Prudential PLC: Management Structure and Governance

VerifiedAdded on 2023/04/05

|13

|3572

|132

AI Summary

This article discusses the management structure and governance of Prudential PLC, a top multinational provider of financial services and life insurance. It also explores the impacts of external factors on the organization.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: PLC 0

Prudential PLc

Business Environment

3/13/2019

Prudential PLc

Business Environment

3/13/2019

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PLC 1

Introduction

Prudential PLC is internationally regarded as the top multinational provider of financial

service and life insurance. It was established in 1848 in London with an objective of

delivering loans and services for elite people. They have four separate business units

Prudential Corporation (in Asia), Prudential U.K. (works in England), M & G (in Europe),

and Jackson (in the U.S.). In the Annual report issued in the year 2014, Prudential

Corporation is the dominant market leader with the fastest and largest developing market of

clients in 14 Asian countries involving United Kingdom (Hugo, 2018). They have officially

started its operations in the United Kingdom in 1996 and it is seen that presently it is a well-

equipped brand name of Pru Life UK. They are valued as the developer in the domestic

insurance industry. It ranks first among 34 insurance-associated-investment suppliers within

the country in respect of revenue, profitability, and market growth. Their main objective is to

maintain existing business in developing markets. They are also committed to maintaining

strong expansion in developing markets to attain competitive advantage, which is committed

to differentiation and market positioning (Biondi and Graeff, 2018). In the following, an

effort has been made to discuss the management structure and governance of the

organization. In addition, it also discusses the impacts of external factors on the Prudential

PLC.

Management structure and governance

Prudential PLC is a global financial and insurance service provider situated in London,

United Kingdom. It was established in London to offer loans to working and professional

people. It manages Prudential Corporation Asia, which has asset management and insurance-

related operations across 14 markets. In the U.K. and Europe, M&G prudential, this is

leading investment and savings provided to the clients. In Asia, Jackson National life

Insurance organization is the biggest insurance providers in the U.S (Dupire and Slagmulder,

2018).

It is established in 1848 to deliver loans to professional people, which is secured by life

assurance. It was founded as The Prudential Mutual Loan and investment association, which

is shortened after a series of acquisitions to the organization. It became a limited company as

following the limited liability partnership, which is owned and managed by the less than 100

stakeholders. They also introduce new policies for family, single women, and home

Introduction

Prudential PLC is internationally regarded as the top multinational provider of financial

service and life insurance. It was established in 1848 in London with an objective of

delivering loans and services for elite people. They have four separate business units

Prudential Corporation (in Asia), Prudential U.K. (works in England), M & G (in Europe),

and Jackson (in the U.S.). In the Annual report issued in the year 2014, Prudential

Corporation is the dominant market leader with the fastest and largest developing market of

clients in 14 Asian countries involving United Kingdom (Hugo, 2018). They have officially

started its operations in the United Kingdom in 1996 and it is seen that presently it is a well-

equipped brand name of Pru Life UK. They are valued as the developer in the domestic

insurance industry. It ranks first among 34 insurance-associated-investment suppliers within

the country in respect of revenue, profitability, and market growth. Their main objective is to

maintain existing business in developing markets. They are also committed to maintaining

strong expansion in developing markets to attain competitive advantage, which is committed

to differentiation and market positioning (Biondi and Graeff, 2018). In the following, an

effort has been made to discuss the management structure and governance of the

organization. In addition, it also discusses the impacts of external factors on the Prudential

PLC.

Management structure and governance

Prudential PLC is a global financial and insurance service provider situated in London,

United Kingdom. It was established in London to offer loans to working and professional

people. It manages Prudential Corporation Asia, which has asset management and insurance-

related operations across 14 markets. In the U.K. and Europe, M&G prudential, this is

leading investment and savings provided to the clients. In Asia, Jackson National life

Insurance organization is the biggest insurance providers in the U.S (Dupire and Slagmulder,

2018).

It is established in 1848 to deliver loans to professional people, which is secured by life

assurance. It was founded as The Prudential Mutual Loan and investment association, which

is shortened after a series of acquisitions to the organization. It became a limited company as

following the limited liability partnership, which is owned and managed by the less than 100

stakeholders. They also introduce new policies for family, single women, and home

PLC 2

protection in which the Prudential shares were distributed on the London Stock Exchange. In

the tenure of 1950s and 1960s, it concentrates on long-term saving products, life insurance,

and retirement annuities. It is stated that its business in the United Kingdom has around 6

million clients and concentrates on savings, pension, and investment along with delivering

retirement income through its profitable annuities business.

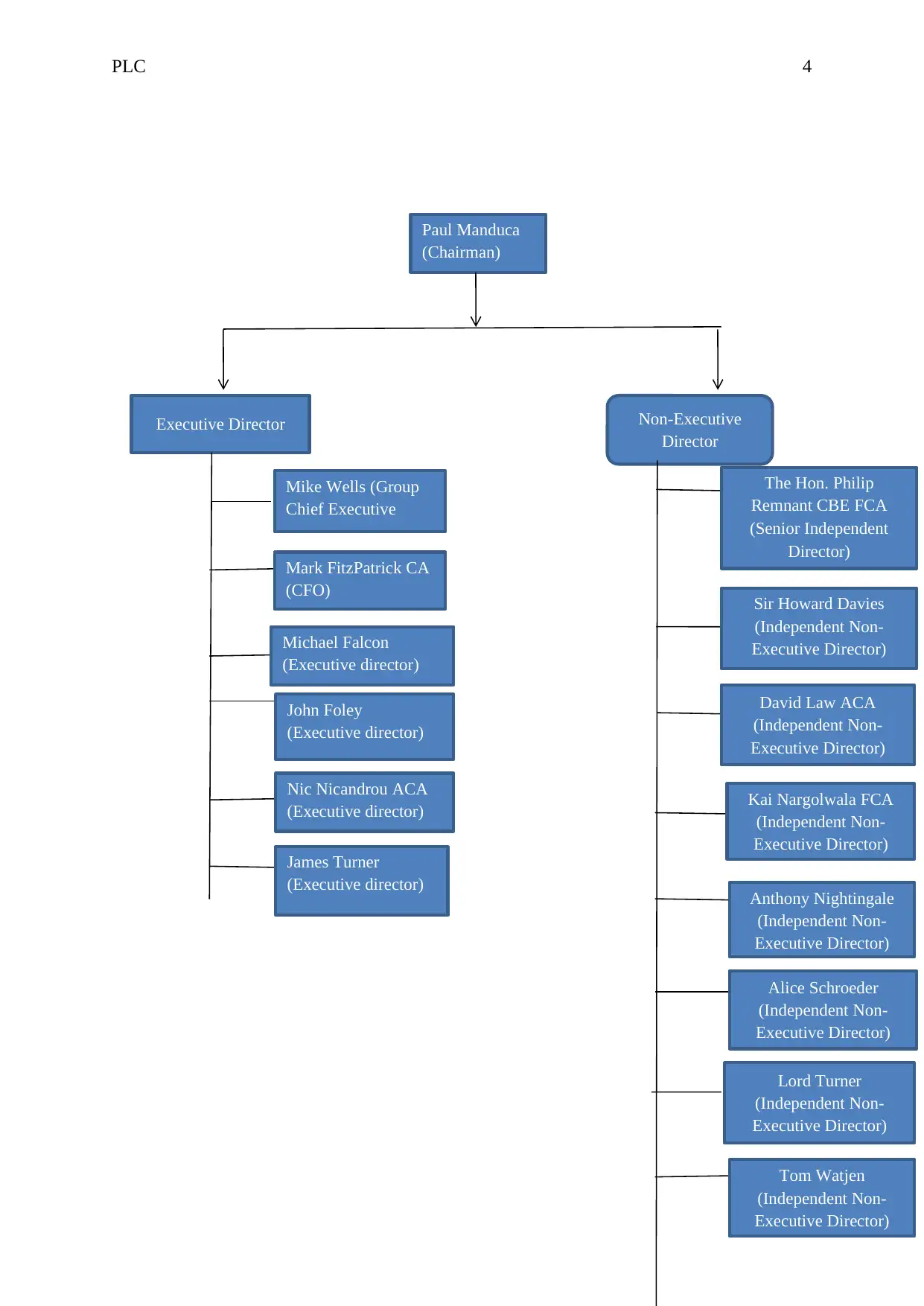

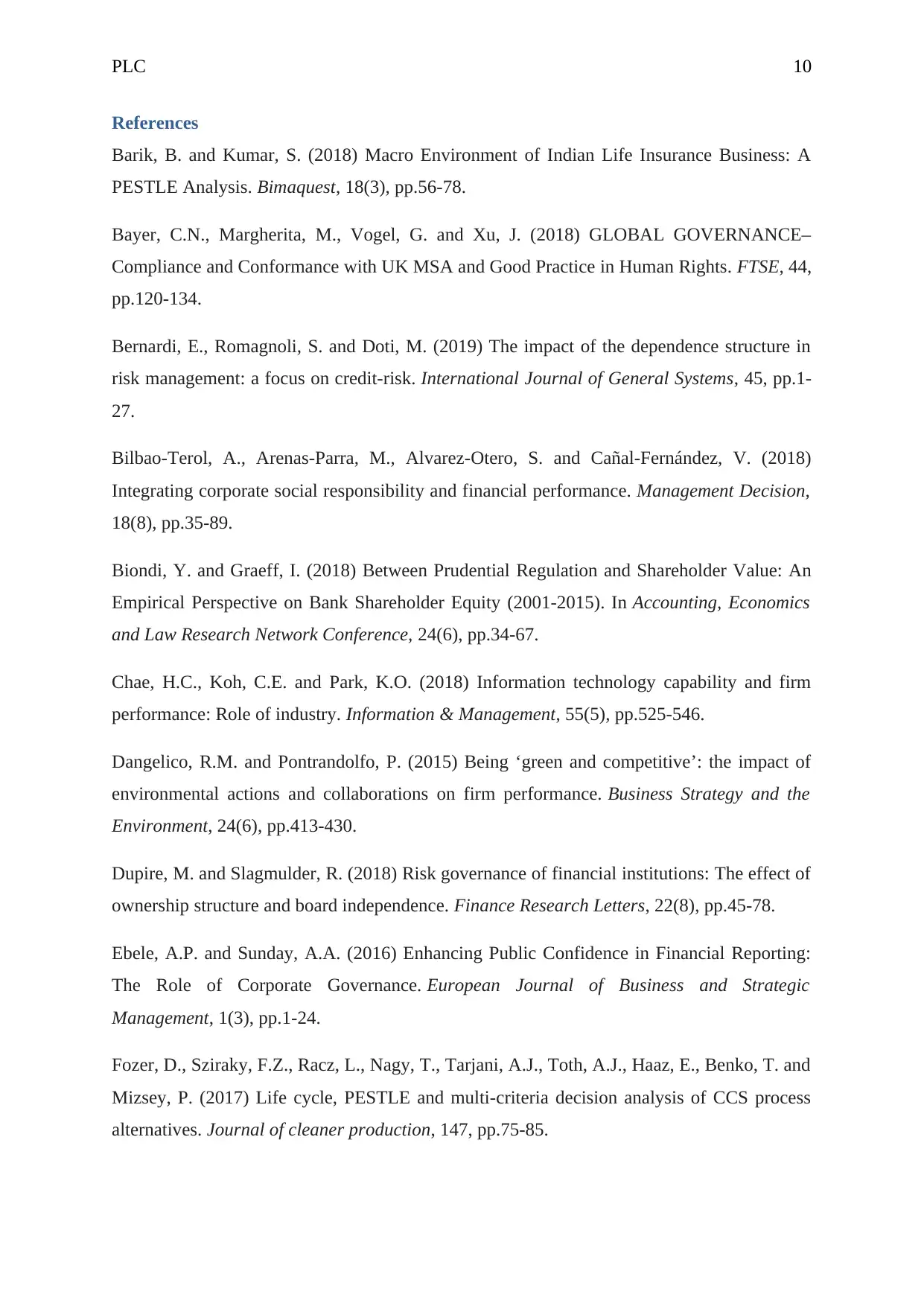

Their Group Chief Executive and Chairman are Tidjane Thiam and Paul Manduca

respectively, which is appointed in October 2010. There are 15 directors on the board and

among these 6 are executive directors and 9 are non-executive directors (Gürtürk and Hahn,

2016).

Corporate governance

It is stated that Prudential PLC has an exclusive listing on the London Stock Exchange, which

is subjected to the U.K. Corporate Governance Code. It has also listed on the main board of

the Stock Exchange, which is subjected to the Code on the Corporate Governance Practices.

Role of the Board-

The Board has agreed to a governance framework, which depicts the internal approach can be

delegated effectively. It is principally accountable for the success of the board and offers

leadership within a framework of efficient management control accepting appropriate risk

management. These collectively relate to the operational management of the business and

involve pre-determined authority delegating in respect of matter associated with day-to-day

operations and management of the businesses. It also ensures for setting a strategic objective

and they make an effort to place appropriately to attain those objectives and satisfy in a

manner constant with its statutory obligations (Bayer et al., 2018).

The board specifically set out the matters to reserve and enable the Board to control and

operate over the affairs of the company. These involve the approval of corporate objectives,

significant transactions, annual and interim results, operating plans, strategy, and matters

influencing the share capital of the organization. The executive directors are accountable for

operating the business functioning and the non-executive directors are required for bringing

scrutiny and independent judgment. The board can also exercise the powers subjected to the

Company’s Articles of Association to provide a guarantee in maintaining other obligation of

the enterprise (Zhang, 2017).

protection in which the Prudential shares were distributed on the London Stock Exchange. In

the tenure of 1950s and 1960s, it concentrates on long-term saving products, life insurance,

and retirement annuities. It is stated that its business in the United Kingdom has around 6

million clients and concentrates on savings, pension, and investment along with delivering

retirement income through its profitable annuities business.

Their Group Chief Executive and Chairman are Tidjane Thiam and Paul Manduca

respectively, which is appointed in October 2010. There are 15 directors on the board and

among these 6 are executive directors and 9 are non-executive directors (Gürtürk and Hahn,

2016).

Corporate governance

It is stated that Prudential PLC has an exclusive listing on the London Stock Exchange, which

is subjected to the U.K. Corporate Governance Code. It has also listed on the main board of

the Stock Exchange, which is subjected to the Code on the Corporate Governance Practices.

Role of the Board-

The Board has agreed to a governance framework, which depicts the internal approach can be

delegated effectively. It is principally accountable for the success of the board and offers

leadership within a framework of efficient management control accepting appropriate risk

management. These collectively relate to the operational management of the business and

involve pre-determined authority delegating in respect of matter associated with day-to-day

operations and management of the businesses. It also ensures for setting a strategic objective

and they make an effort to place appropriately to attain those objectives and satisfy in a

manner constant with its statutory obligations (Bayer et al., 2018).

The board specifically set out the matters to reserve and enable the Board to control and

operate over the affairs of the company. These involve the approval of corporate objectives,

significant transactions, annual and interim results, operating plans, strategy, and matters

influencing the share capital of the organization. The executive directors are accountable for

operating the business functioning and the non-executive directors are required for bringing

scrutiny and independent judgment. The board can also exercise the powers subjected to the

Company’s Articles of Association to provide a guarantee in maintaining other obligation of

the enterprise (Zhang, 2017).

PLC 3

Role of the Chief executive and Chairman-

It is stated that the role and responsibility of both the Chairman and Group Chief Executive

are well defined and separate. It is accountable for the governance and leadership of the board

for the implementation and management of the board strategy.

Role of the Senior Independent Director-

The role and responsibility of the Senior Independent Director are to develop contact with the

stakeholders with a view to identifying the issues and concerns as well as offering support to

the Chairman to the other non-executive director (Kokkinis, 2018).

Meetings-

It is stated that the Board held twelve meetings and a separate strategy event. At least one

board meeting is commonly held in a year in the business operation of the group to maintain

a complete understanding of the business (Ebele and Sunday, 2016).

Committees-

These committees are the main elements of the corporate governance framework, which are

described as they need to review the effectiveness of the compliance processes and monitor

the integrity and accounting policies of the group (Roncalli and Weisang, 2015).

Membership-

It is stated that the membership is formed to offer a broad set of commercial, financial, and

other aspects to satisfy the objectives of the committee. They have invited the board

chairperson, the Group Financial Officer, the Company Secretary, and other senior staff,

which contribute to the respective areas of expertise (Mees and Smith, 2019).

Financial reporting-

The committee should focus on reviewing of financial statements along with clarity of

judgment, accounting policies, and significant audit transactions compliance with accounting

laws, regulations, and governance codes (Bernardi, Romagnoli and Doti, 2019).

Role of the Chief executive and Chairman-

It is stated that the role and responsibility of both the Chairman and Group Chief Executive

are well defined and separate. It is accountable for the governance and leadership of the board

for the implementation and management of the board strategy.

Role of the Senior Independent Director-

The role and responsibility of the Senior Independent Director are to develop contact with the

stakeholders with a view to identifying the issues and concerns as well as offering support to

the Chairman to the other non-executive director (Kokkinis, 2018).

Meetings-

It is stated that the Board held twelve meetings and a separate strategy event. At least one

board meeting is commonly held in a year in the business operation of the group to maintain

a complete understanding of the business (Ebele and Sunday, 2016).

Committees-

These committees are the main elements of the corporate governance framework, which are

described as they need to review the effectiveness of the compliance processes and monitor

the integrity and accounting policies of the group (Roncalli and Weisang, 2015).

Membership-

It is stated that the membership is formed to offer a broad set of commercial, financial, and

other aspects to satisfy the objectives of the committee. They have invited the board

chairperson, the Group Financial Officer, the Company Secretary, and other senior staff,

which contribute to the respective areas of expertise (Mees and Smith, 2019).

Financial reporting-

The committee should focus on reviewing of financial statements along with clarity of

judgment, accounting policies, and significant audit transactions compliance with accounting

laws, regulations, and governance codes (Bernardi, Romagnoli and Doti, 2019).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PLC 4

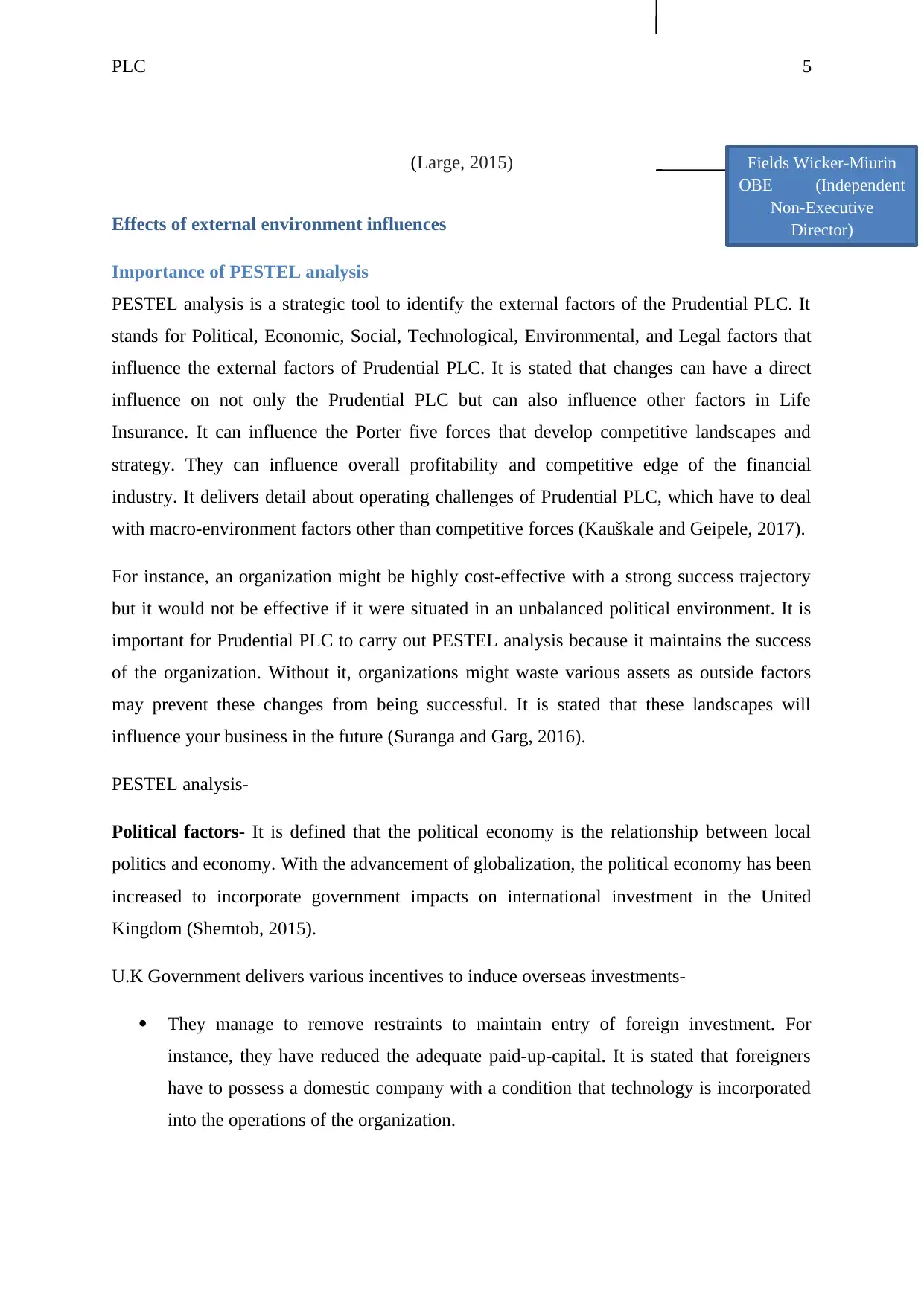

Paul Manduca

(Chairman)

Executive Director Non-Executive

Director

Mike Wells (Group

Chief Executive

Mark FitzPatrick CA

(CFO)

Michael Falcon

(Executive director)

John Foley

(Executive director)

Nic Nicandrou ACA

(Executive director)

James Turner

(Executive director)

The Hon. Philip

Remnant CBE FCA

(Senior Independent

Director)

Sir Howard Davies

(Independent Non-

Executive Director)

David Law ACA

(Independent Non-

Executive Director)

Kai Nargolwala FCA

(Independent Non-

Executive Director)

Anthony Nightingale

(Independent Non-

Executive Director)

Alice Schroeder

(Independent Non-

Executive Director)

Lord Turner

(Independent Non-

Executive Director)

Tom Watjen

(Independent Non-

Executive Director)

Paul Manduca

(Chairman)

Executive Director Non-Executive

Director

Mike Wells (Group

Chief Executive

Mark FitzPatrick CA

(CFO)

Michael Falcon

(Executive director)

John Foley

(Executive director)

Nic Nicandrou ACA

(Executive director)

James Turner

(Executive director)

The Hon. Philip

Remnant CBE FCA

(Senior Independent

Director)

Sir Howard Davies

(Independent Non-

Executive Director)

David Law ACA

(Independent Non-

Executive Director)

Kai Nargolwala FCA

(Independent Non-

Executive Director)

Anthony Nightingale

(Independent Non-

Executive Director)

Alice Schroeder

(Independent Non-

Executive Director)

Lord Turner

(Independent Non-

Executive Director)

Tom Watjen

(Independent Non-

Executive Director)

PLC 5

(Large, 2015)

Effects of external environment influences

Importance of PESTEL analysis

PESTEL analysis is a strategic tool to identify the external factors of the Prudential PLC. It

stands for Political, Economic, Social, Technological, Environmental, and Legal factors that

influence the external factors of Prudential PLC. It is stated that changes can have a direct

influence on not only the Prudential PLC but can also influence other factors in Life

Insurance. It can influence the Porter five forces that develop competitive landscapes and

strategy. They can influence overall profitability and competitive edge of the financial

industry. It delivers detail about operating challenges of Prudential PLC, which have to deal

with macro-environment factors other than competitive forces (Kauškale and Geipele, 2017).

For instance, an organization might be highly cost-effective with a strong success trajectory

but it would not be effective if it were situated in an unbalanced political environment. It is

important for Prudential PLC to carry out PESTEL analysis because it maintains the success

of the organization. Without it, organizations might waste various assets as outside factors

may prevent these changes from being successful. It is stated that these landscapes will

influence your business in the future (Suranga and Garg, 2016).

PESTEL analysis-

Political factors- It is defined that the political economy is the relationship between local

politics and economy. With the advancement of globalization, the political economy has been

increased to incorporate government impacts on international investment in the United

Kingdom (Shemtob, 2015).

U.K Government delivers various incentives to induce overseas investments-

They manage to remove restraints to maintain entry of foreign investment. For

instance, they have reduced the adequate paid-up-capital. It is stated that foreigners

have to possess a domestic company with a condition that technology is incorporated

into the operations of the organization.

Fields Wicker-Miurin

OBE (Independent

Non-Executive

Director)

(Large, 2015)

Effects of external environment influences

Importance of PESTEL analysis

PESTEL analysis is a strategic tool to identify the external factors of the Prudential PLC. It

stands for Political, Economic, Social, Technological, Environmental, and Legal factors that

influence the external factors of Prudential PLC. It is stated that changes can have a direct

influence on not only the Prudential PLC but can also influence other factors in Life

Insurance. It can influence the Porter five forces that develop competitive landscapes and

strategy. They can influence overall profitability and competitive edge of the financial

industry. It delivers detail about operating challenges of Prudential PLC, which have to deal

with macro-environment factors other than competitive forces (Kauškale and Geipele, 2017).

For instance, an organization might be highly cost-effective with a strong success trajectory

but it would not be effective if it were situated in an unbalanced political environment. It is

important for Prudential PLC to carry out PESTEL analysis because it maintains the success

of the organization. Without it, organizations might waste various assets as outside factors

may prevent these changes from being successful. It is stated that these landscapes will

influence your business in the future (Suranga and Garg, 2016).

PESTEL analysis-

Political factors- It is defined that the political economy is the relationship between local

politics and economy. With the advancement of globalization, the political economy has been

increased to incorporate government impacts on international investment in the United

Kingdom (Shemtob, 2015).

U.K Government delivers various incentives to induce overseas investments-

They manage to remove restraints to maintain entry of foreign investment. For

instance, they have reduced the adequate paid-up-capital. It is stated that foreigners

have to possess a domestic company with a condition that technology is incorporated

into the operations of the organization.

Fields Wicker-Miurin

OBE (Independent

Non-Executive

Director)

PLC 6

Profit remittance between a parent corporation and foreign company in the U.K. is

levied a tax rate of 23% with PEZA and other eco-zones in which tax does not apply.

Board of Investment-It incorporates fiscal as well as non-fiscal incentives

It incorporates the political stability and life insurance sectors in the U.K. economy.

Over the last few decades, Prudential PLC has been provided advantage from lower

taxation policies throughout the world. It has led to an increase in spending and high

profits in research and development. The increasing inequality in the United Kingdom

can lead to variations in taxation policies. The local government is also seeking for

particular taxation policies to manage the carbon footprint of the industry (Barik and

Kumar, 2018).

Economic factors- The External environment factors as savings rate, inflation rate, and

foreign exchange rate examines the aggregate demand in an economy. It is stated that factors

as competition norms influence the competitive edge of the organization. Prudential PLC can

utilize the economic indicators consumer spending, life insurance industry, and growth rate to

predict the growth and success (Hartley, Paulson and Rosen, 2016). The economic factors

that affect the organization are-

It is believed that the economic performance of the United Kingdom in the future will

remain stable due to increasing investment and disposable income into the new sector.

The performance of Prudential PLC in the United Kingdom is closely linked with the

economic performance of their economy. The success in the last few decades is

generated upon managing resources and increasing globalization to cater to

international markets.

The skill level of the human workforce in the United Kingdom is moderate to high in

the industry. Prudential PLC can reduce it not only to enhance services but also to

generate global opportunities (Madi, 2016).

Social factors- The Society’s culture of the population and shared beliefs play a great impact

in understanding the customers and design the marketing strategy for Prudential PLC

(Bilbao-Terol et al., 2018). The factors that affect the organization are-

It is stated that with the increasing liberalization, the attitude towards safety and

security are getting lower. They need to take care of the cost of failure is increasing at

a very fast pace.

Profit remittance between a parent corporation and foreign company in the U.K. is

levied a tax rate of 23% with PEZA and other eco-zones in which tax does not apply.

Board of Investment-It incorporates fiscal as well as non-fiscal incentives

It incorporates the political stability and life insurance sectors in the U.K. economy.

Over the last few decades, Prudential PLC has been provided advantage from lower

taxation policies throughout the world. It has led to an increase in spending and high

profits in research and development. The increasing inequality in the United Kingdom

can lead to variations in taxation policies. The local government is also seeking for

particular taxation policies to manage the carbon footprint of the industry (Barik and

Kumar, 2018).

Economic factors- The External environment factors as savings rate, inflation rate, and

foreign exchange rate examines the aggregate demand in an economy. It is stated that factors

as competition norms influence the competitive edge of the organization. Prudential PLC can

utilize the economic indicators consumer spending, life insurance industry, and growth rate to

predict the growth and success (Hartley, Paulson and Rosen, 2016). The economic factors

that affect the organization are-

It is believed that the economic performance of the United Kingdom in the future will

remain stable due to increasing investment and disposable income into the new sector.

The performance of Prudential PLC in the United Kingdom is closely linked with the

economic performance of their economy. The success in the last few decades is

generated upon managing resources and increasing globalization to cater to

international markets.

The skill level of the human workforce in the United Kingdom is moderate to high in

the industry. Prudential PLC can reduce it not only to enhance services but also to

generate global opportunities (Madi, 2016).

Social factors- The Society’s culture of the population and shared beliefs play a great impact

in understanding the customers and design the marketing strategy for Prudential PLC

(Bilbao-Terol et al., 2018). The factors that affect the organization are-

It is stated that with the increasing liberalization, the attitude towards safety and

security are getting lower. They need to take care of the cost of failure is increasing at

a very fast pace.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PLC 7

The gender roles are developing in the United Kingdom so Prudential PLC can

support to the society.

It can be noticed that the broader attitude towards migration is adverse in the United

Kingdom. This can influence the Prudential PLC capability to bring managers and

leaders to maintain operations in the country.

There is an increasing trend of income inequality in the United Kingdom as this has

reformed the power structure that has been consistent in society (Williams, 2016).

Technological factors- Technology are fast disrupting in various industries and sectors.

Some of the technological factors affecting the organization are- access to mobile phones,

supply chain disruption due to technology, innovation in product offering, access to greater

information, and population access to technology (Chae, Koh and Park, 2018).

Prudential PLC has to seek a close eye on the enhancement and advancement of

customer experience with increasing access and speed. This can completely change

the customer experience in the economy.

They need to maintain the strong culture of technology transfer for the fear of

generating opponents out of collaborators.

The latest innovative technology is rapidly lowering the servicing and production

cost in the economy. They need to recapitalize their supply chain to satisfy both

cost structure and customer preferences (Wonglimpiyarat, 2016).

Environmental factors- It is stated that environmental factors and sustainability are

becoming a significant part for the businesses. Some of the factors are climate change,

reducing carbon footprint, insurance policies, safe water treatment, increasing concentration

on sustainability, and laws on regulating pollution (Klumpes, Komarev and Eleftheriou,

2016).

It is stated that waste management for close units has generated more importance for

Prudential PLC as the U.K. government has come up with strict regulations in the

urban areas.

Greater awareness among clients has also put environmental factors at the strategy of

Prudential PLC. They expect to follow to this legal standard but also to increase them

to become a responsible shareholder in the society.

The gender roles are developing in the United Kingdom so Prudential PLC can

support to the society.

It can be noticed that the broader attitude towards migration is adverse in the United

Kingdom. This can influence the Prudential PLC capability to bring managers and

leaders to maintain operations in the country.

There is an increasing trend of income inequality in the United Kingdom as this has

reformed the power structure that has been consistent in society (Williams, 2016).

Technological factors- Technology are fast disrupting in various industries and sectors.

Some of the technological factors affecting the organization are- access to mobile phones,

supply chain disruption due to technology, innovation in product offering, access to greater

information, and population access to technology (Chae, Koh and Park, 2018).

Prudential PLC has to seek a close eye on the enhancement and advancement of

customer experience with increasing access and speed. This can completely change

the customer experience in the economy.

They need to maintain the strong culture of technology transfer for the fear of

generating opponents out of collaborators.

The latest innovative technology is rapidly lowering the servicing and production

cost in the economy. They need to recapitalize their supply chain to satisfy both

cost structure and customer preferences (Wonglimpiyarat, 2016).

Environmental factors- It is stated that environmental factors and sustainability are

becoming a significant part for the businesses. Some of the factors are climate change,

reducing carbon footprint, insurance policies, safe water treatment, increasing concentration

on sustainability, and laws on regulating pollution (Klumpes, Komarev and Eleftheriou,

2016).

It is stated that waste management for close units has generated more importance for

Prudential PLC as the U.K. government has come up with strict regulations in the

urban areas.

Greater awareness among clients has also put environmental factors at the strategy of

Prudential PLC. They expect to follow to this legal standard but also to increase them

to become a responsible shareholder in the society.

PLC 8

The Climate agreement has carried out real targets for the national government of the

United Kingdom. This can result in increased scrutiny of environmental standards for

Prudential PLC (Sethi, Martell and Demir, 2017).

Legal factors- It is stated that in a number of countries involving United Kingdom legal

framework are not strong enough to prevent the intellectual rights of Prudential PLC. They

should examine before entering such markets, which can tends to an overall competitive edge

(Osuji, 2016). Some of the factors are-

They need to take care of the data protection as it has emerged as a significant part

of not only intellectual property rights as well as privacy issues.

Prudential PLC has to measure average time before entering into the market.

It also influences the health and safety law along with discrimination law in the

overall country (Gray, 2016).

Impact on Prudential PLC

Political factors- It is stated that political factor is the significant factor that influences the

Prudential PLC. The regulatory practices and governance system will have a great impact on

the flexibility and adaptability that is going to happen in the external environment of the

Prudential PLC. For instance, News Agency published an article in which it has been stated

that the concern is not just cost structure but the lack of proper financial information. By that,

we can see that political stability is another big issue that emerges (Gray et al., 2016).

Economic factors- The next component of the external environment factors that can

influence the Prudential PLC is the growth, inflation rate, and economic stability. It depends

on many things in the United Kingdom ranging from taxes in the rules and standards

regulated by the government involving the purchasing power and income of the people

(Fozer et al., 2017).

Social factors- It is been evident from the research that the social effects that the

organizations are dealing; they came out with a result that the societal norms, power

structure, migration, and high expectations of utilizing technology are needed to be

considered. Societal needs are advancing at a very fast pace and the Prudential PLC should

think about updating themselves with new ideas and technology. For instance, in the

liberalized and developed communities, Prudential PLC should compete with technology and

customer needs. If they do not manage the customer needs and preferences, they will lose the

The Climate agreement has carried out real targets for the national government of the

United Kingdom. This can result in increased scrutiny of environmental standards for

Prudential PLC (Sethi, Martell and Demir, 2017).

Legal factors- It is stated that in a number of countries involving United Kingdom legal

framework are not strong enough to prevent the intellectual rights of Prudential PLC. They

should examine before entering such markets, which can tends to an overall competitive edge

(Osuji, 2016). Some of the factors are-

They need to take care of the data protection as it has emerged as a significant part

of not only intellectual property rights as well as privacy issues.

Prudential PLC has to measure average time before entering into the market.

It also influences the health and safety law along with discrimination law in the

overall country (Gray, 2016).

Impact on Prudential PLC

Political factors- It is stated that political factor is the significant factor that influences the

Prudential PLC. The regulatory practices and governance system will have a great impact on

the flexibility and adaptability that is going to happen in the external environment of the

Prudential PLC. For instance, News Agency published an article in which it has been stated

that the concern is not just cost structure but the lack of proper financial information. By that,

we can see that political stability is another big issue that emerges (Gray et al., 2016).

Economic factors- The next component of the external environment factors that can

influence the Prudential PLC is the growth, inflation rate, and economic stability. It depends

on many things in the United Kingdom ranging from taxes in the rules and standards

regulated by the government involving the purchasing power and income of the people

(Fozer et al., 2017).

Social factors- It is been evident from the research that the social effects that the

organizations are dealing; they came out with a result that the societal norms, power

structure, migration, and high expectations of utilizing technology are needed to be

considered. Societal needs are advancing at a very fast pace and the Prudential PLC should

think about updating themselves with new ideas and technology. For instance, in the

liberalized and developed communities, Prudential PLC should compete with technology and

customer needs. If they do not manage the customer needs and preferences, they will lose the

PLC 9

clients to another organization, which are more developed and technologically advanced

(Wilden and Gudergan, 2015).

Technological factors- It has been discussed from the fact that they need to concentrate on

technology and competitiveness as Prudential PLC are competing for the most updated

information to deliver the effective product for the client. Prudential PLC should always be

ready for the transformation, which can be the empowerment of 5G potential, technology

transfer, and decreasing cost of production. It directly influences the technological

advancement to stay in the market (Lee and Min, 2015).

Environmental factors- The environmental factors as consumer activism, waste

management agreement, and regular scrutiny can affect the organization in a diverse manner.

Prudential PLC can maintain sustainability, as they need to take care of the environmental

changes and provide life insurance to every person in order to generate adaptability in the

environment (Dangelico and Pontrandolfo, 2015).

Legal factors- Each organization has different rules, regulations, and code of conduct as

these rules sometimes contradict with the new environment that the Prudential PLC is

interring. This kind of impact will face Prudential PLC that become international in diverse

environments (Prajogo, 2016).

Conclusion

In conclusion, it has been stated that Prudential PLC is engaged towards developing strong

communities and offer growing as well as sustainable returns for our stakeholders. They

should maintain long-term value for employees, society, customers, and shareholders. In the

above, the discussion has been made on management structure and governance of the

Prudential PLC. In addition, it also discusses the impacts of an external factor on the

organization. It majorly affects the environmental footprint and develops a broad range of

environmental targets maintained to strengthen management practices.

clients to another organization, which are more developed and technologically advanced

(Wilden and Gudergan, 2015).

Technological factors- It has been discussed from the fact that they need to concentrate on

technology and competitiveness as Prudential PLC are competing for the most updated

information to deliver the effective product for the client. Prudential PLC should always be

ready for the transformation, which can be the empowerment of 5G potential, technology

transfer, and decreasing cost of production. It directly influences the technological

advancement to stay in the market (Lee and Min, 2015).

Environmental factors- The environmental factors as consumer activism, waste

management agreement, and regular scrutiny can affect the organization in a diverse manner.

Prudential PLC can maintain sustainability, as they need to take care of the environmental

changes and provide life insurance to every person in order to generate adaptability in the

environment (Dangelico and Pontrandolfo, 2015).

Legal factors- Each organization has different rules, regulations, and code of conduct as

these rules sometimes contradict with the new environment that the Prudential PLC is

interring. This kind of impact will face Prudential PLC that become international in diverse

environments (Prajogo, 2016).

Conclusion

In conclusion, it has been stated that Prudential PLC is engaged towards developing strong

communities and offer growing as well as sustainable returns for our stakeholders. They

should maintain long-term value for employees, society, customers, and shareholders. In the

above, the discussion has been made on management structure and governance of the

Prudential PLC. In addition, it also discusses the impacts of an external factor on the

organization. It majorly affects the environmental footprint and develops a broad range of

environmental targets maintained to strengthen management practices.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

PLC 10

References

Barik, B. and Kumar, S. (2018) Macro Environment of Indian Life Insurance Business: A

PESTLE Analysis. Bimaquest, 18(3), pp.56-78.

Bayer, C.N., Margherita, M., Vogel, G. and Xu, J. (2018) GLOBAL GOVERNANCE–

Compliance and Conformance with UK MSA and Good Practice in Human Rights. FTSE, 44,

pp.120-134.

Bernardi, E., Romagnoli, S. and Doti, M. (2019) The impact of the dependence structure in

risk management: a focus on credit-risk. International Journal of General Systems, 45, pp.1-

27.

Bilbao-Terol, A., Arenas-Parra, M., Alvarez-Otero, S. and Cañal-Fernández, V. (2018)

Integrating corporate social responsibility and financial performance. Management Decision,

18(8), pp.35-89.

Biondi, Y. and Graeff, I. (2018) Between Prudential Regulation and Shareholder Value: An

Empirical Perspective on Bank Shareholder Equity (2001-2015). In Accounting, Economics

and Law Research Network Conference, 24(6), pp.34-67.

Chae, H.C., Koh, C.E. and Park, K.O. (2018) Information technology capability and firm

performance: Role of industry. Information & Management, 55(5), pp.525-546.

Dangelico, R.M. and Pontrandolfo, P. (2015) Being ‘green and competitive’: the impact of

environmental actions and collaborations on firm performance. Business Strategy and the

Environment, 24(6), pp.413-430.

Dupire, M. and Slagmulder, R. (2018) Risk governance of financial institutions: The effect of

ownership structure and board independence. Finance Research Letters, 22(8), pp.45-78.

Ebele, A.P. and Sunday, A.A. (2016) Enhancing Public Confidence in Financial Reporting:

The Role of Corporate Governance. European Journal of Business and Strategic

Management, 1(3), pp.1-24.

Fozer, D., Sziraky, F.Z., Racz, L., Nagy, T., Tarjani, A.J., Toth, A.J., Haaz, E., Benko, T. and

Mizsey, P. (2017) Life cycle, PESTLE and multi-criteria decision analysis of CCS process

alternatives. Journal of cleaner production, 147, pp.75-85.

References

Barik, B. and Kumar, S. (2018) Macro Environment of Indian Life Insurance Business: A

PESTLE Analysis. Bimaquest, 18(3), pp.56-78.

Bayer, C.N., Margherita, M., Vogel, G. and Xu, J. (2018) GLOBAL GOVERNANCE–

Compliance and Conformance with UK MSA and Good Practice in Human Rights. FTSE, 44,

pp.120-134.

Bernardi, E., Romagnoli, S. and Doti, M. (2019) The impact of the dependence structure in

risk management: a focus on credit-risk. International Journal of General Systems, 45, pp.1-

27.

Bilbao-Terol, A., Arenas-Parra, M., Alvarez-Otero, S. and Cañal-Fernández, V. (2018)

Integrating corporate social responsibility and financial performance. Management Decision,

18(8), pp.35-89.

Biondi, Y. and Graeff, I. (2018) Between Prudential Regulation and Shareholder Value: An

Empirical Perspective on Bank Shareholder Equity (2001-2015). In Accounting, Economics

and Law Research Network Conference, 24(6), pp.34-67.

Chae, H.C., Koh, C.E. and Park, K.O. (2018) Information technology capability and firm

performance: Role of industry. Information & Management, 55(5), pp.525-546.

Dangelico, R.M. and Pontrandolfo, P. (2015) Being ‘green and competitive’: the impact of

environmental actions and collaborations on firm performance. Business Strategy and the

Environment, 24(6), pp.413-430.

Dupire, M. and Slagmulder, R. (2018) Risk governance of financial institutions: The effect of

ownership structure and board independence. Finance Research Letters, 22(8), pp.45-78.

Ebele, A.P. and Sunday, A.A. (2016) Enhancing Public Confidence in Financial Reporting:

The Role of Corporate Governance. European Journal of Business and Strategic

Management, 1(3), pp.1-24.

Fozer, D., Sziraky, F.Z., Racz, L., Nagy, T., Tarjani, A.J., Toth, A.J., Haaz, E., Benko, T. and

Mizsey, P. (2017) Life cycle, PESTLE and multi-criteria decision analysis of CCS process

alternatives. Journal of cleaner production, 147, pp.75-85.

PLC 11

Gray, J. (2016) Lawyers and systemic risk in finance: could (and should) the legal profession

contribute to macroprudential regulation?. Legal Ethics, 19(1), pp.122-144.

Gray, S., O’Mahony, C., Hills, J., O’Dwyer, B., Devoy, R. and Gault, J. (2016) Strengthening

coastal adaptation planning through scenario analysis: a beneficial but incomplete

solution. Marine Policy, 18(6), pp.31-67.

Gürtürk, A. and Hahn, R. (2016) An empirical assessment of assurance statements in

sustainability reports: smoke screens or enlightening information?. Journal of Cleaner

Production, 136, pp.30-41.

Hartley, D., Paulson, A. and Rosen, R.J. (2016) Measuring interest rate risk in the life

insurance sector. The Economics, Regulation, and Systemic Risk of Insurance Markets, 26,

p.124.

Hugo, P. (2018) Introducing Prudential Global Funds. MoneyMarketing, 33(5), pp.13-13.

Kauškale, L. and Geipele, I. (2017) Integrated approach of real estate market analysis in

sustainable development context for decision making. Procedia Engineering, 172, pp.505-

512.

Klumpes, P., Komarev, I. and Eleftheriou, K. (2016) The pricing of audit and non-audit

services in a regulated environment: a longitudinal study of the UK life insurance

industry. Accounting and Business Research, 46(3), pp.278-302.

Kokkinis, A. (2018) Exploring the effects of the ‘bonus cap’rule: the impact of remuneration

structure on risk-taking by bank managers. Journal of Corporate Law Studies, 12, pp.1-29.

Large, A. (2015) Financial Stability Governance Today: A Job Half Done. Group of Thirty

Occasional Papers (USA), 9(2), pp.1-48.

Lee, K.H. and Min, B. (2015) Green R&D for eco-innovation and its impact on carbon

emissions and firm performance. Journal of Cleaner Production, 108, pp.534-542.

Madi, M.E.S. (2016) Determinants of financial stability in UK banks and building societies-

Are they different?. Journal of Business Studies Quarterly, 8(2), p.78.

Mees, B. and Smith, S.A. (2019) Corporate governance reform in Australia: a new

institutional approach. British Journal of Management, 30(1), pp.75-89.

Gray, J. (2016) Lawyers and systemic risk in finance: could (and should) the legal profession

contribute to macroprudential regulation?. Legal Ethics, 19(1), pp.122-144.

Gray, S., O’Mahony, C., Hills, J., O’Dwyer, B., Devoy, R. and Gault, J. (2016) Strengthening

coastal adaptation planning through scenario analysis: a beneficial but incomplete

solution. Marine Policy, 18(6), pp.31-67.

Gürtürk, A. and Hahn, R. (2016) An empirical assessment of assurance statements in

sustainability reports: smoke screens or enlightening information?. Journal of Cleaner

Production, 136, pp.30-41.

Hartley, D., Paulson, A. and Rosen, R.J. (2016) Measuring interest rate risk in the life

insurance sector. The Economics, Regulation, and Systemic Risk of Insurance Markets, 26,

p.124.

Hugo, P. (2018) Introducing Prudential Global Funds. MoneyMarketing, 33(5), pp.13-13.

Kauškale, L. and Geipele, I. (2017) Integrated approach of real estate market analysis in

sustainable development context for decision making. Procedia Engineering, 172, pp.505-

512.

Klumpes, P., Komarev, I. and Eleftheriou, K. (2016) The pricing of audit and non-audit

services in a regulated environment: a longitudinal study of the UK life insurance

industry. Accounting and Business Research, 46(3), pp.278-302.

Kokkinis, A. (2018) Exploring the effects of the ‘bonus cap’rule: the impact of remuneration

structure on risk-taking by bank managers. Journal of Corporate Law Studies, 12, pp.1-29.

Large, A. (2015) Financial Stability Governance Today: A Job Half Done. Group of Thirty

Occasional Papers (USA), 9(2), pp.1-48.

Lee, K.H. and Min, B. (2015) Green R&D for eco-innovation and its impact on carbon

emissions and firm performance. Journal of Cleaner Production, 108, pp.534-542.

Madi, M.E.S. (2016) Determinants of financial stability in UK banks and building societies-

Are they different?. Journal of Business Studies Quarterly, 8(2), p.78.

Mees, B. and Smith, S.A. (2019) Corporate governance reform in Australia: a new

institutional approach. British Journal of Management, 30(1), pp.75-89.

PLC 12

Osuji, O.K. (2016) Responsible lending: consumer protection and prudential regulation

perspectives. In Credit, Consumers and the Law, 43(8), pp. 86-109.

Prajogo, D.I. (2016) The strategic fit between innovation strategies and business environment

in delivering business performance. International Journal of Production Economics, 171,

pp.241-249.

Roncalli, T. and Weisang, G. (2015) Asset management and systemic risk. In Paris

December 2015 Finance Meeting, 54(3), pp.23-68.

Sethi, S.P., Martell, T.F. and Demir, M. (2017) An evaluation of the quality of corporate

social responsibility reports by some of the world’s largest financial institutions. Journal of

Business Ethics, 140(4), pp.787-805.

Shemtob, Z.B. (2015) The Political Question Doctrines: Zivotofsky v. Clinton and Getting

Beyond the Textual-Prudential Paradigm. Geo. LJ, 104, p.1001.

Suranga, M. and Garg, K. (2016) The Importance of Strategic Direction for the Growth of

Small and Medium Scale Enterprises: A Case Study. International Journal of Research in

Social Sciences, 6(6), pp.1-21.

Wilden, R. and Gudergan, S.P. (2015) The impact of dynamic capabilities on operational

marketing and technological capabilities: investigating the role of environmental

turbulence. Journal of the Academy of Marketing Science, 43(2), pp.181-199.

Williams, T. (2016) Consumer finance and the social dimension of banks in a global

economy1. The Routledge Companion to Banking Regulation and Reform, 23, p.411.

Wonglimpiyarat, J. (2016) Technological change of the innovation payment

system. International Journal of Innovation and Technology Management, 13(04), p.165.

Zhang, C. (2017) Global Systemically Important Financial Institutions: A Structural VAR

Approach. SSRN, 45(8), pp.223-234.

Osuji, O.K. (2016) Responsible lending: consumer protection and prudential regulation

perspectives. In Credit, Consumers and the Law, 43(8), pp. 86-109.

Prajogo, D.I. (2016) The strategic fit between innovation strategies and business environment

in delivering business performance. International Journal of Production Economics, 171,

pp.241-249.

Roncalli, T. and Weisang, G. (2015) Asset management and systemic risk. In Paris

December 2015 Finance Meeting, 54(3), pp.23-68.

Sethi, S.P., Martell, T.F. and Demir, M. (2017) An evaluation of the quality of corporate

social responsibility reports by some of the world’s largest financial institutions. Journal of

Business Ethics, 140(4), pp.787-805.

Shemtob, Z.B. (2015) The Political Question Doctrines: Zivotofsky v. Clinton and Getting

Beyond the Textual-Prudential Paradigm. Geo. LJ, 104, p.1001.

Suranga, M. and Garg, K. (2016) The Importance of Strategic Direction for the Growth of

Small and Medium Scale Enterprises: A Case Study. International Journal of Research in

Social Sciences, 6(6), pp.1-21.

Wilden, R. and Gudergan, S.P. (2015) The impact of dynamic capabilities on operational

marketing and technological capabilities: investigating the role of environmental

turbulence. Journal of the Academy of Marketing Science, 43(2), pp.181-199.

Williams, T. (2016) Consumer finance and the social dimension of banks in a global

economy1. The Routledge Companion to Banking Regulation and Reform, 23, p.411.

Wonglimpiyarat, J. (2016) Technological change of the innovation payment

system. International Journal of Innovation and Technology Management, 13(04), p.165.

Zhang, C. (2017) Global Systemically Important Financial Institutions: A Structural VAR

Approach. SSRN, 45(8), pp.223-234.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.