Taxation Law Assignment: Analyzing Income, FBT, and Capital Gains Tax

VerifiedAdded on 2023/06/11

|6

|1254

|306

Homework Assignment

AI Summary

This assignment solution provides a detailed analysis of various taxation law concepts. It addresses whether payments received by Hilary, a mountain climber, for her life story, manuscript sales, and photographs constitute income from personal exertion, concluding they do not due to the lack of intrinsic commercial value in the writing or photography skills. The solution then calculates the taxable value of a car fringe benefit using the statutory formula under FBTAA 1986, considering the car's cost, usage, and employee contributions. Further, it examines the tax implications of a son returning money to his parent, distinguishing between principal repayment (non-taxable) and interest payment (considered a gift and thus non-taxable). Finally, the assignment addresses capital gains tax implications on property sales, including scenarios with different CGT eras, sales to family members at reduced prices, and property ownership by a company, calculating taxable capital gains using appropriate methods like the discount and indexation methods.

TAXATION LAW

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

The analysis of the three payments is indicated below.

Payment from Autobiography

It is evident that Hilary does not possess writing skills and hence the payment offered by

newspaper to Hilary is not for writing the book but to instead communicate personal

information about her life which the newspaper can copyright. This information will have

commercial value owing to famed status of Hilary (CCH, 2013). The act of writing does not

produce income or cashflows but only is a transfer means for the information which already

exists. This position is supported by Brent vs Federal Commissioner of Taxation (1971) 125

CLR case (Barkoczy, 2015). Thus, the proceeds are not classified as income from personal

exertion.

Payment from Manuscript

Since the writing as an activity does not lead to commercial income, hence it can be

understood the value of manuscript is on account of the information contained therein and

association with Hilary. Thus, the proceeds are not classified as income from personal

exertion (Gilders et. a., 2016).

Payment from Photograph

The photographs of the expeditions do not derive value on any superior photography skills

possessed by Hilary but rather on account of these pictures capturing the famous expeditions

of Hilary. Considering that the act of photography lacks any intrinsic worth, hence the

proceeds are not classified as income from personal exertion (Sadiq et. al., 2016).

Change of intent for book

Considering that act of writing is not related with production of commercial value, thus the

underlying intention while writing would lack any significance in relation to the underlying

tax treatment. Hence, there would be any change in the tax treatment owing to intention being

self-satisfaction and not earning money (Deustch et. al., 2016).

1

The analysis of the three payments is indicated below.

Payment from Autobiography

It is evident that Hilary does not possess writing skills and hence the payment offered by

newspaper to Hilary is not for writing the book but to instead communicate personal

information about her life which the newspaper can copyright. This information will have

commercial value owing to famed status of Hilary (CCH, 2013). The act of writing does not

produce income or cashflows but only is a transfer means for the information which already

exists. This position is supported by Brent vs Federal Commissioner of Taxation (1971) 125

CLR case (Barkoczy, 2015). Thus, the proceeds are not classified as income from personal

exertion.

Payment from Manuscript

Since the writing as an activity does not lead to commercial income, hence it can be

understood the value of manuscript is on account of the information contained therein and

association with Hilary. Thus, the proceeds are not classified as income from personal

exertion (Gilders et. a., 2016).

Payment from Photograph

The photographs of the expeditions do not derive value on any superior photography skills

possessed by Hilary but rather on account of these pictures capturing the famous expeditions

of Hilary. Considering that the act of photography lacks any intrinsic worth, hence the

proceeds are not classified as income from personal exertion (Sadiq et. al., 2016).

Change of intent for book

Considering that act of writing is not related with production of commercial value, thus the

underlying intention while writing would lack any significance in relation to the underlying

tax treatment. Hence, there would be any change in the tax treatment owing to intention being

self-satisfaction and not earning money (Deustch et. al., 2016).

1

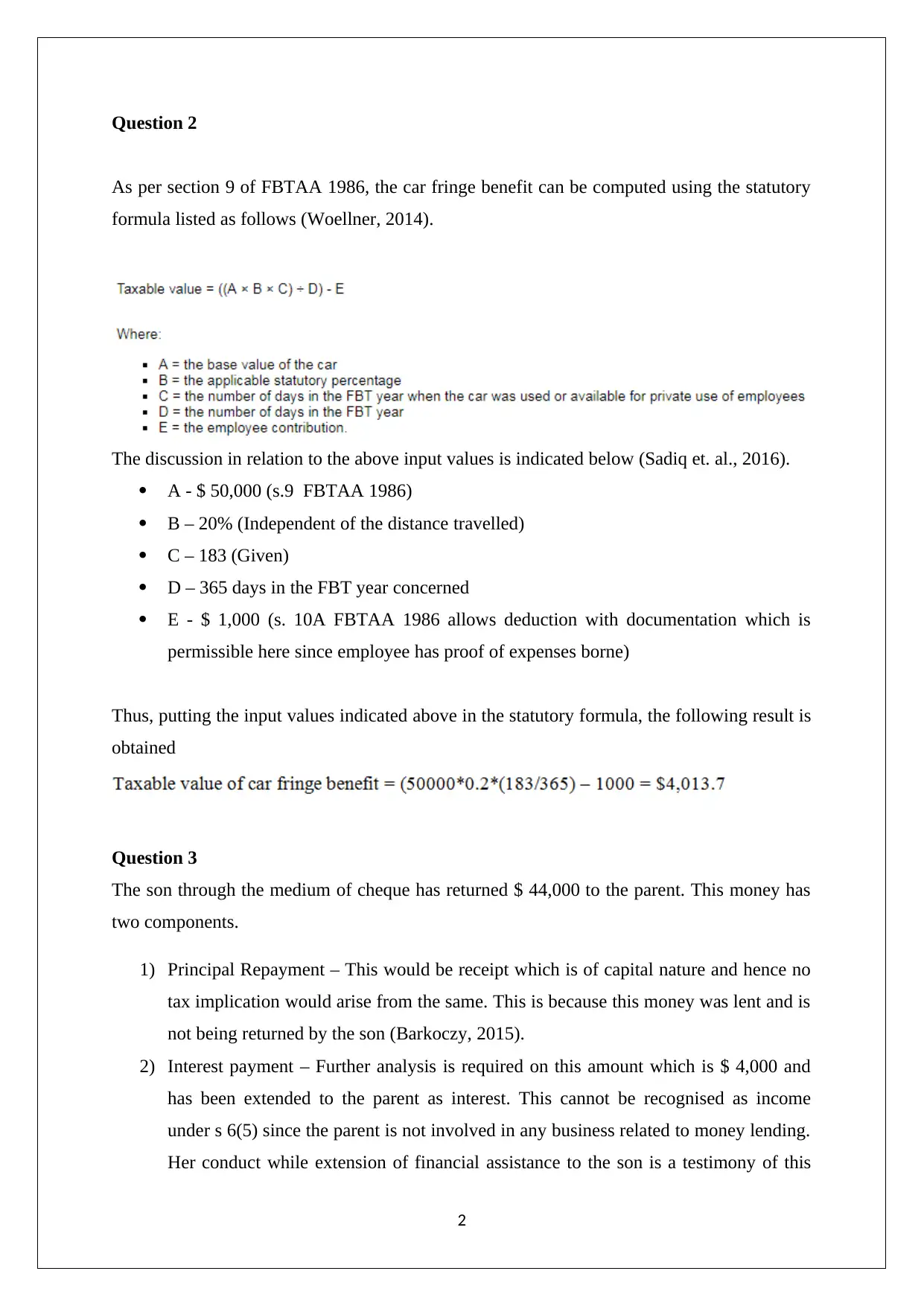

Question 2

As per section 9 of FBTAA 1986, the car fringe benefit can be computed using the statutory

formula listed as follows (Woellner, 2014).

The discussion in relation to the above input values is indicated below (Sadiq et. al., 2016).

A - $ 50,000 (s.9 FBTAA 1986)

B – 20% (Independent of the distance travelled)

C – 183 (Given)

D – 365 days in the FBT year concerned

E - $ 1,000 (s. 10A FBTAA 1986 allows deduction with documentation which is

permissible here since employee has proof of expenses borne)

Thus, putting the input values indicated above in the statutory formula, the following result is

obtained

Question 3

The son through the medium of cheque has returned $ 44,000 to the parent. This money has

two components.

1) Principal Repayment – This would be receipt which is of capital nature and hence no

tax implication would arise from the same. This is because this money was lent and is

not being returned by the son (Barkoczy, 2015).

2) Interest payment – Further analysis is required on this amount which is $ 4,000 and

has been extended to the parent as interest. This cannot be recognised as income

under s 6(5) since the parent is not involved in any business related to money lending.

Her conduct while extension of financial assistance to the son is a testimony of this

2

As per section 9 of FBTAA 1986, the car fringe benefit can be computed using the statutory

formula listed as follows (Woellner, 2014).

The discussion in relation to the above input values is indicated below (Sadiq et. al., 2016).

A - $ 50,000 (s.9 FBTAA 1986)

B – 20% (Independent of the distance travelled)

C – 183 (Given)

D – 365 days in the FBT year concerned

E - $ 1,000 (s. 10A FBTAA 1986 allows deduction with documentation which is

permissible here since employee has proof of expenses borne)

Thus, putting the input values indicated above in the statutory formula, the following result is

obtained

Question 3

The son through the medium of cheque has returned $ 44,000 to the parent. This money has

two components.

1) Principal Repayment – This would be receipt which is of capital nature and hence no

tax implication would arise from the same. This is because this money was lent and is

not being returned by the son (Barkoczy, 2015).

2) Interest payment – Further analysis is required on this amount which is $ 4,000 and

has been extended to the parent as interest. This cannot be recognised as income

under s 6(5) since the parent is not involved in any business related to money lending.

Her conduct while extension of financial assistance to the son is a testimony of this

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Woellner, 2014). Further, $ 4,000 would not be recognised as income under s.15(15).

This section deals with isolated transactions which are enacted to earn profit.

However, this is not the case here since the parent made it obvious that there is no

desire of earning any interest since this was stated to the son (Gilders et. al., 2016).

However, this amount can be termed as a gift owing to the conditions outlined in

TR2005/13 (ATO, 2005).

Through cheque there is transfer of money to the parent.

The parent did not want the $ 4,00 but still same paid by son.

The son does not need to give money for fulfilment of reciprocal expectations since

they can be fulfilled without the same also.

The gift is driven by gratitude and underlying benefaction towards the parent.

On the basis of the arguments highlighted above, it may be concluded that no tax outflow

would occur on the acceptance of $ 44,000 cheque from the son.

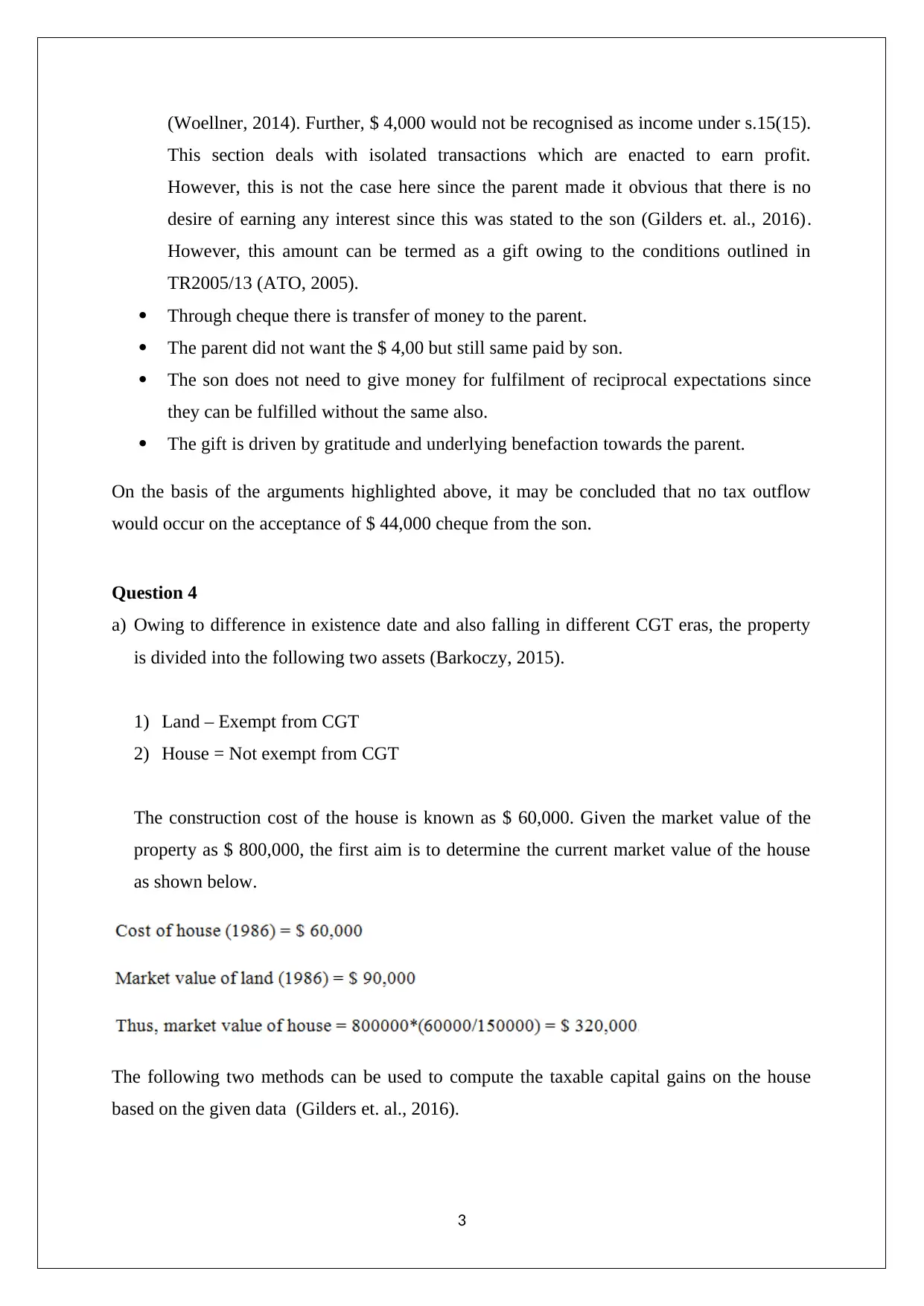

Question 4

a) Owing to difference in existence date and also falling in different CGT eras, the property

is divided into the following two assets (Barkoczy, 2015).

1) Land – Exempt from CGT

2) House = Not exempt from CGT

The construction cost of the house is known as $ 60,000. Given the market value of the

property as $ 800,000, the first aim is to determine the current market value of the house

as shown below.

The following two methods can be used to compute the taxable capital gains on the house

based on the given data (Gilders et. al., 2016).

3

This section deals with isolated transactions which are enacted to earn profit.

However, this is not the case here since the parent made it obvious that there is no

desire of earning any interest since this was stated to the son (Gilders et. al., 2016).

However, this amount can be termed as a gift owing to the conditions outlined in

TR2005/13 (ATO, 2005).

Through cheque there is transfer of money to the parent.

The parent did not want the $ 4,00 but still same paid by son.

The son does not need to give money for fulfilment of reciprocal expectations since

they can be fulfilled without the same also.

The gift is driven by gratitude and underlying benefaction towards the parent.

On the basis of the arguments highlighted above, it may be concluded that no tax outflow

would occur on the acceptance of $ 44,000 cheque from the son.

Question 4

a) Owing to difference in existence date and also falling in different CGT eras, the property

is divided into the following two assets (Barkoczy, 2015).

1) Land – Exempt from CGT

2) House = Not exempt from CGT

The construction cost of the house is known as $ 60,000. Given the market value of the

property as $ 800,000, the first aim is to determine the current market value of the house

as shown below.

The following two methods can be used to compute the taxable capital gains on the house

based on the given data (Gilders et. al., 2016).

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

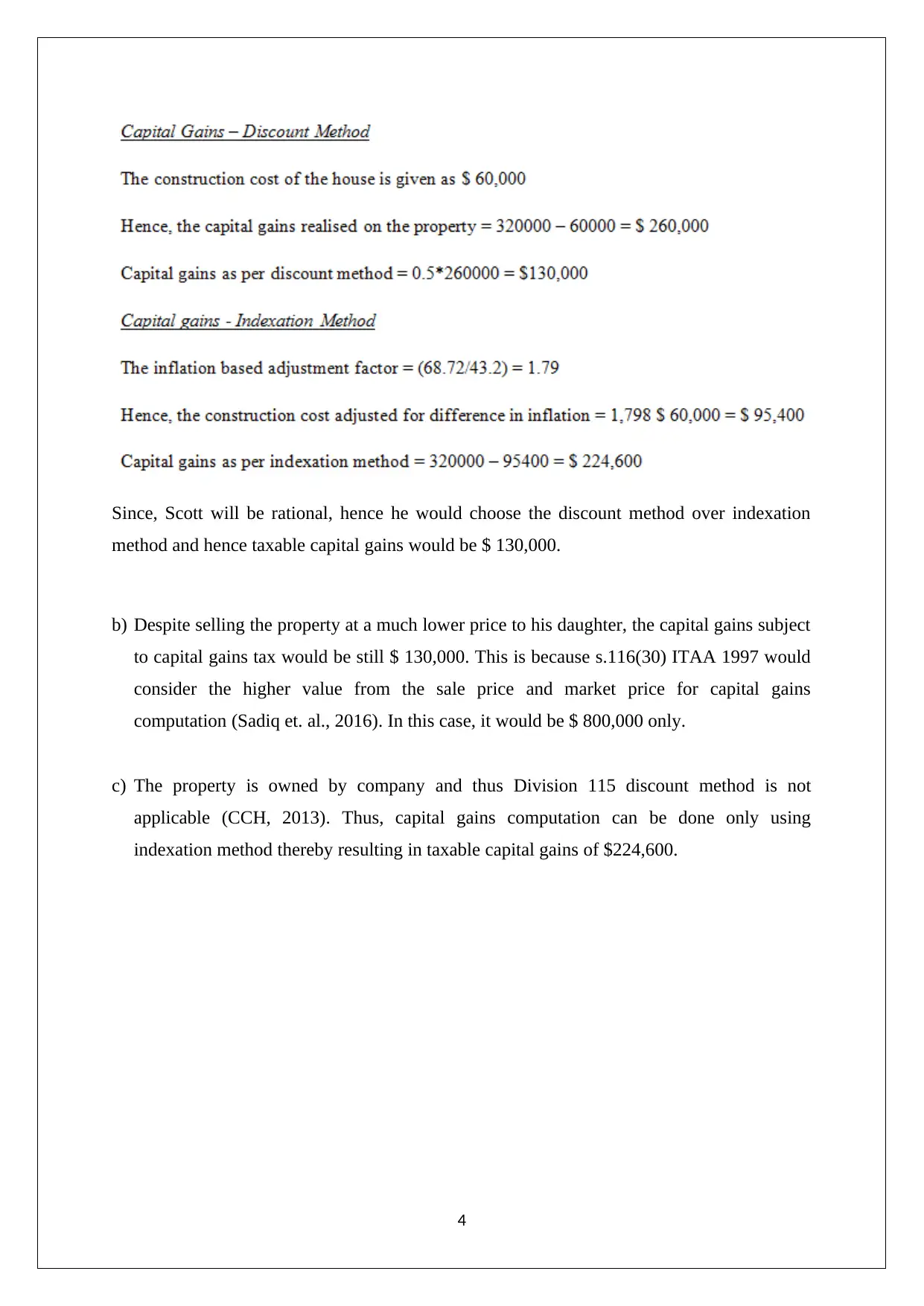

Since, Scott will be rational, hence he would choose the discount method over indexation

method and hence taxable capital gains would be $ 130,000.

b) Despite selling the property at a much lower price to his daughter, the capital gains subject

to capital gains tax would be still $ 130,000. This is because s.116(30) ITAA 1997 would

consider the higher value from the sale price and market price for capital gains

computation (Sadiq et. al., 2016). In this case, it would be $ 800,000 only.

c) The property is owned by company and thus Division 115 discount method is not

applicable (CCH, 2013). Thus, capital gains computation can be done only using

indexation method thereby resulting in taxable capital gains of $224,600.

4

method and hence taxable capital gains would be $ 130,000.

b) Despite selling the property at a much lower price to his daughter, the capital gains subject

to capital gains tax would be still $ 130,000. This is because s.116(30) ITAA 1997 would

consider the higher value from the sale price and market price for capital gains

computation (Sadiq et. al., 2016). In this case, it would be $ 800,000 only.

c) The property is owned by company and thus Division 115 discount method is not

applicable (CCH, 2013). Thus, capital gains computation can be done only using

indexation method thereby resulting in taxable capital gains of $224,600.

4

References

ATO (2005), Tax Ruling TR 2005/13, Retrieved from http://law.ato.gov.au/atolaw/view.htm?

Docid=TXR/TR200513/NAT/ATO/00001

Barkoczy, S. (2015) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University

Press.

CCH (2013), Australian Master Tax Guide 2013, 51st ed., Sydney: Wolters Kluwer

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., & Snape, T. (2016) Australian tax

handbook. 8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. & Ciro, T. (2016) Understanding taxation

law 2016. 9th ed. Sydney: LexisNexis/Butterworths.

Sadiq, K, Coleman, C, Hanegbi, R, Jogarajan, S, Krever, R, Obst, W, & Ting, A

(2016) , Principles of Taxation Law 2016, 8th ed., Pymont: Thomson Reuters

Woellner, R (2014), Australian taxation law 2014 7th ed. North Ryde: CCH Australia

5

ATO (2005), Tax Ruling TR 2005/13, Retrieved from http://law.ato.gov.au/atolaw/view.htm?

Docid=TXR/TR200513/NAT/ATO/00001

Barkoczy, S. (2015) Foundation of Taxation Law 2017. 9th ed. Sydney: Oxford University

Press.

CCH (2013), Australian Master Tax Guide 2013, 51st ed., Sydney: Wolters Kluwer

Deutsch, R., Freizer, M., Fullerton, I., Hanley, P., & Snape, T. (2016) Australian tax

handbook. 8th ed. Pymont: Thomson Reuters.

Gilders, F., Taylor, J., Walpole, M., Burton, M. & Ciro, T. (2016) Understanding taxation

law 2016. 9th ed. Sydney: LexisNexis/Butterworths.

Sadiq, K, Coleman, C, Hanegbi, R, Jogarajan, S, Krever, R, Obst, W, & Ting, A

(2016) , Principles of Taxation Law 2016, 8th ed., Pymont: Thomson Reuters

Woellner, R (2014), Australian taxation law 2014 7th ed. North Ryde: CCH Australia

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.