Management Accounting Report: Costing, Planning, and Financial Issues

VerifiedAdded on 2020/11/12

|20

|6438

|436

Report

AI Summary

This report delves into the realm of management accounting, focusing on its application within the context of AZIO, a small business specializing in PC peripherals. The report commences with an introduction to management accounting, elucidating its role in aiding managerial decision-making and operational efficiency. It then explores various types of management accounting systems, such as cost accounting and inventory management, highlighting their importance in maintaining financial stability and optimizing business operations. The report further examines different managerial accounting reporting methods, including budget reports and job costing reports. The report then analyzes cost accounting techniques, specifically marginal and absorption costing, and their impact on financial reporting. Furthermore, the report discusses the advantages and disadvantages of different planning tools, along with an evaluation of financial issues and the adaptation of management accounting systems to address financial problems. Overall, the report provides a comprehensive overview of management accounting principles and their practical application in a business setting, offering insights into cost analysis, financial reporting, and strategic planning.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1.Management accounting and essentials requirements of various type of management

accounting systems.................................................................................................................1

P2. Various methods used for management accounting reporting.........................................3

M1. Merits of using management accounting system............................................................5

D1 Integration of management accounting system and management accounting report.......5

TASK 2............................................................................................................................................5

P3. Calculate cost using marginal and absorption costing.....................................................5

M2. Use of management accounting techniques....................................................................8

D2. Financial reports that apply for interpret business activities...........................................8

TASK 3............................................................................................................................................8

P4 Advantages and disadvantage of various planning tools..................................................8

M3 Evaluation of planning tools..........................................................................................10

TASK 4..........................................................................................................................................11

P5. Adaption of management accounting system to respond financial problems................11

M4. Evaluation of financial issues.......................................................................................12

D3. Evaluation of planning tools for respond financial problems........................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1.Management accounting and essentials requirements of various type of management

accounting systems.................................................................................................................1

P2. Various methods used for management accounting reporting.........................................3

M1. Merits of using management accounting system............................................................5

D1 Integration of management accounting system and management accounting report.......5

TASK 2............................................................................................................................................5

P3. Calculate cost using marginal and absorption costing.....................................................5

M2. Use of management accounting techniques....................................................................8

D2. Financial reports that apply for interpret business activities...........................................8

TASK 3............................................................................................................................................8

P4 Advantages and disadvantage of various planning tools..................................................8

M3 Evaluation of planning tools..........................................................................................10

TASK 4..........................................................................................................................................11

P5. Adaption of management accounting system to respond financial problems................11

M4. Evaluation of financial issues.......................................................................................12

D3. Evaluation of planning tools for respond financial problems........................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting system refer to the process of developing the financial report

which assist manager in taking corrective decision and in achieve better control over business

activities which in turn will contribute toward the accomplishment of organisational goals and

objectives (Anessi-Pessina and et. al., 2016). One of the main benefit of managerial accounting

system is that it help a company in bring efficiency in its operations. It also provide information

related to financial condition of the company and assist in taking decision related to organising,

directing and controlling of cost by effective utilization of resource. AZIO is a small business

enterprise which is situated in California US, founded in year 2005 and is specialized in

designing and manufacturing PC keyboard, mouse and audio product. This report describes

about various types of managerial accounting system and its importance along with the various

methods of managerial accounting report system. It further explains various techniques of cost

analysis used for preparing income statement using marginal and absorption cost. In addition to

this, it also describe various planning tools which help AZIO in deciding future course of

actions.

TASK 1

P1.Management accounting and essentials requirements of various type of management

accounting systems

Management accounting refers to the process of preparing the internal financial report by

analysing business cost and operations which help manager in decision making process to

achieve organisational goal (Management Accounting, 2018). In other words it is an act of

examining the financial and costing data arranging that data into useful information for

management to assist them in efficient functioning of business activities. One of the major

benefit of management account is that it help manager in getting better control over the business

operations which contribute toward the growth and success of the company. By using the

concept of management accounting, managers of AZIO can collect and analyse the information

related to financial aspects such as financial condition of the business, variation in stock, raw

material etc. which help in performing organisational activities more effectively and in

minimum possible cost. It also help in improving the financial condition of company and bring

stability in financial system.

1

Management accounting system refer to the process of developing the financial report

which assist manager in taking corrective decision and in achieve better control over business

activities which in turn will contribute toward the accomplishment of organisational goals and

objectives (Anessi-Pessina and et. al., 2016). One of the main benefit of managerial accounting

system is that it help a company in bring efficiency in its operations. It also provide information

related to financial condition of the company and assist in taking decision related to organising,

directing and controlling of cost by effective utilization of resource. AZIO is a small business

enterprise which is situated in California US, founded in year 2005 and is specialized in

designing and manufacturing PC keyboard, mouse and audio product. This report describes

about various types of managerial accounting system and its importance along with the various

methods of managerial accounting report system. It further explains various techniques of cost

analysis used for preparing income statement using marginal and absorption cost. In addition to

this, it also describe various planning tools which help AZIO in deciding future course of

actions.

TASK 1

P1.Management accounting and essentials requirements of various type of management

accounting systems

Management accounting refers to the process of preparing the internal financial report by

analysing business cost and operations which help manager in decision making process to

achieve organisational goal (Management Accounting, 2018). In other words it is an act of

examining the financial and costing data arranging that data into useful information for

management to assist them in efficient functioning of business activities. One of the major

benefit of management account is that it help manager in getting better control over the business

operations which contribute toward the growth and success of the company. By using the

concept of management accounting, managers of AZIO can collect and analyse the information

related to financial aspects such as financial condition of the business, variation in stock, raw

material etc. which help in performing organisational activities more effectively and in

minimum possible cost. It also help in improving the financial condition of company and bring

stability in financial system.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

While performing business operations several issues may arises and management

accounting help in overcoming these problems and contributing toward success of an enterprise.

AIZO need to keep and manage a record of its financial operations in order to achieve

organisational goal most effectively. Following are the importance of management accounting

system:- Increases efficiency of business:- Management accounting helps in increasing the

efficiency of business operations. It determines targets of different departments in

advance and accomplishment of these tasks are considered as an efficiency measurement

tool (Baldenius, Nezlobin and Vaysman, 2015). It assist AZIO in planning, controlling

and coordinating operations of the company. Assist in decision making:- Process of management accounting involve the collection &

analysation of data, which can be determined by AZIO before formulating plans and

policies. It help in taking right decision which in turn will contribute toward the

achievement of organisational goals.

Safety and security from trade cycle:- The data collected through management

accounting throws light over past trade cycle which in turn will help company in

ascertaining the cause of errors and its effect. Thus, it help AZIO in safeguarding the

company from any negative affect that may arises because of trade cycle.

Types of accounting system Cost accounting system:- This system of managerial accounting help in estimating the

cost of company's product and services for cost control, profitability analysis and

inventory valuation. As estimation of accurate cost of product is very essential for AZIO

to make business operations more profitable and in preparing financial statement of

company which help in determining the financial condition of the firm throughout the

year. Inventory management system:- The inventory management system of managerial

accounting help company in maintaining the optimum level of cost which in turn will

assist AZIO in reducing overall cost of business operation. It includes number of tools

and techniques that can be used by AZIO to minimize the cost , such as Just in time

approach, Economic order quantity etc. which help in achieving business goals and

objectives (Bennett and James, 2017).

2

accounting help in overcoming these problems and contributing toward success of an enterprise.

AIZO need to keep and manage a record of its financial operations in order to achieve

organisational goal most effectively. Following are the importance of management accounting

system:- Increases efficiency of business:- Management accounting helps in increasing the

efficiency of business operations. It determines targets of different departments in

advance and accomplishment of these tasks are considered as an efficiency measurement

tool (Baldenius, Nezlobin and Vaysman, 2015). It assist AZIO in planning, controlling

and coordinating operations of the company. Assist in decision making:- Process of management accounting involve the collection &

analysation of data, which can be determined by AZIO before formulating plans and

policies. It help in taking right decision which in turn will contribute toward the

achievement of organisational goals.

Safety and security from trade cycle:- The data collected through management

accounting throws light over past trade cycle which in turn will help company in

ascertaining the cause of errors and its effect. Thus, it help AZIO in safeguarding the

company from any negative affect that may arises because of trade cycle.

Types of accounting system Cost accounting system:- This system of managerial accounting help in estimating the

cost of company's product and services for cost control, profitability analysis and

inventory valuation. As estimation of accurate cost of product is very essential for AZIO

to make business operations more profitable and in preparing financial statement of

company which help in determining the financial condition of the firm throughout the

year. Inventory management system:- The inventory management system of managerial

accounting help company in maintaining the optimum level of cost which in turn will

assist AZIO in reducing overall cost of business operation. It includes number of tools

and techniques that can be used by AZIO to minimize the cost , such as Just in time

approach, Economic order quantity etc. which help in achieving business goals and

objectives (Bennett and James, 2017).

2

Job coasting:- The process of accumulating information of the cost associated with a

particular production or service job is known as job coasting. This accounting

management approach assist AZIO in tracking and recording the types of cost incurred

such as overhead, labour, material, manufacturing cost etc. Job coasting put more

emphasis over controlling the expenses and maximizing the revenue of the company.

Price optimization system:- Under this mathematical approach company analysis how

customers react over the different product prices (Booth, 2018). Prize optimization

approach assist manager in setting the best price of the product which help AZIO in

achieving their goals and objective. Information that is used by firm in this approach

consists of operating cost, historic price, inventory and sales.

Benefits of management accounting system

Various management accounting system provide relevant data related with management

of business operations.

Help in take right and timely business decision.

Provide data related with present financial position of organisation.

Help in plan about future actions and decisions of enterprise by offer specific information

based on budgets, environment analysis and surveys.

Data collected from various accounting systems support managers in control

organisation’s success and growth.

Systems of management accounting provide data which is used to determine the issues

and help in deal with the same.

This help manager in analysis the performance which support in set goals.

P2. Various methods used for management accounting reporting

Managerial accounting reports are very important for decision making, planning,

regulating and measuring performance (Managerial Accounting Reports, 2014). These reports

are prepared on ongoing basis in an accounting period according to the requirements. It is

because many decisions and future planning are dependent on this report. Manager of AZIO

analysis managerial accounting reports and convert them into useful information for an

enterprise.

There are several methods which are used by AZIO for preparing accounting reports that are as

follows:

3

particular production or service job is known as job coasting. This accounting

management approach assist AZIO in tracking and recording the types of cost incurred

such as overhead, labour, material, manufacturing cost etc. Job coasting put more

emphasis over controlling the expenses and maximizing the revenue of the company.

Price optimization system:- Under this mathematical approach company analysis how

customers react over the different product prices (Booth, 2018). Prize optimization

approach assist manager in setting the best price of the product which help AZIO in

achieving their goals and objective. Information that is used by firm in this approach

consists of operating cost, historic price, inventory and sales.

Benefits of management accounting system

Various management accounting system provide relevant data related with management

of business operations.

Help in take right and timely business decision.

Provide data related with present financial position of organisation.

Help in plan about future actions and decisions of enterprise by offer specific information

based on budgets, environment analysis and surveys.

Data collected from various accounting systems support managers in control

organisation’s success and growth.

Systems of management accounting provide data which is used to determine the issues

and help in deal with the same.

This help manager in analysis the performance which support in set goals.

P2. Various methods used for management accounting reporting

Managerial accounting reports are very important for decision making, planning,

regulating and measuring performance (Managerial Accounting Reports, 2014). These reports

are prepared on ongoing basis in an accounting period according to the requirements. It is

because many decisions and future planning are dependent on this report. Manager of AZIO

analysis managerial accounting reports and convert them into useful information for an

enterprise.

There are several methods which are used by AZIO for preparing accounting reports that are as

follows:

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

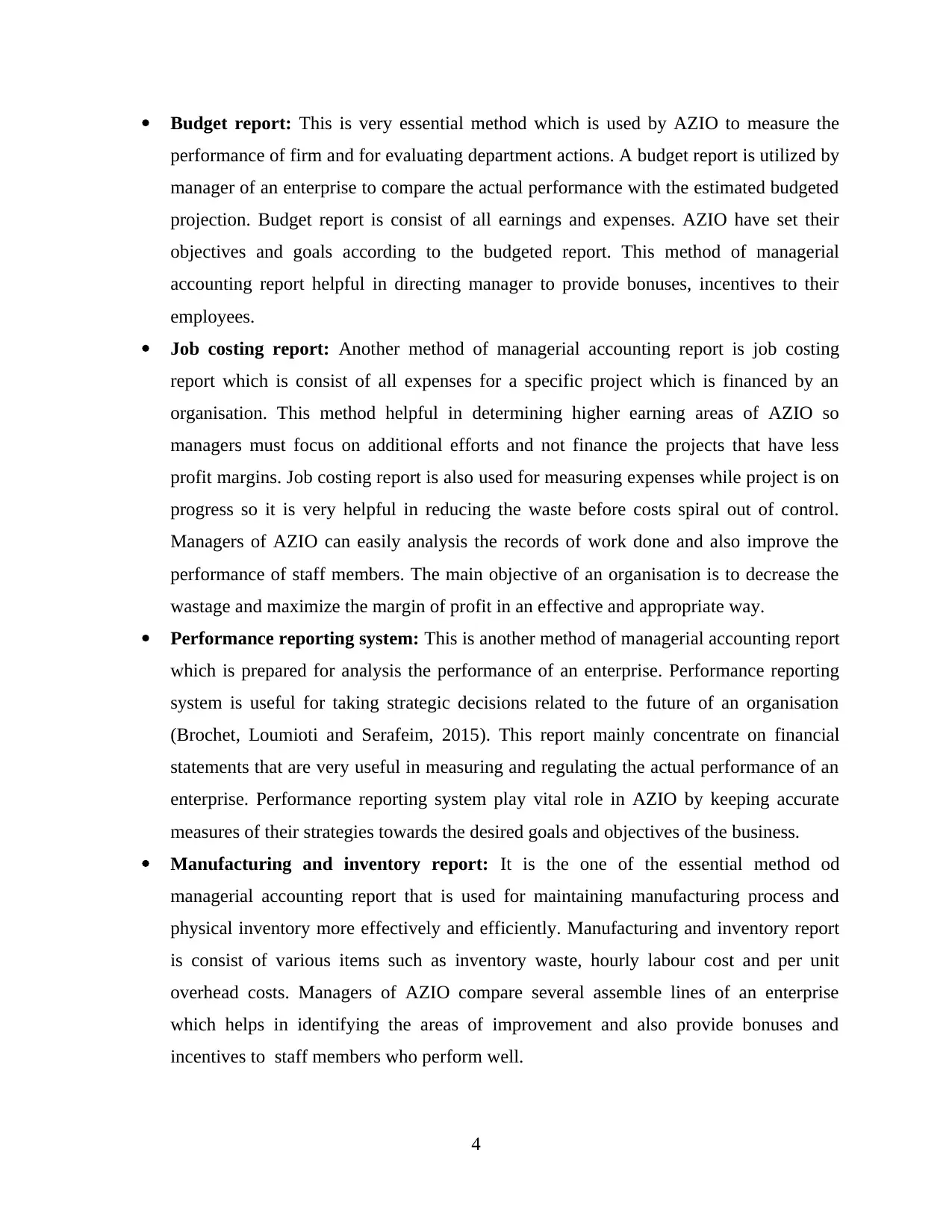

Budget report: This is very essential method which is used by AZIO to measure the

performance of firm and for evaluating department actions. A budget report is utilized by

manager of an enterprise to compare the actual performance with the estimated budgeted

projection. Budget report is consist of all earnings and expenses. AZIO have set their

objectives and goals according to the budgeted report. This method of managerial

accounting report helpful in directing manager to provide bonuses, incentives to their

employees.

Job costing report: Another method of managerial accounting report is job costing

report which is consist of all expenses for a specific project which is financed by an

organisation. This method helpful in determining higher earning areas of AZIO so

managers must focus on additional efforts and not finance the projects that have less

profit margins. Job costing report is also used for measuring expenses while project is on

progress so it is very helpful in reducing the waste before costs spiral out of control.

Managers of AZIO can easily analysis the records of work done and also improve the

performance of staff members. The main objective of an organisation is to decrease the

wastage and maximize the margin of profit in an effective and appropriate way.

Performance reporting system: This is another method of managerial accounting report

which is prepared for analysis the performance of an enterprise. Performance reporting

system is useful for taking strategic decisions related to the future of an organisation

(Brochet, Loumioti and Serafeim, 2015). This report mainly concentrate on financial

statements that are very useful in measuring and regulating the actual performance of an

enterprise. Performance reporting system play vital role in AZIO by keeping accurate

measures of their strategies towards the desired goals and objectives of the business.

Manufacturing and inventory report: It is the one of the essential method od

managerial accounting report that is used for maintaining manufacturing process and

physical inventory more effectively and efficiently. Manufacturing and inventory report

is consist of various items such as inventory waste, hourly labour cost and per unit

overhead costs. Managers of AZIO compare several assemble lines of an enterprise

which helps in identifying the areas of improvement and also provide bonuses and

incentives to staff members who perform well.

4

performance of firm and for evaluating department actions. A budget report is utilized by

manager of an enterprise to compare the actual performance with the estimated budgeted

projection. Budget report is consist of all earnings and expenses. AZIO have set their

objectives and goals according to the budgeted report. This method of managerial

accounting report helpful in directing manager to provide bonuses, incentives to their

employees.

Job costing report: Another method of managerial accounting report is job costing

report which is consist of all expenses for a specific project which is financed by an

organisation. This method helpful in determining higher earning areas of AZIO so

managers must focus on additional efforts and not finance the projects that have less

profit margins. Job costing report is also used for measuring expenses while project is on

progress so it is very helpful in reducing the waste before costs spiral out of control.

Managers of AZIO can easily analysis the records of work done and also improve the

performance of staff members. The main objective of an organisation is to decrease the

wastage and maximize the margin of profit in an effective and appropriate way.

Performance reporting system: This is another method of managerial accounting report

which is prepared for analysis the performance of an enterprise. Performance reporting

system is useful for taking strategic decisions related to the future of an organisation

(Brochet, Loumioti and Serafeim, 2015). This report mainly concentrate on financial

statements that are very useful in measuring and regulating the actual performance of an

enterprise. Performance reporting system play vital role in AZIO by keeping accurate

measures of their strategies towards the desired goals and objectives of the business.

Manufacturing and inventory report: It is the one of the essential method od

managerial accounting report that is used for maintaining manufacturing process and

physical inventory more effectively and efficiently. Manufacturing and inventory report

is consist of various items such as inventory waste, hourly labour cost and per unit

overhead costs. Managers of AZIO compare several assemble lines of an enterprise

which helps in identifying the areas of improvement and also provide bonuses and

incentives to staff members who perform well.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Accounts receivable aging report: It is periodic report which categories an

organisation's account receivable as per the duration of time an invoice has been

outstanding. Manager of AZIO use this method of managerial account report to identify

the problems company's payment collection process. Firm must tighten its credit policy,

when large number of customer not able to pay their amounts. It is very necessary that

there is continuous evaluation of the account receivable aging report to keep the

collection department from overlooking old debts.

Cost managerial accounting reports: This is another method of managerial accounting

report which is useful in computing the cost of products that are manufactured in the

organisation. This report contains various items such as overheads, labour, raw materials

and other cost (Chen and et. al., 2015). Cost managerial accounting report provides the

brief of all the information that is related to the production process.

It is very necessary for manager of AZIO to use these methods of managerial accounting method

for effective and efficient operations in the firm.

M1. Merits of using management accounting system

Management accounting plays an important role in enterprise which helps in managing

and monitoring the financial transaction that takes place in an appropriate manner. It is very

necessary for an organisation to use various accounting systems such as job costing, price

optimisation, inventory management system and cost accounting system which assist in

obtaining effective profitable outcomes (Cooper, Ezzamel and Qu, 2017). This process help

AZIO in improving efficiency of their business operations and also aids in better decision

making. The data collected through procedure of management accounting throws light over

various issues that arises during trade cycle and finding reason behind them so that company can

improve their efficiency by removing these issues.

D1 Integration of management accounting system and management accounting report

According to , growth stability is the main aim of every organisation which can be

achieved by using an integrated approach of accounting which includes reporting system and

management accounting system. Under this manager of AZIO prepares a report using past data

& information and after which, with the help of management accounting system manager

evaluate the performance of the company. This assist manager in taking investment decisions

and minimizing the expenses incurred in financial and operational activities.

5

organisation's account receivable as per the duration of time an invoice has been

outstanding. Manager of AZIO use this method of managerial account report to identify

the problems company's payment collection process. Firm must tighten its credit policy,

when large number of customer not able to pay their amounts. It is very necessary that

there is continuous evaluation of the account receivable aging report to keep the

collection department from overlooking old debts.

Cost managerial accounting reports: This is another method of managerial accounting

report which is useful in computing the cost of products that are manufactured in the

organisation. This report contains various items such as overheads, labour, raw materials

and other cost (Chen and et. al., 2015). Cost managerial accounting report provides the

brief of all the information that is related to the production process.

It is very necessary for manager of AZIO to use these methods of managerial accounting method

for effective and efficient operations in the firm.

M1. Merits of using management accounting system

Management accounting plays an important role in enterprise which helps in managing

and monitoring the financial transaction that takes place in an appropriate manner. It is very

necessary for an organisation to use various accounting systems such as job costing, price

optimisation, inventory management system and cost accounting system which assist in

obtaining effective profitable outcomes (Cooper, Ezzamel and Qu, 2017). This process help

AZIO in improving efficiency of their business operations and also aids in better decision

making. The data collected through procedure of management accounting throws light over

various issues that arises during trade cycle and finding reason behind them so that company can

improve their efficiency by removing these issues.

D1 Integration of management accounting system and management accounting report

According to , growth stability is the main aim of every organisation which can be

achieved by using an integrated approach of accounting which includes reporting system and

management accounting system. Under this manager of AZIO prepares a report using past data

& information and after which, with the help of management accounting system manager

evaluate the performance of the company. This assist manager in taking investment decisions

and minimizing the expenses incurred in financial and operational activities.

5

TASK 2

P3. Calculate cost using marginal and absorption costing

Management accounting is utilised by an enterprise to formulate reports and reduce the

cost of business operations and activities. By using appropriate cost approach, firm can achieve

effective and better outcomes.

Marginal costing: This cost is helpful in decreasing the cost and increasing the

production cost by producing one extra unit (Greene and Robertson, Verizon Business

Global LLC, 2014). This is very effective method of costing as both variable and fixed

cost is change for a particular period of time.

Absorption costing: This is another type of expenditure method of management

accounting that take consideration of all costs related to the manufacturing of goods and

services. Absorption costing is based on the assumption that incurred cost have been

recovered from selling price.

Comparison between marginal costing and absorption costing are as follows:

Basis Marginal costing Absorption costing

Meaning In this costing, variable

overheads are less as per unit

cost of one product and fixed

expenses are calculated for net

income of firm.

In absorption costing, there is

calculation of manufacturing

cost with all overheads like

direct expenses (Hoque, 2018).

Cost identification In marginal cost, production

cost is to be considered as

variable cost and fixed cost

remain constant at the time of

production.

Both variable and fixed cost

considered for calculation of

final cost of manufacturing.

Cost and inventory valuation Variable cost is consider in

marginal costing.

Both fixed and variable cost

are consider into absorption

cost.

6

P3. Calculate cost using marginal and absorption costing

Management accounting is utilised by an enterprise to formulate reports and reduce the

cost of business operations and activities. By using appropriate cost approach, firm can achieve

effective and better outcomes.

Marginal costing: This cost is helpful in decreasing the cost and increasing the

production cost by producing one extra unit (Greene and Robertson, Verizon Business

Global LLC, 2014). This is very effective method of costing as both variable and fixed

cost is change for a particular period of time.

Absorption costing: This is another type of expenditure method of management

accounting that take consideration of all costs related to the manufacturing of goods and

services. Absorption costing is based on the assumption that incurred cost have been

recovered from selling price.

Comparison between marginal costing and absorption costing are as follows:

Basis Marginal costing Absorption costing

Meaning In this costing, variable

overheads are less as per unit

cost of one product and fixed

expenses are calculated for net

income of firm.

In absorption costing, there is

calculation of manufacturing

cost with all overheads like

direct expenses (Hoque, 2018).

Cost identification In marginal cost, production

cost is to be considered as

variable cost and fixed cost

remain constant at the time of

production.

Both variable and fixed cost

considered for calculation of

final cost of manufacturing.

Cost and inventory valuation Variable cost is consider in

marginal costing.

Both fixed and variable cost

are consider into absorption

cost.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Calculation of net profit by using marginal costing method:

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 *

16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

Break even analysis: It is said to be one of the important point at which every cost and

expenditure required to provide equal results for AZIO. It is known as effective point in which

company neither get profit or nor goes into any kind of loss.

Total number of product sold

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

7

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 *

16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

Break even analysis: It is said to be one of the important point at which every cost and

expenditure required to provide equal results for AZIO. It is known as effective point in which

company neither get profit or nor goes into any kind of loss.

Total number of product sold

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BEP in sales 20000

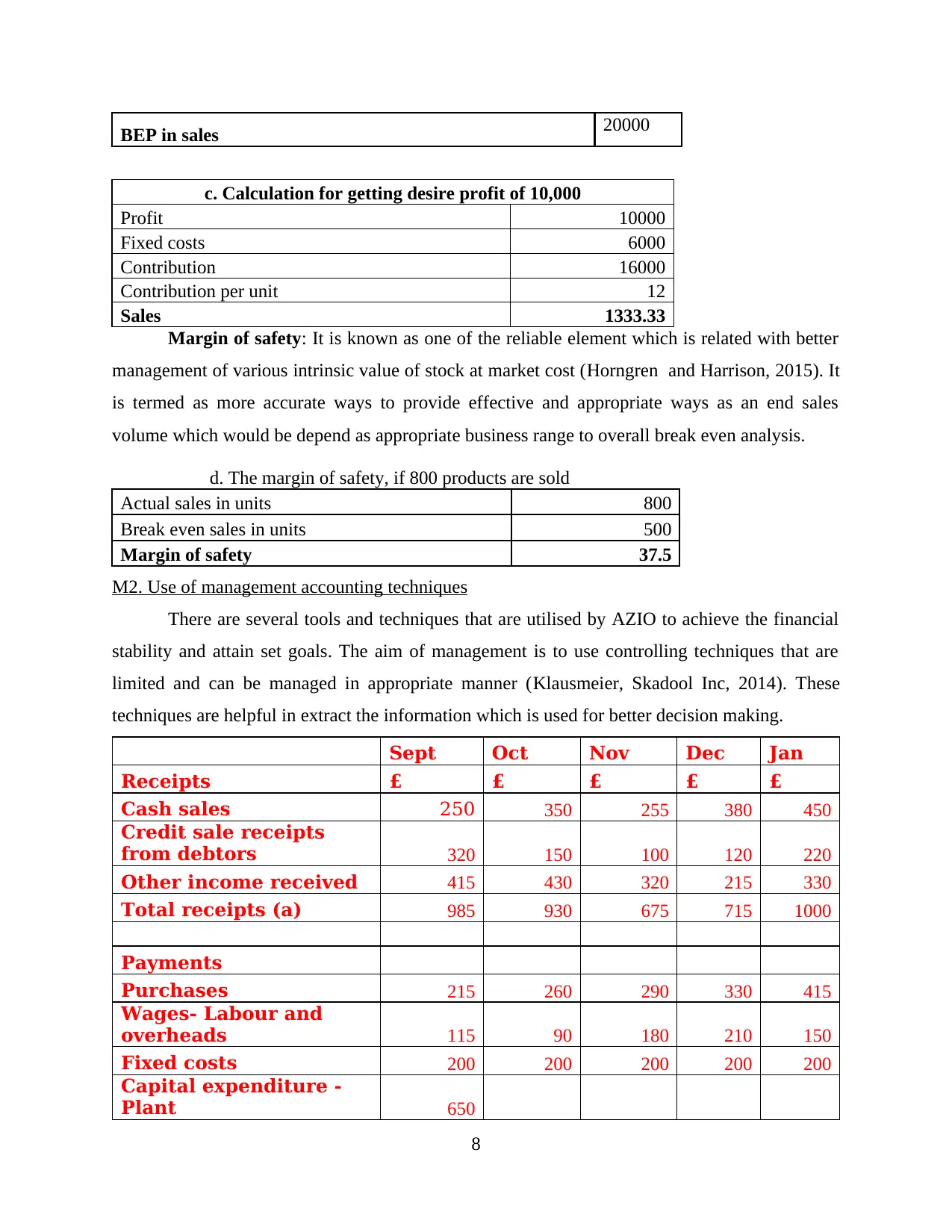

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety: It is known as one of the reliable element which is related with better

management of various intrinsic value of stock at market cost (Horngren and Harrison, 2015). It

is termed as more accurate ways to provide effective and appropriate ways as an end sales

volume which would be depend as appropriate business range to overall break even analysis.

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

M2. Use of management accounting techniques

There are several tools and techniques that are utilised by AZIO to achieve the financial

stability and attain set goals. The aim of management is to use controlling techniques that are

limited and can be managed in appropriate manner (Klausmeier, Skadool Inc, 2014). These

techniques are helpful in extract the information which is used for better decision making.

Sept Oct Nov Dec Jan

Receipts £ £ £ £ £

Cash sales 250 350 255 380 450

Credit sale receipts

from debtors 320 150 100 120 220

Other income received 415 430 320 215 330

Total receipts (a) 985 930 675 715 1000

Payments

Purchases 215 260 290 330 415

Wages- Labour and

overheads 115 90 180 210 150

Fixed costs 200 200 200 200 200

Capital expenditure -

Plant 650

8

c. Calculation for getting desire profit of 10,000

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety: It is known as one of the reliable element which is related with better

management of various intrinsic value of stock at market cost (Horngren and Harrison, 2015). It

is termed as more accurate ways to provide effective and appropriate ways as an end sales

volume which would be depend as appropriate business range to overall break even analysis.

d. The margin of safety, if 800 products are sold

Actual sales in units 800

Break even sales in units 500

Margin of safety 37.5

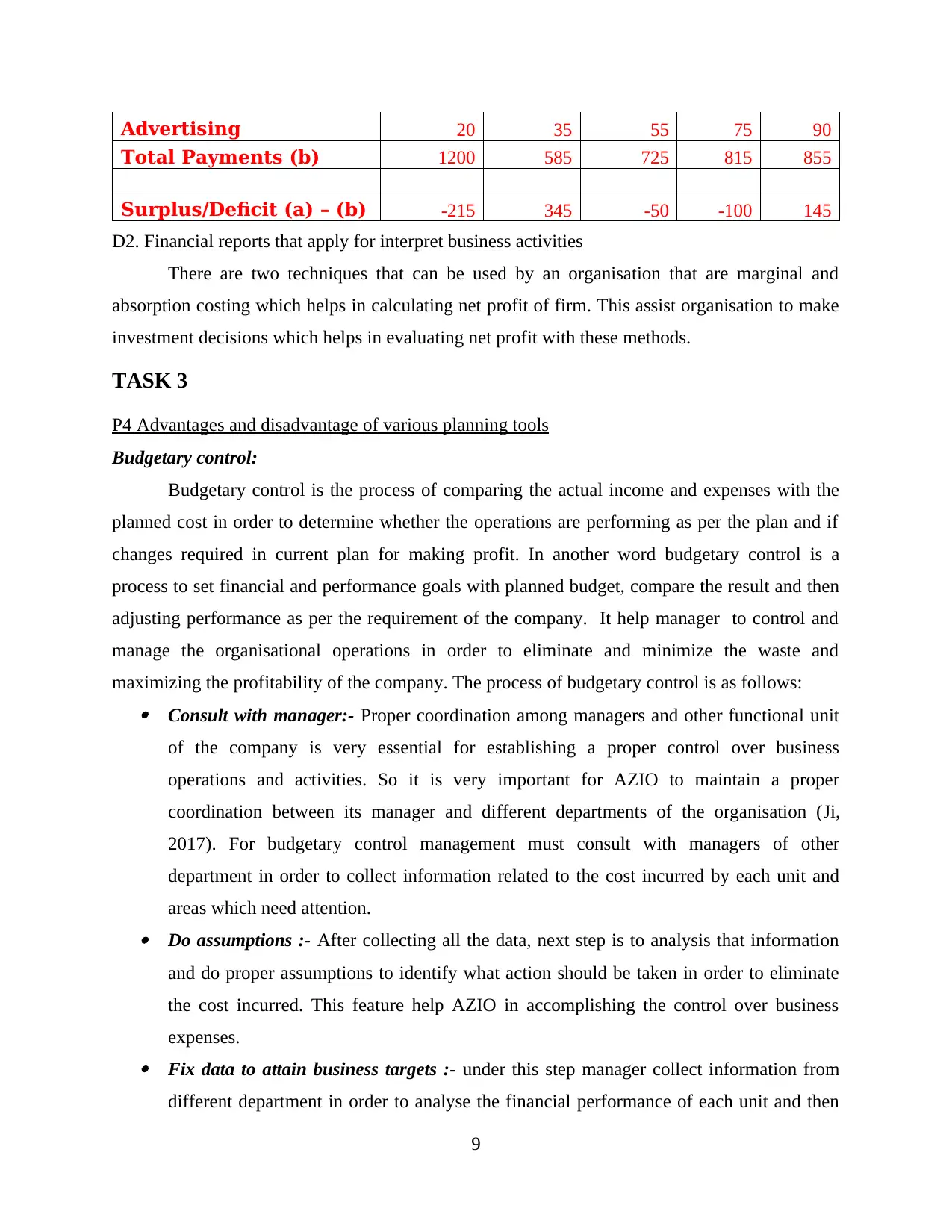

M2. Use of management accounting techniques

There are several tools and techniques that are utilised by AZIO to achieve the financial

stability and attain set goals. The aim of management is to use controlling techniques that are

limited and can be managed in appropriate manner (Klausmeier, Skadool Inc, 2014). These

techniques are helpful in extract the information which is used for better decision making.

Sept Oct Nov Dec Jan

Receipts £ £ £ £ £

Cash sales 250 350 255 380 450

Credit sale receipts

from debtors 320 150 100 120 220

Other income received 415 430 320 215 330

Total receipts (a) 985 930 675 715 1000

Payments

Purchases 215 260 290 330 415

Wages- Labour and

overheads 115 90 180 210 150

Fixed costs 200 200 200 200 200

Capital expenditure -

Plant 650

8

Advertising 20 35 55 75 90

Total Payments (b) 1200 585 725 815 855

Surplus/Deficit (a) – (b) -215 345 -50 -100 145

D2. Financial reports that apply for interpret business activities

There are two techniques that can be used by an organisation that are marginal and

absorption costing which helps in calculating net profit of firm. This assist organisation to make

investment decisions which helps in evaluating net profit with these methods.

TASK 3

P4 Advantages and disadvantage of various planning tools

Budgetary control:

Budgetary control is the process of comparing the actual income and expenses with the

planned cost in order to determine whether the operations are performing as per the plan and if

changes required in current plan for making profit. In another word budgetary control is a

process to set financial and performance goals with planned budget, compare the result and then

adjusting performance as per the requirement of the company. It help manager to control and

manage the organisational operations in order to eliminate and minimize the waste and

maximizing the profitability of the company. The process of budgetary control is as follows: Consult with manager:- Proper coordination among managers and other functional unit

of the company is very essential for establishing a proper control over business

operations and activities. So it is very important for AZIO to maintain a proper

coordination between its manager and different departments of the organisation (Ji,

2017). For budgetary control management must consult with managers of other

department in order to collect information related to the cost incurred by each unit and

areas which need attention. Do assumptions :- After collecting all the data, next step is to analysis that information

and do proper assumptions to identify what action should be taken in order to eliminate

the cost incurred. This feature help AZIO in accomplishing the control over business

expenses. Fix data to attain business targets :- under this step manager collect information from

different department in order to analyse the financial performance of each unit and then

9

Total Payments (b) 1200 585 725 815 855

Surplus/Deficit (a) – (b) -215 345 -50 -100 145

D2. Financial reports that apply for interpret business activities

There are two techniques that can be used by an organisation that are marginal and

absorption costing which helps in calculating net profit of firm. This assist organisation to make

investment decisions which helps in evaluating net profit with these methods.

TASK 3

P4 Advantages and disadvantage of various planning tools

Budgetary control:

Budgetary control is the process of comparing the actual income and expenses with the

planned cost in order to determine whether the operations are performing as per the plan and if

changes required in current plan for making profit. In another word budgetary control is a

process to set financial and performance goals with planned budget, compare the result and then

adjusting performance as per the requirement of the company. It help manager to control and

manage the organisational operations in order to eliminate and minimize the waste and

maximizing the profitability of the company. The process of budgetary control is as follows: Consult with manager:- Proper coordination among managers and other functional unit

of the company is very essential for establishing a proper control over business

operations and activities. So it is very important for AZIO to maintain a proper

coordination between its manager and different departments of the organisation (Ji,

2017). For budgetary control management must consult with managers of other

department in order to collect information related to the cost incurred by each unit and

areas which need attention. Do assumptions :- After collecting all the data, next step is to analysis that information

and do proper assumptions to identify what action should be taken in order to eliminate

the cost incurred. This feature help AZIO in accomplishing the control over business

expenses. Fix data to attain business targets :- under this step manager collect information from

different department in order to analyse the financial performance of each unit and then

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.