Financial Evaluation of Unilever plc

VerifiedAdded on 2023/06/15

|29

|5833

|304

AI Summary

This report evaluates the financial position, financial performance, competitor position and the investment opportunity of Unilever plc. Financial evaluation over an organization is significant as it assists the company to make better decision about the position and the performance of the company. The report explains that the financial performance of the company could be analyzed on the basis of annual report, financial statements of the company, stock price of the company, competitor position of the company and the worth of the company.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: Finance

1

Project Report: Finance

1

Project Report: Finance

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Finance

2

Contents

Introduction.......................................................................................................................4

Company overview...........................................................................................................4

Financial performance and financial position...................................................................4

Profitability ratio...........................................................................................................5

Return on shareholder’s fund....................................................................................5

Operating profit margin............................................................................................6

Gross profit margin...................................................................................................7

Liquidity ratio...............................................................................................................8

(Morningstar, 2018)..................................................................................................8

Current ratio..............................................................................................................8

Acid Test ratio..........................................................................................................9

Efficiency ratio...........................................................................................................11

Receivable collection period...................................................................................11

Payable payment days.............................................................................................12

Inventory days........................................................................................................13

Gearing ratio...............................................................................................................14

Investment ratio..........................................................................................................15

Earnings per share...................................................................................................16

Price earnings ratio.................................................................................................16

Initiative to enhance company’s performance................................................................17

Competitor’s stake in the company................................................................................18

Recommendation............................................................................................................19

References.......................................................................................................................21

Appendix.........................................................................................................................23

2

Contents

Introduction.......................................................................................................................4

Company overview...........................................................................................................4

Financial performance and financial position...................................................................4

Profitability ratio...........................................................................................................5

Return on shareholder’s fund....................................................................................5

Operating profit margin............................................................................................6

Gross profit margin...................................................................................................7

Liquidity ratio...............................................................................................................8

(Morningstar, 2018)..................................................................................................8

Current ratio..............................................................................................................8

Acid Test ratio..........................................................................................................9

Efficiency ratio...........................................................................................................11

Receivable collection period...................................................................................11

Payable payment days.............................................................................................12

Inventory days........................................................................................................13

Gearing ratio...............................................................................................................14

Investment ratio..........................................................................................................15

Earnings per share...................................................................................................16

Price earnings ratio.................................................................................................16

Initiative to enhance company’s performance................................................................17

Competitor’s stake in the company................................................................................18

Recommendation............................................................................................................19

References.......................................................................................................................21

Appendix.........................................................................................................................23

Finance

3

Figure 1: return on shareholders’ Fund............................................................................6

Figure 2: Operating profit margin.....................................................................................7

Figure 3: Gross Profit margin...........................................................................................8

Figure 4: Current ratio......................................................................................................9

Figure 5: Acid Test Ratio...............................................................................................10

Figure 6: Receivable collection period...........................................................................12

Figure 7: Payable collection period................................................................................13

Figure 8: Inventory days.................................................................................................14

Figure 9: Gearing ratio....................................................................................................15

Figure 10: Earnings per share.........................................................................................16

3

Figure 1: return on shareholders’ Fund............................................................................6

Figure 2: Operating profit margin.....................................................................................7

Figure 3: Gross Profit margin...........................................................................................8

Figure 4: Current ratio......................................................................................................9

Figure 5: Acid Test Ratio...............................................................................................10

Figure 6: Receivable collection period...........................................................................12

Figure 7: Payable collection period................................................................................13

Figure 8: Inventory days.................................................................................................14

Figure 9: Gearing ratio....................................................................................................15

Figure 10: Earnings per share.........................................................................................16

Finance

4

Introduction:

This report paper has been prepared to evaluate the financial position, financial

performance, competitor position and the investment opportunity of Unilever plc. Financial

evaluation over an organization is significant as it assists the company to make better

decision about the position and the performance of the company. This report explains that it

becomes easier for the company and the stakeholders of the company to evaluate the position

of the organization and make better conclusion about the position, investment opportunity

and performance of the company. Further, it explains that the financial performance of the

company could be analyzed on the basis of annual report, financial statements of the

company, stock price of the company, competitor position of the company and the worth of

the company.

For this report, financial data of Unilever plc of last 5 years have been analyzed and

the ratio study has been conducted. Further, the competitors financial performance has been

compare with the financial performance of Uniliver plc and lastly, the stock performance and

the investment opportunity of the company has been evaluated.

Company overview:

Unilever plc is one of the fastest growing organizations in consumer goods market.

This company operates its business through foods, home care, personal care refreshment

segment etc. The company has diversified its market among 112 countries and the market

share of the company is huge. Personal segment of the company provides hair care and

skincare products, oral care products and deodorants. Food segment provides sauces, soup,

mayonnaise, margarines, salad dressings, spreads etc. the company has been founded in 1885.

Headquarter of the company is in London, UK (Home, 2018). The financial performance and

the position expresses about various positive and impressive changes into the organization.

Financial performance and financial position:

Financial performance and financial position of an organization could be evaluated

and measured through the financial statement and the market worth of the company.

Basically, it is a process in which the results of an organization are measured through

identifying the policies and the activities of the company in monetary terms (Davies and

4

Introduction:

This report paper has been prepared to evaluate the financial position, financial

performance, competitor position and the investment opportunity of Unilever plc. Financial

evaluation over an organization is significant as it assists the company to make better

decision about the position and the performance of the company. This report explains that it

becomes easier for the company and the stakeholders of the company to evaluate the position

of the organization and make better conclusion about the position, investment opportunity

and performance of the company. Further, it explains that the financial performance of the

company could be analyzed on the basis of annual report, financial statements of the

company, stock price of the company, competitor position of the company and the worth of

the company.

For this report, financial data of Unilever plc of last 5 years have been analyzed and

the ratio study has been conducted. Further, the competitors financial performance has been

compare with the financial performance of Uniliver plc and lastly, the stock performance and

the investment opportunity of the company has been evaluated.

Company overview:

Unilever plc is one of the fastest growing organizations in consumer goods market.

This company operates its business through foods, home care, personal care refreshment

segment etc. The company has diversified its market among 112 countries and the market

share of the company is huge. Personal segment of the company provides hair care and

skincare products, oral care products and deodorants. Food segment provides sauces, soup,

mayonnaise, margarines, salad dressings, spreads etc. the company has been founded in 1885.

Headquarter of the company is in London, UK (Home, 2018). The financial performance and

the position expresses about various positive and impressive changes into the organization.

Financial performance and financial position:

Financial performance and financial position of an organization could be evaluated

and measured through the financial statement and the market worth of the company.

Basically, it is a process in which the results of an organization are measured through

identifying the policies and the activities of the company in monetary terms (Davies and

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Finance

5

Crawford, 2011). The study of financial performance and position of the Unilever plc is as

follows:

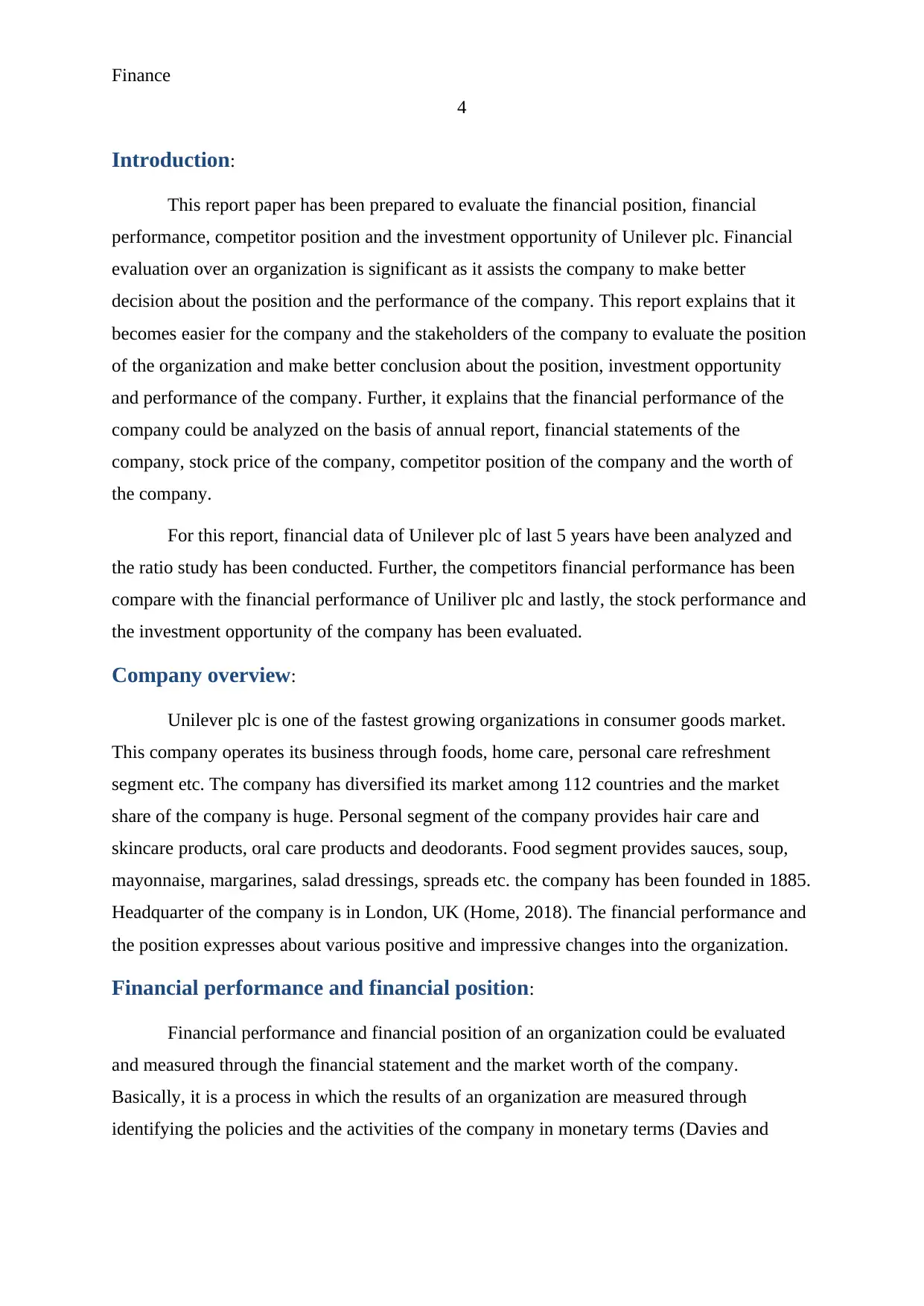

Profitability ratio:

Profitability ratio of the company has been evaluated firstly to identify the financial

performance and position of the company. Profitability ratios are the measurement of profit

position of the company. This explains about the profitability capacity of the company.

Following is the calculations of profitability ratio of the company:

Description Formula Unilever Plc

2017 2016 2015 2014

201

3

Profitabilit

y

Return on

shareholder

funds

NPAT/

Total

equity 31.70% 31.80% 37.88% 33.76%

29.5

5%

Operating

profit

margin

Operating

net profit /

Sales

100.00

% 100.00% 100.00% 100.00%

100.

00%

Gross Profit

Margin

Gross

Profit /

Sales 50.00% 50.00% 50.00% 50.00%

50.0

0%

(Breuer, Rieger and Soypak, 2014)

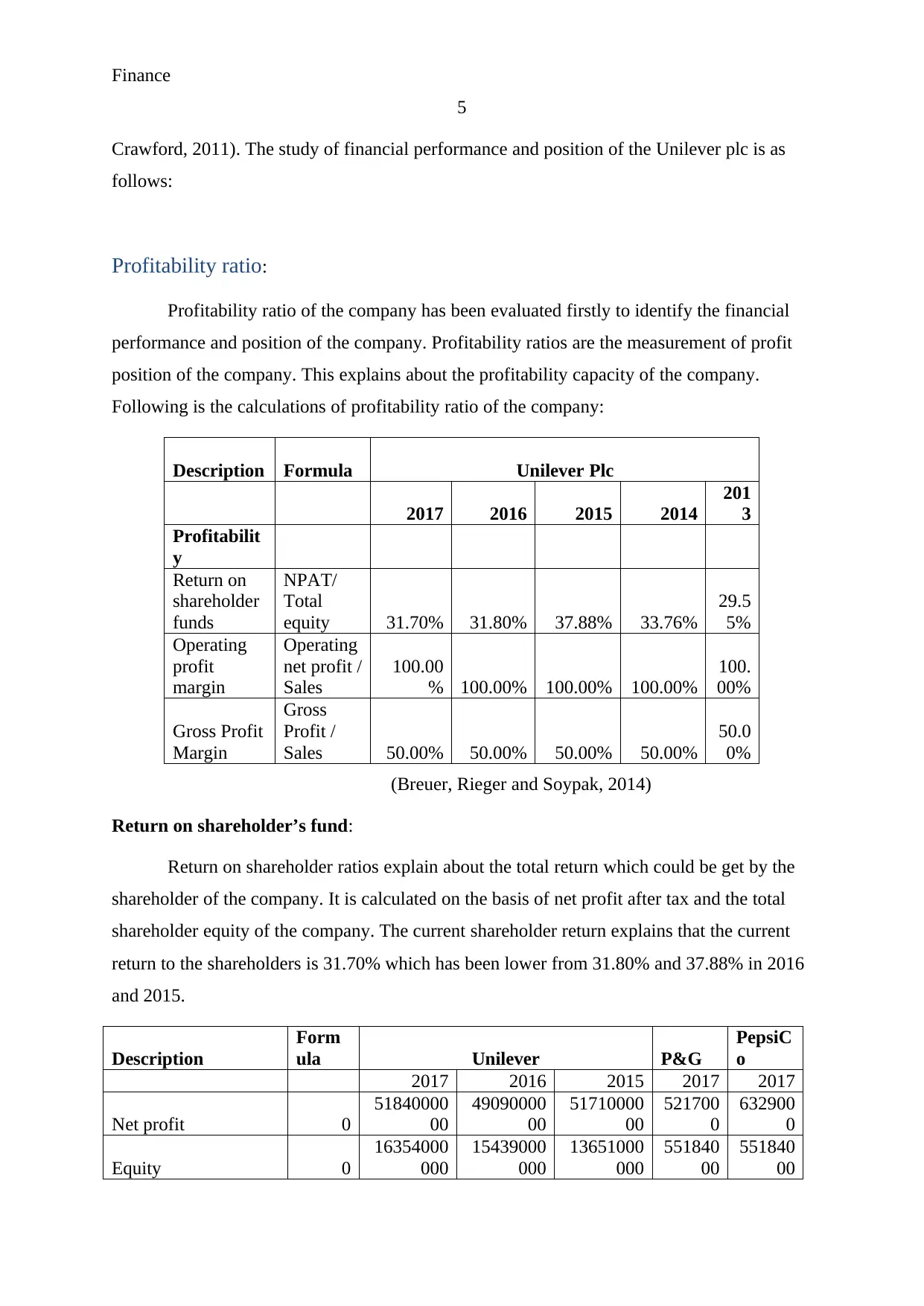

Return on shareholder’s fund:

Return on shareholder ratios explain about the total return which could be get by the

shareholder of the company. It is calculated on the basis of net profit after tax and the total

shareholder equity of the company. The current shareholder return explains that the current

return to the shareholders is 31.70% which has been lower from 31.80% and 37.88% in 2016

and 2015.

Description

Form

ula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Net profit 0

51840000

00

49090000

00

51710000

00

521700

0

632900

0

Equity 0

16354000

000

15439000

000

13651000

000

551840

00

551840

00

5

Crawford, 2011). The study of financial performance and position of the Unilever plc is as

follows:

Profitability ratio:

Profitability ratio of the company has been evaluated firstly to identify the financial

performance and position of the company. Profitability ratios are the measurement of profit

position of the company. This explains about the profitability capacity of the company.

Following is the calculations of profitability ratio of the company:

Description Formula Unilever Plc

2017 2016 2015 2014

201

3

Profitabilit

y

Return on

shareholder

funds

NPAT/

Total

equity 31.70% 31.80% 37.88% 33.76%

29.5

5%

Operating

profit

margin

Operating

net profit /

Sales

100.00

% 100.00% 100.00% 100.00%

100.

00%

Gross Profit

Margin

Gross

Profit /

Sales 50.00% 50.00% 50.00% 50.00%

50.0

0%

(Breuer, Rieger and Soypak, 2014)

Return on shareholder’s fund:

Return on shareholder ratios explain about the total return which could be get by the

shareholder of the company. It is calculated on the basis of net profit after tax and the total

shareholder equity of the company. The current shareholder return explains that the current

return to the shareholders is 31.70% which has been lower from 31.80% and 37.88% in 2016

and 2015.

Description

Form

ula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Net profit 0

51840000

00

49090000

00

51710000

00

521700

0

632900

0

Equity 0

16354000

000

15439000

000

13651000

000

551840

00

551840

00

Finance

6

Return on shareholder

funds

NPAT/

Total

equity 31.70% 31.80% 37.88% 9.45% 11.47%

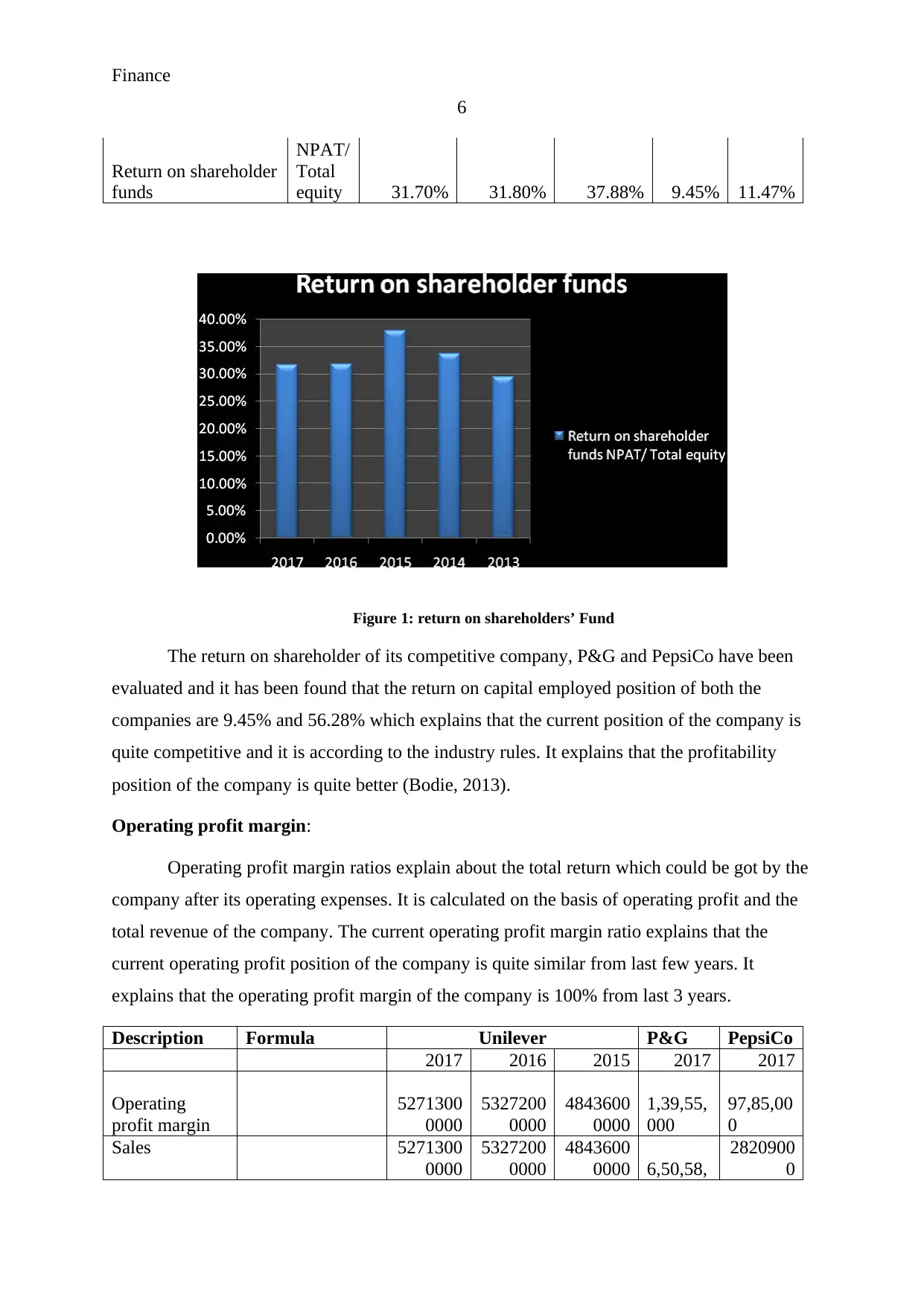

Figure 1: return on shareholders’ Fund

The return on shareholder of its competitive company, P&G and PepsiCo have been

evaluated and it has been found that the return on capital employed position of both the

companies are 9.45% and 56.28% which explains that the current position of the company is

quite competitive and it is according to the industry rules. It explains that the profitability

position of the company is quite better (Bodie, 2013).

Operating profit margin:

Operating profit margin ratios explain about the total return which could be got by the

company after its operating expenses. It is calculated on the basis of operating profit and the

total revenue of the company. The current operating profit margin ratio explains that the

current operating profit position of the company is quite similar from last few years. It

explains that the operating profit margin of the company is 100% from last 3 years.

Description Formula Unilever P&G PepsiCo

2017 2016 2015 2017 2017

Operating

profit margin

5271300

0000

5327200

0000

4843600

0000

1,39,55,

000

97,85,00

0

Sales 5271300

0000

5327200

0000

4843600

0000 6,50,58,

2820900

0

6

Return on shareholder

funds

NPAT/

Total

equity 31.70% 31.80% 37.88% 9.45% 11.47%

Figure 1: return on shareholders’ Fund

The return on shareholder of its competitive company, P&G and PepsiCo have been

evaluated and it has been found that the return on capital employed position of both the

companies are 9.45% and 56.28% which explains that the current position of the company is

quite competitive and it is according to the industry rules. It explains that the profitability

position of the company is quite better (Bodie, 2013).

Operating profit margin:

Operating profit margin ratios explain about the total return which could be got by the

company after its operating expenses. It is calculated on the basis of operating profit and the

total revenue of the company. The current operating profit margin ratio explains that the

current operating profit position of the company is quite similar from last few years. It

explains that the operating profit margin of the company is 100% from last 3 years.

Description Formula Unilever P&G PepsiCo

2017 2016 2015 2017 2017

Operating

profit margin

5271300

0000

5327200

0000

4843600

0000

1,39,55,

000

97,85,00

0

Sales 5271300

0000

5327200

0000

4843600

0000 6,50,58,

2820900

0

Finance

7

000

Operating

profit margin

Operating net

profit / Sales 100.00% 100.00% 100.00% 21.45% 34.69%

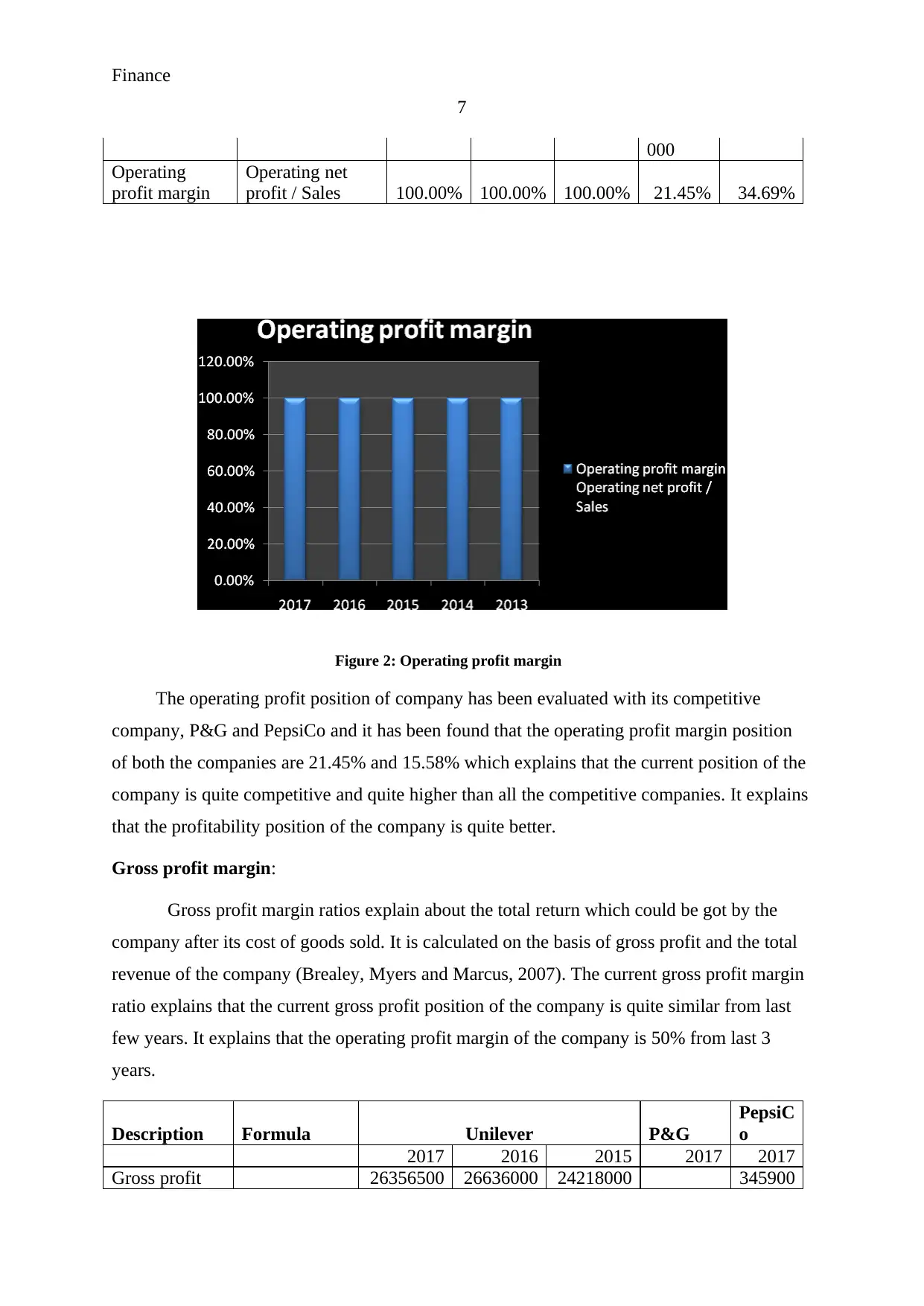

Figure 2: Operating profit margin

The operating profit position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the operating profit margin position

of both the companies are 21.45% and 15.58% which explains that the current position of the

company is quite competitive and quite higher than all the competitive companies. It explains

that the profitability position of the company is quite better.

Gross profit margin:

Gross profit margin ratios explain about the total return which could be got by the

company after its cost of goods sold. It is calculated on the basis of gross profit and the total

revenue of the company (Brealey, Myers and Marcus, 2007). The current gross profit margin

ratio explains that the current gross profit position of the company is quite similar from last

few years. It explains that the operating profit margin of the company is 50% from last 3

years.

Description Formula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Gross profit 26356500 26636000 24218000 345900

7

000

Operating

profit margin

Operating net

profit / Sales 100.00% 100.00% 100.00% 21.45% 34.69%

Figure 2: Operating profit margin

The operating profit position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the operating profit margin position

of both the companies are 21.45% and 15.58% which explains that the current position of the

company is quite competitive and quite higher than all the competitive companies. It explains

that the profitability position of the company is quite better.

Gross profit margin:

Gross profit margin ratios explain about the total return which could be got by the

company after its cost of goods sold. It is calculated on the basis of gross profit and the total

revenue of the company (Brealey, Myers and Marcus, 2007). The current gross profit margin

ratio explains that the current gross profit position of the company is quite similar from last

few years. It explains that the operating profit margin of the company is 50% from last 3

years.

Description Formula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Gross profit 26356500 26636000 24218000 345900

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

8

000 000 000

3,25,23,0

00 00

Sales

52713000

000

53272000

000

48436000

000

6505800

0

282090

00

Gross Profit

Margin

Gross Profit /

Sales 50.00% 50.00% 50.00% 49.99%

122.62

%

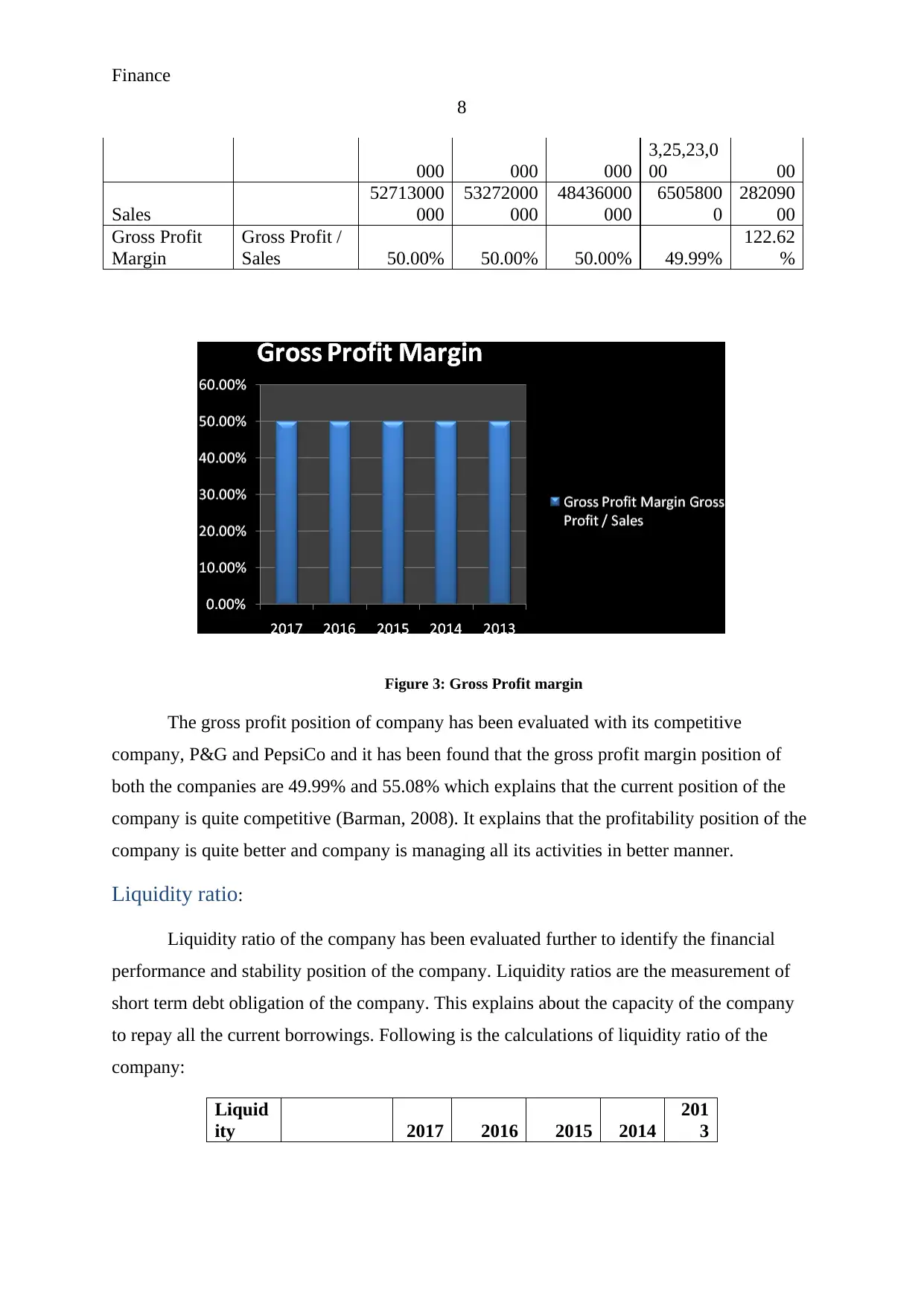

Figure 3: Gross Profit margin

The gross profit position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the gross profit margin position of

both the companies are 49.99% and 55.08% which explains that the current position of the

company is quite competitive (Barman, 2008). It explains that the profitability position of the

company is quite better and company is managing all its activities in better manner.

Liquidity ratio:

Liquidity ratio of the company has been evaluated further to identify the financial

performance and stability position of the company. Liquidity ratios are the measurement of

short term debt obligation of the company. This explains about the capacity of the company

to repay all the current borrowings. Following is the calculations of liquidity ratio of the

company:

Liquid

ity 2017 2016 2015 2014

201

3

8

000 000 000

3,25,23,0

00 00

Sales

52713000

000

53272000

000

48436000

000

6505800

0

282090

00

Gross Profit

Margin

Gross Profit /

Sales 50.00% 50.00% 50.00% 49.99%

122.62

%

Figure 3: Gross Profit margin

The gross profit position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the gross profit margin position of

both the companies are 49.99% and 55.08% which explains that the current position of the

company is quite competitive (Barman, 2008). It explains that the profitability position of the

company is quite better and company is managing all its activities in better manner.

Liquidity ratio:

Liquidity ratio of the company has been evaluated further to identify the financial

performance and stability position of the company. Liquidity ratios are the measurement of

short term debt obligation of the company. This explains about the capacity of the company

to repay all the current borrowings. Following is the calculations of liquidity ratio of the

company:

Liquid

ity 2017 2016 2015 2014

201

3

Finance

9

Current

ratio

Current

assets/curre

nt liabilities 0.68 0.63 0.63 0.70 0.77

Acid

test

ratios

Current

assets-

Inventory/cu

rrent

liabilities 0.47 0.63 0.63 0.47 0.49

(Morningstar, 2018)

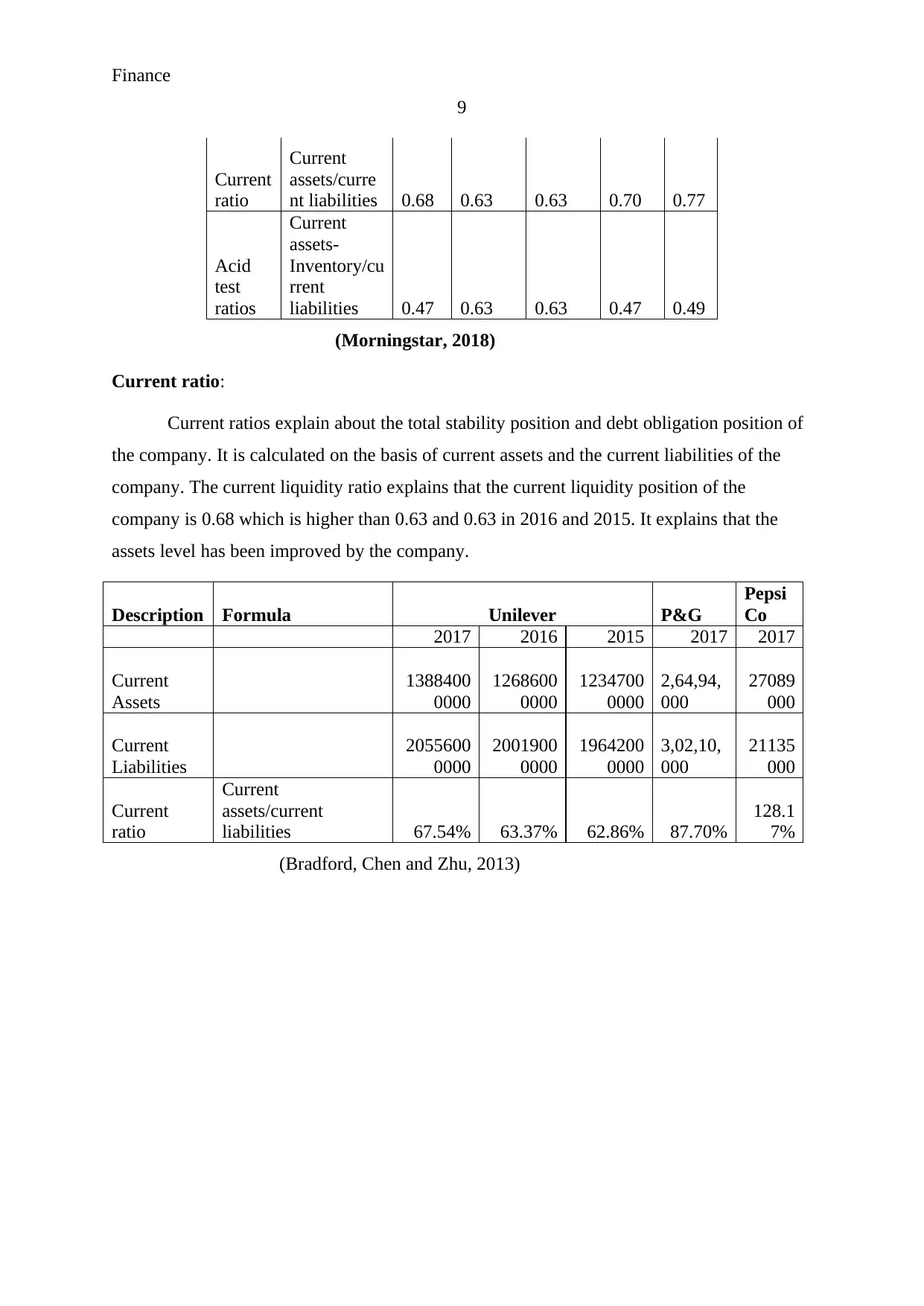

Current ratio:

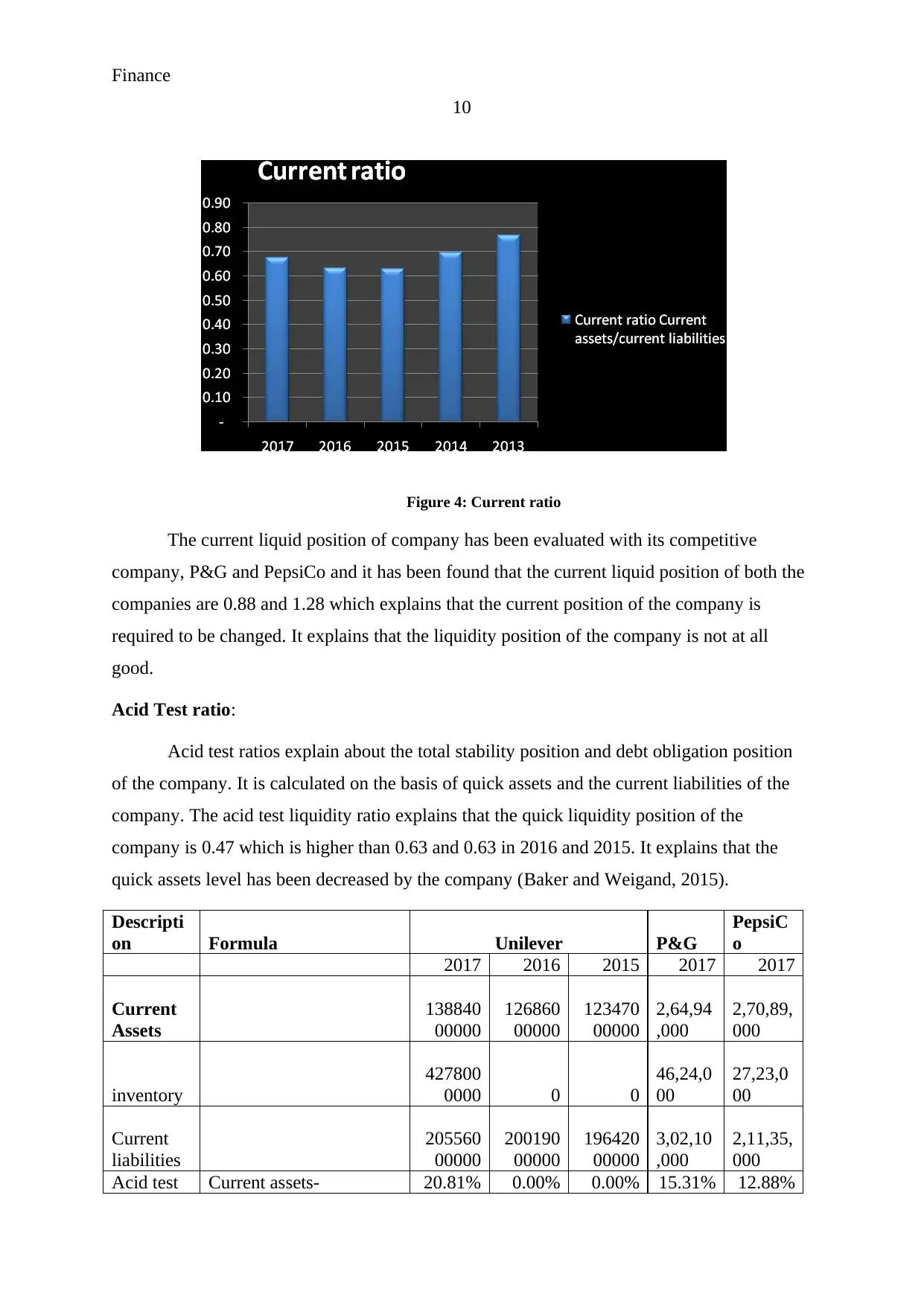

Current ratios explain about the total stability position and debt obligation position of

the company. It is calculated on the basis of current assets and the current liabilities of the

company. The current liquidity ratio explains that the current liquidity position of the

company is 0.68 which is higher than 0.63 and 0.63 in 2016 and 2015. It explains that the

assets level has been improved by the company.

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Current

Assets

1388400

0000

1268600

0000

1234700

0000

2,64,94,

000

27089

000

Current

Liabilities

2055600

0000

2001900

0000

1964200

0000

3,02,10,

000

21135

000

Current

ratio

Current

assets/current

liabilities 67.54% 63.37% 62.86% 87.70%

128.1

7%

(Bradford, Chen and Zhu, 2013)

9

Current

ratio

Current

assets/curre

nt liabilities 0.68 0.63 0.63 0.70 0.77

Acid

test

ratios

Current

assets-

Inventory/cu

rrent

liabilities 0.47 0.63 0.63 0.47 0.49

(Morningstar, 2018)

Current ratio:

Current ratios explain about the total stability position and debt obligation position of

the company. It is calculated on the basis of current assets and the current liabilities of the

company. The current liquidity ratio explains that the current liquidity position of the

company is 0.68 which is higher than 0.63 and 0.63 in 2016 and 2015. It explains that the

assets level has been improved by the company.

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Current

Assets

1388400

0000

1268600

0000

1234700

0000

2,64,94,

000

27089

000

Current

Liabilities

2055600

0000

2001900

0000

1964200

0000

3,02,10,

000

21135

000

Current

ratio

Current

assets/current

liabilities 67.54% 63.37% 62.86% 87.70%

128.1

7%

(Bradford, Chen and Zhu, 2013)

Finance

10

Figure 4: Current ratio

The current liquid position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the current liquid position of both the

companies are 0.88 and 1.28 which explains that the current position of the company is

required to be changed. It explains that the liquidity position of the company is not at all

good.

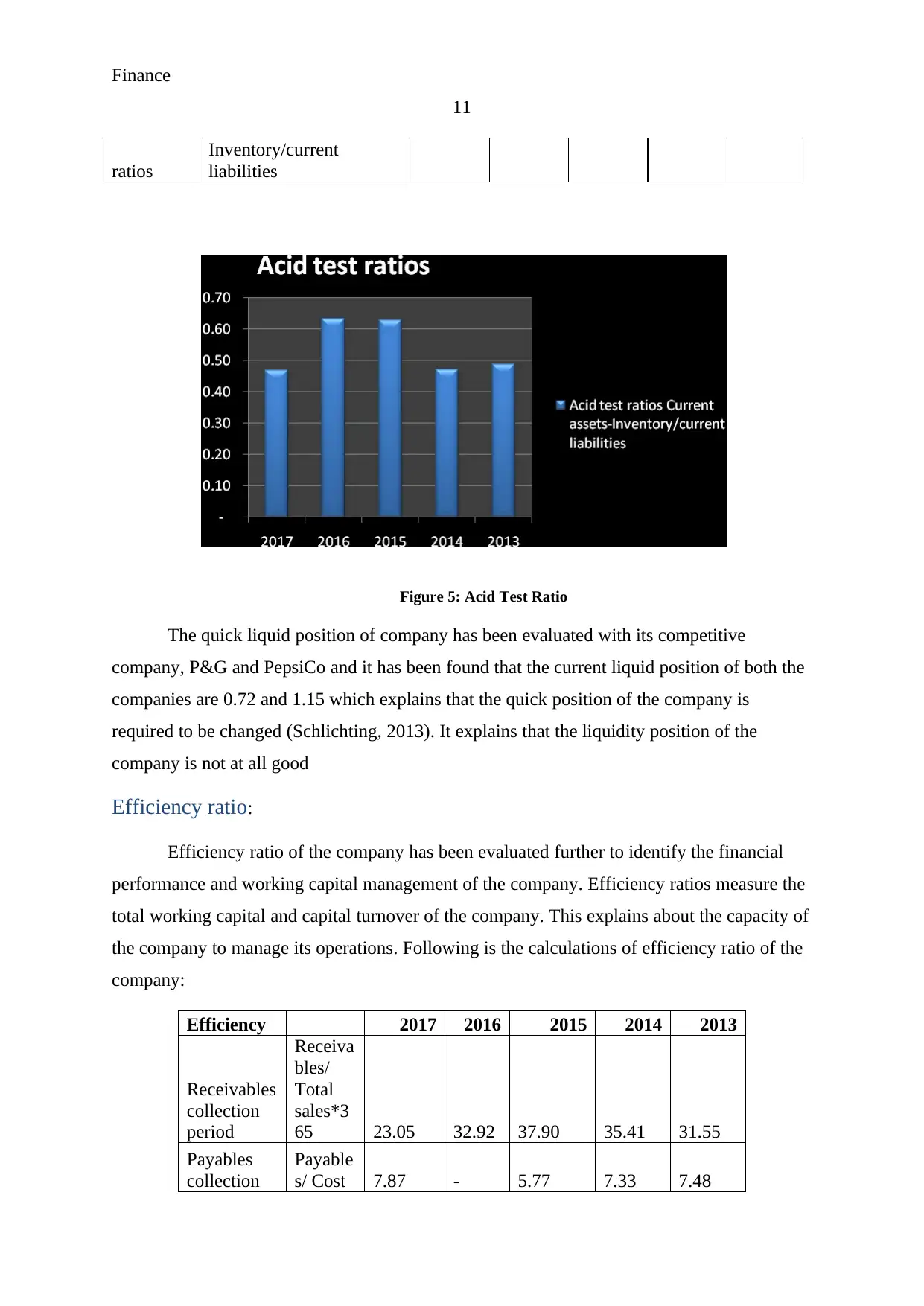

Acid Test ratio:

Acid test ratios explain about the total stability position and debt obligation position

of the company. It is calculated on the basis of quick assets and the current liabilities of the

company. The acid test liquidity ratio explains that the quick liquidity position of the

company is 0.47 which is higher than 0.63 and 0.63 in 2016 and 2015. It explains that the

quick assets level has been decreased by the company (Baker and Weigand, 2015).

Descripti

on Formula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Current

Assets

138840

00000

126860

00000

123470

00000

2,64,94

,000

2,70,89,

000

inventory

427800

0000 0 0

46,24,0

00

27,23,0

00

Current

liabilities

205560

00000

200190

00000

196420

00000

3,02,10

,000

2,11,35,

000

Acid test Current assets- 20.81% 0.00% 0.00% 15.31% 12.88%

10

Figure 4: Current ratio

The current liquid position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the current liquid position of both the

companies are 0.88 and 1.28 which explains that the current position of the company is

required to be changed. It explains that the liquidity position of the company is not at all

good.

Acid Test ratio:

Acid test ratios explain about the total stability position and debt obligation position

of the company. It is calculated on the basis of quick assets and the current liabilities of the

company. The acid test liquidity ratio explains that the quick liquidity position of the

company is 0.47 which is higher than 0.63 and 0.63 in 2016 and 2015. It explains that the

quick assets level has been decreased by the company (Baker and Weigand, 2015).

Descripti

on Formula Unilever P&G

PepsiC

o

2017 2016 2015 2017 2017

Current

Assets

138840

00000

126860

00000

123470

00000

2,64,94

,000

2,70,89,

000

inventory

427800

0000 0 0

46,24,0

00

27,23,0

00

Current

liabilities

205560

00000

200190

00000

196420

00000

3,02,10

,000

2,11,35,

000

Acid test Current assets- 20.81% 0.00% 0.00% 15.31% 12.88%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Finance

11

ratios

Inventory/current

liabilities

Figure 5: Acid Test Ratio

The quick liquid position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the current liquid position of both the

companies are 0.72 and 1.15 which explains that the quick position of the company is

required to be changed (Schlichting, 2013). It explains that the liquidity position of the

company is not at all good

Efficiency ratio:

Efficiency ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Efficiency ratios measure the

total working capital and capital turnover of the company. This explains about the capacity of

the company to manage its operations. Following is the calculations of efficiency ratio of the

company:

Efficiency 2017 2016 2015 2014 2013

Receivables

collection

period

Receiva

bles/

Total

sales*3

65 23.05 32.92 37.90 35.41 31.55

Payables

collection

Payable

s/ Cost 7.87 - 5.77 7.33 7.48

11

ratios

Inventory/current

liabilities

Figure 5: Acid Test Ratio

The quick liquid position of company has been evaluated with its competitive

company, P&G and PepsiCo and it has been found that the current liquid position of both the

companies are 0.72 and 1.15 which explains that the quick position of the company is

required to be changed (Schlichting, 2013). It explains that the liquidity position of the

company is not at all good

Efficiency ratio:

Efficiency ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Efficiency ratios measure the

total working capital and capital turnover of the company. This explains about the capacity of

the company to manage its operations. Following is the calculations of efficiency ratio of the

company:

Efficiency 2017 2016 2015 2014 2013

Receivables

collection

period

Receiva

bles/

Total

sales*3

65 23.05 32.92 37.90 35.41 31.55

Payables

collection

Payable

s/ Cost 7.87 - 5.77 7.33 7.48

Finance

12

period

of

sales*3

65

Inventory

days

Invento

ry/ cost

of

goods

sold

*365 59.24 - - 57.71 63.09

.

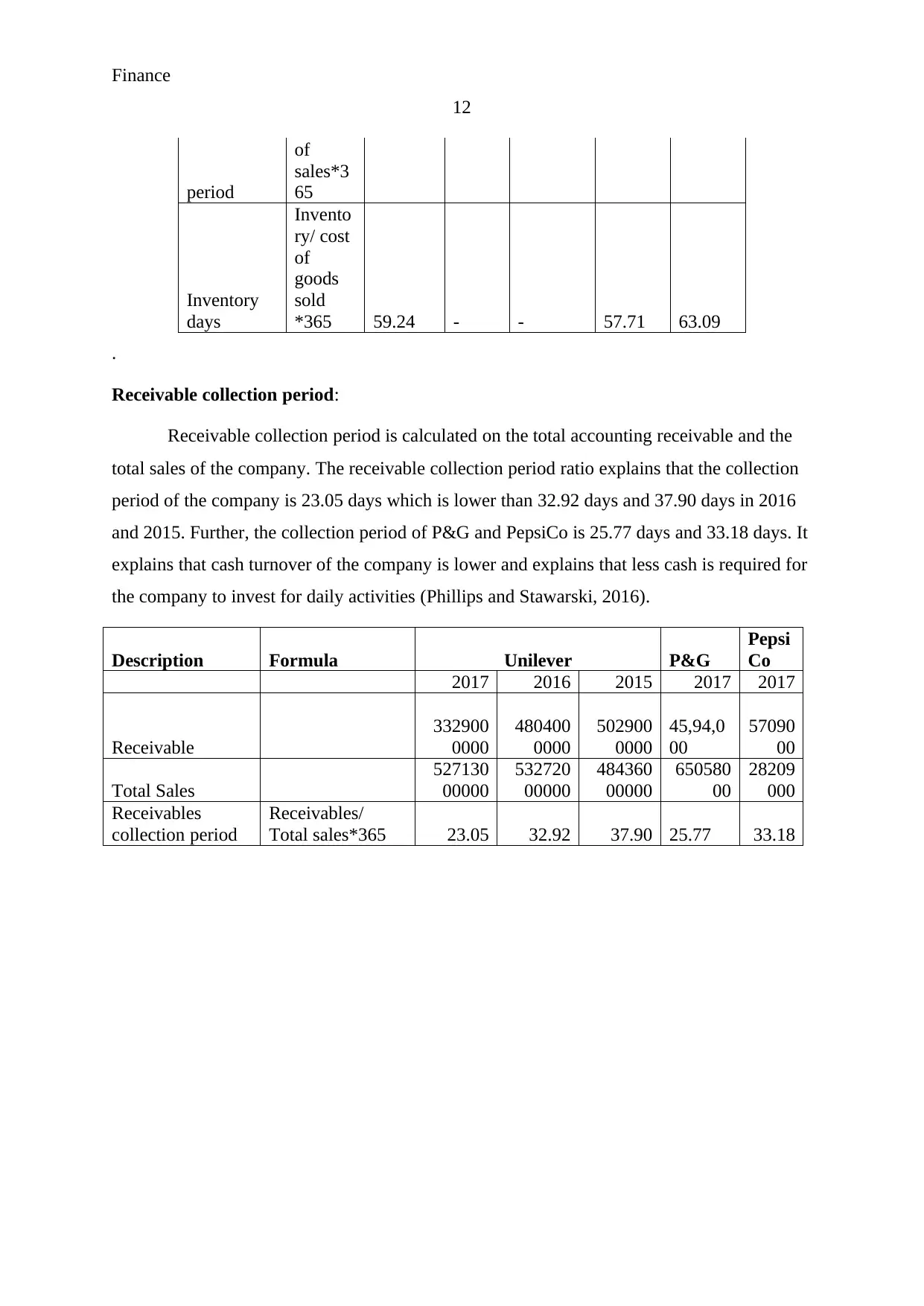

Receivable collection period:

Receivable collection period is calculated on the total accounting receivable and the

total sales of the company. The receivable collection period ratio explains that the collection

period of the company is 23.05 days which is lower than 32.92 days and 37.90 days in 2016

and 2015. Further, the collection period of P&G and PepsiCo is 25.77 days and 33.18 days. It

explains that cash turnover of the company is lower and explains that less cash is required for

the company to invest for daily activities (Phillips and Stawarski, 2016).

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Receivable

332900

0000

480400

0000

502900

0000

45,94,0

00

57090

00

Total Sales

527130

00000

532720

00000

484360

00000

650580

00

28209

000

Receivables

collection period

Receivables/

Total sales*365 23.05 32.92 37.90 25.77 33.18

12

period

of

sales*3

65

Inventory

days

Invento

ry/ cost

of

goods

sold

*365 59.24 - - 57.71 63.09

.

Receivable collection period:

Receivable collection period is calculated on the total accounting receivable and the

total sales of the company. The receivable collection period ratio explains that the collection

period of the company is 23.05 days which is lower than 32.92 days and 37.90 days in 2016

and 2015. Further, the collection period of P&G and PepsiCo is 25.77 days and 33.18 days. It

explains that cash turnover of the company is lower and explains that less cash is required for

the company to invest for daily activities (Phillips and Stawarski, 2016).

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Receivable

332900

0000

480400

0000

502900

0000

45,94,0

00

57090

00

Total Sales

527130

00000

532720

00000

484360

00000

650580

00

28209

000

Receivables

collection period

Receivables/

Total sales*365 23.05 32.92 37.90 25.77 33.18

Finance

13

Figure 6: Receivable collection period

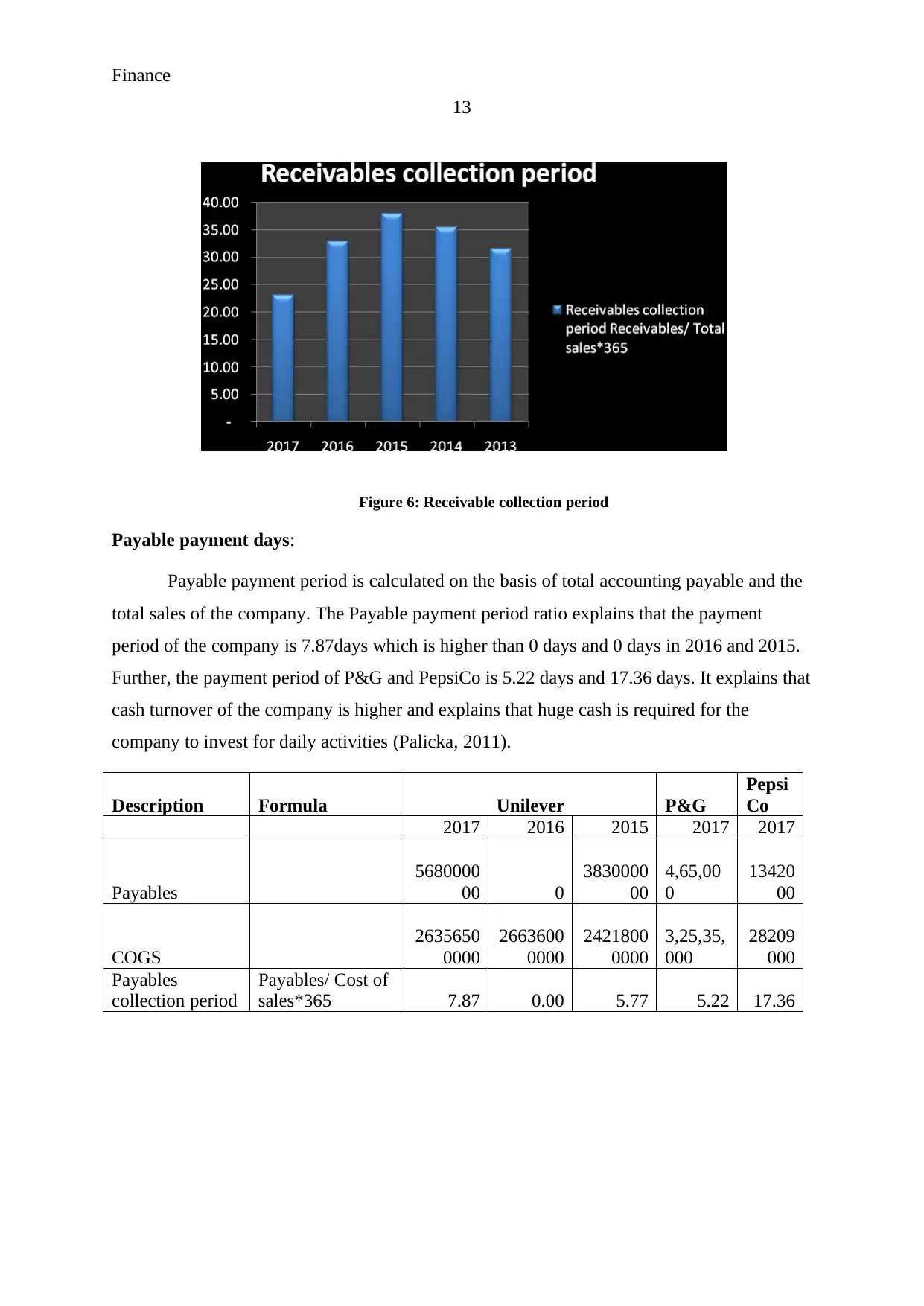

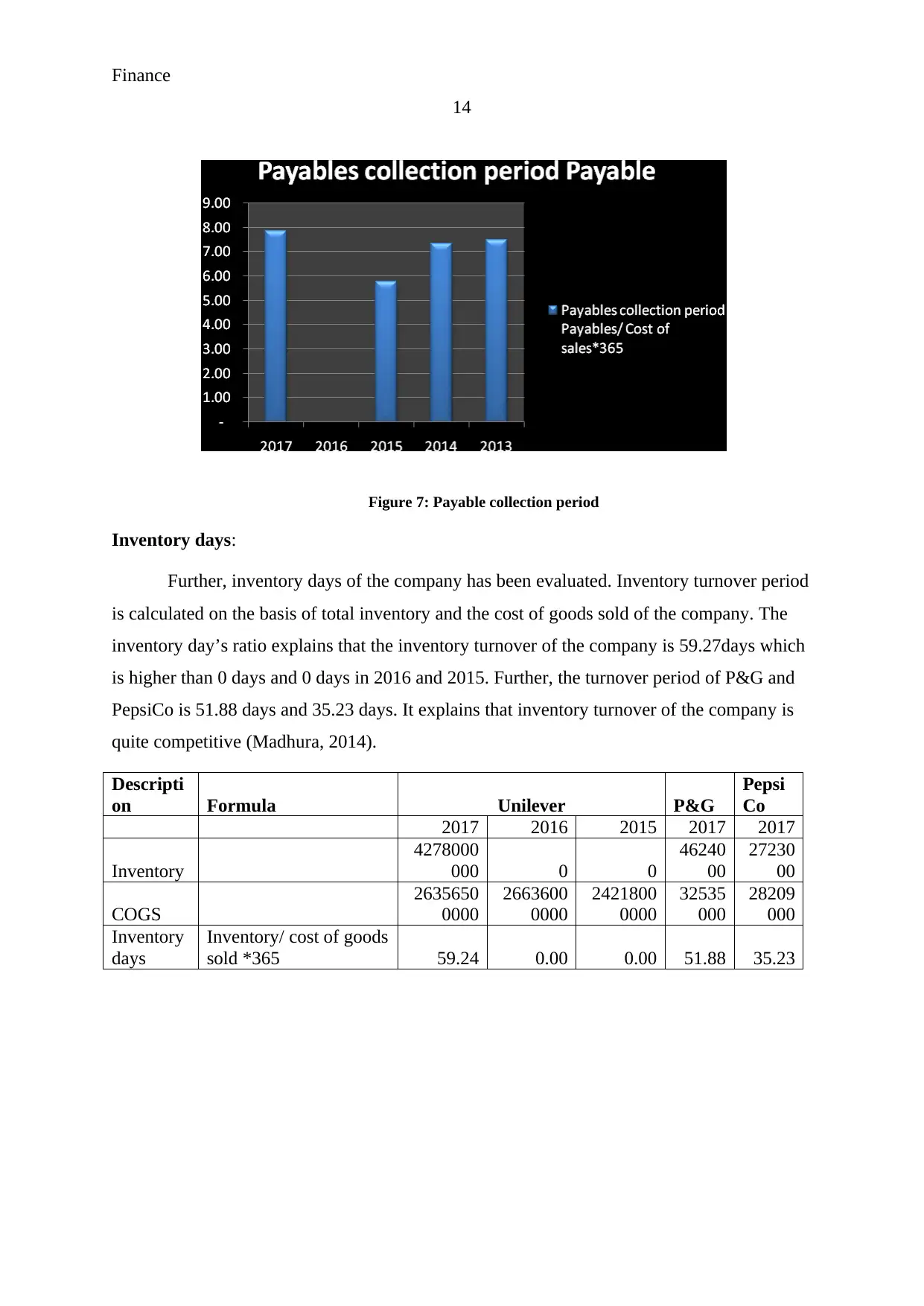

Payable payment days:

Payable payment period is calculated on the basis of total accounting payable and the

total sales of the company. The Payable payment period ratio explains that the payment

period of the company is 7.87days which is higher than 0 days and 0 days in 2016 and 2015.

Further, the payment period of P&G and PepsiCo is 5.22 days and 17.36 days. It explains that

cash turnover of the company is higher and explains that huge cash is required for the

company to invest for daily activities (Palicka, 2011).

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Payables

5680000

00 0

3830000

00

4,65,00

0

13420

00

COGS

2635650

0000

2663600

0000

2421800

0000

3,25,35,

000

28209

000

Payables

collection period

Payables/ Cost of

sales*365 7.87 0.00 5.77 5.22 17.36

13

Figure 6: Receivable collection period

Payable payment days:

Payable payment period is calculated on the basis of total accounting payable and the

total sales of the company. The Payable payment period ratio explains that the payment

period of the company is 7.87days which is higher than 0 days and 0 days in 2016 and 2015.

Further, the payment period of P&G and PepsiCo is 5.22 days and 17.36 days. It explains that

cash turnover of the company is higher and explains that huge cash is required for the

company to invest for daily activities (Palicka, 2011).

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Payables

5680000

00 0

3830000

00

4,65,00

0

13420

00

COGS

2635650

0000

2663600

0000

2421800

0000

3,25,35,

000

28209

000

Payables

collection period

Payables/ Cost of

sales*365 7.87 0.00 5.77 5.22 17.36

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

14

Figure 7: Payable collection period

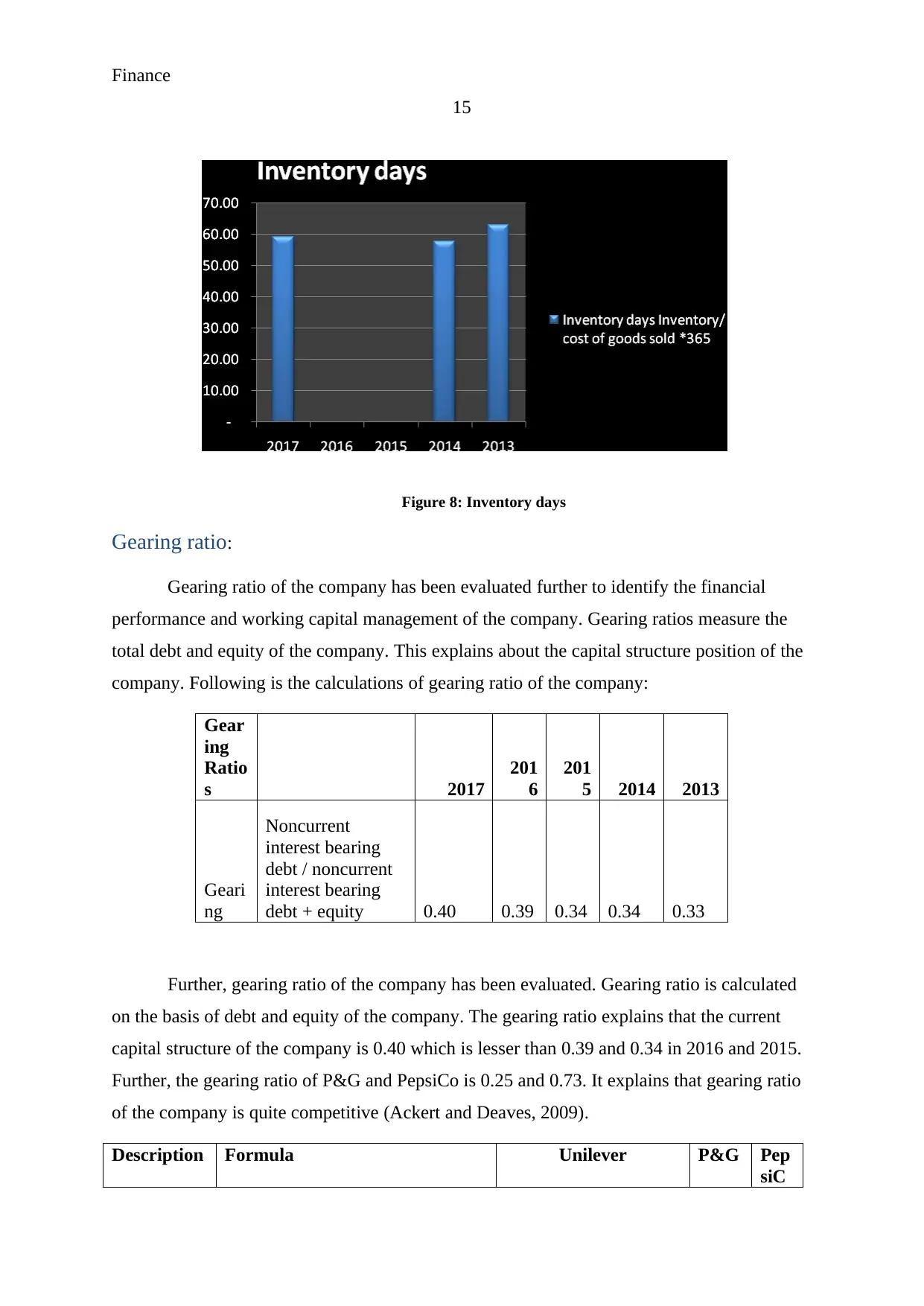

Inventory days:

Further, inventory days of the company has been evaluated. Inventory turnover period

is calculated on the basis of total inventory and the cost of goods sold of the company. The

inventory day’s ratio explains that the inventory turnover of the company is 59.27days which

is higher than 0 days and 0 days in 2016 and 2015. Further, the turnover period of P&G and

PepsiCo is 51.88 days and 35.23 days. It explains that inventory turnover of the company is

quite competitive (Madhura, 2014).

Descripti

on Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Inventory

4278000

000 0 0

46240

00

27230

00

COGS

2635650

0000

2663600

0000

2421800

0000

32535

000

28209

000

Inventory

days

Inventory/ cost of goods

sold *365 59.24 0.00 0.00 51.88 35.23

14

Figure 7: Payable collection period

Inventory days:

Further, inventory days of the company has been evaluated. Inventory turnover period

is calculated on the basis of total inventory and the cost of goods sold of the company. The

inventory day’s ratio explains that the inventory turnover of the company is 59.27days which

is higher than 0 days and 0 days in 2016 and 2015. Further, the turnover period of P&G and

PepsiCo is 51.88 days and 35.23 days. It explains that inventory turnover of the company is

quite competitive (Madhura, 2014).

Descripti

on Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

Inventory

4278000

000 0 0

46240

00

27230

00

COGS

2635650

0000

2663600

0000

2421800

0000

32535

000

28209

000

Inventory

days

Inventory/ cost of goods

sold *365 59.24 0.00 0.00 51.88 35.23

Finance

15

Figure 8: Inventory days

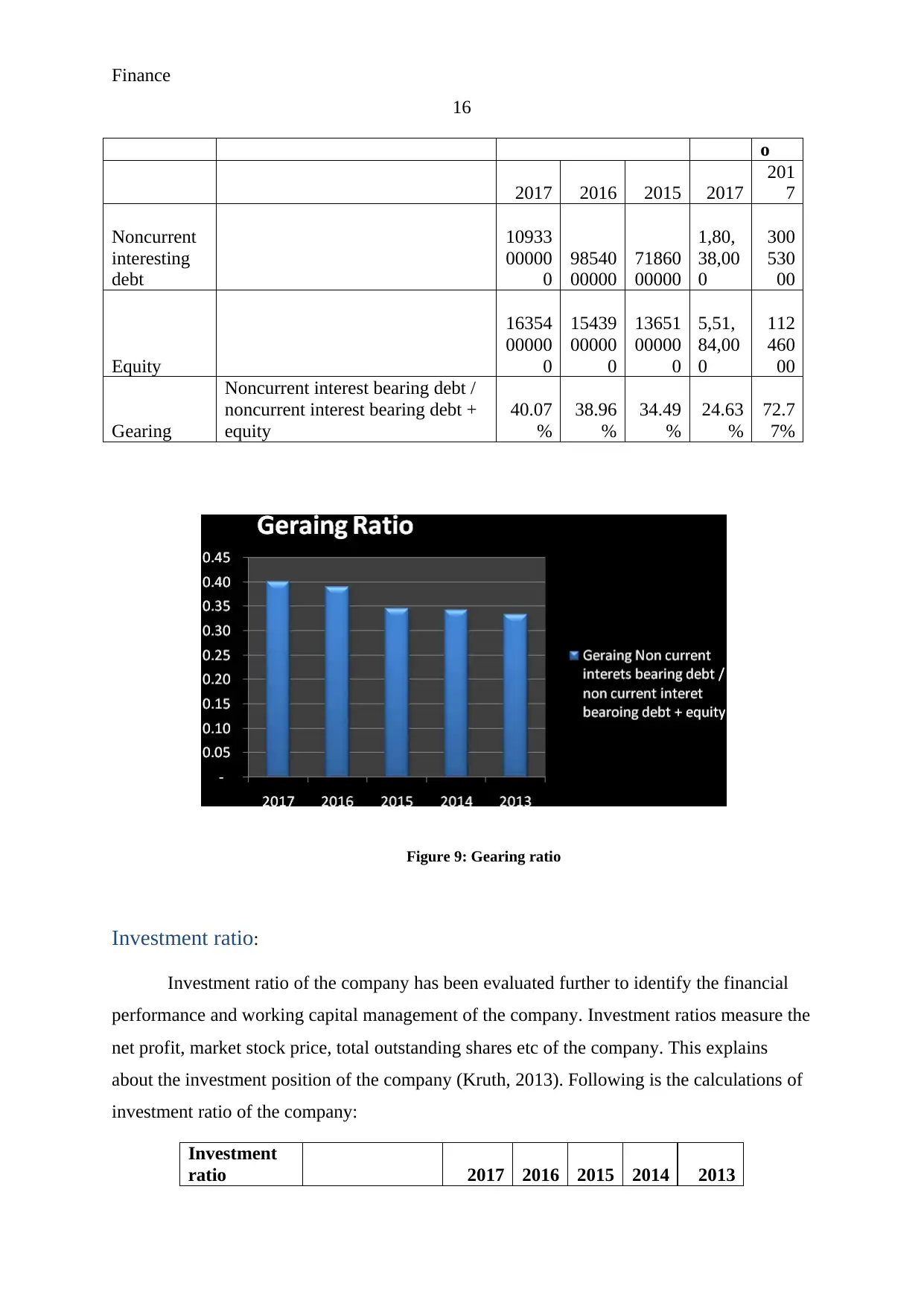

Gearing ratio:

Gearing ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Gearing ratios measure the

total debt and equity of the company. This explains about the capital structure position of the

company. Following is the calculations of gearing ratio of the company:

Gear

ing

Ratio

s 2017

201

6

201

5 2014 2013

Geari

ng

Noncurrent

interest bearing

debt / noncurrent

interest bearing

debt + equity 0.40 0.39 0.34 0.34 0.33

Further, gearing ratio of the company has been evaluated. Gearing ratio is calculated

on the basis of debt and equity of the company. The gearing ratio explains that the current

capital structure of the company is 0.40 which is lesser than 0.39 and 0.34 in 2016 and 2015.

Further, the gearing ratio of P&G and PepsiCo is 0.25 and 0.73. It explains that gearing ratio

of the company is quite competitive (Ackert and Deaves, 2009).

Description Formula Unilever P&G Pep

siC

15

Figure 8: Inventory days

Gearing ratio:

Gearing ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Gearing ratios measure the

total debt and equity of the company. This explains about the capital structure position of the

company. Following is the calculations of gearing ratio of the company:

Gear

ing

Ratio

s 2017

201

6

201

5 2014 2013

Geari

ng

Noncurrent

interest bearing

debt / noncurrent

interest bearing

debt + equity 0.40 0.39 0.34 0.34 0.33

Further, gearing ratio of the company has been evaluated. Gearing ratio is calculated

on the basis of debt and equity of the company. The gearing ratio explains that the current

capital structure of the company is 0.40 which is lesser than 0.39 and 0.34 in 2016 and 2015.

Further, the gearing ratio of P&G and PepsiCo is 0.25 and 0.73. It explains that gearing ratio

of the company is quite competitive (Ackert and Deaves, 2009).

Description Formula Unilever P&G Pep

siC

Finance

16

o

2017 2016 2015 2017

201

7

Noncurrent

interesting

debt

10933

00000

0

98540

00000

71860

00000

1,80,

38,00

0

300

530

00

Equity

16354

00000

0

15439

00000

0

13651

00000

0

5,51,

84,00

0

112

460

00

Gearing

Noncurrent interest bearing debt /

noncurrent interest bearing debt +

equity

40.07

%

38.96

%

34.49

%

24.63

%

72.7

7%

Figure 9: Gearing ratio

Investment ratio:

Investment ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Investment ratios measure the

net profit, market stock price, total outstanding shares etc of the company. This explains

about the investment position of the company (Kruth, 2013). Following is the calculations of

investment ratio of the company:

Investment

ratio 2017 2016 2015 2014 2013

16

o

2017 2016 2015 2017

201

7

Noncurrent

interesting

debt

10933

00000

0

98540

00000

71860

00000

1,80,

38,00

0

300

530

00

Equity

16354

00000

0

15439

00000

0

13651

00000

0

5,51,

84,00

0

112

460

00

Gearing

Noncurrent interest bearing debt /

noncurrent interest bearing debt +

equity

40.07

%

38.96

%

34.49

%

24.63

%

72.7

7%

Figure 9: Gearing ratio

Investment ratio:

Investment ratio of the company has been evaluated further to identify the financial

performance and working capital management of the company. Investment ratios measure the

net profit, market stock price, total outstanding shares etc of the company. This explains

about the investment position of the company (Kruth, 2013). Following is the calculations of

investment ratio of the company:

Investment

ratio 2017 2016 2015 2014 2013

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Finance

17

Earnings per

share

NPAT/ Number

of ordinary

shares 1.83 1.73 1.82 1.71 1.58

Price earnings

ratio

Market price

per share /

earnings per

share 31.68

(Morningstar, 2018)

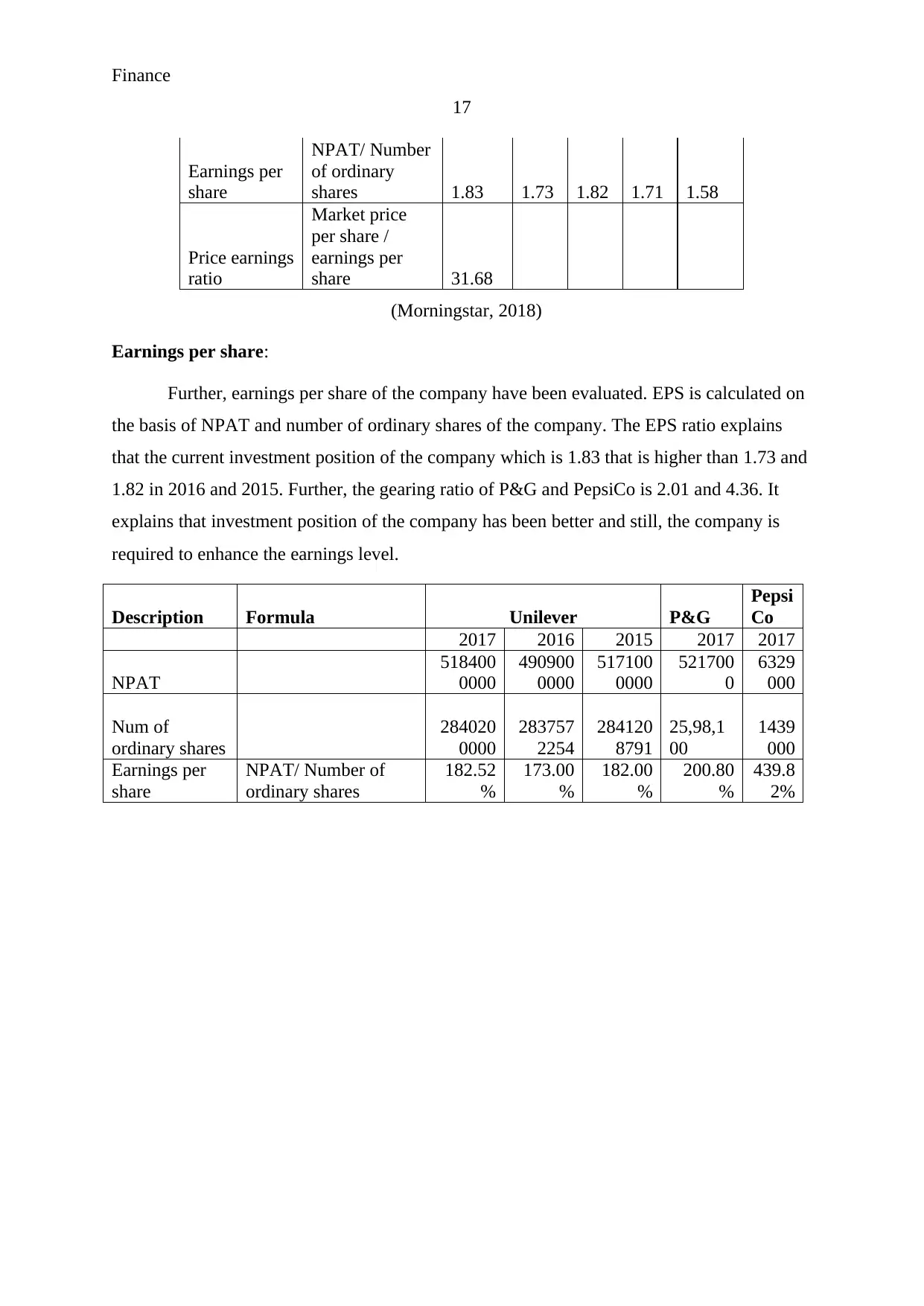

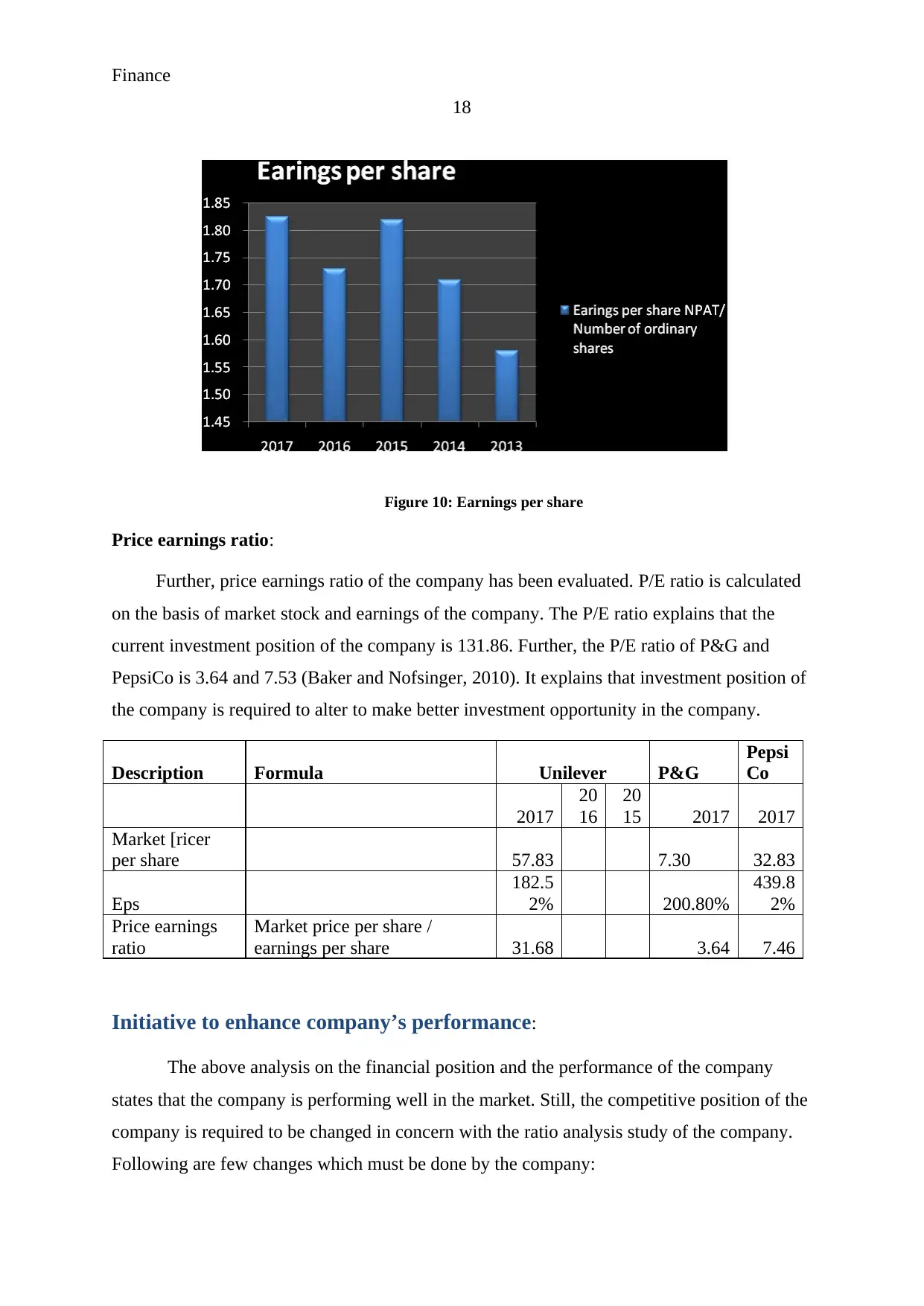

Earnings per share:

Further, earnings per share of the company have been evaluated. EPS is calculated on

the basis of NPAT and number of ordinary shares of the company. The EPS ratio explains

that the current investment position of the company which is 1.83 that is higher than 1.73 and

1.82 in 2016 and 2015. Further, the gearing ratio of P&G and PepsiCo is 2.01 and 4.36. It

explains that investment position of the company has been better and still, the company is

required to enhance the earnings level.

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

NPAT

518400

0000

490900

0000

517100

0000

521700

0

6329

000

Num of

ordinary shares

284020

0000

283757

2254

284120

8791

25,98,1

00

1439

000

Earnings per

share

NPAT/ Number of

ordinary shares

182.52

%

173.00

%

182.00

%

200.80

%

439.8

2%

17

Earnings per

share

NPAT/ Number

of ordinary

shares 1.83 1.73 1.82 1.71 1.58

Price earnings

ratio

Market price

per share /

earnings per

share 31.68

(Morningstar, 2018)

Earnings per share:

Further, earnings per share of the company have been evaluated. EPS is calculated on

the basis of NPAT and number of ordinary shares of the company. The EPS ratio explains

that the current investment position of the company which is 1.83 that is higher than 1.73 and

1.82 in 2016 and 2015. Further, the gearing ratio of P&G and PepsiCo is 2.01 and 4.36. It

explains that investment position of the company has been better and still, the company is

required to enhance the earnings level.

Description Formula Unilever P&G

Pepsi

Co

2017 2016 2015 2017 2017

NPAT

518400

0000

490900

0000

517100

0000

521700

0

6329

000

Num of

ordinary shares

284020

0000

283757

2254

284120

8791

25,98,1

00

1439

000

Earnings per

share

NPAT/ Number of

ordinary shares

182.52

%

173.00

%

182.00

%

200.80

%

439.8

2%

Finance

18

Figure 10: Earnings per share

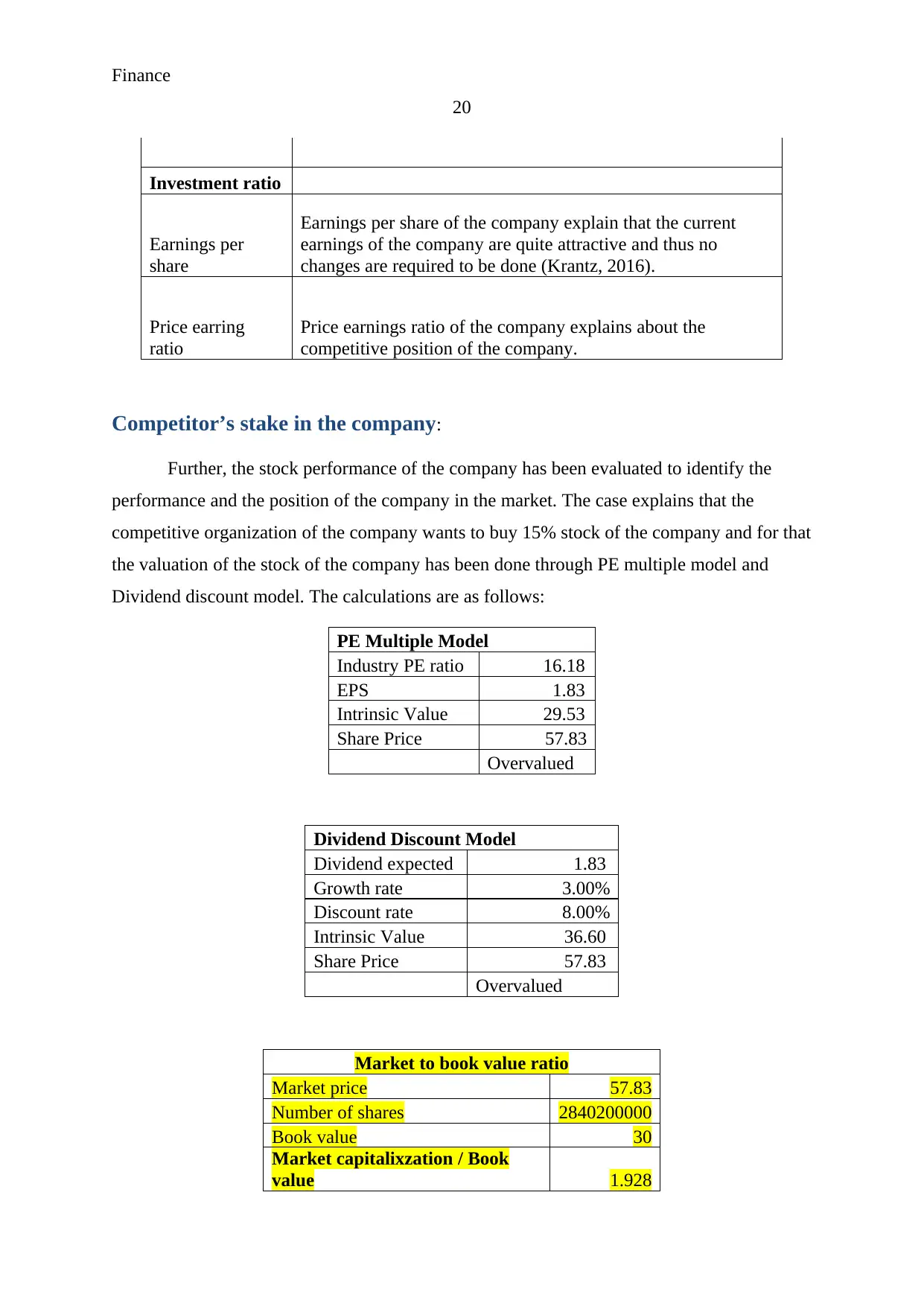

Price earnings ratio:

Further, price earnings ratio of the company has been evaluated. P/E ratio is calculated

on the basis of market stock and earnings of the company. The P/E ratio explains that the

current investment position of the company is 131.86. Further, the P/E ratio of P&G and

PepsiCo is 3.64 and 7.53 (Baker and Nofsinger, 2010). It explains that investment position of

the company is required to alter to make better investment opportunity in the company.

Description Formula Unilever P&G

Pepsi

Co

2017

20

16

20

15 2017 2017

Market [ricer

per share 57.83 7.30 32.83

Eps

182.5

2% 200.80%

439.8

2%

Price earnings

ratio

Market price per share /

earnings per share 31.68 3.64 7.46

Initiative to enhance company’s performance:

The above analysis on the financial position and the performance of the company

states that the company is performing well in the market. Still, the competitive position of the

company is required to be changed in concern with the ratio analysis study of the company.

Following are few changes which must be done by the company:

18

Figure 10: Earnings per share

Price earnings ratio:

Further, price earnings ratio of the company has been evaluated. P/E ratio is calculated

on the basis of market stock and earnings of the company. The P/E ratio explains that the

current investment position of the company is 131.86. Further, the P/E ratio of P&G and

PepsiCo is 3.64 and 7.53 (Baker and Nofsinger, 2010). It explains that investment position of

the company is required to alter to make better investment opportunity in the company.

Description Formula Unilever P&G

Pepsi

Co

2017

20

16

20

15 2017 2017

Market [ricer

per share 57.83 7.30 32.83

Eps

182.5

2% 200.80%

439.8

2%

Price earnings

ratio

Market price per share /

earnings per share 31.68 3.64 7.46

Initiative to enhance company’s performance:

The above analysis on the financial position and the performance of the company

states that the company is performing well in the market. Still, the competitive position of the

company is required to be changed in concern with the ratio analysis study of the company.

Following are few changes which must be done by the company:

Finance

19

Description Initiatives

Profitability

Return on

shareholder funds

Return on shareholder ratio of the company explains that the

current performance of the company is enough competitive and

the company is required to maintain this level.

Operating profit

margin

Operating profit margin ratio of the company explains that the

current performance of the company is better and the company

is suggested to manage the same level.

Gross Profit

Margin

Gross profit margin ratio of the company explains that the

current performance of the company is enough competitive and

the company is required to maintain this level (Elton et al,

2009).

Liquidity

Current ratio

Current ratio of the company explains that the liquidity

position of the company is not at all good. It showcases about

the bad position of the company and depicts that the company

would not be able to pay its entire short term debt obligation at

any time.

Acid test ratios

Acid test ratio of the company explains that the liquidity

position of the company is not at all good. It showcases about

the bad position of the company and depicts that the company

would not be able to pay its entire short term debt obligation at

any time.

Efficiency

Receivables

collection period

Receivable collection period of the company explains that the

receivable turnover of the company is quite less and thus it is

quite good for the company.

Payables

collection period

Payable payment period of the company explains that the

payable turnover of the company is quite less and thus it is

required by the company to reduce the payment turnover.

Inventory days

Inventory days of the company explain that the inventory

turnover of the company is quite less and thus it is quite good

for the company.

Gearing Ratios

Gearing

Gearing ratio of the company explains that the debt and equity

level of the company is not appropriate and the debt level of

the company must be changed for the optimal capital structure

of the company.

19

Description Initiatives

Profitability

Return on

shareholder funds

Return on shareholder ratio of the company explains that the

current performance of the company is enough competitive and

the company is required to maintain this level.

Operating profit

margin

Operating profit margin ratio of the company explains that the

current performance of the company is better and the company

is suggested to manage the same level.

Gross Profit

Margin

Gross profit margin ratio of the company explains that the

current performance of the company is enough competitive and

the company is required to maintain this level (Elton et al,

2009).

Liquidity

Current ratio

Current ratio of the company explains that the liquidity

position of the company is not at all good. It showcases about

the bad position of the company and depicts that the company

would not be able to pay its entire short term debt obligation at

any time.

Acid test ratios

Acid test ratio of the company explains that the liquidity

position of the company is not at all good. It showcases about

the bad position of the company and depicts that the company

would not be able to pay its entire short term debt obligation at

any time.

Efficiency

Receivables

collection period

Receivable collection period of the company explains that the

receivable turnover of the company is quite less and thus it is

quite good for the company.

Payables

collection period

Payable payment period of the company explains that the

payable turnover of the company is quite less and thus it is

required by the company to reduce the payment turnover.

Inventory days

Inventory days of the company explain that the inventory

turnover of the company is quite less and thus it is quite good

for the company.

Gearing Ratios

Gearing

Gearing ratio of the company explains that the debt and equity

level of the company is not appropriate and the debt level of

the company must be changed for the optimal capital structure

of the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

20

Investment ratio

Earnings per

share

Earnings per share of the company explain that the current

earnings of the company are quite attractive and thus no

changes are required to be done (Krantz, 2016).

Price earring

ratio

Price earnings ratio of the company explains about the

competitive position of the company.

Competitor’s stake in the company:

Further, the stock performance of the company has been evaluated to identify the

performance and the position of the company in the market. The case explains that the

competitive organization of the company wants to buy 15% stock of the company and for that

the valuation of the stock of the company has been done through PE multiple model and

Dividend discount model. The calculations are as follows:

PE Multiple Model

Industry PE ratio 16.18

EPS 1.83

Intrinsic Value 29.53

Share Price 57.83

Overvalued

Dividend Discount Model

Dividend expected 1.83

Growth rate 3.00%

Discount rate 8.00%

Intrinsic Value 36.60

Share Price 57.83

Overvalued

Market to book value ratio

Market price 57.83

Number of shares 2840200000

Book value 30

Market capitalixzation / Book

value 1.928

20

Investment ratio

Earnings per

share

Earnings per share of the company explain that the current

earnings of the company are quite attractive and thus no

changes are required to be done (Krantz, 2016).

Price earring

ratio

Price earnings ratio of the company explains about the

competitive position of the company.

Competitor’s stake in the company:

Further, the stock performance of the company has been evaluated to identify the

performance and the position of the company in the market. The case explains that the

competitive organization of the company wants to buy 15% stock of the company and for that

the valuation of the stock of the company has been done through PE multiple model and

Dividend discount model. The calculations are as follows:

PE Multiple Model

Industry PE ratio 16.18

EPS 1.83

Intrinsic Value 29.53

Share Price 57.83

Overvalued

Dividend Discount Model

Dividend expected 1.83

Growth rate 3.00%

Discount rate 8.00%

Intrinsic Value 36.60

Share Price 57.83

Overvalued

Market to book value ratio

Market price 57.83

Number of shares 2840200000

Book value 30

Market capitalixzation / Book

value 1.928

Finance

21

Both of these valuation models explains that the stock price of the company is

overvalued and thus this is not the right time for the competitive company to buy the stocks

of the company. The stocks must be bought by the company when the stock position of the

company is undervalued. PE multiple model of the company explains that the intrinsic value

of the stock should be $ 29.53 which is quite lower than the actual market price of the

company $ 57.83 so this is not the right time to buy the stock (Kruth, 2013).

On the other hand, dividend discount model of the company explains that the intrinsic

value of the stock is $ 36.60 which is quite lower than the actual market price of the company

$ 57.83 so this is not the right time to buy the stock. The market price of the stock of the

company is $ 57.83 which is quite higher then the book value of the stock of the company. It

explains that the market position of the company is quite strong. Further, market book ratio

also explains that the position and the performance of the company is way better in the

market.

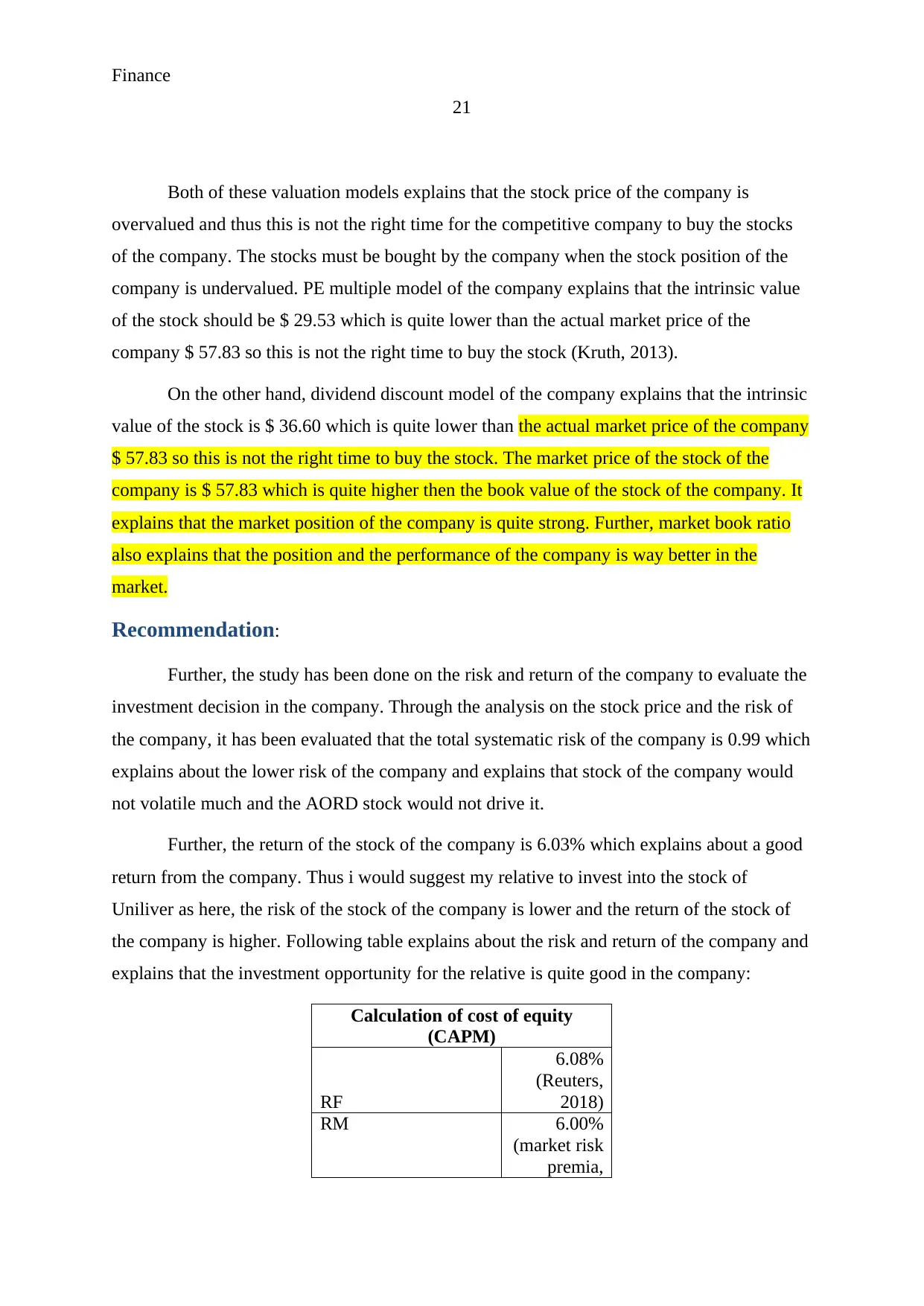

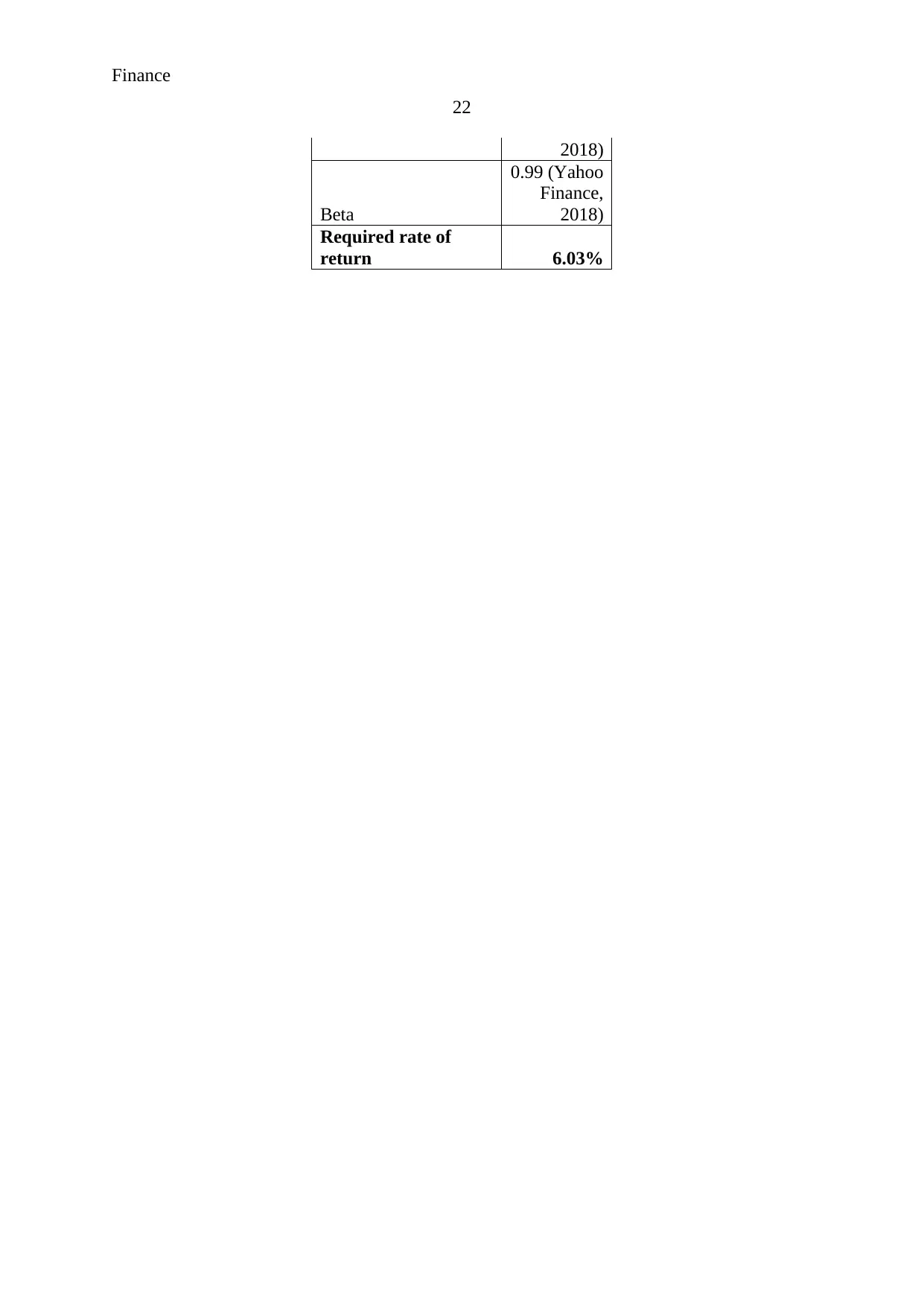

Recommendation:

Further, the study has been done on the risk and return of the company to evaluate the

investment decision in the company. Through the analysis on the stock price and the risk of

the company, it has been evaluated that the total systematic risk of the company is 0.99 which

explains about the lower risk of the company and explains that stock of the company would

not volatile much and the AORD stock would not drive it.

Further, the return of the stock of the company is 6.03% which explains about a good

return from the company. Thus i would suggest my relative to invest into the stock of

Uniliver as here, the risk of the stock of the company is lower and the return of the stock of

the company is higher. Following table explains about the risk and return of the company and

explains that the investment opportunity for the relative is quite good in the company:

Calculation of cost of equity

(CAPM)

RF

6.08%

(Reuters,

2018)

RM 6.00%

(market risk

premia,

21

Both of these valuation models explains that the stock price of the company is

overvalued and thus this is not the right time for the competitive company to buy the stocks

of the company. The stocks must be bought by the company when the stock position of the

company is undervalued. PE multiple model of the company explains that the intrinsic value

of the stock should be $ 29.53 which is quite lower than the actual market price of the

company $ 57.83 so this is not the right time to buy the stock (Kruth, 2013).

On the other hand, dividend discount model of the company explains that the intrinsic

value of the stock is $ 36.60 which is quite lower than the actual market price of the company

$ 57.83 so this is not the right time to buy the stock. The market price of the stock of the

company is $ 57.83 which is quite higher then the book value of the stock of the company. It

explains that the market position of the company is quite strong. Further, market book ratio

also explains that the position and the performance of the company is way better in the

market.

Recommendation:

Further, the study has been done on the risk and return of the company to evaluate the

investment decision in the company. Through the analysis on the stock price and the risk of

the company, it has been evaluated that the total systematic risk of the company is 0.99 which

explains about the lower risk of the company and explains that stock of the company would

not volatile much and the AORD stock would not drive it.

Further, the return of the stock of the company is 6.03% which explains about a good

return from the company. Thus i would suggest my relative to invest into the stock of

Uniliver as here, the risk of the stock of the company is lower and the return of the stock of

the company is higher. Following table explains about the risk and return of the company and

explains that the investment opportunity for the relative is quite good in the company:

Calculation of cost of equity

(CAPM)

RF

6.08%

(Reuters,

2018)

RM 6.00%

(market risk

premia,

Finance

22

2018)

Beta

0.99 (Yahoo

Finance,

2018)

Required rate of

return 6.03%

22

2018)

Beta

0.99 (Yahoo

Finance,

2018)

Required rate of

return 6.03%

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Finance

23

References

Ackert, L. and Deaves, R. 2009. Behavioral Finance: Psychology, Decision-Making, and

Markets. Cengage Learning.

Baker, H.K. and Nofsinger, J.R. 2010. Behavioral Finance: Investors, Corporations, and

Markets. John Wiley & Sons.

Baker, H.K. and Weigand, R., 2015. 777777. Managerial Finance, 41(2), pp.126-144.

Barman, G.P., 2008. An evaluation of how dividend policies impact on the share value of

selected companies. McGraw-Hill.

Bodie, Z., 2013. Investments. McGraw-Hill.

Bradford, W., Chen, C. and Zhu, S., 2013. Cash dividend policy, corporate pyramids, and

ownership structure: Evidence from China. International Review of Economics &

Finance, 27, pp.445-464.

Brealey, R., Myers, S.C. and Marcus, A.J., 2007. FundamentalsofCorporate Finance. Mc

Graw Hill, New York.

Breuer, W., Rieger, M.O. and Soypak, K.C., 2014. The behavioral foundations of corporate

dividend policy a cross-country analysis. Journal of Banking & Finance, 42, pp.247-265.

Davies, T. and Crawford, I., 2011. Business accounting and finance. Pearson.

Elton, E.J., Gruber, M.J., Brown, S.J., and Goetzmann, W.N. 2009. Modern Portfolio Theory

and Investment Analysis. John Wiley & Sons.

Home. 2018. Unilever plc. Viewed 7 Fe 2018, https://www.unilever.com/

Kinsky, R. 2011. Charting Made Simple: A Beginner's Guide to Technical Analysis. John

Wiley & Sons.

Krantz, M. 2016. Fundamental Analysis for Dummies. John Wiley & Sons.

23

References

Ackert, L. and Deaves, R. 2009. Behavioral Finance: Psychology, Decision-Making, and

Markets. Cengage Learning.

Baker, H.K. and Nofsinger, J.R. 2010. Behavioral Finance: Investors, Corporations, and

Markets. John Wiley & Sons.

Baker, H.K. and Weigand, R., 2015. 777777. Managerial Finance, 41(2), pp.126-144.

Barman, G.P., 2008. An evaluation of how dividend policies impact on the share value of

selected companies. McGraw-Hill.

Bodie, Z., 2013. Investments. McGraw-Hill.

Bradford, W., Chen, C. and Zhu, S., 2013. Cash dividend policy, corporate pyramids, and

ownership structure: Evidence from China. International Review of Economics &

Finance, 27, pp.445-464.

Brealey, R., Myers, S.C. and Marcus, A.J., 2007. FundamentalsofCorporate Finance. Mc

Graw Hill, New York.

Breuer, W., Rieger, M.O. and Soypak, K.C., 2014. The behavioral foundations of corporate

dividend policy a cross-country analysis. Journal of Banking & Finance, 42, pp.247-265.

Davies, T. and Crawford, I., 2011. Business accounting and finance. Pearson.

Elton, E.J., Gruber, M.J., Brown, S.J., and Goetzmann, W.N. 2009. Modern Portfolio Theory

and Investment Analysis. John Wiley & Sons.

Home. 2018. Unilever plc. Viewed 7 Fe 2018, https://www.unilever.com/

Kinsky, R. 2011. Charting Made Simple: A Beginner's Guide to Technical Analysis. John

Wiley & Sons.

Krantz, M. 2016. Fundamental Analysis for Dummies. John Wiley & Sons.

Finance

24

Kurth, S. 2013. Critical Review about Implications of the Efficient Market Hypothesis. GRIN

Verlag.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

Market risk Premia. 2018. IMRP. Viewed 7 Feb 2018,

http://www.market-risk-premia.com/gb.html

Morningstar. 2018. Pepsico Plc. Viewed 7 Feb 2018,

http://financials.morningstar.com/income-statement/is.html?t=PEP

Morningstar. 2018. Proctor and Gamble Plc. Viewed 7 Feb 2018,

http://financials.morningstar.com/ratios/r.html?t=PG

Morningstar. 2018. Unilever Plc. Viewed 7 Feb 2018, http://financials.morningstar.com/cash-

flow/cf.html?t=UL®ion=usa&culture=en-US

Palicka, V.J. 2011. Fusion Analysis: Merging Fundamental and Technical Analysis for Risk-

Adjusted Excess Returns. McGraw Hill Professional.

Phillips, P.P. and Stawarski, C.A. 2016. Data Collection: Planning for and Collecting All

Types of Data. John Wiley & Sons.

Reuters. 2018. Unilever Plc. Viewed 7 Feb 2018,

https://www.reuters.com/finance/stocks/overview/ULVR.L

Schlichting, T. 2013. Fundamental Analysis, Behavioral Finance and Technical Analysis on

the Stock Market. GRIN Verlag.

Yahoo Finance. 2018. Unilever Plc. Viewed 7 Feb 2018,

https://au.finance.yahoo.com/quote/UN/history?p=UN

24

Kurth, S. 2013. Critical Review about Implications of the Efficient Market Hypothesis. GRIN

Verlag.

Madura, J. 2014. Financial Markets and Institutions. Cengage Learning.

Market risk Premia. 2018. IMRP. Viewed 7 Feb 2018,

http://www.market-risk-premia.com/gb.html

Morningstar. 2018. Pepsico Plc. Viewed 7 Feb 2018,

http://financials.morningstar.com/income-statement/is.html?t=PEP

Morningstar. 2018. Proctor and Gamble Plc. Viewed 7 Feb 2018,

http://financials.morningstar.com/ratios/r.html?t=PG

Morningstar. 2018. Unilever Plc. Viewed 7 Feb 2018, http://financials.morningstar.com/cash-

flow/cf.html?t=UL®ion=usa&culture=en-US

Palicka, V.J. 2011. Fusion Analysis: Merging Fundamental and Technical Analysis for Risk-

Adjusted Excess Returns. McGraw Hill Professional.

Phillips, P.P. and Stawarski, C.A. 2016. Data Collection: Planning for and Collecting All

Types of Data. John Wiley & Sons.

Reuters. 2018. Unilever Plc. Viewed 7 Feb 2018,

https://www.reuters.com/finance/stocks/overview/ULVR.L

Schlichting, T. 2013. Fundamental Analysis, Behavioral Finance and Technical Analysis on

the Stock Market. GRIN Verlag.

Yahoo Finance. 2018. Unilever Plc. Viewed 7 Feb 2018,

https://au.finance.yahoo.com/quote/UN/history?p=UN

Finance

25

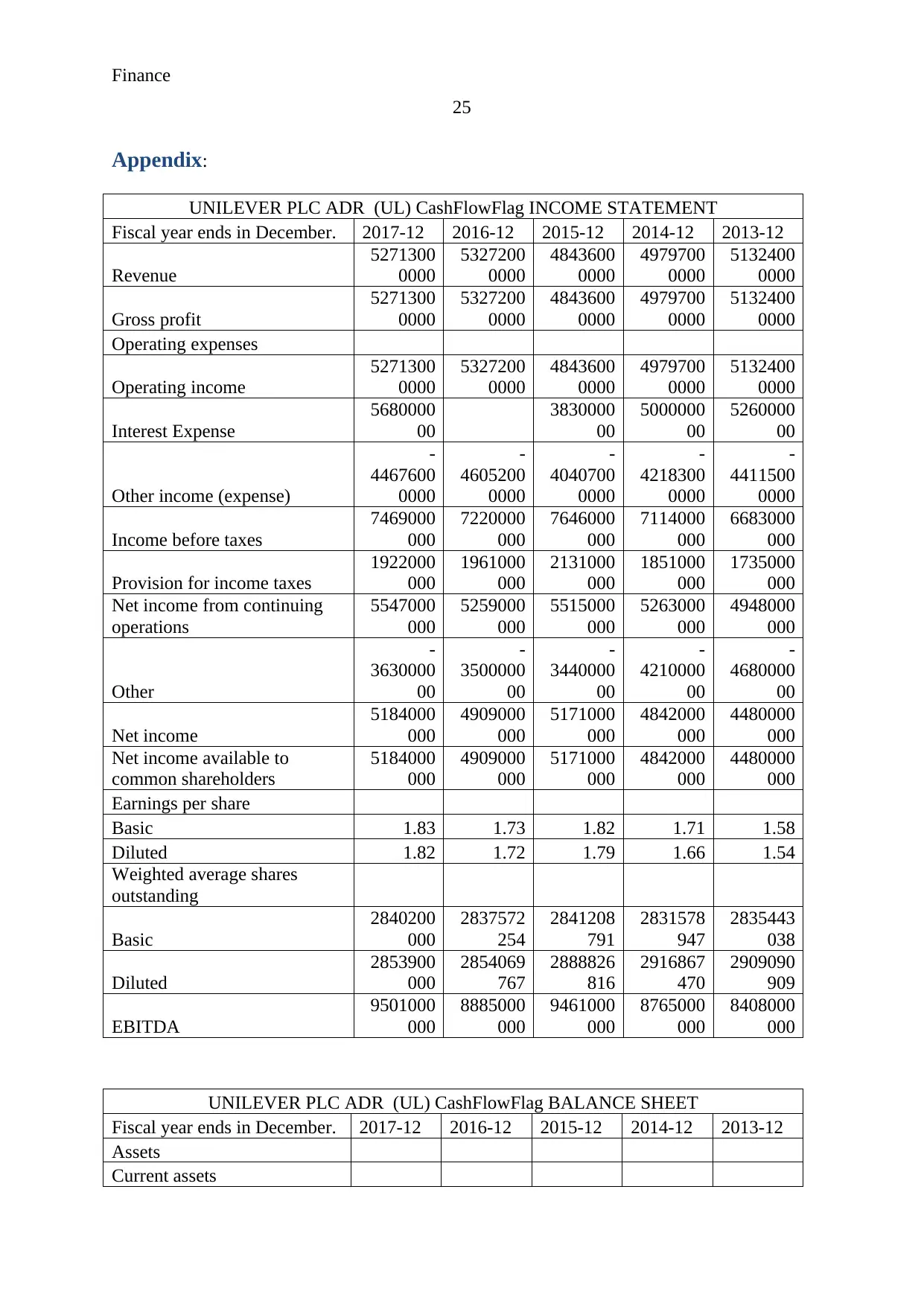

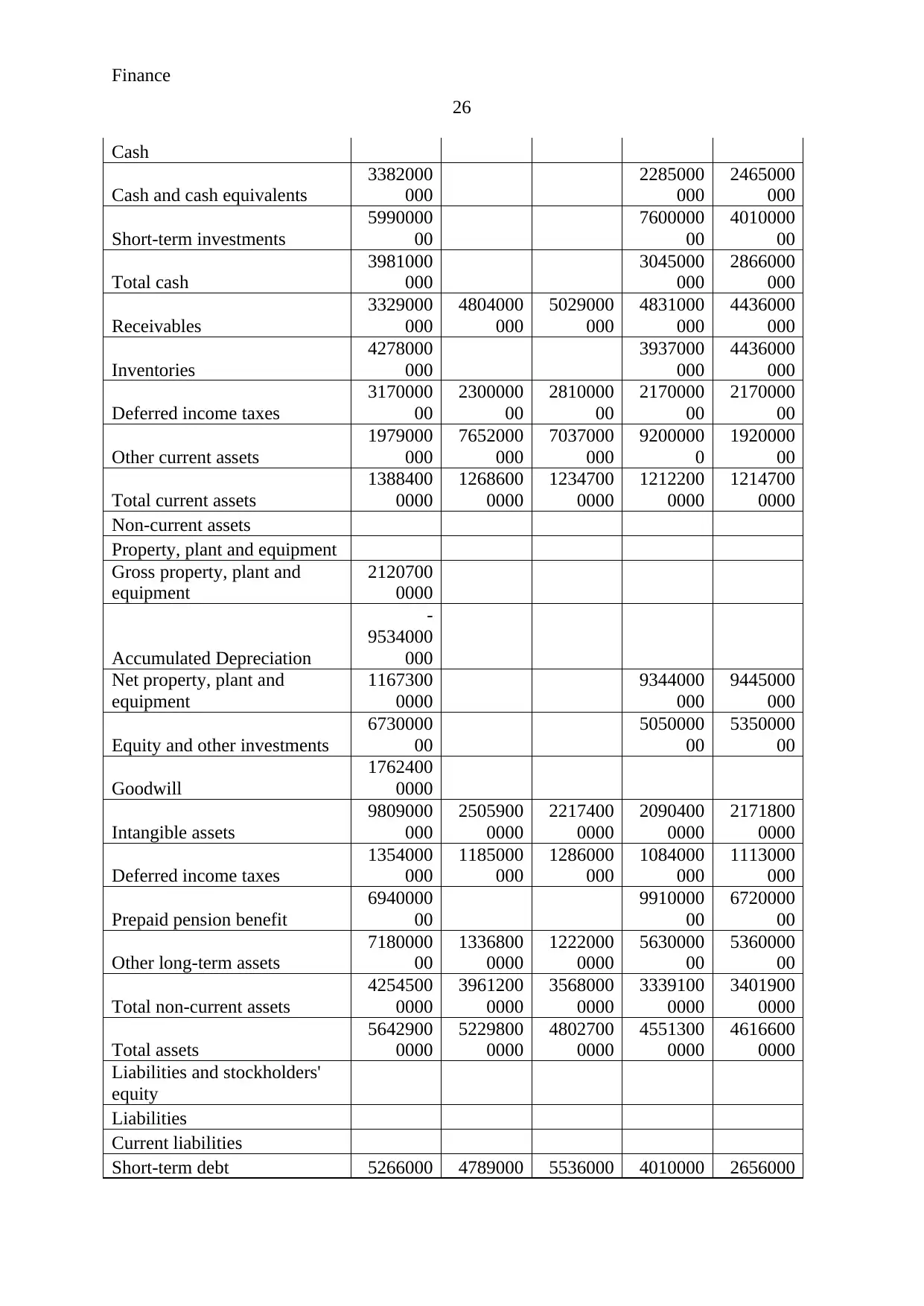

Appendix:

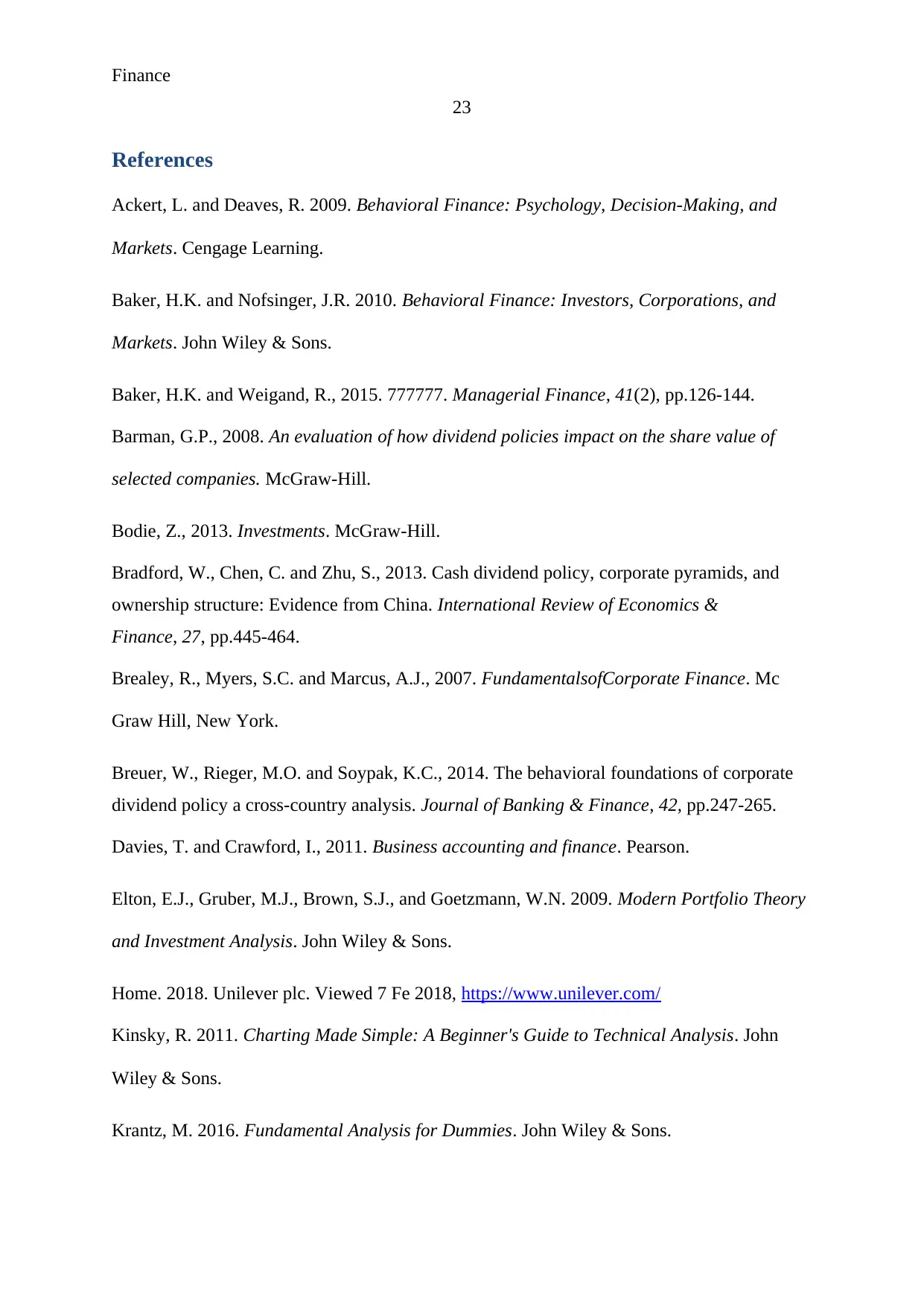

UNILEVER PLC ADR (UL) CashFlowFlag INCOME STATEMENT

Fiscal year ends in December. 2017-12 2016-12 2015-12 2014-12 2013-12

Revenue

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Gross profit

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Operating expenses

Operating income

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Interest Expense

5680000

00

3830000

00

5000000

00

5260000

00

Other income (expense)

-

4467600

0000

-

4605200

0000

-

4040700

0000

-

4218300

0000

-

4411500

0000

Income before taxes

7469000

000

7220000

000

7646000

000

7114000

000

6683000

000

Provision for income taxes

1922000

000

1961000

000

2131000

000

1851000

000

1735000

000

Net income from continuing

operations

5547000

000

5259000

000

5515000

000

5263000

000

4948000

000

Other

-

3630000

00

-

3500000

00

-

3440000

00

-

4210000

00

-

4680000

00

Net income

5184000

000

4909000

000

5171000

000

4842000

000

4480000

000

Net income available to

common shareholders

5184000

000

4909000

000

5171000

000

4842000

000

4480000

000

Earnings per share

Basic 1.83 1.73 1.82 1.71 1.58

Diluted 1.82 1.72 1.79 1.66 1.54

Weighted average shares

outstanding

Basic

2840200

000

2837572

254

2841208

791

2831578

947

2835443

038

Diluted

2853900

000

2854069

767

2888826

816

2916867

470

2909090

909

EBITDA

9501000

000

8885000

000

9461000

000

8765000

000

8408000

000

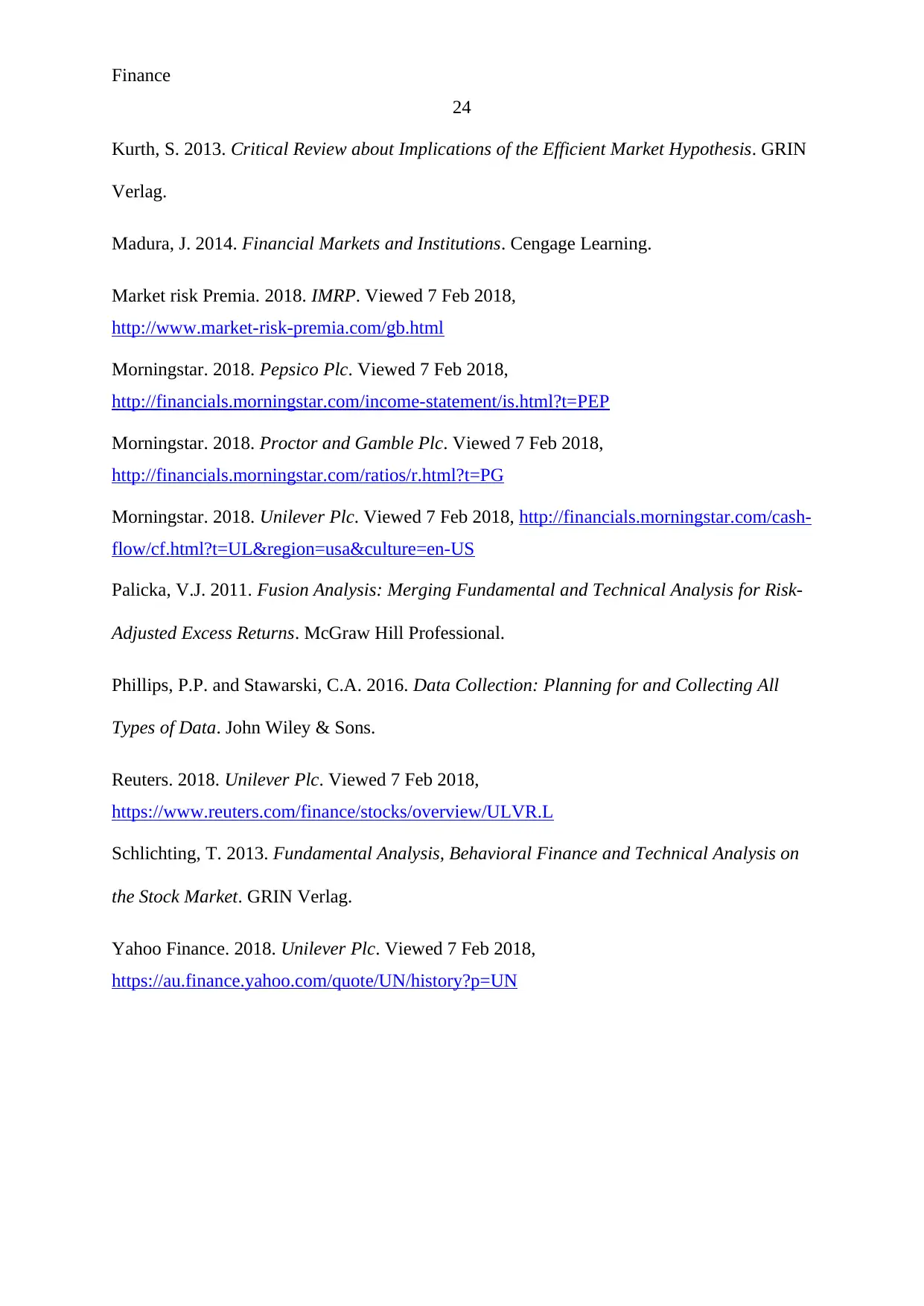

UNILEVER PLC ADR (UL) CashFlowFlag BALANCE SHEET

Fiscal year ends in December. 2017-12 2016-12 2015-12 2014-12 2013-12

Assets

Current assets

25

Appendix:

UNILEVER PLC ADR (UL) CashFlowFlag INCOME STATEMENT

Fiscal year ends in December. 2017-12 2016-12 2015-12 2014-12 2013-12

Revenue

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Gross profit

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Operating expenses

Operating income

5271300

0000

5327200

0000

4843600

0000

4979700

0000

5132400

0000

Interest Expense

5680000

00

3830000

00

5000000

00

5260000

00

Other income (expense)

-

4467600

0000

-

4605200

0000

-

4040700

0000

-

4218300

0000

-

4411500

0000

Income before taxes

7469000

000

7220000

000

7646000

000

7114000

000

6683000

000

Provision for income taxes

1922000

000

1961000

000

2131000

000

1851000

000

1735000

000

Net income from continuing

operations

5547000

000

5259000

000

5515000

000

5263000

000

4948000

000

Other

-

3630000

00

-

3500000

00

-

3440000

00

-

4210000

00

-

4680000

00

Net income

5184000

000

4909000

000

5171000

000

4842000

000

4480000

000

Net income available to

common shareholders

5184000

000

4909000

000

5171000

000

4842000

000

4480000

000

Earnings per share

Basic 1.83 1.73 1.82 1.71 1.58

Diluted 1.82 1.72 1.79 1.66 1.54

Weighted average shares

outstanding

Basic

2840200

000

2837572

254

2841208

791

2831578

947

2835443

038

Diluted

2853900

000

2854069

767

2888826

816

2916867

470

2909090

909

EBITDA

9501000

000

8885000

000

9461000

000

8765000

000

8408000

000

UNILEVER PLC ADR (UL) CashFlowFlag BALANCE SHEET

Fiscal year ends in December. 2017-12 2016-12 2015-12 2014-12 2013-12

Assets

Current assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Finance

26

Cash

Cash and cash equivalents

3382000

000

2285000

000

2465000

000

Short-term investments

5990000

00

7600000

00

4010000

00

Total cash

3981000

000

3045000

000

2866000

000

Receivables

3329000

000

4804000

000

5029000

000

4831000

000

4436000

000

Inventories

4278000

000

3937000

000

4436000

000

Deferred income taxes

3170000

00

2300000

00

2810000

00

2170000

00

2170000

00

Other current assets

1979000

000

7652000

000

7037000

000

9200000

0

1920000

00

Total current assets

1388400

0000

1268600

0000

1234700

0000

1212200

0000

1214700

0000

Non-current assets

Property, plant and equipment

Gross property, plant and

equipment

2120700

0000

Accumulated Depreciation

-

9534000

000

Net property, plant and

equipment

1167300

0000

9344000

000

9445000

000

Equity and other investments

6730000

00

5050000

00

5350000

00

Goodwill

1762400

0000

Intangible assets

9809000

000

2505900

0000

2217400

0000

2090400

0000

2171800

0000

Deferred income taxes

1354000

000

1185000

000

1286000

000

1084000

000

1113000

000

Prepaid pension benefit

6940000

00

9910000

00

6720000

00

Other long-term assets

7180000

00

1336800

0000

1222000

0000

5630000

00

5360000

00

Total non-current assets

4254500

0000

3961200

0000

3568000

0000

3339100

0000

3401900

0000

Total assets

5642900

0000

5229800

0000

4802700

0000

4551300

0000

4616600

0000

Liabilities and stockholders'

equity

Liabilities

Current liabilities

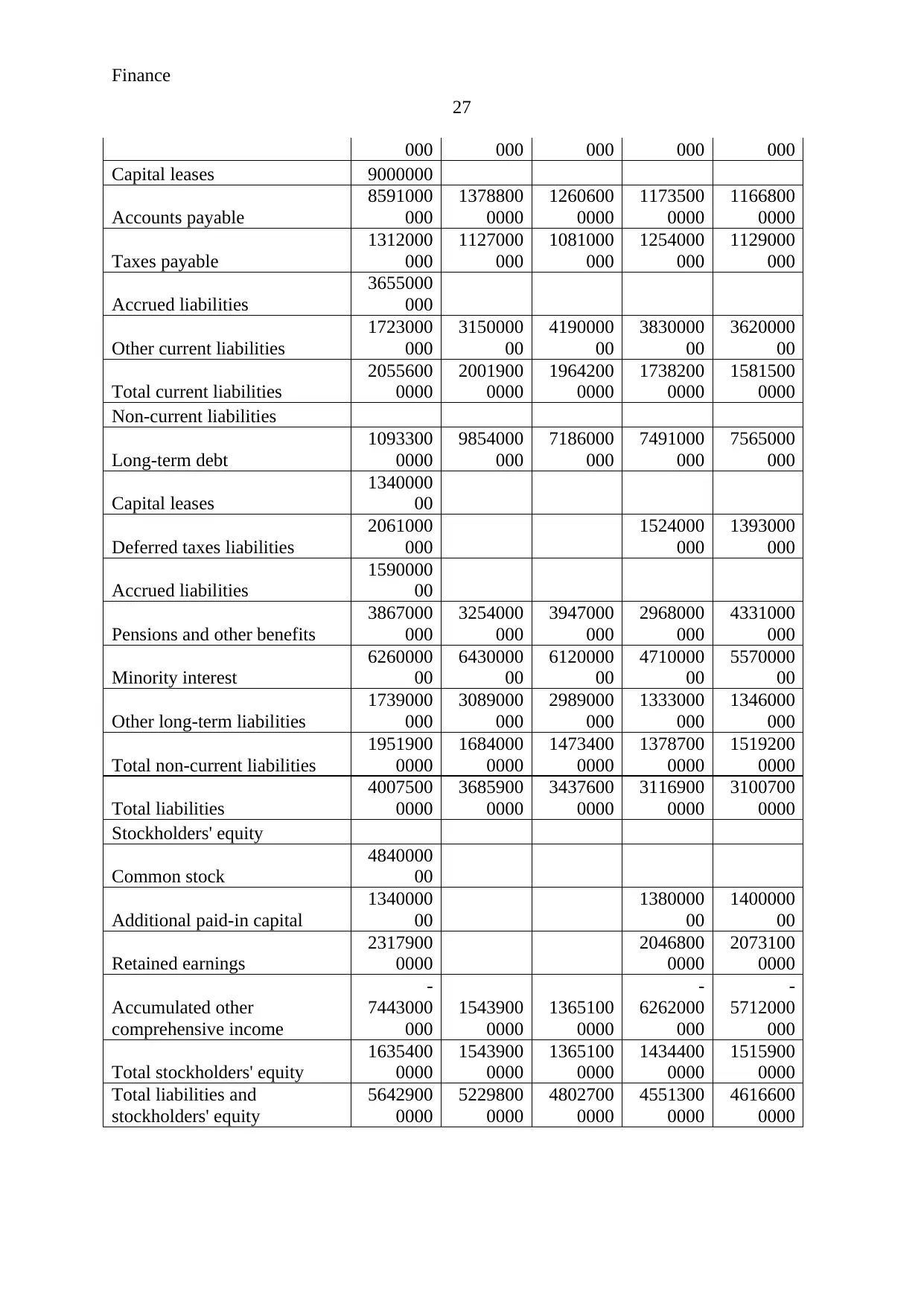

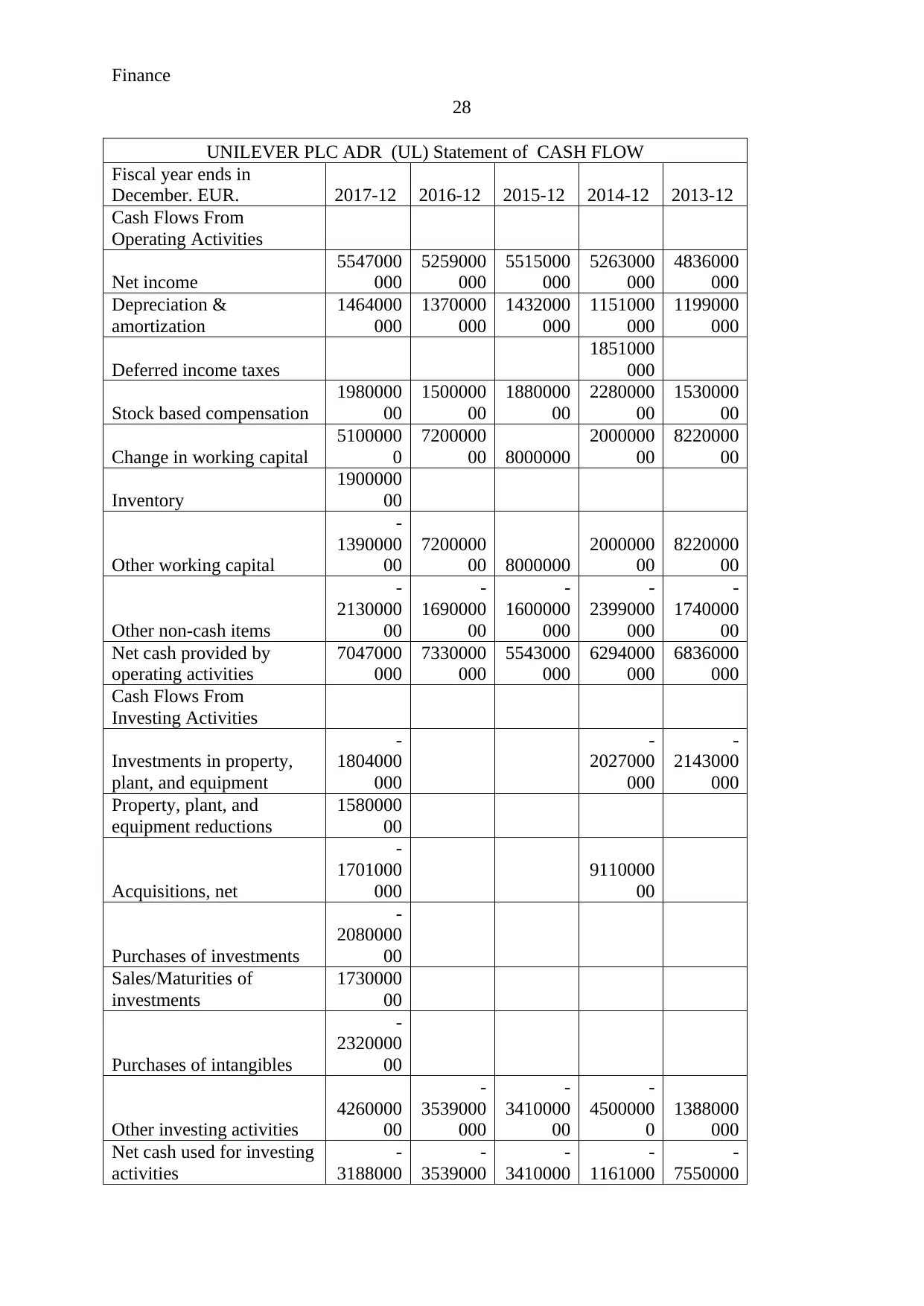

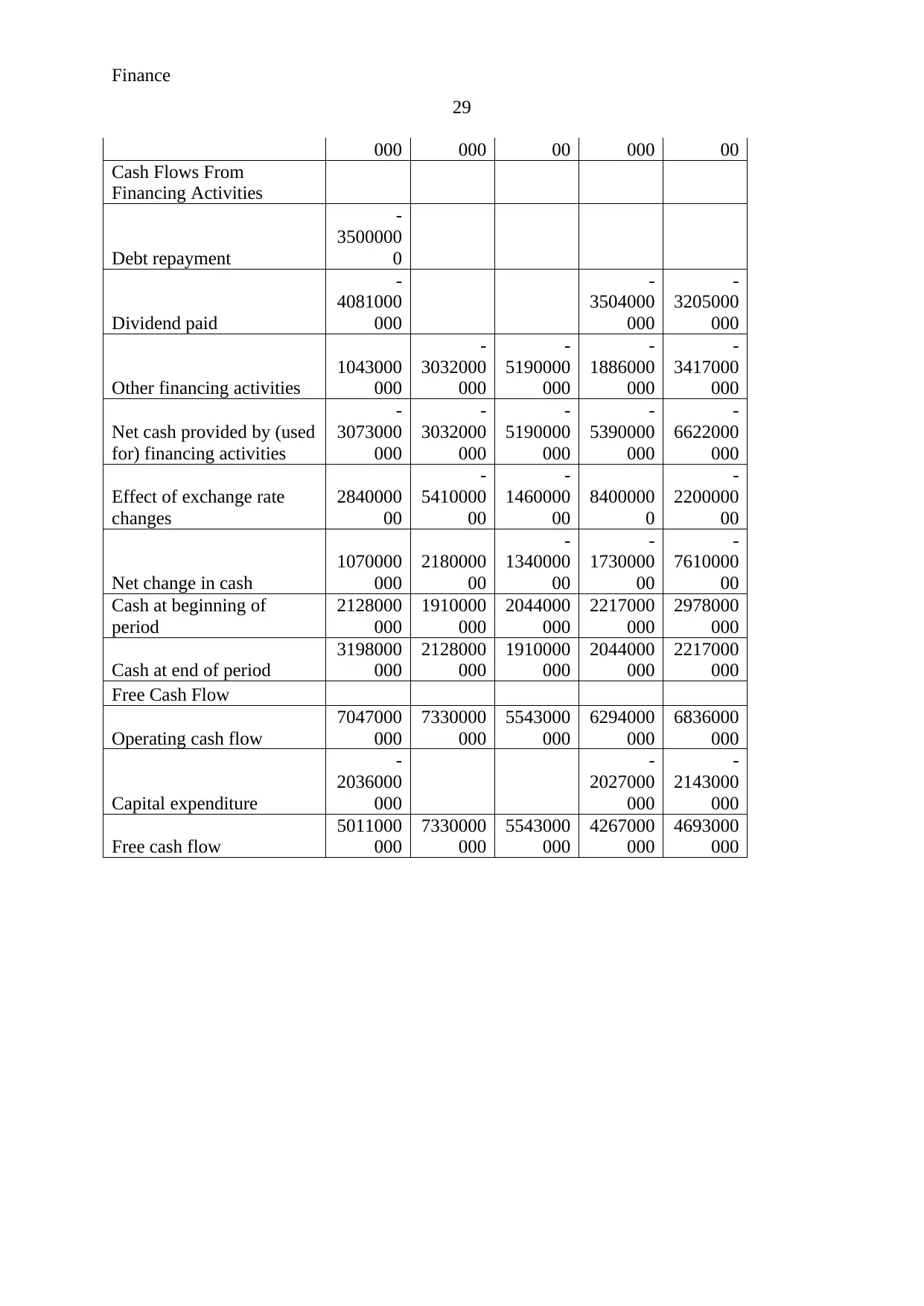

Short-term debt 5266000 4789000 5536000 4010000 2656000

26

Cash

Cash and cash equivalents

3382000

000

2285000

000

2465000

000

Short-term investments

5990000

00

7600000

00

4010000

00

Total cash

3981000

000

3045000

000

2866000

000

Receivables

3329000

000

4804000

000

5029000

000

4831000

000

4436000

000

Inventories

4278000

000

3937000

000

4436000

000

Deferred income taxes

3170000

00

2300000

00

2810000

00

2170000

00

2170000

00

Other current assets

1979000

000

7652000

000

7037000

000

9200000

0

1920000

00

Total current assets

1388400

0000

1268600

0000

1234700