Strategic Management: Analyzing BP, Steel Industry with Frameworks

VerifiedAdded on 2024/05/17

|13

|2777

|381

Report

AI Summary

This strategic management report analyzes BP and the world steel industry using various frameworks. It begins with a PESTEL analysis of BP, identifying political, economic, social, technological, environmental, and legal factors impacting the company, including opportunities in biofuels and threats from oil spills and regulations. The report then uses Porter's Five Forces to assess the attractiveness of the world steel industry, considering the threat of new entrants, bargaining power of customers and suppliers, the threat of substitutes, and competitive rivalry. Finally, it applies the BCG matrix to Samsung products to analyze market share and growth, discussing potential problems and limitations of the BCG matrix approach. Desklib offers a variety of solved assignments and past papers for students.

Strategic Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Question 1........................................................................................................................................3

Task: Using PESTEL, analyse the case study on factors that offer the most important

opportunities to BP, and the most important threats?......................................................................3

Question 2:.......................................................................................................................................6

Task: Analyze using Five Forces analysis on how attractive is the world steel industry? What

accounts for this?.............................................................................................................................6

Question 3:.......................................................................................................................................8

A. Select product or services of a business organization and analyze growth/market share using

BCG market.....................................................................................................................................8

b) Critically analyze the potential problems with the BCG matrix...............................................10

Reference list.................................................................................................................................12

Question 1........................................................................................................................................3

Task: Using PESTEL, analyse the case study on factors that offer the most important

opportunities to BP, and the most important threats?......................................................................3

Question 2:.......................................................................................................................................6

Task: Analyze using Five Forces analysis on how attractive is the world steel industry? What

accounts for this?.............................................................................................................................6

Question 3:.......................................................................................................................................8

A. Select product or services of a business organization and analyze growth/market share using

BCG market.....................................................................................................................................8

b) Critically analyze the potential problems with the BCG matrix...............................................10

Reference list.................................................................................................................................12

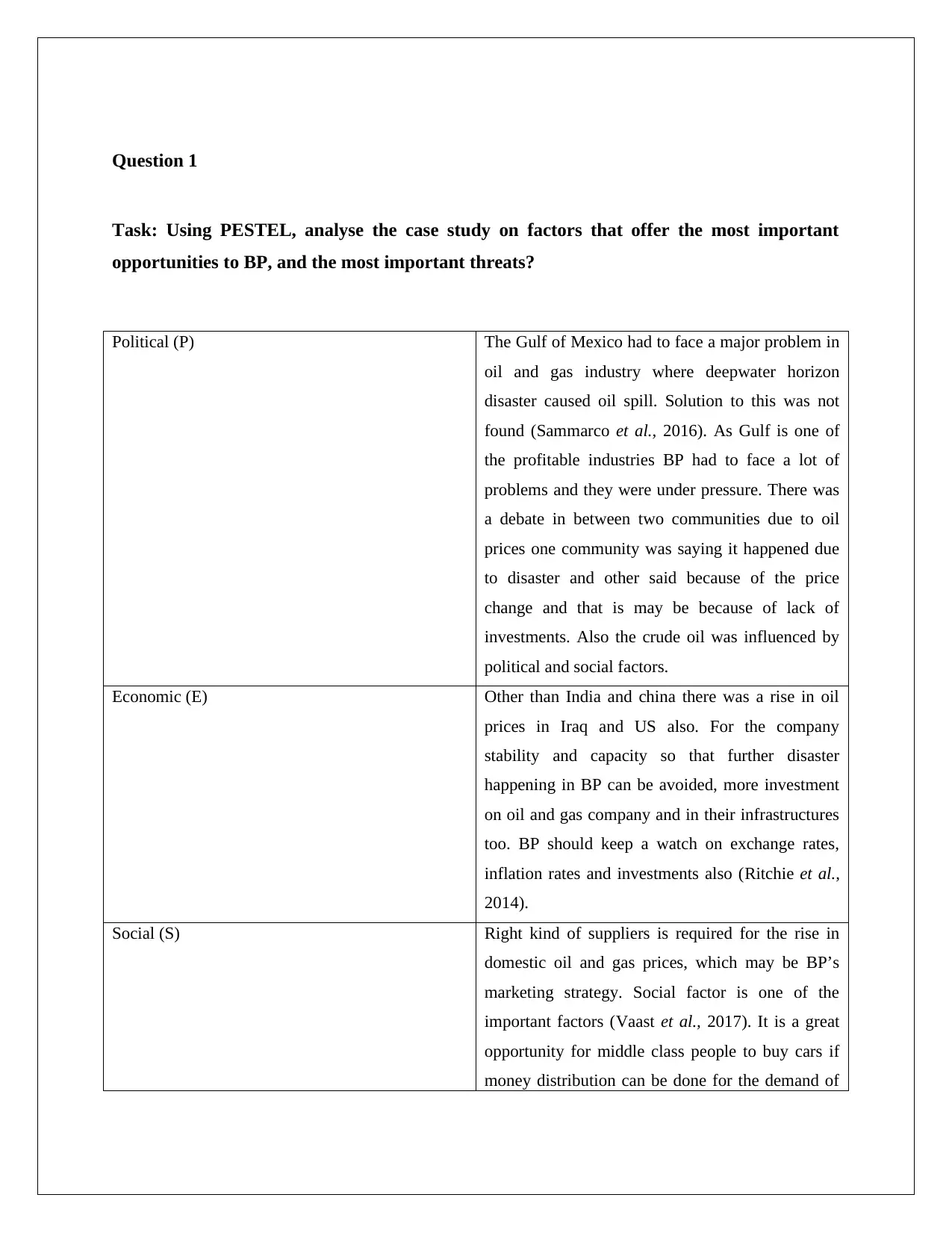

Question 1

Task: Using PESTEL, analyse the case study on factors that offer the most important

opportunities to BP, and the most important threats?

Political (P) The Gulf of Mexico had to face a major problem in

oil and gas industry where deepwater horizon

disaster caused oil spill. Solution to this was not

found (Sammarco et al., 2016). As Gulf is one of

the profitable industries BP had to face a lot of

problems and they were under pressure. There was

a debate in between two communities due to oil

prices one community was saying it happened due

to disaster and other said because of the price

change and that is may be because of lack of

investments. Also the crude oil was influenced by

political and social factors.

Economic (E) Other than India and china there was a rise in oil

prices in Iraq and US also. For the company

stability and capacity so that further disaster

happening in BP can be avoided, more investment

on oil and gas company and in their infrastructures

too. BP should keep a watch on exchange rates,

inflation rates and investments also (Ritchie et al.,

2014).

Social (S) Right kind of suppliers is required for the rise in

domestic oil and gas prices, which may be BP’s

marketing strategy. Social factor is one of the

important factors (Vaast et al., 2017). It is a great

opportunity for middle class people to buy cars if

money distribution can be done for the demand of

Task: Using PESTEL, analyse the case study on factors that offer the most important

opportunities to BP, and the most important threats?

Political (P) The Gulf of Mexico had to face a major problem in

oil and gas industry where deepwater horizon

disaster caused oil spill. Solution to this was not

found (Sammarco et al., 2016). As Gulf is one of

the profitable industries BP had to face a lot of

problems and they were under pressure. There was

a debate in between two communities due to oil

prices one community was saying it happened due

to disaster and other said because of the price

change and that is may be because of lack of

investments. Also the crude oil was influenced by

political and social factors.

Economic (E) Other than India and china there was a rise in oil

prices in Iraq and US also. For the company

stability and capacity so that further disaster

happening in BP can be avoided, more investment

on oil and gas company and in their infrastructures

too. BP should keep a watch on exchange rates,

inflation rates and investments also (Ritchie et al.,

2014).

Social (S) Right kind of suppliers is required for the rise in

domestic oil and gas prices, which may be BP’s

marketing strategy. Social factor is one of the

important factors (Vaast et al., 2017). It is a great

opportunity for middle class people to buy cars if

money distribution can be done for the demand of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

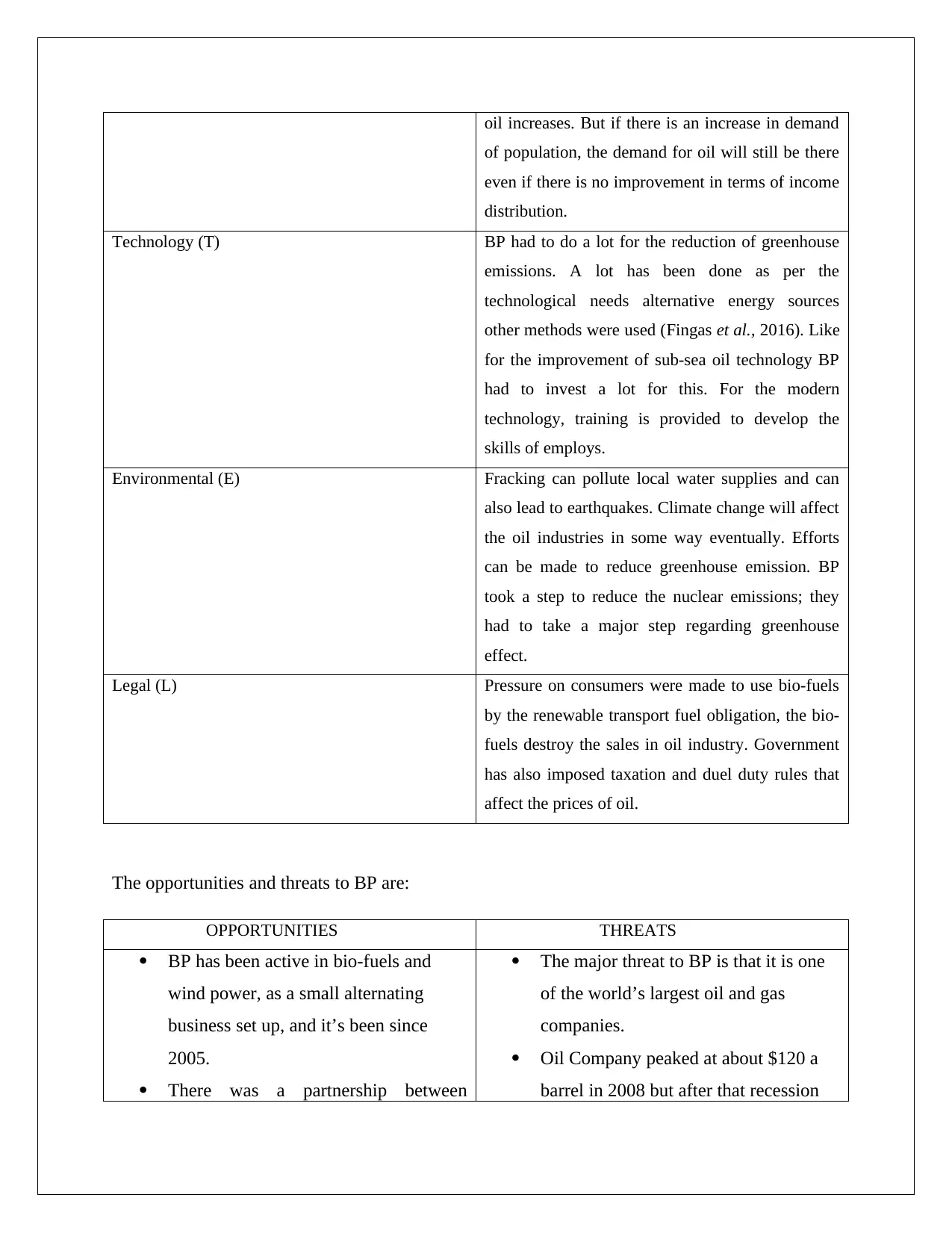

oil increases. But if there is an increase in demand

of population, the demand for oil will still be there

even if there is no improvement in terms of income

distribution.

Technology (T) BP had to do a lot for the reduction of greenhouse

emissions. A lot has been done as per the

technological needs alternative energy sources

other methods were used (Fingas et al., 2016). Like

for the improvement of sub-sea oil technology BP

had to invest a lot for this. For the modern

technology, training is provided to develop the

skills of employs.

Environmental (E) Fracking can pollute local water supplies and can

also lead to earthquakes. Climate change will affect

the oil industries in some way eventually. Efforts

can be made to reduce greenhouse emission. BP

took a step to reduce the nuclear emissions; they

had to take a major step regarding greenhouse

effect.

Legal (L) Pressure on consumers were made to use bio-fuels

by the renewable transport fuel obligation, the bio-

fuels destroy the sales in oil industry. Government

has also imposed taxation and duel duty rules that

affect the prices of oil.

The opportunities and threats to BP are:

OPPORTUNITIES THREATS

BP has been active in bio-fuels and

wind power, as a small alternating

business set up, and it’s been since

2005.

There was a partnership between

The major threat to BP is that it is one

of the world’s largest oil and gas

companies.

Oil Company peaked at about $120 a

barrel in 2008 but after that recession

of population, the demand for oil will still be there

even if there is no improvement in terms of income

distribution.

Technology (T) BP had to do a lot for the reduction of greenhouse

emissions. A lot has been done as per the

technological needs alternative energy sources

other methods were used (Fingas et al., 2016). Like

for the improvement of sub-sea oil technology BP

had to invest a lot for this. For the modern

technology, training is provided to develop the

skills of employs.

Environmental (E) Fracking can pollute local water supplies and can

also lead to earthquakes. Climate change will affect

the oil industries in some way eventually. Efforts

can be made to reduce greenhouse emission. BP

took a step to reduce the nuclear emissions; they

had to take a major step regarding greenhouse

effect.

Legal (L) Pressure on consumers were made to use bio-fuels

by the renewable transport fuel obligation, the bio-

fuels destroy the sales in oil industry. Government

has also imposed taxation and duel duty rules that

affect the prices of oil.

The opportunities and threats to BP are:

OPPORTUNITIES THREATS

BP has been active in bio-fuels and

wind power, as a small alternating

business set up, and it’s been since

2005.

There was a partnership between

The major threat to BP is that it is one

of the world’s largest oil and gas

companies.

Oil Company peaked at about $120 a

barrel in 2008 but after that recession

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

controversial alliance and a leading

Russian businessman as the BP’s oil

business was transferred to the alliance

in which BP’s share was 17 percent

(Susskind et al., 2016).

There was a hike between 2012 and

2020 of about percent per annum in

china.

took place in 2009.

Driving tests have failed in United

Kingdom by about 17 percent.

Russian businessman as the BP’s oil

business was transferred to the alliance

in which BP’s share was 17 percent

(Susskind et al., 2016).

There was a hike between 2012 and

2020 of about percent per annum in

china.

took place in 2009.

Driving tests have failed in United

Kingdom by about 17 percent.

Question 2:

Task: Analyze using Five Forces analysis on how attractive is the world steel industry?

What accounts for this?

On using five forces analysis, how attractive can be the world steel industry

Threat of new entrance (H): The threat of new entrance to the still existing producers in steel

industry is high. At first, producers were nation based, state based but there was no profit, but

after Mittal and Tata bought European steel they made world’s largest steel industry (Chand et

al., 2016). But in the last two decades, china took over the world steel industry and there was a

increase of capacity of about seven times, it reached about 45% in 2011. This led the Chinese

companies on number two position and there was a decrease in the domestic demand which

slowly surged into the international markets.

Bargaining power of customers (L): The bargaining power of customers is low as usually most

of the buyers are from the car manufacturers so there is no such competition in the domestic

market. And most of the car manufacturers work with technological developments in materials.

A lot of car manufacturing companies has new domestic buyers like ford, general motors,

Chrysler have linked up with Toyota, BMW, Honda. Even in metal packaging industry, leading

producers like Crown Holdings, makes food cans of about one third of which is produced in

North America, and they buy this in huge numbers, where purchases are coordinated around the

world.

Bargaining power of suppliers (H): The bargaining power of suppliers is high in steel

industry, as key material in this industry is iron ore and there are three big ore producers- vale,

Rio Tinto and BHP Billiton (Mahapatra et al., 2016). These producers take over the market

around 70 percent for internationally traded ore. And the prices of these ore have risen four times

in between 2005 and 2008. Iron ore has seen a loss but recovered back twice in 2012 as in 2005.

So, this makes up for the bargaining of power suppliers high in steel industry market.

Threat of substitute (H): There’s been a high threat of substitutes in world steel industry, in the

nineteenth century, steel was substituted by other materials, like in cars steel was substituted with

Task: Analyze using Five Forces analysis on how attractive is the world steel industry?

What accounts for this?

On using five forces analysis, how attractive can be the world steel industry

Threat of new entrance (H): The threat of new entrance to the still existing producers in steel

industry is high. At first, producers were nation based, state based but there was no profit, but

after Mittal and Tata bought European steel they made world’s largest steel industry (Chand et

al., 2016). But in the last two decades, china took over the world steel industry and there was a

increase of capacity of about seven times, it reached about 45% in 2011. This led the Chinese

companies on number two position and there was a decrease in the domestic demand which

slowly surged into the international markets.

Bargaining power of customers (L): The bargaining power of customers is low as usually most

of the buyers are from the car manufacturers so there is no such competition in the domestic

market. And most of the car manufacturers work with technological developments in materials.

A lot of car manufacturing companies has new domestic buyers like ford, general motors,

Chrysler have linked up with Toyota, BMW, Honda. Even in metal packaging industry, leading

producers like Crown Holdings, makes food cans of about one third of which is produced in

North America, and they buy this in huge numbers, where purchases are coordinated around the

world.

Bargaining power of suppliers (H): The bargaining power of suppliers is high in steel

industry, as key material in this industry is iron ore and there are three big ore producers- vale,

Rio Tinto and BHP Billiton (Mahapatra et al., 2016). These producers take over the market

around 70 percent for internationally traded ore. And the prices of these ore have risen four times

in between 2005 and 2008. Iron ore has seen a loss but recovered back twice in 2012 as in 2005.

So, this makes up for the bargaining of power suppliers high in steel industry market.

Threat of substitute (H): There’s been a high threat of substitutes in world steel industry, in the

nineteenth century, steel was substituted by other materials, like in cars steel was substituted with

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

aluminum, then plastics and aluminum in packaging and ceramics in many high-tech

applications. Sometimes it’s just steel own advancements which reduced the need of steel and so

steel cans have now become the one third in last few decades.

Competitive rivalry (H): The risk of competitive rivalry is high, as world steel industry was

high by about 50 percent in-between 2000and 2008, which dropped after some point of time.

Despite of Mittal and Tata who made the steel industry, which grossed for some time, the

European steel company, made up 25% in 2012, hearing this Mittal tried to close down the

floorage plant, which the French government tried to nationalize it by threatening them.

applications. Sometimes it’s just steel own advancements which reduced the need of steel and so

steel cans have now become the one third in last few decades.

Competitive rivalry (H): The risk of competitive rivalry is high, as world steel industry was

high by about 50 percent in-between 2000and 2008, which dropped after some point of time.

Despite of Mittal and Tata who made the steel industry, which grossed for some time, the

European steel company, made up 25% in 2012, hearing this Mittal tried to close down the

floorage plant, which the French government tried to nationalize it by threatening them.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 3:

A. Select product or services of a business organization and analyze growth/market share

using BCG market.

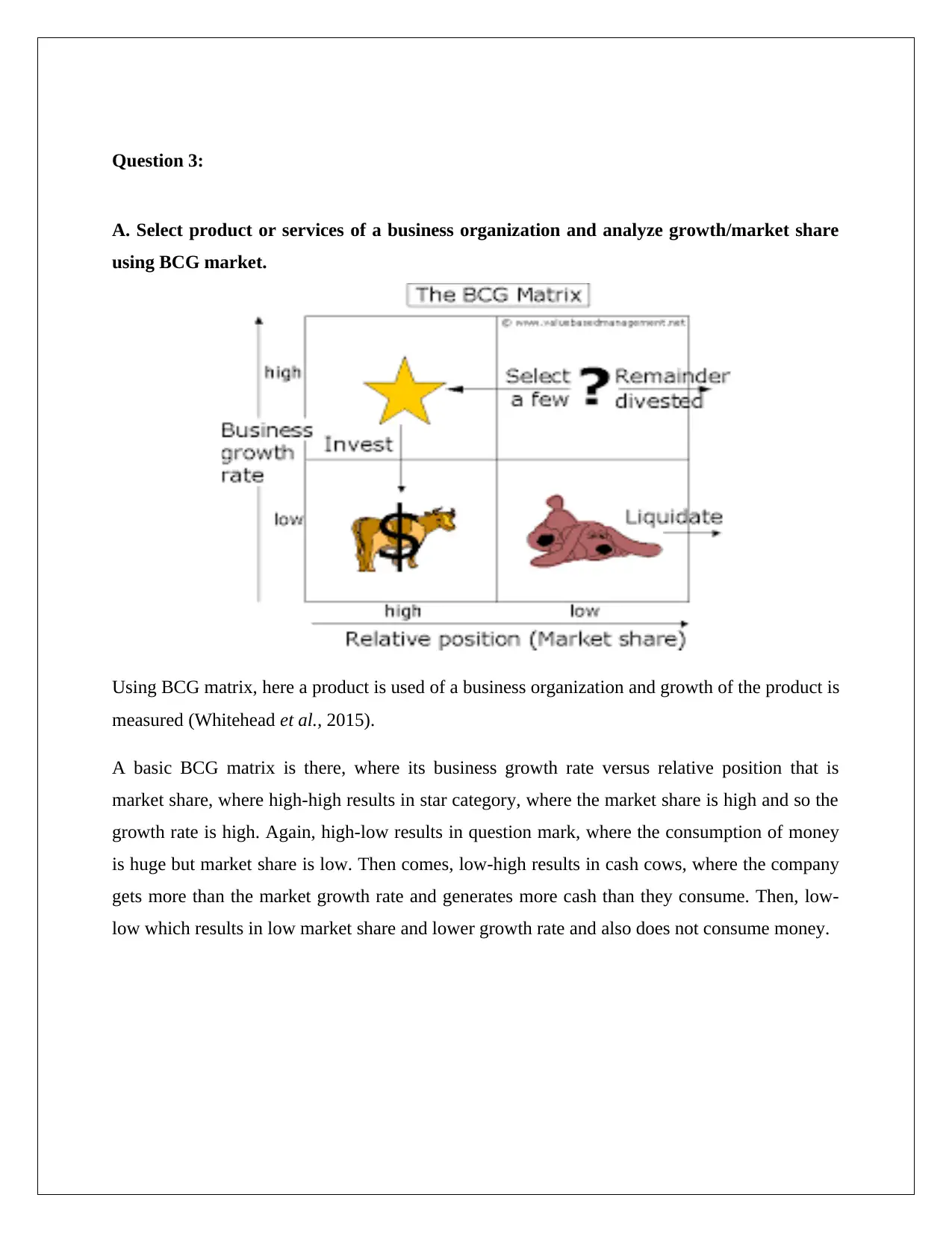

Using BCG matrix, here a product is used of a business organization and growth of the product is

measured (Whitehead et al., 2015).

A basic BCG matrix is there, where its business growth rate versus relative position that is

market share, where high-high results in star category, where the market share is high and so the

growth rate is high. Again, high-low results in question mark, where the consumption of money

is huge but market share is low. Then comes, low-high results in cash cows, where the company

gets more than the market growth rate and generates more cash than they consume. Then, low-

low which results in low market share and lower growth rate and also does not consume money.

A. Select product or services of a business organization and analyze growth/market share

using BCG market.

Using BCG matrix, here a product is used of a business organization and growth of the product is

measured (Whitehead et al., 2015).

A basic BCG matrix is there, where its business growth rate versus relative position that is

market share, where high-high results in star category, where the market share is high and so the

growth rate is high. Again, high-low results in question mark, where the consumption of money

is huge but market share is low. Then comes, low-high results in cash cows, where the company

gets more than the market growth rate and generates more cash than they consume. Then, low-

low which results in low market share and lower growth rate and also does not consume money.

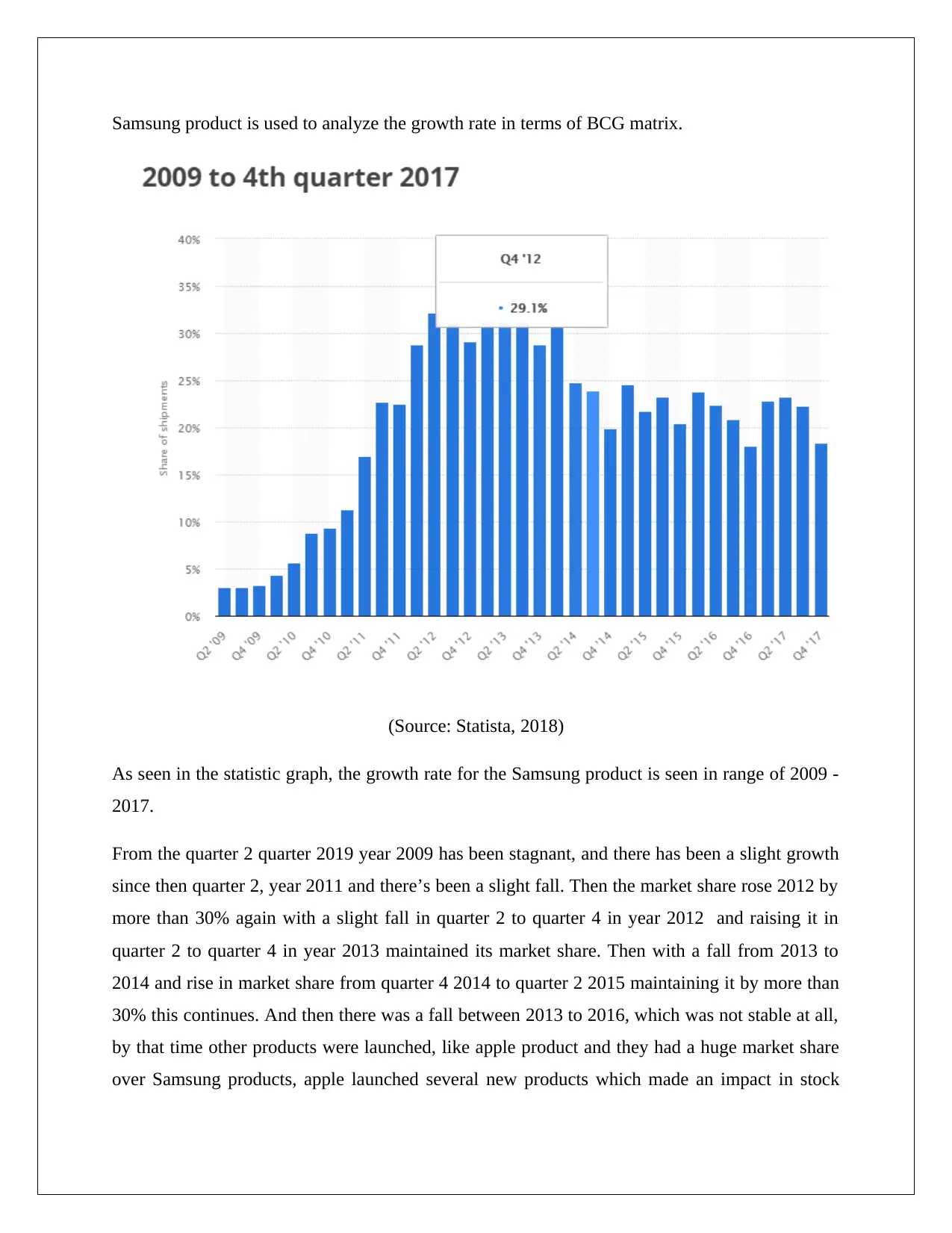

Samsung product is used to analyze the growth rate in terms of BCG matrix.

(Source: Statista, 2018)

As seen in the statistic graph, the growth rate for the Samsung product is seen in range of 2009 -

2017.

From the quarter 2 quarter 2019 year 2009 has been stagnant, and there has been a slight growth

since then quarter 2, year 2011 and there’s been a slight fall. Then the market share rose 2012 by

more than 30% again with a slight fall in quarter 2 to quarter 4 in year 2012 and raising it in

quarter 2 to quarter 4 in year 2013 maintained its market share. Then with a fall from 2013 to

2014 and rise in market share from quarter 4 2014 to quarter 2 2015 maintaining it by more than

30% this continues. And then there was a fall between 2013 to 2016, which was not stable at all,

by that time other products were launched, like apple product and they had a huge market share

over Samsung products, apple launched several new products which made an impact in stock

(Source: Statista, 2018)

As seen in the statistic graph, the growth rate for the Samsung product is seen in range of 2009 -

2017.

From the quarter 2 quarter 2019 year 2009 has been stagnant, and there has been a slight growth

since then quarter 2, year 2011 and there’s been a slight fall. Then the market share rose 2012 by

more than 30% again with a slight fall in quarter 2 to quarter 4 in year 2012 and raising it in

quarter 2 to quarter 4 in year 2013 maintained its market share. Then with a fall from 2013 to

2014 and rise in market share from quarter 4 2014 to quarter 2 2015 maintaining it by more than

30% this continues. And then there was a fall between 2013 to 2016, which was not stable at all,

by that time other products were launched, like apple product and they had a huge market share

over Samsung products, apple launched several new products which made an impact in stock

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

market, which actually made Samsung’s growth rate low. And till now 2017, Samsung is still

showing its progress in the market share with the other products market share.

Samsung Smartphone sales has reached its peak value over the years, from 2009 to 2017 with its

android feature, Samsung Smartphone ruled over the years but then apple products came into the

market and sales of apple products rose higher over the years and Samsung company and apple

company ruled over the years and had huge growth rate. Samsung shipped its products by 2.4

millions and apple shipped its products by 54 million per quarter (Biswas et al., 2016).

b) Critically analyze the potential problems with the BCG matrix.

The problems which can arise from the BCG matrix can be:

BCG matrix can only be classified in high or low businesses, but not in terms of medium

it cannot be classified. But business can be in medium category also. So BCG matrix

does not show the true nature of business.

High share markets, includes both high profits and costs of business. The matrix does not

take into account mediocre profits or sales. Hence the matrix does not take into account

or consideration the performance of the new entrants.

The indication of profitability not only shows the growth rate and relative market it

overlooks other indicators of the model. The model ignores important factors such as the

quality of the people working for the organization or its brand value and only considers

the profit/revenue.

It would be wrong to say, that dogs not only in business gaining competitive but also earn

by cash cows also.

This four quadrant structure is considered to be the simplistic one.

In this BCG matrix, market is not clearly defined. The geographical extent or the various

segments within the market are not clearly distinguished and hence decision making

based on this model can be risky. The term ‘market’ has no clear meaning in BCG

matrix.

In BCG matrix, that specific high growth or low growth cannot be misjudged for a small

time span, but if we see for a larger time span there is a growth rate growing consistently.

Data cannot be interpreted from market share and market rate.

showing its progress in the market share with the other products market share.

Samsung Smartphone sales has reached its peak value over the years, from 2009 to 2017 with its

android feature, Samsung Smartphone ruled over the years but then apple products came into the

market and sales of apple products rose higher over the years and Samsung company and apple

company ruled over the years and had huge growth rate. Samsung shipped its products by 2.4

millions and apple shipped its products by 54 million per quarter (Biswas et al., 2016).

b) Critically analyze the potential problems with the BCG matrix.

The problems which can arise from the BCG matrix can be:

BCG matrix can only be classified in high or low businesses, but not in terms of medium

it cannot be classified. But business can be in medium category also. So BCG matrix

does not show the true nature of business.

High share markets, includes both high profits and costs of business. The matrix does not

take into account mediocre profits or sales. Hence the matrix does not take into account

or consideration the performance of the new entrants.

The indication of profitability not only shows the growth rate and relative market it

overlooks other indicators of the model. The model ignores important factors such as the

quality of the people working for the organization or its brand value and only considers

the profit/revenue.

It would be wrong to say, that dogs not only in business gaining competitive but also earn

by cash cows also.

This four quadrant structure is considered to be the simplistic one.

In this BCG matrix, market is not clearly defined. The geographical extent or the various

segments within the market are not clearly distinguished and hence decision making

based on this model can be risky. The term ‘market’ has no clear meaning in BCG

matrix.

In BCG matrix, that specific high growth or low growth cannot be misjudged for a small

time span, but if we see for a larger time span there is a growth rate growing consistently.

Data cannot be interpreted from market share and market rate.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Low share in business can be profitable.

BCG matrix compares to only one competitor that is the market leader. But it misses out

small growing companies in the industries. Since the model does not consider various

competitors, again decision making is not perfect.

The BCG matrix has only two dimensions that is market share and growth rate. This may

lead to management to a particular product.

Incomplete vertical axis and sales growth rate (Shanbhag et al., 2016).

There are flaws in mathematical calculation in vertical business growth rate and

horizontal market share.

Market share should have an arithmetic average.

In terms of market share, the requirement of sales economy is required. In other words to

compute the market share associated data is also required related to the national GDP,

growth rate etc.

Each and every industry should be taken into consideration, in terms of market share.

Characteristics of any industry must be taken into consideration in terms of market share.

The model as has been previously mentioned does not define the market clearly and

hence the various qualitative factors or the characteristics of the market are not

considered by the same.

BCG matrix compares to only one competitor that is the market leader. But it misses out

small growing companies in the industries. Since the model does not consider various

competitors, again decision making is not perfect.

The BCG matrix has only two dimensions that is market share and growth rate. This may

lead to management to a particular product.

Incomplete vertical axis and sales growth rate (Shanbhag et al., 2016).

There are flaws in mathematical calculation in vertical business growth rate and

horizontal market share.

Market share should have an arithmetic average.

In terms of market share, the requirement of sales economy is required. In other words to

compute the market share associated data is also required related to the national GDP,

growth rate etc.

Each and every industry should be taken into consideration, in terms of market share.

Characteristics of any industry must be taken into consideration in terms of market share.

The model as has been previously mentioned does not define the market clearly and

hence the various qualitative factors or the characteristics of the market are not

considered by the same.

Reference list

Chand, S., Paul, B. and Kumar, M., 2016. Sustainable approaches for LD slag waste

management in steel industries: a review. Metallurgist, 60(1-2), pp.116-128.

Fingas, M., 2016. Oil spill science and technology. Gulf professional publishing.

Mahapatra, R.R., Mukherjee, P., Paul, M., Ray, J. and Manikyamba, C., 2016, October. One

atmosphere experimental studies on Iron Ore Group (IOG) basalts from Dangoaposi-Noamundi-

Koira areas of Singhbhum Craton, Eastern India: Phase equilibrium studies to constrain parent

magma characteristics. In ANNUAL GENERAL MEETING OF THE GEOLOGICAL SOCIETY

OF INDIA (p. 262).

Ritchie, B.W., Crotts, J.C., Zehrer, A. and Volsky, G.T., 2014. Understanding the effects of a

tourism crisis: The impact of the BP oil spill on regional lodging demand. Journal of Travel

Research, 53(1), pp.12-25.

Sammarco, P.W., Kolian, S.R., Warby, R.A., Bouldin, J.L., Subra, W.A. and Porter, S.A., 2016.

Concentrations in human blood of petroleum hydrocarbons associated with the BP/Deepwater

Horizon oil spill, Gulf of Mexico. Archives of toxicology, 90(4), pp.829-837.

Statista. (2018). Samsung smartphone market share worldwide 2009-2017 | Statistic. [online]

Available at: https://www.statista.com/statistics/276477/global-market-share-held-by-samsung-

smartphones/ [Accessed 20 Mar. 2018]

Susskind, A.M., Bonn, M.A., Lawrence, B.C. and Furr, H.L., 2016. Regional contrasts in

consumers’ attitudes and behavior following the BP oil spill. Cornell Hospitality

Quarterly, 57(1), pp.66-81.

Vaast, E., Safadi, H., Lapointe, L. and Negoita, B., 2017. SOCIAL MEDIA AFFORDANCES

FOR CONNECTIVE ACTION: AN EXAMINATION OF MICROBLOGGING USE DURING

THE GULF OF MEXICO OIL SPILL. MIS Quarterly, 41(4).

Whitehead, J., 2015. BCG (Growth Share) Matrix. Wiley Encyclopedia of Management.

Chand, S., Paul, B. and Kumar, M., 2016. Sustainable approaches for LD slag waste

management in steel industries: a review. Metallurgist, 60(1-2), pp.116-128.

Fingas, M., 2016. Oil spill science and technology. Gulf professional publishing.

Mahapatra, R.R., Mukherjee, P., Paul, M., Ray, J. and Manikyamba, C., 2016, October. One

atmosphere experimental studies on Iron Ore Group (IOG) basalts from Dangoaposi-Noamundi-

Koira areas of Singhbhum Craton, Eastern India: Phase equilibrium studies to constrain parent

magma characteristics. In ANNUAL GENERAL MEETING OF THE GEOLOGICAL SOCIETY

OF INDIA (p. 262).

Ritchie, B.W., Crotts, J.C., Zehrer, A. and Volsky, G.T., 2014. Understanding the effects of a

tourism crisis: The impact of the BP oil spill on regional lodging demand. Journal of Travel

Research, 53(1), pp.12-25.

Sammarco, P.W., Kolian, S.R., Warby, R.A., Bouldin, J.L., Subra, W.A. and Porter, S.A., 2016.

Concentrations in human blood of petroleum hydrocarbons associated with the BP/Deepwater

Horizon oil spill, Gulf of Mexico. Archives of toxicology, 90(4), pp.829-837.

Statista. (2018). Samsung smartphone market share worldwide 2009-2017 | Statistic. [online]

Available at: https://www.statista.com/statistics/276477/global-market-share-held-by-samsung-

smartphones/ [Accessed 20 Mar. 2018]

Susskind, A.M., Bonn, M.A., Lawrence, B.C. and Furr, H.L., 2016. Regional contrasts in

consumers’ attitudes and behavior following the BP oil spill. Cornell Hospitality

Quarterly, 57(1), pp.66-81.

Vaast, E., Safadi, H., Lapointe, L. and Negoita, B., 2017. SOCIAL MEDIA AFFORDANCES

FOR CONNECTIVE ACTION: AN EXAMINATION OF MICROBLOGGING USE DURING

THE GULF OF MEXICO OIL SPILL. MIS Quarterly, 41(4).

Whitehead, J., 2015. BCG (Growth Share) Matrix. Wiley Encyclopedia of Management.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.