NEU - Management Accounting: Planning Tools and Financial Problems

VerifiedAdded on 2022/03/28

|22

|5556

|222

Report

AI Summary

This report analyzes management accounting practices, focusing on the application of planning tools and techniques to solve financial problems for two companies: Ricegreen Ltd. and SpaceZ Company. The report explores the advantages and disadvantages of various planning tools such as standard costs, budgets, and balanced scorecards, and evaluates their use in budgetary control and forecasting. It includes calculations related to standard costs, selling prices, and the preparation of monthly budgets for sales revenue, production volume, and resource allocation. Furthermore, it assesses how the companies adapt their management accounting systems to respond to financial problems and evaluates the application of PEST, SWOT, and balanced scorecard analyses. The report also examines the characteristics of an effective management accountant and analyzes how management accounting can lead organizations to sustainable success by appropriately using planning tools to solve financial problems.

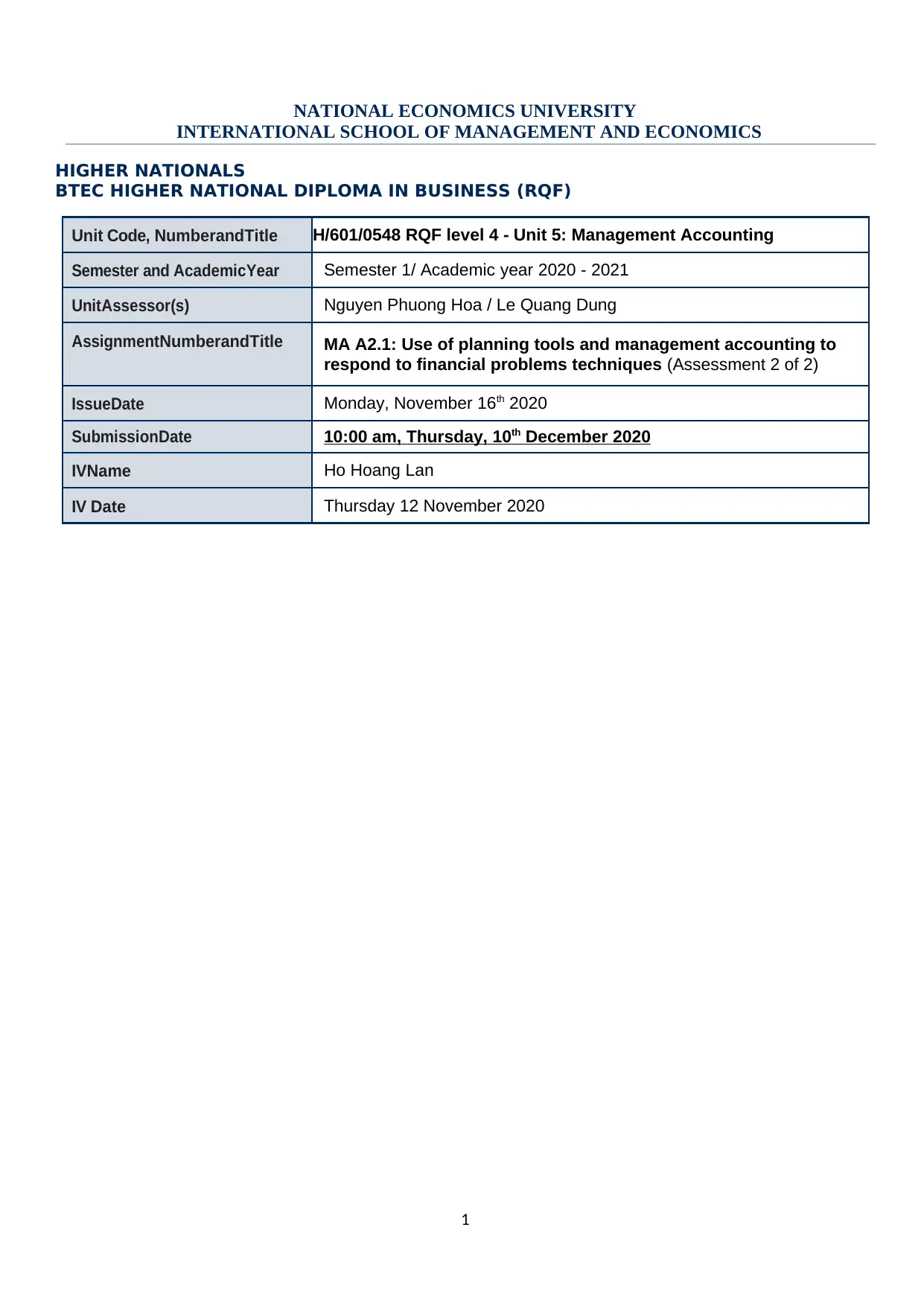

NATIONAL ECONOMICS UNIVERSITY

INTERNATIONAL SCHOOL OF MANAGEMENT AND ECONOMICS

HIGHER NATIONALS

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS (RQF)

Unit Code, NumberandTitle H/601/0548 RQF level 4 - Unit 5: Management Accounting

Semester and AcademicYear Semester 1/ Academic year 2020 - 2021

UnitAssessor(s) Nguyen Phuong Hoa / Le Quang Dung

Assignment NumberandTitle MA A2.1: Use of planning tools and management accounting to

respond to financial problems techniques (Assessment 2 of 2)

IssueDate Monday, November 16th 2020

SubmissionDate 10:00 am, Thursday, 10th December 2020

IVName Ho Hoang Lan

IV Date Thursday 12 November 2020

1

INTERNATIONAL SCHOOL OF MANAGEMENT AND ECONOMICS

HIGHER NATIONALS

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS (RQF)

Unit Code, NumberandTitle H/601/0548 RQF level 4 - Unit 5: Management Accounting

Semester and AcademicYear Semester 1/ Academic year 2020 - 2021

UnitAssessor(s) Nguyen Phuong Hoa / Le Quang Dung

Assignment NumberandTitle MA A2.1: Use of planning tools and management accounting to

respond to financial problems techniques (Assessment 2 of 2)

IssueDate Monday, November 16th 2020

SubmissionDate 10:00 am, Thursday, 10th December 2020

IVName Ho Hoang Lan

IV Date Thursday 12 November 2020

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

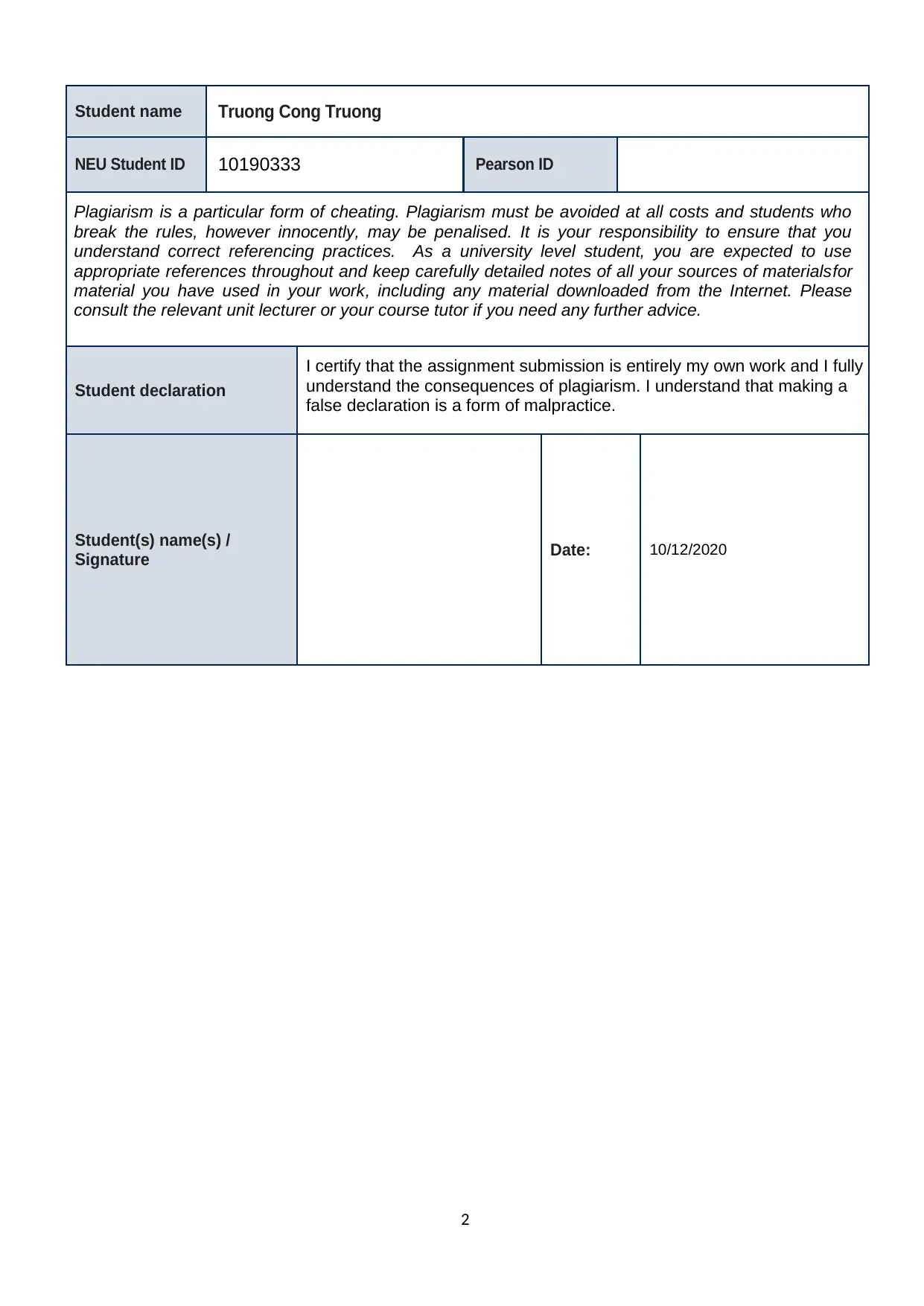

Student name Truong Cong Truong

NEU Student ID 10190333 Pearson ID

Plagiarism is a particular form of cheating. Plagiarism must be avoided at all costs and students who

break the rules, however innocently, may be penalised. It is your responsibility to ensure that you

understand correct referencing practices. As a university level student, you are expected to use

appropriate references throughout and keep carefully detailed notes of all your sources of materialsfor

material you have used in your work, including any material downloaded from the Internet. Please

consult the relevant unit lecturer or your course tutor if you need any further advice.

Student declaration

I certify that the assignment submission is entirely my own work and I fully

understand the consequences of plagiarism. I understand that making a

false declaration is a form of malpractice.

Student(s) name(s) /

Signature Date: 10/12/2020

2

NEU Student ID 10190333 Pearson ID

Plagiarism is a particular form of cheating. Plagiarism must be avoided at all costs and students who

break the rules, however innocently, may be penalised. It is your responsibility to ensure that you

understand correct referencing practices. As a university level student, you are expected to use

appropriate references throughout and keep carefully detailed notes of all your sources of materialsfor

material you have used in your work, including any material downloaded from the Internet. Please

consult the relevant unit lecturer or your course tutor if you need any further advice.

Student declaration

I certify that the assignment submission is entirely my own work and I fully

understand the consequences of plagiarism. I understand that making a

false declaration is a form of malpractice.

Student(s) name(s) /

Signature Date: 10/12/2020

2

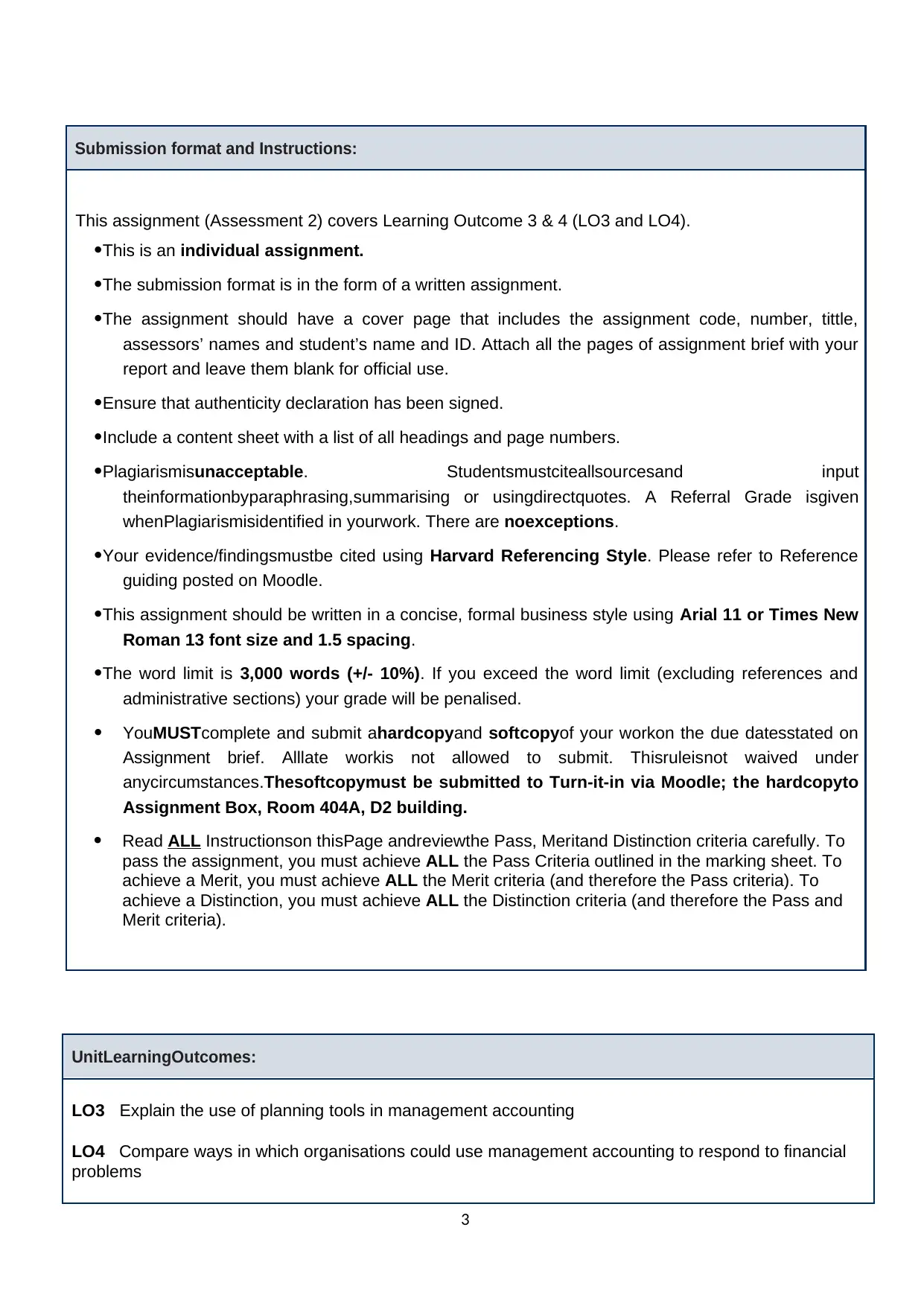

UnitLearningOutcomes:

LO3 Explain the use of planning tools in management accounting

LO4 Compare ways in which organisations could use management accounting to respond to financial

problems

3

Submission format and Instructions:

This assignment (Assessment 2) covers Learning Outcome 3 & 4 (LO3 and LO4).

This is an individual assignment.

The submission format is in the form of a written assignment.

The assignment should have a cover page that includes the assignment code, number, tittle,

assessors’ names and student’s name and ID. Attach all the pages of assignment brief with your

report and leave them blank for official use.

Ensure that authenticity declaration has been signed.

Include a content sheet with a list of all headings and page numbers.

Plagiarismisunacceptable. Studentsmustciteallsourcesand input

theinformationbyparaphrasing,summarising or usingdirectquotes. A Referral Grade isgiven

whenPlagiarismisidentified in yourwork. There are noexceptions.

Your evidence/findingsmustbe cited using Harvard Referencing Style. Please refer to Reference

guiding posted on Moodle.

This assignment should be written in a concise, formal business style using Arial 11 or Times New

Roman 13 font size and 1.5 spacing.

The word limit is 3,000 words (+/- 10%). If you exceed the word limit (excluding references and

administrative sections) your grade will be penalised.

YouMUSTcomplete and submit ahardcopyand softcopyof your workon the due datesstated on

Assignment brief. Alllate workis not allowed to submit. Thisruleisnot waived under

anycircumstances.Thesoftcopymust be submitted to Turn-it-in via Moodle; the hardcopyto

Assignment Box, Room 404A, D2 building.

Read ALL Instructionson thisPage andreviewthe Pass, Meritand Distinction criteria carefully. To

pass the assignment, you must achieve ALL the Pass Criteria outlined in the marking sheet. To

achieve a Merit, you must achieve ALL the Merit criteria (and therefore the Pass criteria). To

achieve a Distinction, you must achieve ALL the Distinction criteria (and therefore the Pass and

Merit criteria).

LO3 Explain the use of planning tools in management accounting

LO4 Compare ways in which organisations could use management accounting to respond to financial

problems

3

Submission format and Instructions:

This assignment (Assessment 2) covers Learning Outcome 3 & 4 (LO3 and LO4).

This is an individual assignment.

The submission format is in the form of a written assignment.

The assignment should have a cover page that includes the assignment code, number, tittle,

assessors’ names and student’s name and ID. Attach all the pages of assignment brief with your

report and leave them blank for official use.

Ensure that authenticity declaration has been signed.

Include a content sheet with a list of all headings and page numbers.

Plagiarismisunacceptable. Studentsmustciteallsourcesand input

theinformationbyparaphrasing,summarising or usingdirectquotes. A Referral Grade isgiven

whenPlagiarismisidentified in yourwork. There are noexceptions.

Your evidence/findingsmustbe cited using Harvard Referencing Style. Please refer to Reference

guiding posted on Moodle.

This assignment should be written in a concise, formal business style using Arial 11 or Times New

Roman 13 font size and 1.5 spacing.

The word limit is 3,000 words (+/- 10%). If you exceed the word limit (excluding references and

administrative sections) your grade will be penalised.

YouMUSTcomplete and submit ahardcopyand softcopyof your workon the due datesstated on

Assignment brief. Alllate workis not allowed to submit. Thisruleisnot waived under

anycircumstances.Thesoftcopymust be submitted to Turn-it-in via Moodle; the hardcopyto

Assignment Box, Room 404A, D2 building.

Read ALL Instructionson thisPage andreviewthe Pass, Meritand Distinction criteria carefully. To

pass the assignment, you must achieve ALL the Pass Criteria outlined in the marking sheet. To

achieve a Merit, you must achieve ALL the Merit criteria (and therefore the Pass criteria). To

achieve a Distinction, you must achieve ALL the Distinction criteria (and therefore the Pass and

Merit criteria).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

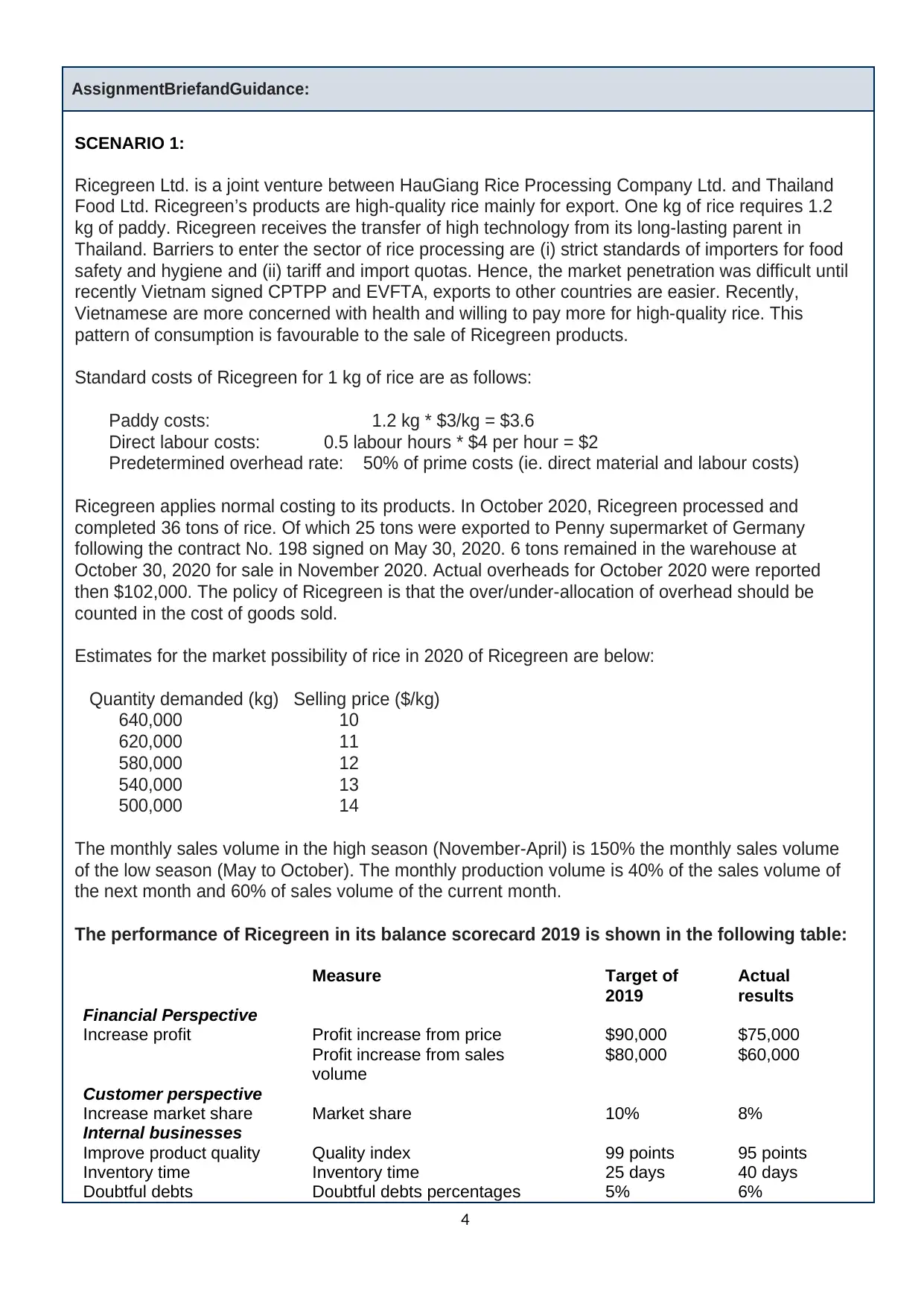

AssignmentBriefandGuidance:

SCENARIO 1:

Ricegreen Ltd. is a joint venture between HauGiang Rice Processing Company Ltd. and Thailand

Food Ltd. Ricegreen’s products are high-quality rice mainly for export. One kg of rice requires 1.2

kg of paddy. Ricegreen receives the transfer of high technology from its long-lasting parent in

Thailand. Barriers to enter the sector of rice processing are (i) strict standards of importers for food

safety and hygiene and (ii) tariff and import quotas. Hence, the market penetration was difficult until

recently Vietnam signed CPTPP and EVFTA, exports to other countries are easier. Recently,

Vietnamese are more concerned with health and willing to pay more for high-quality rice. This

pattern of consumption is favourable to the sale of Ricegreen products.

Standard costs of Ricegreen for 1 kg of rice are as follows:

Paddy costs: 1.2 kg * $3/kg = $3.6

Direct labour costs: 0.5 labour hours * $4 per hour = $2

Predetermined overhead rate: 50% of prime costs (ie. direct material and labour costs)

Ricegreen applies normal costing to its products. In October 2020, Ricegreen processed and

completed 36 tons of rice. Of which 25 tons were exported to Penny supermarket of Germany

following the contract No. 198 signed on May 30, 2020. 6 tons remained in the warehouse at

October 30, 2020 for sale in November 2020. Actual overheads for October 2020 were reported

then $102,000. The policy of Ricegreen is that the over/under-allocation of overhead should be

counted in the cost of goods sold.

Estimates for the market possibility of rice in 2020 of Ricegreen are below:

Quantity demanded (kg) Selling price ($/kg)

640,000 10

620,000 11

580,000 12

540,000 13

500,000 14

The monthly sales volume in the high season (November-April) is 150% the monthly sales volume

of the low season (May to October). The monthly production volume is 40% of the sales volume of

the next month and 60% of sales volume of the current month.

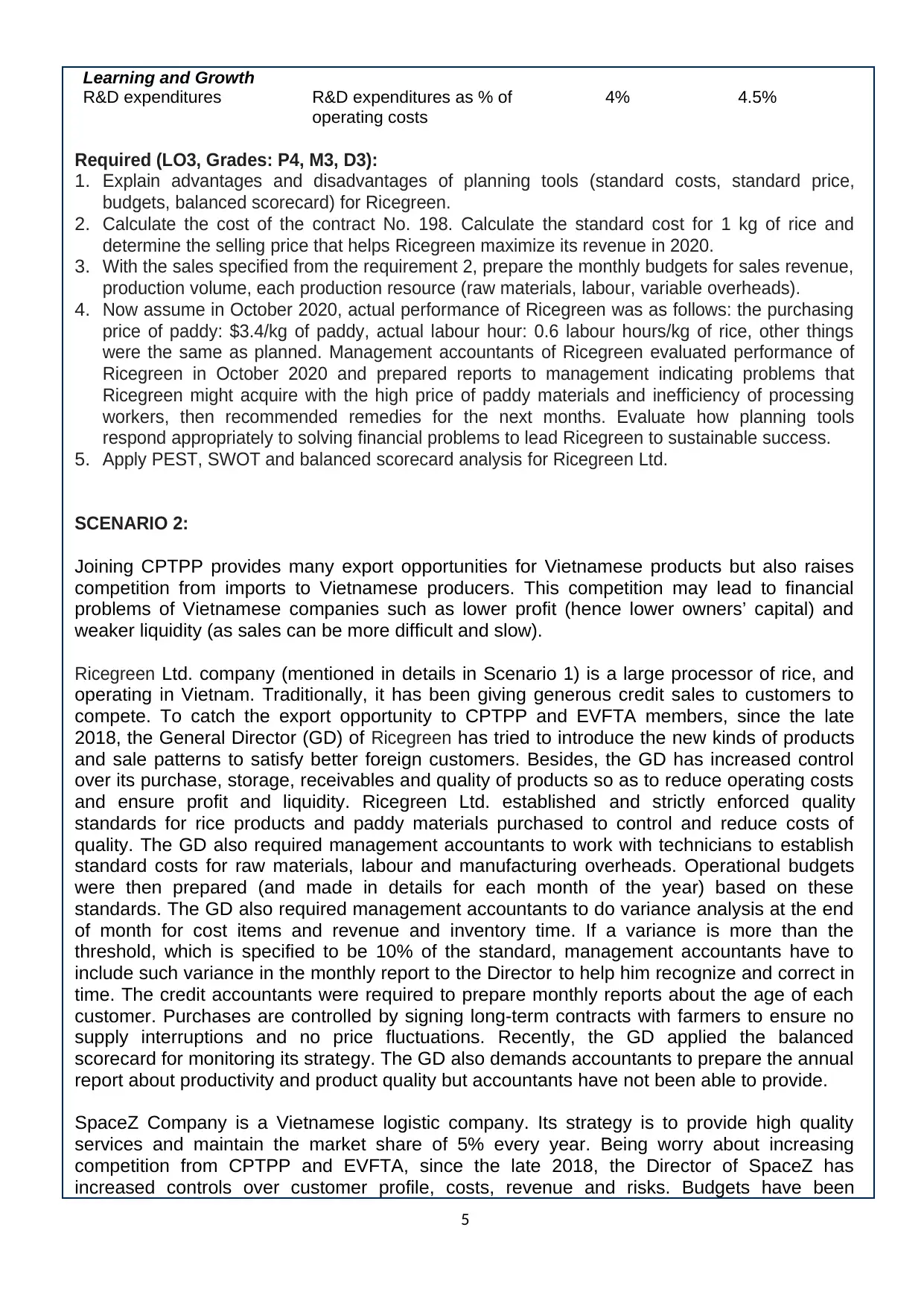

The performance of Ricegreen in its balance scorecard 2019 is shown in the following table:

Measure Target of

2019

Actual

results

Financial Perspective

Increase profit Profit increase from price $90,000 $75,000

Profit increase from sales

volume

$80,000 $60,000

Customer perspective

Increase market share Market share 10% 8%

Internal businesses

Improve product quality Quality index 99 points 95 points

Inventory time Inventory time 25 days 40 days

Doubtful debts Doubtful debts percentages 5% 6%

4

SCENARIO 1:

Ricegreen Ltd. is a joint venture between HauGiang Rice Processing Company Ltd. and Thailand

Food Ltd. Ricegreen’s products are high-quality rice mainly for export. One kg of rice requires 1.2

kg of paddy. Ricegreen receives the transfer of high technology from its long-lasting parent in

Thailand. Barriers to enter the sector of rice processing are (i) strict standards of importers for food

safety and hygiene and (ii) tariff and import quotas. Hence, the market penetration was difficult until

recently Vietnam signed CPTPP and EVFTA, exports to other countries are easier. Recently,

Vietnamese are more concerned with health and willing to pay more for high-quality rice. This

pattern of consumption is favourable to the sale of Ricegreen products.

Standard costs of Ricegreen for 1 kg of rice are as follows:

Paddy costs: 1.2 kg * $3/kg = $3.6

Direct labour costs: 0.5 labour hours * $4 per hour = $2

Predetermined overhead rate: 50% of prime costs (ie. direct material and labour costs)

Ricegreen applies normal costing to its products. In October 2020, Ricegreen processed and

completed 36 tons of rice. Of which 25 tons were exported to Penny supermarket of Germany

following the contract No. 198 signed on May 30, 2020. 6 tons remained in the warehouse at

October 30, 2020 for sale in November 2020. Actual overheads for October 2020 were reported

then $102,000. The policy of Ricegreen is that the over/under-allocation of overhead should be

counted in the cost of goods sold.

Estimates for the market possibility of rice in 2020 of Ricegreen are below:

Quantity demanded (kg) Selling price ($/kg)

640,000 10

620,000 11

580,000 12

540,000 13

500,000 14

The monthly sales volume in the high season (November-April) is 150% the monthly sales volume

of the low season (May to October). The monthly production volume is 40% of the sales volume of

the next month and 60% of sales volume of the current month.

The performance of Ricegreen in its balance scorecard 2019 is shown in the following table:

Measure Target of

2019

Actual

results

Financial Perspective

Increase profit Profit increase from price $90,000 $75,000

Profit increase from sales

volume

$80,000 $60,000

Customer perspective

Increase market share Market share 10% 8%

Internal businesses

Improve product quality Quality index 99 points 95 points

Inventory time Inventory time 25 days 40 days

Doubtful debts Doubtful debts percentages 5% 6%

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Learning and Growth

R&D expenditures R&D expenditures as % of

operating costs

4% 4.5%

Required (LO3, Grades: P4, M3, D3):

1. Explain advantages and disadvantages of planning tools (standard costs, standard price,

budgets, balanced scorecard) for Ricegreen.

2. Calculate the cost of the contract No. 198. Calculate the standard cost for 1 kg of rice and

determine the selling price that helps Ricegreen maximize its revenue in 2020.

3. With the sales specified from the requirement 2, prepare the monthly budgets for sales revenue,

production volume, each production resource (raw materials, labour, variable overheads).

4. Now assume in October 2020, actual performance of Ricegreen was as follows: the purchasing

price of paddy: $3.4/kg of paddy, actual labour hour: 0.6 labour hours/kg of rice, other things

were the same as planned. Management accountants of Ricegreen evaluated performance of

Ricegreen in October 2020 and prepared reports to management indicating problems that

Ricegreen might acquire with the high price of paddy materials and inefficiency of processing

workers, then recommended remedies for the next months. Evaluate how planning tools

respond appropriately to solving financial problems to lead Ricegreen to sustainable success.

5. Apply PEST, SWOT and balanced scorecard analysis for Ricegreen Ltd.

SCENARIO 2:

Joining CPTPP provides many export opportunities for Vietnamese products but also raises

competition from imports to Vietnamese producers. This competition may lead to financial

problems of Vietnamese companies such as lower profit (hence lower owners’ capital) and

weaker liquidity (as sales can be more difficult and slow).

Ricegreen Ltd. company (mentioned in details in Scenario 1) is a large processor of rice, and

operating in Vietnam. Traditionally, it has been giving generous credit sales to customers to

compete. To catch the export opportunity to CPTPP and EVFTA members, since the late

2018, the General Director (GD) of Ricegreen has tried to introduce the new kinds of products

and sale patterns to satisfy better foreign customers. Besides, the GD has increased control

over its purchase, storage, receivables and quality of products so as to reduce operating costs

and ensure profit and liquidity. Ricegreen Ltd. established and strictly enforced quality

standards for rice products and paddy materials purchased to control and reduce costs of

quality. The GD also required management accountants to work with technicians to establish

standard costs for raw materials, labour and manufacturing overheads. Operational budgets

were then prepared (and made in details for each month of the year) based on these

standards. The GD also required management accountants to do variance analysis at the end

of month for cost items and revenue and inventory time. If a variance is more than the

threshold, which is specified to be 10% of the standard, management accountants have to

include such variance in the monthly report to the Director to help him recognize and correct in

time. The credit accountants were required to prepare monthly reports about the age of each

customer. Purchases are controlled by signing long-term contracts with farmers to ensure no

supply interruptions and no price fluctuations. Recently, the GD applied the balanced

scorecard for monitoring its strategy. The GD also demands accountants to prepare the annual

report about productivity and product quality but accountants have not been able to provide.

SpaceZ Company is a Vietnamese logistic company. Its strategy is to provide high quality

services and maintain the market share of 5% every year. Being worry about increasing

competition from CPTPP and EVFTA, since the late 2018, the Director of SpaceZ has

increased controls over customer profile, costs, revenue and risks. Budgets have been

5

R&D expenditures R&D expenditures as % of

operating costs

4% 4.5%

Required (LO3, Grades: P4, M3, D3):

1. Explain advantages and disadvantages of planning tools (standard costs, standard price,

budgets, balanced scorecard) for Ricegreen.

2. Calculate the cost of the contract No. 198. Calculate the standard cost for 1 kg of rice and

determine the selling price that helps Ricegreen maximize its revenue in 2020.

3. With the sales specified from the requirement 2, prepare the monthly budgets for sales revenue,

production volume, each production resource (raw materials, labour, variable overheads).

4. Now assume in October 2020, actual performance of Ricegreen was as follows: the purchasing

price of paddy: $3.4/kg of paddy, actual labour hour: 0.6 labour hours/kg of rice, other things

were the same as planned. Management accountants of Ricegreen evaluated performance of

Ricegreen in October 2020 and prepared reports to management indicating problems that

Ricegreen might acquire with the high price of paddy materials and inefficiency of processing

workers, then recommended remedies for the next months. Evaluate how planning tools

respond appropriately to solving financial problems to lead Ricegreen to sustainable success.

5. Apply PEST, SWOT and balanced scorecard analysis for Ricegreen Ltd.

SCENARIO 2:

Joining CPTPP provides many export opportunities for Vietnamese products but also raises

competition from imports to Vietnamese producers. This competition may lead to financial

problems of Vietnamese companies such as lower profit (hence lower owners’ capital) and

weaker liquidity (as sales can be more difficult and slow).

Ricegreen Ltd. company (mentioned in details in Scenario 1) is a large processor of rice, and

operating in Vietnam. Traditionally, it has been giving generous credit sales to customers to

compete. To catch the export opportunity to CPTPP and EVFTA members, since the late

2018, the General Director (GD) of Ricegreen has tried to introduce the new kinds of products

and sale patterns to satisfy better foreign customers. Besides, the GD has increased control

over its purchase, storage, receivables and quality of products so as to reduce operating costs

and ensure profit and liquidity. Ricegreen Ltd. established and strictly enforced quality

standards for rice products and paddy materials purchased to control and reduce costs of

quality. The GD also required management accountants to work with technicians to establish

standard costs for raw materials, labour and manufacturing overheads. Operational budgets

were then prepared (and made in details for each month of the year) based on these

standards. The GD also required management accountants to do variance analysis at the end

of month for cost items and revenue and inventory time. If a variance is more than the

threshold, which is specified to be 10% of the standard, management accountants have to

include such variance in the monthly report to the Director to help him recognize and correct in

time. The credit accountants were required to prepare monthly reports about the age of each

customer. Purchases are controlled by signing long-term contracts with farmers to ensure no

supply interruptions and no price fluctuations. Recently, the GD applied the balanced

scorecard for monitoring its strategy. The GD also demands accountants to prepare the annual

report about productivity and product quality but accountants have not been able to provide.

SpaceZ Company is a Vietnamese logistic company. Its strategy is to provide high quality

services and maintain the market share of 5% every year. Being worry about increasing

competition from CPTPP and EVFTA, since the late 2018, the Director of SpaceZ has

increased controls over customer profile, costs, revenue and risks. Budgets have been

5

stringent and expenditures have been made based on budget items only. The information

system was upgraded to receive and process quickly orders and complaints of customers, and

to trace easily the process of each order. Revenue and cost reports are prepared each quarter

by each kind of logistic services to help Director decide on expansion or reduction of a service

line. Standard behaviours are designed and trained for staff. Procedures for risk assessment

before signing logistic contracts were updated and communicated thoroughly to staff to reduce

the adverse selection. Feedbacks of customers are scrutinized by the Director to seek

improvements. Recently, the Director started to order McKinsey Vietnam Ltd. to build Porter’s

five forces so as to analyse its positions and to specify coping measures. The Director

demands SpaceZ accountants to analyse and report about SpaceZ competitiveness each

year, but the accountants have not been able to do such work.

Required (LO4, Grades: P5, M4, D3)

1. Compare how Ricegreen and SpaceZ are adapting management accounting systems to

respond to financial problems. Based on scenarios of Ricegreen and SpaceZ, indicate

characteristics of an effective management accountant? Finance problem, accoungting

system.

2. Analyse how in responding to financial problems, management accounting can lead

Ricegreen and SpaceZ to sustainable success.

3. Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead Ricegreen and SpaceZ to sustainable success.

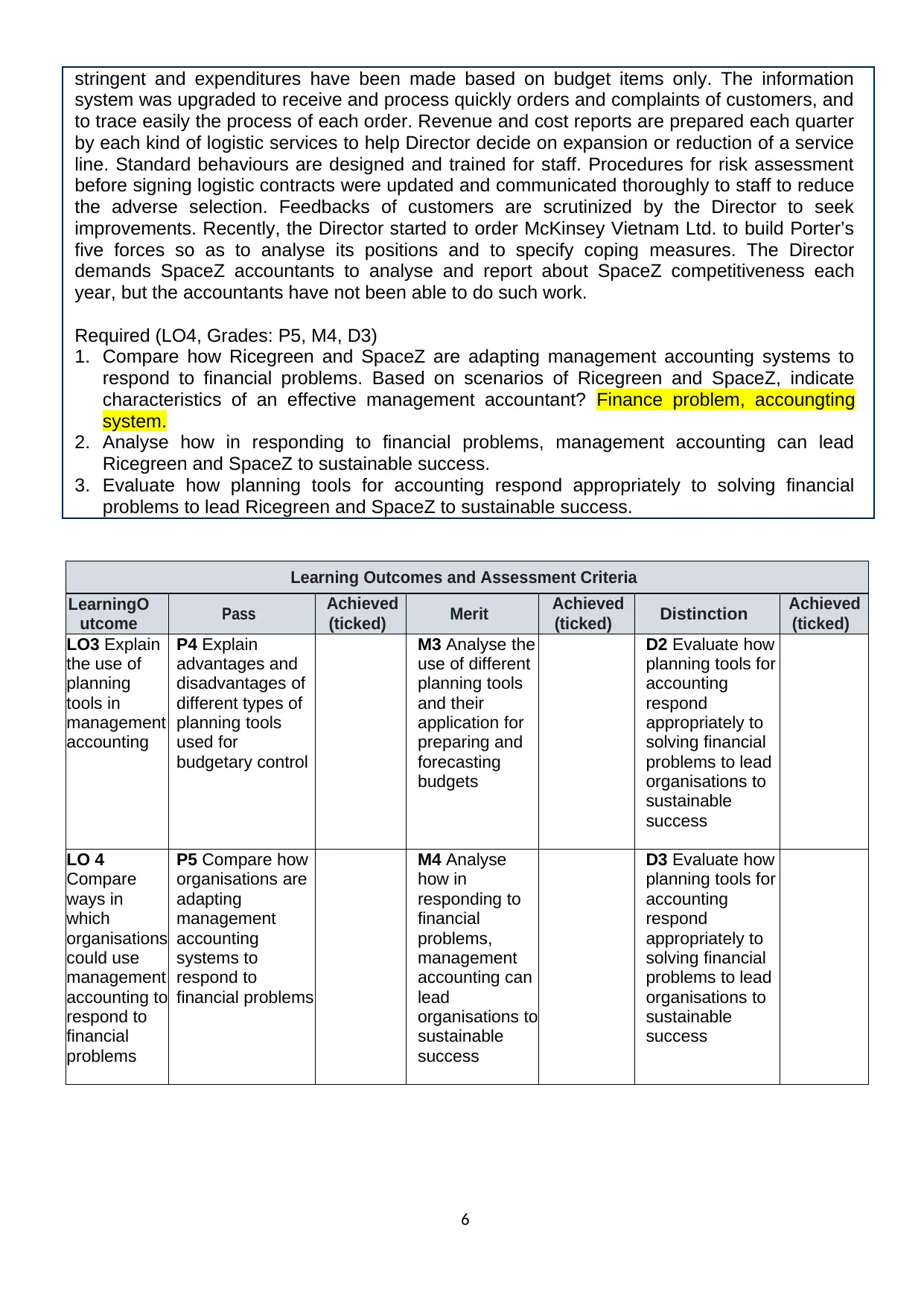

Learning Outcomes and Assessment Criteria

LearningO

utcome Pass Achieved

(ticked) Merit Achieved

(ticked) Distinction Achieved

(ticked)

LO3 Explain

the use of

planning

tools in

management

accounting

P4 Explain

advantages and

disadvantages of

different types of

planning tools

used for

budgetary control

M3 Analyse the

use of different

planning tools

and their

application for

preparing and

forecasting

budgets

D2 Evaluate how

planning tools for

accounting

respond

appropriately to

solving financial

problems to lead

organisations to

sustainable

success

LO 4

Compare

ways in

which

organisations

could use

management

accounting to

respond to

financial

problems

P5 Compare how

organisations are

adapting

management

accounting

systems to

respond to

financial problems

M4 Analyse

how in

responding to

financial

problems,

management

accounting can

lead

organisations to

sustainable

success

D3 Evaluate how

planning tools for

accounting

respond

appropriately to

solving financial

problems to lead

organisations to

sustainable

success

6

system was upgraded to receive and process quickly orders and complaints of customers, and

to trace easily the process of each order. Revenue and cost reports are prepared each quarter

by each kind of logistic services to help Director decide on expansion or reduction of a service

line. Standard behaviours are designed and trained for staff. Procedures for risk assessment

before signing logistic contracts were updated and communicated thoroughly to staff to reduce

the adverse selection. Feedbacks of customers are scrutinized by the Director to seek

improvements. Recently, the Director started to order McKinsey Vietnam Ltd. to build Porter’s

five forces so as to analyse its positions and to specify coping measures. The Director

demands SpaceZ accountants to analyse and report about SpaceZ competitiveness each

year, but the accountants have not been able to do such work.

Required (LO4, Grades: P5, M4, D3)

1. Compare how Ricegreen and SpaceZ are adapting management accounting systems to

respond to financial problems. Based on scenarios of Ricegreen and SpaceZ, indicate

characteristics of an effective management accountant? Finance problem, accoungting

system.

2. Analyse how in responding to financial problems, management accounting can lead

Ricegreen and SpaceZ to sustainable success.

3. Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead Ricegreen and SpaceZ to sustainable success.

Learning Outcomes and Assessment Criteria

LearningO

utcome Pass Achieved

(ticked) Merit Achieved

(ticked) Distinction Achieved

(ticked)

LO3 Explain

the use of

planning

tools in

management

accounting

P4 Explain

advantages and

disadvantages of

different types of

planning tools

used for

budgetary control

M3 Analyse the

use of different

planning tools

and their

application for

preparing and

forecasting

budgets

D2 Evaluate how

planning tools for

accounting

respond

appropriately to

solving financial

problems to lead

organisations to

sustainable

success

LO 4

Compare

ways in

which

organisations

could use

management

accounting to

respond to

financial

problems

P5 Compare how

organisations are

adapting

management

accounting

systems to

respond to

financial problems

M4 Analyse

how in

responding to

financial

problems,

management

accounting can

lead

organisations to

sustainable

success

D3 Evaluate how

planning tools for

accounting

respond

appropriately to

solving financial

problems to lead

organisations to

sustainable

success

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Formative Feedback: Assessor to Student (please specific)

Action Plan

Summative Feedback: Assessor to Student (please specific)

Choose

One

(*)

The Student Is Awarded:

ReferralPASS Grade MERIT Grade DISTINCTION Grade

Name Of Assessor: Date Of Assessment:

Re-submission Feedback:

Choose One

(*)

The Student Is Awarded A:

ReferralPASS Grade

7

Action Plan

Summative Feedback: Assessor to Student (please specific)

Choose

One

(*)

The Student Is Awarded:

ReferralPASS Grade MERIT Grade DISTINCTION Grade

Name Of Assessor: Date Of Assessment:

Re-submission Feedback:

Choose One

(*)

The Student Is Awarded A:

ReferralPASS Grade

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Name Of Assessor: Date Of Assessment:

Feedback: Student to Assessor

Signature & Date:

* Please note that grades are provisional. They are only confirmed once internal and external verifiers

have taken place, and the final decisions have been agreed at the assessment board.

* This grade only reflects the result of this assignment, not for the whole Unit

8

Feedback: Student to Assessor

Signature & Date:

* Please note that grades are provisional. They are only confirmed once internal and external verifiers

have taken place, and the final decisions have been agreed at the assessment board.

* This grade only reflects the result of this assignment, not for the whole Unit

8

Table of Contents

................................................................................................................................................1

NATIONAL ECONOMICS UNIVERSITY..............................................................................1

INTERNATIONAL SCHOOL OF MANAGEMENT AND ECONOMICS..............................1

HIGHER NATIONALS.................................................................................................................1

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS (RQF)............................................................1

1. Benefits and drawbacks of the planning tools.................................................................10

a. Standard costing......................................................................................................................10

b. Standard price.........................................................................................................................10

c. Budgets....................................................................................................................................11

d. Balanced scorecard..................................................................................................................12

2. Cost caculation..............................................................................................................13

3. Preparing the monthly budgets......................................................................................14

4. Using planning tools to solve financial problems............................................................17

5. PEST, SWOT and Balanced scorecard analysis of Rice Green...........................................17

5.1 PEST..........................................................................................................................................17

5.2 SWOT........................................................................................................................................17

5.3 Balanced scorecard...................................................................................................................17

1.Rice Green and SpaceZ......................................................................................................17

2. The analysis of management accounting of Ricegreen and SpaceZ....................................17

a. Rice Green...................................................................................................................................17

b. SpaceZ.........................................................................................................................................17

9

................................................................................................................................................1

NATIONAL ECONOMICS UNIVERSITY..............................................................................1

INTERNATIONAL SCHOOL OF MANAGEMENT AND ECONOMICS..............................1

HIGHER NATIONALS.................................................................................................................1

BTEC HIGHER NATIONAL DIPLOMA IN BUSINESS (RQF)............................................................1

1. Benefits and drawbacks of the planning tools.................................................................10

a. Standard costing......................................................................................................................10

b. Standard price.........................................................................................................................10

c. Budgets....................................................................................................................................11

d. Balanced scorecard..................................................................................................................12

2. Cost caculation..............................................................................................................13

3. Preparing the monthly budgets......................................................................................14

4. Using planning tools to solve financial problems............................................................17

5. PEST, SWOT and Balanced scorecard analysis of Rice Green...........................................17

5.1 PEST..........................................................................................................................................17

5.2 SWOT........................................................................................................................................17

5.3 Balanced scorecard...................................................................................................................17

1.Rice Green and SpaceZ......................................................................................................17

2. The analysis of management accounting of Ricegreen and SpaceZ....................................17

a. Rice Green...................................................................................................................................17

b. SpaceZ.........................................................................................................................................17

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A. Excusetive summary

The research paper has 3 parts. First is the definition and benefits and disadvantages of the

planning tools for Ricegreen and the calculations. Then there is an assessment of the

differences between the two companies Ricegreen and SpaceZ.

B. Scenario 1

1. Benefits and drawbacks of the planning tools

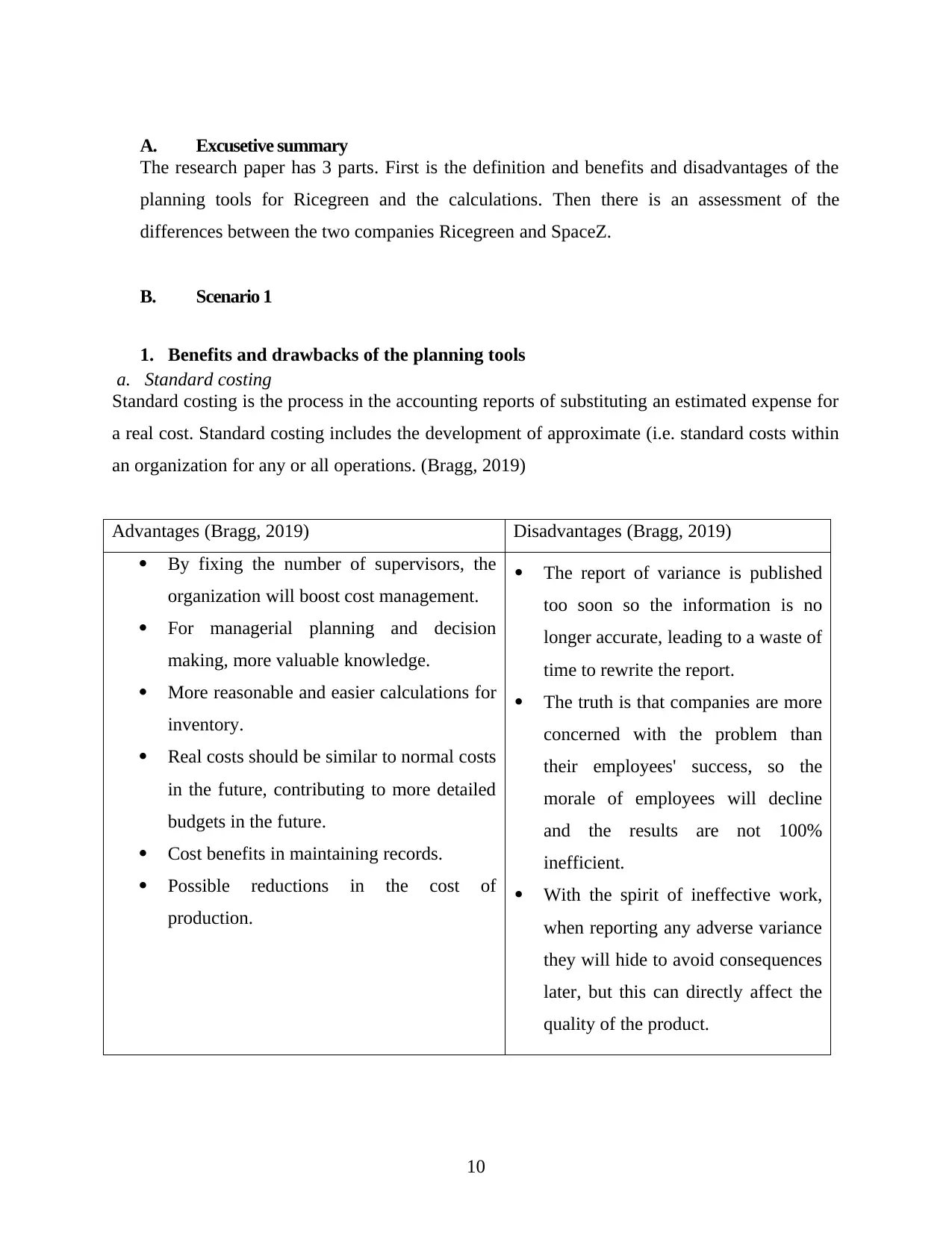

a. Standard costing

Standard costing is the process in the accounting reports of substituting an estimated expense for

a real cost. Standard costing includes the development of approximate (i.e. standard costs within

an organization for any or all operations. (Bragg, 2019)

Advantages (Bragg, 2019) Disadvantages (Bragg, 2019)

By fixing the number of supervisors, the

organization will boost cost management.

For managerial planning and decision

making, more valuable knowledge.

More reasonable and easier calculations for

inventory.

Real costs should be similar to normal costs

in the future, contributing to more detailed

budgets in the future.

Cost benefits in maintaining records.

Possible reductions in the cost of

production.

The report of variance is published

too soon so the information is no

longer accurate, leading to a waste of

time to rewrite the report.

The truth is that companies are more

concerned with the problem than

their employees' success, so the

morale of employees will decline

and the results are not 100%

inefficient.

With the spirit of ineffective work,

when reporting any adverse variance

they will hide to avoid consequences

later, but this can directly affect the

quality of the product.

10

The research paper has 3 parts. First is the definition and benefits and disadvantages of the

planning tools for Ricegreen and the calculations. Then there is an assessment of the

differences between the two companies Ricegreen and SpaceZ.

B. Scenario 1

1. Benefits and drawbacks of the planning tools

a. Standard costing

Standard costing is the process in the accounting reports of substituting an estimated expense for

a real cost. Standard costing includes the development of approximate (i.e. standard costs within

an organization for any or all operations. (Bragg, 2019)

Advantages (Bragg, 2019) Disadvantages (Bragg, 2019)

By fixing the number of supervisors, the

organization will boost cost management.

For managerial planning and decision

making, more valuable knowledge.

More reasonable and easier calculations for

inventory.

Real costs should be similar to normal costs

in the future, contributing to more detailed

budgets in the future.

Cost benefits in maintaining records.

Possible reductions in the cost of

production.

The report of variance is published

too soon so the information is no

longer accurate, leading to a waste of

time to rewrite the report.

The truth is that companies are more

concerned with the problem than

their employees' success, so the

morale of employees will decline

and the results are not 100%

inefficient.

With the spirit of ineffective work,

when reporting any adverse variance

they will hide to avoid consequences

later, but this can directly affect the

quality of the product.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

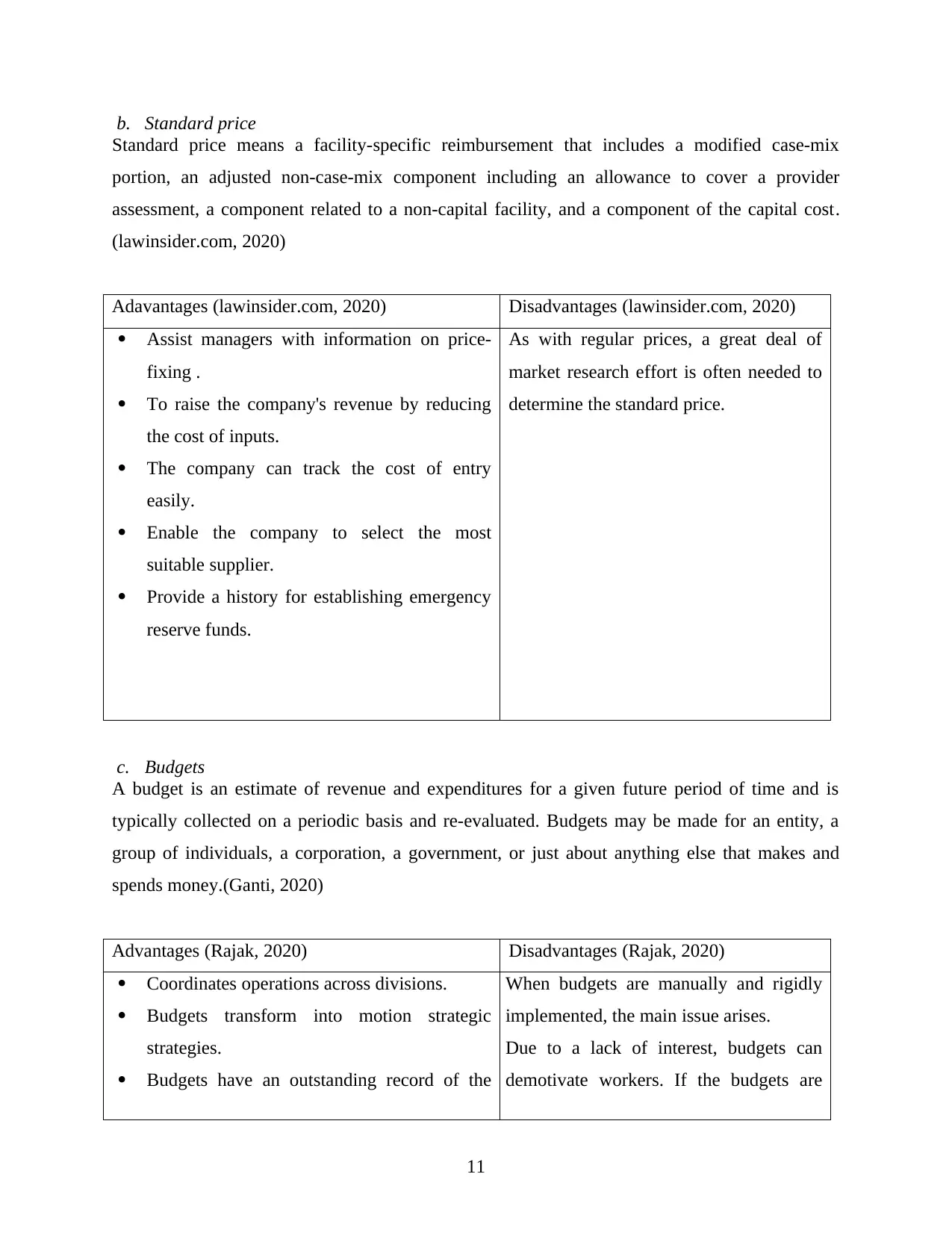

b. Standard price

Standard price means a facility-specific reimbursement that includes a modified case-mix

portion, an adjusted non-case-mix component including an allowance to cover a provider

assessment, a component related to a non-capital facility, and a component of the capital cost.

(lawinsider.com, 2020)

Adavantages (lawinsider.com, 2020) Disadvantages (lawinsider.com, 2020)

Assist managers with information on price-

fixing .

To raise the company's revenue by reducing

the cost of inputs.

The company can track the cost of entry

easily.

Enable the company to select the most

suitable supplier.

Provide a history for establishing emergency

reserve funds.

As with regular prices, a great deal of

market research effort is often needed to

determine the standard price.

c. Budgets

A budget is an estimate of revenue and expenditures for a given future period of time and is

typically collected on a periodic basis and re-evaluated. Budgets may be made for an entity, a

group of individuals, a corporation, a government, or just about anything else that makes and

spends money.(Ganti, 2020)

Advantages (Rajak, 2020) Disadvantages (Rajak, 2020)

Coordinates operations across divisions.

Budgets transform into motion strategic

strategies.

Budgets have an outstanding record of the

When budgets are manually and rigidly

implemented, the main issue arises.

Due to a lack of interest, budgets can

demotivate workers. If the budgets are

11

Standard price means a facility-specific reimbursement that includes a modified case-mix

portion, an adjusted non-case-mix component including an allowance to cover a provider

assessment, a component related to a non-capital facility, and a component of the capital cost.

(lawinsider.com, 2020)

Adavantages (lawinsider.com, 2020) Disadvantages (lawinsider.com, 2020)

Assist managers with information on price-

fixing .

To raise the company's revenue by reducing

the cost of inputs.

The company can track the cost of entry

easily.

Enable the company to select the most

suitable supplier.

Provide a history for establishing emergency

reserve funds.

As with regular prices, a great deal of

market research effort is often needed to

determine the standard price.

c. Budgets

A budget is an estimate of revenue and expenditures for a given future period of time and is

typically collected on a periodic basis and re-evaluated. Budgets may be made for an entity, a

group of individuals, a corporation, a government, or just about anything else that makes and

spends money.(Ganti, 2020)

Advantages (Rajak, 2020) Disadvantages (Rajak, 2020)

Coordinates operations across divisions.

Budgets transform into motion strategic

strategies.

Budgets have an outstanding record of the

When budgets are manually and rigidly

implemented, the main issue arises.

Due to a lack of interest, budgets can

demotivate workers. If the budgets are

11

operations of organisations.

Budgets facilitate contact with workers.

Budgets facilitate the distribution of money,

so all requests are explained and justified.

Budgets offer a tool by reallocations for

corrective action.

unilaterally implemented top-down,

workers will not recognize, and will not

be dedicated to the justification for

budgeted expenses.

Budgets can cause unfairness perceptions.

Budgets can generate competition for

politics and money.

At lower stages, a restrictive budget

system decreases initiative and creativity,

making it difficult to acquire money for

new ideas.

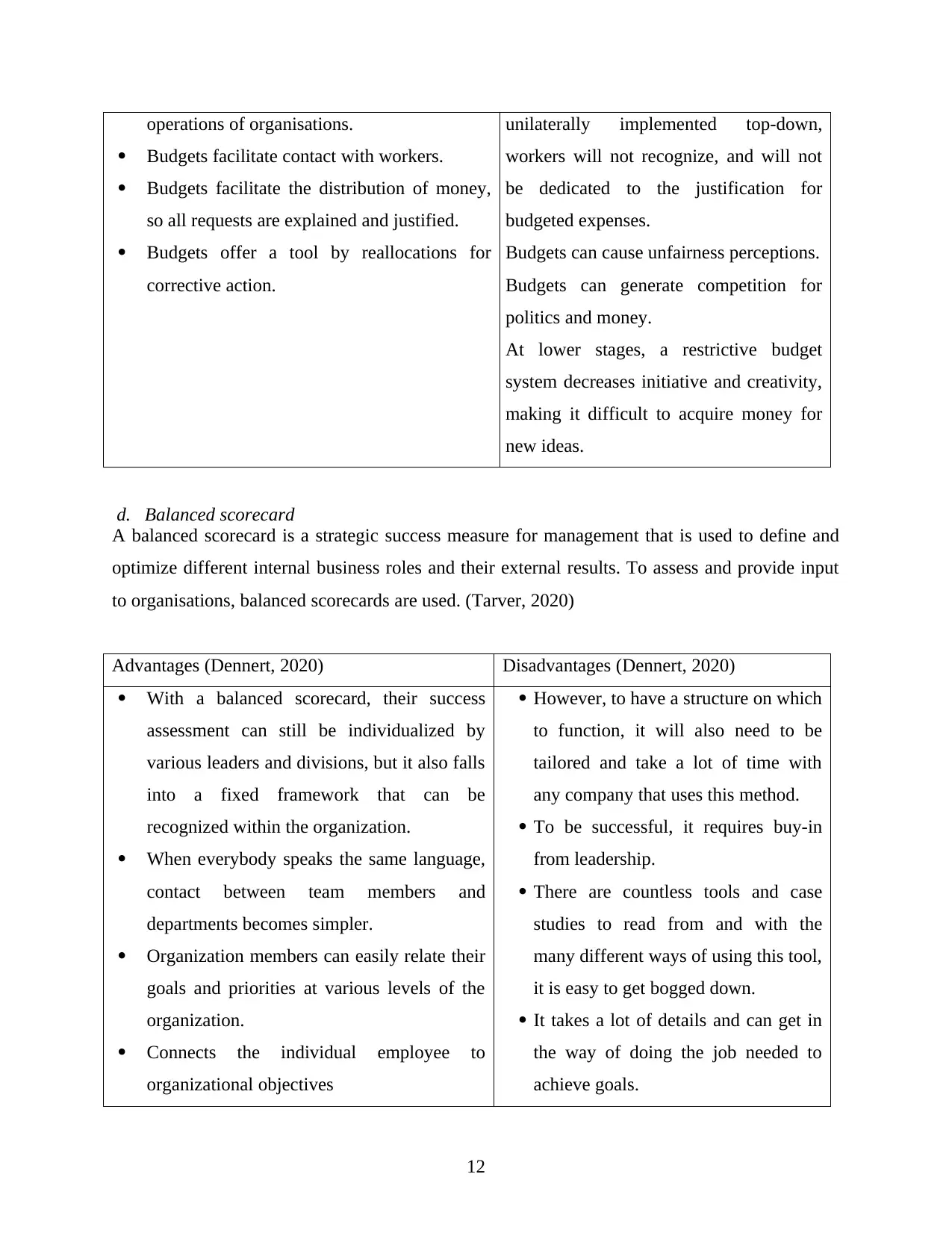

d. Balanced scorecard

A balanced scorecard is a strategic success measure for management that is used to define and

optimize different internal business roles and their external results. To assess and provide input

to organisations, balanced scorecards are used. (Tarver, 2020)

Advantages (Dennert, 2020) Disadvantages (Dennert, 2020)

With a balanced scorecard, their success

assessment can still be individualized by

various leaders and divisions, but it also falls

into a fixed framework that can be

recognized within the organization.

When everybody speaks the same language,

contact between team members and

departments becomes simpler.

Organization members can easily relate their

goals and priorities at various levels of the

organization.

Connects the individual employee to

organizational objectives

However, to have a structure on which

to function, it will also need to be

tailored and take a lot of time with

any company that uses this method.

To be successful, it requires buy-in

from leadership.

There are countless tools and case

studies to read from and with the

many different ways of using this tool,

it is easy to get bogged down.

It takes a lot of details and can get in

the way of doing the job needed to

achieve goals.

12

Budgets facilitate contact with workers.

Budgets facilitate the distribution of money,

so all requests are explained and justified.

Budgets offer a tool by reallocations for

corrective action.

unilaterally implemented top-down,

workers will not recognize, and will not

be dedicated to the justification for

budgeted expenses.

Budgets can cause unfairness perceptions.

Budgets can generate competition for

politics and money.

At lower stages, a restrictive budget

system decreases initiative and creativity,

making it difficult to acquire money for

new ideas.

d. Balanced scorecard

A balanced scorecard is a strategic success measure for management that is used to define and

optimize different internal business roles and their external results. To assess and provide input

to organisations, balanced scorecards are used. (Tarver, 2020)

Advantages (Dennert, 2020) Disadvantages (Dennert, 2020)

With a balanced scorecard, their success

assessment can still be individualized by

various leaders and divisions, but it also falls

into a fixed framework that can be

recognized within the organization.

When everybody speaks the same language,

contact between team members and

departments becomes simpler.

Organization members can easily relate their

goals and priorities at various levels of the

organization.

Connects the individual employee to

organizational objectives

However, to have a structure on which

to function, it will also need to be

tailored and take a lot of time with

any company that uses this method.

To be successful, it requires buy-in

from leadership.

There are countless tools and case

studies to read from and with the

many different ways of using this tool,

it is easy to get bogged down.

It takes a lot of details and can get in

the way of doing the job needed to

achieve goals.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.