SWOT Analysis: SME Lending at Doha Bank 9

VerifiedAdded on 2020/12/23

|61

|15795

|307

AI Summary

REPORT FORMATTING TABLE OF CONTENTS ACKNOWLEDGEMENTS vi EXECUTIVE SUMMARY CHAPTER 1 1 INTRODUCTION 1 1.1 Background 1 1.2 Project 2 1.3 Significance of the study 3 1.4 Methodology 3 1.5 Limitation 4 1.6 Chapter Framework 5 CHAPTER 2 6 PROBLEM IDENTIFICATION 6 2.1 Introduction 6 2.2 Organization Profile 6 2.3 Organizational Analysis: SME Lending at Doha Bank 9 2.3.1 SWOT Analysis: SME Lending at Doha Bank 9 2.3.1.1 Strengths 10 2.3.1.2 Weakness

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

REPORT

FORMATTING

FORMATTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

ACKNOWLEDGEMENTS......................................................................................................vi

EXECUTIVE SUMMARY.....................................................................................................vii

CHAPTER 1..............................................................................................................................1

INTRODUCTION.....................................................................................................................1

1.1 Background......................................................................................................................1

1.2 Project..............................................................................................................................2

1.3 Significance of the study..................................................................................................3

1.4 Methodology....................................................................................................................3

1.5 Limitation.........................................................................................................................4

1.6 Chapter Framework..........................................................................................................5

CHAPTER 2..............................................................................................................................6

PROBLEM IDENTIFICATION...............................................................................................6

2.1 Introduction......................................................................................................................6

2.2 Organization Profile.........................................................................................................6

2.3 Organizational Analysis: SME Section at Doha Bank.....................................................9

2.3.1 SWOT Analysis: SME Lending at Doha Bank...........................................................9

2.3.1.1 Strengths...............................................................................................................10

2.3.1.2 Weaknesses...........................................................................................................11

2.3.1.3 Opportunities........................................................................................................12

2.3.1.4 Threats..................................................................................................................13

2.3.1.5 Conclusion of SWOT Analysis..............................................................................13

2.4 Problem Identification....................................................................................................14

2.5 Problem Description......................................................................................................15

2.6 Summary........................................................................................................................20

i

ACKNOWLEDGEMENTS......................................................................................................vi

EXECUTIVE SUMMARY.....................................................................................................vii

CHAPTER 1..............................................................................................................................1

INTRODUCTION.....................................................................................................................1

1.1 Background......................................................................................................................1

1.2 Project..............................................................................................................................2

1.3 Significance of the study..................................................................................................3

1.4 Methodology....................................................................................................................3

1.5 Limitation.........................................................................................................................4

1.6 Chapter Framework..........................................................................................................5

CHAPTER 2..............................................................................................................................6

PROBLEM IDENTIFICATION...............................................................................................6

2.1 Introduction......................................................................................................................6

2.2 Organization Profile.........................................................................................................6

2.3 Organizational Analysis: SME Section at Doha Bank.....................................................9

2.3.1 SWOT Analysis: SME Lending at Doha Bank...........................................................9

2.3.1.1 Strengths...............................................................................................................10

2.3.1.2 Weaknesses...........................................................................................................11

2.3.1.3 Opportunities........................................................................................................12

2.3.1.4 Threats..................................................................................................................13

2.3.1.5 Conclusion of SWOT Analysis..............................................................................13

2.4 Problem Identification....................................................................................................14

2.5 Problem Description......................................................................................................15

2.6 Summary........................................................................................................................20

i

CHAPTER 3............................................................................................................................21

THEORETICAL FRAMEWORK FOR DIAGNOSIS...........................................................21

3.1 Introduction....................................................................................................................21

3.2 Theoretical background to the problem.........................................................................21

3.2.1 Policy and Procedures............................................................................................24

3.2.2 Employee Productivity............................................................................................25

3.2.3 Time Management...................................................................................................25

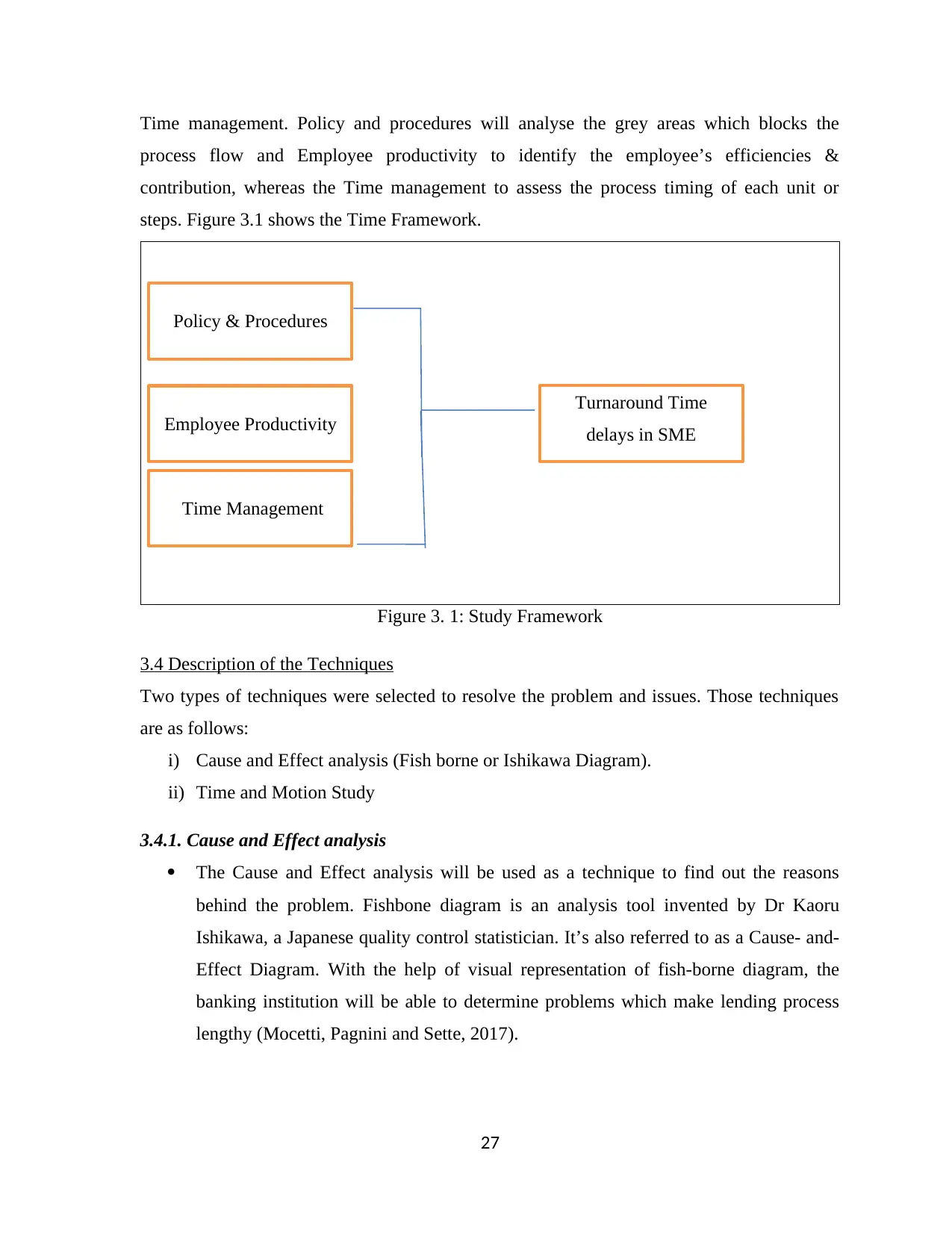

3.3 Framework of the study.................................................................................................26

3.4 Description of the Techniques.......................................................................................27

3.4.1. Cause and Effect analysis.......................................................................................27

3.4.2. Time and motion study...........................................................................................27

3.5 Summary........................................................................................................................28

CHAPTER 4............................................................................................................................29

THE PROJECT........................................................................................................................29

4.1 Introduction....................................................................................................................29

4.2 Project Objectives..........................................................................................................29

4.2.1 The Prime Objective................................................................................................29

4.2.2 Sub Objectives.............................................................................................................30

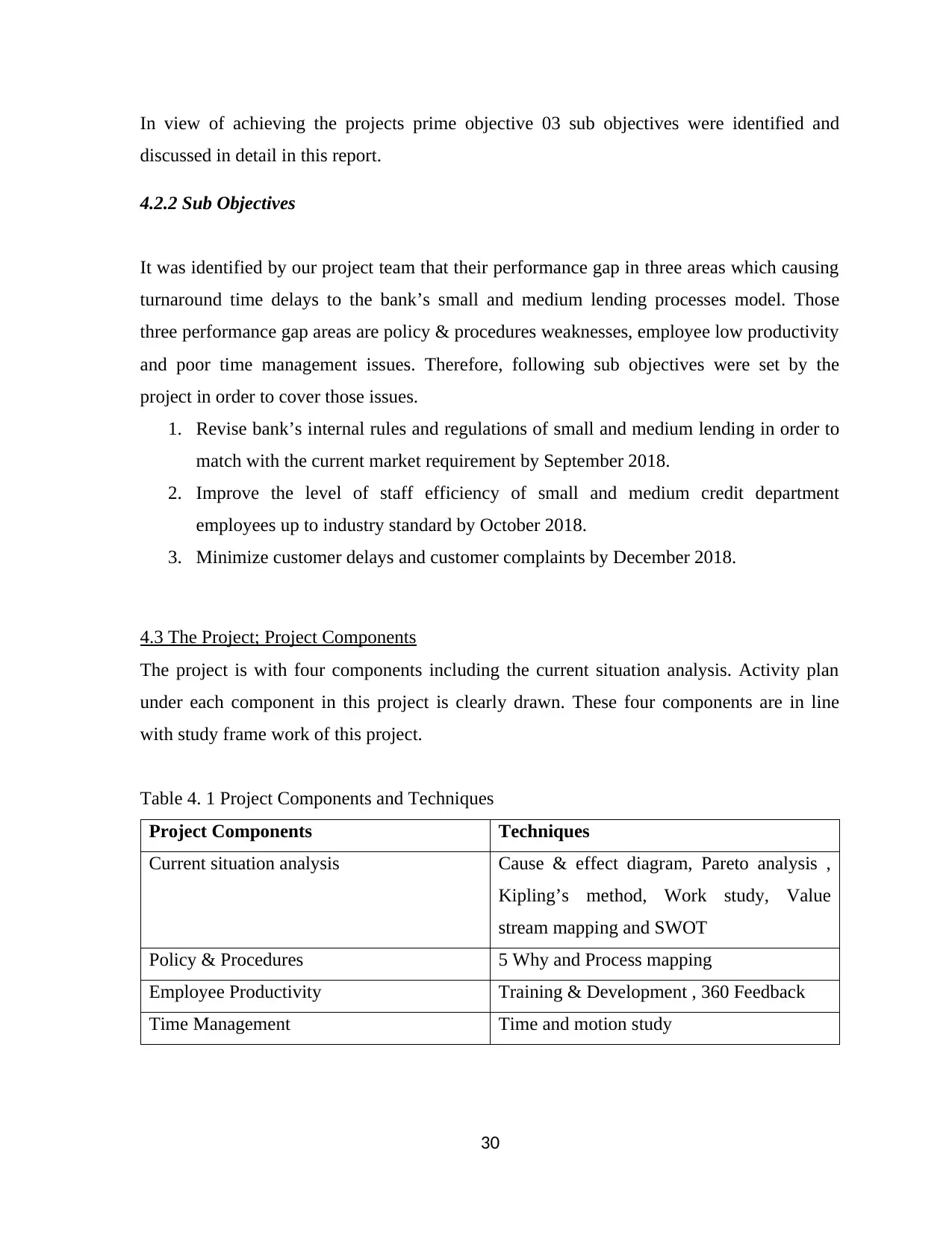

4.3 The Project; Project Components..................................................................................30

4.3.1 Component 1: Current situation analysis...............................................................31

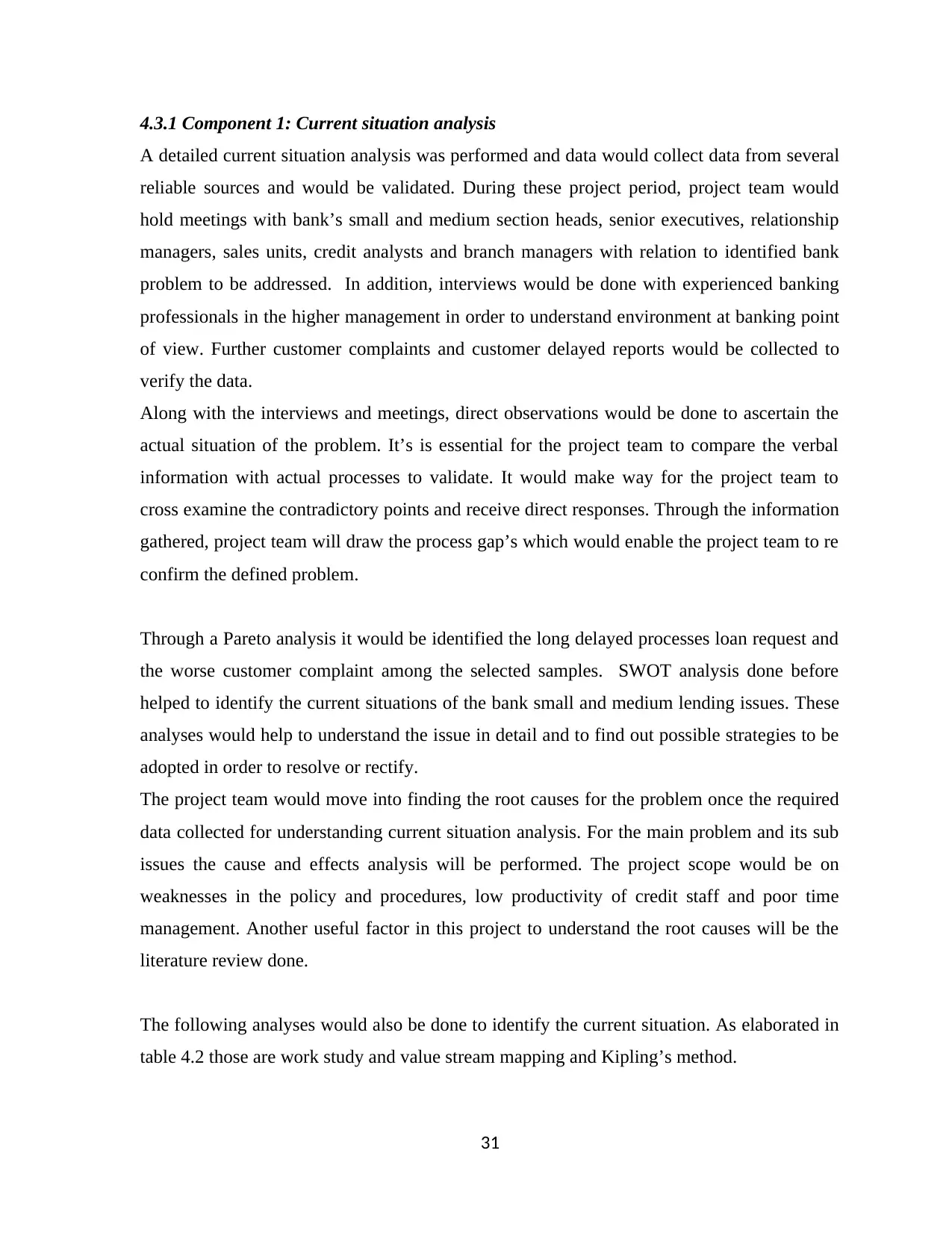

4.3.1.1 Cause and effects analysis....................................................................................32

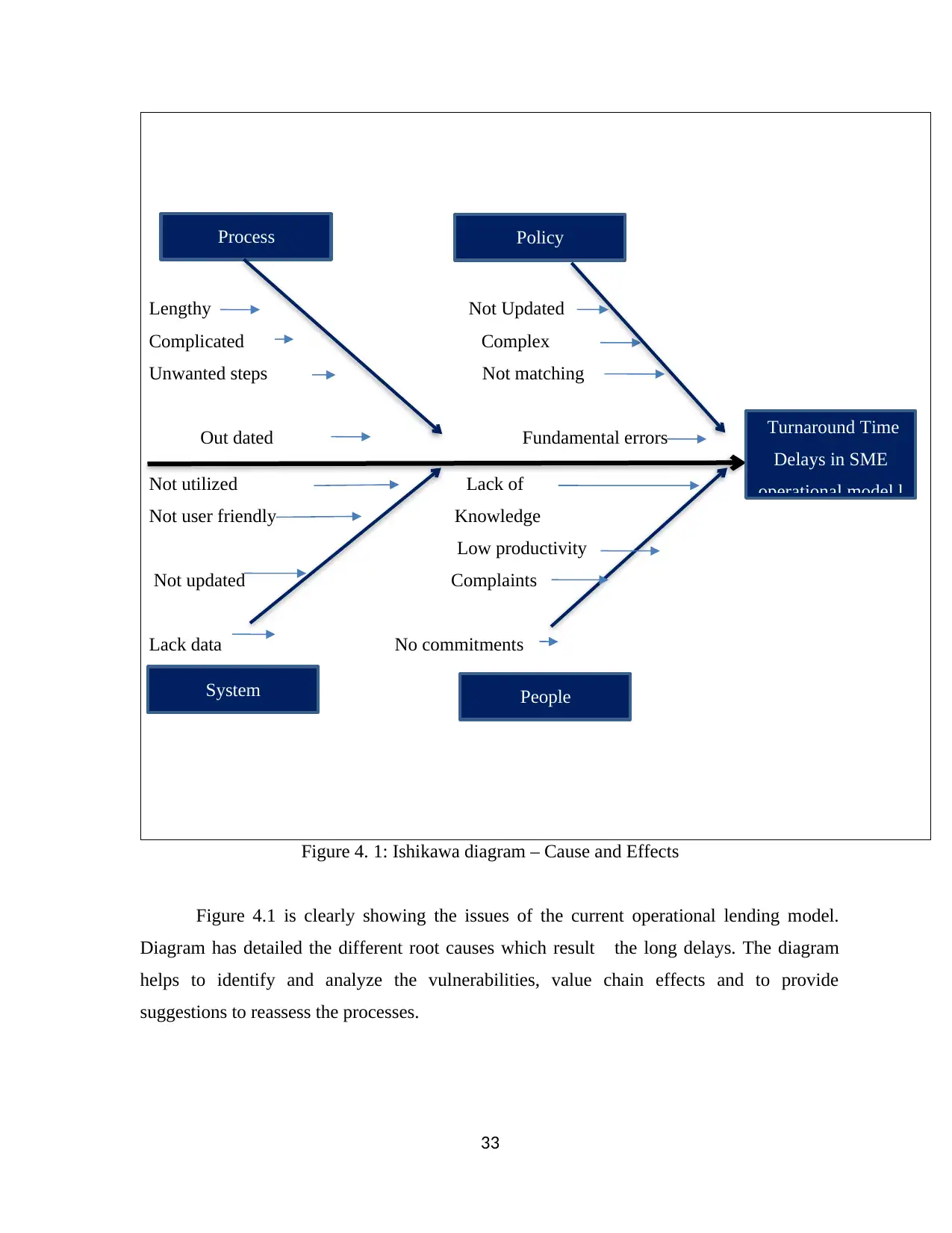

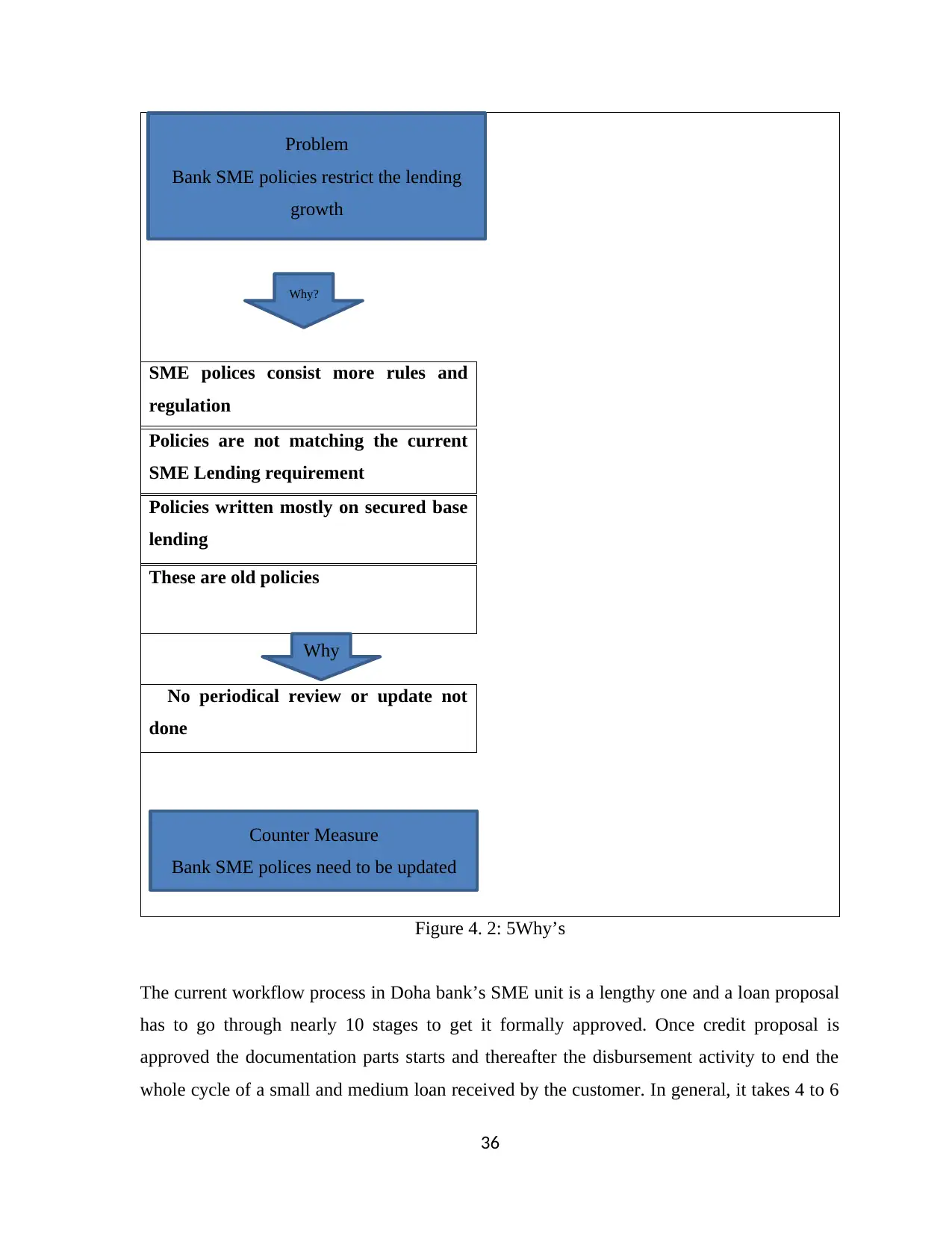

4.3.1.2 Kipling’s Method..................................................................................................34

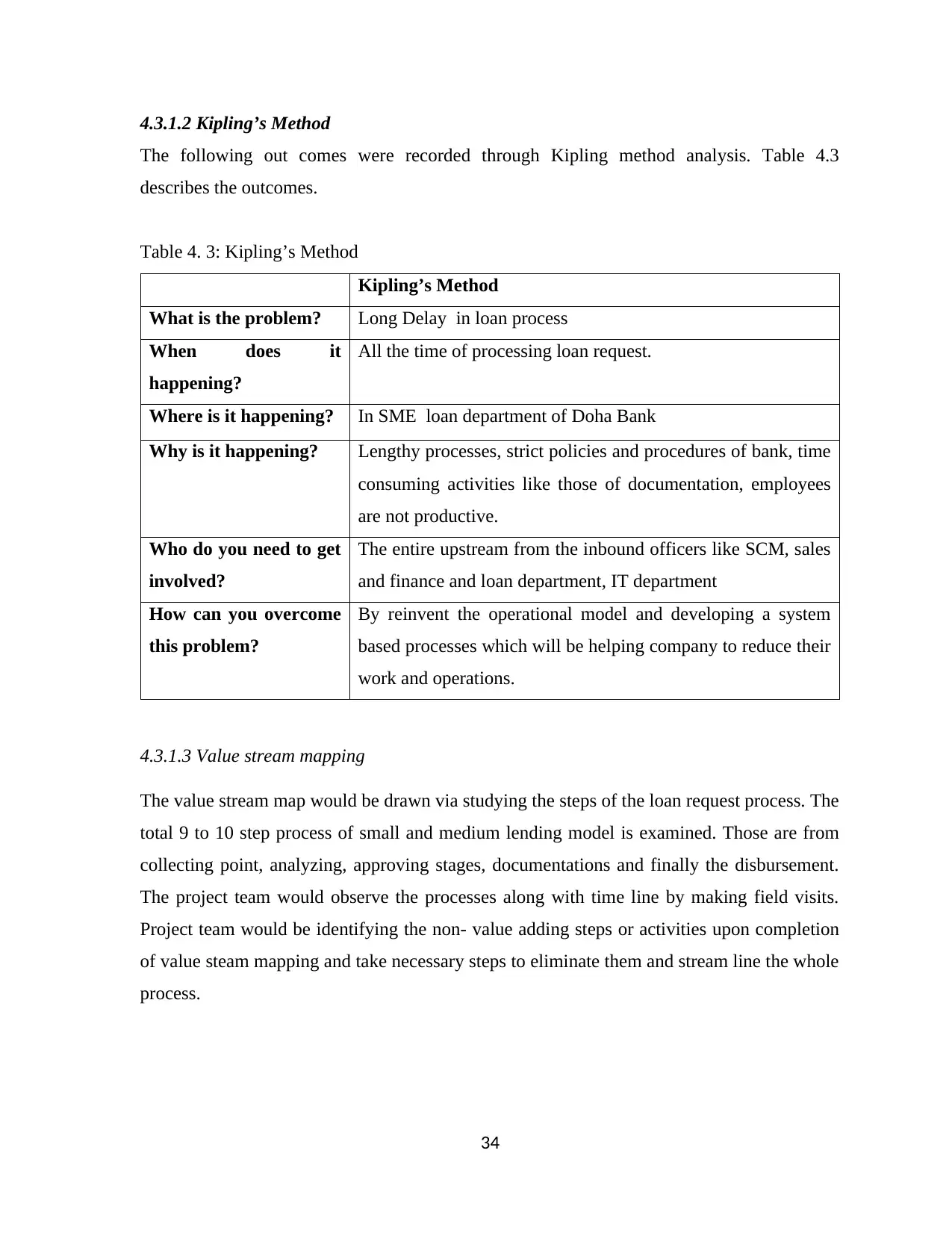

4.3.2 Project component 2: Policy and Procedures........................................................35

4.3.2.1 Solution and Development: Revise of Policy & Procedures................................37

4.3.3 Project component 3: Employee productivity.........................................................41

ii

THEORETICAL FRAMEWORK FOR DIAGNOSIS...........................................................21

3.1 Introduction....................................................................................................................21

3.2 Theoretical background to the problem.........................................................................21

3.2.1 Policy and Procedures............................................................................................24

3.2.2 Employee Productivity............................................................................................25

3.2.3 Time Management...................................................................................................25

3.3 Framework of the study.................................................................................................26

3.4 Description of the Techniques.......................................................................................27

3.4.1. Cause and Effect analysis.......................................................................................27

3.4.2. Time and motion study...........................................................................................27

3.5 Summary........................................................................................................................28

CHAPTER 4............................................................................................................................29

THE PROJECT........................................................................................................................29

4.1 Introduction....................................................................................................................29

4.2 Project Objectives..........................................................................................................29

4.2.1 The Prime Objective................................................................................................29

4.2.2 Sub Objectives.............................................................................................................30

4.3 The Project; Project Components..................................................................................30

4.3.1 Component 1: Current situation analysis...............................................................31

4.3.1.1 Cause and effects analysis....................................................................................32

4.3.1.2 Kipling’s Method..................................................................................................34

4.3.2 Project component 2: Policy and Procedures........................................................35

4.3.2.1 Solution and Development: Revise of Policy & Procedures................................37

4.3.3 Project component 3: Employee productivity.........................................................41

ii

4.3.3.1 Solution and Development: Employee Productivity...........................................41

4.3.4 Project component 4 : Time Management..............................................................42

4.3.4.1 Solution and Developments: Time Management..................................................43

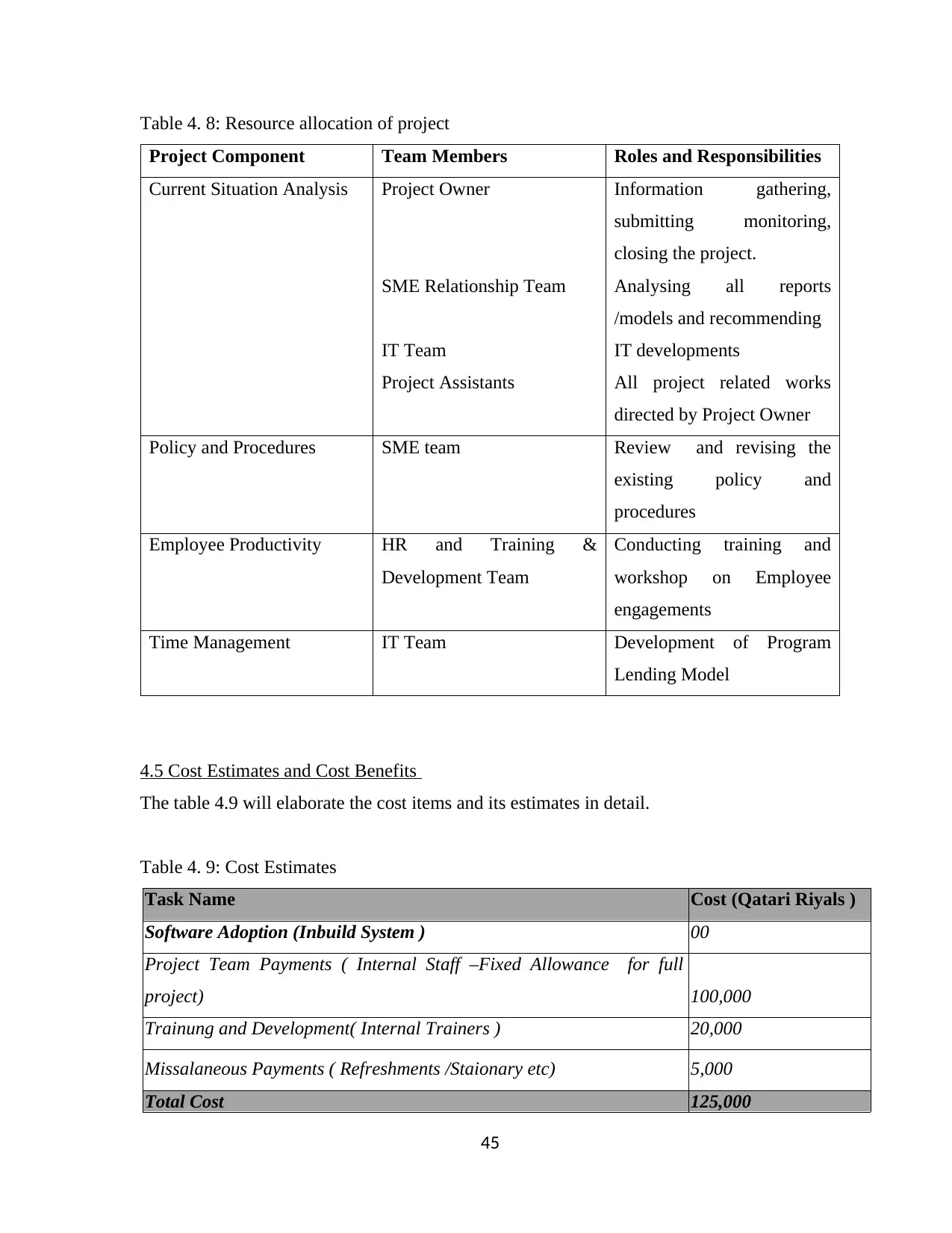

4.4 Resource Allocation.......................................................................................................44

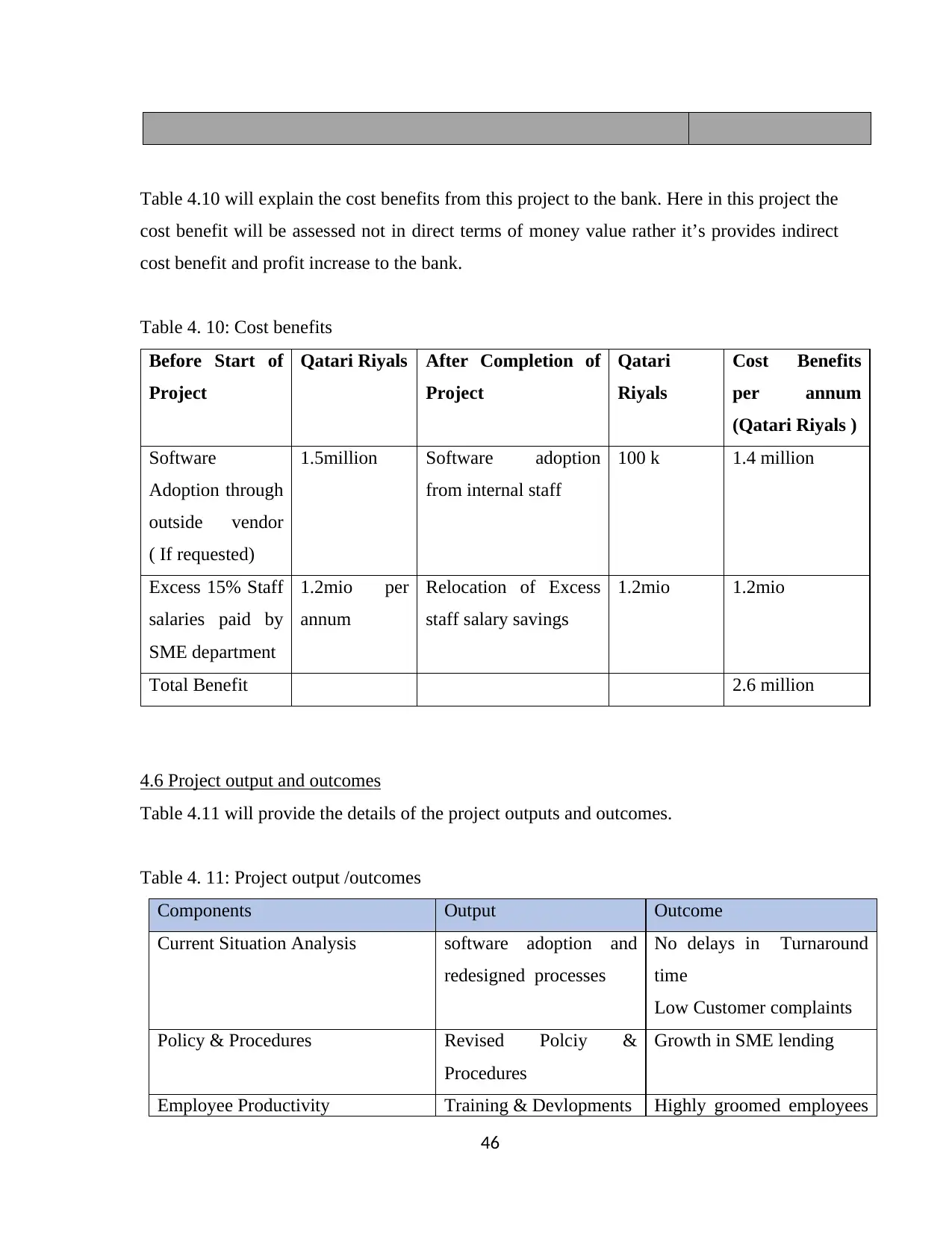

4.5 Cost Estimates and Cost Benefits..................................................................................45

4.6 Project output and outcomes..........................................................................................46

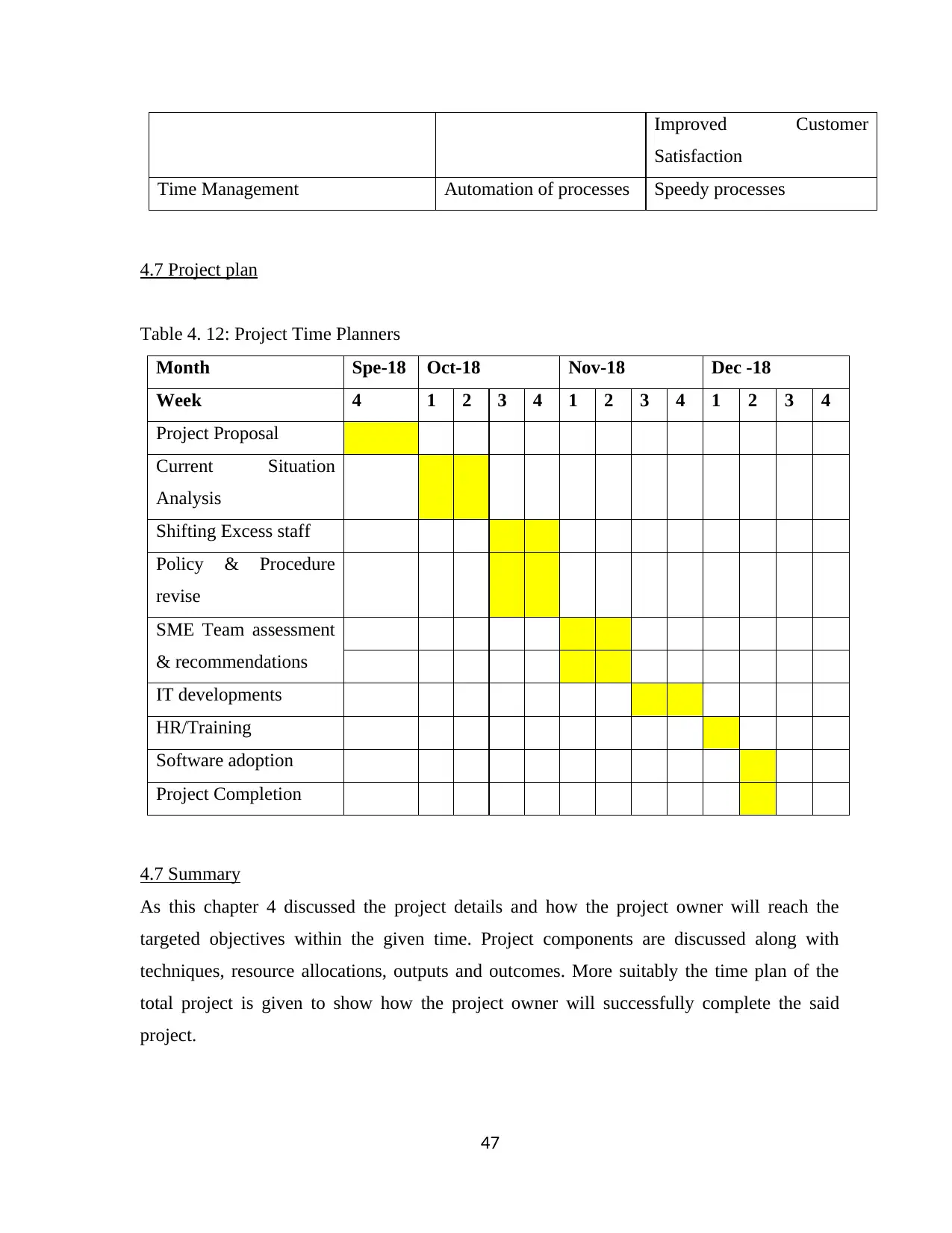

4.7 Project plan....................................................................................................................47

4.7 Summary........................................................................................................................47

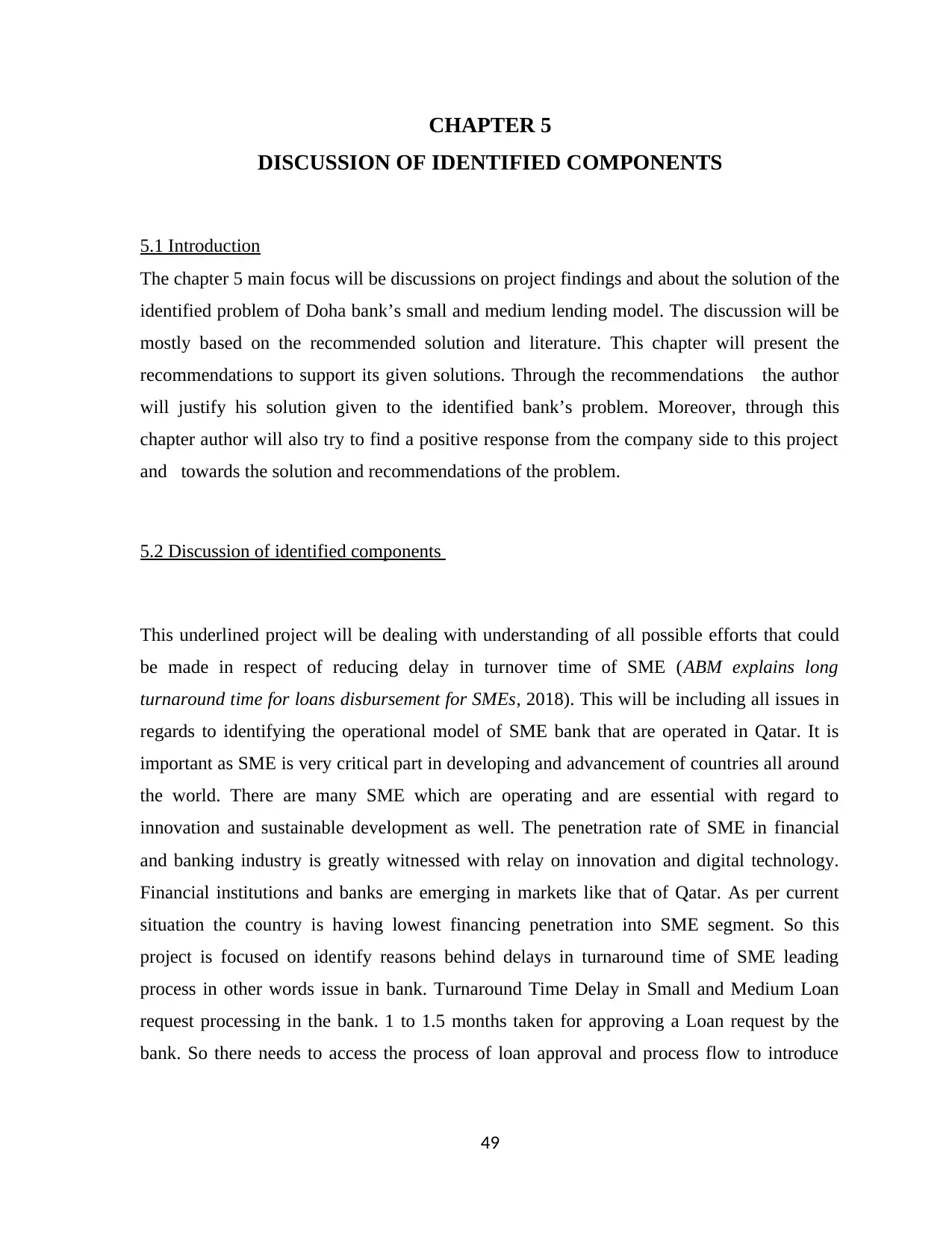

CHAPTER 5............................................................................................................................48

DISCUSSION OF IDENTIFIED COMPONENTS................................................................48

5.1 Introduction....................................................................................................................48

5.2 Discussion of identified components.............................................................................48

5.2.1 Project Component 1: Current Situation Analysis..................................................49

5.2.2 Project Component 2: Policy & Procedures...........................................................49

5.2.3 Project Component 3: Employee Productivity........................................................50

5.2.4 Project Component 4: Time Management...............................................................50

5.3 Recommendations..........................................................................................................51

REFERENCES........................................................................................................................53

iii

4.3.4 Project component 4 : Time Management..............................................................42

4.3.4.1 Solution and Developments: Time Management..................................................43

4.4 Resource Allocation.......................................................................................................44

4.5 Cost Estimates and Cost Benefits..................................................................................45

4.6 Project output and outcomes..........................................................................................46

4.7 Project plan....................................................................................................................47

4.7 Summary........................................................................................................................47

CHAPTER 5............................................................................................................................48

DISCUSSION OF IDENTIFIED COMPONENTS................................................................48

5.1 Introduction....................................................................................................................48

5.2 Discussion of identified components.............................................................................48

5.2.1 Project Component 1: Current Situation Analysis..................................................49

5.2.2 Project Component 2: Policy & Procedures...........................................................49

5.2.3 Project Component 3: Employee Productivity........................................................50

5.2.4 Project Component 4: Time Management...............................................................50

5.3 Recommendations..........................................................................................................51

REFERENCES........................................................................................................................53

iii

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

LIST OF TABLES

TABLE 2. 1: FINANCIAL HIGHLIGHTS...............................................................................7

TABLE 2. 2: RATIO ANALYSIS............................................................................................8

TABLE 2. 3 SWOT ANALYSIS..............................................................................................9

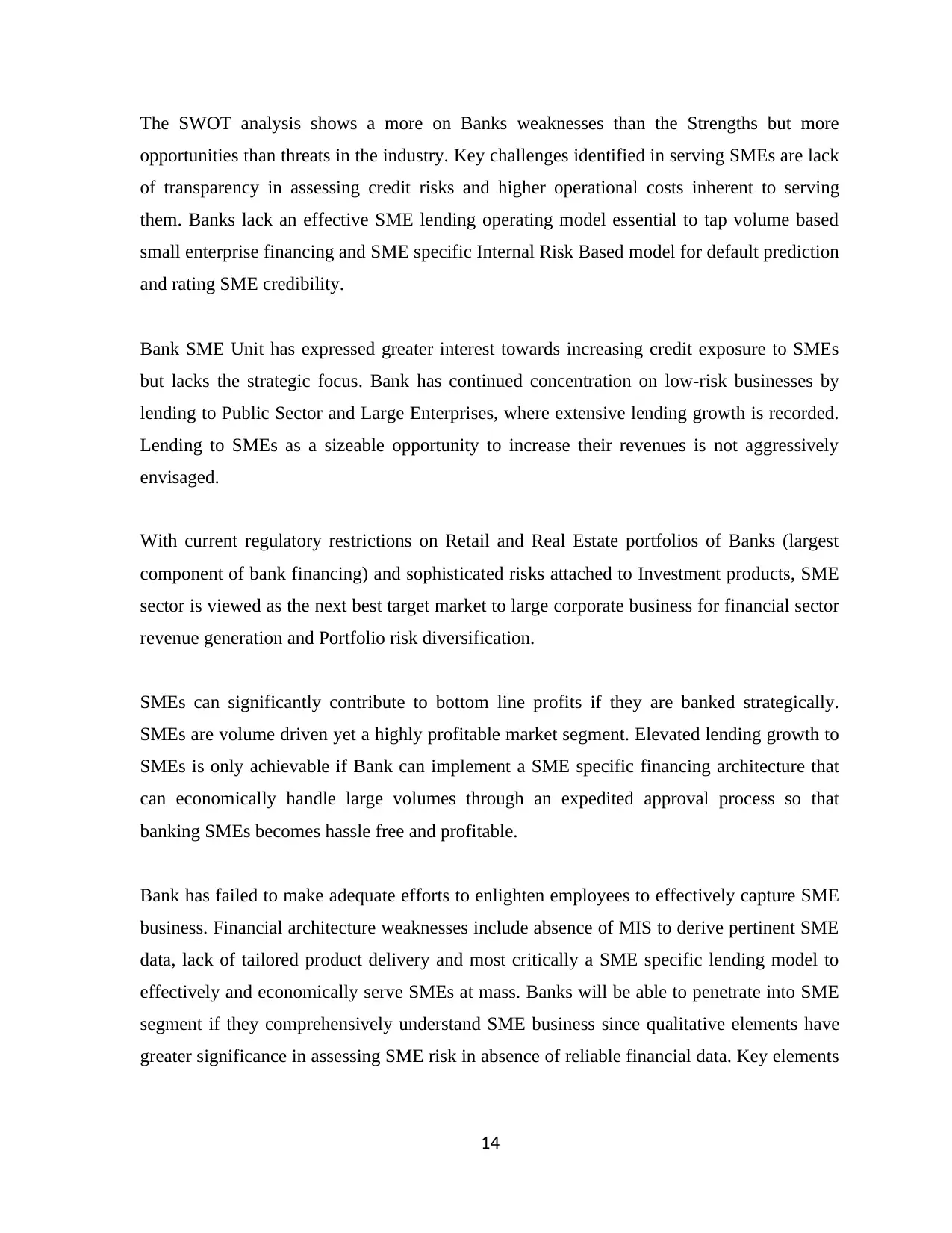

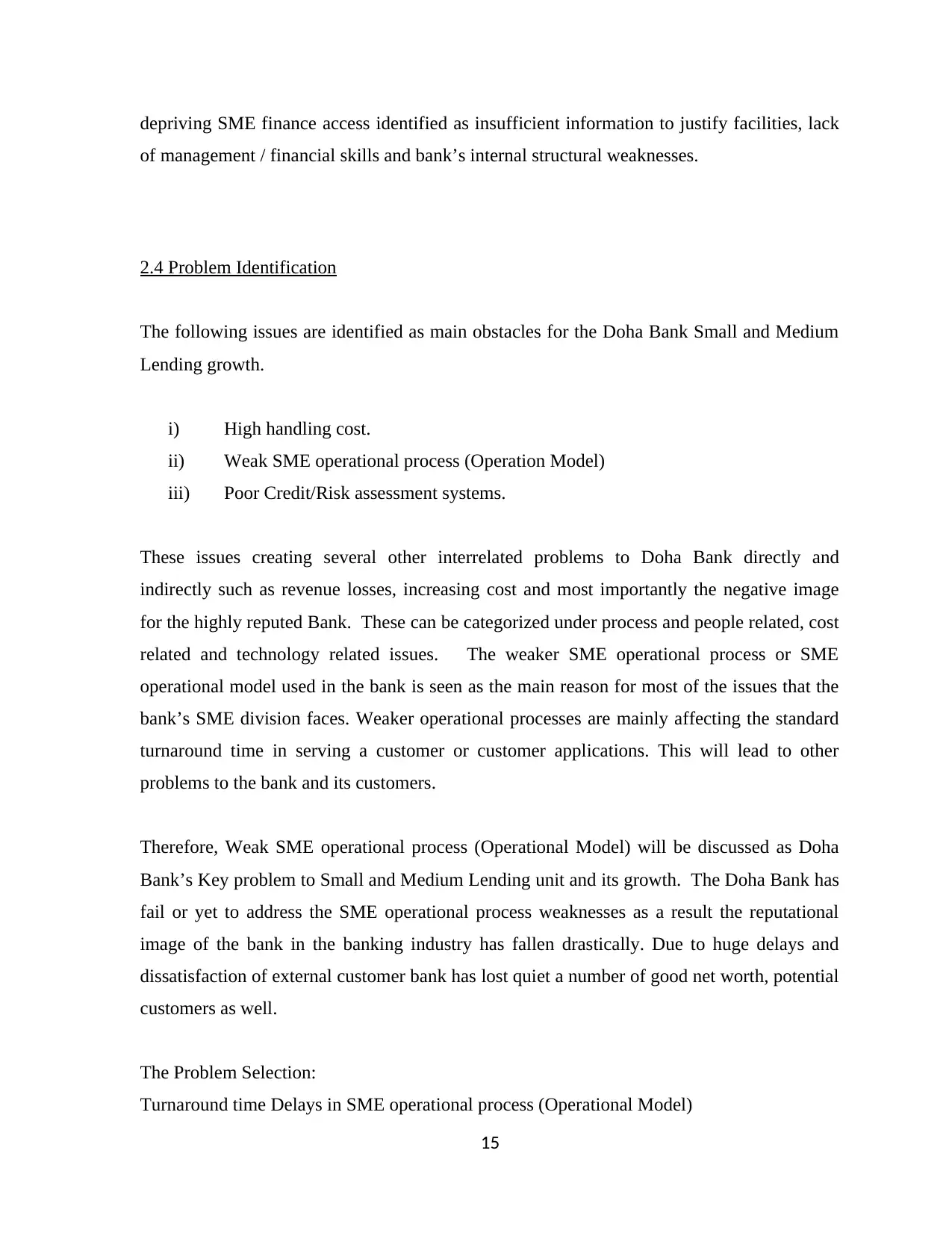

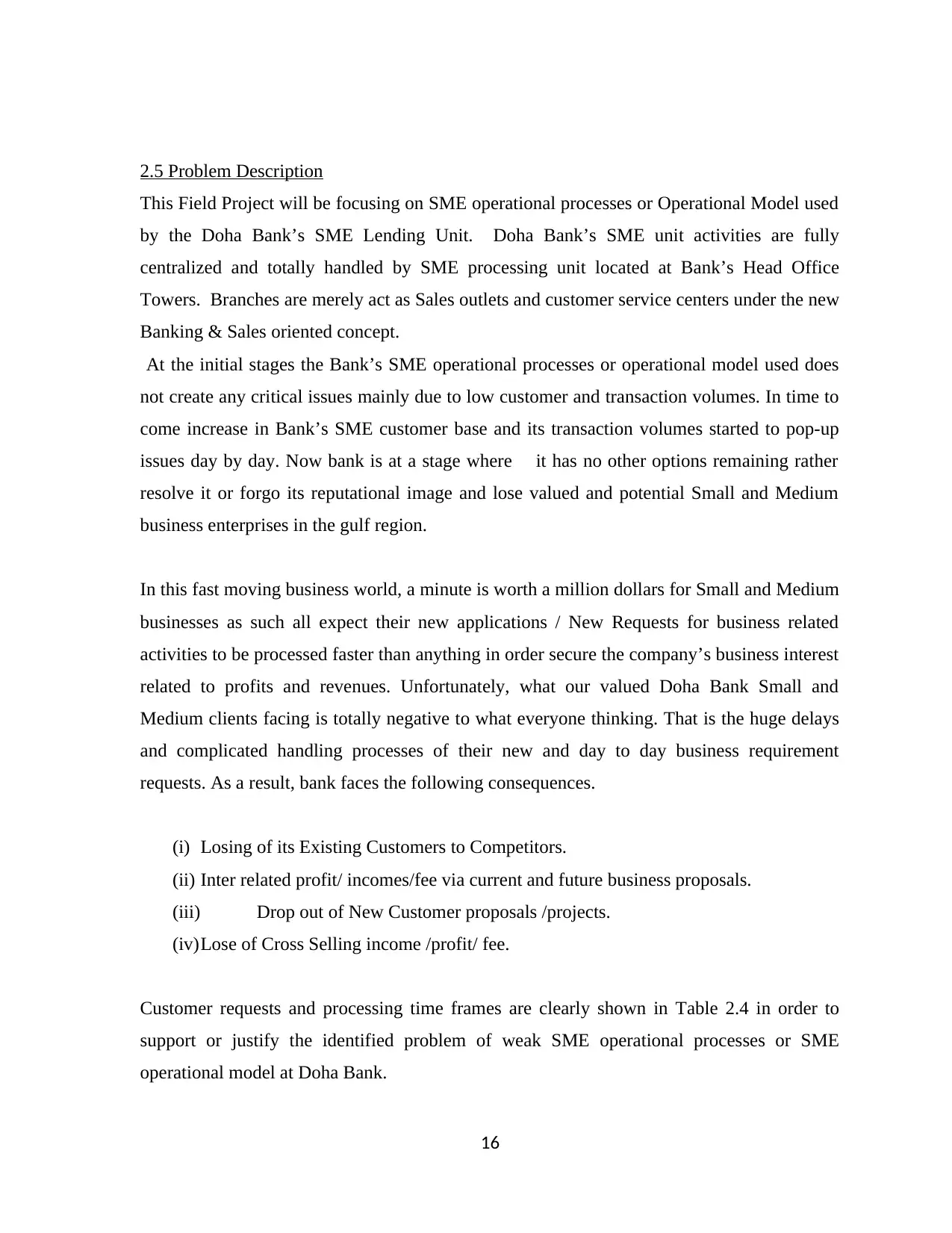

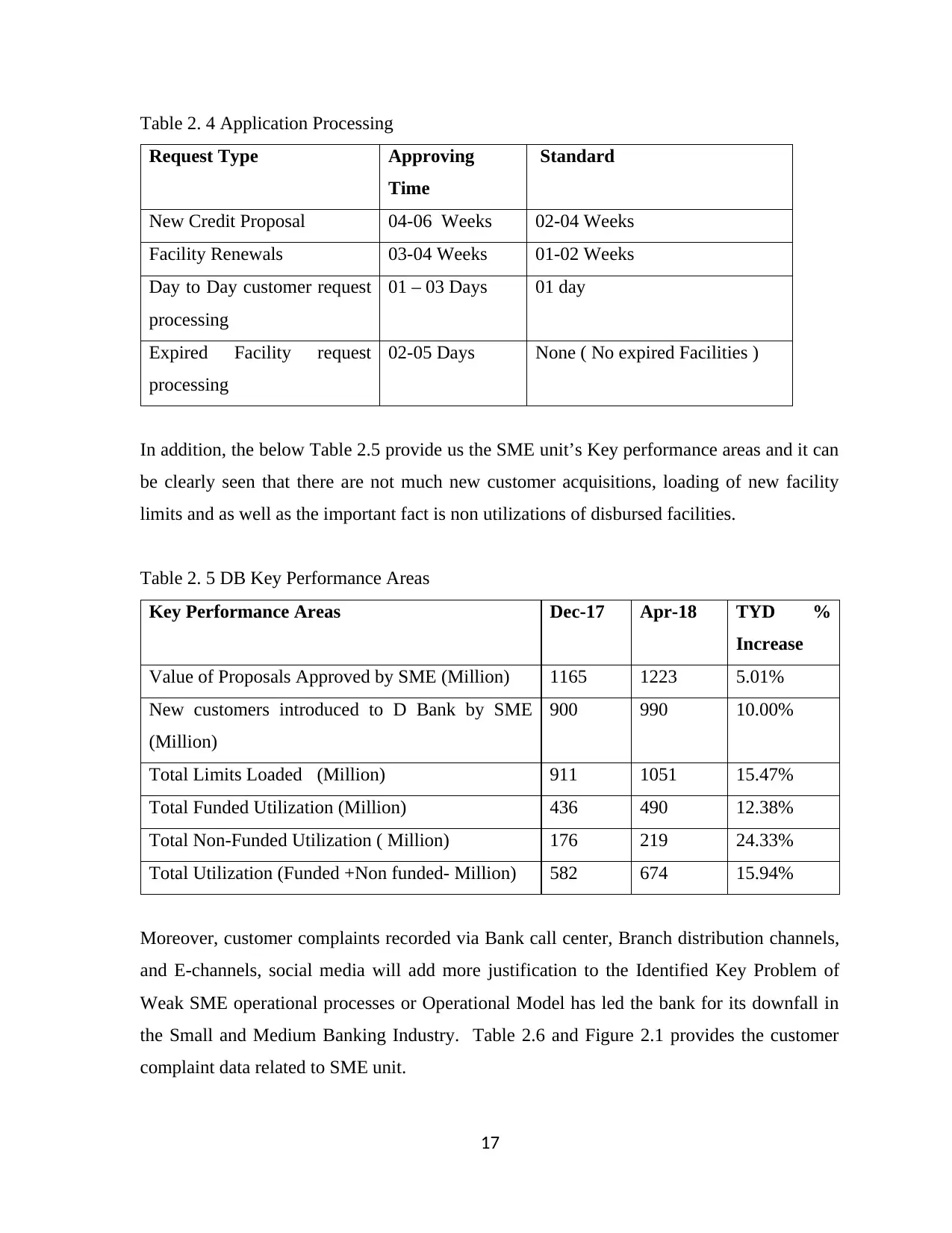

TABLE 2. 4 APPLICATION PROCESSING.........................................................................16

TABLE 2. 5 DB KEY PERFORMANCE AREAS.................................................................17

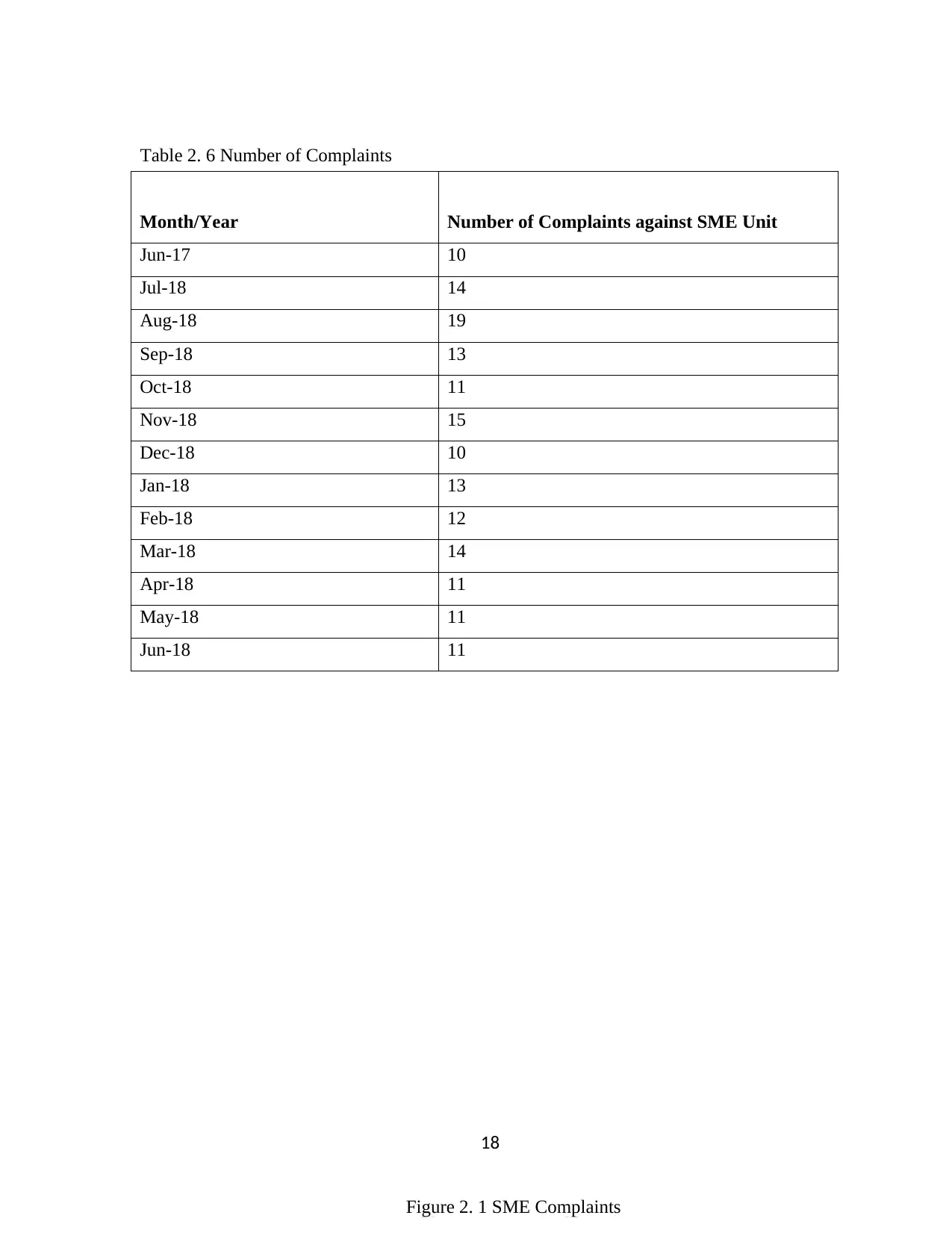

TABLE 2. 6 NUMBER OF COMPLAINTS...........................................................................18

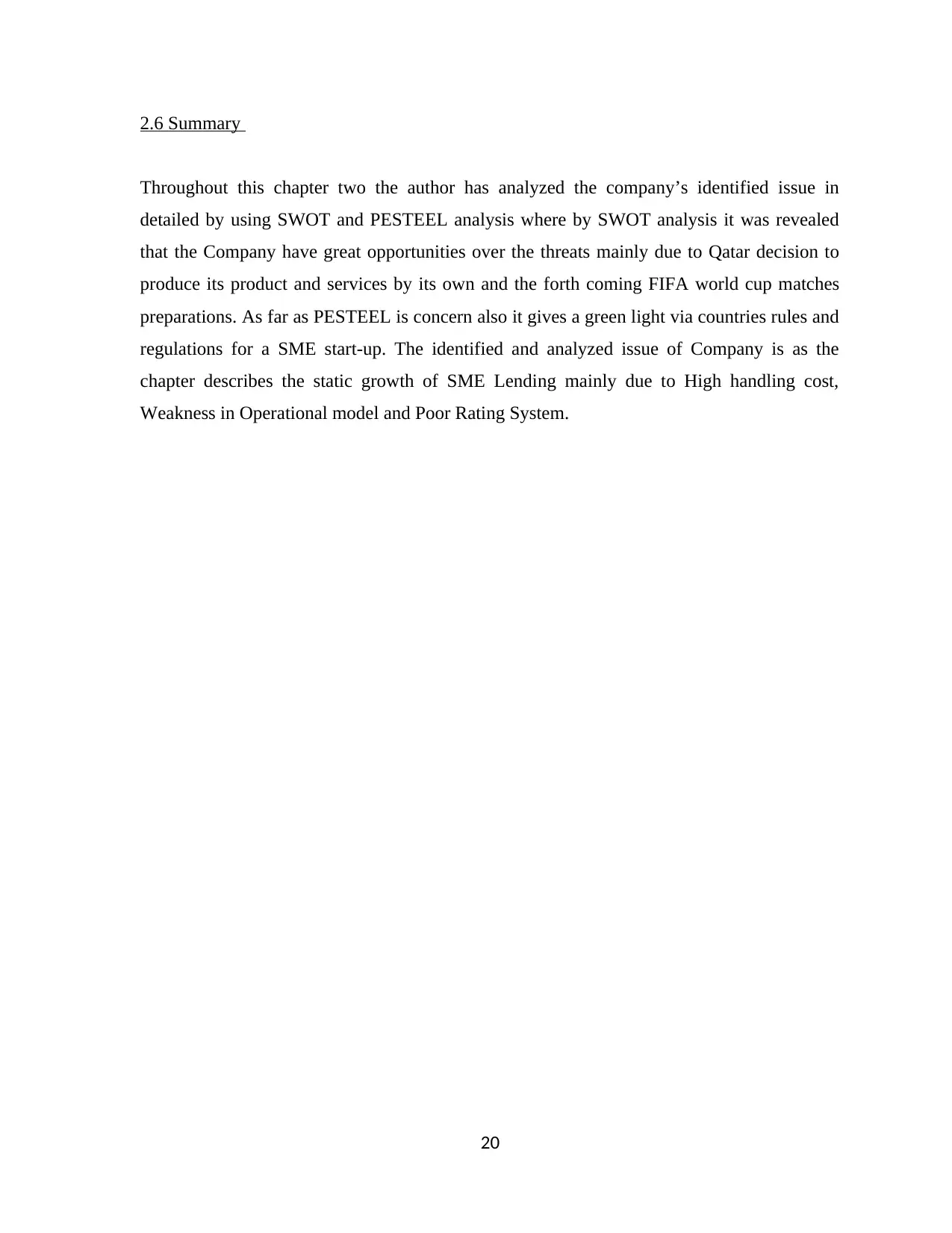

TABLE 2. 7 SME COMPLAINTS AND IMPACT................................................................19

P

TABLE 4. 1 PROJECT COMPONENTS AND TECHNIQUES............................................30

TABLE 4. 2 CURRENT SITUATION ANALYSIS TOOLS.................................................32

TABLE 4. 3: KIPLING’S METHOD......................................................................................34

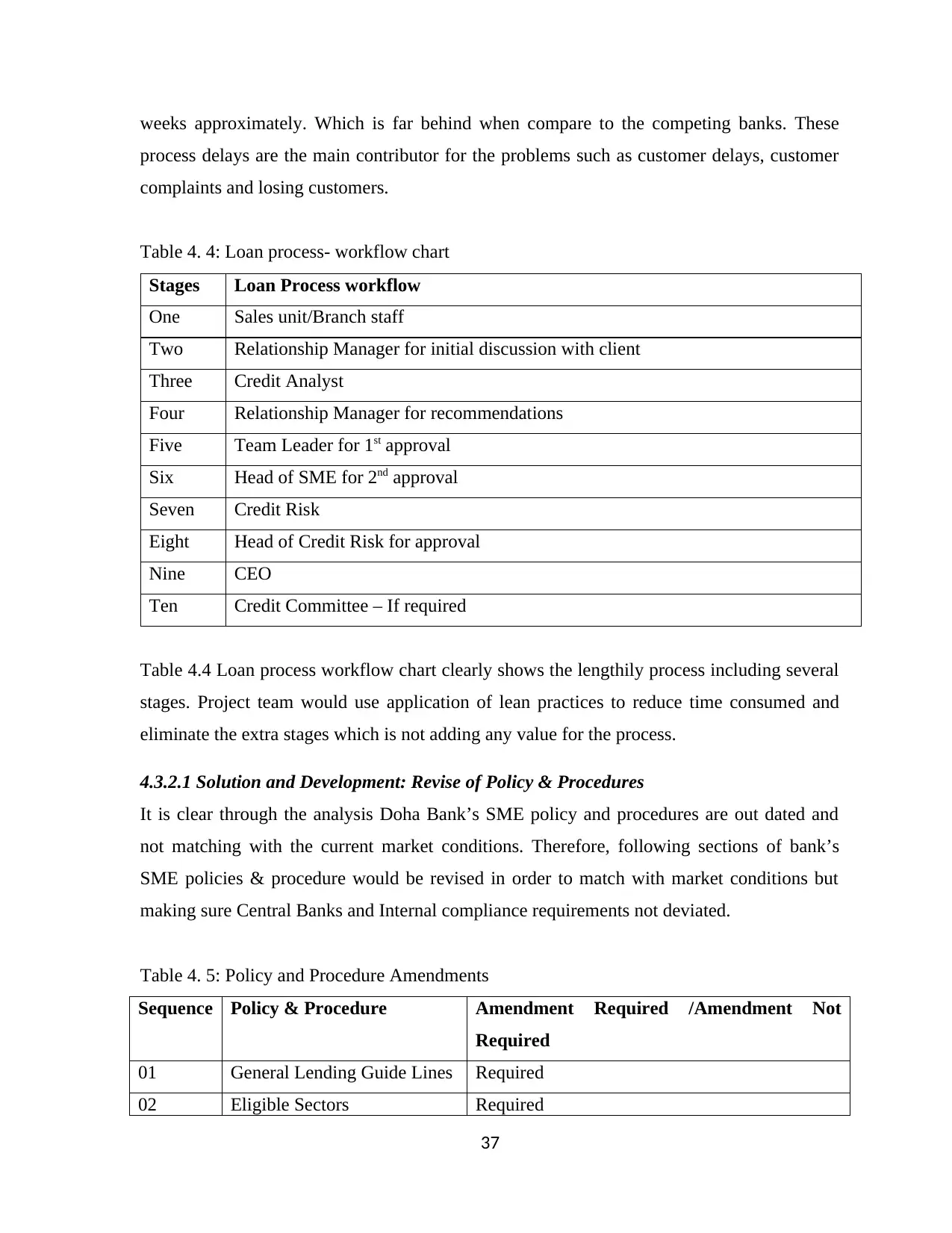

TABLE 4. 4: LOAN PROCESS- WORKFLOW CHART.....................................................37

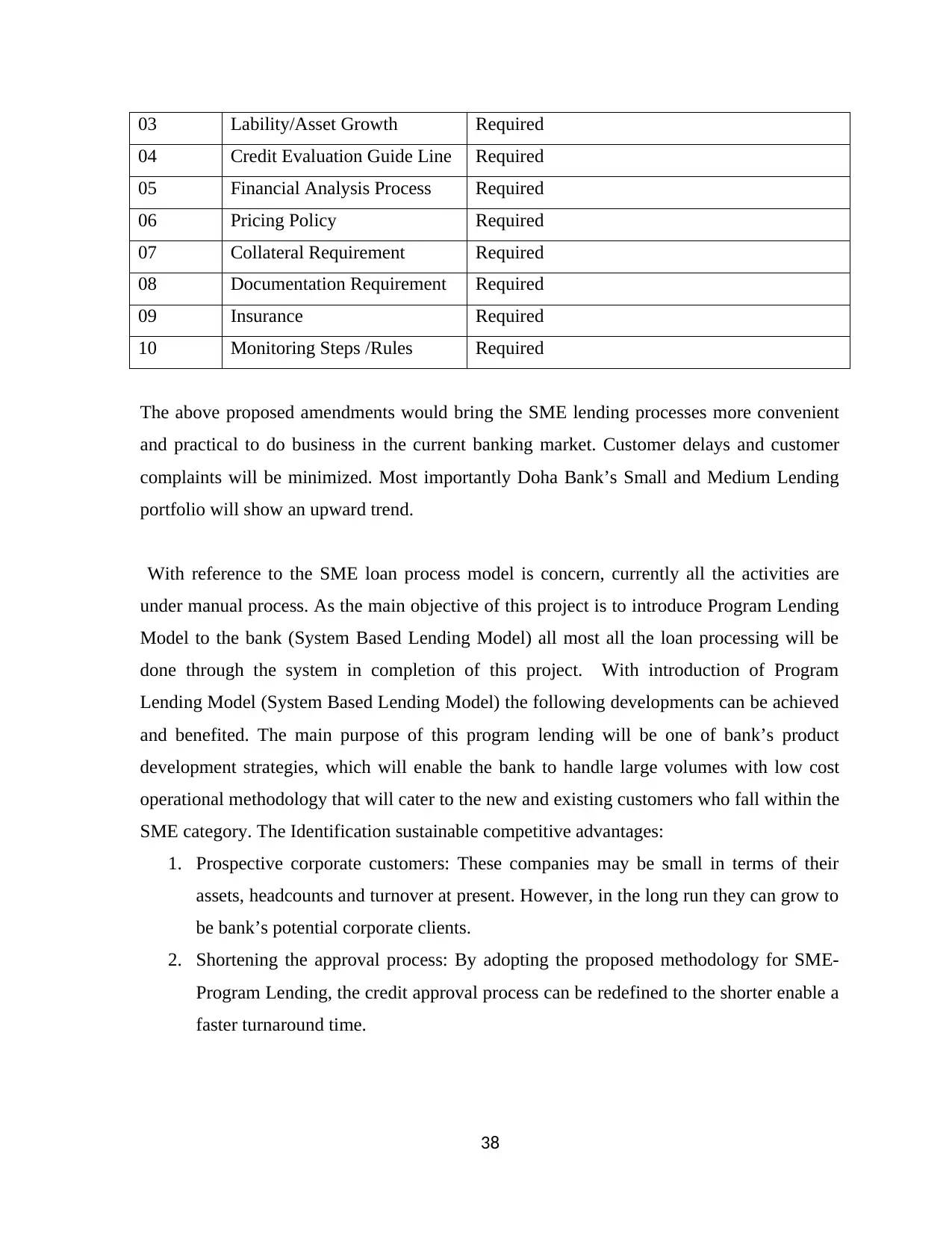

TABLE 4. 5: POLICY AND PROCEDURE AMENDMENTS.............................................37

TABLE 4. 6: TURNAROUND TIME VS LOAN PROCESS STAGES................................42

TABLE 4. 7: TIME AND MOTION STUDY LOAN PROCESS WORKFLOW..................43

TABLE 4. 8: RESOURCE ALLOCATION OF PROJECT....................................................44

TABLE 4. 9: COST ESTIMATES..........................................................................................45

TABLE 4. 10: COST BENEFITS...........................................................................................46

TABLE 4. 11: PROJECT OUTPUT /OUTCOMES................................................................46

TABLE 4. 12: PROJECT TIME PLANNERS........................................................................47

iv

TABLE 2. 1: FINANCIAL HIGHLIGHTS...............................................................................7

TABLE 2. 2: RATIO ANALYSIS............................................................................................8

TABLE 2. 3 SWOT ANALYSIS..............................................................................................9

TABLE 2. 4 APPLICATION PROCESSING.........................................................................16

TABLE 2. 5 DB KEY PERFORMANCE AREAS.................................................................17

TABLE 2. 6 NUMBER OF COMPLAINTS...........................................................................18

TABLE 2. 7 SME COMPLAINTS AND IMPACT................................................................19

P

TABLE 4. 1 PROJECT COMPONENTS AND TECHNIQUES............................................30

TABLE 4. 2 CURRENT SITUATION ANALYSIS TOOLS.................................................32

TABLE 4. 3: KIPLING’S METHOD......................................................................................34

TABLE 4. 4: LOAN PROCESS- WORKFLOW CHART.....................................................37

TABLE 4. 5: POLICY AND PROCEDURE AMENDMENTS.............................................37

TABLE 4. 6: TURNAROUND TIME VS LOAN PROCESS STAGES................................42

TABLE 4. 7: TIME AND MOTION STUDY LOAN PROCESS WORKFLOW..................43

TABLE 4. 8: RESOURCE ALLOCATION OF PROJECT....................................................44

TABLE 4. 9: COST ESTIMATES..........................................................................................45

TABLE 4. 10: COST BENEFITS...........................................................................................46

TABLE 4. 11: PROJECT OUTPUT /OUTCOMES................................................................46

TABLE 4. 12: PROJECT TIME PLANNERS........................................................................47

iv

LIST OF FIGURES

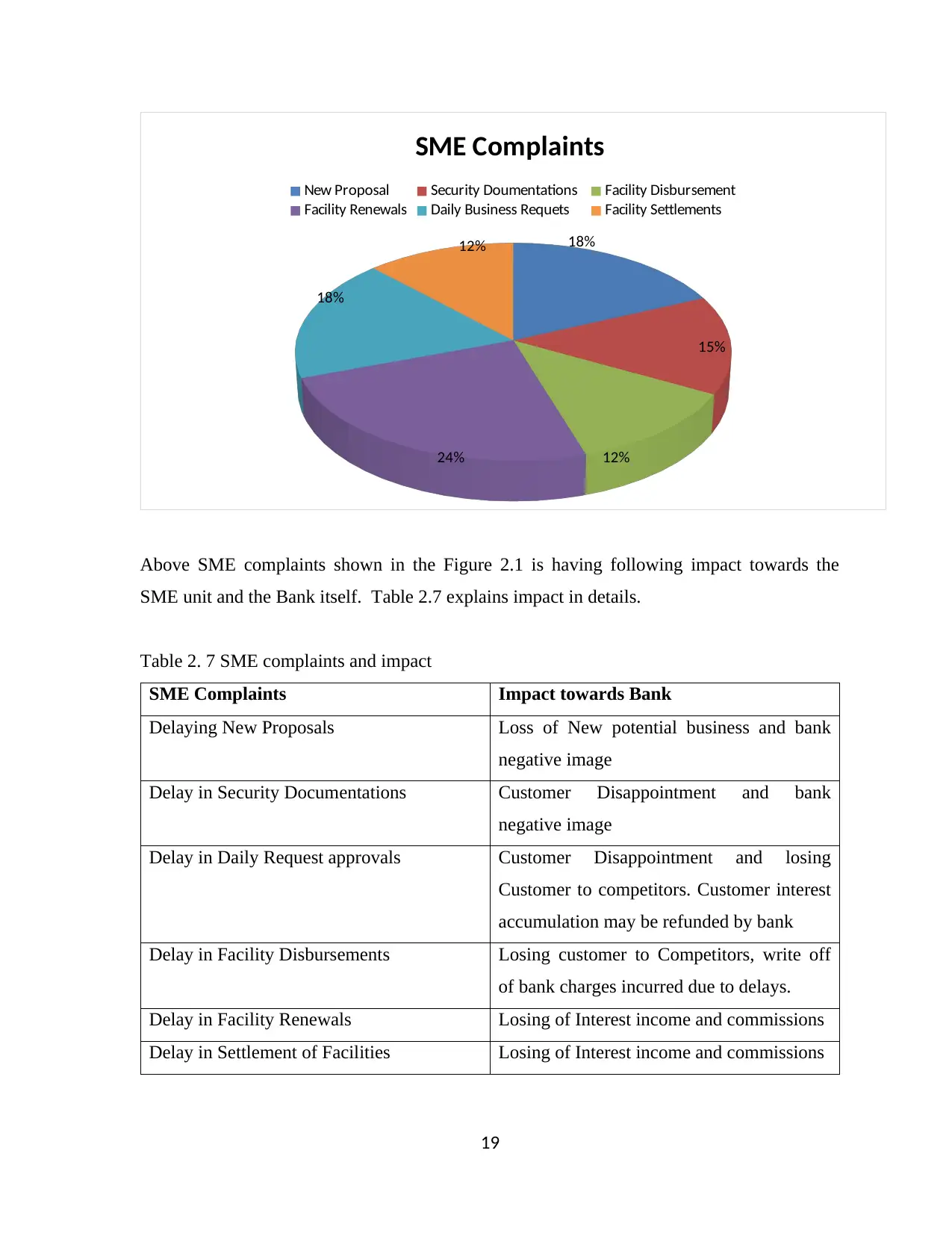

FIGURE 2. 1: SME COMPLAINTS.......................................................................................19

a

FIGURE 3. 1: STUDY FRAMEWORK.................................................................................27

b

FIGURE 4. 1: ISHIKAWA DIAGRAM – CAUSE AND EFFECTS.....................................33

FIGURE 4. 2: 5WHY’S...........................................................................................................36

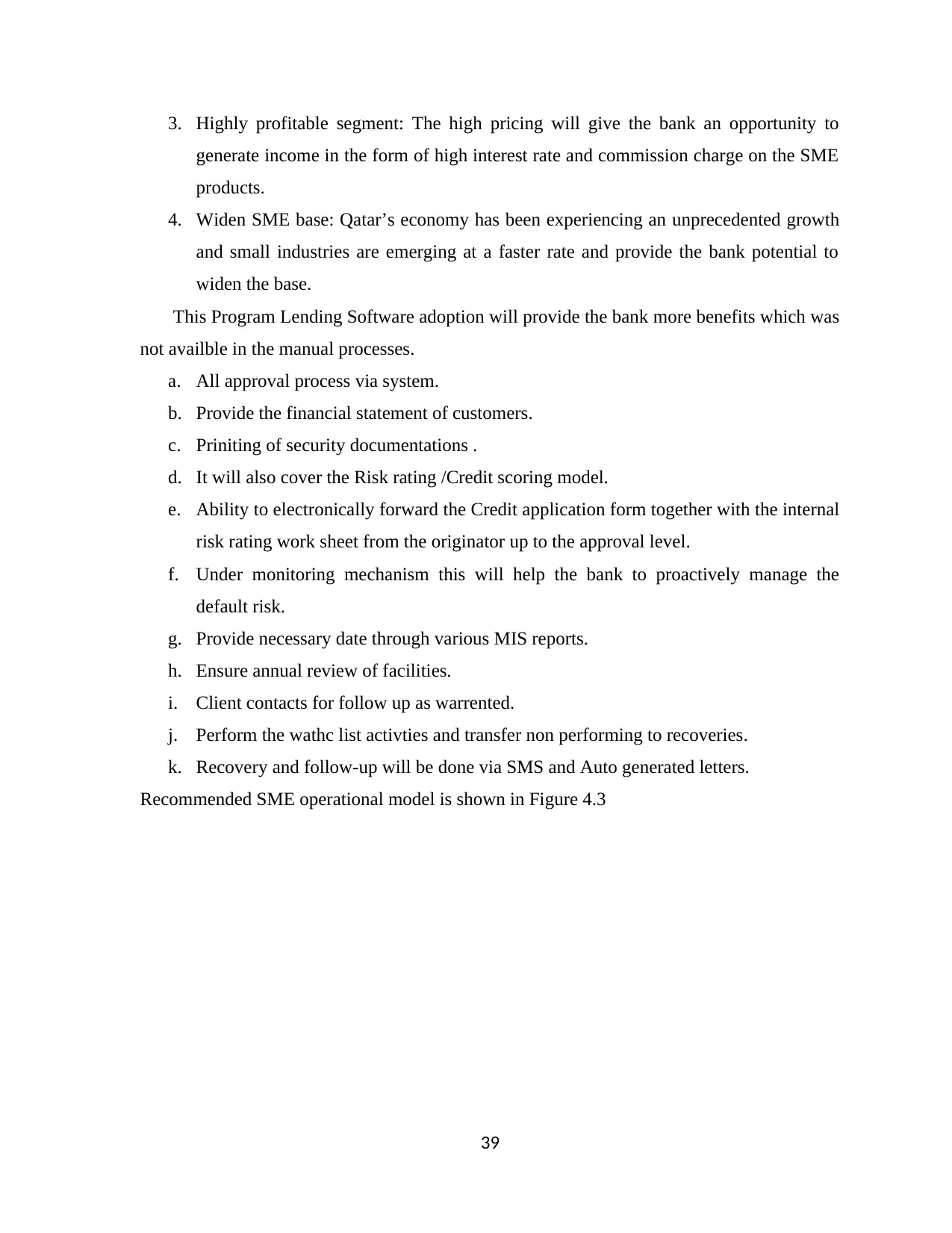

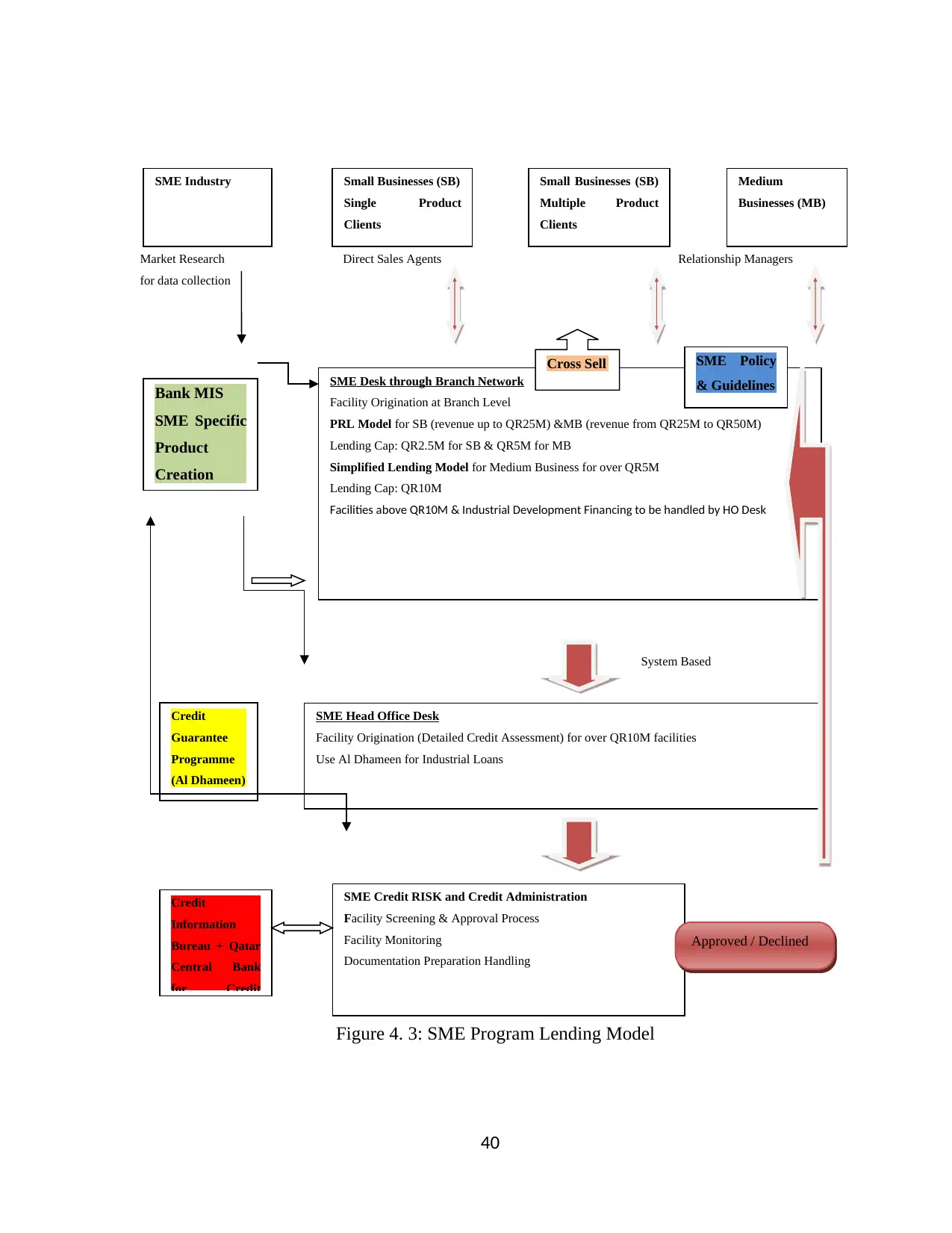

FIGURE 4. 3: SME PROGRAM LENDING MODEL...........................................................40

FIGURE 4. 4: PROJECT TEAM STRUCTURE....................................................................44

v

FIGURE 2. 1: SME COMPLAINTS.......................................................................................19

a

FIGURE 3. 1: STUDY FRAMEWORK.................................................................................27

b

FIGURE 4. 1: ISHIKAWA DIAGRAM – CAUSE AND EFFECTS.....................................33

FIGURE 4. 2: 5WHY’S...........................................................................................................36

FIGURE 4. 3: SME PROGRAM LENDING MODEL...........................................................40

FIGURE 4. 4: PROJECT TEAM STRUCTURE....................................................................44

v

ACKNOWLEDGEMENTS

I would sincerely thank my mentor for providing me immense support and guidance while

carrying out the research. I would also like to express my gratitude towards colleagues,

friends and family members who assisted me at every step of this report. With the help of

their guidance and support, I was able to accomplish the dissertation. I would also be greatly

thankful to my team members for the assistance provided by them in collection of data and

its subsequent analysis.

vi

I would sincerely thank my mentor for providing me immense support and guidance while

carrying out the research. I would also like to express my gratitude towards colleagues,

friends and family members who assisted me at every step of this report. With the help of

their guidance and support, I was able to accomplish the dissertation. I would also be greatly

thankful to my team members for the assistance provided by them in collection of data and

its subsequent analysis.

vi

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

This report has enlightened a vital role of SME’s in innovation with context to the banking

industry of Qatar. It has hereby taken the Doha banks into consideration and has been carried

out in 5 significant sections. The foremost section has provided an overview of this report

with another section called problem identification that is meant to entail the actual issues

related to innovation in the SME’s of banking industry. For this purpose, various theoretical

models and frameworks have been used to analyze the current state of the market in terms of

invention and productivity from it. This has been followed by a theoretical framework for

diagnosis in the third section and the final project in the next section. Lastly, a discussion of

the acquired outcomes has been done at the end of the report.

vii

This report has enlightened a vital role of SME’s in innovation with context to the banking

industry of Qatar. It has hereby taken the Doha banks into consideration and has been carried

out in 5 significant sections. The foremost section has provided an overview of this report

with another section called problem identification that is meant to entail the actual issues

related to innovation in the SME’s of banking industry. For this purpose, various theoretical

models and frameworks have been used to analyze the current state of the market in terms of

invention and productivity from it. This has been followed by a theoretical framework for

diagnosis in the third section and the final project in the next section. Lastly, a discussion of

the acquired outcomes has been done at the end of the report.

vii

CHAPTER 1

INTRODUCTION

1.1 Background

SMEs play a critical role in innovation, advancement and sustainable development

worldwide. In today’s increasingly globalized world, SMEs around the world have to

unprecedentedly compete globally. SMEs attract greater attention of Banks worldwide in

current era in their conquest to increase market share and revenue growth. Nevertheless,

Qatar’s financial sector reflects the lowest financing penetration into SME segment within

the GCC despite of State’s committed strategic direction to diversify its economy with

prominence to developing the local SMEs. SME segment is the best alternative untapped

market that is envisaged lucrative for Qatari Banks resulting to recent regulatory

interventions in Retail space and aggressive competition in corporate space eroding banking

sector profitability. The complexities encountered in Investment banking arena also makes

SME banking encouraging for elevating bank’s bottom line in a risk averse manner.

Doha Bank was the first bank in Qatar to understand and appreciate the importance of the

critical role played by SMEs in the development of the Qatari economy. In view of this,

Doha Bank became the first bank to launch ‘Tatweer’, a dedicated SME unit in 2008.The

infrastructure development taking place in Qatar in the form of ports, roads, airports, rail,

telecom, other utilities and construction activity requires the support of SME businesses.

Doha Bank aims to actively participate in Qatar’s diversification story by encouraging the

SME sector.

In today’s highly competitive environment, speed of delivery and excellent customer service

plays a pivotal role in the success of any Bank. Our main problem start from here Doha

Bank’s is not providing the required speed of delivery. It’s facing delays in Turnaround Time

of SME Lending processing model. Such delays resulted in losing new and existing highly

potential customers, increasing customer complaints, negative impact on Bank’s image, and

loss of interest/commission income and reduction of lending portfolio, down fall of bank’s

profitability in SME lending.

1

INTRODUCTION

1.1 Background

SMEs play a critical role in innovation, advancement and sustainable development

worldwide. In today’s increasingly globalized world, SMEs around the world have to

unprecedentedly compete globally. SMEs attract greater attention of Banks worldwide in

current era in their conquest to increase market share and revenue growth. Nevertheless,

Qatar’s financial sector reflects the lowest financing penetration into SME segment within

the GCC despite of State’s committed strategic direction to diversify its economy with

prominence to developing the local SMEs. SME segment is the best alternative untapped

market that is envisaged lucrative for Qatari Banks resulting to recent regulatory

interventions in Retail space and aggressive competition in corporate space eroding banking

sector profitability. The complexities encountered in Investment banking arena also makes

SME banking encouraging for elevating bank’s bottom line in a risk averse manner.

Doha Bank was the first bank in Qatar to understand and appreciate the importance of the

critical role played by SMEs in the development of the Qatari economy. In view of this,

Doha Bank became the first bank to launch ‘Tatweer’, a dedicated SME unit in 2008.The

infrastructure development taking place in Qatar in the form of ports, roads, airports, rail,

telecom, other utilities and construction activity requires the support of SME businesses.

Doha Bank aims to actively participate in Qatar’s diversification story by encouraging the

SME sector.

In today’s highly competitive environment, speed of delivery and excellent customer service

plays a pivotal role in the success of any Bank. Our main problem start from here Doha

Bank’s is not providing the required speed of delivery. It’s facing delays in Turnaround Time

of SME Lending processing model. Such delays resulted in losing new and existing highly

potential customers, increasing customer complaints, negative impact on Bank’s image, and

loss of interest/commission income and reduction of lending portfolio, down fall of bank’s

profitability in SME lending.

1

The overall study realizes Doha Bank’s financial sector challenges and lending architectural

laxities confining financing interest to this perceived lucrative market segment. The study

work, predominantly exploratory in nature, provides a comprehensive perspective to Bank’s

SME banking with an aim to establishing a competent lending operating model for SME

financing penetration, competitive advantage and revenue maximization.

The findings expose that Doha bank SME lending model to be revitalized to overcome

identified Delays in Turnaround Time. Finally, Recommendations are to be made to

revitalize the financing architecture of the bank, to profitably serve the SMEs at mass for

aggressive penetration whilst adequately mitigating credit risk attached to lending.

Recommendations include implementing internal MIS capabilities, streamlining and

simplifying the credit screening process and strategizing the lending approach to effectively

capture the significantly un-tapped SME market.

1.2 Project

This project mainly focusing on to identify the reasons behind the delays in Turnaround Time

of SME Lending processes in other wards issues in bank’s SME lending operational model.

The prime objectives will be to establish suitable SME lending operational model which will

meet the current market requirement of speed of delivery.

In addition to introducing a SME lending operational model, the project will also concentrate

on identifying constrains of Bank’s policy & procedures. Necessary recommendation to be

made to amend the bank policy & procedures in order meet the current market requirements

complying within bank’s compliance framework.

Further in order to address the customer complaints issues against SME lending, employee’s

productivity to be reassessed. A bench mark on expected standard of productivity will be

created and evaluate, monitor continuously.

Time Management or Analyzing the time GAP in SME lending process is also one of key

aspect of this project. This will help in identifying exact steps and its time delays in SME

lending process map. Such information is vital for when creating a suitable SME lending

operational model.

2

laxities confining financing interest to this perceived lucrative market segment. The study

work, predominantly exploratory in nature, provides a comprehensive perspective to Bank’s

SME banking with an aim to establishing a competent lending operating model for SME

financing penetration, competitive advantage and revenue maximization.

The findings expose that Doha bank SME lending model to be revitalized to overcome

identified Delays in Turnaround Time. Finally, Recommendations are to be made to

revitalize the financing architecture of the bank, to profitably serve the SMEs at mass for

aggressive penetration whilst adequately mitigating credit risk attached to lending.

Recommendations include implementing internal MIS capabilities, streamlining and

simplifying the credit screening process and strategizing the lending approach to effectively

capture the significantly un-tapped SME market.

1.2 Project

This project mainly focusing on to identify the reasons behind the delays in Turnaround Time

of SME Lending processes in other wards issues in bank’s SME lending operational model.

The prime objectives will be to establish suitable SME lending operational model which will

meet the current market requirement of speed of delivery.

In addition to introducing a SME lending operational model, the project will also concentrate

on identifying constrains of Bank’s policy & procedures. Necessary recommendation to be

made to amend the bank policy & procedures in order meet the current market requirements

complying within bank’s compliance framework.

Further in order to address the customer complaints issues against SME lending, employee’s

productivity to be reassessed. A bench mark on expected standard of productivity will be

created and evaluate, monitor continuously.

Time Management or Analyzing the time GAP in SME lending process is also one of key

aspect of this project. This will help in identifying exact steps and its time delays in SME

lending process map. Such information is vital for when creating a suitable SME lending

operational model.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1.3 Significance of the study

The significance of this study is reducing turnaround time and increase productivity without

negatively impacting processes. Implementing new process and technology practices will

thereby be increasing productivity and capacity.

Due to the Turnaround Time Delays in SME Lending processes the bank has suffered huge

direct and indirect losses in terms of reputation, customer complaints, losing potential

customers, negative lending growth and low % of profits in SME lending. All these issues

are expected to be addressed positively through this project or from this study. Business

challenges such as reduce turnaround time, improve productivity in terms of loans per

person/per day, enact changes with no negative impact on accuracy will be resolved and can

be treated as advantages of this study.

Revise of bank’s policy & procedures in order to match the current market trend will resolve

the SME lending barriers and will have a positive impact on SME Lending portfolio. Which

will lead to upwards increase/growth of bank’s commission income, interest income and as

well as the profitability.

Further employee productivity assessments will also be more significant. Whereas

assessment outcome will clearly identify employee productivity GAP’s and will be great

insight for improvements or to consider alternatives such as remove old blood and infuse new

blood to boost the employee productivity.

1.4 Methodology

A well-defined problem is significant to implementing the research course of action for

appropriate assessment, justification and recommendations to the study performed. The

methodology should secure insights to all pertinent aspects which has a bearing to the

identified problem facilitating ultimate understanding of the problem background and

effectively guides in recommending best suited solution whilst overcoming ambiguities.

(Zikmund, 2008)

3

The significance of this study is reducing turnaround time and increase productivity without

negatively impacting processes. Implementing new process and technology practices will

thereby be increasing productivity and capacity.

Due to the Turnaround Time Delays in SME Lending processes the bank has suffered huge

direct and indirect losses in terms of reputation, customer complaints, losing potential

customers, negative lending growth and low % of profits in SME lending. All these issues

are expected to be addressed positively through this project or from this study. Business

challenges such as reduce turnaround time, improve productivity in terms of loans per

person/per day, enact changes with no negative impact on accuracy will be resolved and can

be treated as advantages of this study.

Revise of bank’s policy & procedures in order to match the current market trend will resolve

the SME lending barriers and will have a positive impact on SME Lending portfolio. Which

will lead to upwards increase/growth of bank’s commission income, interest income and as

well as the profitability.

Further employee productivity assessments will also be more significant. Whereas

assessment outcome will clearly identify employee productivity GAP’s and will be great

insight for improvements or to consider alternatives such as remove old blood and infuse new

blood to boost the employee productivity.

1.4 Methodology

A well-defined problem is significant to implementing the research course of action for

appropriate assessment, justification and recommendations to the study performed. The

methodology should secure insights to all pertinent aspects which has a bearing to the

identified problem facilitating ultimate understanding of the problem background and

effectively guides in recommending best suited solution whilst overcoming ambiguities.

(Zikmund, 2008)

3

An in-depth understanding of the problem background will be arrived through an exploratory

study based on SWOT analysis; Cause & effect analysis and Time and motion analysis

covering various elements relevant to the study and has a reflection to the identified problem.

The design of the study is primarily focused on discovering the perception of Doha bank

employees who are actively engaged in SME/Corporate Lending in order to assess Bank’s

SME banking framework. Cross functional teams engaged in SME/Corporate Banking from

business, underwriting and risk assessment departments are surveyed upon to retrieve an

unbiased and experienced view, which was elementary to addressing the identified problem.

Initially SWOT analysis will be done to ascertain current situation of Doha Bank’s SME

Lending processes strengths, weaknesses, opportunities, threats. Depending on the SWOT

outcome impacting issues will be identified and the causes which impact the delays in

Turnaround Time in SME Lending processes or SME Lending operational model.

The Cause and Effect analysis will be used as a technique to find out the reasons behind the

problem. Fishbone diagram is an analysis tool. By using the fish-borne diagram, it will be

possible to determine problems which make SME Lending process lengthy.

Time and motion study will be used to change and update of work frameworks. This

coordinated way to deal with work framework change is known as strategies engineering. At

the end through the identified techniques a suitable solution with recommendations will be

provided against the components and highly productive SME Lending processes model will

be put forward as solution to the identified problem.

1.5 Limitation

Specifying scope of the study is subject to time constraints and practical difficulties arising in

collecting information related to the topic and time Limitations.

1.6 Chapter Framework

Chapter Two will discuss about the selected organizational profile, organizational analysis,

key issues and problem and finally description of the problem supporting with data linked to

the selected organization.

4

study based on SWOT analysis; Cause & effect analysis and Time and motion analysis

covering various elements relevant to the study and has a reflection to the identified problem.

The design of the study is primarily focused on discovering the perception of Doha bank

employees who are actively engaged in SME/Corporate Lending in order to assess Bank’s

SME banking framework. Cross functional teams engaged in SME/Corporate Banking from

business, underwriting and risk assessment departments are surveyed upon to retrieve an

unbiased and experienced view, which was elementary to addressing the identified problem.

Initially SWOT analysis will be done to ascertain current situation of Doha Bank’s SME

Lending processes strengths, weaknesses, opportunities, threats. Depending on the SWOT

outcome impacting issues will be identified and the causes which impact the delays in

Turnaround Time in SME Lending processes or SME Lending operational model.

The Cause and Effect analysis will be used as a technique to find out the reasons behind the

problem. Fishbone diagram is an analysis tool. By using the fish-borne diagram, it will be

possible to determine problems which make SME Lending process lengthy.

Time and motion study will be used to change and update of work frameworks. This

coordinated way to deal with work framework change is known as strategies engineering. At

the end through the identified techniques a suitable solution with recommendations will be

provided against the components and highly productive SME Lending processes model will

be put forward as solution to the identified problem.

1.5 Limitation

Specifying scope of the study is subject to time constraints and practical difficulties arising in

collecting information related to the topic and time Limitations.

1.6 Chapter Framework

Chapter Two will discuss about the selected organizational profile, organizational analysis,

key issues and problem and finally description of the problem supporting with data linked to

the selected organization.

4

Chapter Three will discuss the theoretical back ground to the problem with an extensive

literature reviews, frame work of the study and a detail of description of the techniques

identified.

Chapter Four will discuss the SMART objective of the project, theoretical frame of project

components, resource allocation, cost estimates, project out puts and outcomes and finally

the project plan including the time plan of the project as well as monitoring.

Chapter Five will discuss about the project implementation recommendations and its

variations such as projected delivery and time and finally the issues in project

implementation.

5

literature reviews, frame work of the study and a detail of description of the techniques

identified.

Chapter Four will discuss the SMART objective of the project, theoretical frame of project

components, resource allocation, cost estimates, project out puts and outcomes and finally

the project plan including the time plan of the project as well as monitoring.

Chapter Five will discuss about the project implementation recommendations and its

variations such as projected delivery and time and finally the issues in project

implementation.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CHAPTER 2

PROBLEM IDENTIFICATION

2.1 Introduction

The chapter two will discuss the key issues of the problem identification which the author is

going to study. With regards to said study and review process the Company which will be

subject to SWOT and PESTEEL analysis in detail and driven to a realistic conclusion.

Moreover, the identified problem/issues will be inked to the organizational performances

such as profit /losses, revenue and other inter related activities to find out the impacts /gaps.

Moreover, the findings will be under a detailed analyzed in order to know the root cause of

the issue identified by author.

2.2 Organization Profile

Doha Bank is one of the largest commercial banks in the State of Qatar and has been

consistently registering strong growth during the last decade with participative leadership

philosophy. Inaugurated in 1979, Doha Bank provides domestic and international banking

services for individuals, commercial, corporate and institutional clients through four business

groups Wholesale Banking, Retail Banking, International Banking and Treasury &

Investments.

Doha Bank has been in operation for more than 38 years and having 27 domestic branches, 9

e-branches including pay offices, 1 active mobile branch and more than 110 ATMs as on

30th September 2017. The Bank has expanded its business overseas with branches in the

UAE (Dubai & Abu Dhabi), Kuwait and India (Mumbai, Cochin and Chennai). In addition,

we have representative offices in Singapore, Turkey, Japan, China, United Kingdom,

Canada, Germany, Australia, Hong Kong, South Korea, Sharjah (U.A.E.), Bangladesh and

South Africa.

6

PROBLEM IDENTIFICATION

2.1 Introduction

The chapter two will discuss the key issues of the problem identification which the author is

going to study. With regards to said study and review process the Company which will be

subject to SWOT and PESTEEL analysis in detail and driven to a realistic conclusion.

Moreover, the identified problem/issues will be inked to the organizational performances

such as profit /losses, revenue and other inter related activities to find out the impacts /gaps.

Moreover, the findings will be under a detailed analyzed in order to know the root cause of

the issue identified by author.

2.2 Organization Profile

Doha Bank is one of the largest commercial banks in the State of Qatar and has been

consistently registering strong growth during the last decade with participative leadership

philosophy. Inaugurated in 1979, Doha Bank provides domestic and international banking

services for individuals, commercial, corporate and institutional clients through four business

groups Wholesale Banking, Retail Banking, International Banking and Treasury &

Investments.

Doha Bank has been in operation for more than 38 years and having 27 domestic branches, 9

e-branches including pay offices, 1 active mobile branch and more than 110 ATMs as on

30th September 2017. The Bank has expanded its business overseas with branches in the

UAE (Dubai & Abu Dhabi), Kuwait and India (Mumbai, Cochin and Chennai). In addition,

we have representative offices in Singapore, Turkey, Japan, China, United Kingdom,

Canada, Germany, Australia, Hong Kong, South Korea, Sharjah (U.A.E.), Bangladesh and

South Africa.

6

Doha Bank has received numerous awards in recognition of its achievements. Doha Bank

was adjudged as the ‘Best Regional Commercial Bank’ – The Banker Middle East for the 5th

straight year. Doha Bank was recently awarded as ‘Bank of the Year – Qatar Domestic Trade

Finance’ by Asian Banking & Finance. Additionally, Doha Bank has in the past claimed

various other awards such as, ‘Bank of the Year’ – The Banker, ‘Best Commercial Bank in

the Middle East’ – Global Banking & Finance, ‘Bank of the Year’ – ITP Group, ‘Best Bank

in Qatar’ – IAIR Award and ‘Best Bank in Qatar’ – EMEA Finance.

In recognition of being one of the most active advocates of Corporate Social Responsibility

(CSR) through initiatives such as ‘ECO-School Program ‘Al Dana Green Run’, beach

cleaning, tree planting etc., Doha Bank has won the ‘Environmental Award’ from The Arab

Organization for Social Responsibility as well as ‘Golden Peacock – Global Award for

Sustainability’ from the Institute of Directors. Doha Bank is rated A by Fitch, A2 by

Moody’s and A- by Standard & Poor’s for its long-term local and foreign currency.

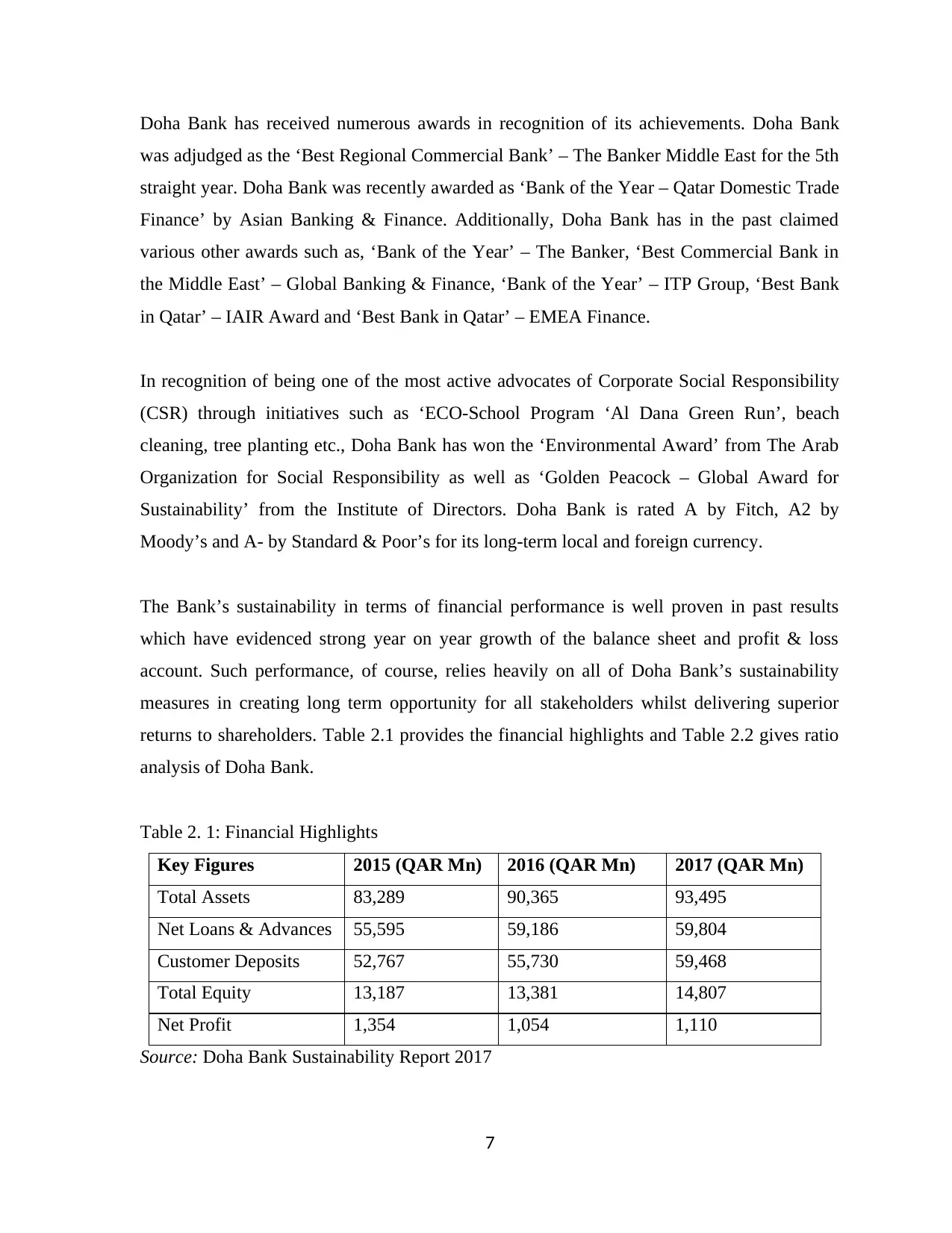

The Bank’s sustainability in terms of financial performance is well proven in past results

which have evidenced strong year on year growth of the balance sheet and profit & loss

account. Such performance, of course, relies heavily on all of Doha Bank’s sustainability

measures in creating long term opportunity for all stakeholders whilst delivering superior

returns to shareholders. Table 2.1 provides the financial highlights and Table 2.2 gives ratio

analysis of Doha Bank.

Table 2. 1: Financial Highlights

Key Figures 2015 (QAR Mn) 2016 (QAR Mn) 2017 (QAR Mn)

Total Assets 83,289 90,365 93,495

Net Loans & Advances 55,595 59,186 59,804

Customer Deposits 52,767 55,730 59,468

Total Equity 13,187 13,381 14,807

Net Profit 1,354 1,054 1,110

Source: Doha Bank Sustainability Report 2017

7

was adjudged as the ‘Best Regional Commercial Bank’ – The Banker Middle East for the 5th

straight year. Doha Bank was recently awarded as ‘Bank of the Year – Qatar Domestic Trade

Finance’ by Asian Banking & Finance. Additionally, Doha Bank has in the past claimed

various other awards such as, ‘Bank of the Year’ – The Banker, ‘Best Commercial Bank in

the Middle East’ – Global Banking & Finance, ‘Bank of the Year’ – ITP Group, ‘Best Bank

in Qatar’ – IAIR Award and ‘Best Bank in Qatar’ – EMEA Finance.

In recognition of being one of the most active advocates of Corporate Social Responsibility

(CSR) through initiatives such as ‘ECO-School Program ‘Al Dana Green Run’, beach

cleaning, tree planting etc., Doha Bank has won the ‘Environmental Award’ from The Arab

Organization for Social Responsibility as well as ‘Golden Peacock – Global Award for

Sustainability’ from the Institute of Directors. Doha Bank is rated A by Fitch, A2 by

Moody’s and A- by Standard & Poor’s for its long-term local and foreign currency.

The Bank’s sustainability in terms of financial performance is well proven in past results

which have evidenced strong year on year growth of the balance sheet and profit & loss

account. Such performance, of course, relies heavily on all of Doha Bank’s sustainability

measures in creating long term opportunity for all stakeholders whilst delivering superior

returns to shareholders. Table 2.1 provides the financial highlights and Table 2.2 gives ratio

analysis of Doha Bank.

Table 2. 1: Financial Highlights

Key Figures 2015 (QAR Mn) 2016 (QAR Mn) 2017 (QAR Mn)

Total Assets 83,289 90,365 93,495

Net Loans & Advances 55,595 59,186 59,804

Customer Deposits 52,767 55,730 59,468

Total Equity 13,187 13,381 14,807

Net Profit 1,354 1,054 1,110

Source: Doha Bank Sustainability Report 2017

7

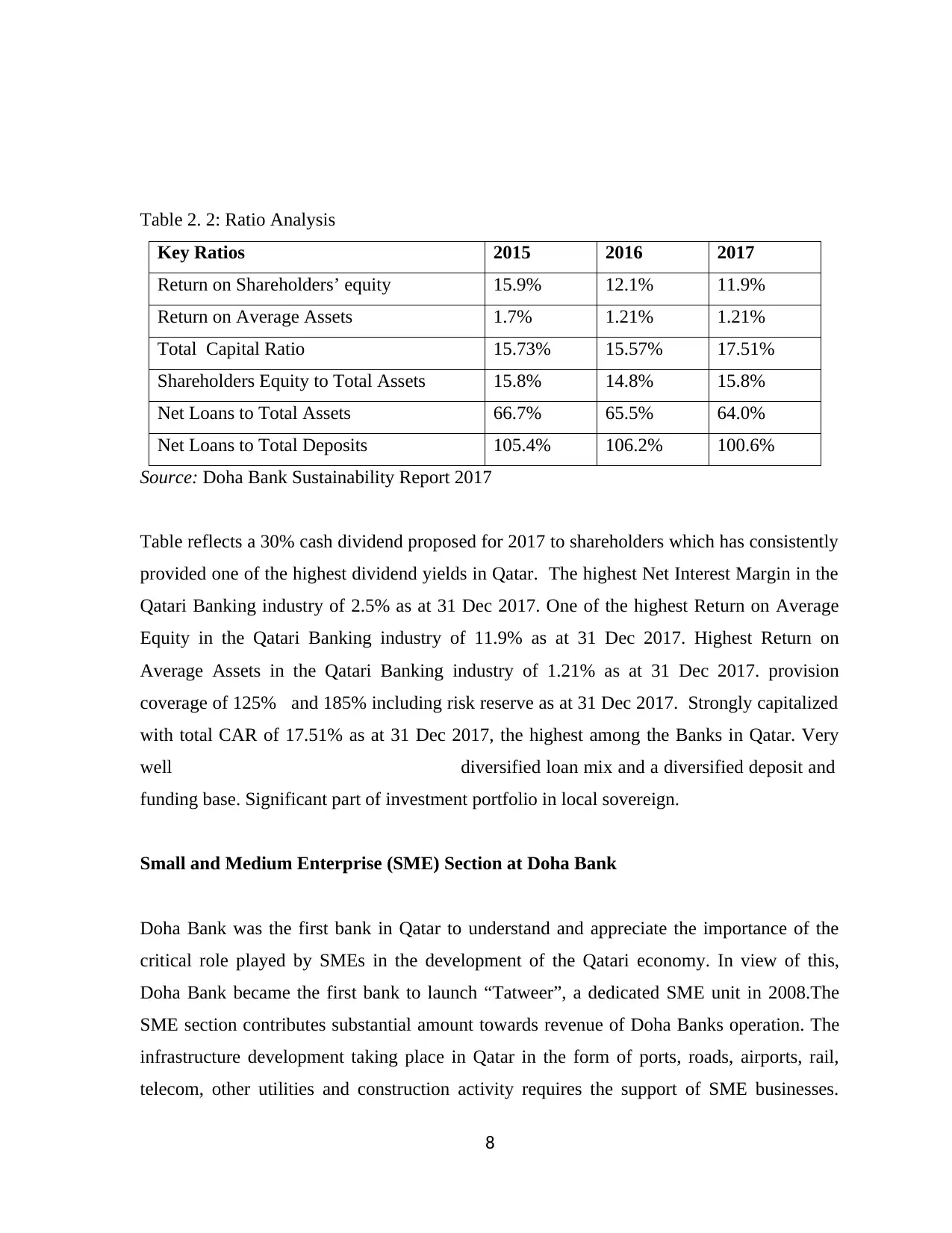

Table 2. 2: Ratio Analysis

Key Ratios 2015 2016 2017

Return on Shareholders’ equity 15.9% 12.1% 11.9%

Return on Average Assets 1.7% 1.21% 1.21%

Total Capital Ratio 15.73% 15.57% 17.51%

Shareholders Equity to Total Assets 15.8% 14.8% 15.8%

Net Loans to Total Assets 66.7% 65.5% 64.0%

Net Loans to Total Deposits 105.4% 106.2% 100.6%

Source: Doha Bank Sustainability Report 2017

Table reflects a 30% cash dividend proposed for 2017 to shareholders which has consistently

provided one of the highest dividend yields in Qatar. The highest Net Interest Margin in the

Qatari Banking industry of 2.5% as at 31 Dec 2017. One of the highest Return on Average

Equity in the Qatari Banking industry of 11.9% as at 31 Dec 2017. Highest Return on

Average Assets in the Qatari Banking industry of 1.21% as at 31 Dec 2017. provision

coverage of 125% and 185% including risk reserve as at 31 Dec 2017. Strongly capitalized

with total CAR of 17.51% as at 31 Dec 2017, the highest among the Banks in Qatar. Very

well diversified loan mix and a diversified deposit and

funding base. Significant part of investment portfolio in local sovereign.

Small and Medium Enterprise (SME) Section at Doha Bank

Doha Bank was the first bank in Qatar to understand and appreciate the importance of the

critical role played by SMEs in the development of the Qatari economy. In view of this,

Doha Bank became the first bank to launch “Tatweer”, a dedicated SME unit in 2008.The

SME section contributes substantial amount towards revenue of Doha Banks operation. The

infrastructure development taking place in Qatar in the form of ports, roads, airports, rail,

telecom, other utilities and construction activity requires the support of SME businesses.

8

Key Ratios 2015 2016 2017

Return on Shareholders’ equity 15.9% 12.1% 11.9%

Return on Average Assets 1.7% 1.21% 1.21%

Total Capital Ratio 15.73% 15.57% 17.51%

Shareholders Equity to Total Assets 15.8% 14.8% 15.8%

Net Loans to Total Assets 66.7% 65.5% 64.0%

Net Loans to Total Deposits 105.4% 106.2% 100.6%

Source: Doha Bank Sustainability Report 2017

Table reflects a 30% cash dividend proposed for 2017 to shareholders which has consistently

provided one of the highest dividend yields in Qatar. The highest Net Interest Margin in the

Qatari Banking industry of 2.5% as at 31 Dec 2017. One of the highest Return on Average

Equity in the Qatari Banking industry of 11.9% as at 31 Dec 2017. Highest Return on

Average Assets in the Qatari Banking industry of 1.21% as at 31 Dec 2017. provision

coverage of 125% and 185% including risk reserve as at 31 Dec 2017. Strongly capitalized

with total CAR of 17.51% as at 31 Dec 2017, the highest among the Banks in Qatar. Very

well diversified loan mix and a diversified deposit and

funding base. Significant part of investment portfolio in local sovereign.

Small and Medium Enterprise (SME) Section at Doha Bank

Doha Bank was the first bank in Qatar to understand and appreciate the importance of the

critical role played by SMEs in the development of the Qatari economy. In view of this,

Doha Bank became the first bank to launch “Tatweer”, a dedicated SME unit in 2008.The

SME section contributes substantial amount towards revenue of Doha Banks operation. The

infrastructure development taking place in Qatar in the form of ports, roads, airports, rail,

telecom, other utilities and construction activity requires the support of SME businesses.

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Doha Bank aims to actively participate in Qatar’s diversification story by encouraging the

SME sector.

Doha Bank has already assisted over 500 SME customers with credit lines more than QAR

1.5 billion to date. Doha Bank firmly believes that today’s SMEs are the emerging large-cap

companies and already have several success stories to boast of. The success stories created

by Doha Bank have encouraged other SME customers to approach Doha Bank for various

financing solutions.

Despite new entrants in the market and stiff competition from local and international players,

Doha Bank continues to be the Banker of First choice for SME customers. These customers

hold Doha Bank in high esteem which speaks volume of their satisfaction levels as the

complete range of products and services are available under one roof along with a team of

dedicated Relationship Managers and Credit & Risk Management team.

2.3 Organizational Analysis: SME Section at Doha Bank

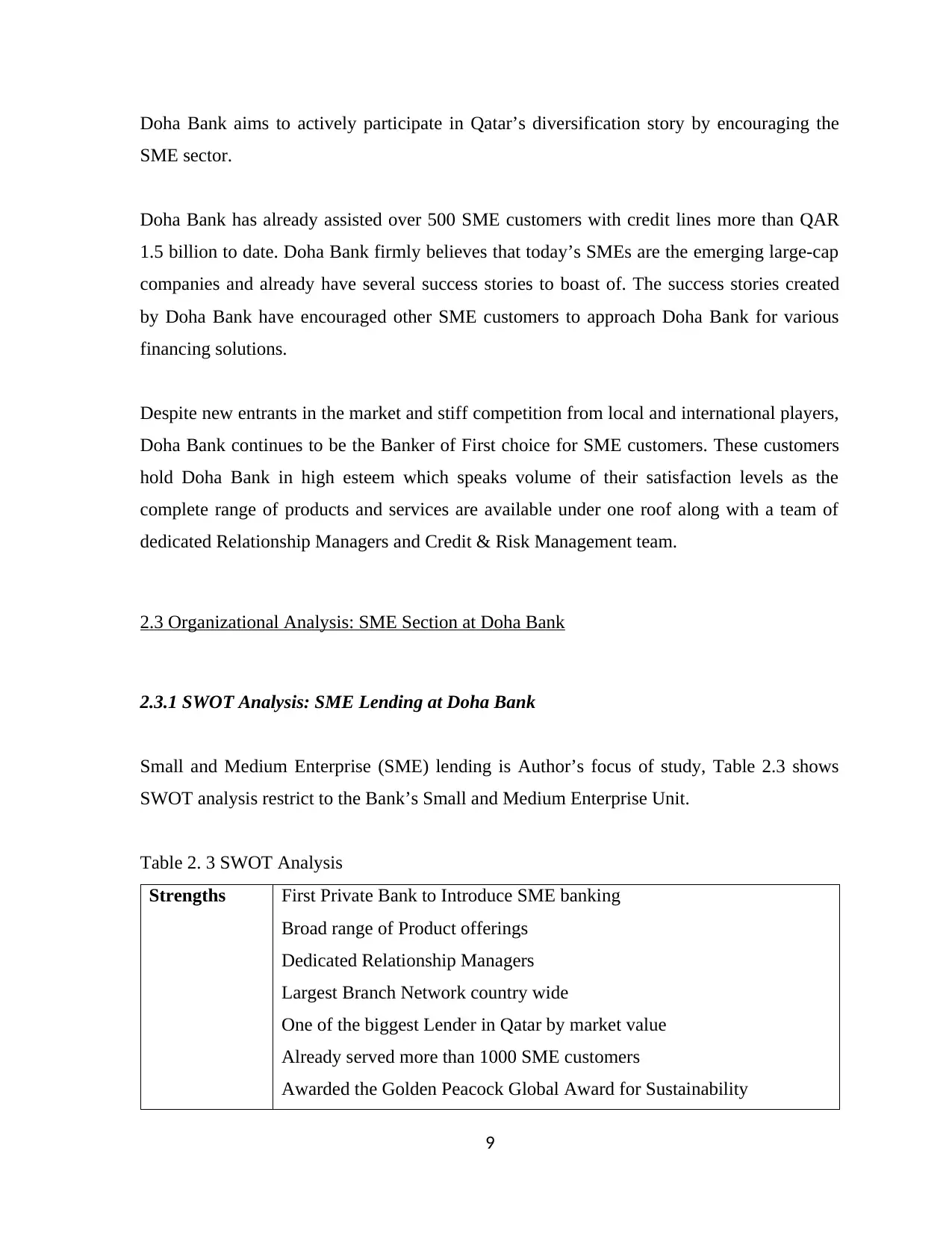

2.3.1 SWOT Analysis: SME Lending at Doha Bank

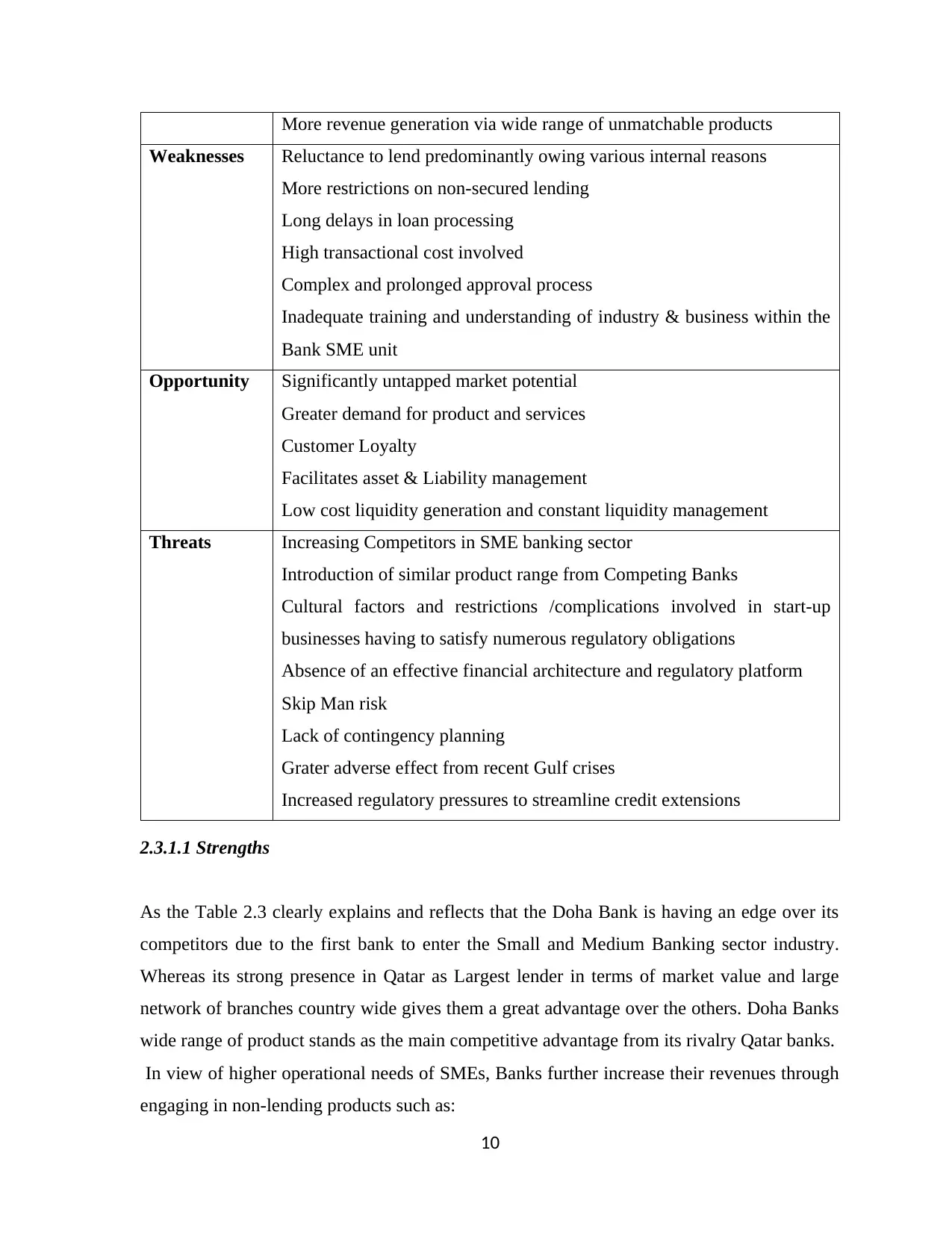

Small and Medium Enterprise (SME) lending is Author’s focus of study, Table 2.3 shows

SWOT analysis restrict to the Bank’s Small and Medium Enterprise Unit.

Table 2. 3 SWOT Analysis

Strengths First Private Bank to Introduce SME banking

Broad range of Product offerings

Dedicated Relationship Managers

Largest Branch Network country wide

One of the biggest Lender in Qatar by market value

Already served more than 1000 SME customers

Awarded the Golden Peacock Global Award for Sustainability

9

SME sector.

Doha Bank has already assisted over 500 SME customers with credit lines more than QAR

1.5 billion to date. Doha Bank firmly believes that today’s SMEs are the emerging large-cap

companies and already have several success stories to boast of. The success stories created

by Doha Bank have encouraged other SME customers to approach Doha Bank for various

financing solutions.

Despite new entrants in the market and stiff competition from local and international players,

Doha Bank continues to be the Banker of First choice for SME customers. These customers

hold Doha Bank in high esteem which speaks volume of their satisfaction levels as the

complete range of products and services are available under one roof along with a team of

dedicated Relationship Managers and Credit & Risk Management team.

2.3 Organizational Analysis: SME Section at Doha Bank

2.3.1 SWOT Analysis: SME Lending at Doha Bank

Small and Medium Enterprise (SME) lending is Author’s focus of study, Table 2.3 shows

SWOT analysis restrict to the Bank’s Small and Medium Enterprise Unit.

Table 2. 3 SWOT Analysis

Strengths First Private Bank to Introduce SME banking

Broad range of Product offerings

Dedicated Relationship Managers

Largest Branch Network country wide

One of the biggest Lender in Qatar by market value

Already served more than 1000 SME customers

Awarded the Golden Peacock Global Award for Sustainability

9

More revenue generation via wide range of unmatchable products

Weaknesses Reluctance to lend predominantly owing various internal reasons

More restrictions on non-secured lending

Long delays in loan processing

High transactional cost involved

Complex and prolonged approval process

Inadequate training and understanding of industry & business within the

Bank SME unit

Opportunity Significantly untapped market potential

Greater demand for product and services

Customer Loyalty

Facilitates asset & Liability management

Low cost liquidity generation and constant liquidity management

Threats Increasing Competitors in SME banking sector

Introduction of similar product range from Competing Banks

Cultural factors and restrictions /complications involved in start-up

businesses having to satisfy numerous regulatory obligations

Absence of an effective financial architecture and regulatory platform

Skip Man risk

Lack of contingency planning

Grater adverse effect from recent Gulf crises

Increased regulatory pressures to streamline credit extensions

2.3.1.1 Strengths

As the Table 2.3 clearly explains and reflects that the Doha Bank is having an edge over its

competitors due to the first bank to enter the Small and Medium Banking sector industry.

Whereas its strong presence in Qatar as Largest lender in terms of market value and large

network of branches country wide gives them a great advantage over the others. Doha Banks

wide range of product stands as the main competitive advantage from its rivalry Qatar banks.

In view of higher operational needs of SMEs, Banks further increase their revenues through

engaging in non-lending products such as:

10

Weaknesses Reluctance to lend predominantly owing various internal reasons

More restrictions on non-secured lending

Long delays in loan processing

High transactional cost involved

Complex and prolonged approval process

Inadequate training and understanding of industry & business within the

Bank SME unit

Opportunity Significantly untapped market potential

Greater demand for product and services

Customer Loyalty

Facilitates asset & Liability management

Low cost liquidity generation and constant liquidity management

Threats Increasing Competitors in SME banking sector

Introduction of similar product range from Competing Banks

Cultural factors and restrictions /complications involved in start-up

businesses having to satisfy numerous regulatory obligations

Absence of an effective financial architecture and regulatory platform

Skip Man risk

Lack of contingency planning

Grater adverse effect from recent Gulf crises

Increased regulatory pressures to streamline credit extensions

2.3.1.1 Strengths

As the Table 2.3 clearly explains and reflects that the Doha Bank is having an edge over its

competitors due to the first bank to enter the Small and Medium Banking sector industry.

Whereas its strong presence in Qatar as Largest lender in terms of market value and large

network of branches country wide gives them a great advantage over the others. Doha Banks

wide range of product stands as the main competitive advantage from its rivalry Qatar banks.

In view of higher operational needs of SMEs, Banks further increase their revenues through

engaging in non-lending products such as:

10

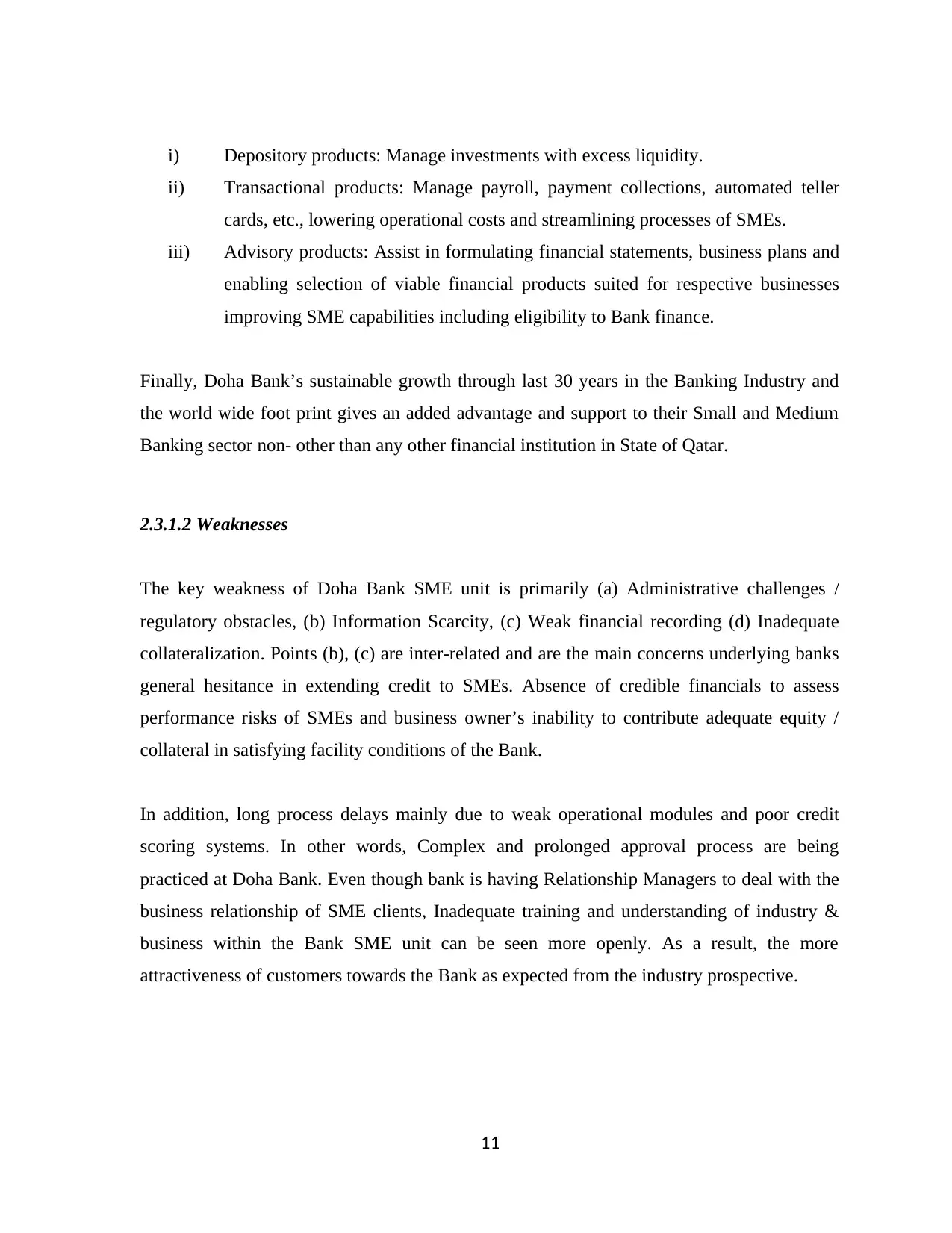

i) Depository products: Manage investments with excess liquidity.

ii) Transactional products: Manage payroll, payment collections, automated teller

cards, etc., lowering operational costs and streamlining processes of SMEs.

iii) Advisory products: Assist in formulating financial statements, business plans and

enabling selection of viable financial products suited for respective businesses

improving SME capabilities including eligibility to Bank finance.

Finally, Doha Bank’s sustainable growth through last 30 years in the Banking Industry and

the world wide foot print gives an added advantage and support to their Small and Medium

Banking sector non- other than any other financial institution in State of Qatar.

2.3.1.2 Weaknesses

The key weakness of Doha Bank SME unit is primarily (a) Administrative challenges /

regulatory obstacles, (b) Information Scarcity, (c) Weak financial recording (d) Inadequate

collateralization. Points (b), (c) are inter-related and are the main concerns underlying banks

general hesitance in extending credit to SMEs. Absence of credible financials to assess

performance risks of SMEs and business owner’s inability to contribute adequate equity /

collateral in satisfying facility conditions of the Bank.

In addition, long process delays mainly due to weak operational modules and poor credit

scoring systems. In other words, Complex and prolonged approval process are being

practiced at Doha Bank. Even though bank is having Relationship Managers to deal with the

business relationship of SME clients, Inadequate training and understanding of industry &

business within the Bank SME unit can be seen more openly. As a result, the more

attractiveness of customers towards the Bank as expected from the industry prospective.

11

ii) Transactional products: Manage payroll, payment collections, automated teller

cards, etc., lowering operational costs and streamlining processes of SMEs.

iii) Advisory products: Assist in formulating financial statements, business plans and

enabling selection of viable financial products suited for respective businesses

improving SME capabilities including eligibility to Bank finance.

Finally, Doha Bank’s sustainable growth through last 30 years in the Banking Industry and

the world wide foot print gives an added advantage and support to their Small and Medium

Banking sector non- other than any other financial institution in State of Qatar.

2.3.1.2 Weaknesses

The key weakness of Doha Bank SME unit is primarily (a) Administrative challenges /

regulatory obstacles, (b) Information Scarcity, (c) Weak financial recording (d) Inadequate

collateralization. Points (b), (c) are inter-related and are the main concerns underlying banks

general hesitance in extending credit to SMEs. Absence of credible financials to assess

performance risks of SMEs and business owner’s inability to contribute adequate equity /

collateral in satisfying facility conditions of the Bank.

In addition, long process delays mainly due to weak operational modules and poor credit

scoring systems. In other words, Complex and prolonged approval process are being

practiced at Doha Bank. Even though bank is having Relationship Managers to deal with the

business relationship of SME clients, Inadequate training and understanding of industry &

business within the Bank SME unit can be seen more openly. As a result, the more

attractiveness of customers towards the Bank as expected from the industry prospective.

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

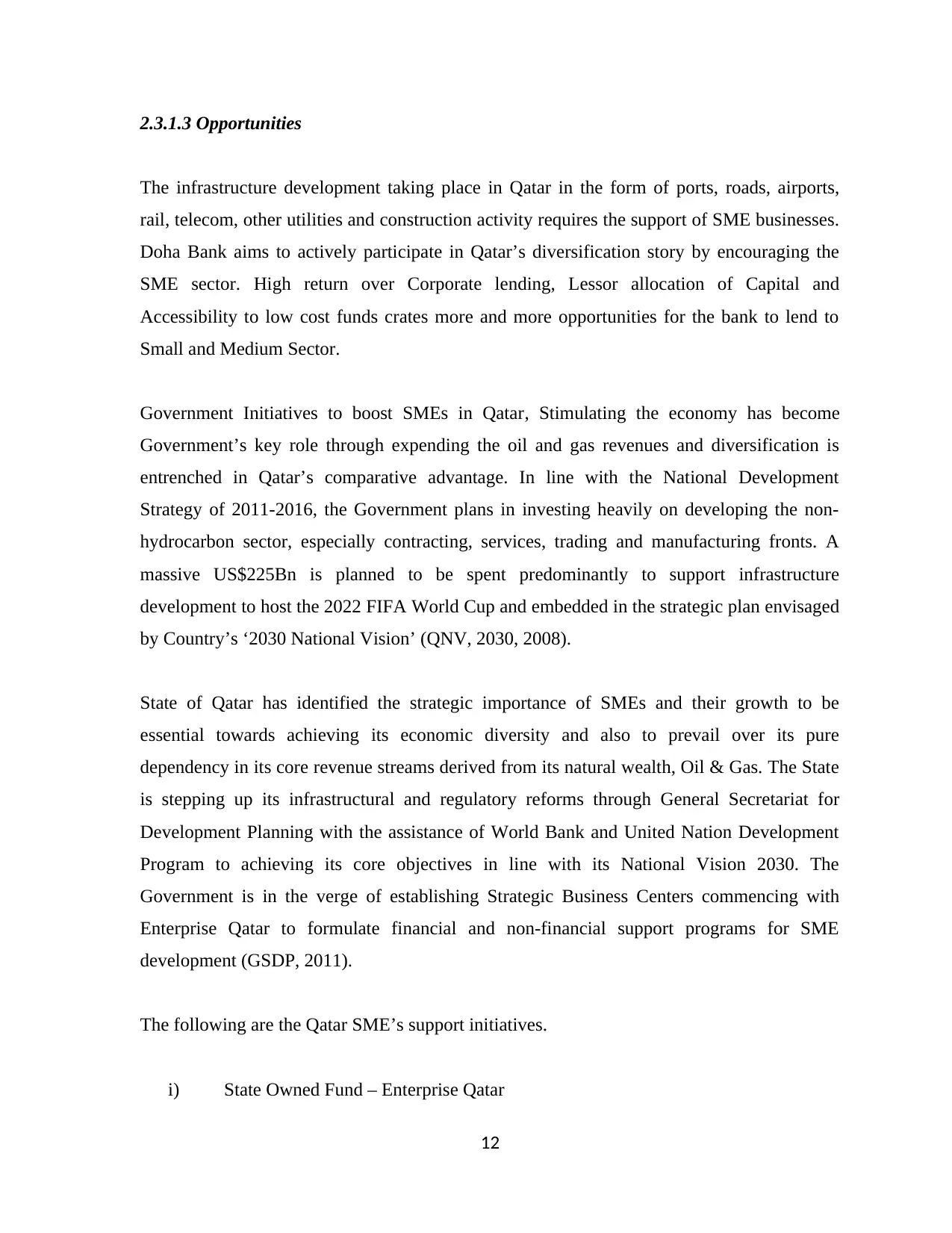

2.3.1.3 Opportunities

The infrastructure development taking place in Qatar in the form of ports, roads, airports,

rail, telecom, other utilities and construction activity requires the support of SME businesses.

Doha Bank aims to actively participate in Qatar’s diversification story by encouraging the

SME sector. High return over Corporate lending, Lessor allocation of Capital and

Accessibility to low cost funds crates more and more opportunities for the bank to lend to

Small and Medium Sector.

Government Initiatives to boost SMEs in Qatar, Stimulating the economy has become

Government’s key role through expending the oil and gas revenues and diversification is

entrenched in Qatar’s comparative advantage. In line with the National Development

Strategy of 2011-2016, the Government plans in investing heavily on developing the non-

hydrocarbon sector, especially contracting, services, trading and manufacturing fronts. A

massive US$225Bn is planned to be spent predominantly to support infrastructure

development to host the 2022 FIFA World Cup and embedded in the strategic plan envisaged

by Country’s ‘2030 National Vision’ (QNV, 2030, 2008).

State of Qatar has identified the strategic importance of SMEs and their growth to be

essential towards achieving its economic diversity and also to prevail over its pure

dependency in its core revenue streams derived from its natural wealth, Oil & Gas. The State

is stepping up its infrastructural and regulatory reforms through General Secretariat for

Development Planning with the assistance of World Bank and United Nation Development

Program to achieving its core objectives in line with its National Vision 2030. The

Government is in the verge of establishing Strategic Business Centers commencing with

Enterprise Qatar to formulate financial and non-financial support programs for SME

development (GSDP, 2011).

The following are the Qatar SME’s support initiatives.

i) State Owned Fund – Enterprise Qatar

12

The infrastructure development taking place in Qatar in the form of ports, roads, airports,

rail, telecom, other utilities and construction activity requires the support of SME businesses.

Doha Bank aims to actively participate in Qatar’s diversification story by encouraging the

SME sector. High return over Corporate lending, Lessor allocation of Capital and

Accessibility to low cost funds crates more and more opportunities for the bank to lend to

Small and Medium Sector.

Government Initiatives to boost SMEs in Qatar, Stimulating the economy has become

Government’s key role through expending the oil and gas revenues and diversification is

entrenched in Qatar’s comparative advantage. In line with the National Development

Strategy of 2011-2016, the Government plans in investing heavily on developing the non-

hydrocarbon sector, especially contracting, services, trading and manufacturing fronts. A

massive US$225Bn is planned to be spent predominantly to support infrastructure

development to host the 2022 FIFA World Cup and embedded in the strategic plan envisaged

by Country’s ‘2030 National Vision’ (QNV, 2030, 2008).

State of Qatar has identified the strategic importance of SMEs and their growth to be

essential towards achieving its economic diversity and also to prevail over its pure

dependency in its core revenue streams derived from its natural wealth, Oil & Gas. The State

is stepping up its infrastructural and regulatory reforms through General Secretariat for

Development Planning with the assistance of World Bank and United Nation Development

Program to achieving its core objectives in line with its National Vision 2030. The

Government is in the verge of establishing Strategic Business Centers commencing with

Enterprise Qatar to formulate financial and non-financial support programs for SME

development (GSDP, 2011).

The following are the Qatar SME’s support initiatives.

i) State Owned Fund – Enterprise Qatar

12

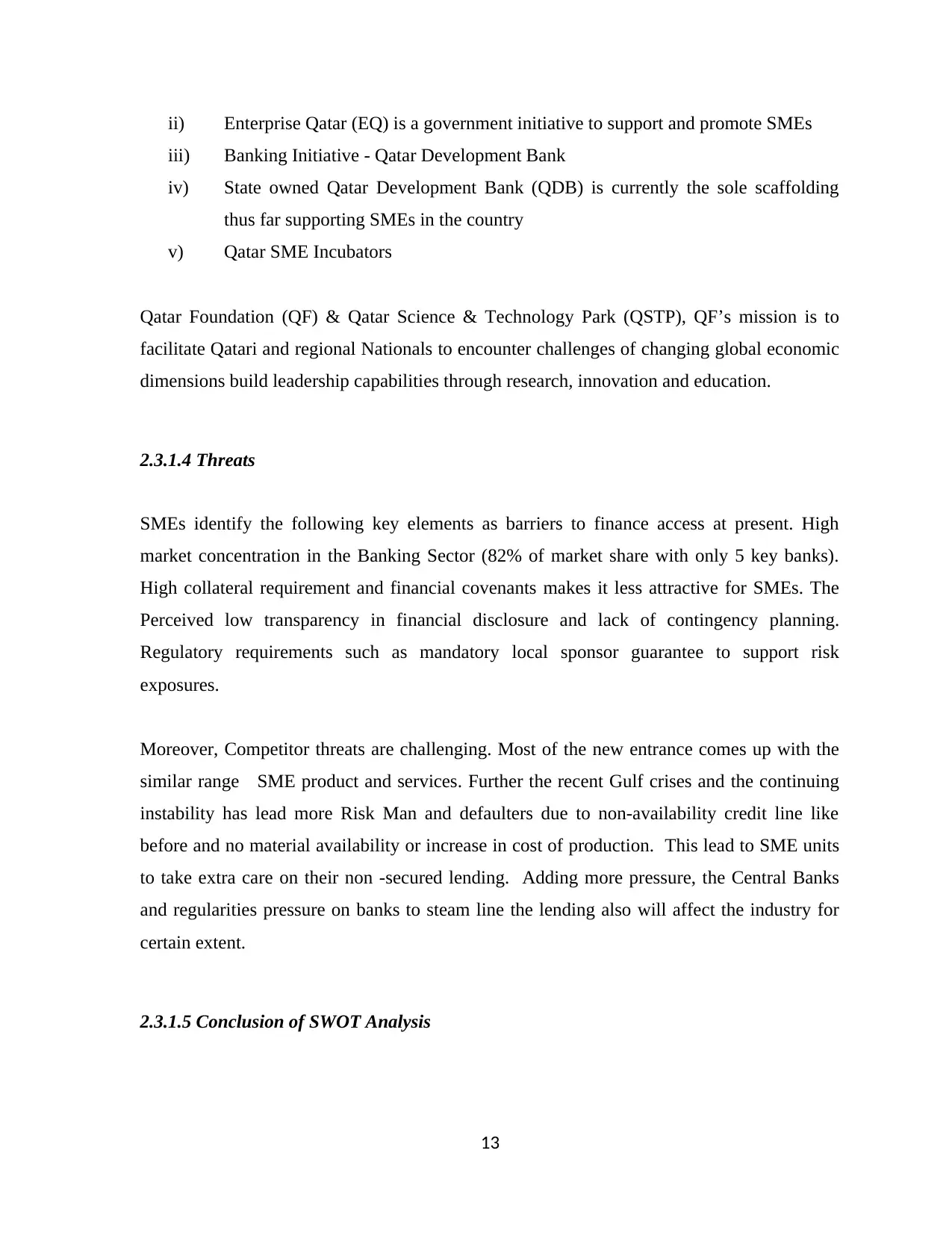

ii) Enterprise Qatar (EQ) is a government initiative to support and promote SMEs

iii) Banking Initiative - Qatar Development Bank

iv) State owned Qatar Development Bank (QDB) is currently the sole scaffolding

thus far supporting SMEs in the country

v) Qatar SME Incubators

Qatar Foundation (QF) & Qatar Science & Technology Park (QSTP), QF’s mission is to

facilitate Qatari and regional Nationals to encounter challenges of changing global economic

dimensions build leadership capabilities through research, innovation and education.

2.3.1.4 Threats

SMEs identify the following key elements as barriers to finance access at present. High

market concentration in the Banking Sector (82% of market share with only 5 key banks).

High collateral requirement and financial covenants makes it less attractive for SMEs. The

Perceived low transparency in financial disclosure and lack of contingency planning.

Regulatory requirements such as mandatory local sponsor guarantee to support risk

exposures.

Moreover, Competitor threats are challenging. Most of the new entrance comes up with the

similar range SME product and services. Further the recent Gulf crises and the continuing

instability has lead more Risk Man and defaulters due to non-availability credit line like

before and no material availability or increase in cost of production. This lead to SME units

to take extra care on their non -secured lending. Adding more pressure, the Central Banks

and regularities pressure on banks to steam line the lending also will affect the industry for

certain extent.

2.3.1.5 Conclusion of SWOT Analysis

13

iii) Banking Initiative - Qatar Development Bank

iv) State owned Qatar Development Bank (QDB) is currently the sole scaffolding

thus far supporting SMEs in the country

v) Qatar SME Incubators

Qatar Foundation (QF) & Qatar Science & Technology Park (QSTP), QF’s mission is to

facilitate Qatari and regional Nationals to encounter challenges of changing global economic

dimensions build leadership capabilities through research, innovation and education.

2.3.1.4 Threats

SMEs identify the following key elements as barriers to finance access at present. High

market concentration in the Banking Sector (82% of market share with only 5 key banks).

High collateral requirement and financial covenants makes it less attractive for SMEs. The

Perceived low transparency in financial disclosure and lack of contingency planning.

Regulatory requirements such as mandatory local sponsor guarantee to support risk

exposures.

Moreover, Competitor threats are challenging. Most of the new entrance comes up with the

similar range SME product and services. Further the recent Gulf crises and the continuing

instability has lead more Risk Man and defaulters due to non-availability credit line like

before and no material availability or increase in cost of production. This lead to SME units

to take extra care on their non -secured lending. Adding more pressure, the Central Banks

and regularities pressure on banks to steam line the lending also will affect the industry for

certain extent.

2.3.1.5 Conclusion of SWOT Analysis

13

The SWOT analysis shows a more on Banks weaknesses than the Strengths but more

opportunities than threats in the industry. Key challenges identified in serving SMEs are lack

of transparency in assessing credit risks and higher operational costs inherent to serving

them. Banks lack an effective SME lending operating model essential to tap volume based

small enterprise financing and SME specific Internal Risk Based model for default prediction

and rating SME credibility.

Bank SME Unit has expressed greater interest towards increasing credit exposure to SMEs

but lacks the strategic focus. Bank has continued concentration on low-risk businesses by

lending to Public Sector and Large Enterprises, where extensive lending growth is recorded.

Lending to SMEs as a sizeable opportunity to increase their revenues is not aggressively

envisaged.

With current regulatory restrictions on Retail and Real Estate portfolios of Banks (largest

component of bank financing) and sophisticated risks attached to Investment products, SME

sector is viewed as the next best target market to large corporate business for financial sector

revenue generation and Portfolio risk diversification.

SMEs can significantly contribute to bottom line profits if they are banked strategically.

SMEs are volume driven yet a highly profitable market segment. Elevated lending growth to

SMEs is only achievable if Bank can implement a SME specific financing architecture that

can economically handle large volumes through an expedited approval process so that

banking SMEs becomes hassle free and profitable.

Bank has failed to make adequate efforts to enlighten employees to effectively capture SME

business. Financial architecture weaknesses include absence of MIS to derive pertinent SME

data, lack of tailored product delivery and most critically a SME specific lending model to

effectively and economically serve SMEs at mass. Banks will be able to penetrate into SME

segment if they comprehensively understand SME business since qualitative elements have

greater significance in assessing SME risk in absence of reliable financial data. Key elements

14

opportunities than threats in the industry. Key challenges identified in serving SMEs are lack

of transparency in assessing credit risks and higher operational costs inherent to serving

them. Banks lack an effective SME lending operating model essential to tap volume based

small enterprise financing and SME specific Internal Risk Based model for default prediction

and rating SME credibility.

Bank SME Unit has expressed greater interest towards increasing credit exposure to SMEs

but lacks the strategic focus. Bank has continued concentration on low-risk businesses by

lending to Public Sector and Large Enterprises, where extensive lending growth is recorded.

Lending to SMEs as a sizeable opportunity to increase their revenues is not aggressively

envisaged.

With current regulatory restrictions on Retail and Real Estate portfolios of Banks (largest

component of bank financing) and sophisticated risks attached to Investment products, SME

sector is viewed as the next best target market to large corporate business for financial sector

revenue generation and Portfolio risk diversification.

SMEs can significantly contribute to bottom line profits if they are banked strategically.

SMEs are volume driven yet a highly profitable market segment. Elevated lending growth to

SMEs is only achievable if Bank can implement a SME specific financing architecture that

can economically handle large volumes through an expedited approval process so that

banking SMEs becomes hassle free and profitable.

Bank has failed to make adequate efforts to enlighten employees to effectively capture SME

business. Financial architecture weaknesses include absence of MIS to derive pertinent SME

data, lack of tailored product delivery and most critically a SME specific lending model to

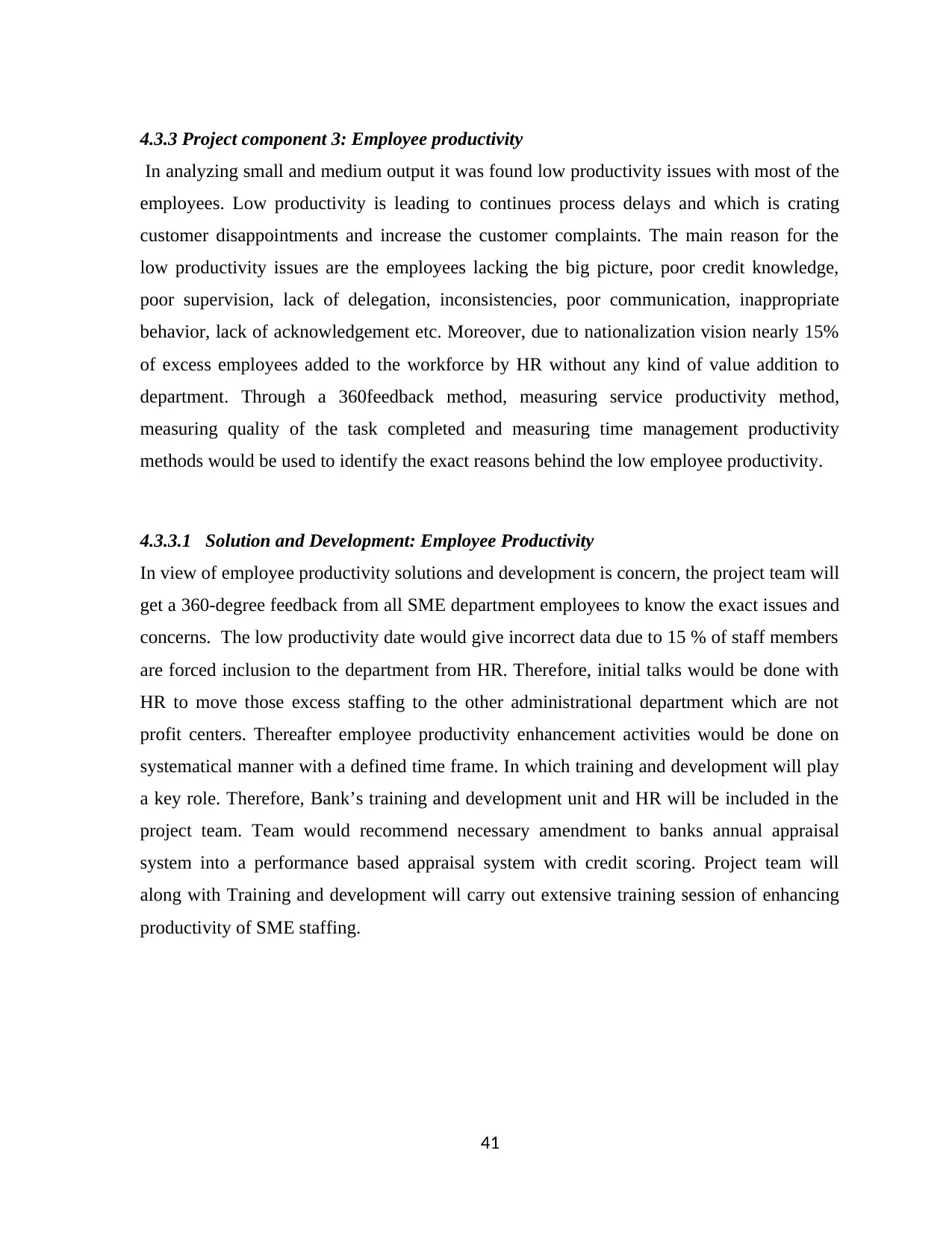

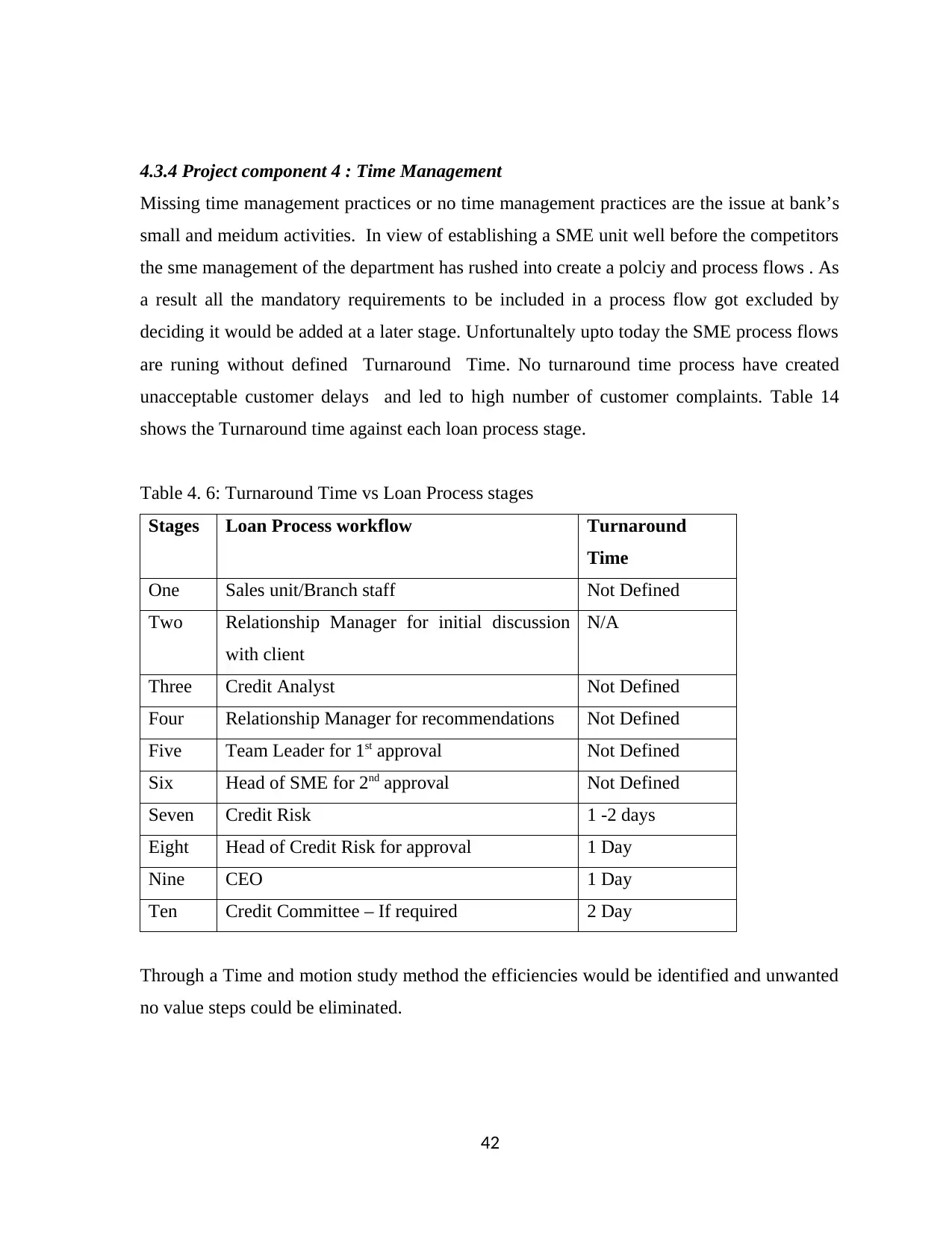

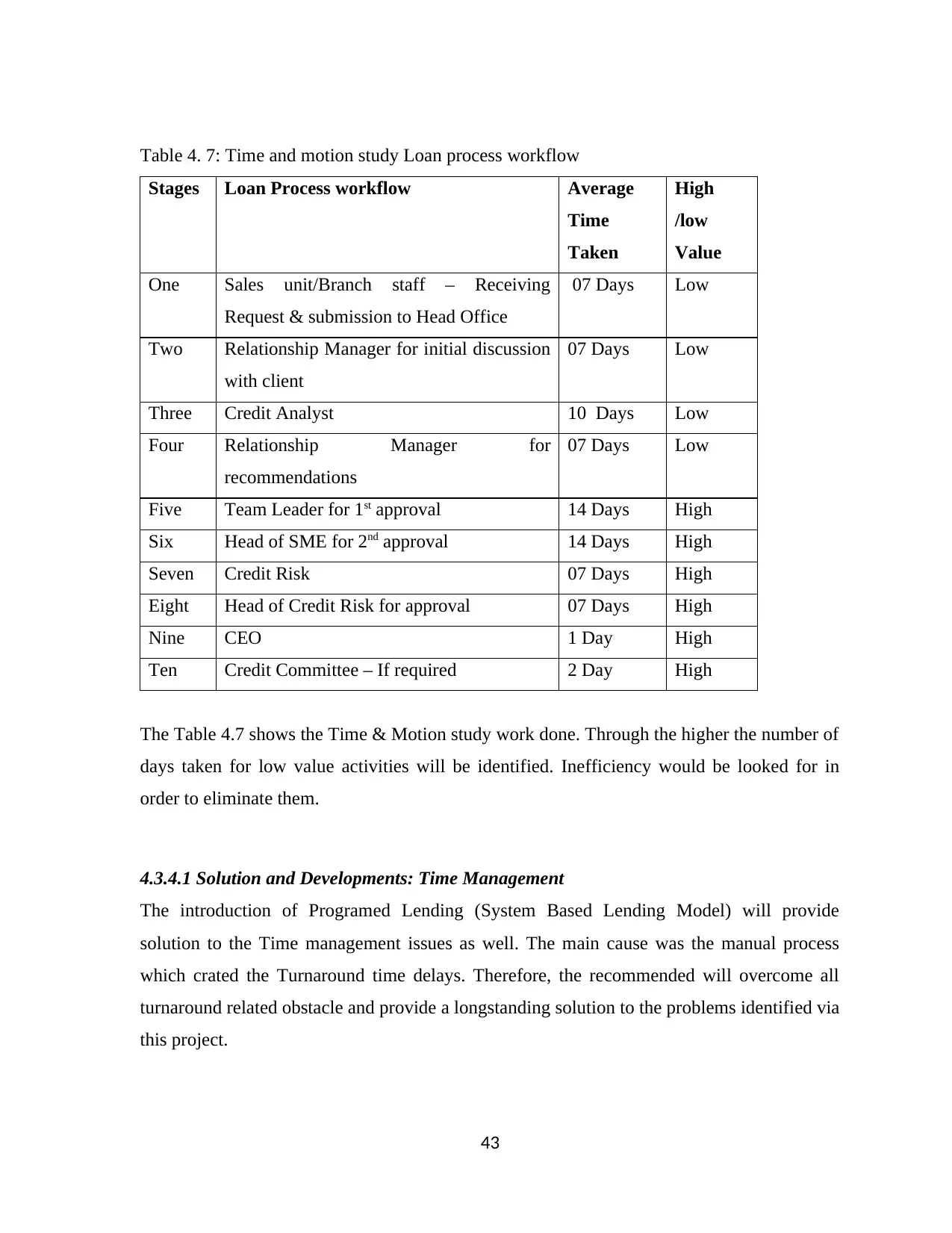

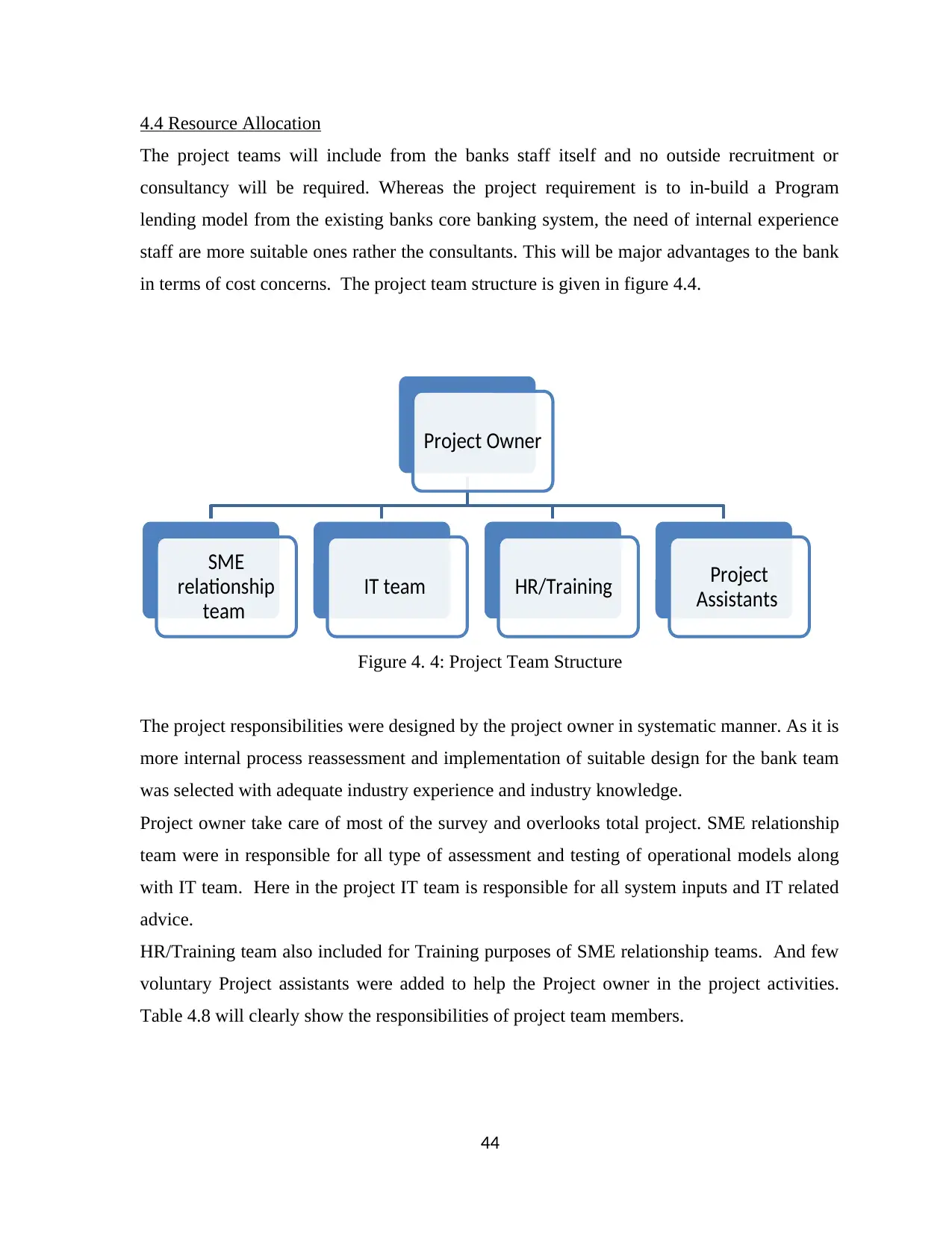

effectively and economically serve SMEs at mass. Banks will be able to penetrate into SME