Taxation Law Assignment - Principles, Cases, and ATO Measures

VerifiedAdded on 2023/01/04

|12

|2952

|67

Homework Assignment

AI Summary

This taxation law assignment provides a comprehensive analysis of the Australian tax system. It begins with an overview of the legislative powers related to taxation, specifically referencing Section 51 (ii) of the Constitution and the roles of the Australian government and the ATO in tax policy and administration. The assignment then explores Double Tax Agreements (DTA), using the US-Australia DTA as an example, to determine the taxability of business profits. The core of the assignment focuses on capital gains tax (CGT), examining the application of CGT to various scenarios, including land subdivision and the sale of assets, with detailed calculations of capital gains and tax liabilities. Furthermore, the assignment addresses post-cessation expenditure and its deductibility, referencing relevant case law. It also provides an in-depth analysis of CGT implications for personal use assets and vacant land. Finally, the assignment includes an analysis of two articles from Afr.com, one discussing ATO measures to remove "inequitable" inquiries and the other concerning measures to close the gap on multinational tax avoidance, connecting these issues to broader tax policy principles and concepts.

Running head: TAXATION LAW

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Taxation Law

Name of the Student

Name of the University

Authors Note

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1TAXATION LAW

Table of Contents

Answer to question 1:.................................................................................................................3

Answer to A:..........................................................................................................................3

Answer to B:..........................................................................................................................3

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................4

Part 1:.....................................................................................................................................4

Answer to A:..........................................................................................................................4

Answer to B:..........................................................................................................................5

Answer to part 2:........................................................................................................................5

Answer to question 4:.................................................................................................................6

Answer to question 5:.................................................................................................................7

Answer to question 6:.................................................................................................................8

Article 1: ATO measures of removing “inequitable” inquiry:...................................................8

Article 2: ATO considers measures for closing gap on multinational Tax Avoidance:........9

Answer to question 7:.................................................................................................................9

References:...............................................................................................................................11

Table of Contents

Answer to question 1:.................................................................................................................3

Answer to A:..........................................................................................................................3

Answer to B:..........................................................................................................................3

Answer to question 2:.................................................................................................................4

Answer to question 3:.................................................................................................................4

Part 1:.....................................................................................................................................4

Answer to A:..........................................................................................................................4

Answer to B:..........................................................................................................................5

Answer to part 2:........................................................................................................................5

Answer to question 4:.................................................................................................................6

Answer to question 5:.................................................................................................................7

Answer to question 6:.................................................................................................................8

Article 1: ATO measures of removing “inequitable” inquiry:...................................................8

Article 2: ATO considers measures for closing gap on multinational Tax Avoidance:........9

Answer to question 7:.................................................................................................................9

References:...............................................................................................................................11

2TAXATION LAW

Answer to question 1:

Answer to A:

According to the “Section 51 (ii)” the commonwealth has the exclusive power of

making laws in Australia. With regard to the “Section 51 (ii)” the commonwealth has the

authority of making laws that is associated to tax but it involves no kind of discrimination

among the state or any part of the country (Loveland, 2018). As per the “Section 51 (ii)” the

commonwealth has the legislative power of applying tax that remain entrusted with this

legislative provision and possess the authority of making constitutional laws.

Answer to B:

The Australian government is accountable for creating an overall improvement in the

tax policy and the treasury minister is accountable for applying the laws. The ATO is

accountable for framing tax policies and judicial process that demonstrates the relation

between the laws and administrative characteristics of the tax system (Dyzenhaus &

Thorburn, 2016). The management of laws relating to the tax and superannuation is

administered by ATO that are passed by parliament. To apply the laws, the government

imposes the tax which is formed by the ATO including the valuable advice to the taxpayers

regarding their obligations and duties.

An important role relating to the application and interpretation of the tax is played by

the ATO in Australia for the legislative cases that has definite civic importance. It also

includes the challenges that relates to validity of constitution and hearing appeals bought by

territory, state and federal courts. The structure of parliament includes the upper and lower

houses and the bills must be passed from the parliament. The lower house introduces the bills

of taxation and the bills are sent to upper house for final approval.

Answer to question 1:

Answer to A:

According to the “Section 51 (ii)” the commonwealth has the exclusive power of

making laws in Australia. With regard to the “Section 51 (ii)” the commonwealth has the

authority of making laws that is associated to tax but it involves no kind of discrimination

among the state or any part of the country (Loveland, 2018). As per the “Section 51 (ii)” the

commonwealth has the legislative power of applying tax that remain entrusted with this

legislative provision and possess the authority of making constitutional laws.

Answer to B:

The Australian government is accountable for creating an overall improvement in the

tax policy and the treasury minister is accountable for applying the laws. The ATO is

accountable for framing tax policies and judicial process that demonstrates the relation

between the laws and administrative characteristics of the tax system (Dyzenhaus &

Thorburn, 2016). The management of laws relating to the tax and superannuation is

administered by ATO that are passed by parliament. To apply the laws, the government

imposes the tax which is formed by the ATO including the valuable advice to the taxpayers

regarding their obligations and duties.

An important role relating to the application and interpretation of the tax is played by

the ATO in Australia for the legislative cases that has definite civic importance. It also

includes the challenges that relates to validity of constitution and hearing appeals bought by

territory, state and federal courts. The structure of parliament includes the upper and lower

houses and the bills must be passed from the parliament. The lower house introduces the bills

of taxation and the bills are sent to upper house for final approval.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3TAXATION LAW

Answer to question 2:

Subject to the provision of paragraph (3), where the company of the contracting

country conducts business in the other contracting nation with the help of permanent

establishment that is located therein, then in each of the contracting country the business

profits will be attributable that might be anticipated to make if it was separate and

independent company indulged in the identical activities under the identical conditions for the

business that has the permanent establishment in that nation.

An enterprise is treated as the Australian occupant company provided that the

business’s central administration and control is in Australia (Dumiter & Jimon, 2016).

Therefore, the US and Australia DTA agreement explains that the business profits made in

one country state will be held taxable in that nation where its business operations are

performed. The court in “C of T (NSW) v Hillsdon Watts Ltd (1937)” explained that income

from business originates where the transaction occurs (McClure et al., 2017). With respect to

DTA the business income obtained by the US manufacturing company in Australia will be

taxable since the profits were sourced in Australia.

Answer to question 3:

Part 1:

Answer to A:

“Section 102-5, ITAA 1997” includes the net amount of capital gains for the income

year in their taxable income. The capital losses must be quarantined and can only be allowed

to offset against the capital gains that are not deductible while the net losses can be carried

forward (Jones, 2018). The capital gains is only allowed on the assets which is purchased

after 20 September 1985. Indiana on subdividing the land and disposing off for making

profits, any capital gains that are derived is included for assessment purpose. Nevertheless,

Answer to question 2:

Subject to the provision of paragraph (3), where the company of the contracting

country conducts business in the other contracting nation with the help of permanent

establishment that is located therein, then in each of the contracting country the business

profits will be attributable that might be anticipated to make if it was separate and

independent company indulged in the identical activities under the identical conditions for the

business that has the permanent establishment in that nation.

An enterprise is treated as the Australian occupant company provided that the

business’s central administration and control is in Australia (Dumiter & Jimon, 2016).

Therefore, the US and Australia DTA agreement explains that the business profits made in

one country state will be held taxable in that nation where its business operations are

performed. The court in “C of T (NSW) v Hillsdon Watts Ltd (1937)” explained that income

from business originates where the transaction occurs (McClure et al., 2017). With respect to

DTA the business income obtained by the US manufacturing company in Australia will be

taxable since the profits were sourced in Australia.

Answer to question 3:

Part 1:

Answer to A:

“Section 102-5, ITAA 1997” includes the net amount of capital gains for the income

year in their taxable income. The capital losses must be quarantined and can only be allowed

to offset against the capital gains that are not deductible while the net losses can be carried

forward (Jones, 2018). The capital gains is only allowed on the assets which is purchased

after 20 September 1985. Indiana on subdividing the land and disposing off for making

profits, any capital gains that are derived is included for assessment purpose. Nevertheless,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4TAXATION LAW

when the property is bought before the introduction of CGT tax system and capital gains

made thereon is considered tax exempted because the asset constitutes pre-CGT.

Answer to B:

In the first option, if Indiana purchases the land in 1986 and sells it to property

developer by subdividing into 80 blocks, then the provision should be applied. It is presumed

that the land does not constitute a trading stock and the gains that is made from disposal of

land by Indiana is treated assessable as ordinary earnings under “section 6-5, ITAA 1997”.

In the second option, Indiana upon selling the land in auction to the highest bidder

then the subdivided lot of land will be taken into account as trading stock. Nevertheless,

capital gains derived from selling the 80 block of land is considered taxable as ordinary

income under “section 6-5, ITAA 1997” (Richardson, 2015).

In the third option, if Indiana considers the decision of not subdividing the land and

selling it completely to the property developer then the gains which is earned upon the

disposal of land is considered as chargeable capital gains. The gains is taxable within the

meaning of ordinary concepts and GST will be imposed on the gains derived.

Answer to part 2:

Option A:

If the subdivision of land results in mere realisation of the capital asset by Indiana, the

any part of the profits that are derived by her will be considered as profit from the land

development business. Sale of subdivided land may contribute in treating the land as revenue

asset and the capital gains will be treated as taxable under “section 6-5, ITAA 1997”

(Bankman et al., 2018).

Option B:

when the property is bought before the introduction of CGT tax system and capital gains

made thereon is considered tax exempted because the asset constitutes pre-CGT.

Answer to B:

In the first option, if Indiana purchases the land in 1986 and sells it to property

developer by subdividing into 80 blocks, then the provision should be applied. It is presumed

that the land does not constitute a trading stock and the gains that is made from disposal of

land by Indiana is treated assessable as ordinary earnings under “section 6-5, ITAA 1997”.

In the second option, Indiana upon selling the land in auction to the highest bidder

then the subdivided lot of land will be taken into account as trading stock. Nevertheless,

capital gains derived from selling the 80 block of land is considered taxable as ordinary

income under “section 6-5, ITAA 1997” (Richardson, 2015).

In the third option, if Indiana considers the decision of not subdividing the land and

selling it completely to the property developer then the gains which is earned upon the

disposal of land is considered as chargeable capital gains. The gains is taxable within the

meaning of ordinary concepts and GST will be imposed on the gains derived.

Answer to part 2:

Option A:

If the subdivision of land results in mere realisation of the capital asset by Indiana, the

any part of the profits that are derived by her will be considered as profit from the land

development business. Sale of subdivided land may contribute in treating the land as revenue

asset and the capital gains will be treated as taxable under “section 6-5, ITAA 1997”

(Bankman et al., 2018).

Option B:

5TAXATION LAW

If Indiana decides to undertake the identical activities of conducting the auction on 80

subdivided land then those 80 subdivided blocks will be held as trading stock starting from

the time when the subdivision began. It is anticipated that the subdivision of 80 lots is sold at

the market value. Then Indiana will be considered taxable for adopting the commercial

method of selling the land to derive profit. Hence, the capital gains made thereof constitute an

ordinary income under the legislation of “section 6-5, ITAA 1997” (Steyn et al., 2018).

Option C:

Indiana in the third option decides to simply divide the land into numerous lots and

ultimately making the disposal of land to the property developer then the gains that are made

is considered taxable under the legislation of “section 25 (1), ITAA 1936” as the profits

obtained from revenue producing scheme (Burkhauser et al., 2018).

Answer to question 4:

Where a business incurs the post-cessation expenditure than it will be considered as

tax deduction expenditure provided that the event of loss or outgoings is noticed in the

functions of business that was previously performed by the taxpayer with the objective of

deriving the taxable income. The court of law in the case of “AGC (Advances) Ltd v FCT

(1975)” allowed the taxpayer with the deduction for the losses that was occurred in respect of

the bad debts that arises from the earlier business activities (Evans et al., 2015).

Evident in the case of Amity it is noticed that an interest on loan was incurred by the

taxpayer particularly for the business which is sold by her. Citing the case of “AGC

(Advances) Ltd v FCT (1975)” Amity will be permitted to obtain the deduction for the

interest on loan within the legislative “section 8-1, ITAA 1997” since the outlays occurred

were related to the derivation of assessable income (Grudnoff, 2015).

If Indiana decides to undertake the identical activities of conducting the auction on 80

subdivided land then those 80 subdivided blocks will be held as trading stock starting from

the time when the subdivision began. It is anticipated that the subdivision of 80 lots is sold at

the market value. Then Indiana will be considered taxable for adopting the commercial

method of selling the land to derive profit. Hence, the capital gains made thereof constitute an

ordinary income under the legislation of “section 6-5, ITAA 1997” (Steyn et al., 2018).

Option C:

Indiana in the third option decides to simply divide the land into numerous lots and

ultimately making the disposal of land to the property developer then the gains that are made

is considered taxable under the legislation of “section 25 (1), ITAA 1936” as the profits

obtained from revenue producing scheme (Burkhauser et al., 2018).

Answer to question 4:

Where a business incurs the post-cessation expenditure than it will be considered as

tax deduction expenditure provided that the event of loss or outgoings is noticed in the

functions of business that was previously performed by the taxpayer with the objective of

deriving the taxable income. The court of law in the case of “AGC (Advances) Ltd v FCT

(1975)” allowed the taxpayer with the deduction for the losses that was occurred in respect of

the bad debts that arises from the earlier business activities (Evans et al., 2015).

Evident in the case of Amity it is noticed that an interest on loan was incurred by the

taxpayer particularly for the business which is sold by her. Citing the case of “AGC

(Advances) Ltd v FCT (1975)” Amity will be permitted to obtain the deduction for the

interest on loan within the legislative “section 8-1, ITAA 1997” since the outlays occurred

were related to the derivation of assessable income (Grudnoff, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6TAXATION LAW

Answer to question 5:

According to the CGT regime asset only qualifies for the capital gains tax when it is

purchased after 20th September 1985. The ATO explains that for the application of exemption

on the dwelling it should qualify as the main residence of the taxpayer (Feld et al., 2016).

Whether the dwelling is regarded as the main residence the taxpayer will be the subject of

question of fact. Maurice purchased a home which she entirely used it for main residence

purpose. The property was later sold for $325,000. The capital gains that is made from the

sale of home is exempted from CGT because the house was the main residence for taxpayer

during the time of ownership.

Maurice purchased shares on 1984 for $15,000 and sold for $19,000 on 15th March. It

can be stated that the capital gains which she has made from the shares will be exempted

because it is pre-CGT asset. Importantly under “section 108-20 (2), ITAA 1997” personal

use asset means those asset which is used by taxpayer for their own enjoyment purpose

(Chardon et al., 2016). Considerably, under “section 118-10 (3), ITAA 1997” gains or loss

from personal use asset costing below $10,000 is disregarded. So furniture which was sold by

Maurice for $5,000 in May 2018 was originally purchased for $9,500. Therefore, the cost

base is less than $10,000 and the capital loss made by Maurice is disregarded.

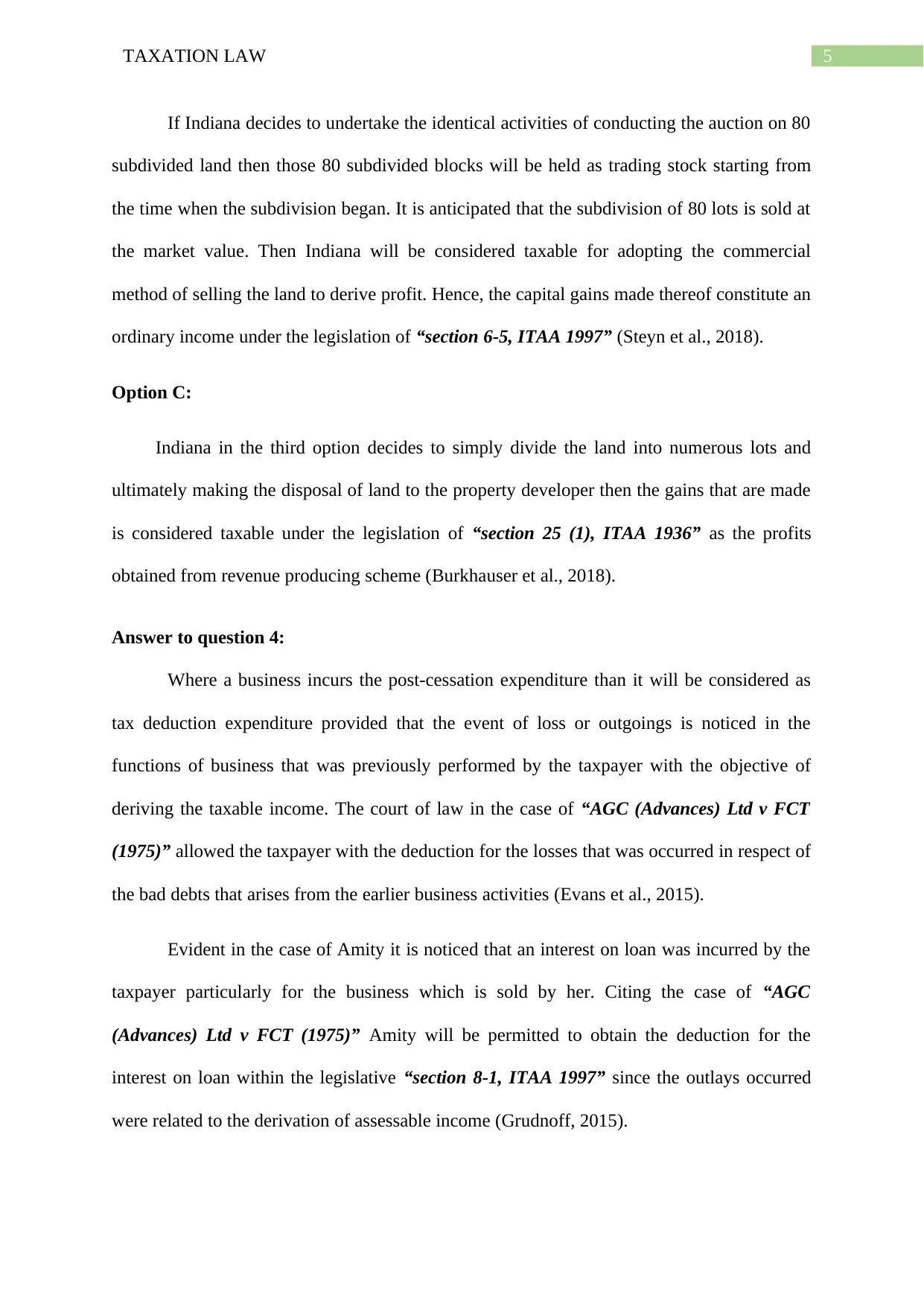

A taxpayer when acquires the vacant land to use for their personal or investment

purpose then the land is considered as the capital asset. Selling the vacant block of land will

give rise in capital gains tax consequences. Maurice acquired the vacant land on 20th June

1997 and sold the same on 15th May for $465,000. Sale of land led to in CGT event A1 under

“section 104-10(1)), ITAA 1997” (Buenker, 2018). Expenditure such as interest is included

under the third element of cost base to calculate the net capital gains made thereon. Below is

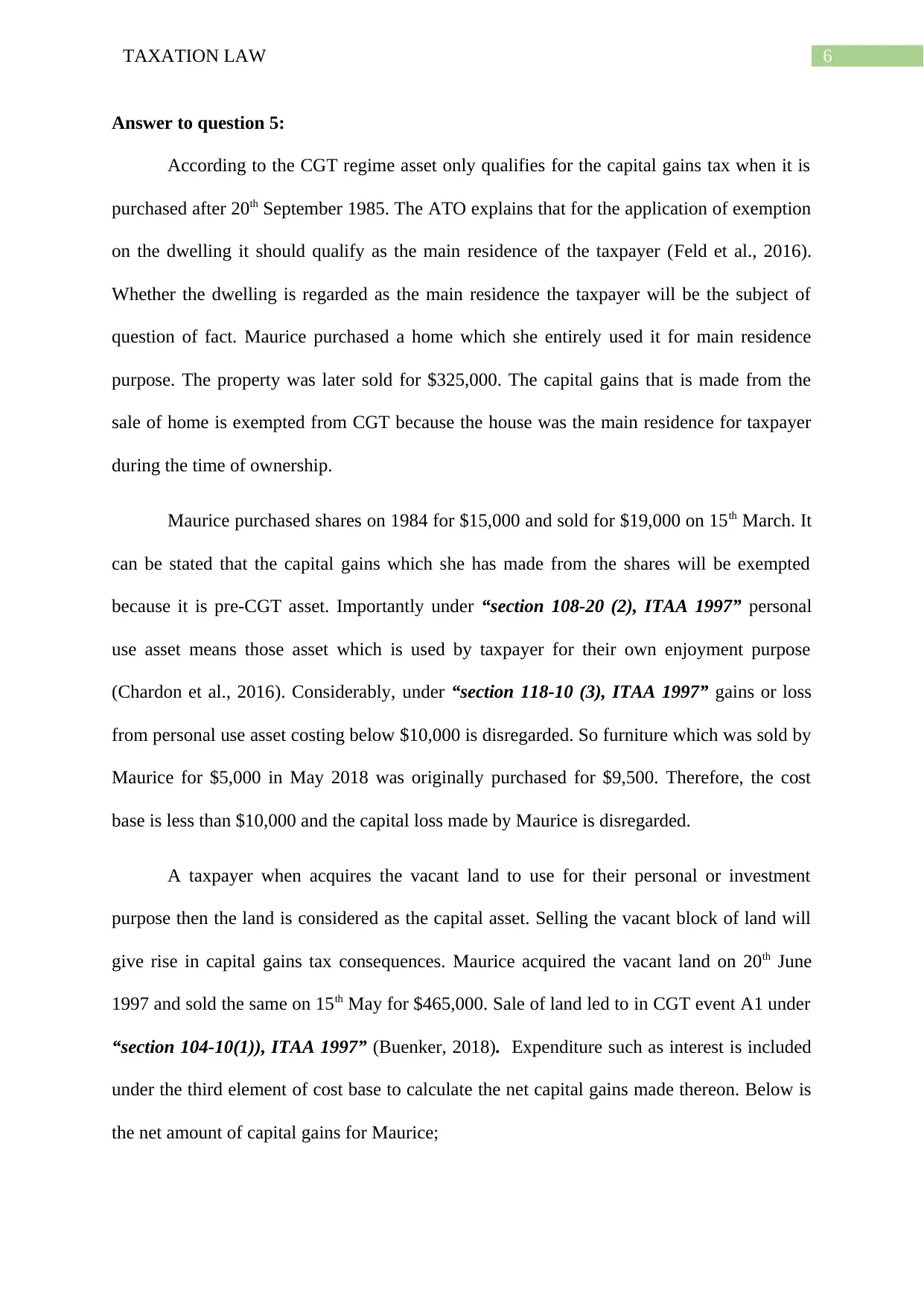

the net amount of capital gains for Maurice;

Answer to question 5:

According to the CGT regime asset only qualifies for the capital gains tax when it is

purchased after 20th September 1985. The ATO explains that for the application of exemption

on the dwelling it should qualify as the main residence of the taxpayer (Feld et al., 2016).

Whether the dwelling is regarded as the main residence the taxpayer will be the subject of

question of fact. Maurice purchased a home which she entirely used it for main residence

purpose. The property was later sold for $325,000. The capital gains that is made from the

sale of home is exempted from CGT because the house was the main residence for taxpayer

during the time of ownership.

Maurice purchased shares on 1984 for $15,000 and sold for $19,000 on 15th March. It

can be stated that the capital gains which she has made from the shares will be exempted

because it is pre-CGT asset. Importantly under “section 108-20 (2), ITAA 1997” personal

use asset means those asset which is used by taxpayer for their own enjoyment purpose

(Chardon et al., 2016). Considerably, under “section 118-10 (3), ITAA 1997” gains or loss

from personal use asset costing below $10,000 is disregarded. So furniture which was sold by

Maurice for $5,000 in May 2018 was originally purchased for $9,500. Therefore, the cost

base is less than $10,000 and the capital loss made by Maurice is disregarded.

A taxpayer when acquires the vacant land to use for their personal or investment

purpose then the land is considered as the capital asset. Selling the vacant block of land will

give rise in capital gains tax consequences. Maurice acquired the vacant land on 20th June

1997 and sold the same on 15th May for $465,000. Sale of land led to in CGT event A1 under

“section 104-10(1)), ITAA 1997” (Buenker, 2018). Expenditure such as interest is included

under the third element of cost base to calculate the net capital gains made thereon. Below is

the net amount of capital gains for Maurice;

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7TAXATION LAW

Particulars Amount ($) Amount ($)

Sales proceeds (S-104-10(1)) 465000

Cost Base Item (S-110-25(1))

Element 1 - Cost of Acqusition 100000

Element 3- Non-Capital Costs

Interest Expenses 110000

Total Cost Base 210000

Capital Gain 255000

50% CGT Discount 127500

Net Taxable Capital Gains 127500

Computation of Capital Gains Tax

Answer to question 6:

Article 1: ATO measures of removing “inequitable” inquiry:

Facts:

The proposal stated by the labor party includes the abolition of refundable franking

credit for the SMSF funds and individuals. The current policy is considered to be unbalanced

and contains faults. The committee has considered the proposal of abolishing refundable

franking credit for both the SMSF and individuals (Afr.com, 2019). The committee has

however stated that policy is highly favoured towards higher income group.

Concise explanation of taxation concepts:

The committee has however stated that removing the refundable franking credit

would contribute unfairly towards moderate income earners and those that are presently

retired and may not come back to labour force for covering up the lost incomes.

Explanation of connection between concepts and indicators of good tax policy:

The article states that this kind of policy reformation may be regarded as the element

equal package for complete tax information (Afr.com, 2019). The article provides an

explanation that policy has been unfair towards the middle income group people.

Particulars Amount ($) Amount ($)

Sales proceeds (S-104-10(1)) 465000

Cost Base Item (S-110-25(1))

Element 1 - Cost of Acqusition 100000

Element 3- Non-Capital Costs

Interest Expenses 110000

Total Cost Base 210000

Capital Gain 255000

50% CGT Discount 127500

Net Taxable Capital Gains 127500

Computation of Capital Gains Tax

Answer to question 6:

Article 1: ATO measures of removing “inequitable” inquiry:

Facts:

The proposal stated by the labor party includes the abolition of refundable franking

credit for the SMSF funds and individuals. The current policy is considered to be unbalanced

and contains faults. The committee has considered the proposal of abolishing refundable

franking credit for both the SMSF and individuals (Afr.com, 2019). The committee has

however stated that policy is highly favoured towards higher income group.

Concise explanation of taxation concepts:

The committee has however stated that removing the refundable franking credit

would contribute unfairly towards moderate income earners and those that are presently

retired and may not come back to labour force for covering up the lost incomes.

Explanation of connection between concepts and indicators of good tax policy:

The article states that this kind of policy reformation may be regarded as the element

equal package for complete tax information (Afr.com, 2019). The article provides an

explanation that policy has been unfair towards the middle income group people.

8TAXATION LAW

Article 2: ATO considers measures for closing gap on multinational Tax Avoidance:

Facts:

The ATO has launched the special multinational tax avoidance programme and has

been successful in collecting more than $8 billion of tax revenues from the multinational

companies that have overseas ownership (Afr.com, 2019). It is estimated that around 95% of

the big companies are satisfying their full liabilities in Australia. As per the article, around

29% of all the companies have paid their taxes while 42% tax is paid by top 100 businesses.

Concise explanation of taxation concepts:

According to the article, the gap in tax which was noticed in the previous year

showcase a trend of reducing gap. Following the introduction of program there has been a

significant improvement in tax gap with more than 1500 big multinational companies have

paid around $44 billion as tax in Australia every year.

Explanation of connection between concepts and indicators of good tax policy:

According to the article the current tax compliance is higher among the Australian

companies which also includes the laws relating to multinational tax avoidance, state by state

reporting and anti-hybrid laws with updated guidelines for transfer pricing.

Answer to question 7:

The role of tax advisors is given below;

a. The tax advisers are accountable for assisting their clients in complying with the

obligations under the tax laws and to enable the clients in making the complete use of

their rights relating to taxation matters.

Article 2: ATO considers measures for closing gap on multinational Tax Avoidance:

Facts:

The ATO has launched the special multinational tax avoidance programme and has

been successful in collecting more than $8 billion of tax revenues from the multinational

companies that have overseas ownership (Afr.com, 2019). It is estimated that around 95% of

the big companies are satisfying their full liabilities in Australia. As per the article, around

29% of all the companies have paid their taxes while 42% tax is paid by top 100 businesses.

Concise explanation of taxation concepts:

According to the article, the gap in tax which was noticed in the previous year

showcase a trend of reducing gap. Following the introduction of program there has been a

significant improvement in tax gap with more than 1500 big multinational companies have

paid around $44 billion as tax in Australia every year.

Explanation of connection between concepts and indicators of good tax policy:

According to the article the current tax compliance is higher among the Australian

companies which also includes the laws relating to multinational tax avoidance, state by state

reporting and anti-hybrid laws with updated guidelines for transfer pricing.

Answer to question 7:

The role of tax advisors is given below;

a. The tax advisers are accountable for assisting their clients in complying with the

obligations under the tax laws and to enable the clients in making the complete use of

their rights relating to taxation matters.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9TAXATION LAW

b. The tax advisers are required to completely enable their clients to respect the law.

Where the letter contained in law is not clear then the tax advisors are required to use

the meaning of law for better interpretations.

c. The tax advisors are required to make the clients aware regarding the real opportunity

available to reduce the burden of tax. This includes that engaging the client in

arrangement that are legal and not liable for recourse or sanctions.

b. The tax advisers are required to completely enable their clients to respect the law.

Where the letter contained in law is not clear then the tax advisors are required to use

the meaning of law for better interpretations.

c. The tax advisors are required to make the clients aware regarding the real opportunity

available to reduce the burden of tax. This includes that engaging the client in

arrangement that are legal and not liable for recourse or sanctions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10TAXATION LAW

References:

ATO closing the gap on multinational tax avoidance. (2019). Retrieved from

https://www.afr.com/personal-finance/tax/ato-closing-the-gap-on-multinational-tax-

avoidance-20190318-p51577

Bankman, J., Shaviro, D. N., Stark, K. J., & Kleinbard, E. D. (2018). Federal Income

Taxation. Aspen Publishers.

Buenker, J. D. (2018). The Income Tax and the Progressive Era. Routledge.

Burkhauser, R. V., Hahn, M. H., & Wilkins, R. (2015). Measuring top incomes using tax

record data: A cautionary tale from Australia. The Journal of Economic

Inequality, 13(2), 181-205.

Chardon, T., Freudenberg, B., & Brimble, M. (2016). Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, 321.

Dumiter, F., & Jimon, Ș. (2016). Double Taxation Conventions in Central and Eastern

European Countries. Journal of legal studies, 18(32), 1-12.

Dyzenhaus, D., & Thorburn, M. (Eds.). (2016). Philosophical Foundations of Constitutional

Law. Oxford University Press.

Evans, C., Minas, J., & Lim, Y. (2015). Taxing personal capital gains in Australia: an

alternative way forward. Austl. Tax F., 30, 735.

Feld, L. P., Ruf, M., Schreiber, U., Todtenhaupt, M., & Voget, J. (2016). Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

References:

ATO closing the gap on multinational tax avoidance. (2019). Retrieved from

https://www.afr.com/personal-finance/tax/ato-closing-the-gap-on-multinational-tax-

avoidance-20190318-p51577

Bankman, J., Shaviro, D. N., Stark, K. J., & Kleinbard, E. D. (2018). Federal Income

Taxation. Aspen Publishers.

Buenker, J. D. (2018). The Income Tax and the Progressive Era. Routledge.

Burkhauser, R. V., Hahn, M. H., & Wilkins, R. (2015). Measuring top incomes using tax

record data: A cautionary tale from Australia. The Journal of Economic

Inequality, 13(2), 181-205.

Chardon, T., Freudenberg, B., & Brimble, M. (2016). Tax literacy in Australia: not knowing

your deduction from your offset. Austl. Tax F., 31, 321.

Dumiter, F., & Jimon, Ș. (2016). Double Taxation Conventions in Central and Eastern

European Countries. Journal of legal studies, 18(32), 1-12.

Dyzenhaus, D., & Thorburn, M. (Eds.). (2016). Philosophical Foundations of Constitutional

Law. Oxford University Press.

Evans, C., Minas, J., & Lim, Y. (2015). Taxing personal capital gains in Australia: an

alternative way forward. Austl. Tax F., 30, 735.

Feld, L. P., Ruf, M., Schreiber, U., Todtenhaupt, M., & Voget, J. (2016). Taxing away M&A:

The effect of corporate capital gains taxes on acquisition activity.

11TAXATION LAW

Franking credit removal 'inequitable': inquiry. (2019). Retrieved from

https://www.afr.com/personal-finance/tax/franking-credit-removal-inequitable-and-

deeply-flawed-inquiry-20190404-p51az9

Grudnoff, M. (2015). Top gears: how negative gearing and the capital gains tax discount

benefit the top 10 per cent and drive up house prices.

Jones, D. (2018). Complexity of tax residency attracts review. Taxation in Australia, 53(6),

296.

Loveland, I. D. (2018). Constitutional law. Routledge.

McClure, R., Lanis, R., & Govendir, B. (2017). Analysis of tax avoidance strategies of top

foreign multinationals operating in Australia: An expose.

Richardson, D. (2015). Corporate tax avoidance. The Australia Institute, 1-16.

Steyn, T., Smulders, S., Stark, K., & Penning, I. (2018). Capital gains tax research: an initial

synthesis of the literature. eJTR, 16, 278.

Franking credit removal 'inequitable': inquiry. (2019). Retrieved from

https://www.afr.com/personal-finance/tax/franking-credit-removal-inequitable-and-

deeply-flawed-inquiry-20190404-p51az9

Grudnoff, M. (2015). Top gears: how negative gearing and the capital gains tax discount

benefit the top 10 per cent and drive up house prices.

Jones, D. (2018). Complexity of tax residency attracts review. Taxation in Australia, 53(6),

296.

Loveland, I. D. (2018). Constitutional law. Routledge.

McClure, R., Lanis, R., & Govendir, B. (2017). Analysis of tax avoidance strategies of top

foreign multinationals operating in Australia: An expose.

Richardson, D. (2015). Corporate tax avoidance. The Australia Institute, 1-16.

Steyn, T., Smulders, S., Stark, K., & Penning, I. (2018). Capital gains tax research: an initial

synthesis of the literature. eJTR, 16, 278.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.