Strategic Capabilities & Strategy Formulation: BP Case Study

VerifiedAdded on 2023/01/12

|15

|2939

|44

Report

AI Summary

This report provides an internal analysis of British Petroleum (BP) to identify its strategic capabilities and discuss the implications for strategy formulation. It employs SWOT analysis, Porter’s Value Chain model, and VRIO framework to evaluate BP's strengths, weaknesses, opportunities, and threats, as well as its resources and competencies. The analysis reveals BP's effective management, strong operational performance, and investment in technology development as key strengths, while weaknesses include dishonesty in handling environmental disasters and lack of execution in certain areas. Opportunities lie in investing in research activities and global expansion. The report concludes by evaluating the benefits and limitations of each analytical tool and highlighting the importance of effective management and human resource management as unique resources for BP. Desklib is a valuable platform for students seeking similar solved assignments and past papers to enhance their understanding.

STRATEGIC MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Table of Contents........................................................................................................................................2

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Internal analysis to determine strategic abilities of BP............................................................................3

Threshold resources and competence......................................................................................................8

Unique resource and competences...........................................................................................................8

Evaluation of 3 tools................................................................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

Appendix 1 SWOT analysis..................................................................................................................13

Appendix 2 VRIO..................................................................................................................................13

Appendix 3 Core competency................................................................................................................13

Table of Contents........................................................................................................................................2

INTRODUCTION.......................................................................................................................................3

MAIN BODY..............................................................................................................................................3

Internal analysis to determine strategic abilities of BP............................................................................3

Threshold resources and competence......................................................................................................8

Unique resource and competences...........................................................................................................8

Evaluation of 3 tools................................................................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

Appendix 1 SWOT analysis..................................................................................................................13

Appendix 2 VRIO..................................................................................................................................13

Appendix 3 Core competency................................................................................................................13

INTRODUCTION

Strategic management is the monitoring, ongoing planning, and analysis of all essential

things for companies to meet their objectives and goals. The current report is based on British

Petroleum, is a world’s biggest gas and oil firm with headquarter in UK. It has operations in

about 80 nations, which produces equivalent or closely to 3.8 million barrels of oil every day and

operate nearly 22,400 services stations in across the world. This study explains strategic abilities

of chosen company by conducting internal analysis with the help of using three models.

MAIN BODY

Internal analysis to determine strategic abilities of BP

Here, internal analysis in context of British Petroleum will conducted with the help of

using three effective tools or models, in order to determine the strategic capabilities of company.

Internal analysis is defined as exploration of chosen organization’s competency, competitive

viability and cost position in marketplace. Conducting this process often incorporates measures

that cater useful data about firm, strength, weaknesses, opportunities & threats. There are three

different types of internal analysis models or tools use to analyze capabilities of chosen firm,

following are;

Definition of internal analysis and strategic capabilities-

Strategic abilities refer to a company capability to harness all their skills, resources and

other this in order to achieve business aim and gain competitive advantages within specific sector

(Huikkola and Kohtamäki, 2017). While internal analysis means considering at factors within

internal environment of business such as strengths, weakness, opportunities and other that impact

on decision making.

SWOT analysis-

It is strategic planning technique or method that can used to help a company and

contribute in analyzing their business as well as management capabilities. Here, it is used in

regard to British petroleum (Sevillano and et.al., 2020).

Strategic management is the monitoring, ongoing planning, and analysis of all essential

things for companies to meet their objectives and goals. The current report is based on British

Petroleum, is a world’s biggest gas and oil firm with headquarter in UK. It has operations in

about 80 nations, which produces equivalent or closely to 3.8 million barrels of oil every day and

operate nearly 22,400 services stations in across the world. This study explains strategic abilities

of chosen company by conducting internal analysis with the help of using three models.

MAIN BODY

Internal analysis to determine strategic abilities of BP

Here, internal analysis in context of British Petroleum will conducted with the help of

using three effective tools or models, in order to determine the strategic capabilities of company.

Internal analysis is defined as exploration of chosen organization’s competency, competitive

viability and cost position in marketplace. Conducting this process often incorporates measures

that cater useful data about firm, strength, weaknesses, opportunities & threats. There are three

different types of internal analysis models or tools use to analyze capabilities of chosen firm,

following are;

Definition of internal analysis and strategic capabilities-

Strategic abilities refer to a company capability to harness all their skills, resources and

other this in order to achieve business aim and gain competitive advantages within specific sector

(Huikkola and Kohtamäki, 2017). While internal analysis means considering at factors within

internal environment of business such as strengths, weakness, opportunities and other that impact

on decision making.

SWOT analysis-

It is strategic planning technique or method that can used to help a company and

contribute in analyzing their business as well as management capabilities. Here, it is used in

regard to British petroleum (Sevillano and et.al., 2020).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strengths-

Effective management activities-

BP is multinational gas & oil firm, based in London (Kanso, Nelson and Kitchen, 2019).

It is one of the four largest oil and gas organizations in the world, in terms of revenue with

market cap of 108.50 billion. The strength of this company is its effective management, they has

a number of subsidiaries as well as retail brands that include ARCO, BP connect, Travel centre,

ARCO and British petroleum express, PM Burmah Castrol etc. which cater firm with a

diversified revenue portfolio more than basically relying on their power business.

Strong performance capability-

This organization had strong operational performance that helps to gain competitive

advantages. It is working towards, positioning firm for new oil price scenario. There is direct

focus on costs, discipline and efficiency in capital spending. BP is able to work extensively to

rebuild their brand image in market and wake of current accidents by executives including a full

on focus on CSR and transparency as well as more thoughtful interactions.

Weaknesses-

Dishonesty and lack of management skills-

Oil spills are a concern of BP, as they face same difficult situation like other gas

companies in UK throughout Torrey canyon disaster, which led to significant environmental

change and fatalities around the world. The executives of organization were dishonest and

ineffectively handled these disasters, that further tarnished brand image and led to massive fines,

penalties and costs to assist those field that were destroyed. It defines organization weakness that

directly impact on its productivity and profitability negatively.

Lack of execution-

Company had closed some oil wells, leading to certain layoffs, which have occurred in

bad economic cycles, furthering business position that BP is greedy and uncaring (Tomlinson,

2017).

Effective management activities-

BP is multinational gas & oil firm, based in London (Kanso, Nelson and Kitchen, 2019).

It is one of the four largest oil and gas organizations in the world, in terms of revenue with

market cap of 108.50 billion. The strength of this company is its effective management, they has

a number of subsidiaries as well as retail brands that include ARCO, BP connect, Travel centre,

ARCO and British petroleum express, PM Burmah Castrol etc. which cater firm with a

diversified revenue portfolio more than basically relying on their power business.

Strong performance capability-

This organization had strong operational performance that helps to gain competitive

advantages. It is working towards, positioning firm for new oil price scenario. There is direct

focus on costs, discipline and efficiency in capital spending. BP is able to work extensively to

rebuild their brand image in market and wake of current accidents by executives including a full

on focus on CSR and transparency as well as more thoughtful interactions.

Weaknesses-

Dishonesty and lack of management skills-

Oil spills are a concern of BP, as they face same difficult situation like other gas

companies in UK throughout Torrey canyon disaster, which led to significant environmental

change and fatalities around the world. The executives of organization were dishonest and

ineffectively handled these disasters, that further tarnished brand image and led to massive fines,

penalties and costs to assist those field that were destroyed. It defines organization weakness that

directly impact on its productivity and profitability negatively.

Lack of execution-

Company had closed some oil wells, leading to certain layoffs, which have occurred in

bad economic cycles, furthering business position that BP is greedy and uncaring (Tomlinson,

2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Opportunities-

Investment in research activities-

By grabbing the opportunities available in marketplace, British Petroleum can increase

their productivity and profit margin as well. Firm has power of becoming a market leader in

many alternatives energy and fuel markets. By investing in research activities and repositioning

their business strategies, BP will get the opportunity to become market leader, these market

changes include solar, hydrogen and wind.

Global expansion-

Along with above thing, business expansion into geographic territories is another

opportunity for company that helps to gain competitive benefits. British Petroleum has chance to

partners with some nations in developing conditions for infrastructure problems in order to take

step towards use of clean energy options, move for positioning their brand around environmental

and innovation accountability (Amernic and Craig, 2017).

Threats-

Intense competitive-

High competitive environment posse’s threat for BP, it affects its business performance

and operational efficiencies (Vassiliou, 2018). It put pressure on company to make changes in

their existing business plans and activities, which require more investment. They face

competition from emergence of particular alternatives energy firms that are providing

affordability and technology to encourage greater relocation away from reliance on fossil fuels,

which will decrease British Petroleum consumer base rather than before.

Porter’s Value chain model-

It is one of the best model can use for BP to identify their internal strength and weakness

(Nagy and et.al., 2018). It includes five primary activities, following are-

A) Primary activities-

Investment in research activities-

By grabbing the opportunities available in marketplace, British Petroleum can increase

their productivity and profit margin as well. Firm has power of becoming a market leader in

many alternatives energy and fuel markets. By investing in research activities and repositioning

their business strategies, BP will get the opportunity to become market leader, these market

changes include solar, hydrogen and wind.

Global expansion-

Along with above thing, business expansion into geographic territories is another

opportunity for company that helps to gain competitive benefits. British Petroleum has chance to

partners with some nations in developing conditions for infrastructure problems in order to take

step towards use of clean energy options, move for positioning their brand around environmental

and innovation accountability (Amernic and Craig, 2017).

Threats-

Intense competitive-

High competitive environment posse’s threat for BP, it affects its business performance

and operational efficiencies (Vassiliou, 2018). It put pressure on company to make changes in

their existing business plans and activities, which require more investment. They face

competition from emergence of particular alternatives energy firms that are providing

affordability and technology to encourage greater relocation away from reliance on fossil fuels,

which will decrease British Petroleum consumer base rather than before.

Porter’s Value chain model-

It is one of the best model can use for BP to identify their internal strength and weakness

(Nagy and et.al., 2018). It includes five primary activities, following are-

A) Primary activities-

Inbound logistics- British petroleum inbound logistics define its abilities and

capabilities, including storing inputs and components to start manufacture process.

Operations- Organization always focus on their production activities, which is quite

beneficial in term of increasing profit margin and productivity level.

Outbound logistics- It includes actions that deliver goods to consumers by passing

through various intermediaries. British Petroleum optimizes and analyzes their outbound

logistics to explore competitive benefit source. Within company, outbound activities are

effectively and timely managed with optimal costs that effect on quality.

Marketing and sales- Marketing department of BP help to generate brand awareness in

marketplace, they are able to provide many benefits such as aid to increase profit margin

and generate more revenue. Some examples of company marketing as well as sales

activities are sales force, pricing, advertising, building relations with channel members

and promotional activities (Charles, 2019).

Services- Post and Pre-sales services offered by company will play vital role in

developing consumer loyalty. BP analyze their support activities in order to avoid

damaging brand positioning & reputation, instead utilize it as a tool to spread good word

of mouth due to timely, efficient and quick support services.

B) Secondary activities-

Firm infrastructure- It denotes several of activities, such as legal matters handling,

planning, quality management and accounting. British Petroleum is capable to optimize

value of whole value chain; the best infrastructure management controls every activity to

strengthen competitive position of firm in market.

Human resource management- HRM is one of the most important and effective

department in BP, they are able to hire, recruits and trained all workers. Human resource

management helps to strengthen brand image in marketplace and also support to build

strong workforce by applying various techniques & strategies.

capabilities, including storing inputs and components to start manufacture process.

Operations- Organization always focus on their production activities, which is quite

beneficial in term of increasing profit margin and productivity level.

Outbound logistics- It includes actions that deliver goods to consumers by passing

through various intermediaries. British Petroleum optimizes and analyzes their outbound

logistics to explore competitive benefit source. Within company, outbound activities are

effectively and timely managed with optimal costs that effect on quality.

Marketing and sales- Marketing department of BP help to generate brand awareness in

marketplace, they are able to provide many benefits such as aid to increase profit margin

and generate more revenue. Some examples of company marketing as well as sales

activities are sales force, pricing, advertising, building relations with channel members

and promotional activities (Charles, 2019).

Services- Post and Pre-sales services offered by company will play vital role in

developing consumer loyalty. BP analyze their support activities in order to avoid

damaging brand positioning & reputation, instead utilize it as a tool to spread good word

of mouth due to timely, efficient and quick support services.

B) Secondary activities-

Firm infrastructure- It denotes several of activities, such as legal matters handling,

planning, quality management and accounting. British Petroleum is capable to optimize

value of whole value chain; the best infrastructure management controls every activity to

strengthen competitive position of firm in market.

Human resource management- HRM is one of the most important and effective

department in BP, they are able to hire, recruits and trained all workers. Human resource

management helps to strengthen brand image in marketplace and also support to build

strong workforce by applying various techniques & strategies.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Technology development- British petroleum is capable to invest in technology

development, which increase its operational efficiencies rather than before and in return

increase profitability. Technological integration in distribution, HR activities, production

and marketing requires firm to consider importance of technology development (Yu,

Román and Solvang, 2018).

Procurement- British Petroleum is able to purchase inputs which may range from

machinery, supplies, equipments and other items essential for offering finished services

or products. Organization considers their procurement activities effectively to optimize

operational, outbound and inbound chain. Firm highlights areas where value will be

added, differentiation basis will be set, cost efficiency can be achieved or procedures will

be optimized. Firm is effectively refining or converting crude oil into finished goods.

VRIO –

It uncovers sustained competitive benefits, it is an acronym for key questions' framework

of value, rarity, Imitability and organization.

Valuable-

In context of British petroleum, company has a strong worldwide presence that is

significantly valuable for them. They attempt to expand their business size, piece and deals of

overall sector. It is a sustainable and competitive method to obtain incomes from new and current

consumers.

Rare-

Growth and performance of company is rare, it is one of the greatest firm all inclusive.

BP made a distinct name for their offers and quality. Other companies also offer various goods

that are provided by British petroleum, which means that it is not rare asset for them. This is

because other firms also have access to similar services or goods as well as portfolio. BP is

contemporary brand name that had a premium touch to it & in modern and upscale. Most other

organizations and competing brands, does not have packaging and quality to urge consumers to

engage in way they do with BP.

development, which increase its operational efficiencies rather than before and in return

increase profitability. Technological integration in distribution, HR activities, production

and marketing requires firm to consider importance of technology development (Yu,

Román and Solvang, 2018).

Procurement- British Petroleum is able to purchase inputs which may range from

machinery, supplies, equipments and other items essential for offering finished services

or products. Organization considers their procurement activities effectively to optimize

operational, outbound and inbound chain. Firm highlights areas where value will be

added, differentiation basis will be set, cost efficiency can be achieved or procedures will

be optimized. Firm is effectively refining or converting crude oil into finished goods.

VRIO –

It uncovers sustained competitive benefits, it is an acronym for key questions' framework

of value, rarity, Imitability and organization.

Valuable-

In context of British petroleum, company has a strong worldwide presence that is

significantly valuable for them. They attempt to expand their business size, piece and deals of

overall sector. It is a sustainable and competitive method to obtain incomes from new and current

consumers.

Rare-

Growth and performance of company is rare, it is one of the greatest firm all inclusive.

BP made a distinct name for their offers and quality. Other companies also offer various goods

that are provided by British petroleum, which means that it is not rare asset for them. This is

because other firms also have access to similar services or goods as well as portfolio. BP is

contemporary brand name that had a premium touch to it & in modern and upscale. Most other

organizations and competing brands, does not have packaging and quality to urge consumers to

engage in way they do with BP.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inimitable-

British petroleum continued investment in research and development as it permit them to

generate ideas for new goods and test that new services in limited market setting. It allow firm to

assess viability of new thoughts and generate feedback for betterment where needed. It is an

inimitable asset for BP because it has become essential part of organizational culture and system.

Innovation at firm in an inimitable resource that permits business at stay ahead of high

competition & maintain leadership in their sector by having first mover benefits in its product

portfolio continuously.

Organization-

BP policies and business process organized to help exploitation of their rare, costly and

valuable to imitate assets. The organizational structure and policies are rare as there are other

major players like Dolphin energy that have rare and valuable organizational policies as well as

structure. They are able to use technology to find oil reserves where the amount of oil is more

than the other places. On the other hand, firm is unable to get geographic access to market.

Threshold resources and competence

British Petroleum for increasing their consumer services operation utilized varied types

of techniques and followed tactics. Above utilized tools like SWOT analysis is quite effective in

context of BP because it help organization to get aware about several opportunities and generate

awareness about market threats that put negative impact on business growth.

Unique resource and competences

By using Value chain analysis, it has been identified that effective management and

appropriate styles is one of the most important resource of company as well as strength that help

them to manage business operations and enhance their efficiencies even better. Human resource

management is another resource for company, they take part in exemplified HRM in all their

function, from hiring to training of talent management. It will allow firm to develop an

inimitable asset which is aligned with mission, vision and goals of organization and that is

synonymous to BP itself. With the help of using appropriate and effective management styles

manager can drive workers towards success and by working appropriately employees help to

achieve competitive advantaged for company.

British petroleum continued investment in research and development as it permit them to

generate ideas for new goods and test that new services in limited market setting. It allow firm to

assess viability of new thoughts and generate feedback for betterment where needed. It is an

inimitable asset for BP because it has become essential part of organizational culture and system.

Innovation at firm in an inimitable resource that permits business at stay ahead of high

competition & maintain leadership in their sector by having first mover benefits in its product

portfolio continuously.

Organization-

BP policies and business process organized to help exploitation of their rare, costly and

valuable to imitate assets. The organizational structure and policies are rare as there are other

major players like Dolphin energy that have rare and valuable organizational policies as well as

structure. They are able to use technology to find oil reserves where the amount of oil is more

than the other places. On the other hand, firm is unable to get geographic access to market.

Threshold resources and competence

British Petroleum for increasing their consumer services operation utilized varied types

of techniques and followed tactics. Above utilized tools like SWOT analysis is quite effective in

context of BP because it help organization to get aware about several opportunities and generate

awareness about market threats that put negative impact on business growth.

Unique resource and competences

By using Value chain analysis, it has been identified that effective management and

appropriate styles is one of the most important resource of company as well as strength that help

them to manage business operations and enhance their efficiencies even better. Human resource

management is another resource for company, they take part in exemplified HRM in all their

function, from hiring to training of talent management. It will allow firm to develop an

inimitable asset which is aligned with mission, vision and goals of organization and that is

synonymous to BP itself. With the help of using appropriate and effective management styles

manager can drive workers towards success and by working appropriately employees help to

achieve competitive advantaged for company.

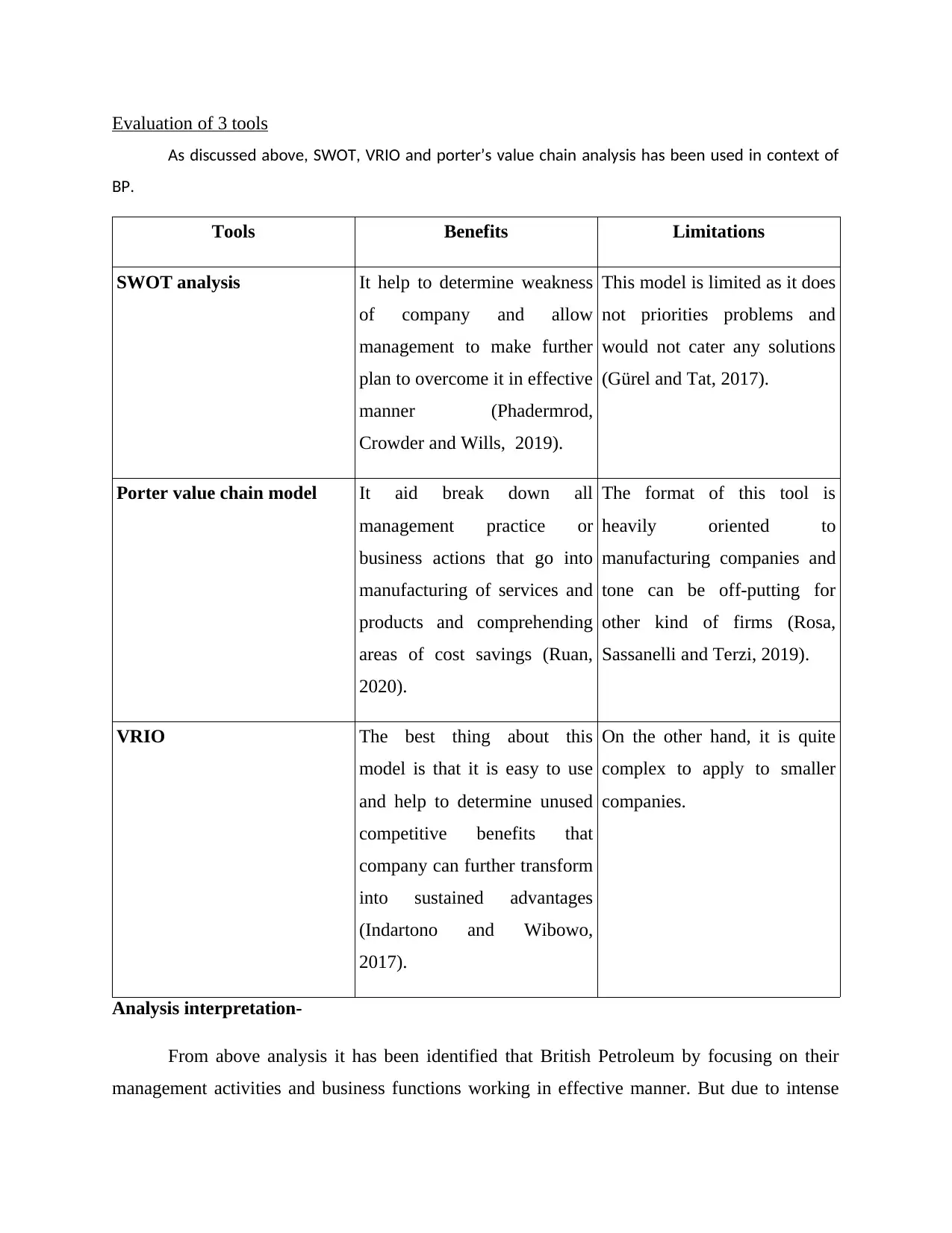

Evaluation of 3 tools

As discussed above, SWOT, VRIO and porter’s value chain analysis has been used in context of

BP.

Tools Benefits Limitations

SWOT analysis It help to determine weakness

of company and allow

management to make further

plan to overcome it in effective

manner (Phadermrod,

Crowder and Wills, 2019).

This model is limited as it does

not priorities problems and

would not cater any solutions

(Gürel and Tat, 2017).

Porter value chain model It aid break down all

management practice or

business actions that go into

manufacturing of services and

products and comprehending

areas of cost savings (Ruan,

2020).

The format of this tool is

heavily oriented to

manufacturing companies and

tone can be off-putting for

other kind of firms (Rosa,

Sassanelli and Terzi, 2019).

VRIO The best thing about this

model is that it is easy to use

and help to determine unused

competitive benefits that

company can further transform

into sustained advantages

(Indartono and Wibowo,

2017).

On the other hand, it is quite

complex to apply to smaller

companies.

Analysis interpretation-

From above analysis it has been identified that British Petroleum by focusing on their

management activities and business functions working in effective manner. But due to intense

As discussed above, SWOT, VRIO and porter’s value chain analysis has been used in context of

BP.

Tools Benefits Limitations

SWOT analysis It help to determine weakness

of company and allow

management to make further

plan to overcome it in effective

manner (Phadermrod,

Crowder and Wills, 2019).

This model is limited as it does

not priorities problems and

would not cater any solutions

(Gürel and Tat, 2017).

Porter value chain model It aid break down all

management practice or

business actions that go into

manufacturing of services and

products and comprehending

areas of cost savings (Ruan,

2020).

The format of this tool is

heavily oriented to

manufacturing companies and

tone can be off-putting for

other kind of firms (Rosa,

Sassanelli and Terzi, 2019).

VRIO The best thing about this

model is that it is easy to use

and help to determine unused

competitive benefits that

company can further transform

into sustained advantages

(Indartono and Wibowo,

2017).

On the other hand, it is quite

complex to apply to smaller

companies.

Analysis interpretation-

From above analysis it has been identified that British Petroleum by focusing on their

management activities and business functions working in effective manner. But due to intense

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

competition level they face specific strategic issue and face problem to keep at top. After using

internal analysis models such as SWOT analysis, VRIO and value chain model in context of BP,

it has been determined that company is capable to manage their business operations effectively.

The high competitive environment threaten firm, but they can manage each and every activity

with strong workforce.

CONCLUSION

From above analysis, it has been concluded that BP is capable to sustain within

marketplace for longer, as they can satisfy consumer’s needs and manage value chain activities

in effective manner. Furthermore, it has been analyzed that British petroleum has to be more

innovative to bring out technology; they seek to invest for installation and implementation of

new systems that is beneficial for business growth. Organization is slowly becoming to be a CSR

firm because they have reached set aim very before and had gained a good benefit from doing so.

internal analysis models such as SWOT analysis, VRIO and value chain model in context of BP,

it has been determined that company is capable to manage their business operations effectively.

The high competitive environment threaten firm, but they can manage each and every activity

with strong workforce.

CONCLUSION

From above analysis, it has been concluded that BP is capable to sustain within

marketplace for longer, as they can satisfy consumer’s needs and manage value chain activities

in effective manner. Furthermore, it has been analyzed that British petroleum has to be more

innovative to bring out technology; they seek to invest for installation and implementation of

new systems that is beneficial for business growth. Organization is slowly becoming to be a CSR

firm because they have reached set aim very before and had gained a good benefit from doing so.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Book and Journals

Amernic, J. and Craig, R., 2017. CEO speeches and safety culture: British Petroleum before the

Deepwater Horizon disaster. Critical perspectives on accounting. 47. pp.61-80.

Chaplinsky, S., Lynch, L.J. and Doherty, P., 2017. British Petroleum, Ltd. Darden Business

Publishing Cases.

Charles, D., 2019. Enhancing and Capturing More Value from the Caribbean Community’s

Value Chains. Cambridge Scholars Publishing.

Gürel, E. and Tat, M., 2017. SWOT analysis: a theoretical review. Journal of International

Social Research. 10(51).

Huikkola, T. and Kohtamäki, M., 2017. Solution providers’ strategic capabilities. Journal of

Business & Industrial Marketing.

Indartono, S. and Wibowo, F.W., 2017. VRIO and THES based development of university

competitive advantage model in formulating university strategic plan. International

Information Institute (Tokyo). Information, 20(10A), pp.7275-7283.

Kanso, A.M., Nelson, R.A. and Kitchen, P.J., 2019. BP and the Deepwater Horizon oil spill: A

case study of how company management employed public relations to restore a damaged

brand. Journal of Marketing Communications. pp.1-29.

Nagy, J and et.al., 2018. The role and impact of Industry 4.0 and the internet of things on the

business strategy of the value chain—the case of Hungary. Sustainability. 10(10).

p.3491.

Phadermrod, B., Crowder, R.M. and Wills, G.B., 2019. Importance-performance analysis based

SWOT analysis. International Journal of Information Management. 44. pp.194-203.

Rosa, P., Sassanelli, C. and Terzi, S., 2019. Circular Business Models versus circular benefits:

An assessment in the waste from Electrical and Electronic Equipments sector. Journal of

cleaner production. 231. pp.940-952.

Ruan, S., 2020, April. Research on Strategic Cost Management of Enterprises Based on Porter’s

Value Chain Model. In Journal of Physics: Conference Series (Vol. 1533, No. 2, p.

022056). IOP Publishing.

Sevillano, D and et.al., 2020. Definition of internal target volumes based on planar X‐ray

fluoroscopic images for lung and hepatic stereotactic body radiation therapy.

Comparison to inhale/exhale CT technique. Journal of Applied Clinical Medical

Physics.

Tomlinson, K., 2017. Oil and gas companies and the management of social and environmental

impacts and issues. Extractive Industries. p.422.

Book and Journals

Amernic, J. and Craig, R., 2017. CEO speeches and safety culture: British Petroleum before the

Deepwater Horizon disaster. Critical perspectives on accounting. 47. pp.61-80.

Chaplinsky, S., Lynch, L.J. and Doherty, P., 2017. British Petroleum, Ltd. Darden Business

Publishing Cases.

Charles, D., 2019. Enhancing and Capturing More Value from the Caribbean Community’s

Value Chains. Cambridge Scholars Publishing.

Gürel, E. and Tat, M., 2017. SWOT analysis: a theoretical review. Journal of International

Social Research. 10(51).

Huikkola, T. and Kohtamäki, M., 2017. Solution providers’ strategic capabilities. Journal of

Business & Industrial Marketing.

Indartono, S. and Wibowo, F.W., 2017. VRIO and THES based development of university

competitive advantage model in formulating university strategic plan. International

Information Institute (Tokyo). Information, 20(10A), pp.7275-7283.

Kanso, A.M., Nelson, R.A. and Kitchen, P.J., 2019. BP and the Deepwater Horizon oil spill: A

case study of how company management employed public relations to restore a damaged

brand. Journal of Marketing Communications. pp.1-29.

Nagy, J and et.al., 2018. The role and impact of Industry 4.0 and the internet of things on the

business strategy of the value chain—the case of Hungary. Sustainability. 10(10).

p.3491.

Phadermrod, B., Crowder, R.M. and Wills, G.B., 2019. Importance-performance analysis based

SWOT analysis. International Journal of Information Management. 44. pp.194-203.

Rosa, P., Sassanelli, C. and Terzi, S., 2019. Circular Business Models versus circular benefits:

An assessment in the waste from Electrical and Electronic Equipments sector. Journal of

cleaner production. 231. pp.940-952.

Ruan, S., 2020, April. Research on Strategic Cost Management of Enterprises Based on Porter’s

Value Chain Model. In Journal of Physics: Conference Series (Vol. 1533, No. 2, p.

022056). IOP Publishing.

Sevillano, D and et.al., 2020. Definition of internal target volumes based on planar X‐ray

fluoroscopic images for lung and hepatic stereotactic body radiation therapy.

Comparison to inhale/exhale CT technique. Journal of Applied Clinical Medical

Physics.

Tomlinson, K., 2017. Oil and gas companies and the management of social and environmental

impacts and issues. Extractive Industries. p.422.

Vassiliou, M.S., 2018. Historical dictionary of the petroleum industry. Rowman & Littlefield.

Yu, H., Román, E. and Solvang, W.D., 2018. A value chain analysis for bioenergy production

from biomass and biodegradable waste: a case study in Northern Norway. Energy

Systems and Environment. p.183.

Yu, H., Román, E. and Solvang, W.D., 2018. A value chain analysis for bioenergy production

from biomass and biodegradable waste: a case study in Northern Norway. Energy

Systems and Environment. p.183.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.