Management Accounting Report

VerifiedAdded on 2020/02/14

|15

|4358

|94

Report

AI Summary

The report on management accounting for Imda Tech Limited outlines various functions of management accounting, types of management accounting systems, income statements for marginal and absorption costing, types of budgets, and pricing strategies. It emphasizes the importance of budgeting and the balanced scorecard in enhancing financial governance and addressing financial challenges faced by the company.

MANAGEMEN

T

ACCOUNTING

T

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A- Report defining functions of management accounting....................................................1

B- Define types of Management Accounting Systems...........................................................3

TASK 2............................................................................................................................................5

A- Income statement for marginal costing and absorption costing........................................5

TASK 3............................................................................................................................................7

A- Types of budgets with the advantages and disadvantages...............................................7

B- Process of Budget preparation...........................................................................................9

C- Pricing Strategies.............................................................................................................10

TASK 4..........................................................................................................................................11

A. I. Balanced Score Card and explain its implementation..................................................11

A.ll. Role of Balanced scorecard in addressing the financial problems and enhancing the

financial governance.............................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A- Report defining functions of management accounting....................................................1

B- Define types of Management Accounting Systems...........................................................3

TASK 2............................................................................................................................................5

A- Income statement for marginal costing and absorption costing........................................5

TASK 3............................................................................................................................................7

A- Types of budgets with the advantages and disadvantages...............................................7

B- Process of Budget preparation...........................................................................................9

C- Pricing Strategies.............................................................................................................10

TASK 4..........................................................................................................................................11

A. I. Balanced Score Card and explain its implementation..................................................11

A.ll. Role of Balanced scorecard in addressing the financial problems and enhancing the

financial governance.............................................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

Illustration Index

Illustration 1: The budget process....................................................................................................8

Illustration 2: Balanced Score Card...............................................................................................10

Index of Tables

Table 1: Income statement of absorption costing............................................................................5

Table 2: Income statement of Marginal costing..............................................................................5

Illustration 1: The budget process....................................................................................................8

Illustration 2: Balanced Score Card...............................................................................................10

Index of Tables

Table 1: Income statement of absorption costing............................................................................5

Table 2: Income statement of Marginal costing..............................................................................5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

The management accounting aims at providing information to the managers to enable

them to take meaningful decisions for the company. The present report focuses on various

systems that applies to Imda Tech Limited which is engaged in the production of the Special

charger for the mobile telephone and other carry on gadgets and supplying the same to retail

outlets in UK and also uses various other systems which are cost accounting systems, inventory

management systems etc. however this also focus on the various types of budgets and its

preparation and also the balanced Score Card approach to address the problems in the

organization.

TASK 1

A- Report defining functions of management accounting.

Report

The management accounting is the founding tool for any business. It is aimed at gathering the

information which will ultimately be helpful for the decision making. Imda tech being engaged in

producing special charger for the telephone and also carry-on gadgets for many retail outlets in UK and this

aims at creating strategies making policies for running the business effectively.

It is very different from Financial Accounting as this focuses on the preparation of financial

statements in order to provide the material information which will be required for the external uses to make

their decisions, the transactions are of monetary nature and for this the reporting done to the internal as well

as to the external user so as to enable them to take decisions... (Cooper, 2016). In management accounting

as the reporting is done only to the internal management

has many functions to perform which are as follows: Forecasting- For determining the long and short duration goals for decision making, intern aids in

providing with information it which will ultimately be required for decision making. Coordination- The main aim for any organization is to earn profits as well as increasing the

efficiency. To coordinate among various departments, best measures are to use the budgets, costing

etc.

Communication-Final results which are generated needs to be communicated to the management a

with the help of reports and thus enabling to take appropriate decisions

As this is a great tool for decision making as there are many decisions in the organization to be

1

The management accounting aims at providing information to the managers to enable

them to take meaningful decisions for the company. The present report focuses on various

systems that applies to Imda Tech Limited which is engaged in the production of the Special

charger for the mobile telephone and other carry on gadgets and supplying the same to retail

outlets in UK and also uses various other systems which are cost accounting systems, inventory

management systems etc. however this also focus on the various types of budgets and its

preparation and also the balanced Score Card approach to address the problems in the

organization.

TASK 1

A- Report defining functions of management accounting.

Report

The management accounting is the founding tool for any business. It is aimed at gathering the

information which will ultimately be helpful for the decision making. Imda tech being engaged in

producing special charger for the telephone and also carry-on gadgets for many retail outlets in UK and this

aims at creating strategies making policies for running the business effectively.

It is very different from Financial Accounting as this focuses on the preparation of financial

statements in order to provide the material information which will be required for the external uses to make

their decisions, the transactions are of monetary nature and for this the reporting done to the internal as well

as to the external user so as to enable them to take decisions... (Cooper, 2016). In management accounting

as the reporting is done only to the internal management

has many functions to perform which are as follows: Forecasting- For determining the long and short duration goals for decision making, intern aids in

providing with information it which will ultimately be required for decision making. Coordination- The main aim for any organization is to earn profits as well as increasing the

efficiency. To coordinate among various departments, best measures are to use the budgets, costing

etc.

Communication-Final results which are generated needs to be communicated to the management a

with the help of reports and thus enabling to take appropriate decisions

As this is a great tool for decision making as there are many decisions in the organization to be

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

taken from minute to strategic decisions (Quattrone, 2016). As sales affects the profits, so the concentration

is shifted towards the same. For getting the best results, marketing efforts are to be enhanced .. The task

begins with identifying the products to sell and later on focusing on the customers to whom it is sold.

Moreover, it helps in targeting the efforts accordingly it.

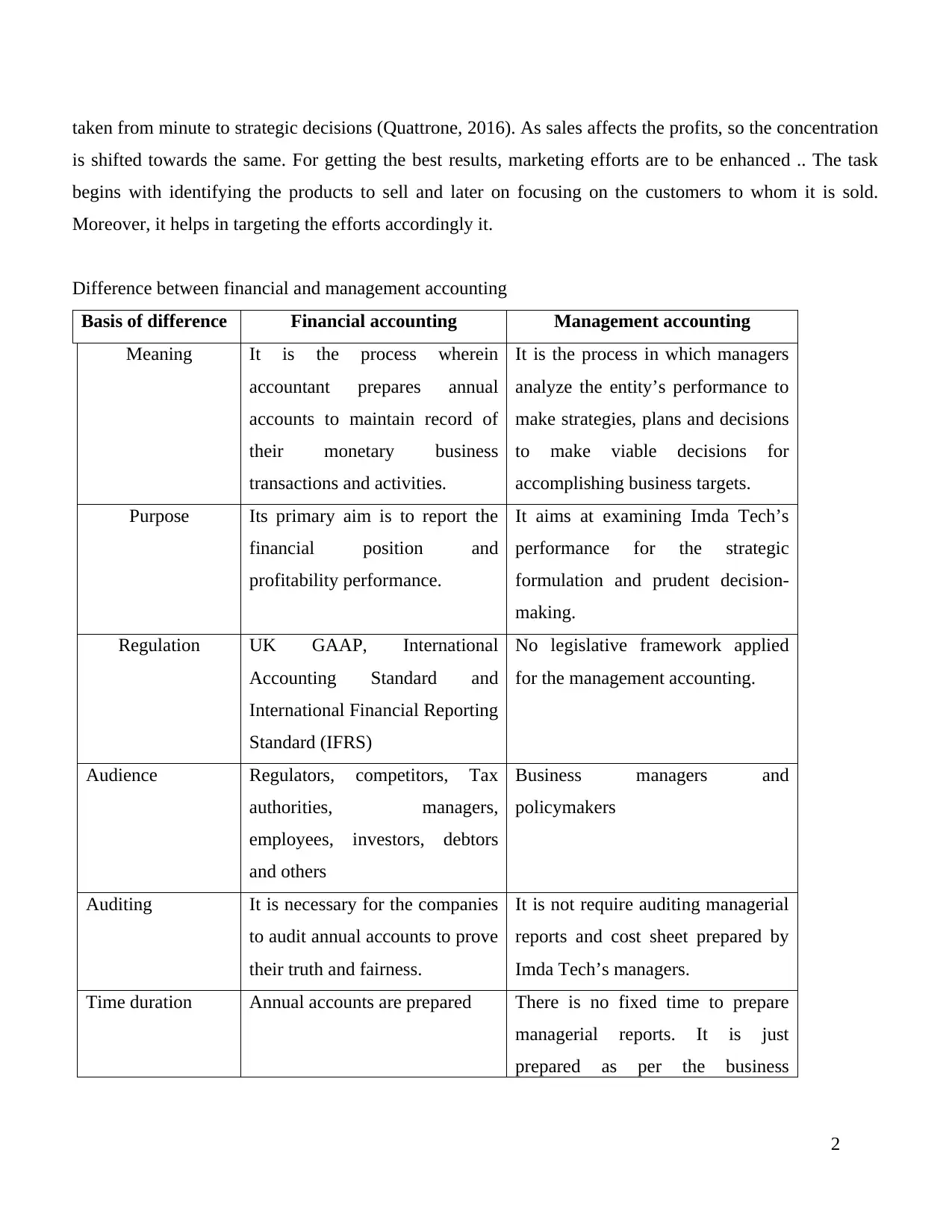

Difference between financial and management accounting

Basis of difference Financial accounting Management accounting

Meaning It is the process wherein

accountant prepares annual

accounts to maintain record of

their monetary business

transactions and activities.

It is the process in which managers

analyze the entity’s performance to

make strategies, plans and decisions

to make viable decisions for

accomplishing business targets.

Purpose Its primary aim is to report the

financial position and

profitability performance.

It aims at examining Imda Tech’s

performance for the strategic

formulation and prudent decision-

making.

Regulation UK GAAP, International

Accounting Standard and

International Financial Reporting

Standard (IFRS)

No legislative framework applied

for the management accounting.

Audience Regulators, competitors, Tax

authorities, managers,

employees, investors, debtors

and others

Business managers and

policymakers

Auditing It is necessary for the companies

to audit annual accounts to prove

their truth and fairness.

It is not require auditing managerial

reports and cost sheet prepared by

Imda Tech’s managers.

Time duration Annual accounts are prepared There is no fixed time to prepare

managerial reports. It is just

prepared as per the business

2

is shifted towards the same. For getting the best results, marketing efforts are to be enhanced .. The task

begins with identifying the products to sell and later on focusing on the customers to whom it is sold.

Moreover, it helps in targeting the efforts accordingly it.

Difference between financial and management accounting

Basis of difference Financial accounting Management accounting

Meaning It is the process wherein

accountant prepares annual

accounts to maintain record of

their monetary business

transactions and activities.

It is the process in which managers

analyze the entity’s performance to

make strategies, plans and decisions

to make viable decisions for

accomplishing business targets.

Purpose Its primary aim is to report the

financial position and

profitability performance.

It aims at examining Imda Tech’s

performance for the strategic

formulation and prudent decision-

making.

Regulation UK GAAP, International

Accounting Standard and

International Financial Reporting

Standard (IFRS)

No legislative framework applied

for the management accounting.

Audience Regulators, competitors, Tax

authorities, managers,

employees, investors, debtors

and others

Business managers and

policymakers

Auditing It is necessary for the companies

to audit annual accounts to prove

their truth and fairness.

It is not require auditing managerial

reports and cost sheet prepared by

Imda Tech’s managers.

Time duration Annual accounts are prepared There is no fixed time to prepare

managerial reports. It is just

prepared as per the business

2

requirement.

Management accountant Trainee

B- Define types of Management Accounting Systems.

Report

Imda Tech Limited. This accounting is very important for the organization. It helps in gathering

the relevant information. This is done to make the work speedy and helpful in decision making.

There are various systems for management accounting which helps in making the decisions

faster and accurate.

These can be classifying into the following-

Cost Accounting Systems- this aims at identifying and estimating the costs for the

product which will ultimately results in the higher profitability of the company

including. Various costs such material costs, labor and overhead costs

(Maynard, 2017). This involves various types of costing such as Normal costing,

this involves the use of the actual figures or prices for determining the cost of the

product. The components of normal costs are Actual cost of materials, actual cost

of the labor and the standards overhead rate. These are calculated to design the

cost of the product.

Standard costing, is a tool for preparation of the budgets which is used to check

the deviations from the actual cost (Wang, 2016). For estimating anything a

estimate or standard is set looking at the previous operations and then the actual

expenses are incurred. The main aim of this is to compare the standards cost with

the actual cost to check the deviations and correcting the same. Actual Costing,

here the accounting is done based on the actual cost of production.

Inventory Management Systems- Every organization has the unsold stock which

is waiting to be sold thus to manage the same is important task to perform. To

avoid the wastage of inventory by physically verifying the stock to control the

inventory by regular updating. Another method can be managing the orders and c

by maintaining cordial relations with the suppliers etc.

3

Management accountant Trainee

B- Define types of Management Accounting Systems.

Report

Imda Tech Limited. This accounting is very important for the organization. It helps in gathering

the relevant information. This is done to make the work speedy and helpful in decision making.

There are various systems for management accounting which helps in making the decisions

faster and accurate.

These can be classifying into the following-

Cost Accounting Systems- this aims at identifying and estimating the costs for the

product which will ultimately results in the higher profitability of the company

including. Various costs such material costs, labor and overhead costs

(Maynard, 2017). This involves various types of costing such as Normal costing,

this involves the use of the actual figures or prices for determining the cost of the

product. The components of normal costs are Actual cost of materials, actual cost

of the labor and the standards overhead rate. These are calculated to design the

cost of the product.

Standard costing, is a tool for preparation of the budgets which is used to check

the deviations from the actual cost (Wang, 2016). For estimating anything a

estimate or standard is set looking at the previous operations and then the actual

expenses are incurred. The main aim of this is to compare the standards cost with

the actual cost to check the deviations and correcting the same. Actual Costing,

here the accounting is done based on the actual cost of production.

Inventory Management Systems- Every organization has the unsold stock which

is waiting to be sold thus to manage the same is important task to perform. To

avoid the wastage of inventory by physically verifying the stock to control the

inventory by regular updating. Another method can be managing the orders and c

by maintaining cordial relations with the suppliers etc.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job Costing Systems- When the customers have specified needs for different

products. For that, it needs an entire system is establish which the cost is

determined separately for each system. As the production line for each product is

different hence costs are determined for each products separately.

Price optimizing systems – In an organization there are various costs for different

products and observing the behaviors of the people which change in the prices.

This change in the prices creates the change in demand as well. So, this system

helps in identifying the different prices for different segments of consumers and

hence achieving profits.

Imda Tech uses the above systems in order to generate profits. It used the cost accounting

systems to analyze the various costs on the charger. It used job costing systems as per the needs

of the customers for their mobile phones and developing as per the different needs of the

customers. It uses the inventory management systems to control and manage the inventory to

avoid the wastage. Imda Tech has developed different prices for its different types of retailers.

As for the different accounting systems the costs are recorded in an entirely different way

hence integration is required between the reporting and the accounts. Based on the chosen system

the reporting systems is followed accordingly. Not all the systems can be followed by the single

organization so as per the needs the reporting method changes.

Management accountant Trainee

TASK 2

A- Income statement for marginal costing and absorption costing.

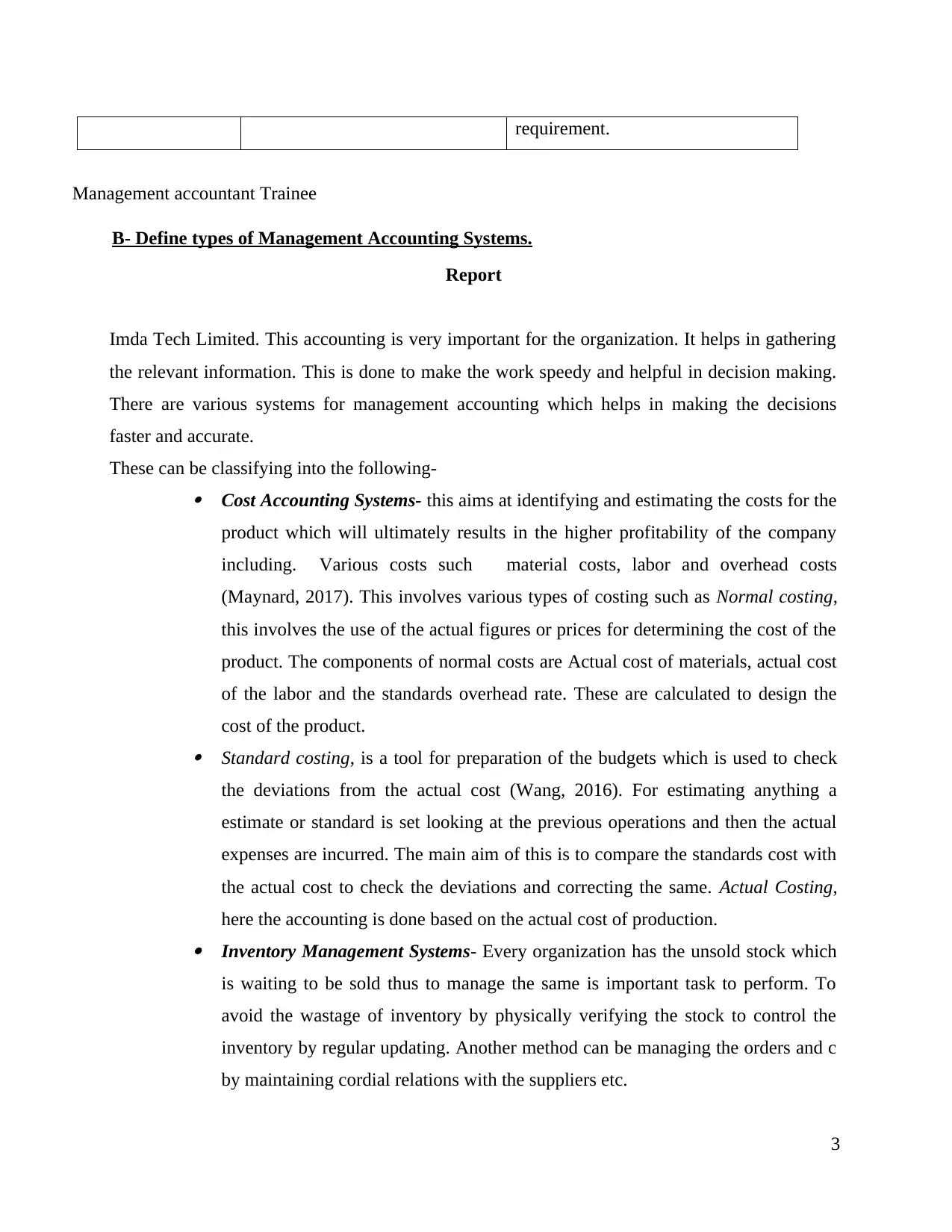

Table 1: Income statement of absorption costing

Particulars Cost Total (£)

Sales (sales price*number of units) 35*1500 52500

Less: variable cost

Direct Material 8 2000 16000

Direct Labor 5 2000 10000

Variable Production Overhead 2 2000 4000

Selling, distribution and admin expenses 7875

4

products. For that, it needs an entire system is establish which the cost is

determined separately for each system. As the production line for each product is

different hence costs are determined for each products separately.

Price optimizing systems – In an organization there are various costs for different

products and observing the behaviors of the people which change in the prices.

This change in the prices creates the change in demand as well. So, this system

helps in identifying the different prices for different segments of consumers and

hence achieving profits.

Imda Tech uses the above systems in order to generate profits. It used the cost accounting

systems to analyze the various costs on the charger. It used job costing systems as per the needs

of the customers for their mobile phones and developing as per the different needs of the

customers. It uses the inventory management systems to control and manage the inventory to

avoid the wastage. Imda Tech has developed different prices for its different types of retailers.

As for the different accounting systems the costs are recorded in an entirely different way

hence integration is required between the reporting and the accounts. Based on the chosen system

the reporting systems is followed accordingly. Not all the systems can be followed by the single

organization so as per the needs the reporting method changes.

Management accountant Trainee

TASK 2

A- Income statement for marginal costing and absorption costing.

Table 1: Income statement of absorption costing

Particulars Cost Total (£)

Sales (sales price*number of units) 35*1500 52500

Less: variable cost

Direct Material 8 2000 16000

Direct Labor 5 2000 10000

Variable Production Overhead 2 2000 4000

Selling, distribution and admin expenses 7875

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total Variable cost 37875

Contribution 14625

Less: Fixed cost

Production overhead 5 2000 10000

Fixed selling expenses 10000

Total fixed cost 20000

Net Profit (Contribution-Fixed cost) -5375

Interpretation: While calculating the profit as per the absorption costing, all the fixed as well as

variable overheads are considered in the calculation of the profit. In this case the resultant figure

came out to be a loss of GBP 5375. In this all the cost is the product cost Ans the same is

allocated to the product.

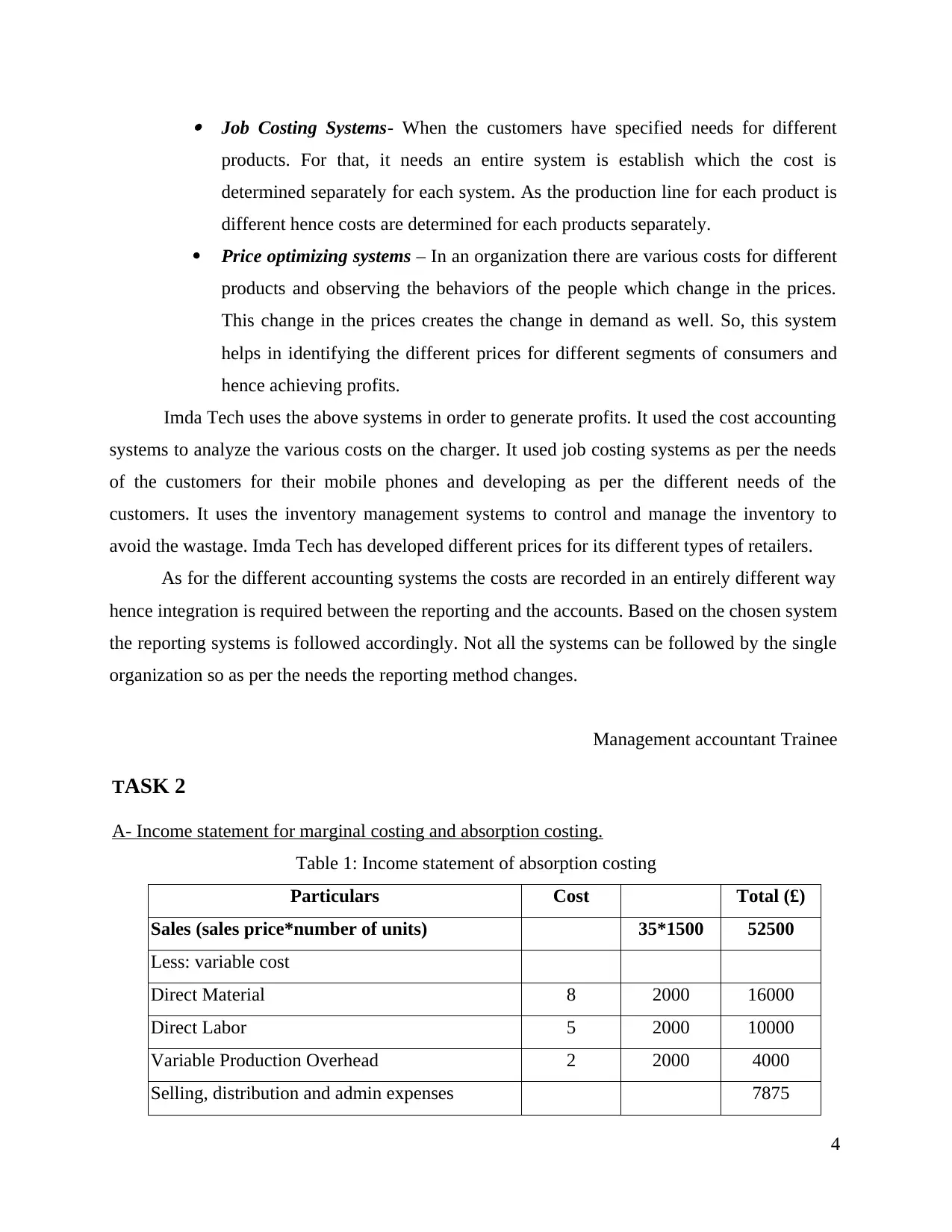

Table 2: Income statement of Marginal costing

Particulars Cost Total (£)

Sales (sales price*number of units) 35*1500 52500

Less: variable cost

Direct Material cost 8 2000 16000

Direct Labor cost 5 2000 10000

Variable Production Overhead 2 2000 4000

Selling, distribution and admin expenses 7875

Total Variable cost 37875

Contribution 14625

Less: Fixed cost

Production overhead 0

Administration Cost 10000

Total fixed cost 10000

Net Profit (Contribution-Fixed cost) 4625

5

Contribution 14625

Less: Fixed cost

Production overhead 5 2000 10000

Fixed selling expenses 10000

Total fixed cost 20000

Net Profit (Contribution-Fixed cost) -5375

Interpretation: While calculating the profit as per the absorption costing, all the fixed as well as

variable overheads are considered in the calculation of the profit. In this case the resultant figure

came out to be a loss of GBP 5375. In this all the cost is the product cost Ans the same is

allocated to the product.

Table 2: Income statement of Marginal costing

Particulars Cost Total (£)

Sales (sales price*number of units) 35*1500 52500

Less: variable cost

Direct Material cost 8 2000 16000

Direct Labor cost 5 2000 10000

Variable Production Overhead 2 2000 4000

Selling, distribution and admin expenses 7875

Total Variable cost 37875

Contribution 14625

Less: Fixed cost

Production overhead 0

Administration Cost 10000

Total fixed cost 10000

Net Profit (Contribution-Fixed cost) 4625

5

Interpretation: In the marginal costing, the profit calculated is based on just the variable

overheads and the fixed overheads are not considered. Hence, there is a profit of GBP 4625 as in

this only the variable overhead is the product cost and the fixed overheads are the period cost

which is not included in the calculation.

TASK 3

A- Types of budgets with the advantages and disadvantages.

Report

Imda Tech Limited

For the Imda Tech Limited setting budgets are very important for the organization.

There is no particular type of budget which suits all the organizations. Hence, there are different

types of budgets as per the needs of different people classified as-

1. Master Budget- It is the summation of the entire individual budget to represent the

entire picture of the organization. Whenever one has to gauge the performance then it

can directly refer to the master budget and one does not have to refer to the individual

budgets (Maynard2017).

Advantages: -

It helps in predicting the future. It summarizes the content of all the other budgets It provides a clear picture of the possible results of future business activities and

functions. It is useful for the Imda tech to prepare solid plans for the future years to achieve their

aims and objectives.

Disadvantages: -

It becomes difficult to interpret the budget because many categories of expenditures and

incomes are included in it.

It comprises the results of all the future business activities, thus, it lacks simplicity.

2. Cash Budgets- It involves all the cash inflows and outflows from the organization. And thus,

helps in identifying the overall usage of cash within the organization and the available cash as

well.

Advantages: -

6

overheads and the fixed overheads are not considered. Hence, there is a profit of GBP 4625 as in

this only the variable overhead is the product cost and the fixed overheads are the period cost

which is not included in the calculation.

TASK 3

A- Types of budgets with the advantages and disadvantages.

Report

Imda Tech Limited

For the Imda Tech Limited setting budgets are very important for the organization.

There is no particular type of budget which suits all the organizations. Hence, there are different

types of budgets as per the needs of different people classified as-

1. Master Budget- It is the summation of the entire individual budget to represent the

entire picture of the organization. Whenever one has to gauge the performance then it

can directly refer to the master budget and one does not have to refer to the individual

budgets (Maynard2017).

Advantages: -

It helps in predicting the future. It summarizes the content of all the other budgets It provides a clear picture of the possible results of future business activities and

functions. It is useful for the Imda tech to prepare solid plans for the future years to achieve their

aims and objectives.

Disadvantages: -

It becomes difficult to interpret the budget because many categories of expenditures and

incomes are included in it.

It comprises the results of all the future business activities, thus, it lacks simplicity.

2. Cash Budgets- It involves all the cash inflows and outflows from the organization. And thus,

helps in identifying the overall usage of cash within the organization and the available cash as

well.

Advantages: -

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Helpful in the cost minimization which lead to the maximization of the profits.

It helps to determine the cash availability for the future because cash incomes are being

subtracted with the sum of expenditures to assess that whether entity will have enough

resources or not to meet their business need.

It enables management to consider the future and control the use of cash through better

coordination.

Disadvantages: -

It does not provide helps to determine net profitability for the upcoming period because

cash surplus or deficit is different from the profit.

Reliance on estimates is also a disadvantage of it because in the uncertain environment,

projects may really vary from the actual outcomes and affects the results.

Production budget:

As name implies, the budget provides an estimation regarding the probable manufacturing

activities of the business for future period.

Benefits:

It helps to effectively utilize the business assets such as plant and machinery and labor

hours for production of required quantity of goods at minimal cost.

It assists Imda Tech’s managers to minimize their production expenditures through

regular supervision.

Disadvantages:

Being a manufacturing organization, Imda Tech’s managerial team have to conduct a

thoroughly and deeply market research for assessing the future production requirement

to address consumer need which leads to incur high cost of marketing.

In case of sudden rise in demand, companies may face issues to meet the exceeded

market demand as it will be difficult to enhance the production volume immediately.

7

It helps to determine the cash availability for the future because cash incomes are being

subtracted with the sum of expenditures to assess that whether entity will have enough

resources or not to meet their business need.

It enables management to consider the future and control the use of cash through better

coordination.

Disadvantages: -

It does not provide helps to determine net profitability for the upcoming period because

cash surplus or deficit is different from the profit.

Reliance on estimates is also a disadvantage of it because in the uncertain environment,

projects may really vary from the actual outcomes and affects the results.

Production budget:

As name implies, the budget provides an estimation regarding the probable manufacturing

activities of the business for future period.

Benefits:

It helps to effectively utilize the business assets such as plant and machinery and labor

hours for production of required quantity of goods at minimal cost.

It assists Imda Tech’s managers to minimize their production expenditures through

regular supervision.

Disadvantages:

Being a manufacturing organization, Imda Tech’s managerial team have to conduct a

thoroughly and deeply market research for assessing the future production requirement

to address consumer need which leads to incur high cost of marketing.

In case of sudden rise in demand, companies may face issues to meet the exceeded

market demand as it will be difficult to enhance the production volume immediately.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

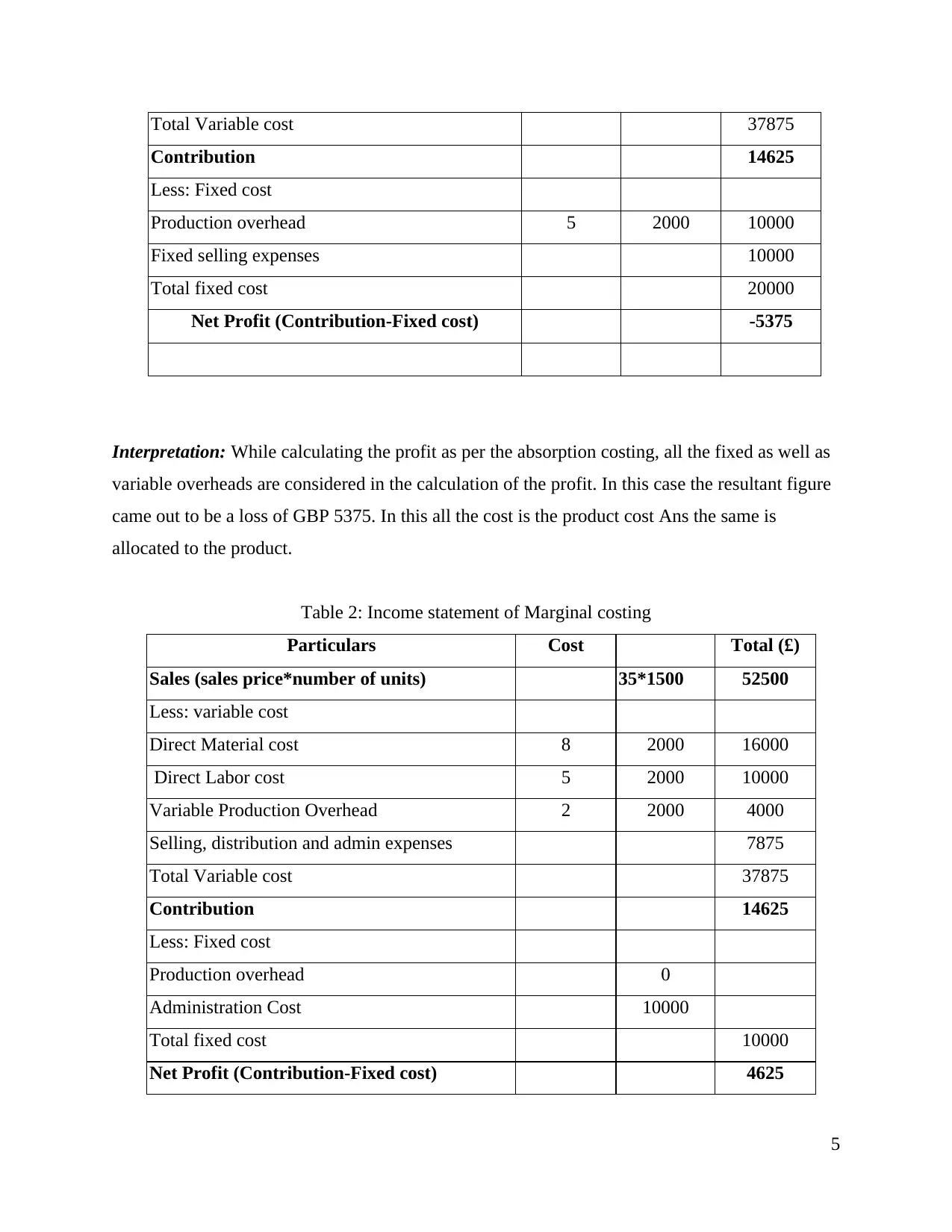

B- Process of Budget preparation.

Illustration 1: The budget process

Source: Saylord.com

The process of budget preparation completes in five stages.

1. For the preparation of the budgets the first step goes with the collection of data which is

relevant. For the budgets to be appropriate the data which is gathered is appropriate

(Cooper, 2016). If the data is not relevant and I not appropriate and just based on the

estimates it will not generate the desired results and the overall calculation may go

wrong. He past performance of the organization has to be seen and on that basis the

estimation for the budgets can be seen. This involves the proper planning done at the part

of the management and then only then the process can be initiated. Here the draft of type

budget is prepared.

2. After the preparation of the draft budget the same is taken to the management for the

approval. When the changes mentioned are been made in the draft budget the same

becomes the final budget and this is used for the measuring the performance of the

organization.

8

Illustration 1: The budget process

Source: Saylord.com

The process of budget preparation completes in five stages.

1. For the preparation of the budgets the first step goes with the collection of data which is

relevant. For the budgets to be appropriate the data which is gathered is appropriate

(Cooper, 2016). If the data is not relevant and I not appropriate and just based on the

estimates it will not generate the desired results and the overall calculation may go

wrong. He past performance of the organization has to be seen and on that basis the

estimation for the budgets can be seen. This involves the proper planning done at the part

of the management and then only then the process can be initiated. Here the draft of type

budget is prepared.

2. After the preparation of the draft budget the same is taken to the management for the

approval. When the changes mentioned are been made in the draft budget the same

becomes the final budget and this is used for the measuring the performance of the

organization.

8

3. After the budget is put into action and the tasks has been performed for the period for

which the budget is prepared and then the performance is measured and the actual results

is compared with the standard budget and then the evaluation is done and if there are

deviations then appropriate measures are taken to control the movement.

4. After this the budget is analyzed, if there are deviations then the budget is adjusted as per

the needs and requirements(Quattrone, 2016). This process ends with the revision of the

budget if it does not meet the requirements as specified before.

C- Pricing Strategies.

There are various pricing strategies which the company can use are as follows-1. Price Skimming- When a new product of a well-established brand is introduced this is

done to generate high profits as keeping the prices high. It is useful to target the

customers who apply for the product and not waiting for reducing the price to attract the

customers. While recovering the costs at the initial stages it and one does not have to wait

for the establishment of the product (Gong, 2016). It is opposite to the penetration pricing

as in that initially the price is kept lower to attract as many customers as possible.2. Cost plus pricing- Setting up the price keeping the cost incurred as well as including the

profit margin in that. For example if the costs for the company are GBP 200 and the

profit margin is kept as 15% then accordingly the cost would be GBP 230 (GBP 200 +

15% profit). As here the entire concept is very different here the aim is not setting the

high price or low price. Here correct price is very important which aims at earning the

profit margin

3. Bundle Pricing- In this type of pricing strategy as the name suggests the sales id not done

of the single product, here the products are sold according to the bundle means selling a

combination of the products for a lower price. If the products are bought individually

then the prices for the product will be high. Imda Tech limited incorporates this strategy

as it can sell the charger with set at a lower price to attract more and more customers. The

effect of this is that more customers will be satisfied as they will get many products at a

relatively less cost as compare to the individual purchase.

9

which the budget is prepared and then the performance is measured and the actual results

is compared with the standard budget and then the evaluation is done and if there are

deviations then appropriate measures are taken to control the movement.

4. After this the budget is analyzed, if there are deviations then the budget is adjusted as per

the needs and requirements(Quattrone, 2016). This process ends with the revision of the

budget if it does not meet the requirements as specified before.

C- Pricing Strategies.

There are various pricing strategies which the company can use are as follows-1. Price Skimming- When a new product of a well-established brand is introduced this is

done to generate high profits as keeping the prices high. It is useful to target the

customers who apply for the product and not waiting for reducing the price to attract the

customers. While recovering the costs at the initial stages it and one does not have to wait

for the establishment of the product (Gong, 2016). It is opposite to the penetration pricing

as in that initially the price is kept lower to attract as many customers as possible.2. Cost plus pricing- Setting up the price keeping the cost incurred as well as including the

profit margin in that. For example if the costs for the company are GBP 200 and the

profit margin is kept as 15% then accordingly the cost would be GBP 230 (GBP 200 +

15% profit). As here the entire concept is very different here the aim is not setting the

high price or low price. Here correct price is very important which aims at earning the

profit margin

3. Bundle Pricing- In this type of pricing strategy as the name suggests the sales id not done

of the single product, here the products are sold according to the bundle means selling a

combination of the products for a lower price. If the products are bought individually

then the prices for the product will be high. Imda Tech limited incorporates this strategy

as it can sell the charger with set at a lower price to attract more and more customers. The

effect of this is that more customers will be satisfied as they will get many products at a

relatively less cost as compare to the individual purchase.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.