Strategic information system Assignment

VerifiedAdded on 2021/06/15

|17

|3794

|17

AI Summary

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: STRATEGIC INFORMTION SYSTEM

STRATEGIC INFORMTION SYSTEM

Name of the Student:

Name of the University:

Author Note:

STRATEGIC INFORMTION SYSTEM

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1STRATEGIC INFORMTION SYSTEM

Table of Contents

Introduction......................................................................................................................................2

Discussion........................................................................................................................................3

Part 1:...........................................................................................................................................3

The current structure of the organization.....................................................................................3

Operational problems organization could experience because of this structure:.........................4

Possible system acquisition method:...........................................................................................5

Flowchart of the sales procedure:................................................................................................6

Identification of control problems and possible fraud in the system:..........................................8

Part 2:.........................................................................................................................................10

Development and adoption of the accounting software package:............................................10

The current market size of the Commonwealth Bank of Australia:..........................................10

Lenders in the market and the competitive advantage:.............................................................11

Competitive advantage of the Commonwealth Bank:...............................................................11

Recommendations:....................................................................................................................12

Conclusion.....................................................................................................................................12

References......................................................................................................................................14

Table of Contents

Introduction......................................................................................................................................2

Discussion........................................................................................................................................3

Part 1:...........................................................................................................................................3

The current structure of the organization.....................................................................................3

Operational problems organization could experience because of this structure:.........................4

Possible system acquisition method:...........................................................................................5

Flowchart of the sales procedure:................................................................................................6

Identification of control problems and possible fraud in the system:..........................................8

Part 2:.........................................................................................................................................10

Development and adoption of the accounting software package:............................................10

The current market size of the Commonwealth Bank of Australia:..........................................10

Lenders in the market and the competitive advantage:.............................................................11

Competitive advantage of the Commonwealth Bank:...............................................................11

Recommendations:....................................................................................................................12

Conclusion.....................................................................................................................................12

References......................................................................................................................................14

2STRATEGIC INFORMTION SYSTEM

Introduction

Commonwealth Bank of Australia is a Australian multinational bank which has its

business in different countries including Asia, United States and Australia. The bank provides

various services which includes retail banking, corporate banking, management of funds. This

bank has been listed as the largest financial organization listed in the security exchange of

Australia. The bank was founded in 1911 and became a private bank on 1996 (Thaichon et

al.,2017).The commonwealth bank is regarded as one of the ‘big four’ in the Australian Banking

sector. The organization has taken many effective business decisions regarding the foreign

collaboration. In 2005 the bank has done an agreement with the two Chinese banks and set up a

branch at India. The bank has gained some reputations. It was the only financial institution listed

in the ‘Dream Employer’s ‘ top 20 list in 2010 and 2011 respectively (Laing & Dunbar, 2015).

The main objective of this paper is to evaluate the business process of the Commonwealth Bank.

This will include the analysis of the business structure and the business procedures of the

company. In order to modify the process in the business system, further recommendations are

made on the basis of position of organization in the market and the challenges and future

opportunities in front of the organization. The paper tries to give the overall business process

evaluation of Commonwealth Bank of Australia.

Introduction

Commonwealth Bank of Australia is a Australian multinational bank which has its

business in different countries including Asia, United States and Australia. The bank provides

various services which includes retail banking, corporate banking, management of funds. This

bank has been listed as the largest financial organization listed in the security exchange of

Australia. The bank was founded in 1911 and became a private bank on 1996 (Thaichon et

al.,2017).The commonwealth bank is regarded as one of the ‘big four’ in the Australian Banking

sector. The organization has taken many effective business decisions regarding the foreign

collaboration. In 2005 the bank has done an agreement with the two Chinese banks and set up a

branch at India. The bank has gained some reputations. It was the only financial institution listed

in the ‘Dream Employer’s ‘ top 20 list in 2010 and 2011 respectively (Laing & Dunbar, 2015).

The main objective of this paper is to evaluate the business process of the Commonwealth Bank.

This will include the analysis of the business structure and the business procedures of the

company. In order to modify the process in the business system, further recommendations are

made on the basis of position of organization in the market and the challenges and future

opportunities in front of the organization. The paper tries to give the overall business process

evaluation of Commonwealth Bank of Australia.

3STRATEGIC INFORMTION SYSTEM

Discussion

Part 1:

The current structure of the organization

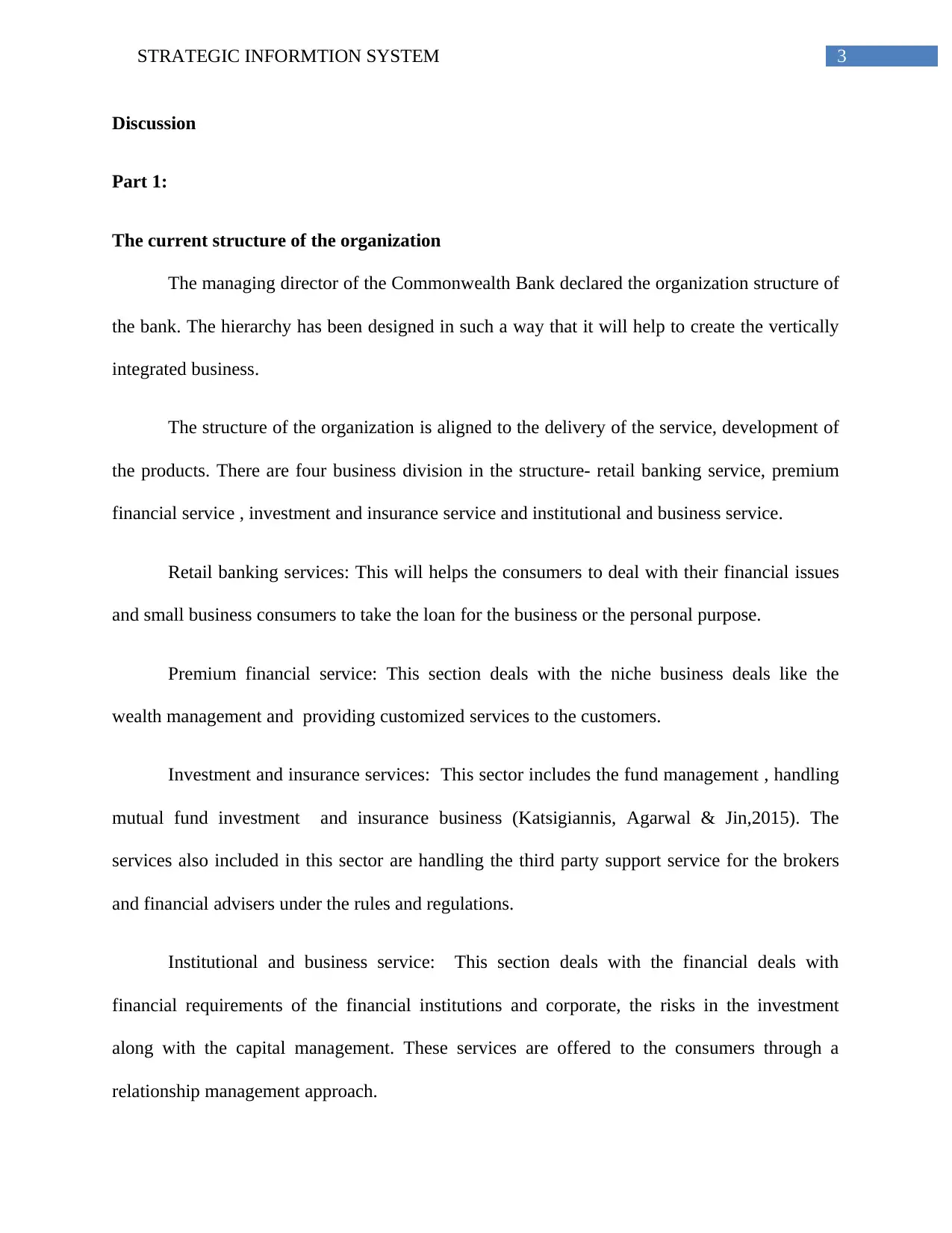

The managing director of the Commonwealth Bank declared the organization structure of

the bank. The hierarchy has been designed in such a way that it will help to create the vertically

integrated business.

The structure of the organization is aligned to the delivery of the service, development of

the products. There are four business division in the structure- retail banking service, premium

financial service , investment and insurance service and institutional and business service.

Retail banking services: This will helps the consumers to deal with their financial issues

and small business consumers to take the loan for the business or the personal purpose.

Premium financial service: This section deals with the niche business deals like the

wealth management and providing customized services to the customers.

Investment and insurance services: This sector includes the fund management , handling

mutual fund investment and insurance business (Katsigiannis, Agarwal & Jin,2015). The

services also included in this sector are handling the third party support service for the brokers

and financial advisers under the rules and regulations.

Institutional and business service: This section deals with the financial deals with

financial requirements of the financial institutions and corporate, the risks in the investment

along with the capital management. These services are offered to the consumers through a

relationship management approach.

Discussion

Part 1:

The current structure of the organization

The managing director of the Commonwealth Bank declared the organization structure of

the bank. The hierarchy has been designed in such a way that it will help to create the vertically

integrated business.

The structure of the organization is aligned to the delivery of the service, development of

the products. There are four business division in the structure- retail banking service, premium

financial service , investment and insurance service and institutional and business service.

Retail banking services: This will helps the consumers to deal with their financial issues

and small business consumers to take the loan for the business or the personal purpose.

Premium financial service: This section deals with the niche business deals like the

wealth management and providing customized services to the customers.

Investment and insurance services: This sector includes the fund management , handling

mutual fund investment and insurance business (Katsigiannis, Agarwal & Jin,2015). The

services also included in this sector are handling the third party support service for the brokers

and financial advisers under the rules and regulations.

Institutional and business service: This section deals with the financial deals with

financial requirements of the financial institutions and corporate, the risks in the investment

along with the capital management. These services are offered to the consumers through a

relationship management approach.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4STRATEGIC INFORMTION SYSTEM

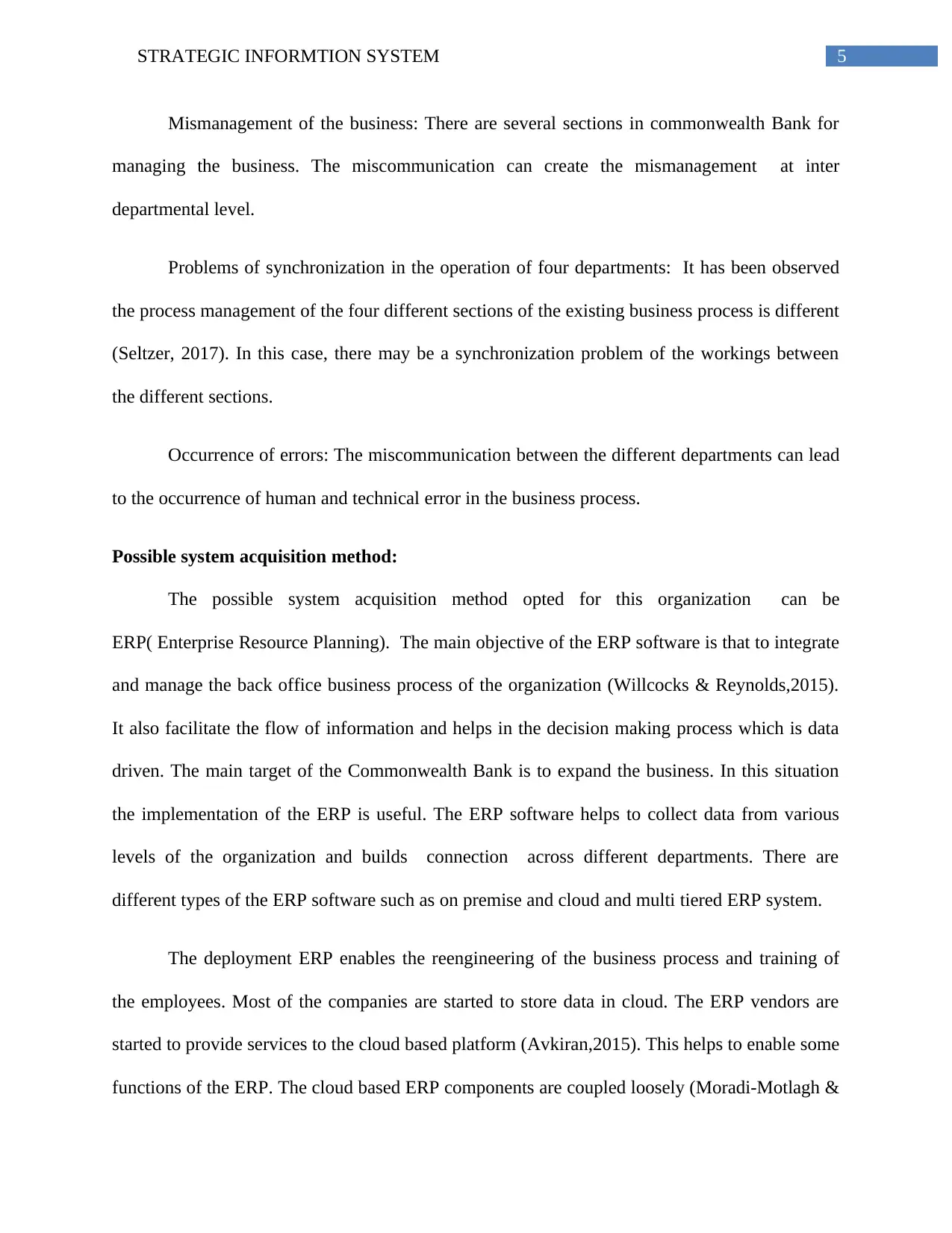

Figure 1: Organizational Structure of the Commonwealth Bank

(Source: ":: Commonwealth Bank :: | Organization Structure", 2018)

The business structure of this bank encourages the better wealth management with

improvised customer service by providing them better financial advices.

Operational problems organization could experience because of this structure:

Lack of communication: The organizational hierarchy is a tree structure. There are

certain advantages of this kind of structure. However, there can be a gap of communication

between the lower management and higher management of the structure.

Lack in the flow of communication: The flow of information delays as it has to pass

different phases of the hierarchy.

Figure 1: Organizational Structure of the Commonwealth Bank

(Source: ":: Commonwealth Bank :: | Organization Structure", 2018)

The business structure of this bank encourages the better wealth management with

improvised customer service by providing them better financial advices.

Operational problems organization could experience because of this structure:

Lack of communication: The organizational hierarchy is a tree structure. There are

certain advantages of this kind of structure. However, there can be a gap of communication

between the lower management and higher management of the structure.

Lack in the flow of communication: The flow of information delays as it has to pass

different phases of the hierarchy.

5STRATEGIC INFORMTION SYSTEM

Mismanagement of the business: There are several sections in commonwealth Bank for

managing the business. The miscommunication can create the mismanagement at inter

departmental level.

Problems of synchronization in the operation of four departments: It has been observed

the process management of the four different sections of the existing business process is different

(Seltzer, 2017). In this case, there may be a synchronization problem of the workings between

the different sections.

Occurrence of errors: The miscommunication between the different departments can lead

to the occurrence of human and technical error in the business process.

Possible system acquisition method:

The possible system acquisition method opted for this organization can be

ERP( Enterprise Resource Planning). The main objective of the ERP software is that to integrate

and manage the back office business process of the organization (Willcocks & Reynolds,2015).

It also facilitate the flow of information and helps in the decision making process which is data

driven. The main target of the Commonwealth Bank is to expand the business. In this situation

the implementation of the ERP is useful. The ERP software helps to collect data from various

levels of the organization and builds connection across different departments. There are

different types of the ERP software such as on premise and cloud and multi tiered ERP system.

The deployment ERP enables the reengineering of the business process and training of

the employees. Most of the companies are started to store data in cloud. The ERP vendors are

started to provide services to the cloud based platform (Avkiran,2015). This helps to enable some

functions of the ERP. The cloud based ERP components are coupled loosely (Moradi-Motlagh &

Mismanagement of the business: There are several sections in commonwealth Bank for

managing the business. The miscommunication can create the mismanagement at inter

departmental level.

Problems of synchronization in the operation of four departments: It has been observed

the process management of the four different sections of the existing business process is different

(Seltzer, 2017). In this case, there may be a synchronization problem of the workings between

the different sections.

Occurrence of errors: The miscommunication between the different departments can lead

to the occurrence of human and technical error in the business process.

Possible system acquisition method:

The possible system acquisition method opted for this organization can be

ERP( Enterprise Resource Planning). The main objective of the ERP software is that to integrate

and manage the back office business process of the organization (Willcocks & Reynolds,2015).

It also facilitate the flow of information and helps in the decision making process which is data

driven. The main target of the Commonwealth Bank is to expand the business. In this situation

the implementation of the ERP is useful. The ERP software helps to collect data from various

levels of the organization and builds connection across different departments. There are

different types of the ERP software such as on premise and cloud and multi tiered ERP system.

The deployment ERP enables the reengineering of the business process and training of

the employees. Most of the companies are started to store data in cloud. The ERP vendors are

started to provide services to the cloud based platform (Avkiran,2015). This helps to enable some

functions of the ERP. The cloud based ERP components are coupled loosely (Moradi-Motlagh &

6STRATEGIC INFORMTION SYSTEM

Babacan, 2015). This reduces the cost and the complexity of the implementation. The

organization can deploy the hybrid cloud model in order to run the business and the organization.

In multi tiered ERP approach enables the use of multiple ERP system under one

environment t. This method is known as two tier ERP (Oates & Dias, 2016). The bank can adopt

this implementation of ERP as there are geographic difference between the branches of the bank

and the different divisions in the bank are running under different systems.

The decision of implementation of the type of ERP depends on the collaborated decision of

the management of the banks and the different stakeholders of the bank. The implementation of

the ERP in the Commonwealth Bank can be beneficial in following ways:

Finance: The ERP will help to gather , manage and generates the financial reports like

trial balance data and the ledgers.

Managing the human resource: The deployment of ERP in this system will enable the

gathering of data and generation of reports regarding the recruitment of the employee and

review of their performance. It also helps in the decisions regarding the skill development

of the employees.

Managing the inventory process: The use of ERP in this section will help to generate the

report regarding the management of assets and stock items.

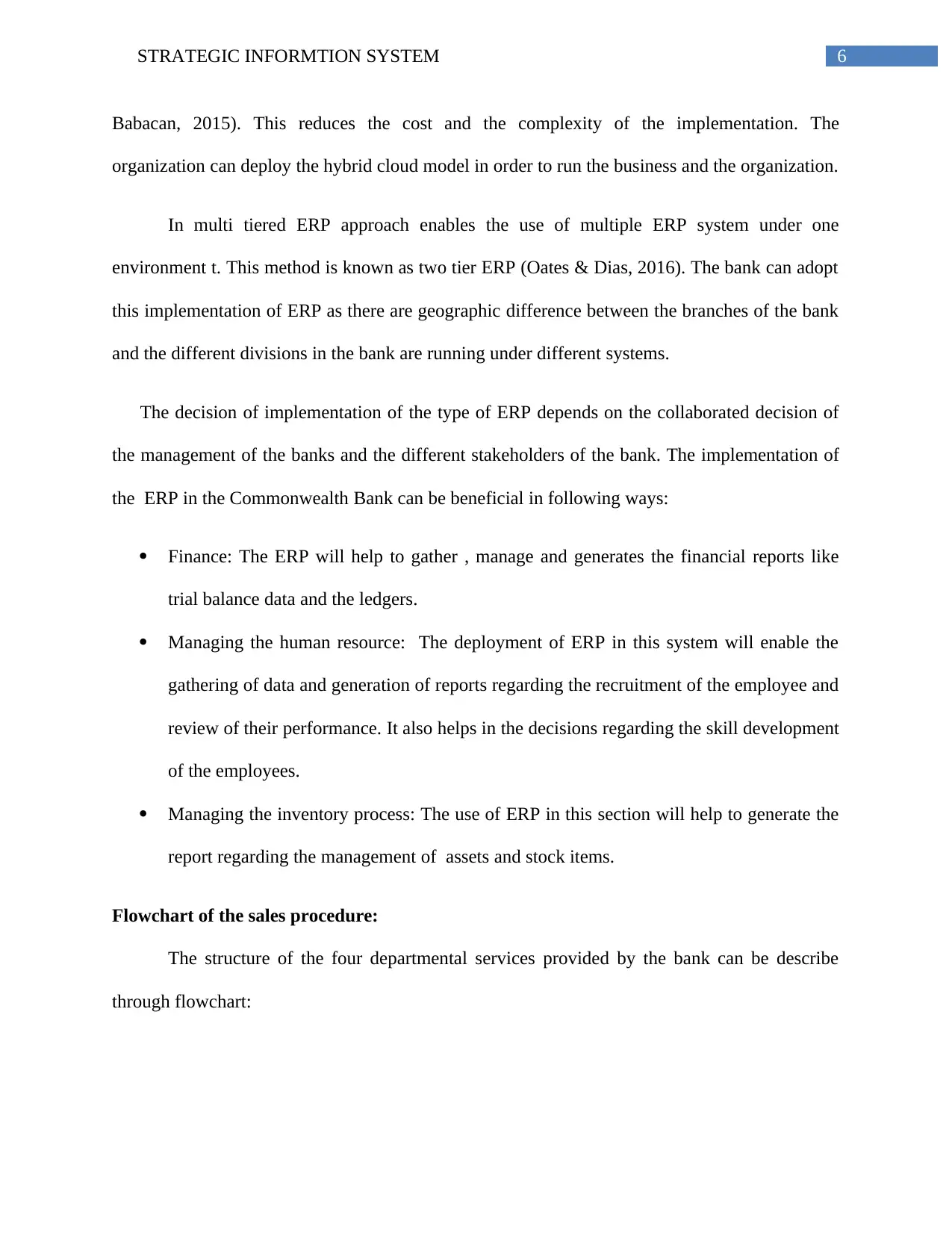

Flowchart of the sales procedure:

The structure of the four departmental services provided by the bank can be describe

through flowchart:

Babacan, 2015). This reduces the cost and the complexity of the implementation. The

organization can deploy the hybrid cloud model in order to run the business and the organization.

In multi tiered ERP approach enables the use of multiple ERP system under one

environment t. This method is known as two tier ERP (Oates & Dias, 2016). The bank can adopt

this implementation of ERP as there are geographic difference between the branches of the bank

and the different divisions in the bank are running under different systems.

The decision of implementation of the type of ERP depends on the collaborated decision of

the management of the banks and the different stakeholders of the bank. The implementation of

the ERP in the Commonwealth Bank can be beneficial in following ways:

Finance: The ERP will help to gather , manage and generates the financial reports like

trial balance data and the ledgers.

Managing the human resource: The deployment of ERP in this system will enable the

gathering of data and generation of reports regarding the recruitment of the employee and

review of their performance. It also helps in the decisions regarding the skill development

of the employees.

Managing the inventory process: The use of ERP in this section will help to generate the

report regarding the management of assets and stock items.

Flowchart of the sales procedure:

The structure of the four departmental services provided by the bank can be describe

through flowchart:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7STRATEGIC INFORMTION SYSTEM

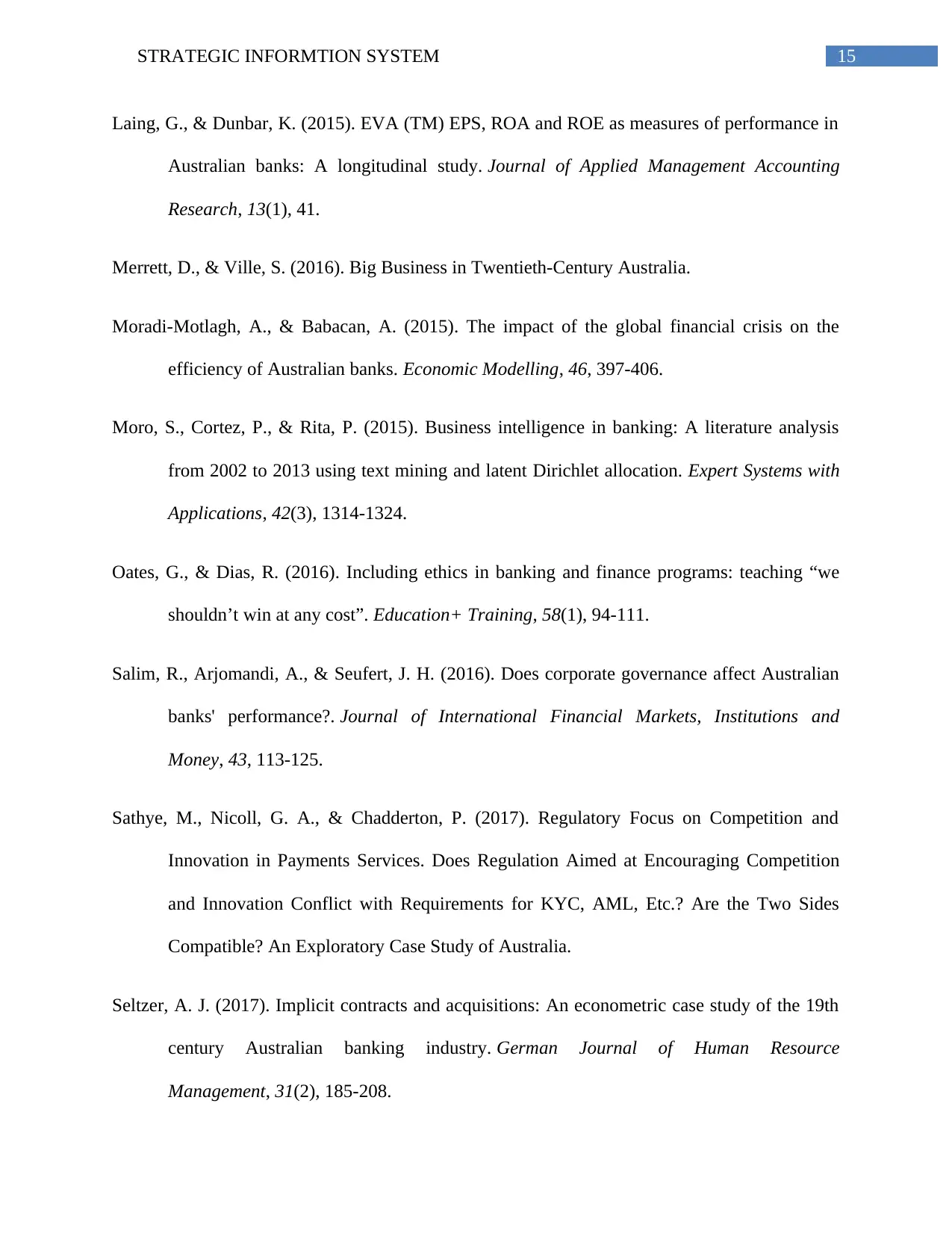

Figure 2: Retail Banking

(Source: Kozubíková et al., 2015)

In the above flowchart the process of handling the application regarding account opening

is shown. The opening and handling of the account is under the retail baking section. The

interested consumer has to fill up the application form (Kozubíková et al., 2015). The documents

submitted by the consumers are verified by the authority of the bank. The recommendation from

the existing consumer of the bank is asked for, in case if it is needed (Merrett & Ville, 2016).

The successful verification of the document makes the receiving and accepting of the

application. In case, if the documents are not verified and there is any mistake in the application

form, the request for the opening of the account can be rejected.

Figure 2: Retail Banking

(Source: Kozubíková et al., 2015)

In the above flowchart the process of handling the application regarding account opening

is shown. The opening and handling of the account is under the retail baking section. The

interested consumer has to fill up the application form (Kozubíková et al., 2015). The documents

submitted by the consumers are verified by the authority of the bank. The recommendation from

the existing consumer of the bank is asked for, in case if it is needed (Merrett & Ville, 2016).

The successful verification of the document makes the receiving and accepting of the

application. In case, if the documents are not verified and there is any mistake in the application

form, the request for the opening of the account can be rejected.

8STRATEGIC INFORMTION SYSTEM

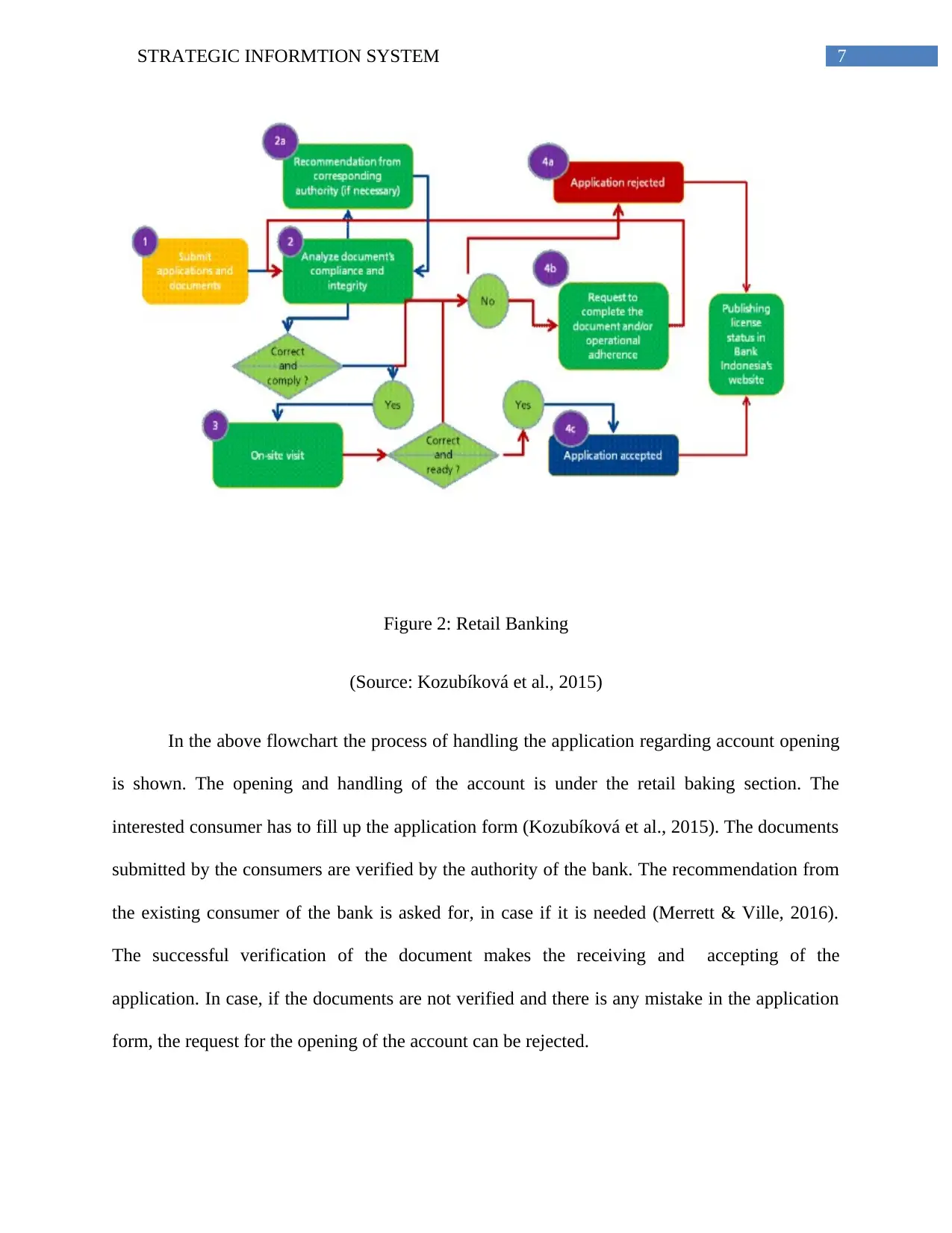

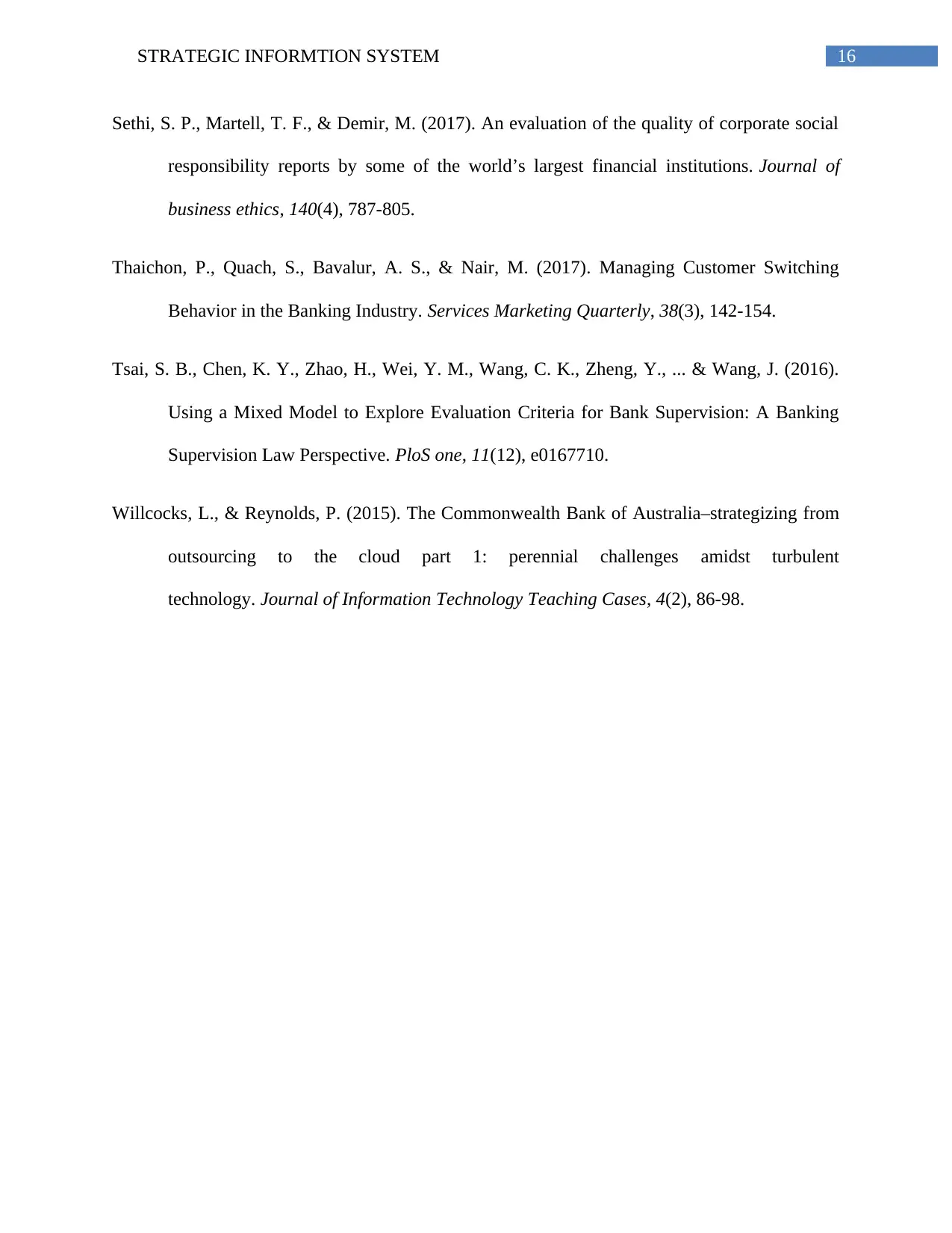

Figure 3: Premium financial services

(Source: Sethi, Martell & Demir, 2017)

In case of providing the premium financial services , trust pays the interest to the lender

and lender funds the premium. The grantor makes the trust to pay the interest. Heirs receives the

trust proceeds from life insurance trust.

Identification of control problems and possible fraud in the system:

There can be certain control system problems and the fraud cases , those can be happened

in the baking sector. However, the discussion is about Commonwealth Bank of Australia, there

are the chances that those fraud in this bank also.

Figure 3: Premium financial services

(Source: Sethi, Martell & Demir, 2017)

In case of providing the premium financial services , trust pays the interest to the lender

and lender funds the premium. The grantor makes the trust to pay the interest. Heirs receives the

trust proceeds from life insurance trust.

Identification of control problems and possible fraud in the system:

There can be certain control system problems and the fraud cases , those can be happened

in the baking sector. However, the discussion is about Commonwealth Bank of Australia, there

are the chances that those fraud in this bank also.

9STRATEGIC INFORMTION SYSTEM

Cyber crime: The bank can be affected from the activities of cyber crime. Currently this

bank is giving services to the customers through the online banking such as and e-banking. The

consumers of the bank is using the ATM of the bank (Bai, Krishnamurthy & Weymuller, 2018).

The attacks on the server of the bank along with the ATM can cause the hackers to access all the

confidential data of the consumers along with stealing the money from the bank.

Identity theft: With the advancement of the technology and the easy available services

through online has developed a chance to use the identity of the other person to access the

account of the bank.

Loss from loan: The bank can be affected from the due loans. Due to the improper

regulations and monitoring the loan defaults can be increased day by day causing the bank a

huge loss.

There are certain problems can occur related to the control system in the bank. These

problems can be regarded as the internal problem of the banks.

Dealing with the money: There is a chance of mistake while counting the money by any

employee of the bank. However, this can be prevented but implementation of the counting

machine at the counter (Keneley, 2017). Though this implementation does not assure the

correctness of counting the money , however, it will reduce the chances of the risks.

Problems with the rules and regulations: The hierarchy of the organizations leads to the

implementation of many rules regarding deposition of the money and processing the cheques

and the money (Sathye, Nicoll & Chadderton, 2017). Without proper understanding of these

rules can make an employee and the customer to become confused about the process.

Cyber crime: The bank can be affected from the activities of cyber crime. Currently this

bank is giving services to the customers through the online banking such as and e-banking. The

consumers of the bank is using the ATM of the bank (Bai, Krishnamurthy & Weymuller, 2018).

The attacks on the server of the bank along with the ATM can cause the hackers to access all the

confidential data of the consumers along with stealing the money from the bank.

Identity theft: With the advancement of the technology and the easy available services

through online has developed a chance to use the identity of the other person to access the

account of the bank.

Loss from loan: The bank can be affected from the due loans. Due to the improper

regulations and monitoring the loan defaults can be increased day by day causing the bank a

huge loss.

There are certain problems can occur related to the control system in the bank. These

problems can be regarded as the internal problem of the banks.

Dealing with the money: There is a chance of mistake while counting the money by any

employee of the bank. However, this can be prevented but implementation of the counting

machine at the counter (Keneley, 2017). Though this implementation does not assure the

correctness of counting the money , however, it will reduce the chances of the risks.

Problems with the rules and regulations: The hierarchy of the organizations leads to the

implementation of many rules regarding deposition of the money and processing the cheques

and the money (Sathye, Nicoll & Chadderton, 2017). Without proper understanding of these

rules can make an employee and the customer to become confused about the process.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10STRATEGIC INFORMTION SYSTEM

Part 2:

Development and adoption of the accounting software package:

Commonwealth Bank of Australia is considered as the most innovative bank in terms of

using technology. The bank is currently approaching to make an mobile app which will enable

the users to do various retail banking functions through internet (Moro, Cortez & Rita,2015).

The bank is currently using 7 vendors named-cloudera for the data management, vizier for the

HR and employee management system, verint system for managing the workforce, for the cloud

security tools Vasco data is used, form managing the customer relationship management

salesforce is used, Oracle Exadata is used for the data warehousing, for managing the branding

and advertisement agencies brand culture communications is used.

All the existing software vendors has its own functionality. The data and the process of

the internal banking system is maintained by the software packages are important. However, for

the accounting purpose the bank can adopt certain advanced software like NetSuit ERP and

Xero. The use of these software will help in the digitization of the bank. Apart from that it will

help to eliminate the problems with the manual banking system. There are various types of

accounting software can be use in this context- accounts payable software , accounts receivable

software, general ledger software.

The current market size of the Commonwealth Bank of Australia:

The commonwealth bank is based on Australia. However, it has its business over the

United States and Asia. It has total employee of 51800 across 11 countries. The Commonwealth

Bank of Australia is the largest financial sector in the stock exchange of the Australia.

Currently it is holding 20.5% of total market share . However, the market share of the

Part 2:

Development and adoption of the accounting software package:

Commonwealth Bank of Australia is considered as the most innovative bank in terms of

using technology. The bank is currently approaching to make an mobile app which will enable

the users to do various retail banking functions through internet (Moro, Cortez & Rita,2015).

The bank is currently using 7 vendors named-cloudera for the data management, vizier for the

HR and employee management system, verint system for managing the workforce, for the cloud

security tools Vasco data is used, form managing the customer relationship management

salesforce is used, Oracle Exadata is used for the data warehousing, for managing the branding

and advertisement agencies brand culture communications is used.

All the existing software vendors has its own functionality. The data and the process of

the internal banking system is maintained by the software packages are important. However, for

the accounting purpose the bank can adopt certain advanced software like NetSuit ERP and

Xero. The use of these software will help in the digitization of the bank. Apart from that it will

help to eliminate the problems with the manual banking system. There are various types of

accounting software can be use in this context- accounts payable software , accounts receivable

software, general ledger software.

The current market size of the Commonwealth Bank of Australia:

The commonwealth bank is based on Australia. However, it has its business over the

United States and Asia. It has total employee of 51800 across 11 countries. The Commonwealth

Bank of Australia is the largest financial sector in the stock exchange of the Australia.

Currently it is holding 20.5% of total market share . However, the market share of the

11STRATEGIC INFORMTION SYSTEM

Commonwealth Bank of Australia has been dropped from 25.5% to 15.5%. The experts says this

is the result of changing the strategy of the bank. This bank has removed its focus from the major

investors and the in concentrating on the marketers to meet the lending cap.

Lenders in the market and the competitive advantage:

The lenders of the bank is common people. The people who choose the bank for taking

the loans are the lenders of the bank as they return the money after a certain period of time to the

banks. Investors are also the lenders of the banks (Kumar, Charles & Mishra, 2016). They may

use the bank for their financial business. In that case the organizations can choose the

commonwealth bank for keeping the money (Salim, Arjomandi& Seufert, 2016). The common

people who have chosen the bank for the deposition of their money can be considered as the

lender of the bank. The bank can lend money to the common people and the business

organization by using the deposited money in the bank. The whole process goes in a cycle, where

the investors and the people keeps and invest the money in the bank. Bank uses those money to

give loan to the organization and the people as a loan. The bank repays the depositors by the

money it collects through the repayment of the loans.

Competitive advantage of the Commonwealth Bank:

The banks are advancing their services by increasing the quality of the services and the

products and better consumer services. This is making the business of the banking sector more

competitive. However, the main advantage of the Commonwealth Bank lies in its uniqueness

and the brand value. The Commonwealth Bank can be considered one of the largest bank in the

Australia. The main feature of this bank is that is makes the sustainable changes with the change

of the time( Drehmann & Juselius,2014). This helps the m]bank to stay far ahead from the other

banks in the competitive market (Tsai et al.,2016). The quality off the services and the expansion

Commonwealth Bank of Australia has been dropped from 25.5% to 15.5%. The experts says this

is the result of changing the strategy of the bank. This bank has removed its focus from the major

investors and the in concentrating on the marketers to meet the lending cap.

Lenders in the market and the competitive advantage:

The lenders of the bank is common people. The people who choose the bank for taking

the loans are the lenders of the bank as they return the money after a certain period of time to the

banks. Investors are also the lenders of the banks (Kumar, Charles & Mishra, 2016). They may

use the bank for their financial business. In that case the organizations can choose the

commonwealth bank for keeping the money (Salim, Arjomandi& Seufert, 2016). The common

people who have chosen the bank for the deposition of their money can be considered as the

lender of the bank. The bank can lend money to the common people and the business

organization by using the deposited money in the bank. The whole process goes in a cycle, where

the investors and the people keeps and invest the money in the bank. Bank uses those money to

give loan to the organization and the people as a loan. The bank repays the depositors by the

money it collects through the repayment of the loans.

Competitive advantage of the Commonwealth Bank:

The banks are advancing their services by increasing the quality of the services and the

products and better consumer services. This is making the business of the banking sector more

competitive. However, the main advantage of the Commonwealth Bank lies in its uniqueness

and the brand value. The Commonwealth Bank can be considered one of the largest bank in the

Australia. The main feature of this bank is that is makes the sustainable changes with the change

of the time( Drehmann & Juselius,2014). This helps the m]bank to stay far ahead from the other

banks in the competitive market (Tsai et al.,2016). The quality off the services and the expansion

12STRATEGIC INFORMTION SYSTEM

of the business along with the digital disruption I the banking process of the commonwealth bank

give it the extra advantage. The another positive point taken by the management of the bank is

that , the bank always take the opportunities and the decision making process regarding the

running of the system in the Commonwealth Bank is taken with concern.

Gaps and challenges regarding the accounting software:

However, with the use of the accounting software in the banking process may help the

process to enhance the positivity of the digitization, there are certain gaps between the

familiarity of the users of these software and the level of functionality of the software. The users

of these software are mainly the employees of the banks. The employees of the banks are used to

the manual processing system of the accounts. At first they may feel uncomfortable using these

software in the accounting system. Many of the employees may not have the equivalent

knowledge about the different functionality of the software which can cause the human error.

However this problems can be solved.

Recommendations:

The recommendation for the elimination of this problem is to give the proper training to

the employees and the workers about the use of the software. Trainings should be given to

employees on certain time interval so that they can stay update with the changing environment of

the process and the business.

Conclusion

It can be concluded from the above discussion that the Commonwealth Bank is doing

well in the business and the business of this bank is expanding. However there are certain areas

which should be considered by the bank for getting the advantage in the competitive market. The

of the business along with the digital disruption I the banking process of the commonwealth bank

give it the extra advantage. The another positive point taken by the management of the bank is

that , the bank always take the opportunities and the decision making process regarding the

running of the system in the Commonwealth Bank is taken with concern.

Gaps and challenges regarding the accounting software:

However, with the use of the accounting software in the banking process may help the

process to enhance the positivity of the digitization, there are certain gaps between the

familiarity of the users of these software and the level of functionality of the software. The users

of these software are mainly the employees of the banks. The employees of the banks are used to

the manual processing system of the accounts. At first they may feel uncomfortable using these

software in the accounting system. Many of the employees may not have the equivalent

knowledge about the different functionality of the software which can cause the human error.

However this problems can be solved.

Recommendations:

The recommendation for the elimination of this problem is to give the proper training to

the employees and the workers about the use of the software. Trainings should be given to

employees on certain time interval so that they can stay update with the changing environment of

the process and the business.

Conclusion

It can be concluded from the above discussion that the Commonwealth Bank is doing

well in the business and the business of this bank is expanding. However there are certain areas

which should be considered by the bank for getting the advantage in the competitive market. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13STRATEGIC INFORMTION SYSTEM

implementation of the digitization should be done in order to expand the business of the bank

and meeting the demands of the customers. The current market condition and other important

factors regarding the lenders of the bank and the business process of the bank has been discussed

in this paper. The findings of this article indicates the proper implementation of the digitization

and effective business plans will help this bank to doo well in the business.

implementation of the digitization should be done in order to expand the business of the bank

and meeting the demands of the customers. The current market condition and other important

factors regarding the lenders of the bank and the business process of the bank has been discussed

in this paper. The findings of this article indicates the proper implementation of the digitization

and effective business plans will help this bank to doo well in the business.

14STRATEGIC INFORMTION SYSTEM

References

Avkiran, N. (2015). A Multiple-Stakeholder Perspective on Bank Performance Measurement.

Bai, J., Krishnamurthy, A., & Weymuller, C. H. (2018). Measuring liquidity mismatch in the

banking sector. The Journal of Finance, 73(1), 51-93.

Commonwealth Bank :: | Organization Structure. (2018). Retrieved from

https://www.commbank.co.id/upublic/mod_home/default_content.aspx?code=pr_strorg

Drehmann, M., & Juselius, M. (2014). Evaluating early warning indicators of banking crises:

Satisfying policy requirements. International Journal of Forecasting, 30(3), 759-780.

Katsigiannis, T., Agarwal, R., & Jin, K. (2015). Business model approach to public service

innovation. In The Handbook of Service Innovation (pp. 751-778). Springer, London.

Keneley, M. J. (2017). The breakdown of the workplace ‘family’and the rise of personnel

management within an Australian financial institution 1950–1980. Business

History, 59(2), 250-267.

Kozubíková, L., Belás, J., Bilan, Y., & Bartos, P. (2015). Personal characteristics of

entrepreneurs in the context of perception and management of business risk in the SME

segment. Economics & Sociology, 8(1), 41.

Kumar, M., Charles, V., & Mishra, C. S. (2016). Evaluating the performance of indian banking

sector using DEA during post-reform and global financial crisis. Journal of Business

Economics and Management, 17(1), 156-172.

References

Avkiran, N. (2015). A Multiple-Stakeholder Perspective on Bank Performance Measurement.

Bai, J., Krishnamurthy, A., & Weymuller, C. H. (2018). Measuring liquidity mismatch in the

banking sector. The Journal of Finance, 73(1), 51-93.

Commonwealth Bank :: | Organization Structure. (2018). Retrieved from

https://www.commbank.co.id/upublic/mod_home/default_content.aspx?code=pr_strorg

Drehmann, M., & Juselius, M. (2014). Evaluating early warning indicators of banking crises:

Satisfying policy requirements. International Journal of Forecasting, 30(3), 759-780.

Katsigiannis, T., Agarwal, R., & Jin, K. (2015). Business model approach to public service

innovation. In The Handbook of Service Innovation (pp. 751-778). Springer, London.

Keneley, M. J. (2017). The breakdown of the workplace ‘family’and the rise of personnel

management within an Australian financial institution 1950–1980. Business

History, 59(2), 250-267.

Kozubíková, L., Belás, J., Bilan, Y., & Bartos, P. (2015). Personal characteristics of

entrepreneurs in the context of perception and management of business risk in the SME

segment. Economics & Sociology, 8(1), 41.

Kumar, M., Charles, V., & Mishra, C. S. (2016). Evaluating the performance of indian banking

sector using DEA during post-reform and global financial crisis. Journal of Business

Economics and Management, 17(1), 156-172.

15STRATEGIC INFORMTION SYSTEM

Laing, G., & Dunbar, K. (2015). EVA (TM) EPS, ROA and ROE as measures of performance in

Australian banks: A longitudinal study. Journal of Applied Management Accounting

Research, 13(1), 41.

Merrett, D., & Ville, S. (2016). Big Business in Twentieth-Century Australia.

Moradi-Motlagh, A., & Babacan, A. (2015). The impact of the global financial crisis on the

efficiency of Australian banks. Economic Modelling, 46, 397-406.

Moro, S., Cortez, P., & Rita, P. (2015). Business intelligence in banking: A literature analysis

from 2002 to 2013 using text mining and latent Dirichlet allocation. Expert Systems with

Applications, 42(3), 1314-1324.

Oates, G., & Dias, R. (2016). Including ethics in banking and finance programs: teaching “we

shouldn’t win at any cost”. Education+ Training, 58(1), 94-111.

Salim, R., Arjomandi, A., & Seufert, J. H. (2016). Does corporate governance affect Australian

banks' performance?. Journal of International Financial Markets, Institutions and

Money, 43, 113-125.

Sathye, M., Nicoll, G. A., & Chadderton, P. (2017). Regulatory Focus on Competition and

Innovation in Payments Services. Does Regulation Aimed at Encouraging Competition

and Innovation Conflict with Requirements for KYC, AML, Etc.? Are the Two Sides

Compatible? An Exploratory Case Study of Australia.

Seltzer, A. J. (2017). Implicit contracts and acquisitions: An econometric case study of the 19th

century Australian banking industry. German Journal of Human Resource

Management, 31(2), 185-208.

Laing, G., & Dunbar, K. (2015). EVA (TM) EPS, ROA and ROE as measures of performance in

Australian banks: A longitudinal study. Journal of Applied Management Accounting

Research, 13(1), 41.

Merrett, D., & Ville, S. (2016). Big Business in Twentieth-Century Australia.

Moradi-Motlagh, A., & Babacan, A. (2015). The impact of the global financial crisis on the

efficiency of Australian banks. Economic Modelling, 46, 397-406.

Moro, S., Cortez, P., & Rita, P. (2015). Business intelligence in banking: A literature analysis

from 2002 to 2013 using text mining and latent Dirichlet allocation. Expert Systems with

Applications, 42(3), 1314-1324.

Oates, G., & Dias, R. (2016). Including ethics in banking and finance programs: teaching “we

shouldn’t win at any cost”. Education+ Training, 58(1), 94-111.

Salim, R., Arjomandi, A., & Seufert, J. H. (2016). Does corporate governance affect Australian

banks' performance?. Journal of International Financial Markets, Institutions and

Money, 43, 113-125.

Sathye, M., Nicoll, G. A., & Chadderton, P. (2017). Regulatory Focus on Competition and

Innovation in Payments Services. Does Regulation Aimed at Encouraging Competition

and Innovation Conflict with Requirements for KYC, AML, Etc.? Are the Two Sides

Compatible? An Exploratory Case Study of Australia.

Seltzer, A. J. (2017). Implicit contracts and acquisitions: An econometric case study of the 19th

century Australian banking industry. German Journal of Human Resource

Management, 31(2), 185-208.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16STRATEGIC INFORMTION SYSTEM

Sethi, S. P., Martell, T. F., & Demir, M. (2017). An evaluation of the quality of corporate social

responsibility reports by some of the world’s largest financial institutions. Journal of

business ethics, 140(4), 787-805.

Thaichon, P., Quach, S., Bavalur, A. S., & Nair, M. (2017). Managing Customer Switching

Behavior in the Banking Industry. Services Marketing Quarterly, 38(3), 142-154.

Tsai, S. B., Chen, K. Y., Zhao, H., Wei, Y. M., Wang, C. K., Zheng, Y., ... & Wang, J. (2016).

Using a Mixed Model to Explore Evaluation Criteria for Bank Supervision: A Banking

Supervision Law Perspective. PloS one, 11(12), e0167710.

Willcocks, L., & Reynolds, P. (2015). The Commonwealth Bank of Australia–strategizing from

outsourcing to the cloud part 1: perennial challenges amidst turbulent

technology. Journal of Information Technology Teaching Cases, 4(2), 86-98.

Sethi, S. P., Martell, T. F., & Demir, M. (2017). An evaluation of the quality of corporate social

responsibility reports by some of the world’s largest financial institutions. Journal of

business ethics, 140(4), 787-805.

Thaichon, P., Quach, S., Bavalur, A. S., & Nair, M. (2017). Managing Customer Switching

Behavior in the Banking Industry. Services Marketing Quarterly, 38(3), 142-154.

Tsai, S. B., Chen, K. Y., Zhao, H., Wei, Y. M., Wang, C. K., Zheng, Y., ... & Wang, J. (2016).

Using a Mixed Model to Explore Evaluation Criteria for Bank Supervision: A Banking

Supervision Law Perspective. PloS one, 11(12), e0167710.

Willcocks, L., & Reynolds, P. (2015). The Commonwealth Bank of Australia–strategizing from

outsourcing to the cloud part 1: perennial challenges amidst turbulent

technology. Journal of Information Technology Teaching Cases, 4(2), 86-98.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.