Case Study: Tesla Motors in 2016 - Strategic Analysis

VerifiedAdded on 2023/04/26

|7

|1681

|300

Case Study

AI Summary

This case study analyzes Tesla Motors in 2016, examining its strategic position amidst challenges like low gasoline prices and growing competition. It includes a SWOT analysis, evaluating Tesla's strengths (e.g., innovative electric cars, supercharger network) and weaknesses (e.g., production costs, limited model variety), along with opportunities (e.g., rising demand for electric cars, advancements in solar power) and threats (e.g., competition from Nissan, sales bans in certain states). The analysis covers Tesla's diversification strategy with Tesla Energy, vertical integration in distribution, manufacturing strategy, and marketing approach. It also explores key elements of Tesla's culture, identifying both positive aspects and potential pitfalls like overpromises and profit challenges. The study offers recommendations for long-term goals, focusing on production capacity, addressing battery stigmas, and expanding charging infrastructure.

Running Head: MANAGEMENT 0

CASE STUDY

CASE STUDY

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 1

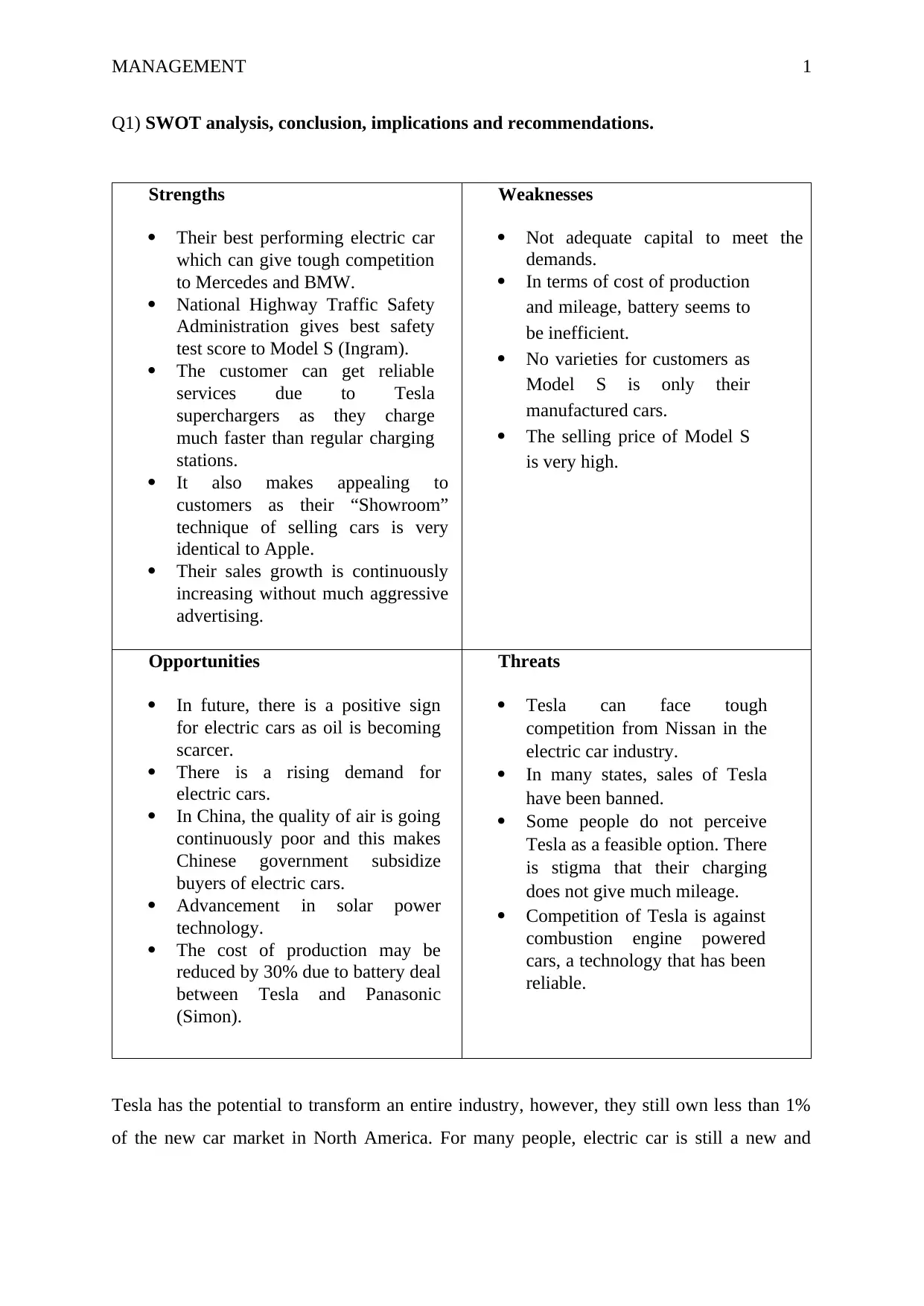

Q1) SWOT analysis, conclusion, implications and recommendations.

Strengths

Their best performing electric car

which can give tough competition

to Mercedes and BMW.

National Highway Traffic Safety

Administration gives best safety

test score to Model S (Ingram).

The customer can get reliable

services due to Tesla

superchargers as they charge

much faster than regular charging

stations.

It also makes appealing to

customers as their “Showroom”

technique of selling cars is very

identical to Apple.

Their sales growth is continuously

increasing without much aggressive

advertising.

Weaknesses

Not adequate capital to meet the

demands.

In terms of cost of production

and mileage, battery seems to

be inefficient.

No varieties for customers as

Model S is only their

manufactured cars.

The selling price of Model S

is very high.

Opportunities

In future, there is a positive sign

for electric cars as oil is becoming

scarcer.

There is a rising demand for

electric cars.

In China, the quality of air is going

continuously poor and this makes

Chinese government subsidize

buyers of electric cars.

Advancement in solar power

technology.

The cost of production may be

reduced by 30% due to battery deal

between Tesla and Panasonic

(Simon).

Threats

Tesla can face tough

competition from Nissan in the

electric car industry.

In many states, sales of Tesla

have been banned.

Some people do not perceive

Tesla as a feasible option. There

is stigma that their charging

does not give much mileage.

Competition of Tesla is against

combustion engine powered

cars, a technology that has been

reliable.

Tesla has the potential to transform an entire industry, however, they still own less than 1%

of the new car market in North America. For many people, electric car is still a new and

Q1) SWOT analysis, conclusion, implications and recommendations.

Strengths

Their best performing electric car

which can give tough competition

to Mercedes and BMW.

National Highway Traffic Safety

Administration gives best safety

test score to Model S (Ingram).

The customer can get reliable

services due to Tesla

superchargers as they charge

much faster than regular charging

stations.

It also makes appealing to

customers as their “Showroom”

technique of selling cars is very

identical to Apple.

Their sales growth is continuously

increasing without much aggressive

advertising.

Weaknesses

Not adequate capital to meet the

demands.

In terms of cost of production

and mileage, battery seems to

be inefficient.

No varieties for customers as

Model S is only their

manufactured cars.

The selling price of Model S

is very high.

Opportunities

In future, there is a positive sign

for electric cars as oil is becoming

scarcer.

There is a rising demand for

electric cars.

In China, the quality of air is going

continuously poor and this makes

Chinese government subsidize

buyers of electric cars.

Advancement in solar power

technology.

The cost of production may be

reduced by 30% due to battery deal

between Tesla and Panasonic

(Simon).

Threats

Tesla can face tough

competition from Nissan in the

electric car industry.

In many states, sales of Tesla

have been banned.

Some people do not perceive

Tesla as a feasible option. There

is stigma that their charging

does not give much mileage.

Competition of Tesla is against

combustion engine powered

cars, a technology that has been

reliable.

Tesla has the potential to transform an entire industry, however, they still own less than 1%

of the new car market in North America. For many people, electric car is still a new and

MANAGEMENT 2

misunderstood technology, although Model S of Tesla is a primary cause. My

recommendations are linked with long term goals achievement.

Elon Musk needs to proactively act on opportunity as due to scarcity in oil, demands for

electric cars are rising and still, Tesla has not improved their production capabilities as a

faster rate to meet up with growing demands. If this drift continues, the new vehicles cannot

be delivered at time and causing poor customer service. Hence, on urgency basis, Tesla needs

to invest in new plant as North America is still their biggest market.

I also believe that Tesla needs to continue to break the stigma surrounding electric vehicles.

For many customers, batteries are not as much developed as combustion engines and this can

cause not buying electric vehicles. I also recommend to build up more charging stations all

over the world and Tesla need to ensure that their superchargers are faster and more powerful

as compare to regular charging areas.

The company should confirm signed a deal with Panasonic to become the primary provider of

battery. Signing agreement with Panasonic and going forward with “Gigafactory” will help

their cause (Loveday).

Q2) Potential pitfalls of this alliance

Tesla Partnership with Mercedes-Benz: Daimler AG is the parent company for Mercedes-

Benz. It is one of the famous brands in the globe. Being an American based company, Tesla

is focusing on building automobiles through solar power and electricity. Gaining an equity

stake of nearly 10 per cent in Tesla for a stated $50 million will speed up the development of

Tesla lithium-ion battery technology. However, from other perspectives, this alliance build up

with Mercedes will lead to potential pitfall on share of organisation on the market command.

There can also be resistance of certain employees to new concepts that can cause chaos on the

efforts to develop a flourishing treaty. In addition, Tesla is doing impressive innovation and

they have more than 700 patents. Entering of Mercedes into the system will lead to

solidification of the patents.

misunderstood technology, although Model S of Tesla is a primary cause. My

recommendations are linked with long term goals achievement.

Elon Musk needs to proactively act on opportunity as due to scarcity in oil, demands for

electric cars are rising and still, Tesla has not improved their production capabilities as a

faster rate to meet up with growing demands. If this drift continues, the new vehicles cannot

be delivered at time and causing poor customer service. Hence, on urgency basis, Tesla needs

to invest in new plant as North America is still their biggest market.

I also believe that Tesla needs to continue to break the stigma surrounding electric vehicles.

For many customers, batteries are not as much developed as combustion engines and this can

cause not buying electric vehicles. I also recommend to build up more charging stations all

over the world and Tesla need to ensure that their superchargers are faster and more powerful

as compare to regular charging areas.

The company should confirm signed a deal with Panasonic to become the primary provider of

battery. Signing agreement with Panasonic and going forward with “Gigafactory” will help

their cause (Loveday).

Q2) Potential pitfalls of this alliance

Tesla Partnership with Mercedes-Benz: Daimler AG is the parent company for Mercedes-

Benz. It is one of the famous brands in the globe. Being an American based company, Tesla

is focusing on building automobiles through solar power and electricity. Gaining an equity

stake of nearly 10 per cent in Tesla for a stated $50 million will speed up the development of

Tesla lithium-ion battery technology. However, from other perspectives, this alliance build up

with Mercedes will lead to potential pitfall on share of organisation on the market command.

There can also be resistance of certain employees to new concepts that can cause chaos on the

efforts to develop a flourishing treaty. In addition, Tesla is doing impressive innovation and

they have more than 700 patents. Entering of Mercedes into the system will lead to

solidification of the patents.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT 3

Q3) Type of diversification strategy does the launch of Tesla Energy represent

Related diversification is a strategy when a firm expands its activities into product lines that

are parallel to those it currently offers. The launch of Tesla energy represents using of related

diversification as due to significant similarities with the enterprise existing industry. In

addition, they were also in the process of diversification acquired SolarCity and constructed

the Gigafactory to warehouse its battery and automobile production. In 2016, SolarCity

succeeded more solar systems for homes than any other solar enterprise in the US. Yes, they

have met the three tests of corporate advantage since the business is attractive including

strong potential revenue for the industry. It is hard to get realise of any other manufacturers

as being serious about electrification when they are so far behind Tesla. Hence, it can be said

that Tesla dominates the future of automobiles.

Q4) What kind of vertical integration strategy did Tesla choose for its distribution and

supply chain?

In respect to distribution and supply chains and considering vertical integration strategy,

Tesla opts for forwarding integration where organisation will get many benefits with

ownership over the preceding consumers. With forwards integration strategy, Tesla will get

control of direct distribution or supply of organisation products. The major benefits of this

strategy will be improved quality of suppliers, lower costs, enhancement in the coordination

in supply chain, and good market share. In addition, Tesla will also be able to create

economies of scale as by keeping management consolidated, overhead and other costs are

often reduced. Considering disadvantages, it includes rise in bureaucracy and reduced

flexibility due to greater investment. Moreover, there can also be lower quality of products

due to ownership of channels related to supply and distribution. Being an innovative

company, Tesla will now be more rigid to trends, given how the supply chain is set up.

Q3) Type of diversification strategy does the launch of Tesla Energy represent

Related diversification is a strategy when a firm expands its activities into product lines that

are parallel to those it currently offers. The launch of Tesla energy represents using of related

diversification as due to significant similarities with the enterprise existing industry. In

addition, they were also in the process of diversification acquired SolarCity and constructed

the Gigafactory to warehouse its battery and automobile production. In 2016, SolarCity

succeeded more solar systems for homes than any other solar enterprise in the US. Yes, they

have met the three tests of corporate advantage since the business is attractive including

strong potential revenue for the industry. It is hard to get realise of any other manufacturers

as being serious about electrification when they are so far behind Tesla. Hence, it can be said

that Tesla dominates the future of automobiles.

Q4) What kind of vertical integration strategy did Tesla choose for its distribution and

supply chain?

In respect to distribution and supply chains and considering vertical integration strategy,

Tesla opts for forwarding integration where organisation will get many benefits with

ownership over the preceding consumers. With forwards integration strategy, Tesla will get

control of direct distribution or supply of organisation products. The major benefits of this

strategy will be improved quality of suppliers, lower costs, enhancement in the coordination

in supply chain, and good market share. In addition, Tesla will also be able to create

economies of scale as by keeping management consolidated, overhead and other costs are

often reduced. Considering disadvantages, it includes rise in bureaucracy and reduced

flexibility due to greater investment. Moreover, there can also be lower quality of products

due to ownership of channels related to supply and distribution. Being an innovative

company, Tesla will now be more rigid to trends, given how the supply chain is set up.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGEMENT 4

Q5) Tesla manufacturing strategy

By reviewing Tesla manufacturing strategy, it can be said that their value chain is definitely

made strategic sense as in most cases they cut costs and understand the true insource-

outsource trade-offs enabling the frugal outcomes. With seasoned supply chains, the

company work to rapidly developing and churning out their own electric cars in align with

government options to pursue low-emission and eco-friendly transit options. In addition,

Tesla is doing things radically dissimilar than various other car markets. The company is

focusing on making everything in house rather than outsourcing. The sales channels are also

insourced by them seeking for innovation. Tesla sells directly to the public through their

websites and in showroom in shopping centres.

Q6) From which five generic strategies are Tesla pursuing with its marketing strategy?

Tesla has adopted a broad differentiation strategy in extent with the premium electric vehicle

company so as to widen the respective sales and capture the market. (Leinwand & Mainardi).

However, in this case, it was founded that Tesla motors are also concentrated on offering

their vehicles to consumers at lower prices in relating to the costs they use in generating the

batteries. Since analysing the complete economical approach, focused differentiated strategy

will be best preferred. It is not only an electric company, however, but it is also one of the

major foremost premium brands in the industry right now.

Therefore, it is rational to say that the vehicles are produced by Tesla produced to meet the

perception of consumers by outcompeting all its competitors. Hence, employing this strategy

is leading them to achieve competitive advantage.

Q7) key elements of Tesla’s culture

There is been identified three major key elements of Tesla culture which includes ambitious

innovation, lack of bureaucracy and adherence to ‘First Principles’ method. The major

problems that can be seen in their culture amid growing competition are – overpromises and

under delivers, workman claims and lawsuits and earning of continuous profit. In detail,

Tesla not fulfil order of Model 3, their first electric vehicle designed for masses. In addition,

Q5) Tesla manufacturing strategy

By reviewing Tesla manufacturing strategy, it can be said that their value chain is definitely

made strategic sense as in most cases they cut costs and understand the true insource-

outsource trade-offs enabling the frugal outcomes. With seasoned supply chains, the

company work to rapidly developing and churning out their own electric cars in align with

government options to pursue low-emission and eco-friendly transit options. In addition,

Tesla is doing things radically dissimilar than various other car markets. The company is

focusing on making everything in house rather than outsourcing. The sales channels are also

insourced by them seeking for innovation. Tesla sells directly to the public through their

websites and in showroom in shopping centres.

Q6) From which five generic strategies are Tesla pursuing with its marketing strategy?

Tesla has adopted a broad differentiation strategy in extent with the premium electric vehicle

company so as to widen the respective sales and capture the market. (Leinwand & Mainardi).

However, in this case, it was founded that Tesla motors are also concentrated on offering

their vehicles to consumers at lower prices in relating to the costs they use in generating the

batteries. Since analysing the complete economical approach, focused differentiated strategy

will be best preferred. It is not only an electric company, however, but it is also one of the

major foremost premium brands in the industry right now.

Therefore, it is rational to say that the vehicles are produced by Tesla produced to meet the

perception of consumers by outcompeting all its competitors. Hence, employing this strategy

is leading them to achieve competitive advantage.

Q7) key elements of Tesla’s culture

There is been identified three major key elements of Tesla culture which includes ambitious

innovation, lack of bureaucracy and adherence to ‘First Principles’ method. The major

problems that can be seen in their culture amid growing competition are – overpromises and

under delivers, workman claims and lawsuits and earning of continuous profit. In detail,

Tesla not fulfil order of Model 3, their first electric vehicle designed for masses. In addition,

MANAGEMENT 5

complaints by the workmen also not addressed properly related to threatened violence,

pervasive harassment and so on. Lastly, the company also not able to earn the profit

continuously, as later ten years of losses, it was finally announced by Tesla its first-ever

quarterly profit in 2013. Conversely, in February 2018, the enterprise proclaimed that it

ended 2017 with its biggest quarterly loss of around $675 million.

complaints by the workmen also not addressed properly related to threatened violence,

pervasive harassment and so on. Lastly, the company also not able to earn the profit

continuously, as later ten years of losses, it was finally announced by Tesla its first-ever

quarterly profit in 2013. Conversely, in February 2018, the enterprise proclaimed that it

ended 2017 with its biggest quarterly loss of around $675 million.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGEMENT 6

References

Ingram, Antony. “Tesla Models S Gets Highest Safety-Test Score Ever Awarded By

NHTSA.” Greencarreports, 20 Aug. 2013,

https://www.greencarreports.com/news/1086352_tesla-models-s-gets-highest-safety-test-

score-ever-awarded-by-nhtsa

Leinwand, Paul., & Mainardi, Cesare. “Your Whole Company Needs to Be Distinctive, Not

Just Your Product.” hbr, 19 May. 2016, https://hbr.org/2016/05/your-whole-company-needs-

to-be-distinctive-not-just-your-product

Alvarez, Simon. “Tesla partner Panasonic to boost Gigafactory battery production capacity

by 30% to address Model 3 ramp.” teslarati, 31 July. 2018, https://www.teslarati.com/tesla-

panasonic-gigafactory-battery-output-model-3-ramp/

Loveday, Eric. “Panasonic To Sign Gigafactory Battery Deal With Tesla This Month.”

insideevs, 17 July. 2014, https://insideevs.com/panasonic-sign-gigafactory-battery-deal-tesla-

month/

Lee, Timothy. “Batteries could be Tesla’s secret weapon.” 18 April. 2017, Vox,

https://www.vox.com/new-money/2017/4/17/15293892/tesla-batteries-gigafactory-bet

References

Ingram, Antony. “Tesla Models S Gets Highest Safety-Test Score Ever Awarded By

NHTSA.” Greencarreports, 20 Aug. 2013,

https://www.greencarreports.com/news/1086352_tesla-models-s-gets-highest-safety-test-

score-ever-awarded-by-nhtsa

Leinwand, Paul., & Mainardi, Cesare. “Your Whole Company Needs to Be Distinctive, Not

Just Your Product.” hbr, 19 May. 2016, https://hbr.org/2016/05/your-whole-company-needs-

to-be-distinctive-not-just-your-product

Alvarez, Simon. “Tesla partner Panasonic to boost Gigafactory battery production capacity

by 30% to address Model 3 ramp.” teslarati, 31 July. 2018, https://www.teslarati.com/tesla-

panasonic-gigafactory-battery-output-model-3-ramp/

Loveday, Eric. “Panasonic To Sign Gigafactory Battery Deal With Tesla This Month.”

insideevs, 17 July. 2014, https://insideevs.com/panasonic-sign-gigafactory-battery-deal-tesla-

month/

Lee, Timothy. “Batteries could be Tesla’s secret weapon.” 18 April. 2017, Vox,

https://www.vox.com/new-money/2017/4/17/15293892/tesla-batteries-gigafactory-bet

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.