Woolworths’ Organizational Context and Business Operations

VerifiedAdded on 2023/06/04

|10

|2349

|422

AI Summary

This article discusses Woolworths’ organizational context, business operations, supply network system, market segmentation, and adaptation of business model. It also highlights the challenges faced by Woolworths and its strategies to overcome them.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: OPERATIONS MANAGEMENT

OPERATIONS MANAGEMENT

Name of the Student:

Name of the University:

Author note:

OPERATIONS MANAGEMENT

Name of the Student:

Name of the University:

Author note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1OPERATIONS MANAGEMENT

Woolworths’ Organizational Context

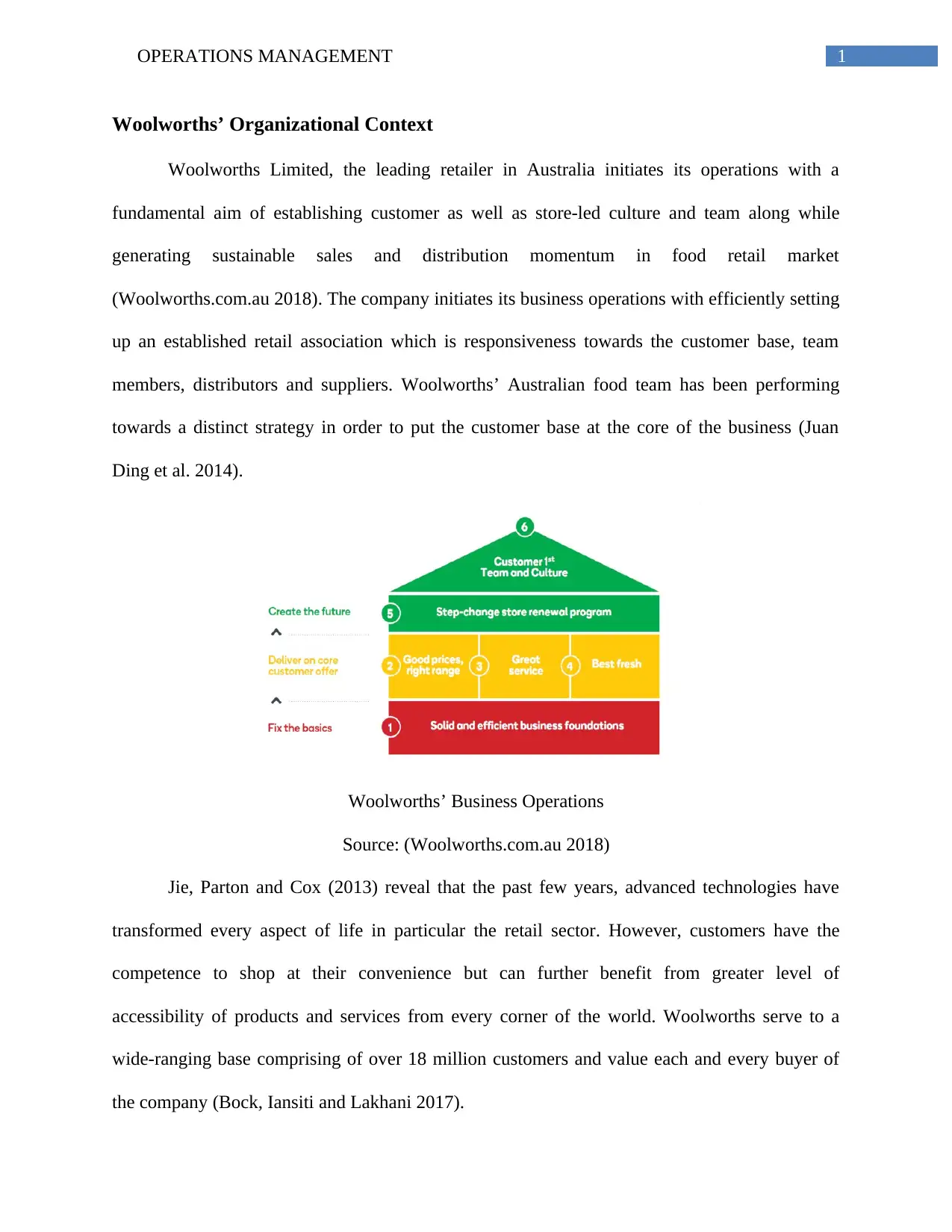

Woolworths Limited, the leading retailer in Australia initiates its operations with a

fundamental aim of establishing customer as well as store-led culture and team along while

generating sustainable sales and distribution momentum in food retail market

(Woolworths.com.au 2018). The company initiates its business operations with efficiently setting

up an established retail association which is responsiveness towards the customer base, team

members, distributors and suppliers. Woolworths’ Australian food team has been performing

towards a distinct strategy in order to put the customer base at the core of the business (Juan

Ding et al. 2014).

Woolworths’ Business Operations

Source: (Woolworths.com.au 2018)

Jie, Parton and Cox (2013) reveal that the past few years, advanced technologies have

transformed every aspect of life in particular the retail sector. However, customers have the

competence to shop at their convenience but can further benefit from greater level of

accessibility of products and services from every corner of the world. Woolworths serve to a

wide-ranging base comprising of over 18 million customers and value each and every buyer of

the company (Bock, Iansiti and Lakhani 2017).

Woolworths’ Organizational Context

Woolworths Limited, the leading retailer in Australia initiates its operations with a

fundamental aim of establishing customer as well as store-led culture and team along while

generating sustainable sales and distribution momentum in food retail market

(Woolworths.com.au 2018). The company initiates its business operations with efficiently setting

up an established retail association which is responsiveness towards the customer base, team

members, distributors and suppliers. Woolworths’ Australian food team has been performing

towards a distinct strategy in order to put the customer base at the core of the business (Juan

Ding et al. 2014).

Woolworths’ Business Operations

Source: (Woolworths.com.au 2018)

Jie, Parton and Cox (2013) reveal that the past few years, advanced technologies have

transformed every aspect of life in particular the retail sector. However, customers have the

competence to shop at their convenience but can further benefit from greater level of

accessibility of products and services from every corner of the world. Woolworths serve to a

wide-ranging base comprising of over 18 million customers and value each and every buyer of

the company (Bock, Iansiti and Lakhani 2017).

2OPERATIONS MANAGEMENT

Woolworths Supply Network System

Redesign Function and Series of Distribution Outlets

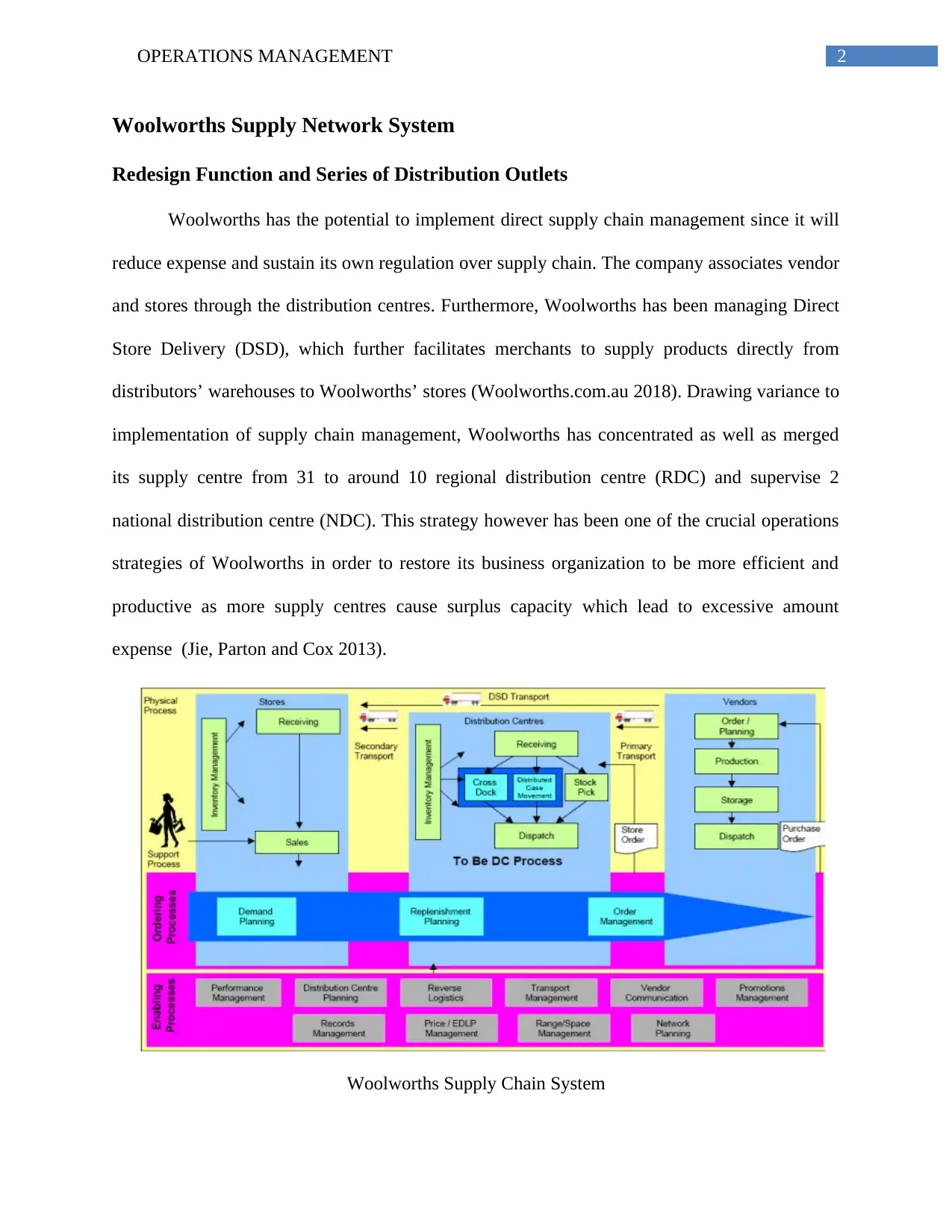

Woolworths has the potential to implement direct supply chain management since it will

reduce expense and sustain its own regulation over supply chain. The company associates vendor

and stores through the distribution centres. Furthermore, Woolworths has been managing Direct

Store Delivery (DSD), which further facilitates merchants to supply products directly from

distributors’ warehouses to Woolworths’ stores (Woolworths.com.au 2018). Drawing variance to

implementation of supply chain management, Woolworths has concentrated as well as merged

its supply centre from 31 to around 10 regional distribution centre (RDC) and supervise 2

national distribution centre (NDC). This strategy however has been one of the crucial operations

strategies of Woolworths in order to restore its business organization to be more efficient and

productive as more supply centres cause surplus capacity which lead to excessive amount

expense (Jie, Parton and Cox 2013).

Woolworths Supply Chain System

Woolworths Supply Network System

Redesign Function and Series of Distribution Outlets

Woolworths has the potential to implement direct supply chain management since it will

reduce expense and sustain its own regulation over supply chain. The company associates vendor

and stores through the distribution centres. Furthermore, Woolworths has been managing Direct

Store Delivery (DSD), which further facilitates merchants to supply products directly from

distributors’ warehouses to Woolworths’ stores (Woolworths.com.au 2018). Drawing variance to

implementation of supply chain management, Woolworths has concentrated as well as merged

its supply centre from 31 to around 10 regional distribution centre (RDC) and supervise 2

national distribution centre (NDC). This strategy however has been one of the crucial operations

strategies of Woolworths in order to restore its business organization to be more efficient and

productive as more supply centres cause surplus capacity which lead to excessive amount

expense (Jie, Parton and Cox 2013).

Woolworths Supply Chain System

3OPERATIONS MANAGEMENT

Source: (Woolworths.com.au 2018)

RDCs of Woolworths are primarily located across Australia such as Brisbane, Perth,

Adelaide and Townsville, while two national distribution centres has been located in Victoria

and New South Wales. However the decision to execute two NDCs in Victoria as well as New

South Wales has been identified as the company’s strategic decision making procedures

(Woolworths.com.au 2018). The company has executed the strategic decision process to

successfully reduce freight expense from suppliers to distribution centre as over 80% of

productions are generated in regions of Eastern Australia. Furthermore, the decrease of delivery

and supply centre will reduce warehousing expenses such as site or warehouse centres as well as

stock handling expenses (Jie, Parton and Cox 2013).

Woolworths’ Market Segmentation

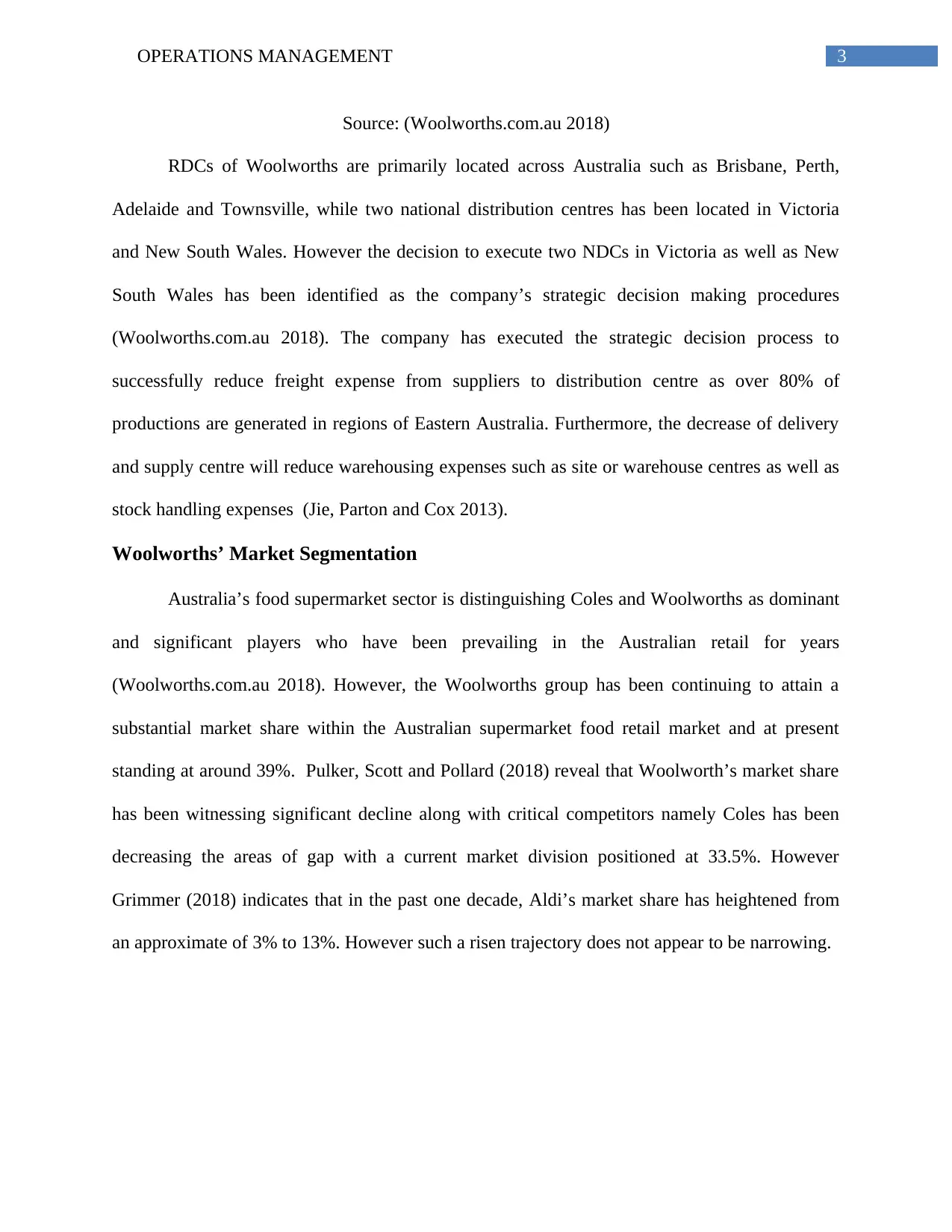

Australia’s food supermarket sector is distinguishing Coles and Woolworths as dominant

and significant players who have been prevailing in the Australian retail for years

(Woolworths.com.au 2018). However, the Woolworths group has been continuing to attain a

substantial market share within the Australian supermarket food retail market and at present

standing at around 39%. Pulker, Scott and Pollard (2018) reveal that Woolworth’s market share

has been witnessing significant decline along with critical competitors namely Coles has been

decreasing the areas of gap with a current market division positioned at 33.5%. However

Grimmer (2018) indicates that in the past one decade, Aldi’s market share has heightened from

an approximate of 3% to 13%. However such a risen trajectory does not appear to be narrowing.

Source: (Woolworths.com.au 2018)

RDCs of Woolworths are primarily located across Australia such as Brisbane, Perth,

Adelaide and Townsville, while two national distribution centres has been located in Victoria

and New South Wales. However the decision to execute two NDCs in Victoria as well as New

South Wales has been identified as the company’s strategic decision making procedures

(Woolworths.com.au 2018). The company has executed the strategic decision process to

successfully reduce freight expense from suppliers to distribution centre as over 80% of

productions are generated in regions of Eastern Australia. Furthermore, the decrease of delivery

and supply centre will reduce warehousing expenses such as site or warehouse centres as well as

stock handling expenses (Jie, Parton and Cox 2013).

Woolworths’ Market Segmentation

Australia’s food supermarket sector is distinguishing Coles and Woolworths as dominant

and significant players who have been prevailing in the Australian retail for years

(Woolworths.com.au 2018). However, the Woolworths group has been continuing to attain a

substantial market share within the Australian supermarket food retail market and at present

standing at around 39%. Pulker, Scott and Pollard (2018) reveal that Woolworth’s market share

has been witnessing significant decline along with critical competitors namely Coles has been

decreasing the areas of gap with a current market division positioned at 33.5%. However

Grimmer (2018) indicates that in the past one decade, Aldi’s market share has heightened from

an approximate of 3% to 13%. However such a risen trajectory does not appear to be narrowing.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4OPERATIONS MANAGEMENT

Woolworths’ Market Share

Source: (Morgan 2014)

Sullivan and Gouldson (2017) reveal current data which further indicate Woolworths’

incompetence in sustaining their current market position in Australian retail. It is highly

inconsistent for the company to pursue similar price-driven market share such as Coles and Aldi,

thus they need to seek their areas of divergences to compete in this competitive retail market.

Market segmentation will facilitate Woolworths with distinct focus on the range of customers

who have greater degree of inclination towards the Woolworths brand (Bayne, Schepis and

Purchase 2017). Woolworths can segment their market purchasers with transparent customer

designs and needs and further distinguish the areas of segment where Woolworths can serve with

utmost efficiency.

Woolworths’ management could take into consideration a significant quality as well as

convenience proposition by further providing its buyers with excellent quality goods at great and

attractive prices range which could magnetize high rate of customers at diverse store locations

(Juan Ding et al. 2014). Furthermore, eliminating the focus on price assessment to quality and

product excellence, the Australian leading retail organization, Woolworths market differentiation

Woolworths’ Market Share

Source: (Morgan 2014)

Sullivan and Gouldson (2017) reveal current data which further indicate Woolworths’

incompetence in sustaining their current market position in Australian retail. It is highly

inconsistent for the company to pursue similar price-driven market share such as Coles and Aldi,

thus they need to seek their areas of divergences to compete in this competitive retail market.

Market segmentation will facilitate Woolworths with distinct focus on the range of customers

who have greater degree of inclination towards the Woolworths brand (Bayne, Schepis and

Purchase 2017). Woolworths can segment their market purchasers with transparent customer

designs and needs and further distinguish the areas of segment where Woolworths can serve with

utmost efficiency.

Woolworths’ management could take into consideration a significant quality as well as

convenience proposition by further providing its buyers with excellent quality goods at great and

attractive prices range which could magnetize high rate of customers at diverse store locations

(Juan Ding et al. 2014). Furthermore, eliminating the focus on price assessment to quality and

product excellence, the Australian leading retail organization, Woolworths market differentiation

5OPERATIONS MANAGEMENT

has also retained its position and ‘The fresh food people ‘will sustain its relevance in a quality

market context. Mialon et al. (2016) has suggested that the strongest growing demographic is

primarily based on singles as well as couples without children (SWOCs) who constitute the

highest disposable incomes. This particular group will signify approximately over 55% of

households by the next 10-12 years (Pulker, Scott and Pollard 2018). However, major segment

of these upwardly mobile demographic are identified in metropolitan areas and seeking for

conveniences. Furthermore, as an additional segment are those with high earnings and potentially

with higher disposable earnings level. It has been noted by Woolworths.com.au (2018) that the

company’s higher quality products would further appeal to wider range of achievement

consumers- referred to those purchasing goods and products as well as services which illustrate

achievements to others.

As a result, Woolworths would be aiming at various segments with a greater level of

disposable earnings as well as in relation to segmentation strategy which could adapt diverse

product ranges to dissimilar customer segments at each location (Pulker, Scott and Pollard

2018). For instance, high quality convenience meals in the city as well as high quality food

products along with specialized ranges in the larger outlets. It has been noted that the concept

behind an attainable market segmentation strategy is to successfully establish a dominant

position within the market whereby competitors will be reluctant or incompetent to contest

completion successfully. However, Woolworths’ primary target market that is the Woolies is

being encountered by its primary competitors such as Coles (Morgan 2014). Evaluating market

segmentation based on geography in the domain of globalization, restricted geographical

existence of Woolworths is the major cause of limited customer range in comparison to other

retailers (Jie, Parton and Cox 2013). For instance, it has been noted that one of Woolworths’

has also retained its position and ‘The fresh food people ‘will sustain its relevance in a quality

market context. Mialon et al. (2016) has suggested that the strongest growing demographic is

primarily based on singles as well as couples without children (SWOCs) who constitute the

highest disposable incomes. This particular group will signify approximately over 55% of

households by the next 10-12 years (Pulker, Scott and Pollard 2018). However, major segment

of these upwardly mobile demographic are identified in metropolitan areas and seeking for

conveniences. Furthermore, as an additional segment are those with high earnings and potentially

with higher disposable earnings level. It has been noted by Woolworths.com.au (2018) that the

company’s higher quality products would further appeal to wider range of achievement

consumers- referred to those purchasing goods and products as well as services which illustrate

achievements to others.

As a result, Woolworths would be aiming at various segments with a greater level of

disposable earnings as well as in relation to segmentation strategy which could adapt diverse

product ranges to dissimilar customer segments at each location (Pulker, Scott and Pollard

2018). For instance, high quality convenience meals in the city as well as high quality food

products along with specialized ranges in the larger outlets. It has been noted that the concept

behind an attainable market segmentation strategy is to successfully establish a dominant

position within the market whereby competitors will be reluctant or incompetent to contest

completion successfully. However, Woolworths’ primary target market that is the Woolies is

being encountered by its primary competitors such as Coles (Morgan 2014). Evaluating market

segmentation based on geography in the domain of globalization, restricted geographical

existence of Woolworths is the major cause of limited customer range in comparison to other

retailers (Jie, Parton and Cox 2013). For instance, it has been noted that one of Woolworths’

6OPERATIONS MANAGEMENT

global primary rivals, Walmart who comprises extensive business operations in the United

States, South America, Europe and Mexico, whereby Woolworths functions its business

operations only in Australia and New Zealand (Woolworths.com.au 2018). Furthermore,

Woolworths’ restricted existence tends to restrict its consumer base and further does not permit

the company to benefit from geographical diversification and further enhances its level of risk

related with these narrow markets. Thus, Woolworths sells its products and services to all range

of demographic base and their marketing activities tend to target all ages of people (Juan Ding et

al. 2014). However this strategy is distinguished as less productive as reiterating similar

marketing strategies to diverse customer base is referred as less convincing in comparison to

single individual (Pulker, Scott and Pollard 2018). Thus, Grimmer (2018) note that in such

scenarios, process of mass customization of products along with marketing activities is required

for Woolworths’ to enhance customers’ relationship promotion strategies.

Woolworths’ Adaptation of Business Model

All managers in globalized market scenario has been making operating decisions

whereby decisions which stimulate strategies and planning which interpret strategy into action.

Digitization has been dramatically transforming the characteristic, locus and rapidness of these

decisions and technologies, methods which facilitate effective as well as productive operating

performances. Bock, Iansiti and Lakhani (2017) noted that broad employment of digital

technology necessitates rethinking of both businesses as well as operating models in which a

business model aims to define the course executed by the organization of the way it creates as

well as captures value. Studies revealed that strategies which took Woolworths to adapt to the

growing B2B grocery buying segment (Bock, Iansiti and Lakhani 2017). Recently, Woolworths

has evolved its digital competencies in order to attain the increasing market developments in

global primary rivals, Walmart who comprises extensive business operations in the United

States, South America, Europe and Mexico, whereby Woolworths functions its business

operations only in Australia and New Zealand (Woolworths.com.au 2018). Furthermore,

Woolworths’ restricted existence tends to restrict its consumer base and further does not permit

the company to benefit from geographical diversification and further enhances its level of risk

related with these narrow markets. Thus, Woolworths sells its products and services to all range

of demographic base and their marketing activities tend to target all ages of people (Juan Ding et

al. 2014). However this strategy is distinguished as less productive as reiterating similar

marketing strategies to diverse customer base is referred as less convincing in comparison to

single individual (Pulker, Scott and Pollard 2018). Thus, Grimmer (2018) note that in such

scenarios, process of mass customization of products along with marketing activities is required

for Woolworths’ to enhance customers’ relationship promotion strategies.

Woolworths’ Adaptation of Business Model

All managers in globalized market scenario has been making operating decisions

whereby decisions which stimulate strategies and planning which interpret strategy into action.

Digitization has been dramatically transforming the characteristic, locus and rapidness of these

decisions and technologies, methods which facilitate effective as well as productive operating

performances. Bock, Iansiti and Lakhani (2017) noted that broad employment of digital

technology necessitates rethinking of both businesses as well as operating models in which a

business model aims to define the course executed by the organization of the way it creates as

well as captures value. Studies revealed that strategies which took Woolworths to adapt to the

growing B2B grocery buying segment (Bock, Iansiti and Lakhani 2017). Recently, Woolworths

has evolved its digital competencies in order to attain the increasing market developments in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7OPERATIONS MANAGEMENT

business purchasing groceries. Furthermore, it has been stated that Woolworths digital expansion

will be purposed to give its consumer base improved level of choices while providing an

enhanced level of B2B convenience.

Woolworths has been facing significant challenge as its brand perception has typically

relied on B2C comprising broad target market dimension and profile. Furthermore, Woolworths

brand had been more challenging customer demands and expectations along with strong

competitors (Bock, Iansiti and Lakhani 2017). The company in order to adapt B2C space must

initiate in thriving new online service offerings and endorsing Woolworths Online-e-commerce

cite as a place whereby businesses can acquire wide ranging grocery needs and in one-stop-shop

and further delivered to them in order to consume time and reduce expenditure costs (Cameron

2015). The new and advanced digital platform will further offer tailored business support,

discounts, offers along with interest-free credit accounts. It has been noted that over 40,000

businesses have registered in the company’s digital website and Woolworths’ online digital

forum has witnessed double-digit revenues and incomes in prospective years. In addition to this,

with regards to product improvement and innovation (Bock, Iansiti and Lakhani 2017),

Woolworths will be setting up new business division that is Woolworths FoodCo which will

comprise the accountability for launching new product segments and enhancing sourcing

business partner associations. Thus digital transformation has been the core pillar in

accomplishing buyers along with an increasing factor of Woolworths’ revenue and incomes.

business purchasing groceries. Furthermore, it has been stated that Woolworths digital expansion

will be purposed to give its consumer base improved level of choices while providing an

enhanced level of B2B convenience.

Woolworths has been facing significant challenge as its brand perception has typically

relied on B2C comprising broad target market dimension and profile. Furthermore, Woolworths

brand had been more challenging customer demands and expectations along with strong

competitors (Bock, Iansiti and Lakhani 2017). The company in order to adapt B2C space must

initiate in thriving new online service offerings and endorsing Woolworths Online-e-commerce

cite as a place whereby businesses can acquire wide ranging grocery needs and in one-stop-shop

and further delivered to them in order to consume time and reduce expenditure costs (Cameron

2015). The new and advanced digital platform will further offer tailored business support,

discounts, offers along with interest-free credit accounts. It has been noted that over 40,000

businesses have registered in the company’s digital website and Woolworths’ online digital

forum has witnessed double-digit revenues and incomes in prospective years. In addition to this,

with regards to product improvement and innovation (Bock, Iansiti and Lakhani 2017),

Woolworths will be setting up new business division that is Woolworths FoodCo which will

comprise the accountability for launching new product segments and enhancing sourcing

business partner associations. Thus digital transformation has been the core pillar in

accomplishing buyers along with an increasing factor of Woolworths’ revenue and incomes.

8OPERATIONS MANAGEMENT

References

Bayne, L., Schepis, D. and Purchase, S., 2017. A framework for understanding strategic network

performance: Exploring efficiency and effectiveness at the network level. Industrial Marketing

Management, 67, pp.134-147.

Bock, R., Iansiti, M. and Lakhani, K.R., 2017. What the companies on the right side of the

digital business divide have in common. Harvard Business Review”, January 31st.

Bock, R., Iansiti, M. and Lakhani, K. 2017. What the Companies on the Right Side of the Digital

Business Divide Have in Common. Available from https://hbr.org/2017/01/what-the-companies-

on-the-right-side-of-the-digital-business-divide-have-in-common Accessed on 1st October 2018.

Cameron, N. 2015. Woolworths details 3-year strategy to become customer centric. Available

from https://www.cmo.com.au/article/574302/woolworths-details-3-year-strategy-become-

customer-centric/ Accessed on 1st October 2018.

Ghaderi, H., Cahoon, S. and Nguyen, H.O., 2015. An investigation into the non-bulk rail freight

transport in Australia. The Asian Journal of Shipping and Logistics, 31(1), pp.59-83.

Grimmer, L., 2018. The diminished stakeholder: Examining the relationship between suppliers

and supermarkets in the Australian grocery industry. Journal of Consumer Behaviour, 17(1),

pp.e13-e20.

Jie, F., Parton, K.A. and Cox, R.J., 2013. Linking supply chain practices to competitive

advantage: An example from Australian agribusiness. British Food Journal, 115(7), pp.1003-

1024.

Juan Ding, M., Jie, F., A. Parton, K. and J. Matanda, M., 2014. Relationships between quality of

information sharing and supply chain food quality in the Australian beef processing industry. The

international journal of logistics management, 25(1), pp.85-108.

References

Bayne, L., Schepis, D. and Purchase, S., 2017. A framework for understanding strategic network

performance: Exploring efficiency and effectiveness at the network level. Industrial Marketing

Management, 67, pp.134-147.

Bock, R., Iansiti, M. and Lakhani, K.R., 2017. What the companies on the right side of the

digital business divide have in common. Harvard Business Review”, January 31st.

Bock, R., Iansiti, M. and Lakhani, K. 2017. What the Companies on the Right Side of the Digital

Business Divide Have in Common. Available from https://hbr.org/2017/01/what-the-companies-

on-the-right-side-of-the-digital-business-divide-have-in-common Accessed on 1st October 2018.

Cameron, N. 2015. Woolworths details 3-year strategy to become customer centric. Available

from https://www.cmo.com.au/article/574302/woolworths-details-3-year-strategy-become-

customer-centric/ Accessed on 1st October 2018.

Ghaderi, H., Cahoon, S. and Nguyen, H.O., 2015. An investigation into the non-bulk rail freight

transport in Australia. The Asian Journal of Shipping and Logistics, 31(1), pp.59-83.

Grimmer, L., 2018. The diminished stakeholder: Examining the relationship between suppliers

and supermarkets in the Australian grocery industry. Journal of Consumer Behaviour, 17(1),

pp.e13-e20.

Jie, F., Parton, K.A. and Cox, R.J., 2013. Linking supply chain practices to competitive

advantage: An example from Australian agribusiness. British Food Journal, 115(7), pp.1003-

1024.

Juan Ding, M., Jie, F., A. Parton, K. and J. Matanda, M., 2014. Relationships between quality of

information sharing and supply chain food quality in the Australian beef processing industry. The

international journal of logistics management, 25(1), pp.85-108.

9OPERATIONS MANAGEMENT

Mialon, M., Swinburn, B., Allender, S. and Sacks, G., 2016. Systematic examination of publicly-

available information reveals the diverse and extensive corporate political activity of the food

industry in Australia. BMC public health, 16(1), p.283.

Morgan, R., 2014. Market share narrows between Coles and Woolworths, while ALDI makes

important gains. Retrieved December, 30, p.2015.

Pulker, C.E., Scott, J.A. and Pollard, C.M., 2018. Ultra-processed family foods in Australia:

nutrition claims, health claims and marketing techniques. Public health nutrition, 21(1), pp.38-

48.

Sullivan, R. and Gouldson, A., 2017. The governance of corporate responses to climate change:

An international comparison. Business Strategy and the Environment, 26(4), pp.413-425.

Woolworths.com.au 2018. [online] Woolworths.com.au. Available at:

https://www.woolworths.com.au/ [Accessed 1 Oct. 2018].

Mialon, M., Swinburn, B., Allender, S. and Sacks, G., 2016. Systematic examination of publicly-

available information reveals the diverse and extensive corporate political activity of the food

industry in Australia. BMC public health, 16(1), p.283.

Morgan, R., 2014. Market share narrows between Coles and Woolworths, while ALDI makes

important gains. Retrieved December, 30, p.2015.

Pulker, C.E., Scott, J.A. and Pollard, C.M., 2018. Ultra-processed family foods in Australia:

nutrition claims, health claims and marketing techniques. Public health nutrition, 21(1), pp.38-

48.

Sullivan, R. and Gouldson, A., 2017. The governance of corporate responses to climate change:

An international comparison. Business Strategy and the Environment, 26(4), pp.413-425.

Woolworths.com.au 2018. [online] Woolworths.com.au. Available at:

https://www.woolworths.com.au/ [Accessed 1 Oct. 2018].

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.