Financial Analysis and Budgeting Techniques for Unilever Plc

VerifiedAdded on 2020/12/10

|13

|3216

|342

Report

AI Summary

This report presents a financial analysis of Unilever Plc, comparing its performance with competitors using key financial ratios such as ROCE, GP margin, operating margin, gearing ratio, and interest coverage ratio for 2015 and 2016. The analysis reveals insights into Unilever's profitability, efficiency, and financial position relative to peers like Procter & Gamble, Reckitt Beckinser, Henkel, and Colgate-Palmolive. The report also evaluates budgeting techniques applicable to large global companies, emphasizing their role in planning, control, and decision-making. It discusses criticisms associated with budgeting and highlights the importance of financial analysis and budgeting in determining overall business performance. The report concludes with an assessment of Unilever's financial standing and recommendations for improvement, underscoring the importance of strategic financial management.

Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Presentation of the financial analysis of for 2015 and 2016 and comparison with peers

companion's performances..........................................................................................................1

PART 2............................................................................................................................................8

Critical evaluation of the budgetary techniques that can help to large global companies........8

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................1

PART 1............................................................................................................................................1

Presentation of the financial analysis of for 2015 and 2016 and comparison with peers

companion's performances..........................................................................................................1

PART 2............................................................................................................................................8

Critical evaluation of the budgetary techniques that can help to large global companies........8

REFERENCES..............................................................................................................................11

INTRODUCTION

For every organisation financial analysis and budgeting are two of the essential criteria

which determines the overall performance of the business. On one hand, with financial analysis

the past and present position of the business performances is interpreted along with its

competitors. On the others hand with using different budgeting techniques the organization are

applied for planning and controlling of the various activities and operations of the firm.

Financial analysis of an entity is carried out through calculations of various ratios which is

considered as one of the best tool to determined the financial position of an organization.

Below is presented a financial report related with performance evaluation of Unilever

Plc along with 4 other competitors. The analysis is carried out with interpretation of 5 different

ratios namely ROCE, GP margin, OP margin, Interest coverage ratio and gearing ratio. All theses

5 ratio are the one which initiated the profitability, effective and financial position of the

companies. In the next part of the report Advises is given on the application of the budgeting

techniques for planning and controlling the operational performance of large global companies

for providing them better understanding of the operational performance of its division. Along

with the different performance measures are also discussed relevant with the appropriateness

with the environment. In the last part of the report Key issues related with divisional directors are

presented.

PART 1

Presentation of the financial analysis of for 2015 and 2016 and comparison with peers

companion's performances

Over all data for all five companies:

Particulars Unilever PLc Procter and

Gamble

Reckitt

Beckinser

Henkel Colgate

_palmolive

Years 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016

Return on

capital

employed

18.94 - 26.82 26.88 18.8

1

18.2

8

14.03 12.39 20.62 -

Gross profits 42.17 42.65 52.41 54.78 59.1 60.9 48.21 47.94 58.62 60.04

1

For every organisation financial analysis and budgeting are two of the essential criteria

which determines the overall performance of the business. On one hand, with financial analysis

the past and present position of the business performances is interpreted along with its

competitors. On the others hand with using different budgeting techniques the organization are

applied for planning and controlling of the various activities and operations of the firm.

Financial analysis of an entity is carried out through calculations of various ratios which is

considered as one of the best tool to determined the financial position of an organization.

Below is presented a financial report related with performance evaluation of Unilever

Plc along with 4 other competitors. The analysis is carried out with interpretation of 5 different

ratios namely ROCE, GP margin, OP margin, Interest coverage ratio and gearing ratio. All theses

5 ratio are the one which initiated the profitability, effective and financial position of the

companies. In the next part of the report Advises is given on the application of the budgeting

techniques for planning and controlling the operational performance of large global companies

for providing them better understanding of the operational performance of its division. Along

with the different performance measures are also discussed relevant with the appropriateness

with the environment. In the last part of the report Key issues related with divisional directors are

presented.

PART 1

Presentation of the financial analysis of for 2015 and 2016 and comparison with peers

companion's performances

Over all data for all five companies:

Particulars Unilever PLc Procter and

Gamble

Reckitt

Beckinser

Henkel Colgate

_palmolive

Years 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016

Return on

capital

employed

18.94 - 26.82 26.88 18.8

1

18.2

8

14.03 12.39 20.62 -

Gross profits 42.17 42.65 52.41 54.78 59.1 60.9 48.21 47.94 58.62 60.04

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

margin % % 2 2 % %

Operating

margin

13.88

%

14.62

%

19.33 22.80 26.7

5

28.0

8

14.47 14.80 24.30 25.35

Gearing ratio 0.62 - - - 0.10 0.10 - 1.86 -- -

Interest

coverage ratio

14.18 14.15 88.55 159.3

4

51.1

8

46.1

7

37.15 65.55 21.77 26.09

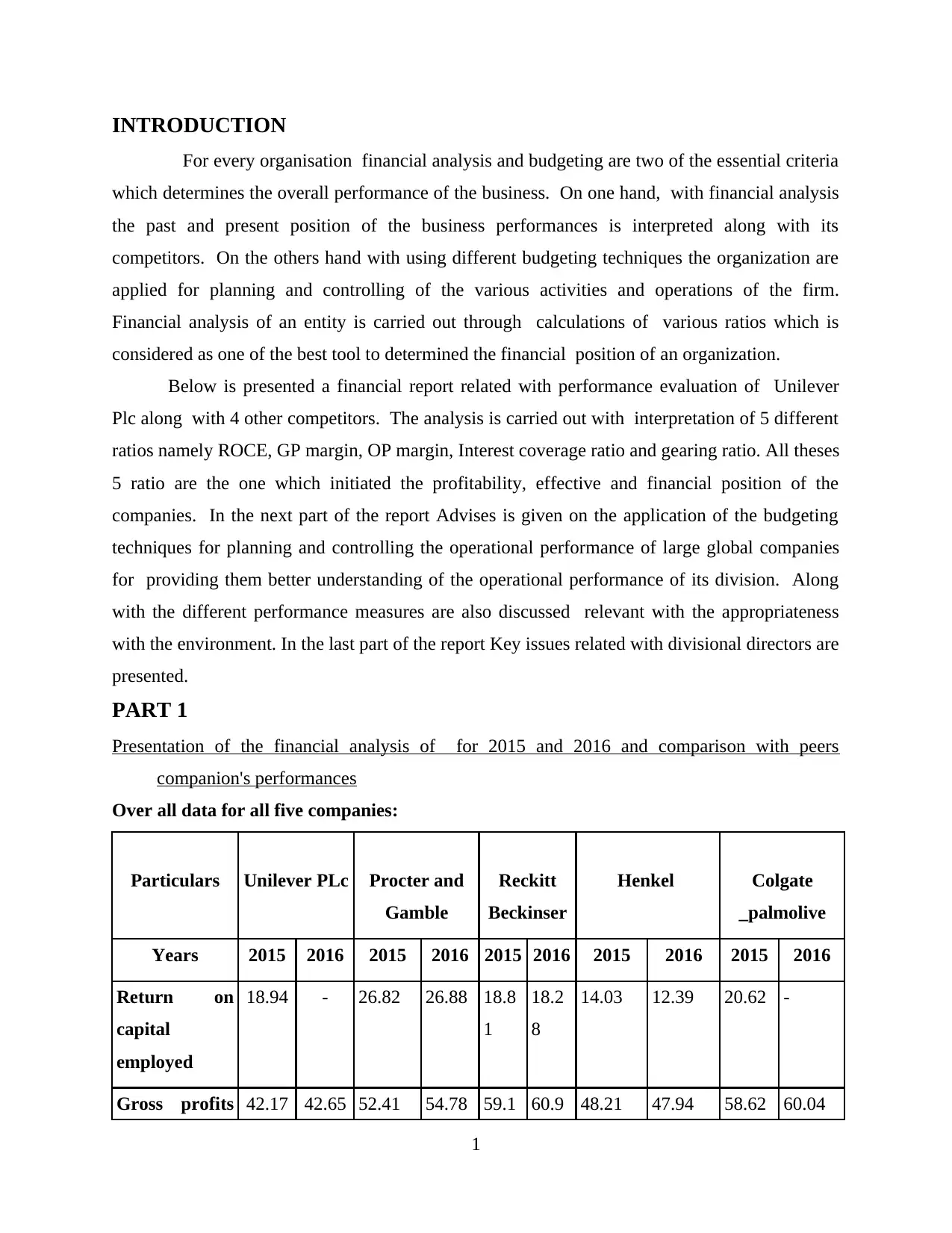

Analysis of the performance of the Unilever Plc:

The above table gives a representation of the financial performance of the Unilever Plc

for a period of two years that is 2015 and 2016. The profitability of these group can be defined as

there has been an increase in the operating profit margin but the gross profit margin have

experiences a minor change in the context of the percentage growth. This can be stated that the

cost of production of goods and services have not been changed from 2015 to 2016. Growth in

the net margin is a result of the control over the administration and operating cost (Guler and

et.al., 2014). With controlling the overheads and increase on the sales revenuers and not many

changes in the manufacturing overheads the operating profits of the Unilever Plc have increased

in time frame of 1 years by 0.74%. The return on capital employed and Gearing ratio for this

group was 18.94 and 0.62 respectively in the year 2015. Interest coverage ratio for 2015 was

14.18 and fro 2016 it was 14.15, this states the fact that these is no change in the ration depicting

that no changes in the capacity of the firm to pay is interest expenses hence no changes in the

debt holding of the Unilever Plc. The overall performance of the organisation can be stated as

stable and directing towered growth as the gross profits and interest coverage ration are almost

same for both years i.e. 2015 and 2016 and the net profit margins of the group have increased by

less 1% this reflects the growth factors of the business.

Comparison of the performance of Unilever with its Peers:

1. Return on capital employed:

Particular 2015 2016

Unilever PLc 18.94 0

2

Operating

margin

13.88

%

14.62

%

19.33 22.80 26.7

5

28.0

8

14.47 14.80 24.30 25.35

Gearing ratio 0.62 - - - 0.10 0.10 - 1.86 -- -

Interest

coverage ratio

14.18 14.15 88.55 159.3

4

51.1

8

46.1

7

37.15 65.55 21.77 26.09

Analysis of the performance of the Unilever Plc:

The above table gives a representation of the financial performance of the Unilever Plc

for a period of two years that is 2015 and 2016. The profitability of these group can be defined as

there has been an increase in the operating profit margin but the gross profit margin have

experiences a minor change in the context of the percentage growth. This can be stated that the

cost of production of goods and services have not been changed from 2015 to 2016. Growth in

the net margin is a result of the control over the administration and operating cost (Guler and

et.al., 2014). With controlling the overheads and increase on the sales revenuers and not many

changes in the manufacturing overheads the operating profits of the Unilever Plc have increased

in time frame of 1 years by 0.74%. The return on capital employed and Gearing ratio for this

group was 18.94 and 0.62 respectively in the year 2015. Interest coverage ratio for 2015 was

14.18 and fro 2016 it was 14.15, this states the fact that these is no change in the ration depicting

that no changes in the capacity of the firm to pay is interest expenses hence no changes in the

debt holding of the Unilever Plc. The overall performance of the organisation can be stated as

stable and directing towered growth as the gross profits and interest coverage ration are almost

same for both years i.e. 2015 and 2016 and the net profit margins of the group have increased by

less 1% this reflects the growth factors of the business.

Comparison of the performance of Unilever with its Peers:

1. Return on capital employed:

Particular 2015 2016

Unilever PLc 18.94 0

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Procter and Gamble 26.82 26.88

Reckitt Beckinser 18.81 18.28

Henkel 14.03 12.39

Colgate _palmolive 20.62 0

2015 2016

0

5

10

15

20

25

30

18.94

0

26.82 26.88

18.81 18.28

14.03

12.39

20.62

0

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

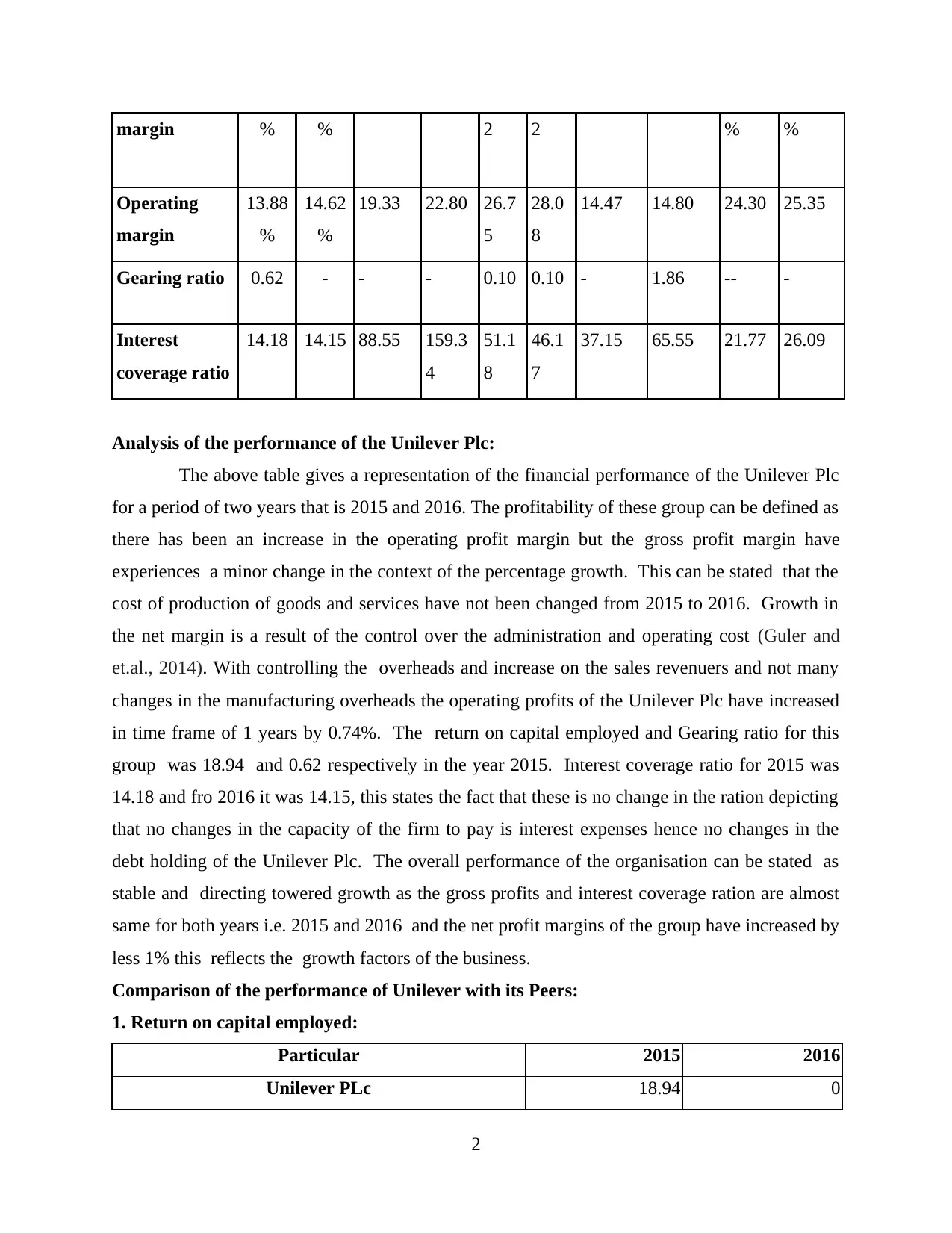

Interpretation:

Return on capital employed ration is the one which measures the profitability and

efficiency of an organisation. The ratios are one of the most effective way of comparison of the

past and present performance and also with other businesses (Hausmann, Kokkinaki and Leng,

2019). The above graph is representing the performance of 5 different companies that is

Unilever Plc, Procter and Gamble (P&G), Reckitt and Beckinser, Henkle and Colgate Pamolive.

This is a useful matric for comparing the performances across the companies, this ratio measure

the ability of the organization to earn the profits before interest and taxes over the capital

invested in the business. From the above table and graph this can interpreted that P&G is one of

the best performer for both the years among all 5 companies and the lowest performer in this

sector is Henkle. The status of the Unilever Plc in all theses 5 business at moderate level. With

this it can be clearly stats that P&g earns the highest level of profits before payment of interest

and taxes for the capital investment in its business. The second position for this ratio can be

given to Reckitt and Beckinser as for both years the ratio was at the level of 18%.

3

Reckitt Beckinser 18.81 18.28

Henkel 14.03 12.39

Colgate _palmolive 20.62 0

2015 2016

0

5

10

15

20

25

30

18.94

0

26.82 26.88

18.81 18.28

14.03

12.39

20.62

0

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

Interpretation:

Return on capital employed ration is the one which measures the profitability and

efficiency of an organisation. The ratios are one of the most effective way of comparison of the

past and present performance and also with other businesses (Hausmann, Kokkinaki and Leng,

2019). The above graph is representing the performance of 5 different companies that is

Unilever Plc, Procter and Gamble (P&G), Reckitt and Beckinser, Henkle and Colgate Pamolive.

This is a useful matric for comparing the performances across the companies, this ratio measure

the ability of the organization to earn the profits before interest and taxes over the capital

invested in the business. From the above table and graph this can interpreted that P&G is one of

the best performer for both the years among all 5 companies and the lowest performer in this

sector is Henkle. The status of the Unilever Plc in all theses 5 business at moderate level. With

this it can be clearly stats that P&g earns the highest level of profits before payment of interest

and taxes for the capital investment in its business. The second position for this ratio can be

given to Reckitt and Beckinser as for both years the ratio was at the level of 18%.

3

2. Gross profits margin

Particular 2015 2016

Unilever PLc 42.17 42.65

Procter and Gamble 52.41 54.78

Reckitt Beckinser 59.12 60.92

Henkel 48.21 47.94

Colgate _palmolive 58.62 60.04

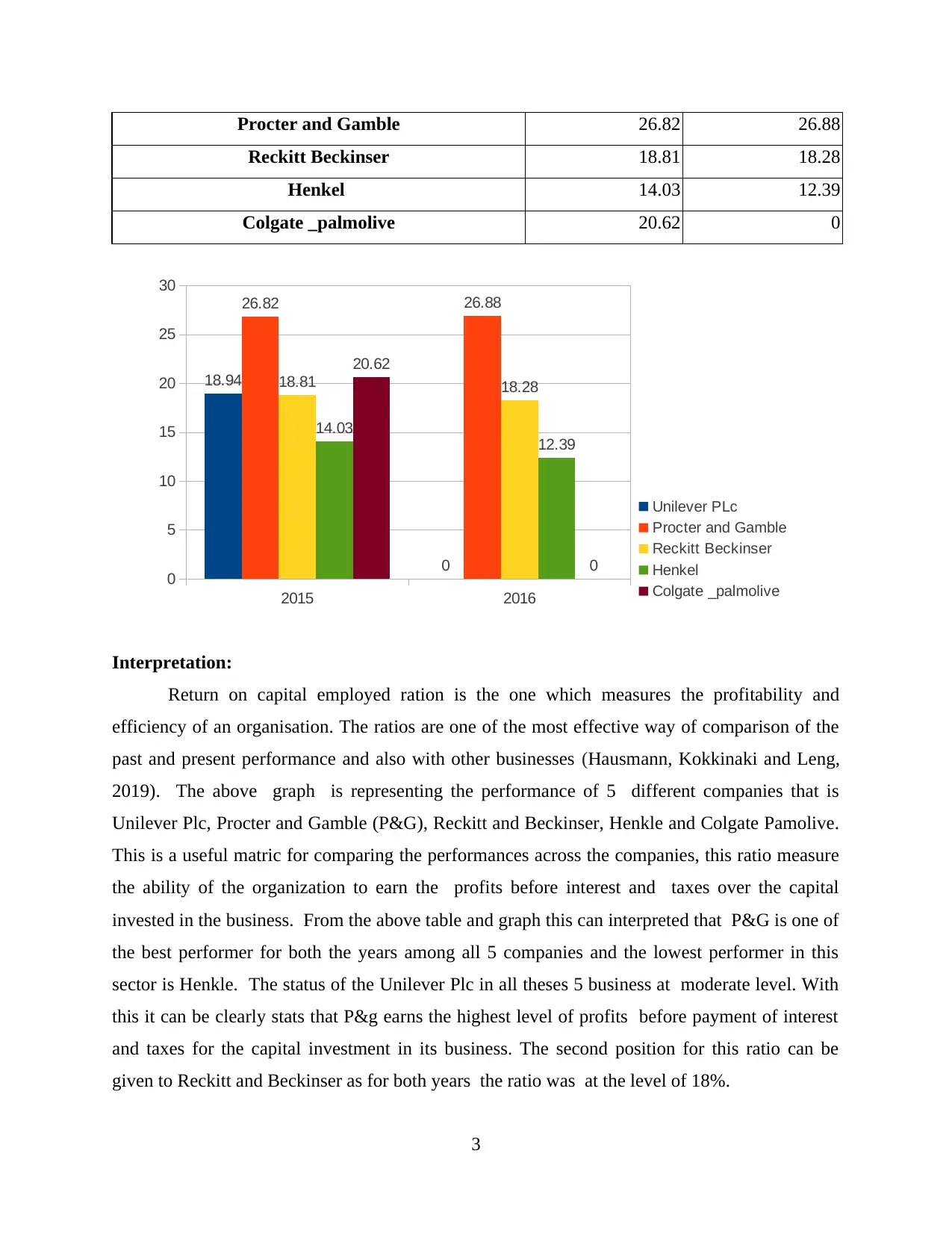

Interpretation:

This is one of the most important ratio that measure the profitability of a business. The

best performer for this ratio among all 5 business organization is determined as Colgate

Pamolive which was the one having the lowest return on capital employed. Unilever Plc is

having the lowest profits margin of all 5. This can be stated the organization is not in a good

position in the industry and market though at the personal level the business is having a growth

at moderate level but in the industry the performance is not so good. The second position in the

respect is interpreted as for Reckitt and Beckinser (Keshavarz-Ghorabaee and et.al., 2018). With

analysis of this ratio it has been found out that Unilever is not at good profitable position as

compared to the peers in the industry and Pamolive is enjoying the best profitability level

followed by Reckitt and Beckinser in this line. The third organisation in this line is P&G.

4

2015 2016

0

10

20

30

40

50

60

70

42.17 42.65

52.41 54.78

59.12 60.92

48.21 47.94

58.62 60.04

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

Particular 2015 2016

Unilever PLc 42.17 42.65

Procter and Gamble 52.41 54.78

Reckitt Beckinser 59.12 60.92

Henkel 48.21 47.94

Colgate _palmolive 58.62 60.04

Interpretation:

This is one of the most important ratio that measure the profitability of a business. The

best performer for this ratio among all 5 business organization is determined as Colgate

Pamolive which was the one having the lowest return on capital employed. Unilever Plc is

having the lowest profits margin of all 5. This can be stated the organization is not in a good

position in the industry and market though at the personal level the business is having a growth

at moderate level but in the industry the performance is not so good. The second position in the

respect is interpreted as for Reckitt and Beckinser (Keshavarz-Ghorabaee and et.al., 2018). With

analysis of this ratio it has been found out that Unilever is not at good profitable position as

compared to the peers in the industry and Pamolive is enjoying the best profitability level

followed by Reckitt and Beckinser in this line. The third organisation in this line is P&G.

4

2015 2016

0

10

20

30

40

50

60

70

42.17 42.65

52.41 54.78

59.12 60.92

48.21 47.94

58.62 60.04

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Another factors that has been determined from the adobe graph is that all 5 business did not

experience major change in the gross profit margin from 2015 to 2016. All are performing at

same level for both the year with minor changes in the ratio.

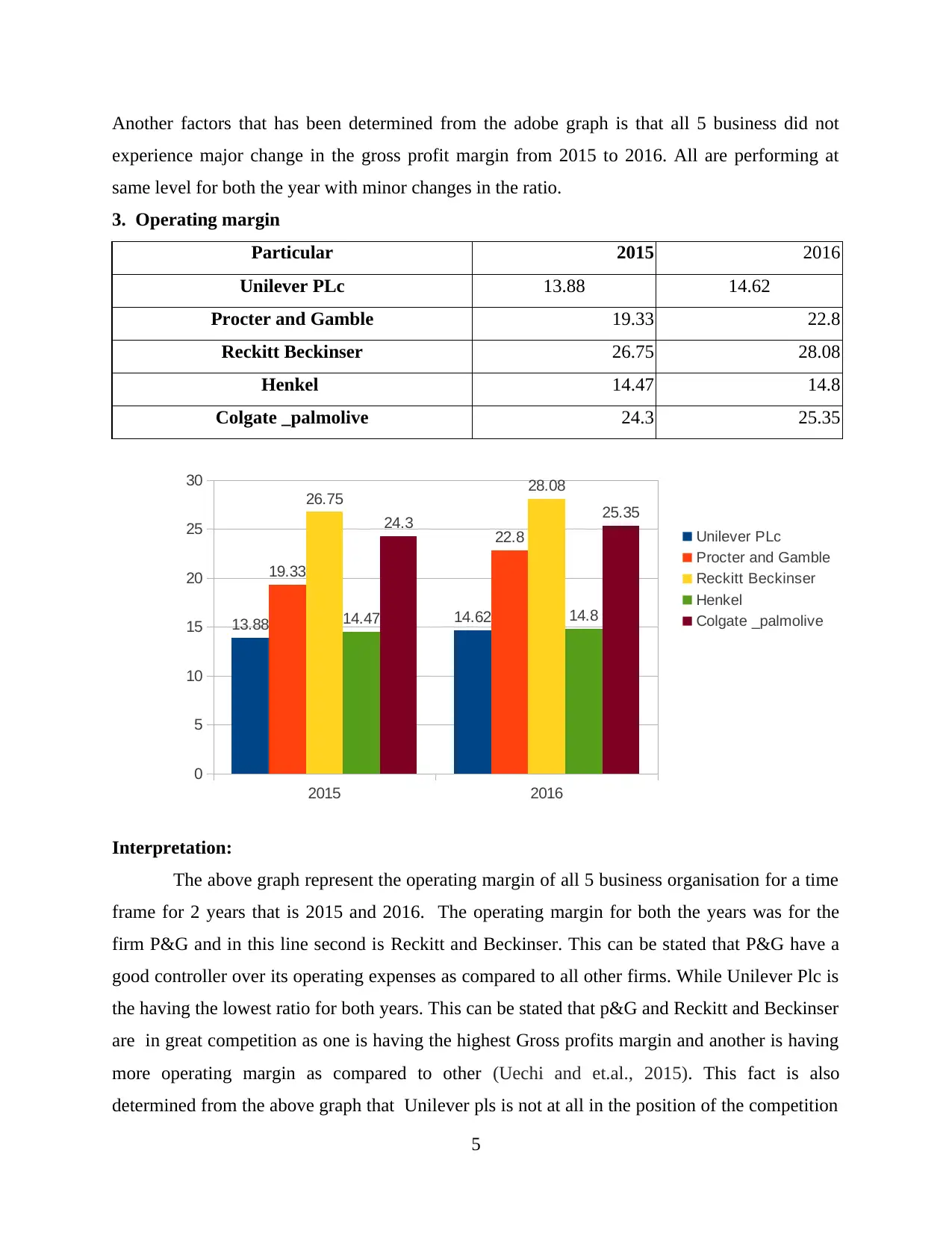

3. Operating margin

Particular 2015 2016

Unilever PLc 13.88 14.62

Procter and Gamble 19.33 22.8

Reckitt Beckinser 26.75 28.08

Henkel 14.47 14.8

Colgate _palmolive 24.3 25.35

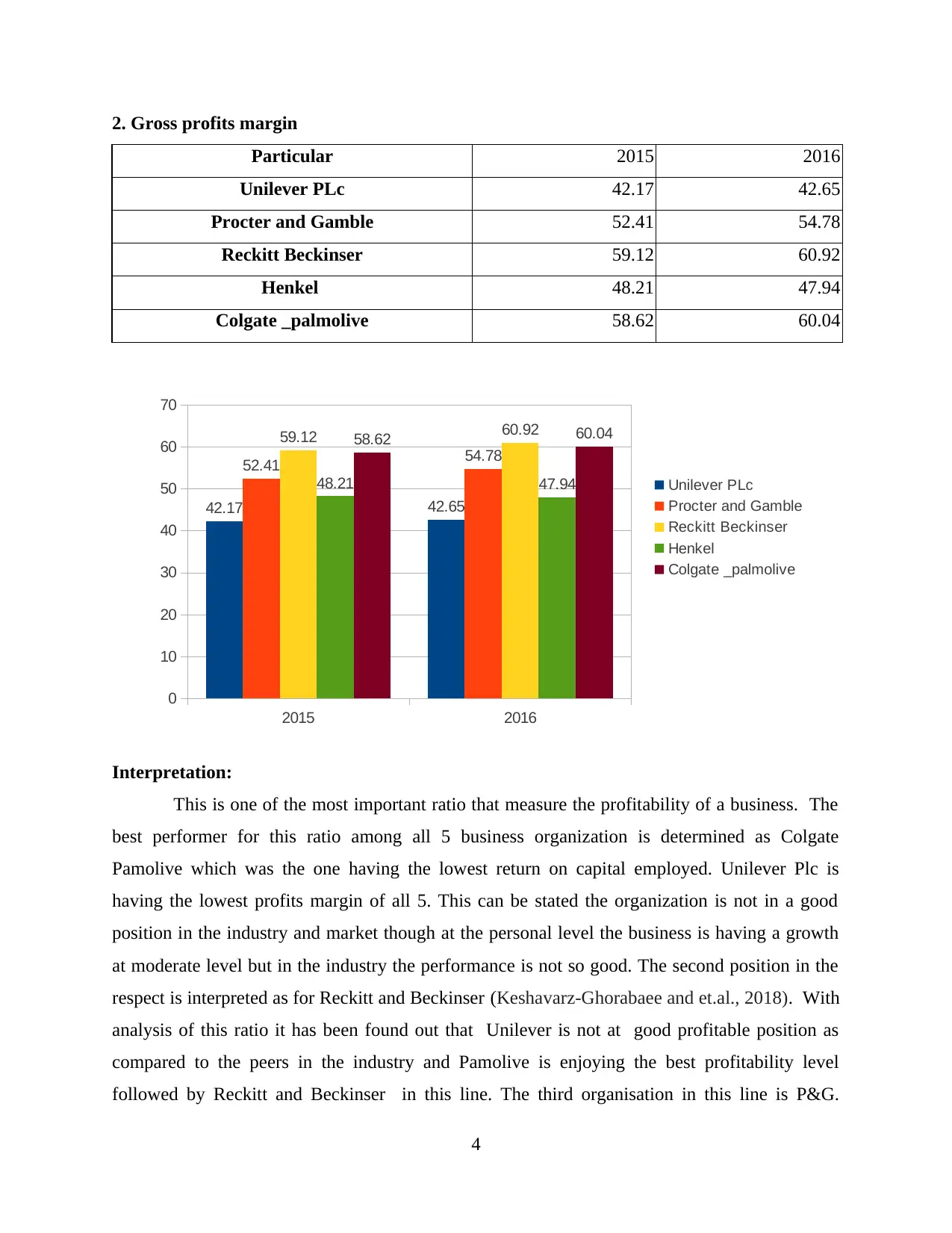

Interpretation:

The above graph represent the operating margin of all 5 business organisation for a time

frame for 2 years that is 2015 and 2016. The operating margin for both the years was for the

firm P&G and in this line second is Reckitt and Beckinser. This can be stated that P&G have a

good controller over its operating expenses as compared to all other firms. While Unilever Plc is

the having the lowest ratio for both years. This can be stated that p&G and Reckitt and Beckinser

are in great competition as one is having the highest Gross profits margin and another is having

more operating margin as compared to other (Uechi and et.al., 2015). This fact is also

determined from the above graph that Unilever pls is not at all in the position of the competition

5

2015 2016

0

5

10

15

20

25

30

13.88 14.62

19.33

22.8

26.75 28.08

14.47 14.8

24.3 25.35

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

experience major change in the gross profit margin from 2015 to 2016. All are performing at

same level for both the year with minor changes in the ratio.

3. Operating margin

Particular 2015 2016

Unilever PLc 13.88 14.62

Procter and Gamble 19.33 22.8

Reckitt Beckinser 26.75 28.08

Henkel 14.47 14.8

Colgate _palmolive 24.3 25.35

Interpretation:

The above graph represent the operating margin of all 5 business organisation for a time

frame for 2 years that is 2015 and 2016. The operating margin for both the years was for the

firm P&G and in this line second is Reckitt and Beckinser. This can be stated that P&G have a

good controller over its operating expenses as compared to all other firms. While Unilever Plc is

the having the lowest ratio for both years. This can be stated that p&G and Reckitt and Beckinser

are in great competition as one is having the highest Gross profits margin and another is having

more operating margin as compared to other (Uechi and et.al., 2015). This fact is also

determined from the above graph that Unilever pls is not at all in the position of the competition

5

2015 2016

0

5

10

15

20

25

30

13.88 14.62

19.33

22.8

26.75 28.08

14.47 14.8

24.3 25.35

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

with these two firms rather t is the organization with the lower most ration for operational profit

margin. In this line Henkel is also not performing well among all the 5 businesses. With this it

can be stated that Unilever and Henkle are the two business organisation with the lower most

gross profit ratio.

4. Gearing ratio:

Particular 2015 2016

Unilever PLc 0.62 0

Procter and Gamble 0 0

Reckitt Beckinser 0.1 0.1

Henkel 0 1.86

Colgate _palmolive 0 0

Interpretation:

The gearing ratio depicts the financial leverage of the firm with the degree to which its

operations are funded by the equity capital versus the credit financing. Higher gearing ratios

indicate a company has a higher degree of financial leverage and is more susceptible to

downturns in the economy and the business cycle. Companies with lower gearing ratio

calculations have more equity to rely upon as financing is needed. The data is available for only

two firms only and this can be stated that for both the years the Reckitt and Beckinser ratio is

6

2015 2016

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

margin. In this line Henkel is also not performing well among all the 5 businesses. With this it

can be stated that Unilever and Henkle are the two business organisation with the lower most

gross profit ratio.

4. Gearing ratio:

Particular 2015 2016

Unilever PLc 0.62 0

Procter and Gamble 0 0

Reckitt Beckinser 0.1 0.1

Henkel 0 1.86

Colgate _palmolive 0 0

Interpretation:

The gearing ratio depicts the financial leverage of the firm with the degree to which its

operations are funded by the equity capital versus the credit financing. Higher gearing ratios

indicate a company has a higher degree of financial leverage and is more susceptible to

downturns in the economy and the business cycle. Companies with lower gearing ratio

calculations have more equity to rely upon as financing is needed. The data is available for only

two firms only and this can be stated that for both the years the Reckitt and Beckinser ratio is

6

2015 2016

0

0.2

0.4

0.6

0.8

1

1.2

1.4

1.6

1.8

2

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

0.10 times which means the business is relying more on the equity funding for its financial

needs rather on the debt sources (Zolfani, Yazdani and Zavadskas, 2018)(. The ratio for

Unilever for 2015 was 0.62, which means it relies to a minimum level to funds its business

operation on the debt funds rather its has sufficient funds to carry on its daily activities of the

firm. From the above graph it can be interpreted that Hankle do not have a good gearing ratio

which was at 1.86 times in 2016 means it takes more funds from the debt funding to carry out

the day to day business operations.

5. Interest coverage ratio:

Particular 2015 2016

Unilever PLc 14.18 14.15

Procter and Gamble 88.55 159.34

Reckitt Beckinser 51.18 37.15

Henkel 37.15 65.55

Colgate _palmolive 21.77 26.09

Interpretation:

Interest coverage ratio is the one through which an organisation determines the ability of

the organisation to pay the interest expenses on the outstanding debts. This ratio is calculated by

diving the earning before interest and tax by the interest expense of the business. This give the

ratio in times which means that how many times the interest expenses can be paid by the firm

7

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

2015 2016

0

20

40

60

80

100

120

140

160

180

14.18 14.15

88.55

159.34

51.18

37.1537.15

65.55

21.77 26.09

needs rather on the debt sources (Zolfani, Yazdani and Zavadskas, 2018)(. The ratio for

Unilever for 2015 was 0.62, which means it relies to a minimum level to funds its business

operation on the debt funds rather its has sufficient funds to carry on its daily activities of the

firm. From the above graph it can be interpreted that Hankle do not have a good gearing ratio

which was at 1.86 times in 2016 means it takes more funds from the debt funding to carry out

the day to day business operations.

5. Interest coverage ratio:

Particular 2015 2016

Unilever PLc 14.18 14.15

Procter and Gamble 88.55 159.34

Reckitt Beckinser 51.18 37.15

Henkel 37.15 65.55

Colgate _palmolive 21.77 26.09

Interpretation:

Interest coverage ratio is the one through which an organisation determines the ability of

the organisation to pay the interest expenses on the outstanding debts. This ratio is calculated by

diving the earning before interest and tax by the interest expense of the business. This give the

ratio in times which means that how many times the interest expenses can be paid by the firm

7

Unilever PLc

Procter and Gamble

Reckitt Beckinser

Henkel

Colgate _palmolive

2015 2016

0

20

40

60

80

100

120

140

160

180

14.18 14.15

88.55

159.34

51.18

37.1537.15

65.55

21.77 26.09

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

from its EBIT. From the above grape it can be interpreted that among all 5 businesses the best

interest coverage ratio is for P&G at 88.55 and 159.34 for 2015 and 2016 receptively. The ratio

of all other firms are also good but not as good as compared to P&G. This means that this

organisation earns good profits to covers its interests expenses. For year 2016 the ratio was at

159.34 that reflect the fact the profits are way to higher that the interest expenses of the firm

means company have a capacity to pay the interest on the debt holding for almost 160 times for

year 2016. This ratio for Unilever is also at the last number with 14.18 and 14.15 in 2015 and

2016 respectively. Though the company have a capacity to meet the cost f interest for

approximately 14 times in both the years. But when compared with the overall performance

with its peers its position in the market can not be considered as good for 2015 and 2016.

Conclusion

With analysis 5 different ratios of 5 organisation of the market it can clearly be

interpreted that the position of the Unilever in industry can not be considered at good level as

out of 5 ratios for 3 it has the lowest ration which is not a good performance indicator. For all the

ration the performance of the Unilever plc is not at all goods when compared with the

performances of peers in the industry, the fact have been determined that both two years at the

individual level performance of the organisation is at stable position but overall industrial

presentation the business is not at a good level the gross and operating profits level of the firms

are toll low instead all other peers socially Reckitt and Beckinser are at much higher earning

level. The ability of the organisation to cover its interest cost and the ration of its debt to the

equity is also not good, rather other firms are playing at well position in context of efficiency and

solvency.

PART 2

Critical evaluation of the budgetary techniques that can help to large global companies

Budgeting: in simple terms budging can be explained as creating a plan to spend the

money of the business of different activities, investments and projects related with the operation

of the large corporations. Under this measure budgets are prepared by the management of an

international organization for significant activities of the entity. Budges are forecast for a future

period with taking guidance from the past trends and the standards for limits are set for expenses

to be incurred on the operational activities or the level of profits or achievement to be attained in

a stipulated time frame. This is one of the important toll that aids in that decision making process

8

interest coverage ratio is for P&G at 88.55 and 159.34 for 2015 and 2016 receptively. The ratio

of all other firms are also good but not as good as compared to P&G. This means that this

organisation earns good profits to covers its interests expenses. For year 2016 the ratio was at

159.34 that reflect the fact the profits are way to higher that the interest expenses of the firm

means company have a capacity to pay the interest on the debt holding for almost 160 times for

year 2016. This ratio for Unilever is also at the last number with 14.18 and 14.15 in 2015 and

2016 respectively. Though the company have a capacity to meet the cost f interest for

approximately 14 times in both the years. But when compared with the overall performance

with its peers its position in the market can not be considered as good for 2015 and 2016.

Conclusion

With analysis 5 different ratios of 5 organisation of the market it can clearly be

interpreted that the position of the Unilever in industry can not be considered at good level as

out of 5 ratios for 3 it has the lowest ration which is not a good performance indicator. For all the

ration the performance of the Unilever plc is not at all goods when compared with the

performances of peers in the industry, the fact have been determined that both two years at the

individual level performance of the organisation is at stable position but overall industrial

presentation the business is not at a good level the gross and operating profits level of the firms

are toll low instead all other peers socially Reckitt and Beckinser are at much higher earning

level. The ability of the organisation to cover its interest cost and the ration of its debt to the

equity is also not good, rather other firms are playing at well position in context of efficiency and

solvency.

PART 2

Critical evaluation of the budgetary techniques that can help to large global companies

Budgeting: in simple terms budging can be explained as creating a plan to spend the

money of the business of different activities, investments and projects related with the operation

of the large corporations. Under this measure budgets are prepared by the management of an

international organization for significant activities of the entity. Budges are forecast for a future

period with taking guidance from the past trends and the standards for limits are set for expenses

to be incurred on the operational activities or the level of profits or achievement to be attained in

a stipulated time frame. This is one of the important toll that aids in that decision making process

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

as with this the expanses are determined and with this management knows that where and how

much resources must be allocated of each operational decision. Moreover, controlling measures

are also taking to attainment set goals in given time frame with keeping a regular monitoring.

With this organization at global level are assisted to a great extent in managing the business and

economic fluctuation as with regular monitoring changes are predicted and actions are taken to

meet those uncertainties.

The budget are vital in decision making process of organisation specially for those who

are operating at the global level. The assistance is provided as with the forecast of resource

requirement and expenses that will be incurred all financial and other resources are allocated

in accordance with need and expenditures. Planning and forecasting do help the modern

organisation at international level to determine the future uncertainty on time and this assisted

them to monitor the future and application of the controlling measure to avoid or to cope with

such circumstances.

Criticism associated with budgeting: Major drawbacks related with budgeting are:

It is highly dependent on assumptions and this raises the chances of inaccuracy in budget

preparation.

These do not consider the present times and changes as budgets are based on future

trends which can not stated as 100% correct.

Comprehensive Budgeting techniques: it can be defined as one of the most importance tool

used by the management of global organisation for determination of planning and controlling

decision. The budgeting process is an all encompassing task that brings in focus all short and

long run goals and objectives of the business (Comprehensive Business Budgeting, 2018). The

process of preparing a budget compels management to explicitly recognize and assign

quantitative values to all marketing, production, and financial decisions. Its usefulness of this

can be stated as improvement of organizational structure, Increased emphasis on setting of long-

term objectives, better evaluation of the organisational performance etc.

Revenue budgets: This is the budget which is prepared by the internation organisation

to forecast the sales revenue and capital expenditures of the firm. This assist the business

to save time and efforts in the allocation of the resources. This budgets includes the

incomers and expenses for a year which will be earned incurred regularly when the

9

much resources must be allocated of each operational decision. Moreover, controlling measures

are also taking to attainment set goals in given time frame with keeping a regular monitoring.

With this organization at global level are assisted to a great extent in managing the business and

economic fluctuation as with regular monitoring changes are predicted and actions are taken to

meet those uncertainties.

The budget are vital in decision making process of organisation specially for those who

are operating at the global level. The assistance is provided as with the forecast of resource

requirement and expenses that will be incurred all financial and other resources are allocated

in accordance with need and expenditures. Planning and forecasting do help the modern

organisation at international level to determine the future uncertainty on time and this assisted

them to monitor the future and application of the controlling measure to avoid or to cope with

such circumstances.

Criticism associated with budgeting: Major drawbacks related with budgeting are:

It is highly dependent on assumptions and this raises the chances of inaccuracy in budget

preparation.

These do not consider the present times and changes as budgets are based on future

trends which can not stated as 100% correct.

Comprehensive Budgeting techniques: it can be defined as one of the most importance tool

used by the management of global organisation for determination of planning and controlling

decision. The budgeting process is an all encompassing task that brings in focus all short and

long run goals and objectives of the business (Comprehensive Business Budgeting, 2018). The

process of preparing a budget compels management to explicitly recognize and assign

quantitative values to all marketing, production, and financial decisions. Its usefulness of this

can be stated as improvement of organizational structure, Increased emphasis on setting of long-

term objectives, better evaluation of the organisational performance etc.

Revenue budgets: This is the budget which is prepared by the internation organisation

to forecast the sales revenue and capital expenditures of the firm. This assist the business

to save time and efforts in the allocation of the resources. This budgets includes the

incomers and expenses for a year which will be earned incurred regularly when the

9

business operations are being carried out. The sales are estimated from all the business

establishment around the globe dan in accordance with it resources are being allocated.

Activity based budgets: in this method budgets are prepared for the using the cost of

separate activities after taking into consideration the overheads cost of overall

operations of the international organization (Activity Based Budgeting, 2018). With this,

budgets more transparency in the budging system is provided. In which revenues

generated from instructional and research activities are allocated directly to the unit

responsible for the activity. The budges are prepared after searching into efficiency in

the significant business operations and then budgets are developed based on those

activities.

Zero based Budgeting: this is a method in which all budgets are prepared from the zero

base, this means that all the expanses in the budgets must be justifies for each new

period. Each and every function of the operational division are analysed for its

requirements and costs. This type of budgets are more flexible, focus on operational and

lower costs. In this, budgets no old trends of cost and expenses are taking into account

rather they are prepared for all new period with base as Zero. All the resource needs and

expenses are determined for each new period.

Capital budgeting: this can be defined as that techniques which is used by international

organisation before making an investment or purchase decision. The corporation at global level

remain depended on this when making capital expenditures. The decisions that are made on the

basis of outcomes given by different techniques of capital budgeting includes determination of

the projects such as deployment of smart technologies, acquisitions, purchase of land, building,

and machinery, investment in R&D, innovations etc.

Beyond budgeting: this can be defined as a principle under which the global

corporations are needed to go beyond budgeting because of inherent fleas in the budging.

Beyond command-and-control toward a management model that is more empowered and

adaptive (Beyond budgeting, 2018). This is a new concept in the budging process where the

management is required to go beyond the budgeting and rethinking how to manage organizations

activities at global level. s

Role of Technology in budgeting, planning and Forecasting: Technology is a big part

of every organisation specially for those operating at global lever as with the advance technology

10

establishment around the globe dan in accordance with it resources are being allocated.

Activity based budgets: in this method budgets are prepared for the using the cost of

separate activities after taking into consideration the overheads cost of overall

operations of the international organization (Activity Based Budgeting, 2018). With this,

budgets more transparency in the budging system is provided. In which revenues

generated from instructional and research activities are allocated directly to the unit

responsible for the activity. The budges are prepared after searching into efficiency in

the significant business operations and then budgets are developed based on those

activities.

Zero based Budgeting: this is a method in which all budgets are prepared from the zero

base, this means that all the expanses in the budgets must be justifies for each new

period. Each and every function of the operational division are analysed for its

requirements and costs. This type of budgets are more flexible, focus on operational and

lower costs. In this, budgets no old trends of cost and expenses are taking into account

rather they are prepared for all new period with base as Zero. All the resource needs and

expenses are determined for each new period.

Capital budgeting: this can be defined as that techniques which is used by international

organisation before making an investment or purchase decision. The corporation at global level

remain depended on this when making capital expenditures. The decisions that are made on the

basis of outcomes given by different techniques of capital budgeting includes determination of

the projects such as deployment of smart technologies, acquisitions, purchase of land, building,

and machinery, investment in R&D, innovations etc.

Beyond budgeting: this can be defined as a principle under which the global

corporations are needed to go beyond budgeting because of inherent fleas in the budging.

Beyond command-and-control toward a management model that is more empowered and

adaptive (Beyond budgeting, 2018). This is a new concept in the budging process where the

management is required to go beyond the budgeting and rethinking how to manage organizations

activities at global level. s

Role of Technology in budgeting, planning and Forecasting: Technology is a big part

of every organisation specially for those operating at global lever as with the advance technology

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.