Sales Management: Training Workbook and Financial Analysis Report

VerifiedAdded on 2019/09/24

|15

|3060

|165

Report

AI Summary

This report presents a comprehensive analysis of sales management principles, encompassing a training workbook and financial analysis. The training workbook delves into crucial concepts such as customer lifetime value, target profitability, and potential variable costs, providing a practical guide for sales team members. The financial analysis section assesses accounting procedures, customer account profit statements, business and financial risks, and the value of each customer. It also includes a review of financial performance, identifying key trends and variances, and outlines business decisions based on financial data. Furthermore, the report addresses contingency plans and communication strategies to ensure access to financial performance data, offering a holistic view of sales management practices.

Sales Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Task 1: Training workbook for the members of sales team.........................................................................3

1.1: Lifetime Value Cash Flow..................................................................................................................3

1.2: Target Profitability............................................................................................................................3

1.3: Potential Variable Cost.....................................................................................................................4

2.1: Accounting procedures of management for the following costs:.....................................................7

2.2: Customer account profit statement.................................................................................................8

Task 2: Preparation of financial analysis report.........................................................................................10

3.1: Business and financial risk associated with each account..............................................................10

3.2: Value of each customer of the organization...................................................................................10

3.3: Reviewing the financial performance for identifying the key trends and variances.......................11

3.4: Business decisions about the future direction of account on the basis of its financial performance

...............................................................................................................................................................12

3.5: Contingency plan for addressing the financial performance of an account....................................12

3.6: Communicating with the stakeholder to ensure access to financial performance data.................12

2

Task 1: Training workbook for the members of sales team.........................................................................3

1.1: Lifetime Value Cash Flow..................................................................................................................3

1.2: Target Profitability............................................................................................................................3

1.3: Potential Variable Cost.....................................................................................................................4

2.1: Accounting procedures of management for the following costs:.....................................................7

2.2: Customer account profit statement.................................................................................................8

Task 2: Preparation of financial analysis report.........................................................................................10

3.1: Business and financial risk associated with each account..............................................................10

3.2: Value of each customer of the organization...................................................................................10

3.3: Reviewing the financial performance for identifying the key trends and variances.......................11

3.4: Business decisions about the future direction of account on the basis of its financial performance

...............................................................................................................................................................12

3.5: Contingency plan for addressing the financial performance of an account....................................12

3.6: Communicating with the stakeholder to ensure access to financial performance data.................12

2

Task 1: Training workbook for the members of sales team

1.1: Lifetime Value Cash Flow

Customer life time value is a prediction of the net profit attributed to the entire future

relationship with a customer. It can also be understand as the value of money in the terms of

customer relationship (Sadgrove, 2016). It is based on the present value of the budgeted cash

flow from the customer relationship. It is an important concept and it shows a limit that needs

spending to acquire new customers.

Customer period of time price (LTV) is that the expected profit you realize from sales to a

specific customer within the future. It’s primarily based totally on the customer’s expected

retention and spending rate.

Customer time period price has intuitive charm as a selling conception, as a result of in theory it

represents precisely what quantity every client is price in financial terms, and thus precisely what

quantity a selling department ought to be willing to pay to amass every client, particularly in

direct response selling (Bol&Lill, 2015).

Lifetime price is usually accustomed decide the appropriateness of the prices of acquisition of a

client. As an instance, if a brand new client prices $50 to amass (COCA, or price of client

acquisition), and their time period price is $60, then the client is judged to be profitable, and

acquisition of further similar customers is suitable.

1.2: Target Profitability

Target profit is the budgeted profit that is decided by the management of the organization to

achieve by the end of the fixed period. Sometimes it is achieved easily and sometimes it doesn’t.

The difference between the actual profit and the target profit is known as variance in the profit

and it is the responsibility of the management to how to reduce the variance. The target profit is

comes from the process of budgeting and after that it is compared with the actual income in

profit and loss account (Gleason, et. al., 2013). The target profit of an organization can be

3

1.1: Lifetime Value Cash Flow

Customer life time value is a prediction of the net profit attributed to the entire future

relationship with a customer. It can also be understand as the value of money in the terms of

customer relationship (Sadgrove, 2016). It is based on the present value of the budgeted cash

flow from the customer relationship. It is an important concept and it shows a limit that needs

spending to acquire new customers.

Customer period of time price (LTV) is that the expected profit you realize from sales to a

specific customer within the future. It’s primarily based totally on the customer’s expected

retention and spending rate.

Customer time period price has intuitive charm as a selling conception, as a result of in theory it

represents precisely what quantity every client is price in financial terms, and thus precisely what

quantity a selling department ought to be willing to pay to amass every client, particularly in

direct response selling (Bol&Lill, 2015).

Lifetime price is usually accustomed decide the appropriateness of the prices of acquisition of a

client. As an instance, if a brand new client prices $50 to amass (COCA, or price of client

acquisition), and their time period price is $60, then the client is judged to be profitable, and

acquisition of further similar customers is suitable.

1.2: Target Profitability

Target profit is the budgeted profit that is decided by the management of the organization to

achieve by the end of the fixed period. Sometimes it is achieved easily and sometimes it doesn’t.

The difference between the actual profit and the target profit is known as variance in the profit

and it is the responsibility of the management to how to reduce the variance. The target profit is

comes from the process of budgeting and after that it is compared with the actual income in

profit and loss account (Gleason, et. al., 2013). The target profit of an organization can be

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

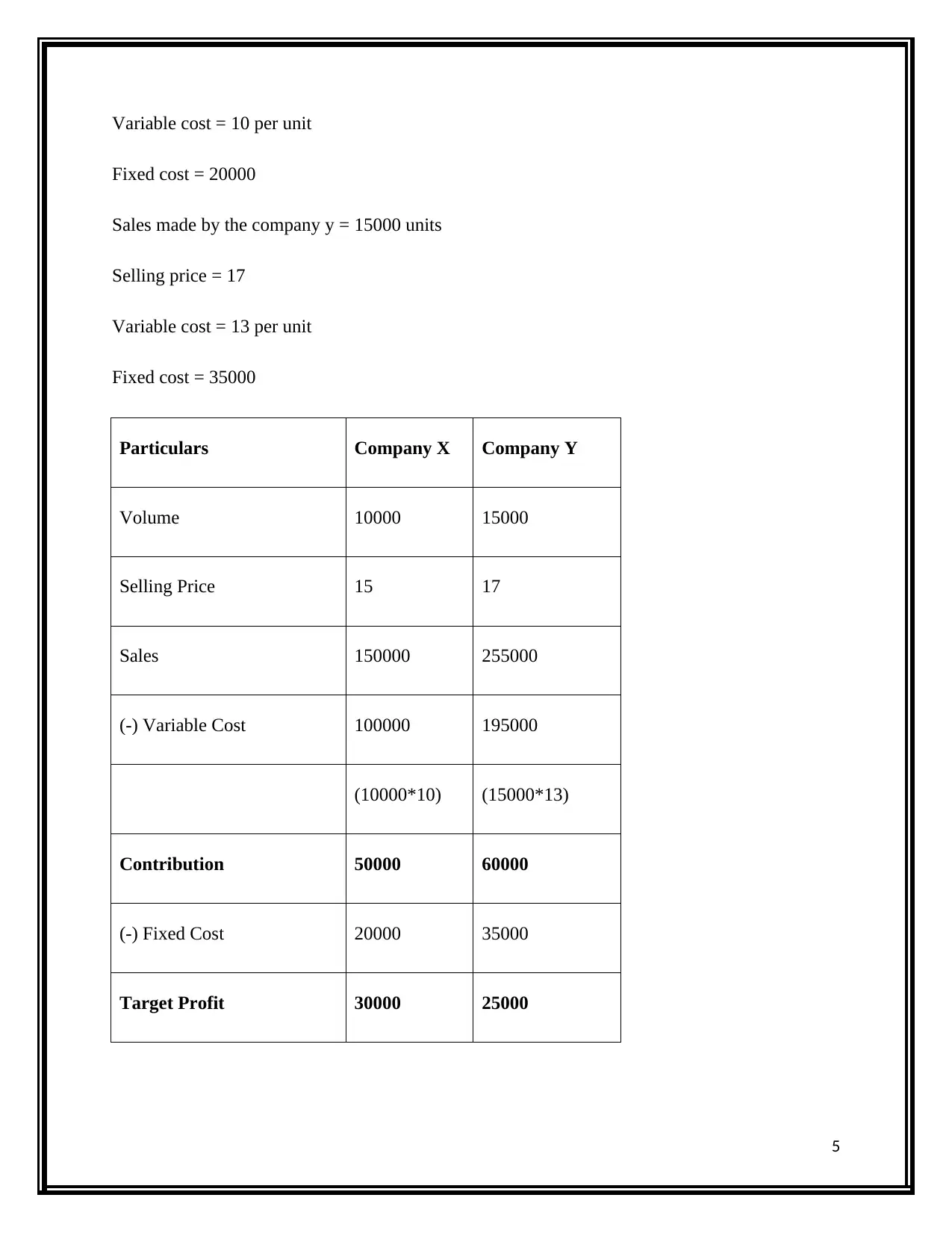

calculated by using the formula of CVP analysis. The formula for the cost volume price analysis

is as follows:

Fixed Cost + Target Profit / Contribution per unit

1.3: Potential Variable Cost

Variable cost is that cost which changes with change in the volume. It changes with the changes

in the production output of a product. If the production of an organization increases then the

variable cost increases and if the production volume of an organization decreases then the

variable cost decreases. Some of the examples of the variable cost are the direct material cost,

direct labor cost, variable overhead (Chang, et. al., 2012). Profitability of an organization affects

from the different type of variable cost. One of the types of variable cost is semi variable cost.

The formula for calculating the variable cost of a product is as follows:

Variable cost = Total cost – Fixed Cost

Variable cost = Sales – Contribution

Fixed Cost

Fixed cost is that cost which does not change with the change in volume and remains same. For

example; if the company produces 1000 units of product X the fixed cost of the company is 20.

And the company produces 1200 units the fixed cost also remains same i.e 20. The fixed cost

changes when there is a change in the capacity.

A fixed cost is associate expense or value that doesn't amendment with a rise or decrease within

the variety of products or services made or oversubscribed. Fixed cost is expenses that ought to

be paid by an organization, freelance of any endeavor (Wu, et. al., 2016). It’s one in every of the

2 elements of the whole cost of running a business, the opposite being variable cost.

For Example:

Sales made by the company x = 10000 units

Selling price = 15

4

is as follows:

Fixed Cost + Target Profit / Contribution per unit

1.3: Potential Variable Cost

Variable cost is that cost which changes with change in the volume. It changes with the changes

in the production output of a product. If the production of an organization increases then the

variable cost increases and if the production volume of an organization decreases then the

variable cost decreases. Some of the examples of the variable cost are the direct material cost,

direct labor cost, variable overhead (Chang, et. al., 2012). Profitability of an organization affects

from the different type of variable cost. One of the types of variable cost is semi variable cost.

The formula for calculating the variable cost of a product is as follows:

Variable cost = Total cost – Fixed Cost

Variable cost = Sales – Contribution

Fixed Cost

Fixed cost is that cost which does not change with the change in volume and remains same. For

example; if the company produces 1000 units of product X the fixed cost of the company is 20.

And the company produces 1200 units the fixed cost also remains same i.e 20. The fixed cost

changes when there is a change in the capacity.

A fixed cost is associate expense or value that doesn't amendment with a rise or decrease within

the variety of products or services made or oversubscribed. Fixed cost is expenses that ought to

be paid by an organization, freelance of any endeavor (Wu, et. al., 2016). It’s one in every of the

2 elements of the whole cost of running a business, the opposite being variable cost.

For Example:

Sales made by the company x = 10000 units

Selling price = 15

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Variable cost = 10 per unit

Fixed cost = 20000

Sales made by the company y = 15000 units

Selling price = 17

Variable cost = 13 per unit

Fixed cost = 35000

Particulars Company X Company Y

Volume 10000 15000

Selling Price 15 17

Sales 150000 255000

(-) Variable Cost 100000 195000

(10000*10) (15000*13)

Contribution 50000 60000

(-) Fixed Cost 20000 35000

Target Profit 30000 25000

5

Fixed cost = 20000

Sales made by the company y = 15000 units

Selling price = 17

Variable cost = 13 per unit

Fixed cost = 35000

Particulars Company X Company Y

Volume 10000 15000

Selling Price 15 17

Sales 150000 255000

(-) Variable Cost 100000 195000

(10000*10) (15000*13)

Contribution 50000 60000

(-) Fixed Cost 20000 35000

Target Profit 30000 25000

5

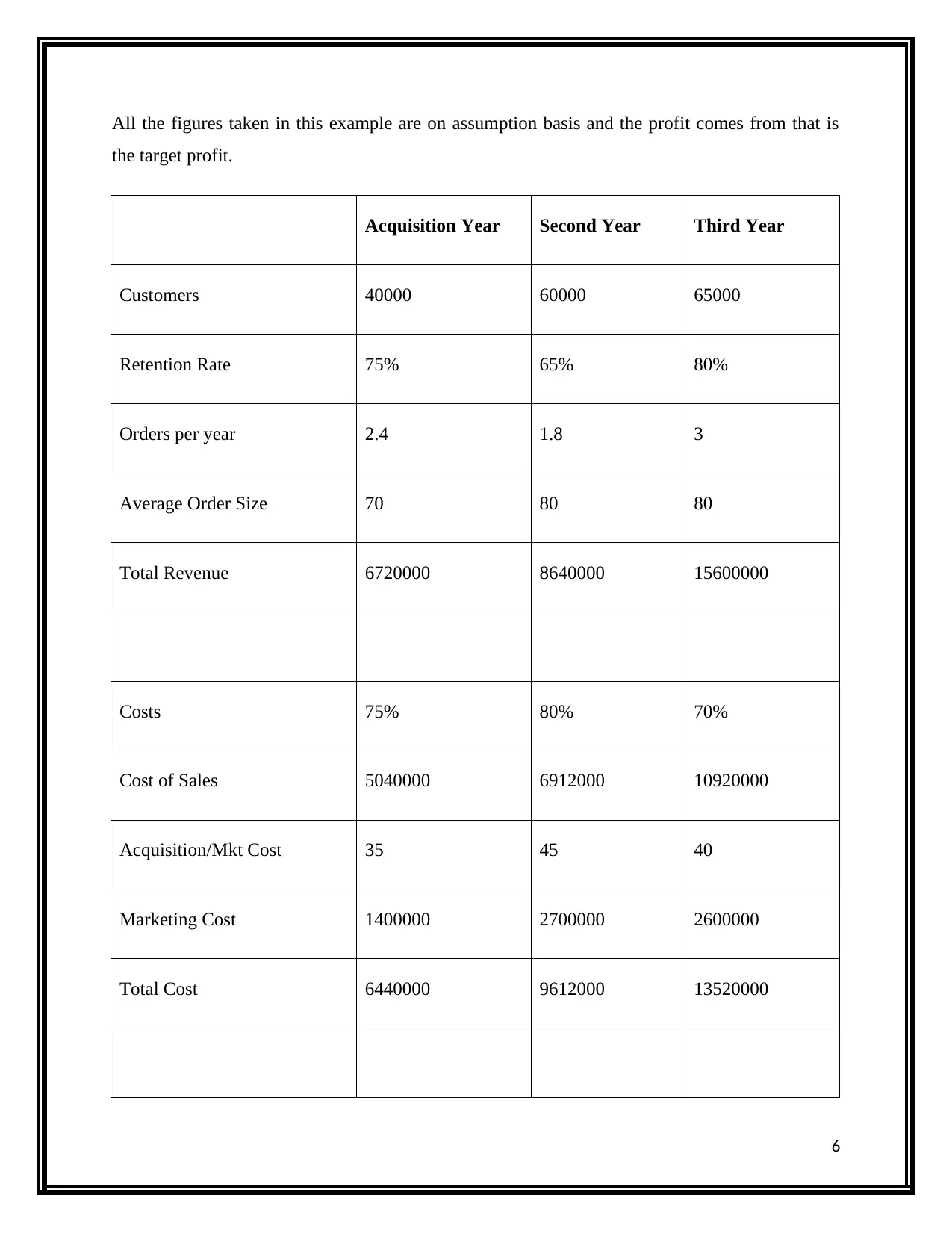

All the figures taken in this example are on assumption basis and the profit comes from that is

the target profit.

Acquisition Year Second Year Third Year

Customers 40000 60000 65000

Retention Rate 75% 65% 80%

Orders per year 2.4 1.8 3

Average Order Size 70 80 80

Total Revenue 6720000 8640000 15600000

Costs 75% 80% 70%

Cost of Sales 5040000 6912000 10920000

Acquisition/Mkt Cost 35 45 40

Marketing Cost 1400000 2700000 2600000

Total Cost 6440000 9612000 13520000

6

the target profit.

Acquisition Year Second Year Third Year

Customers 40000 60000 65000

Retention Rate 75% 65% 80%

Orders per year 2.4 1.8 3

Average Order Size 70 80 80

Total Revenue 6720000 8640000 15600000

Costs 75% 80% 70%

Cost of Sales 5040000 6912000 10920000

Acquisition/Mkt Cost 35 45 40

Marketing Cost 1400000 2700000 2600000

Total Cost 6440000 9612000 13520000

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

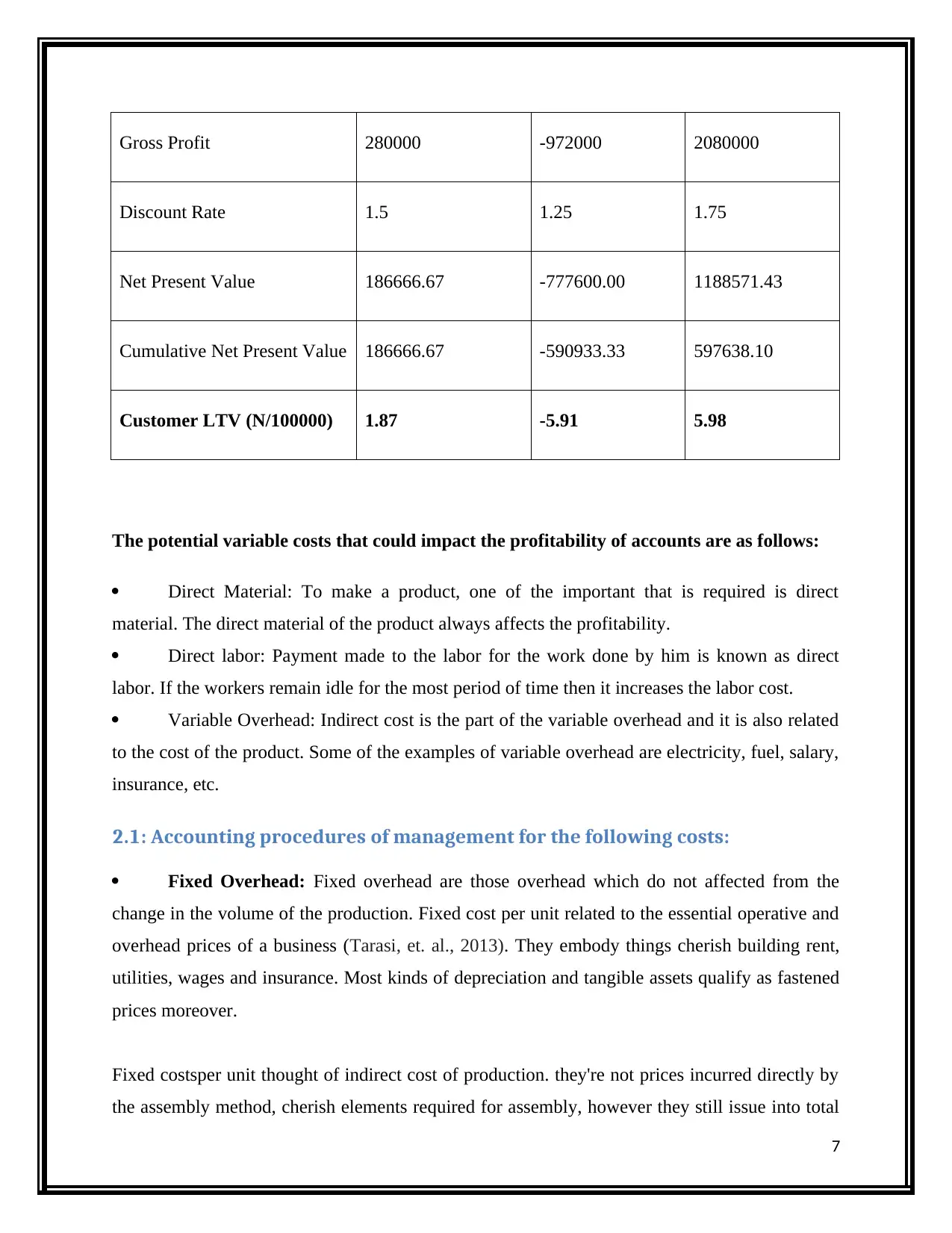

Gross Profit 280000 -972000 2080000

Discount Rate 1.5 1.25 1.75

Net Present Value 186666.67 -777600.00 1188571.43

Cumulative Net Present Value 186666.67 -590933.33 597638.10

Customer LTV (N/100000) 1.87 -5.91 5.98

The potential variable costs that could impact the profitability of accounts are as follows:

Direct Material: To make a product, one of the important that is required is direct

material. The direct material of the product always affects the profitability.

Direct labor: Payment made to the labor for the work done by him is known as direct

labor. If the workers remain idle for the most period of time then it increases the labor cost.

Variable Overhead: Indirect cost is the part of the variable overhead and it is also related

to the cost of the product. Some of the examples of variable overhead are electricity, fuel, salary,

insurance, etc.

2.1: Accounting procedures of management for the following costs:

Fixed Overhead: Fixed overhead are those overhead which do not affected from the

change in the volume of the production. Fixed cost per unit related to the essential operative and

overhead prices of a business (Tarasi, et. al., 2013). They embody things cherish building rent,

utilities, wages and insurance. Most kinds of depreciation and tangible assets qualify as fastened

prices moreover.

Fixed costsper unit thought of indirect cost of production. they're not prices incurred directly by

the assembly method, cherish elements required for assembly, however they still issue into total

7

Discount Rate 1.5 1.25 1.75

Net Present Value 186666.67 -777600.00 1188571.43

Cumulative Net Present Value 186666.67 -590933.33 597638.10

Customer LTV (N/100000) 1.87 -5.91 5.98

The potential variable costs that could impact the profitability of accounts are as follows:

Direct Material: To make a product, one of the important that is required is direct

material. The direct material of the product always affects the profitability.

Direct labor: Payment made to the labor for the work done by him is known as direct

labor. If the workers remain idle for the most period of time then it increases the labor cost.

Variable Overhead: Indirect cost is the part of the variable overhead and it is also related

to the cost of the product. Some of the examples of variable overhead are electricity, fuel, salary,

insurance, etc.

2.1: Accounting procedures of management for the following costs:

Fixed Overhead: Fixed overhead are those overhead which do not affected from the

change in the volume of the production. Fixed cost per unit related to the essential operative and

overhead prices of a business (Tarasi, et. al., 2013). They embody things cherish building rent,

utilities, wages and insurance. Most kinds of depreciation and tangible assets qualify as fastened

prices moreover.

Fixed costsper unit thought of indirect cost of production. they're not prices incurred directly by

the assembly method, cherish elements required for assembly, however they still issue into total

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

production costs; for there to be production, the business has got to be functioning and

operational, and stuck costs represent those necessary operative costs.

"Fixed" during this context doesn't mean utterly unchangeable, solely that the cost don't typically

amendment supported production levels or revenue (Saeidi, et. al., 2015). However, increasing

prices amendment somewhat over time as a corporation makes changes or expands and

consequently hires extra personnel or acquires new facilities.

Administrative Support:Administrative workers are worked at official levels and

support the company. It includes the management, answering phones, speaking with clients. The

management of the company held liable for all the works done by them. They are responsible to

manage the administrative work of the company and achieve the objectives set by them.

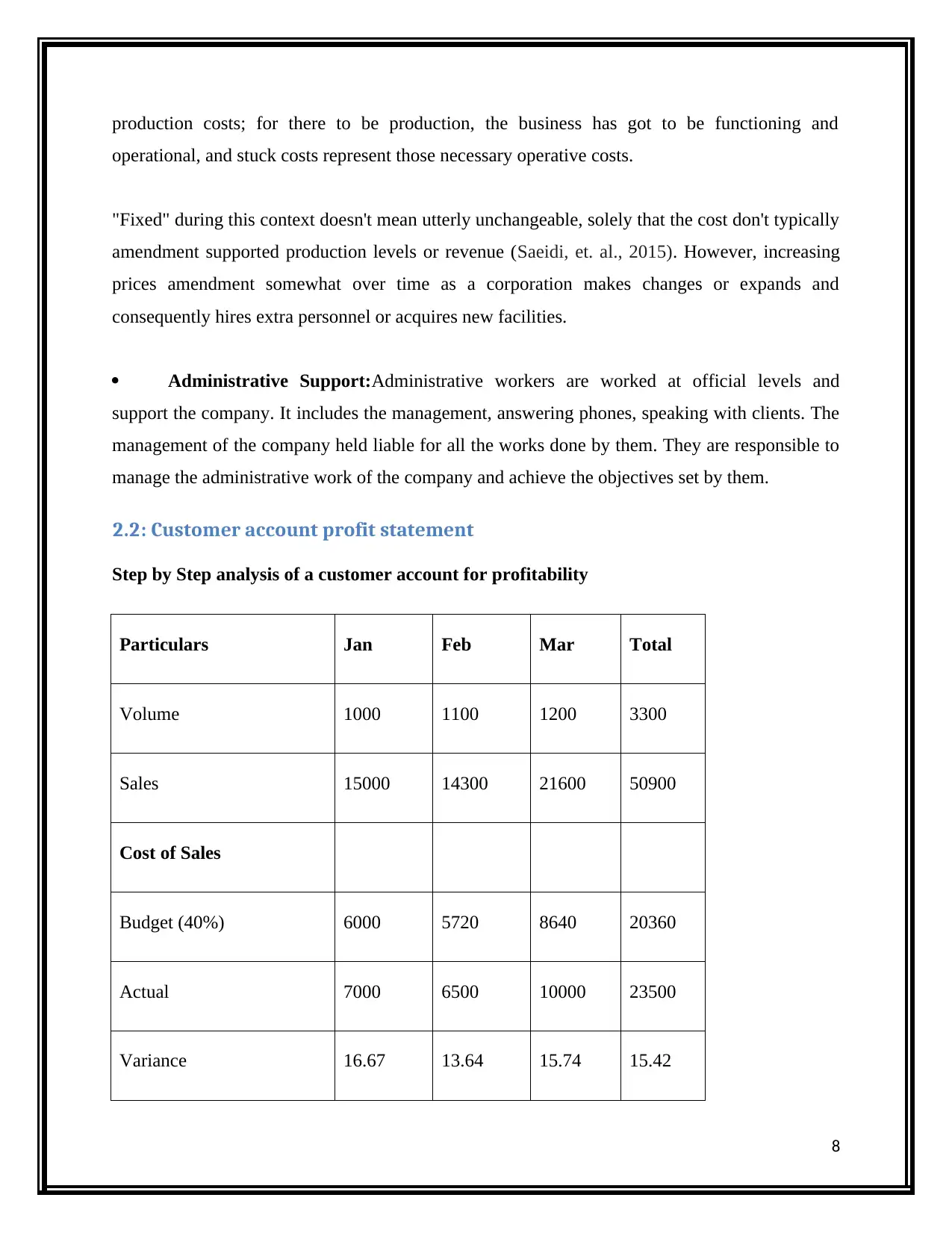

2.2: Customer account profit statement

Step by Step analysis of a customer account for profitability

Particulars Jan Feb Mar Total

Volume 1000 1100 1200 3300

Sales 15000 14300 21600 50900

Cost of Sales

Budget (40%) 6000 5720 8640 20360

Actual 7000 6500 10000 23500

Variance 16.67 13.64 15.74 15.42

8

operational, and stuck costs represent those necessary operative costs.

"Fixed" during this context doesn't mean utterly unchangeable, solely that the cost don't typically

amendment supported production levels or revenue (Saeidi, et. al., 2015). However, increasing

prices amendment somewhat over time as a corporation makes changes or expands and

consequently hires extra personnel or acquires new facilities.

Administrative Support:Administrative workers are worked at official levels and

support the company. It includes the management, answering phones, speaking with clients. The

management of the company held liable for all the works done by them. They are responsible to

manage the administrative work of the company and achieve the objectives set by them.

2.2: Customer account profit statement

Step by Step analysis of a customer account for profitability

Particulars Jan Feb Mar Total

Volume 1000 1100 1200 3300

Sales 15000 14300 21600 50900

Cost of Sales

Budget (40%) 6000 5720 8640 20360

Actual 7000 6500 10000 23500

Variance 16.67 13.64 15.74 15.42

8

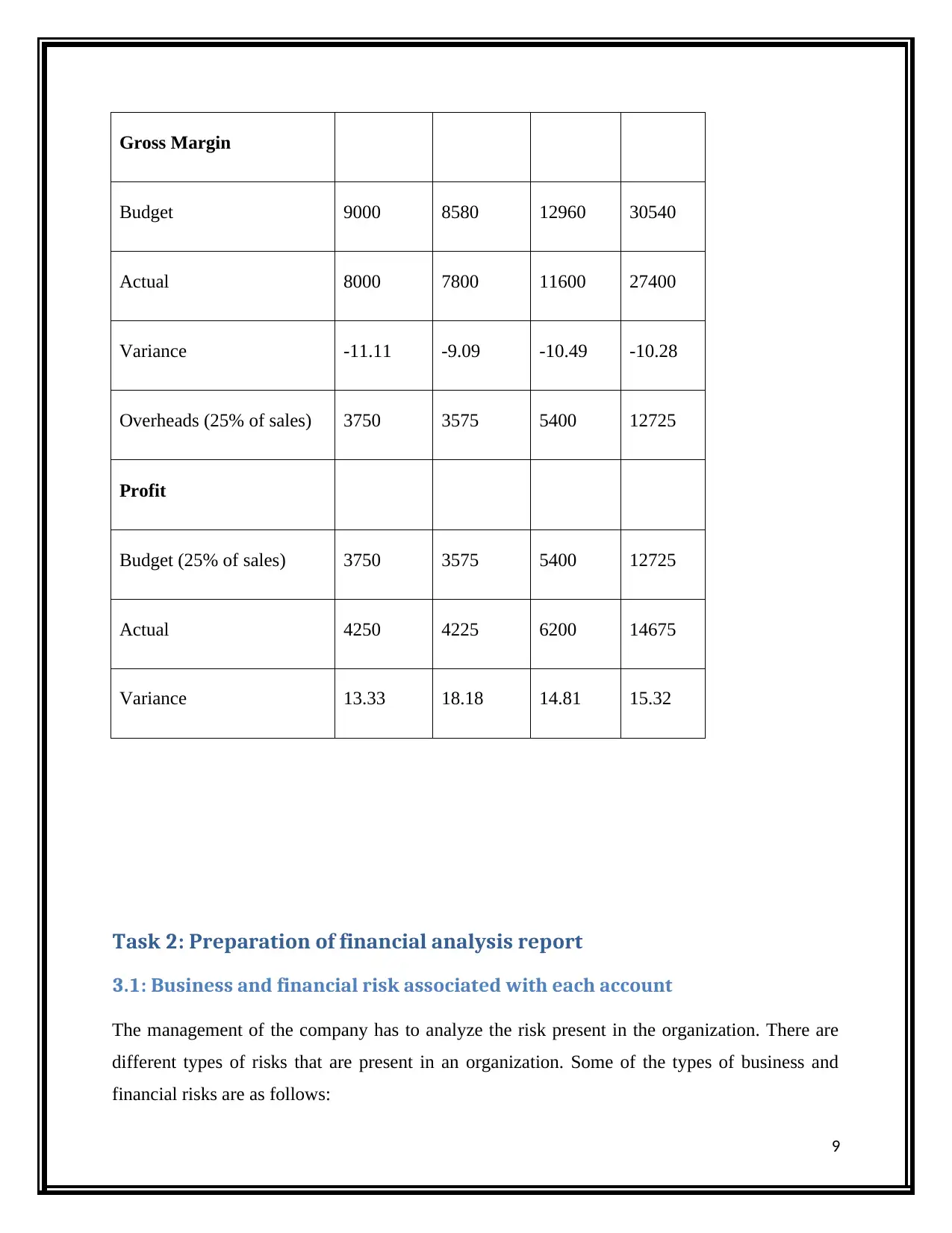

Gross Margin

Budget 9000 8580 12960 30540

Actual 8000 7800 11600 27400

Variance -11.11 -9.09 -10.49 -10.28

Overheads (25% of sales) 3750 3575 5400 12725

Profit

Budget (25% of sales) 3750 3575 5400 12725

Actual 4250 4225 6200 14675

Variance 13.33 18.18 14.81 15.32

Task 2: Preparation of financial analysis report

3.1: Business and financial risk associated with each account

The management of the company has to analyze the risk present in the organization. There are

different types of risks that are present in an organization. Some of the types of business and

financial risks are as follows:

9

Budget 9000 8580 12960 30540

Actual 8000 7800 11600 27400

Variance -11.11 -9.09 -10.49 -10.28

Overheads (25% of sales) 3750 3575 5400 12725

Profit

Budget (25% of sales) 3750 3575 5400 12725

Actual 4250 4225 6200 14675

Variance 13.33 18.18 14.81 15.32

Task 2: Preparation of financial analysis report

3.1: Business and financial risk associated with each account

The management of the company has to analyze the risk present in the organization. There are

different types of risks that are present in an organization. Some of the types of business and

financial risks are as follows:

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Credit Risk: Credit risk is that risk that is associated with the credit sales made by the

company. To increase the sales, every company has to sell their product on credit basis. There

are always the chances of bad debts. If the financial position of a customer is a bad then credit

risk in this case increases.

Profitability of Sales: Profit on sales always contains the risk. If the sales made by the

company is high then the chances of the profit increases but if the sales of the goods decreases

then the profit of the company also decreases.

Fixed Cost Investments: If the prices of the investments fall then the value of the assets of

an organization also decreases and this increases the financial risk.

Legal Risks: If the company has any contingent liability then there is a chance of

payment of that liability and because of that there is always the chance of legal risk (Best, 2012).

Availability of Raw Material: Every company has to maintain the minimum stock in the

case of emergency and this creates the risk of shortage of material in the future.

3.2: Value of each customer of the organization

The customer focused organization is 60% profitable in comparison to the non-customer focused

organizations. The customer focused organization provides too much focus on the features of the

product and the features of their product attract the customers to buy more. The customer

focused organizations has more focus on the quality of the product. Customer satisfaction is what

they seek. If the customer in an organization is new customer then the management gives less

focus on them. The value of old customer is more as they are connected with the company for a

long time and their loyalty is matter to the company. The customer that is connected with the

company beyond three years will receive some special benefits from the company in comparison

to the other customer (Yu,et. al., 2013). The organization has gained their trust and because of

that if they increase the price of the product in the future there will be less problem. The old

customer will purchase the product on high price as he thinks the product sold by the company is

good.

Recommendations to increase the customers of an organization

Customer want value, not products:Very low percentage of people chooses the product

because of the vendor. Large range of customers wants value from the organization.

10

company. To increase the sales, every company has to sell their product on credit basis. There

are always the chances of bad debts. If the financial position of a customer is a bad then credit

risk in this case increases.

Profitability of Sales: Profit on sales always contains the risk. If the sales made by the

company is high then the chances of the profit increases but if the sales of the goods decreases

then the profit of the company also decreases.

Fixed Cost Investments: If the prices of the investments fall then the value of the assets of

an organization also decreases and this increases the financial risk.

Legal Risks: If the company has any contingent liability then there is a chance of

payment of that liability and because of that there is always the chance of legal risk (Best, 2012).

Availability of Raw Material: Every company has to maintain the minimum stock in the

case of emergency and this creates the risk of shortage of material in the future.

3.2: Value of each customer of the organization

The customer focused organization is 60% profitable in comparison to the non-customer focused

organizations. The customer focused organization provides too much focus on the features of the

product and the features of their product attract the customers to buy more. The customer

focused organizations has more focus on the quality of the product. Customer satisfaction is what

they seek. If the customer in an organization is new customer then the management gives less

focus on them. The value of old customer is more as they are connected with the company for a

long time and their loyalty is matter to the company. The customer that is connected with the

company beyond three years will receive some special benefits from the company in comparison

to the other customer (Yu,et. al., 2013). The organization has gained their trust and because of

that if they increase the price of the product in the future there will be less problem. The old

customer will purchase the product on high price as he thinks the product sold by the company is

good.

Recommendations to increase the customers of an organization

Customer want value, not products:Very low percentage of people chooses the product

because of the vendor. Large range of customers wants value from the organization.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Uses value approach: If the company uses value approach to lure the customer then it

can increase the customers for their product.

Connecting with customer: The main focus always remains on the customer and seek

what they want.

Marketing and sales need to collaborate: The marketing department and the sales

department of the company needs to collaborated to increase the customers of the organization.

Provide after sale services: Sale of a product to a customer is not the only thing that can

increase the customers (Nickel, et. al., 2012). After sale services can help in increasing the

customers.

3.3: Reviewing the financial performance for identifying the key trends and

variances

As per the information provided in the customer account the financial performance of the

company is not satisfactory because in case of different components of this account the variance

shown is generally on negative side. For example, the positive variance in the cost of sales

shows that the company is not able to manage its budgeted cost and as a result in all the months

the cost has increased.

In case of Gross margin, the company has earned margin than the budgeted one. This shows

that there are inefficient operations of the company and as a result the gross margin has

decreased in all the months. However, the profit shows a positive variance which means that the

customer is purchasing the products of the company and the company is able to recover its fixed

costs.

3.4: Business decisions about the future direction of account on the basis of its

financial performance

The decision with respect to the future direction of a customer’s account would be made by

critically evaluating and balancing with the corporate objectives of the company. Thus, the

decisions would mainly focus upon factors such as customer potential, changing trends of the

economy, cut-throat competition in the market and profitability improvement of the company.

All these decision will aim at improving the current market position of the company which will

ultimately affect the attitude of its customers.

11

can increase the customers for their product.

Connecting with customer: The main focus always remains on the customer and seek

what they want.

Marketing and sales need to collaborate: The marketing department and the sales

department of the company needs to collaborated to increase the customers of the organization.

Provide after sale services: Sale of a product to a customer is not the only thing that can

increase the customers (Nickel, et. al., 2012). After sale services can help in increasing the

customers.

3.3: Reviewing the financial performance for identifying the key trends and

variances

As per the information provided in the customer account the financial performance of the

company is not satisfactory because in case of different components of this account the variance

shown is generally on negative side. For example, the positive variance in the cost of sales

shows that the company is not able to manage its budgeted cost and as a result in all the months

the cost has increased.

In case of Gross margin, the company has earned margin than the budgeted one. This shows

that there are inefficient operations of the company and as a result the gross margin has

decreased in all the months. However, the profit shows a positive variance which means that the

customer is purchasing the products of the company and the company is able to recover its fixed

costs.

3.4: Business decisions about the future direction of account on the basis of its

financial performance

The decision with respect to the future direction of a customer’s account would be made by

critically evaluating and balancing with the corporate objectives of the company. Thus, the

decisions would mainly focus upon factors such as customer potential, changing trends of the

economy, cut-throat competition in the market and profitability improvement of the company.

All these decision will aim at improving the current market position of the company which will

ultimately affect the attitude of its customers.

11

3.5: Contingency plan for addressing the financial performance of an account

The contingency plan in respect to this would include improving the existing sales and marketing

strategies so that the particular customer does not go with the competitor. Further, the plan will

include greater involvement of the sales and marketing staff so that they can analyze the change

in the buying behaviour of the particular customer account. They can devise new methods and

product to attract the existing and new customers.

3.6: Communicating with the stakeholder to ensure access to financial

performance data

The stakeholders regarding this include the top management of the company, department of sales

and production, purchasing and sales staff and the customer themselves. It is required that the

most appropriate information reaches to these groups so that they can take the right decision at

the right time. The active engagement of these stakeholders can be achieved by communicating

financial data through modes like e-mails, online financial reports and company websites.

12

The contingency plan in respect to this would include improving the existing sales and marketing

strategies so that the particular customer does not go with the competitor. Further, the plan will

include greater involvement of the sales and marketing staff so that they can analyze the change

in the buying behaviour of the particular customer account. They can devise new methods and

product to attract the existing and new customers.

3.6: Communicating with the stakeholder to ensure access to financial

performance data

The stakeholders regarding this include the top management of the company, department of sales

and production, purchasing and sales staff and the customer themselves. It is required that the

most appropriate information reaches to these groups so that they can take the right decision at

the right time. The active engagement of these stakeholders can be achieved by communicating

financial data through modes like e-mails, online financial reports and company websites.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.