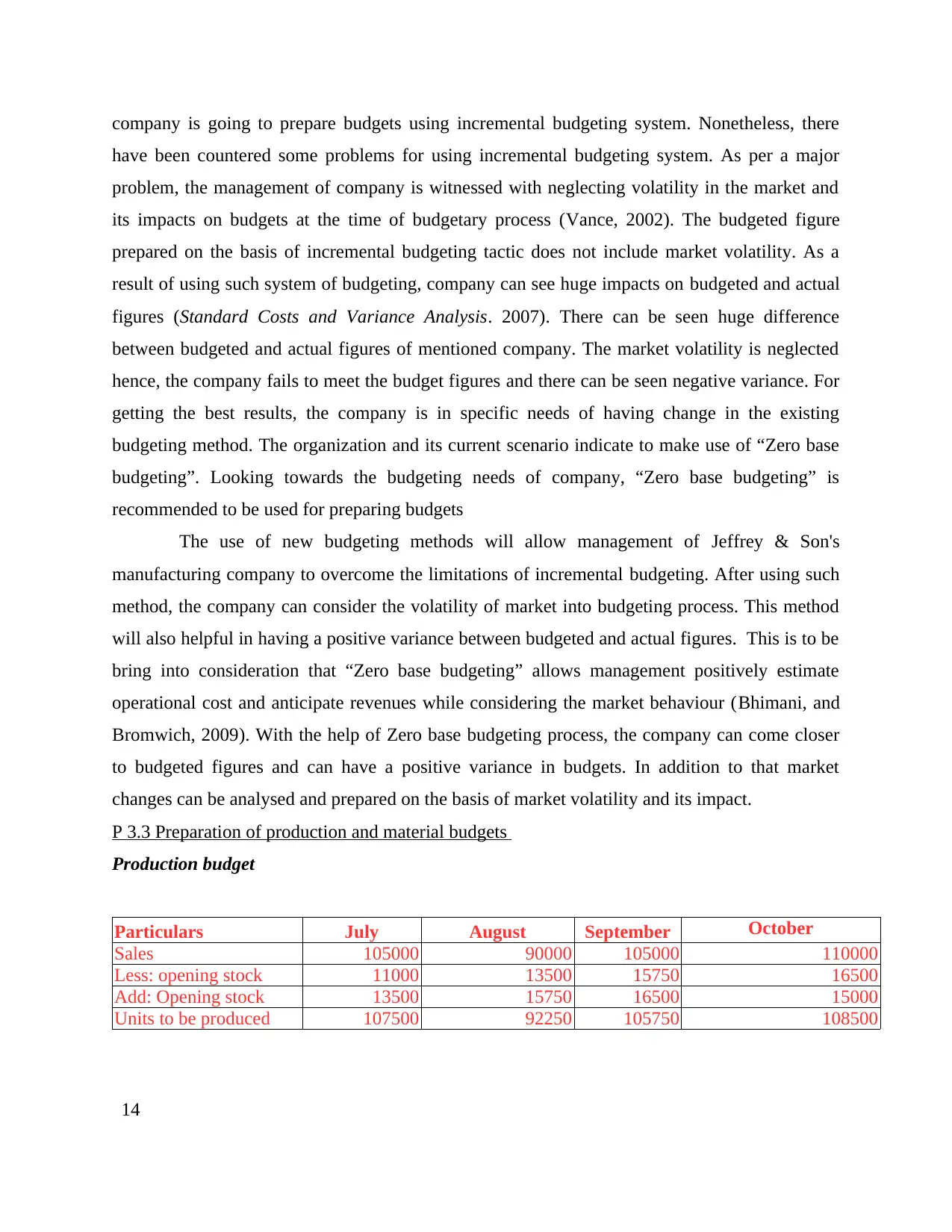

Material purchase budget

July August September October

Material usage 215000 184500 211500 217000

Less: Opening stock 52000 46125 52875

Add: Closing stock 46125 52875 54250

Purchases 209125 191250 212875

July opening stock = 52000 kg and closing = 25%* 184500 = 46125

Material purchase budget of Jeffrey and Son's smake

Particulars July August September

Units to be produced 107500 92250 104250

Material cost £3.50 £3.50 £3.50

Material to be purchased £376,250.00 £322,875.00 £364,875.00

Add: cost of material in ending inventory £80,718.75 £91,218.75 £91,218.75

Total cost of material needed £456,968.75 £414,093.75 £456,093.75

Less: Cost of material in beginning

inventory -£166,400.00 -£80,718.75 -£166,400.00

Cost of material to be purchased £290,568.75 £333,375.00 £289,693.75

Material usage budget

July material usage= 107500 units * 2 kg = 215000 kg

August material usage= 92250 units * 2 kg = 184500 kg

September material usage= 105570 units * 2 kg= 211,500 kg

October material usage= 108500 units * 2 kg = 217,000 kg

15

July = 15% * August sales = 15%*90000 = 13500

August = 15% * Sept. sales = 15%*105000 = 15750

September = 15% * Oct. sales = 15%*110000 = 16500

October = 15%*Nov. sales = 15%*100000 = 15000

Material purchase budget

July August September October

Material usage 215000 184500 211500 217000

Less: Opening stock 52000 46125 52875

Add: Closing stock 46125 52875 54250

Purchases 209125 191250 212875

July opening stock = 52000 kg and closing = 25%* 184500 = 46125

Material purchase budget of Jeffrey and Son's smake

Particulars July August September

Units to be produced 107500 92250 104250

Material cost £3.50 £3.50 £3.50

Material to be purchased £376,250.00 £322,875.00 £364,875.00

Add: cost of material in ending inventory £80,718.75 £91,218.75 £91,218.75

Total cost of material needed £456,968.75 £414,093.75 £456,093.75

Less: Cost of material in beginning

inventory -£166,400.00 -£80,718.75 -£166,400.00

Cost of material to be purchased £290,568.75 £333,375.00 £289,693.75

Material usage budget

July material usage= 107500 units * 2 kg = 215000 kg

August material usage= 92250 units * 2 kg = 184500 kg

September material usage= 105570 units * 2 kg= 211,500 kg

October material usage= 108500 units * 2 kg = 217,000 kg

15

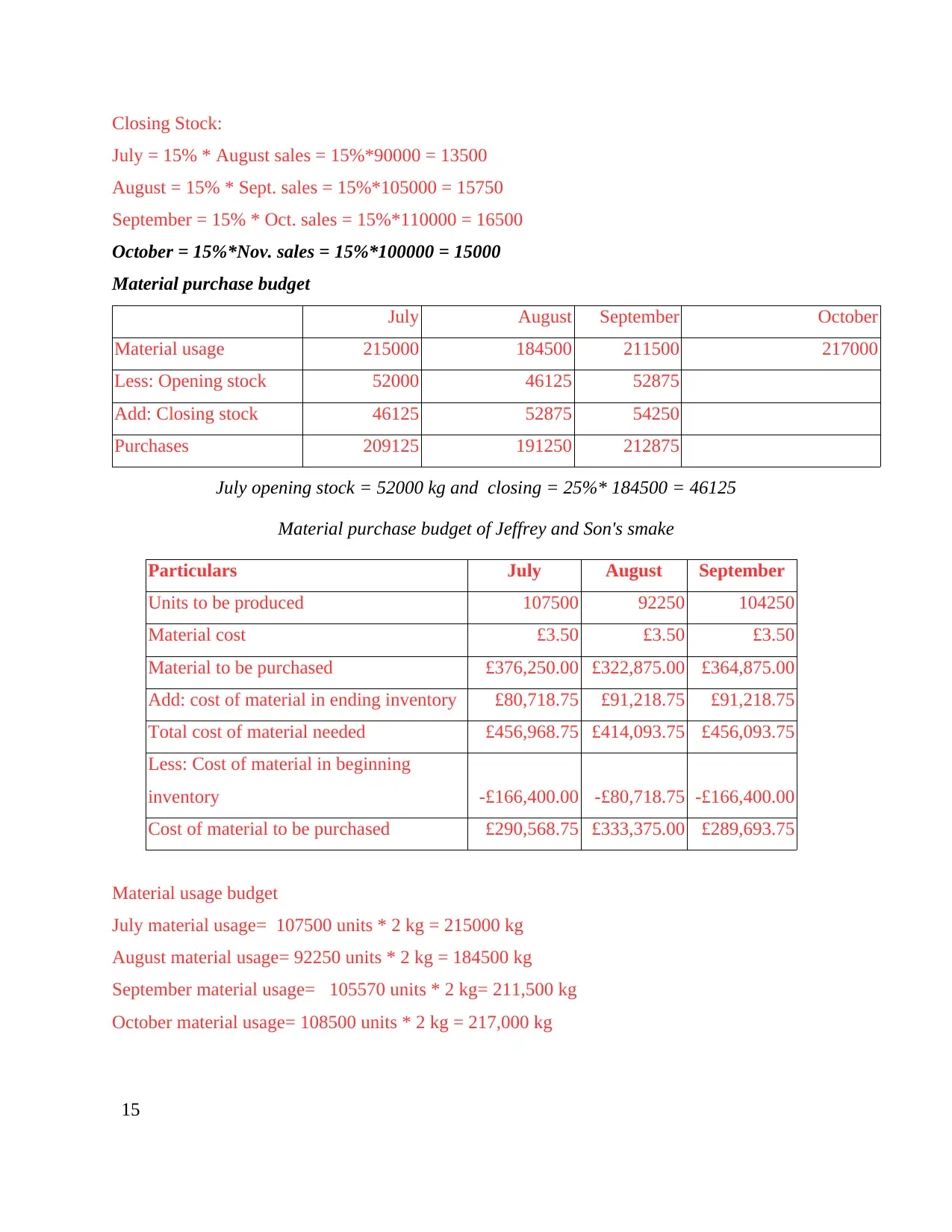

P 3.4 Preparation of cash Budget

Cash budget of Jeffrey and Son's smake

Particulars July August September

Opening balance of cash £16,000.00 £204,431.25 £192,306.25

Received from debtors £333,000.00 £335,250.00 £330,750.00

Cash sales £567,000.00 £486,000.00 £567,000.00

Total receivable £916,000.00 £1,025,681.25 £1,090,056.25

Expenses

Payment to creditors £290,568.75 £333,375.00 £289,693.75

Direct wages £300,000.00 £300,000.00 £300,000.00

Variable overhead £46,000.00 £100,000.00 £100,000.00

Fixed overhead £75,000.00 £100,000.00 £100,000.00

Total payable £711,568.75 £833,375.00 £789,693.75

Closing balance of cash £204,431.25 £192,306.25 £300,362.50

Working notes

Computation of amount receivable from debtors

July August September

Amount received for sales before a month 247500 236250 236250

Amount received for sales before two months 85500 99000 94500

Sum 333000 335250 330750

Computation of amount of overhead payment

Overhead payment July August September

Variable overhead 46000 100000 100000

Fixed overhead 75000 100000 100000

Computation of production cost

July August September

Material cost £3.50 £3.50 £3.50

Wages £3.00 £3.00 £3.00

Variable overhead £1.00 £1.00 £1.00

Total variable cost £7.50 £7.50 £7.50

Fixed overhead £100,000.00 £100,000.00 £100,000.00

Units to be produced 107500 92250 104250

Total variable cost £806,250.00 £691,875.00 £781,875.00

Total production cost £906,250.00 £791,875.00 £881,875.00

16

Cash budget of Jeffrey and Son's smake

Particulars July August September

Opening balance of cash £16,000.00 £204,431.25 £192,306.25

Received from debtors £333,000.00 £335,250.00 £330,750.00

Cash sales £567,000.00 £486,000.00 £567,000.00

Total receivable £916,000.00 £1,025,681.25 £1,090,056.25

Expenses

Payment to creditors £290,568.75 £333,375.00 £289,693.75

Direct wages £300,000.00 £300,000.00 £300,000.00

Variable overhead £46,000.00 £100,000.00 £100,000.00

Fixed overhead £75,000.00 £100,000.00 £100,000.00

Total payable £711,568.75 £833,375.00 £789,693.75

Closing balance of cash £204,431.25 £192,306.25 £300,362.50

Working notes

Computation of amount receivable from debtors

July August September

Amount received for sales before a month 247500 236250 236250

Amount received for sales before two months 85500 99000 94500

Sum 333000 335250 330750

Computation of amount of overhead payment

Overhead payment July August September

Variable overhead 46000 100000 100000

Fixed overhead 75000 100000 100000

Computation of production cost

July August September

Material cost £3.50 £3.50 £3.50

Wages £3.00 £3.00 £3.00

Variable overhead £1.00 £1.00 £1.00

Total variable cost £7.50 £7.50 £7.50

Fixed overhead £100,000.00 £100,000.00 £100,000.00

Units to be produced 107500 92250 104250

Total variable cost £806,250.00 £691,875.00 £781,875.00

Total production cost £906,250.00 £791,875.00 £881,875.00

16

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

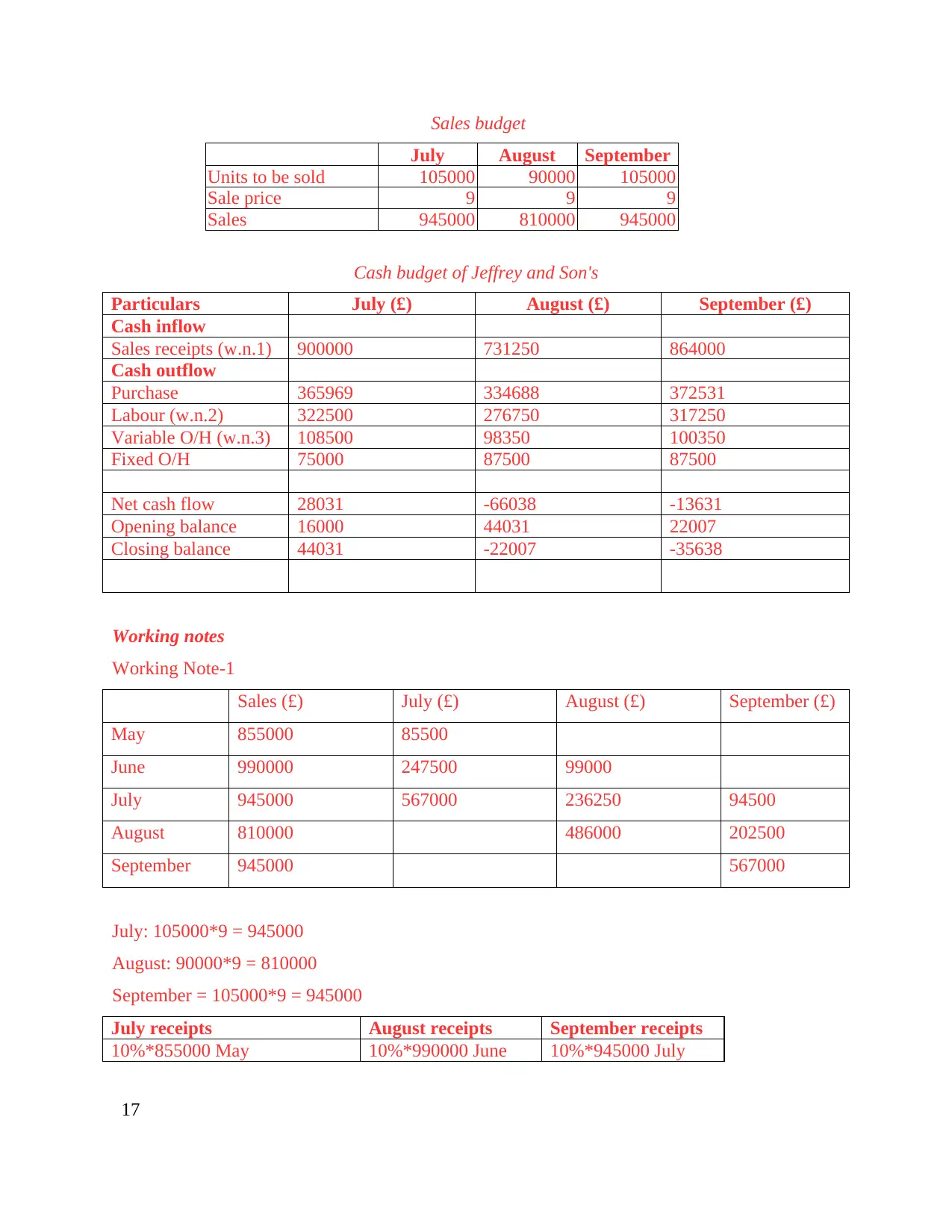

Sales budget

July August September

Units to be sold 105000 90000 105000

Sale price 9 9 9

Sales 945000 810000 945000

Cash budget of Jeffrey and Son's

Particulars July (£) August (£) September (£)

Cash inflow

Sales receipts (w.n.1) 900000 731250 864000

Cash outflow

Purchase 365969 334688 372531

Labour (w.n.2) 322500 276750 317250

Variable O/H (w.n.3) 108500 98350 100350

Fixed O/H 75000 87500 87500

Net cash flow 28031 -66038 -13631

Opening balance 16000 44031 22007

Closing balance 44031 -22007 -35638

Working notes

Working Note-1

Sales (£) July (£) August (£) September (£)

May 855000 85500

June 990000 247500 99000

July 945000 567000 236250 94500

August 810000 486000 202500

September 945000 567000

July: 105000*9 = 945000

August: 90000*9 = 810000

September = 105000*9 = 945000

July receipts August receipts September receipts

10%*855000 May 10%*990000 June 10%*945000 July

17

July August September

Units to be sold 105000 90000 105000

Sale price 9 9 9

Sales 945000 810000 945000

Cash budget of Jeffrey and Son's

Particulars July (£) August (£) September (£)

Cash inflow

Sales receipts (w.n.1) 900000 731250 864000

Cash outflow

Purchase 365969 334688 372531

Labour (w.n.2) 322500 276750 317250

Variable O/H (w.n.3) 108500 98350 100350

Fixed O/H 75000 87500 87500

Net cash flow 28031 -66038 -13631

Opening balance 16000 44031 22007

Closing balance 44031 -22007 -35638

Working notes

Working Note-1

Sales (£) July (£) August (£) September (£)

May 855000 85500

June 990000 247500 99000

July 945000 567000 236250 94500

August 810000 486000 202500

September 945000 567000

July: 105000*9 = 945000

August: 90000*9 = 810000

September = 105000*9 = 945000

July receipts August receipts September receipts

10%*855000 May 10%*990000 June 10%*945000 July

17

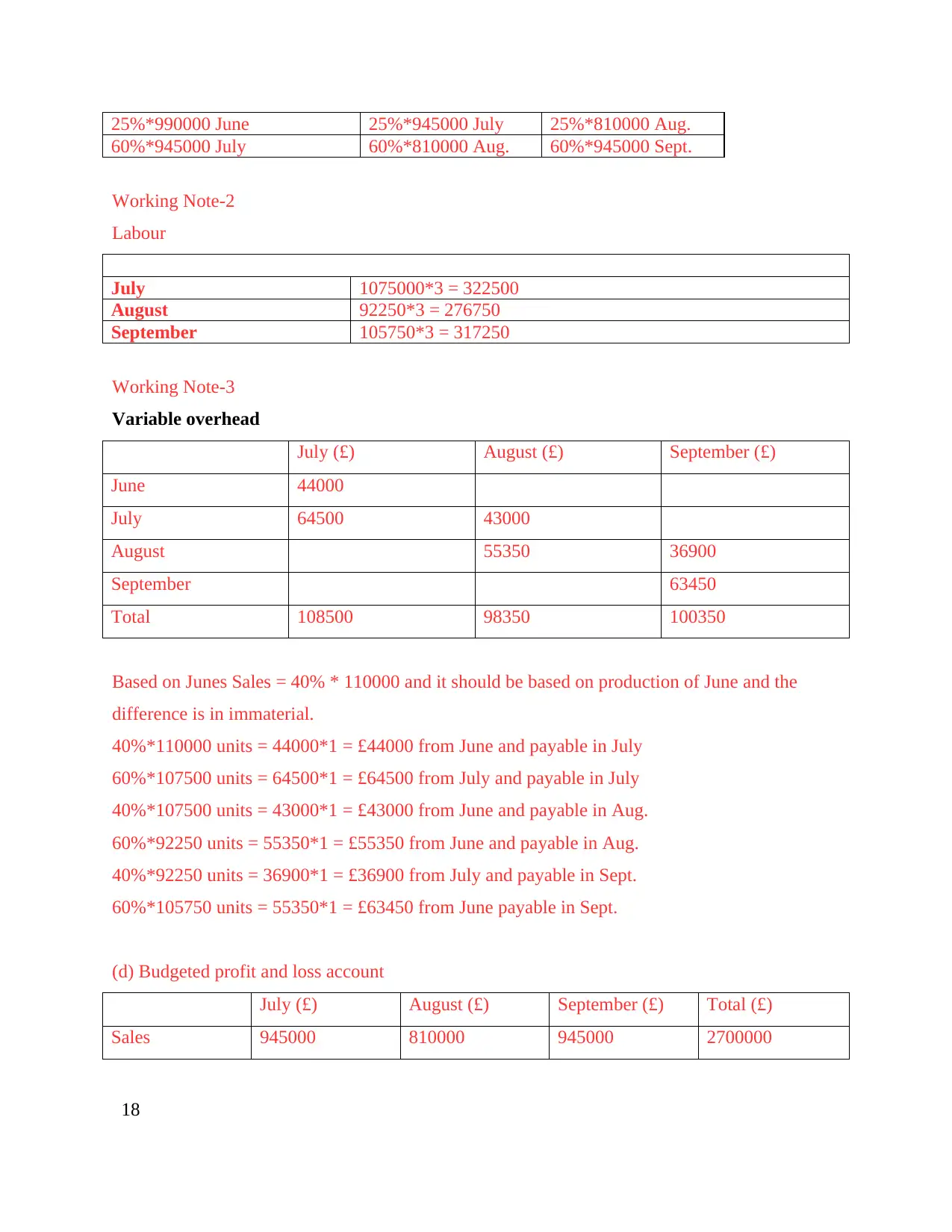

25%*990000 June 25%*945000 July 25%*810000 Aug.

60%*945000 July 60%*810000 Aug. 60%*945000 Sept.

Working Note-2

Labour

July 1075000*3 = 322500

August 92250*3 = 276750

September 105750*3 = 317250

Working Note-3

Variable overhead

July (£) August (£) September (£)

June 44000

July 64500 43000

August 55350 36900

September 63450

Total 108500 98350 100350

Based on Junes Sales = 40% * 110000 and it should be based on production of June and the

difference is in immaterial.

40%*110000 units = 44000*1 = £44000 from June and payable in July

60%*107500 units = 64500*1 = £64500 from July and payable in July

40%*107500 units = 43000*1 = £43000 from June and payable in Aug.

60%*92250 units = 55350*1 = £55350 from June and payable in Aug.

40%*92250 units = 36900*1 = £36900 from July and payable in Sept.

60%*105750 units = 55350*1 = £63450 from June payable in Sept.

(d) Budgeted profit and loss account

July (£) August (£) September (£) Total (£)

Sales 945000 810000 945000 2700000

18

60%*945000 July 60%*810000 Aug. 60%*945000 Sept.

Working Note-2

Labour

July 1075000*3 = 322500

August 92250*3 = 276750

September 105750*3 = 317250

Working Note-3

Variable overhead

July (£) August (£) September (£)

June 44000

July 64500 43000

August 55350 36900

September 63450

Total 108500 98350 100350

Based on Junes Sales = 40% * 110000 and it should be based on production of June and the

difference is in immaterial.

40%*110000 units = 44000*1 = £44000 from June and payable in July

60%*107500 units = 64500*1 = £64500 from July and payable in July

40%*107500 units = 43000*1 = £43000 from June and payable in Aug.

60%*92250 units = 55350*1 = £55350 from June and payable in Aug.

40%*92250 units = 36900*1 = £36900 from July and payable in Sept.

60%*105750 units = 55350*1 = £63450 from June payable in Sept.

(d) Budgeted profit and loss account

July (£) August (£) September (£) Total (£)

Sales 945000 810000 945000 2700000

18

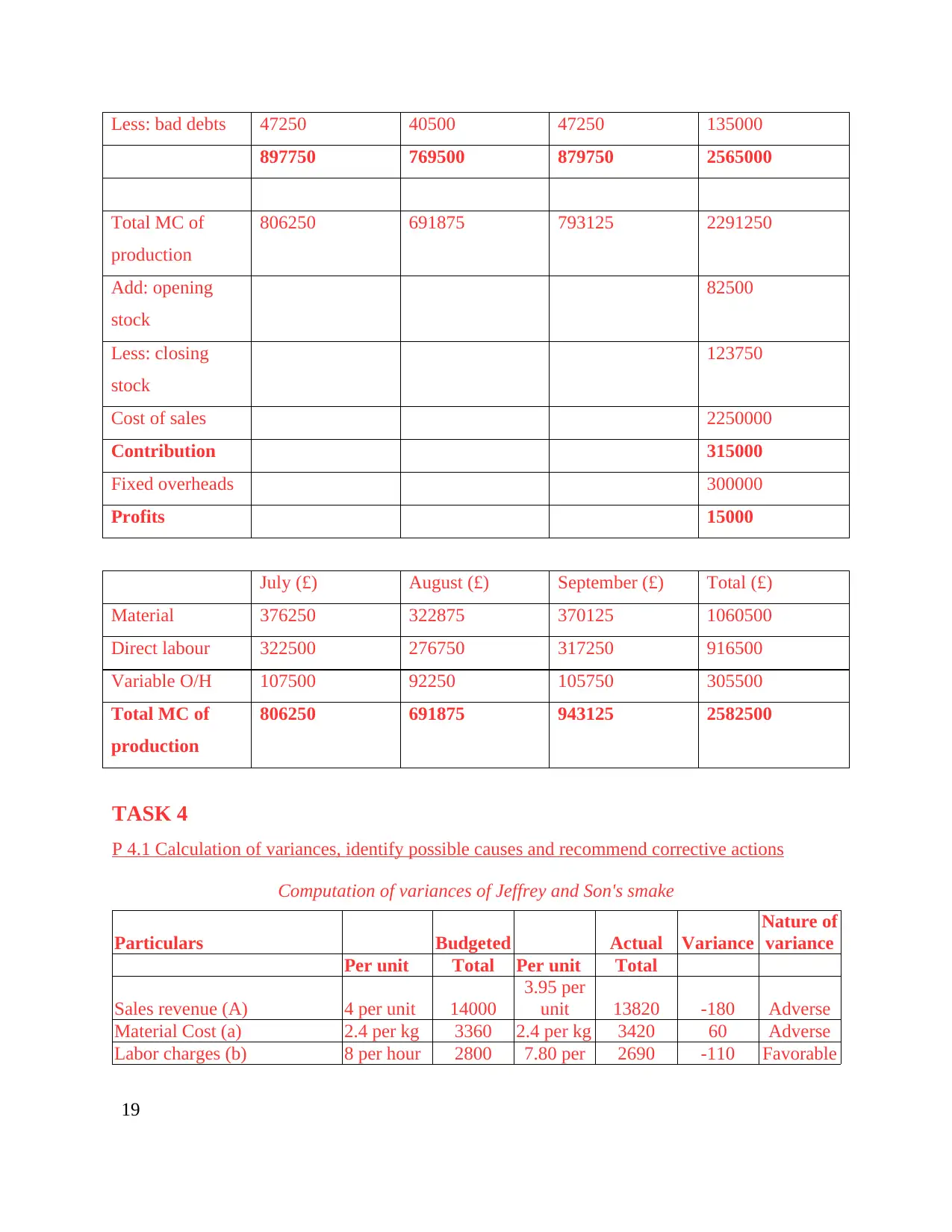

Less: bad debts 47250 40500 47250 135000

897750 769500 879750 2565000

Total MC of

production

806250 691875 793125 2291250

Add: opening

stock

82500

Less: closing

stock

123750

Cost of sales 2250000

Contribution 315000

Fixed overheads 300000

Profits 15000

July (£) August (£) September (£) Total (£)

Material 376250 322875 370125 1060500

Direct labour 322500 276750 317250 916500

Variable O/H 107500 92250 105750 305500

Total MC of

production

806250 691875 943125 2582500

TASK 4

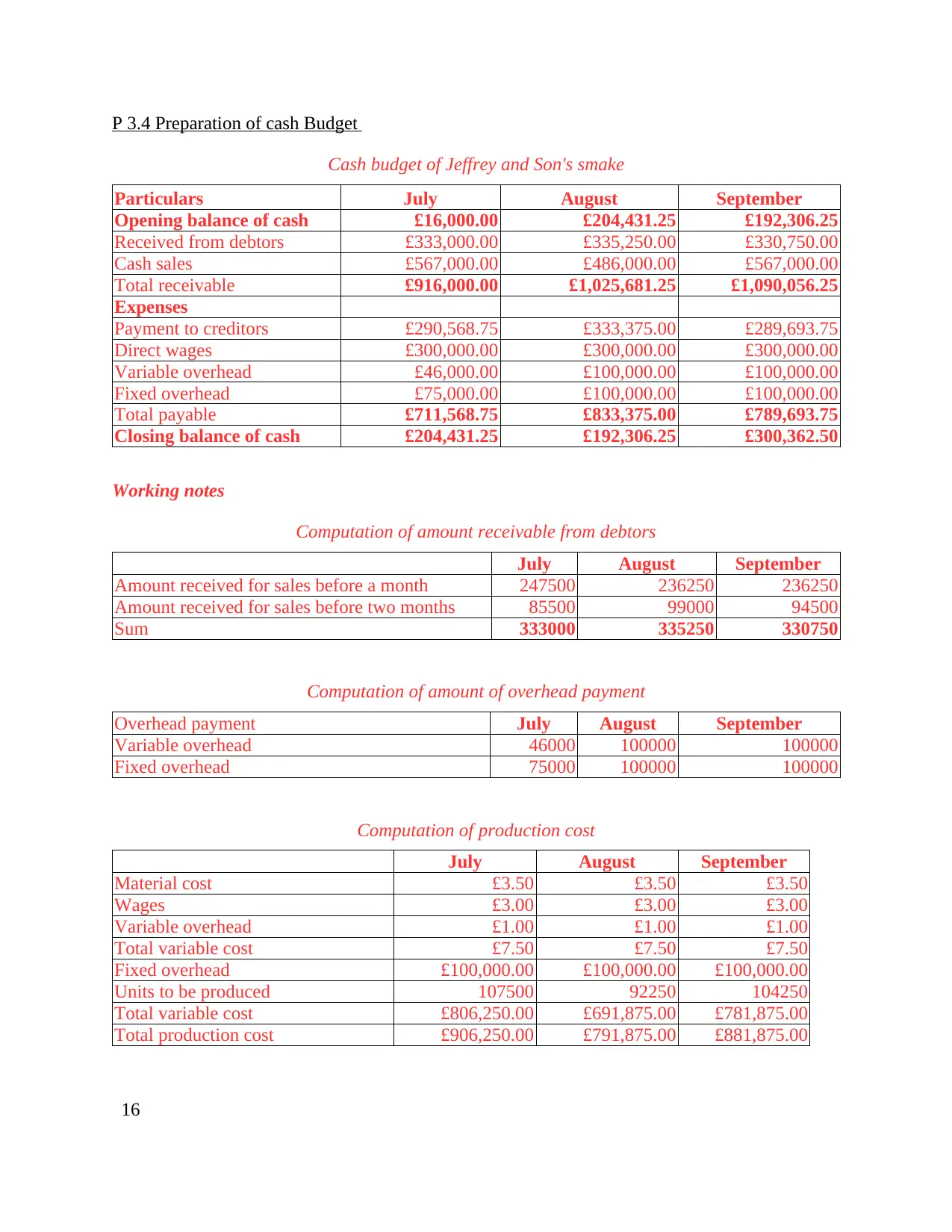

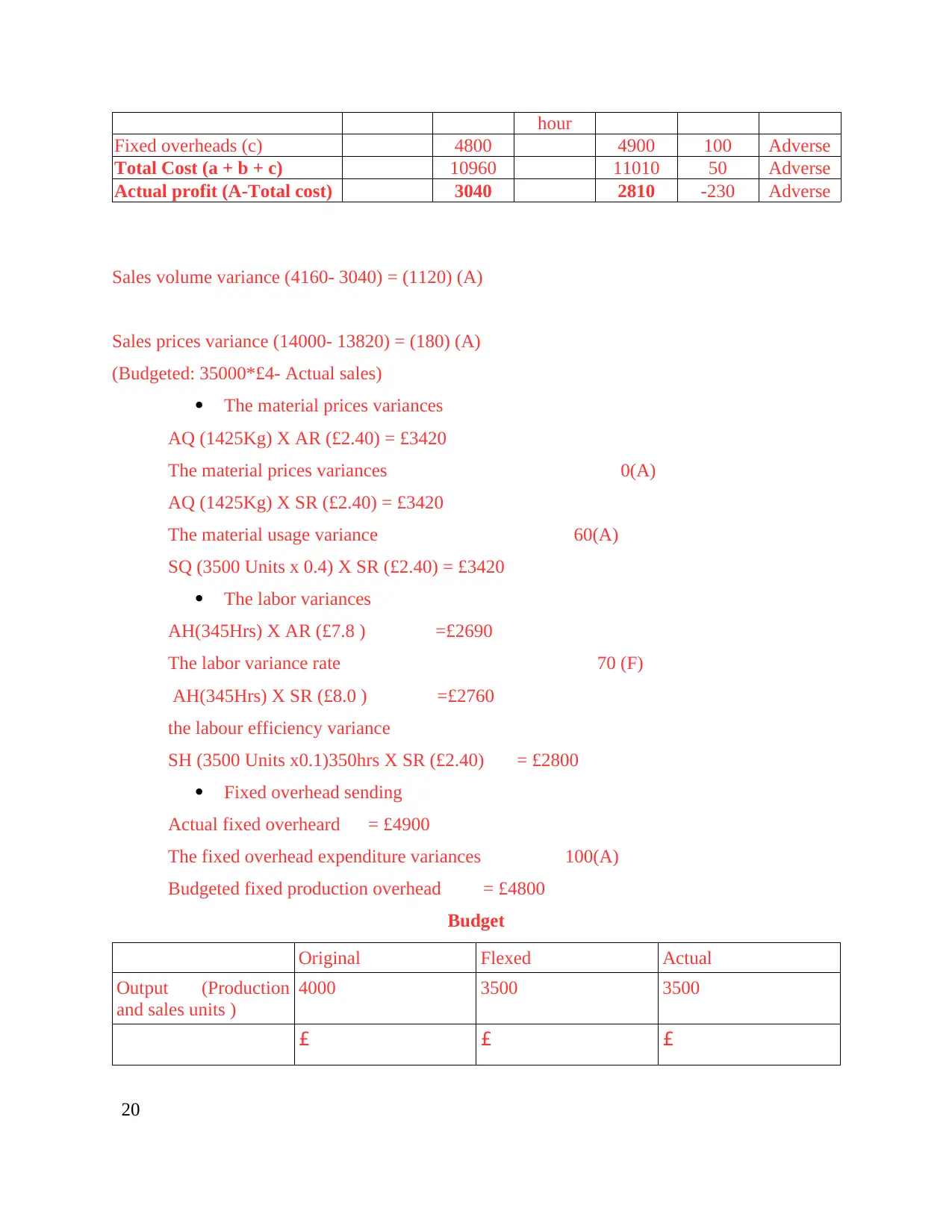

P 4.1 Calculation of variances, identify possible causes and recommend corrective actions

Computation of variances of Jeffrey and Son's smake

Particulars Budgeted Actual Variance

Nature of

variance

Per unit Total Per unit Total

Sales revenue (A) 4 per unit 14000

3.95 per

unit 13820 -180 Adverse

Material Cost (a) 2.4 per kg 3360 2.4 per kg 3420 60 Adverse

Labor charges (b) 8 per hour 2800 7.80 per 2690 -110 Favorable

19

897750 769500 879750 2565000

Total MC of

production

806250 691875 793125 2291250

Add: opening

stock

82500

Less: closing

stock

123750

Cost of sales 2250000

Contribution 315000

Fixed overheads 300000

Profits 15000

July (£) August (£) September (£) Total (£)

Material 376250 322875 370125 1060500

Direct labour 322500 276750 317250 916500

Variable O/H 107500 92250 105750 305500

Total MC of

production

806250 691875 943125 2582500

TASK 4

P 4.1 Calculation of variances, identify possible causes and recommend corrective actions

Computation of variances of Jeffrey and Son's smake

Particulars Budgeted Actual Variance

Nature of

variance

Per unit Total Per unit Total

Sales revenue (A) 4 per unit 14000

3.95 per

unit 13820 -180 Adverse

Material Cost (a) 2.4 per kg 3360 2.4 per kg 3420 60 Adverse

Labor charges (b) 8 per hour 2800 7.80 per 2690 -110 Favorable

19

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

hour

Fixed overheads (c) 4800 4900 100 Adverse

Total Cost (a + b + c) 10960 11010 50 Adverse

Actual profit (A-Total cost) 3040 2810 -230 Adverse

Sales volume variance (4160- 3040) = (1120) (A)

Sales prices variance (14000- 13820) = (180) (A)

(Budgeted: 35000*£4- Actual sales)

The material prices variances

AQ (1425Kg) X AR (£2.40) = £3420

The material prices variances 0(A)

AQ (1425Kg) X SR (£2.40) = £3420

The material usage variance 60(A)

SQ (3500 Units x 0.4) X SR (£2.40) = £3420

The labor variances

AH(345Hrs) X AR (£7.8 ) =£2690

The labor variance rate 70 (F)

AH(345Hrs) X SR (£8.0 ) =£2760

the labour efficiency variance

SH (3500 Units x0.1)350hrs X SR (£2.40) = £2800

Fixed overhead sending

Actual fixed overheard = £4900

The fixed overhead expenditure variances 100(A)

Budgeted fixed production overhead = £4800

Budget

Original Flexed Actual

Output (Production

and sales units )

4000 3500 3500

£ £ £

20

Fixed overheads (c) 4800 4900 100 Adverse

Total Cost (a + b + c) 10960 11010 50 Adverse

Actual profit (A-Total cost) 3040 2810 -230 Adverse

Sales volume variance (4160- 3040) = (1120) (A)

Sales prices variance (14000- 13820) = (180) (A)

(Budgeted: 35000*£4- Actual sales)

The material prices variances

AQ (1425Kg) X AR (£2.40) = £3420

The material prices variances 0(A)

AQ (1425Kg) X SR (£2.40) = £3420

The material usage variance 60(A)

SQ (3500 Units x 0.4) X SR (£2.40) = £3420

The labor variances

AH(345Hrs) X AR (£7.8 ) =£2690

The labor variance rate 70 (F)

AH(345Hrs) X SR (£8.0 ) =£2760

the labour efficiency variance

SH (3500 Units x0.1)350hrs X SR (£2.40) = £2800

Fixed overhead sending

Actual fixed overheard = £4900

The fixed overhead expenditure variances 100(A)

Budgeted fixed production overhead = £4800

Budget

Original Flexed Actual

Output (Production

and sales units )

4000 3500 3500

£ £ £

20

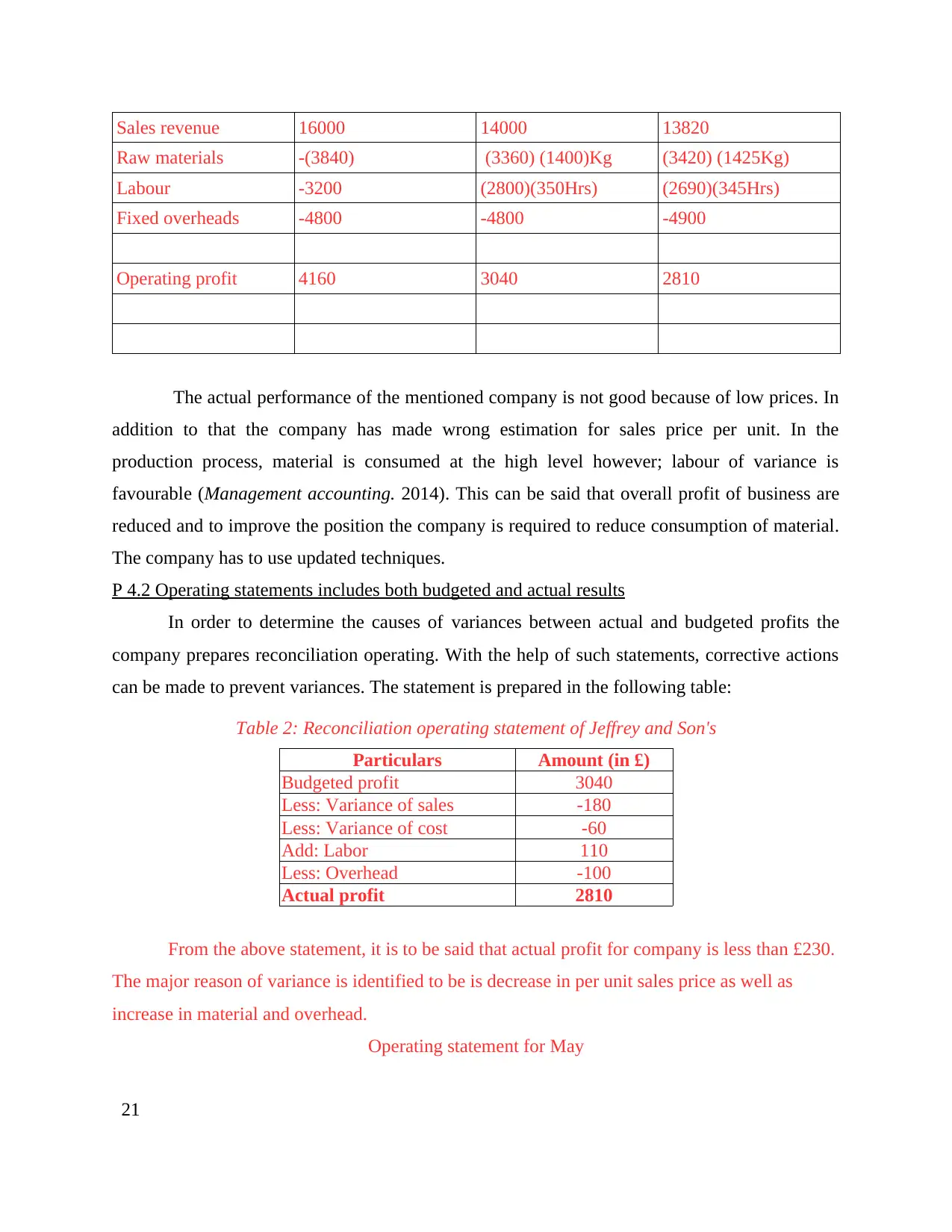

Sales revenue 16000 14000 13820

Raw materials -(3840) (3360) (1400)Kg (3420) (1425Kg)

Labour -3200 (2800)(350Hrs) (2690)(345Hrs)

Fixed overheads -4800 -4800 -4900

Operating profit 4160 3040 2810

The actual performance of the mentioned company is not good because of low prices. In

addition to that the company has made wrong estimation for sales price per unit. In the

production process, material is consumed at the high level however; labour of variance is

favourable (Management accounting. 2014). This can be said that overall profit of business are

reduced and to improve the position the company is required to reduce consumption of material.

The company has to use updated techniques.

P 4.2 Operating statements includes both budgeted and actual results

In order to determine the causes of variances between actual and budgeted profits the

company prepares reconciliation operating. With the help of such statements, corrective actions

can be made to prevent variances. The statement is prepared in the following table:

Table 2: Reconciliation operating statement of Jeffrey and Son's

Particulars Amount (in £)

Budgeted profit 3040

Less: Variance of sales -180

Less: Variance of cost -60

Add: Labor 110

Less: Overhead -100

Actual profit 2810

From the above statement, it is to be said that actual profit for company is less than £230.

The major reason of variance is identified to be is decrease in per unit sales price as well as

increase in material and overhead.

Operating statement for May

21

Raw materials -(3840) (3360) (1400)Kg (3420) (1425Kg)

Labour -3200 (2800)(350Hrs) (2690)(345Hrs)

Fixed overheads -4800 -4800 -4900

Operating profit 4160 3040 2810

The actual performance of the mentioned company is not good because of low prices. In

addition to that the company has made wrong estimation for sales price per unit. In the

production process, material is consumed at the high level however; labour of variance is

favourable (Management accounting. 2014). This can be said that overall profit of business are

reduced and to improve the position the company is required to reduce consumption of material.

The company has to use updated techniques.

P 4.2 Operating statements includes both budgeted and actual results

In order to determine the causes of variances between actual and budgeted profits the

company prepares reconciliation operating. With the help of such statements, corrective actions

can be made to prevent variances. The statement is prepared in the following table:

Table 2: Reconciliation operating statement of Jeffrey and Son's

Particulars Amount (in £)

Budgeted profit 3040

Less: Variance of sales -180

Less: Variance of cost -60

Add: Labor 110

Less: Overhead -100

Actual profit 2810

From the above statement, it is to be said that actual profit for company is less than £230.

The major reason of variance is identified to be is decrease in per unit sales price as well as

increase in material and overhead.

Operating statement for May

21

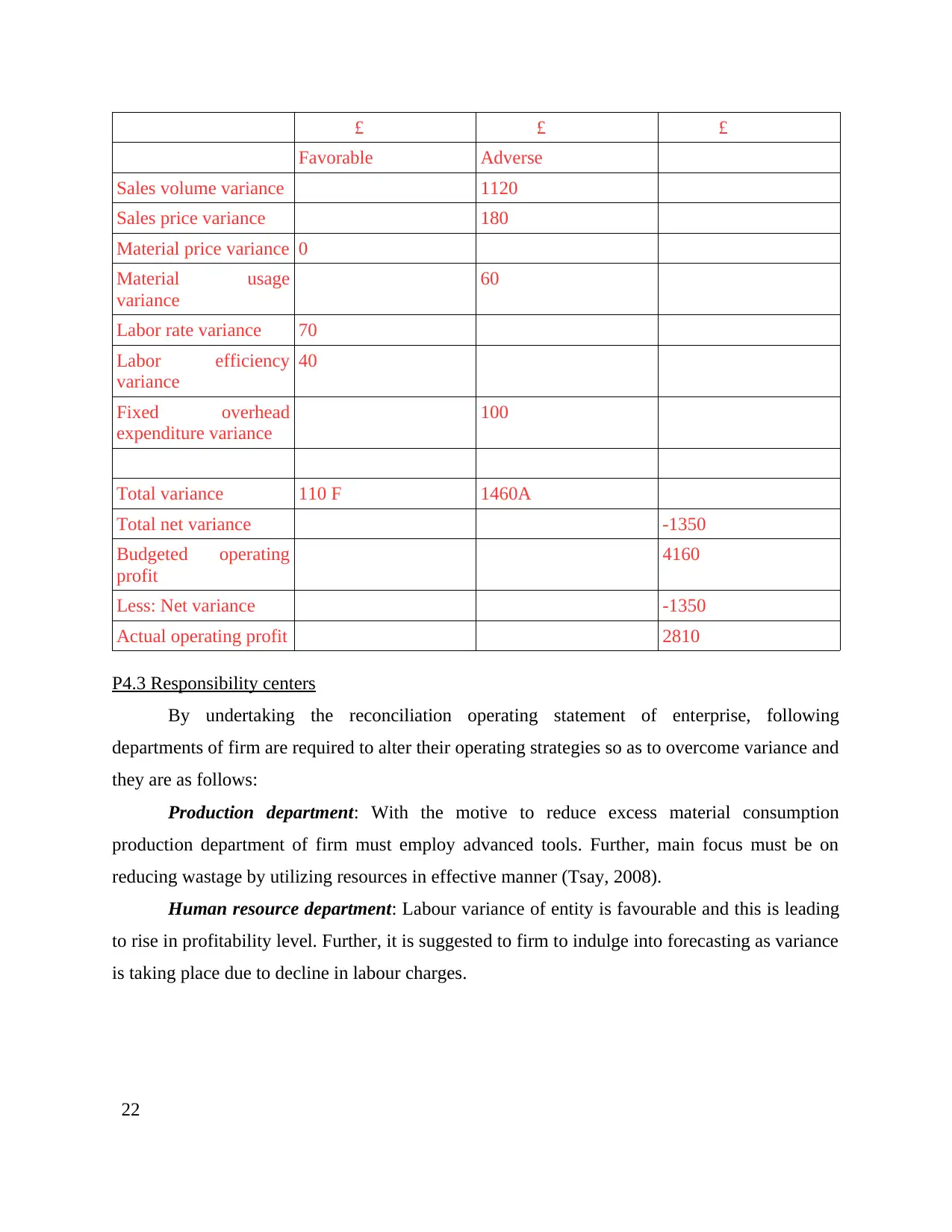

£ £ £

Favorable Adverse

Sales volume variance 1120

Sales price variance 180

Material price variance 0

Material usage

variance

60

Labor rate variance 70

Labor efficiency

variance

40

Fixed overhead

expenditure variance

100

Total variance 110 F 1460A

Total net variance -1350

Budgeted operating

profit

4160

Less: Net variance -1350

Actual operating profit 2810

P4.3 Responsibility centers

By undertaking the reconciliation operating statement of enterprise, following

departments of firm are required to alter their operating strategies so as to overcome variance and

they are as follows:

Production department: With the motive to reduce excess material consumption

production department of firm must employ advanced tools. Further, main focus must be on

reducing wastage by utilizing resources in effective manner (Tsay, 2008).

Human resource department: Labour variance of entity is favourable and this is leading

to rise in profitability level. Further, it is suggested to firm to indulge into forecasting as variance

is taking place due to decline in labour charges.

22

Favorable Adverse

Sales volume variance 1120

Sales price variance 180

Material price variance 0

Material usage

variance

60

Labor rate variance 70

Labor efficiency

variance

40

Fixed overhead

expenditure variance

100

Total variance 110 F 1460A

Total net variance -1350

Budgeted operating

profit

4160

Less: Net variance -1350

Actual operating profit 2810

P4.3 Responsibility centers

By undertaking the reconciliation operating statement of enterprise, following

departments of firm are required to alter their operating strategies so as to overcome variance and

they are as follows:

Production department: With the motive to reduce excess material consumption

production department of firm must employ advanced tools. Further, main focus must be on

reducing wastage by utilizing resources in effective manner (Tsay, 2008).

Human resource department: Labour variance of entity is favourable and this is leading

to rise in profitability level. Further, it is suggested to firm to indulge into forecasting as variance

is taking place due to decline in labour charges.

22

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CONCLUSION

The report above discussed about different types of cost classification and calculation of

the unit costing and total job cost by using Job Costing method. In a nutshell, Jeffrey & Son's

manufacturing company is advised to make use of “Zero base budgeting” so as to gain positive

outcomes and remove uncertainties from budgeted figures. On the basis of this report, it can be

said that to improve the position the company is required to reduce consumption of material.

23

The report above discussed about different types of cost classification and calculation of

the unit costing and total job cost by using Job Costing method. In a nutshell, Jeffrey & Son's

manufacturing company is advised to make use of “Zero base budgeting” so as to gain positive

outcomes and remove uncertainties from budgeted figures. On the basis of this report, it can be

said that to improve the position the company is required to reduce consumption of material.

23

REFERENCES

Books and Journals

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between

theory and practice in management accounting.Management Accounting Research, 21(2),

pp.79-82.

Banks, A., 2008. Budgeting. 3rd ed. McGraw-Hill Australia

Bhimani, A., and Bromwich, M., 2009. Management Accounting: Retrospect and prospect.

Elsevier.

Burns, J. and Scapens, R.W., 2000. Conceptualizing management accounting change: an

institutional framework. Management accounting research, 11(1), pp.3-25.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change, 6(2), pp.228-259.

Cooper, R. and Kaplan, R.S., 2008. How cost accounting distorts product costs. Management

accounting, 69(10), pp.20-27.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Ho, J. C. L., Liu, S. C. and Tsay, J., 2008. Further evidence on financial analysts' reaction to

enterprise resource planning implementation announcements. Review of Accounting and

Finance. 7(3) pp. 213 – 235.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Keown, A., 2005. Financial management. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Prior, P. B., 2004. Managing Financial Resources and Decisions. BPP Professional Education.

Vance, D., 2002. Financial Analysis and Decision Making. McGraw Hill Professional.

Ward, K., 2012. Strategic management accounting. Routledge.

Zikmund, W., 2012. Business research methods. John Wiley & Sons

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

Online

24

Books and Journals

Baldvinsdottir, G., Mitchell, F. and Nørreklit, H., 2010. Issues in the relationship between

theory and practice in management accounting.Management Accounting Research, 21(2),

pp.79-82.

Banks, A., 2008. Budgeting. 3rd ed. McGraw-Hill Australia

Bhimani, A., and Bromwich, M., 2009. Management Accounting: Retrospect and prospect.

Elsevier.

Burns, J. and Scapens, R.W., 2000. Conceptualizing management accounting change: an

institutional framework. Management accounting research, 11(1), pp.3-25.

Cinquini, L. and Tenucci, A., 2010. Strategic management accounting and business strategy: a

loose coupling?. Journal of Accounting & organizational change, 6(2), pp.228-259.

Cooper, R. and Kaplan, R.S., 2008. How cost accounting distorts product costs. Management

accounting, 69(10), pp.20-27.

DRURY, C.M., 2013. Management and cost accounting. Springer.

Garrison, R.H., Noreen, E.W., Brewer, P.C. and McGowan, A., 2010. Managerial

accounting. Issues in Accounting Education, 25(4), pp.792-793.

Ho, J. C. L., Liu, S. C. and Tsay, J., 2008. Further evidence on financial analysts' reaction to

enterprise resource planning implementation announcements. Review of Accounting and

Finance. 7(3) pp. 213 – 235.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Keown, A., 2005. Financial management. Upper Saddle River, N.J.: Pearson/Prentice Hall.

Prior, P. B., 2004. Managing Financial Resources and Decisions. BPP Professional Education.

Vance, D., 2002. Financial Analysis and Decision Making. McGraw Hill Professional.

Ward, K., 2012. Strategic management accounting. Routledge.

Zikmund, W., 2012. Business research methods. John Wiley & Sons

Zimmerman, J.L. and Yahya-Zadeh, M., 2011. Accounting for decision making and

control. Issues in Accounting Education, 26(1), pp.258-259.

Online

24

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.