Strategic Information Systems: Bell Studio Cash Management Analysis

VerifiedAdded on 2022/12/23

|17

|2724

|91

Case Study

AI Summary

This case study evaluates the internal management of cash at Bell Studio, an Adelaide-based wholesaler, from a business analyst's perspective. The analysis encompasses the purchase, cash disbursement, and payroll systems, using data flow diagrams and system flowcharts to illustrate the processes. The study identifies internal control weaknesses, such as weak apex management control and unrealistic assumptions, and assesses the associated risks. The report examines the flow of data and documents within each system, highlighting the roles of various departments and personnel involved in cash management. The ultimate aim is to evaluate the effectiveness of the cash management process, the risks associated with the current system, and the internal controls in place to ensure financial accountability. The assignment offers an in-depth look at the financial processes of the business and offers insights into how the internal management of cash can be improved.

Running head: INTERNAL MANAGEMENT OF CASH

Management of Cash At Bell Studio

Name of the Student:

Name of the University:

Author Note:

Management of Cash At Bell Studio

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

INTERNAL MANAGEMENT OF CASH

Table of Contents

Introduction:....................................................................................................................................3

Body:................................................................................................................................................3

Data flow diagram of purchases and cash disbursements systems:.................................................3

Data flow diagram of payroll system:.............................................................................................7

System flowchart of purchases system:...........................................................................................9

System flowchart of cash disbursements system:..........................................................................10

System flowchart of payroll system:.............................................................................................12

INTERNAL MANAGEMENT OF CASH

Table of Contents

Introduction:....................................................................................................................................3

Body:................................................................................................................................................3

Data flow diagram of purchases and cash disbursements systems:.................................................3

Data flow diagram of payroll system:.............................................................................................7

System flowchart of purchases system:...........................................................................................9

System flowchart of cash disbursements system:..........................................................................10

System flowchart of payroll system:.............................................................................................12

2

INTERNAL MANAGEMENT OF CASH

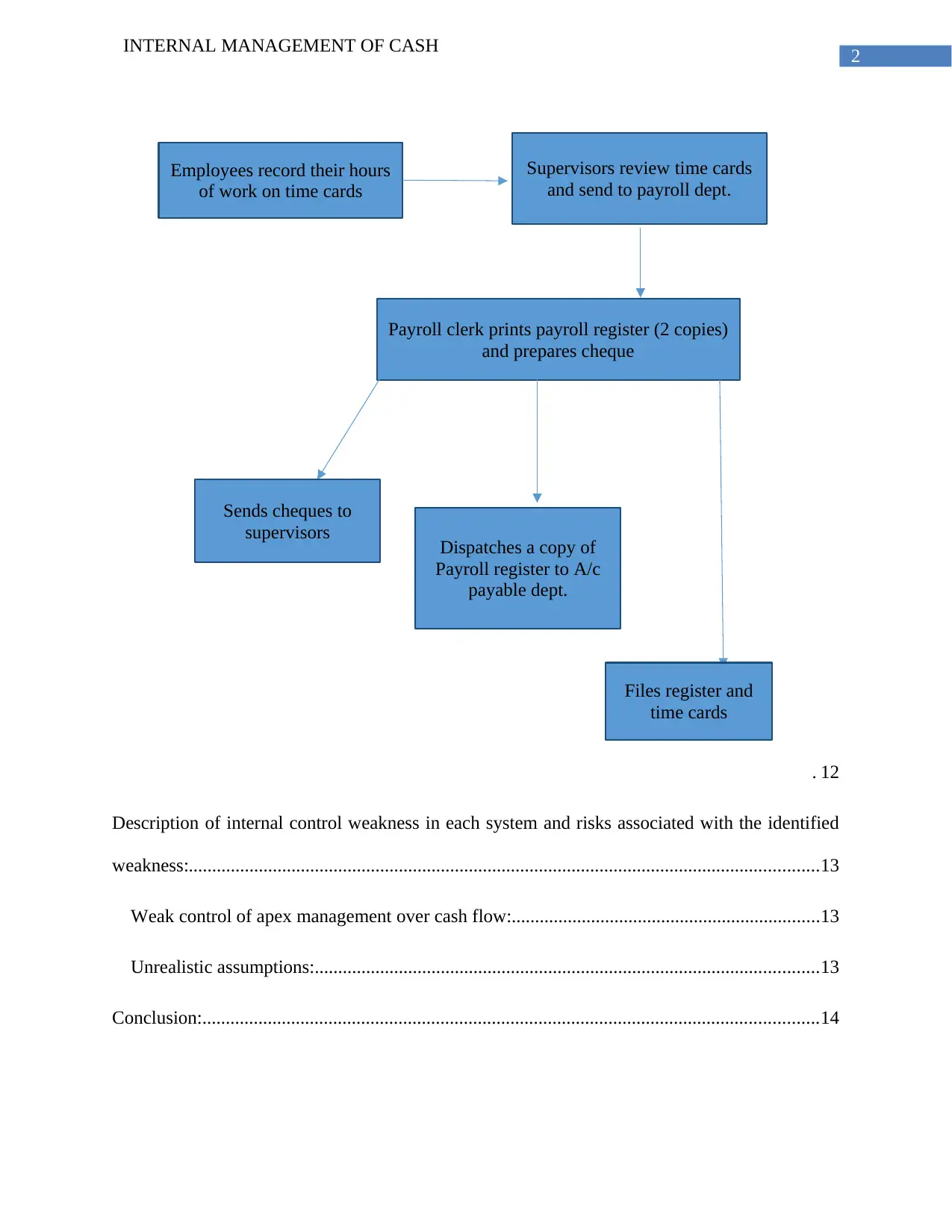

Employees record their hours

of work on time cards

Supervisors review time cards

and send to payroll dept.

Payroll clerk prints payroll register (2 copies)

and prepares cheque

Sends cheques to

supervisors Dispatches a copy of

Payroll register to A/c

payable dept.

Files register and

time cards

. 12

Description of internal control weakness in each system and risks associated with the identified

weakness:.......................................................................................................................................13

Weak control of apex management over cash flow:..................................................................13

Unrealistic assumptions:............................................................................................................13

Conclusion:....................................................................................................................................14

INTERNAL MANAGEMENT OF CASH

Employees record their hours

of work on time cards

Supervisors review time cards

and send to payroll dept.

Payroll clerk prints payroll register (2 copies)

and prepares cheque

Sends cheques to

supervisors Dispatches a copy of

Payroll register to A/c

payable dept.

Files register and

time cards

. 12

Description of internal control weakness in each system and risks associated with the identified

weakness:.......................................................................................................................................13

Weak control of apex management over cash flow:..................................................................13

Unrealistic assumptions:............................................................................................................13

Conclusion:....................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

INTERNAL MANAGEMENT OF CASH

Introduction:

Internal management of cash is one of the most significant operations which business

organisations conduct. Internal management of cash management with the account department at

its helm and under direct supervision of the apex management involves accounting of payments

as well as receipts of money in all the departments. The entire process of cash management as a

result involve myriads of operations like making payments of suppliers and payment of salaries

to the employees on the payroll of the business organisations (Arango et al. 2016). Thus, cash

management attracts substantial risks which have impacts on all the other department. The aim

of the paper is to evaluate the cash management process of Bell Studio, an Adelaide based

wholesaler of artefacts from the view of a business analyst. This would be followed by

evaluation of risk which the present cash management system of Bell Studio presents. The third

part of the evaluation of the internal controls which the accounts department of Bell Studio

follow to ensure its expenditure cycle is aligned to the business requirement of the studio. The

report would be based on a case study which takes into account three areas of cash management

at Bell Studio namely, purchase systems, cash disbursements system and the payroll system.

Body:

Data flow diagram of purchases and cash disbursements systems:

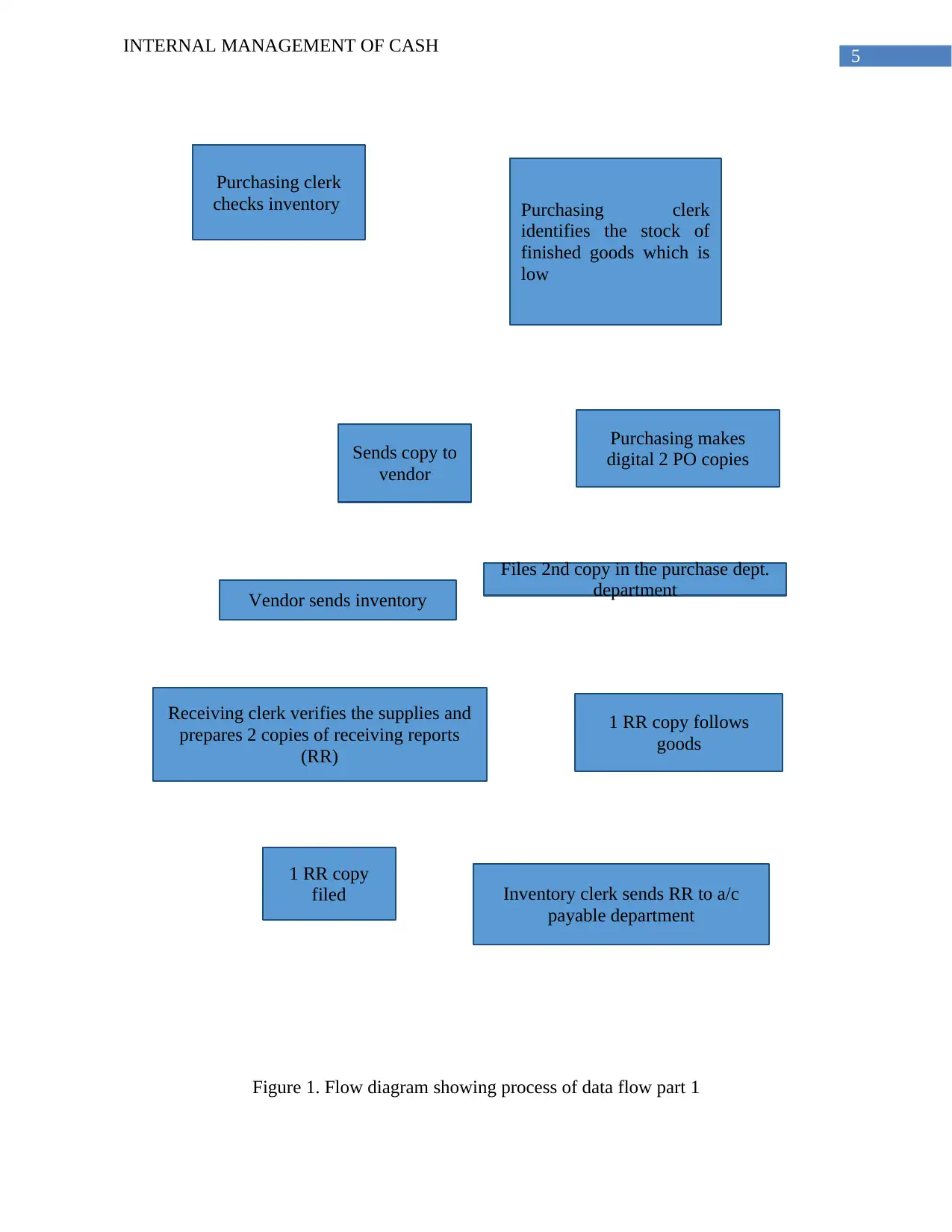

The flow diagram shown below shows that entire data flow process of purchase systems

and cash disbursement system which took in Bell Studio. It must be pointed out that the data

flow in this case refers to the flow of data like the orders placed with the supplier through the

PO. The The diagram below that the purchase systems of Bell Studio was initiated by the

purchase clerk who took opening inventory recording for a particular day and identified the

inventory items which were insufficient (Seifert and Gonenc 2018). The purchase clerk placed

INTERNAL MANAGEMENT OF CASH

Introduction:

Internal management of cash is one of the most significant operations which business

organisations conduct. Internal management of cash management with the account department at

its helm and under direct supervision of the apex management involves accounting of payments

as well as receipts of money in all the departments. The entire process of cash management as a

result involve myriads of operations like making payments of suppliers and payment of salaries

to the employees on the payroll of the business organisations (Arango et al. 2016). Thus, cash

management attracts substantial risks which have impacts on all the other department. The aim

of the paper is to evaluate the cash management process of Bell Studio, an Adelaide based

wholesaler of artefacts from the view of a business analyst. This would be followed by

evaluation of risk which the present cash management system of Bell Studio presents. The third

part of the evaluation of the internal controls which the accounts department of Bell Studio

follow to ensure its expenditure cycle is aligned to the business requirement of the studio. The

report would be based on a case study which takes into account three areas of cash management

at Bell Studio namely, purchase systems, cash disbursements system and the payroll system.

Body:

Data flow diagram of purchases and cash disbursements systems:

The flow diagram shown below shows that entire data flow process of purchase systems

and cash disbursement system which took in Bell Studio. It must be pointed out that the data

flow in this case refers to the flow of data like the orders placed with the supplier through the

PO. The The diagram below that the purchase systems of Bell Studio was initiated by the

purchase clerk who took opening inventory recording for a particular day and identified the

inventory items which were insufficient (Seifert and Gonenc 2018). The purchase clerk placed

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

INTERNAL MANAGEMENT OF CASH

order(s) for the item(s) which was/were short with the vendors as per the ‘valid vendor file’ by

preparing a digital purchase order or PO.

The next stage of data flow is initiated by the receiving clerk on receipt of the supplies of

goods received from the supplier. There would be two main documents containing the data

namely, purchase order and the receiving report, the former being prepared by the purchase clerk

while the latter would be prepared by the receiving clerk upon receipt of the inventory. The

receiving clerk at the receiving clerk on receiving the inventory inspected the goods and tallied

the inventory against the particulars mentioned in the PO. The receiving clerk prepared two

copies of Receiving Report or RR one of which was sent with the inventory to the inventory

warehouse while the other was filed by the clerk. The inventory department sent the copy of the

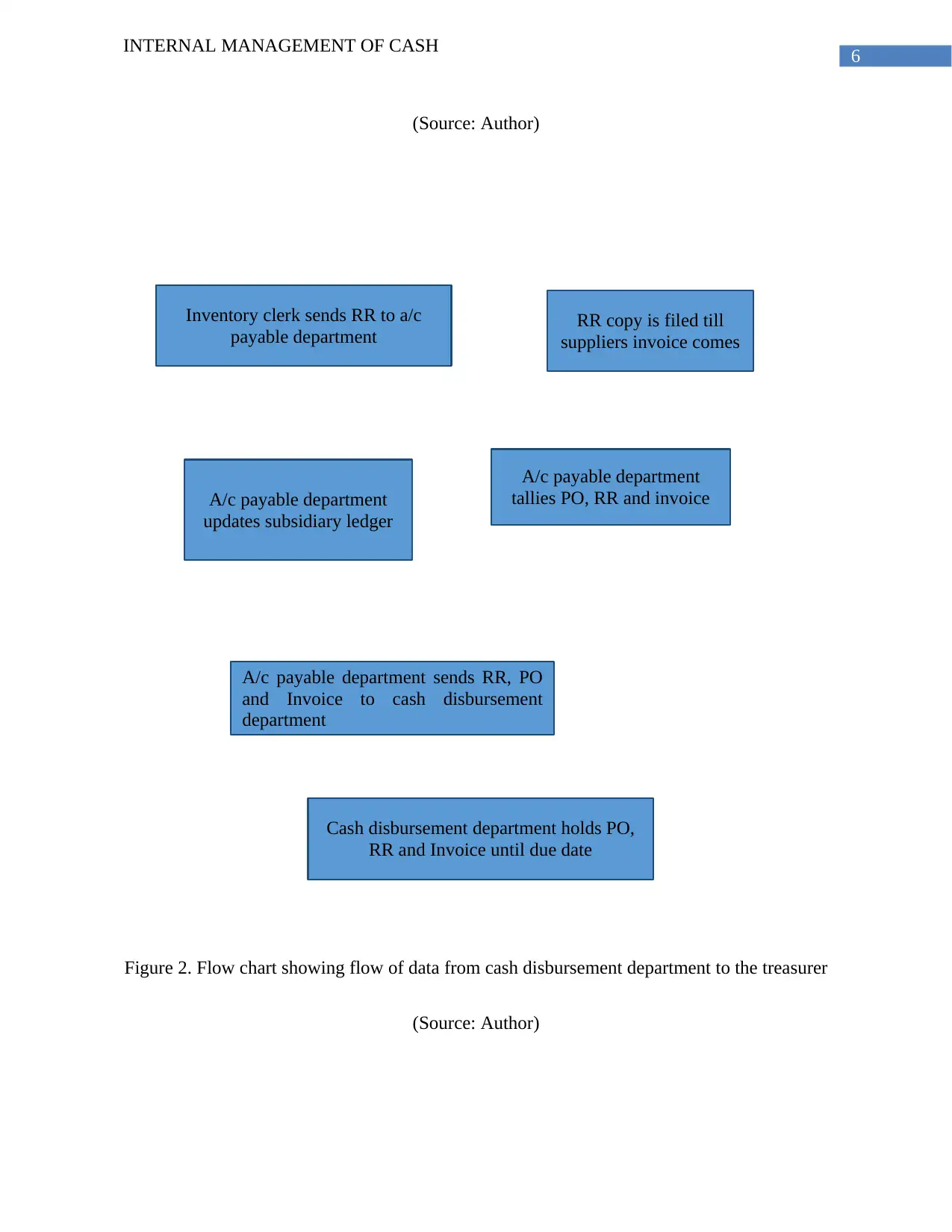

RR attached to the goods to the accounts payable department (Ang 2018). The accounts payable

clerk on receiving the RR tallied its particulars with the PO and the invoice received from the

supplier(s) concerned, following which all the three documents were sent to the cash

disbursement department for processing the payment. The cash disbursement department clerk

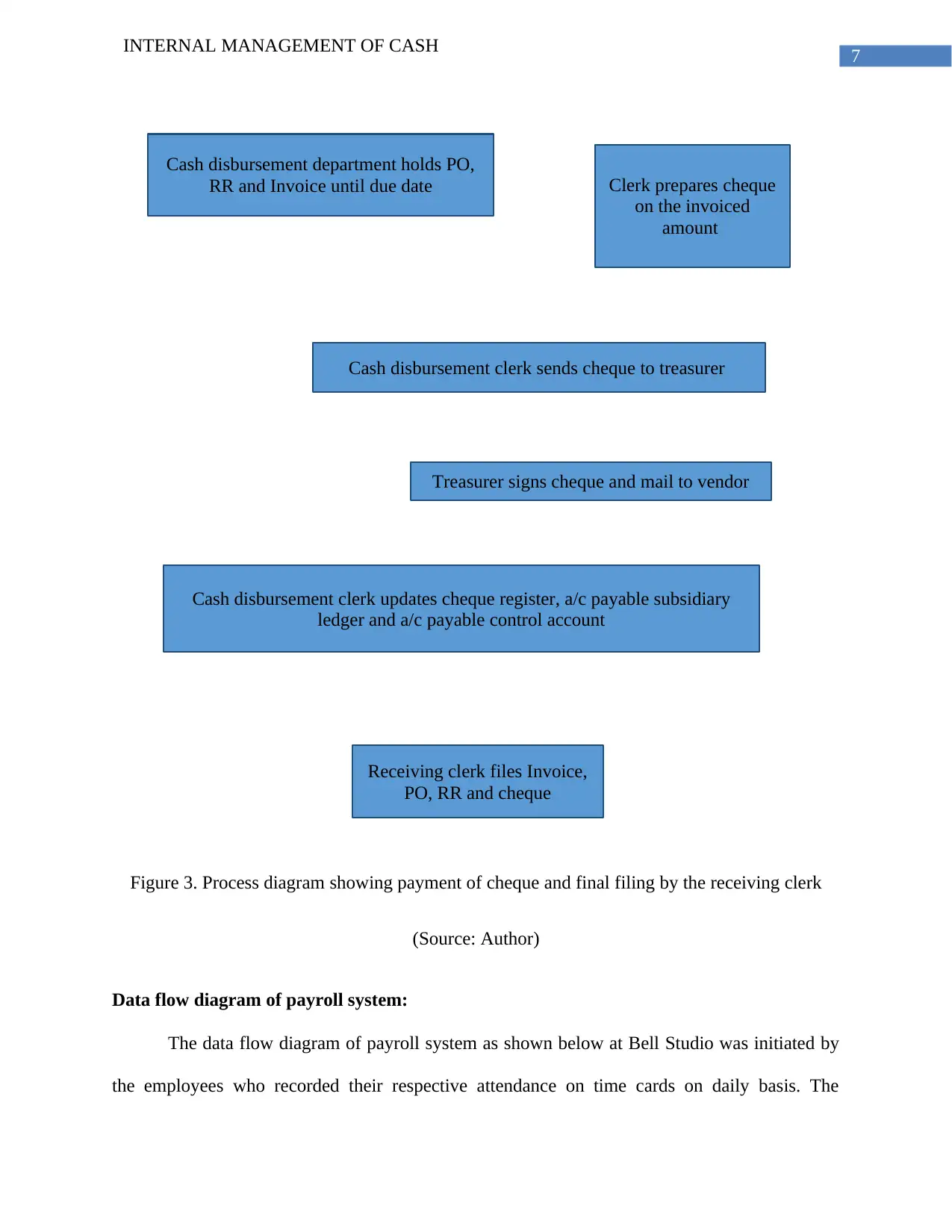

held the three documents till the due date of making the payment. The cash disbursement

department clerk then prepared to cheque which was sent to the treasurer along with the three

documents for approval of the treasurer. Thus, the purchase data being carried by the RR,

Invoice and PO are passed down to the treasurer for processing the cheque payment to the

supplier(s). The treasurer signed the cheque and mailed it to the supplier(s) concerned. The

receiving clerk then filed the copies of the three documents namely, PO, RR and Invoice along

with a copy of the cheque.

INTERNAL MANAGEMENT OF CASH

order(s) for the item(s) which was/were short with the vendors as per the ‘valid vendor file’ by

preparing a digital purchase order or PO.

The next stage of data flow is initiated by the receiving clerk on receipt of the supplies of

goods received from the supplier. There would be two main documents containing the data

namely, purchase order and the receiving report, the former being prepared by the purchase clerk

while the latter would be prepared by the receiving clerk upon receipt of the inventory. The

receiving clerk at the receiving clerk on receiving the inventory inspected the goods and tallied

the inventory against the particulars mentioned in the PO. The receiving clerk prepared two

copies of Receiving Report or RR one of which was sent with the inventory to the inventory

warehouse while the other was filed by the clerk. The inventory department sent the copy of the

RR attached to the goods to the accounts payable department (Ang 2018). The accounts payable

clerk on receiving the RR tallied its particulars with the PO and the invoice received from the

supplier(s) concerned, following which all the three documents were sent to the cash

disbursement department for processing the payment. The cash disbursement department clerk

held the three documents till the due date of making the payment. The cash disbursement

department clerk then prepared to cheque which was sent to the treasurer along with the three

documents for approval of the treasurer. Thus, the purchase data being carried by the RR,

Invoice and PO are passed down to the treasurer for processing the cheque payment to the

supplier(s). The treasurer signed the cheque and mailed it to the supplier(s) concerned. The

receiving clerk then filed the copies of the three documents namely, PO, RR and Invoice along

with a copy of the cheque.

5

INTERNAL MANAGEMENT OF CASH

Purchasing clerk

checks inventory Purchasing clerk

identifies the stock of

finished goods which is

low

Purchasing makes

digital 2 PO copiesSends copy to

vendor

Files 2nd copy in the purchase dept.

department

Vendor sends inventory

Receiving clerk verifies the supplies and

prepares 2 copies of receiving reports

(RR)

1 RR copy follows

goods

1 RR copy

filed Inventory clerk sends RR to a/c

payable department

Figure 1. Flow diagram showing process of data flow part 1

INTERNAL MANAGEMENT OF CASH

Purchasing clerk

checks inventory Purchasing clerk

identifies the stock of

finished goods which is

low

Purchasing makes

digital 2 PO copiesSends copy to

vendor

Files 2nd copy in the purchase dept.

department

Vendor sends inventory

Receiving clerk verifies the supplies and

prepares 2 copies of receiving reports

(RR)

1 RR copy follows

goods

1 RR copy

filed Inventory clerk sends RR to a/c

payable department

Figure 1. Flow diagram showing process of data flow part 1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

INTERNAL MANAGEMENT OF CASH

Inventory clerk sends RR to a/c

payable department RR copy is filed till

suppliers invoice comes

A/c payable department

tallies PO, RR and invoiceA/c payable department

updates subsidiary ledger

A/c payable department sends RR, PO

and Invoice to cash disbursement

department

Cash disbursement department holds PO,

RR and Invoice until due date

(Source: Author)

Figure 2. Flow chart showing flow of data from cash disbursement department to the treasurer

(Source: Author)

INTERNAL MANAGEMENT OF CASH

Inventory clerk sends RR to a/c

payable department RR copy is filed till

suppliers invoice comes

A/c payable department

tallies PO, RR and invoiceA/c payable department

updates subsidiary ledger

A/c payable department sends RR, PO

and Invoice to cash disbursement

department

Cash disbursement department holds PO,

RR and Invoice until due date

(Source: Author)

Figure 2. Flow chart showing flow of data from cash disbursement department to the treasurer

(Source: Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

INTERNAL MANAGEMENT OF CASH

Cash disbursement department holds PO,

RR and Invoice until due date Clerk prepares cheque

on the invoiced

amount

Cash disbursement clerk sends cheque to treasurer

Treasurer signs cheque and mail to vendor

Cash disbursement clerk updates cheque register, a/c payable subsidiary

ledger and a/c payable control account

Receiving clerk files Invoice,

PO, RR and cheque

Figure 3. Process diagram showing payment of cheque and final filing by the receiving clerk

(Source: Author)

Data flow diagram of payroll system:

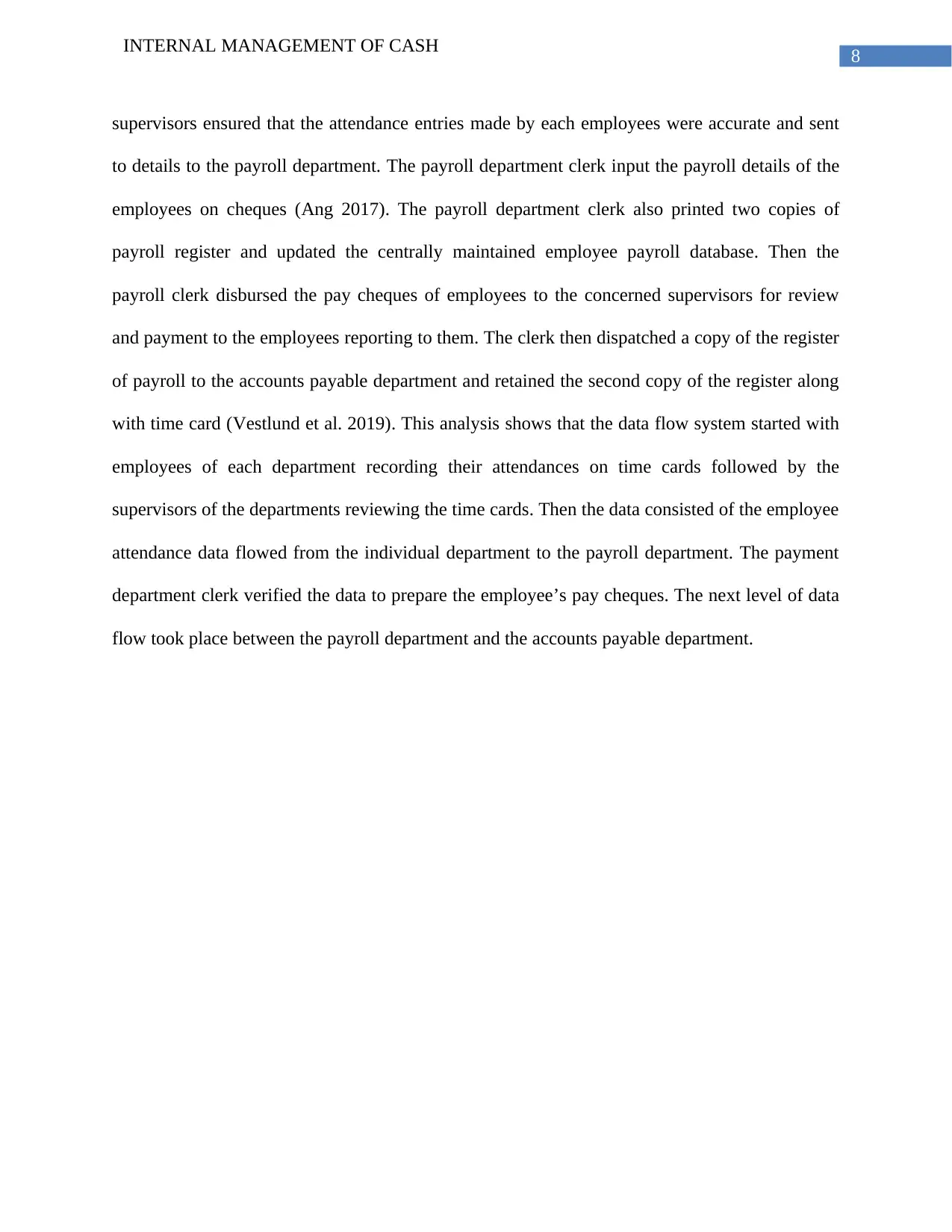

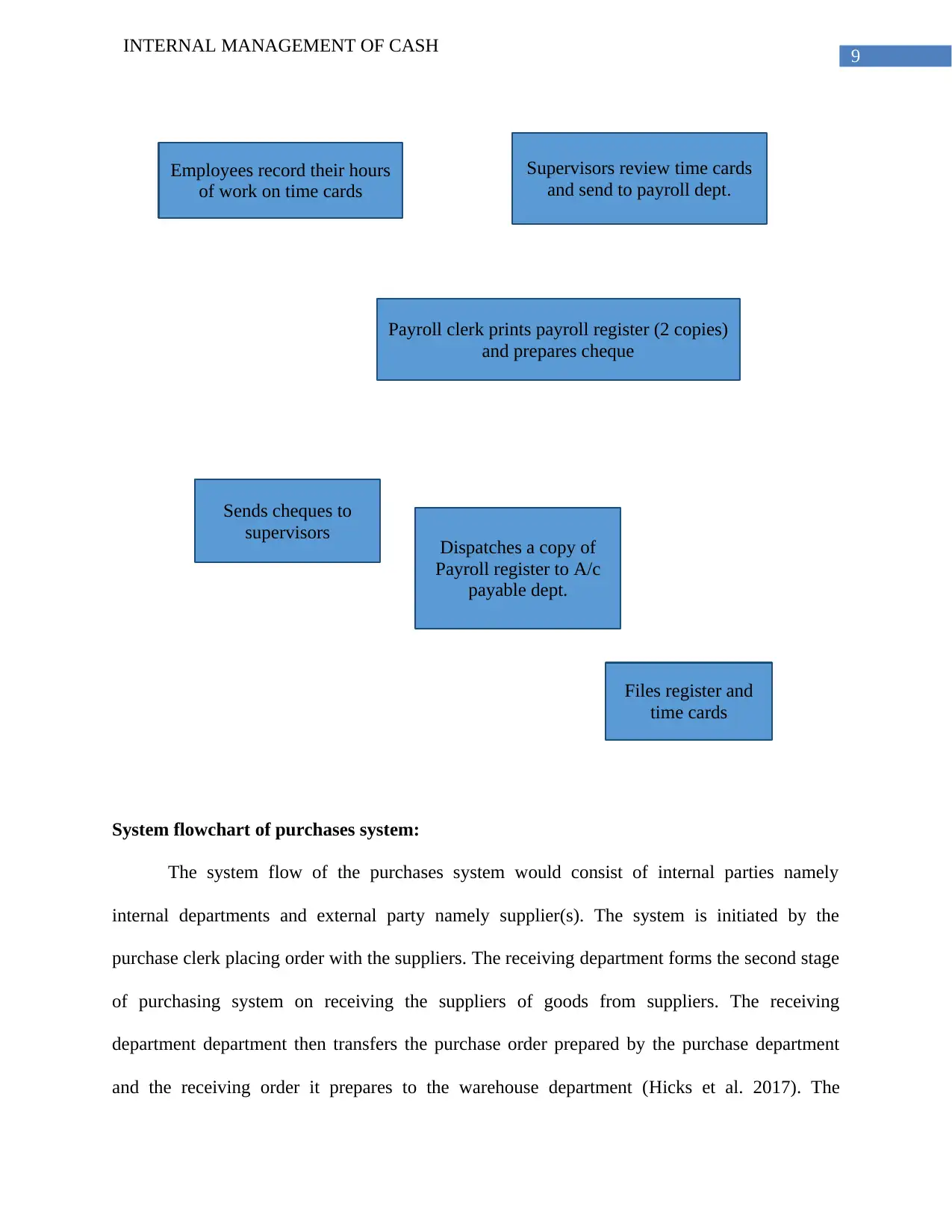

The data flow diagram of payroll system as shown below at Bell Studio was initiated by

the employees who recorded their respective attendance on time cards on daily basis. The

INTERNAL MANAGEMENT OF CASH

Cash disbursement department holds PO,

RR and Invoice until due date Clerk prepares cheque

on the invoiced

amount

Cash disbursement clerk sends cheque to treasurer

Treasurer signs cheque and mail to vendor

Cash disbursement clerk updates cheque register, a/c payable subsidiary

ledger and a/c payable control account

Receiving clerk files Invoice,

PO, RR and cheque

Figure 3. Process diagram showing payment of cheque and final filing by the receiving clerk

(Source: Author)

Data flow diagram of payroll system:

The data flow diagram of payroll system as shown below at Bell Studio was initiated by

the employees who recorded their respective attendance on time cards on daily basis. The

8

INTERNAL MANAGEMENT OF CASH

supervisors ensured that the attendance entries made by each employees were accurate and sent

to details to the payroll department. The payroll department clerk input the payroll details of the

employees on cheques (Ang 2017). The payroll department clerk also printed two copies of

payroll register and updated the centrally maintained employee payroll database. Then the

payroll clerk disbursed the pay cheques of employees to the concerned supervisors for review

and payment to the employees reporting to them. The clerk then dispatched a copy of the register

of payroll to the accounts payable department and retained the second copy of the register along

with time card (Vestlund et al. 2019). This analysis shows that the data flow system started with

employees of each department recording their attendances on time cards followed by the

supervisors of the departments reviewing the time cards. Then the data consisted of the employee

attendance data flowed from the individual department to the payroll department. The payment

department clerk verified the data to prepare the employee’s pay cheques. The next level of data

flow took place between the payroll department and the accounts payable department.

INTERNAL MANAGEMENT OF CASH

supervisors ensured that the attendance entries made by each employees were accurate and sent

to details to the payroll department. The payroll department clerk input the payroll details of the

employees on cheques (Ang 2017). The payroll department clerk also printed two copies of

payroll register and updated the centrally maintained employee payroll database. Then the

payroll clerk disbursed the pay cheques of employees to the concerned supervisors for review

and payment to the employees reporting to them. The clerk then dispatched a copy of the register

of payroll to the accounts payable department and retained the second copy of the register along

with time card (Vestlund et al. 2019). This analysis shows that the data flow system started with

employees of each department recording their attendances on time cards followed by the

supervisors of the departments reviewing the time cards. Then the data consisted of the employee

attendance data flowed from the individual department to the payroll department. The payment

department clerk verified the data to prepare the employee’s pay cheques. The next level of data

flow took place between the payroll department and the accounts payable department.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

INTERNAL MANAGEMENT OF CASH

Employees record their hours

of work on time cards

Supervisors review time cards

and send to payroll dept.

Payroll clerk prints payroll register (2 copies)

and prepares cheque

Sends cheques to

supervisors Dispatches a copy of

Payroll register to A/c

payable dept.

Files register and

time cards

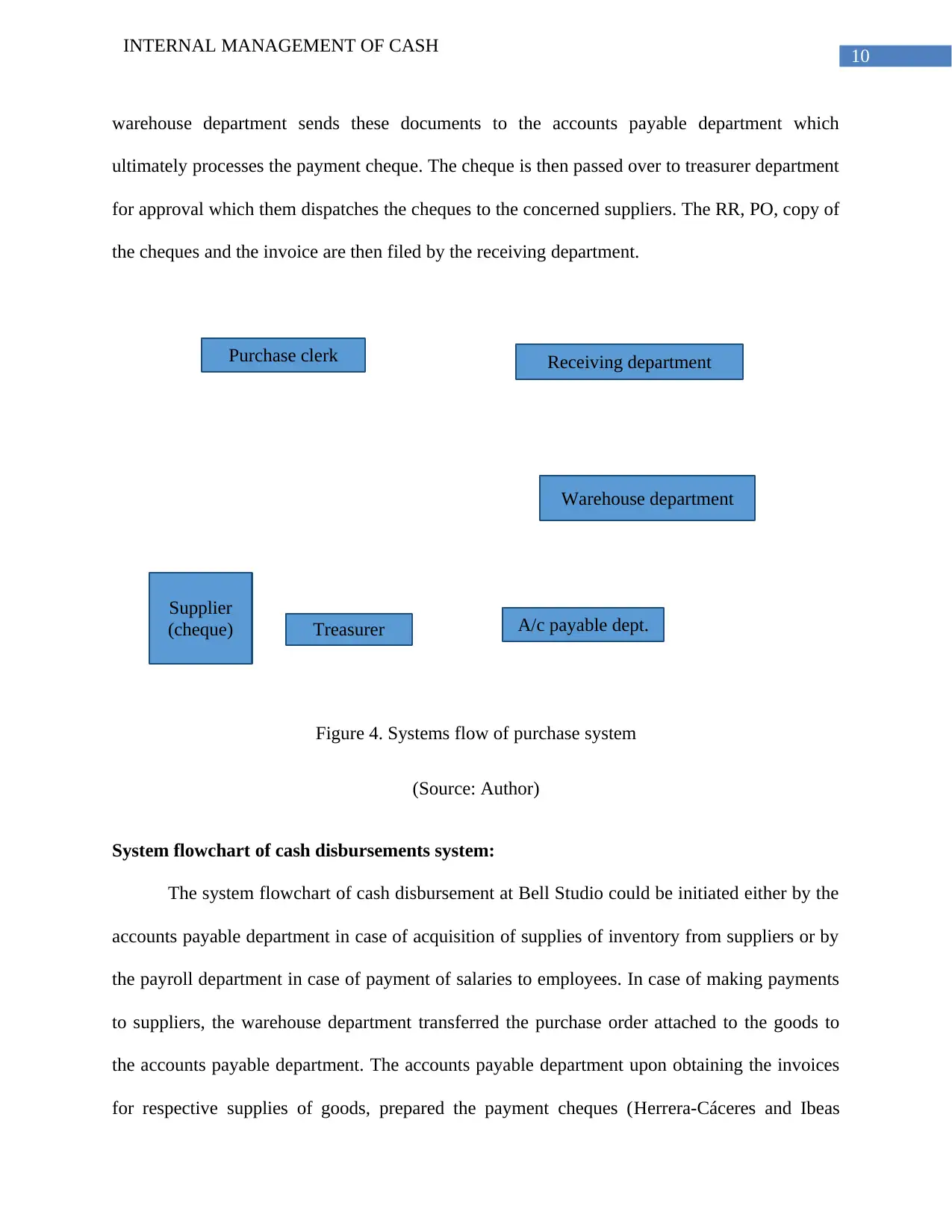

System flowchart of purchases system:

The system flow of the purchases system would consist of internal parties namely

internal departments and external party namely supplier(s). The system is initiated by the

purchase clerk placing order with the suppliers. The receiving department forms the second stage

of purchasing system on receiving the suppliers of goods from suppliers. The receiving

department department then transfers the purchase order prepared by the purchase department

and the receiving order it prepares to the warehouse department (Hicks et al. 2017). The

INTERNAL MANAGEMENT OF CASH

Employees record their hours

of work on time cards

Supervisors review time cards

and send to payroll dept.

Payroll clerk prints payroll register (2 copies)

and prepares cheque

Sends cheques to

supervisors Dispatches a copy of

Payroll register to A/c

payable dept.

Files register and

time cards

System flowchart of purchases system:

The system flow of the purchases system would consist of internal parties namely

internal departments and external party namely supplier(s). The system is initiated by the

purchase clerk placing order with the suppliers. The receiving department forms the second stage

of purchasing system on receiving the suppliers of goods from suppliers. The receiving

department department then transfers the purchase order prepared by the purchase department

and the receiving order it prepares to the warehouse department (Hicks et al. 2017). The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

INTERNAL MANAGEMENT OF CASH

Purchase clerk Receiving department

Warehouse department

A/c payable dept.Treasurer

Supplier

(cheque)

warehouse department sends these documents to the accounts payable department which

ultimately processes the payment cheque. The cheque is then passed over to treasurer department

for approval which them dispatches the cheques to the concerned suppliers. The RR, PO, copy of

the cheques and the invoice are then filed by the receiving department.

Figure 4. Systems flow of purchase system

(Source: Author)

System flowchart of cash disbursements system:

The system flowchart of cash disbursement at Bell Studio could be initiated either by the

accounts payable department in case of acquisition of supplies of inventory from suppliers or by

the payroll department in case of payment of salaries to employees. In case of making payments

to suppliers, the warehouse department transferred the purchase order attached to the goods to

the accounts payable department. The accounts payable department upon obtaining the invoices

for respective supplies of goods, prepared the payment cheques (Herrera-Cáceres and Ibeas

INTERNAL MANAGEMENT OF CASH

Purchase clerk Receiving department

Warehouse department

A/c payable dept.Treasurer

Supplier

(cheque)

warehouse department sends these documents to the accounts payable department which

ultimately processes the payment cheque. The cheque is then passed over to treasurer department

for approval which them dispatches the cheques to the concerned suppliers. The RR, PO, copy of

the cheques and the invoice are then filed by the receiving department.

Figure 4. Systems flow of purchase system

(Source: Author)

System flowchart of cash disbursements system:

The system flowchart of cash disbursement at Bell Studio could be initiated either by the

accounts payable department in case of acquisition of supplies of inventory from suppliers or by

the payroll department in case of payment of salaries to employees. In case of making payments

to suppliers, the warehouse department transferred the purchase order attached to the goods to

the accounts payable department. The accounts payable department upon obtaining the invoices

for respective supplies of goods, prepared the payment cheques (Herrera-Cáceres and Ibeas

11

INTERNAL MANAGEMENT OF CASH

Cash disbursement

system

A/c payable clerk sends

cheque for payment to

suppliers

Payroll department

sends employee pay

cheques

Cheque payment(s) to

suppliers

Salary payment to

employees

2016). The accounts payable department then forwarded the cheque to the treasurer for approval.

The latter then dispatched the cheques to the suppliers.

The second part of cash disbursement at Bell Studio occurred during making salary

compensation to employees. The processes was initiated with the supervisors sending the payroll

records of the employees to the payroll department which after verification of the same issued

payment cheques to the supervisors for disbursement (Gillett 2016).

Figure 5. Cash disbursement system of Bell Studio

(Source: Author)

INTERNAL MANAGEMENT OF CASH

Cash disbursement

system

A/c payable clerk sends

cheque for payment to

suppliers

Payroll department

sends employee pay

cheques

Cheque payment(s) to

suppliers

Salary payment to

employees

2016). The accounts payable department then forwarded the cheque to the treasurer for approval.

The latter then dispatched the cheques to the suppliers.

The second part of cash disbursement at Bell Studio occurred during making salary

compensation to employees. The processes was initiated with the supervisors sending the payroll

records of the employees to the payroll department which after verification of the same issued

payment cheques to the supervisors for disbursement (Gillett 2016).

Figure 5. Cash disbursement system of Bell Studio

(Source: Author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.