HI6028 Taxation Law: Partnership Income and Fringe Benefit Tax

VerifiedAdded on 2023/04/23

|12

|2626

|241

Report

AI Summary

This report provides a detailed analysis of taxation law, focusing on partnership income assessment and fringe benefit tax (FBT). It examines the tax liabilities of a partnership, considering ordinary income, deductible expenses, and relevant sections of the ITAA 1997. The report also addresses fringe benefit tax obligations for employers, specifically concerning expense payments and housing benefits, referencing the FBTAA 1986. Calculations for net partnership income and taxable values of fringe benefits are included, offering a comprehensive overview of the tax implications discussed. Desklib provides a platform for students to access similar solved assignments and study tools.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................2

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................3

Conclusion:................................................................................................................................7

Answer to question 2:.................................................................................................................7

Issues:.........................................................................................................................................7

Rule:...........................................................................................................................................7

Application:................................................................................................................................8

Conclusion:................................................................................................................................9

References:...............................................................................................................................10

Table of Contents

Answer to question 1:.................................................................................................................2

Issues:.........................................................................................................................................2

Rule:...........................................................................................................................................2

Application:................................................................................................................................3

Conclusion:................................................................................................................................7

Answer to question 2:.................................................................................................................7

Issues:.........................................................................................................................................7

Rule:...........................................................................................................................................7

Application:................................................................................................................................8

Conclusion:................................................................................................................................9

References:...............................................................................................................................10

2TAXATION LAW

Answer to question 1:

Issues:

Will the taxpayer be liable for assessment under “section 995-1 of the ITAA 1997”

for carrying on the business with the common view of earning profit? Is the taxpayer under

the partnership liable for net income or loss under section 90?

Rule:

According to the “section 90 of the ITAA 1997” the net income of the partnership

includes the assessable income less the permissible deductions (Barkoczy, 2014). “Section

92 of the ITAA 1997” states that the net income or the loss is distributed among the partners

that pay tax based on their distribution. According to the “section 995-1 (1)” partnership is

defined as carrying on of the business with the common view of earning profit.

Ordinary income does not has any definition under the taxation acts. The ordinary

income is included into the taxpayer’s assessable income under the “section 6-5 of the ITAA

1997” (Grange et al., 2014). As held in “Scott v FCT 14 ATD 286” income is viewed as the

word of art and what forms the receipts are comprehended inside it. Receipts must be treated

as income within the ordinary concepts and usage of mankind unless the statute indicate the

intention of treating the income not under the parlance of ordinary income.

There are two positive limbs under “section 8-1, ITAA 1997” that allows a taxpayer

from their taxable income to deduct any loss or outgoing up to the extent that it is occurred

while producing their taxable income or the outgoings is necessarily occurred in carrying on

the business for generating taxable earnings (Jover-Ledesma, 2014). Whereas the negative

limbs of “section 8-1 (2), ITAA 1997” does not allows a taxpayer from deducting any loss or

Answer to question 1:

Issues:

Will the taxpayer be liable for assessment under “section 995-1 of the ITAA 1997”

for carrying on the business with the common view of earning profit? Is the taxpayer under

the partnership liable for net income or loss under section 90?

Rule:

According to the “section 90 of the ITAA 1997” the net income of the partnership

includes the assessable income less the permissible deductions (Barkoczy, 2014). “Section

92 of the ITAA 1997” states that the net income or the loss is distributed among the partners

that pay tax based on their distribution. According to the “section 995-1 (1)” partnership is

defined as carrying on of the business with the common view of earning profit.

Ordinary income does not has any definition under the taxation acts. The ordinary

income is included into the taxpayer’s assessable income under the “section 6-5 of the ITAA

1997” (Grange et al., 2014). As held in “Scott v FCT 14 ATD 286” income is viewed as the

word of art and what forms the receipts are comprehended inside it. Receipts must be treated

as income within the ordinary concepts and usage of mankind unless the statute indicate the

intention of treating the income not under the parlance of ordinary income.

There are two positive limbs under “section 8-1, ITAA 1997” that allows a taxpayer

from their taxable income to deduct any loss or outgoing up to the extent that it is occurred

while producing their taxable income or the outgoings is necessarily occurred in carrying on

the business for generating taxable earnings (Jover-Ledesma, 2014). Whereas the negative

limbs of “section 8-1 (2), ITAA 1997” does not allows a taxpayer from deducting any loss or

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

expenditures under this section. Accordingly, under “section 8-1 (2), ITAA 1997” any loss of

capital, domestic or private in nature are not permissible for income tax deduction.

In context of the “section 25-10 of the ITAA 1997”, repairs can be defined as work

done on the premises, plant, machinery or articles (Kenny et al., 2018). A repair simply

replaces the part of the something or corrects anything that is already existent and has

become worn out or dilapidated. According to “section 25-10” there are some kind of

maintenance that is known as repair such as painting of plant or business premises to correct

the existing deterioration and preventing further deterioration.

Unlike painting, the cost of replacing an item particularly locks and exhaust fans that

are permanent fixture installed in the premises used for producing income is considered is

held as deductible repairs under “section 25-10” (Sadiq et al., 2018). However, it constitutes

that the replacement of the worn out unit by the new unit of identical designs to simply

restore the efficiency of the function and does not constitute as the improvement.

The Australian taxation office states that a business is allowed to instantly write-off

the purchase value of the assets for depreciation given the cost of assets is below $20,000.

Application:

The instances gained from the case study of Olivia and Daniel suggest that they are

carrying on the business under partnership within the meaning of “section 995-1 (1) of the

ITAA 1997” with the common objective of earning profits (Taylor et al., 2018). To determine

the net income or loss of the partnership reference to section 90 has been made in the case

study of Olivia and Daniel. During the year ended 30th June 2017 the partnership reported the

receipts from the cash business sales and receipts from the debtors. With reference to the

judgement made in “Scott v FCT 14 ATD 286” the receipts of Daniel and Olivia under the

partnership are treated as business receipts. Citing “section 6-5 of the ITAA 1997” these

expenditures under this section. Accordingly, under “section 8-1 (2), ITAA 1997” any loss of

capital, domestic or private in nature are not permissible for income tax deduction.

In context of the “section 25-10 of the ITAA 1997”, repairs can be defined as work

done on the premises, plant, machinery or articles (Kenny et al., 2018). A repair simply

replaces the part of the something or corrects anything that is already existent and has

become worn out or dilapidated. According to “section 25-10” there are some kind of

maintenance that is known as repair such as painting of plant or business premises to correct

the existing deterioration and preventing further deterioration.

Unlike painting, the cost of replacing an item particularly locks and exhaust fans that

are permanent fixture installed in the premises used for producing income is considered is

held as deductible repairs under “section 25-10” (Sadiq et al., 2018). However, it constitutes

that the replacement of the worn out unit by the new unit of identical designs to simply

restore the efficiency of the function and does not constitute as the improvement.

The Australian taxation office states that a business is allowed to instantly write-off

the purchase value of the assets for depreciation given the cost of assets is below $20,000.

Application:

The instances gained from the case study of Olivia and Daniel suggest that they are

carrying on the business under partnership within the meaning of “section 995-1 (1) of the

ITAA 1997” with the common objective of earning profits (Taylor et al., 2018). To determine

the net income or loss of the partnership reference to section 90 has been made in the case

study of Olivia and Daniel. During the year ended 30th June 2017 the partnership reported the

receipts from the cash business sales and receipts from the debtors. With reference to the

judgement made in “Scott v FCT 14 ATD 286” the receipts of Daniel and Olivia under the

partnership are treated as business receipts. Citing “section 6-5 of the ITAA 1997” these

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

business receipts are ordinary business income for Daniel and Olivia and it is included for

assessment in determining the net income of partnership.

The partnership also reported drawings. According to the section 92 depending upon

the partner’s interest in the net income or loss the drawings made by Daniel and Olivia are

irrelevant for income tax deduction. The partners Daniel and Olivia reported drawings of

items from the bottle shop for personal use and additional cash of $5,600 for the private

purpose. Citing the negative limbs of “section 8-1 (2), ITAA 1997” the drawings constitute

private expenses and would not be allowed for income tax deductions.

Later repairs and maintenance expense was reported for shop painting and refrigerator

motor replacement. In context of the “section 25-10 of the ITAA 1997”, the shop painting

constitutes repairs of business premises to correct the existing deterioration and preventing

further deterioration. These expenses is included for income tax deductions (Woellner et al.,

2018). On the other hand, the partners also reported expenses for refrigerator motor

replacement. The cost of replacing refrigerator motor replacement represents a permanent

fixture that is installed in the premises used for producing income and hence it is held as

deductible repairs under “section 25-10”.

The partnership also reported the purchase of new air-condition that costs $1200.

Based on the ATO statement the cost of business asset is below $20,000 and hence it is

allowed as permissible income tax deductions.

business receipts are ordinary business income for Daniel and Olivia and it is included for

assessment in determining the net income of partnership.

The partnership also reported drawings. According to the section 92 depending upon

the partner’s interest in the net income or loss the drawings made by Daniel and Olivia are

irrelevant for income tax deduction. The partners Daniel and Olivia reported drawings of

items from the bottle shop for personal use and additional cash of $5,600 for the private

purpose. Citing the negative limbs of “section 8-1 (2), ITAA 1997” the drawings constitute

private expenses and would not be allowed for income tax deductions.

Later repairs and maintenance expense was reported for shop painting and refrigerator

motor replacement. In context of the “section 25-10 of the ITAA 1997”, the shop painting

constitutes repairs of business premises to correct the existing deterioration and preventing

further deterioration. These expenses is included for income tax deductions (Woellner et al.,

2018). On the other hand, the partners also reported expenses for refrigerator motor

replacement. The cost of replacing refrigerator motor replacement represents a permanent

fixture that is installed in the premises used for producing income and hence it is held as

deductible repairs under “section 25-10”.

The partnership also reported the purchase of new air-condition that costs $1200.

Based on the ATO statement the cost of business asset is below $20,000 and hence it is

allowed as permissible income tax deductions.

5TAXATION LAW

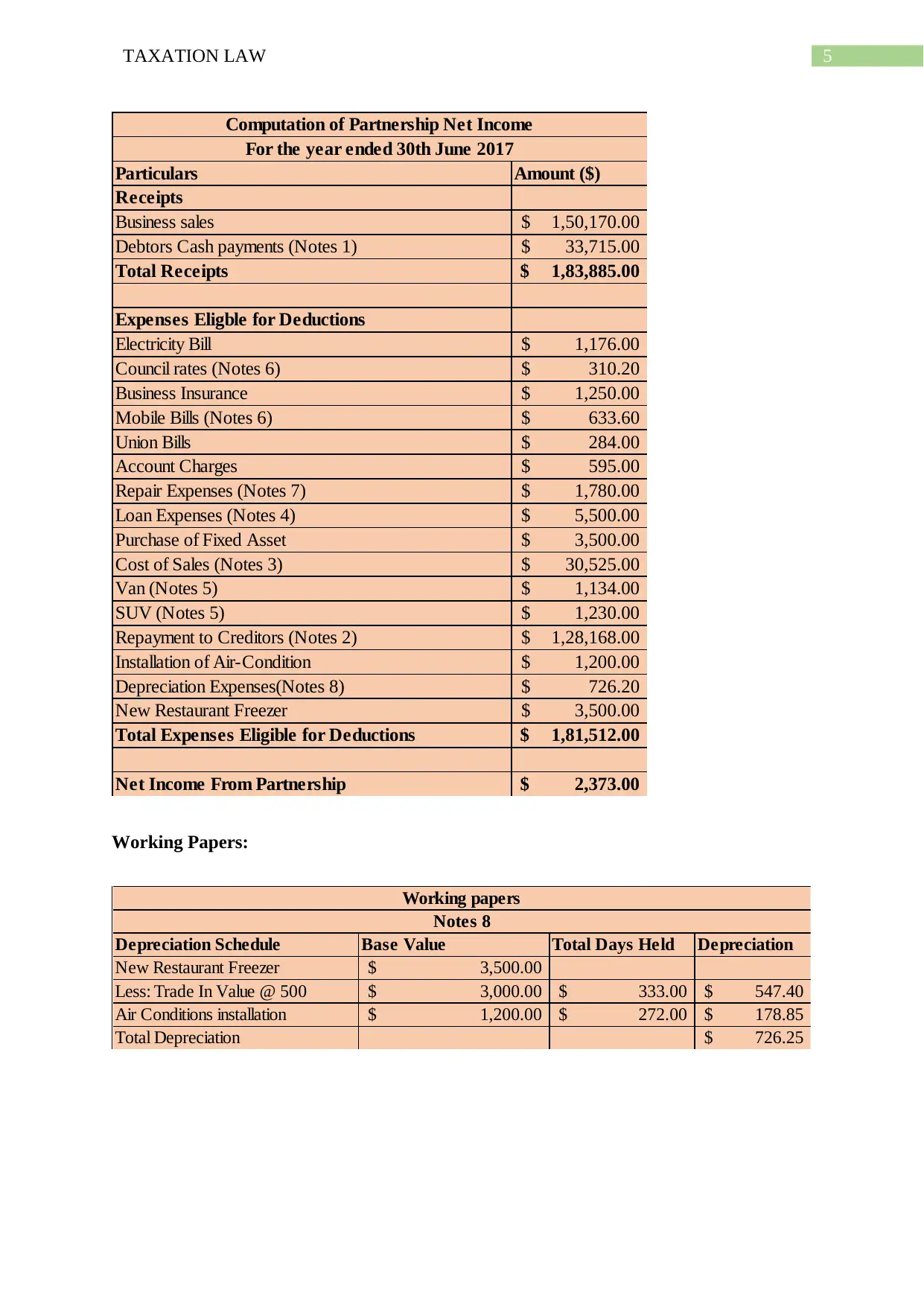

Particulars Amount ($)

Receipts

Business sales 1,50,170.00$

Debtors Cash payments (Notes 1) 33,715.00$

Total Receipts 1,83,885.00$

Expenses Eligble for Deductions

Electricity Bill 1,176.00$

Council rates (Notes 6) 310.20$

Business Insurance 1,250.00$

Mobile Bills (Notes 6) 633.60$

Union Bills 284.00$

Account Charges 595.00$

Repair Expenses (Notes 7) 1,780.00$

Loan Expenses (Notes 4) 5,500.00$

Purchase of Fixed Asset 3,500.00$

Cost of Sales (Notes 3) 30,525.00$

Van (Notes 5) 1,134.00$

SUV (Notes 5) 1,230.00$

Repayment to Creditors (Notes 2) 1,28,168.00$

Installation of Air-Condition 1,200.00$

Depreciation Expenses(Notes 8) 726.20$

New Restaurant Freezer 3,500.00$

Total Expenses Eligible for Deductions 1,81,512.00$

Net Income From Partnership 2,373.00$

Computation of Partnership Net Income

For the year ended 30th June 2017

Working Papers:

Depreciation Schedule Base Value Total Days Held Depreciation

New Restaurant Freezer 3,500.00$

Less: Trade In Value @ 500 3,000.00$ 333.00$ 547.40$

Air Conditions installation 1,200.00$ 272.00$ 178.85$

Total Depreciation 726.25$

Working papers

Notes 8

Particulars Amount ($)

Receipts

Business sales 1,50,170.00$

Debtors Cash payments (Notes 1) 33,715.00$

Total Receipts 1,83,885.00$

Expenses Eligble for Deductions

Electricity Bill 1,176.00$

Council rates (Notes 6) 310.20$

Business Insurance 1,250.00$

Mobile Bills (Notes 6) 633.60$

Union Bills 284.00$

Account Charges 595.00$

Repair Expenses (Notes 7) 1,780.00$

Loan Expenses (Notes 4) 5,500.00$

Purchase of Fixed Asset 3,500.00$

Cost of Sales (Notes 3) 30,525.00$

Van (Notes 5) 1,134.00$

SUV (Notes 5) 1,230.00$

Repayment to Creditors (Notes 2) 1,28,168.00$

Installation of Air-Condition 1,200.00$

Depreciation Expenses(Notes 8) 726.20$

New Restaurant Freezer 3,500.00$

Total Expenses Eligible for Deductions 1,81,512.00$

Net Income From Partnership 2,373.00$

Computation of Partnership Net Income

For the year ended 30th June 2017

Working Papers:

Depreciation Schedule Base Value Total Days Held Depreciation

New Restaurant Freezer 3,500.00$

Less: Trade In Value @ 500 3,000.00$ 333.00$ 547.40$

Air Conditions installation 1,200.00$ 272.00$ 178.85$

Total Depreciation 726.25$

Working papers

Notes 8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

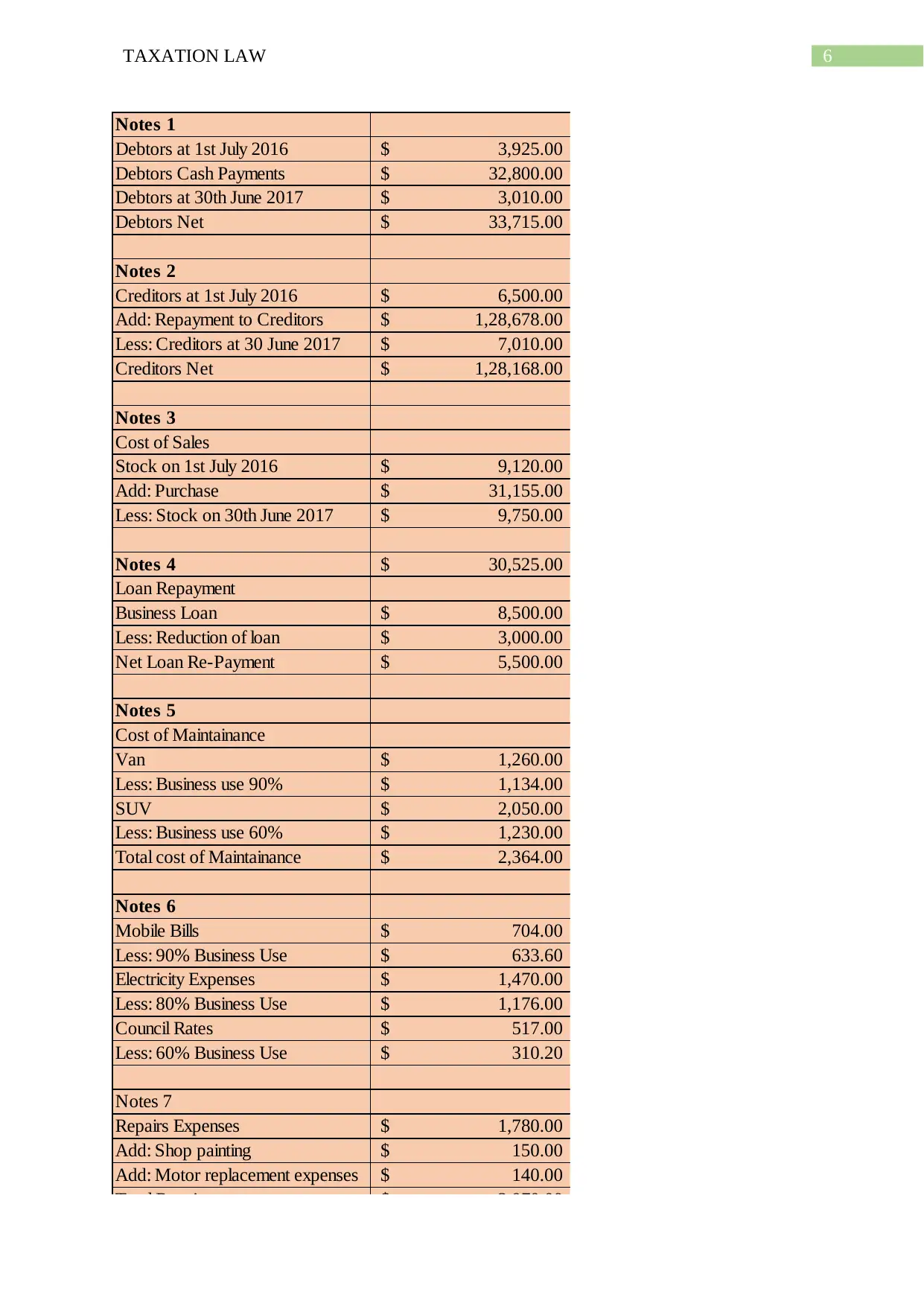

Notes 1

Debtors at 1st July 2016 3,925.00$

Debtors Cash Payments 32,800.00$

Debtors at 30th June 2017 3,010.00$

Debtors Net 33,715.00$

Notes 2

Creditors at 1st July 2016 6,500.00$

Add: Repayment to Creditors 1,28,678.00$

Less: Creditors at 30 June 2017 7,010.00$

Creditors Net 1,28,168.00$

Notes 3

Cost of Sales

Stock on 1st July 2016 9,120.00$

Add: Purchase 31,155.00$

Less: Stock on 30th June 2017 9,750.00$

Notes 4 30,525.00$

Loan Repayment

Business Loan 8,500.00$

Less: Reduction of loan 3,000.00$

Net Loan Re-Payment 5,500.00$

Notes 5

Cost of Maintainance

Van 1,260.00$

Less: Business use 90% 1,134.00$

SUV 2,050.00$

Less: Business use 60% 1,230.00$

Total cost of Maintainance 2,364.00$

Notes 6

Mobile Bills 704.00$

Less: 90% Business Use 633.60$

Electricity Expenses 1,470.00$

Less: 80% Business Use 1,176.00$

Council Rates 517.00$

Less: 60% Business Use 310.20$

Notes 7

Repairs Expenses 1,780.00$

Add: Shop painting 150.00$

Add: Motor replacement expenses 140.00$

Total Repairs 2,070.00$

Notes 1

Debtors at 1st July 2016 3,925.00$

Debtors Cash Payments 32,800.00$

Debtors at 30th June 2017 3,010.00$

Debtors Net 33,715.00$

Notes 2

Creditors at 1st July 2016 6,500.00$

Add: Repayment to Creditors 1,28,678.00$

Less: Creditors at 30 June 2017 7,010.00$

Creditors Net 1,28,168.00$

Notes 3

Cost of Sales

Stock on 1st July 2016 9,120.00$

Add: Purchase 31,155.00$

Less: Stock on 30th June 2017 9,750.00$

Notes 4 30,525.00$

Loan Repayment

Business Loan 8,500.00$

Less: Reduction of loan 3,000.00$

Net Loan Re-Payment 5,500.00$

Notes 5

Cost of Maintainance

Van 1,260.00$

Less: Business use 90% 1,134.00$

SUV 2,050.00$

Less: Business use 60% 1,230.00$

Total cost of Maintainance 2,364.00$

Notes 6

Mobile Bills 704.00$

Less: 90% Business Use 633.60$

Electricity Expenses 1,470.00$

Less: 80% Business Use 1,176.00$

Council Rates 517.00$

Less: 60% Business Use 310.20$

Notes 7

Repairs Expenses 1,780.00$

Add: Shop painting 150.00$

Add: Motor replacement expenses 140.00$

Total Repairs 2,070.00$

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Conclusion:

On a conclusive note, under section 90 the net income of partners following the

deductions stood $2,373 for the year ended 30th June 2017.

Answer to question 2:

Issues:

The current issue is based on determining the amount of fringe benefit tax payable by

the employer in respect of the fringe benefit provided to the employee under the legislation of

“FBTAA 1986”.

Rule:

Fringe benefit is referred as the payment that is made to the employee however, it is

recognized diverse from the salary or wages. As defined under the fringe benefit tax

legislation, a fringe benefit is regarded as the benefit that is provided by the employer to the

member of the staff in relation to their employment (Austlii.edu.au, 2019). The fringe benefit

tax is paid by the employer, if the employer makes the payment to the employee, company

director or the office holder that is subjected to the obligation of withholding. However, the

employer here can claim a deduction on the income tax relating to the cost of providing

fringe benefit and relating to the amount of fringe benefit tax the employer pays.

“Section 20 of the FBTAA 1986” is related to the expense payment fringe benefit.

“Under section 20”, where the provider of benefit makes any payment either whole or in part

as the obligation of another person to pay the amount to the third party in relation the

expenses incurred by the recipient constitute expense payment fringe benefit (Wilson et al.,

2015). The taxable value of the expenditure payment fringe benefit for employer is the

amount that they reimburse of pay.

Conclusion:

On a conclusive note, under section 90 the net income of partners following the

deductions stood $2,373 for the year ended 30th June 2017.

Answer to question 2:

Issues:

The current issue is based on determining the amount of fringe benefit tax payable by

the employer in respect of the fringe benefit provided to the employee under the legislation of

“FBTAA 1986”.

Rule:

Fringe benefit is referred as the payment that is made to the employee however, it is

recognized diverse from the salary or wages. As defined under the fringe benefit tax

legislation, a fringe benefit is regarded as the benefit that is provided by the employer to the

member of the staff in relation to their employment (Austlii.edu.au, 2019). The fringe benefit

tax is paid by the employer, if the employer makes the payment to the employee, company

director or the office holder that is subjected to the obligation of withholding. However, the

employer here can claim a deduction on the income tax relating to the cost of providing

fringe benefit and relating to the amount of fringe benefit tax the employer pays.

“Section 20 of the FBTAA 1986” is related to the expense payment fringe benefit.

“Under section 20”, where the provider of benefit makes any payment either whole or in part

as the obligation of another person to pay the amount to the third party in relation the

expenses incurred by the recipient constitute expense payment fringe benefit (Wilson et al.,

2015). The taxable value of the expenditure payment fringe benefit for employer is the

amount that they reimburse of pay.

8TAXATION LAW

“Section 25 of the FBTAA 1986” provides with the housing fringe benefit (Reid

Robertson, 2015). According to the “section 25 of the FBTAA 1986” housing fringe benefit

arises where the existence through the year or the part of the year of housing right provided to

the recipient by the provider should be considered as the benefit provided by the provider to

the recipient in relation to the year of taxation (Leibowitz, 2014). “Section 27 of the FBTAA

1986” provides for the determination of the market value of housing right. Under “section 27

(1)” to determine the market value of the recipients present housing right in relation to

housing fringe benefit, where the recipient is required to make payment in discharge either in

whole or in part as the obligation of recipient to pay the amount in relation to the expenses

occurred.

Application:

John who is employed as senior executive with the printing company and as the part

of his remuneration package the employer pays the child school fees of John that costs

$15,000. Under “section 20 of the FBTAA 1986”, the provider of benefit here is the

employer that makes payment of John’s child school fees either whole or in part as the

obligation of another person to pay the amount to the third party in relation the expenses

incurred by the employee and constitutes expense payment fringe benefit. The taxable value

of the expenditure payment fringe benefit for employer is the amount that is paid for John’s

child school fees.

John is also provided with the unit of accommodation in Sydney apartment all

through the FBT year to which John contributes $100 rent per week while the market value of

rent is $800 per week. Under “section 25, FBTAA 1986” the receipt of accommodation to

John by his employer constitutes housing fringe benefit (Popkin, 2017). While John’s

employer would be liable for the taxable value of the housing fringe benefit under “section

27 (1) of the FBTAA 1986”. The taxable value of the housing fringe benefit for the employer

“Section 25 of the FBTAA 1986” provides with the housing fringe benefit (Reid

Robertson, 2015). According to the “section 25 of the FBTAA 1986” housing fringe benefit

arises where the existence through the year or the part of the year of housing right provided to

the recipient by the provider should be considered as the benefit provided by the provider to

the recipient in relation to the year of taxation (Leibowitz, 2014). “Section 27 of the FBTAA

1986” provides for the determination of the market value of housing right. Under “section 27

(1)” to determine the market value of the recipients present housing right in relation to

housing fringe benefit, where the recipient is required to make payment in discharge either in

whole or in part as the obligation of recipient to pay the amount in relation to the expenses

occurred.

Application:

John who is employed as senior executive with the printing company and as the part

of his remuneration package the employer pays the child school fees of John that costs

$15,000. Under “section 20 of the FBTAA 1986”, the provider of benefit here is the

employer that makes payment of John’s child school fees either whole or in part as the

obligation of another person to pay the amount to the third party in relation the expenses

incurred by the employee and constitutes expense payment fringe benefit. The taxable value

of the expenditure payment fringe benefit for employer is the amount that is paid for John’s

child school fees.

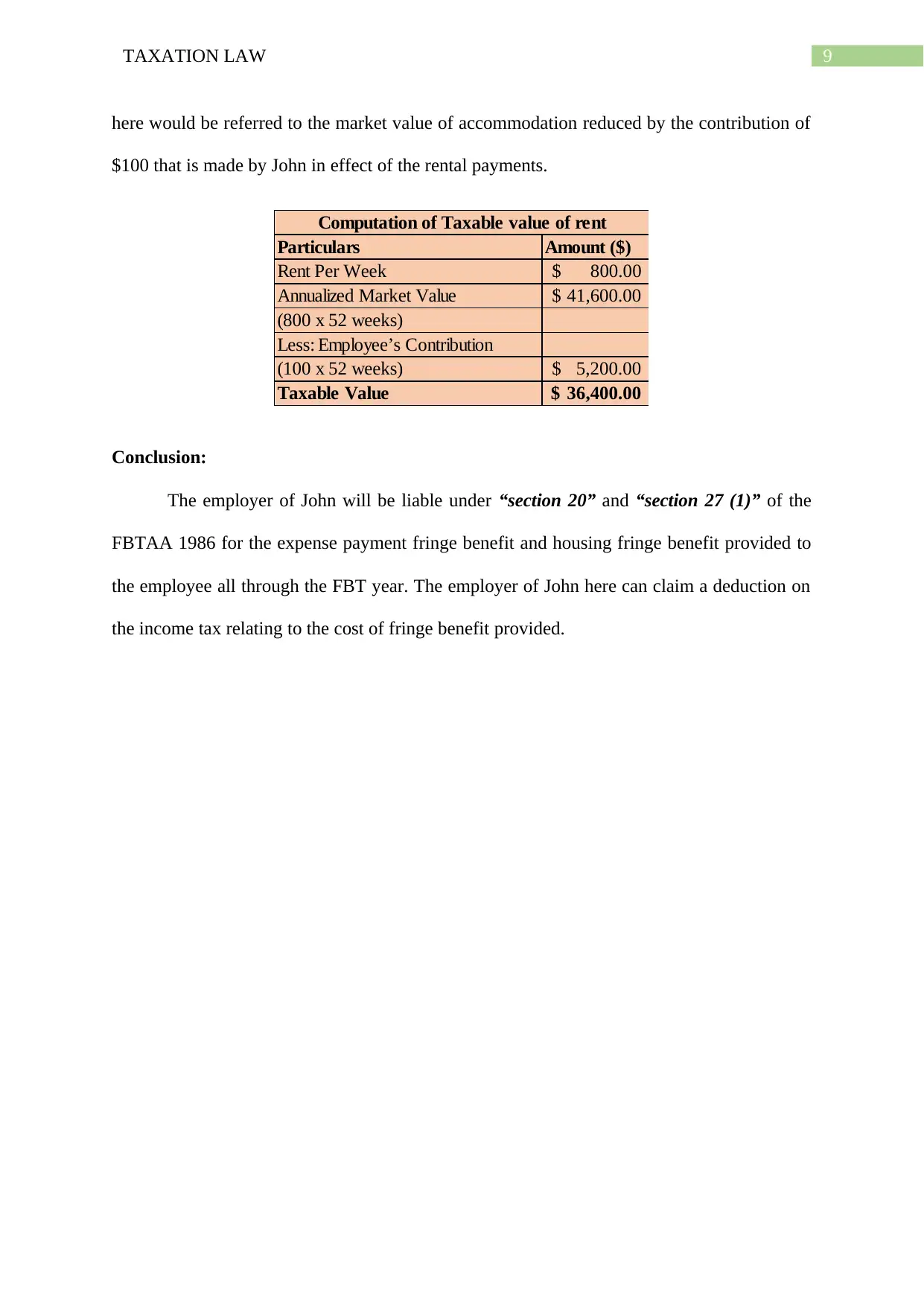

John is also provided with the unit of accommodation in Sydney apartment all

through the FBT year to which John contributes $100 rent per week while the market value of

rent is $800 per week. Under “section 25, FBTAA 1986” the receipt of accommodation to

John by his employer constitutes housing fringe benefit (Popkin, 2017). While John’s

employer would be liable for the taxable value of the housing fringe benefit under “section

27 (1) of the FBTAA 1986”. The taxable value of the housing fringe benefit for the employer

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

here would be referred to the market value of accommodation reduced by the contribution of

$100 that is made by John in effect of the rental payments.

Particulars Amount ($)

Rent Per Week 800.00$

Annualized Market Value 41,600.00$

(800 x 52 weeks)

Less: Employee’s Contribution

(100 x 52 weeks) 5,200.00$

Taxable Value 36,400.00$

Computation of Taxable value of rent

Conclusion:

The employer of John will be liable under “section 20” and “section 27 (1)” of the

FBTAA 1986 for the expense payment fringe benefit and housing fringe benefit provided to

the employee all through the FBT year. The employer of John here can claim a deduction on

the income tax relating to the cost of fringe benefit provided.

here would be referred to the market value of accommodation reduced by the contribution of

$100 that is made by John in effect of the rental payments.

Particulars Amount ($)

Rent Per Week 800.00$

Annualized Market Value 41,600.00$

(800 x 52 weeks)

Less: Employee’s Contribution

(100 x 52 weeks) 5,200.00$

Taxable Value 36,400.00$

Computation of Taxable value of rent

Conclusion:

The employer of John will be liable under “section 20” and “section 27 (1)” of the

FBTAA 1986 for the expense payment fringe benefit and housing fringe benefit provided to

the employee all through the FBT year. The employer of John here can claim a deduction on

the income tax relating to the cost of fringe benefit provided.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

References:

Barkoczy, S. (2014). Foundations of taxation law 2014.

FRINGE BENEFITS TAX ASSESSMENT ACT 1986. (2019). Retrieved from

http://classic.austlii.edu.au/au/legis/cth/num_act/fbtaa1986312/

Grange, J., Jover-Ledesma, G., & Maydew, G. (2014). Principles of business taxation.

Jover-Ledesma, G. (2014). Principles of business taxation 2015. Cch Incorporated.

Kenny, P., Blissenden, M., & Villios, S. (2018). Australian Tax 2018.

Leibowitz, A. (2014). Fringe benefits in employee compensation. In The measurement of

labor cost (pp. 371-394). University of Chicago Press.

Popkin, W. D. (2017). The Taxation of Employee Fringe Benefits. BCL Rev., 22, 439.

Reid, G.L. & Robertson, D.J. eds., (2015). Fringe benefits, labour costs, and social

security (No. 5). Allen & Unwin.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., & Obst, W. et al.

(2018). Principles of taxation law 2018.

Taylor, C., Walpole, M., Burton, M., Ciro, T., & Murray, I. (2018). Understanding taxation

law 2018.

Wilson, M., Northcraft, G. B., & Neale, M. A. (2015). The perceived value of fringe

benefits. Personnel Psychology, 38(2), 309-320.

Woellner, R., Barkoczy, S., & Murphy, S. (2018). Australian Taxation Law 2018 ebook 28e.

Melbourne: OUPANZ.

References:

Barkoczy, S. (2014). Foundations of taxation law 2014.

FRINGE BENEFITS TAX ASSESSMENT ACT 1986. (2019). Retrieved from

http://classic.austlii.edu.au/au/legis/cth/num_act/fbtaa1986312/

Grange, J., Jover-Ledesma, G., & Maydew, G. (2014). Principles of business taxation.

Jover-Ledesma, G. (2014). Principles of business taxation 2015. Cch Incorporated.

Kenny, P., Blissenden, M., & Villios, S. (2018). Australian Tax 2018.

Leibowitz, A. (2014). Fringe benefits in employee compensation. In The measurement of

labor cost (pp. 371-394). University of Chicago Press.

Popkin, W. D. (2017). The Taxation of Employee Fringe Benefits. BCL Rev., 22, 439.

Reid, G.L. & Robertson, D.J. eds., (2015). Fringe benefits, labour costs, and social

security (No. 5). Allen & Unwin.

Sadiq, K., Coleman, C., Hanegbi, R., Jogarajan, S., Krever, R., & Obst, W. et al.

(2018). Principles of taxation law 2018.

Taylor, C., Walpole, M., Burton, M., Ciro, T., & Murray, I. (2018). Understanding taxation

law 2018.

Wilson, M., Northcraft, G. B., & Neale, M. A. (2015). The perceived value of fringe

benefits. Personnel Psychology, 38(2), 309-320.

Woellner, R., Barkoczy, S., & Murphy, S. (2018). Australian Taxation Law 2018 ebook 28e.

Melbourne: OUPANZ.

11TAXATION LAW

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.