Financial Services Compliance Assessment

VerifiedAdded on 2020/04/21

|55

|13917

|91

AI Summary

This document is a comprehensive assessment focused on the legal and regulatory framework within the financial services industry. It covers key elements such as evaluating legal contexts, identifying compliance requirements, developing procedures to ensure adherence, and monitoring compliance effectiveness. The assessment includes detailed instructions, example scenarios, and verification statements for practical application.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assessment Tool Page 1 of 55

FNSACC403B: Make decisions in a legal context.

Name of Participant:............................................... Date:.....................................

Element of Competency

1. Evaluate legal context for financial services work

2. Identify compliance requirements.

3. Develop procedures to ensure compliance.

Complete the following assessment tasks and ensure that any manual printouts of

evidence are signed by yourself in the bottom right hand corner. The completed

Assessment Tasks and any evidence must be provided to your Trainer in order to be

assessed on the subject, and ultimately marked Competent.

User Guide Activities

The course activities will require you to work through both the Make Decisions in a

Legal Context (FNSACC403B) User Guide.

Activity Task 1 – UG Topic 1.1

a) Write down a list of some of the decisions you could make as part of your daily

tasks within the Financial Services Industry?

1. It is the duty of the financial manager to provides report, developing strategies,

financial organizational plans for the Financial Service Industry.

2. The Financial Managers is used to provide services in many places like banks

and other insurance companies.

3. They help in the preparation in the business activity along with the financial

reports.

4. helps in final financial reports and helps to review in reduce costs

5. Helps in taking decision and looks for the financial marketing opportunities for

expanding the strategies.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

ASSESSMENT TOOL

Part # 321ATF10VOL

Version # 4.12.1

FNSACC403B: Make decisions in a legal context.

Name of Participant:............................................... Date:.....................................

Element of Competency

1. Evaluate legal context for financial services work

2. Identify compliance requirements.

3. Develop procedures to ensure compliance.

Complete the following assessment tasks and ensure that any manual printouts of

evidence are signed by yourself in the bottom right hand corner. The completed

Assessment Tasks and any evidence must be provided to your Trainer in order to be

assessed on the subject, and ultimately marked Competent.

User Guide Activities

The course activities will require you to work through both the Make Decisions in a

Legal Context (FNSACC403B) User Guide.

Activity Task 1 – UG Topic 1.1

a) Write down a list of some of the decisions you could make as part of your daily

tasks within the Financial Services Industry?

1. It is the duty of the financial manager to provides report, developing strategies,

financial organizational plans for the Financial Service Industry.

2. The Financial Managers is used to provide services in many places like banks

and other insurance companies.

3. They help in the preparation in the business activity along with the financial

reports.

4. helps in final financial reports and helps to review in reduce costs

5. Helps in taking decision and looks for the financial marketing opportunities for

expanding the strategies.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

ASSESSMENT TOOL

Part # 321ATF10VOL

Version # 4.12.1

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment Tool Page 2 of 55

a) List the Acts, legislation or laws that you are aware of that may affect the way

that you make these decisions.

The legislations are The Australian Securities and Investment Commission

(ASIC), Australian Prudential Regulatory Authority (APRA), Australian

Competition and Consumer Commission (ACCC) AND Anti-Money Laundering

and Counter-Terrorism Financing Act 2008.

b) How could you ensure that you are up to date with changes to the legislation

listed in your answer above?

It is necessary to ensure about all the details of the legislations, which related

with financial services and must keep the records of the details about the new

updates. It is also need to track down about the records where the details of

update legislations need to mention.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

a) List the Acts, legislation or laws that you are aware of that may affect the way

that you make these decisions.

The legislations are The Australian Securities and Investment Commission

(ASIC), Australian Prudential Regulatory Authority (APRA), Australian

Competition and Consumer Commission (ACCC) AND Anti-Money Laundering

and Counter-Terrorism Financing Act 2008.

b) How could you ensure that you are up to date with changes to the legislation

listed in your answer above?

It is necessary to ensure about all the details of the legislations, which related

with financial services and must keep the records of the details about the new

updates. It is also need to track down about the records where the details of

update legislations need to mention.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 3 of 55

c) Explain the consequences that could be enforced if you fail to comply with

these requirements.

According to the all legislations in the Financial Industry it is necessary to ensure

about the details about it and the legislations has made for the keeping the

regulation for the people who are related with the financial industry. If the

legislations are not followed according o the Code of Conduct then they ,ay face

the consequences and it may affect in their financial occupations.

Activity Task 2 – UG Topics 1.2

a) With reference to the three tables listed in this section, who is the main

supervisor/regulator of the Australian Banking Industry?

The Australian Prudential Regulation Authority (APRA)

The Australian Securities and Investments Commission (ASIC)

The Reserve Bank of Australia (RBA);

The Australian Treasury.

The Council of Financial Regulators (CFR).

b) Access the ASIC website and access the section that covers the compliance

requirements that apply to your business within the Financial Services Industry:

http://www.asic.gov.au/asic/ASIC.ASF/byHeadline/Codes-of-practice

c) Select and print one Code of Practice relevant to your organisation.

Read through the Code and record three key points extracted from the Code in the

space provided below.

In addition, undertake some research and locate information in regards to the

penalties that can be imposed in the case of non-compliance against the Code.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

c) Explain the consequences that could be enforced if you fail to comply with

these requirements.

According to the all legislations in the Financial Industry it is necessary to ensure

about the details about it and the legislations has made for the keeping the

regulation for the people who are related with the financial industry. If the

legislations are not followed according o the Code of Conduct then they ,ay face

the consequences and it may affect in their financial occupations.

Activity Task 2 – UG Topics 1.2

a) With reference to the three tables listed in this section, who is the main

supervisor/regulator of the Australian Banking Industry?

The Australian Prudential Regulation Authority (APRA)

The Australian Securities and Investments Commission (ASIC)

The Reserve Bank of Australia (RBA);

The Australian Treasury.

The Council of Financial Regulators (CFR).

b) Access the ASIC website and access the section that covers the compliance

requirements that apply to your business within the Financial Services Industry:

http://www.asic.gov.au/asic/ASIC.ASF/byHeadline/Codes-of-practice

c) Select and print one Code of Practice relevant to your organisation.

Read through the Code and record three key points extracted from the Code in the

space provided below.

In addition, undertake some research and locate information in regards to the

penalties that can be imposed in the case of non-compliance against the Code.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 4 of 55

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment Tool Page 5 of 55

Code of Conduct: Code of Banking Practice

Key Point 1: the code provides a new commitment to small businesses consumers ten

written days notice of changes materially adverse alteration in the credit facilities.

(unless the alterations are also applicable on to the othe small businesses facilities or a

shorter period of notice is required for reducing or voiding the increase in the credit risk

of the bank.)

Key Point 2: commitment has been provided to those customers in the indigenous

remote communities which includes commitment to record information in relation to

available banking services in a manner accessible and towards assisting the customer

to meet the requirements of identification.

Key Point 3: Provisions in order to deal with those customers who are in financial

difficulties which also includes commitment towards dealing with an authorised financial

representative or counsellor on request for the purpose of providing a written response

along with reasons for making a assistance request and also to include details about

the dealing processes with financially challenged people on the bank website.

Penalties for non-compliance: where the code it not complied with it results in financial

penalties and fines as well as cancellation of licence in certain situations resulting out

of serious breaches

Activity Task 3 – UG Topic 1.3

a) Choose a Code of Practice or an Act from the list within this section of the User

guide and describe its purpose and how it affects the Financial Services

Industry.

Act/CoP : The National Consumer Credit Protection Act 2009

Website: http://www.asic.gov.au/asic/ASIC.NSF/byHeadline/Codes-of-practice

Purpose: The purpose is ensuring the benefits of equivalent, which helps to

protect from the air, soil and pollution and noises. The Business also helps to set

the protocols, guidelines, standard and protocols.

Effect on Financial Services Industry:

The act helps to protect the ambient the quality of air, marine, fresh water. The

environmental protection, which are hazardous wastes and the motor vehicle and

emissions.

b) List any other Acts you are aware of, that are applicable to the Financial

Services Industry, which were not listed here.

The Taxation Administration Act 1953 is one of the important acts, which is

applicable in the Financial Industry helps in managing the interpretation,

management and enforcement in the Australian Tax System.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Code of Conduct: Code of Banking Practice

Key Point 1: the code provides a new commitment to small businesses consumers ten

written days notice of changes materially adverse alteration in the credit facilities.

(unless the alterations are also applicable on to the othe small businesses facilities or a

shorter period of notice is required for reducing or voiding the increase in the credit risk

of the bank.)

Key Point 2: commitment has been provided to those customers in the indigenous

remote communities which includes commitment to record information in relation to

available banking services in a manner accessible and towards assisting the customer

to meet the requirements of identification.

Key Point 3: Provisions in order to deal with those customers who are in financial

difficulties which also includes commitment towards dealing with an authorised financial

representative or counsellor on request for the purpose of providing a written response

along with reasons for making a assistance request and also to include details about

the dealing processes with financially challenged people on the bank website.

Penalties for non-compliance: where the code it not complied with it results in financial

penalties and fines as well as cancellation of licence in certain situations resulting out

of serious breaches

Activity Task 3 – UG Topic 1.3

a) Choose a Code of Practice or an Act from the list within this section of the User

guide and describe its purpose and how it affects the Financial Services

Industry.

Act/CoP : The National Consumer Credit Protection Act 2009

Website: http://www.asic.gov.au/asic/ASIC.NSF/byHeadline/Codes-of-practice

Purpose: The purpose is ensuring the benefits of equivalent, which helps to

protect from the air, soil and pollution and noises. The Business also helps to set

the protocols, guidelines, standard and protocols.

Effect on Financial Services Industry:

The act helps to protect the ambient the quality of air, marine, fresh water. The

environmental protection, which are hazardous wastes and the motor vehicle and

emissions.

b) List any other Acts you are aware of, that are applicable to the Financial

Services Industry, which were not listed here.

The Taxation Administration Act 1953 is one of the important acts, which is

applicable in the Financial Industry helps in managing the interpretation,

management and enforcement in the Australian Tax System.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 6 of 55

c) Discuss below the importance of non-financial related legislation such as

environmental or OH&S requirements.

The Occupational Health and Safety (OH&S) is one of the important legislation

which help in provide the safety for the workers and the public in their workplace

and the safe workplace environment for the employees must be provided by the

employers. Now the employees will have responsibilities according to the

employers, supervisors or team leaders and the employees. Both Commonwealth

and state bodies control health and safety in the workplace. Within these OH&S

Acts are OH&S Regulations, Standards, Codes of Practice and guidelines

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

c) Discuss below the importance of non-financial related legislation such as

environmental or OH&S requirements.

The Occupational Health and Safety (OH&S) is one of the important legislation

which help in provide the safety for the workers and the public in their workplace

and the safe workplace environment for the employees must be provided by the

employers. Now the employees will have responsibilities according to the

employers, supervisors or team leaders and the employees. Both Commonwealth

and state bodies control health and safety in the workplace. Within these OH&S

Acts are OH&S Regulations, Standards, Codes of Practice and guidelines

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 7 of 55

Activity Task 4 – Research Activity – UG Topics 1.4 – 1.5

(a) Undertake some research on the website for Certified Practicing Accountants and

locate information in regards to the statutory requirements for CPA membership.

Requirements for membership

For the purpose of becoming a CPA member a person must hold a degree which is

recognised by CPA Australia in any discipline.

The person must have completed the CPA program, which includes the persons

experience within a time frame of six years.

Examination process

a foundation examination is conducted by the CPA for the purpose of giving those who

are not having a degree in the fields of finance are provided the opportunity to complete

a CPA program.

Other requirements

the person making an application has to provide personal details, payment of application

fees and supporting documents for being eligible to make an application

Timeframes for compliance

the exam has to be scheduled between 12 months of enrolment.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Activity Task 4 – Research Activity – UG Topics 1.4 – 1.5

(a) Undertake some research on the website for Certified Practicing Accountants and

locate information in regards to the statutory requirements for CPA membership.

Requirements for membership

For the purpose of becoming a CPA member a person must hold a degree which is

recognised by CPA Australia in any discipline.

The person must have completed the CPA program, which includes the persons

experience within a time frame of six years.

Examination process

a foundation examination is conducted by the CPA for the purpose of giving those who

are not having a degree in the fields of finance are provided the opportunity to complete

a CPA program.

Other requirements

the person making an application has to provide personal details, payment of application

fees and supporting documents for being eligible to make an application

Timeframes for compliance

the exam has to be scheduled between 12 months of enrolment.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Tool Page 8 of 55

(b) Apart from a statutory requirement, discuss some other advantages that

may be realised by becoming a CPA.

CPA certified accountant are considered to have lot more expertise that a normal

accountant; the is a need for CPA accountants everywhere as they are trusted;

payments which are made to CPA certified

(c) What methods can you undertake to assist you in maintaining up to date

knowledge on the governing requirements that affect you (legislation/Acts,

location of information, etc.) - How often should you do this? (Hint – maybe look

for some historical version information?)

Legislation - methods Frequency of check

Information from Industry website Daily

Governing Body Website Monthly

Experienced book keepers Monthly

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(b) Apart from a statutory requirement, discuss some other advantages that

may be realised by becoming a CPA.

CPA certified accountant are considered to have lot more expertise that a normal

accountant; the is a need for CPA accountants everywhere as they are trusted;

payments which are made to CPA certified

(c) What methods can you undertake to assist you in maintaining up to date

knowledge on the governing requirements that affect you (legislation/Acts,

location of information, etc.) - How often should you do this? (Hint – maybe look

for some historical version information?)

Legislation - methods Frequency of check

Information from Industry website Daily

Governing Body Website Monthly

Experienced book keepers Monthly

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 9 of 55

(d) Refer to the Real Life Example, Changes to Statutory Requirements for Tax

Agents in Section 1.4 of this user guide and use the information within this

section (or elsewhere if required) to complete the following:

What are the current requirements?

Bookkeepers who work on a contractual

basis have to hold a professional

indemnity insurance an must be

registered as a BAS agent.

Who does this affect? All tax practitioners registered with the

TPB.

What are the current processes? No statues currently exists in relation

to PI insurance.

What needs to be changed? All Tax Practitioners will be required to

either take out PI insurance or check

that their cover is in line with the

requirements as set out by the TPB.

What needs to be done?

The TPB will be contacting all

registered

agents to outline PI requirements.

Each

tax professional will need to refer to

this

documentation or locate it within the

TPB

website to ensure that their cover is

adequate.

Each current PI policy will need to be

checked to ensure that it meets the

requirements outlined by the TPB.

When does this have to be done

by? (Statutory Timeframes)

All agents will need to notify

the Board of

their PI insurance status by 1

July 2011.

What are the penalties for non

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(d) Refer to the Real Life Example, Changes to Statutory Requirements for Tax

Agents in Section 1.4 of this user guide and use the information within this

section (or elsewhere if required) to complete the following:

What are the current requirements?

Bookkeepers who work on a contractual

basis have to hold a professional

indemnity insurance an must be

registered as a BAS agent.

Who does this affect? All tax practitioners registered with the

TPB.

What are the current processes? No statues currently exists in relation

to PI insurance.

What needs to be changed? All Tax Practitioners will be required to

either take out PI insurance or check

that their cover is in line with the

requirements as set out by the TPB.

What needs to be done?

The TPB will be contacting all

registered

agents to outline PI requirements.

Each

tax professional will need to refer to

this

documentation or locate it within the

TPB

website to ensure that their cover is

adequate.

Each current PI policy will need to be

checked to ensure that it meets the

requirements outlined by the TPB.

When does this have to be done

by? (Statutory Timeframes)

All agents will need to notify

the Board of

their PI insurance status by 1

July 2011.

What are the penalties for non

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 10 of 55

compliance?

an agent fails to maintain PI

cover that

meets the Board’s

requirements, the

Board may sanction the agent

for a

breach of the Code under

section 30-

10(13) of the TASA. Depending

on the

circumstances, the sanctions

available to

the Board range from cautions

to

suspension or termination of an

agent’s

registration

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

compliance?

an agent fails to maintain PI

cover that

meets the Board’s

requirements, the

Board may sanction the agent

for a

breach of the Code under

section 30-

10(13) of the TASA. Depending

on the

circumstances, the sanctions

available to

the Board range from cautions

to

suspension or termination of an

agent’s

registration

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment Tool Page 11 of 55

Activity Task 5 – UG Topics 1.6 – 1.7

(a) Describe an example of why a business in the Financial Services Industry

could potentially be involved in a court case for each type of common

law.

Negligence

If any injury or a person is identified with a negligence activity and someone

affected and faced any damages or loss due to the duty of care then it will

recognize as negligence.

Contract Law

Contract is define as a mutual agreement between two parties where it should

formalise a promise which must be legally binding. Under the contract the

agreement could made for buying a house pr car, for repay the loan.

Employment Law

The Employment law provides the consequences for the employees where an

employee must got the employment under this act. The Act also provides the

leaves, services, time allowable and on the terms of the employment this act also

provides under an employment contract which provides the legislations and

protect from every workplace bullying and sexual harassment.

Criminal Law

The Criminal Act of Australia has legislated the part, which helps to provide the

protection from the crime, which is included like assault, robbery, fraud and

harassments. This law provide the protection under the Criminal activities.

Environmental Law

The Environmental provides the legislations where it is regulated by the

governing body of Australia and helps to manage the management of the

environment. Under the Environmental Law it protects the area which iare

affected by the pollution, waste, green house gases, recycling and natural

resources.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Activity Task 5 – UG Topics 1.6 – 1.7

(a) Describe an example of why a business in the Financial Services Industry

could potentially be involved in a court case for each type of common

law.

Negligence

If any injury or a person is identified with a negligence activity and someone

affected and faced any damages or loss due to the duty of care then it will

recognize as negligence.

Contract Law

Contract is define as a mutual agreement between two parties where it should

formalise a promise which must be legally binding. Under the contract the

agreement could made for buying a house pr car, for repay the loan.

Employment Law

The Employment law provides the consequences for the employees where an

employee must got the employment under this act. The Act also provides the

leaves, services, time allowable and on the terms of the employment this act also

provides under an employment contract which provides the legislations and

protect from every workplace bullying and sexual harassment.

Criminal Law

The Criminal Act of Australia has legislated the part, which helps to provide the

protection from the crime, which is included like assault, robbery, fraud and

harassments. This law provide the protection under the Criminal activities.

Environmental Law

The Environmental provides the legislations where it is regulated by the

governing body of Australia and helps to manage the management of the

environment. Under the Environmental Law it protects the area which iare

affected by the pollution, waste, green house gases, recycling and natural

resources.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 12 of 55

(b) Refer to the common law case examples within this section of the user guide and

discuss the following points with your group/supervisor.

Real Life Case #3 - Negligence

Outline of case – In the case of ASIC v Brighton Hall Securities Pty Ltd (in

Liquidation) the negligence has found and the compensations has been claimed.

Damages sought/awarded

According to the case study, the damage has occur due to the negligence by the

Brighton Hall Securities who carried a financial service business and ASIC has

charged against them for the negligent act and claimed $14 million as

compensations.

Issues argued

The issues has been argued by the ASIC that the negligence has occur for the

parties where they have aimed to preventing the need to commence litigation.

Now the ASIC has the rights to the Section 50 of the ASIC act where it will

applicable on the begin and carry on civil proceeding for damages for investors

where it appears and proceeds according to the public interest.

Real Life Case #4 – Unfair dismissal

Outline of case

Candyce Arathoon v Zurich Financial Services Australia Limited

Damages sought/awarded

In this case the Australian Industrial Commission has found that a person

employment Has been unjust or unreasonable. in this settlement the

discontinuance matter has been put under the conciliation process and given

statement provided against the client by the unreasonable actions.

Issues argued

In this case the Australian Industrial Commission has found that a person

employment Has been unjust or unreasonable. in this settlement the

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(b) Refer to the common law case examples within this section of the user guide and

discuss the following points with your group/supervisor.

Real Life Case #3 - Negligence

Outline of case – In the case of ASIC v Brighton Hall Securities Pty Ltd (in

Liquidation) the negligence has found and the compensations has been claimed.

Damages sought/awarded

According to the case study, the damage has occur due to the negligence by the

Brighton Hall Securities who carried a financial service business and ASIC has

charged against them for the negligent act and claimed $14 million as

compensations.

Issues argued

The issues has been argued by the ASIC that the negligence has occur for the

parties where they have aimed to preventing the need to commence litigation.

Now the ASIC has the rights to the Section 50 of the ASIC act where it will

applicable on the begin and carry on civil proceeding for damages for investors

where it appears and proceeds according to the public interest.

Real Life Case #4 – Unfair dismissal

Outline of case

Candyce Arathoon v Zurich Financial Services Australia Limited

Damages sought/awarded

In this case the Australian Industrial Commission has found that a person

employment Has been unjust or unreasonable. in this settlement the

discontinuance matter has been put under the conciliation process and given

statement provided against the client by the unreasonable actions.

Issues argued

In this case the Australian Industrial Commission has found that a person

employment Has been unjust or unreasonable. in this settlement the

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 13 of 55

discontinuance matter has been put under the conciliation process and given

statement provided against the client by the unreasonable actions. in such

situation the former commission comments on this case where the representative

submitted the previous statement where it also offers the prejudice offer.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

discontinuance matter has been put under the conciliation process and given

statement provided against the client by the unreasonable actions. in such

situation the former commission comments on this case where the representative

submitted the previous statement where it also offers the prejudice offer.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Tool Page 14 of 55

Activity Task 6 – UG Topic 1.8

(a) List four instances which could happen in a workplace that are subject to a

certain Act, legislation or law (e.g. provision of a privacy policy statement). Refer

to the legislation or Act and list the possible penalties for non compliance (You

may need to do some research!).

1.

Act, legislation or law: Corporation Act 2001 (Cth) – breach of officers duties

Non compliance penalty: civil penalties $200000 for individuals.

2.

Act, legislation or law: Privacy Act 1986

Non-compliance penalty: Breach of confidentiality in relation to private documents

of clients may result in fines and penalties.

3.

Fair Work Act 2009

Nor providing employment rights to the employees of the business may result in

penalties and compensation.

4.

Australian Human Rights Commission Act 1986

Where any person in ill treated within the work place- fines and penalties to

compensate the employee

(b) Refer back to the Real Life Example #1 (PI insurance) in the Researching

Legislative, Statutory and Regulatory Requirements section of this user guide

and undertake some research to find the potential penalties that could

apply.

Non-compliance of requirements in relation to professional indemnity insurance

can lead to the termination of the registration as the agents would not comply

with the registration requirements and the breach of the code of conduct.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Activity Task 6 – UG Topic 1.8

(a) List four instances which could happen in a workplace that are subject to a

certain Act, legislation or law (e.g. provision of a privacy policy statement). Refer

to the legislation or Act and list the possible penalties for non compliance (You

may need to do some research!).

1.

Act, legislation or law: Corporation Act 2001 (Cth) – breach of officers duties

Non compliance penalty: civil penalties $200000 for individuals.

2.

Act, legislation or law: Privacy Act 1986

Non-compliance penalty: Breach of confidentiality in relation to private documents

of clients may result in fines and penalties.

3.

Fair Work Act 2009

Nor providing employment rights to the employees of the business may result in

penalties and compensation.

4.

Australian Human Rights Commission Act 1986

Where any person in ill treated within the work place- fines and penalties to

compensate the employee

(b) Refer back to the Real Life Example #1 (PI insurance) in the Researching

Legislative, Statutory and Regulatory Requirements section of this user guide

and undertake some research to find the potential penalties that could

apply.

Non-compliance of requirements in relation to professional indemnity insurance

can lead to the termination of the registration as the agents would not comply

with the registration requirements and the breach of the code of conduct.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 15 of 55

(c) Discuss how these penalties could affect you, your business, and your industry.

You

if I do not comply with the PI insurance provisions my registration may be

suspended as I would not be meeting the criteria for the registration as well as

would be breaching the code of conduct

Business

the penalties would mean that the businesses must ensure that the employees

have professional indemnity insurance or else they would be liable for employer

non registered agents.

Industry

The industry would have a good effect of the penalties as most of the agents

would incorporate a PI insurance and therefore the risk of negligence in the

industry would be reduced.

Activity Task 7 – Individual Knowledge Check- Unit 1

Use this quiz to check your knowledge of the content covered in this topic. Challenge

yourself by attempting to answer all questions initially without reference to your notes.

(a) Complete this sentence: The Australian Financial Services Industry is one of the

fastest growing sectors in the Australian economy and is the…

United States is the second largest sector in the economy.

China is the third largest sector in the economy.

Germany is the fourth largest sector in the economy.

(b) Who are the two main regulators of Financial Institutions in Australia?

1) Australian Prudential Regulation Authority (APRA)___________________

2) Australian Securities & Investments Commission (ASIC)______________

(c) What are the three main types of Financial Institutions in Australia?

Provide an example of each.

Type: Authorised Deposit-taking Institutions (ADIs)_________________

Example: bank, Building Societies, credit Unions_______________

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(c) Discuss how these penalties could affect you, your business, and your industry.

You

if I do not comply with the PI insurance provisions my registration may be

suspended as I would not be meeting the criteria for the registration as well as

would be breaching the code of conduct

Business

the penalties would mean that the businesses must ensure that the employees

have professional indemnity insurance or else they would be liable for employer

non registered agents.

Industry

The industry would have a good effect of the penalties as most of the agents

would incorporate a PI insurance and therefore the risk of negligence in the

industry would be reduced.

Activity Task 7 – Individual Knowledge Check- Unit 1

Use this quiz to check your knowledge of the content covered in this topic. Challenge

yourself by attempting to answer all questions initially without reference to your notes.

(a) Complete this sentence: The Australian Financial Services Industry is one of the

fastest growing sectors in the Australian economy and is the…

United States is the second largest sector in the economy.

China is the third largest sector in the economy.

Germany is the fourth largest sector in the economy.

(b) Who are the two main regulators of Financial Institutions in Australia?

1) Australian Prudential Regulation Authority (APRA)___________________

2) Australian Securities & Investments Commission (ASIC)______________

(c) What are the three main types of Financial Institutions in Australia?

Provide an example of each.

Type: Authorised Deposit-taking Institutions (ADIs)_________________

Example: bank, Building Societies, credit Unions_______________

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 16 of 55

Type: Non-ADI Financial Institutions__________________________________

Example: Money Market Corporation, Finance Companies and Securities____

Type: Insurers and Funds Managers__________________________________

Example: Life Insurance Companies, General Insurance Companies, Superannuation

and Approved Deposit Funds (ADFs)__________________________________

(d) Apart from the two Regulators identified at question (b), list three other key

pieces of Legislation, Act or Codes applicable to the Financial Services Industry.

1) Taxation Administration Act 1953__________________

2) Privacy Act 1988_______________________________

3) Financial Transactions Reports Act 1988 (FTR Act)____

(e) List five (5) possible ramifications should a member of the Australian Financial

Service Industry breach an Act, legislation or law.

1) The anti-money laundering and counter-terrorism financing (AML/CTF)_____

2) Occupational Health and Safety (OH&S) Legislation

3) Competition and Consumer Act 2010________________________________

4) National Environment Protection Council (NEPC)______________________

5) The Financial Services Reform Act_________________________________

Activity Task 8 – Case Study Activity

Refer to the Real Life Example #5 - Fraud Case in the Failure to Comply with Common

Law section of this user guide and answer the following questions.

(a) What common law has this bookkeeper broken?

Fraud- this is because she had intentionally used her position to direct the money

to her bank account a caused financial losses to the company and its clients

(b) What court would this case have been tried in? Why?

County Court- it has been provided through the example she had been trailed at

the county court

(c) What was her role in the workplace?

She was a bookkeeper having the responsibility to transfer payments form the

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Type: Non-ADI Financial Institutions__________________________________

Example: Money Market Corporation, Finance Companies and Securities____

Type: Insurers and Funds Managers__________________________________

Example: Life Insurance Companies, General Insurance Companies, Superannuation

and Approved Deposit Funds (ADFs)__________________________________

(d) Apart from the two Regulators identified at question (b), list three other key

pieces of Legislation, Act or Codes applicable to the Financial Services Industry.

1) Taxation Administration Act 1953__________________

2) Privacy Act 1988_______________________________

3) Financial Transactions Reports Act 1988 (FTR Act)____

(e) List five (5) possible ramifications should a member of the Australian Financial

Service Industry breach an Act, legislation or law.

1) The anti-money laundering and counter-terrorism financing (AML/CTF)_____

2) Occupational Health and Safety (OH&S) Legislation

3) Competition and Consumer Act 2010________________________________

4) National Environment Protection Council (NEPC)______________________

5) The Financial Services Reform Act_________________________________

Activity Task 8 – Case Study Activity

Refer to the Real Life Example #5 - Fraud Case in the Failure to Comply with Common

Law section of this user guide and answer the following questions.

(a) What common law has this bookkeeper broken?

Fraud- this is because she had intentionally used her position to direct the money

to her bank account a caused financial losses to the company and its clients

(b) What court would this case have been tried in? Why?

County Court- it has been provided through the example she had been trailed at

the county court

(c) What was her role in the workplace?

She was a bookkeeper having the responsibility to transfer payments form the

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment Tool Page 17 of 55

company

(d) How did she commit her fraud?

Instead of making the transfer of payments to the clients she directed the

payments to her own account.

(e) What factors did she say contributed to her decision to defraud the company?

She had a mother who gambling debts. She had lost respect for the managers of

the company. She spent the money to by hand bags and take her family on

holidays.

(f) In preparation for the next chapter of the user guide, what processes could have

been implemented in an effort to stop this offense from occurring?

Process such as strict supervisions over the activities of employees who have a

financial role in the organization have to be implemented to ensure that there is

no future occurrence of such crime.

Activity Task 9 – UG Topics 2.1 – 2.2

Discuss and record your group responses to the questions below.

(a) How and where does your organisation keep a record of their policies and

procedures, e.g. online, printed?

Correct policies and procedures are critical to the daily practices and

legal compliance of any workplace. They not only give staff members a

complete

guide to their job requirements, but also form the basis for other

documents such

as job descriptions and employment contracts.

Policy: Policy documents outline the protocols, standards and objectives of a

company or workplace. They outline expectations, beliefs and any moral

behaviours that must be followed whilst in the process of performing any duties

with the workplace.

Procedure: Procedure documents are written for staff members to follow and

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

company

(d) How did she commit her fraud?

Instead of making the transfer of payments to the clients she directed the

payments to her own account.

(e) What factors did she say contributed to her decision to defraud the company?

She had a mother who gambling debts. She had lost respect for the managers of

the company. She spent the money to by hand bags and take her family on

holidays.

(f) In preparation for the next chapter of the user guide, what processes could have

been implemented in an effort to stop this offense from occurring?

Process such as strict supervisions over the activities of employees who have a

financial role in the organization have to be implemented to ensure that there is

no future occurrence of such crime.

Activity Task 9 – UG Topics 2.1 – 2.2

Discuss and record your group responses to the questions below.

(a) How and where does your organisation keep a record of their policies and

procedures, e.g. online, printed?

Correct policies and procedures are critical to the daily practices and

legal compliance of any workplace. They not only give staff members a

complete

guide to their job requirements, but also form the basis for other

documents such

as job descriptions and employment contracts.

Policy: Policy documents outline the protocols, standards and objectives of a

company or workplace. They outline expectations, beliefs and any moral

behaviours that must be followed whilst in the process of performing any duties

with the workplace.

Procedure: Procedure documents are written for staff members to follow and

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 18 of 55

they outline the steps that are required to meet the policies and general

workplace requirements of the company.

(b) Who within your organisation is responsible for updating the policies and

procedures?

Correct policies and procedures are critical to the daily practices and legal

compliance of any workplace. They not only give staff members a complete

guide to their job requirements, but also form the basis for other documents such

as job descriptions and employment contracts.

(c) How can you keep up to date with changes to policies and procedures?

1. be written in consultation with applicable persons such as department

managers, supervisors and/or consultants.

2. be easy to follow, using plain language that is relevant and easy to

understand.

3. identify the positions to which the procedure is applicable (avoid staff

member names as they can become dated).

4. describe the precise processes to be undertaken in sequence, including

and timeframes and legislative requirements.

(d) What steps could you undertake to ensure that the behaviours demonstrated

within the workplace meet the requirements set out in the documents below:

Document Behaviour

Mission Statement

Company Charter

A mission statement is a usually a short purpose

written statement that spells out the overall

goals, purposes or convictions of the company.

Every task that is undertaken should be

influenced by the company mission statement or

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

they outline the steps that are required to meet the policies and general

workplace requirements of the company.

(b) Who within your organisation is responsible for updating the policies and

procedures?

Correct policies and procedures are critical to the daily practices and legal

compliance of any workplace. They not only give staff members a complete

guide to their job requirements, but also form the basis for other documents such

as job descriptions and employment contracts.

(c) How can you keep up to date with changes to policies and procedures?

1. be written in consultation with applicable persons such as department

managers, supervisors and/or consultants.

2. be easy to follow, using plain language that is relevant and easy to

understand.

3. identify the positions to which the procedure is applicable (avoid staff

member names as they can become dated).

4. describe the precise processes to be undertaken in sequence, including

and timeframes and legislative requirements.

(d) What steps could you undertake to ensure that the behaviours demonstrated

within the workplace meet the requirements set out in the documents below:

Document Behaviour

Mission Statement

Company Charter

A mission statement is a usually a short purpose

written statement that spells out the overall

goals, purposes or convictions of the company.

Every task that is undertaken should be

influenced by the company mission statement or

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

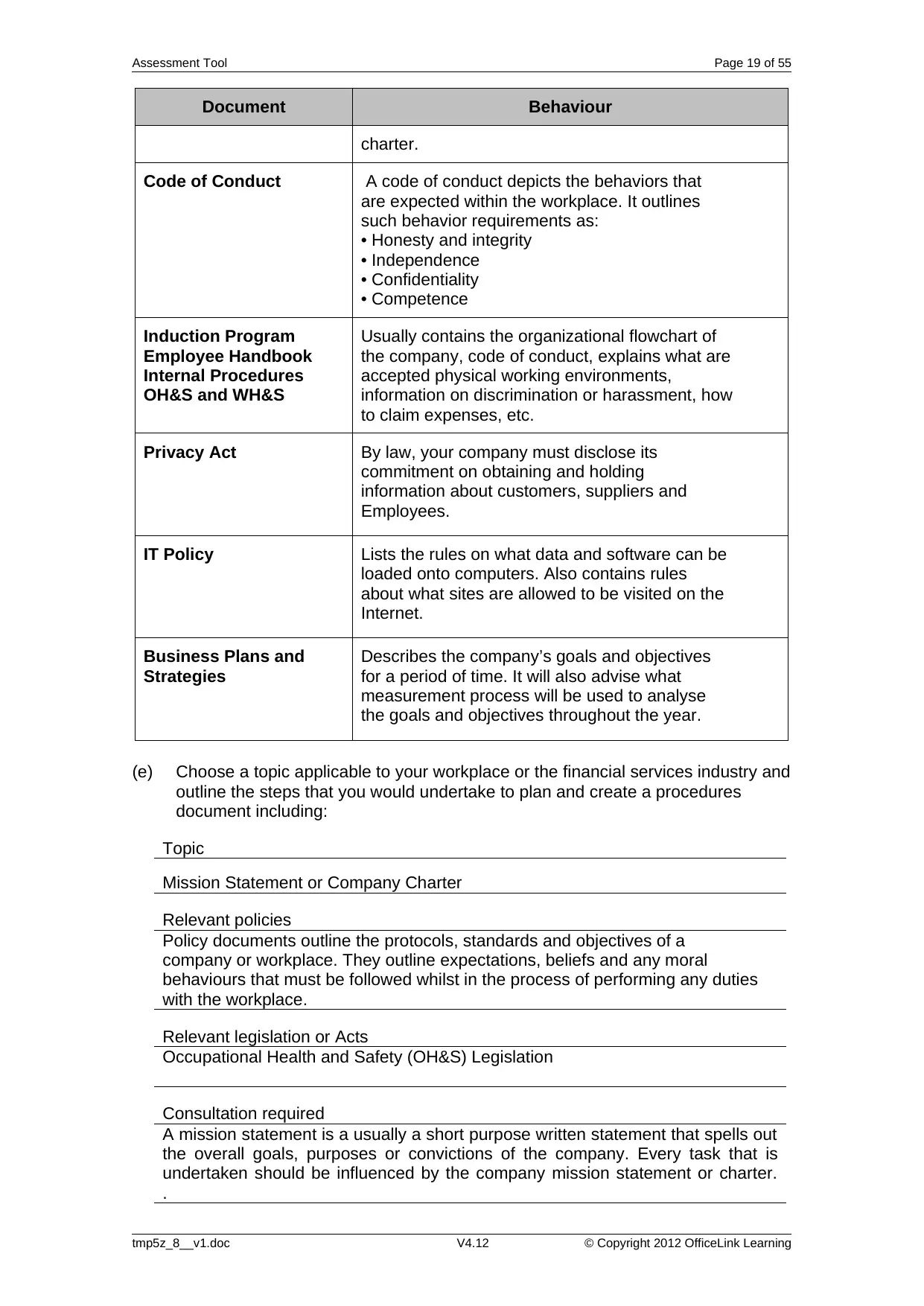

Assessment Tool Page 19 of 55

Document Behaviour

charter.

Code of Conduct A code of conduct depicts the behaviors that

are expected within the workplace. It outlines

such behavior requirements as:

• Honesty and integrity

• Independence

• Confidentiality

• Competence

Induction Program

Employee Handbook

Internal Procedures

OH&S and WH&S

Usually contains the organizational flowchart of

the company, code of conduct, explains what are

accepted physical working environments,

information on discrimination or harassment, how

to claim expenses, etc.

Privacy Act By law, your company must disclose its

commitment on obtaining and holding

information about customers, suppliers and

Employees.

IT Policy Lists the rules on what data and software can be

loaded onto computers. Also contains rules

about what sites are allowed to be visited on the

Internet.

Business Plans and

Strategies

Describes the company’s goals and objectives

for a period of time. It will also advise what

measurement process will be used to analyse

the goals and objectives throughout the year.

(e) Choose a topic applicable to your workplace or the financial services industry and

outline the steps that you would undertake to plan and create a procedures

document including:

Topic

Mission Statement or Company Charter

Relevant policies

Policy documents outline the protocols, standards and objectives of a

company or workplace. They outline expectations, beliefs and any moral

behaviours that must be followed whilst in the process of performing any duties

with the workplace.

Relevant legislation or Acts

Occupational Health and Safety (OH&S) Legislation

Consultation required

A mission statement is a usually a short purpose written statement that spells out

the overall goals, purposes or convictions of the company. Every task that is

undertaken should be influenced by the company mission statement or charter.

.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Document Behaviour

charter.

Code of Conduct A code of conduct depicts the behaviors that

are expected within the workplace. It outlines

such behavior requirements as:

• Honesty and integrity

• Independence

• Confidentiality

• Competence

Induction Program

Employee Handbook

Internal Procedures

OH&S and WH&S

Usually contains the organizational flowchart of

the company, code of conduct, explains what are

accepted physical working environments,

information on discrimination or harassment, how

to claim expenses, etc.

Privacy Act By law, your company must disclose its

commitment on obtaining and holding

information about customers, suppliers and

Employees.

IT Policy Lists the rules on what data and software can be

loaded onto computers. Also contains rules

about what sites are allowed to be visited on the

Internet.

Business Plans and

Strategies

Describes the company’s goals and objectives

for a period of time. It will also advise what

measurement process will be used to analyse

the goals and objectives throughout the year.

(e) Choose a topic applicable to your workplace or the financial services industry and

outline the steps that you would undertake to plan and create a procedures

document including:

Topic

Mission Statement or Company Charter

Relevant policies

Policy documents outline the protocols, standards and objectives of a

company or workplace. They outline expectations, beliefs and any moral

behaviours that must be followed whilst in the process of performing any duties

with the workplace.

Relevant legislation or Acts

Occupational Health and Safety (OH&S) Legislation

Consultation required

A mission statement is a usually a short purpose written statement that spells out

the overall goals, purposes or convictions of the company. Every task that is

undertaken should be influenced by the company mission statement or charter.

.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Tool Page 20 of 55

Authorisation steps

Procedure documents are written for staff members to follow and

they outline the steps that are required to meet the policies and general

workplace requirements of the company.

Communication and implementation processes

All financial advisors are bound by these legal requirements as a measure of

protection for both themselves and their clients. Finance industry members who

give advice or act outside of these restrictions may find themselves liable for any

losses sustained by their clients, fined, or in extreme cases, prosecuted in a court

of law.

Review and maintenance processes and timeframes

Requests constant referral to the applicable policy.

• Ensures relevant referral steps are undertaken, including consulting with

Governance and Policy units.

• Outlines steps for consultation, drafting, authorization, implementation

and maintenance of documentation.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Authorisation steps

Procedure documents are written for staff members to follow and

they outline the steps that are required to meet the policies and general

workplace requirements of the company.

Communication and implementation processes

All financial advisors are bound by these legal requirements as a measure of

protection for both themselves and their clients. Finance industry members who

give advice or act outside of these restrictions may find themselves liable for any

losses sustained by their clients, fined, or in extreme cases, prosecuted in a court

of law.

Review and maintenance processes and timeframes

Requests constant referral to the applicable policy.

• Ensures relevant referral steps are undertaken, including consulting with

Governance and Policy units.

• Outlines steps for consultation, drafting, authorization, implementation

and maintenance of documentation.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 21 of 55

(f) Using a program of your choice, for example Microsoft Word, Excel, Publisher or

PowerPoint, create a draft procedures document relevant to the topic outlined

above. If it is a large topic, just create part of it.

Once you have completed this task, save your document and include it with your

Assessment Tool when submitting your work to your Trainer/Assessor.

Activity Task 10 – UG Topic 2.3

Locate and discuss the following terms (include the Acts, legislations and laws that

relate):

(a) The No-Disadvantage Test.

The federal Workplace Relations Act 1996 now necessitate a new workplace

contract to accord with the ‘no-disadvantage test’ (NDT) prior to the agreement

can be enforceable legally. In this test the terms of the contract are compared to

that of the minimum conditions provided by law in order to determine whether any

condition is providing any disadvantage to the employee or not.

Act / legislation / code of practice / law / standard it relates to:

The federal Workplace Relations Act 1996 and Fair Work Act 2009 (Cth)

(b) Australian Fair Pay and Conditions Standard

The Australian Fair Pay and Conditions Standard provide five statutory

requirements in relation to conditions and wages. 1. casual loadings and

basic rates of pay 2. annual leave 3. maximum ordinary hours of work 4.

parental leave and related entitlements 5. personal leave (including carer's

leave and compassionate leave)

Act / legislation / code of practice / law / standard it relates to:

Introduced by the Australian Labour Law 2006 and abolished by Fair Work Act

2009 in 2010.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(f) Using a program of your choice, for example Microsoft Word, Excel, Publisher or

PowerPoint, create a draft procedures document relevant to the topic outlined

above. If it is a large topic, just create part of it.

Once you have completed this task, save your document and include it with your

Assessment Tool when submitting your work to your Trainer/Assessor.

Activity Task 10 – UG Topic 2.3

Locate and discuss the following terms (include the Acts, legislations and laws that

relate):

(a) The No-Disadvantage Test.

The federal Workplace Relations Act 1996 now necessitate a new workplace

contract to accord with the ‘no-disadvantage test’ (NDT) prior to the agreement

can be enforceable legally. In this test the terms of the contract are compared to

that of the minimum conditions provided by law in order to determine whether any

condition is providing any disadvantage to the employee or not.

Act / legislation / code of practice / law / standard it relates to:

The federal Workplace Relations Act 1996 and Fair Work Act 2009 (Cth)

(b) Australian Fair Pay and Conditions Standard

The Australian Fair Pay and Conditions Standard provide five statutory

requirements in relation to conditions and wages. 1. casual loadings and

basic rates of pay 2. annual leave 3. maximum ordinary hours of work 4.

parental leave and related entitlements 5. personal leave (including carer's

leave and compassionate leave)

Act / legislation / code of practice / law / standard it relates to:

Introduced by the Australian Labour Law 2006 and abolished by Fair Work Act

2009 in 2010.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 22 of 55

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment Tool Page 23 of 55

Activity Task 11 – UG Topic 2.4

(a) Undertake some research and locate two codes of conduct documents. One

from the Financial Services Industry and one from another (or just find the

complete versions of the examples in the User Guide).

The code of conducts are:

• Honesty and integrity

• Independence

• Confidentiality

• Competence

• Other responsibilities (including not knowingly obstructing the proper

Administration of the taxation tax).

(b) Compare the two and outline any differences.

Each of the associations maintains a Code of Conduct (or Code of

Ethics or

similar) which determines standards and guidelines for the behavior of

members

and in support of these categories and principles, administrative

sanctions can be

imposed for breaches of the Code. These may include:

• Association of Chartered Certified Accountants

• Association of Taxation & Management Accountants (ATMA)

• CPA Australia

• Institute of Chartered Accountants in Australia (ICAA)

• National Institute of Accountants (NIA)

• Taxation Institute of Australia (TIA)

• Chartered Institute of Management Accountants (CIMA)

• Australian Association of Professional Bookkeepers (AAPB)

• Institute of Certified Bookkeepers (ICB)

• Association of Certified Bookkeepers Inc. (CBK)

• Association of Accounting Technicians (AAT) Australia

(c) Refer to questions (a) and (b) above then list below the Acts, legislation, or

standards which could also relate to this Code of conduct.

The Australian Prudential Regulation Authority (APRA)

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Activity Task 11 – UG Topic 2.4

(a) Undertake some research and locate two codes of conduct documents. One

from the Financial Services Industry and one from another (or just find the

complete versions of the examples in the User Guide).

The code of conducts are:

• Honesty and integrity

• Independence

• Confidentiality

• Competence

• Other responsibilities (including not knowingly obstructing the proper

Administration of the taxation tax).

(b) Compare the two and outline any differences.

Each of the associations maintains a Code of Conduct (or Code of

Ethics or

similar) which determines standards and guidelines for the behavior of

members

and in support of these categories and principles, administrative

sanctions can be

imposed for breaches of the Code. These may include:

• Association of Chartered Certified Accountants

• Association of Taxation & Management Accountants (ATMA)

• CPA Australia

• Institute of Chartered Accountants in Australia (ICAA)

• National Institute of Accountants (NIA)

• Taxation Institute of Australia (TIA)

• Chartered Institute of Management Accountants (CIMA)

• Australian Association of Professional Bookkeepers (AAPB)

• Institute of Certified Bookkeepers (ICB)

• Association of Certified Bookkeepers Inc. (CBK)

• Association of Accounting Technicians (AAT) Australia

(c) Refer to questions (a) and (b) above then list below the Acts, legislation, or

standards which could also relate to this Code of conduct.

The Australian Prudential Regulation Authority (APRA)

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

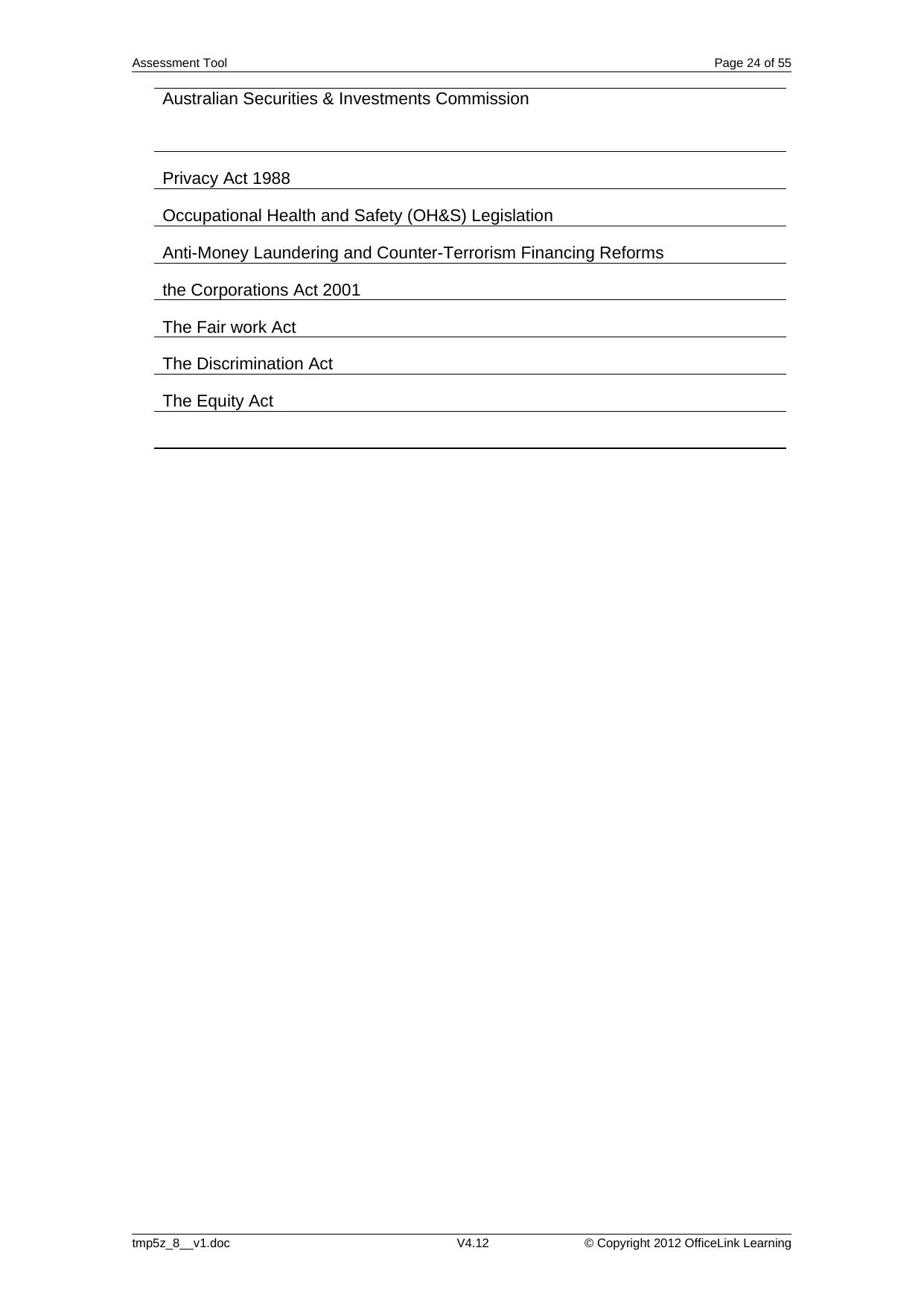

Assessment Tool Page 24 of 55

Australian Securities & Investments Commission

Privacy Act 1988

Occupational Health and Safety (OH&S) Legislation

Anti-Money Laundering and Counter-Terrorism Financing Reforms

the Corporations Act 2001

The Fair work Act

The Discrimination Act

The Equity Act

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Australian Securities & Investments Commission

Privacy Act 1988

Occupational Health and Safety (OH&S) Legislation

Anti-Money Laundering and Counter-Terrorism Financing Reforms

the Corporations Act 2001

The Fair work Act

The Discrimination Act

The Equity Act

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 25 of 55

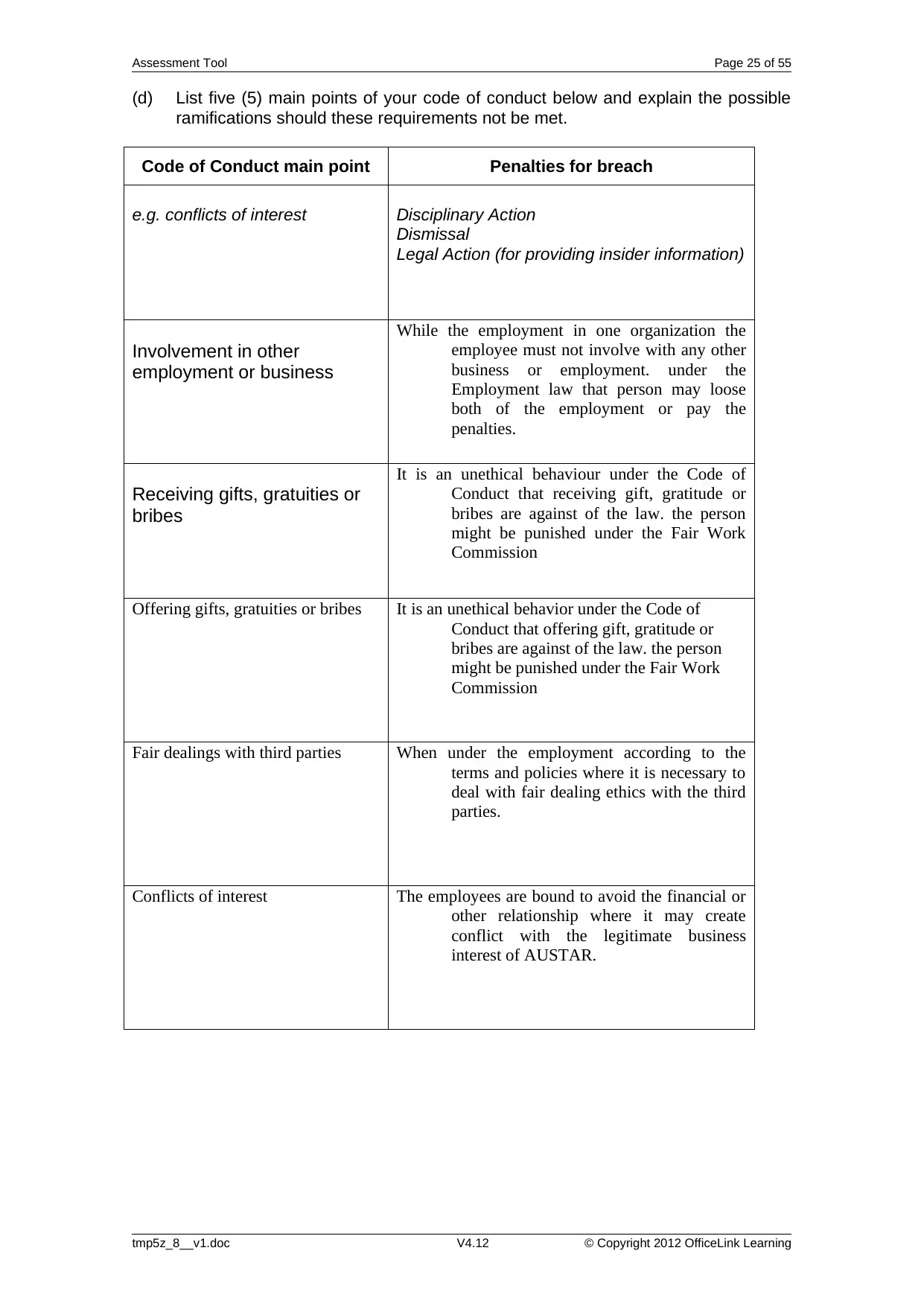

(d) List five (5) main points of your code of conduct below and explain the possible

ramifications should these requirements not be met.

Code of Conduct main point Penalties for breach

e.g. conflicts of interest Disciplinary Action

Dismissal

Legal Action (for providing insider information)

Involvement in other

employment or business

While the employment in one organization the

employee must not involve with any other

business or employment. under the

Employment law that person may loose

both of the employment or pay the

penalties.

Receiving gifts, gratuities or

bribes

It is an unethical behaviour under the Code of

Conduct that receiving gift, gratitude or

bribes are against of the law. the person

might be punished under the Fair Work

Commission

Offering gifts, gratuities or bribes It is an unethical behavior under the Code of

Conduct that offering gift, gratitude or

bribes are against of the law. the person

might be punished under the Fair Work

Commission

Fair dealings with third parties When under the employment according to the

terms and policies where it is necessary to

deal with fair dealing ethics with the third

parties.

Conflicts of interest The employees are bound to avoid the financial or

other relationship where it may create

conflict with the legitimate business

interest of AUSTAR.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

(d) List five (5) main points of your code of conduct below and explain the possible

ramifications should these requirements not be met.

Code of Conduct main point Penalties for breach

e.g. conflicts of interest Disciplinary Action

Dismissal

Legal Action (for providing insider information)

Involvement in other

employment or business

While the employment in one organization the

employee must not involve with any other

business or employment. under the

Employment law that person may loose

both of the employment or pay the

penalties.

Receiving gifts, gratuities or

bribes

It is an unethical behaviour under the Code of

Conduct that receiving gift, gratitude or

bribes are against of the law. the person

might be punished under the Fair Work

Commission

Offering gifts, gratuities or bribes It is an unethical behavior under the Code of

Conduct that offering gift, gratitude or

bribes are against of the law. the person

might be punished under the Fair Work

Commission

Fair dealings with third parties When under the employment according to the

terms and policies where it is necessary to

deal with fair dealing ethics with the third

parties.

Conflicts of interest The employees are bound to avoid the financial or

other relationship where it may create

conflict with the legitimate business

interest of AUSTAR.

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Assessment Tool Page 26 of 55

Activity Task 12 – UG Topic 2.5

(a) Read and discuss below the following ethical dilemma.

Scenario:

Six years ago you commenced employment for a new company owned solely by

Jamie Smith. Recently the company was bought out by his cousin Simone who

now has sole ownership. The buy-out agreement allows Jamie to rent his office

space and use of the printer, fax machine and bookkeeper (you) for an extended

period provided he pays an agreed sum to Simone. As a result, you are now

employed by Simone, but complete bookkeeping for both Simone’s and Jamie’s

companies.

Now Jamie is insisting that you inform him of any financial matters concerning his

cousin’s company, such as deposits, loans, cash flow problems, etc.

You have explained that you thought such questions placed you in an awkward

position; however, he is becoming very insistent, stating that after six years you

have a loyalty to him. He also argued that as he started the company and

because the new owner “is family”, he has the right to know everything that goes

on.

(b) Are you right to have ethical concerns? Why?

__________________________________________________________________

Yes. I am right to have ethical concerns in this scenario as now I am an employee of

Simone. I own him a fiduciary duty of confidentiality in the role of his employee. The

duty of loyalty which I owed to Jamie has ended once I have stopped working for him.

As Jaime is trying to gain information in relation to Simone business which I possess

this is an ethical dilemma for me as on one hand I have Jamie for whom I had worked

for 6 years and Simone who is my present employer.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

(c) What are your obligations? What actions should you take?

__________________________________________________________________

I may obliged to work for the best interest of my employer primarily. I must not use the

information obtained through the company for the personal interest of any other person

and to the detriment of the company. In such situation of a conflict of interest it would

always be my obligation to give importance to the interest of the company which is the

interest of Simone. Thus I should restrain from providing any such information to the

Jamie in relation to the company which have been asked by him.

__________________________________________________________________

__________________________________________________________________

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Activity Task 12 – UG Topic 2.5

(a) Read and discuss below the following ethical dilemma.

Scenario:

Six years ago you commenced employment for a new company owned solely by

Jamie Smith. Recently the company was bought out by his cousin Simone who

now has sole ownership. The buy-out agreement allows Jamie to rent his office

space and use of the printer, fax machine and bookkeeper (you) for an extended

period provided he pays an agreed sum to Simone. As a result, you are now

employed by Simone, but complete bookkeeping for both Simone’s and Jamie’s

companies.

Now Jamie is insisting that you inform him of any financial matters concerning his

cousin’s company, such as deposits, loans, cash flow problems, etc.

You have explained that you thought such questions placed you in an awkward

position; however, he is becoming very insistent, stating that after six years you

have a loyalty to him. He also argued that as he started the company and

because the new owner “is family”, he has the right to know everything that goes

on.

(b) Are you right to have ethical concerns? Why?

__________________________________________________________________

Yes. I am right to have ethical concerns in this scenario as now I am an employee of

Simone. I own him a fiduciary duty of confidentiality in the role of his employee. The

duty of loyalty which I owed to Jamie has ended once I have stopped working for him.

As Jaime is trying to gain information in relation to Simone business which I possess

this is an ethical dilemma for me as on one hand I have Jamie for whom I had worked

for 6 years and Simone who is my present employer.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

(c) What are your obligations? What actions should you take?

__________________________________________________________________

I may obliged to work for the best interest of my employer primarily. I must not use the

information obtained through the company for the personal interest of any other person

and to the detriment of the company. In such situation of a conflict of interest it would

always be my obligation to give importance to the interest of the company which is the

interest of Simone. Thus I should restrain from providing any such information to the

Jamie in relation to the company which have been asked by him.

__________________________________________________________________

__________________________________________________________________

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

Assessment Tool Page 27 of 55

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

(d) Which Acts, legislations or laws should be taken into account in this situation?

__________________________________________________________________

I should take into account the provisions of the Corporation Act 2001 (Cth) specially

those which provide under section 180-183 of the legislation. It is my duty under

section 183 of the legislation to not misuse the information of the company for personal

interest or the interest of any other third party. I may also make a breach of the

provisions which have been provided through The Privacy Act 1968 (Cth) in relation to

safeguarding and not leaking confidential information if I pass the information

demanded by Jaime to him.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

(e) What penalties could be levelled directly at you, the bookkeeper, if you provide

the information that is being asked for?

__________________________________________________________________

In case I provide the information which have been asked by Jaime to him I would

breach the provisions of the legislation discussed above. In addition I would also violate

the code of conduct in relation to book keepers. Therefore i may have my licence

cancelled and in addition be asked to compensate the company for any loss which

have been caused by the activities. I may also be liable under the Criminal Code for

such activities.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

tmp5z_8__v1.doc V4.12 © Copyright 2012 OfficeLink Learning

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

(d) Which Acts, legislations or laws should be taken into account in this situation?

__________________________________________________________________

I should take into account the provisions of the Corporation Act 2001 (Cth) specially

those which provide under section 180-183 of the legislation. It is my duty under

section 183 of the legislation to not misuse the information of the company for personal