R Robson (Guinot) Cosmetic Company: Growth, Funding, and Planning

VerifiedAdded on 2020/12/09

|16

|4819

|412

Report

AI Summary

This report examines the growth strategies of R Robson (Guinot), a cosmetic company, focusing on planning for growth and securing funding. It analyzes key considerations for evaluating growth opportunities, including Porter's Generic Competitive Strategies and PESTLE analysis. The report applies Ansoff's growth vector matrix to evaluate growth opportunities, particularly market and product development strategies. It assesses potential funding sources, such as personal investment and bank loans, discussing their benefits and drawbacks. Furthermore, the report outlines the design of a business plan for growth, incorporating financial information and strategic objectives. Finally, it explores exit or succession options for a small business, evaluating their advantages and disadvantages to offer recommendations.

PLANNING FOR GROWTH

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1. Analysing key considerations for evaluating growth opportunities and justifying them.1

P2. Evaluating the opportunities for growth applying Ansoff’s growth vector matrix..........4

M1: Options for growth using a range of analytical frameworks..........................................5

D1: Critically evaluating specific options and pathways for growth.....................................5

LO 2.................................................................................................................................................5

P3. Assessing the potential sources of funding available to businesses and discussing its

benefits and drawbacks...........................................................................................................5

M2: Potential sources of funding and justification.................................................................7

D2: Evaluating potential sources of funding with justified argument....................................7

LO 3.................................................................................................................................................8

P4. Designing a business plan for growth including financial information and strategic

objectives................................................................................................................................8

LO 4...............................................................................................................................................10

P5. Assessing exit or succession options for a small business with explaining their benefits

and drawbacks......................................................................................................................10

M4: Evaluating exit or succession options for a small business comparing and contrasting the

options and making valid recommendations........................................................................12

D4: Critical evaluation of the exit or succession options for a small business and appropriate

justified recommendations to support implementation........................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

LO 1.................................................................................................................................................1

P1. Analysing key considerations for evaluating growth opportunities and justifying them.1

P2. Evaluating the opportunities for growth applying Ansoff’s growth vector matrix..........4

M1: Options for growth using a range of analytical frameworks..........................................5

D1: Critically evaluating specific options and pathways for growth.....................................5

LO 2.................................................................................................................................................5

P3. Assessing the potential sources of funding available to businesses and discussing its

benefits and drawbacks...........................................................................................................5

M2: Potential sources of funding and justification.................................................................7

D2: Evaluating potential sources of funding with justified argument....................................7

LO 3.................................................................................................................................................8

P4. Designing a business plan for growth including financial information and strategic

objectives................................................................................................................................8

LO 4...............................................................................................................................................10

P5. Assessing exit or succession options for a small business with explaining their benefits

and drawbacks......................................................................................................................10

M4: Evaluating exit or succession options for a small business comparing and contrasting the

options and making valid recommendations........................................................................12

D4: Critical evaluation of the exit or succession options for a small business and appropriate

justified recommendations to support implementation........................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

INTRODUCTION

Planning plays an important role for an organization in order to manage their work

effectively and properly. Planning includes all the factors which can affect their system, such as,

managing their employees, products and services, etc. Without proper planning it becomes

difficult for the company to improve their overall performance. Planning for growth in business

is a strategic activity which helps the firm to make innovative ideas through which they can

increase their revenue.

Present report will study about R Robson (Guinot) which is a cosmetic company situated

in Ascot, Berkshire, United Kingdom. It will also assist in evaluating the overall growth of firm

through Ansoff’s growth vector matrix. This study will discuss about different sources of

funding which is available in market with their advantages and disadvantages. It will also design

a business plan which will include their financial data and strategic objectives of the firm and

explains exit or succession options for small business.

LO 1

P1. Analysing key considerations for evaluating growth opportunities and justifying them

R Robson (Guinot) is a cosmetic company which provides beauty treatments products to

their customers. It is a business to business (B2B) organization that is running its company

successfully in beauty industry. Now this company is planning to introduce some herbal product

range for the treatment of skin related issues, such as, acne, dark circles, wrinkles, etc. For R

Robson, it is very important to have a good planning so that it can help them in introducing their

product effectively in market. For this they can implement various analysis to analyse the growth

opportunities that are present for them in market (Wu, 2015). For example, they can use Porter

generic strategic model to evaluate their competitors that are present in industry and from

PESTLE analysis they can understand the different factors which can affect their product, such

as, political, economic, technological, etc. These approaches are explained in detail below:

Porter’s Generic Competitive Strategies: This is a process which is helpful in

explaining the strategic planning of their competitors that can affect their marketing and

business as well. This method will help in introducing their new organic range effectively

(Keough, 2015). There are three elements present in this model, i.e.,

1. Cost Leadership: In this method, it basically focuses on introducing their products at lower

1

Planning plays an important role for an organization in order to manage their work

effectively and properly. Planning includes all the factors which can affect their system, such as,

managing their employees, products and services, etc. Without proper planning it becomes

difficult for the company to improve their overall performance. Planning for growth in business

is a strategic activity which helps the firm to make innovative ideas through which they can

increase their revenue.

Present report will study about R Robson (Guinot) which is a cosmetic company situated

in Ascot, Berkshire, United Kingdom. It will also assist in evaluating the overall growth of firm

through Ansoff’s growth vector matrix. This study will discuss about different sources of

funding which is available in market with their advantages and disadvantages. It will also design

a business plan which will include their financial data and strategic objectives of the firm and

explains exit or succession options for small business.

LO 1

P1. Analysing key considerations for evaluating growth opportunities and justifying them

R Robson (Guinot) is a cosmetic company which provides beauty treatments products to

their customers. It is a business to business (B2B) organization that is running its company

successfully in beauty industry. Now this company is planning to introduce some herbal product

range for the treatment of skin related issues, such as, acne, dark circles, wrinkles, etc. For R

Robson, it is very important to have a good planning so that it can help them in introducing their

product effectively in market. For this they can implement various analysis to analyse the growth

opportunities that are present for them in market (Wu, 2015). For example, they can use Porter

generic strategic model to evaluate their competitors that are present in industry and from

PESTLE analysis they can understand the different factors which can affect their product, such

as, political, economic, technological, etc. These approaches are explained in detail below:

Porter’s Generic Competitive Strategies: This is a process which is helpful in

explaining the strategic planning of their competitors that can affect their marketing and

business as well. This method will help in introducing their new organic range effectively

(Keough, 2015). There are three elements present in this model, i.e.,

1. Cost Leadership: In this method, it basically focuses on introducing their products at lower

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cost as compared to their competitors. This will help an organization to attract more customers

and can earn a good profit.

2. Differentiation: In this strategy, company focuses on creating a product that is totally

different from other products that are available in market already. For R Robson it is very

essential to introduce their herbal product range with some uniqueness so that it will help them

in attracting more customers (Grover, Bokalo and Greenway, 2014).

3. Focus: This is the factors which basically focuses on selected target market which is

beneficial for them. This will help them in increasing their sales and revenue as well. This

strategy is divided into two sections, i.e.,

3a. Cost Focus

In this method, company tries to focus on the

cost factors of their products to make it

affordable for their customers.

3b. Differentiation Focus

In this process, organization seeks

differentiation in its target segment, such as,

young group, ladies, etc (Darroch, 2014).

PESTLE Analysis: This process plays an important role in the identification of growth

opportunities that are available in industry which can help them in introducing their new

herbal treatment cosmetic products range. This analysis helps in analysing different

factors which can have a huge impact on their products range, such as, political,

economic, social, technological, environmental and legal which is explained below:

Political Factor These factors have a huge impact on any business activity as it is very

important to follow all the regulations that have been made for such

companies, such as,

They have to properly register their products before launching

it in the industry (Ying, Chaolin and Xiaojiang, 2014).

R Robson has to follow all the taxation policies, laws, etc. in

order to work properly.

Economic Factor These are the economic factors which can affect their business in

numerous ways, for example,

The most important economic factor is impact of inflation rate

2

and can earn a good profit.

2. Differentiation: In this strategy, company focuses on creating a product that is totally

different from other products that are available in market already. For R Robson it is very

essential to introduce their herbal product range with some uniqueness so that it will help them

in attracting more customers (Grover, Bokalo and Greenway, 2014).

3. Focus: This is the factors which basically focuses on selected target market which is

beneficial for them. This will help them in increasing their sales and revenue as well. This

strategy is divided into two sections, i.e.,

3a. Cost Focus

In this method, company tries to focus on the

cost factors of their products to make it

affordable for their customers.

3b. Differentiation Focus

In this process, organization seeks

differentiation in its target segment, such as,

young group, ladies, etc (Darroch, 2014).

PESTLE Analysis: This process plays an important role in the identification of growth

opportunities that are available in industry which can help them in introducing their new

herbal treatment cosmetic products range. This analysis helps in analysing different

factors which can have a huge impact on their products range, such as, political,

economic, social, technological, environmental and legal which is explained below:

Political Factor These factors have a huge impact on any business activity as it is very

important to follow all the regulations that have been made for such

companies, such as,

They have to properly register their products before launching

it in the industry (Ying, Chaolin and Xiaojiang, 2014).

R Robson has to follow all the taxation policies, laws, etc. in

order to work properly.

Economic Factor These are the economic factors which can affect their business in

numerous ways, for example,

The most important economic factor is impact of inflation rate

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

in market.

They also have to cope up with increased interest rates which

can affect their products.

Social Factor Such factors are related to the behaviour of customers which can have

a huge impact on R Robson, such as;

Change in the purchasing behaviour of customer is a huge

factor for such industry.

Element based on age, gender, lifestyle, etc. is another issue

for R Robson to deal with.

Technological Factor It is very essential for a cosmetic company to have all the latest tools

and technology which can enhance their product and can help them in

increase their sales effectively. These can include,

Products with new herbal constituents (Zalengera and et.al.,

2014).

No chemical cosmetic range, etc.

Legal Factor There are various legal factors which can affect their business, for

example,

They have to properly follow all the laws and regulations that

are mandatory for R Robson to implement efficiently in their

company.

Environmental Factor This plays an important role for any organization. R Robson has to

ensure that they are not harming the environment in their

manufacturing processes.

They have to make sure that they are using biodegradable

packaging for their products.

For R Robson it is very important to focus on the cost leadership strategy as this will help

them in reaching maximum number of customers. This will increase their sales and overall

generated revenue as well.

3

They also have to cope up with increased interest rates which

can affect their products.

Social Factor Such factors are related to the behaviour of customers which can have

a huge impact on R Robson, such as;

Change in the purchasing behaviour of customer is a huge

factor for such industry.

Element based on age, gender, lifestyle, etc. is another issue

for R Robson to deal with.

Technological Factor It is very essential for a cosmetic company to have all the latest tools

and technology which can enhance their product and can help them in

increase their sales effectively. These can include,

Products with new herbal constituents (Zalengera and et.al.,

2014).

No chemical cosmetic range, etc.

Legal Factor There are various legal factors which can affect their business, for

example,

They have to properly follow all the laws and regulations that

are mandatory for R Robson to implement efficiently in their

company.

Environmental Factor This plays an important role for any organization. R Robson has to

ensure that they are not harming the environment in their

manufacturing processes.

They have to make sure that they are using biodegradable

packaging for their products.

For R Robson it is very important to focus on the cost leadership strategy as this will help

them in reaching maximum number of customers. This will increase their sales and overall

generated revenue as well.

3

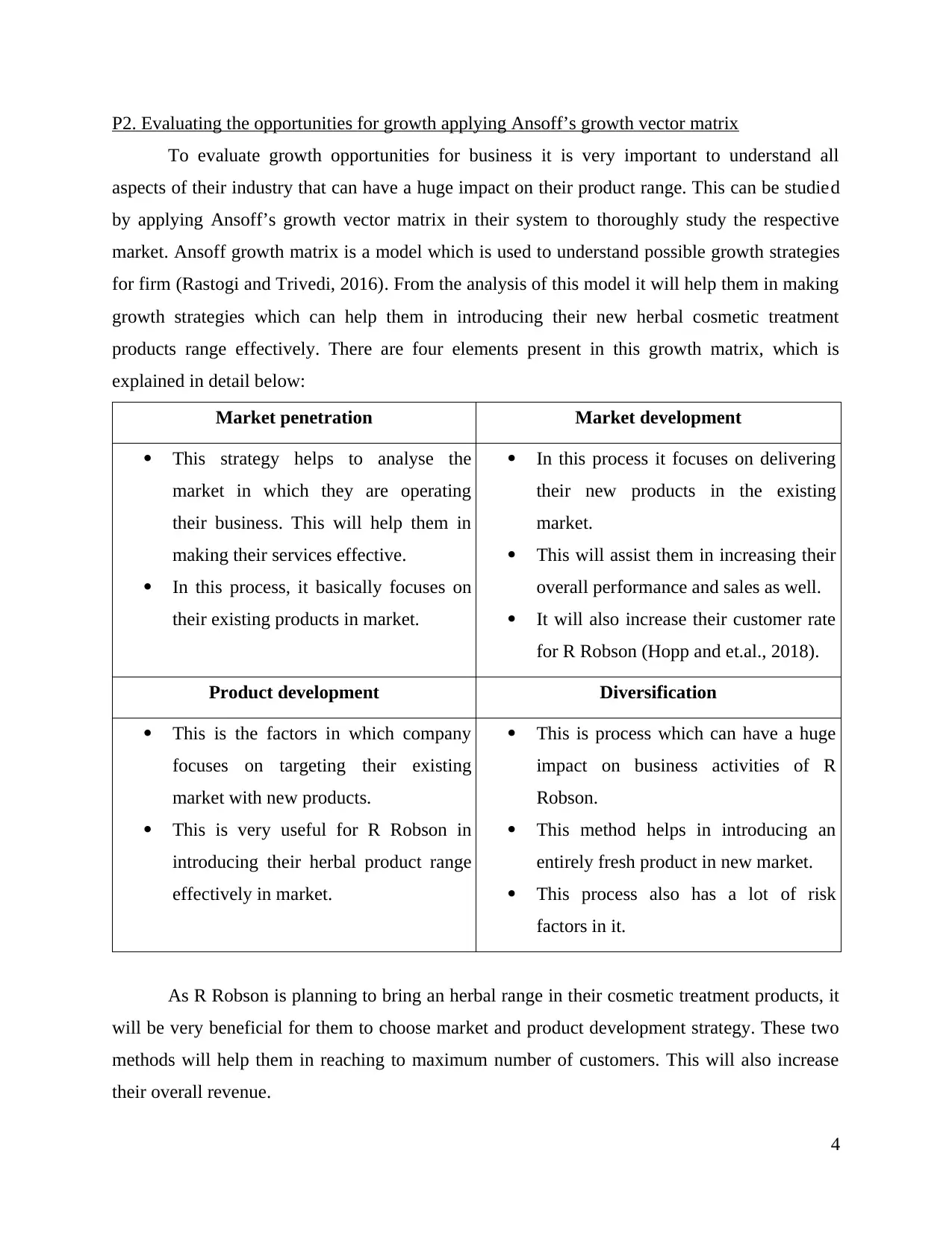

P2. Evaluating the opportunities for growth applying Ansoff’s growth vector matrix

To evaluate growth opportunities for business it is very important to understand all

aspects of their industry that can have a huge impact on their product range. This can be studied

by applying Ansoff’s growth vector matrix in their system to thoroughly study the respective

market. Ansoff growth matrix is a model which is used to understand possible growth strategies

for firm (Rastogi and Trivedi, 2016). From the analysis of this model it will help them in making

growth strategies which can help them in introducing their new herbal cosmetic treatment

products range effectively. There are four elements present in this growth matrix, which is

explained in detail below:

Market penetration Market development

This strategy helps to analyse the

market in which they are operating

their business. This will help them in

making their services effective.

In this process, it basically focuses on

their existing products in market.

In this process it focuses on delivering

their new products in the existing

market.

This will assist them in increasing their

overall performance and sales as well.

It will also increase their customer rate

for R Robson (Hopp and et.al., 2018).

Product development Diversification

This is the factors in which company

focuses on targeting their existing

market with new products.

This is very useful for R Robson in

introducing their herbal product range

effectively in market.

This is process which can have a huge

impact on business activities of R

Robson.

This method helps in introducing an

entirely fresh product in new market.

This process also has a lot of risk

factors in it.

As R Robson is planning to bring an herbal range in their cosmetic treatment products, it

will be very beneficial for them to choose market and product development strategy. These two

methods will help them in reaching to maximum number of customers. This will also increase

their overall revenue.

4

To evaluate growth opportunities for business it is very important to understand all

aspects of their industry that can have a huge impact on their product range. This can be studied

by applying Ansoff’s growth vector matrix in their system to thoroughly study the respective

market. Ansoff growth matrix is a model which is used to understand possible growth strategies

for firm (Rastogi and Trivedi, 2016). From the analysis of this model it will help them in making

growth strategies which can help them in introducing their new herbal cosmetic treatment

products range effectively. There are four elements present in this growth matrix, which is

explained in detail below:

Market penetration Market development

This strategy helps to analyse the

market in which they are operating

their business. This will help them in

making their services effective.

In this process, it basically focuses on

their existing products in market.

In this process it focuses on delivering

their new products in the existing

market.

This will assist them in increasing their

overall performance and sales as well.

It will also increase their customer rate

for R Robson (Hopp and et.al., 2018).

Product development Diversification

This is the factors in which company

focuses on targeting their existing

market with new products.

This is very useful for R Robson in

introducing their herbal product range

effectively in market.

This is process which can have a huge

impact on business activities of R

Robson.

This method helps in introducing an

entirely fresh product in new market.

This process also has a lot of risk

factors in it.

As R Robson is planning to bring an herbal range in their cosmetic treatment products, it

will be very beneficial for them to choose market and product development strategy. These two

methods will help them in reaching to maximum number of customers. This will also increase

their overall revenue.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

M1: Options for growth using a range of analytical frameworks

Using various models and analysis can help them in analysing their growth opportunities

which is very useful for them in improving and expanding their business in market. There are

various theories and studies which can be used by R Robson, for example, Ansoff matrix,

PESTLE analysis, Porter generic model, etc.

D1: Critically evaluating specific options and pathways for growth

From Porter’s generic strategy model, it is clear that for R Robson cost leadership plan

will be very effective as from this scheme they can reach to maximum number of customers in

less time. And from Ansoff growth matrix, they have chosen market and product development

strategy both as it will be useful for them in introducing their herbal cosmetic treatment products

effectively. Other factors of these models are very risky to implement in their business activity as

they are unable to understand reaction of customers at initial level. So it is better for them to use

safe strategy.

LO 2

P3. Assessing the potential sources of funding available to businesses and discussing its benefits

and drawbacks

For any new business planning funding plays an important role as it will help in

providing the firm financial support. It is very important to have effective source of funding

which can help them in achieving their target successfully (Denton, Forsyth and MacLennan,

2017). They have only £20000 to invest in their business plan. They want a total amount of

£200000. Remaining £200000 can be collected through funding by company. There are various

methods through which this funding can be achieved, such as:

Internal sources

Personal investment: investment of personal resources in business in the common source of

funding is the most cost-effective way to provide financing rather than other sources (Rastogi

and Trivedi, 2016).

Advantages of personal investments:

A person knows the specific amount to be invested in own business.

It gives much more control on business.

5

Using various models and analysis can help them in analysing their growth opportunities

which is very useful for them in improving and expanding their business in market. There are

various theories and studies which can be used by R Robson, for example, Ansoff matrix,

PESTLE analysis, Porter generic model, etc.

D1: Critically evaluating specific options and pathways for growth

From Porter’s generic strategy model, it is clear that for R Robson cost leadership plan

will be very effective as from this scheme they can reach to maximum number of customers in

less time. And from Ansoff growth matrix, they have chosen market and product development

strategy both as it will be useful for them in introducing their herbal cosmetic treatment products

effectively. Other factors of these models are very risky to implement in their business activity as

they are unable to understand reaction of customers at initial level. So it is better for them to use

safe strategy.

LO 2

P3. Assessing the potential sources of funding available to businesses and discussing its benefits

and drawbacks

For any new business planning funding plays an important role as it will help in

providing the firm financial support. It is very important to have effective source of funding

which can help them in achieving their target successfully (Denton, Forsyth and MacLennan,

2017). They have only £20000 to invest in their business plan. They want a total amount of

£200000. Remaining £200000 can be collected through funding by company. There are various

methods through which this funding can be achieved, such as:

Internal sources

Personal investment: investment of personal resources in business in the common source of

funding is the most cost-effective way to provide financing rather than other sources (Rastogi

and Trivedi, 2016).

Advantages of personal investments:

A person knows the specific amount to be invested in own business.

It gives much more control on business.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Personal investment will give full ownership of businesses; it will help to retain all

profits.

Disadvantage of personal investment:

There is a risk of losing all the personal saving if business plan fails. Using money will have a strain on family and personal life.

External sources

Bank loans: taking loans from bank are most common and easiest method of granting

loans for start-up businesses. Banks provides loans on basis of amount of funds. Loans can be

given for a specific period depending on tenure of loan. Banks takes regular interest on amount

of fund, this involvement have benefits in tax deduction. Unlike other sources banks wants

personal commitment or collateral security for granting loans.

Benefits of bank loans:

In raising funds from bank one should only worry about the statement, banks don't

monitor how they use the amount as long as they make payment on time, so an owner can

invest the amount they want.

In terms of interest rate., bank is more cost-effective than any other sources, lower bank

rates help to save the profit.

Banks only demands their instalment and principle amount; they don't require and share

of profit. So all the earnings can be retained.

Bank interest are tax deductible cost which helps in showing more expenses while

preparing tax (Gurcaylilar-Yenidogan and Aksoy, 2018).

Disadvantages of bank loans:

They are very lengthy process to accomplish.

Repayment burden: periodic instalment in banks is a hectic process. Different interest rate can cause irregular payment amount.

Government grants: Government agencies provides financing such as grants and subsidies

that may be available to your business. But there are lot of competition for taking subsidization

through government. Grants can easily be rewarded to start-ups, government wants some detail

description of projects and how it will be beneficial to society and economic development.

Advantages of government grants:

6

profits.

Disadvantage of personal investment:

There is a risk of losing all the personal saving if business plan fails. Using money will have a strain on family and personal life.

External sources

Bank loans: taking loans from bank are most common and easiest method of granting

loans for start-up businesses. Banks provides loans on basis of amount of funds. Loans can be

given for a specific period depending on tenure of loan. Banks takes regular interest on amount

of fund, this involvement have benefits in tax deduction. Unlike other sources banks wants

personal commitment or collateral security for granting loans.

Benefits of bank loans:

In raising funds from bank one should only worry about the statement, banks don't

monitor how they use the amount as long as they make payment on time, so an owner can

invest the amount they want.

In terms of interest rate., bank is more cost-effective than any other sources, lower bank

rates help to save the profit.

Banks only demands their instalment and principle amount; they don't require and share

of profit. So all the earnings can be retained.

Bank interest are tax deductible cost which helps in showing more expenses while

preparing tax (Gurcaylilar-Yenidogan and Aksoy, 2018).

Disadvantages of bank loans:

They are very lengthy process to accomplish.

Repayment burden: periodic instalment in banks is a hectic process. Different interest rate can cause irregular payment amount.

Government grants: Government agencies provides financing such as grants and subsidies

that may be available to your business. But there are lot of competition for taking subsidization

through government. Grants can easily be rewarded to start-ups, government wants some detail

description of projects and how it will be beneficial to society and economic development.

Advantages of government grants:

6

The main advantage of government grants is; the company need not have to pay back

their funds.

The government will also help in increasing networking that would help in starting

business.

Grants from government is not taxable amount.

Disadvantages of Government grants:

There are lots of competitive firms which have applied for government grants.

The paperwork for application of grants is a complex process and time consuming. Company may not get the expected amount of funds for new business.

Crowd funding: The crowdfunding is the use of amount of capital from numerous

individuals to finance a new business venture. It is easy to access the use of large network to

bring investors together.

Advantages of Crowd funding:

Sharing business idea to investors will help in getting feedback and advice to improve

plan.

Disadvantages of Crowd funding:

It is a lengthy process and time consuming to choose right platform of investors.

M2: Potential sources of funding and justification

For R Robson, personal investment and crowdfunding will be a great option to choose for

their business planning effectively. As this will help them in achieving their target and objective

in short time.

D2: Evaluating potential sources of funding with justified argument

Various sources of funding are available for R Robson to get sufficient amount for their

business planning. From all the above sources, personal investment and crowdfunding are very

useful for them and easy to implement in their business. All the other processes that are present

in funding, such as, bank loans, capital investment, government grants, etc. all are time

consuming and lengthy process. These processes will delay their plan in introducing their herbal

cosmetic products in market.

7

their funds.

The government will also help in increasing networking that would help in starting

business.

Grants from government is not taxable amount.

Disadvantages of Government grants:

There are lots of competitive firms which have applied for government grants.

The paperwork for application of grants is a complex process and time consuming. Company may not get the expected amount of funds for new business.

Crowd funding: The crowdfunding is the use of amount of capital from numerous

individuals to finance a new business venture. It is easy to access the use of large network to

bring investors together.

Advantages of Crowd funding:

Sharing business idea to investors will help in getting feedback and advice to improve

plan.

Disadvantages of Crowd funding:

It is a lengthy process and time consuming to choose right platform of investors.

M2: Potential sources of funding and justification

For R Robson, personal investment and crowdfunding will be a great option to choose for

their business planning effectively. As this will help them in achieving their target and objective

in short time.

D2: Evaluating potential sources of funding with justified argument

Various sources of funding are available for R Robson to get sufficient amount for their

business planning. From all the above sources, personal investment and crowdfunding are very

useful for them and easy to implement in their business. All the other processes that are present

in funding, such as, bank loans, capital investment, government grants, etc. all are time

consuming and lengthy process. These processes will delay their plan in introducing their herbal

cosmetic products in market.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

LO 3

P4. Designing a business plan for growth including financial information and strategic objectives

For any organization or small business, it is very important to have effective business

plan which can help them in achieving their objectives. It is very essential for R Robson to

calculate all the aspects and issues which can affect their company. Various elements that are

present in a good business plan includes,

Executive Summary: This has a huge importance for an organization. This will include

all the details of company and will help in explaining every information of their business

plan. R Robson has to describe all the functions that will be included in their plan

effectively.

Business Description: This will include the details of their business plan and how they

will execute it. In the present plan R Robson is introducing a new range of herbal

treatment cosmetic products range for skin treatment, such as acne, pimple, dark circles,

etc. in market.

Mission and Vision: Their mission is to reach maximum number of customers through

their products specifically. Mission and vision has to be clear for R Robson in order to

plan their strategies. And vision of this company is provide their customers some good

and herbal products which can help them in treating their skin problems effectively

(Ghezzi and et.al., 2015).

Product or Service Description: This part of business plan includes the detailed

description of their products. For example, in their herbal products range it will include

all the naturally extracted products to make it more effective and good.

Competitor Analysis: This method will help R Robson to analyse their competitors.

From this analysis it will be very helpful for them to make improvements in their

products to make it more successful. For example, Herrco Cosmetic Limited can be a

competition for them. To compete with them they have to deliver their products better

than them.

Market Analysis: To implement any business plan it is very important to perform an

industry investigation as this helps in understanding their respective market. For R

Robson, it has a huge impact as it will enable them to provide their service as per their

8

P4. Designing a business plan for growth including financial information and strategic objectives

For any organization or small business, it is very important to have effective business

plan which can help them in achieving their objectives. It is very essential for R Robson to

calculate all the aspects and issues which can affect their company. Various elements that are

present in a good business plan includes,

Executive Summary: This has a huge importance for an organization. This will include

all the details of company and will help in explaining every information of their business

plan. R Robson has to describe all the functions that will be included in their plan

effectively.

Business Description: This will include the details of their business plan and how they

will execute it. In the present plan R Robson is introducing a new range of herbal

treatment cosmetic products range for skin treatment, such as acne, pimple, dark circles,

etc. in market.

Mission and Vision: Their mission is to reach maximum number of customers through

their products specifically. Mission and vision has to be clear for R Robson in order to

plan their strategies. And vision of this company is provide their customers some good

and herbal products which can help them in treating their skin problems effectively

(Ghezzi and et.al., 2015).

Product or Service Description: This part of business plan includes the detailed

description of their products. For example, in their herbal products range it will include

all the naturally extracted products to make it more effective and good.

Competitor Analysis: This method will help R Robson to analyse their competitors.

From this analysis it will be very helpful for them to make improvements in their

products to make it more successful. For example, Herrco Cosmetic Limited can be a

competition for them. To compete with them they have to deliver their products better

than them.

Market Analysis: To implement any business plan it is very important to perform an

industry investigation as this helps in understanding their respective market. For R

Robson, it has a huge impact as it will enable them to provide their service as per their

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

customer's preferences which will assist them in increasing their overall sales. For

example, interacting with people and getting a knowledge of their preferences in

cosmetic product will be very helpful for R Robson.

SWOT Analysis: This method helps in evaluating strength and weaknesses of an

organization along with its opportunities and threats that are present in market. Strength

of R Robson is that they are introducing an herbal product range which will not affect

their customer's skin in any ways possible. Financial status of R Robson can create a

huge hurdle in the execution of their business plan.

Strategic Objectives: This will include all strategic objectives which is required in

achievement of their plan effectively. The primary objective behind this plan is to

introduce a new product range which is herbal and effective for skin treatment. This will

also help them in expanding their business more and increasing their overall generated

revenue (Okagak and Dean, 2016).

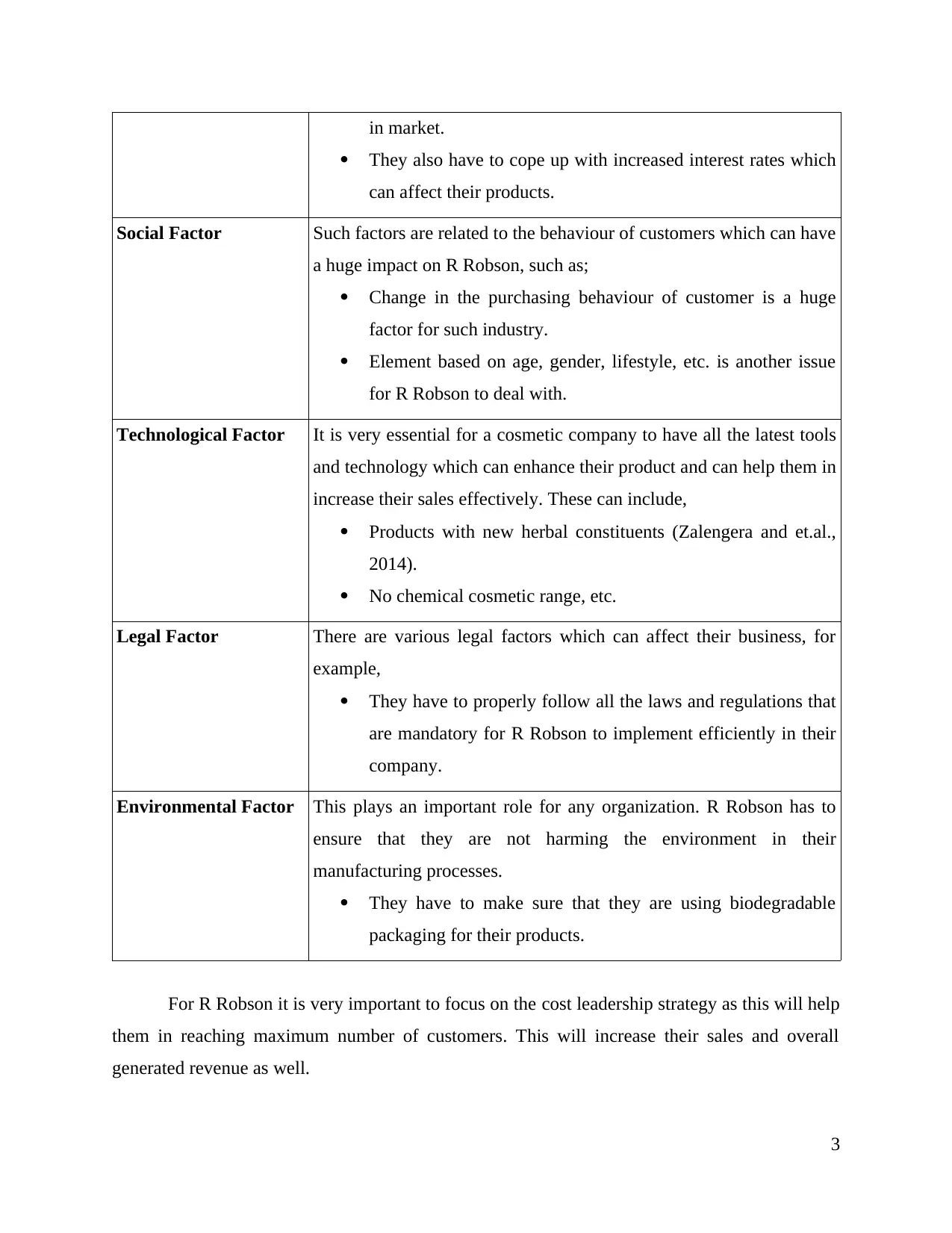

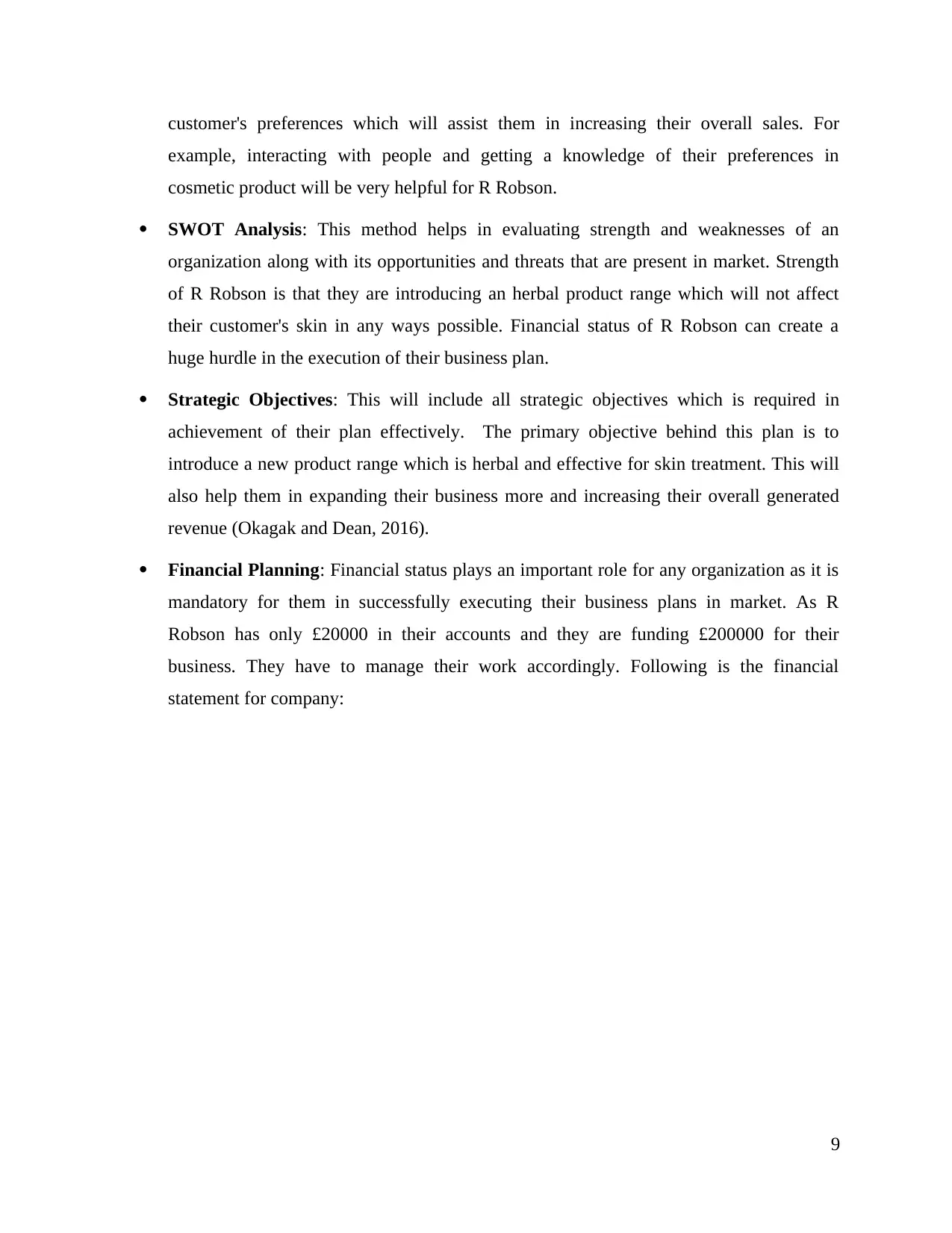

Financial Planning: Financial status plays an important role for any organization as it is

mandatory for them in successfully executing their business plans in market. As R

Robson has only £20000 in their accounts and they are funding £200000 for their

business. They have to manage their work accordingly. Following is the financial

statement for company:

9

example, interacting with people and getting a knowledge of their preferences in

cosmetic product will be very helpful for R Robson.

SWOT Analysis: This method helps in evaluating strength and weaknesses of an

organization along with its opportunities and threats that are present in market. Strength

of R Robson is that they are introducing an herbal product range which will not affect

their customer's skin in any ways possible. Financial status of R Robson can create a

huge hurdle in the execution of their business plan.

Strategic Objectives: This will include all strategic objectives which is required in

achievement of their plan effectively. The primary objective behind this plan is to

introduce a new product range which is herbal and effective for skin treatment. This will

also help them in expanding their business more and increasing their overall generated

revenue (Okagak and Dean, 2016).

Financial Planning: Financial status plays an important role for any organization as it is

mandatory for them in successfully executing their business plans in market. As R

Robson has only £20000 in their accounts and they are funding £200000 for their

business. They have to manage their work accordingly. Following is the financial

statement for company:

9

Figure: 1

LO 4

P5. Assessing exit or succession options for a small business with explaining their benefits and

drawbacks

Exit or succession options are very important for any small business if they are planning

to close their business. There are numerous reasons behind this, such as, retirement, health

issues, not interested to continue the business (Succession planning: 3 exit strategies for

entrepreneurs, 2016). There are various options that can be useful for them for exit or

succession, such as: Mergers and acquisitions: In this process it basically helps in combining two companies

together. This can also be considered as effective option for small business to choose

from. Merger basically happens when two different companies of same size merges

together in order to increase their sales, efficiencies, etc. Whereas, in acquisition process,

one company buys another firm.

10

LO 4

P5. Assessing exit or succession options for a small business with explaining their benefits and

drawbacks

Exit or succession options are very important for any small business if they are planning

to close their business. There are numerous reasons behind this, such as, retirement, health

issues, not interested to continue the business (Succession planning: 3 exit strategies for

entrepreneurs, 2016). There are various options that can be useful for them for exit or

succession, such as: Mergers and acquisitions: In this process it basically helps in combining two companies

together. This can also be considered as effective option for small business to choose

from. Merger basically happens when two different companies of same size merges

together in order to increase their sales, efficiencies, etc. Whereas, in acquisition process,

one company buys another firm.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.