Adventure Tours Financial Analysis

VerifiedAdded on 2020/02/24

|28

|7948

|39

AI Summary

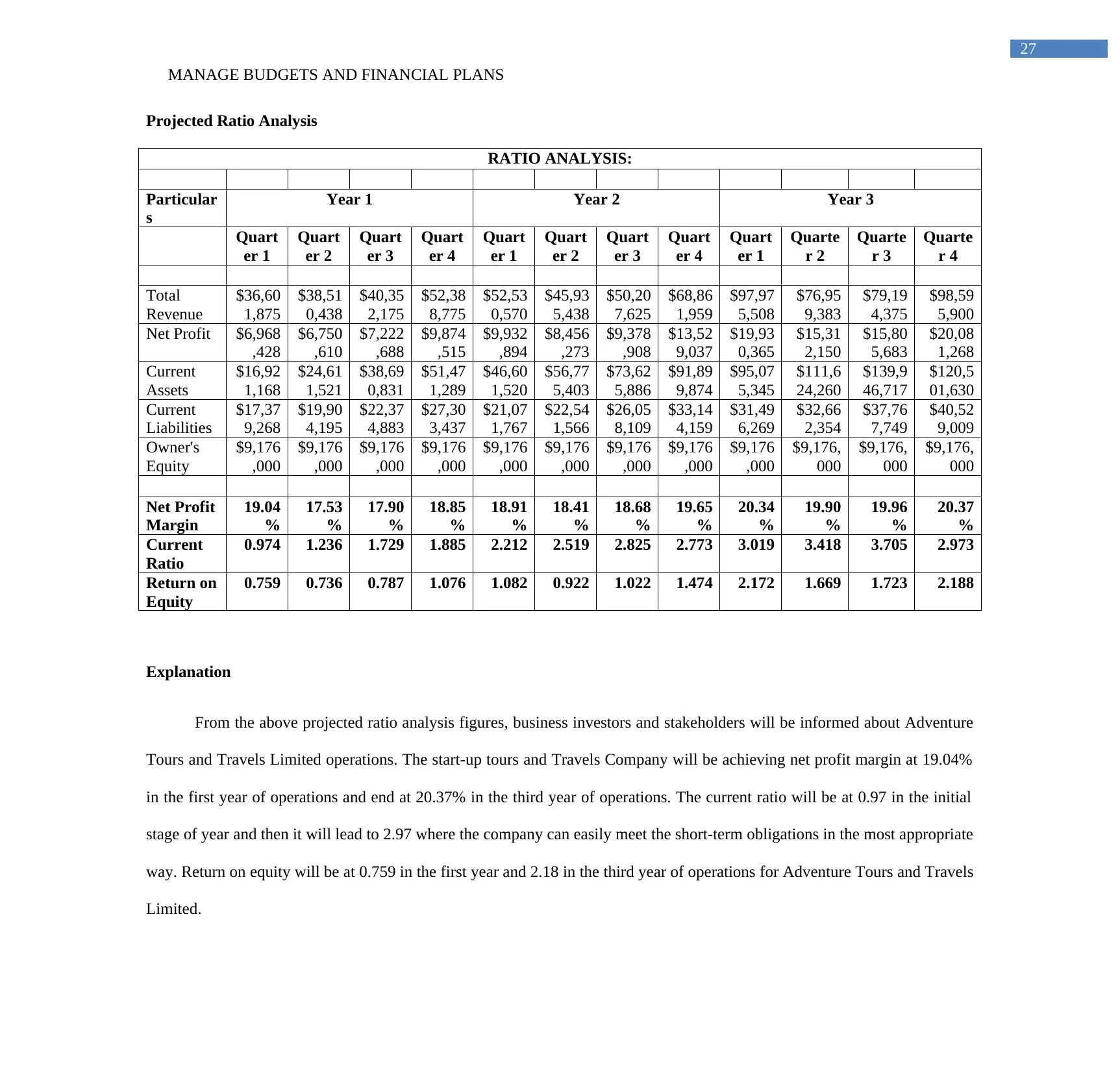

This assignment tasks you with analyzing the projected financial performance of Adventure Tours and Travels Limited using key financial ratios. The analysis covers Net Profit Margin, Current Ratio, and Return on Equity over a three-year period. The objective is to provide insights into the company's profitability, liquidity, and efficiency based on these ratios for investors and stakeholders.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: MANAGE BUDGETS AND FINANCIAL PLANS

Manage Budgets and Financial Plans

Name of the Student:

Name of the University:

Author Note:

Manage Budgets and Financial Plans

Name of the Student:

Name of the University:

Author Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

MANAGE BUDGETS AND FINANCIAL PLANS

Executive Summary

The tourism industry in Australia had undergone rapid growth over several past decades. The

current trend shows that there is an increase in the number of tourists who enter the country and

provides an opportunity for Australian tours for penetrating in the market. The services of

Adventure Travel and Tours Limited will be positioned very carefully where the company will

deal with providing extremely high quality as well as comfortable experience to the clients so

that they have greater appreciation in the natural environment. In an nutshell, Adventure Travel

and Tours Limited do not just intend to market or sell the service but also to sell travel solutions

and provide a total quality environment to their valued customers that will help in establishing

reputable corporate image.

MANAGE BUDGETS AND FINANCIAL PLANS

Executive Summary

The tourism industry in Australia had undergone rapid growth over several past decades. The

current trend shows that there is an increase in the number of tourists who enter the country and

provides an opportunity for Australian tours for penetrating in the market. The services of

Adventure Travel and Tours Limited will be positioned very carefully where the company will

deal with providing extremely high quality as well as comfortable experience to the clients so

that they have greater appreciation in the natural environment. In an nutshell, Adventure Travel

and Tours Limited do not just intend to market or sell the service but also to sell travel solutions

and provide a total quality environment to their valued customers that will help in establishing

reputable corporate image.

3

MANAGE BUDGETS AND FINANCIAL PLANS

Table of Contents

Introduction to Business investors or stakeholders.........................................................................3

Vision Statement of Adventure Travel and Tours Limited.........................................................3

Mission Statement of Adventure Travel and Tours Limited.......................................................3

Goal of Adventure Travel and Tours Limited.............................................................................3

Objectives of Adventure Travel and Tours Limited....................................................................3

Financial Plan..................................................................................................................................5

Basic Assumptions.......................................................................................................................5

Start-up Cost................................................................................................................................6

Depreciation and Amortization Schedule....................................................................................7

Projected Room Bookings...........................................................................................................8

Projected Sales Revenue............................................................................................................10

Projected Expenses....................................................................................................................11

Projected Income Statement......................................................................................................13

Projected Balance Sheet............................................................................................................15

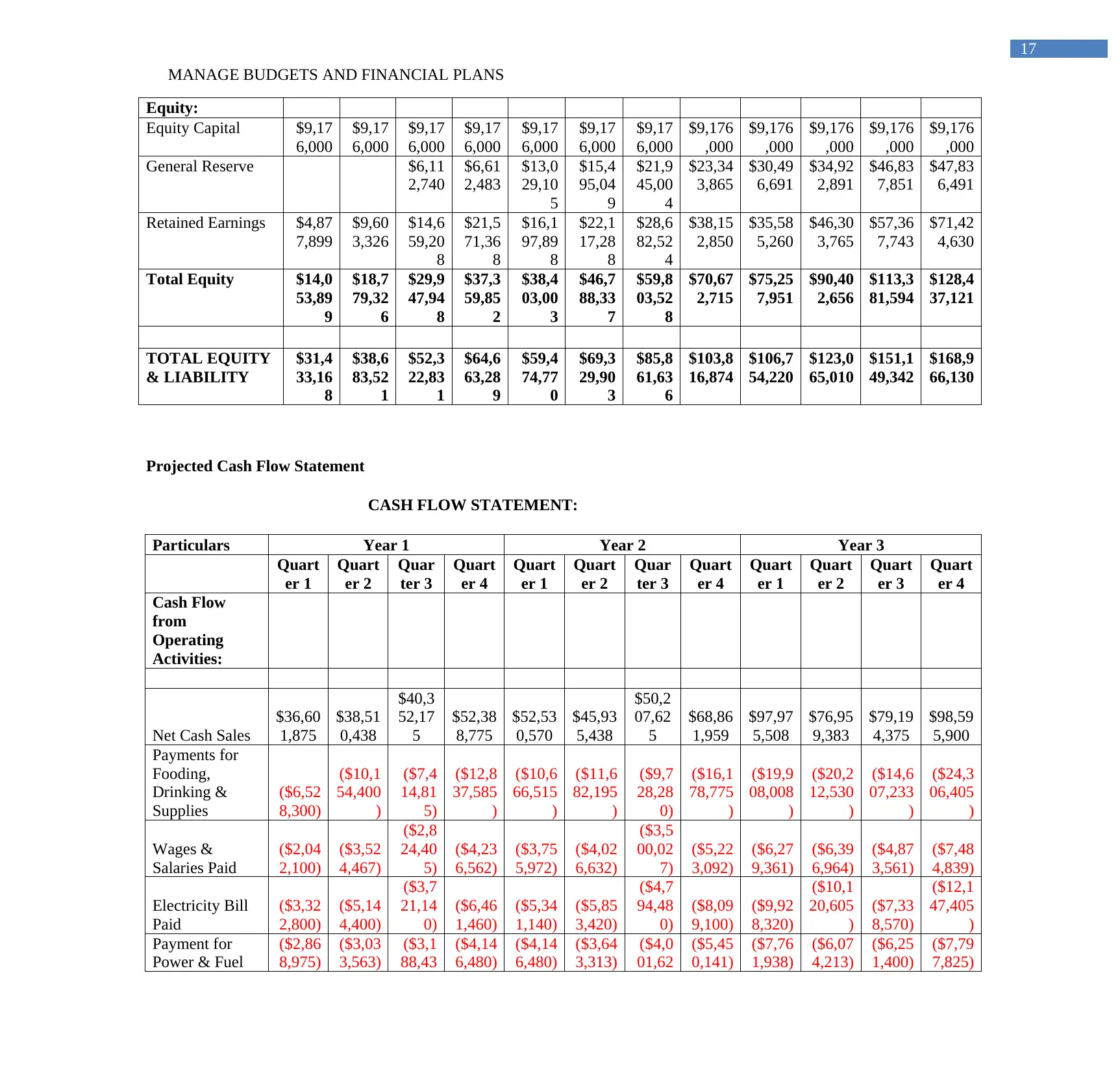

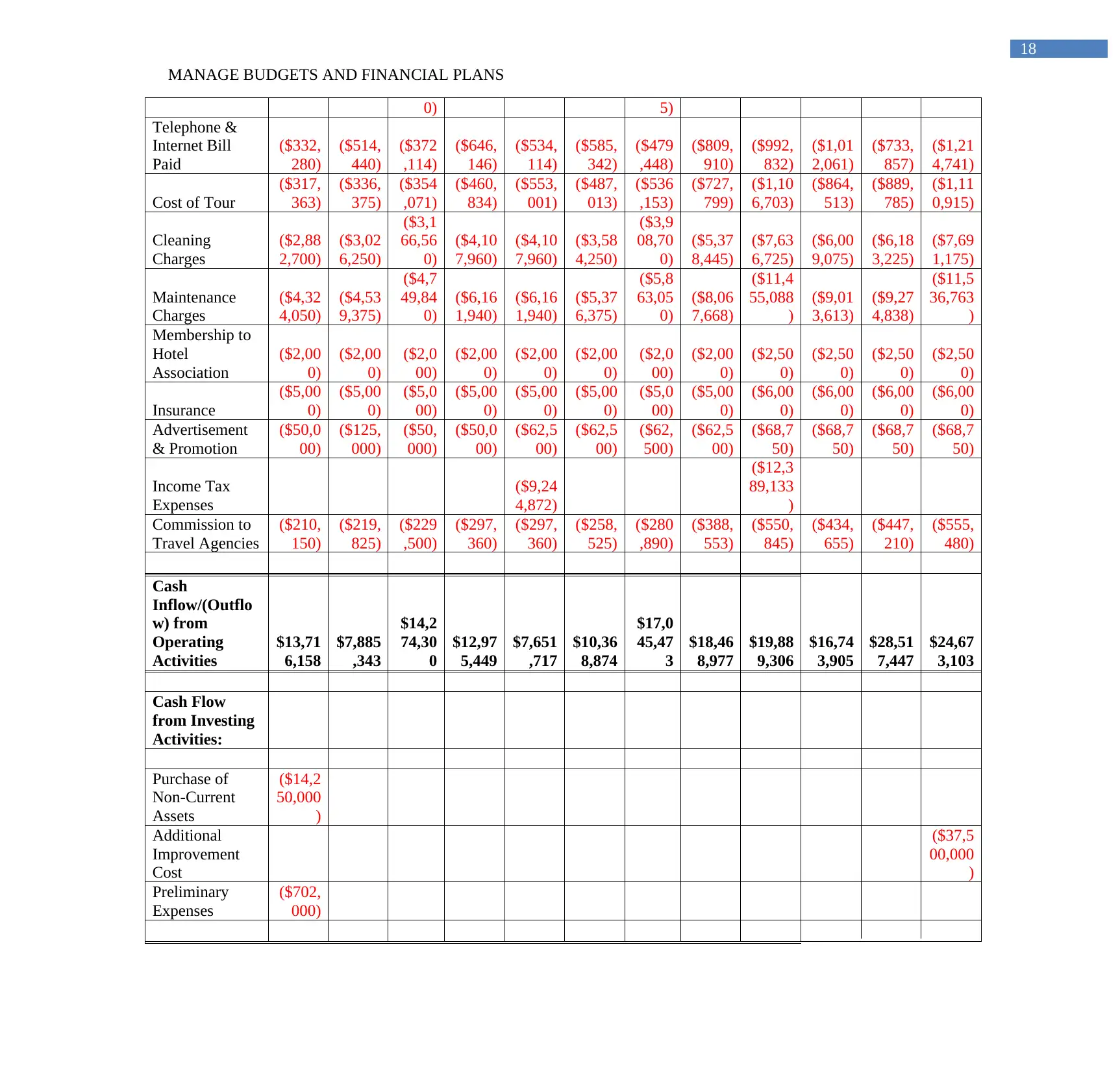

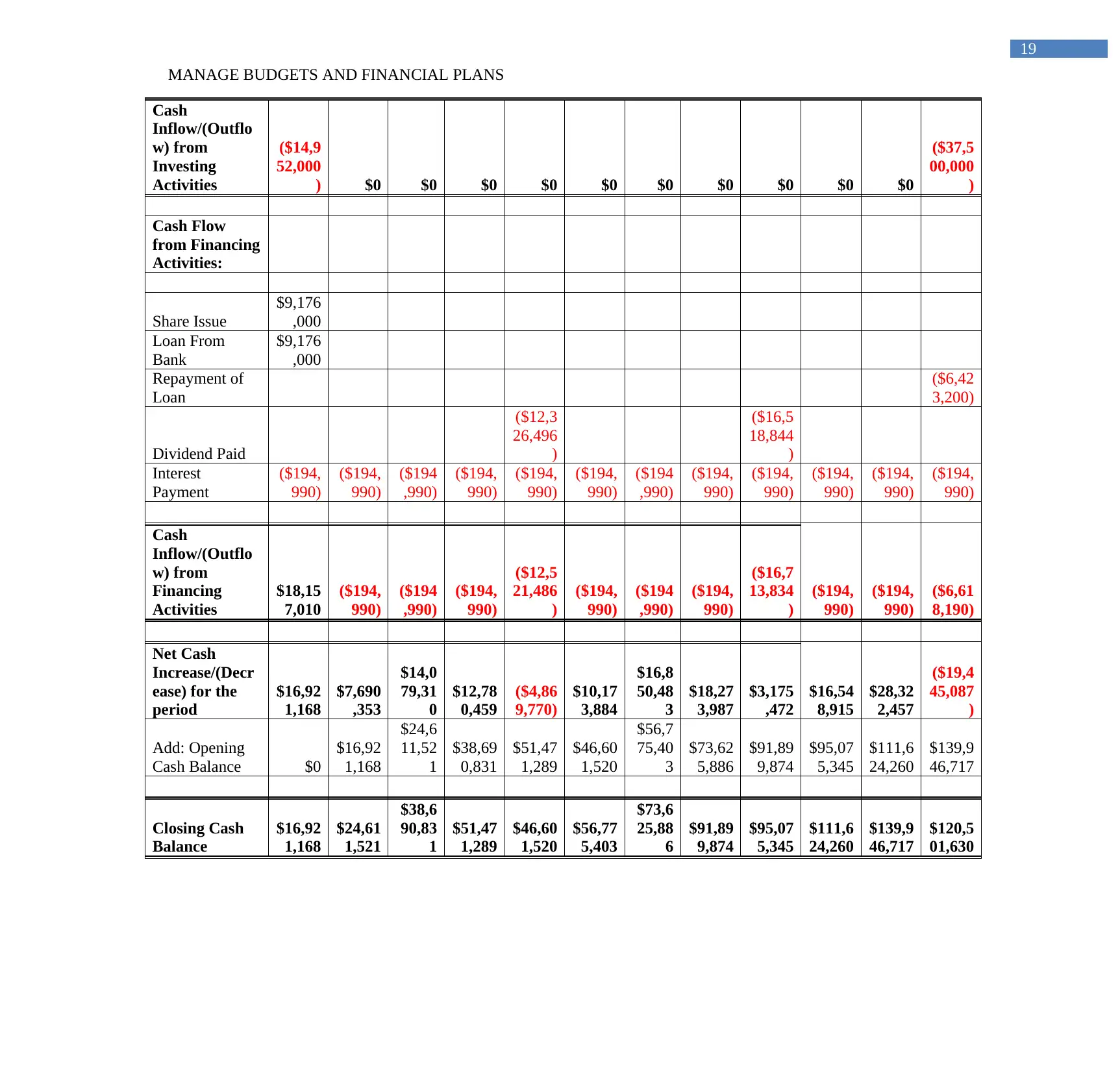

Projected Cash Flow Statement.................................................................................................17

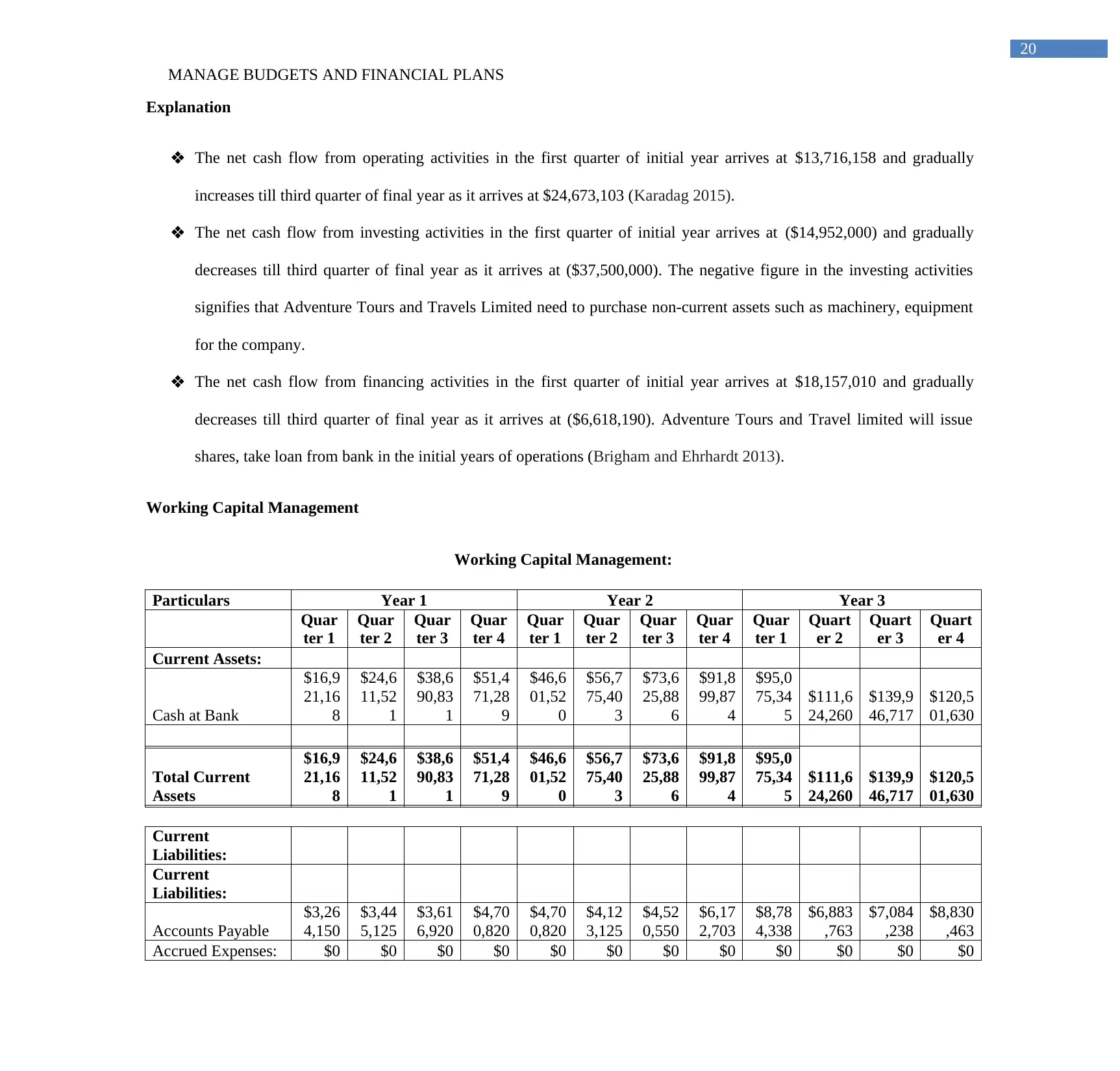

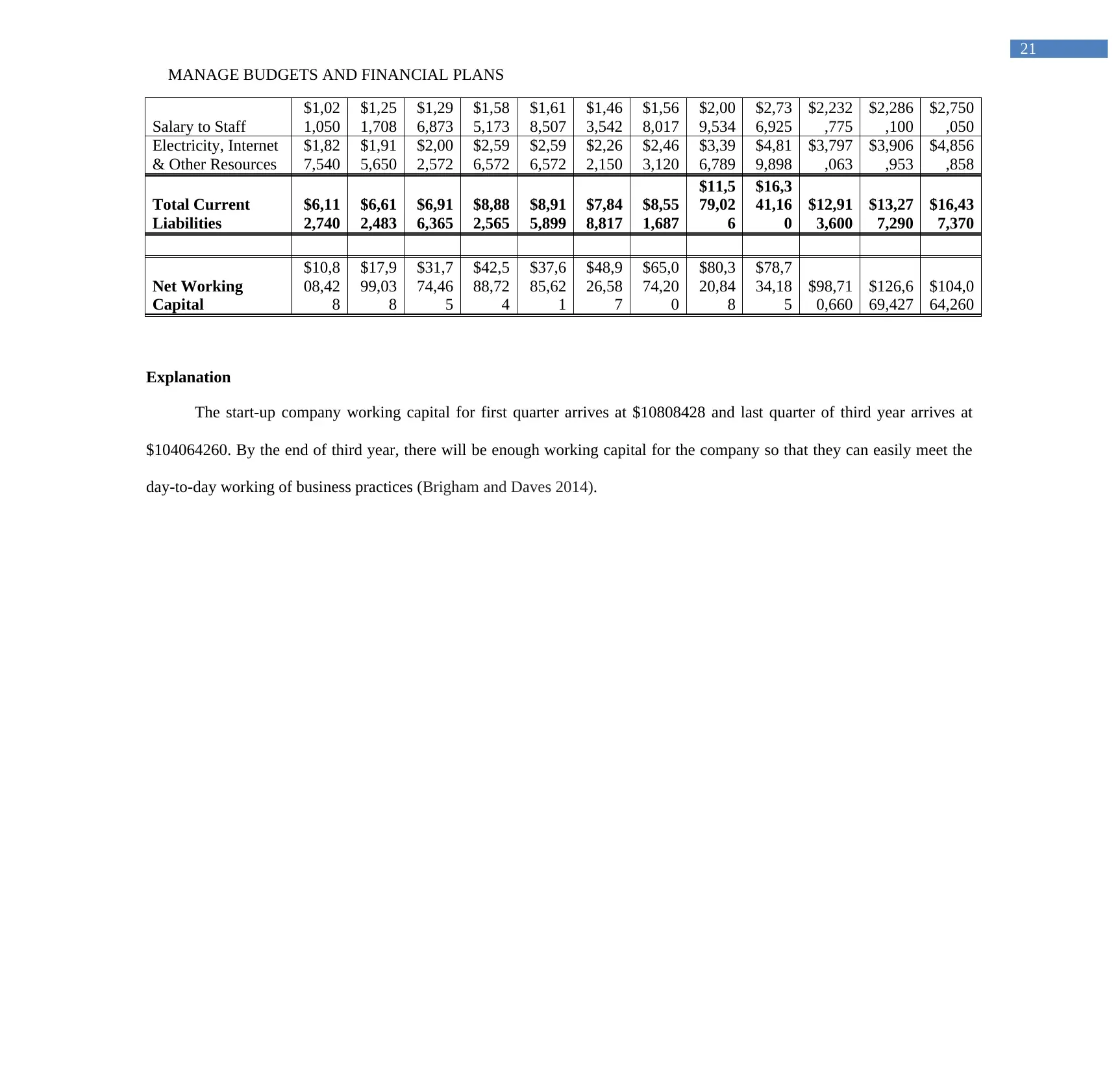

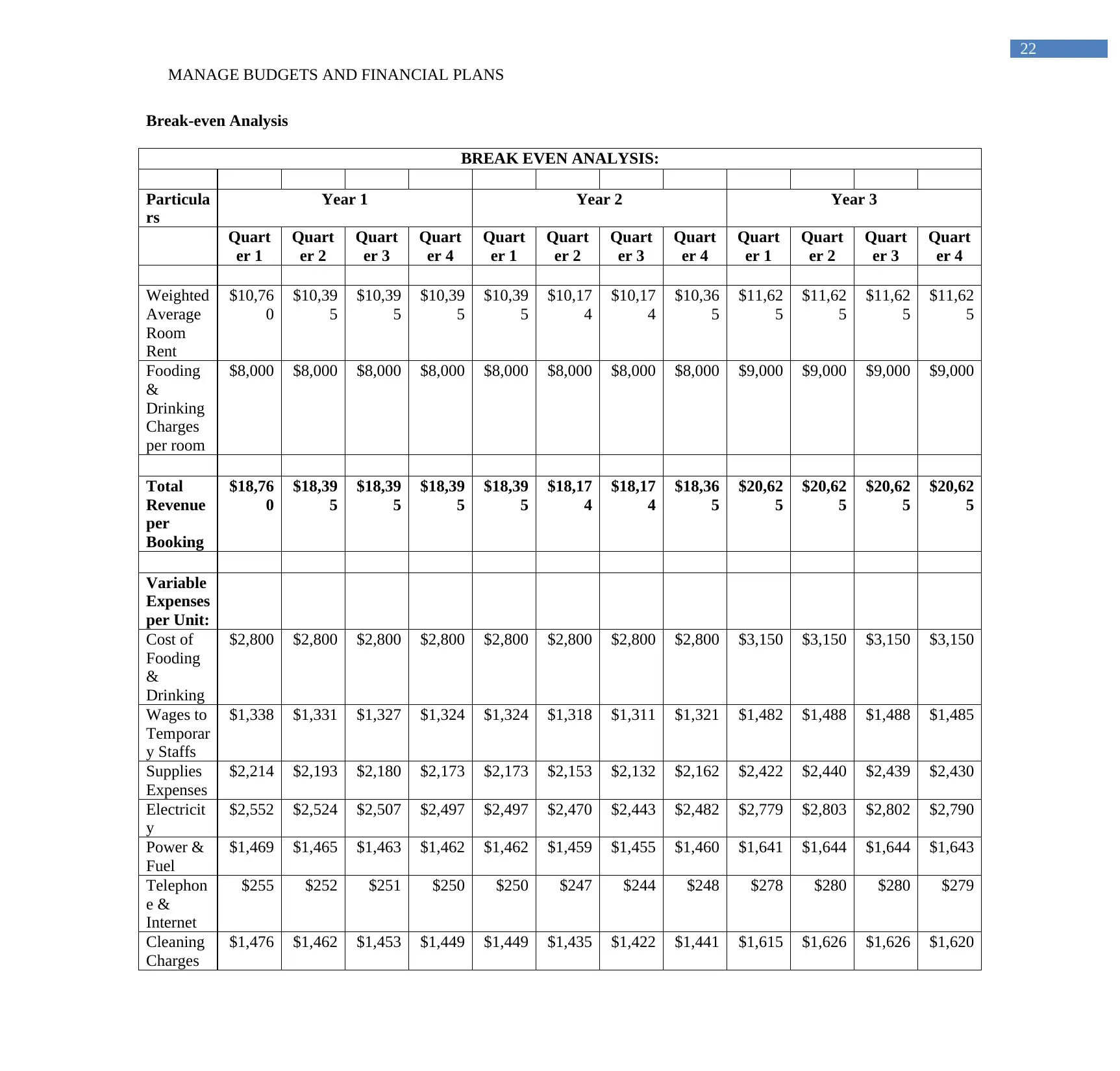

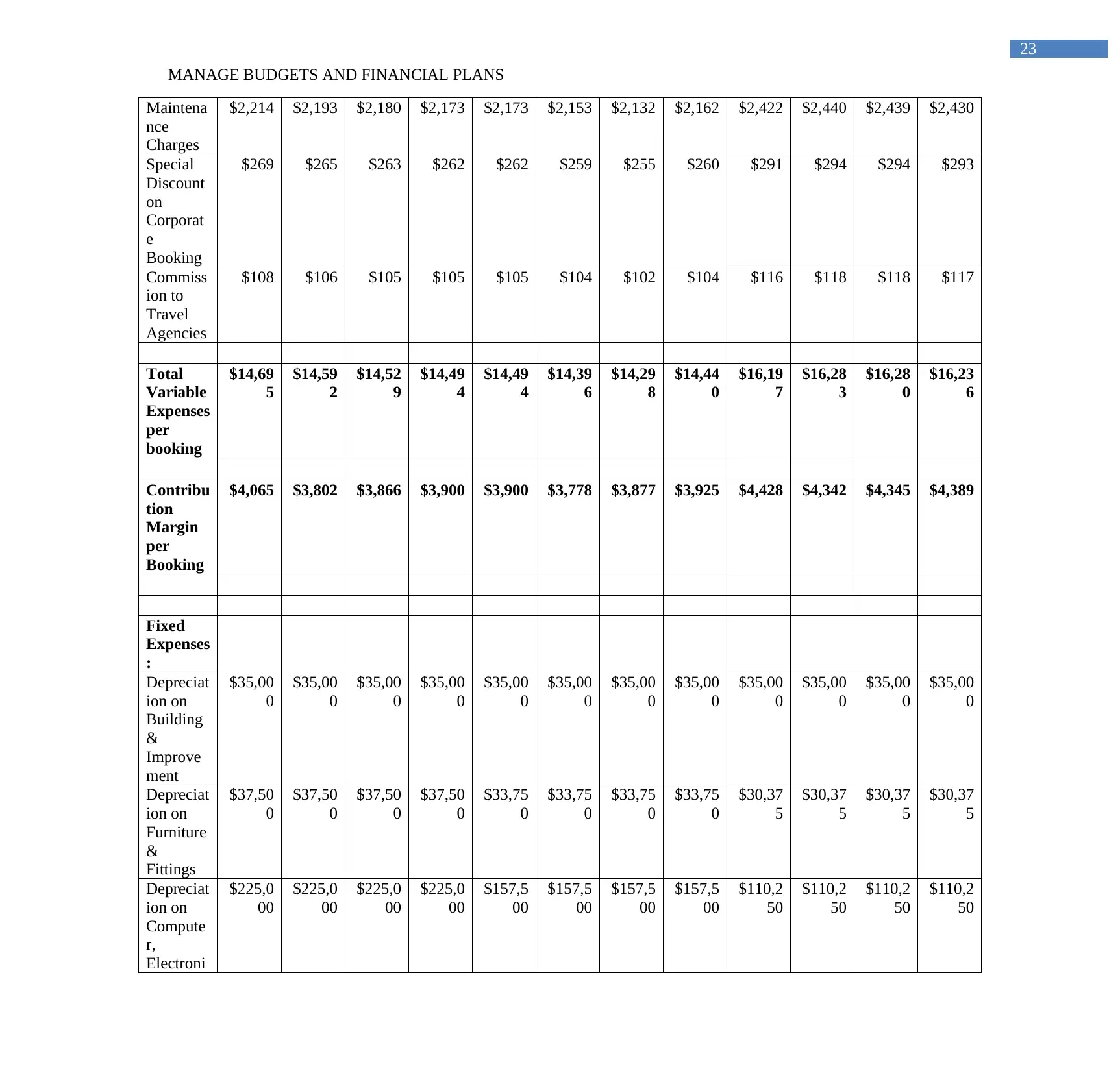

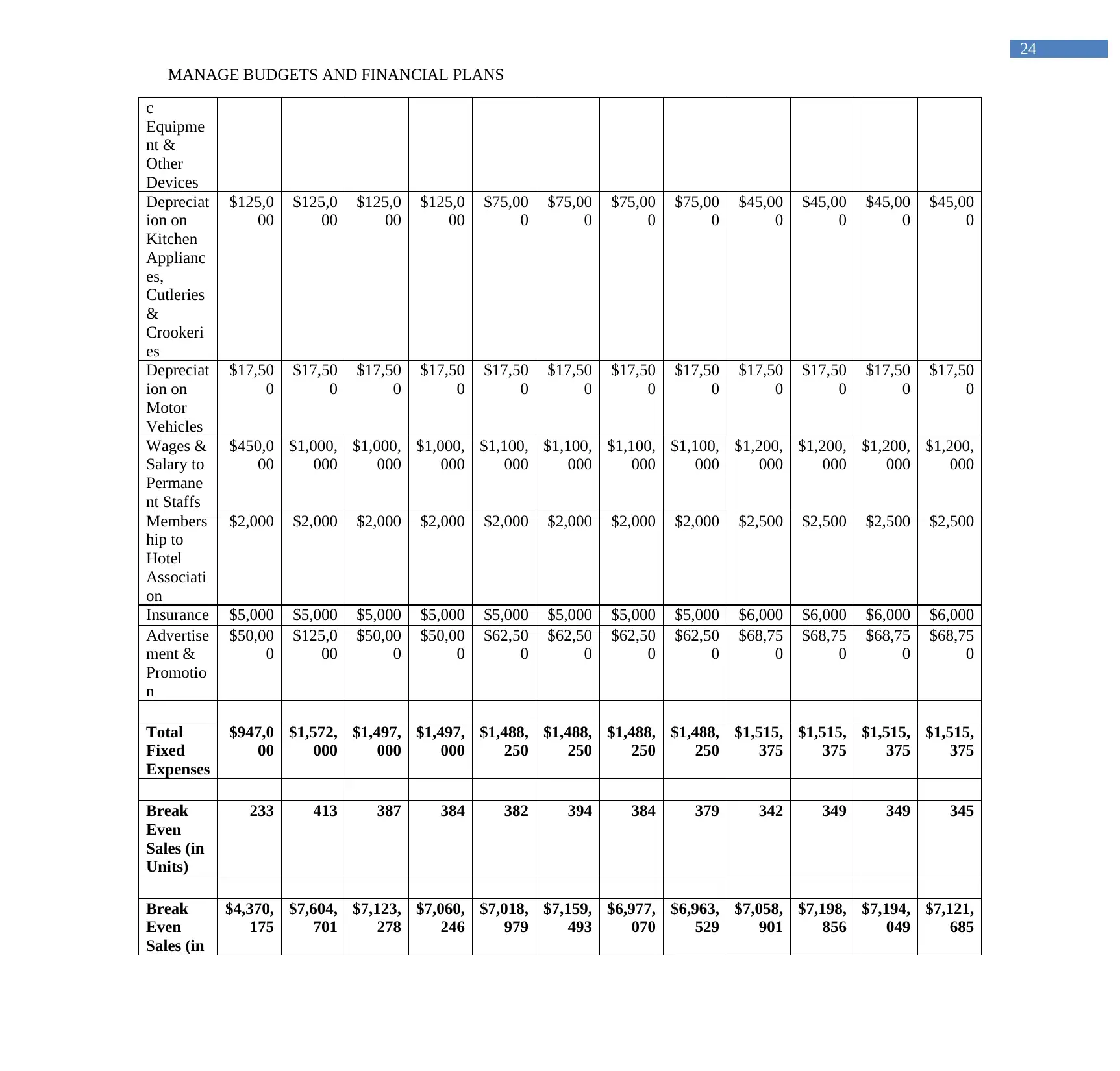

Break-even Analysis..................................................................................................................22

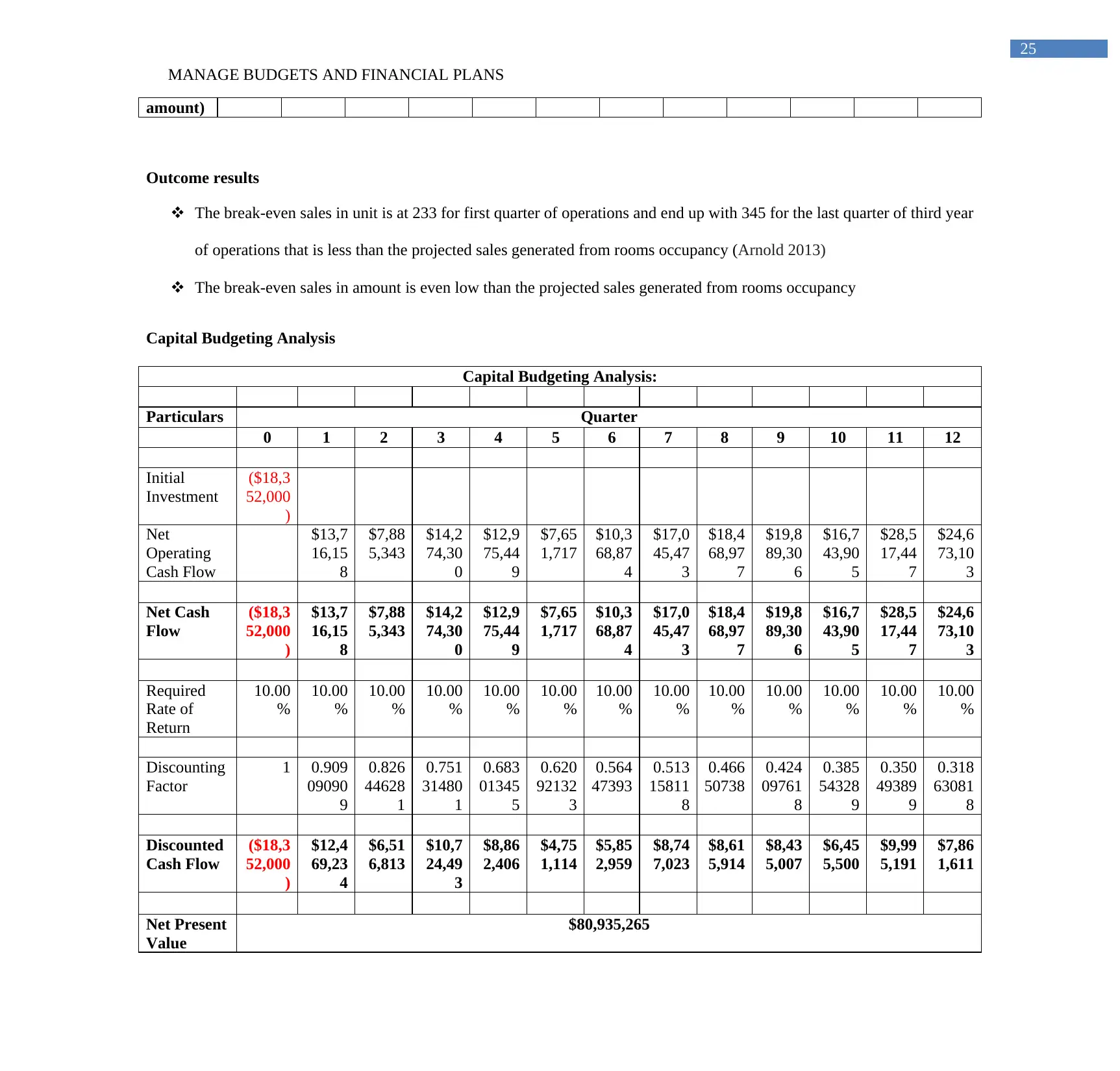

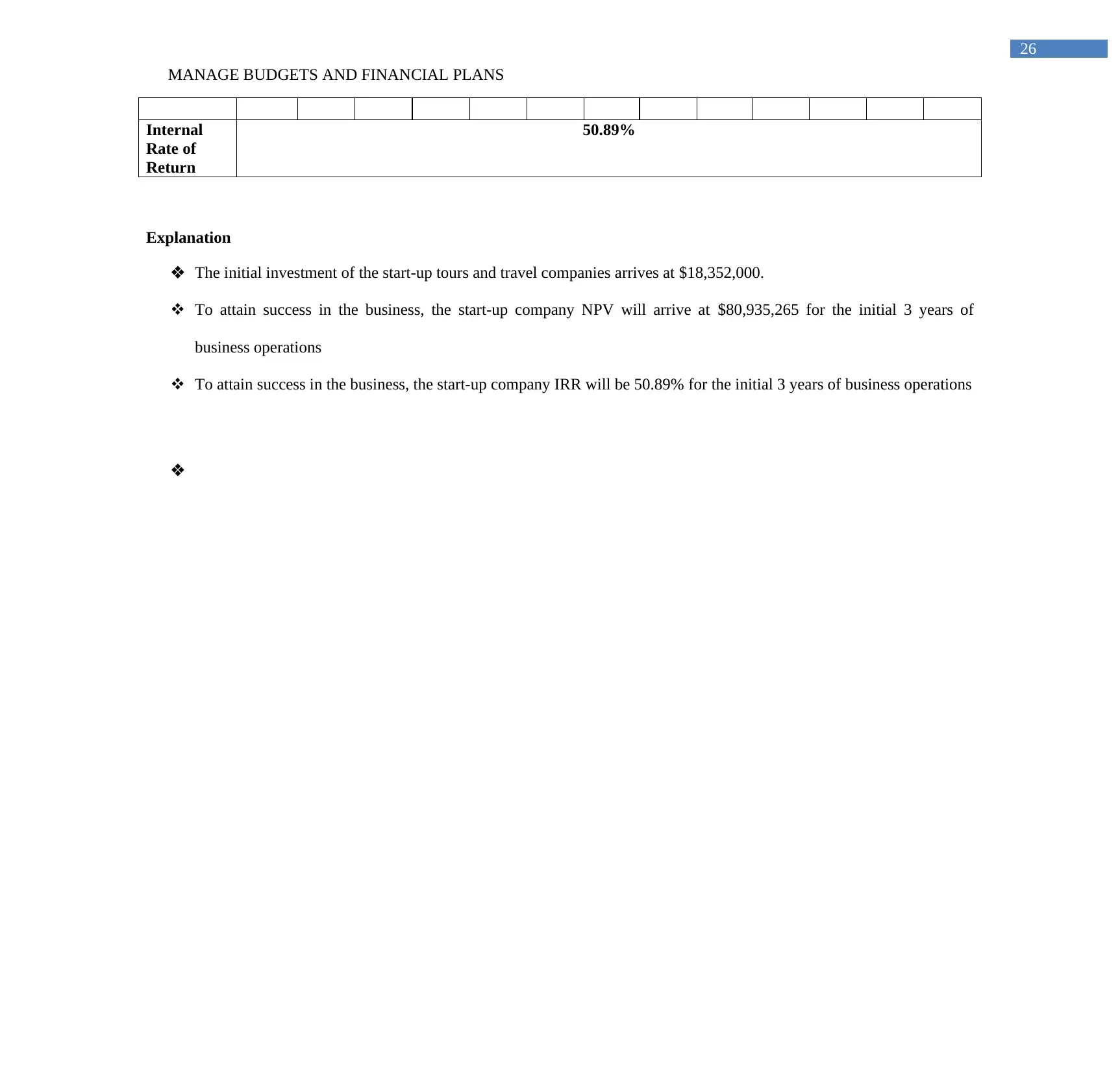

Capital Budgeting Analysis.......................................................................................................25

Projected Ratio Analysis............................................................................................................26

Reference List................................................................................................................................27

MANAGE BUDGETS AND FINANCIAL PLANS

Table of Contents

Introduction to Business investors or stakeholders.........................................................................3

Vision Statement of Adventure Travel and Tours Limited.........................................................3

Mission Statement of Adventure Travel and Tours Limited.......................................................3

Goal of Adventure Travel and Tours Limited.............................................................................3

Objectives of Adventure Travel and Tours Limited....................................................................3

Financial Plan..................................................................................................................................5

Basic Assumptions.......................................................................................................................5

Start-up Cost................................................................................................................................6

Depreciation and Amortization Schedule....................................................................................7

Projected Room Bookings...........................................................................................................8

Projected Sales Revenue............................................................................................................10

Projected Expenses....................................................................................................................11

Projected Income Statement......................................................................................................13

Projected Balance Sheet............................................................................................................15

Projected Cash Flow Statement.................................................................................................17

Break-even Analysis..................................................................................................................22

Capital Budgeting Analysis.......................................................................................................25

Projected Ratio Analysis............................................................................................................26

Reference List................................................................................................................................27

4

MANAGE BUDGETS AND FINANCIAL PLANS

Introduction to Business investors or stakeholders

Vision Statement of Adventure Travel and Tours Limited

The vision statement of Adventure Travel and Tours Limited is to become one of the

well-known tourist resorts in Australia in the eyes of community, people and customer. The start-

up tourist resort expects and demands the best that they desire to offer by keeping the service on

top of the choice of valued local visitors and tourists (Renz 2016).

Mission Statement of Adventure Travel and Tours Limited

The mission statement of Adventure Travel and Tours Limited is to offer superior

hospitality experience and enhance guest’s maximum satisfaction. In addition, the start-up tourist

resort believes in creation of positive work environment for attainment of results to satisfy

guests, investors and employees. Adventure Travel and Tours Limited aims at satisfying the

tourist and local visitors who actually travel for relaxation (Petty et al. 2015).

Goal of Adventure Travel and Tours Limited

The goal of Adventure Travel and Tours Limited is to satisfy the need of valued

customers and guests by conducting market research.

Objectives of Adventure Travel and Tours Limited

To exceed in the customer expectations where the start-up company will provide access

to luxury services to the valued customers in terms of tours, travels and resort

To maintain 90% occupancy rate at the time of peak periods

To hire experienced and hardworking staff members

MANAGE BUDGETS AND FINANCIAL PLANS

Introduction to Business investors or stakeholders

Vision Statement of Adventure Travel and Tours Limited

The vision statement of Adventure Travel and Tours Limited is to become one of the

well-known tourist resorts in Australia in the eyes of community, people and customer. The start-

up tourist resort expects and demands the best that they desire to offer by keeping the service on

top of the choice of valued local visitors and tourists (Renz 2016).

Mission Statement of Adventure Travel and Tours Limited

The mission statement of Adventure Travel and Tours Limited is to offer superior

hospitality experience and enhance guest’s maximum satisfaction. In addition, the start-up tourist

resort believes in creation of positive work environment for attainment of results to satisfy

guests, investors and employees. Adventure Travel and Tours Limited aims at satisfying the

tourist and local visitors who actually travel for relaxation (Petty et al. 2015).

Goal of Adventure Travel and Tours Limited

The goal of Adventure Travel and Tours Limited is to satisfy the need of valued

customers and guests by conducting market research.

Objectives of Adventure Travel and Tours Limited

To exceed in the customer expectations where the start-up company will provide access

to luxury services to the valued customers in terms of tours, travels and resort

To maintain 90% occupancy rate at the time of peak periods

To hire experienced and hardworking staff members

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

MANAGE BUDGETS AND FINANCIAL PLANS

Financial Plan

Basic Assumptions

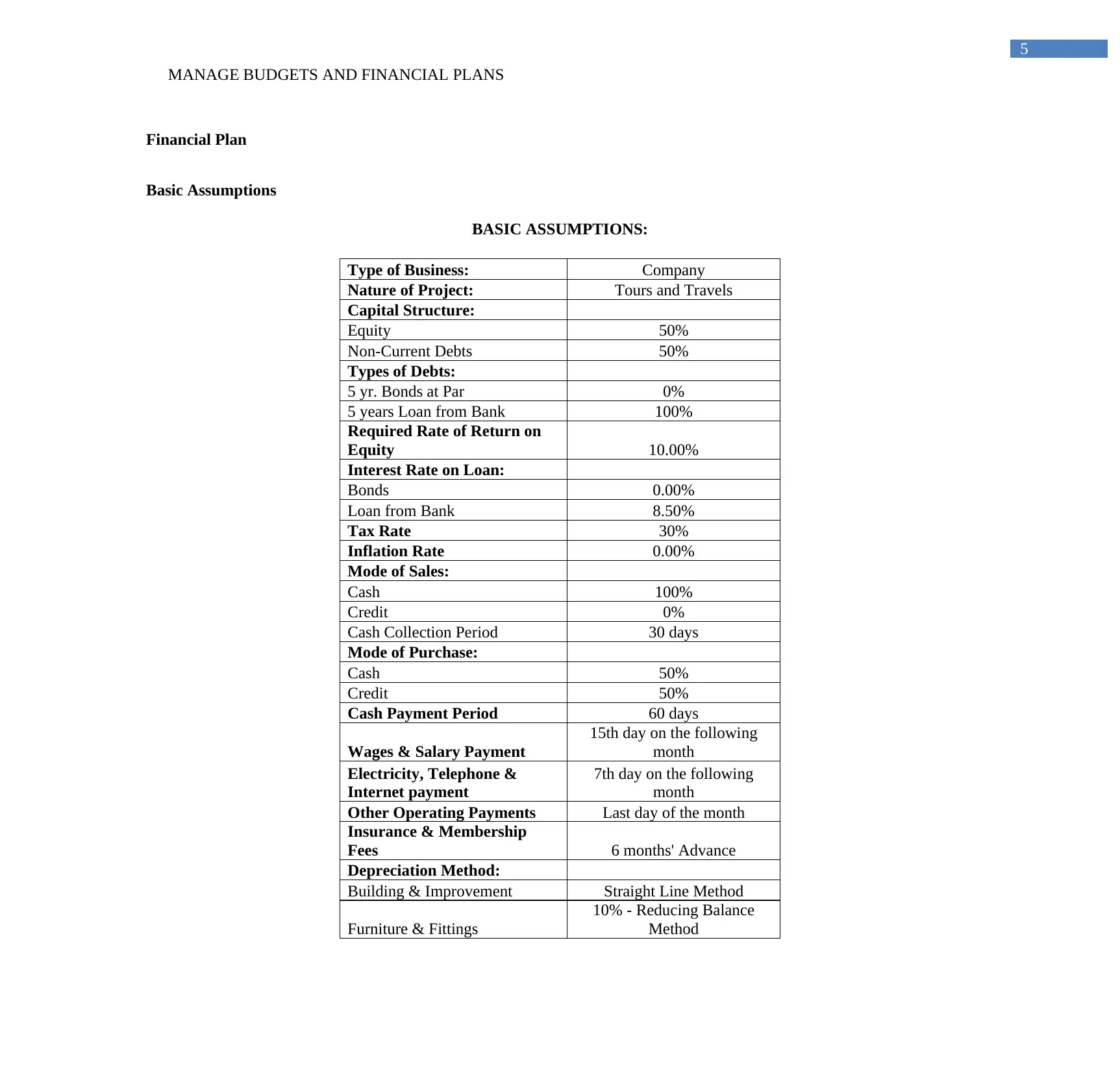

BASIC ASSUMPTIONS:

Type of Business: Company

Nature of Project: Tours and Travels

Capital Structure:

Equity 50%

Non-Current Debts 50%

Types of Debts:

5 yr. Bonds at Par 0%

5 years Loan from Bank 100%

Required Rate of Return on

Equity 10.00%

Interest Rate on Loan:

Bonds 0.00%

Loan from Bank 8.50%

Tax Rate 30%

Inflation Rate 0.00%

Mode of Sales:

Cash 100%

Credit 0%

Cash Collection Period 30 days

Mode of Purchase:

Cash 50%

Credit 50%

Cash Payment Period 60 days

Wages & Salary Payment

15th day on the following

month

Electricity, Telephone &

Internet payment

7th day on the following

month

Other Operating Payments Last day of the month

Insurance & Membership

Fees 6 months' Advance

Depreciation Method:

Building & Improvement Straight Line Method

Furniture & Fittings

10% - Reducing Balance

Method

MANAGE BUDGETS AND FINANCIAL PLANS

Financial Plan

Basic Assumptions

BASIC ASSUMPTIONS:

Type of Business: Company

Nature of Project: Tours and Travels

Capital Structure:

Equity 50%

Non-Current Debts 50%

Types of Debts:

5 yr. Bonds at Par 0%

5 years Loan from Bank 100%

Required Rate of Return on

Equity 10.00%

Interest Rate on Loan:

Bonds 0.00%

Loan from Bank 8.50%

Tax Rate 30%

Inflation Rate 0.00%

Mode of Sales:

Cash 100%

Credit 0%

Cash Collection Period 30 days

Mode of Purchase:

Cash 50%

Credit 50%

Cash Payment Period 60 days

Wages & Salary Payment

15th day on the following

month

Electricity, Telephone &

Internet payment

7th day on the following

month

Other Operating Payments Last day of the month

Insurance & Membership

Fees 6 months' Advance

Depreciation Method:

Building & Improvement Straight Line Method

Furniture & Fittings

10% - Reducing Balance

Method

6

MANAGE BUDGETS AND FINANCIAL PLANS

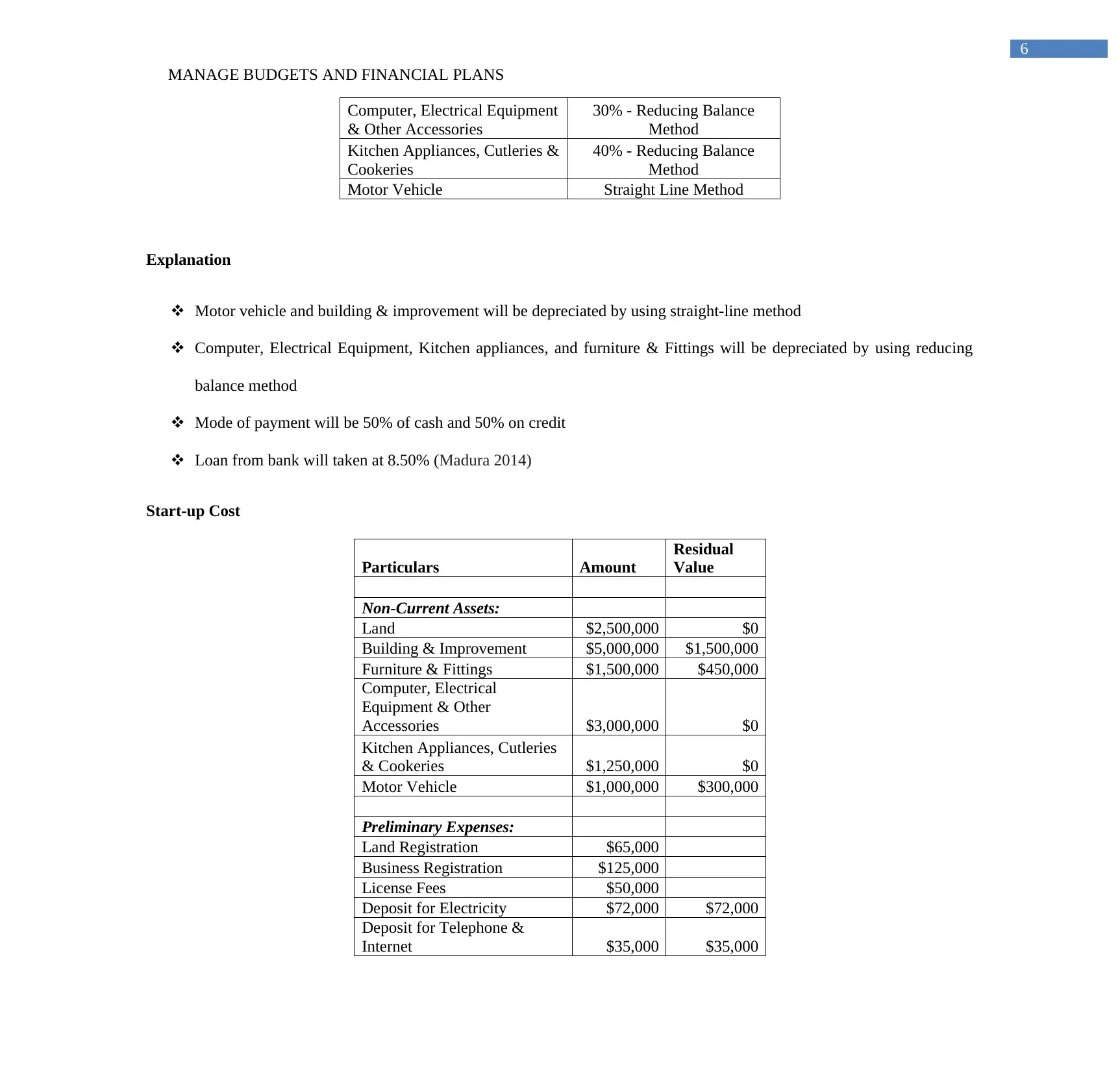

Computer, Electrical Equipment

& Other Accessories

30% - Reducing Balance

Method

Kitchen Appliances, Cutleries &

Cookeries

40% - Reducing Balance

Method

Motor Vehicle Straight Line Method

Explanation

Motor vehicle and building & improvement will be depreciated by using straight-line method

Computer, Electrical Equipment, Kitchen appliances, and furniture & Fittings will be depreciated by using reducing

balance method

Mode of payment will be 50% of cash and 50% on credit

Loan from bank will taken at 8.50% (Madura 2014)

Start-up Cost

Particulars Amount

Residual

Value

Non-Current Assets:

Land $2,500,000 $0

Building & Improvement $5,000,000 $1,500,000

Furniture & Fittings $1,500,000 $450,000

Computer, Electrical

Equipment & Other

Accessories $3,000,000 $0

Kitchen Appliances, Cutleries

& Cookeries $1,250,000 $0

Motor Vehicle $1,000,000 $300,000

Preliminary Expenses:

Land Registration $65,000

Business Registration $125,000

License Fees $50,000

Deposit for Electricity $72,000 $72,000

Deposit for Telephone &

Internet $35,000 $35,000

MANAGE BUDGETS AND FINANCIAL PLANS

Computer, Electrical Equipment

& Other Accessories

30% - Reducing Balance

Method

Kitchen Appliances, Cutleries &

Cookeries

40% - Reducing Balance

Method

Motor Vehicle Straight Line Method

Explanation

Motor vehicle and building & improvement will be depreciated by using straight-line method

Computer, Electrical Equipment, Kitchen appliances, and furniture & Fittings will be depreciated by using reducing

balance method

Mode of payment will be 50% of cash and 50% on credit

Loan from bank will taken at 8.50% (Madura 2014)

Start-up Cost

Particulars Amount

Residual

Value

Non-Current Assets:

Land $2,500,000 $0

Building & Improvement $5,000,000 $1,500,000

Furniture & Fittings $1,500,000 $450,000

Computer, Electrical

Equipment & Other

Accessories $3,000,000 $0

Kitchen Appliances, Cutleries

& Cookeries $1,250,000 $0

Motor Vehicle $1,000,000 $300,000

Preliminary Expenses:

Land Registration $65,000

Business Registration $125,000

License Fees $50,000

Deposit for Electricity $72,000 $72,000

Deposit for Telephone &

Internet $35,000 $35,000

7

MANAGE BUDGETS AND FINANCIAL PLANS

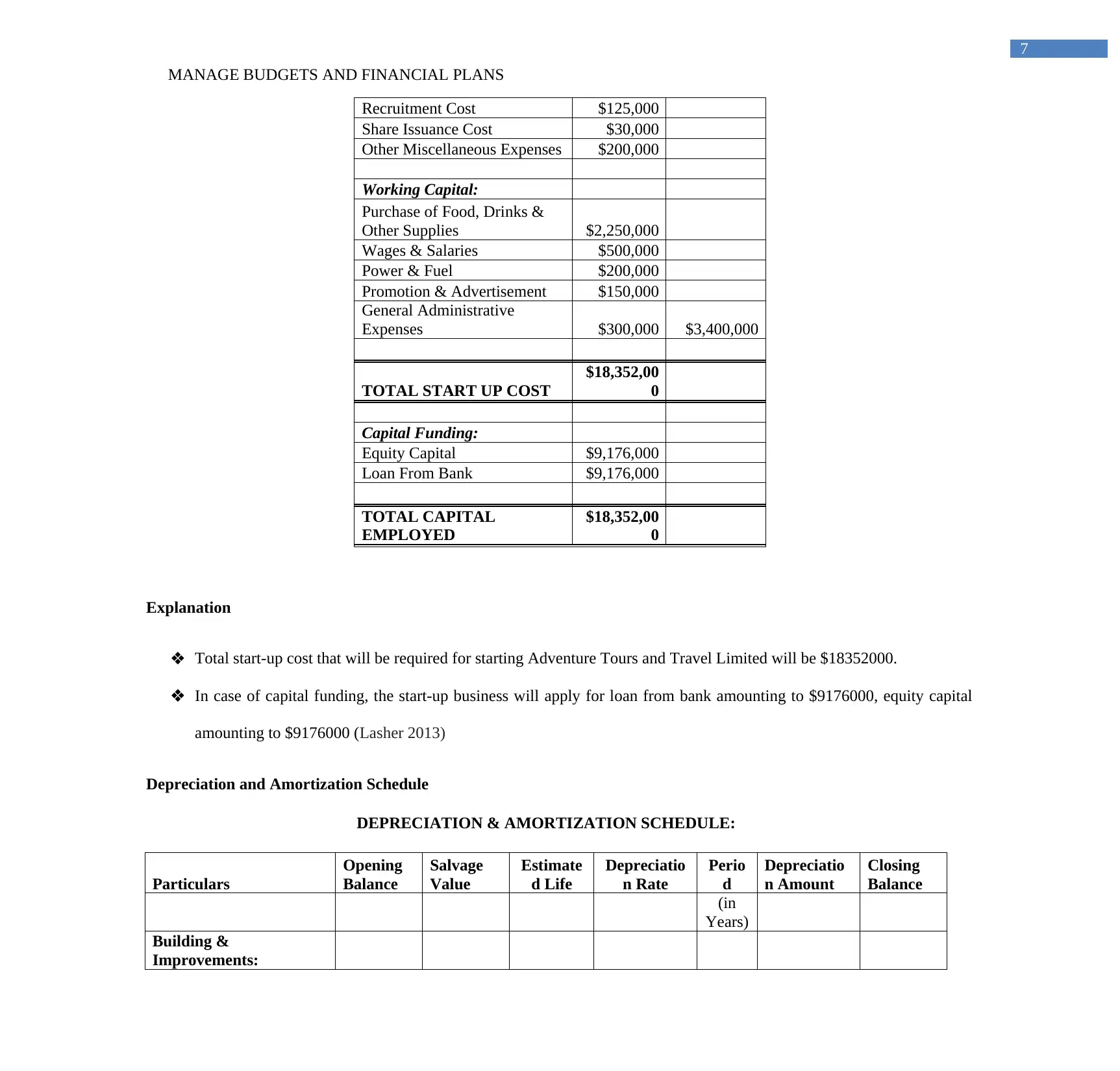

Recruitment Cost $125,000

Share Issuance Cost $30,000

Other Miscellaneous Expenses $200,000

Working Capital:

Purchase of Food, Drinks &

Other Supplies $2,250,000

Wages & Salaries $500,000

Power & Fuel $200,000

Promotion & Advertisement $150,000

General Administrative

Expenses $300,000 $3,400,000

TOTAL START UP COST

$18,352,00

0

Capital Funding:

Equity Capital $9,176,000

Loan From Bank $9,176,000

TOTAL CAPITAL

EMPLOYED

$18,352,00

0

Explanation

Total start-up cost that will be required for starting Adventure Tours and Travel Limited will be $18352000.

In case of capital funding, the start-up business will apply for loan from bank amounting to $9176000, equity capital

amounting to $9176000 (Lasher 2013)

Depreciation and Amortization Schedule

DEPRECIATION & AMORTIZATION SCHEDULE:

Particulars

Opening

Balance

Salvage

Value

Estimate

d Life

Depreciatio

n Rate

Perio

d

Depreciatio

n Amount

Closing

Balance

(in

Years)

Building &

Improvements:

MANAGE BUDGETS AND FINANCIAL PLANS

Recruitment Cost $125,000

Share Issuance Cost $30,000

Other Miscellaneous Expenses $200,000

Working Capital:

Purchase of Food, Drinks &

Other Supplies $2,250,000

Wages & Salaries $500,000

Power & Fuel $200,000

Promotion & Advertisement $150,000

General Administrative

Expenses $300,000 $3,400,000

TOTAL START UP COST

$18,352,00

0

Capital Funding:

Equity Capital $9,176,000

Loan From Bank $9,176,000

TOTAL CAPITAL

EMPLOYED

$18,352,00

0

Explanation

Total start-up cost that will be required for starting Adventure Tours and Travel Limited will be $18352000.

In case of capital funding, the start-up business will apply for loan from bank amounting to $9176000, equity capital

amounting to $9176000 (Lasher 2013)

Depreciation and Amortization Schedule

DEPRECIATION & AMORTIZATION SCHEDULE:

Particulars

Opening

Balance

Salvage

Value

Estimate

d Life

Depreciatio

n Rate

Perio

d

Depreciatio

n Amount

Closing

Balance

(in

Years)

Building &

Improvements:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

MANAGE BUDGETS AND FINANCIAL PLANS

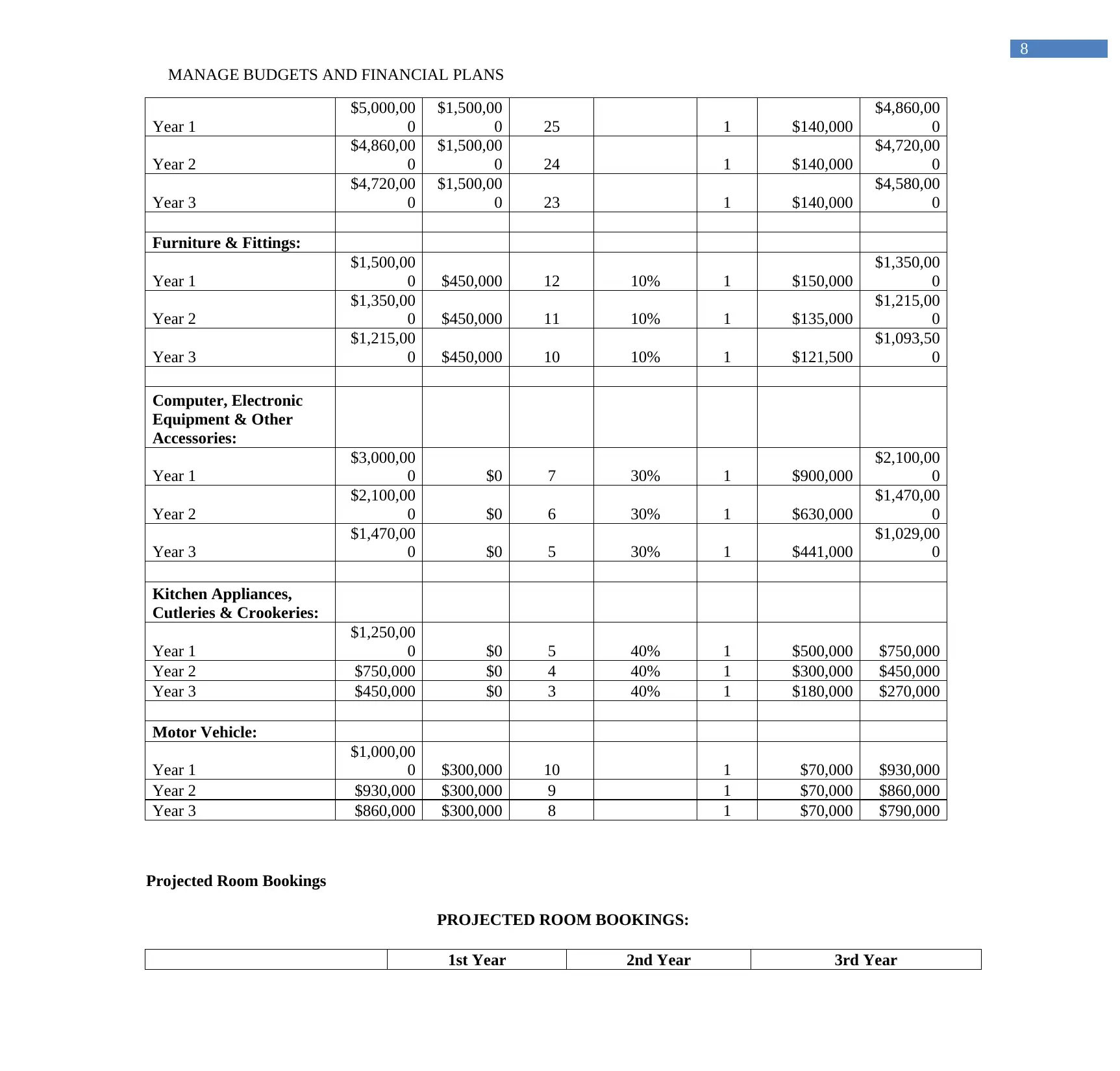

Year 1

$5,000,00

0

$1,500,00

0 25 1 $140,000

$4,860,00

0

Year 2

$4,860,00

0

$1,500,00

0 24 1 $140,000

$4,720,00

0

Year 3

$4,720,00

0

$1,500,00

0 23 1 $140,000

$4,580,00

0

Furniture & Fittings:

Year 1

$1,500,00

0 $450,000 12 10% 1 $150,000

$1,350,00

0

Year 2

$1,350,00

0 $450,000 11 10% 1 $135,000

$1,215,00

0

Year 3

$1,215,00

0 $450,000 10 10% 1 $121,500

$1,093,50

0

Computer, Electronic

Equipment & Other

Accessories:

Year 1

$3,000,00

0 $0 7 30% 1 $900,000

$2,100,00

0

Year 2

$2,100,00

0 $0 6 30% 1 $630,000

$1,470,00

0

Year 3

$1,470,00

0 $0 5 30% 1 $441,000

$1,029,00

0

Kitchen Appliances,

Cutleries & Crookeries:

Year 1

$1,250,00

0 $0 5 40% 1 $500,000 $750,000

Year 2 $750,000 $0 4 40% 1 $300,000 $450,000

Year 3 $450,000 $0 3 40% 1 $180,000 $270,000

Motor Vehicle:

Year 1

$1,000,00

0 $300,000 10 1 $70,000 $930,000

Year 2 $930,000 $300,000 9 1 $70,000 $860,000

Year 3 $860,000 $300,000 8 1 $70,000 $790,000

Projected Room Bookings

PROJECTED ROOM BOOKINGS:

1st Year 2nd Year 3rd Year

MANAGE BUDGETS AND FINANCIAL PLANS

Year 1

$5,000,00

0

$1,500,00

0 25 1 $140,000

$4,860,00

0

Year 2

$4,860,00

0

$1,500,00

0 24 1 $140,000

$4,720,00

0

Year 3

$4,720,00

0

$1,500,00

0 23 1 $140,000

$4,580,00

0

Furniture & Fittings:

Year 1

$1,500,00

0 $450,000 12 10% 1 $150,000

$1,350,00

0

Year 2

$1,350,00

0 $450,000 11 10% 1 $135,000

$1,215,00

0

Year 3

$1,215,00

0 $450,000 10 10% 1 $121,500

$1,093,50

0

Computer, Electronic

Equipment & Other

Accessories:

Year 1

$3,000,00

0 $0 7 30% 1 $900,000

$2,100,00

0

Year 2

$2,100,00

0 $0 6 30% 1 $630,000

$1,470,00

0

Year 3

$1,470,00

0 $0 5 30% 1 $441,000

$1,029,00

0

Kitchen Appliances,

Cutleries & Crookeries:

Year 1

$1,250,00

0 $0 5 40% 1 $500,000 $750,000

Year 2 $750,000 $0 4 40% 1 $300,000 $450,000

Year 3 $450,000 $0 3 40% 1 $180,000 $270,000

Motor Vehicle:

Year 1

$1,000,00

0 $300,000 10 1 $70,000 $930,000

Year 2 $930,000 $300,000 9 1 $70,000 $860,000

Year 3 $860,000 $300,000 8 1 $70,000 $790,000

Projected Room Bookings

PROJECTED ROOM BOOKINGS:

1st Year 2nd Year 3rd Year

9

MANAGE BUDGETS AND FINANCIAL PLANS

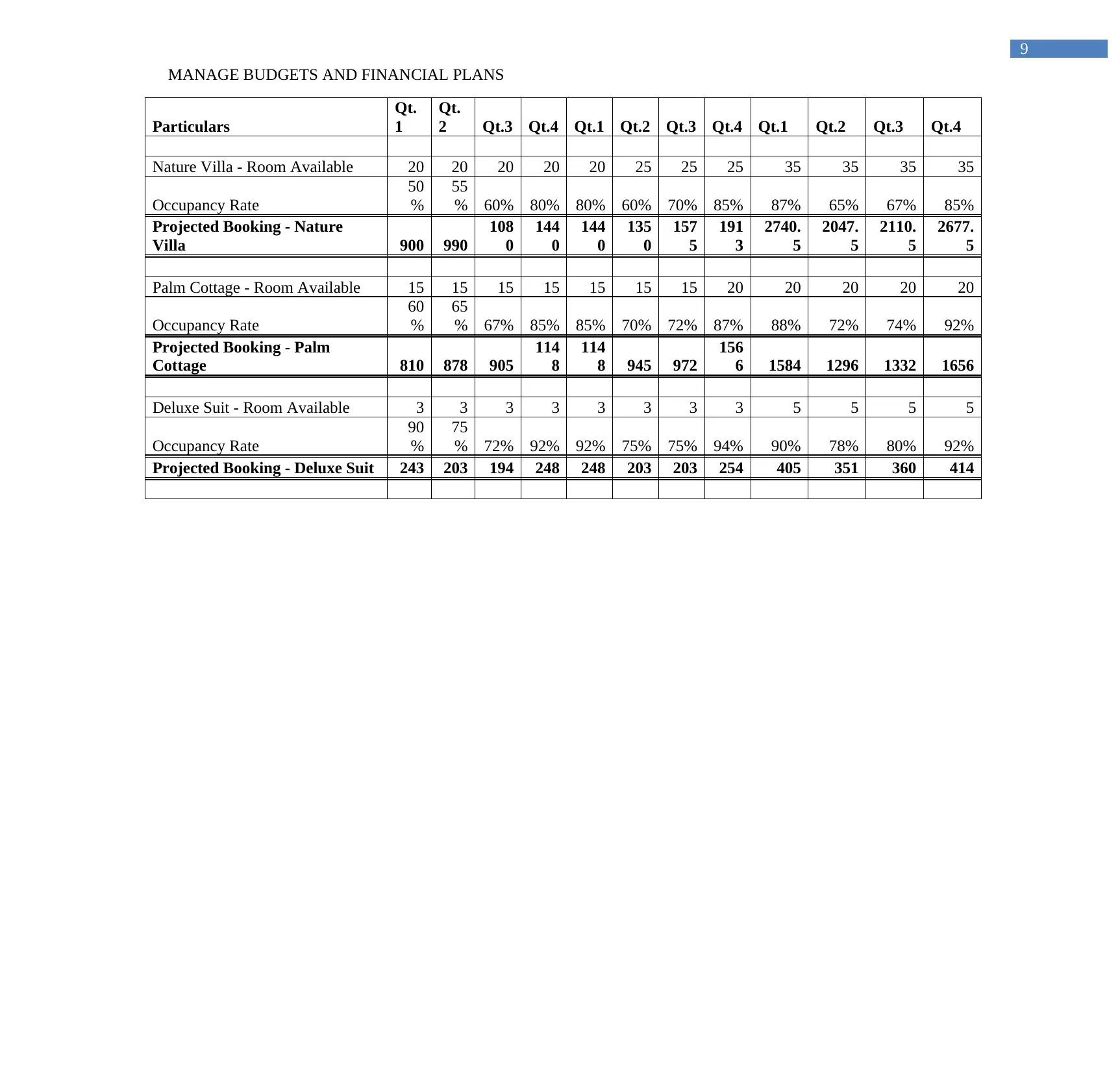

Particulars

Qt.

1

Qt.

2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

Nature Villa - Room Available 20 20 20 20 20 25 25 25 35 35 35 35

Occupancy Rate

50

%

55

% 60% 80% 80% 60% 70% 85% 87% 65% 67% 85%

Projected Booking - Nature

Villa 900 990

108

0

144

0

144

0

135

0

157

5

191

3

2740.

5

2047.

5

2110.

5

2677.

5

Palm Cottage - Room Available 15 15 15 15 15 15 15 20 20 20 20 20

Occupancy Rate

60

%

65

% 67% 85% 85% 70% 72% 87% 88% 72% 74% 92%

Projected Booking - Palm

Cottage 810 878 905

114

8

114

8 945 972

156

6 1584 1296 1332 1656

Deluxe Suit - Room Available 3 3 3 3 3 3 3 3 5 5 5 5

Occupancy Rate

90

%

75

% 72% 92% 92% 75% 75% 94% 90% 78% 80% 92%

Projected Booking - Deluxe Suit 243 203 194 248 248 203 203 254 405 351 360 414

MANAGE BUDGETS AND FINANCIAL PLANS

Particulars

Qt.

1

Qt.

2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

Nature Villa - Room Available 20 20 20 20 20 25 25 25 35 35 35 35

Occupancy Rate

50

%

55

% 60% 80% 80% 60% 70% 85% 87% 65% 67% 85%

Projected Booking - Nature

Villa 900 990

108

0

144

0

144

0

135

0

157

5

191

3

2740.

5

2047.

5

2110.

5

2677.

5

Palm Cottage - Room Available 15 15 15 15 15 15 15 20 20 20 20 20

Occupancy Rate

60

%

65

% 67% 85% 85% 70% 72% 87% 88% 72% 74% 92%

Projected Booking - Palm

Cottage 810 878 905

114

8

114

8 945 972

156

6 1584 1296 1332 1656

Deluxe Suit - Room Available 3 3 3 3 3 3 3 3 5 5 5 5

Occupancy Rate

90

%

75

% 72% 92% 92% 75% 75% 94% 90% 78% 80% 92%

Projected Booking - Deluxe Suit 243 203 194 248 248 203 203 254 405 351 360 414

10

MANAGE BUDGETS AND FINANCIAL PLANS

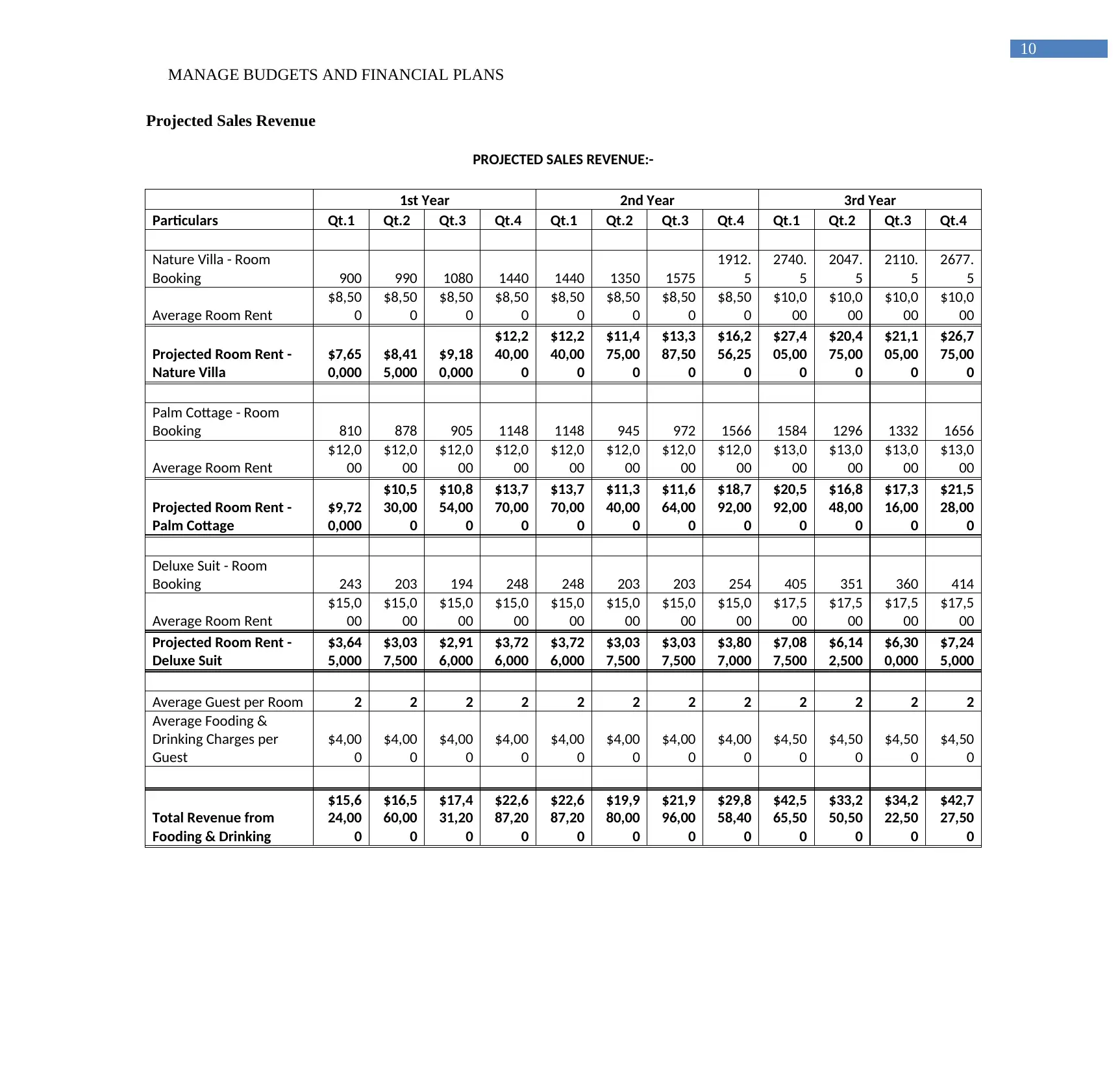

Projected Sales Revenue

PROJECTED SALES REVENUE:-

1st Year 2nd Year 3rd Year

Particulars Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

Nature Villa - Room

Booking 900 990 1080 1440 1440 1350 1575

1912.

5

2740.

5

2047.

5

2110.

5

2677.

5

Average Room Rent

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$10,0

00

$10,0

00

$10,0

00

$10,0

00

Projected Room Rent -

Nature Villa

$7,65

0,000

$8,41

5,000

$9,18

0,000

$12,2

40,00

0

$12,2

40,00

0

$11,4

75,00

0

$13,3

87,50

0

$16,2

56,25

0

$27,4

05,00

0

$20,4

75,00

0

$21,1

05,00

0

$26,7

75,00

0

Palm Cottage - Room

Booking 810 878 905 1148 1148 945 972 1566 1584 1296 1332 1656

Average Room Rent

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$13,0

00

$13,0

00

$13,0

00

$13,0

00

Projected Room Rent -

Palm Cottage

$9,72

0,000

$10,5

30,00

0

$10,8

54,00

0

$13,7

70,00

0

$13,7

70,00

0

$11,3

40,00

0

$11,6

64,00

0

$18,7

92,00

0

$20,5

92,00

0

$16,8

48,00

0

$17,3

16,00

0

$21,5

28,00

0

Deluxe Suit - Room

Booking 243 203 194 248 248 203 203 254 405 351 360 414

Average Room Rent

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$17,5

00

$17,5

00

$17,5

00

$17,5

00

Projected Room Rent -

Deluxe Suit

$3,64

5,000

$3,03

7,500

$2,91

6,000

$3,72

6,000

$3,72

6,000

$3,03

7,500

$3,03

7,500

$3,80

7,000

$7,08

7,500

$6,14

2,500

$6,30

0,000

$7,24

5,000

Average Guest per Room 2 2 2 2 2 2 2 2 2 2 2 2

Average Fooding &

Drinking Charges per

Guest

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,50

0

$4,50

0

$4,50

0

$4,50

0

Total Revenue from

Fooding & Drinking

$15,6

24,00

0

$16,5

60,00

0

$17,4

31,20

0

$22,6

87,20

0

$22,6

87,20

0

$19,9

80,00

0

$21,9

96,00

0

$29,8

58,40

0

$42,5

65,50

0

$33,2

50,50

0

$34,2

22,50

0

$42,7

27,50

0

MANAGE BUDGETS AND FINANCIAL PLANS

Projected Sales Revenue

PROJECTED SALES REVENUE:-

1st Year 2nd Year 3rd Year

Particulars Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

Nature Villa - Room

Booking 900 990 1080 1440 1440 1350 1575

1912.

5

2740.

5

2047.

5

2110.

5

2677.

5

Average Room Rent

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$8,50

0

$10,0

00

$10,0

00

$10,0

00

$10,0

00

Projected Room Rent -

Nature Villa

$7,65

0,000

$8,41

5,000

$9,18

0,000

$12,2

40,00

0

$12,2

40,00

0

$11,4

75,00

0

$13,3

87,50

0

$16,2

56,25

0

$27,4

05,00

0

$20,4

75,00

0

$21,1

05,00

0

$26,7

75,00

0

Palm Cottage - Room

Booking 810 878 905 1148 1148 945 972 1566 1584 1296 1332 1656

Average Room Rent

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$12,0

00

$13,0

00

$13,0

00

$13,0

00

$13,0

00

Projected Room Rent -

Palm Cottage

$9,72

0,000

$10,5

30,00

0

$10,8

54,00

0

$13,7

70,00

0

$13,7

70,00

0

$11,3

40,00

0

$11,6

64,00

0

$18,7

92,00

0

$20,5

92,00

0

$16,8

48,00

0

$17,3

16,00

0

$21,5

28,00

0

Deluxe Suit - Room

Booking 243 203 194 248 248 203 203 254 405 351 360 414

Average Room Rent

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$15,0

00

$17,5

00

$17,5

00

$17,5

00

$17,5

00

Projected Room Rent -

Deluxe Suit

$3,64

5,000

$3,03

7,500

$2,91

6,000

$3,72

6,000

$3,72

6,000

$3,03

7,500

$3,03

7,500

$3,80

7,000

$7,08

7,500

$6,14

2,500

$6,30

0,000

$7,24

5,000

Average Guest per Room 2 2 2 2 2 2 2 2 2 2 2 2

Average Fooding &

Drinking Charges per

Guest

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,00

0

$4,50

0

$4,50

0

$4,50

0

$4,50

0

Total Revenue from

Fooding & Drinking

$15,6

24,00

0

$16,5

60,00

0

$17,4

31,20

0

$22,6

87,20

0

$22,6

87,20

0

$19,9

80,00

0

$21,9

96,00

0

$29,8

58,40

0

$42,5

65,50

0

$33,2

50,50

0

$34,2

22,50

0

$42,7

27,50

0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

MANAGE BUDGETS AND FINANCIAL PLANS

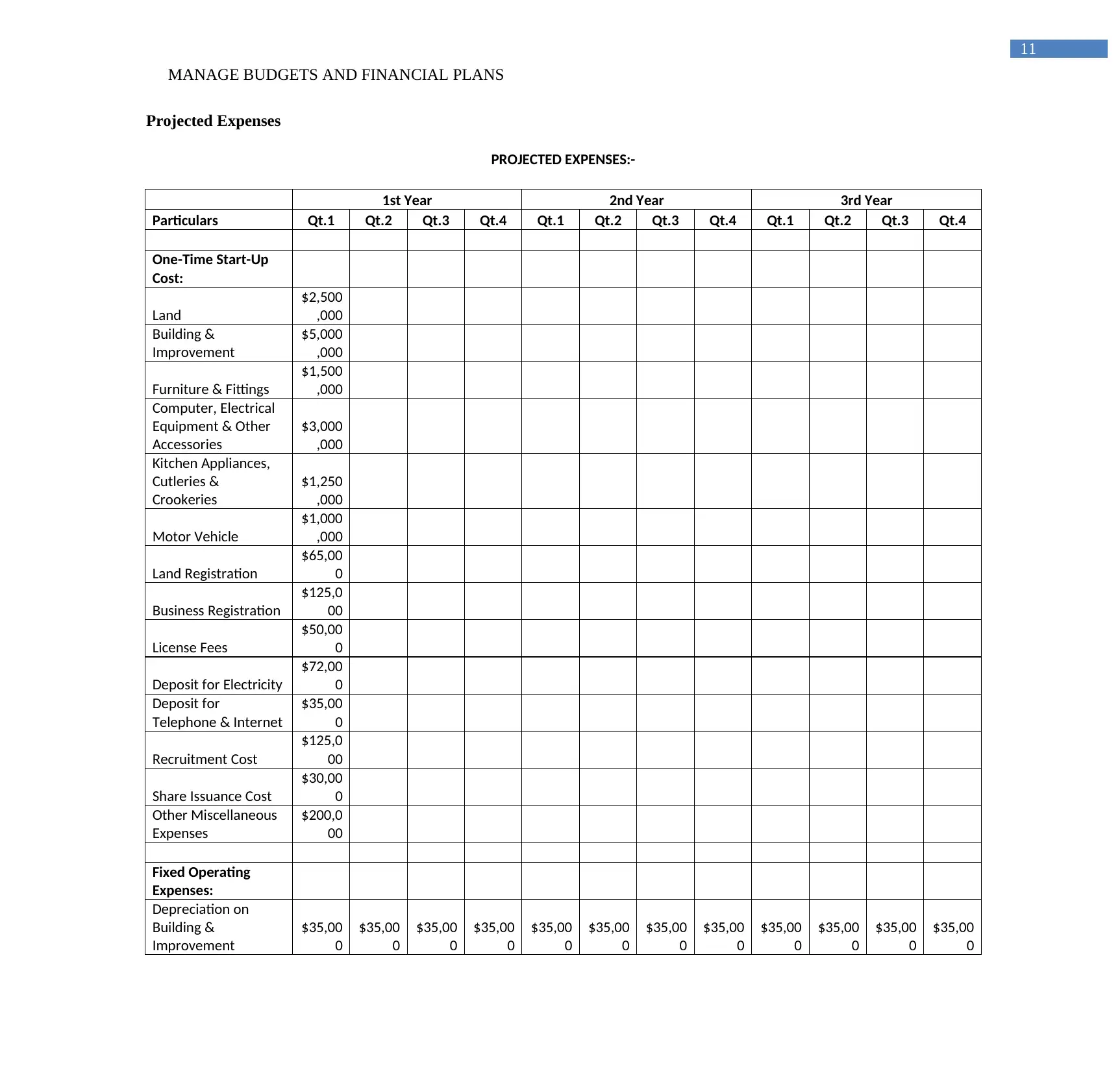

Projected Expenses

PROJECTED EXPENSES:-

1st Year 2nd Year 3rd Year

Particulars Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

One-Time Start-Up

Cost:

Land

$2,500

,000

Building &

Improvement

$5,000

,000

Furniture & Fittings

$1,500

,000

Computer, Electrical

Equipment & Other

Accessories

$3,000

,000

Kitchen Appliances,

Cutleries &

Crookeries

$1,250

,000

Motor Vehicle

$1,000

,000

Land Registration

$65,00

0

Business Registration

$125,0

00

License Fees

$50,00

0

Deposit for Electricity

$72,00

0

Deposit for

Telephone & Internet

$35,00

0

Recruitment Cost

$125,0

00

Share Issuance Cost

$30,00

0

Other Miscellaneous

Expenses

$200,0

00

Fixed Operating

Expenses:

Depreciation on

Building &

Improvement

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

MANAGE BUDGETS AND FINANCIAL PLANS

Projected Expenses

PROJECTED EXPENSES:-

1st Year 2nd Year 3rd Year

Particulars Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4 Qt.1 Qt.2 Qt.3 Qt.4

One-Time Start-Up

Cost:

Land

$2,500

,000

Building &

Improvement

$5,000

,000

Furniture & Fittings

$1,500

,000

Computer, Electrical

Equipment & Other

Accessories

$3,000

,000

Kitchen Appliances,

Cutleries &

Crookeries

$1,250

,000

Motor Vehicle

$1,000

,000

Land Registration

$65,00

0

Business Registration

$125,0

00

License Fees

$50,00

0

Deposit for Electricity

$72,00

0

Deposit for

Telephone & Internet

$35,00

0

Recruitment Cost

$125,0

00

Share Issuance Cost

$30,00

0

Other Miscellaneous

Expenses

$200,0

00

Fixed Operating

Expenses:

Depreciation on

Building &

Improvement

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

$35,00

0

12

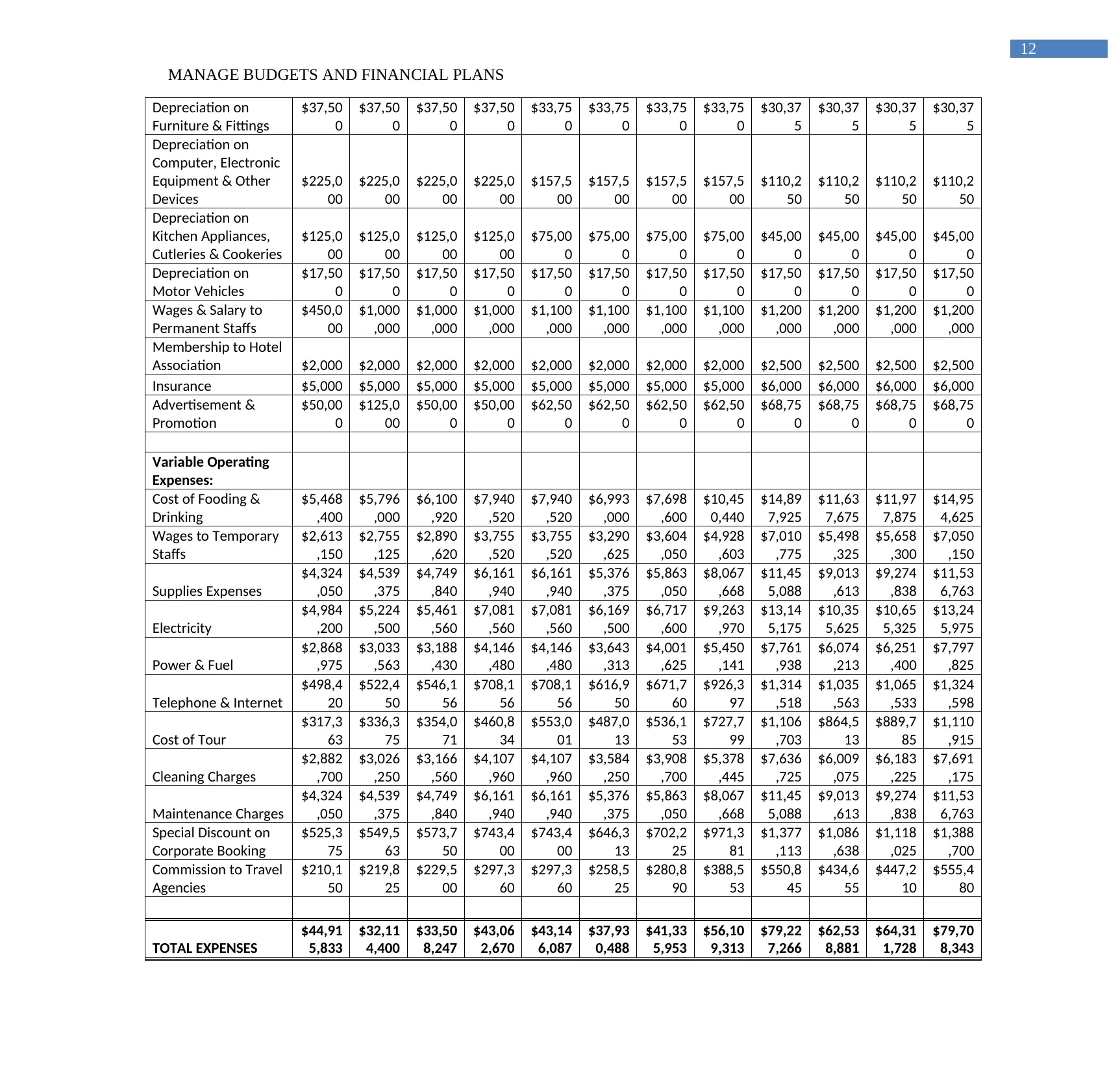

MANAGE BUDGETS AND FINANCIAL PLANS

Depreciation on

Furniture & Fittings

$37,50

0

$37,50

0

$37,50

0

$37,50

0

$33,75

0

$33,75

0

$33,75

0

$33,75

0

$30,37

5

$30,37

5

$30,37

5

$30,37

5

Depreciation on

Computer, Electronic

Equipment & Other

Devices

$225,0

00

$225,0

00

$225,0

00

$225,0

00

$157,5

00

$157,5

00

$157,5

00

$157,5

00

$110,2

50

$110,2

50

$110,2

50

$110,2

50

Depreciation on

Kitchen Appliances,

Cutleries & Cookeries

$125,0

00

$125,0

00

$125,0

00

$125,0

00

$75,00

0

$75,00

0

$75,00

0

$75,00

0

$45,00

0

$45,00

0

$45,00

0

$45,00

0

Depreciation on

Motor Vehicles

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

Wages & Salary to

Permanent Staffs

$450,0

00

$1,000

,000

$1,000

,000

$1,000

,000

$1,100

,000

$1,100

,000

$1,100

,000

$1,100

,000

$1,200

,000

$1,200

,000

$1,200

,000

$1,200

,000

Membership to Hotel

Association $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,500 $2,500 $2,500 $2,500

Insurance $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $6,000 $6,000 $6,000 $6,000

Advertisement &

Promotion

$50,00

0

$125,0

00

$50,00

0

$50,00

0

$62,50

0

$62,50

0

$62,50

0

$62,50

0

$68,75

0

$68,75

0

$68,75

0

$68,75

0

Variable Operating

Expenses:

Cost of Fooding &

Drinking

$5,468

,400

$5,796

,000

$6,100

,920

$7,940

,520

$7,940

,520

$6,993

,000

$7,698

,600

$10,45

0,440

$14,89

7,925

$11,63

7,675

$11,97

7,875

$14,95

4,625

Wages to Temporary

Staffs

$2,613

,150

$2,755

,125

$2,890

,620

$3,755

,520

$3,755

,520

$3,290

,625

$3,604

,050

$4,928

,603

$7,010

,775

$5,498

,325

$5,658

,300

$7,050

,150

Supplies Expenses

$4,324

,050

$4,539

,375

$4,749

,840

$6,161

,940

$6,161

,940

$5,376

,375

$5,863

,050

$8,067

,668

$11,45

5,088

$9,013

,613

$9,274

,838

$11,53

6,763

Electricity

$4,984

,200

$5,224

,500

$5,461

,560

$7,081

,560

$7,081

,560

$6,169

,500

$6,717

,600

$9,263

,970

$13,14

5,175

$10,35

5,625

$10,65

5,325

$13,24

5,975

Power & Fuel

$2,868

,975

$3,033

,563

$3,188

,430

$4,146

,480

$4,146

,480

$3,643

,313

$4,001

,625

$5,450

,141

$7,761

,938

$6,074

,213

$6,251

,400

$7,797

,825

Telephone & Internet

$498,4

20

$522,4

50

$546,1

56

$708,1

56

$708,1

56

$616,9

50

$671,7

60

$926,3

97

$1,314

,518

$1,035

,563

$1,065

,533

$1,324

,598

Cost of Tour

$317,3

63

$336,3

75

$354,0

71

$460,8

34

$553,0

01

$487,0

13

$536,1

53

$727,7

99

$1,106

,703

$864,5

13

$889,7

85

$1,110

,915

Cleaning Charges

$2,882

,700

$3,026

,250

$3,166

,560

$4,107

,960

$4,107

,960

$3,584

,250

$3,908

,700

$5,378

,445

$7,636

,725

$6,009

,075

$6,183

,225

$7,691

,175

Maintenance Charges

$4,324

,050

$4,539

,375

$4,749

,840

$6,161

,940

$6,161

,940

$5,376

,375

$5,863

,050

$8,067

,668

$11,45

5,088

$9,013

,613

$9,274

,838

$11,53

6,763

Special Discount on

Corporate Booking

$525,3

75

$549,5

63

$573,7

50

$743,4

00

$743,4

00

$646,3

13

$702,2

25

$971,3

81

$1,377

,113

$1,086

,638

$1,118

,025

$1,388

,700

Commission to Travel

Agencies

$210,1

50

$219,8

25

$229,5

00

$297,3

60

$297,3

60

$258,5

25

$280,8

90

$388,5

53

$550,8

45

$434,6

55

$447,2

10

$555,4

80

TOTAL EXPENSES

$44,91

5,833

$32,11

4,400

$33,50

8,247

$43,06

2,670

$43,14

6,087

$37,93

0,488

$41,33

5,953

$56,10

9,313

$79,22

7,266

$62,53

8,881

$64,31

1,728

$79,70

8,343

MANAGE BUDGETS AND FINANCIAL PLANS

Depreciation on

Furniture & Fittings

$37,50

0

$37,50

0

$37,50

0

$37,50

0

$33,75

0

$33,75

0

$33,75

0

$33,75

0

$30,37

5

$30,37

5

$30,37

5

$30,37

5

Depreciation on

Computer, Electronic

Equipment & Other

Devices

$225,0

00

$225,0

00

$225,0

00

$225,0

00

$157,5

00

$157,5

00

$157,5

00

$157,5

00

$110,2

50

$110,2

50

$110,2

50

$110,2

50

Depreciation on

Kitchen Appliances,

Cutleries & Cookeries

$125,0

00

$125,0

00

$125,0

00

$125,0

00

$75,00

0

$75,00

0

$75,00

0

$75,00

0

$45,00

0

$45,00

0

$45,00

0

$45,00

0

Depreciation on

Motor Vehicles

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

$17,50

0

Wages & Salary to

Permanent Staffs

$450,0

00

$1,000

,000

$1,000

,000

$1,000

,000

$1,100

,000

$1,100

,000

$1,100

,000

$1,100

,000

$1,200

,000

$1,200

,000

$1,200

,000

$1,200

,000

Membership to Hotel

Association $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,000 $2,500 $2,500 $2,500 $2,500

Insurance $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $5,000 $6,000 $6,000 $6,000 $6,000

Advertisement &

Promotion

$50,00

0

$125,0

00

$50,00

0

$50,00

0

$62,50

0

$62,50

0

$62,50

0

$62,50

0

$68,75

0

$68,75

0

$68,75

0

$68,75

0

Variable Operating

Expenses:

Cost of Fooding &

Drinking

$5,468

,400

$5,796

,000

$6,100

,920

$7,940

,520

$7,940

,520

$6,993

,000

$7,698

,600

$10,45

0,440

$14,89

7,925

$11,63

7,675

$11,97

7,875

$14,95

4,625

Wages to Temporary

Staffs

$2,613

,150

$2,755

,125

$2,890

,620

$3,755

,520

$3,755

,520

$3,290

,625

$3,604

,050

$4,928

,603

$7,010

,775

$5,498

,325

$5,658

,300

$7,050

,150

Supplies Expenses

$4,324

,050

$4,539

,375

$4,749

,840

$6,161

,940

$6,161

,940

$5,376

,375

$5,863

,050

$8,067

,668

$11,45

5,088

$9,013

,613

$9,274

,838

$11,53

6,763

Electricity

$4,984

,200

$5,224

,500

$5,461

,560

$7,081

,560

$7,081

,560

$6,169

,500

$6,717

,600

$9,263

,970

$13,14

5,175

$10,35

5,625

$10,65

5,325

$13,24

5,975

Power & Fuel

$2,868

,975

$3,033

,563

$3,188

,430

$4,146

,480

$4,146

,480

$3,643

,313

$4,001

,625

$5,450

,141

$7,761

,938

$6,074

,213

$6,251

,400

$7,797

,825

Telephone & Internet

$498,4

20

$522,4

50

$546,1

56

$708,1

56

$708,1

56

$616,9

50

$671,7

60

$926,3

97

$1,314

,518

$1,035

,563

$1,065

,533

$1,324

,598

Cost of Tour

$317,3

63

$336,3

75

$354,0

71

$460,8

34

$553,0

01

$487,0

13

$536,1

53

$727,7

99

$1,106

,703

$864,5

13

$889,7

85

$1,110

,915

Cleaning Charges

$2,882

,700

$3,026

,250

$3,166

,560

$4,107

,960

$4,107

,960

$3,584

,250

$3,908

,700

$5,378

,445

$7,636

,725

$6,009

,075

$6,183

,225

$7,691

,175

Maintenance Charges

$4,324

,050

$4,539

,375

$4,749

,840

$6,161

,940

$6,161

,940

$5,376

,375

$5,863

,050

$8,067

,668

$11,45

5,088

$9,013

,613

$9,274

,838

$11,53

6,763

Special Discount on

Corporate Booking

$525,3

75

$549,5

63

$573,7

50

$743,4

00

$743,4

00

$646,3

13

$702,2

25

$971,3

81

$1,377

,113

$1,086

,638

$1,118

,025

$1,388

,700

Commission to Travel

Agencies

$210,1

50

$219,8

25

$229,5

00

$297,3

60

$297,3

60

$258,5

25

$280,8

90

$388,5

53

$550,8

45

$434,6

55

$447,2

10

$555,4

80

TOTAL EXPENSES

$44,91

5,833

$32,11

4,400

$33,50

8,247

$43,06

2,670

$43,14

6,087

$37,93

0,488

$41,33

5,953

$56,10

9,313

$79,22

7,266

$62,53

8,881

$64,31

1,728

$79,70

8,343

13

MANAGE BUDGETS AND FINANCIAL PLANS

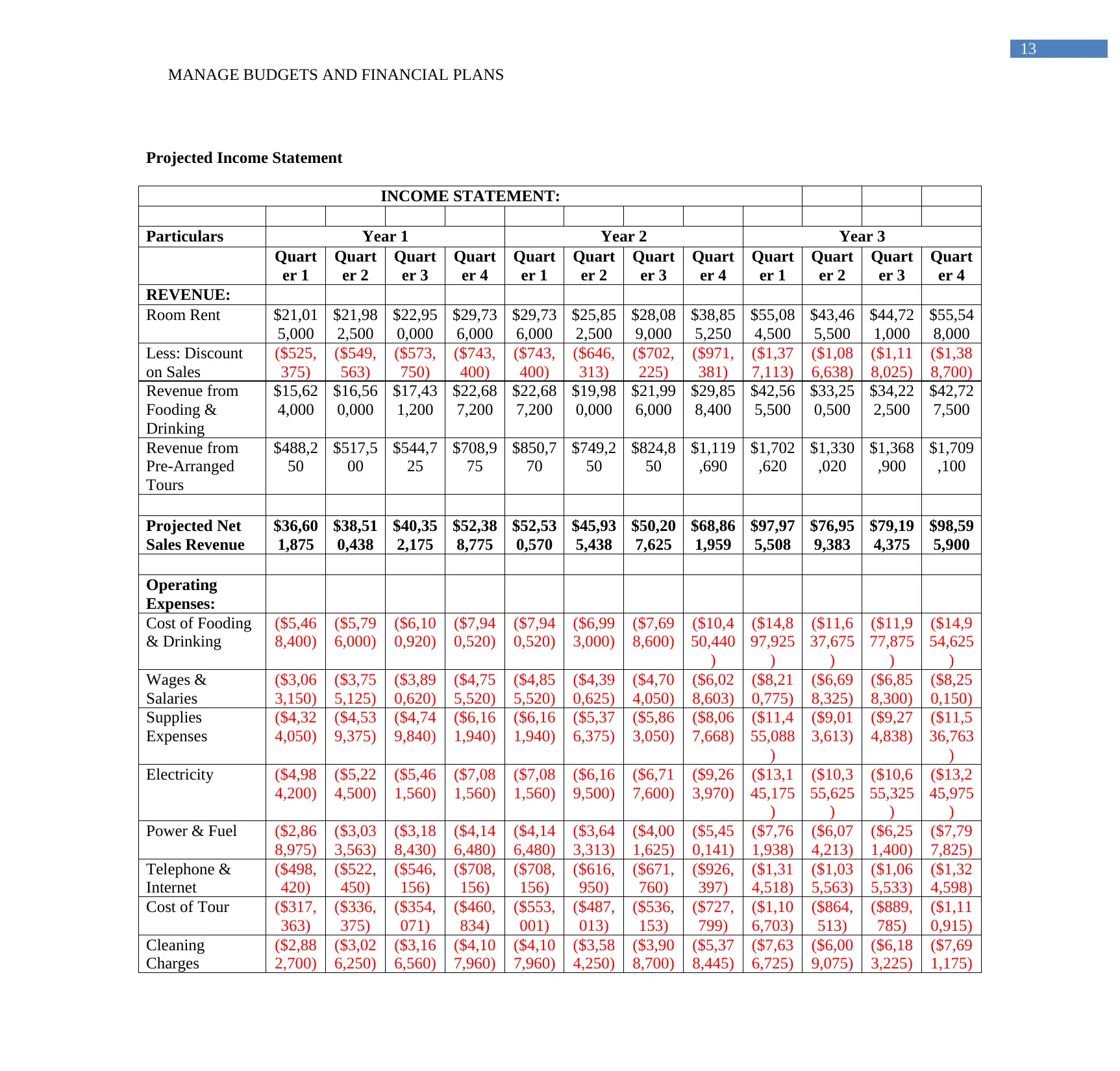

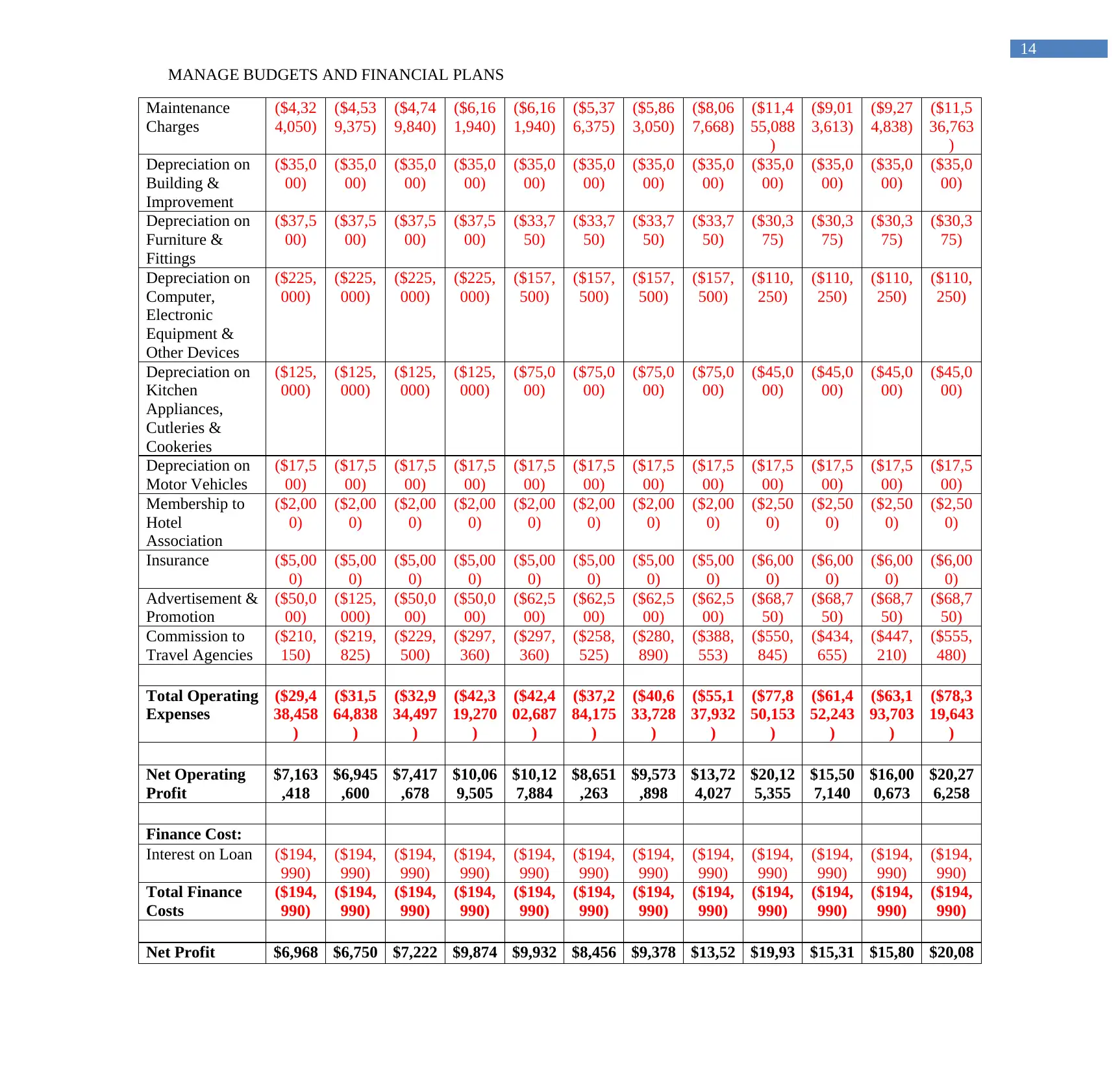

Projected Income Statement

INCOME STATEMENT:

Particulars Year 1 Year 2 Year 3

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

REVENUE:

Room Rent $21,01

5,000

$21,98

2,500

$22,95

0,000

$29,73

6,000

$29,73

6,000

$25,85

2,500

$28,08

9,000

$38,85

5,250

$55,08

4,500

$43,46

5,500

$44,72

1,000

$55,54

8,000

Less: Discount

on Sales

($525,

375)

($549,

563)

($573,

750)

($743,

400)

($743,

400)

($646,

313)

($702,

225)

($971,

381)

($1,37

7,113)

($1,08

6,638)

($1,11

8,025)

($1,38

8,700)

Revenue from

Fooding &

Drinking

$15,62

4,000

$16,56

0,000

$17,43

1,200

$22,68

7,200

$22,68

7,200

$19,98

0,000

$21,99

6,000

$29,85

8,400

$42,56

5,500

$33,25

0,500

$34,22

2,500

$42,72

7,500

Revenue from

Pre-Arranged

Tours

$488,2

50

$517,5

00

$544,7

25

$708,9

75

$850,7

70

$749,2

50

$824,8

50

$1,119

,690

$1,702

,620

$1,330

,020

$1,368

,900

$1,709

,100

Projected Net

Sales Revenue

$36,60

1,875

$38,51

0,438

$40,35

2,175

$52,38

8,775

$52,53

0,570

$45,93

5,438

$50,20

7,625

$68,86

1,959

$97,97

5,508

$76,95

9,383

$79,19

4,375

$98,59

5,900

Operating

Expenses:

Cost of Fooding

& Drinking

($5,46

8,400)

($5,79

6,000)

($6,10

0,920)

($7,94

0,520)

($7,94

0,520)

($6,99

3,000)

($7,69

8,600)

($10,4

50,440

)

($14,8

97,925

)

($11,6

37,675

)

($11,9

77,875

)

($14,9

54,625

)

Wages &

Salaries

($3,06

3,150)

($3,75

5,125)

($3,89

0,620)

($4,75

5,520)

($4,85

5,520)

($4,39

0,625)

($4,70

4,050)

($6,02

8,603)

($8,21

0,775)

($6,69

8,325)

($6,85

8,300)

($8,25

0,150)

Supplies

Expenses

($4,32

4,050)

($4,53

9,375)

($4,74

9,840)

($6,16

1,940)

($6,16

1,940)

($5,37

6,375)

($5,86

3,050)

($8,06

7,668)

($11,4

55,088

)

($9,01

3,613)

($9,27

4,838)

($11,5

36,763

)

Electricity ($4,98

4,200)

($5,22

4,500)

($5,46

1,560)

($7,08

1,560)

($7,08

1,560)

($6,16

9,500)

($6,71

7,600)

($9,26

3,970)

($13,1

45,175

)

($10,3

55,625

)

($10,6

55,325

)

($13,2

45,975

)

Power & Fuel ($2,86

8,975)

($3,03

3,563)

($3,18

8,430)

($4,14

6,480)

($4,14

6,480)

($3,64

3,313)

($4,00

1,625)

($5,45

0,141)

($7,76

1,938)

($6,07

4,213)

($6,25

1,400)

($7,79

7,825)

Telephone &

Internet

($498,

420)

($522,

450)

($546,

156)

($708,

156)

($708,

156)

($616,

950)

($671,

760)

($926,

397)

($1,31

4,518)

($1,03

5,563)

($1,06

5,533)

($1,32

4,598)

Cost of Tour ($317,

363)

($336,

375)

($354,

071)

($460,

834)

($553,

001)

($487,

013)

($536,

153)

($727,

799)

($1,10

6,703)

($864,

513)

($889,

785)

($1,11

0,915)

Cleaning

Charges

($2,88

2,700)

($3,02

6,250)

($3,16

6,560)

($4,10

7,960)

($4,10

7,960)

($3,58

4,250)

($3,90

8,700)

($5,37

8,445)

($7,63

6,725)

($6,00

9,075)

($6,18

3,225)

($7,69

1,175)

MANAGE BUDGETS AND FINANCIAL PLANS

Projected Income Statement

INCOME STATEMENT:

Particulars Year 1 Year 2 Year 3

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

REVENUE:

Room Rent $21,01

5,000

$21,98

2,500

$22,95

0,000

$29,73

6,000

$29,73

6,000

$25,85

2,500

$28,08

9,000

$38,85

5,250

$55,08

4,500

$43,46

5,500

$44,72

1,000

$55,54

8,000

Less: Discount

on Sales

($525,

375)

($549,

563)

($573,

750)

($743,

400)

($743,

400)

($646,

313)

($702,

225)

($971,

381)

($1,37

7,113)

($1,08

6,638)

($1,11

8,025)

($1,38

8,700)

Revenue from

Fooding &

Drinking

$15,62

4,000

$16,56

0,000

$17,43

1,200

$22,68

7,200

$22,68

7,200

$19,98

0,000

$21,99

6,000

$29,85

8,400

$42,56

5,500

$33,25

0,500

$34,22

2,500

$42,72

7,500

Revenue from

Pre-Arranged

Tours

$488,2

50

$517,5

00

$544,7

25

$708,9

75

$850,7

70

$749,2

50

$824,8

50

$1,119

,690

$1,702

,620

$1,330

,020

$1,368

,900

$1,709

,100

Projected Net

Sales Revenue

$36,60

1,875

$38,51

0,438

$40,35

2,175

$52,38

8,775

$52,53

0,570

$45,93

5,438

$50,20

7,625

$68,86

1,959

$97,97

5,508

$76,95

9,383

$79,19

4,375

$98,59

5,900

Operating

Expenses:

Cost of Fooding

& Drinking

($5,46

8,400)

($5,79

6,000)

($6,10

0,920)

($7,94

0,520)

($7,94

0,520)

($6,99

3,000)

($7,69

8,600)

($10,4

50,440

)

($14,8

97,925

)

($11,6

37,675

)

($11,9

77,875

)

($14,9

54,625

)

Wages &

Salaries

($3,06

3,150)

($3,75

5,125)

($3,89

0,620)

($4,75

5,520)

($4,85

5,520)

($4,39

0,625)

($4,70

4,050)

($6,02

8,603)

($8,21

0,775)

($6,69

8,325)

($6,85

8,300)

($8,25

0,150)

Supplies

Expenses

($4,32

4,050)

($4,53

9,375)

($4,74

9,840)

($6,16

1,940)

($6,16

1,940)

($5,37

6,375)

($5,86

3,050)

($8,06

7,668)

($11,4

55,088

)

($9,01

3,613)

($9,27

4,838)

($11,5

36,763

)

Electricity ($4,98

4,200)

($5,22

4,500)

($5,46

1,560)

($7,08

1,560)

($7,08

1,560)

($6,16

9,500)

($6,71

7,600)

($9,26

3,970)

($13,1

45,175

)

($10,3

55,625

)

($10,6

55,325

)

($13,2

45,975

)

Power & Fuel ($2,86

8,975)

($3,03

3,563)

($3,18

8,430)

($4,14

6,480)

($4,14

6,480)

($3,64

3,313)

($4,00

1,625)

($5,45

0,141)

($7,76

1,938)

($6,07

4,213)

($6,25

1,400)

($7,79

7,825)

Telephone &

Internet

($498,

420)

($522,

450)

($546,

156)

($708,

156)

($708,

156)

($616,

950)

($671,

760)

($926,

397)

($1,31

4,518)

($1,03

5,563)

($1,06

5,533)

($1,32

4,598)

Cost of Tour ($317,

363)

($336,

375)

($354,

071)

($460,

834)

($553,

001)

($487,

013)

($536,

153)

($727,

799)

($1,10

6,703)

($864,

513)

($889,

785)

($1,11

0,915)

Cleaning

Charges

($2,88

2,700)

($3,02

6,250)

($3,16

6,560)

($4,10

7,960)

($4,10

7,960)

($3,58

4,250)

($3,90

8,700)

($5,37

8,445)

($7,63

6,725)

($6,00

9,075)

($6,18

3,225)

($7,69

1,175)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

MANAGE BUDGETS AND FINANCIAL PLANS

Maintenance

Charges

($4,32

4,050)

($4,53

9,375)

($4,74

9,840)

($6,16

1,940)

($6,16

1,940)

($5,37

6,375)

($5,86

3,050)

($8,06

7,668)

($11,4

55,088

)

($9,01

3,613)

($9,27

4,838)

($11,5

36,763

)

Depreciation on

Building &

Improvement

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

Depreciation on

Furniture &

Fittings

($37,5

00)

($37,5

00)

($37,5

00)

($37,5

00)

($33,7

50)

($33,7

50)

($33,7

50)

($33,7

50)

($30,3

75)

($30,3

75)

($30,3

75)

($30,3

75)

Depreciation on

Computer,

Electronic

Equipment &

Other Devices

($225,

000)

($225,

000)

($225,

000)

($225,

000)

($157,

500)

($157,

500)

($157,

500)

($157,

500)

($110,

250)

($110,

250)

($110,

250)

($110,

250)

Depreciation on

Kitchen

Appliances,

Cutleries &

Cookeries

($125,

000)

($125,

000)

($125,

000)

($125,

000)

($75,0

00)

($75,0

00)

($75,0

00)

($75,0

00)

($45,0

00)

($45,0

00)

($45,0

00)

($45,0

00)

Depreciation on

Motor Vehicles

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

Membership to

Hotel

Association

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,50

0)

($2,50

0)

($2,50

0)

($2,50

0)

Insurance ($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($6,00

0)

($6,00

0)

($6,00

0)

($6,00

0)

Advertisement &

Promotion

($50,0

00)

($125,

000)

($50,0

00)

($50,0

00)

($62,5

00)

($62,5

00)

($62,5

00)

($62,5

00)

($68,7

50)

($68,7

50)

($68,7

50)

($68,7

50)

Commission to

Travel Agencies

($210,

150)

($219,

825)

($229,

500)

($297,

360)

($297,

360)

($258,

525)

($280,

890)

($388,

553)

($550,

845)

($434,

655)

($447,

210)

($555,

480)

Total Operating

Expenses

($29,4

38,458

)

($31,5

64,838

)

($32,9

34,497

)

($42,3

19,270

)

($42,4

02,687

)

($37,2

84,175

)

($40,6

33,728

)

($55,1

37,932

)

($77,8

50,153

)

($61,4

52,243

)

($63,1

93,703

)

($78,3

19,643

)

Net Operating

Profit

$7,163

,418

$6,945

,600

$7,417

,678

$10,06

9,505

$10,12

7,884

$8,651

,263

$9,573

,898

$13,72

4,027

$20,12

5,355

$15,50

7,140

$16,00

0,673

$20,27

6,258

Finance Cost:

Interest on Loan ($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

Total Finance

Costs

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

Net Profit $6,968 $6,750 $7,222 $9,874 $9,932 $8,456 $9,378 $13,52 $19,93 $15,31 $15,80 $20,08

MANAGE BUDGETS AND FINANCIAL PLANS

Maintenance

Charges

($4,32

4,050)

($4,53

9,375)

($4,74

9,840)

($6,16

1,940)

($6,16

1,940)

($5,37

6,375)

($5,86

3,050)

($8,06

7,668)

($11,4

55,088

)

($9,01

3,613)

($9,27

4,838)

($11,5

36,763

)

Depreciation on

Building &

Improvement

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

($35,0

00)

Depreciation on

Furniture &

Fittings

($37,5

00)

($37,5

00)

($37,5

00)

($37,5

00)

($33,7

50)

($33,7

50)

($33,7

50)

($33,7

50)

($30,3

75)

($30,3

75)

($30,3

75)

($30,3

75)

Depreciation on

Computer,

Electronic

Equipment &

Other Devices

($225,

000)

($225,

000)

($225,

000)

($225,

000)

($157,

500)

($157,

500)

($157,

500)

($157,

500)

($110,

250)

($110,

250)

($110,

250)

($110,

250)

Depreciation on

Kitchen

Appliances,

Cutleries &

Cookeries

($125,

000)

($125,

000)

($125,

000)

($125,

000)

($75,0

00)

($75,0

00)

($75,0

00)

($75,0

00)

($45,0

00)

($45,0

00)

($45,0

00)

($45,0

00)

Depreciation on

Motor Vehicles

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

($17,5

00)

Membership to

Hotel

Association

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,00

0)

($2,50

0)

($2,50

0)

($2,50

0)

($2,50

0)

Insurance ($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($5,00

0)

($6,00

0)

($6,00

0)

($6,00

0)

($6,00

0)

Advertisement &

Promotion

($50,0

00)

($125,

000)

($50,0

00)

($50,0

00)

($62,5

00)

($62,5

00)

($62,5

00)

($62,5

00)

($68,7

50)

($68,7

50)

($68,7

50)

($68,7

50)

Commission to

Travel Agencies

($210,

150)

($219,

825)

($229,

500)

($297,

360)

($297,

360)

($258,

525)

($280,

890)

($388,

553)

($550,

845)

($434,

655)

($447,

210)

($555,

480)

Total Operating

Expenses

($29,4

38,458

)

($31,5

64,838

)

($32,9

34,497

)

($42,3

19,270

)

($42,4

02,687

)

($37,2

84,175

)

($40,6

33,728

)

($55,1

37,932

)

($77,8

50,153

)

($61,4

52,243

)

($63,1

93,703

)

($78,3

19,643

)

Net Operating

Profit

$7,163

,418

$6,945

,600

$7,417

,678

$10,06

9,505

$10,12

7,884

$8,651

,263

$9,573

,898

$13,72

4,027

$20,12

5,355

$15,50

7,140

$16,00

0,673

$20,27

6,258

Finance Cost:

Interest on Loan ($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

Total Finance

Costs

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

($194,

990)

Net Profit $6,968 $6,750 $7,222 $9,874 $9,932 $8,456 $9,378 $13,52 $19,93 $15,31 $15,80 $20,08

15

MANAGE BUDGETS AND FINANCIAL PLANS

before Tax ,428 ,610 ,688 ,515 ,894 ,273 ,908 9,037 0,365 2,150 5,683 1,268

Income Tax

Expenses

($2,09

0,528)

($2,02

5,183)

($2,16

6,806)

($2,96

2,355)

($2,97

9,868)

($2,53

6,882)

($2,81

3,672)

($4,05

8,711)

($5,97

9,109)

($4,59

3,645)

($4,74

1,705)

($6,02

4,380)

Net Profit for

the period

$4,877

,899

$4,725

,427

$5,055

,881

$6,912

,161

$6,953

,025

$5,919

,391

$6,565

,235

$9,470

,326

$13,95

1,255

$10,71

8,505

$11,06

3,978

$14,05

6,887

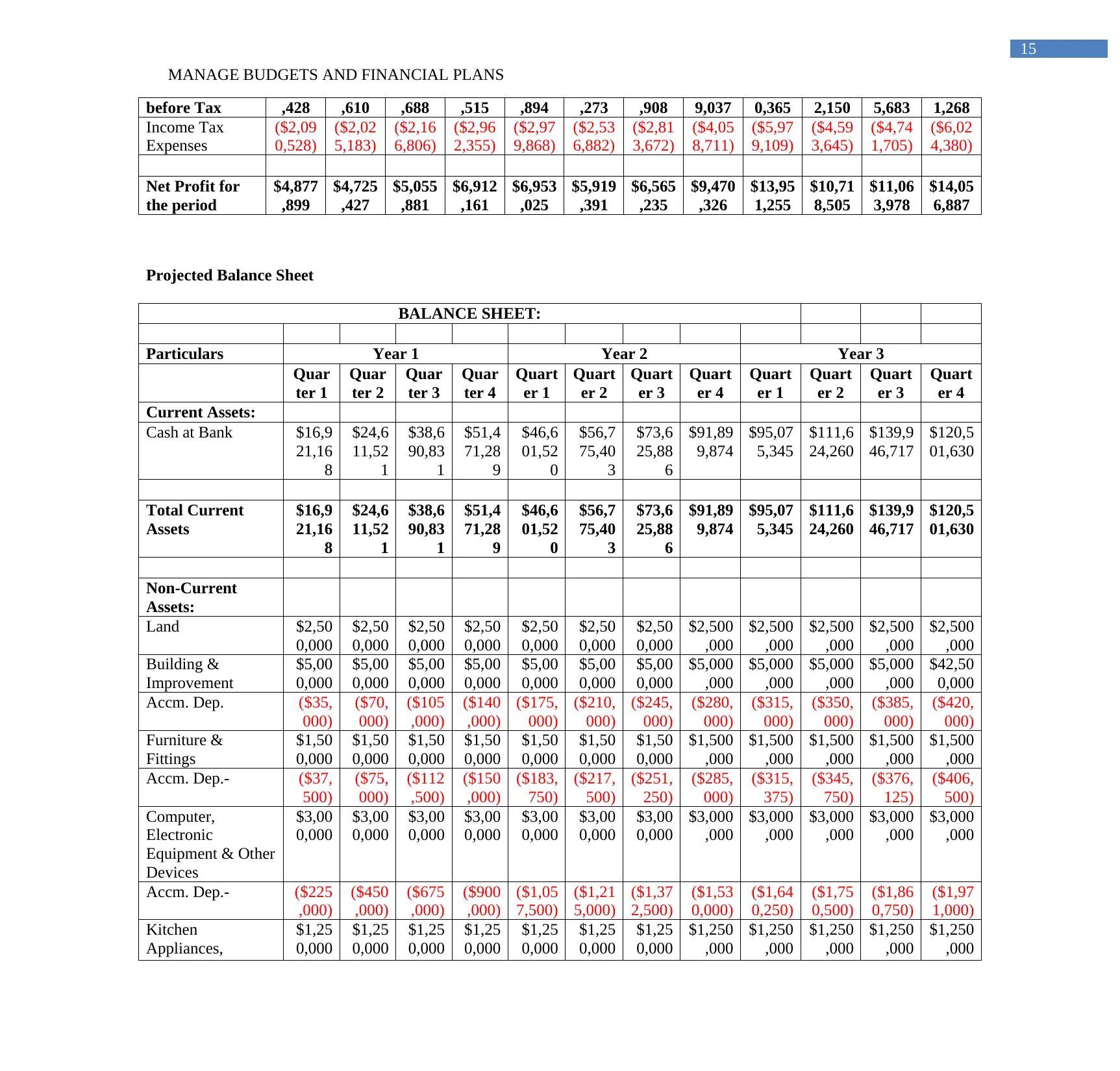

Projected Balance Sheet

BALANCE SHEET:

Particulars Year 1 Year 2 Year 3

Quar

ter 1

Quar

ter 2

Quar

ter 3

Quar

ter 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Current Assets:

Cash at Bank $16,9

21,16

8

$24,6

11,52

1

$38,6

90,83

1

$51,4

71,28

9

$46,6

01,52

0

$56,7

75,40

3

$73,6

25,88

6

$91,89

9,874

$95,07

5,345

$111,6

24,260

$139,9

46,717

$120,5

01,630

Total Current

Assets

$16,9

21,16

8

$24,6

11,52

1

$38,6

90,83

1

$51,4

71,28

9

$46,6

01,52

0

$56,7

75,40

3

$73,6

25,88

6

$91,89

9,874

$95,07

5,345

$111,6

24,260

$139,9

46,717

$120,5

01,630

Non-Current

Assets:

Land $2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,500

,000

$2,500

,000

$2,500

,000

$2,500

,000

$2,500

,000

Building &

Improvement

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,000

,000

$5,000

,000

$5,000

,000

$5,000

,000

$42,50

0,000

Accm. Dep. ($35,

000)

($70,

000)

($105

,000)

($140

,000)

($175,

000)

($210,

000)

($245,

000)

($280,

000)

($315,

000)

($350,

000)

($385,

000)

($420,

000)

Furniture &

Fittings

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,500

,000

$1,500

,000

$1,500

,000

$1,500

,000

$1,500

,000

Accm. Dep.- ($37,

500)

($75,

000)

($112

,500)

($150

,000)

($183,

750)

($217,

500)

($251,

250)

($285,

000)

($315,

375)

($345,

750)

($376,

125)

($406,

500)

Computer,

Electronic

Equipment & Other

Devices

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,000

,000

$3,000

,000

$3,000

,000

$3,000

,000

$3,000

,000

Accm. Dep.- ($225

,000)

($450

,000)

($675

,000)

($900

,000)

($1,05

7,500)

($1,21

5,000)

($1,37

2,500)

($1,53

0,000)

($1,64

0,250)

($1,75

0,500)

($1,86

0,750)

($1,97

1,000)

Kitchen

Appliances,

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,250

,000

$1,250

,000

$1,250

,000

$1,250

,000

$1,250

,000

MANAGE BUDGETS AND FINANCIAL PLANS

before Tax ,428 ,610 ,688 ,515 ,894 ,273 ,908 9,037 0,365 2,150 5,683 1,268

Income Tax

Expenses

($2,09

0,528)

($2,02

5,183)

($2,16

6,806)

($2,96

2,355)

($2,97

9,868)

($2,53

6,882)

($2,81

3,672)

($4,05

8,711)

($5,97

9,109)

($4,59

3,645)

($4,74

1,705)

($6,02

4,380)

Net Profit for

the period

$4,877

,899

$4,725

,427

$5,055

,881

$6,912

,161

$6,953

,025

$5,919

,391

$6,565

,235

$9,470

,326

$13,95

1,255

$10,71

8,505

$11,06

3,978

$14,05

6,887

Projected Balance Sheet

BALANCE SHEET:

Particulars Year 1 Year 2 Year 3

Quar

ter 1

Quar

ter 2

Quar

ter 3

Quar

ter 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Quart

er 1

Quart

er 2

Quart

er 3

Quart

er 4

Current Assets:

Cash at Bank $16,9

21,16

8

$24,6

11,52

1

$38,6

90,83

1

$51,4

71,28

9

$46,6

01,52

0

$56,7

75,40

3

$73,6

25,88

6

$91,89

9,874

$95,07

5,345

$111,6

24,260

$139,9

46,717

$120,5

01,630

Total Current

Assets

$16,9

21,16

8

$24,6

11,52

1

$38,6

90,83

1

$51,4

71,28

9

$46,6

01,52

0

$56,7

75,40

3

$73,6

25,88

6

$91,89

9,874

$95,07

5,345

$111,6

24,260

$139,9

46,717

$120,5

01,630

Non-Current

Assets:

Land $2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,50

0,000

$2,500

,000

$2,500

,000

$2,500

,000

$2,500

,000

$2,500

,000

Building &

Improvement

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,00

0,000

$5,000

,000

$5,000

,000

$5,000

,000

$5,000

,000

$42,50

0,000

Accm. Dep. ($35,

000)

($70,

000)

($105

,000)

($140

,000)

($175,

000)

($210,

000)

($245,

000)

($280,

000)

($315,

000)

($350,

000)

($385,

000)

($420,

000)

Furniture &

Fittings

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,50

0,000

$1,500

,000

$1,500

,000

$1,500

,000

$1,500

,000

$1,500

,000

Accm. Dep.- ($37,

500)

($75,

000)

($112

,500)

($150

,000)

($183,

750)

($217,

500)

($251,

250)

($285,

000)

($315,

375)

($345,

750)

($376,

125)

($406,

500)

Computer,

Electronic

Equipment & Other

Devices

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,00

0,000

$3,000

,000

$3,000

,000

$3,000

,000

$3,000

,000

$3,000

,000

Accm. Dep.- ($225

,000)

($450

,000)

($675

,000)

($900

,000)

($1,05

7,500)

($1,21

5,000)

($1,37

2,500)

($1,53

0,000)

($1,64

0,250)

($1,75

0,500)

($1,86

0,750)

($1,97

1,000)

Kitchen

Appliances,

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,25

0,000

$1,250

,000

$1,250

,000

$1,250

,000

$1,250

,000

$1,250

,000

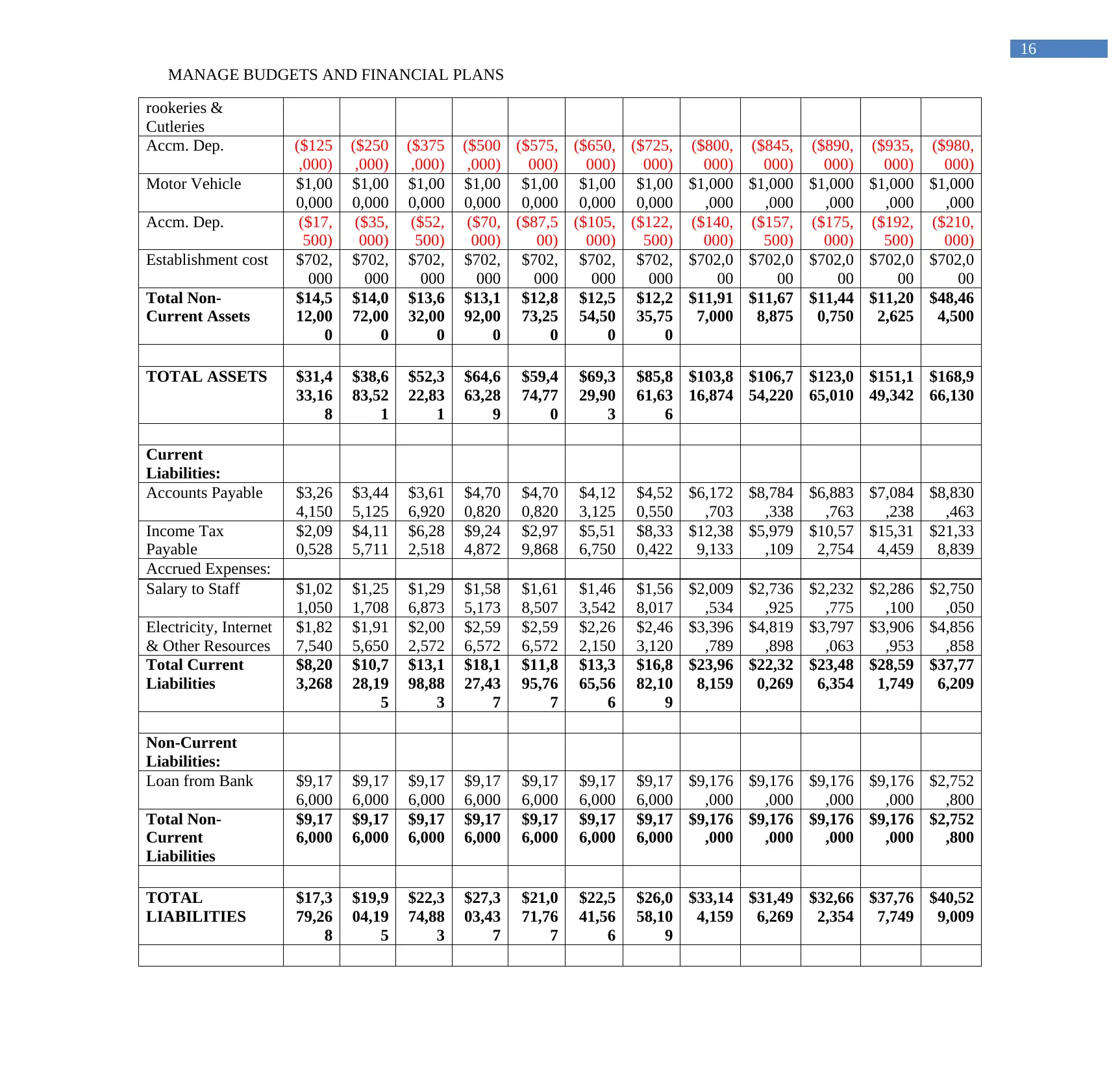

16

MANAGE BUDGETS AND FINANCIAL PLANS

rookeries &

Cutleries

Accm. Dep. ($125

,000)

($250

,000)

($375

,000)

($500

,000)

($575,

000)

($650,

000)

($725,

000)

($800,

000)

($845,

000)

($890,

000)

($935,

000)

($980,

000)

Motor Vehicle $1,00

0,000

$1,00

0,000

$1,00

0,000

$1,00

0,000

$1,00

0,000

$1,00

0,000

$1,00

0,000

$1,000

,000

$1,000

,000

$1,000

,000

$1,000

,000

$1,000

,000

Accm. Dep. ($17,

500)

($35,

000)

($52,

500)

($70,

000)

($87,5

00)

($105,

000)

($122,

500)

($140,

000)

($157,

500)

($175,

000)

($192,

500)

($210,

000)

Establishment cost $702,

000

$702,

000

$702,

000

$702,

000

$702,

000

$702,

000

$702,

000

$702,0

00

$702,0

00

$702,0

00

$702,0

00

$702,0

00

Total Non-

Current Assets

$14,5

12,00

0

$14,0

72,00

0

$13,6

32,00

0

$13,1

92,00

0

$12,8

73,25

0

$12,5

54,50

0

$12,2

35,75

0

$11,91

7,000

$11,67

8,875

$11,44

0,750

$11,20

2,625

$48,46

4,500

TOTAL ASSETS $31,4

33,16

8

$38,6

83,52

1

$52,3

22,83

1

$64,6

63,28

9

$59,4

74,77

0

$69,3

29,90

3

$85,8

61,63

6

$103,8

16,874

$106,7

54,220

$123,0

65,010

$151,1

49,342

$168,9

66,130

Current

Liabilities:

Accounts Payable $3,26

4,150