In-Depth Financial Analysis & Investment Appraisal - Bitmap Plc

VerifiedAdded on 2023/04/21

|19

|4738

|279

Report

AI Summary

This report provides a comprehensive financial analysis of Bitmap Plc, evaluating its performance from 2016 to 2017 using various financial ratios including profitability, liquidity, gearing, asset utilization, and investor ratios. Key metrics such as Return on Capital Employed, Operating Profit Margin, Debt to Equity Ratio, and Current Ratio are analyzed to assess the company's financial health and stability. The report also includes an investment appraisal of Toyland Ltd, comparing Machine A and Machine B using payback period, discounted payback period, accounting rate of return, net present value, and internal rate of return, concluding that Machine A is the better investment. Finally, the report discusses budgeting and its relation to strategic objectives and plans, outlining the budget process and its importance in achieving organizational goals. Desklib provides access to similar solved assignments and past papers for students.

Running head: FINANCIAL ANALYSIS

Financial Analysis

Name of the Student:

Name of the University:

Author’s Note:

Financial Analysis

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1FINANCIAL ANALYSIS

Table of Contents

Part A...............................................................................................................................................2

Financial Analysis of Bitmap Plc................................................................................................2

Profitability Ratio....................................................................................................................2

Gearing Ratios:........................................................................................................................3

Liquidity Ratio:........................................................................................................................3

Asset Utilization......................................................................................................................4

Investor’s Ratio........................................................................................................................4

Working Capital...........................................................................................................................6

Part B...............................................................................................................................................7

Investment Appraisal Techniques................................................................................................7

Benefits and Limitations of Investment Appraisal Techniques.................................................10

Sources of Funding....................................................................................................................12

Part C.............................................................................................................................................14

Budgeting & demonstrating how budgets, strategic objectives & strategic plans are related...14

Budget Process...........................................................................................................................14

References......................................................................................................................................16

Table of Contents

Part A...............................................................................................................................................2

Financial Analysis of Bitmap Plc................................................................................................2

Profitability Ratio....................................................................................................................2

Gearing Ratios:........................................................................................................................3

Liquidity Ratio:........................................................................................................................3

Asset Utilization......................................................................................................................4

Investor’s Ratio........................................................................................................................4

Working Capital...........................................................................................................................6

Part B...............................................................................................................................................7

Investment Appraisal Techniques................................................................................................7

Benefits and Limitations of Investment Appraisal Techniques.................................................10

Sources of Funding....................................................................................................................12

Part C.............................................................................................................................................14

Budgeting & demonstrating how budgets, strategic objectives & strategic plans are related...14

Budget Process...........................................................................................................................14

References......................................................................................................................................16

2FINANCIAL ANALYSIS

Part A

Financial Analysis of Bitmap Plc

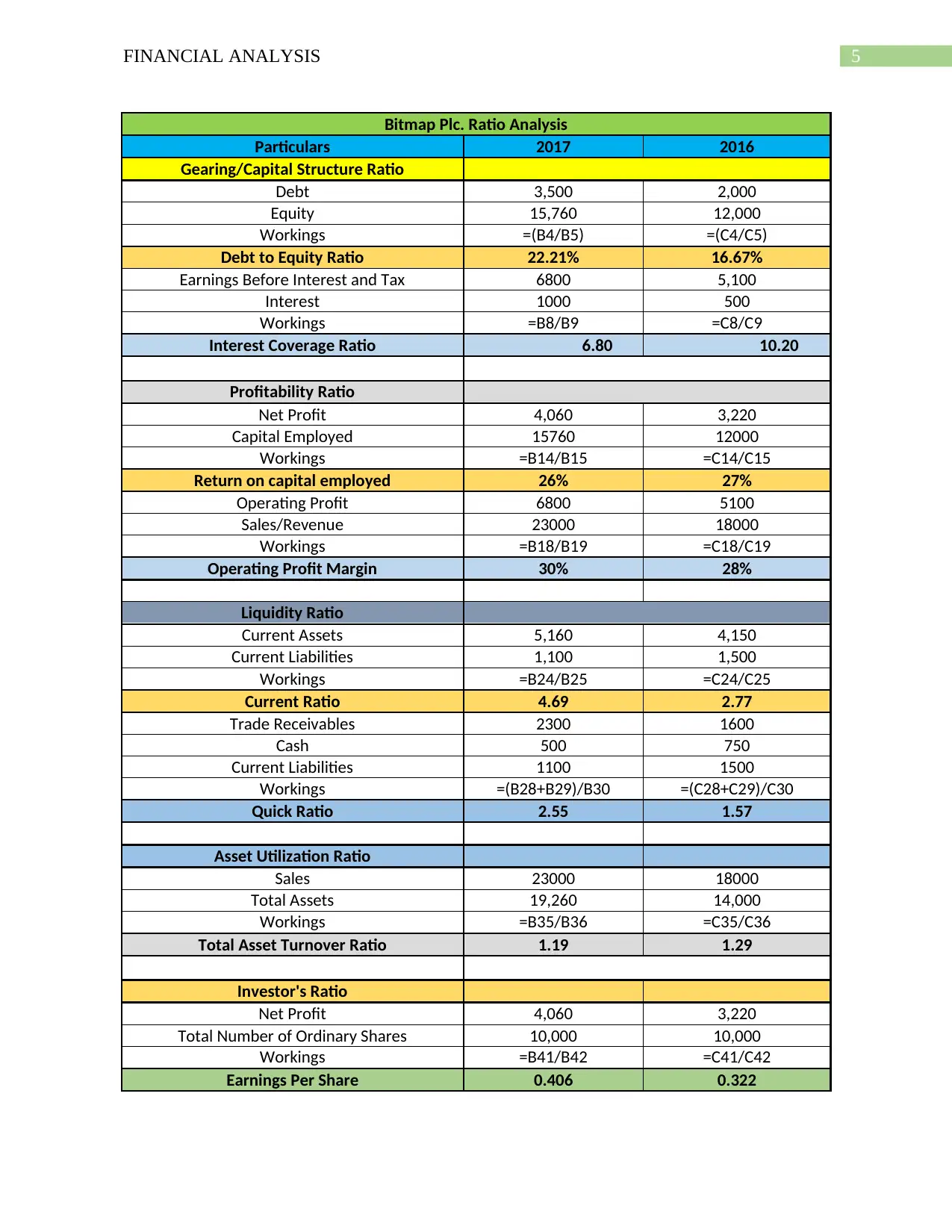

The financial analysis of the Bitmap Plc. was evaluated thereby assessing the financial

performance of the company with the help of the ratio analysis. The financial performance of the

company was evaluated for the trend period 2016-2017. Various factors were analysed for the

company in respect to the profitability, liquidity, gearing, and asset utilisation and investor

potential ratio for the company. The profitability condition for the company was evaluated by

incorporating various factors like the return generated on the capital employed and the operating

profit margin for the company (Luo et al. 2015). The key profitability ratio has analysed for the

company plays a crucial role in the development and sustainability of the company in the long

term. Liquidity Ratio for the company were analysed in order to see whether the company is able

to meet the current obligations of the company. The efficiency ratio for the company was

evaluated for the company thereby assessing the utilisation and efficiency of resources for the

company. The exposure of debt on the financial statement of the company was evaluated for

assessing the financial risk associated with the company.

Profitability Ratio

Return on Capital Employed: The return on capital employed by the company shows the

profitability generated by Bitmap Company on the total capital employed by the shareholders of

the company. The return on capital employed by the company in the year 2016 was around 27%

and was around 26% in the year 2018. The slight decrease in the return was due to the constant

increase in the equity base of the company in contrast to the profitability of the company.

Part A

Financial Analysis of Bitmap Plc

The financial analysis of the Bitmap Plc. was evaluated thereby assessing the financial

performance of the company with the help of the ratio analysis. The financial performance of the

company was evaluated for the trend period 2016-2017. Various factors were analysed for the

company in respect to the profitability, liquidity, gearing, and asset utilisation and investor

potential ratio for the company. The profitability condition for the company was evaluated by

incorporating various factors like the return generated on the capital employed and the operating

profit margin for the company (Luo et al. 2015). The key profitability ratio has analysed for the

company plays a crucial role in the development and sustainability of the company in the long

term. Liquidity Ratio for the company were analysed in order to see whether the company is able

to meet the current obligations of the company. The efficiency ratio for the company was

evaluated for the company thereby assessing the utilisation and efficiency of resources for the

company. The exposure of debt on the financial statement of the company was evaluated for

assessing the financial risk associated with the company.

Profitability Ratio

Return on Capital Employed: The return on capital employed by the company shows the

profitability generated by Bitmap Company on the total capital employed by the shareholders of

the company. The return on capital employed by the company in the year 2016 was around 27%

and was around 26% in the year 2018. The slight decrease in the return was due to the constant

increase in the equity base of the company in contrast to the profitability of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3FINANCIAL ANALYSIS

Operating Profit Margin: The operating profit margin for the company reflects the efficiency

of the company in earning the revenue of the company with the direct expenses of the company.

The operating profit margin for the company was around 30% in the year, which increased

consistently from the last year figures of 2016 that was around 28%.

Gearing Ratios:

Debt to Equity Ratio: The debt to equity ratio for the company shows the exposure of debt and

the weightage of debt on the capital structure of the company (Petruzzo et al. 2015). The debt to

equity ratio for the company was around 16.67% in the year 2016 and was around 22.21% in the

year 2017. The company has constantly increased the level of debt in the trend period analysed

for the company.

Interest Coverage Ratio: The interest coverage ratio shows the effect of interest on the

operating income of the company. The exposure of debt could be well assessed and the impact

the interest is creating on the profitability of the company. The interest coverage ratio for the

company was around 10.20 times in the year 2016 and was around 6.80times in the year 2017.

The interest weightage in contrast to the operating income for the company increased which

might affect the net profitability of the company.

Liquidity Ratio:

Current Ratio: The current ratio for the company shows the potential for the company in

meeting up the current liability of the company (Erasmus et al. 2016). The current ratio for the

company was around 2.77 times in the year 2016 and was around 4.69 times in the year. The

company has increased the current assets of the company significantly in contrast to the financial

assets of the company. The same can also result in the decrease in the opportunity cost of capital

for the company.

Operating Profit Margin: The operating profit margin for the company reflects the efficiency

of the company in earning the revenue of the company with the direct expenses of the company.

The operating profit margin for the company was around 30% in the year, which increased

consistently from the last year figures of 2016 that was around 28%.

Gearing Ratios:

Debt to Equity Ratio: The debt to equity ratio for the company shows the exposure of debt and

the weightage of debt on the capital structure of the company (Petruzzo et al. 2015). The debt to

equity ratio for the company was around 16.67% in the year 2016 and was around 22.21% in the

year 2017. The company has constantly increased the level of debt in the trend period analysed

for the company.

Interest Coverage Ratio: The interest coverage ratio shows the effect of interest on the

operating income of the company. The exposure of debt could be well assessed and the impact

the interest is creating on the profitability of the company. The interest coverage ratio for the

company was around 10.20 times in the year 2016 and was around 6.80times in the year 2017.

The interest weightage in contrast to the operating income for the company increased which

might affect the net profitability of the company.

Liquidity Ratio:

Current Ratio: The current ratio for the company shows the potential for the company in

meeting up the current liability of the company (Erasmus et al. 2016). The current ratio for the

company was around 2.77 times in the year 2016 and was around 4.69 times in the year. The

company has increased the current assets of the company significantly in contrast to the financial

assets of the company. The same can also result in the decrease in the opportunity cost of capital

for the company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4FINANCIAL ANALYSIS

Quick Ratio: The quick ratio for the company ignores the inventory in the current assets of the

company and just includes the liquid assets of the company such as trade receivables, cash and

short-term investment (Kanapickienė and Grundienė 2015). The quick ratio for the company was

around 1.57 times in the year 2016 and was around 2.55 times in the year 2017 for the company.

The quick ratio for the company also removed in the trend period analysed for the company.

Asset Utilization

Sales to Total Asset Turnover Ratio: The sales to total asset turnover ratio for the company

reflects the potential for the company in utilizing the assets of the company (Caudron et al.

2018). The ratio also shows the efficiency of the company ion managing the resources of the

company. The sales to total asset turnover ratio for the company was around 1.29 times in the

year 2016 and was around 1.19 times in the year 2017. The slight decrease in the ratio could be

well attributed to the fall in revenue of the company that made the company report a lower ratio.

Investor’s Ratio

Earnings Per Share: The earning per share for the company reflects the potential for the

company in generating the value or profitability for the shareholders of the company. The ratio

shows the amount of profitability generated by the company on a per share basis for the

company. The Earning Per Share for Bitmap was around 0.322 cents in the year 2016 which

increased gradually to 0.406 cents in the year 2017.

Bitmap Plc. Company on an overall basis has performed well as evaluated by

incorporating various ratio for the company. The financial performance of the company has

somewhat been stable and growth trend for the company thereby reflecting that the company

might be increasing the performance and efficiency of the company.

Quick Ratio: The quick ratio for the company ignores the inventory in the current assets of the

company and just includes the liquid assets of the company such as trade receivables, cash and

short-term investment (Kanapickienė and Grundienė 2015). The quick ratio for the company was

around 1.57 times in the year 2016 and was around 2.55 times in the year 2017 for the company.

The quick ratio for the company also removed in the trend period analysed for the company.

Asset Utilization

Sales to Total Asset Turnover Ratio: The sales to total asset turnover ratio for the company

reflects the potential for the company in utilizing the assets of the company (Caudron et al.

2018). The ratio also shows the efficiency of the company ion managing the resources of the

company. The sales to total asset turnover ratio for the company was around 1.29 times in the

year 2016 and was around 1.19 times in the year 2017. The slight decrease in the ratio could be

well attributed to the fall in revenue of the company that made the company report a lower ratio.

Investor’s Ratio

Earnings Per Share: The earning per share for the company reflects the potential for the

company in generating the value or profitability for the shareholders of the company. The ratio

shows the amount of profitability generated by the company on a per share basis for the

company. The Earning Per Share for Bitmap was around 0.322 cents in the year 2016 which

increased gradually to 0.406 cents in the year 2017.

Bitmap Plc. Company on an overall basis has performed well as evaluated by

incorporating various ratio for the company. The financial performance of the company has

somewhat been stable and growth trend for the company thereby reflecting that the company

might be increasing the performance and efficiency of the company.

5FINANCIAL ANALYSIS

Bitmap Plc. Ratio Analysis

Particulars 2017 2016

Gearing/Capital Structure Ratio

Debt 3,500 2,000

Equity 15,760 12,000

Workings =(B4/B5) =(C4/C5)

Debt to Equity Ratio 22.21% 16.67%

Earnings Before Interest and Tax 6800 5,100

Interest 1000 500

Workings =B8/B9 =C8/C9

Interest Coverage Ratio 6.80 10.20

Profitability Ratio

Net Profit 4,060 3,220

Capital Employed 15760 12000

Workings =B14/B15 =C14/C15

Return on capital employed 26% 27%

Operating Profit 6800 5100

Sales/Revenue 23000 18000

Workings =B18/B19 =C18/C19

Operating Profit Margin 30% 28%

Liquidity Ratio

Current Assets 5,160 4,150

Current Liabilities 1,100 1,500

Workings =B24/B25 =C24/C25

Current Ratio 4.69 2.77

Trade Receivables 2300 1600

Cash 500 750

Current Liabilities 1100 1500

Workings =(B28+B29)/B30 =(C28+C29)/C30

Quick Ratio 2.55 1.57

Asset Utilization Ratio

Sales 23000 18000

Total Assets 19,260 14,000

Workings =B35/B36 =C35/C36

Total Asset Turnover Ratio 1.19 1.29

Investor's Ratio

Net Profit 4,060 3,220

Total Number of Ordinary Shares 10,000 10,000

Workings =B41/B42 =C41/C42

Earnings Per Share 0.406 0.322

Bitmap Plc. Ratio Analysis

Particulars 2017 2016

Gearing/Capital Structure Ratio

Debt 3,500 2,000

Equity 15,760 12,000

Workings =(B4/B5) =(C4/C5)

Debt to Equity Ratio 22.21% 16.67%

Earnings Before Interest and Tax 6800 5,100

Interest 1000 500

Workings =B8/B9 =C8/C9

Interest Coverage Ratio 6.80 10.20

Profitability Ratio

Net Profit 4,060 3,220

Capital Employed 15760 12000

Workings =B14/B15 =C14/C15

Return on capital employed 26% 27%

Operating Profit 6800 5100

Sales/Revenue 23000 18000

Workings =B18/B19 =C18/C19

Operating Profit Margin 30% 28%

Liquidity Ratio

Current Assets 5,160 4,150

Current Liabilities 1,100 1,500

Workings =B24/B25 =C24/C25

Current Ratio 4.69 2.77

Trade Receivables 2300 1600

Cash 500 750

Current Liabilities 1100 1500

Workings =(B28+B29)/B30 =(C28+C29)/C30

Quick Ratio 2.55 1.57

Asset Utilization Ratio

Sales 23000 18000

Total Assets 19,260 14,000

Workings =B35/B36 =C35/C36

Total Asset Turnover Ratio 1.19 1.29

Investor's Ratio

Net Profit 4,060 3,220

Total Number of Ordinary Shares 10,000 10,000

Workings =B41/B42 =C41/C42

Earnings Per Share 0.406 0.322

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6FINANCIAL ANALYSIS

Working Capital

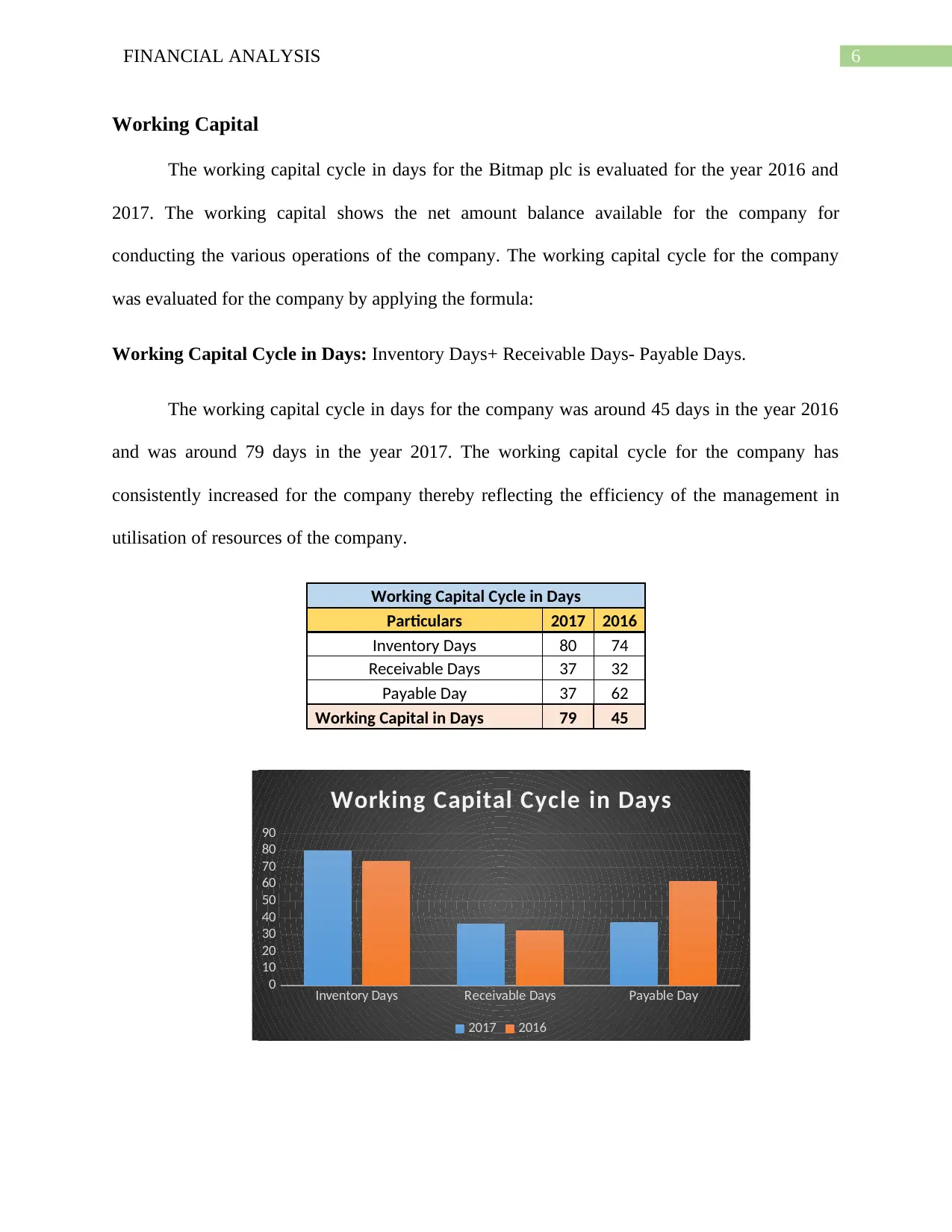

The working capital cycle in days for the Bitmap plc is evaluated for the year 2016 and

2017. The working capital shows the net amount balance available for the company for

conducting the various operations of the company. The working capital cycle for the company

was evaluated for the company by applying the formula:

Working Capital Cycle in Days: Inventory Days+ Receivable Days- Payable Days.

The working capital cycle in days for the company was around 45 days in the year 2016

and was around 79 days in the year 2017. The working capital cycle for the company has

consistently increased for the company thereby reflecting the efficiency of the management in

utilisation of resources of the company.

Working Capital Cycle in Days

Particulars 2017 2016

Inventory Days 80 74

Receivable Days 37 32

Payable Day 37 62

Working Capital in Days 79 45

Inventory Days Receivable Days Payable Day

0

10

20

30

40

50

60

70

80

90

Working Capital Cycle in Days

2017 2016

Working Capital

The working capital cycle in days for the Bitmap plc is evaluated for the year 2016 and

2017. The working capital shows the net amount balance available for the company for

conducting the various operations of the company. The working capital cycle for the company

was evaluated for the company by applying the formula:

Working Capital Cycle in Days: Inventory Days+ Receivable Days- Payable Days.

The working capital cycle in days for the company was around 45 days in the year 2016

and was around 79 days in the year 2017. The working capital cycle for the company has

consistently increased for the company thereby reflecting the efficiency of the management in

utilisation of resources of the company.

Working Capital Cycle in Days

Particulars 2017 2016

Inventory Days 80 74

Receivable Days 37 32

Payable Day 37 62

Working Capital in Days 79 45

Inventory Days Receivable Days Payable Day

0

10

20

30

40

50

60

70

80

90

Working Capital Cycle in Days

2017 2016

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7FINANCIAL ANALYSIS

Part B

Investment Appraisal Techniques

Toyland Ltd Company is expanding the operations of the company by expanding into the

business by purchasing assets and machinery for the company. The company is significantly

increasing the expansion of the company by purchasing assets for the company in the form of

capital expenditure for the company. The company currently has two machines in which the

company can invest in Machine A and Machine B and the economic feasibility of the project was

assessed by applying various investment assessment tools. The required rate of return was

around 10% for the company, which was applied for assessing the economic feasibility and

viability of the project.

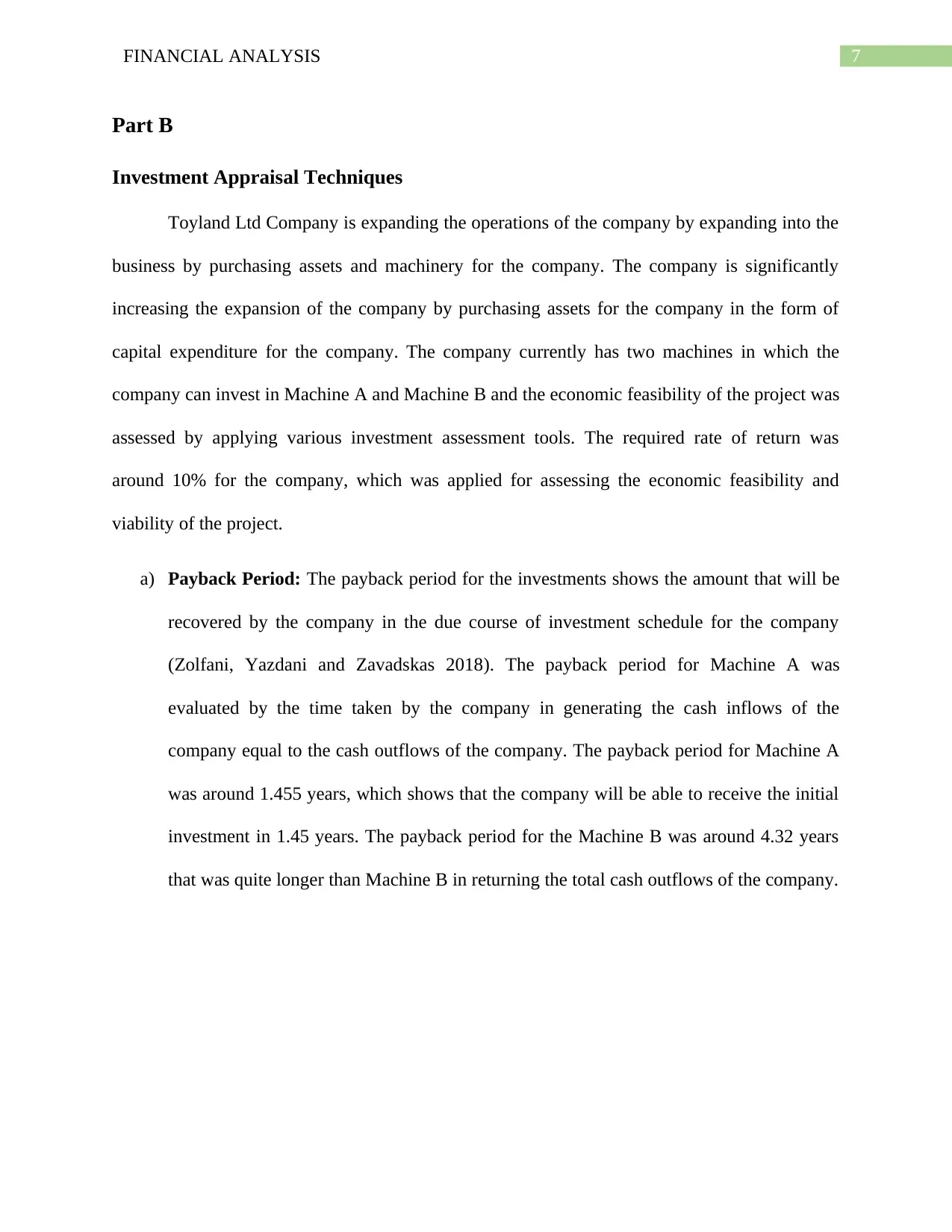

a) Payback Period: The payback period for the investments shows the amount that will be

recovered by the company in the due course of investment schedule for the company

(Zolfani, Yazdani and Zavadskas 2018). The payback period for Machine A was

evaluated by the time taken by the company in generating the cash inflows of the

company equal to the cash outflows of the company. The payback period for Machine A

was around 1.455 years, which shows that the company will be able to receive the initial

investment in 1.45 years. The payback period for the Machine B was around 4.32 years

that was quite longer than Machine B in returning the total cash outflows of the company.

Part B

Investment Appraisal Techniques

Toyland Ltd Company is expanding the operations of the company by expanding into the

business by purchasing assets and machinery for the company. The company is significantly

increasing the expansion of the company by purchasing assets for the company in the form of

capital expenditure for the company. The company currently has two machines in which the

company can invest in Machine A and Machine B and the economic feasibility of the project was

assessed by applying various investment assessment tools. The required rate of return was

around 10% for the company, which was applied for assessing the economic feasibility and

viability of the project.

a) Payback Period: The payback period for the investments shows the amount that will be

recovered by the company in the due course of investment schedule for the company

(Zolfani, Yazdani and Zavadskas 2018). The payback period for Machine A was

evaluated by the time taken by the company in generating the cash inflows of the

company equal to the cash outflows of the company. The payback period for Machine A

was around 1.455 years, which shows that the company will be able to receive the initial

investment in 1.45 years. The payback period for the Machine B was around 4.32 years

that was quite longer than Machine B in returning the total cash outflows of the company.

8FINANCIAL ANALYSIS

Payback Period

Particulars

Machine

A

Payback Period Machine

B

Payback Period

Years Cash

flow

Amt.

Recovered

Year Cash

flow

Amt.

Recovered

Year

0 -500,000 -500,000

1 300,000 300,000 1 20,000 20,000 1

2 250,000 550,000 0.45 50,000 70,000 2

3 200,000 750,000 150,000 220,000 3

4 150,000 900,000 200,000 420,000 4

5 50,000 950,000 250,000 670,000 0.32

6 70,000 1,020,000 350,000 1,020,000

Payback Period in Years 1.455 Payback Period in Years 4.32

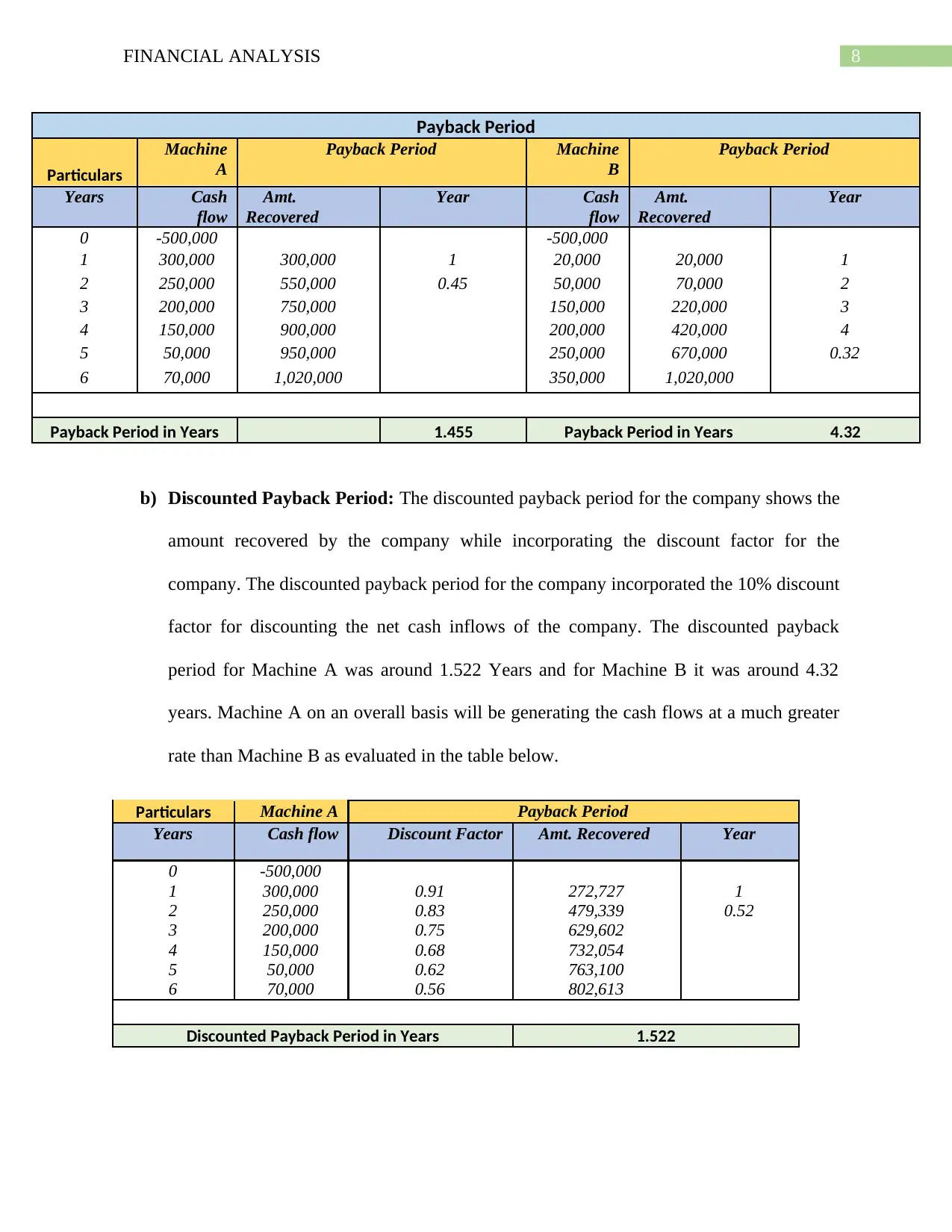

b) Discounted Payback Period: The discounted payback period for the company shows the

amount recovered by the company while incorporating the discount factor for the

company. The discounted payback period for the company incorporated the 10% discount

factor for discounting the net cash inflows of the company. The discounted payback

period for Machine A was around 1.522 Years and for Machine B it was around 4.32

years. Machine A on an overall basis will be generating the cash flows at a much greater

rate than Machine B as evaluated in the table below.

Particulars Machine A Payback Period

Years Cash flow Discount Factor Amt. Recovered Year

0 -500,000

1 300,000 0.91 272,727 1

2 250,000 0.83 479,339 0.52

3 200,000 0.75 629,602

4 150,000 0.68 732,054

5 50,000 0.62 763,100

6 70,000 0.56 802,613

Discounted Payback Period in Years 1.522

Payback Period

Particulars

Machine

A

Payback Period Machine

B

Payback Period

Years Cash

flow

Amt.

Recovered

Year Cash

flow

Amt.

Recovered

Year

0 -500,000 -500,000

1 300,000 300,000 1 20,000 20,000 1

2 250,000 550,000 0.45 50,000 70,000 2

3 200,000 750,000 150,000 220,000 3

4 150,000 900,000 200,000 420,000 4

5 50,000 950,000 250,000 670,000 0.32

6 70,000 1,020,000 350,000 1,020,000

Payback Period in Years 1.455 Payback Period in Years 4.32

b) Discounted Payback Period: The discounted payback period for the company shows the

amount recovered by the company while incorporating the discount factor for the

company. The discounted payback period for the company incorporated the 10% discount

factor for discounting the net cash inflows of the company. The discounted payback

period for Machine A was around 1.522 Years and for Machine B it was around 4.32

years. Machine A on an overall basis will be generating the cash flows at a much greater

rate than Machine B as evaluated in the table below.

Particulars Machine A Payback Period

Years Cash flow Discount Factor Amt. Recovered Year

0 -500,000

1 300,000 0.91 272,727 1

2 250,000 0.83 479,339 0.52

3 200,000 0.75 629,602

4 150,000 0.68 732,054

5 50,000 0.62 763,100

6 70,000 0.56 802,613

Discounted Payback Period in Years 1.522

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9FINANCIAL ANALYSIS

Machine B Payback Period

Cash flow Discount Factor Amt. Recovered Year

-500,000

20,000 0.91 18,182 1

50,000 0.83 59,504 2

150,000 0.75 172,201 3

200,000 0.68 308,804 4

250,000 0.62 464,034 0.32

350,000 0.56 661,600

Discounted Payback Period in Years 4.32

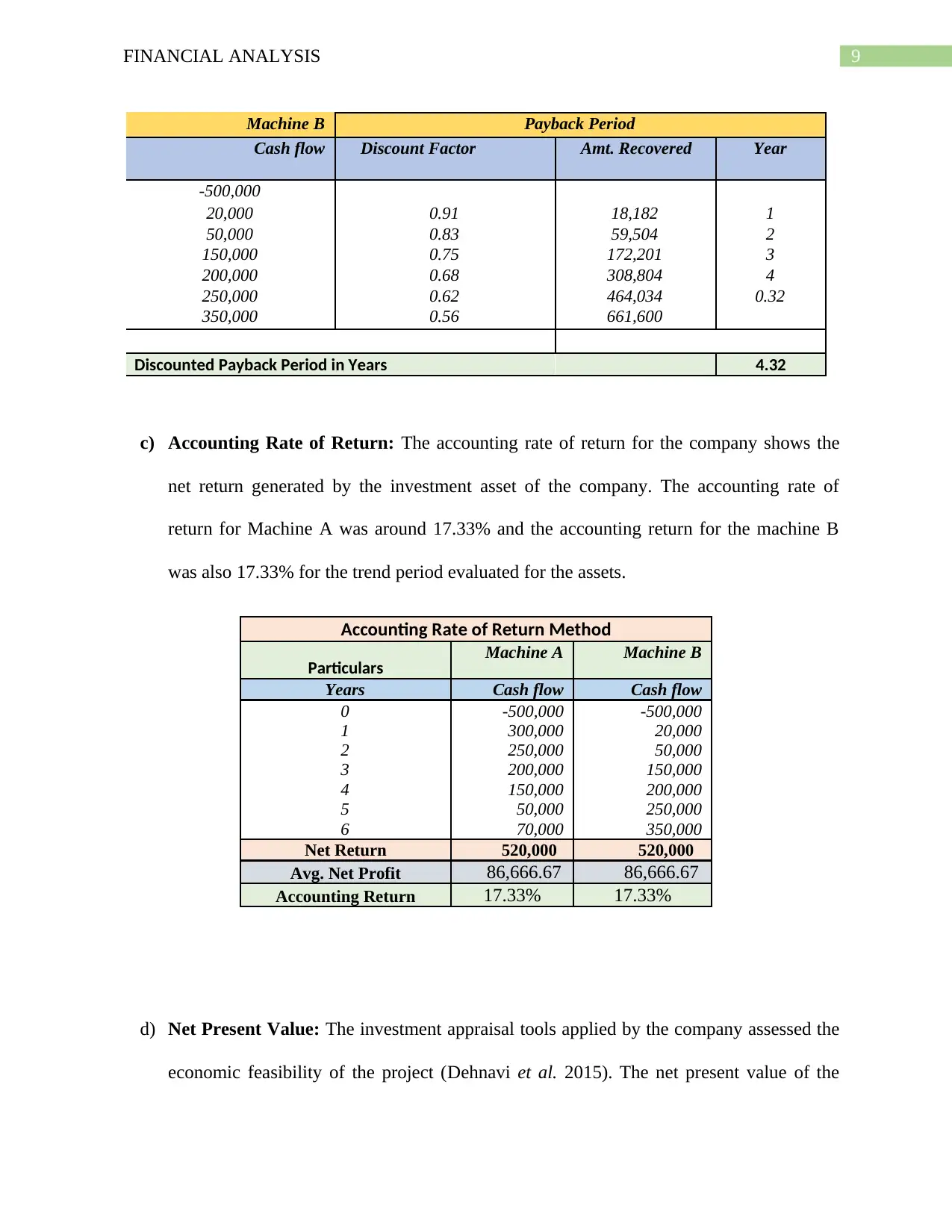

c) Accounting Rate of Return: The accounting rate of return for the company shows the

net return generated by the investment asset of the company. The accounting rate of

return for Machine A was around 17.33% and the accounting return for the machine B

was also 17.33% for the trend period evaluated for the assets.

Accounting Rate of Return Method

Particulars Machine A Machine B

Years Cash flow Cash flow

0 -500,000 -500,000

1 300,000 20,000

2 250,000 50,000

3 200,000 150,000

4 150,000 200,000

5 50,000 250,000

6 70,000 350,000

Net Return 520,000 520,000

Avg. Net Profit 86,666.67 86,666.67

Accounting Return 17.33% 17.33%

d) Net Present Value: The investment appraisal tools applied by the company assessed the

economic feasibility of the project (Dehnavi et al. 2015). The net present value of the

Machine B Payback Period

Cash flow Discount Factor Amt. Recovered Year

-500,000

20,000 0.91 18,182 1

50,000 0.83 59,504 2

150,000 0.75 172,201 3

200,000 0.68 308,804 4

250,000 0.62 464,034 0.32

350,000 0.56 661,600

Discounted Payback Period in Years 4.32

c) Accounting Rate of Return: The accounting rate of return for the company shows the

net return generated by the investment asset of the company. The accounting rate of

return for Machine A was around 17.33% and the accounting return for the machine B

was also 17.33% for the trend period evaluated for the assets.

Accounting Rate of Return Method

Particulars Machine A Machine B

Years Cash flow Cash flow

0 -500,000 -500,000

1 300,000 20,000

2 250,000 50,000

3 200,000 150,000

4 150,000 200,000

5 50,000 250,000

6 70,000 350,000

Net Return 520,000 520,000

Avg. Net Profit 86,666.67 86,666.67

Accounting Return 17.33% 17.33%

d) Net Present Value: The investment appraisal tools applied by the company assessed the

economic feasibility of the project (Dehnavi et al. 2015). The net present value of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10FINANCIAL ANALYSIS

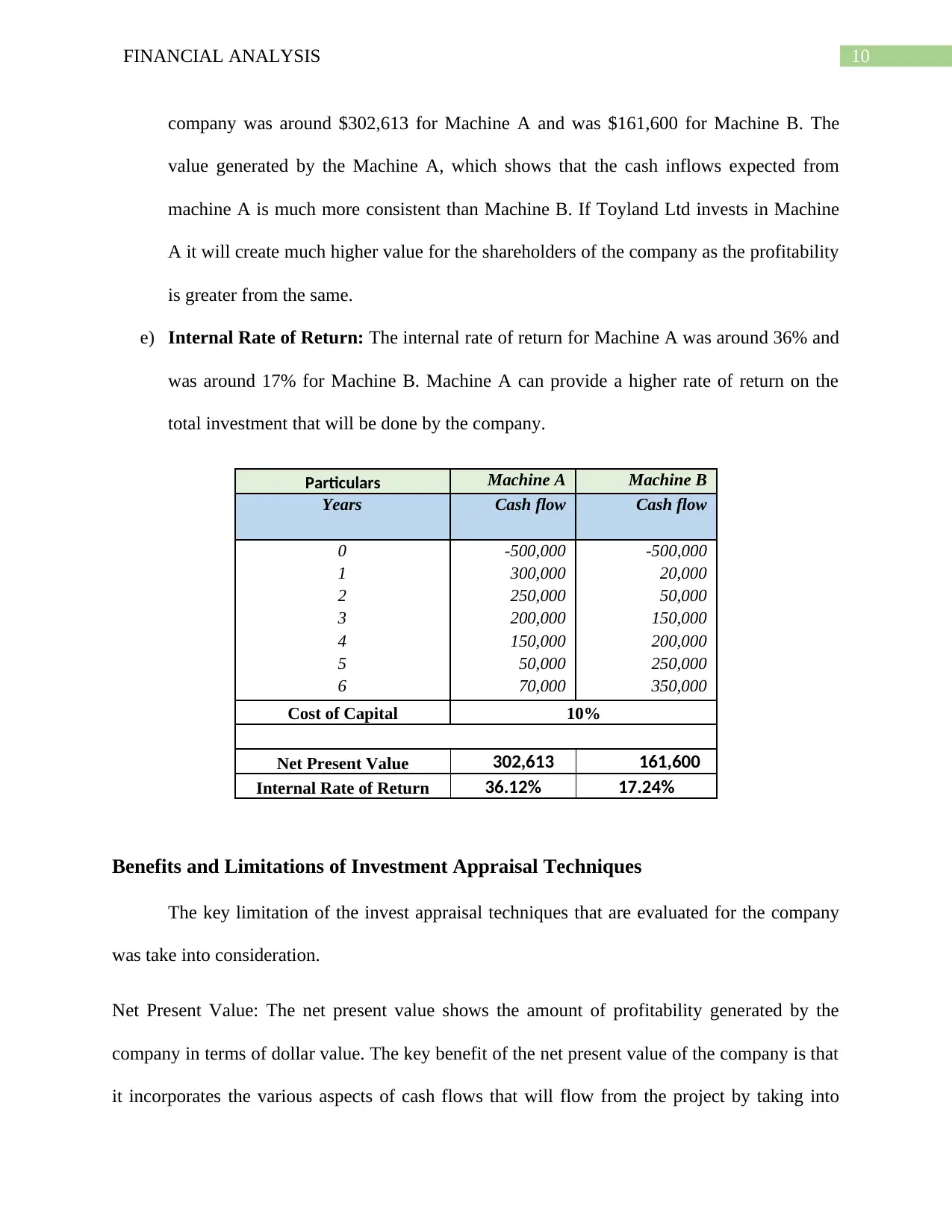

company was around $302,613 for Machine A and was $161,600 for Machine B. The

value generated by the Machine A, which shows that the cash inflows expected from

machine A is much more consistent than Machine B. If Toyland Ltd invests in Machine

A it will create much higher value for the shareholders of the company as the profitability

is greater from the same.

e) Internal Rate of Return: The internal rate of return for Machine A was around 36% and

was around 17% for Machine B. Machine A can provide a higher rate of return on the

total investment that will be done by the company.

Particulars Machine A Machine B

Years Cash flow Cash flow

0 -500,000 -500,000

1 300,000 20,000

2 250,000 50,000

3 200,000 150,000

4 150,000 200,000

5 50,000 250,000

6 70,000 350,000

Cost of Capital 10%

Net Present Value 302,613 161,600

Internal Rate of Return 36.12% 17.24%

Benefits and Limitations of Investment Appraisal Techniques

The key limitation of the invest appraisal techniques that are evaluated for the company

was take into consideration.

Net Present Value: The net present value shows the amount of profitability generated by the

company in terms of dollar value. The key benefit of the net present value of the company is that

it incorporates the various aspects of cash flows that will flow from the project by taking into

company was around $302,613 for Machine A and was $161,600 for Machine B. The

value generated by the Machine A, which shows that the cash inflows expected from

machine A is much more consistent than Machine B. If Toyland Ltd invests in Machine

A it will create much higher value for the shareholders of the company as the profitability

is greater from the same.

e) Internal Rate of Return: The internal rate of return for Machine A was around 36% and

was around 17% for Machine B. Machine A can provide a higher rate of return on the

total investment that will be done by the company.

Particulars Machine A Machine B

Years Cash flow Cash flow

0 -500,000 -500,000

1 300,000 20,000

2 250,000 50,000

3 200,000 150,000

4 150,000 200,000

5 50,000 250,000

6 70,000 350,000

Cost of Capital 10%

Net Present Value 302,613 161,600

Internal Rate of Return 36.12% 17.24%

Benefits and Limitations of Investment Appraisal Techniques

The key limitation of the invest appraisal techniques that are evaluated for the company

was take into consideration.

Net Present Value: The net present value shows the amount of profitability generated by the

company in terms of dollar value. The key benefit of the net present value of the company is that

it incorporates the various aspects of cash flows that will flow from the project by taking into

11FINANCIAL ANALYSIS

account the time when the same will be received by the company in the due course of the

investment (Booksmythe et al. 2017). The key limitation of the net present value for the

company is that the net present value of the company is not quantifiable which can be compared

with the required return for accepting or rejecting a project. The amount of wealth created by the

investment project is solely dependent on the required return which is an important factor. The

investment appraisal method is commonly used by organisations for the purpose of investment

appraisal.

Internal Rate of Return: The internal rate of return shows the return of the project in terms of

the percentage, which helps the investor in assessing and benchmarking the performing of the

company (Sarker, Sultana and Prodhan 2017). The internal rate of return shows the return

generated by the project in percentage term which is helpful for the investor in assessment of the

financial information’s of the company (Barman and Sengupta 2017). The key disadvantage of

the internal rate of return is that the same does not consider various important factors like

duration of the project, future cost associated with the company and the size of the project. The

tool is applied by various organisations for evaluating the viability of the investment project.

Payback Period: The key advantage of the payback period is that the tool is simple and clear

and shows the management of the company the time taken by the investment project in returning

the initial capital inflow of the company (Trivedi et al. 2016). The key disadvantage of the

discounted payback period is that the same ignores the concept of time value of money for

assessment of the project which is a crucial part.

Discounted Payback Period: The discounted payback period for the investment project strength

is that the same allows application of time value of money. The discounted payback period may

at times be complex for the investment project manager for assessing the financial information

account the time when the same will be received by the company in the due course of the

investment (Booksmythe et al. 2017). The key limitation of the net present value for the

company is that the net present value of the company is not quantifiable which can be compared

with the required return for accepting or rejecting a project. The amount of wealth created by the

investment project is solely dependent on the required return which is an important factor. The

investment appraisal method is commonly used by organisations for the purpose of investment

appraisal.

Internal Rate of Return: The internal rate of return shows the return of the project in terms of

the percentage, which helps the investor in assessing and benchmarking the performing of the

company (Sarker, Sultana and Prodhan 2017). The internal rate of return shows the return

generated by the project in percentage term which is helpful for the investor in assessment of the

financial information’s of the company (Barman and Sengupta 2017). The key disadvantage of

the internal rate of return is that the same does not consider various important factors like

duration of the project, future cost associated with the company and the size of the project. The

tool is applied by various organisations for evaluating the viability of the investment project.

Payback Period: The key advantage of the payback period is that the tool is simple and clear

and shows the management of the company the time taken by the investment project in returning

the initial capital inflow of the company (Trivedi et al. 2016). The key disadvantage of the

discounted payback period is that the same ignores the concept of time value of money for

assessment of the project which is a crucial part.

Discounted Payback Period: The discounted payback period for the investment project strength

is that the same allows application of time value of money. The discounted payback period may

at times be complex for the investment project manager for assessing the financial information

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.