Management Accounting Report: Cost Analysis, Variance, and Budgeting

VerifiedAdded on 2020/01/23

|17

|5403

|31

Report

AI Summary

This report delves into the realm of management accounting, focusing on its application within Jeffrey & Son's, a manufacturing company producing Exquisite products. The report begins with an introduction to management accounting, highlighting its significance in strategic decision-making and organizational success. It then proceeds to analyze various cost classifications, including elements, functions, nature, and behavior. Furthermore, the report calculates job costs using the job costing method and determines exquisite costs through absorption costing techniques. It also analyzes cost data, prepares cost reports, and determines variances. The report covers the budgeting process, including the preparation of production, material purchase, and cash budgets. Finally, it identifies variances, their causes, and the actions needed to correct them, culminating in an operating statement that combines budgeted and actual results, and reports the findings to management, in accordance with responsibility centers.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Different types of cost classification.........................................................................1

AC 1.2 calculation of job cost for 200 units using job costing method................................2

AC 1.3 Determination of Exquisite cost using absorption costing technique.......................3

AC 1.4 Analyse cost data using appropriate techniques.......................................................5

TASK 2......................................................................................................................................6

AC 2.1 Preparation and analysis of cost report and determine variances.............................6

AC 2.2 Performance indicator that helps to find the areas for potential improvements.......7

AC 2.3 Ways that helps to reduce cost, improve quality and enhance value to the business

...............................................................................................................................................7

TASK 3......................................................................................................................................8

AC 3.1 Budgeting process: Nature and Purpose to the budget holders of Jeffery & Son's...8

AC 3.2 Appropriate budgeting methods for Jeffrey & Son's and its need............................8

AC 3.3 Preparation of production and Material purchase budget.........................................9

AC 3.4 Preparation of cash budget......................................................................................11

TASK 4....................................................................................................................................12

AC 4.1 Identify variances, its causes and taking corrective actions....................................12

AC 4.2 Preparation of operating statement through combining budgeted and actual results

.............................................................................................................................................12

AC 4.3 Report the findings to the management along in accordance with the responsibility

.............................................................................................................................................13

Centres.................................................................................................................................13

CONCLUSION........................................................................................................................13

INTRODUCTION......................................................................................................................1

TASK 1......................................................................................................................................1

AC 1.1 Different types of cost classification.........................................................................1

AC 1.2 calculation of job cost for 200 units using job costing method................................2

AC 1.3 Determination of Exquisite cost using absorption costing technique.......................3

AC 1.4 Analyse cost data using appropriate techniques.......................................................5

TASK 2......................................................................................................................................6

AC 2.1 Preparation and analysis of cost report and determine variances.............................6

AC 2.2 Performance indicator that helps to find the areas for potential improvements.......7

AC 2.3 Ways that helps to reduce cost, improve quality and enhance value to the business

...............................................................................................................................................7

TASK 3......................................................................................................................................8

AC 3.1 Budgeting process: Nature and Purpose to the budget holders of Jeffery & Son's...8

AC 3.2 Appropriate budgeting methods for Jeffrey & Son's and its need............................8

AC 3.3 Preparation of production and Material purchase budget.........................................9

AC 3.4 Preparation of cash budget......................................................................................11

TASK 4....................................................................................................................................12

AC 4.1 Identify variances, its causes and taking corrective actions....................................12

AC 4.2 Preparation of operating statement through combining budgeted and actual results

.............................................................................................................................................12

AC 4.3 Report the findings to the management along in accordance with the responsibility

.............................................................................................................................................13

Centres.................................................................................................................................13

CONCLUSION........................................................................................................................13

INTRODUCTION

Management accounting is one of the special branches of accounting. In the present

competitive and dynamic business environment, every organization needs to make effective

decision making. Strategic and qualified managerial decisions help organizations to ensure

long term survival. Analysis, interpretation and evaluation of financial information help to

build strategic management process in an effective manner. Financial and management

accounting are distinct from each other. Financial accounting refers to the consolidation of

financial data and information of an organization. However, under management accounting,

managers use information from the financial statements so as to reduce uncertainty and risk.

Jeffrey and Sons is a manufacturing company that produces variety of products such

as Exquisite. The present report mainly aims at identifying the role of managerial decisions in

the organization success. The report will discuss various management accounting practices

and techniques for achieving the organizational goals. The present report discusses the nature

of cost related information and decisions in order to reduce product cost. Moreover, the

importance of budgeting process techniques will be discussed that controls business

expenditures and maximize its revenues.

TASK 1

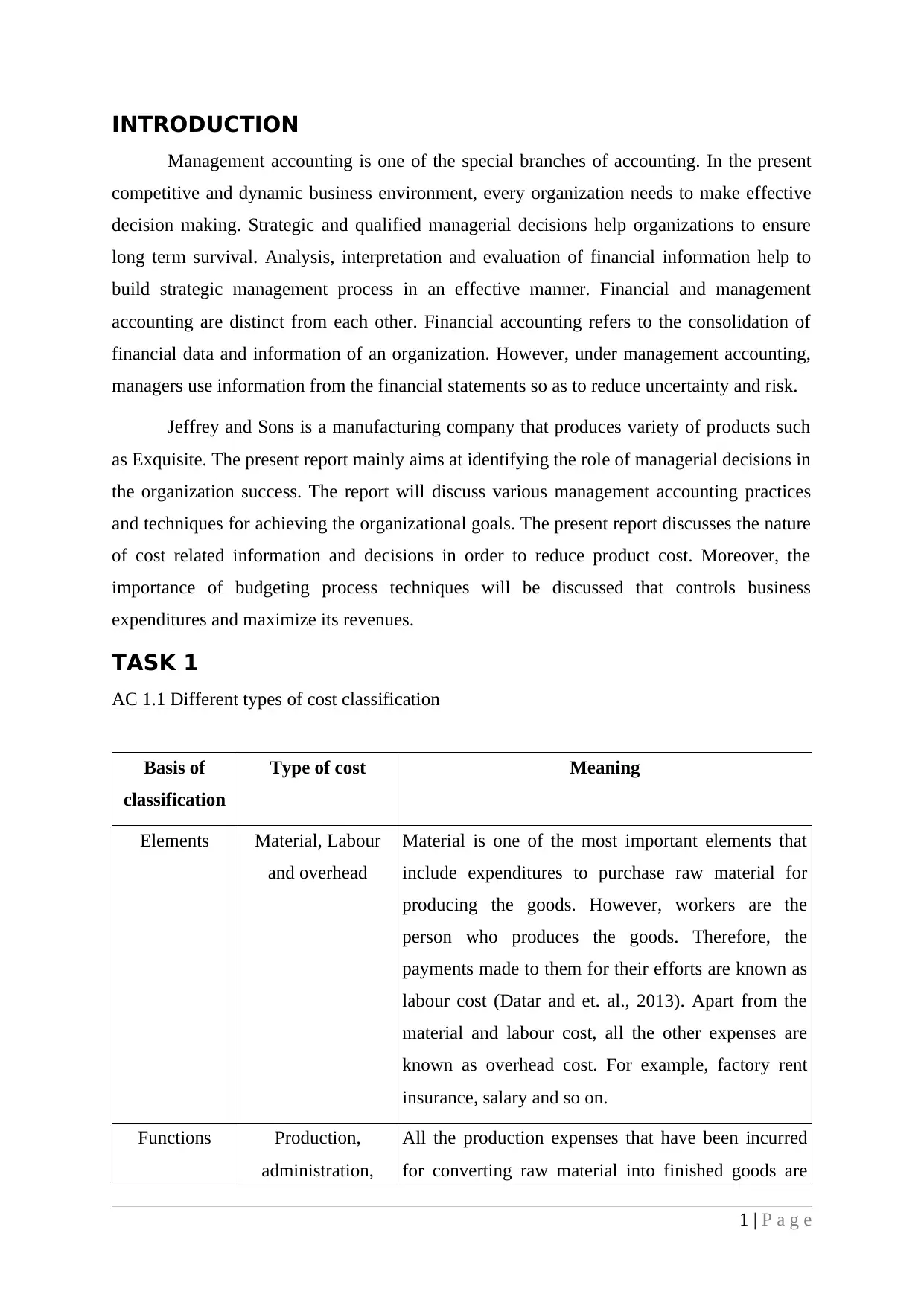

AC 1.1 Different types of cost classification

Basis of

classification

Type of cost Meaning

Elements Material, Labour

and overhead

Material is one of the most important elements that

include expenditures to purchase raw material for

producing the goods. However, workers are the

person who produces the goods. Therefore, the

payments made to them for their efforts are known as

labour cost (Datar and et. al., 2013). Apart from the

material and labour cost, all the other expenses are

known as overhead cost. For example, factory rent

insurance, salary and so on.

Functions Production,

administration,

All the production expenses that have been incurred

for converting raw material into finished goods are

1 | P a g e

Management accounting is one of the special branches of accounting. In the present

competitive and dynamic business environment, every organization needs to make effective

decision making. Strategic and qualified managerial decisions help organizations to ensure

long term survival. Analysis, interpretation and evaluation of financial information help to

build strategic management process in an effective manner. Financial and management

accounting are distinct from each other. Financial accounting refers to the consolidation of

financial data and information of an organization. However, under management accounting,

managers use information from the financial statements so as to reduce uncertainty and risk.

Jeffrey and Sons is a manufacturing company that produces variety of products such

as Exquisite. The present report mainly aims at identifying the role of managerial decisions in

the organization success. The report will discuss various management accounting practices

and techniques for achieving the organizational goals. The present report discusses the nature

of cost related information and decisions in order to reduce product cost. Moreover, the

importance of budgeting process techniques will be discussed that controls business

expenditures and maximize its revenues.

TASK 1

AC 1.1 Different types of cost classification

Basis of

classification

Type of cost Meaning

Elements Material, Labour

and overhead

Material is one of the most important elements that

include expenditures to purchase raw material for

producing the goods. However, workers are the

person who produces the goods. Therefore, the

payments made to them for their efforts are known as

labour cost (Datar and et. al., 2013). Apart from the

material and labour cost, all the other expenses are

known as overhead cost. For example, factory rent

insurance, salary and so on.

Functions Production,

administration,

All the production expenses that have been incurred

for converting raw material into finished goods are

1 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

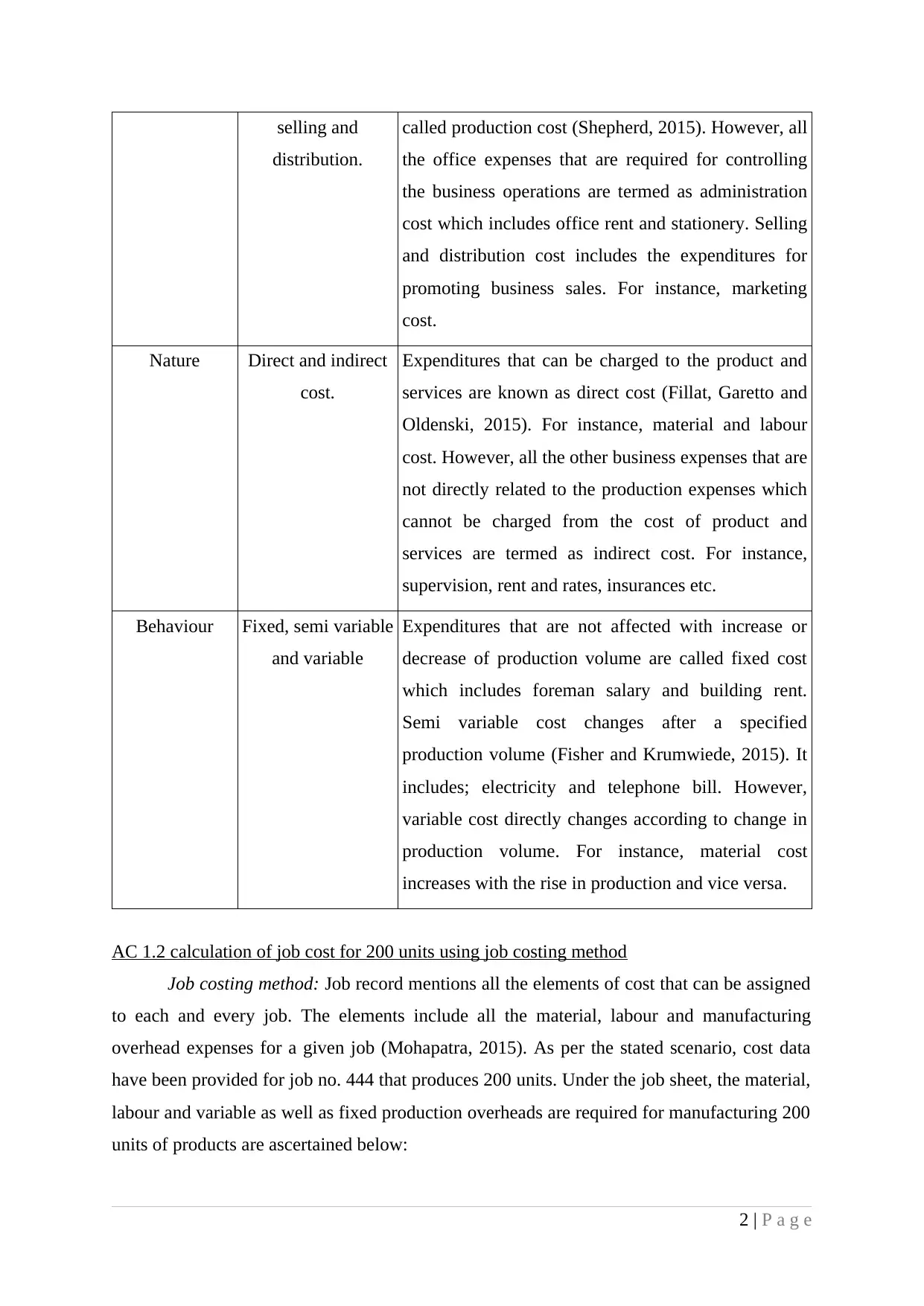

selling and

distribution.

called production cost (Shepherd, 2015). However, all

the office expenses that are required for controlling

the business operations are termed as administration

cost which includes office rent and stationery. Selling

and distribution cost includes the expenditures for

promoting business sales. For instance, marketing

cost.

Nature Direct and indirect

cost.

Expenditures that can be charged to the product and

services are known as direct cost (Fillat, Garetto and

Oldenski, 2015). For instance, material and labour

cost. However, all the other business expenses that are

not directly related to the production expenses which

cannot be charged from the cost of product and

services are termed as indirect cost. For instance,

supervision, rent and rates, insurances etc.

Behaviour Fixed, semi variable

and variable

Expenditures that are not affected with increase or

decrease of production volume are called fixed cost

which includes foreman salary and building rent.

Semi variable cost changes after a specified

production volume (Fisher and Krumwiede, 2015). It

includes; electricity and telephone bill. However,

variable cost directly changes according to change in

production volume. For instance, material cost

increases with the rise in production and vice versa.

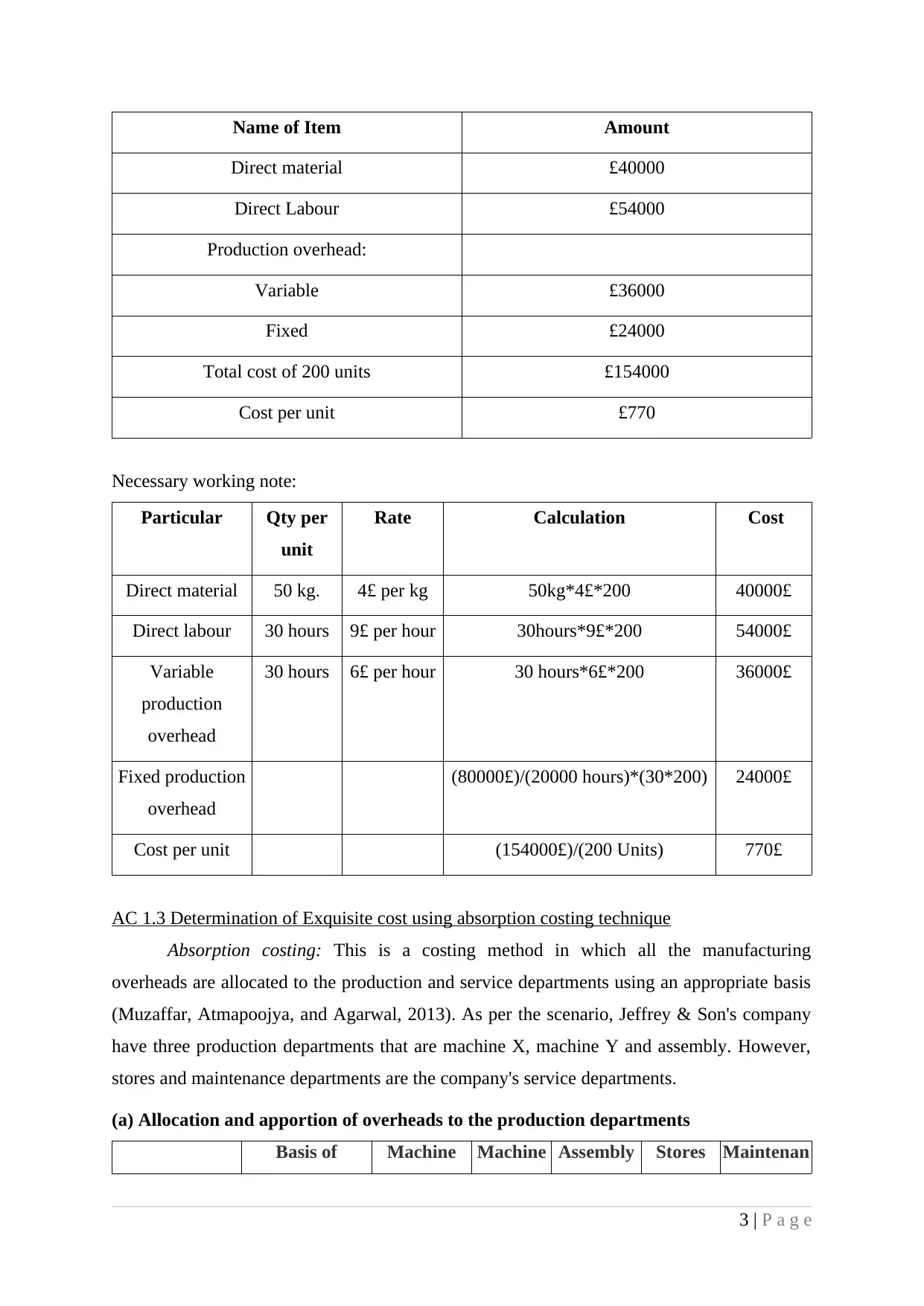

AC 1.2 calculation of job cost for 200 units using job costing method

Job costing method: Job record mentions all the elements of cost that can be assigned

to each and every job. The elements include all the material, labour and manufacturing

overhead expenses for a given job (Mohapatra, 2015). As per the stated scenario, cost data

have been provided for job no. 444 that produces 200 units. Under the job sheet, the material,

labour and variable as well as fixed production overheads are required for manufacturing 200

units of products are ascertained below:

2 | P a g e

distribution.

called production cost (Shepherd, 2015). However, all

the office expenses that are required for controlling

the business operations are termed as administration

cost which includes office rent and stationery. Selling

and distribution cost includes the expenditures for

promoting business sales. For instance, marketing

cost.

Nature Direct and indirect

cost.

Expenditures that can be charged to the product and

services are known as direct cost (Fillat, Garetto and

Oldenski, 2015). For instance, material and labour

cost. However, all the other business expenses that are

not directly related to the production expenses which

cannot be charged from the cost of product and

services are termed as indirect cost. For instance,

supervision, rent and rates, insurances etc.

Behaviour Fixed, semi variable

and variable

Expenditures that are not affected with increase or

decrease of production volume are called fixed cost

which includes foreman salary and building rent.

Semi variable cost changes after a specified

production volume (Fisher and Krumwiede, 2015). It

includes; electricity and telephone bill. However,

variable cost directly changes according to change in

production volume. For instance, material cost

increases with the rise in production and vice versa.

AC 1.2 calculation of job cost for 200 units using job costing method

Job costing method: Job record mentions all the elements of cost that can be assigned

to each and every job. The elements include all the material, labour and manufacturing

overhead expenses for a given job (Mohapatra, 2015). As per the stated scenario, cost data

have been provided for job no. 444 that produces 200 units. Under the job sheet, the material,

labour and variable as well as fixed production overheads are required for manufacturing 200

units of products are ascertained below:

2 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Name of Item Amount

Direct material £40000

Direct Labour £54000

Production overhead:

Variable £36000

Fixed £24000

Total cost of 200 units £154000

Cost per unit £770

Necessary working note:

Particular Qty per

unit

Rate Calculation Cost

Direct material 50 kg. 4£ per kg 50kg*4£*200 40000£

Direct labour 30 hours 9£ per hour 30hours*9£*200 54000£

Variable

production

overhead

30 hours 6£ per hour 30 hours*6£*200 36000£

Fixed production

overhead

(80000£)/(20000 hours)*(30*200) 24000£

Cost per unit (154000£)/(200 Units) 770£

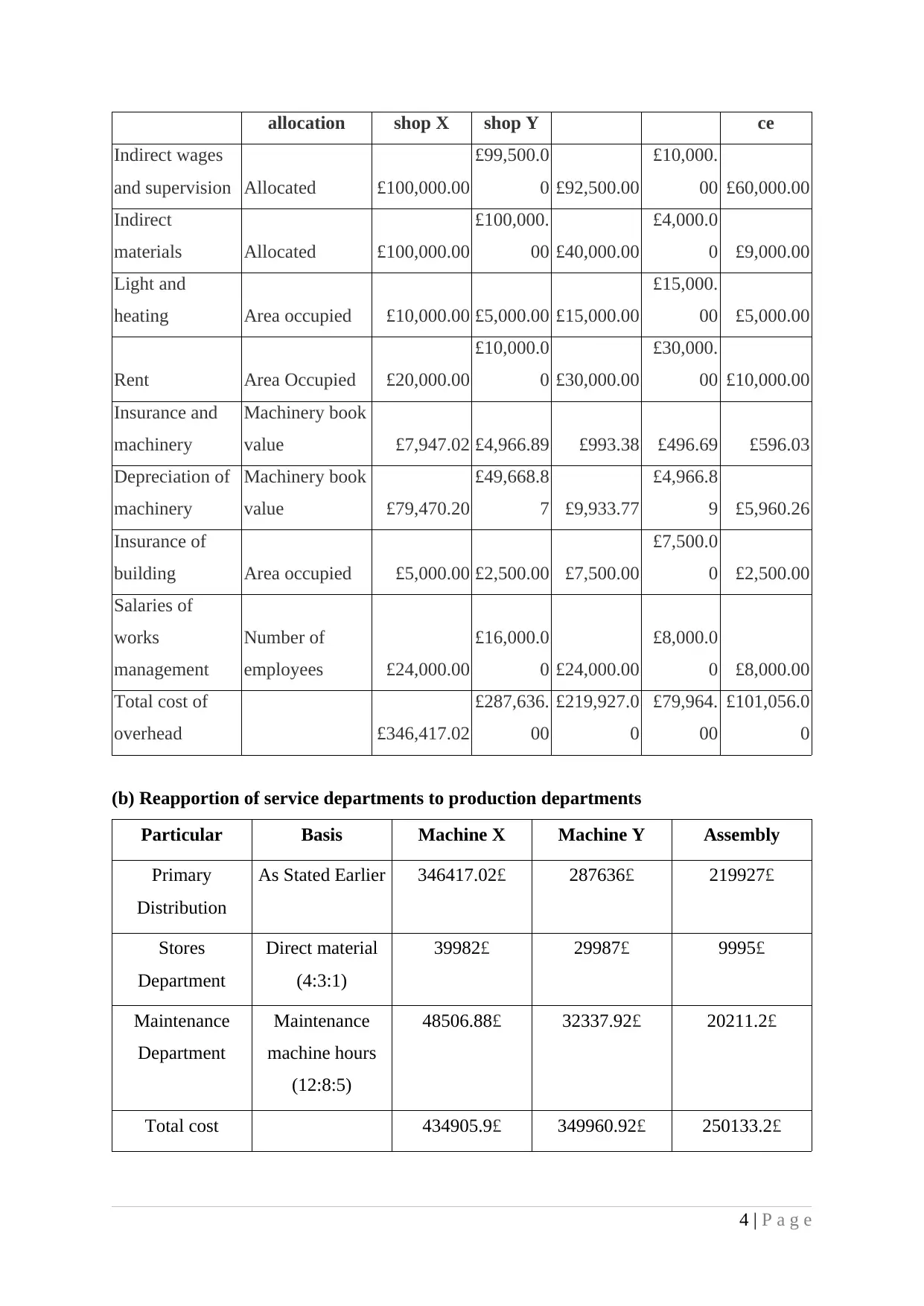

AC 1.3 Determination of Exquisite cost using absorption costing technique

Absorption costing: This is a costing method in which all the manufacturing

overheads are allocated to the production and service departments using an appropriate basis

(Muzaffar, Atmapoojya, and Agarwal, 2013). As per the scenario, Jeffrey & Son's company

have three production departments that are machine X, machine Y and assembly. However,

stores and maintenance departments are the company's service departments.

(a) Allocation and apportion of overheads to the production departments

Basis of Machine Machine Assembly Stores Maintenan

3 | P a g e

Direct material £40000

Direct Labour £54000

Production overhead:

Variable £36000

Fixed £24000

Total cost of 200 units £154000

Cost per unit £770

Necessary working note:

Particular Qty per

unit

Rate Calculation Cost

Direct material 50 kg. 4£ per kg 50kg*4£*200 40000£

Direct labour 30 hours 9£ per hour 30hours*9£*200 54000£

Variable

production

overhead

30 hours 6£ per hour 30 hours*6£*200 36000£

Fixed production

overhead

(80000£)/(20000 hours)*(30*200) 24000£

Cost per unit (154000£)/(200 Units) 770£

AC 1.3 Determination of Exquisite cost using absorption costing technique

Absorption costing: This is a costing method in which all the manufacturing

overheads are allocated to the production and service departments using an appropriate basis

(Muzaffar, Atmapoojya, and Agarwal, 2013). As per the scenario, Jeffrey & Son's company

have three production departments that are machine X, machine Y and assembly. However,

stores and maintenance departments are the company's service departments.

(a) Allocation and apportion of overheads to the production departments

Basis of Machine Machine Assembly Stores Maintenan

3 | P a g e

allocation shop X shop Y ce

Indirect wages

and supervision Allocated £100,000.00

£99,500.0

0 £92,500.00

£10,000.

00 £60,000.00

Indirect

materials Allocated £100,000.00

£100,000.

00 £40,000.00

£4,000.0

0 £9,000.00

Light and

heating Area occupied £10,000.00 £5,000.00 £15,000.00

£15,000.

00 £5,000.00

Rent Area Occupied £20,000.00

£10,000.0

0 £30,000.00

£30,000.

00 £10,000.00

Insurance and

machinery

Machinery book

value £7,947.02 £4,966.89 £993.38 £496.69 £596.03

Depreciation of

machinery

Machinery book

value £79,470.20

£49,668.8

7 £9,933.77

£4,966.8

9 £5,960.26

Insurance of

building Area occupied £5,000.00 £2,500.00 £7,500.00

£7,500.0

0 £2,500.00

Salaries of

works

management

Number of

employees £24,000.00

£16,000.0

0 £24,000.00

£8,000.0

0 £8,000.00

Total cost of

overhead £346,417.02

£287,636.

00

£219,927.0

0

£79,964.

00

£101,056.0

0

(b) Reapportion of service departments to production departments

Particular Basis Machine X Machine Y Assembly

Primary

Distribution

As Stated Earlier 346417.02£ 287636£ 219927£

Stores

Department

Direct material

(4:3:1)

39982£ 29987£ 9995£

Maintenance

Department

Maintenance

machine hours

(12:8:5)

48506.88£ 32337.92£ 20211.2£

Total cost 434905.9£ 349960.92£ 250133.2£

4 | P a g e

Indirect wages

and supervision Allocated £100,000.00

£99,500.0

0 £92,500.00

£10,000.

00 £60,000.00

Indirect

materials Allocated £100,000.00

£100,000.

00 £40,000.00

£4,000.0

0 £9,000.00

Light and

heating Area occupied £10,000.00 £5,000.00 £15,000.00

£15,000.

00 £5,000.00

Rent Area Occupied £20,000.00

£10,000.0

0 £30,000.00

£30,000.

00 £10,000.00

Insurance and

machinery

Machinery book

value £7,947.02 £4,966.89 £993.38 £496.69 £596.03

Depreciation of

machinery

Machinery book

value £79,470.20

£49,668.8

7 £9,933.77

£4,966.8

9 £5,960.26

Insurance of

building Area occupied £5,000.00 £2,500.00 £7,500.00

£7,500.0

0 £2,500.00

Salaries of

works

management

Number of

employees £24,000.00

£16,000.0

0 £24,000.00

£8,000.0

0 £8,000.00

Total cost of

overhead £346,417.02

£287,636.

00

£219,927.0

0

£79,964.

00

£101,056.0

0

(b) Reapportion of service departments to production departments

Particular Basis Machine X Machine Y Assembly

Primary

Distribution

As Stated Earlier 346417.02£ 287636£ 219927£

Stores

Department

Direct material

(4:3:1)

39982£ 29987£ 9995£

Maintenance

Department

Maintenance

machine hours

(12:8:5)

48506.88£ 32337.92£ 20211.2£

Total cost 434905.9£ 349960.92£ 250133.2£

4 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

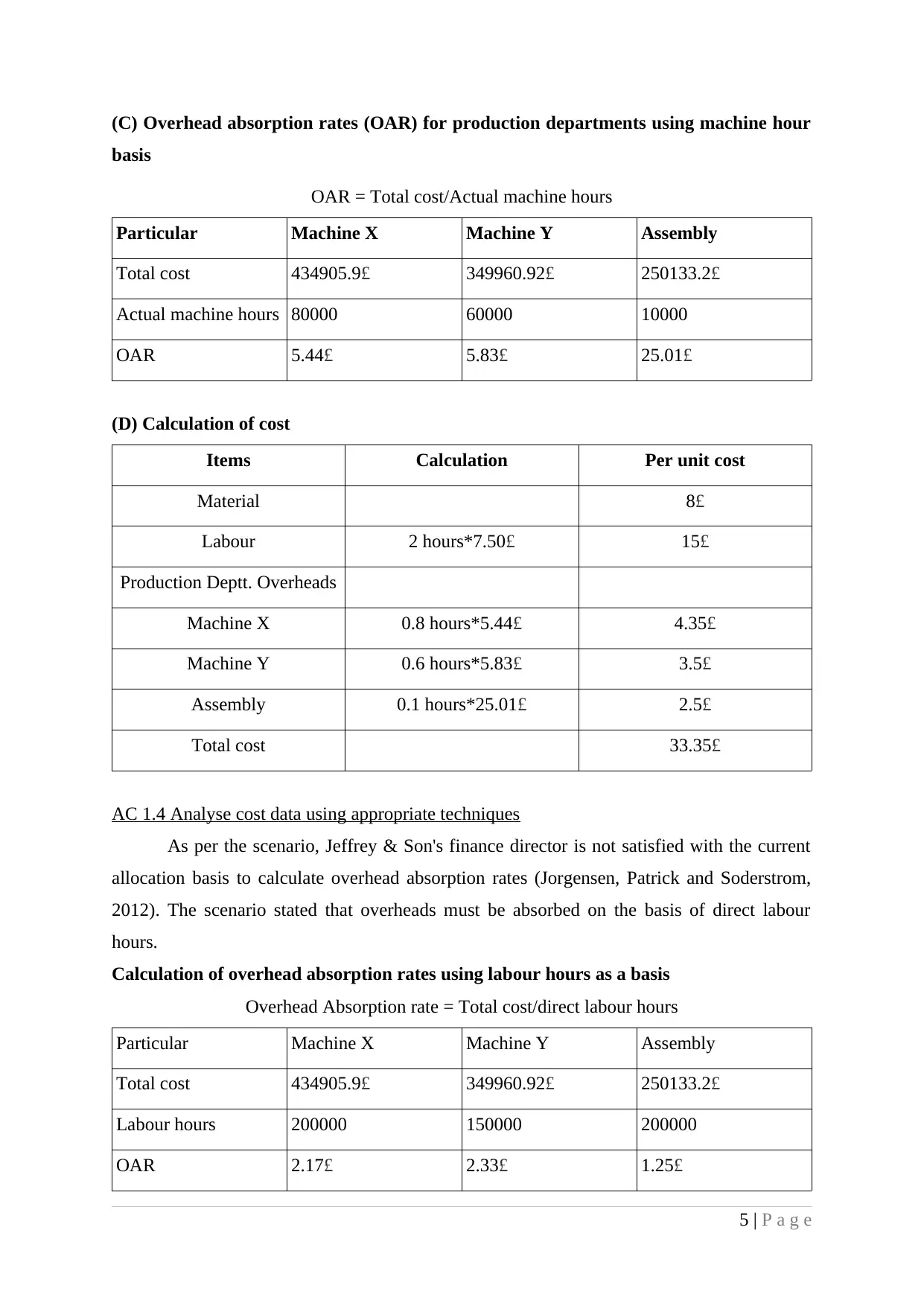

(C) Overhead absorption rates (OAR) for production departments using machine hour

basis

OAR = Total cost/Actual machine hours

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Actual machine hours 80000 60000 10000

OAR 5.44£ 5.83£ 25.01£

(D) Calculation of cost

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Production Deptt. Overheads

Machine X 0.8 hours*5.44£ 4.35£

Machine Y 0.6 hours*5.83£ 3.5£

Assembly 0.1 hours*25.01£ 2.5£

Total cost 33.35£

AC 1.4 Analyse cost data using appropriate techniques

As per the scenario, Jeffrey & Son's finance director is not satisfied with the current

allocation basis to calculate overhead absorption rates (Jorgensen, Patrick and Soderstrom,

2012). The scenario stated that overheads must be absorbed on the basis of direct labour

hours.

Calculation of overhead absorption rates using labour hours as a basis

Overhead Absorption rate = Total cost/direct labour hours

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Labour hours 200000 150000 200000

OAR 2.17£ 2.33£ 1.25£

5 | P a g e

basis

OAR = Total cost/Actual machine hours

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Actual machine hours 80000 60000 10000

OAR 5.44£ 5.83£ 25.01£

(D) Calculation of cost

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Production Deptt. Overheads

Machine X 0.8 hours*5.44£ 4.35£

Machine Y 0.6 hours*5.83£ 3.5£

Assembly 0.1 hours*25.01£ 2.5£

Total cost 33.35£

AC 1.4 Analyse cost data using appropriate techniques

As per the scenario, Jeffrey & Son's finance director is not satisfied with the current

allocation basis to calculate overhead absorption rates (Jorgensen, Patrick and Soderstrom,

2012). The scenario stated that overheads must be absorbed on the basis of direct labour

hours.

Calculation of overhead absorption rates using labour hours as a basis

Overhead Absorption rate = Total cost/direct labour hours

Particular Machine X Machine Y Assembly

Total cost 434905.9£ 349960.92£ 250133.2£

Labour hours 200000 150000 200000

OAR 2.17£ 2.33£ 1.25£

5 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

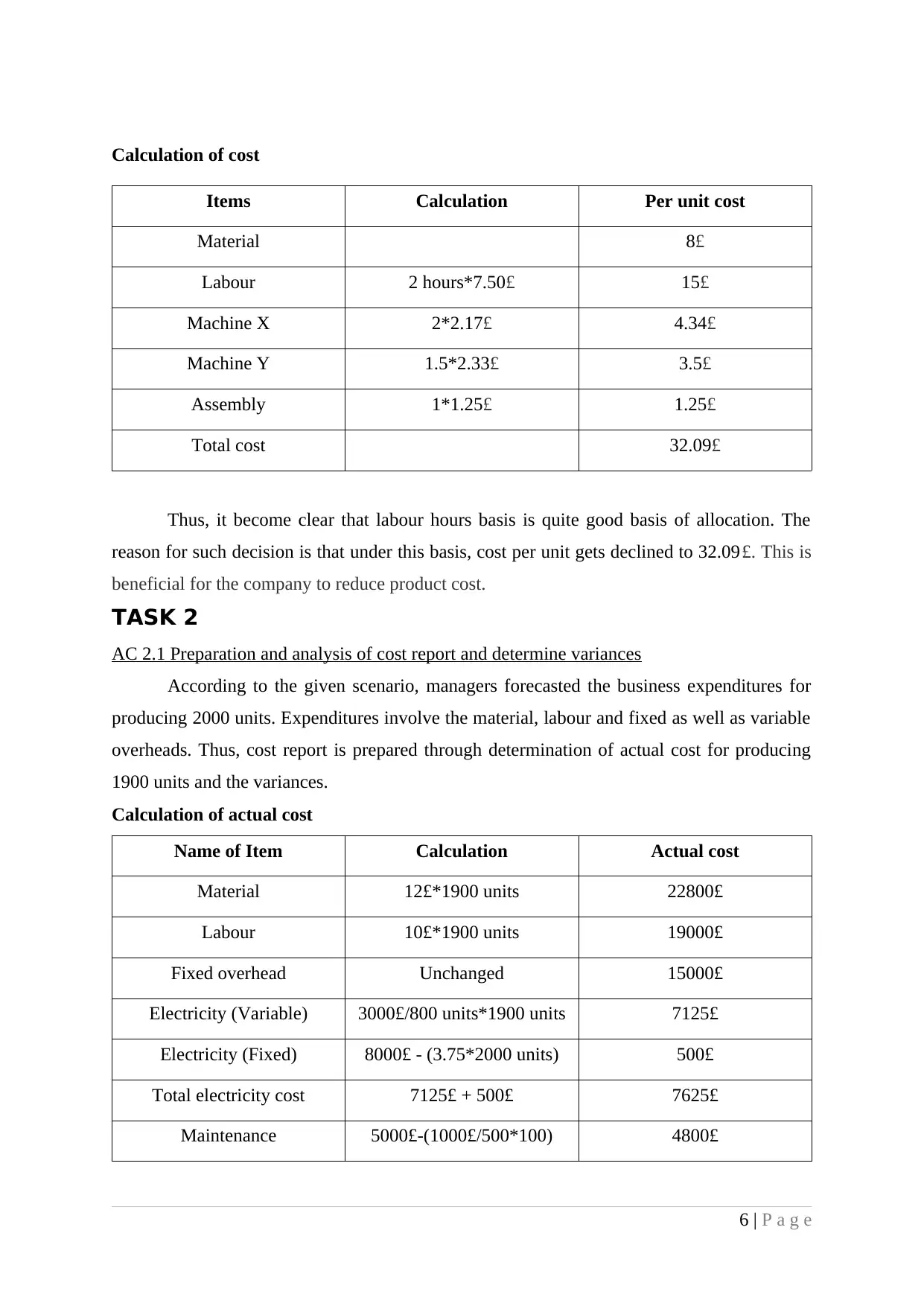

Calculation of cost

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Machine X 2*2.17£ 4.34£

Machine Y 1.5*2.33£ 3.5£

Assembly 1*1.25£ 1.25£

Total cost 32.09£

Thus, it become clear that labour hours basis is quite good basis of allocation. The

reason for such decision is that under this basis, cost per unit gets declined to 32.09£. This is

beneficial for the company to reduce product cost.

TASK 2

AC 2.1 Preparation and analysis of cost report and determine variances

According to the given scenario, managers forecasted the business expenditures for

producing 2000 units. Expenditures involve the material, labour and fixed as well as variable

overheads. Thus, cost report is prepared through determination of actual cost for producing

1900 units and the variances.

Calculation of actual cost

Name of Item Calculation Actual cost

Material 12£*1900 units 22800£

Labour 10£*1900 units 19000£

Fixed overhead Unchanged 15000£

Electricity (Variable) 3000£/800 units*1900 units 7125£

Electricity (Fixed) 8000£ - (3.75*2000 units) 500£

Total electricity cost 7125£ + 500£ 7625£

Maintenance 5000£-(1000£/500*100) 4800£

6 | P a g e

Items Calculation Per unit cost

Material 8£

Labour 2 hours*7.50£ 15£

Machine X 2*2.17£ 4.34£

Machine Y 1.5*2.33£ 3.5£

Assembly 1*1.25£ 1.25£

Total cost 32.09£

Thus, it become clear that labour hours basis is quite good basis of allocation. The

reason for such decision is that under this basis, cost per unit gets declined to 32.09£. This is

beneficial for the company to reduce product cost.

TASK 2

AC 2.1 Preparation and analysis of cost report and determine variances

According to the given scenario, managers forecasted the business expenditures for

producing 2000 units. Expenditures involve the material, labour and fixed as well as variable

overheads. Thus, cost report is prepared through determination of actual cost for producing

1900 units and the variances.

Calculation of actual cost

Name of Item Calculation Actual cost

Material 12£*1900 units 22800£

Labour 10£*1900 units 19000£

Fixed overhead Unchanged 15000£

Electricity (Variable) 3000£/800 units*1900 units 7125£

Electricity (Fixed) 8000£ - (3.75*2000 units) 500£

Total electricity cost 7125£ + 500£ 7625£

Maintenance 5000£-(1000£/500*100) 4800£

6 | P a g e

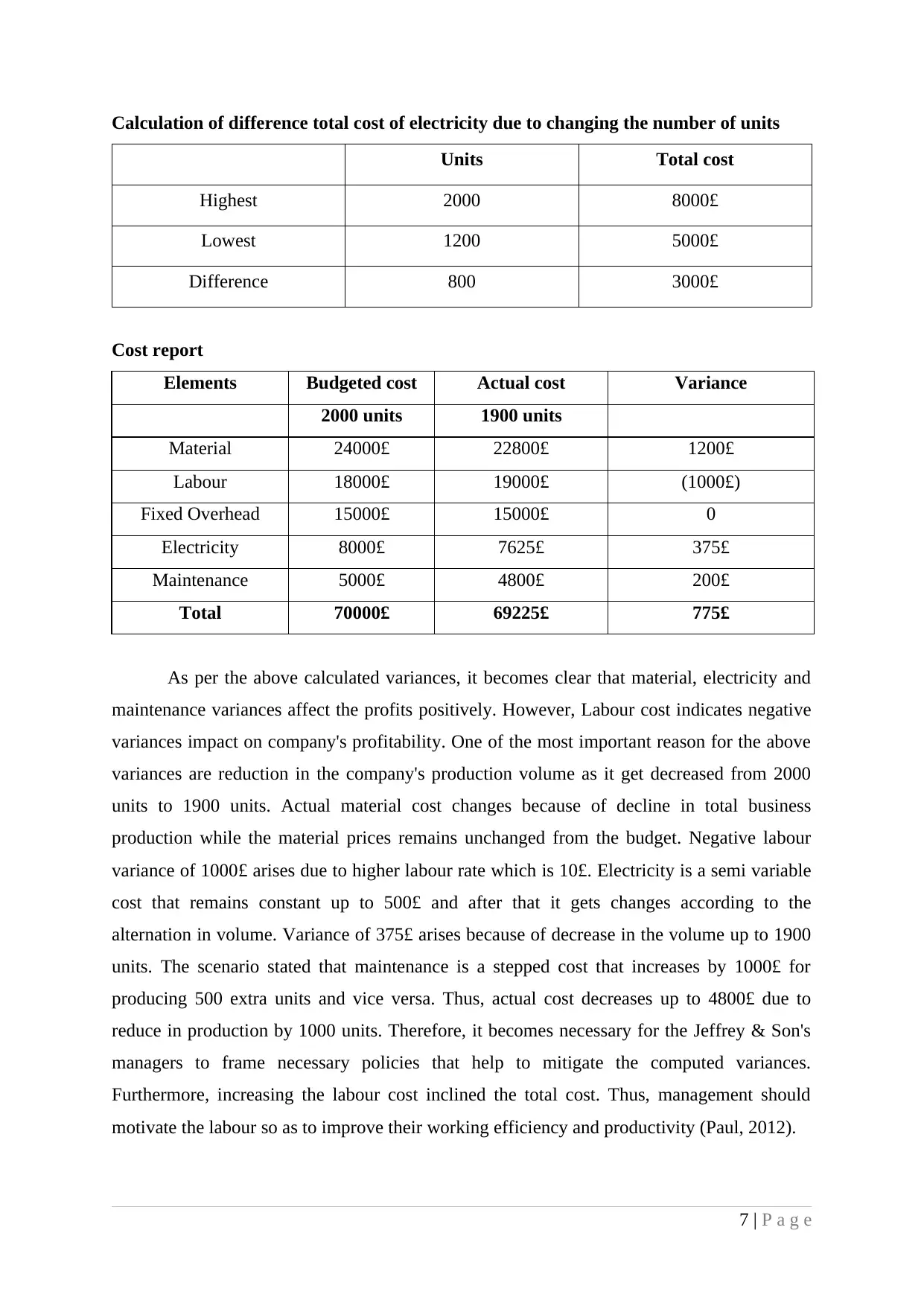

Calculation of difference total cost of electricity due to changing the number of units

Units Total cost

Highest 2000 8000£

Lowest 1200 5000£

Difference 800 3000£

Cost report

Elements Budgeted cost Actual cost Variance

2000 units 1900 units

Material 24000£ 22800£ 1200£

Labour 18000£ 19000£ (1000£)

Fixed Overhead 15000£ 15000£ 0

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

As per the above calculated variances, it becomes clear that material, electricity and

maintenance variances affect the profits positively. However, Labour cost indicates negative

variances impact on company's profitability. One of the most important reason for the above

variances are reduction in the company's production volume as it get decreased from 2000

units to 1900 units. Actual material cost changes because of decline in total business

production while the material prices remains unchanged from the budget. Negative labour

variance of 1000£ arises due to higher labour rate which is 10£. Electricity is a semi variable

cost that remains constant up to 500£ and after that it gets changes according to the

alternation in volume. Variance of 375£ arises because of decrease in the volume up to 1900

units. The scenario stated that maintenance is a stepped cost that increases by 1000£ for

producing 500 extra units and vice versa. Thus, actual cost decreases up to 4800£ due to

reduce in production by 1000 units. Therefore, it becomes necessary for the Jeffrey & Son's

managers to frame necessary policies that help to mitigate the computed variances.

Furthermore, increasing the labour cost inclined the total cost. Thus, management should

motivate the labour so as to improve their working efficiency and productivity (Paul, 2012).

7 | P a g e

Units Total cost

Highest 2000 8000£

Lowest 1200 5000£

Difference 800 3000£

Cost report

Elements Budgeted cost Actual cost Variance

2000 units 1900 units

Material 24000£ 22800£ 1200£

Labour 18000£ 19000£ (1000£)

Fixed Overhead 15000£ 15000£ 0

Electricity 8000£ 7625£ 375£

Maintenance 5000£ 4800£ 200£

Total 70000£ 69225£ 775£

As per the above calculated variances, it becomes clear that material, electricity and

maintenance variances affect the profits positively. However, Labour cost indicates negative

variances impact on company's profitability. One of the most important reason for the above

variances are reduction in the company's production volume as it get decreased from 2000

units to 1900 units. Actual material cost changes because of decline in total business

production while the material prices remains unchanged from the budget. Negative labour

variance of 1000£ arises due to higher labour rate which is 10£. Electricity is a semi variable

cost that remains constant up to 500£ and after that it gets changes according to the

alternation in volume. Variance of 375£ arises because of decrease in the volume up to 1900

units. The scenario stated that maintenance is a stepped cost that increases by 1000£ for

producing 500 extra units and vice versa. Thus, actual cost decreases up to 4800£ due to

reduce in production by 1000 units. Therefore, it becomes necessary for the Jeffrey & Son's

managers to frame necessary policies that help to mitigate the computed variances.

Furthermore, increasing the labour cost inclined the total cost. Thus, management should

motivate the labour so as to improve their working efficiency and productivity (Paul, 2012).

7 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

AC 2.2 Performance indicator that helps to find the areas for potential improvements

Present competitive environment enable the businesses to identify their performance

on a regular basis. Performance indicators support organization to determine the areas at

which company require to make improvement that helps to compete effectively at the market.

Business revenue is one of the most significant indicator through which managers can

determine the performance (Kipp and et. al., 2012). Jeffrey & Son's generate revenues

through selling the exquisite products to the customers. Increase in business sales indicates

that the market performance of the company is good. Along with the sales, cost is also very

important component. Increasing the business cost without rising sales indicate that business

has to maintain effective control over the costs. Further, when the sales and cost both are

increasing but the costs are increases at higher rate than it reduce the business profit margin.

Thus, it is clear that along with the sales increase, company also need to control business cost

through regular monitoring. Furthermore, profits indicate the operational results. Higher

profitability shows good business performance and vice versa.

AC 2.3 Ways that helps to reduce cost, improve quality and enhance value to the business

Total Quality Management (TQM) is a most effective way that will help Jeffery &

Son's to reduce its business cost and improve their quality. The process helps to improve the

organization's competitiveness, effectiveness, productivity and its efficiency to a great extent.

The term ''Total'' involves all the operating activities of the business. However, ‘Quality’

refers to meeting customer demands and the term '' Management'' explains that managers

need to manage quality. The process bring number of benefits for the organization which

mainly includes higher customer satisfaction, meeting of customer demands at right time,

reduction of products and services cost, effective training of employees, and reduction in

waiting time of customers to get the product and service (Hochbaum and Wagner, 2015).

Thus, it can be said that successful implication of the process will maintain the costs and

improve quality. Moreover, using innovative and advanced technology, quality can be

improved to a great extent.

Apart from this, business value can be enhanced through increasing the business

profits. Moreover, great position, larger investment, effective development plans and business

expansions also enhance value to the business. This in turn provides enterprise with benefits

of growth, business development and long term surveillance.

8 | P a g e

Present competitive environment enable the businesses to identify their performance

on a regular basis. Performance indicators support organization to determine the areas at

which company require to make improvement that helps to compete effectively at the market.

Business revenue is one of the most significant indicator through which managers can

determine the performance (Kipp and et. al., 2012). Jeffrey & Son's generate revenues

through selling the exquisite products to the customers. Increase in business sales indicates

that the market performance of the company is good. Along with the sales, cost is also very

important component. Increasing the business cost without rising sales indicate that business

has to maintain effective control over the costs. Further, when the sales and cost both are

increasing but the costs are increases at higher rate than it reduce the business profit margin.

Thus, it is clear that along with the sales increase, company also need to control business cost

through regular monitoring. Furthermore, profits indicate the operational results. Higher

profitability shows good business performance and vice versa.

AC 2.3 Ways that helps to reduce cost, improve quality and enhance value to the business

Total Quality Management (TQM) is a most effective way that will help Jeffery &

Son's to reduce its business cost and improve their quality. The process helps to improve the

organization's competitiveness, effectiveness, productivity and its efficiency to a great extent.

The term ''Total'' involves all the operating activities of the business. However, ‘Quality’

refers to meeting customer demands and the term '' Management'' explains that managers

need to manage quality. The process bring number of benefits for the organization which

mainly includes higher customer satisfaction, meeting of customer demands at right time,

reduction of products and services cost, effective training of employees, and reduction in

waiting time of customers to get the product and service (Hochbaum and Wagner, 2015).

Thus, it can be said that successful implication of the process will maintain the costs and

improve quality. Moreover, using innovative and advanced technology, quality can be

improved to a great extent.

Apart from this, business value can be enhanced through increasing the business

profits. Moreover, great position, larger investment, effective development plans and business

expansions also enhance value to the business. This in turn provides enterprise with benefits

of growth, business development and long term surveillance.

8 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

AC 3.1 budgeting process: Nature and Purpose to the budget holders of Jeffery & Son's

Purpose of budgeting process: All the businesses organizations whether small or

large, estimate business revenues and expenses that can be occur in future period. Budget is a

monetary tool that combines the probable business incomes and expenses related to operating

functions of all the business departments. It mainly aims at forecasting the future business

profits which can be determined through subtracting total expenditures from the total

incomes. Moreover, it aims at providing significant information to the managers that helps in

their decision making process (DRURY, 2013). Furthermore, the purpose of budgets is to

determine variances or deviations through comparing budgeted and actual outputs.

Nature of budgeting process: Budget can be prepared on the basis of budget of last

year. Jeffrey & Son's Company managers can identify the possible incomes from their sales

operations and other activities. However, under the expenditures cost of material, labour and

all the overheads need to be estimated. Thereafter, the excess of company's incomes over the

expenses are termed as cash surplus. However, in case of higher cash expenses than incomes,

the balance will be called deficit. At last, the managers have to revise and review all the

estimates and submit it to all the departments to achieve the budgeted targets. At ending the

budget period, actual yields must be compared with the decided targets to consider variances

and take appropriate decisions and corrective actions to eliminate them.

AC 3.2 Appropriate budgeting methods for Jeffrey & Son's and its need

Budget must be prepare by using appropriate techniques as inappropriate methods

may give incorrect information and cannot help to take effective managerial decisions.

According to the given scenario, Jeffrey & Son's started work on preparing budget for

upcoming year. The scenario said that volatile market conditions and market forces makes

difficult for the business to plan ahead. However, survival of the company is greatly depends

on taking right decisions at right time with right cost.

As per the scenario, Jeffrey & Son's budget manual indicated that sales volume is the

most important component under the budgeting process. Another, according to the company's

marketing manager; paramount is the basis for managing the coordination need in the

budgeting process. Thus, it is clear that budget is preparing on the basis of incremental

budgeting technique. Under this technique, previous year budget is taken as a basis for

estimating future year results in terms of revenues and expenses (Adah and Mamman, 2013).

9 | P a g e

AC 3.1 budgeting process: Nature and Purpose to the budget holders of Jeffery & Son's

Purpose of budgeting process: All the businesses organizations whether small or

large, estimate business revenues and expenses that can be occur in future period. Budget is a

monetary tool that combines the probable business incomes and expenses related to operating

functions of all the business departments. It mainly aims at forecasting the future business

profits which can be determined through subtracting total expenditures from the total

incomes. Moreover, it aims at providing significant information to the managers that helps in

their decision making process (DRURY, 2013). Furthermore, the purpose of budgets is to

determine variances or deviations through comparing budgeted and actual outputs.

Nature of budgeting process: Budget can be prepared on the basis of budget of last

year. Jeffrey & Son's Company managers can identify the possible incomes from their sales

operations and other activities. However, under the expenditures cost of material, labour and

all the overheads need to be estimated. Thereafter, the excess of company's incomes over the

expenses are termed as cash surplus. However, in case of higher cash expenses than incomes,

the balance will be called deficit. At last, the managers have to revise and review all the

estimates and submit it to all the departments to achieve the budgeted targets. At ending the

budget period, actual yields must be compared with the decided targets to consider variances

and take appropriate decisions and corrective actions to eliminate them.

AC 3.2 Appropriate budgeting methods for Jeffrey & Son's and its need

Budget must be prepare by using appropriate techniques as inappropriate methods

may give incorrect information and cannot help to take effective managerial decisions.

According to the given scenario, Jeffrey & Son's started work on preparing budget for

upcoming year. The scenario said that volatile market conditions and market forces makes

difficult for the business to plan ahead. However, survival of the company is greatly depends

on taking right decisions at right time with right cost.

As per the scenario, Jeffrey & Son's budget manual indicated that sales volume is the

most important component under the budgeting process. Another, according to the company's

marketing manager; paramount is the basis for managing the coordination need in the

budgeting process. Thus, it is clear that budget is preparing on the basis of incremental

budgeting technique. Under this technique, previous year budget is taken as a basis for

estimating future year results in terms of revenues and expenses (Adah and Mamman, 2013).

9 | P a g e

Therefore, the marketing manager as a budget holder will face many queries. The reason

behind this is under this budgeting method manager added a certain amount in all the

incomes and revenues without examining the future need of the business operations.

Therefore, it can be suggested to Jeffrey & Son's to prepare budget through adopting

Zero base budgeting technique. Under such method, all the previous years’ operating

activities are identified and their importance and need will be examining with the future

context (Glass, Stefanova and Prinzivalli, 2014). Unnecessary operating functions will not

carry out in the future period and excluded from the budget. This in turn, helps to reduce the

business cost and increase profitability. Moreover, the need of this method is that the incomes

are allocated under different business activities in an efficient manner. This in turn, helps to

ensure optimum allocation and maximum uses of resources.

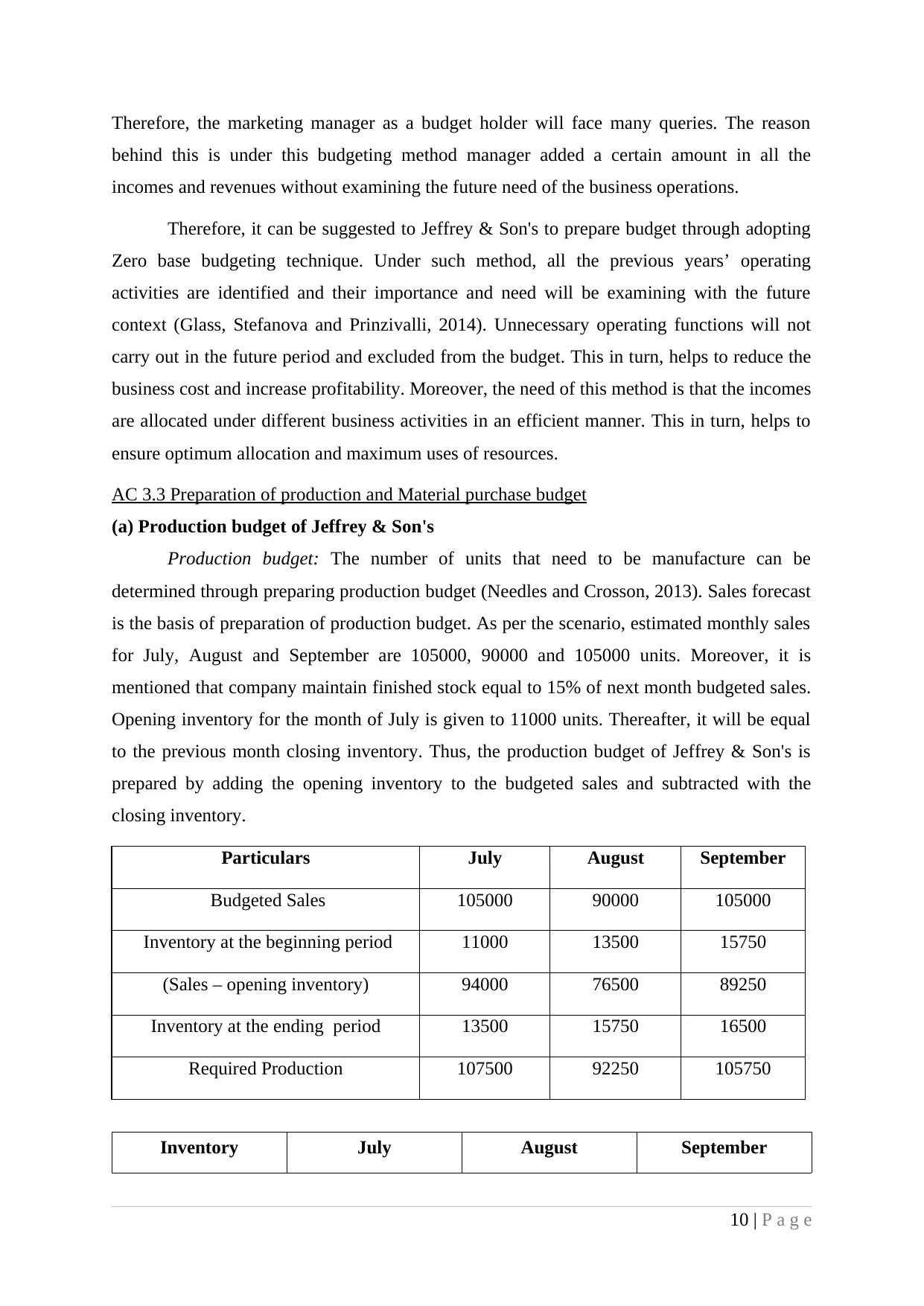

AC 3.3 Preparation of production and Material purchase budget

(a) Production budget of Jeffrey & Son's

Production budget: The number of units that need to be manufacture can be

determined through preparing production budget (Needles and Crosson, 2013). Sales forecast

is the basis of preparation of production budget. As per the scenario, estimated monthly sales

for July, August and September are 105000, 90000 and 105000 units. Moreover, it is

mentioned that company maintain finished stock equal to 15% of next month budgeted sales.

Opening inventory for the month of July is given to 11000 units. Thereafter, it will be equal

to the previous month closing inventory. Thus, the production budget of Jeffrey & Son's is

prepared by adding the opening inventory to the budgeted sales and subtracted with the

closing inventory.

Particulars July August September

Budgeted Sales 105000 90000 105000

Inventory at the beginning period 11000 13500 15750

(Sales – opening inventory) 94000 76500 89250

Inventory at the ending period 13500 15750 16500

Required Production 107500 92250 105750

Inventory July August September

10 | P a g e

behind this is under this budgeting method manager added a certain amount in all the

incomes and revenues without examining the future need of the business operations.

Therefore, it can be suggested to Jeffrey & Son's to prepare budget through adopting

Zero base budgeting technique. Under such method, all the previous years’ operating

activities are identified and their importance and need will be examining with the future

context (Glass, Stefanova and Prinzivalli, 2014). Unnecessary operating functions will not

carry out in the future period and excluded from the budget. This in turn, helps to reduce the

business cost and increase profitability. Moreover, the need of this method is that the incomes

are allocated under different business activities in an efficient manner. This in turn, helps to

ensure optimum allocation and maximum uses of resources.

AC 3.3 Preparation of production and Material purchase budget

(a) Production budget of Jeffrey & Son's

Production budget: The number of units that need to be manufacture can be

determined through preparing production budget (Needles and Crosson, 2013). Sales forecast

is the basis of preparation of production budget. As per the scenario, estimated monthly sales

for July, August and September are 105000, 90000 and 105000 units. Moreover, it is

mentioned that company maintain finished stock equal to 15% of next month budgeted sales.

Opening inventory for the month of July is given to 11000 units. Thereafter, it will be equal

to the previous month closing inventory. Thus, the production budget of Jeffrey & Son's is

prepared by adding the opening inventory to the budgeted sales and subtracted with the

closing inventory.

Particulars July August September

Budgeted Sales 105000 90000 105000

Inventory at the beginning period 11000 13500 15750

(Sales – opening inventory) 94000 76500 89250

Inventory at the ending period 13500 15750 16500

Required Production 107500 92250 105750

Inventory July August September

10 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.