Business Statistics: Regression Analysis of R&D Expenses and Assets

VerifiedAdded on 2023/06/03

|17

|2546

|373

Homework Assignment

AI Summary

This assignment analyzes the relationship between Research and Development (R&D) expenses and total assets of technology companies. The analysis begins with a scatter plot revealing a positive linear correlation, with the coefficient of determination indicating the proportion of variance in R&D expenses explained by total assets. Outliers are identified and their impact on the model assessed. The least squares regression line is estimated, and the intercept and slope are interpreted, including their statistical significance. Histograms of both variables are examined, and residual plots are analyzed for outliers and the accuracy of the model. Further, the analysis explores the relationship between R&D spending and assets using log transformations, comparing different regression models and interpreting the coefficients. The assignment also investigates the use of multiple regression models with cost of goods sold and total assets as predictors, addressing potential multicollinearity issues. The interpretation of coefficients and the statistical significance of the models are discussed, alongside prediction and confidence intervals. Finally, marginal utility and elasticity of R&D spending are examined in relation to the cost of goods sold.

Business Statistics

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Q1.R& D Expenses

Q2.

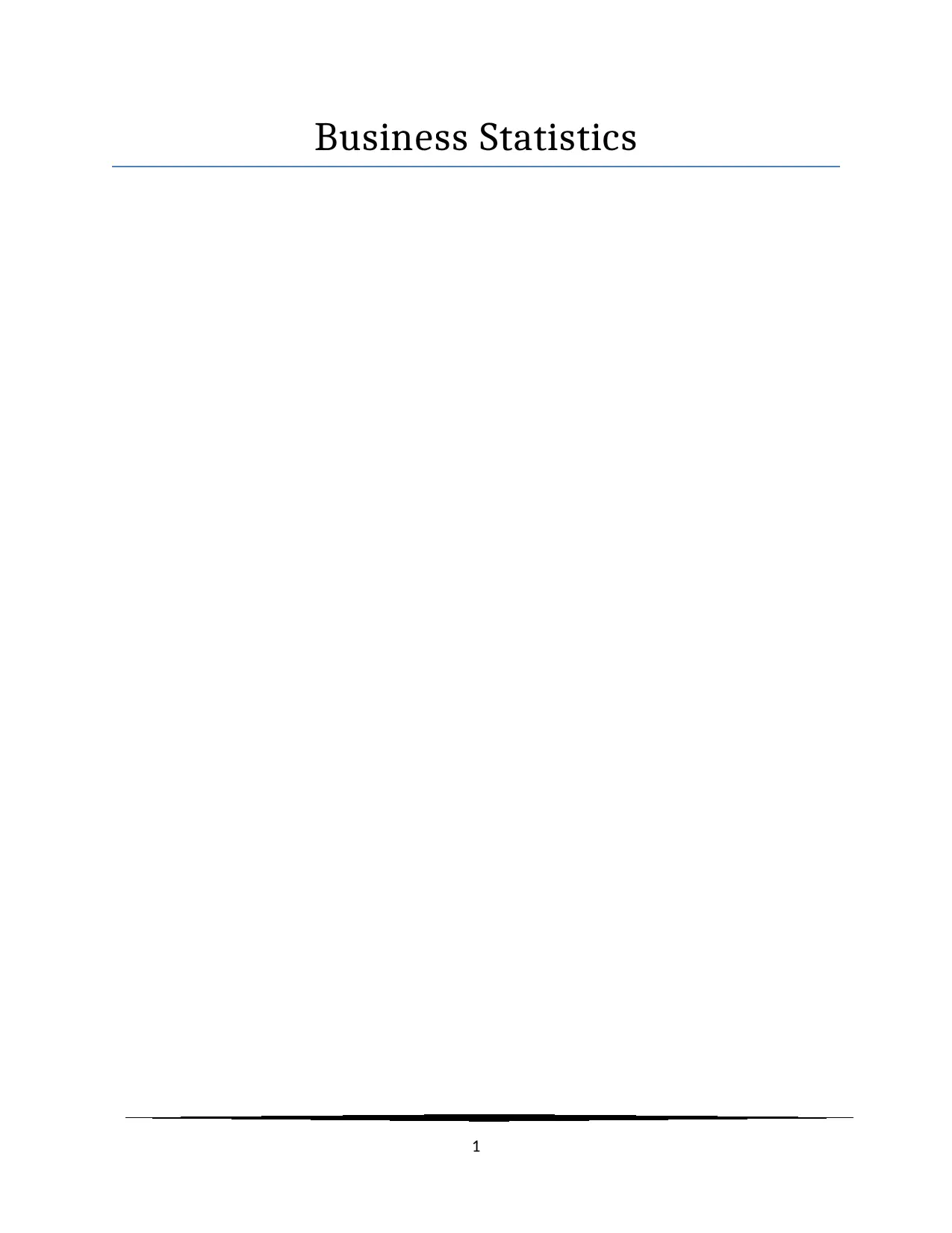

a. Scatter plot R&D Expense on Assets given underneath.

Figure 1: Scatter plot R&D Expense on Assets

The trend line in the two-way scatter plot revealed the positive linear and highly correlated

association between the two variables. From the coefficient of Determination of 0.952, it

was possible to explain 95.2% variation in R&D expenses by total assets of the firms.

Outliers were identified from the three sigma limits, and were clearly evident from the

scatter plot diagram. The companies with R&D expenses outside the three sigma range (-

1257.37, 1434.19) and assets outside (-14139.15, 16082.25) were identified as outlier

companies. But, presence of some outlier values of asset and expense were within the

confidence interval of the linear trend line. The scatter plot was redrawn by excluding the

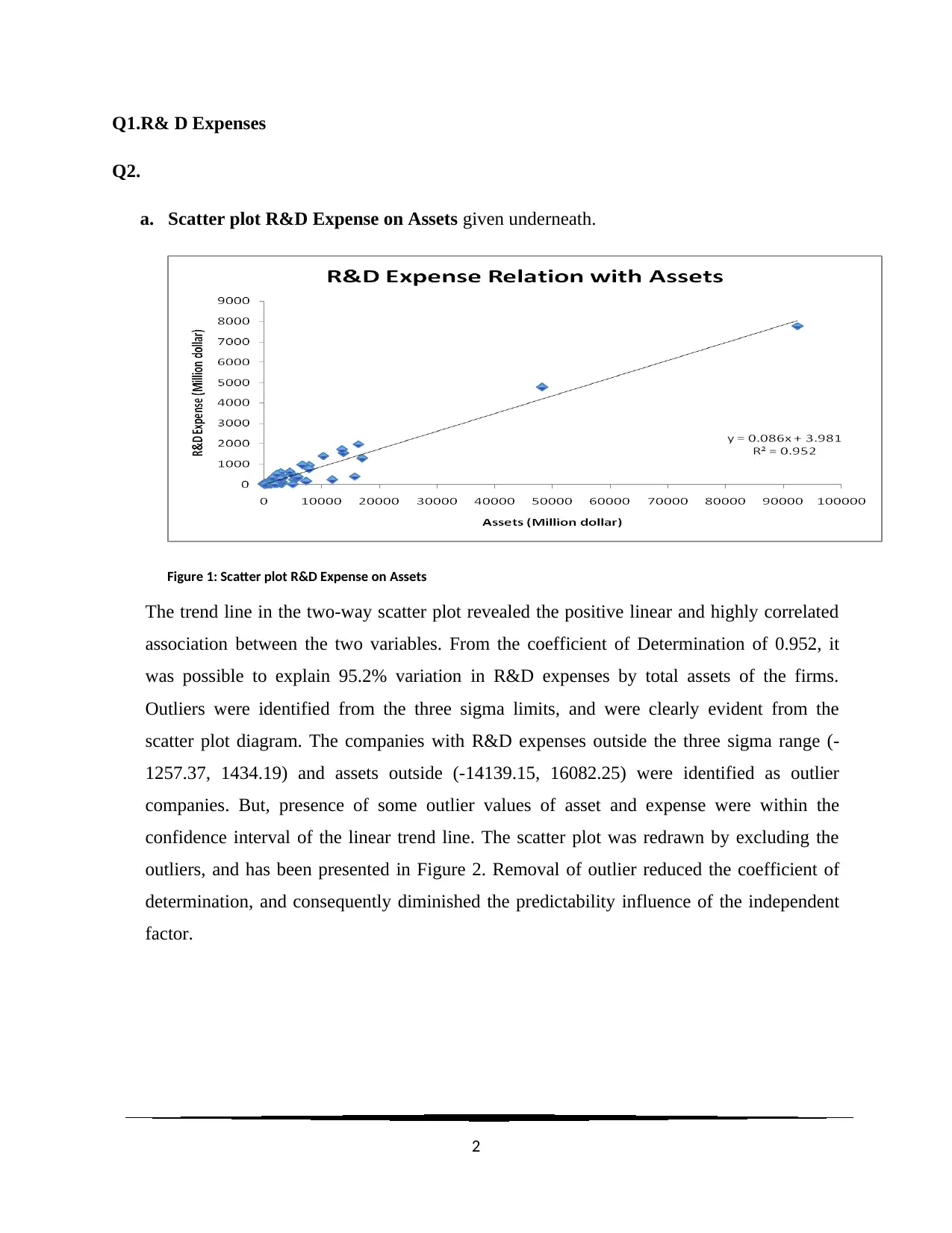

outliers, and has been presented in Figure 2. Removal of outlier reduced the coefficient of

determination, and consequently diminished the predictability influence of the independent

factor.

2

Q2.

a. Scatter plot R&D Expense on Assets given underneath.

Figure 1: Scatter plot R&D Expense on Assets

The trend line in the two-way scatter plot revealed the positive linear and highly correlated

association between the two variables. From the coefficient of Determination of 0.952, it

was possible to explain 95.2% variation in R&D expenses by total assets of the firms.

Outliers were identified from the three sigma limits, and were clearly evident from the

scatter plot diagram. The companies with R&D expenses outside the three sigma range (-

1257.37, 1434.19) and assets outside (-14139.15, 16082.25) were identified as outlier

companies. But, presence of some outlier values of asset and expense were within the

confidence interval of the linear trend line. The scatter plot was redrawn by excluding the

outliers, and has been presented in Figure 2. Removal of outlier reduced the coefficient of

determination, and consequently diminished the predictability influence of the independent

factor.

2

Figure 2: Scatter plot R&D Expense on Assets – Without outliers

b. The least square regression line was estimated as R∧D Expense=0 . 087∗Asset +3 . 982 .

The intercept of 3.982 signified that R&D expenses were $ 3,982,000 for zero asset of the

company. Practically, the implication was statistically irrelevant (t = 0.883, p = 0.378)

and indicated that companies were investing aggressively on R&D purposes. The slope of

the regression of 0.087 was statistically significant (t = 98.778, p < 0.05) at 5% level of

significance, and implied a strong positive linear association between the variables.

Table 1: Regression Model for R&D on Assets

Regression Statistics

Multiple R 0.976

R Square 0.952

Adjusted R Square 0.952

Standard Error 98.292

Observations 493

ANOVA

df SS MS F Significance F

Regression 1 94265529.619 94265529.619 9757.100 0.000

Residual 491 4743661.117 9661.224

Total 492 99009190.736

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 3.982 4.509 0.883 0.378 -4.877 12.840

Assets 0.087 0.001 98.778 0.000 0.085 0.089

3

b. The least square regression line was estimated as R∧D Expense=0 . 087∗Asset +3 . 982 .

The intercept of 3.982 signified that R&D expenses were $ 3,982,000 for zero asset of the

company. Practically, the implication was statistically irrelevant (t = 0.883, p = 0.378)

and indicated that companies were investing aggressively on R&D purposes. The slope of

the regression of 0.087 was statistically significant (t = 98.778, p < 0.05) at 5% level of

significance, and implied a strong positive linear association between the variables.

Table 1: Regression Model for R&D on Assets

Regression Statistics

Multiple R 0.976

R Square 0.952

Adjusted R Square 0.952

Standard Error 98.292

Observations 493

ANOVA

df SS MS F Significance F

Regression 1 94265529.619 94265529.619 9757.100 0.000

Residual 491 4743661.117 9661.224

Total 492 99009190.736

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 3.982 4.509 0.883 0.378 -4.877 12.840

Assets 0.087 0.001 98.778 0.000 0.085 0.089

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

c. Coefficient of determination was 0.952, implying 95.2% variation in R&D expenses were

explained by total assets of the company. In fact, the adjusted R square for the inclusion of

Assets as an impact factor implied the statistical significance of the predictor (t = 98.78, p <

0.05). The standard error of 0.001 or 0.1% signified that the observations were within the

0.1% spread ($ -166940.16, $ 173716.20) of the regression equation. The regression line

accurately characterized the strong positive correlation between the variables.

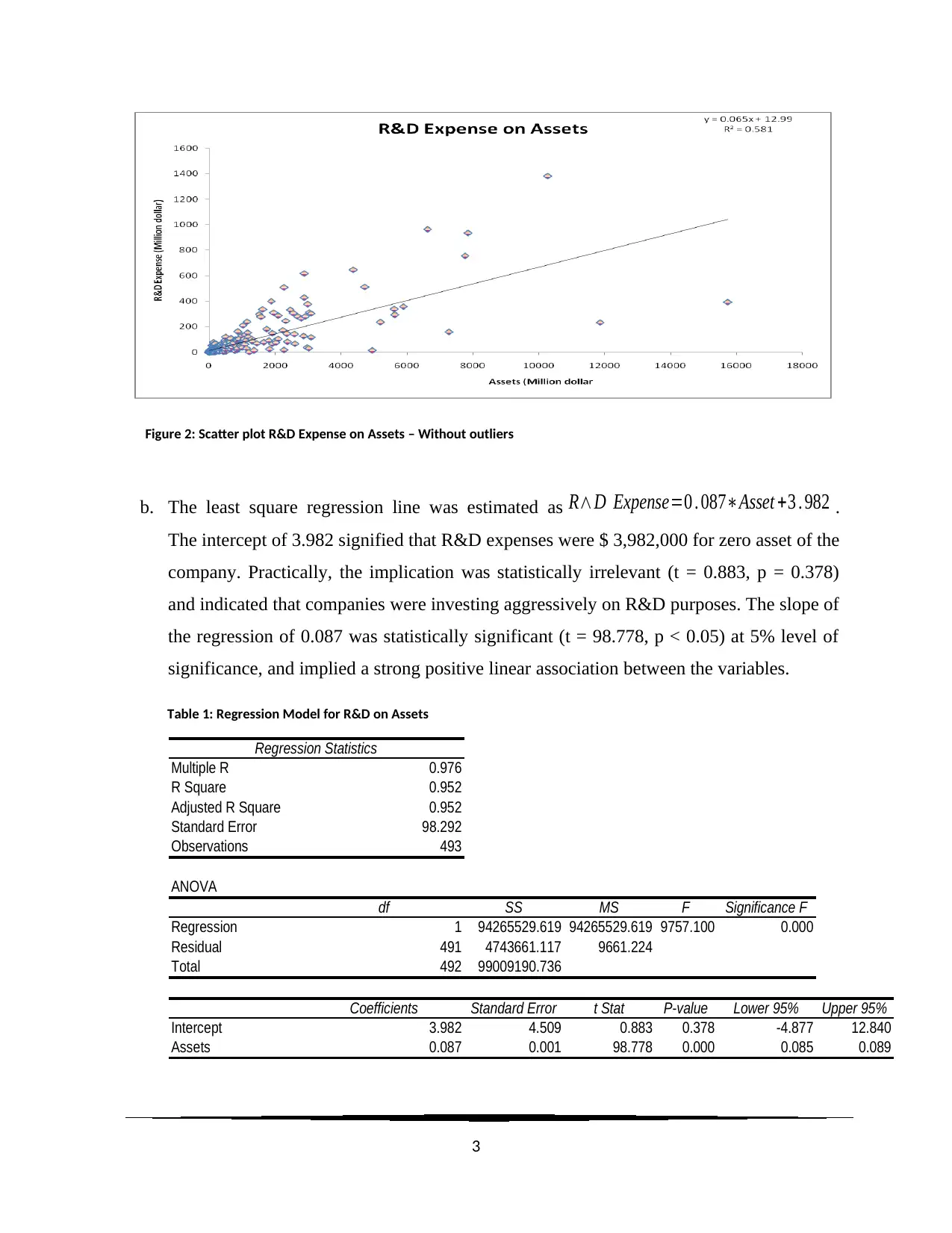

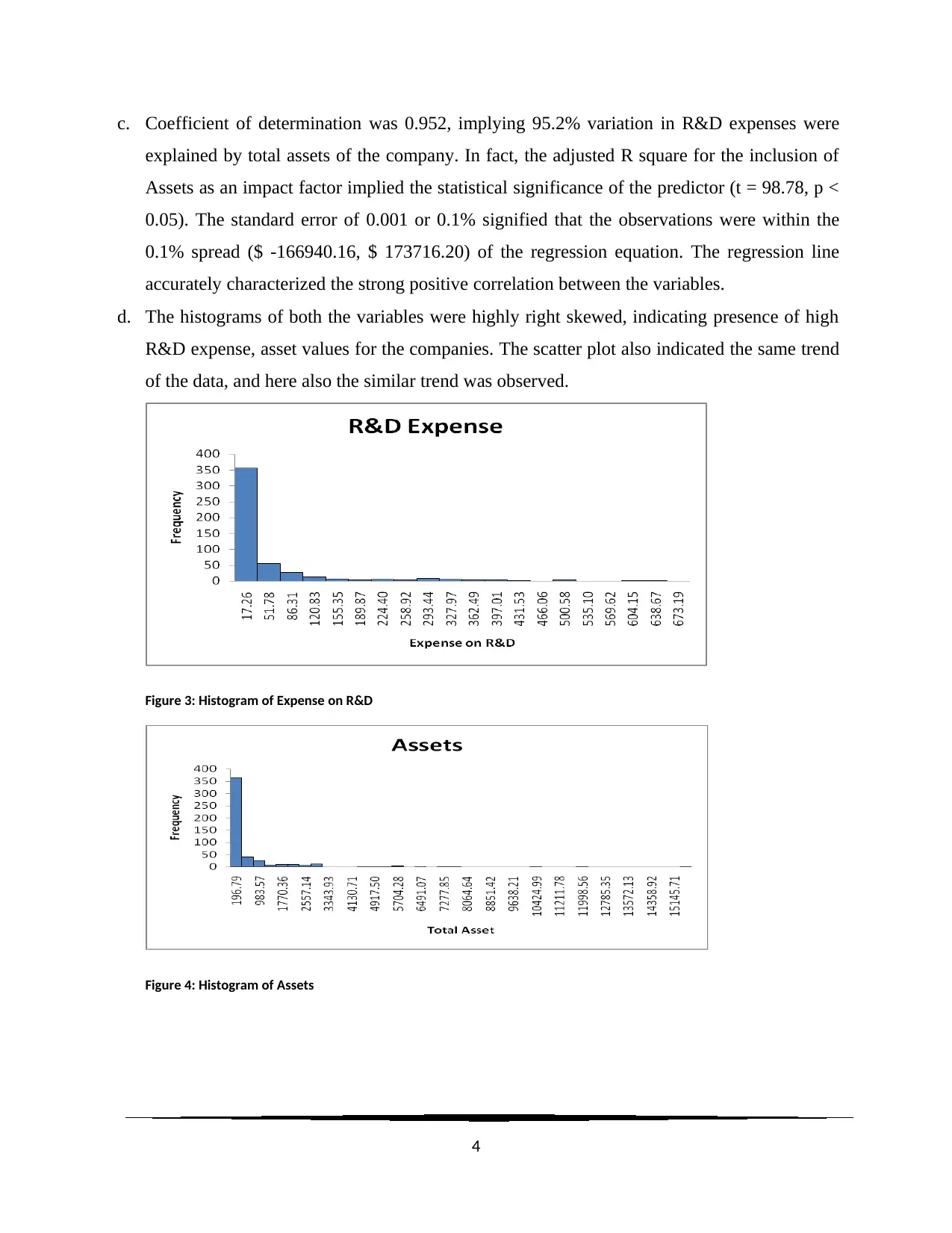

d. The histograms of both the variables were highly right skewed, indicating presence of high

R&D expense, asset values for the companies. The scatter plot also indicated the same trend

of the data, and here also the similar trend was observed.

Figure 3: Histogram of Expense on R&D

Figure 4: Histogram of Assets

4

explained by total assets of the company. In fact, the adjusted R square for the inclusion of

Assets as an impact factor implied the statistical significance of the predictor (t = 98.78, p <

0.05). The standard error of 0.001 or 0.1% signified that the observations were within the

0.1% spread ($ -166940.16, $ 173716.20) of the regression equation. The regression line

accurately characterized the strong positive correlation between the variables.

d. The histograms of both the variables were highly right skewed, indicating presence of high

R&D expense, asset values for the companies. The scatter plot also indicated the same trend

of the data, and here also the similar trend was observed.

Figure 3: Histogram of Expense on R&D

Figure 4: Histogram of Assets

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

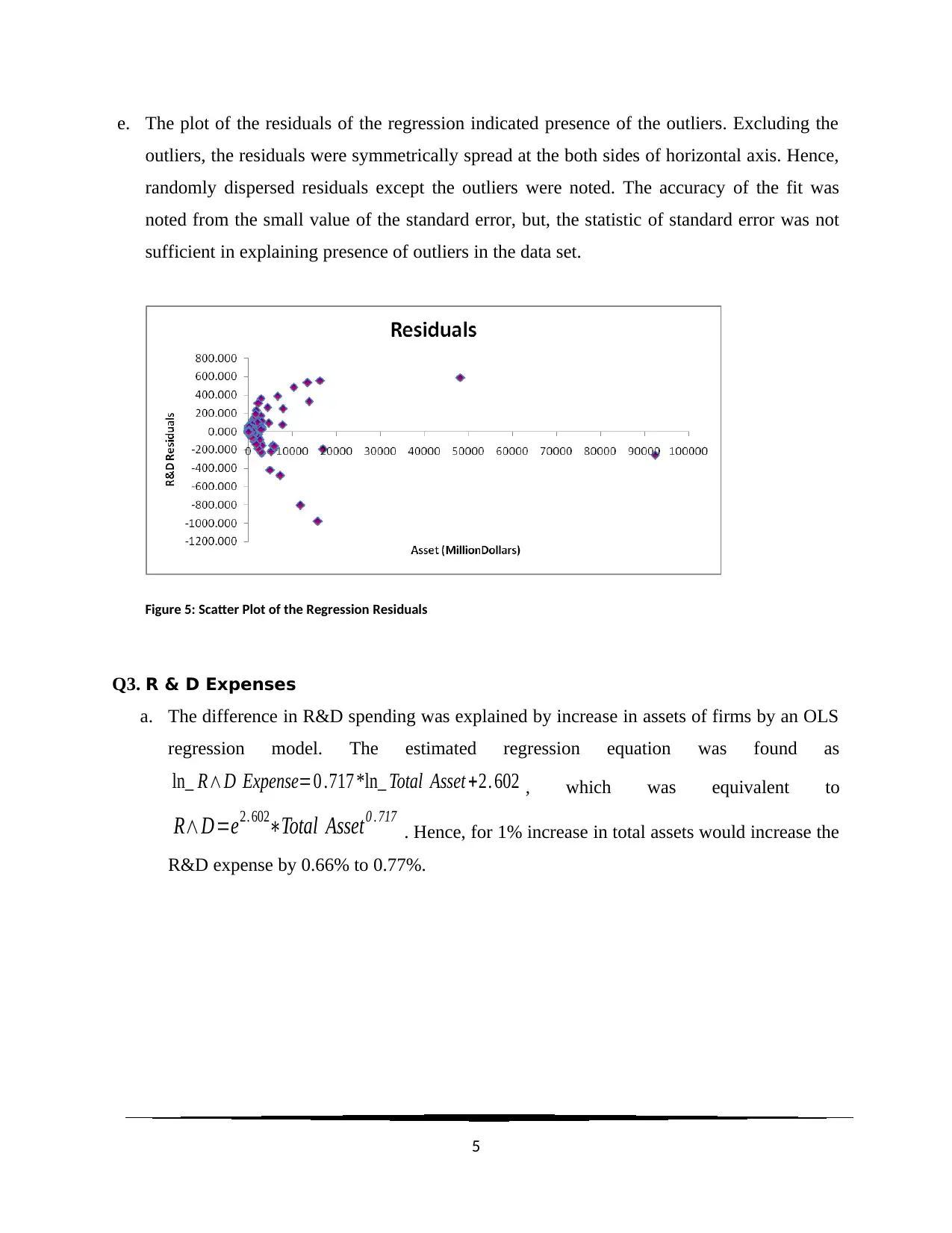

e. The plot of the residuals of the regression indicated presence of the outliers. Excluding the

outliers, the residuals were symmetrically spread at the both sides of horizontal axis. Hence,

randomly dispersed residuals except the outliers were noted. The accuracy of the fit was

noted from the small value of the standard error, but, the statistic of standard error was not

sufficient in explaining presence of outliers in the data set.

Figure 5: Scatter Plot of the Regression Residuals

Q3. R & D Expenses

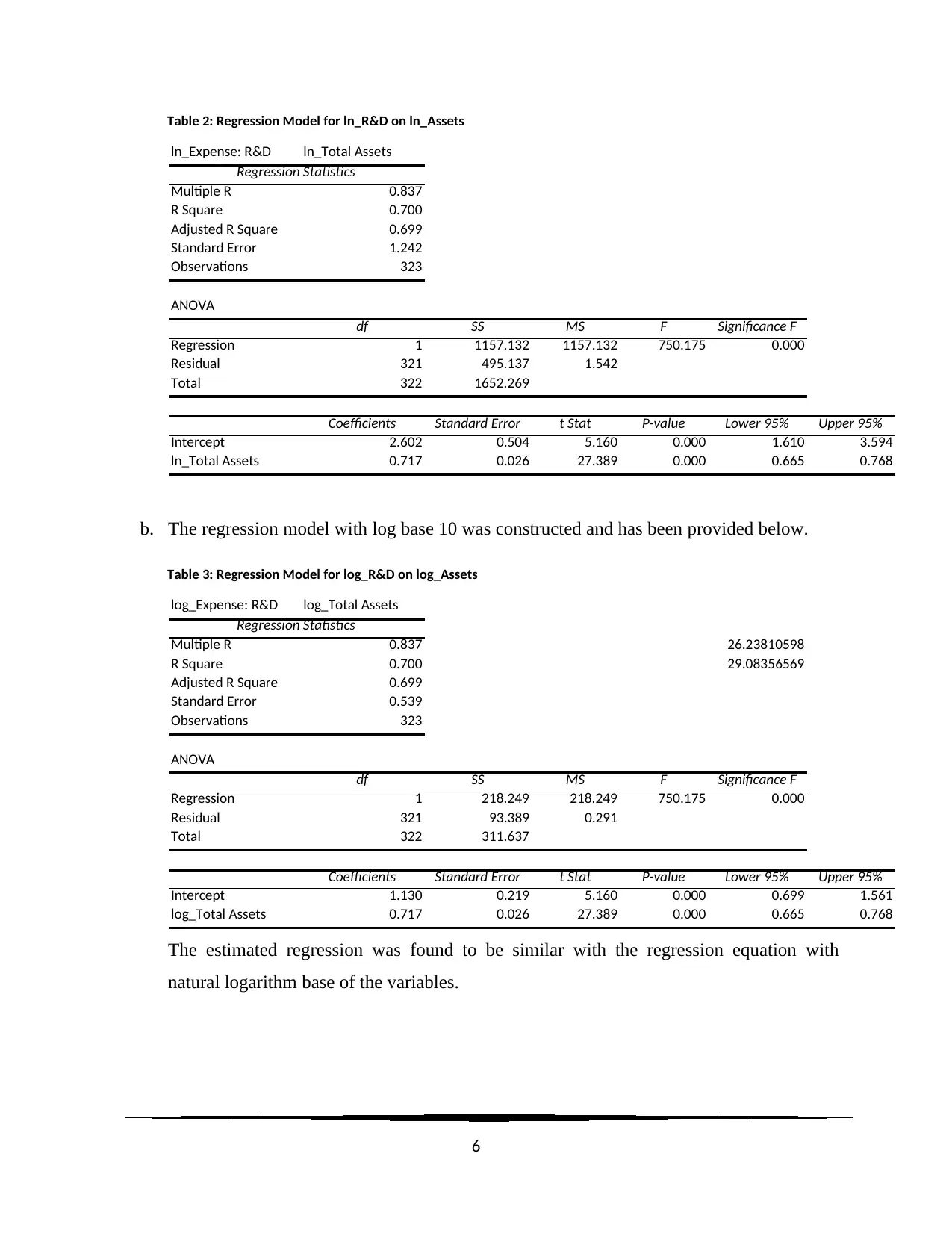

a. The difference in R&D spending was explained by increase in assets of firms by an OLS

regression model. The estimated regression equation was found as

ln_ R∧D Expense=0 .717 *ln_ Total Asset +2. 602 , which was equivalent to

R∧D=e2. 602∗Total Asset0 . 717

. Hence, for 1% increase in total assets would increase the

R&D expense by 0.66% to 0.77%.

5

outliers, the residuals were symmetrically spread at the both sides of horizontal axis. Hence,

randomly dispersed residuals except the outliers were noted. The accuracy of the fit was

noted from the small value of the standard error, but, the statistic of standard error was not

sufficient in explaining presence of outliers in the data set.

Figure 5: Scatter Plot of the Regression Residuals

Q3. R & D Expenses

a. The difference in R&D spending was explained by increase in assets of firms by an OLS

regression model. The estimated regression equation was found as

ln_ R∧D Expense=0 .717 *ln_ Total Asset +2. 602 , which was equivalent to

R∧D=e2. 602∗Total Asset0 . 717

. Hence, for 1% increase in total assets would increase the

R&D expense by 0.66% to 0.77%.

5

Table 2: Regression Model for ln_R&D on ln_Assets

ln_Expense: R&D ln_Total Assets

Regression Statistics

Multiple R 0.837

R Square 0.700

Adjusted R Square 0.699

Standard Error 1.242

Observations 323

ANOVA

df SS MS F Significance F

Regression 1 1157.132 1157.132 750.175 0.000

Residual 321 495.137 1.542

Total 322 1652.269

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.602 0.504 5.160 0.000 1.610 3.594

ln_Total Assets 0.717 0.026 27.389 0.000 0.665 0.768

b. The regression model with log base 10 was constructed and has been provided below.

Table 3: Regression Model for log_R&D on log_Assets

log_Expense: R&D log_Total Assets

Regression Statistics

Multiple R 0.837 26.23810598

R Square 0.700 29.08356569

Adjusted R Square 0.699

Standard Error 0.539

Observations 323

ANOVA

df SS MS F Significance F

Regression 1 218.249 218.249 750.175 0.000

Residual 321 93.389 0.291

Total 322 311.637

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 1.130 0.219 5.160 0.000 0.699 1.561

log_Total Assets 0.717 0.026 27.389 0.000 0.665 0.768

The estimated regression was found to be similar with the regression equation with

natural logarithm base of the variables.

6

ln_Expense: R&D ln_Total Assets

Regression Statistics

Multiple R 0.837

R Square 0.700

Adjusted R Square 0.699

Standard Error 1.242

Observations 323

ANOVA

df SS MS F Significance F

Regression 1 1157.132 1157.132 750.175 0.000

Residual 321 495.137 1.542

Total 322 1652.269

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.602 0.504 5.160 0.000 1.610 3.594

ln_Total Assets 0.717 0.026 27.389 0.000 0.665 0.768

b. The regression model with log base 10 was constructed and has been provided below.

Table 3: Regression Model for log_R&D on log_Assets

log_Expense: R&D log_Total Assets

Regression Statistics

Multiple R 0.837 26.23810598

R Square 0.700 29.08356569

Adjusted R Square 0.699

Standard Error 0.539

Observations 323

ANOVA

df SS MS F Significance F

Regression 1 218.249 218.249 750.175 0.000

Residual 321 93.389 0.291

Total 322 311.637

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 1.130 0.219 5.160 0.000 0.699 1.561

log_Total Assets 0.717 0.026 27.389 0.000 0.665 0.768

The estimated regression was found to be similar with the regression equation with

natural logarithm base of the variables.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

c. The 95% prediction interval for the R&D expenses as $ 1 billion in assets was calculated

as X ±1. 96∗σ =[−$ 39 , 92 , 63 , 961. 50 , $ 2 , 39 ,92 , 63 , 961. 50 ] where σ =$ 713910184 . 44 was the

standard deviation of R&D expenses. The 95% confidence interval was estimated as

[$ 8, 06, 33,489.70, $ 23, 63, 47, 748.69], and noted that the prediction interval contained

the confidence interval of average R&D of the population. As, the 95% prediction

interval included the 95% confidence interval for average R&D expenses, it was expected

to have 95% coverage of the data set.

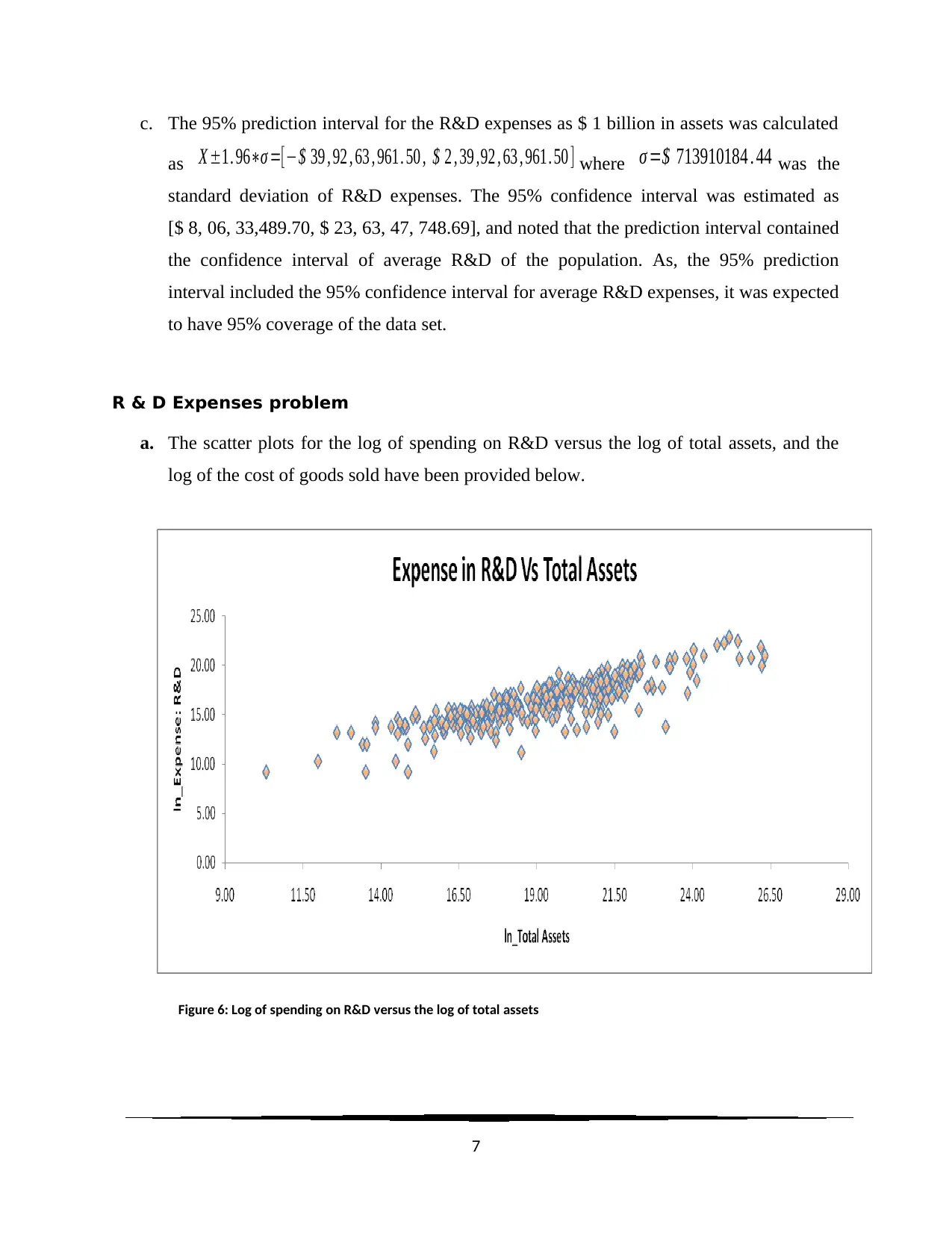

R & D Expenses problem

a. The scatter plots for the log of spending on R&D versus the log of total assets, and the

log of the cost of goods sold have been provided below.

Figure 6: Log of spending on R&D versus the log of total assets

7

as X ±1. 96∗σ =[−$ 39 , 92 , 63 , 961. 50 , $ 2 , 39 ,92 , 63 , 961. 50 ] where σ =$ 713910184 . 44 was the

standard deviation of R&D expenses. The 95% confidence interval was estimated as

[$ 8, 06, 33,489.70, $ 23, 63, 47, 748.69], and noted that the prediction interval contained

the confidence interval of average R&D of the population. As, the 95% prediction

interval included the 95% confidence interval for average R&D expenses, it was expected

to have 95% coverage of the data set.

R & D Expenses problem

a. The scatter plots for the log of spending on R&D versus the log of total assets, and the

log of the cost of goods sold have been provided below.

Figure 6: Log of spending on R&D versus the log of total assets

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

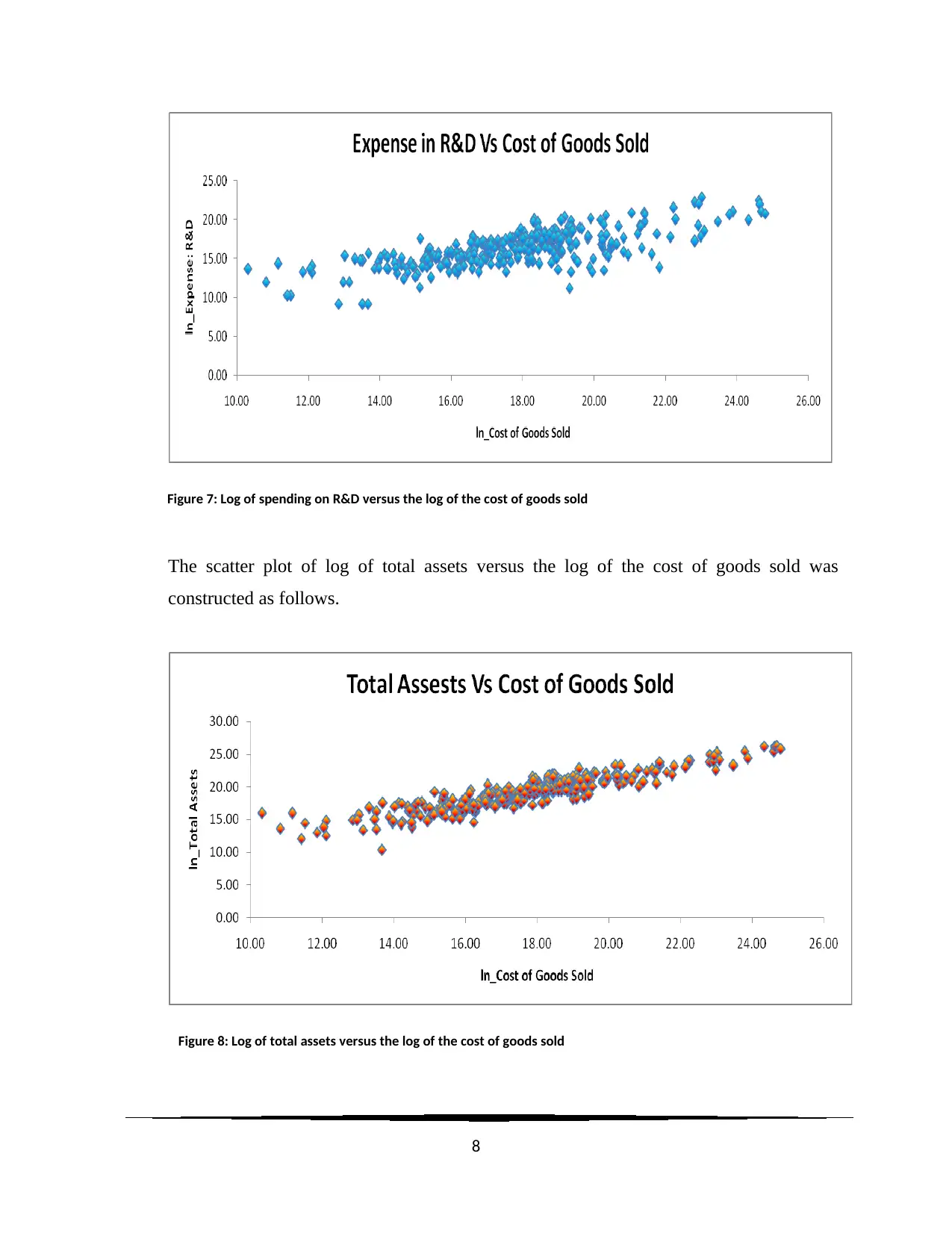

Figure 7: Log of spending on R&D versus the log of the cost of goods sold

The scatter plot of log of total assets versus the log of the cost of goods sold was

constructed as follows.

Figure 8: Log of total assets versus the log of the cost of goods sold

8

The scatter plot of log of total assets versus the log of the cost of goods sold was

constructed as follows.

Figure 8: Log of total assets versus the log of the cost of goods sold

8

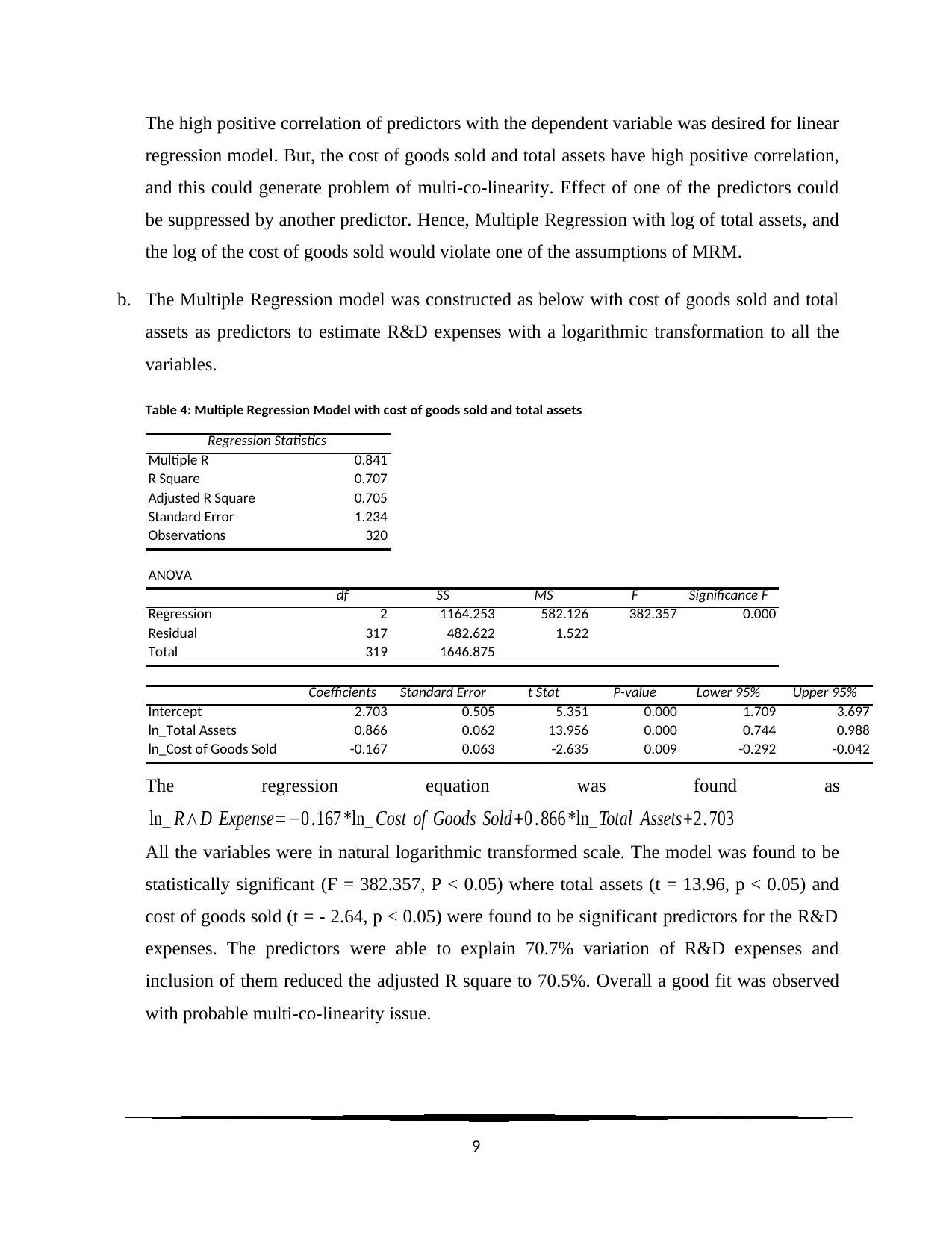

The high positive correlation of predictors with the dependent variable was desired for linear

regression model. But, the cost of goods sold and total assets have high positive correlation,

and this could generate problem of multi-co-linearity. Effect of one of the predictors could

be suppressed by another predictor. Hence, Multiple Regression with log of total assets, and

the log of the cost of goods sold would violate one of the assumptions of MRM.

b. The Multiple Regression model was constructed as below with cost of goods sold and total

assets as predictors to estimate R&D expenses with a logarithmic transformation to all the

variables.

Table 4: Multiple Regression Model with cost of goods sold and total assets

Regression Statistics

Multiple R 0.841

R Square 0.707

Adjusted R Square 0.705

Standard Error 1.234

Observations 320

ANOVA

df SS MS F Significance F

Regression 2 1164.253 582.126 382.357 0.000

Residual 317 482.622 1.522

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.703 0.505 5.351 0.000 1.709 3.697

ln_Total Assets 0.866 0.062 13.956 0.000 0.744 0.988

ln_Cost of Goods Sold -0.167 0.063 -2.635 0.009 -0.292 -0.042

The regression equation was found as

ln_ R∧D Expense=−0 .167 *ln_ Cost of Goods Sold +0 . 866 *ln_Total Assets+2. 703

All the variables were in natural logarithmic transformed scale. The model was found to be

statistically significant (F = 382.357, P < 0.05) where total assets (t = 13.96, p < 0.05) and

cost of goods sold (t = - 2.64, p < 0.05) were found to be significant predictors for the R&D

expenses. The predictors were able to explain 70.7% variation of R&D expenses and

inclusion of them reduced the adjusted R square to 70.5%. Overall a good fit was observed

with probable multi-co-linearity issue.

9

regression model. But, the cost of goods sold and total assets have high positive correlation,

and this could generate problem of multi-co-linearity. Effect of one of the predictors could

be suppressed by another predictor. Hence, Multiple Regression with log of total assets, and

the log of the cost of goods sold would violate one of the assumptions of MRM.

b. The Multiple Regression model was constructed as below with cost of goods sold and total

assets as predictors to estimate R&D expenses with a logarithmic transformation to all the

variables.

Table 4: Multiple Regression Model with cost of goods sold and total assets

Regression Statistics

Multiple R 0.841

R Square 0.707

Adjusted R Square 0.705

Standard Error 1.234

Observations 320

ANOVA

df SS MS F Significance F

Regression 2 1164.253 582.126 382.357 0.000

Residual 317 482.622 1.522

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.703 0.505 5.351 0.000 1.709 3.697

ln_Total Assets 0.866 0.062 13.956 0.000 0.744 0.988

ln_Cost of Goods Sold -0.167 0.063 -2.635 0.009 -0.292 -0.042

The regression equation was found as

ln_ R∧D Expense=−0 .167 *ln_ Cost of Goods Sold +0 . 866 *ln_Total Assets+2. 703

All the variables were in natural logarithmic transformed scale. The model was found to be

statistically significant (F = 382.357, P < 0.05) where total assets (t = 13.96, p < 0.05) and

cost of goods sold (t = - 2.64, p < 0.05) were found to be significant predictors for the R&D

expenses. The predictors were able to explain 70.7% variation of R&D expenses and

inclusion of them reduced the adjusted R square to 70.5%. Overall a good fit was observed

with probable multi-co-linearity issue.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

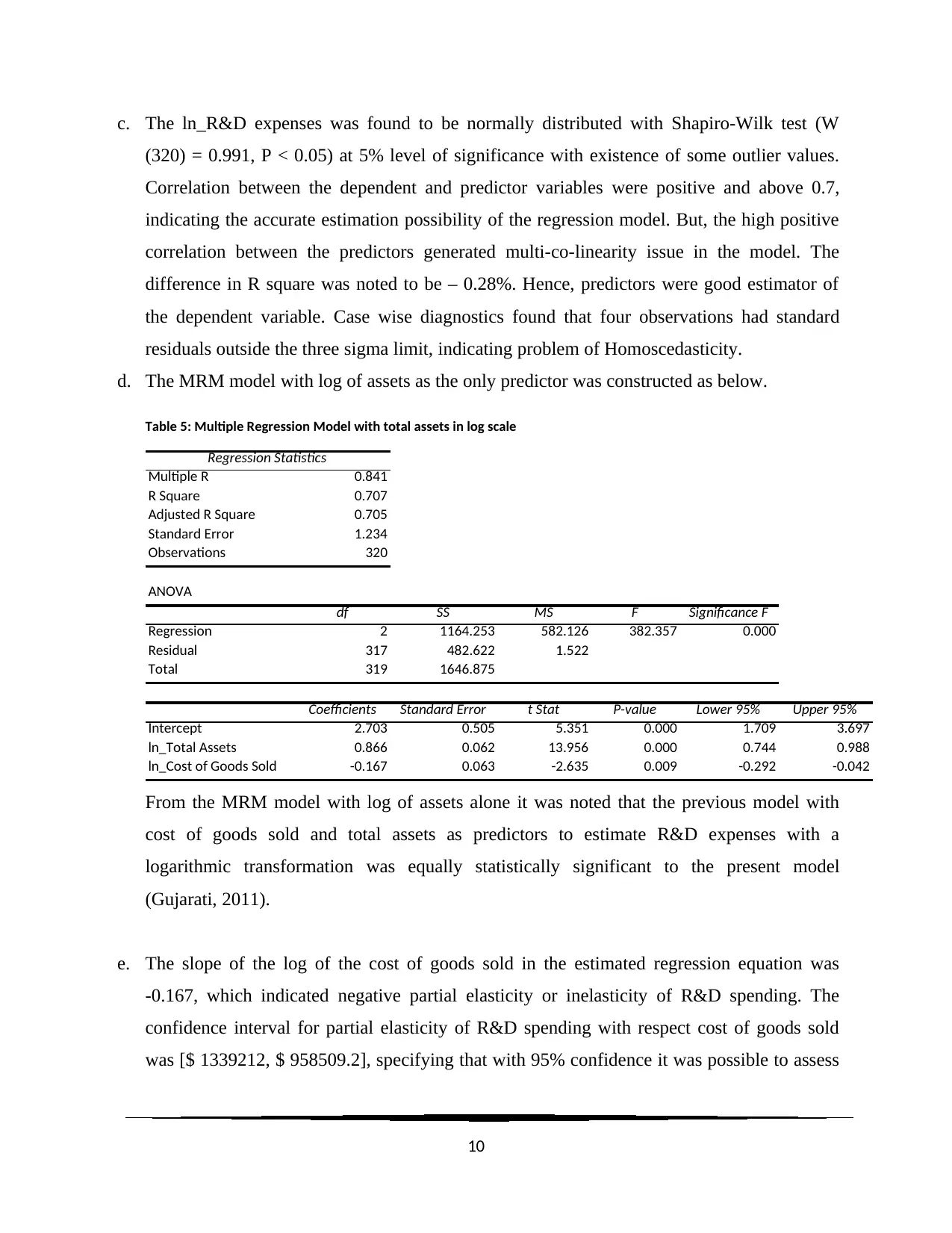

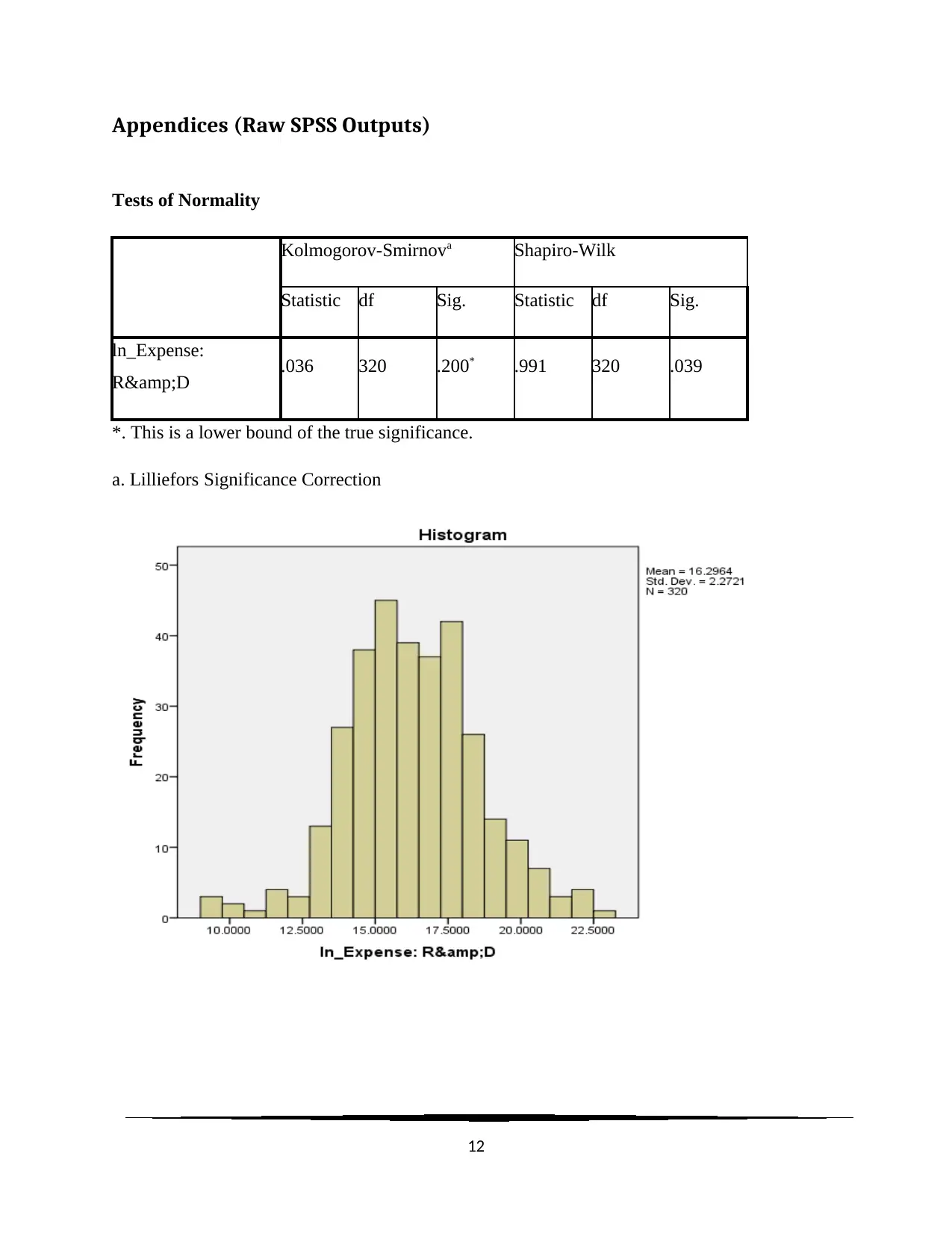

c. The ln_R&D expenses was found to be normally distributed with Shapiro-Wilk test (W

(320) = 0.991, P < 0.05) at 5% level of significance with existence of some outlier values.

Correlation between the dependent and predictor variables were positive and above 0.7,

indicating the accurate estimation possibility of the regression model. But, the high positive

correlation between the predictors generated multi-co-linearity issue in the model. The

difference in R square was noted to be – 0.28%. Hence, predictors were good estimator of

the dependent variable. Case wise diagnostics found that four observations had standard

residuals outside the three sigma limit, indicating problem of Homoscedasticity.

d. The MRM model with log of assets as the only predictor was constructed as below.

Table 5: Multiple Regression Model with total assets in log scale

Regression Statistics

Multiple R 0.841

R Square 0.707

Adjusted R Square 0.705

Standard Error 1.234

Observations 320

ANOVA

df SS MS F Significance F

Regression 2 1164.253 582.126 382.357 0.000

Residual 317 482.622 1.522

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.703 0.505 5.351 0.000 1.709 3.697

ln_Total Assets 0.866 0.062 13.956 0.000 0.744 0.988

ln_Cost of Goods Sold -0.167 0.063 -2.635 0.009 -0.292 -0.042

From the MRM model with log of assets alone it was noted that the previous model with

cost of goods sold and total assets as predictors to estimate R&D expenses with a

logarithmic transformation was equally statistically significant to the present model

(Gujarati, 2011).

e. The slope of the log of the cost of goods sold in the estimated regression equation was

-0.167, which indicated negative partial elasticity or inelasticity of R&D spending. The

confidence interval for partial elasticity of R&D spending with respect cost of goods sold

was [$ 1339212, $ 958509.2], specifying that with 95% confidence it was possible to assess

10

(320) = 0.991, P < 0.05) at 5% level of significance with existence of some outlier values.

Correlation between the dependent and predictor variables were positive and above 0.7,

indicating the accurate estimation possibility of the regression model. But, the high positive

correlation between the predictors generated multi-co-linearity issue in the model. The

difference in R square was noted to be – 0.28%. Hence, predictors were good estimator of

the dependent variable. Case wise diagnostics found that four observations had standard

residuals outside the three sigma limit, indicating problem of Homoscedasticity.

d. The MRM model with log of assets as the only predictor was constructed as below.

Table 5: Multiple Regression Model with total assets in log scale

Regression Statistics

Multiple R 0.841

R Square 0.707

Adjusted R Square 0.705

Standard Error 1.234

Observations 320

ANOVA

df SS MS F Significance F

Regression 2 1164.253 582.126 382.357 0.000

Residual 317 482.622 1.522

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 2.703 0.505 5.351 0.000 1.709 3.697

ln_Total Assets 0.866 0.062 13.956 0.000 0.744 0.988

ln_Cost of Goods Sold -0.167 0.063 -2.635 0.009 -0.292 -0.042

From the MRM model with log of assets alone it was noted that the previous model with

cost of goods sold and total assets as predictors to estimate R&D expenses with a

logarithmic transformation was equally statistically significant to the present model

(Gujarati, 2011).

e. The slope of the log of the cost of goods sold in the estimated regression equation was

-0.167, which indicated negative partial elasticity or inelasticity of R&D spending. The

confidence interval for partial elasticity of R&D spending with respect cost of goods sold

was [$ 1339212, $ 958509.2], specifying that with 95% confidence it was possible to assess

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

that partial elasticity of R&D spending with respect cost of goods sold was with the

specified range of the confidence interval.

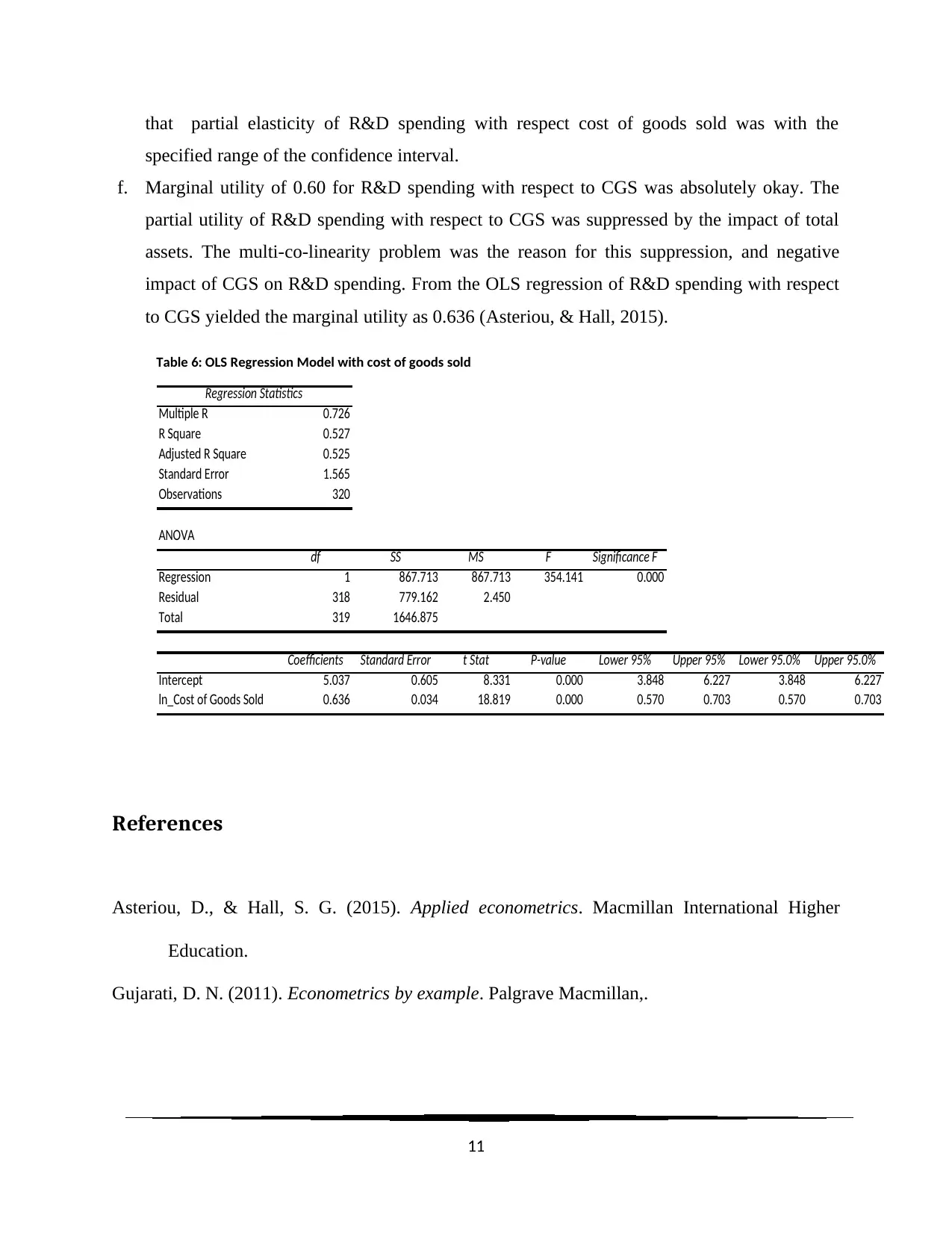

f. Marginal utility of 0.60 for R&D spending with respect to CGS was absolutely okay. The

partial utility of R&D spending with respect to CGS was suppressed by the impact of total

assets. The multi-co-linearity problem was the reason for this suppression, and negative

impact of CGS on R&D spending. From the OLS regression of R&D spending with respect

to CGS yielded the marginal utility as 0.636 (Asteriou, & Hall, 2015).

Table 6: OLS Regression Model with cost of goods sold

Regression Statistics

Multiple R 0.726

R Square 0.527

Adjusted R Square 0.525

Standard Error 1.565

Observations 320

ANOVA

df SS MS F Significance F

Regression 1 867.713 867.713 354.141 0.000

Residual 318 779.162 2.450

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0%

Intercept 5.037 0.605 8.331 0.000 3.848 6.227 3.848 6.227

ln_Cost of Goods Sold 0.636 0.034 18.819 0.000 0.570 0.703 0.570 0.703

References

Asteriou, D., & Hall, S. G. (2015). Applied econometrics. Macmillan International Higher

Education.

Gujarati, D. N. (2011). Econometrics by example. Palgrave Macmillan,.

11

specified range of the confidence interval.

f. Marginal utility of 0.60 for R&D spending with respect to CGS was absolutely okay. The

partial utility of R&D spending with respect to CGS was suppressed by the impact of total

assets. The multi-co-linearity problem was the reason for this suppression, and negative

impact of CGS on R&D spending. From the OLS regression of R&D spending with respect

to CGS yielded the marginal utility as 0.636 (Asteriou, & Hall, 2015).

Table 6: OLS Regression Model with cost of goods sold

Regression Statistics

Multiple R 0.726

R Square 0.527

Adjusted R Square 0.525

Standard Error 1.565

Observations 320

ANOVA

df SS MS F Significance F

Regression 1 867.713 867.713 354.141 0.000

Residual 318 779.162 2.450

Total 319 1646.875

Coefficients Standard Error t Stat P-value Lower 95% Upper 95% Lower 95.0% Upper 95.0%

Intercept 5.037 0.605 8.331 0.000 3.848 6.227 3.848 6.227

ln_Cost of Goods Sold 0.636 0.034 18.819 0.000 0.570 0.703 0.570 0.703

References

Asteriou, D., & Hall, S. G. (2015). Applied econometrics. Macmillan International Higher

Education.

Gujarati, D. N. (2011). Econometrics by example. Palgrave Macmillan,.

11

Appendices (Raw SPSS Outputs)

Tests of Normality

Kolmogorov-Smirnova Shapiro-Wilk

Statistic df Sig. Statistic df Sig.

ln_Expense:

R&D .036 320 .200* .991 320 .039

*. This is a lower bound of the true significance.

a. Lilliefors Significance Correction

12

Tests of Normality

Kolmogorov-Smirnova Shapiro-Wilk

Statistic df Sig. Statistic df Sig.

ln_Expense:

R&D .036 320 .200* .991 320 .039

*. This is a lower bound of the true significance.

a. Lilliefors Significance Correction

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.